1 | Maximus: Q1 FY22 Earnings Presentation David Mutryn Chief Financial Officer Fiscal 2022 First Quarter Earnings Call February 3, 2022

2 | Maximus: Q1 FY22 Earnings Presentation These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. In this presentation, we use terms such as “normalized organic growth.” We calculate this number by removing the effects of the U.S. Census contract, the estimated revenues from COVID-19 response work, the benefit from our acquisitions and the period-over-period currency effects from our revenue. We believe normalized organic growth allows our investors to understand the effect on our revenue and revenue growth of various key drivers whose effects will vary from year to year. It should be used to complement analysis of our revenue and revenue growth. Included in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “opportunity,” “could,” “potential,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will,” and similar references to future periods. Forward-looking statements that are not historical facts, including statements about our confidence, strategies and initiatives and our expectations about revenues, results of operations, profitability, liquidity, market demand or the impact of the pandemic are forward-looking statements that involve risks and uncertainties such as those related to the impact of the pandemic and our recently-completed acquisitions. These risks could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. A summary of risk factors can be found in Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the year ended September 30, 2021, which was filed with the Securities and Exchange Commission (SEC) on November 18, 2021. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Throughout this presentation, numbers may not add due to rounding. Forward-looking Statements & Non-GAAP Information

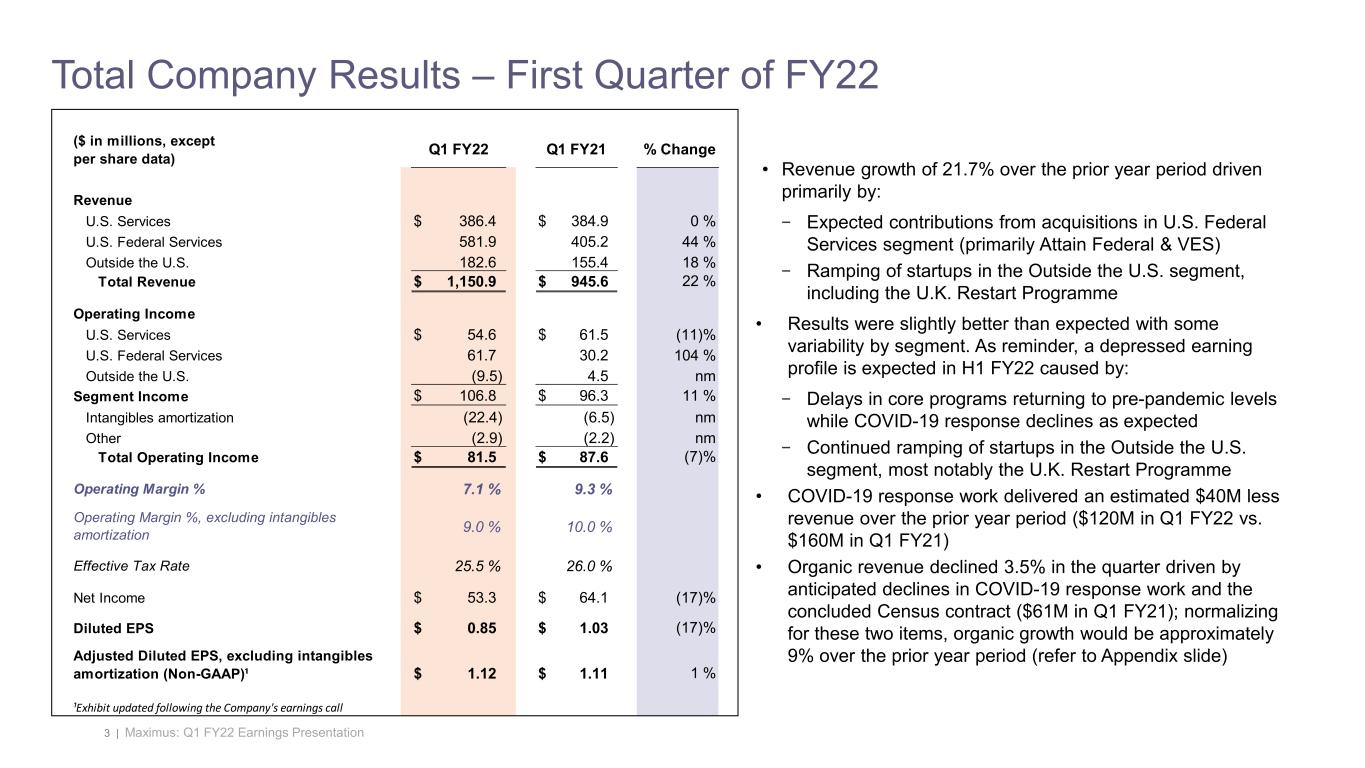

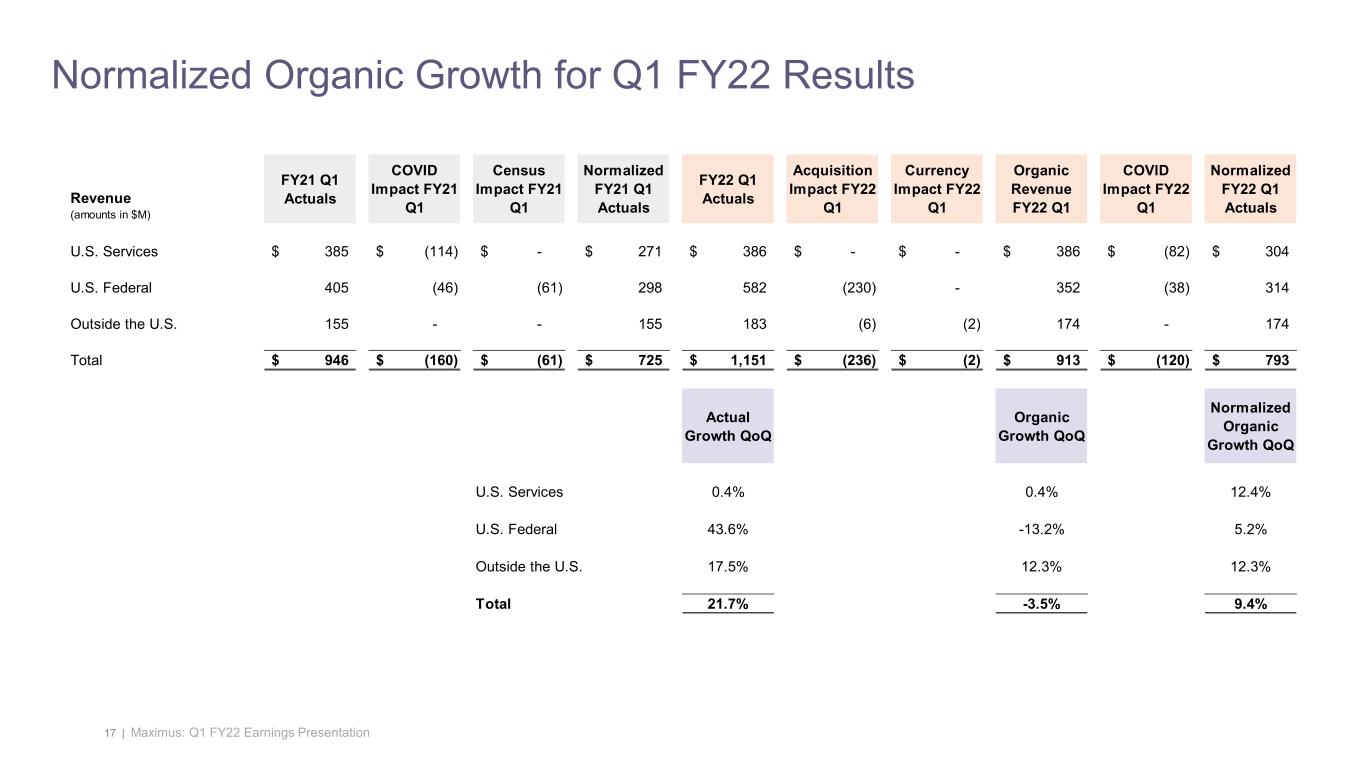

3 | Maximus: Q1 FY22 Earnings Presentation Total Company Results – First Quarter of FY22 • Revenue growth of 21.7% over the prior year period driven primarily by: − Expected contributions from acquisitions in U.S. Federal Services segment (primarily Attain Federal & VES) − Ramping of startups in the Outside the U.S. segment, including the U.K. Restart Programme • Results were slightly better than expected with some variability by segment. As reminder, a depressed earning profile is expected in H1 FY22 caused by: − Delays in core programs returning to pre-pandemic levels while COVID-19 response declines as expected − Continued ramping of startups in the Outside the U.S. segment, most notably the U.K. Restart Programme • COVID-19 response work delivered an estimated $40M less revenue over the prior year period ($120M in Q1 FY22 vs. $160M in Q1 FY21) • Organic revenue declined 3.5% in the quarter driven by anticipated declines in COVID-19 response work and the concluded Census contract ($61M in Q1 FY21); normalizing for these two items, organic growth would be approximately 9% over the prior year period (refer to Appendix slide) ($ in millions, except per share data) Q1 FY22 Q1 FY21 % Change Revenue U.S. Services $ 386.4 $ 384.9 0 % U.S. Federal Services 581.9 405.2 44 % Outside the U.S. 182.6 155.4 18 % Total Revenue $ 1,150.9 $ 945.6 22 % Operating Income U.S. Services $ 54.6 $ 61.5 (11)% U.S. Federal Services 61.7 30.2 104 % Outside the U.S. (9.5) 4.5 nm Segment Income $ 106.8 $ 96.3 11 % Intangibles amortization (22.4) (6.5) nm Other (2.9) (2.2) nm Total Operating Income $ 81.5 $ 87.6 (7)% Operating Margin % 7.1 % 9.3 % Operating Margin %, excluding intangibles amortization 9.0 % 10.0 % Effective Tax Rate 25.5 % 26.0 % Net Income $ 53.3 $ 64.1 (17)% Diluted EPS $ 0.85 $ 1.03 (17)% Adjusted Diluted EPS, excluding intangibles amortization (Non-GAAP)¹ $ 1.12 $ 1.11 1 % ¹Exhibit updated following the Company's earnings call

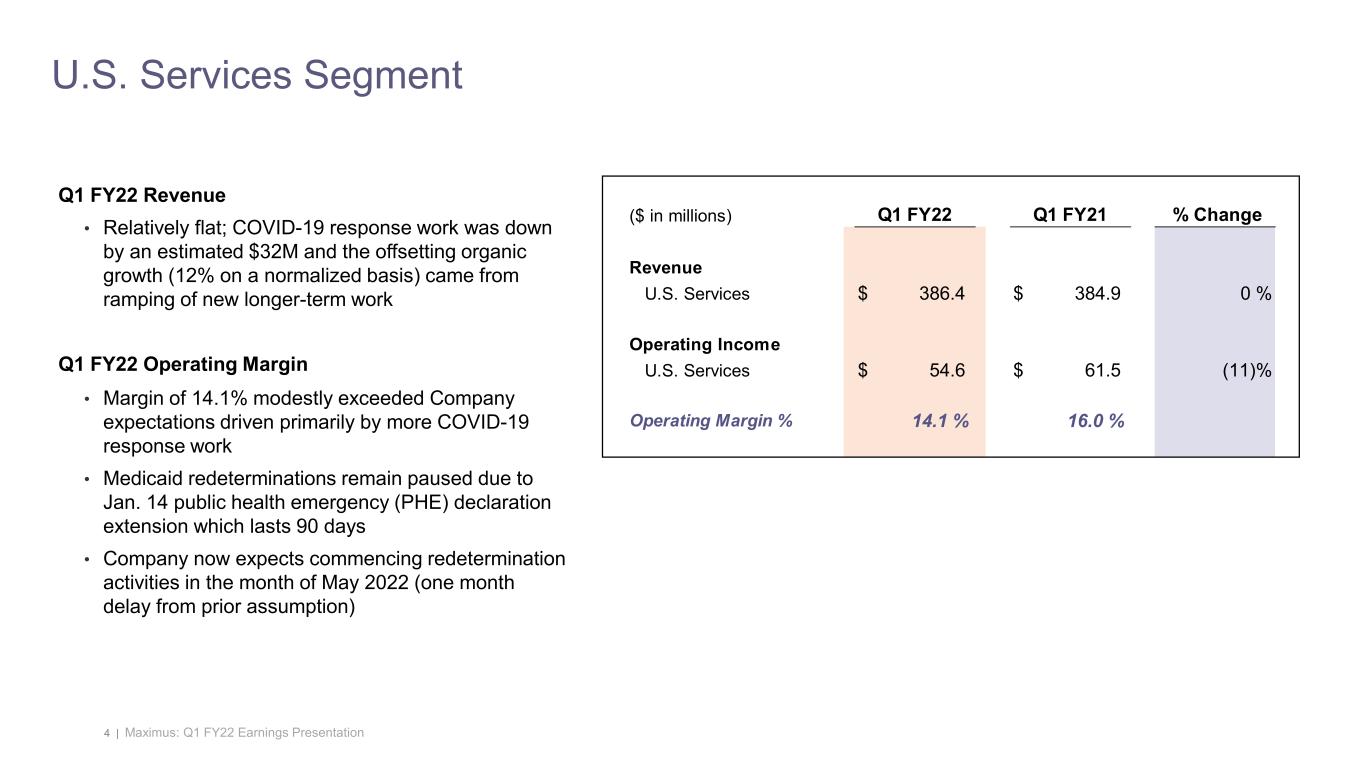

4 | Maximus: Q1 FY22 Earnings Presentation Q1 FY22 Revenue • Relatively flat; COVID-19 response work was down by an estimated $32M and the offsetting organic growth (12% on a normalized basis) came from ramping of new longer-term work Q1 FY22 Operating Margin • Margin of 14.1% modestly exceeded Company expectations driven primarily by more COVID-19 response work • Medicaid redeterminations remain paused due to Jan. 14 public health emergency (PHE) declaration extension which lasts 90 days • Company now expects commencing redetermination activities in the month of May 2022 (one month delay from prior assumption) U.S. Services Segment ($ in millions) Q1 FY22 Q1 FY21 % Change Revenue U.S. Services $ 386.4 $ 384.9 0 % Operating Income U.S. Services $ 54.6 $ 61.5 (11)% Operating Margin % 14.1 % 16.0 %

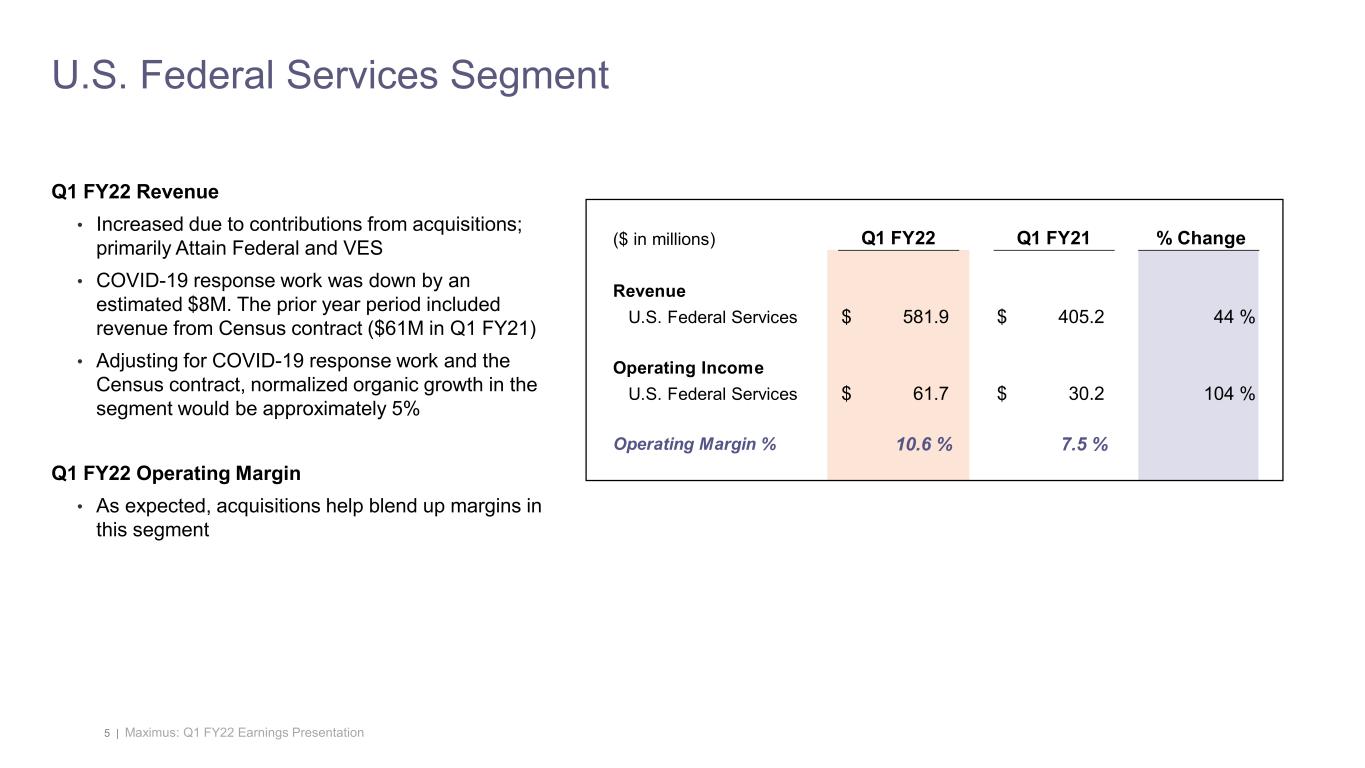

5 | Maximus: Q1 FY22 Earnings Presentation U.S. Federal Services Segment Q1 FY22 Revenue • Increased due to contributions from acquisitions; primarily Attain Federal and VES • COVID-19 response work was down by an estimated $8M. The prior year period included revenue from Census contract ($61M in Q1 FY21) • Adjusting for COVID-19 response work and the Census contract, normalized organic growth in the segment would be approximately 5% Q1 FY22 Operating Margin • As expected, acquisitions help blend up margins in this segment ($ in millions) Q1 FY22 Q1 FY21 % Change Revenue U.S. Federal Services $ 581.9 $ 405.2 44 % Operating Income U.S. Federal Services $ 61.7 $ 30.2 104 % Operating Margin % 10.6 % 7.5 %

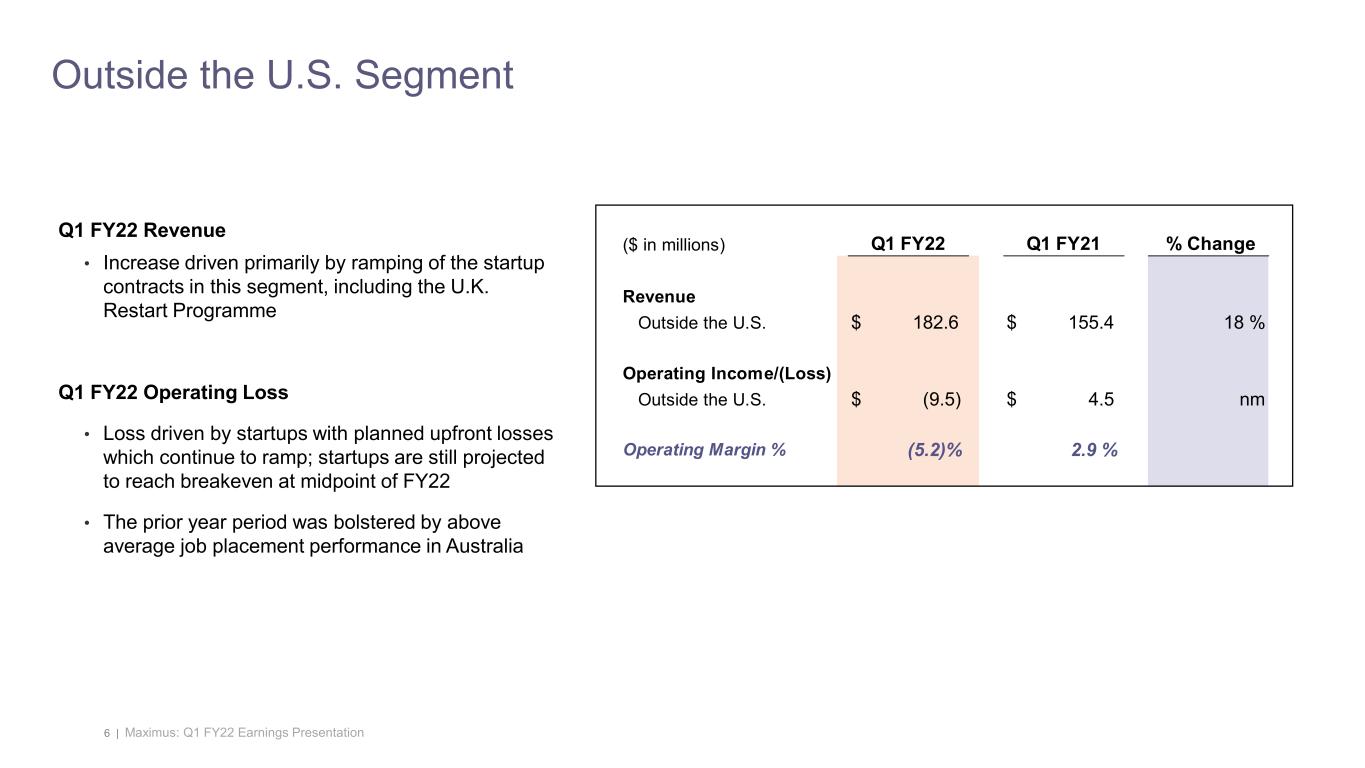

6 | Maximus: Q1 FY22 Earnings Presentation Outside the U.S. Segment Q1 FY22 Revenue • Increase driven primarily by ramping of the startup contracts in this segment, including the U.K. Restart Programme Q1 FY22 Operating Loss • Loss driven by startups with planned upfront losses which continue to ramp; startups are still projected to reach breakeven at midpoint of FY22 • The prior year period was bolstered by above average job placement performance in Australia ($ in millions) Q1 FY22 Q1 FY21 % Change Revenue Outside the U.S. $ 182.6 $ 155.4 18 % Operating Income/(Loss) Outside the U.S. $ (9.5) $ 4.5 nm Operating Margin % (5.2)% 2.9 %

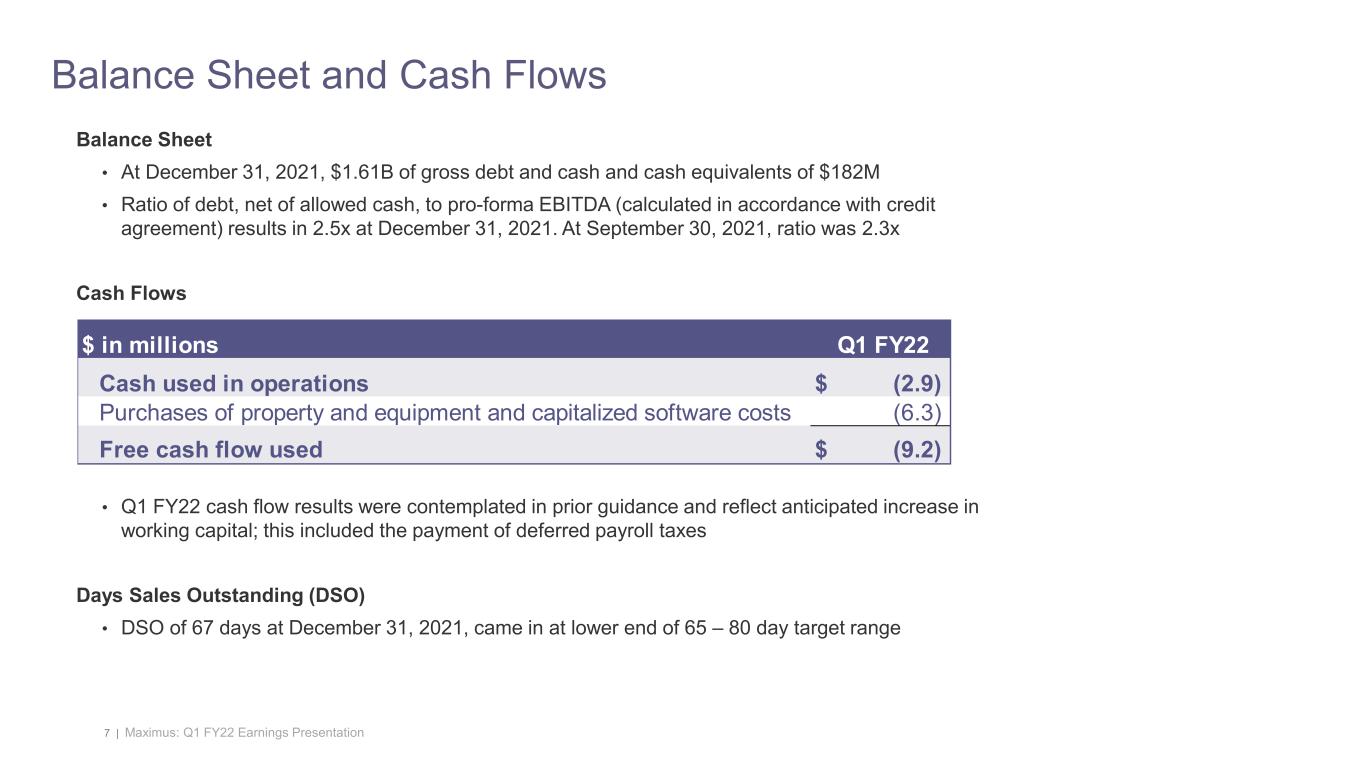

7 | Maximus: Q1 FY22 Earnings Presentation Balance Sheet • At December 31, 2021, $1.61B of gross debt and cash and cash equivalents of $182M • Ratio of debt, net of allowed cash, to pro-forma EBITDA (calculated in accordance with credit agreement) results in 2.5x at December 31, 2021. At September 30, 2021, ratio was 2.3x Cash Flows • Q1 FY22 cash flow results were contemplated in prior guidance and reflect anticipated increase in working capital; this included the payment of deferred payroll taxes Days Sales Outstanding (DSO) • DSO of 67 days at December 31, 2021, came in at lower end of 65 – 80 day target range Balance Sheet and Cash Flows $ in millions Q1 FY22 Cash used in operations $ (2.9) Purchases of property and equipment and capitalized software costs (6.3) Free cash flow used $ (9.2)

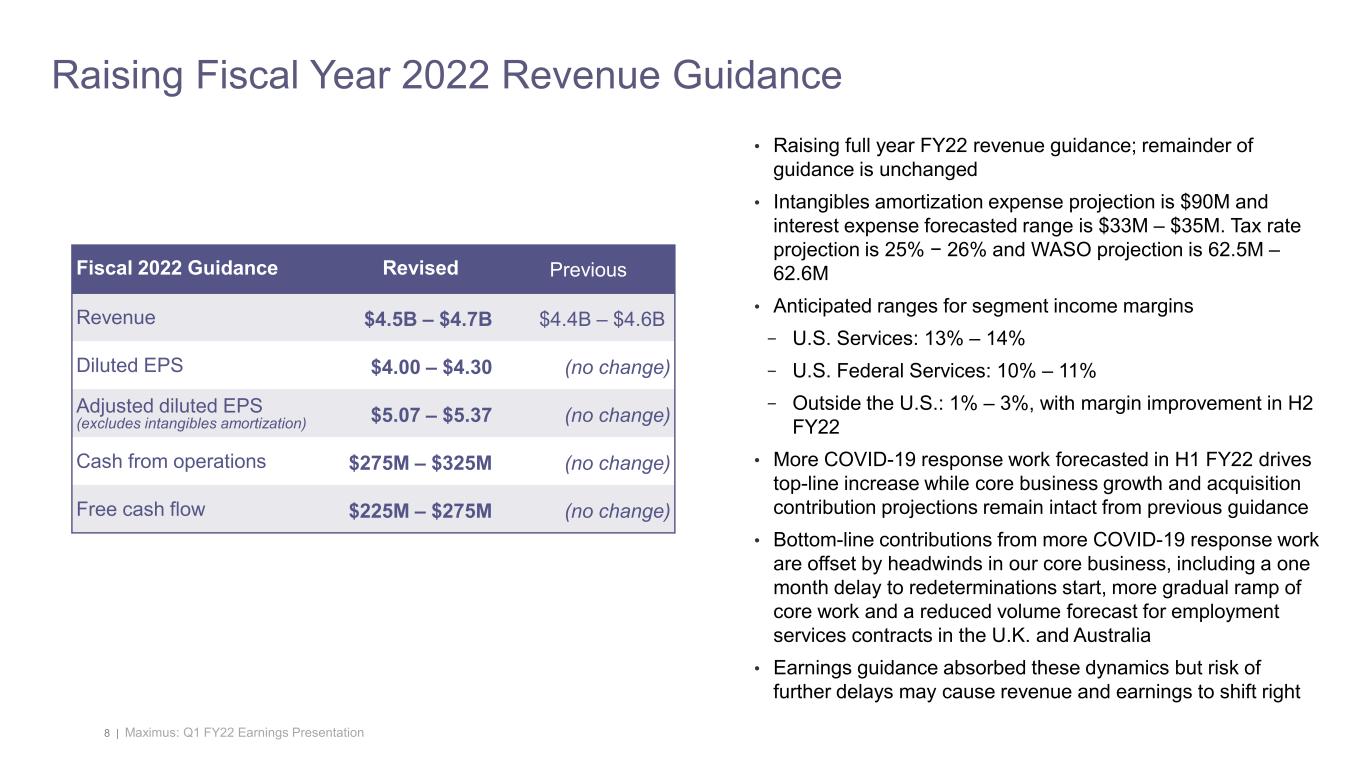

8 | Maximus: Q1 FY22 Earnings Presentation Raising Fiscal Year 2022 Revenue Guidance • Raising full year FY22 revenue guidance; remainder of guidance is unchanged • Intangibles amortization expense projection is $90M and interest expense forecasted range is $33M – $35M. Tax rate projection is 25% − 26% and WASO projection is 62.5M – 62.6M • Anticipated ranges for segment income margins − U.S. Services: 13% – 14% − U.S. Federal Services: 10% – 11% − Outside the U.S.: 1% – 3%, with margin improvement in H2 FY22 • More COVID-19 response work forecasted in H1 FY22 drives top-line increase while core business growth and acquisition contribution projections remain intact from previous guidance • Bottom-line contributions from more COVID-19 response work are offset by headwinds in our core business, including a one month delay to redeterminations start, more gradual ramp of core work and a reduced volume forecast for employment services contracts in the U.K. and Australia • Earnings guidance absorbed these dynamics but risk of further delays may cause revenue and earnings to shift right Fiscal 2022 Guidance Revised Previous Revenue $4.5B – $4.7B $4.4B – $4.6B Diluted EPS $4.00 – $4.30 (no change) Adjusted diluted EPS (excludes intangibles amortization) $5.07 – $5.37 (no change) Cash from operations $275M – $325M (no change) Free cash flow $225M – $275M (no change)

9 | Maximus: Q1 FY22 Earnings Presentation Bruce Caswell President & Chief Executive Officer Fiscal 2022 First Quarter Earnings Call February 3, 2022

10 | Maximus: Q1 FY22 Earnings Presentation Changing Nature of COVID Response Work Omicron and Public Health Emergency (PHE) Impacts • Awarded some additional COVID extension work in light of Omicron and extended PHE • CDC task order under our prior sole source award • Illustrates Maximus as a vendor-of-choice, particularly for urgent client needs Evolution of COVID Response Work • Nature of this work is changing and provides positive proof points for our strategy of evolving COVID response work into new scope and extended relationships • Position ourselves as a long-term public health partner Past Performance Positioning New Opportunities • New work for FY22 includes award for a multi-year unemployment insurance contract with a state client • Estimated $100M+ TCV • Awards of this nature underpin our core business organic growth • Additional new contract to support eligibility operations by Arkansas Department of Human Services • $68M TCV over one base year and six option years, forecasted to contribute revenue in first half of FY22 • Past Maximus efforts helping the client address inventory positioned us for this opportunity • Illustrates strength of our brand value as go-to-partner • Positioning Maximus to support states with the forthcoming “PHE unwinding”

11 | Maximus: Q1 FY22 Earnings Presentation Economy Dynamics • Varying conditions in major economies in which we operate, such as U.K. and Australia • Certain elements operating at depressed levels as a result of Omicron variant • Policies often suspend job seeker obligations as a result, leading to lower labor force participation • Elsewhere, economic recovery outpaces the models on which programs were based, resulting in lower than anticipated unemployment rates • As a result, employment services programs in some countries are seeing reduced volume forecast, including U.K. Restart and Australian jobactive programs Solid Execution • Q1 illustrated Restart team executing well, despite uncontrollable labor market • Referral volumes and job starts performing above customer’s revised expectations • Continue to expect to achieve break-even in second half of FY22 • Working with customer and vendor community to bring clarity to this dynamic situation and longer-term expectations for the program Outside the U.S. Segment

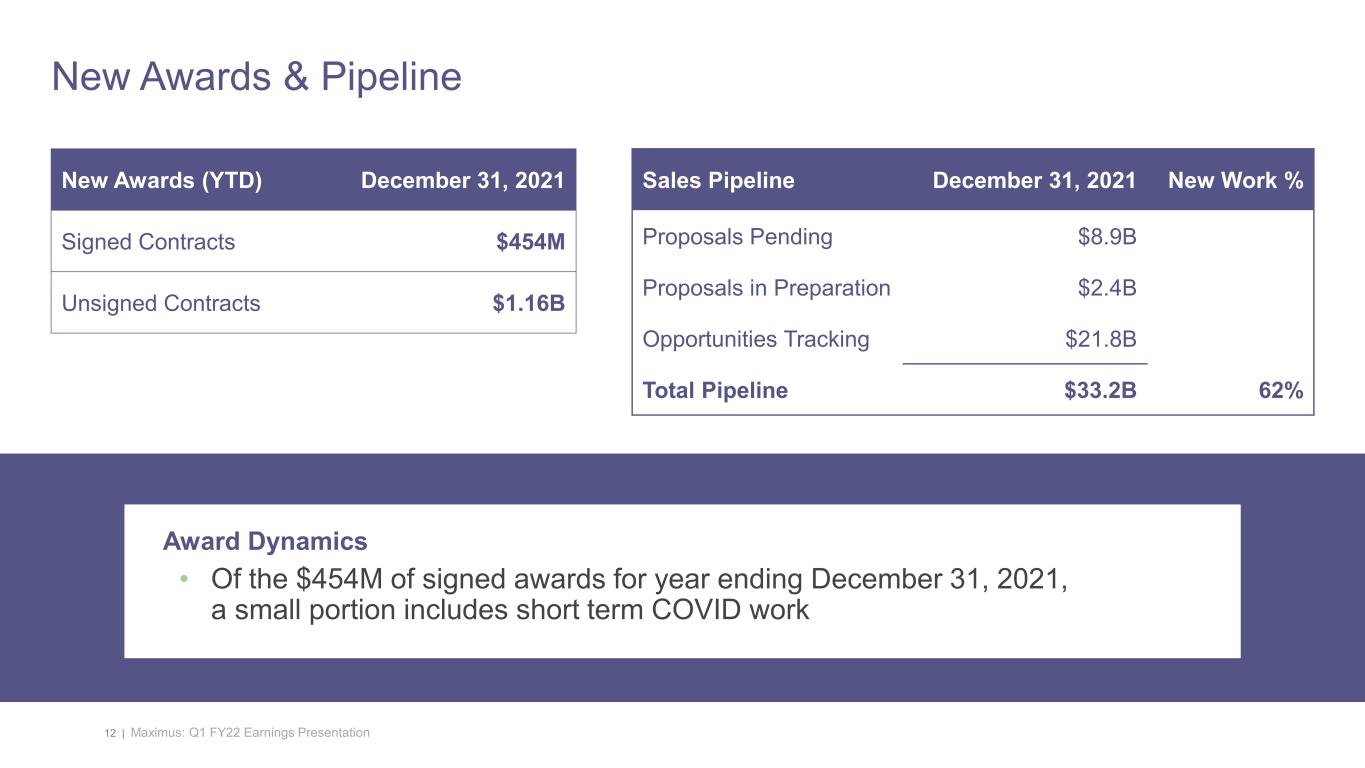

12 | Maximus: Q1 FY22 Earnings Presentation Sales Pipeline December 31, 2021 New Work % Proposals Pending $8.9B Proposals in Preparation $2.4B Opportunities Tracking $21.8B Total Pipeline $33.2B 62% New Awards (YTD) December 31, 2021 Signed Contracts $454M Unsigned Contracts $1.16B New Awards & Pipeline Award Dynamics • Of the $454M of signed awards for year ending December 31, 2021, a small portion includes short term COVID work

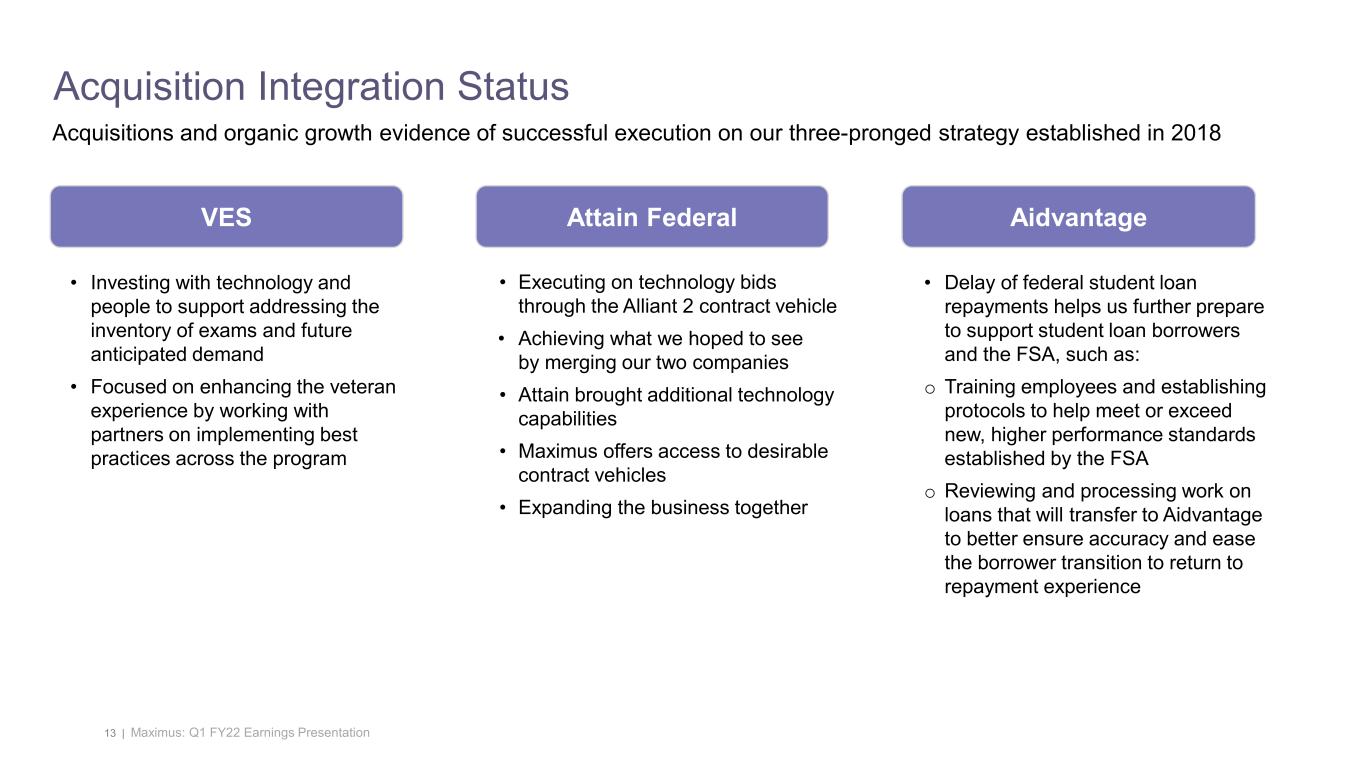

13 | Maximus: Q1 FY22 Earnings Presentation Acquisition Integration Status VES • Investing with technology and people to support addressing the inventory of exams and future anticipated demand • Focused on enhancing the veteran experience by working with partners on implementing best practices across the program Attain Federal • Executing on technology bids through the Alliant 2 contract vehicle • Achieving what we hoped to see by merging our two companies • Attain brought additional technology capabilities • Maximus offers access to desirable contract vehicles • Expanding the business together Aidvantage • Delay of federal student loan repayments helps us further prepare to support student loan borrowers and the FSA, such as: o Training employees and establishing protocols to help meet or exceed new, higher performance standards established by the FSA o Reviewing and processing work on loans that will transfer to Aidvantage to better ensure accuracy and ease the borrower transition to return to repayment experience Acquisitions and organic growth evidence of successful execution on our three-pronged strategy established in 2018

14 | Maximus: Q1 FY22 Earnings Presentation • Looking forward at how we leverage capabilities and expand total addressable market • Evolving longer-term strategy (three to five years) • Strategic pillars, operational capabilities, and organization model to be congruent with our plan to deliver ongoing shareholder value through reliable organic growth and margin expansion • Next strategic phase expected to incorporate a continuation of key elements: – Digital solutions to enhance the citizen experience – Clinical services to address evolving government priorities – Additional clarity around expanded vision for Maximus as sought-after provider of innovative technology solutions that address the mission priorities of our government customers, particularly the Federal marketplace • More detail forthcoming at our 2022 Investor Day Corporate Strategy

15 | Maximus: Q1 FY21 Earnings Presentation • Continue to expect a solid second half of FY22 • Operating in a dynamic environment compared to pre-pandemic Timeline to Unwind the PHE • FY22 expectation would be negatively impacted by potential extension of timeline for PHE unwinding • Positive opportunities also created to respond to the changing needs of our customers in light of extension, evidenced in Q1 results Prioritizing the Wellbeing of our People • Continue to prioritize employee safety and wellbeing • Actively monitor guidance and update procedures accordingly • Invested in employee benefit enhancements including: – Increased 401K match – Expanded health benefits – Employee Assistance Fund to provide financial assistance Ongoing Dynamics

16 | Maximus: Q1 FY22 Earnings Presentation Appendix

17 | Maximus: Q1 FY22 Earnings Presentation Normalized Organic Growth for Q1 FY22 Results Revenue (amounts in $M) FY21 Q1 Actuals COVID Impact FY21 Q1 Census Impact FY21 Q1 Normalized FY21 Q1 Actuals FY22 Q1 Actuals Acquisition Impact FY22 Q1 Currency Impact FY22 Q1 Organic Revenue FY22 Q1 COVID Impact FY22 Q1 Normalized FY22 Q1 Actuals U.S. Services 385$ (114)$ -$ 271$ 386$ -$ -$ 386$ (82)$ 304$ U.S. Federal 405 (46) (61) 298 582 (230) - 352 (38) 314 Outside the U.S. 155 - - 155 183 (6) (2) 174 - 174 Total 946$ (160)$ (61)$ 725$ 1,151$ (236)$ (2)$ 913$ (120)$ 793$ Actual Growth QoQ Organic Growth QoQ Normalized Organic Growth QoQ U.S. Services 0.4% 0.4% 12.4% U.S. Federal 43.6% -13.2% 5.2% Outside the U.S. 17.5% 12.3% 12.3% Total 21.7% -3.5% 9.4%