Operator: Greetings and welcome to the MAXIMUS fiscal 2014 fourth quarter and year-end conference call.

At this time, all participants are in a listen-only mode.

A brief question-and-answer session will follow the formal presentation.

In the interest of time and so that other participants have the opportunity to ask their question during the conference as well, we ask that you please limit yourself to one question and one follow-up question during the Q&A.

If anyone should require operator assistance during the conference, please press star-zero on your telephone keypad.

As a reminder, this conference is being recorded.

I would now like to turn the conference over to your host Lisa Miles. Thank you. You may begin.

Ms. Lisa Miles: Good morning. Thank you for joining us on today's conference call.

As a reminder, we've prepared a presentation to assist in your analysis of the company's 2014 financial results.

You may find the presentation particularly useful in following along with Rich's prepared comments.

This presentation can be found on our Website under the Investor Relations page.

With me today is Rich Montoni, Chief Executive Officer; Rick Nadeau, Chief Financial Officer; and Bruce Caswell, President.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 1 |

Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings.

We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC.

The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons.

For a reconciliation of non-GAAP measures presented in this document, please see the company's most recent quarterly earnings press release.

And with that, I'll turn the call over to Rick.

Mr. Rick Nadeau: Thanks, Lisa.

Fiscal 2014 was highlighted by strong growth built on solid execution.

As a reminder, we entered fiscal 2014 with an unprecedented number of startups.

Not only did we deliver on these new programs, but we also offered increased support to clients during the first year of the Affordable Care Act or ACA.

Clients continue to turn to MAXIMUS because of our proven ability to offer reliable solutions and scalability in order to meet programmatic objectives.

As you know, this led to a great year for MAXIMUS.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 2 |

Some key highlights of fiscal 2014 include unprecedented growth in our core markets and expansion into new adjacencies with important new wins, both in the United States and the United Kingdom; full-year earnings

toward the top end of our increased range; and strong operating margins, even as we experienced an increase in cost-reimbursable, lower-margin work from certain new contracts.

Let's get into the financial details, starting with the fourth quarter of fiscal year 2014.

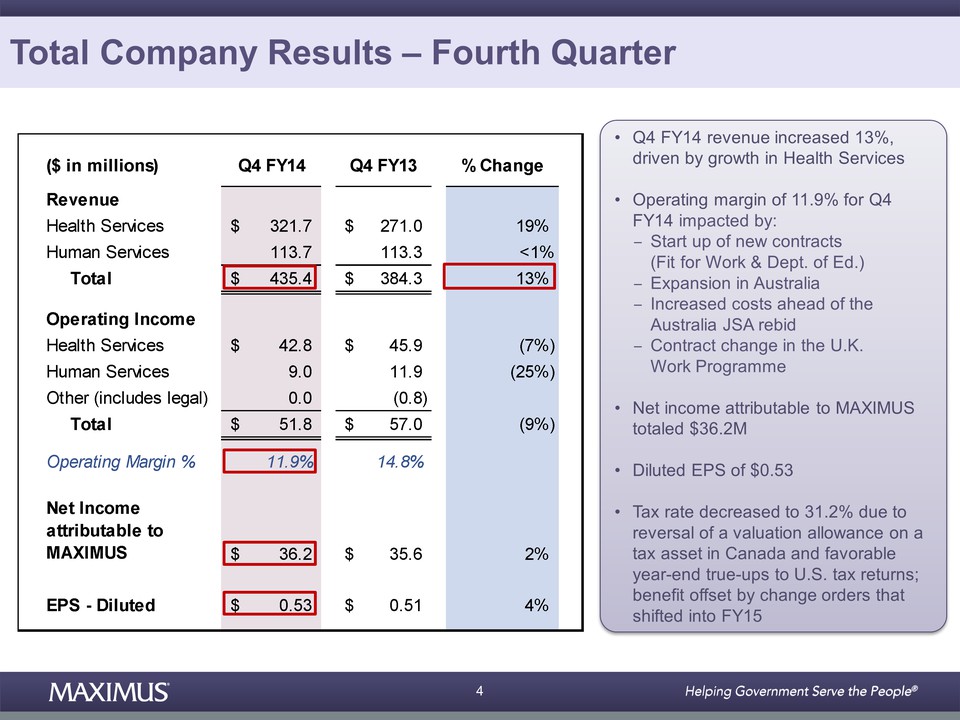

Compared to last year, fourth quarter revenue increased 13 percent to $435.4 million, driven by growth in the health services segment.

Operating margin in the quarter was largely as expected at 11.9 percent.

As a reminder, operating margins in the fourth quarter were impacted by program startup, including Fit for Work in the U.K., the Department of Education contract, and the new site reallocations in Australia.

In addition, we had increased costs as we prepared for the rebid in Australia along with a contract change in the U.K. Work Programme that unfavorably impacted margin.

Fiscal 2014 fourth quarter net income attributable to MAXIMUS totaled $36.2 million, which computes to diluted earnings per share of 53 cents.

In the fourth quarter, MAXIMUS realized benefits that decreased the tax rate to 31.2 percent.

This resulted from the reversal of a valuation allowance on a tax asset in Canada and a favorable true-up of our tax charges to our U.S. state tax returns.

The majority of these tax adjustments are normal course that often fall in the fourth quarter.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 3 |

The benefit from the lower tax rate was offset by some change orders shifting into next year.

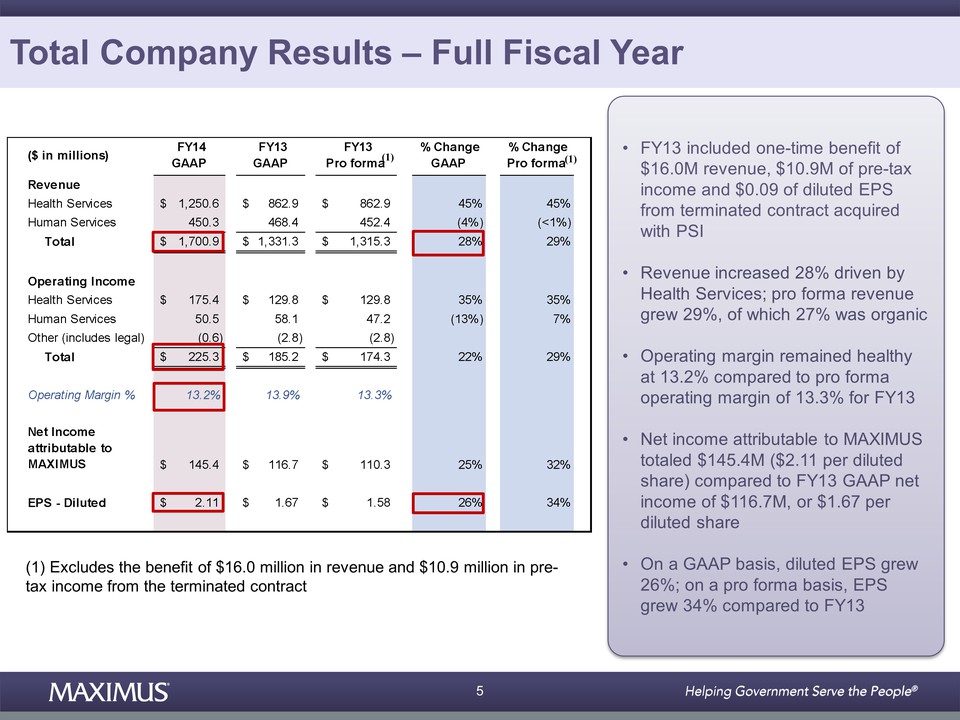

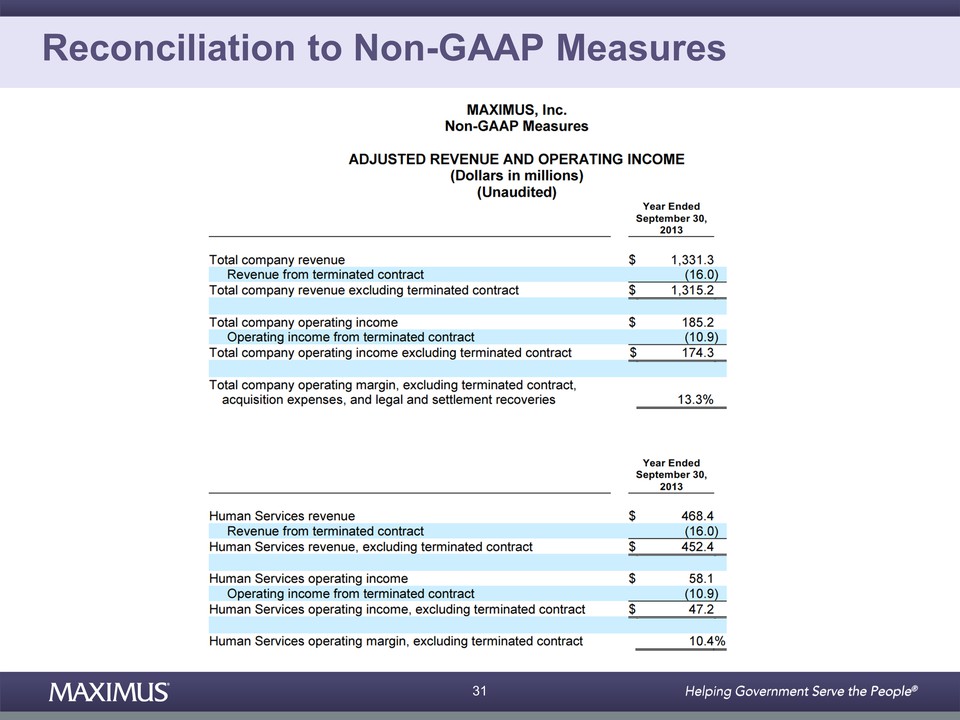

Before I move into the full-year results, I would like to remind everyone that fiscal year 2013 included a one-time benefit of approximately $16 million of nonrecurring revenue, $10.9 million of pretax income, and approximately 9 cents of diluted earnings per share from a terminating contract that was acquired with the PSI acquisition.

I will refer to this one-time termination throughout my comments.

Revenue for fiscal year 2014 increased 28 percent to $1.701 billion compared to $1.331 billion reported for fiscal year 2013.

Revenue increases for the full year were driven by the health services segment.

Excluding revenue from the terminated contract, revenue grew 29 percent, of which 27 percent was organic.

Total company operating margins for fiscal 2014 remained healthy at 13.2 percent compared to 13.9 percent reported last year.

Excluding the terminated contract, operating margins for fiscal year 2013 were 13.3 percent.

For fiscal 2014, net income attributable to MAXIMUS shareholders totaled $145.4 million or $2.11 per diluted share.

This compares to net income attributable to MAXIMUS of $116.7 million or $1.67 per diluted share for fiscal 2013.

Diluted earnings per share grew 26 percent in fiscal 2014 compared to last year.

Now, I will speak to results by segment, starting with health services.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 4 |

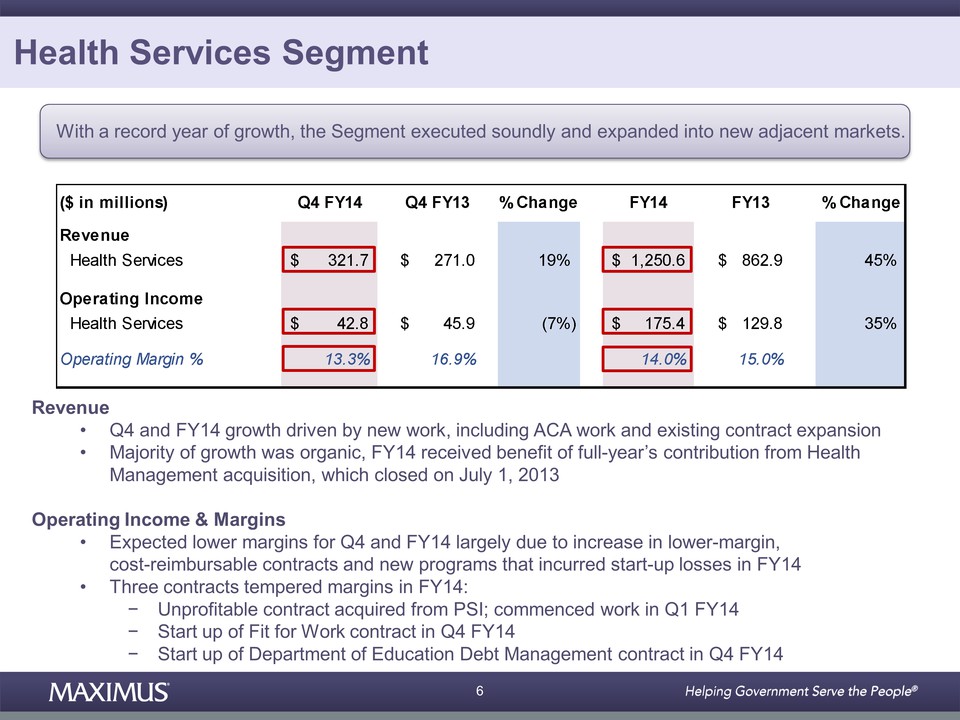

Our health services segment continues to deliver consistently strong results.

With a record year of growth, the segment executed soundly while at the same time expanding into new adjacent markets.

Health services segment revenue for the fourth quarter increased 19 percent to $321.7 million. And operating income for the segment totaled $42.8 million compared to $45.9 million for the same period last year.

The segment delivered an operating margin of 13.3 percent in the quarter.

For the full fiscal year, health services segment revenue grew 45 percent to $1.25 billion. And segment operating income increased 35 percent over the prior year to $175.4 million.

Operating margins remained healthy at 14 percent for fiscal 2014.

Revenue growth in both the quarter and fiscal year 2014 was driven by contributions from new work, including work related to the Affordable Care Act, as well as expansion on existing contracts.

While the majority of growth was organic, fiscal year 2014 also received the benefit of a full year's contribution from the health management acquisition in the U.K., which occurred in July 2013.

As expected, health services segment operating margins were lower for the fourth quarter and the full year.

This was largely due to an increased level of lower margin, cost reimbursable contracts, as well as certain new programs that incurred startup losses in fiscal 2014.

As a reminder, in the first quarter of 2014, we commenced work on an unprofitable contract that was acquired with the PSI acquisition.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 5 |

And in the fourth quarter, we had two large programs in startup, including Fit for Work in the U.K. and the Department of Education debt management contract.

In aggregate, all three contracts tempered margins for fiscal year 2014.

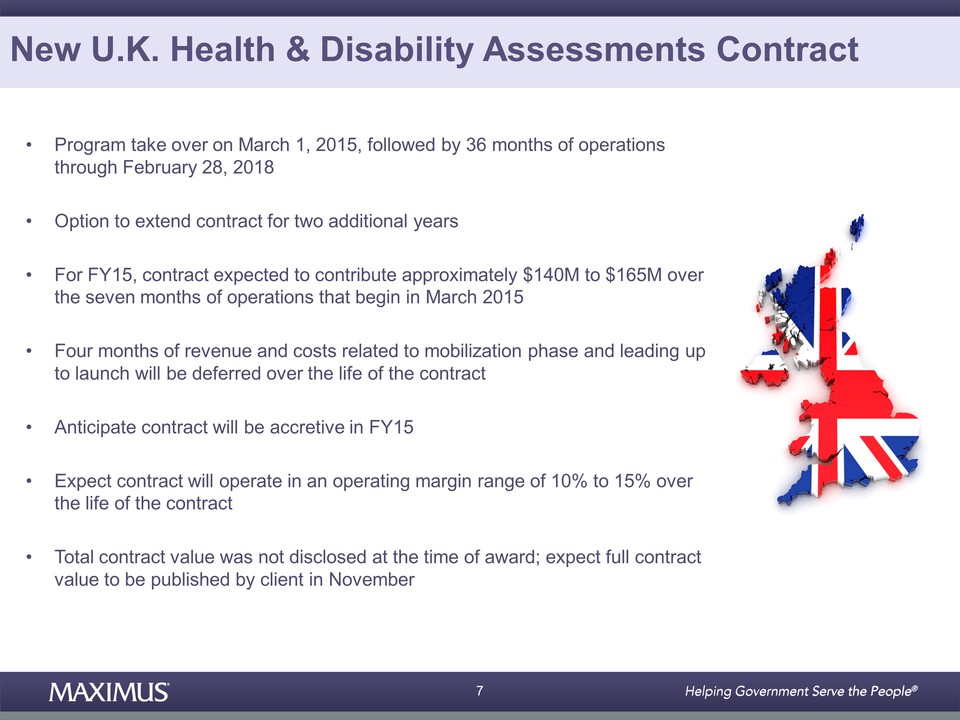

Subsequent to quarter close, the U.K. Department for Work and Pensions or DWP awarded MAXIMUS a new large contract to provide health and disability assessment services.

We're already hard at work and in the midst of a four-month transition and mobilization period.

Program takeover will be March 1, 2015, followed by 36 months of operations through February 28, 2018.

In addition, the DWP has the option to extend the contract for two additional years.

As we disclosed in our 8-K filing on October 30th, we expect that, for fiscal 2015, the contract will contribute approximately $140 million to $165 million in revenue over the seven months of operations beginning in March of 2015.

In addition, the four months of revenue and costs related to the mobilization phase and leading up to the launch will be deferred over the life of the contract.

We anticipate that the contract will be accretive to fiscal 2015.

We expect that the contract will operate in an operating margin range from 10 percent to 15 percent over the life of the contract.

Total contract value was not disclosed at the time of award, but we expect that the DWP will file the contract through its normal process in late November, at which time we anticipate the full contract value will be published.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 6 |

Rich will go into more details about the strategic win in his commentary.

In conclusion, another great year for the health services segment.

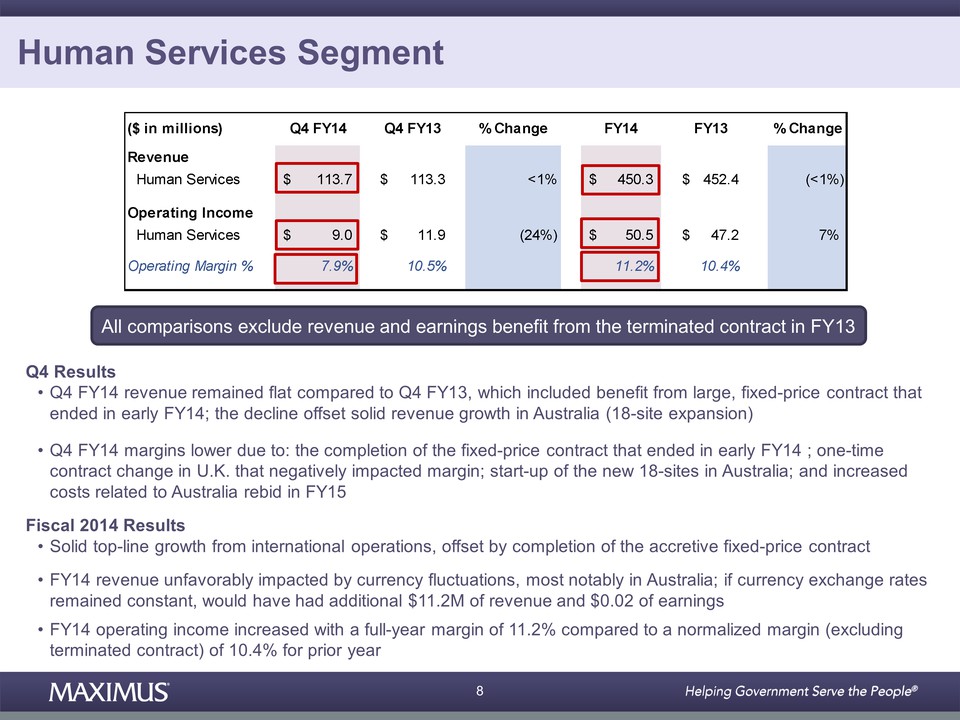

Let's turn our attention to financial results for the human services segment.

For simplicity, all comparisons to fiscal year 2013 exclude revenue and earnings contributions from the terminated contract.

For the fourth quarter of fiscal 2014, human services segment revenue remained flat at $113.7 million compared to the same period last year.

As a reminder, the prior-year period included the benefit of accretive revenue from a large fixed-price contract that ended earlier this fiscal year.

This revenue decline offset solid revenue growth from our Australian operations, where we launched 18 new sites as part of a recent reallocation under our job services Australia contract.

Fourth quarter operating income for the segment totaled $9.0 million, which reflects an operating margin of 7.9 percent.

As expected, fourth quarter margins were lower due to the completion of the fixed-price contract, a one-time contract change in the U.K. which negatively impacted margin, and lower margins in Australia due to the new site

startups and increased costs related to preparing for the rebid.

For the full fiscal year, revenue for the human services segment generated solid top-line growth from our international operations, which offset the expected completion of the accretive fixed-price contract.

Fiscal 2014 revenue for the human services segment was also unfavorably impacted by currency fluctuations, most notably in Australia.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 7 |

Segment revenue remained relatively flat at $450.3 million compared to the previous fiscal year.

If currency exchange rates had remained constant, we would've had an additional $11.2 million in revenue and 2 cents of earnings for the full fiscal year.

For fiscal 2014, operating income for the segment increased to $50.5 million with a full-year operating margin of 11.2 percent.

This compared to a normalized margin, excluding the terminated contract of 10.4 percent for the prior year.

Let me move on to discuss cash flow and balance sheet items.

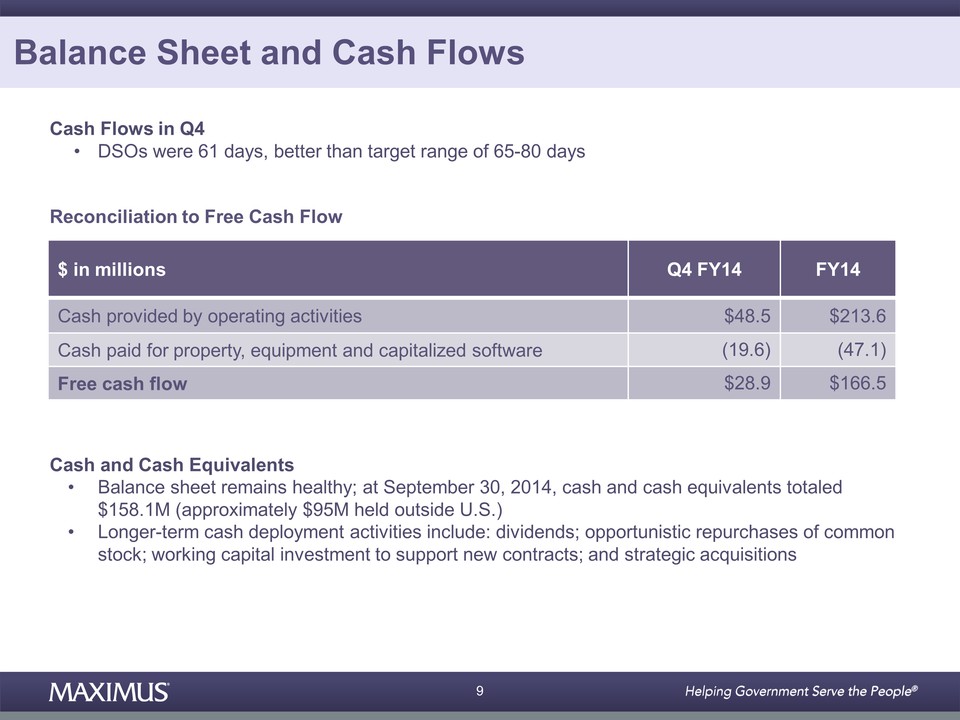

Days sales outstanding were 61 days for the fourth quarter, which is better than our target range of 65 to 80 days.

For the fourth quarter of fiscal 2014, cash provided by operating activities totaled $48.5 million, with free cash flow of $28.9 million.

For the full fiscal year, cash provided by operating activities totaled $213.6 million, with free cash flow of $166.5 million.

Our balance sheet remains healthy, and we ended the fiscal year with cash and cash equivalents totaling $158.1 million, of which approximately $95 million was held outside of the United States.

Our long-term cash deployment activities will continue to include dividends, opportunistic repurchases of common stock, working capital investment to support new contracts, and strategic acquisitions.

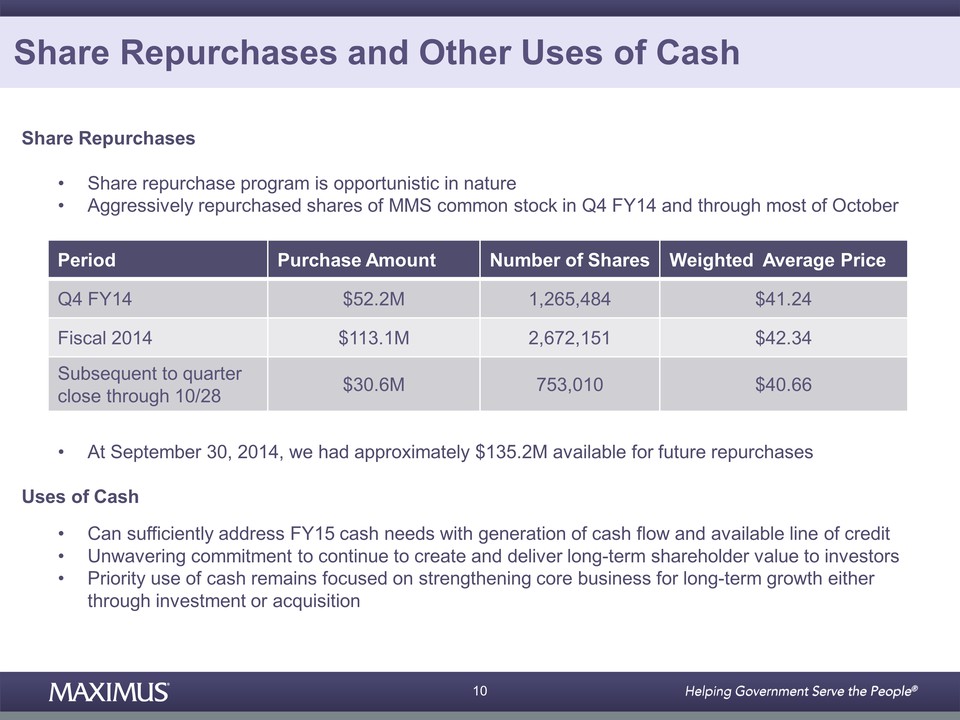

As we have previously disclosed, we consider our share repurchase program to be opportunistic in nature.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 8 |

As such, we aggressively repurchased shares of MAXIMUS common stock in our fourth fiscal quarter and throughout most of October.

During the fourth quarter, we spent $52.2 million to repurchase 1,265,000 shares of MAXIMUS stock, which is a weighted average price of $41.24.

For the full year, we repurchased a total of 2,672,000 shares for a total of $113.1 million, which is a weighted average price of $42.34.

At September 30, 2014, MAXIMUS had approximately $135.2 million available for future repurchases under its buyback program.

Subsequent to quarter close, we continued to buy, repurchasing an additional 753,000 shares for approximately $30.6 million, which is a weighted average price of $40.66.

With the generation of free cash flow and our available line of credit, we can sufficiently address our cash needs in 2015.

We have an unwavering commitment to continue to create and deliver long-term shareholder value to investors.

Therefore, we remain committed to sensible uses of cash.

Most importantly, our priority use of cash remains squarely focused on strengthening our core business for long-term growth, either through investment or acquisition.

Let me now speak to guidance.

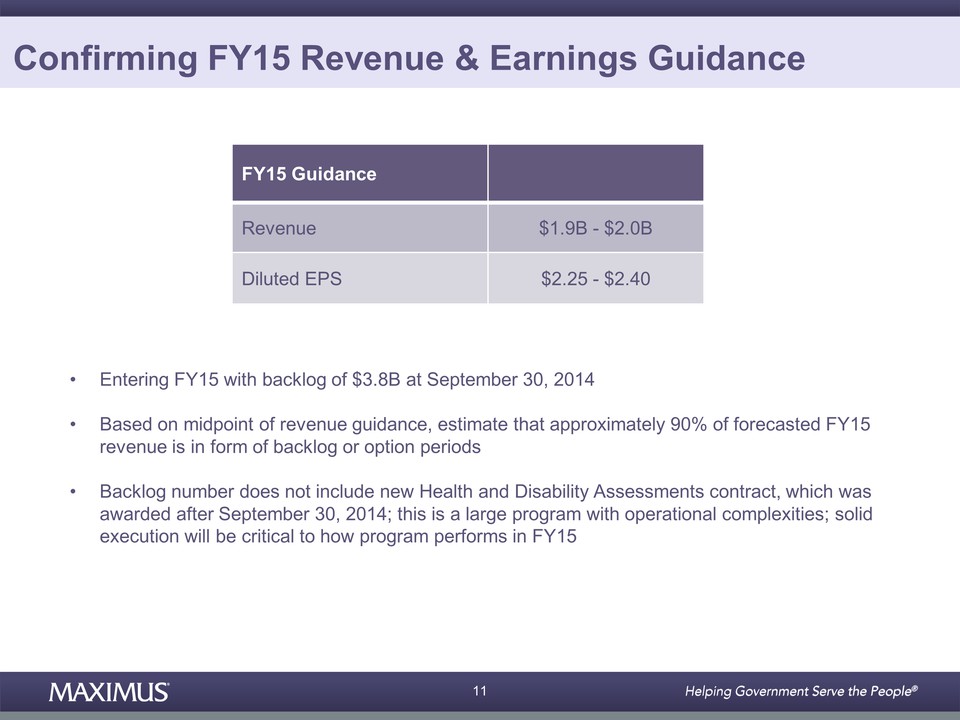

On October 28th, we established fiscal year 2015 revenue and earnings guidance.

Today, we are confirming that we still expect revenue to range between $1.9 billion and $2.0 billion and earnings per diluted share to range between $2.25 and $2.40.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 9 |

As you may remember, at the beginning of each year, we provide data on the percentage of forecasted revenue that is in the form of backlog or contract options.

We enter into fiscal 2015 with backlog of $3.8 billion at September 30, 2014.

Based on the midpoint of our 2015 revenue guidance range, we estimate that approximately 90 percent of our forecasted fiscal year 2015 revenue is in the form of backlog or option periods.

In addition, the backlog number does not include the new health and disability contract, which was awarded after September 30.

But, this is a large program that has operational complexities, and solid execution will be critical to how the program performs in fiscal 2015.

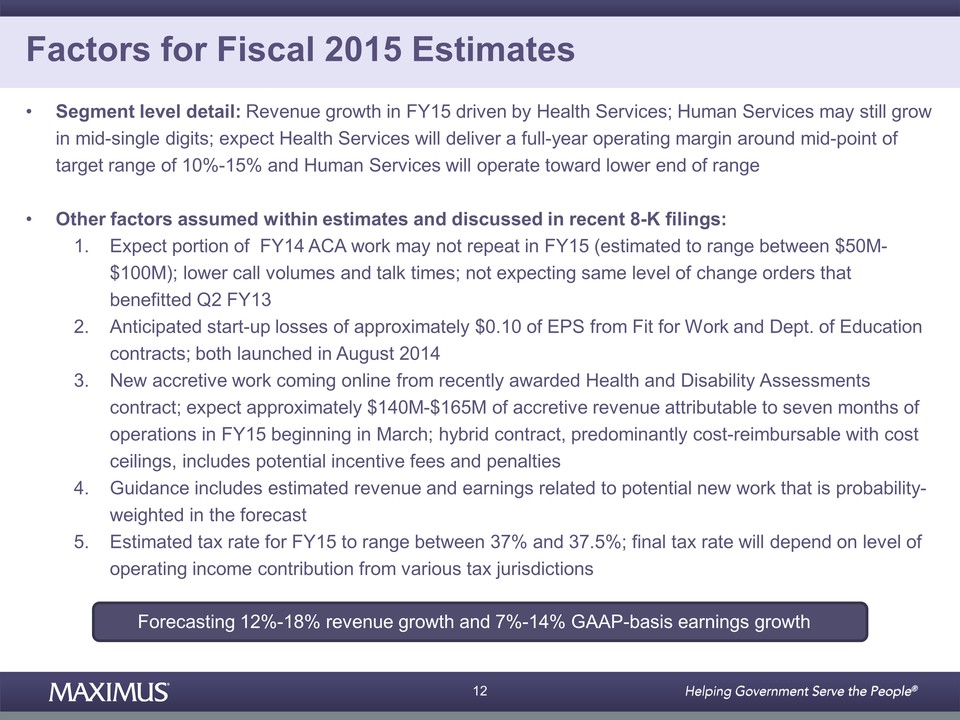

Drilling down into the details at the segment level, we expect that revenue growth in fiscal 2015 will be driven predominantly by the health services segment but that the human services segment may still grow in the mid-single digits.

We expect that the health services segment will deliver a full-year margin around the midpoint of our target range of 10 to 15 percent and that the human services segment will operate towards the lower end of the range.

Let me walk you through some of the other factors that are assumed within our estimates and discussed in our recent 8-K filings.

First, we expect that a portion of the Affordable Care Act work from fiscal 2014 may not repeat in fiscal 2015.

We have estimated this to range between $50 million and $100 million of ACA revenue that may not repeat in 2015.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 10 |

While it is difficult to precisely predict what the second enrollment period will look like, our estimates assume the call volumes and talk times will be lower as a result of better functioning technology and Websites.

This means that we are not expecting the same level of change orders that benefited last year's second quarter.

Second, we are anticipating startup losses of approximately 10 cents of earnings per diluted share from the U.K. Fit for Work and the U.S. Federal Department of Education debt management contracts, both of which launched in August 2014.

Our contracts are long term in nature, and while some may have startup losses, we expect every contract to generate solid economic returns that contribute to meaningful long-term shareholder value.

Third, we also have new accretive work coming online from the recently awarded health and disability assessment services contract in the U.K.

As I noted earlier, we expect approximately 140 million to $165 million of accretive revenue attributable to the seven months of operations in fiscal 2015 beginning in March.

This is a hybrid contract that is predominantly cost reimbursable with cost ceilings and includes potential incentive fees and penalties.

Fourth, our guidance always includes estimated revenue and earnings related to potential new work that is probability weighted.

And lastly, we're estimating that the tax rate for fiscal 2015 will range between 37 and 37.5 percent.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 11 |

The final tax rate will ultimately depend on the level of operating income contribution from our various tax jurisdictions.

So, when you add it all up, we are forecasting revenue growth between 11 percent and 18 percent and GAAP basis earnings growth between 7 percent and 14 percent for fiscal 2015.

We appreciate that investors prefer some insight into our quarterly performance.

Because of a number of variables; the quarters could fluctuate throughout fiscal 2015.

As you might expect, on a sequential basis, we are presently forecasting a strong first quarter driven by the seasonality with ACA open enrollment.

As with last year, we are again anticipating a dip in the second quarter as open enrollment winds down.

However, it is simply too soon to predict how consumer behavior might affect call volumes and talk times this year.

As we move into the third quarter, we will go live with the new health and disability assessment services contract, which should provide a boost to Q3 relative to Q2.

And as many of you know, we are in the midst of a rebid process for our job services Australia or JSA contract.

Should we be successful in the rebid, the new contract contains features that will cause us to experience startup losses on the new contract in our fiscal year 2015 fourth quarter.

The new contract is presently expected to start on July 1, 2015.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 12 |

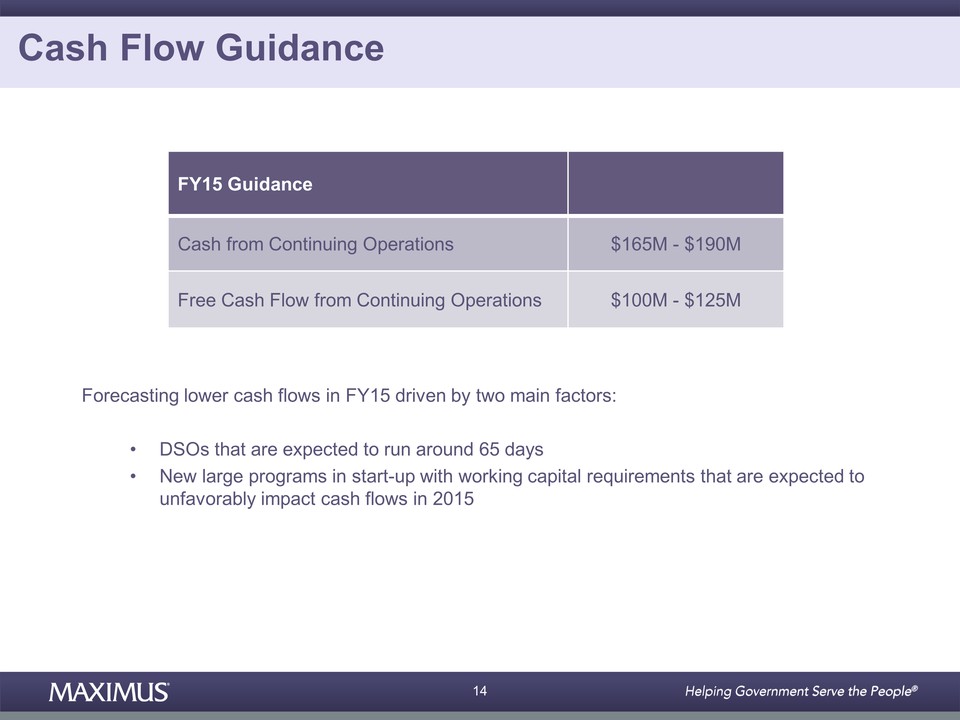

Wrapping up with cash flow guidance, we expect cash provided by operating activities to be in the range of 165 to $190 million for fiscal 2015, and we expect free cash flow to range between $100 million and $125 million.

We are forecasting lower cash flows in fiscal 2015 driven by two main factors.

First, we are forecasting DSOs to run around 65 days.

And second, we also have some new large programs in startup that may have working capital requirements that are expected to unfavorably impact cash flows in 2015.

In conclusion, MAXIMUS achieved another year of strong financial results.

Thank you for your continued interest.

And now, I will turn the call over to Rich.

Mr. Rich Montoni: Good morning, and thank you, Rick.

MAXIMUS is coming off a great fiscal 2014, and we are proud of our solid operational and financial results.

We continue to make significant progress towards our long-term strategic goals that are the underpinnings for consistent growth and creating shareholder value.

These include growing our operations outside the United States, expanding our U.S. federal operations to serve new agencies and programs, and continuing to grow our U.S. business.

In my remarks today, I will talk about how our achievements in the past continue to shape our expectations for the future.

Over the past eight years, MAXIMUS has experienced a remarkable transformation.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 13 |

We've optimized our business, shed noncore business lines, and launched a keenly focused growth platform that will benefit us for decades to come.

One of the primary ways we grow our business is through our land-and-expand model. This includes new geographies, new adjacencies, and new client agencies.

Across our entire portfolio of contracts, we have pertinent examples of this successful strategy.

We continue to demonstrate key strategic successes. Of special note, over the past 18 months; successes include two new contracts in the United Kingdom, Fit for Work and health and disability assessments; the ongoing expansion in Australia, where our top-rated performance has been critical to consistent expansion; and the recently launched debt management contract with the U.S. Department of Education.

So, let's start today with our new work outside the U.S., where we see continued demand for our services driven principally by two factors: reform efforts to address rising caseloads and improve the effectiveness of social benefit programs, and a trend towards more outcomes based government programs.

Our most recent contract award announcement was for the U.K.'s health and disability assessment service under the Department of Work and Pensions, which also goes by DWP.

As part of a broader welfare reform effort laid out over the last several years, the U.K. government developed criteria and assessment process for determining eligibility for various benefits programs.

Under this new contract, our role is to conduct assessments for individuals seeking certain disability benefits according to the rules set down by Parliament.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 14 |

The results from each assessment are then used by DWP to determine the level of support for different benefits.

Our performance under this program is tied to quality, timeliness, and the number of assessments completed.

Since MAXIMUS does not make the final determination on benefits, we have no financial incentive to determine if someone is eligible for benefits or able to return to work.

There has been a considerable amount of press on this program, and there is also a wide range of views on welfare policy in the United Kingdom.

As you may have read, the program faces significant challenges out of the gate that will take some time to improve.

We believe that our experience and expertise makes us ideally suited to tackle some of the challenges that exist today.

Our number one goal under the program is to improve the overall customer experience.

We want to reduce the long wait times, improve the quality of the assessment, and make the assessment process less intimidating for customers.

This should also help reduce the number of people who failed to show up for their assessment, which has been a concern in the past.

This win is right in the heart of our core services, and we bring a proven track record of turning around troubled programs as we did in British Columbia and Texas.

There, we made sizable improvements and delivered a significantly improved service to program participants over the long run.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 15 |

The health and disability assessments contract win comes on the heels of our new Fit for Work contract.

The Fit for Work program was a result of the government review of employee sickness absence.

A DWP analysis considered how the current sickness absent systems could be improved to help people stay in work, reduce cost, and contribute to economic growth.

The analysis also found that there were 140 million days lost to sickness absence, costing employers GBP9 billion each year.

The Fit for Work program was established to help employers and employees balance medical conditions and work requirements more effectively.

The program offers small- to medium-sized businesses access to occupational health assessments and return-to-work plans for people who reach or are expected to reach a four-week sickness absence period.

As I mentioned in the last quarter, we are in the mobilization phase and will begin a phased operations launch next month.

Both of these contracts are great examples of how our services meet the needs of governments by addressing rising caseloads to more effectively manage benefit programs in implementing performance-based metrics to achieve the outcomes that matter.

They also provide confirming data points for our U.K. land-and-expand model.

We completed a strategic acquisition of HML in July of 2013 and built off the solid reputation established by our human services team.

Our human services and HML personnel in the United Kingdom deserve recognition for their contributions to these key wins.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 16 |

Turning now to Australia, where we also have more positive news to share, the team has done a tremendous job of expanding our business with consistently solid results under the star ratings program.

Recently, the Australian government decided to move caseloads that were historically managed in house to outside providers.

These caseloads relate specifically to the Disability Employment Services program or DES where MAXIMUS has been a strong performer.

Just last week, we were notified that MAXIMUS was a successful bidder for this new work.

This win will effectively double our DES book of business taking our current DES run rate from about $30 million a year to approximately $60 million a year.

The new work will begin in March and will provide a partial-year contribution that is already baked into our fiscal 2015 guidance.

As Rick noted, the Australian team is also hard at work on the JSA rebid.

Our response to the tender is due later this month, and we expect to hear the results in the spring.

As a reminder, this rebid is not expected to be a winner-take-all award.

Based on past procurements, the awards are done on a location-by-location basis.

As evidenced by our organic growth in Australia alone, MAXIMUS has excelled in this outcomes-based market, and we remain cautiously optimistic about our position on this important rebid.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 17 |

Moving now to our operations inside the U.S., where we are gearing up for the next Affordable Care Act open enrollment period, this starts this Saturday and runs through February 15th, 2015.

We expect this year will be smoother with fewer technology challenges for the exchanges as states and the federal government apply the lessons learned from last year.

Overall, we believe that volumes may be lower due to improved technology and more self-service tools.

However, this open enrollment period will include new tax forms, individuals renewing current coverage, and new populations.

So, it's difficult to predict how these factors might impact call volumes and talk times.

The enrollment trends for exchanges remain fluid, and we still expect that activities won't reach a steady state for several years.

Therefore, we continue to believe future opportunities will develop for supporting our clients with the ongoing implementation and stabilization of the Affordable Care Act.

These include work for the various exchanges, as well as helping states adapt their Medicaid programs to meet program requirements.

Let's turn our attention to rebids.

For fiscal 2014, we either won or were extended on approximately 91 percent of the total base contract value of our rebids.

As we've mentioned on previous calls, fiscal 2014 was a lighter rebid year, but all in all another great year for securing the base.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 18 |

For fiscal 2015, we have 10 contracts up for rebid, where the combined total value of the base contracts is approximately $1.2 billion.

This includes the Australian JSA rebid, which we presently estimate to be approximately $690 million over the five years.

This updated value now includes the contributions from the recently reallocated sites.

In addition, we also have our Texas eligibility support contract up for rebid.

The contract runs through December 2015, and the total contract value is estimated to be $324 million over its three-year life.

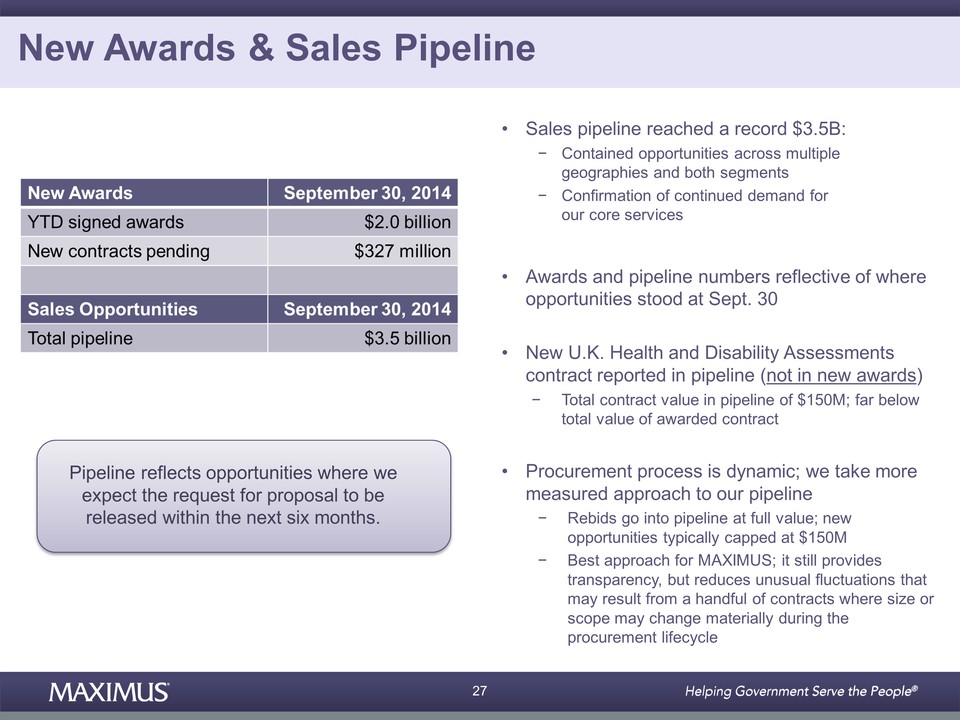

Moving onto new awards in the pipeline, fiscal 2014 was another solid year of strong sales awards for MAXIMUS.

For fiscal 2014, final year-to-date signed contracts were $2 billion.

We also had an additional $327 million in new contracts that have been awarded but not yet signed as of September 30th.

We are also excited to share that our sales pipeline reached a record $3.5 billion at September 30th, 2014.

The pipeline contains new opportunities across multiple geographies in both segments and serves as confirmation of continued demand for our core services.

As a reminder, our awards and pipeline numbers are reflective of where opportunities stood at September 30th.

Therefore, the new U.K. health and disability assessments contract is reported in the pipeline and not in new awards.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 19 |

The new contract is carried in the pipeline at a total contract value of $150 million, which is far below the total value of the awarded contract.

The procurement process is dynamic. So, we take a more measured approach to our pipeline.

While rebids go into the pipeline at full value, we cap the value of new opportunities typically at $150 million.

We believe this is the best approach for MAXIMUS. It still provides transparency, but reduces unusual fluctuations that might result from a handful of contracts where the size and scope of the contract may change materially throughout the procurement lifecycle.

And as a general reminder, our reported pipeline only reflects opportunities where we believe the RFP is expected to be released within the next six months.

We believe this offers a higher-quality view into opportunities on the horizon.

As we've said in the past, governments around the world face the same challenges of increasing populations, rising caseloads, and the need to effectively manage their social programs.

And as many of you already know, the demand trends for our business can span decades.

We enter into contracts that are sometimes up to 10 years long. And as Rick noted, we expect all of our contracts to provide meaningful returns and contribute to long-term shareholder value over the life of the contract.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 20 |

While some contracts may generate initial startup losses, our historical experience is that, in subsequent years, they become accretive and are in line or better than our overall portfolio margin targeted in the range of 10 percent to 15 percent.

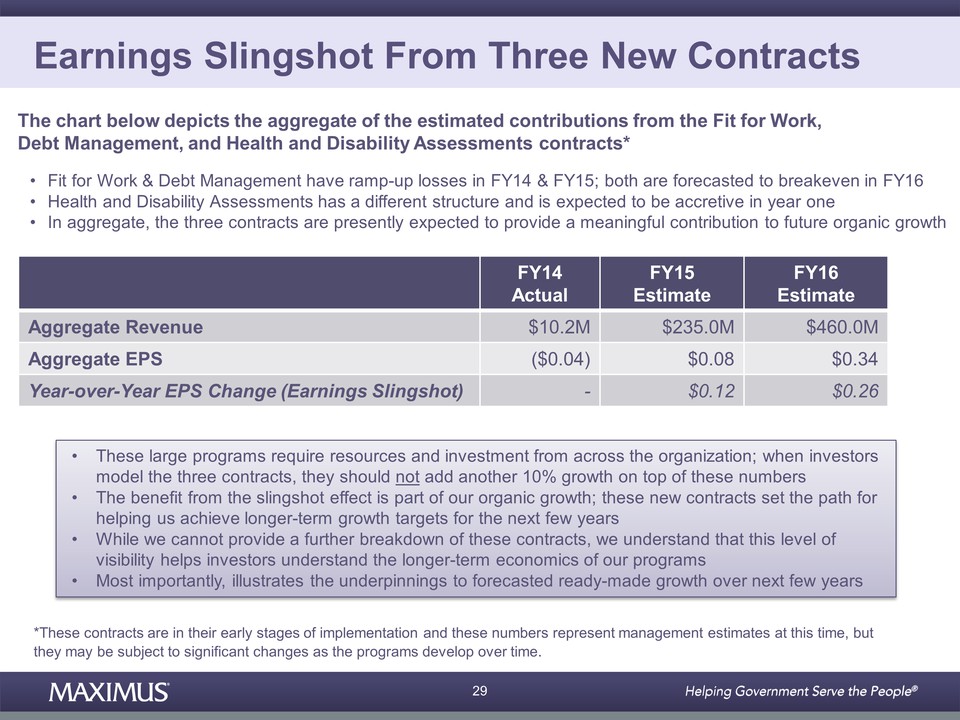

The Fit for Work and debt management contracts have ramp-up losses in fiscal 2015, and both are forecasted to breakeven during 2016.

Our new health and disability assessments contract has a different structure and is expected to be accretive in year one.

So, in aggregate, these contracts are presently expected to provide a meaningful contribution to our organic growth targets over the next few years.

In fiscal 2014, two of the three contracts were active and had $10.2 million in revenue but losses of approximately 4 cents per share.

In fiscal 2015, we expect the three contracts in aggregate to contribute approximately $235 million in revenue and 8 cents of earnings per share.

So, the aggregate slingshot off these three startups in fiscal '15 is approximately 12 cents of earnings per share.

Looking ahead to fiscal 2016, we are forecasting approximately 460 million in revenue and about 34 cents of earnings per share from these three contracts.

This sets up an earnings-per-share slingshot of 26 cents in fiscal 2016.

It's important for investors to understand that these programs are large. They require resources and investment from across the organization.

When investors model these out, they should not add another 10 percent growth on top of these numbers.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 21 |

The benefit from the slingshot effect is part of our organic growth, and these new contracts set the path to helping us achieve our longer-term growth targets for the next few years.

So, in summary, we're coming off a great fiscal 2014. And all things being equal, the table is set for solid growth in 2015 and well beyond.

We're excited about the significant progress we've made in establishing ourselves in the markets, new adjacencies, and new agencies.

The increasing demand for our services is evidenced by our successes in these new areas.

With a growing business and solid demand, both inside and outside the U.S., we believe that MAXIMUS should no longer be viewed as just another Affordable Care Act play.

Around the globe, governments continue to seek solutions for balancing the need to provide diverse populations with social benefits with operating cost-effective public programs.

We believe that MAXIMUS remains well positioned to partner with governments to improve overall program efficiency, deliver the outcomes that matter, and achieve value for taxpayer dollars, and most importantly deliver the best service to citizens.

And before I open it up to questions, I just want to take a moment and thank our more than 13,000 employees worldwide for their unwavering dedication to helping people access government, health, and social services programs.

Helping people is the heart of what we do, and we're proud of it.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 22 |

I also extend my congratulations to Bruce Caswell on his appointment as President, which was effective October 1st. Congratulations, Bruce.

And with that, let's open it up for questions. Operator?

Operator: Thank you.

We will now be conducting a question-and-answer session.

If you would like to ask a question, please press star-one on your telephone keypad.

A confirmation tone will indicate that your line is in the question queue.

And you may press star-two if you would like to remove your question from the queue.

For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys.

In the interest of time and so that other participants have the opportunity to ask their question during the conference as well, we ask that you please limit yourself to one question and one follow-up question during the Q&A.

Our first question comes from the line of Charlie Strauzer with CJS. Please proceed with your question.

Mr. Charlie Strauzer: Hi, good morning.

Mr. Rich Montoni: Good morning, Charlie. How are you?

Mr. Charlie Strauzer: Good. Thanks. Rich, if we could expand a little bit more on the pipeline, it's swelled significantly over the course of the year, especially, even sequentially from last quarter.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 23 |

And when you look at that--that 3.5 billion number and you look at, you know, quote, kind of that growth there, does that include--obviously, it includes, some expectation from--like you said, from the new U.K. contract.

But, obviously, that does not include no longer the Ireland contract because I think that was awarded to another party. Is that correct?

Mr. Rich Montoni: That's correct, Charlie. On the Ireland contract, that was said and done by September 30th.

The Department of Social Protection in Ireland, did make a public announcement.

They combined four of the regions in Ireland into two combined lots.

MAXIMUS was not selected as a vendor for either combined lot.

By the way, we were ranked, highest from a technical score perspective, but price ended up being the deciding factor in the award.

Mr. Charlie Strauzer: Got it. And then when you--just a little bit more color, if you can, on the timing of the pipeline.

I know you said that, you know, RFPs will be, you know, let out in the next six months in that number.

But, just a general timeframe of when you think some of these awards could be made.

Is it more, you know, the bulk in '15, or is it more kind of slipping, you know, half and half in '15 and '16?

Mr. Rich Montoni: Well, it really is across the board.

I think the pipeline metrics--and you're right, we keep a short-term look-see on it.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 24 |

We do not include items where we think it's going to take more than six months for the RFP to come out the door.

So, I think a lot of it is in fact fiscal '15, new sales opportunities, and it's across the board.

Keep in mind it also includes rebid situations as well. And we've got couple of big rebids.

We've mentioned Australia. We mentioned Texas, which'll be fiscal '15 event, so there in that--in that pipeline opportunity.

But, I'd also say that a lot of the pipeline is new work.

Mr. Charlie Strauzer: Thank you very much.

Ms. Lisa Miles: Next question, please?

Operator: Thank you. And our next question comes from the line of Dave Styblo with Jefferies. Please proceed with your question.

Mr. Dave Styblo: Good morning. Thanks for taking the questions.

First one out was--it was just on the bridge. If you could help me understand the revenue guidance because I just can't help but feel like there's a healthy dose of conservatism in there, or there's an element I'm missing.

I guess, during the last earnings call, management pointed to revenue growth of upwards of 10 percent plus.

And so, the guidance now implies 15 percent at the midpoint. But, it's only about mid-single digits when you exclude the U.K. health and disability award and then partial Australia disability award.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 25 |

So, I know you obviously probability-weight your pipeline. But, it seems we went from revenue growth of 10 percentish plus to 5 percent, excluding, those two announcements. So, can you help me connect the dots there?

Mr. Rich Montoni: glad to do it, Dave. And I'm going to ask, Rick Nadeau to take a first pass at it. and then I may come back and share my thoughts as well.

Mr. Rick Nadeau: sure. as we--as I said on the call, at the beginning of the year, we had 90 percent of our, estimated revenue for 2015, sitting in the backlog. And that meant that 10 percent was, in that pipeline, weighted.

I think, if you look at it, I wouldn't exclude the, HDAS from the--from that calculation. I think that is part of our organic growth.

If you do put that HDAS, contract into there, yes, I think we are creeping up, into the, you know, higher 90s.

And so, yes, I would feel like, our revenue guidance is, less risky than our earnings, guidance on the other side.

I'd have to caution you that we have a number of startups and, in particular, that, health and disability assessment services contract.

And I think that those startups are risky, both from the timing of revenue and in the requirement that you have excellent execution on them.

So, yes, if you wanted to make an observation that our revenue, guidance was less risky than our earnings guidance, I think I would agree with that. but, I will caution you that we do have to have excellent execution on that contract.

Mr. Rich Montoni: And, Dave, I would add it's great to have these new wins that put us into double-digit topline zone.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 26 |

And we do have a nice slingshot impact, into fiscal 2016, from these three contracts as we mentioned on the call.

But, I think, as part of any organization, you have some new work, and we're very fortunate to have a lot of new work that we're winning.

Yeah, but, you also have some work that does roll off, and you need to keep that in mind.

So, as we did in fiscal--as we go from '14 to '15, we do think there's some of the Affordable Care Act that's going to roll off. So, it goes in the other direction.

And you're right. We do take our sales pipeline and probability affect it. And that's what landed us in the guidance that we have on the table today.

Mr. Dave Styblo: Okay. And my follow up is just on, your strategy for, I guess, delicately handling the U.K. health and disability award. Obviously, it's been high profile in the news.

What--and you started to elaborate on this during your prepared remarks. But, what is it that you can do to mitigate the risk? And what are some of the things that could go wrong that either affect revenue, the penalties, and the risk to earnings?

Can you help just flesh those out on the downside that we would need be worried about?

Mr. Rich Montoni: Yeah, I'm going to talk about, the first part of your question. And then Bruce Caswell is here as well. And Bruce can talk about some of the penalties and the credits in the sense that it's--it is a hybrid type contract, fundamentally cost plus. But, there are some adjustments to that.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 27 |

In terms of management, I just think that MAXIMUS has the right culture, you know, the right history, and, the right, I'd say attributes to do this type of work.

It is one where it's received a lot of attention in the past. it is an area that impacts a lot of individuals.

So, we're going to have to--we will take over workforce for the current provider. And we're going to work very hard to provide the best people that we have across all of MAXIMUS. And we've already started that with the mobilization phase.

And, we're going to work very hard to drive our culture and our values into this program. And we'll be open about it. It's going to take a long time to make improvements. And, we're going to be receptive to suggestions in terms of how you improve the process.

Bruce?

Mr. Bruce Caswell: Thanks, Rich. And, Dave, some other factors you'd asked, you know, what are some of the key elements of the ramp up of the program?

The biggest one is really the conversion of the existing staff over from Atos as the incumbent provider, as we ramp up to the March launch, and then the hiring of additional staff, so that we can hit the peak requirement for, healthcare professionals and related staff, to meet the volume targets and objectives for the first year of the program.

As you've probably read, there is a meaningful backlog that we're seeking to reduce. And I think it's--we've said, you know, presently in the press recently that it could take about 18 months to reduce that backlog.

So, the key driver is really the staffing plan and the conversion over from the prior contractor in terms of staff and facilities.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 28 |

Ms. Lisa Miles: Thanks, Dave. Next question, please?

Operator: Thank you. And once again, as a reminder, you may press star-one on your telephone keypad if you would like to ask a question at this time.

And our next question comes from the line of Richard Close with Avondale Partners. Please proceed with your question.

Mr. Richard Close: Yes, thank you. Just really quick, I'd like to hit on the one-time U.K. contract change, if you can go into that a little bit.

And then as a follow up, the JSA startup losses that you discussed, you know, if you potentially win--rewin that, business, can you go through that?

Mr. Rick Nadeau: Yes. This is Rick. on the first, item you ask about is that U.K.--it's the work program contract.

And, there was an amendment to the contract that affected all of the, participants in the contract. And it really related to technically how you were do--we were doing a calculation and the whole industry was doing a calculation inside the contract.

And so. What you have is, the amendment caused us to, and have an adjustment to the cumulative profit.

So, it--you know, it weights--it has an--a high-weighted effect on that particular quarter.

Mr. Richard Close: --Can you quantify that?

Mr. Rick Nadeau: Well, I--we don't quantify on individual contracts. But, that would be, you know, a one-time adjustment to that profit. So, we would think that we would go back to a normal profit level run on that contract on a going-forward basis.

The-- JSA contract, the new contract is expected to start on July 1.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 29 |

As Rich said, that's not a winner-take-all type of arrangement.

But, the new contract does have a feature in it where, payments that we get are spread out over a longer period of time.

And so, we'll actually have some reduced cash flow in the early parts of the contract.

And the way we have to account for that, that will actually hurt our income statement in the fourth quarter.

We have assumed, a level, area of-- our, market share there.

Obviously, if we win more, then that will impact you, proportionately, or if we win less.

Ms. Lisa Miles: Thanks, Richard. Next question, please?

Operator: Thank you. And our next question comes from the line of Brian Kinstlinger with Maxim. Please proceed with your question.

Mr. Brian Kinstlinger: Great. Thanks. You mentioned 90 percent of your revenue guidance is in backlog or some form of.

Is that the low or midpoint? And is that based on the quarter end backlog or the backlog that you sit with today that includes your health and disability contract?

Mr. Rick Nadeau: That was the year-end. And so, it did not include the health and disability assessment services contract that we won in October. And it goes to the, midpoints.

Mr. Brian Kinstlinger: Okay. And then, the follow up that I've got is, the human services segment has really stalled it seems like on the top line over the last four to six quarters for a variety of reasons.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 30 |

And you're expecting, single-digit growth and maybe mid-single-digit growth in '15.

In the past, you've said there's plenty of opportunity within that segment.

So, I'm wondering if something changed in that market competitively. Is pricing the main culprit? And maybe go through what the pipeline looks for the welfare-to-work type programs.

Mr. Rich Montoni: good morning, Brian. This is Rich. I'm going to try to answer--.

Mr. Brian Kinstlinger: --Hi, Rich--.

Mr. Rich Montoni: --Your question. Good morning. I think you've got a number of questions in that one question.

So, health and human services, has been at the lower end of the 10 to 50 percent targeted range for the portfolio.

You will note that, in the fourth quarter of this year, it was 7.9 percent, which is even below that 10 percent lower end.

By the way, Rick talked about in his call notes the drivers to that being that work program amendment, which was just discussed, some good news, new work, new sites in Australia, which is new work, and also, we had, some work pushed to the right.

When you normalize that 7.9 percent for all of those three items to give you some quantification, human services would've been north of 10 percent, operating income.

So, we don't see the 7.9 percent as being a recurring, op--operating income for human services.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 31 |

We--it's had some wins. It's done well, more notably internationally than U.S. domestic.

I just think, in the U.S., all eyes have been on the Affordable Care Act in healthcare. We shall see as we move forward.

There are some early indications that some of the human services-related programs may get more attention and may generate additional opportunities as we move down the road.

Is that helpful, Brian?

Mr. Brian Kinstlinger: Thank you very much.

Mr. Rich Montoni: Sure.

Ms. Lisa Miles: Thanks, Brian. Next question, please?

Operator: Thank you. And once again, as a reminder, you may press star-one on your telephone keypad if you would like to ask a question.

Our next question comes from the line of Carl McDonald with Citigroup. Please proceed with your question.

Mr. Carl McDonald: Great. Thank you. So, first question was on, the JSA contract in Australia.

What is your market share now with the 18 sites? Basically, what I'm trying to get to is, relative to your, call it, 700 million contract value, what is the total contract value in Australia?

Mr. Rich Montoni: Fair enough, Carl. Good morning. And I'm going to ask Rick Nadeau to handle that question, the JSA, Australia contract market share I think is your question.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 32 |

Mr. Rick Nadeau: Yeah, it's about 12.5 percent.

Mr. Carl McDonald: Got it. Okay. anything, in the--now that the RFP has been released, anything in the RFP, you know, other than that, you know, fourth quarter issue you mentioned that changes your view of where the--margin on that JSA contract will end up, relative to what you've, generated the last few years?

Mr. Rick Nadeau: No, not really. I think it'll have more variability than, fixed pricing in it. But, I think the margins we expect would be similar to where we're performing today.

Mr. Carl McDonald: Excellent. And then, if you could just remind us on the, Texas eligibility support contract, I believe you've had that since the late 1990s.

But, just sort of--just some general color on how long you've had that contract, how many rebids you've gone through over that period of time.

Mr. Rich Montoni: Carl, we have Bruce Caswell with us here. And it ultimately reports to Bruce. So--.

Mr. Bruce Caswell: --Sure--.

Mr. Rich Montoni: --Yeah, we've won, I think, one rebid at least with that situation.

Mr. Bruce Caswell: That's right. Exactly. And we've held that contract since the probably 2005 time range because this is--I want to make the distinction that there are really three pieces of work we've historically done in Texas, the eligibility support services, the CHIP program operations, and the Medicaid managed care enrollment broker work.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 33 |

And this relating to eligibility support, was from that 2005/'06 timeframe and has been won once before.

Ms. Lisa Miles: Thanks, Carl. Next question, please?

Operator: Thank you. And our next question comes from the line of Richard Close with Avondale Partners. Please go ahead with your question.

Mr. Richard Close: Yeah, so, just a follow up to make sure I, understand the disability assessment contract and where it sits in your pipeline.

If you can go over that, I know you had some bullets, on your presentation. But, I think you said you had 150 million cap. and walk us through those caps.

And when we get an 8-K or some sort of, formal, statement, I guess, on the total value of the contract, at that point, does it go in at a greater rate?

Mr. Rich Montoni: Richard, let me try and, help you with that one. We do--in our sales pipeline; we put a cap on what we refer to as new work.

So--and the reason we do that is because, with new work, new contracts, it's very, very judgmental in terms of the amount of the ultimate contract.

We may expect that, government X is going to come out with a bid in six months. And we think it may be a five-year contract, and a run rate of X. And ultimately; it ends up being a one-year contract and a run rate of Y.

So, so that we basically button up and firm up the credibility in the pipeline, we'll put a cap on such things.

For existing work, we will put it in our existing run rate. So, rebid type situations, like Australia, like Texas, we'll put that in the sales pipeline, generally at the--at the current run rate, or if we've got some known increases, we'll put it in.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 34 |

So, it will oftentimes and in fact does at September 30th exceed the $150 million amount, the cap that we otherwise put on new work.

And as it relates to HDAS, we did put--we did have that in our, sales pipeline. I believe we re--had it recorded as pending, proposals pending at, $150 million.

So, obviously, since we've won that, at a much higher amount, we will report that as a sale, not a sales pipeline, but as a win, at the actual amount, which is much greater than 150.

Mr. Richard Close: Okay. And then, I guess a final question for me is, you've had an incredible amount of success here, on disability and assessment recently.

And I wonder if you could talk about the overall pipeline, how you see that breaking out in various products. I mean, is there more disability in the assessment business to be won out there, how you feel about that?

Mr. Rich Montoni: You know, I'm not going to slice and dice the sales pipeline. But, I will say this, that I do think--and this fits into something that we've said for a very, very long time and really is a strategic, underpinning.

And we do think that governments are pressured, with more individuals and, unfortunately, more of them, looking to their government, either for financial help or health assistance or a combination of all of the above, and oftentimes job assistance.

And those pressures are really compelling governments to do a couple of things. They're looking to firms like MAXIMUS to bring world-class capabilities to the table.

But, they're also having to perform more assessments and as more appeals that go along with it.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 35 |

So, whether it's the United Kingdom or here in the U.S., you have similar pressures in the Veterans' Administration and the Social Security Administration. And I could go on and on. And it even occurs on a state-by-state basis.

I view all of this as really just confirming data points to that longer-term strategy.

Ms. Lisa Miles: Next question, please?

Operator: Thank you. And our next question comes from the line of Frank Sparacino with First Analysis. Please proceed with your question.

Mr. Frank Sparacino: Hi, guys. First, just wanted to start with, can you give us a sense of how you are thinking about the exchange activity this year, you know, in terms of some of your assumptions?

Obviously, we've seen some of the new enrollment projections. But, also, you know, I noticed, New York, one of your clients, was increasing their call center capacity.

So, just trying to understand some of the dynamics, to sort of the baseline, you’re thinking going into the year.

Mr. Rich Montoni: Frank, I know that, Bruce Caswell would welcome the opportunity.

Mr. Bruce Caswell: Hey, Frank. Good morning. And, you're right that, you know, first of all, you have to keep in mind that, this enrollment period is half the length of the prior one. So, it's a three-month enrollment period versus a six-month enrollment period.

So, it's not uncommon across the board to see some clients increasing their call center staffing, as we get into it.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 36 |

California, similarly, has announced they're going to do that. And there was an article in the New York Times yesterday that spoke to other states that are doing that.

So, I would say there are kind of puts and takes across the entire system that we've baked into our guidance.

And you know, staffing is one element. And, ultimately, the call volumes that we're going to see are really a function of a number of factors.

You know, this is the first year when we're going to have, renewals coming into the system.

I think HHS's most recent number was somewhere in the range of 5.9 million.

We're going to have folks that will be receiving in January these, tax forms related to their advanced premium tax credits and calling the customer contact centers to address with that, questions related to that.

We'll have new enrollees coming into the system. And that's an interesting one because, some, you know, statistics that I've read recently would suggest that the majority of the remaining uninsured are actually unaware that open enrollment's beginning, later this week.

And so, the amount of money that the states and other entities will put into outreach is going to be a key determinant of call volumes as well.

So, as we look at it across the board, it's really, difficult to predict, what the ultimate impact's going to be.

And we've, you know, tried to staff up, following guidance from our clients accordingly and, be prepared to see how it plays out.

Does that help?

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 37 |

Mr. Frank Sparacino: It does. Thank you, Bruce.

And maybe, lastly, just sort of a follow up I guess to Richard's question around, you know, health. Obviously, you've had a ton of success in the U.K. I don't know how much more room there is to run in the U.K.

But, I'm interested in, when you look at other countries, you know, with significant opportunities like you've had in the U.K., whether it's Australia, can you just talk about, you know, maybe what you think are some, ideal countries or new markets to enter on that side?

Mr. Rich Montoni: I'm not going to mention any specific countries for competitive reasons.

But, my overall observation in handicapping how this all happens is that, once a country decides to move aggressively towards partnerships like this, and certainly the United Kingdom and Australia, have headed in that direction, and we're starting to see an increasing propensity to outsource, as we refer to it, even here in the U.S.

Then I think it opens up the door for a significant amount of new work.

And, we do, as a matter of, course, pulse other countries. and I do think that there is a long-term trend out there. And I--as I've always said, it's difficult to handicap which particular country at what point in time is likely to move from a low propensity to outsource to an increased propensity to outsource.

But, I think it's likely we'll see additional countries as we move forward. But, I'm going to decline the opportunity to mention which ones.

Ms. Lisa Miles: Thanks, Frank. Next question, please?

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 38 |

Operator: Thank you. And our final question comes from the line of Brian Kinstlinger with Maxim. Please proceed with your question.

Mr. Brian Kinstlinger: Great. Thank you. As it relates to health and disability, is there any reason to assume the average monthly revenue is not a proxy for future revenues?

I guess, what I'm asking, is there any work that you are doing that won't repeat, or is there any work that you're not doing yet, and as you get more efficient, you'll be able to increase your volumes?

Mr. Rick Nadeau: Yeah, Brian. It's Rick. I think, I said in my prepared comments that the mobilization of that--those payments we got for that get spread over the entirety of the contract.

So, the revenue that we quoted in there is really seven months' revenue, March 30--March 1, 2015, through September 30, 2015.

But, that contract's in a ramp period during that. And so, I would think that you would expect to see the full-year FY '16 revenue be greater than 12 times--12 divided by seven times the number that you--.

Mr. Brian Kingstlinger: --Right--.

Mr. Rick Nadeau: --See there. It will be a greater number in FY, '16.

Mr. Brian Kingstlinger: Great. And the last question I--.

Mr. Rich Montoni: --I just want to make it clear we did provide some estimates as it relates to, the estimated slingshot impact of the three contracts, which includes the HDAS. So, I think we've baked that element into it.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 39 |

Mr. Brian Kinstlinger: Right. And as it relates--we haven't talked about Medicaid expansion in a while.

I guess, I'm wondering if the states that have elected to expand Medicaid that--where you're the enrollment broker, I'm curious, under this first year that you have under your belt, how much of the incremental potential volume have you captured, do you think?

Mr. Rich Montoni: Bruce Caswell?

Mr. Bruce Caswell: Yeah, that's a great question. And, it's important to remember that we're actually not, the determiner of eligibility for these state Medicaid programs.

And so, when we get new enrollments, we don't know whether that's somebody who's previously ineligible coming into the system, like a woodwork effect person, versus a Medicaid expansion effect person. so, it's difficult to break that out.

But, I will say that I think, if you look at some of the Kaiser data, you know, Medicaid rolls have grown through expansion nationally by about 8.3 percent.

Mr. Rich Montoni: Right.

Mr. Bruce Caswell: So, you can make some assumptions in there.

Also, I might also mention that--you know, and I think you've probably read this as well that the effect of the midterm elections on Medicaid expansion is probably not substantial, in that, you know, any, incumbent Republican governors, who were against expansion previously, generally won office again.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 40 |

And while there were two states that had committed to expansion, and had Democratic governors and those have flipped to Republican governors, our understanding is that both of them are going to continue with their expansion plans.

Is that helpful?

Mr. Brian Kinstlinger: Thank you.

Mr. Bruce Caswell: Great.

Ms. Lisa Miles: I think that concludes our call today. So, thank you very much for joining us. We appreciate your ongoing support.

Operator: Thank you for joining us today.

This concludes today's call.

You may now disconnect your lines.

| Fiscal Year 2014 Fourth Quarter and Year End Earnings Call |

11/13/2014 - 0900 ET - 41 |