Exhibit 99.2

Operator: Greetings.

Welcome to the MAXIMUS Fiscal 2014 First Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question and answer session will follow the formal presentation. If anyone should require operator assistance during the conference, please press star-zero on your telephone keypad.

As a reminder, this conference is being recorded. It is now my pleasure to introduce your host Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you, Ms. Miles. You may now begin.

Ms. Lisa Miles: Good morning.

Thank you for joining us on today's conference call. I would like to point out that we've posted a presentation on our Web site under the Investor Relations page to assist you in following along with the call. With me today is Rich Montoni, Chief Executive Officer; David Walker, Chief Financial Officer; and Bruce Caswell, President and General Manager of the Health Services Segment.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10K filed with the SEC.

The company does not assume any obligation to revise or update these

forward-looking statements to reflect subsequent events or

circumstances. Today's presentation may contain non-GAAP financial

information. Management uses this information in its internal analysis

of results and believes that this information may be informative to

investors in gauging the quality of our financial performance,

identifying trends in our results, and providing meaningful

period-to-period comparisons. For a reconciliation of non-GAAP measures

presented in this document, please see the company's most recent

quarterly earnings press release. And with that, I'll turn the call

over to Dave.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 1 |

Mr. David Walker: Thanks, Lisa.

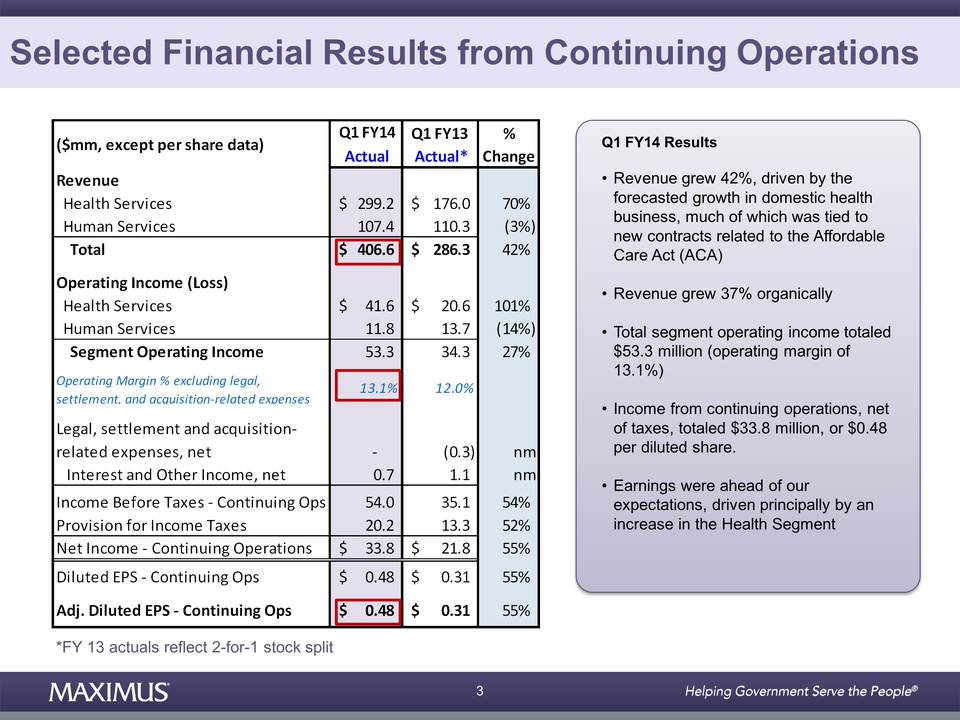

This morning MAXIMUS reported first quarter revenue of $406.6 million, a 42 percent increase compared to the same period last year. As expected, organic growth in the quarter was significant at 37 percent. Top line increases for the quarter were attributable to the forecasted growth in our domestic health business, much of which was tied to new contracts from the Affordable Care Act. Total segment operating income totaled $53.3 million in the first fiscal quarter, and operating margin was 13.1 percent.

For the first quarter, income from continuing operations, net of taxes, totaled $33.8 million, or 48 cents per diluted share. This is a 55 percent increase to diluted EPS, compared to 31 cents reported for the same period last year. Earnings in the quarter were ahead of our expectations, driven principally by the increase in the health segment.

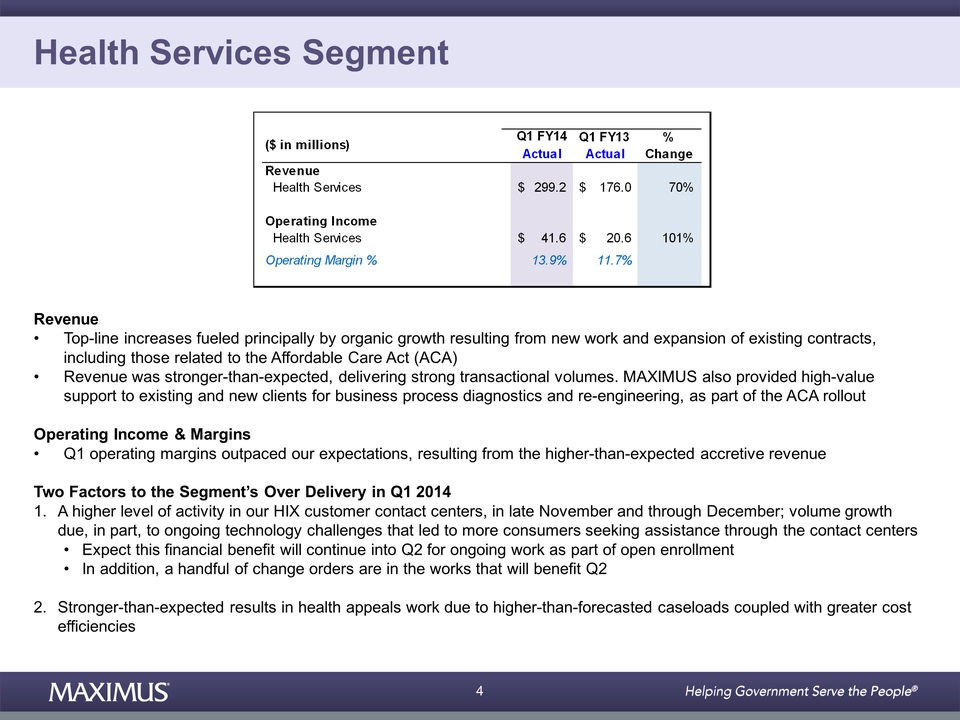

Let's jump into results by segment, starting with health services. The health services segment delivered an exceptionally strong quarter, with revenue increasing 70 percent to $299.2 million, compared to the same period last year. Top line increases were fueled principally by organic growth resulting from new work and expansion of existing contracts, most notably those related to the Affordable Care Act.

As a reminder, the open enrollment period for health insurance exchanges

commenced on October 1st, and as expected, drove volumes and revenue in

our customer contact centers. Health segment revenue was stronger than

expected, delivering strong transactional volumes. We also provided

additional high value support to existing and new clients, for business

process diagnostics, business process reengineering, and greater shared

services delivery as part of the ACA rollout.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 2 |

Rich will talk more about the specifics in his prepared remarks. Health services segment operating income in the first quarter of Fiscal 2014 more than doubled, compared to the same period last year, and totals $41.6 million, with an operating margin of 13.9 percent. Operating margins for the health segment were higher compared to the same period last year. Health segment operating margin in the first quarter outpaced our expectations resulting from the higher-than-expected accretive revenue.

Two main factors drove the over-delivery in the health segment in the first quarter. First, we simply experienced a higher level of activity in our health insurance exchange customer contact centers in the latter part of the first quarter. Volumes in October and early November were tracking relatively in line with forecasts. However, overall volumes came on much stronger than expected in the back half of November and through December. This volume growth resulted in part from the ongoing technology challenges that made it difficult for consumers to enroll online.

In addition, as the December deadline loomed to enroll in a subsidized

health plan for coverage starting in January, many consumers turned to

the customer contact centers in order to complete their enrollments. In

many of our projects, we increased staff and added overtime hours to

help our clients deal with the demands and challenges. Rich will touch

upon some qualitative examples of where we added scope and scaled our

staff in support of our clients' ACA efforts.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 3 |

We do expect that this financial benefit from expanded scope on certain exchange contracts will continue into the second quarter as we stepped up to help our clients manage the considerable change associated with the ACA rollout. We continue to provide increased support to some clients through the open enrollment period, which is currently slated to end on March 31st and coincides with the end of our second quarter.

Additionally, we have a handful of change orders in the works that will benefit the second quarter. Some of these change orders reflect work already performed where we have not finalized the change order, and therefore revenue lags behind.

Secondly, we experienced stronger than expected results in our health appeals work due to higher than forecasted case loads. As we discussed last quarter, we had initially forecasted that appeals volumes would step down relative to the peak we experienced in the second half of Fiscal 2013. The results were bolstered in the quarter because the caseloads did not decrease as much as we expected, coupled with greater cost efficiencies.

So, in summary, the health services segment was ahead of expectations, which contributed to stronger revenue and operating income. We've increased our health forecast for the remainder of the year to reflect the uplift from ACA and the upward revision of health appeals volumes.

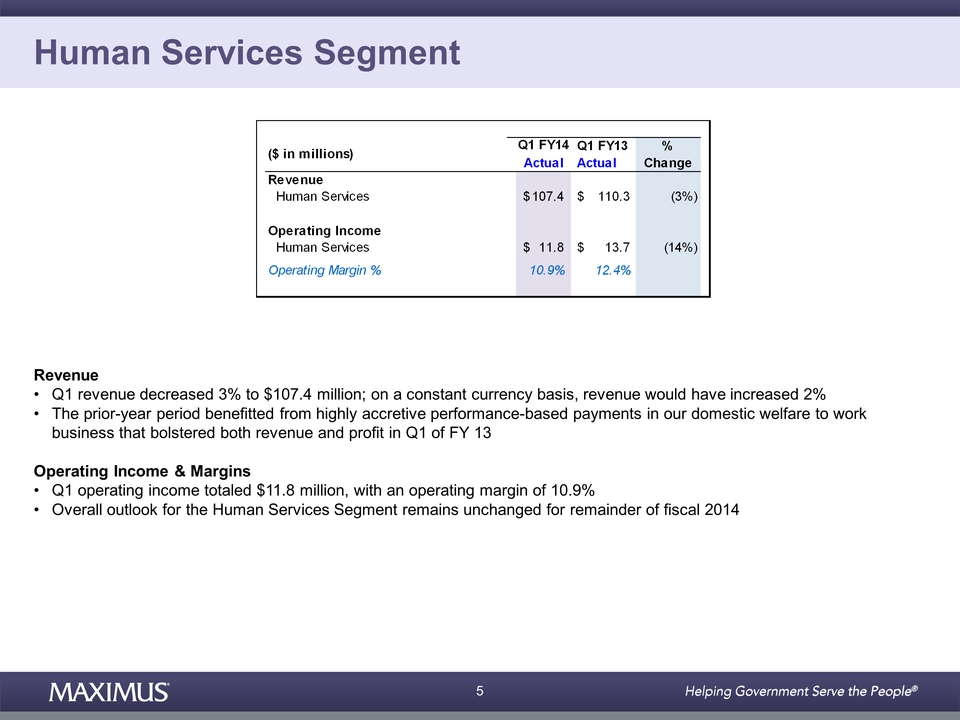

Let's now turn our attention to the financial results for human

services. For the first fiscal quarter, revenue for the human services

segment decreased 3 percent, to $107.4 million, compared to $110.3

million last year. However, on a constant currency basis, revenue

would've increased 2 percent. As a reminder, the prior year benefitted

from highly accretive performance-based payments in our domestic welfare

to work business, which bolstered both revenue and profit in Q1 of last

year. First quarter operating income for the human services segment

totaled $11.8 million, delivering an operating margin of 10.9 percent.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 4 |

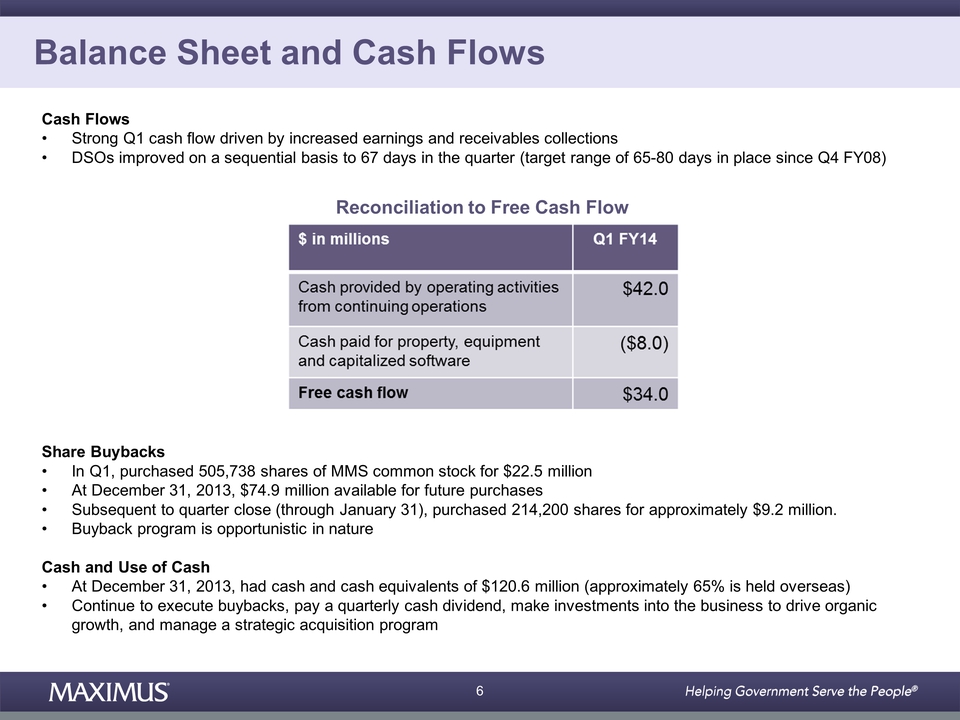

Our overall outlook for the segment remains unchanged for Fiscal 2014. Moving on to cash flow and balance sheet items, cash flow in the fiscal first quarter was strong, driven by increased earnings and receivables collections. As expected, DSOs improved on a sequential basis to 67 days in the quarter, which remains well inside our target range of 65 to 80 days. As a reminder, our target DSO range has been in place since the fourth quarter 2008. For the first quarter of Fiscal 2014, cash provided by operating activities from continuing operations totaled $42 million and free cash flow was $34 million.

As a reminder, free cash flow is defined as cash provided from operating activities from continuing operations, less property and equipment and capitalized software. During the quarter, we continued to purchase shares of MAXIMUS common stock under our board-authorized program. In Q1, we repurchased 555,738 shares, for a total $22.5 million At December 31, 2013, we had approximately $74.9 million available for share repurchases under this program. Subsequent to quarter close and through January 31, we purchased an additional 214,200 shares for approximately $9.2 million.

As we said in the past, we consider our buyback program to be opportunistic in nature, and our recent purchases reflect our overall preferred approach to buying back shares. At December 31st, we had $120.6 million in cash and cash equivalents, of which approximately 65 percent is held overseas. The strength of our balance sheet provides us with a great deal of flexibility in deploying capital, and we are focused on sensible deployment of cash. We continue to execute buybacks, pay a quarterly cash dividend, make investments in the business to drive organic growth, and manage a strategic acquisition program.

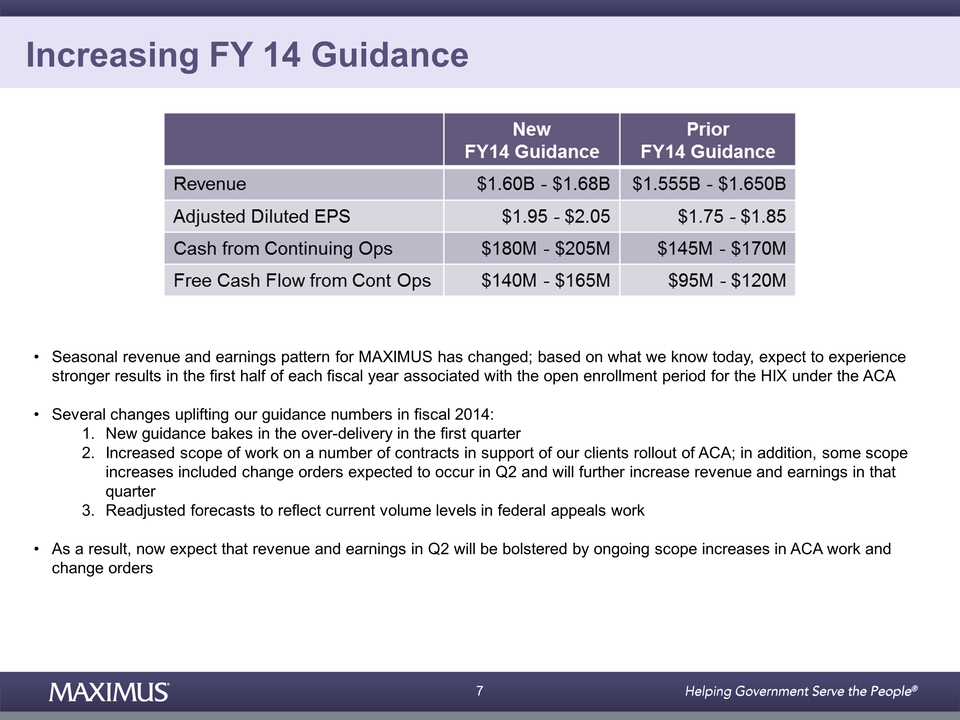

And lastly, guidance--as noted in this morning's press release, we are increasing our fiscal 2014 revenue and earnings guidance. We now expect revenue in the fiscal 2014 to range between $1.6 billion and $1.68 billion, and we expect earnings per diluted share from continuing operations to range between $1.95 and $2.05. Going forward, we believe that the seasonal revenue and earnings pattern for MAXIMUS has changed.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 5 |

Based on what we know today, we expect to experience stronger results in the first half of each fiscal year associated with the open enrollment period for the health insurance exchanges under ACA. We strongly recommend that this seasonality be considered when building longer term financial models. Let's walk through the changes that are uplifting our guidance numbers in fiscal 2014. First, our new guidance bakes in the over-delivery in the first quarter.

Second, as I mentioned earlier, we increased our scope of work on a number of contracts in support of our clients' rollout of the Affordable Care Act. In addition, some of these scope increases included change orders that didn't fall into Q1. Much of this benefit is expected to occur in the second quarter and will bolster revenue and earnings in that quarter. The exact timing of change orders is always difficult to predict, as procedures vary by client, but we are currently on target for these to be executed in the second quarter.

Third, we have readjusted our forecast to reflect current volume levels in our health appeals work. As a result, we now expect that our revenue and earnings in our fiscal second quarter will be bolstered by the ongoing scope increases in some of our ACA work and change orders. We are increasing our cash flow guidance for fiscal 2014.

We now expect cash provided by operating activities derived from continuing operations to be in the range of $180 million to $205 million. And we expect free cash flow from continuing operations to be in the range of $140 to $165 million. Thank for joining us this morning, and now I'll turn the call over to Rich.

Mr. Rich Montoni: Good morning, and thank you, David.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 6 |

We are pleased with a solid start to fiscal 2014, having achieved top and bottom line results that beat expectations and allow us to raise our outlook for the remainder of the year. These results are even more impressive when you consider the demanding market environment for private sector government partners that operate highly visible health and human services programs. For MAXIMUS, our continued success is based upon our ability to understand the needs of our clients as we provide the appropriate level of support during these challenging times.

This morning I'd like to focus my commentary on how we are doing just that, adding value to our clients through scalable, flexible, and responsive operations. Challenges within the implementation of the Affordable Care Act have dominated the headlines for several months. As the federal government in several states face problems with the technology side of their exchanges, our health services team found opportunities to provide alternatives in implementing comprehensive contingency plans for both existing and new clients.

Our solutions allowed the exchange work flow to continue, while our clients and their systems vendors address the technology speed bumps. The technical deficiencies created the immediate need for direct consumer contact in order to continue the application and enrollment process. For example, a number of states did not anticipate the need for a large volume of paper applications or the additional effort required to assist consumers in completing applications through their Web portal.

In response, we quickly ramped up staffing and trained workers, bridging

the gaps in the HIX work flows and helping enrollments to continue. As

David noted, volumes in many of our HIX contact centers came on strong

during the last six weeks of calendar 2013. In response, we added more

than 1300 staff across our contact centers to handle the volumes. The

surge in calls came from consumers who were unable to enroll into health

plans online and needed additional assistance over the phone.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 7 |

In addition, many of these consumers were trying to meet the December deadlines in order to get insurance coverage effective January 1st, 2014. In the month of December, our incoming calls were more than 30 percent higher than forecast in our state customer contact centers. Our flexible staffing model allowed us to respond to our clients' forecast in the peaks and valleys of call volumes.

With the first open enrollment period presently scheduled to end on March 31st, we will continue to staff to the ebb and flow of volumes and activities that are part of the cyclical nature of HIX operations. However, our client-centric solutions even provided support to clients outside of our eight HIX customer contact centers. Let me give you a couple of examples. For a new client, the state of Oregon, MAXIMUS provided an operational review of the business processes that led to MAXIMUS providing call center and operational overflow capacity to assist consumers in completing enrollments.

The operational assistance was provided to ease workload from exchange workers overwhelmed by high volumes of paper applications. Cover Oregon ultimately asked us to handle both inbound and outbound calls to help consumers complete their health plan shopping and selection, all leveraging an existing customer center. This allowed for a vastly improved work flow, as Cover Oregon was able to offload tasks related to plan selection completion so that exchange workers could focus their efforts on eligibility determinations.

We've spoken for years about how this model, in which MAXIMUS employees

act as sous chefs to state or county eligibility workers, is a

demonstration of the partnership model through which our clients derive

value. In Colorado, we were able to help the state overcome a major

influx of applications through our existing contract vehicle and

business process reengineering. As you may know, consumers must be

deemed ineligible for Medicaid before being considered for a subsidy.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 8 |

As a result, the state experienced a surge in consumer applications. Incorrect and inaccurate applications were not able to get a real time Medicaid eligibility determination online. In October 2013, the state, in close monitoring of the MAXIMUS application volumes, asked us to increase our level of commitment to process applications. At the same time, we faced a daily average intake of new cases that was significantly higher than what our operations are normally staffed to handle. We worked hand in hand with the state to produce and implement a very aggressive plan to clear the applications and maintain the daily inventory of new cases.

The goal was to ensure that everyone who applied online received the appropriate outcome within 24 hours, so they were able to receive benefits by January 1st. In response, MAXIMUS and the state quickly hired and trained additional staff in three locations. Together we successfully executed the plan and met the deadline to get thousands of Coloradans enrolled in health plans through the state's exchange and through Medicaid and CHP+. MAXIMUS, in conjunction with the state, has processed more than 32,500 cases since October.

We are stilled receiving nearly 300 new cases daily, and will continue to process them within one business day. While these are just a couple of examples, we are certainly pleased to be a go-to partner to help a number of clients deal with the growing pains of the Affordable Care Act. It's important to note that growing pains are common with large system rollouts, and it typically takes time before a system is running at optimal performance.

So, we believe the need for additional assistance in this area will

continue for quite some time, particularly when reenrollment cycles are

considered. Looking beyond this first open enrollment cycle, we expect

the Affordable Care Act to continue to serve as a multi-year growth

driver for our US operations. As we've said in the past, some of the

states currently on the federal marketplace will likely start to look to

operate their own exchanges over the next several years. At the same

time, some states may also consider enhancing their public insurance

programs, including expanding Medicaid.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 9 |

In October 2013 survey of states conducted by the Kaiser Family Foundation predicts that 2014 will be a transformative year for Medicaid with increases in both spending and enrollment. MAXIMUS is already responding to this long term transformation as we see material increases to our existing Medicaid enrollment broker business through contract amendments and change orders. We continue to believe over the long term that more states will expand Medicaid. Some will follow the standard path, while others will seek to set their own terms through waiver requests negotiated with the centers for Medicare and Medicaid services.

We believe we are well-positioned for either scenario, but recognize reality that state legislators and federal waiver requests often move slowly. So, Medicaid expansion remains a long-term, multi-year growth opportunity that doesn't reach its steady state until 2016 at the earliest. As Medicaid expansion continues to proceed, we also remain engaged with a number of our state clients on the dual demonstration projects.

Dozens of governors have made this a priority agenda item as they look

for real solutions for these super utilizers of Medicaid and

Medicare. While the federally guided state demonstration projects don't

provide a large financial contribution to MAXIMUS, the duals market is

an important plank in our long-term services and supports platform. We

are currently working with five states to address cost, quality, and

care coordination among the duals population, and this includes

California, which is largely considered a leader in creating a potential

blueprint for this population.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 10 |

We also received some very positive news in Illinois, where we've been working with the state to help root out Medicaid fraud. As you may recall, our eligibility and enrollment verification project was designed to help ensure that only those eligible for Medicaid are actually receiving coverage and services. The project was slated to end in December. However, on December 17th, the state received a supplemental arbitration order, allowing MAXIMUS to retain some work through June 2015.

We are very pleased to retain a meaningful level of responsibility in support of the state's ongoing initiative to reform their Medicaid program. Also, within our heal segment, our federal services business again delivered solid financial results reflecting the team's ability to deliver on increased levels of appeals. The MAXIMUS federal team has done a great job to manage increased volumes, while at the same time winning new work that's centered on our core capabilities.

Moving on to our international operations where we recently completed a small tuck-in acquisition to complement our human services business in Australia. MAXIMUS acquired work force services assets from Centacare, a provider of welfare to work and disability employment services under the Job Services Australia and Disability Employment Services programs. This tuck-in acquisition expands our geographic footprint in Australia, while maximizing the utilization of our existing operational capacity to serve the government.

The transaction closed on January 31st, 2014, and is expected to

contribute approximately $10 million in new annual revenue. Moving on

to rebids, on our last quarter's call, we mentioned that fiscal 2014

will be a light year for rebids and overall total awards. Thus far,

we're pleased with our progress. Of the 15 contracts worth a total of

225 million up for rebid, we've won three, with a total contract value

of $46 million.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 11 |

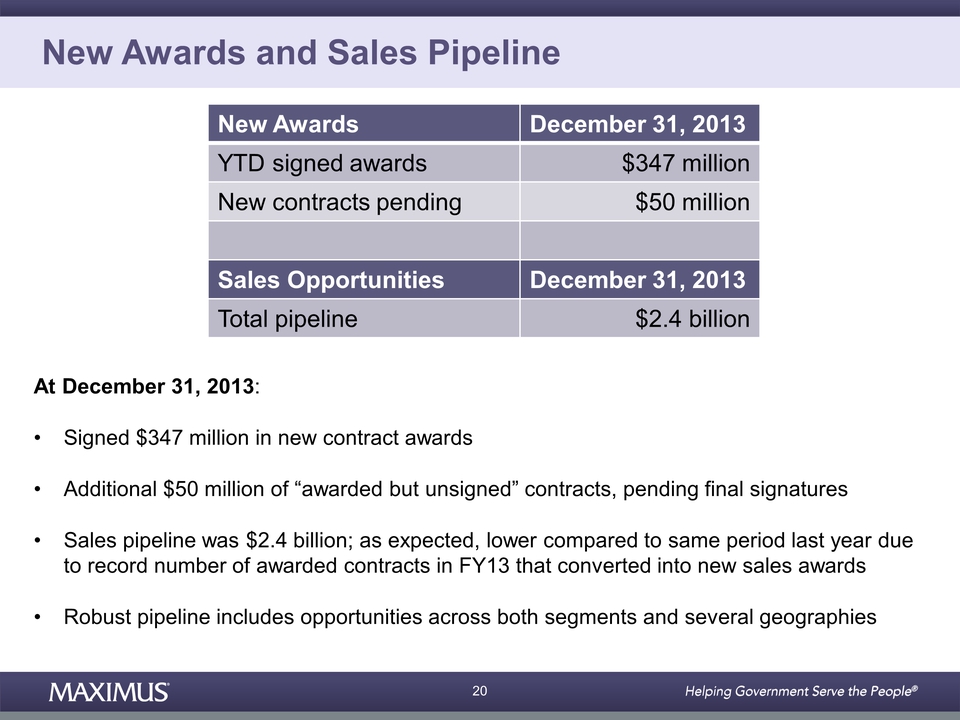

Wrapping up with our new sales awards in the pipeline, for the first quarter of fiscal 2014, we signed awards worth $347 million, and at December 31st, 2013, we had an additional $50 million in new contracts pending, those unsigned contracts where we've received award notification and are in contract negotiations. Sales pipeline at December 31st, 2013, was $2.4 billion. Compared to the same period, as expected, the pipeline is lower due to the record number of awarded contracts in fiscal 2013 that moved out of the pipeline and into our sales awards.

As a reminder, we expect normal fluctuations in our pipeline, primarily as opportunities convert into new sales. On a sequential basis, the pipeline is comparable to the fourth quarter of fiscal 2013. The pipeline remains robust and includes opportunities across multiple geographies in both segments.

In closing, our plans for long term growth continue to be shaped around our three strategic priorities, which include enhancing our US operations by supporting clients through the next phase of the Affordable Care Act, growing our federal business as demonstrated by superb growth in the past couple of years including this quarter, and expanding our international operations with health and human services opportunities in multiple geographies.

Underpinning this growth, we'll always be providing the highest of

service for our government clients. They entrust us to operate highly

visible programs. We take this responsibility most serious and strive

to provide topnotch customer service for citizens and to achieve

important program outcomes for our clients. We are pleased to offer an

even brighter outlook for the remainder of the year, and for fiscal 2015

and beyond, our long term growth outlook remains optimistic.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 12 |

Before we move onto questions and answers, I'd like to take a moment and thank our chief financial officer, Dave Walker, for all that he's done to drive success for MAXIMUS. In December, David announced his intent to retire later this year, but he will remain with the company to provide support for special projects. We kicked off the search process in tandem with the announcement in December. We have a good stream of qualified candidates, but expect the process to take several months.

While we'd like to have someone identified by the summer, David has assured that he will remain in a fulltime position until we find the right person. David leaves big shoes to fill, but we are fortunate that he will remain with the company in this new downshifted role, providing valuable support for special projects. So, thank you, David, and thank you to all our employees worldwide who continue to deliver each day on our commitments to our valued clients. And now, let's open it up for questions. Operator?

Operator: Thank you.

We will now be conducting a question and answer session. Please limit your questions to two. If you wish to ask additional questions, you may reenter the queue. If you would like to ask a question, please press star-one on your telephone keypad. A confirmation tone will indicate your line is in the question queue.

You may press star-two if you would like to remove your question from the queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys. One moment please while we poll for questions.

Thank you. Our first question is coming from the line of Charlie Strauzer with CJS Securities. Please go ahead with your question.

Mr. Charlie Strauzer: Hi, good morning.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 13 |

Can you hear me okay?

Mr. David Walker: We can hear you fine.

Mr. Charlie Strauzer: Fantastic.

My two questions are very simple. Just when you look at the influx of some of the, higher volumes from, you know, the, ACA enrollment and some of the appeals work that you saw higher volumes into it, is this more kind of an emergency triage kind of one-time related, or do you think they'll be, you know, longer term opportunities that will come out of this?

And also, the second question would be, you know, other larger opportunities that are not, uh--that are kind of in the pipelines for both domestic and international, can you talk a little bit more about that as well? Thanks.

Mr. David Walker: Okay, Charlie.

Well, we'll give it a go here. on your first question as it relates to the additional volumes we're currently experiencing under the Affordable Care Act, I think it is helpful to break the discussion area into two pieces, the appeals work that we do, and, the additional work that we are doing and I expect we'll continue to do for the foreseeable future related to, ACA/the health insurance exchanges.

In general, on that topic we think that the Affordable Care Act will have, I would say more legs and longer legs, if you will, than previously anticipated. And by that, I mean, we were pleasantly, rewarded this quarter with additional scope from our clients', additional needs. And our team, did a--teams did a great job to step up and provide surge support. I do think that that will continue in that these large transformations, as we all know, these large system transformations oftentimes take longer, to reach the point of optimal operations.

And I do think while technology will step up, should step up and play, a

very important role, the populations will--with which we, which we work,

do need, face-to-face, services. And that's what we're very, very good

at. So, I think, that this is gonna last longer than most folks

anticipate. And I think our role will continue longer than most folks

anticipate. We also think that there'll be additional work in terms of

scope and services.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 14 |

We've talked about, well, we talked about HIX 2.0 really as transferring into the Affordable Care Act 2.0. So, I would expect there'll be additional work, including such things as some states decide to, move off the federal exchange onto their own state-based exchange. as it related to the appeals work that we're doing, we've been very fortunate. And all that's related to the Medicare program. We haven't really gotten into the appeals, that we will do as it relates to our separate contract, under the Affordable Care Act.

but the federal appeals for the Medicare, as you know, fall of last year have been running higher. The volumes have been running higher. And, we expect that at least in the short term, they're going to be running higher--at that higher level. I don't think they're gonna spike any higher than they have been. We've been working on backlog.

And I think that's gonna keep us quite busy for the short term. And then, clearly we need to keep an eye on what happens as it relates to RAC-related initiatives, regulations, et cetera, and the balance--the future balance that's to be achieved with changing regulation, and, the extent to RACs move into other areas of audit focus. Is that helpful on your first question?

Mr. Charlie Strauzer: Very much so. Thank you.

Mr. David Walker: Okay.

On other large opportunities, I'm really pleased with the, quality of

the opportunities in, the pipeline. When we look at, we do see

significant opportunities across the board, across the geographies and

across the segments.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 15 |

And as you'd expect, some of those related to our health business and the Affordable Care Act, but we have meaningful opportunities outside that as well. So, the best way I would describe it is it's very diversified, and a good portion, the majority of the work in the pipeline represents new work, which you would expect given the fact that we've got a light rebid year coming up. So, the rebid piece plays less of a role than perhaps historically it had.

Mr. Charlie Strauzer: Great. Thank you very much.

Mr. David Walker: Sure.

Operator: Our next question is coming from the line of Brian Gesuale of Raymond James. Please go ahead with your question.

Mr. Brian Gesuale: Yeah. Good morning.

Nice job on the quarter, and, David, congratulations on retirement. First one's actually for you. You look, really relaxed on that picture on slide 22. Was that Photoshopped, or does pending retirement feel that good?

Mr. David Walker: You know, I'm always pretty relaxed, Brian. It--.

Mr. Brian Gesuale: --Seriously, I guess, I wanted to talk a little bit about pipeline. Can you maybe give us a little color on, the pipeline that's domestic versus international, as well as maybe any health and human split?

Mr. Rich Montoni: Well Dave and I are gonna tag team on that one, Brian. This is Rich. And I think that's kind of a follow on as it related to, the prior question. pipeline quality, again, I would go back and say it remains at a very high level, essentially consistent with the prior period. And the split is very pleasing between domestic and international health and human services.

And when I think about, Brian, I really do think that what's playing out

here is the long term thesis that we've had on the table that as these

governments move forward and try to deal with their fiscal challenges,

coupled with, the demographic challenges, increasing populations and

more folks needing assistance, from their government, it continues to

open up opportunities for MAXIMUS long term.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 16 |

So, we've got some things that are, really new work with new geographies. And again, those take time, Brian. I mean, these particularly federal governments can take quite a bit of time for them to reengineer a program, be it a health program or welfare program. But we remained--we remain excited and convinced that that trend is real. And it will continue for quite some time. And I think we're very well-positioned.

Mr. David Walker: And as a reminder, Brian, about 23 percent of our work is outside the US in fiscal '13. And so, we're seeing our opportunities track generally with our mix.

Mr. Rich Montoni: And the other thing I would, remind us is that we do have a goal to increase our health business outside of the US, piggybacking on, the nice platform and brand that our human services has laid before. so again, our goal is to expand our health business outside the US. And we're starting to see some real opportunities bubble up in that context.

Mr. Brian Gesuale: Okay. Terrific.

And, Rich, wondering if you could--if there's any specific geographies--you've highlighted Canada and the UK in the past. Any geographies where you're particularly excited as you look out over the next 12 months?

Mr. Rich Montoni: You know, I've got to tell, I don't have any bias. It almost feels like a horse race where they're all engaged. They do play up one another. I think it's fascinating to see how the world operates today. At a country level, there's a very significant appetite for country leaders to learn what other countries are doing and share best practices and lessons learned.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 17 |

And I think we play, a meaningful role in that when we visit with our clients and our prospects. And it also happens with our teams. So, we'll see a--as an example, we'll see, and exciting win in the US. And then the folks up in Canada will run with it. Or we'll see some best practices here in the US. And, our prospects and clients in the UK are very interested to speak to our US leaders. We'll have them visit. We'll have them share some details on the program.

And last, I don't wanna forget our folks in Australia. They continue to do a great job. And, while at one point in time, we looked at the mountaintops in Australia and felt that there--it may be more of a steady state business, but based upon the performance of that team, they continue to receive additional assignments. And I still see it as some pretty good growth opportunities.

Mr. Brian Gesuale: Okay. Thanks very much.

Mr. Rich Montoni: Okay. Thank you.

Ms. Lisa Miles: Next question please.

Operator: The next question is coming from the line of Richard Close of Avondale Partners. Please go ahead with your question

Mr. Richard Close: Yes.

Just really quick, I'm curious if you guys can talk a little bit about the health margins. Obviously, stronger than what we were looking for. Can you talk, a little bit about the trends in that or what you expect maybe in the second quarter based on the number of changes order and volumes that you're talking about?

Mr. David Walker: Yeah.

That's a great question, Richard. Let me generally just talk and

reiterate about what we expect by segment for the whole year and for the

question. In human, you know, our guidance really remains

unchanged. We expect the revenue to be fairly flat to slightly up. But

in the lower half of our 10 to 15 percent range now on point in health,

which has really been driving our business as of late with health

insurance exchanges, as you know. And we're going to continue to be

bolstered by open enrollment.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 18 |

So, we saw the spike, happen late in this quarter. And that'll continue into Q2. So, you'll see Q2 up, and the margin's gonna go with that, just simply because of the continuation of what we saw in Q1. As well, some contract-by-contract types, we had to get an equitable adjustment. So, we'll see those lag into Q2, but some of the work and cost had already been incurred.

So, you would expect our margin to have some seasonality improvement in Q2. But if you look at the margins in health overall for the year, it'll be the higher end of our 10 to 15 percent range. So, the margins will be very strong in health.

Mr. Richard Close: Okay.

I--and the follow up question, I guess on, the outperformance of ACA versus appeals, I assume it's more skewed towards the ACA than appeals. And if you can talk a little bit about appeals going forward, everything that's going on with the RACs you mentioned, the rebid process, and the regulatory, I'm curious to get your thoughts on appeals backlogs going forward, and then maybe the impact of the two-midnight rule on those potential backlogs.

Mr. Bruce Caswell: Yeah.

Let me start at a high level, and then I'll turn it in for Rich and

other to chime in. You know, first of all, as a reminder, the appeals

actually performed better than our expectation. We actually expected

them to turn down more than they have. So, we just didn't see that,

right, which is what bolstered us.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 19 |

So, it's less that the appeals were growing, that they just really haven't turned down, okay? And, when we look at the delivery, and the over-delivery in health, it's really across the board. You know, ACA certainly is strong. but we've seen all our programs, come on strong. So, the whole portfolio's performing very well. And so, I think we happen to be at the right place where there's a lot of needs. And that's what it's reflecting.

Mr. Rich Montoni: --Good.

And Richard, on the moratorium it relates to the RACs, and just to, set the discussion, we do know that in the last week, CMS extended the moratorium on RAC claims for what's referred to as short inpatient stays. And at this point--and we do know that those are prior, moratoriums. This is just an extension of that date. We've not seen a material impact as a result of moratorium. And, we have not seen a slowing of the caseloads coming in. That being said, we do understand the trends.

I do think there is a leg factor. So, given the leg factor, but given the backlog, we don't see a short-term impact to us as it related to, this extended moratorium. And, I also say remember that the work we do here is just one element of the appeals work that we do. we do expect that if the RACs are, defocused from the short-term in patient state type, work or claims, that they'll focus in other areas.

So, I view this, as not meaningful to fiscal '14, again, given the backlog and given, the leg factor, more relevant to '15 and beyond. And what'll be interesting to monitor is, what the RACs do as to refocus. So, we happen to believe there are some pretty significant additional areas for improvement as it relates to, the claims work in the Medicare program.

Mr. Richard Close: Okay. Thanks.

Congratulations on your, successful execution here.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 20 |

Mr. David Walker: Thank you, Richard. Appreciate that.

Ms. Lisa Miles: Next question please.

Operator: The next question is from, Frank Sparacino of First Analysis. Please proceed with your question.

Mr. Frank Sparacino: Hi, guys.

Rich, just sort of following up on that, as it relates to the appeals for the exchanges, maybe just talk about your expectations in timing when you'll start to see some of that work coming in in a meaningful way. And also, I assume there's a correlation, related to, you know, the call center volume that you've had that have been better than expected due to the technology challenges. I assume there's a similar parallel as it relates to the appeals. But, maybe just talk on those two things.

Mr. Rich Montoni: I think that's fair. I'm gonna ask Bruce Caswell to respond to that, Frank.

Mr. Bruce Caswell: Great.

Good morning, Frank. thanks for the question. And, as you're well aware, we handle the appeals for the, um--at the federal marketplace level. And as it has been in the press recently, a reasonable backlog has been building up. But at the same time, we've been working to resolve upwards of about 4,000 appeals that can be resolved through just an administrative process, outreach to the consumer, working with them to clarify their application, and ultimately, to resolve that.

So, while the technology challenges remain, there are business process

work-arounds that, lead to increased labor on our part. And it's

important to note that, that is a cost reimbursable contract. So,

there's really not a financial risk associated with the scope issues, in

that appeals work.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 21 |

So, we are continuing to handle the eligibility appeals that come in and triage them, those that can be handled, and then work hand in hand with our client to identify additional work-arounds to the business process and prioritization of the technology remediations, that are really the responsibility of other contractors, to get that program stabilized.

Mr. Frank Sparacino: And just, a follow-up on the last question, on the Medicare appeals business, can you give us a sense as to--it seems like your confidence in that business looking forward has a lot to do with the backlog that you have. I mean, there's been a lot of talk, obviously, at the level three appeals, of the backlog issues. Do you have a substantially--substantial backlog right now, as it relates to the level two that you're working on?

Mr. Rich Montoni: Well, Frank, it's, it's fair to say that not all RACs, obviously, perform at the same level of efficiency, right? So, our understanding would be that some of the RACs have more backlog that they're working through than others. And as a consequence, the higher volumes that we've seen are likely a function of that effect.

So, as we, you know, as we've said, as we continue to move forward, not only do we currently not see a decline in that, but it's likely that the RACs are gonna continue to substitute a way to other types of appeals that they'll look at. It's interesting. Under the final rule, the CMS-1599-F final rule related to the two-midnight stay, it's really just the patient status reviews that RACs look at that are excluded from this process.

But importantly, there are other types of claims that the RACs can

continue to work in an inpatient hospital environment. And those would

include coding reviews, reviews for medical necessity of a surgical

procedure, and so forth. So, there's some reviews in that area that

they continue to work and that we continue to see. And then obviously

we anticipate they'll continue to substitute a way to other areas.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 22 |

Mr. Frank Sparacino: Thank you, guys.

Mr. David Walker: You bet.

Ms. Lisa Miles: Thanks, Frank. Next question please.

Operator: The next question is from Brian Kinstlinger of Sidoti & Company. Please proceed with your question.

Mr. Brian Kinstlinger: Great. Thanks so much.

The first question I have, I see the Department of Education award is still under protect. Can you remind us if you actually generating revenue as a result from this contract? And then if the GAO keeps this contract in their hands, does this change your guidance in any way for this year in the top or bottom line?

Mr. Rich Montoni: Let me kind of refresh folks in terms of where that protest stands. And then I'm gonna ask Dave Walker to address your specific question as it relates revenue and guidance for fiscal, '14. As you're aware, that protest, and it's akin to a legal matter, so we can't give you a whole lot of details, but the GAO, is handling that protest. They are scheduled to render their opinion on the protest on or before February 20th. So, that's a significant date. Dave Walker, as it relates to revenue--?

Mr. David Walker: --Sure--.

Mr. Rich Montoni: --What would you add?

Mr. David Walker: Listen, Frank, 'cause there's a group of--or Brian--there's a group of probabilities on this thing. So, we do have on a weighted basis a small amount of revenue in our '14 guidance, but it's very neutral to earnings. So, really it affects next year for us.

Mr. Rich Montoni: And to specifically, I don't think, regardless

of the outcome of that, I don't think we would amend our guidance for

fiscal '14 on that event.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 23 |

Mr. David Walker: Yeah.

Mr. Brian Kinstlinger: Right.

And then, Dave, you mentioned the seasonality, the new seasonality. If I have it right, revenue peaks in the second quarter, and then goes slightly lower sequentially in the third and the fourth quarter. But if we think about EPS as in the fourth quarter, you've generally had a low amount of very high margin revenue that typically spikes earnings. Will fourth quarter still be seasonally strong in earnings? Or do you think not so much?

Mr. David Walker: Not like it had because some of the businesses that tended to drive that seasonality are not as large relative to the whole portfolio mix, okay? And really you'll see, if you just think about it, a macro of your modeling beyond '14, the first half of our year is gonna be our strongest permanently because of HIX, or this particular because it's just not only because of the momentum going into Q2, but the change orders hitting in Q2 as well, you'll have an exceptionally strong quarter in Q2.

We'll still do, generally okay in the fourth quarter, but not like it was proportionately. We used to have what is called a hockey stick model, and now it'll be much more front-loaded.

Mr. Brian Kinstlinger: Great. Thanks so much.

Ms. Lisa Miles: Next question please.

Operator: As a reminder, you may press star-one to ask a question. Please limit your questions to two. If you wish to ask additional questions, you may reenter the queue. The next question is from Dave Sagalov of Jefferies. Please go ahead with your question.

Mr. Dave Sagalov: Good morning. Thanks for taking the questions, guys.

I hopped on the call a little bit late, so I apologize if this has been

asked and answered. just taking a step back and staying on appeals

business, is that still--can you give us an updated amount of the

percentage of revenue that that drives?

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 24 |

Mr. David Walker: On the appeals business, and I assume you're talking strictly about the Medicare, appeals business, we don't disclose the percentage of revenue as it relates to individual divisions of service line offerings. So, we're not able to give you that percentage, Dave.

Mr. Dave Sagalov: On a higher level, have you--I think you've talked about the federal operations being around 10 percent. So, you know, I think my understanding was that the RAC component was less than 3 percent that you may have spiked out once or twice. Do you--?

Mr. David Walker: Again, I, I can't get into whether it's 3 percent or the 10 percent, but it's within the 10 percent. So, you can deduce that it's less than 10 percent, the Medicare appeals, per se.

Mr. Dave Sagalov: Okay. Got it.

And then just moving along to the business that you're--basically have raised guidance for, it sounds like some of it is organic. Some of it could be from states that are having trouble, and you're helping them out. Do you have a sense for how much of this might be one time in nature and could roll off as we go into next year?

Mr. Rich Montoni: I think that's a great question. I think it's less than one might think. I do think you should expect that some of this work will pull back. On the other hand, I think it's gonna take longer to pull it back. You need to remember that you're gonna--that reenrollment is gonna be here again before you know it.

And I also think that the wild card in the whole equation, Dave, is how

long will it take not only to fix the technology underlying this, but to

really, optimize the processes, so that the system is--in its total, is

working for people in a very efficient fashion.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 25 |

So, I think it's gonna take multiple quarters for all of that to, to work out. And I think it's gonna extend well into fiscal '15 is my sense at this particular point. And I also think what all of the noise that we're seeing is gonna create a pretty significant demand for appeals, in the Medicaid/Affordable Care Act space.

Mr. Dave Sagalov: That's really helpful.

Those--on that point of it extending into '15, can you speak to the term of the contracts? obviously in some of the periods leading up until, it was contained within a year, but does--are you suggesting that the terms of this contract bleed over for, you know, a one, two, or even a three year period as you help these states out?

Mr. Rich Montoni: Bruce?

Mr. Bruce Caswell: Yeah.

I'd be happy to answer that, Dave. They--generally our HIX service center contracts are multi-year in nature. And so, they would continue into the '15, enrollment period and beyond. And that's obviously consistent with our overall business model of developing decades-long relationship.

And also I'd maybe like to add a little more depth to it too, to say the work that we're doing to support our clients in the Affordable Care Act is not just limited to running the service centers. There are many existing clients in the Medicaid space that have needs at their level to comply to the Affordable Care Act, like modifying their business processes to handle the new eligibility rules around modified adjusted gross income to look as they see a higher influx of Medicaid applications for support in processing those.

That's that sous chef work that Rich referred to, and to work, as Rich

has also referred to, handling eligibility appeals. So, our eligibility

appeals work is not just at the federal level, but for many of our state

clients. We can help with, if you will, the teeing up of an appeal and

the completion of a case such that then ultimately a state Medicaid

employee can make that determination. So, it's actually a very rich

kind of tapestry, if you will, of ACA support functions.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 26 |

And furthermore, as we enter the summer months, you know, you're probably quite aware that the qualified life events, in through which people can actually continue to apply for and gain coverage during the non-open enrollment are fairly, rich, right? They can include everything from, enabling individuals that have a change in income that affects their subsidy to select a plan. If you move to a new area that offers different plan, that's a qualifying life event, typical ones like marriage, birth, adoption, losing coverage due to divorce, things like that.

So, while we certainly expect some seasonality, you know, reflecting the close of open enrollment presently, which is scheduled for March 31st, and I say that presently because there's certainly some talk about a potential extension there, and then the reopening in November 15th, you know, there are, additional, if you will, volumes and services related to that type of work and those transactions that you see during that interim period.

Mr. David Walker: So, Dave, just as a reminder, our health contracts tend to have like three-year base, two-year options. So, they tend to be about five years, some higher or lower, but they average just shy all our contracts of under five years. And these are no different. And generally change is our friend.

Mr. Rich Montoni: And then one point to that. Most of the work

that we do in the additional scope work we're doing is just piggybacking

on the existing contracts in the form of change orders. And some of

them it's already just hardwired in.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 27 |

The exception would be the additional work. The work we're doing for new states that heretofore haven't been customers, and we've received inbound calls to action to help those states. And I think I talked about one of them, Oregon, on my call notes.

Ms. Lisa Miles: Rob [sp?], we'll go ahead and take one last question today.

Operator: Thank you.

The last question is a follow up from the line of Brian Kinstlinger of Sidotti. Please go ahead with your question.

Mr. Brian Kinstlinger: Great. Thanks.

Just one, we've talked a lot about the appeals for, Medicare. I'm not sure we talked too much about the appeals work for the Federal Exchange. I'm curious, when that contract, has provided revenue [unintelligible], I think [unintelligible] lags the enrollment period. And so, when is the seasonality also for that contract?

Mr. Rich Montoni: Brian, I think we touched upon it, earlier, but, that is--that contract is very, very young in terms of its startup. We are engaged. We are working with our client. I think we've built a great relationship with our client to help them meander through all of the technological changes, as you would expect that, one would experience as you're trying to handle appeals for the Federal Health Insurance Exchange.

And given the complications, and it looks like the volumes are gonna get there sooner or later, I do think that we--the table is set for some pretty significant volumes on the Federal Health Insurance Exchange. I don't see this reaching full equilibrium until fiscal '15. That's my gut.

Mr. David Walker: And then just a reminder, that contract's

reimbursable. So, you know, as--so, as--well, it's lower margin, but it

self-adjusts as, you know, they are having interfaces or technology

challenges, as new clients always will have, you know, and we conform

our technology, et cetera, it self-adjusts, you know, to size.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 28 |

And sometimes that stuff that we're doing that's out of scope normally with the original bid, you won't see in our pipeline numbers. So, sometimes in our organic growth is actually some of that new business as we help our clients cope with changes. In that regard, it's complicated.

Mr. Brian Kinstlinger: Great. Thank you, guys.

Mr. Rich Montoni: Very welcome. Thank you.

Operator: Thank you.

This concludes today's teleconference. You may disconnect your lines at

this time. Thank you for your participation.

| Fiscal 2014 First Quarter Conference |

02/06/14 - 9:00 a.m. ET - 29 |

Title: David N. Walker Chief Financial Officer and Treasurer February 6, 2014 Fiscal 2014 First Quarter Earnings

Title: Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from the Company’s most recent quarterly earnings conference call.This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release.A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Title: Selected Financial Results from Continuing Operations Q1 FY14 ResultsRevenue grew 42%, driven by the forecasted growth in domestic health business, much of which was tied to new contracts related to the Affordable Care Act (ACA)Revenue grew 37% organicallyTotal segment operating income totaled $53.3 million (operating margin of 13.1%)Income from continuing operations, net of taxes, totaled $33.8 million, or $0.48 per diluted share.Earnings were ahead of our expectations, driven principally by an increase in the Health Segment *FY 13 actuals reflect 2-for-1 stock split ($mm, except per share data) Q1 FY14 Q1 FY13 % Actual Actual* Change Revenue Health Services $ 299.2 $ 176.0 70% Human Services 107.4 110.3 (3%) Total $ 406.6 $ 286.3 42% Operating Income (Loss) Health Services $ 41.6 $ 20.6 101% Human Services 11.8 13.7 (14%) Segment Operating Income 53.3 34.3 27% Operating Margin % excluding legal, settlement, and acquisition-related expenses 13.1% 12.0% Legal, settlement and acquisition-related expenses, net - (0.3) nm Interest and Other Income, net 0.7 1.1 nm - Income Before Taxes - Continuing Ops 54.0 35.1 54% Provision for Income Taxes 20.2 13.3 52% Net Income - Continuing Operations $ 33.8 $ 21.8 55% Diluted EPS - Continuing Ops $ 0.48 $ 0.31 55% Adj. Diluted EPS - Continuing Ops $ 0.48 $ 0.31 55%

Title: Health Services Segment Revenue Top-line increases fueled principally by organic growth resulting from new work and expansion of existing contracts, including those related to the Affordable Care Act (ACA)Revenue was stronger-than-expected, delivering strong transactional volumes. MAXIMUS also provided high-value support to existing and new clients for business process diagnostics and re-engineering, as part of the ACA rollout Operating Income & MarginsQ1 operating margins outpaced our expectations, resulting from the higher-than-expected accretive revenueTwo Factors to the Segment’s Over Delivery in Q1 2014A higher level of activity in our HIX customer contact centers, in late November and through December; volume growth due, in part, to ongoing technology challenges that led to more consumers seeking assistance through the contact centersExpect this financial benefit will continue into Q2 for ongoing work as part of open enrollmentIn addition, a handful of change orders are in the works that will benefit Q2Stronger-than-expected results in health appeals work due to higher-than-forecasted caseloads coupled with greater cost efficiencies $299.2 $176.0 70% 101% 11.7% 13.9% $41.6 $20.6 Revenue Health Services Operating Income Health Services Operating Margin % Q1 FY14 FY13 Actual Change

Title: Human Services Segment RevenueQ1 revenue decreased 3% to $107.4 million; on a constant currency basis, revenue would have increased 2%The prior-year period benefitted from highly accretive performance-based payments in our domestic welfare to work business that bolstered both revenue and profit in Q1 of FY 13Operating Income & MarginsQ1 operating income totaled $11.8 million, with an operating margin of 10.9%Overall outlook for the Human Services Segment remains unchanged for remainder of fiscal 2014$107.4 $110.3 (3%) (14%) $11.8 $13.7 10.9% 12.4% Revenue Human Services Operating Income Operating Margin Q1 FY13 FY 14 Actual Change

Title: Balance Sheet and Cash Flows Share BuybacksIn Q1, purchased 505,738 shares of MMS common stock for $22.5 million At December 31, 2013, $74.9 million available for future purchasesSubsequent to quarter close (through January 31), purchased 214,200 shares for approximately $9.2 million.Buyback program is opportunistic in natureCash and Use of CashAt December 31, 2013, had cash and cash equivalents of $120.6 million (approximately 65% is held overseas)Continue to execute buybacks, pay a quarterly cash dividend, make investments into the business to drive organic growth, and manage a strategic acquisition program Reconciliation to Free Cash Flow Cash Flows Strong Q1 cash flow driven by increased earnings and receivables collectionsDSOs improved on a sequential basis to 67 days in the quarter (target range of 65-80 days in place since Q4 FY08) $42.0 ($8.0) $34.0 Q1 FY14 in millions Cash provided by operating activities from continuing operations Free cash flow Cash paid for property, equipment and capitalized software

Title: Increasing FY 14 Guidance Seasonal revenue and earnings pattern for MAXIMUS has changed; based on what we know today, expect to experience stronger results in the first half of each fiscal year associated with the open enrollment period for the HIX under the ACASeveral changes uplifting our guidance numbers in fiscal 2014: New guidance bakes in the over-delivery in the first quarterIncreased scope of work on a number of contracts in support of our clients rollout of ACA; in addition, some scope increases included change orders expected to occur in Q2 and will further increase revenue and earnings in that quarter Readjusted forecasts to reflect current volume levels in federal appeals work As a result, now expect that revenue and earnings in Q2 will be bolstered by ongoing scope increases in ACA work and change orders

Title: Richard A. Montoni President and Chief Executive Officer February 6, 2014 Fiscal 2014 First Quarter Earnings

Title: Achieving a Solid Start to Fiscal 2014 Solid start to fiscal 2014 with top- and bottom-line results that beat expectations; raising outlook for FY 14Even more impressive results within a demanding market environment for private-sector government partners that operate highly visible health and human services programs Continued success is based on our ability to understand client needs; we add value through scalable, flexible and responsive operations

Title: Helping Clients Address ACA Challenges As governments faced problems with the exchange technology, our health team found opportunities to provide alternatives and implement comprehensive contingency plans for existing and new clientsOur solutions allowed exchange workflow to continue while our clients and their systems vendors addressed technology “speed bumps” that created the immediate need for direct consumer contactSome states did not anticipate the volume of paper applications or the additional effort required to assist consumers in completing online applications; in response, we ramped up staffing and training, bridging the gaps in the HIX workflows and helping enrollments to continue

Title: Seeing Increased Activity in HIX Contact Centers Volumes in many of our HIX contact centers came on strong the last six weeks of calendar 2013 Added 1,300+ staffSurge in calls from consumers unable to enroll into health plans online and needed assistance over the phoneMany consumers trying to meet the December deadlines to get insurance coverage effective January 1, 2014 December’s incoming calls 30%-plus higher-than-forecast across state customer contact centersFlexible staffing model responsive to clients’ forecasts and changing call volumes First open enrollment period presently scheduled to end on March 31; we will continue to staff to the ebb and flow of volumes and activities that are part of the cyclical nature of HIX operations

Title: Improving HIX Workflow for Cover Oregon Provided operational review of business processes that led to us providing call center and other overflow capacity to assist consumers in completing enrollmentsOperational assistance eased workload from exchange workers overwhelmed by high volumes of paper applicationsCover Oregon asked us to handle calls to help consumers complete health plan shopping and selection, all leveraging an existing contact centerAllowed for a vastly improved workflow; Cover Oregon could offload tasks for plan selection, so exchange workers could focus efforts on eligibility determinationsThis model, in which MAXIMUS employees act as “sous chefs” to state or county eligibility workers, is a demonstration of the partnership model we seek and through which our clients derive value

Title: Overcoming an Influx of Applications in Colorado Helped Colorado overcome an influx of applications through our existing contract vehicle and business process re-engineering; consumers must be deemed ineligible for Medicaid before being considered for a subsidy; state experienced a surge in consumer applications; incorrect and inaccurate applications were not able to get a real-time Medicaid eligibility determination online The state asked us to increase our level of commitment to process applications; at the same time, we faced a daily average intake of new cases significantly higher than what normal staff levels could handleWorked collaboratively with client to produce and implement a very aggressive plan to clear the applications and maintain the daily inventory of new cases; the goal was to ensure that everyone who applied online received appropriate outcome within 24 hours so that they can receive benefits January 1Together, we quickly hired and trained additional staff, successfully executed the plan, and met the deadline to get thousands of Coloradans enrolled in health plans through the state’s exchange and through Medicaid and CHP+MAXIMUS, in conjunction with the state, processed 32,500+ cases since October; still receiving nearly 300 new cases daily; will continue to process them within 1 business day

Title: Responding to Medicaid Transformation ACA to serve as a multi-year growth driver for MAXIMUS; some states likely to operate their own exchanges over the next several years, as well as enhance public health insurance programs, including expanding Medicaid Kaiser Family Foundation predicts 2014 as a “transformative” year for Medicaid with increases in both spending and enrollmentMAXIMUS is responding to this long-term transformation; seeing material increases to existing Medicaid enrollment broker business through contract amendments and change ordersContinue to believe more states will expand Medicaid over the long-term, but state legislatures and federal waiver requests often move slowlyMedicaid expansion remains a long-term, multi-year growth opportunity that doesn’t reach its steady state until 2016 at the earliest

Title: Remaining Engaged with the Duals Market Engaged on some dual demonstration projectsDozens of governors made this a priority agenda item as they look for real solutions for these “super utilizers” of Medicaid and MedicareWhile not a large financial contribution to MAXIMUS, the duals market is an important plank in our long-term services and supports platform Working with five states to address cost, quality and care coordination among the duals population, including California, considered a leader in creating a potential blueprint for duals population

Title: Continuing Medicaid Review Work in Illinois Received some very positive news in Illinois where we had been working with the state to help root out Medicaid fraudEligibility and Enrollment Verification project designed to help ensure that only those eligible for Medicaid are actually receiving coverage and servicesProject was slated to end in December On December 17th, the state received a supplemental arbitration order allowing MAXIMUS to retain work through June 2015Pleased to retain meaningful level of responsibility to support ongoing initiative to reform state’s Medicaid program

Title: Delivering Solid Results in Federal Market Federal Services business again delivered solid financial resultsReflects the team’s ability to deliver on the increased level of appealsThe MAXIMUS Federal team has done a great job to manage increased volumes, while at the same time winning new work that’s centered on our core capabilities

Title: Expanding Geographic Footprint in Australia Recently completely a small tuck-in acquisition to complement our human services business in AustraliaAcquired workforce services assets from Centacare, a provider of welfare-to-work and disability employment services under the Job Services Australia and Disability Employment Services programsExpands geographic footprint in Australia while maximizing the utilization of existing operational capacity Transaction closed on January 31, 2014 and is expected to contribute approximately $10 million in new annual revenue

Title: Contract Rebids 2014 will be a light year for rebids and overall total awardsThus far, we’re pleased with our progressOf the 15 contracts worth a total of $225 million up for bid, we’ve won 3 for a total contract value of $46 million

Title: New Awards and Sales Pipeline At December 31, 2013:Signed $347 million in new contract awardsAdditional $50 million of “awarded but unsigned” contracts, pending final signaturesSales pipeline was $2.4 billion; as expected, lower compared to same period last year due to record number of awarded contracts in FY13 that converted into new sales awardsRobust pipeline includes opportunities across both segments and several geographies

Title: Conclusion Plans for long-term growth continue to be shaped by our three strategic priorities:Enhancing our U.S. operations by supporting clients through the next phase of the Affordable Care ActGrowing our federal businessExpanding our international operations with health and human services opportunitiesUnderpinning this growth will always be providing the highest level of service for our government clients; they entrust us to operate highly visible programs and we take this responsibility most seriously and strive to provide top-notch customer service for citizens and achieve important program outcomes for our clientsWe are pleased to offer an even brighter outlook for the remainder of the year; for fiscal 2015 and beyond, our long-term outlook remains optimistic

Title: Thank You to CFO David Walker Thank you to our Chief Financial Officer, David Walker, for all that he’s done to drive success for MAXIMUSIn December, David announced his intent to retire, but will remain with the Company to provide support for special projects We kicked off the search process in tandem with the announcement in December; have a good stream of qualified candidates, but expect the process to take several months; David has assured us that he will remain in a full-time position until we find the right person David leaves big shoes to fill, but we are fortunate that he will remain with the Company in this new, “downshifted” role, providing valuable support for special projects