SECURITIES & EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

NOTICE OF EXEMPT SOLICITATION (VOLUNTARY SUBMISSION)

NAME OF REGISTRANT: MAXIMUS, Inc.

NAME OF PERSON RELYING ON EXEMPTION: CtW Investment Group

ADDRESS OF PERSON RELYING ON EXEMPTION: 1900 L Street, N.W., Suite 900, Washington, D.C. 20036

Written materials are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934:

____________________________________________________________________________________________________________________________________________________________________

To MAXIMUS Shareholders,

We urge you to vote FOR Proposal #5, Shareholder Proposal Regarding Lobbying Activities and Expenditures, at MAXIUMUS’ annual shareholder meeting on March 17, 2020.

The proposal asks MAXIMUS to prepare an annual report on its lobbying:

Resolved, the shareholders of MAXIMUS request the preparation of a report, updated annually, disclosing:

1. Company policy and procedures governing lobbying, both direct and indirect, and grassroots lobbying communications.

2. Payments by MAXIMUS used for (a) direct or indirect lobbying or (b) grassroots lobbying communications, in each case including the amount of the payment and the recipient.

3. MAXIMUS’s membership in and payments to any tax-exempt organization that writes and endorses model legislation.

4. Description of management’s and the Board’s decision-making process and oversight for making payments described in sections 2 and 3 above.

Widespread Support for Disclosure of Corporate Political Spending

Following the Supreme Court’s Citizen’s United decision in 2010, investors have been pressing companies to fully disclose all spending that attempts to influence regulation, legislation, and election results. Since 2011, 316 companies in the S&P 500 have adopted some form of political spending disclosure, including 281 disclosing state-level spending and 234 disclosing trade association contributions, according to the Center for Political Accountability’s 2019 CPA-Zicklin Index.1

Moreover, as former Chief Justice of the Delaware Supreme Court Leo Strine has argued:

Companies themselves face heightened risks from the Wild West environment that now surrounds political spending. Contributions that conflict with their core values and positions endanger their reputations, their relationship with consumers

and employees and their bottom lines.”2 Absent the disclosures that this Resolution calls for, shareholder have no basis for determining if companies are managing these risks effectively.

Many international corporate governance standard-setters support corporate disclosure of lobbying spending, including the International Corporate Governance Network (ICGN), the UN’s Principles for Responsible Investment (PRI), and the OECD in its Principles for Transparency and Integrity in Lobbying.

MAXIMUS’ Spending on Lobbying is Substantial, But Difficult to Track

Because MAXIMUS operates as a contractor to both states and the federal government, its lobbying expenditures are difficult to comprehensively capture. Between 2010 and 2018, MAXIMUS has spent over $4.6 million on federal lobbying. As recently as 2014, MAXIMUS also lobbied in 33 states which have a complex array of cumbersome, delayed, or even absent mechanisms through which such lobbying expenses are disclosed.3 From the few states where such data can be readily obtained, we know that the Company’s state-level lobbying expenses must rival their federal spending: From 2011-2018, MAXIMUS spent $1.9 million lobbying in New York, and between $1.4 million and $2.6 million in Texas. As the Company has set its sights on work outside the US, it has begun to engage in foreign lobbying, which creates its own risks and is even more difficult to track. Adopting this Resolution would ensure that this information is available to shareholders in a comprehensive and easy to find form.

MAXIMUS Trails Major Federal Contractors In Disclosing Political Spending

In its statement opposing this Resolution the MAXIMUS board claims that:

Because organizations with interests adverse to MAXIMUS also participate in the political process to their business advantage, any unilateral expanded disclosure, above what is required by law and equally applicable to all similar parties engaged in public debate, could benefit those organizations while harming the interests of MAXIMUS and our shareholders.

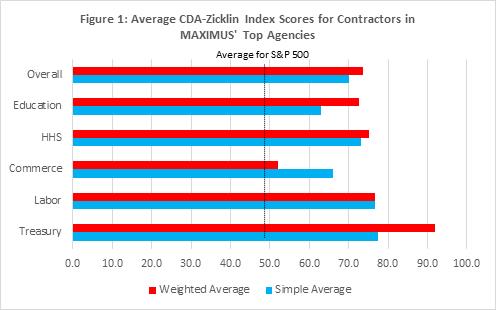

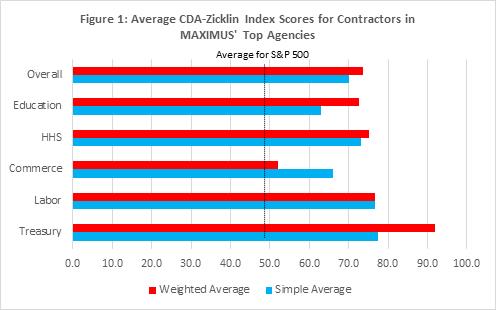

Figure 1 below fatally undermines MAXIUMUS’ explanation for not disclosing any information on its political or lobbying spending. Compared to other large publicly traded companies that contract with the agencies and departments that are MAXIMUS’ primary federal clients, MAXIMUS is clearly behind. As Figure 1 illustrates, federal contractors that are included in the S&P 500 have well-above average scores on the CPA-Zicklin Index, which includes disclosure of state-level, trade association, and non-profit spending.4

While the CPA-Zicklin Index does not measure federal lobbying expenses, the major contractors against whom MAXIMUS competes clearly recognize the risk management and reputational benefits of embracing disclosure, and are already disclosing far more about their political spending than MAXIMUS, including many of the disclosures called for by this Resolution.

MAXIMUS’ Reputation at Risk

As noted by Judge Strine above, companies that engage in political activity risk compromising their reputations if that activity is seen to violate its core values or undermine its relationship with consumers or workers. Indeed, MAXIMUS’s lobbying activities have already drawn critical attention, particularly with respect to the connection between MAXIMUS’s efforts to obtain new contracts.5 MAXIMUS’s foreign lobbying, such as its efforts to obtain contracts in the U.K. for Work Capability Assessments contracts, which test disabled persons applying for benefits, has drawn similar scrutiny.6 Given that MAXIMUS is already grappling with multiple allegations of misclassifying workers, failing to provide adequate health benefits, and interfering with legally protected employee activity, incurring further risk by failing to disclose its lobbying expenditures seems unwarranted.7

Indirect Spending Blind Spot Exacerbates Reputational Risk

MAXIMUS does not disclose its membership in, or payments to, either trade associations or tax-exempt organizations, nor does it disclose the proportions used for lobbying. Both trade associations and tax-exempt organizations spend millions annually lobbying indirectly on behalf of companies. Such organizations also write and endorse model legislation, sometimes resulting in contributing companies coming under public criticism for unpopular polices. The American Legislative Exchange Council (ALEC)’s support for “stand your ground” gun laws, for instance, attracted significant negative attention to companies that had contributed to or participated in its activities, ultimately resulting in many companies leaving the organization. Moreover, even if the board technically has access to or reviews company contributions to trade associations and tax-exempt organization, absent disclosure there is the live possibility that the board will

underestimate the potential public attention and reputational damage these relationships may cause. After all, what gets disclosed gets managed.

MAXIMUS’s lack of lobbying disclosure presents reputational risks that could harm long-term value creation by MAXIMUS, and thus we urge you to join us is voting FOR Proposal #5, Shareholder Proposal Regarding Lobbying Activities and Expenditures. If you have any questions or would like further information, please contact our Research Director Richard Clayton at richard.clayton@ctwinvestmentgroup.com.

Sincerely,

Dieter Waizenegger

Executive Director

_____________________________________

1 Center for Political Accountability, The 2019 CPA-Zicklin Index of Corporate Political Disclosure and Accountability, published October 24, 2019.

2 Ibid., pg. 7.

3 https://publicintegrity.org/state-politics/here-are-the-interests-lobbying-in-every-statehouse/

4 CDA-Zicklin only scores S&P 500 companies, while Maximus and most of the peers listed in its proxy statement are in mid-cap indexes such as the S&P 400. Companies included in Figure 1 are as follows: Overall (Accenture, IBM, Northrup Grumman, McKesson, GE, AT&T, United Technologies, UnitedHealth, Boeing, Merck, Fluor, Humana, Honeywell, AmerisourceBergen, Lockheed Martin, Pfizer, Cardinal Health, L3, FedEx, Raytheon, General Dynamics, Alliant, Centene, Textron, Rockwell Collins, Harris, Huntington Ingalls); Commerce (GD, Harris, Raytheon, Accenture, IBM, Lockheed Martin); Treasury (UPS, GD, Accenture, Jacobs Engineering, IBM, AT&T, Northrup Grumman, Verizon, Newell); Labor (Accenture, GD, Fluor); HHS (Merck, GD, Pfizer, McKesson, Northrup Grumman, Accenture, UnitedHealth, Johnson & Johnson, IBM, ThermoFisher, Omnicon, HPE, Interpublic); Education (Accenture, GD, United Health, IBM, Interpublic, Jacobs Engineering).

5 https://www.motherjones.com/politics/2018/12/how-one-company-is-making-millions-off-trumps-war-on-the-poor/

6 https://www.vice.com/en_us/article/ppxg7z/solomon-hughes-caroline-flint-labour-deputy-leadership-campaign-901

7 http://amsterdamnews.com/news/2019/dec/05/bogalusas-call-workers-issue-complaint-through-nlr/; https://www.motherjones.com/politics/2020/02/maximus-health-insurance-union-pay-wage-theft/; https://www.cjonline.com/news/20200206/maximus-employees-say-company-lowballs-wages-with-errant-classifications; https://nymag.com/intelligencer/2020/02/for-maximus-inequality-is-big-business.html; https://news.bloomberglaw.com/health-law-and-business/medicare-call-center-woes-persist-with-maximus-taking-charge-1

![]()

![]()