Exhibit 99.2

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Operator: Greetings, and welcome to the MAXIMUS Fiscal 2013 Fourth Quarter and Year End Conference Call.

At this time, all participants are in a listen only mode.

A brief question and answer session will follow the formal presentation.

If anyone should require operator assistance during the conference, please press star, zero on your telephone keypad.

As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS.

Thank you, Ms. Miles. You may begin.

Ms. Lisa Miles: Good morning. Thank you for joining us on today's conference call.

I would like to point out that we've posted a presentation on our website under the investor relations page to assist you in following along with the call.

With me today is Rich Montoni, Chief Executive Officer, David Walker, Chief Financial Officer, and Bruce Caswell, President and General Manager of the Health Services Segment.

Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC.

The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

11/15/13 - 9:00 a.m. ET - 1

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and providing meaningful period to period comparisons.

For a reconciliation of non-GAAP measures presented in this document, please see the company's most recent quarterly earnings press release.

And with that, I'll turn the call over to Dave.

Mr. David Walker: Thanks, Lisa.

We are pleased to report another year of solid financial results and strong growth, reflecting the contributions of work coming online from new programs as well as the ongoing expansion on existing contracts.

Some key highlights of fiscal 2013 include overall solid growth in core and adjacent markets, several new contracts related to the Affordable Care Act, and the acquisition of Health Management, which broadens our footprint in the UK.

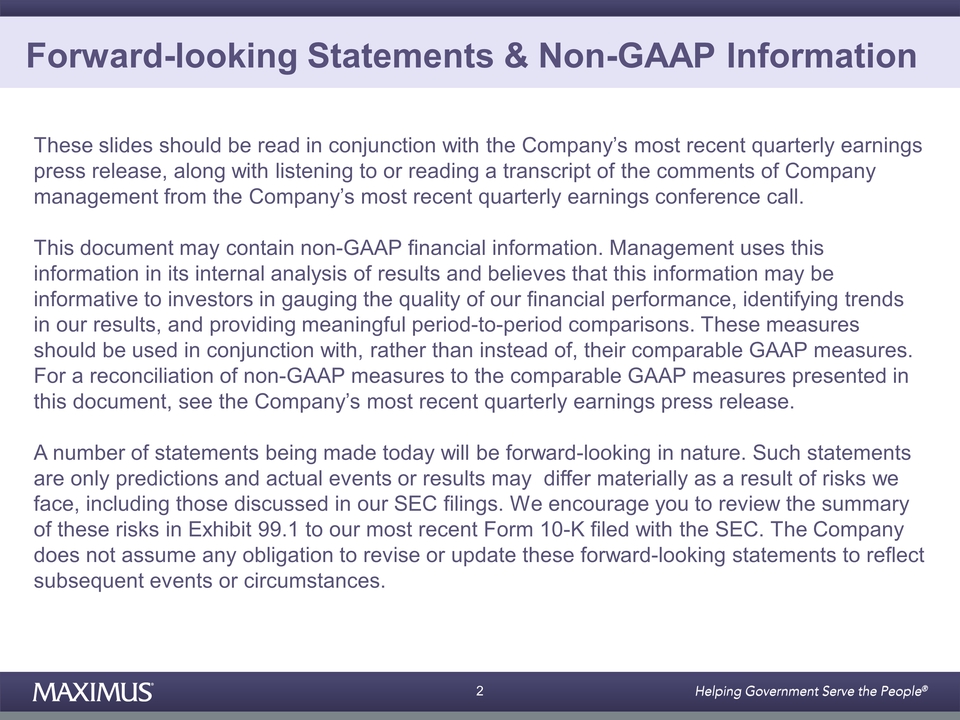

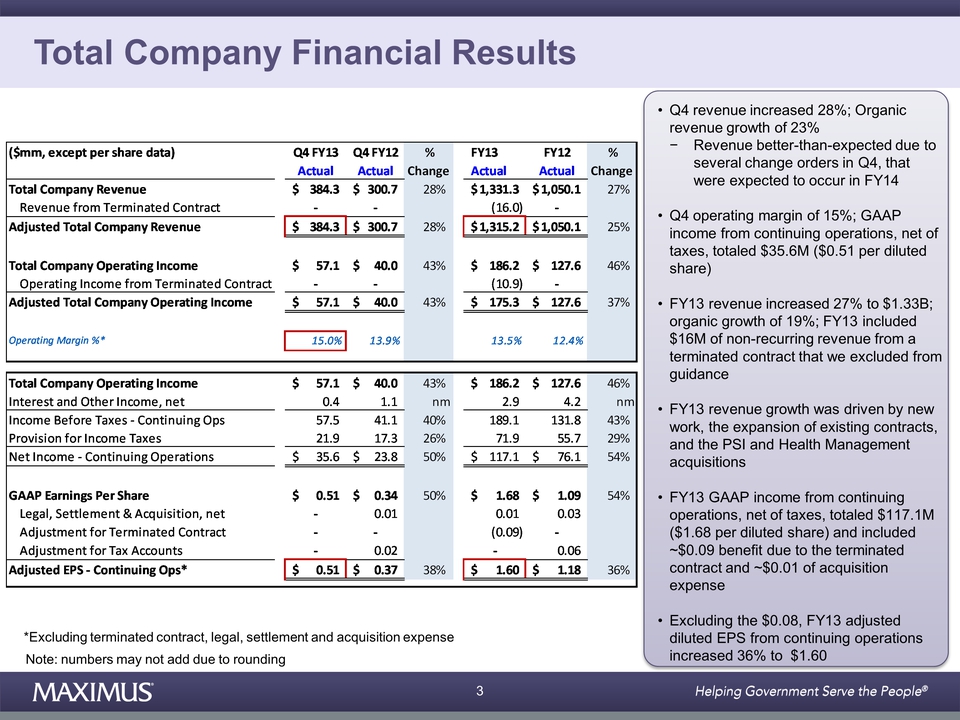

Let’s move into the financial details, starting with the fourth quarter. Total company revenue from continuing operations grew 28 percent to $384.3 million compared to the fourth quarter of last year driven by the health segment.

Organic revenue in the fourth quarter of fiscal 2013 was solid at 23 percent. Fourth quarter revenue was a little better than expected simply due to several change orders that were executed in the fourth quarter that had previously been anticipated to occur in fiscal 2014.

11/15/13 - 9:00 a.m. ET - 2

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Operating margin in the quarter was largely as expected at 15 percent. And for the fourth quarter, GAAP income from continuing operations net of taxes totaled $35.6 million, or 51 cents per diluted share.

For the full fiscal year, revenue increased to $1.33 billion or 27 percent compared to fiscal 2012. As a reminder, revenue in the full year included approximately $16 million of non-recurring revenue from a terminated contract in the second quarter that we excluded from our guidance. Excluding that revenue, we over delivered on the top-line by about $5 million compared to our full year guidance, primarily due to change orders.

For the full fiscal year, revenue growth was driven by new work, the expansion of existing contracts and the acquisition of PSI and Health Management.

For the full year, GAAP income from continuing operations net of taxes totaled $117.1 million, or $1.68 per diluted share. This included approximately 9 cents of benefit related to the terminated contract and about a penny that’s primarily related to acquisition expense.

Excluding the 8 cents contribution from these two items, adjusted diluted earnings per share from continuing operations for the full year totaled $1.60, an increase of 36 percent compared to $1.18 in fiscal 2012.

Since adjusted EPS is a non-GAAP view of our earnings, we have included a reconciliation table that details all our adjustments in the financial schedules of the press release.

Let’s turn to results by segment starting with Health Services. The Health Services segment continues to deliver consistent solid results. Fiscal 2013 was highlighted by our success in securing new work related to the Affordable Care Act or ACA.

11/15/13 - 9:00 a.m. ET - 3

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

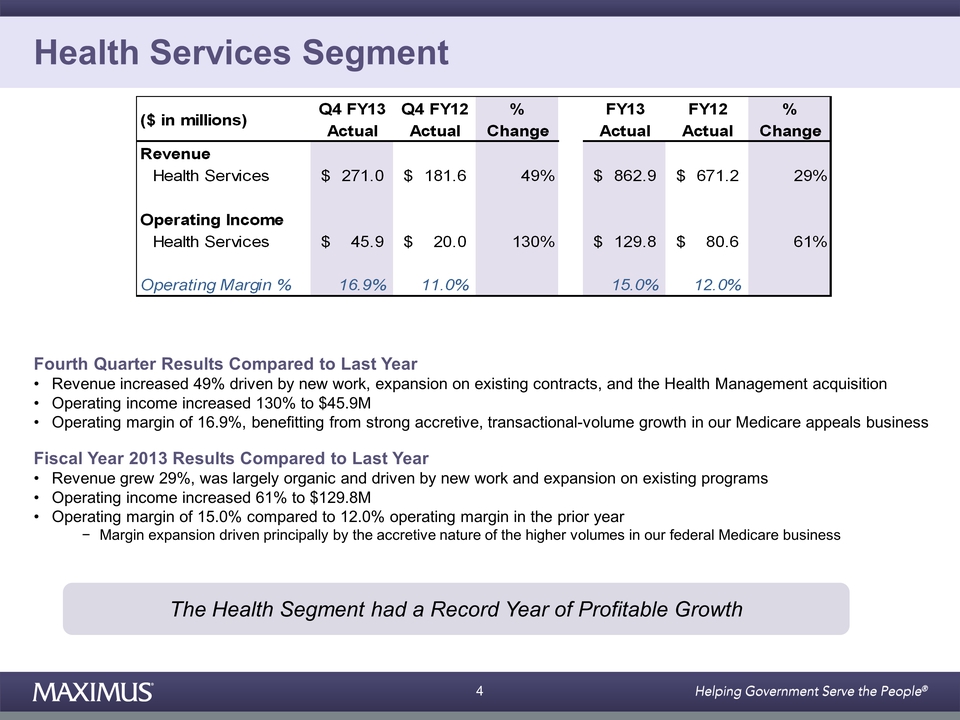

The company also benefited from healthy volumes in our federal Medicare appeals business and other new work across the segment. While the majority of growth was organic in nature, the segment did have a full year contribution from the PSI acquisition as well as Q4 contributions from the Health Management acquisition. Most importantly, the segment had a record year of profitable growth.

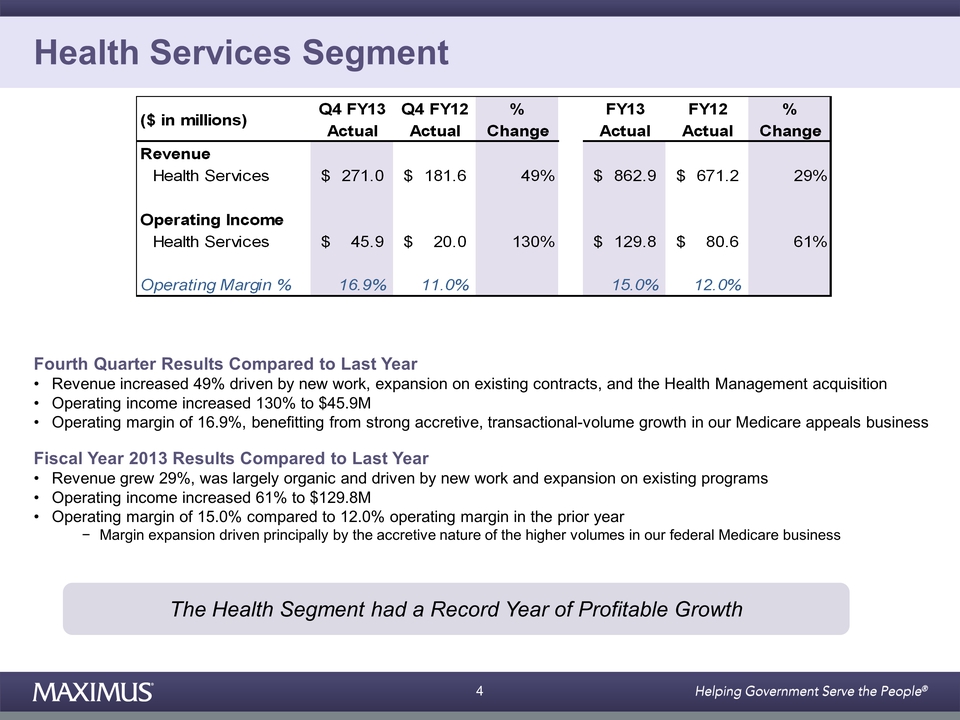

Let’s start with results for the fourth quarter. Revenue in Q4 increased 49 percent to $271 million compared to the same period last year driven by new work, expansion on existing contracts and the Health Management acquisition.

Fourth quarter operating income for the segment increased 130 percent to $45.9 million compared to the prior year. And the segment delivered an operating margin of 16.9 percent in the quarter, benefiting from strong accretive transactional volume growth in our federal Medicare appeals business.

For the full fiscal year, Health Services revenue grew 29 percent to $862.9 million, which was largely organic and driven by new work and expansions on existing programs. For fiscal 2013, Health Services segment operating income increased to $129.8 million, a 61 percent increase over fiscal 2012 with a full year operating margin of 15 percent. This compared to a 12 percent operating margin in the prior year.

The margin expansion in fiscal 2013 was driven principally by the accretive nature of the higher volumes in our federal Medicare business - all in all, another great year for the Health segment.

11/15/13 - 9:00 a.m. ET - 4

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

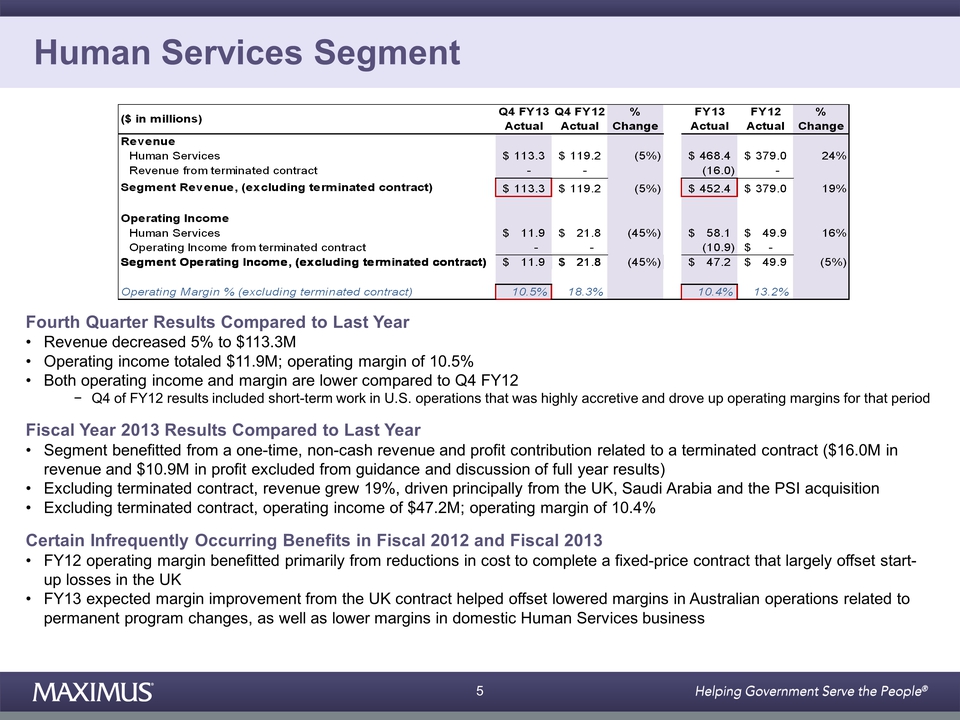

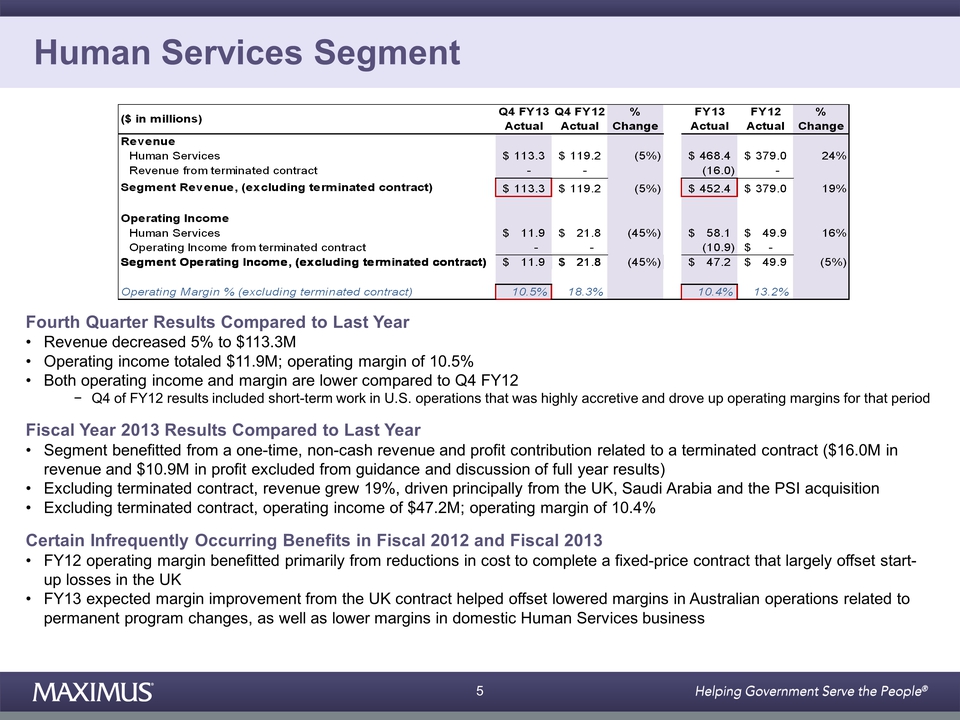

Let’s turn our attention to financial results for the Human Services segment. Overall, the segment performed largely as expected for the full fiscal year, benefiting from the ramp-up in the UK, a new contract in Saudi Arabia and the PSI acquisition, which contributed a full year of revenue compared to only five months in fiscal 2012.

For the fourth quarter of fiscal 2013, revenue for the Human Services segment decreased 5 percent to $113.3 million compared to the same period last year. Fourth quarter operating income for the segment totaled $11.9 million, and operating margin was 10.5 percent.

Both operating income and margin were down compared to the fourth quarter of last year. This is because last year’s Q4 results included short-term work in our U.S. operations that was highly accretive and drove up operating margins for that period.

As you may recall from our Q2 call, our fiscal 2013 results from the Human Services segment were improved by a one-time non-cash revenue and profit contribution related to a terminated contracted. Because of the unusual nature of this windfall, we have excluded $16 million in revenue and 10.9 million in profit from our guidance in discussion of full year results

Because this is a non-GAAP view, we have provided a reconciliation table in the press release.

Excluding this terminated contract, full year revenue grew 19 percent to $452.4 million compared to fiscal 2012. Revenue growth was driven principally from the UK, Saudi Arabia and the PSI acquisition.

For the full year, operating income for the Human Services segment totaled $47.2 million resulting in a full year operating margin of 10.4 percent. As a reminder, both fiscal 2012 and fiscal 2013 included certain infrequently occurring benefits to revenue, operating income and margin.

11/15/13 - 9:00 a.m. ET - 5

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

In fiscal '12, operating margin benefited primarily from reductions in the cost to complete a fixed price contract, which largely offset the startup losses in the UK. In fiscal 2013, the expected margin improvement from the UK contract help offset the lowered margins in our Australian operations that were related to permanent program changes as well as lower margins in our domestic Human Services business.

Generally, the U.S. Human Services business has lower margins and the full year benefited the PSI acquisition tempered margins.

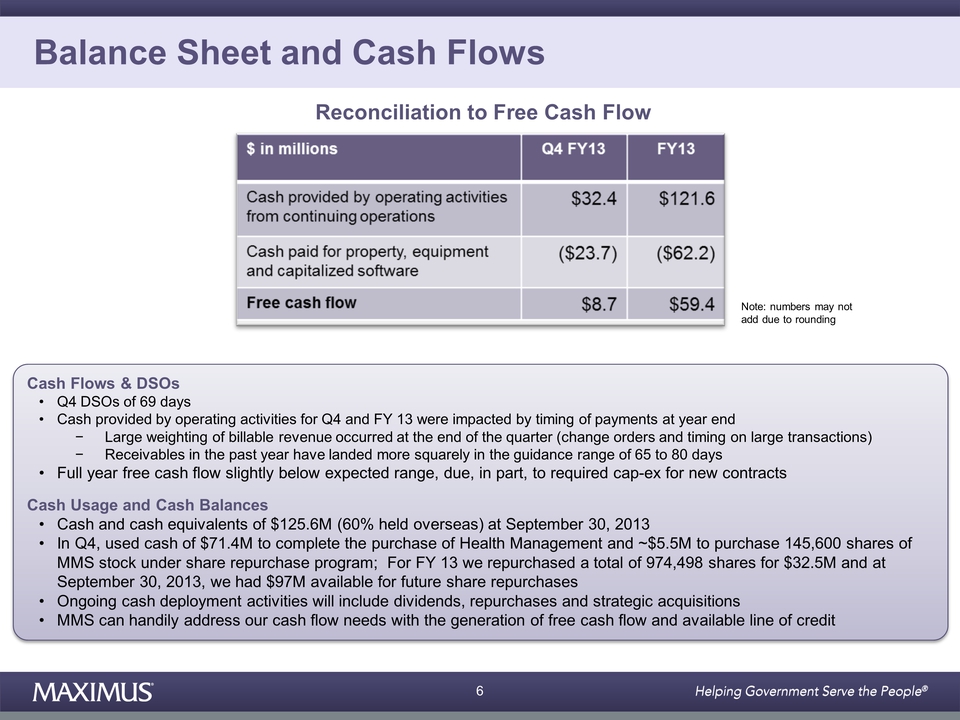

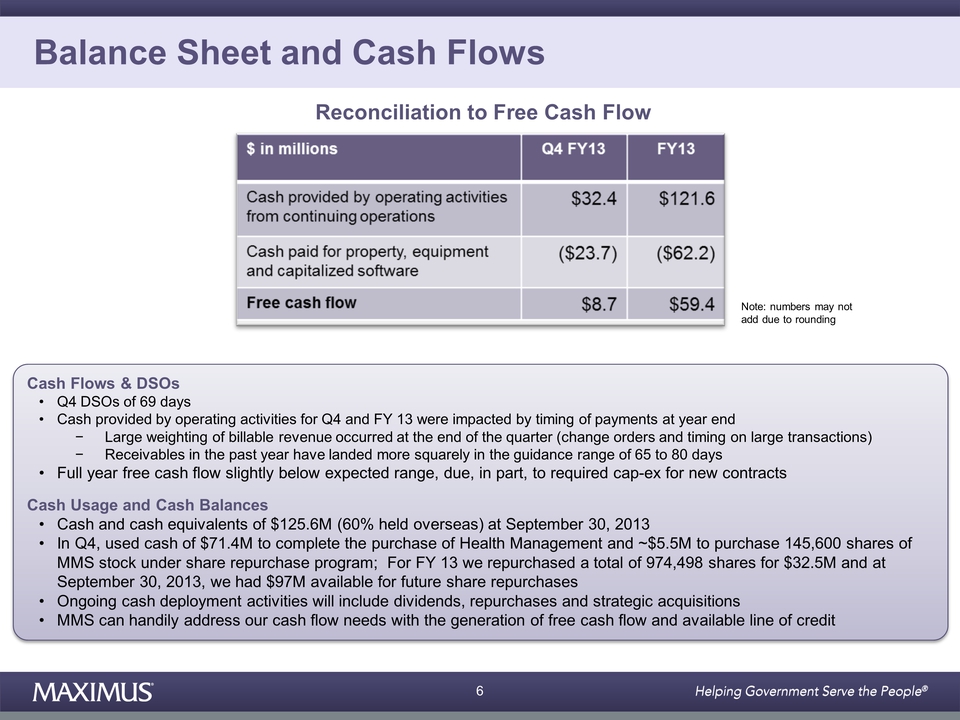

Moving on to cash flow and balance sheet items, days sales outstanding were 69 days for the fourth quarter. Cash provided by operating activities for both the fourth quarter and full year were impacted primarily by timing of payments at the end of the year.

We had a large weighting of billable revenue occurring at the back end of the quarter, driven by change orders and the timing of large transactions.

Additionally, we are seeing more administrative review of invoices prior to payments. As a result, our receivables in the past year have landed more squarely in the guidance range that we’ve already provided of 65 to 80 days.

For the fourth quarter, cash provided from operating activities from continuing operations totaled $32.4 million with free cash flow of $8.7 million. And for the full fiscal year, cash provided by operating activities from continuing operations totaled $121.6 million with free cash flow of $59.4 million.

11/15/13 - 9:00 a.m. ET - 6

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Our full year free cash flow was slightly below our range due in part to required CapEx specifically tied to a large number of new contracts.

Our balance sheet remains healthy, and we ended the fiscal year with cash and cash equivalents totaling $125.6 million of which 60 percent is held overseas.

During the fourth quarter, we used cash of $71.4 million of our overseas cash to complete the purchase of Health Management.

Also in the quarter, we used approximately $5.5 million to purchase 145,600 shares of MAXIMUS’ common stock under our share repurchase program. For the full year, we repurchased a total of 974,498 shares for $32.5 million. At September 30, 2013, MAXIMUS had approximately $97 million available for future repurchases. All share amounts are adjusted for a stock split in June of this year.

Our ongoing cash deployment activities will continue to include dividends, repurchases and strategic acquisitions. With the generation of free cash flow and available line of credit, we feel we can handily address our cash flow needs.

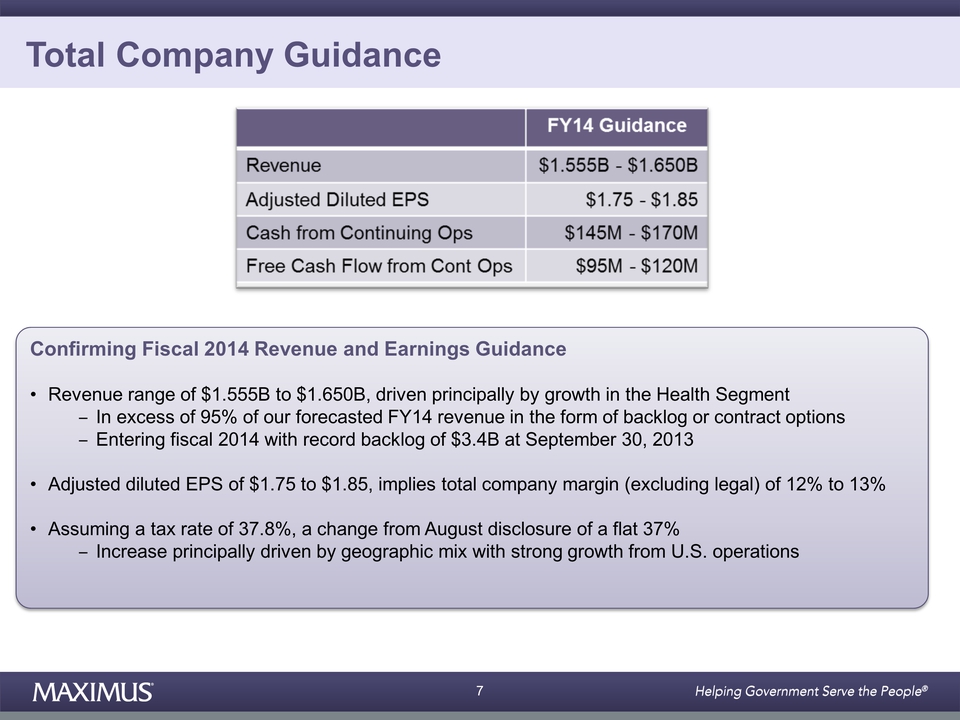

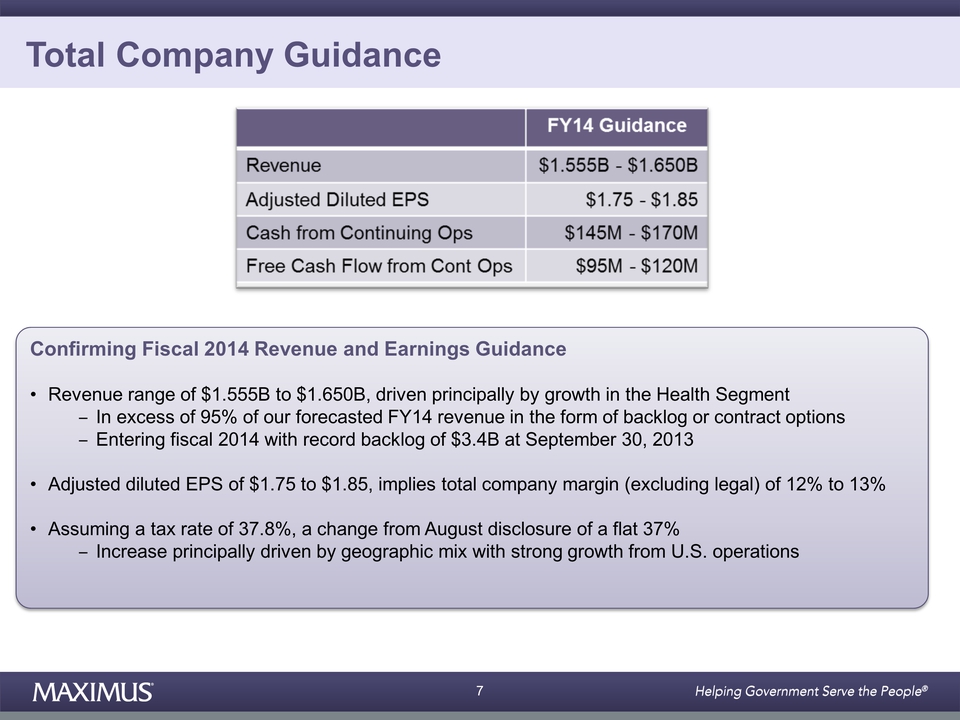

Moving on to guidance, since our last call, we’ve completed our detailed bottoms-up planning and budgeting process. To that end, we are confirming our fiscal 2014 guidance.

We continue to expect revenue to a range between $1.555 billion to $1.650 billion, driven principally by growth in the health segment. Furthermore, in excess of 95 percent of our forecasted fiscal 2014 revenue is in the form of backlog or contract options. This is based upon the midpoint of our revenue range. We entered fiscal 2014 with backlog at September 30th of $3.4 billion.

11/15/13 - 9:00 a.m. ET - 7

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

On the bottom line, we continue to expect adjusted diluted EPS from continuing operations in the range of 1.75 to $1.85. This would imply a total company margin excluding legal to range between 12 percent and 13 percent.

We remain confident that the necessary drivers are in place for solid growth in fiscal 2014. Last quarter I talked about some of the assumptions that went into our fiscal 2014 guidance, and I’ll revisit those today.

We are now assuming a tax rate of 37.8 percent, which is a change from our last disclosure in August where we were modeling a flat 37 percent. The tax rate increase is principally driven by geographic mix with strong growth coming from our U.S. operations.

We are also forecasting that the vast majority of growth will come from the Health Segment and that the Human Services segment will be fairly flat compared to fiscal year '13.

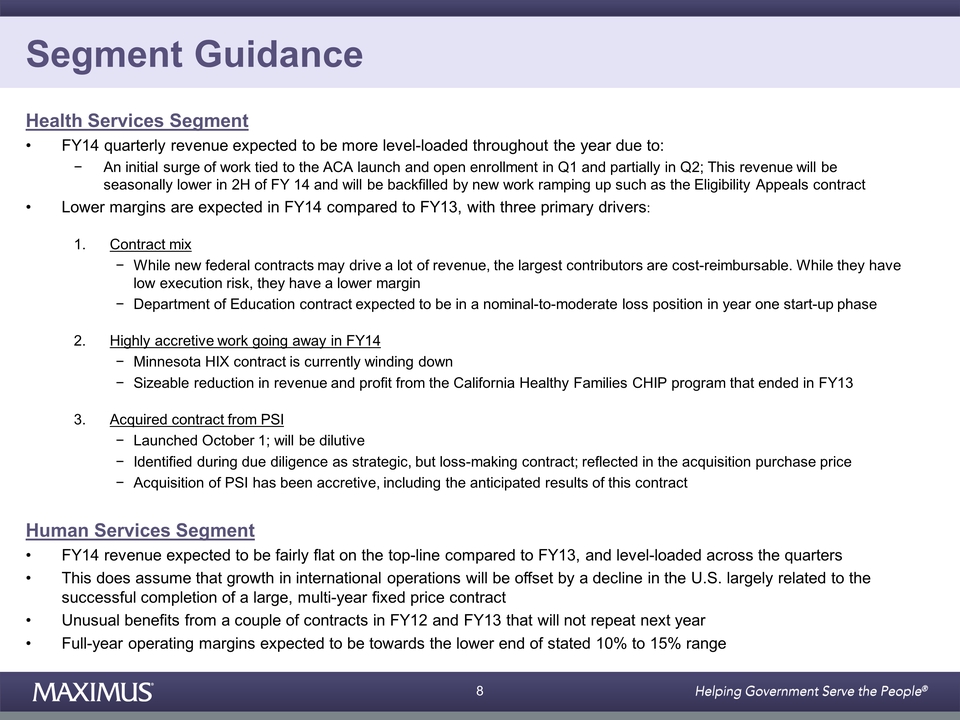

Let’s cover the details by segment. For the Health Segment, we believe revenue will be more level loaded throughout the year. This is due to an initial surge of work tied to the ACA launch and open enrollment in Q1 and partially in Q2. We expect that this revenue will be seasonally lower in the back half of the year and will be back-filled by new work that is ramping up such as federal eligibility appeals contracts.

We continue to expect lower margins in the Health Segment in fiscal year '14 compared to fiscal year '13 with three primary drivers.

First, contract mix - while our new federal contracts may drive a lot of revenue in fiscal year 2014, the largest contributors are cost reimbursable. While they have low execution risk, they have a lower margin.

11/15/13 - 9:00 a.m. ET - 8

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

As a reminder, our new Department of Ed contract is forecasted to be in a nominal to moderate loss position in the year one start-up phase.

Second, we have some highly accretive work going away in fiscal year '14, such as the Minnesota HIX contract, which is currently winding down--additionally, the sizable reduction in revenue and profit from the California Healthy Families CHIP program, which ended in fiscal 2013.

And lastly, a large contract that was acquired as part of the PSI deal launched on October 1st will be dilutive. During the due diligence process, we identified this as a strategic, the loss making contract which was reflected in the acquisition purchase price. The acquisition of PSI has been accretive including the anticipated results of this contract.

On the Human Services side, we are forecasting that the year will be fairly flat on the top line compared to fiscal year '13. However, this assumes that growth in our international Human Services operation will be offset by a decline in the U.S., largely related to the successful completion of a large multi-year fixed price contract. In addition, we anticipate that Human Services revenue will be more level loaded across the quarters.

In fiscal '12 and fiscal '13, the segment enjoyed unusual benefits from a couple of contracts that will not repeat next year. So, right now, we believe that full year operating margins in the Human Services segment will be towards the lower end of our stated range of 10 to 15 percent.

Moving on to cash flow guidance, we expect cash provided by operating activities derived from continuing operations to be in the range of 145 million to $170 million for fiscal 2014. And we expect free cash flow from continuing operations to range between 95 million and $120 million.

11/15/13 - 9:00 a.m. ET - 9

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So, all in all, MAXIMUS wrapped up another year of great financial results. And we see fiscal year '14 shaping up to be a year of continued growth.

Thanks for your continued interest, and now I’ll turn the call over to Rich.

Mr. Rich Montoni: Thank you, David, and good morning, everyone.

We are very pleased with another year of continued solid top and bottom line growth. First, thanks to our 12,000 employees for their tremendous efforts in making fiscal 2013 so successful for MAXIMUS. The operational expansion this year and the future growth trajectory we have in place are both a direct result of their contributions.

The past fiscal year was defined by the significant progress we made on our long-term growth objectives and other areas where we can best maximize shareholder value.

Today, I’ll share updates on our three primary goals, which include, securing our fair share and little more of work related to the health care reform in the United States, growing our U.S. federal book of business and expanding our international operations in both segments.

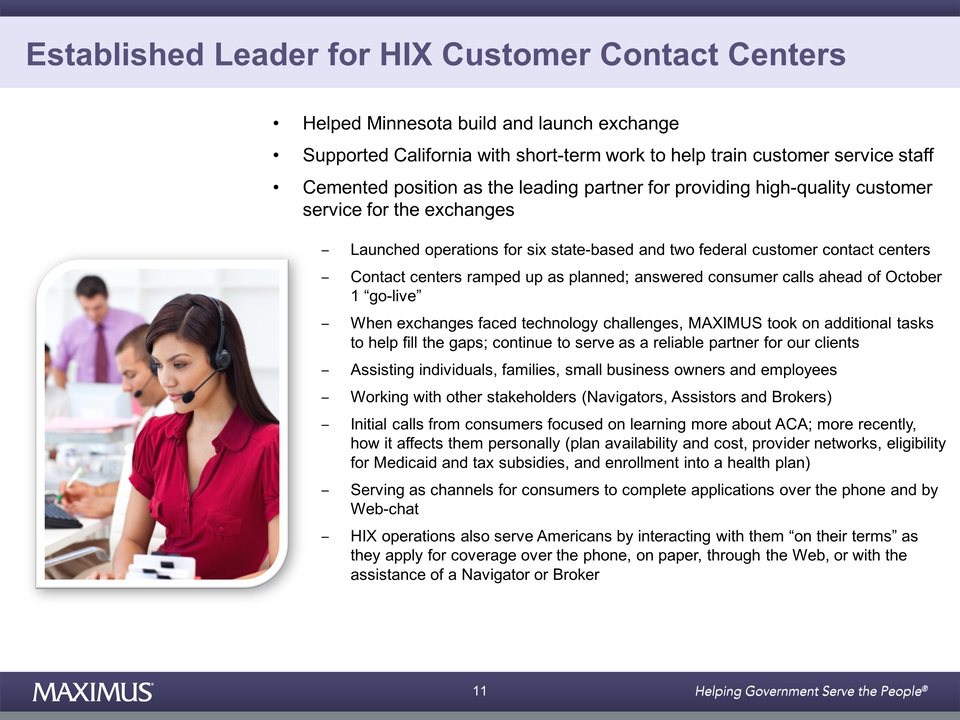

Let’s start off with an update on our first area of long-term growth, health care reform in U.S. In fiscal 2013, MAXIMUS successfully established a leading position in the health insurance exchange market. We helped Minnesota build and launch their exchange, and we supported California with some short-term work to help train customer service staff.

Most importantly, we submitted our position as the leading partner for providing high quality customer service for the exchanges as we launched operations for six state-based and two federal customer contact centers. We’re delivering value to these important reform efforts, and we’re proud of our work.

11/15/13 - 9:00 a.m. ET - 10

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Our exchange customer contact centers ramped up as planned, and we’re already answering consumer calls in many of our operations well ahead of the October 1st go-live.

As you know from the extensive press coverage, a number of exchanges have faced a variety of challenges, mostly from a technology perspective. But, I’m very pleased with our performance as we delivered on the scope and requirements of our contracts. And in some cases, we’ve stepped up to take on additional tasks to help fill the gaps through our Health Insurance Exchange, or HIX, contact centers and we continue to serve as a reliable partner for our clients.

Our contact centers provide assistance to a wide range of consumers including individuals and families as well as, in some cases, small business owners and their employees. We also work closely with other stakeholders including the navigators, assisters and brokers.

Initial calls from consumers primarily focused on learning more about the Affordable Care Act and its benefits. More recently, we are hearing from consumers who need additional assistance with how the law affects them personally.

Our staff is answering questions related to the following - plan availability and cost, provider networks, eligibility for Medicaid and tax subsidies and enrollment into a health plan.

Some of our contact centers are also serving as channels for consumers to submit and complete their applications over the phone and by web chat. We’ve often talked about how our ability to interact with consumers on their terms is a value add for our clients. Through our HIX operations, we apply this area of expertise to serve Americans as they apply for coverage, whether it’s over the phone, on paper, through the web or with the assistance of a navigator or broker.

11/15/13 - 9:00 a.m. ET - 11

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

We’re also gearing up under our new contract to form eligibility appeal services for the federal exchange. Under this program, MAXIMUS will provide the overall management of the eligibility appeals process. This work relates to helping individuals who believe their eligibility determination was incorrect and are appealing the decision.

MAXIMUS will operate a resolution process for appeals, review appeal requests and supporting documents, coordinate data collections with appellants and provide general case management. We’re scheduled to fully launch our operations in early January.

Looking ahead, we continue to view health insurance exchanges and other work related to the Affordable Care Act as a multiyear growth driver. Over the next several years, we expect some states will consider transitioning to their own state-based exchanges. And lastly, demographic trends are likely to push certain states to consider an expansion of companion programs such as Medicaid.

Let’s move onto our second area for long-term growth, the expansion of our federal operations. These are part of our Health Services segment.

We’re extremely pleased with the success we’ve had in expanding the federal book of business in our traditional service line supporting CMS. But, as I’ve talked about in the past, we put a sizable effort into serving new federal markets.

11/15/13 - 9:00 a.m. ET - 12

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And certainly, over the past two years, we have enhanced our current offerings, invested heavily in business development and delivery of resources and identified opportunities to apply our core areas of expertise to new federal agencies. And these efforts have led to the recently announced contract win from the U.S. Department of Education, Office of Federal Student Aid.

The core business functions of this new contract are very similar to the work we do across our Health Segment and right in our wheelhouse.

While we are excited about this new work, we have just been advised that the award has been protested to GAO. The agency has 100 days to review the protest. At this point, we have stopped work on the contract while the protest is under review.

From a financial perspective, we don’t believe this will have a meaningful impact to fiscal 2014. Furthermore, protests are common and are to be expected as we grow into larger, new federal markets.

But, overall, we’re extremely pleased with the substantial progress that our federal team has achieved in fiscal 2013. The team's focus today is on executing these new wins, and we are optimistic about other opportunities down the road as they work to backfill their pipeline.

Turning now to our third growth area, expanding our international operations - this expansion has taken several forms from importing core competencies into both existing and new markets to increasing the scope of current operations. We also continue to assess new geographies where governments seek assistance from partners like MAXIMUS from important reform efforts. But our primary efforts today are keenly focused on delivering new services into existing markets.

11/15/13 - 9:00 a.m. ET - 13

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

The acquisition of Health Management in July provided a strategic platform for introducing our core health offerings to the UK. The integration of the Health Management organization has resulted in an exceptionally strong delivery team that is well positioned for future work, including emerging opportunities that we believe may lead to proposal activity during fiscal 2014.

Our growth plans for Health Management build upon their reputation and demonstrated performance of our welfare to work operations in the UK.

In late September, the Department for Work and Pensions issued the most recent quarterly report covering vendor performance through June of 2013. I’m pleased to share that MAXIMUS remains one of the highest performing providers under the work program.

In fact, our Thames Valley region is ranked third across all regions since the start of the contract. And when you look at cumulative performance since the beginning of the program, MAXIMUS is tied for third out of 18 providers.

In Saudi Arabia, we have a formal memorandum of understanding with the Kingdom of Saudi Arabia that extends the pilot program for three years. We expect to sign contract by the end of this quarter.

Looking ahead, our international growth strategy will continue to be based on our land and expand approach and be driven by multiple factors. We continue to review opportunities across both segments with governments that are implementing health and human services reform programs.

It’s important to note that administrative and policy changes can accelerate or delay reform initiatives. However, we believe that our international operations have the potential to be significant contributors to total company revenue over the long-term as they have been in recent years.

11/15/13 - 9:00 a.m. ET - 14

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Moving on to rebids - for fiscal 2013, we had 14 contracts with a total contract value of approximately $475 million up for rebid. By September 30th, 2013, we secured 95 percent of this total contract value through contract wins or extensions as well as 100 percent of our option periods. As we mentioned on the last quarter’s call, we expect fiscal 2014 to be a light year from a rebid perspective.

Contact rebids are cyclical by nature, and our reported numbers are sensitive to the timing of when rebids are procured and awarded.

For fiscal 2014, we have 15 contracts with a total contract value of approximately $225 million up for rebid. We also have 15 option periods up for extension or option election with a total value of approximately $135 million.

So, fiscal 2014 will be an extraordinarily light year for rebids, and with fewer rebids up for bid, we anticipate this will ultimately lower our overall total awards in fiscal 2014, as well. Since both fiscal '13 and '14 were light rebid years, we anticipate that fiscal '15 will be a heavier rebid year.

Based on what we know today, we believe we will have more than $1 billion of total contract value up for rebid in fiscal 2015. But, it’s very early, and that number can change as governments may extent contracts, which is a trend that we've seen. Nevertheless, we felt it would be helpful to give investors some perspective since we've had some light rebid years of late.

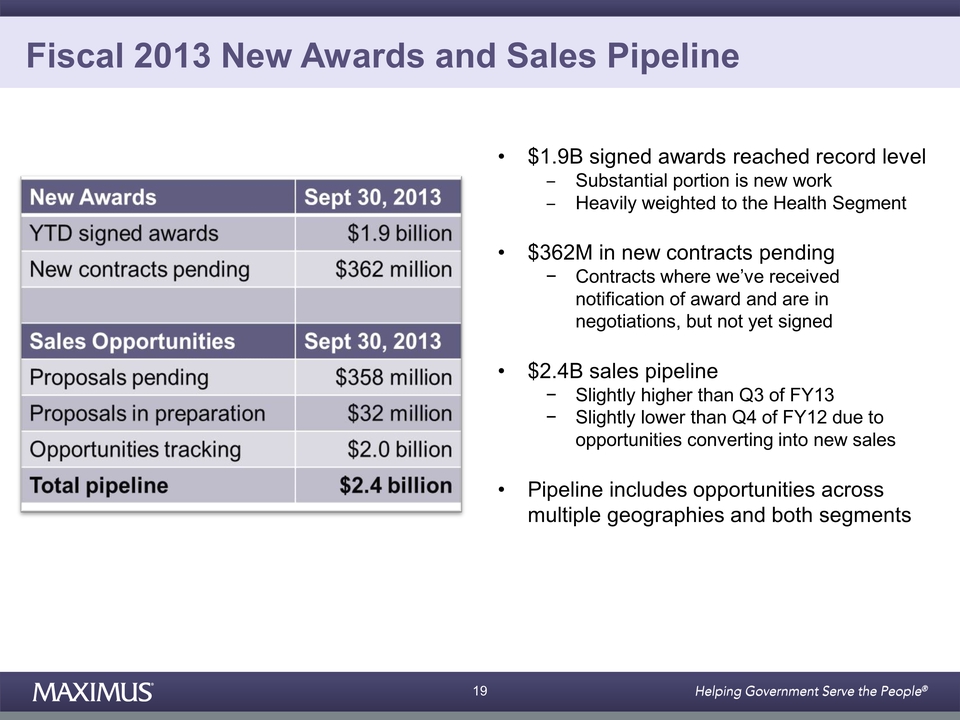

Let’s turn now to our new sales awards and the pipeline. Signed awards reached a record level in fiscal 2013 with $1.9 billion in signed contract awards of which a substantial portion was derived from new work, and as expected, heavily weighted to the health segment.

11/15/13 - 9:00 a.m. ET - 15

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And at September 30, 2013, we had an additional $362 million in new contracts pending. As a reminder, these are contracts where we’ve received notification of award and are in contract negotiations but have not yet been signed.

Sales pipeline at September 30th, 2013 was $2.4 billion, which is slightly higher than last quarter. The pipeline is slightly lower compared to the same period in fiscal 2012 due to opportunities converting into new sales.

It’s important to remember that we expect normal fluctuations in our pipeline, primarily as opportunities convert into new sales. The pipeline includes opportunities across multiple geographies in both of our segments.

When you add it all up, we had a very good year in terms of rebids and options, as well as a pipeline that remains robust. This sets a solid platform for continued growth through fiscal 2014 and beyond.

In closing, as we look to the future, we remain keenly focused on our top three strategic growth priorities, including winning additional work related to Phase 2 of the Affordable Care Act over the next several years, continued growth for our federal book of business and further expansion of our international operations across both of our segments. While we have these specific areas of focus, our long-term growth is not dependent on a single geography or program, but instead is driven by macro trends and the extended growth drivers.

Governments around the globe continue to seek partnerships with companies like MAXIMUS and we continue to focus on operating efficient and effective health and human services programs and achieving those outcomes that matter most to our clients and to their citizens. With our fiscal 2014 preliminary guidance now confirmed, we are excited about the future growth opportunities and remain committed to generating long-term value for our shareholders.

11/15/13 - 9:00 a.m. ET - 16

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And with that, let’s open it up for questions. Operator?

Operator: Thank you.

We will now be conducting a question-and-answer session.

Please limit your questions to two. If you wish to additional questions, you may reenter the queue.

If you'd like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate your line is in the question queue.

You may also press star, two if you would like to remove your question from the queue.

For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star key.

Once again, please press star, one on your telephone keypad if you wish to ask a question at this time.

And our first question comes from the line of Brian Kinstlinger with Sidoti and Company. Please proceed with your question.

Mr. Brian Kinstlinger: Hi, good morning, guys. Thanks so much.

The first question I had was, I’d like to understand a little bit more about the Human Services segment. What was the impact that led to the drop in revenue? What was the impact of FX maybe? And why was the guidance flat year-over-year? I guess that leads to how large was the contract that reached successful completion?

11/15/13 - 9:00 a.m. ET - 17

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Mr. Rich Montoni: Good morning, Brian. This is Rich. We’re gonna ask Dave Walker to field your questions.

Mr. David Walker: Hey, thanks Brian.

Well, first of all, let's just talk about the drop in Human Services in Q4. The segment decreased 5 percent, and last year’s Q4, quarter-over-quarter, had some short-term work in the U.S. operations that was highly accretive, drove up margins for that period. So, it’s less that this Q4 dropped and the Q4 was extraordinarily high last year on both revenue and margins.

FX is a great question, and we’ve all been watching the strong U.S. dollar. And when you look at FX, for particularly in the fourth quarter, there was a currency impact. The fourth quarter is, down, 2 percent, of revenue and 1 percent for the year.

But, in terms of real dollars, that’s a decline of $6.7 million in the quarter and 7.2 million in the year, largely related to Human Services.

So, when you look at Human Services that is adversely impacted more by the currency than Health, which is driving down the quarter and somewhat next year.

When we talk about the guidance for, Human Services, and just what’s happening, there's puts and takes, in any business, and that’s what we’re seeing in '14. We have a large fixed price contract that’s coming to an end, which will be offset in part by growth in our international operations.

You asked about the size of that contract, and for the last two years, it’s averaged about 20 million a year. And it was--it’s been very accretive. So, it was a very successful contract, and in fact, the definition of success with this one was to prepare an operations for the client. So it ended, and in--for all the right reasons.

11/15/13 - 9:00 a.m. ET - 18

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And if you look overall, the pipeline, includes, you know, a lot of opportunities about Human Services. So, we’re really optimistic about the long-term prospects in Human Services, and particularly internationally. But, it is flat, a little currency, a little bit of this successful contract coming to an end.

And then, certainly, that contract going away has an impact in margin. It was a large contract. It was highly accretive. And that will drive down the margin a bit.

So, we’ll see more normalized margins. We also are getting a full year benefit of PSI and Human Services and, we’ve often talked about, but I’ll reiterate - our Human Services business in the U.S. tends to be lower than our international business, and so when we increase the full-year benefit of that work, it has a dilutive effect on the business.

But I would describe the business in the U.S. as steady in the boat and accretive as I was saying with PSI.

Mr. Brian Kinstlinger: Great.

And my second question is, maybe can you talk about how low enrollments on the federal exchange or the problems on the website impact your call center volume? You touched on it a little bit. But then, has the early glitches slowed or increased the number of people you need to hire on these programs this year, which would obviously impact revenue since it's cost-plus?

Mr. Rich Montoni: Brian, this is Rich. What I’d like to do is I’d like to share with you just a couple thoughts, from a summary level on the Affordable Care Act and MAXIMUS’s position. And we have Bruce Caswell here who, as you know, is the President and General Manager of our Health Segment. So Bruce day-in and day-out is leading all of these dynamics.

11/15/13 - 9:00 a.m. ET - 19

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So, as it relates to the impact of the enrollment numbers, and the glitches, I’m gonna ask Bruce to, respond to that. But, first, just a couple of comments from a summary level perspective - I think it’s important to separate the operations of the health insurance exchanges, which is the role that MAXIMUS plays from the system work of others, the system work we have seen under the microscope, on a daily basis, from a headline perspective.

We always said our primary focus is the operation side. And, in our role of operating the contact centers that we do operate, we have delivered on our contractual commitments, we’ve supported our customers, and in some cases, we’re able to fill, some gaps that were created because of these glitches. And it’s interesting, to think back that, well over a year ago, when we knew this Affordable Care Act was coming at us, we focused on capacity management, we wanted to make sure we had the right resources assigned to the right opportunities and the right clients.

And, frankly, it involved declining some opportunities that were out there where we thought there was high risk of non-performance. So, today, we’re very, very pleased with our performance as it relates to the operations, it’s really on.

But, I think what’s happened thus far is really I think a great testimony to MAXIMUS’s ability to deliver and also the strategic path we took to focus. And as you know, we’re big, big fans on focus. I think it’s proven out that focus puts us in a position to deliver on those commitments, which I think, given all that’s going around is very, very important.

11/15/13 - 9:00 a.m. ET - 20

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So, with that backdrop, Bruce you want to take a minute or two and talk about these other two aspects?

Mr. Bruce Caswell: Sure. I’d be happy to. And, Brian, good morning. Thanks for the question.

In fact, I’ll start I think with the question related to the glitches, and then obviously, since that has an impact on enrollments, bridged to that. So, as Rich noted, you know, our work is largely state based, and we did not have any involvement in the, construction of the healthcare.gov website in that system.

Clearly, with the, issues that they were experiencing, there have been increases initially in calls to our call center. The call center volumes were in fact quite high. And on a temporary basis, we’ve been able to add staff to adjust to that, and managed really our operations accordingly in that regard.

But that--it’s important to note that that’s been temporary in nature. And as the issues get resolved, we’d expect that the staffing profile and those federal call centers will return to what we previously forecast under those contracts.

Bridging to the state level, certainly, a number of the state projects have gone quite well, and others, still have implementation issues that they’re addressing.

And so, I guess I would characterize it as, a bit of the mix in the sense that, while there have been some bumps, I think I'd really pride our team on the planning that they put into developing contingency plans in conjunctions with out clients.

11/15/13 - 9:00 a.m. ET - 21

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And I’m reminded of, an example from day one when there literally was a manual on the floor that we would refer to as issues arose, and we’d stand with our clients and make a decision at that point in time on how to implement the contingency plan, executed immediately and do so effectively.

And so, you have to be agile in this environment, and I think our experience as a company has proven out well in that, in that instance.

So, we’ve managed, I think quite well to our contractual requirements. I’m very pleased with the performance across the projects at the state level and the federal level to date. And I think that speaks to the flexibility.

So, fundamentally, we don’t see any real material change to our current expectations as a consequence of those issues that have been addressed.

Turning separately then to enrollments - as you’re probably well aware from the enrollment information that was released by the Administration, the enrollments have been fairly strong at the state level, and the majority of the work that we’re doing, is with the state based exchanges.

You'll recall that we're, a partner to General Dynamics in the federal marketplace, and we actually only operate two of the 17 customer contact centers under that contract.

So, for the state, portals and so forth that have actually been, functioning, I think it’s fair to characterize at a higher level. The next important point is that we’re not actually paid on enrollments, we're paid on the activities that we, complete in those service centers – example of those might be taking calls, assisting with application completion, performing in some instances certain mail house operations. In a number of contracts, we support the SHOP Exchange as well as the individual.

11/15/13 - 9:00 a.m. ET - 22

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And thus far, I'd say broadly, the overall activity volumes on which we are compensated have been very much in the fairway for the programs and their forecasted targets.

It’s also worth noting that our largest, customer contact operations, both at the federal and the state level, are paid for on a cost reimbursable basis, and that model offers some protections obviously to the downside for any potential margin erosion. I hope that addresses the question.

Ms. Lisa Miles: Next question please.

Operator: Thank you.

And our next question comes from the line of Carl McDonald with Citigroup. Please proceed with your question.

Mr. Carl McDonald: Great, thank you.

Wanted to stick on that topic - just understand the contractual relationships that you have, either with the federal or the state exchanges. Is it purely a cost-plus relationship, or is there a situation where, if volumes run above expected levels, you have to go back and renegotiate something? Or, is it just purely cost-plus, if volumes are higher, you get paid more?

Mr. Bruce Caswell: Good morning, Carl. It’s Bruce. Thanks for the question.

So, for the federal contract, and that would be the call center contact as well as the upcoming Eligibility Appeals contract, those are cost reimbursed or cost plus contracts. Similarly, for one of our largest state contracts, it is also cost reimbursable.

So, we're really able to toggle the resources that we assign on those accordingly to adjust to volume changes either positive or negative.

11/15/13 - 9:00 a.m. ET - 23

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

The rest of the contracts I would characterize as being very similar to the way we’ve done Health Services contracts in the past.

And as we’ve described those they--often--they're performance based, but they have a fixed and a variable component. And so, we structure them such that the fixed component that we're paid for covers the ongoing kind of structural cost to the program. And the variable payments, can relate to everything from call minutes to, in some instances, mailings, applications completed and so forth.

And as a consequence, there, we're able to modulate, if you will, our variable cost structure to accommodate volume changes accordingly.

So, overall, it’s been I think a very strong model for this, relatively uncertain marketplace in the early days.

Mr. Carl McDonald: Great.

And, how much of a concern is it to you if the, federal website issues persist, and just for the sake of argument, instead of 7 million people enrolling in exchanges, it ends up being half of that? Just wondering about the impact that would have on the, the Medicare appeals revenue. Presumably if enrollment is much lower, you wouldn’t end up with as many appeals, down the road.

Mr. Bruce Caswell: I guess, I’d like to maybe just call a distinction between the enrollments through the Affordable Care Act and Medicare. I think what we might be talking about is eligibility appeals.

Mr. Carl McDonald: Sorry, eligibility appeals.

Mr. Bruce Caswell: Great.

11/15/13 - 9:00 a.m. ET - 24

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So, I think, you're right that eligibility appeals are going to be a function of volume, but also, they're a function of system functionality, right? So, if issues persist related to data matching, availability of third-party data sources, consumers, might find themselves in a situation where they're more inclined to appeal because, either they might believe that their application didn’t fully reflect, you know, for example, income, for the period being looked at and so forth.

So, there are a lot of variables that are gonna factor into whether an eligibility appeal is generated. I do think that you’re right - the primary driver will be volumes over time, but it’s really early days, and very early days to know what that impact will be.

The larger issue that some states are concerned about is ultimately sustainability as these volumes materialize. And in that regard, again, it’s still very, very early in the process, and states have a lot of levers at their disposal to modulate their cost structures.

And furthermore, you may recall that the establishment grants that are available to states can actually be applied for and drawn down on through the end of 2014 with level two money being able to be spent for three years subsequent. So, there's some call it funding backstops that are available to them to address that issue.

Mr. Carl McDonald: Great. Thank you.

Mr. Rich Montoni: You’re welcome.

Ms. Lisa Miles: Next question please.

Operator: Thank you.

And our next question comes from the line of Dave Styblo with Jefferies. Please proceed with your question.

Mr. Dave Styblo: Good morning. Thanks for taking the questions.

11/15/13 - 9:00 a.m. ET - 25

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

First on what just--thinking--getting back to the health margins that was originally asked, and those are kind of coming in at the lower end of the 10 to 15 percent range for fiscal '14. I'm just curious - with some of the pressures going on there, of new business coming online, how should we think about that over the longer term after '14? Is that something that should trail, you know, closer to the midpoint of the 10 to 15 percent as you re-price business, and other M&A, deals that you’ve folded in there and just simply improve operations?

Ms. Lisa Miles: David, please, can you clarify which segment you’re asking about. You said Health, but I think you might be referring to Human Services.

Mr. Dave Styblo: I’m sorry, I mean, Human, yep, thanks.

Ms. Lisa Miles: Okay, thanks.

Mr. Rich Montoni: Okay.

That being the case, I’m going to ask Dave Walker to, field your question David.

Mr. David Walker: You know, David, we talked a little bit about it. The margins came down to the lower end of the range because the large accretive contract went away. And, we certainly have a bigger volume in the U.S., but we also talked about the contract going away in terms of revenue, which is why it’s flat, being back filled by international work, which generally tends to be more accretive.

So, if you look beyond '14, I think it’s tied to how successful we are internationally. And margins are tricky. And I’ll remind you of the UK contract - depends on revenue recognition.

So, I could be really successful in getting case workload, but if it’s tied to outcomes like in the UK, where there's a six month deferral, I could get a lag in the margin, so it would be subject to some timing of the revenue recognition on those large BPO sort of contracts.

11/15/13 - 9:00 a.m. ET - 26

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So, long-term, we think there's a lot of opportunities internationally that we think will be very helpful, to margin and just growth. And, short-term, you know, I think the U.S. market tends to be steady in the boat and accretive.

Mr. Dave Styblo: Okay.

And if I could just have my follow-up on the guidance for '14 here - obviously, this is the second update we’ve had on it, and I’m just curious, now that you have more visibility, we know the Department of Education outcome, the eligibility appeals is out. What, you know, what gives you, confidence in that range? Do you feel like you are biased to the upwards part of that range now that you have more visibility? Or what are the factors that could cause you to deviate from the mid-point there?

Mr. David Walker: Well, you know, really we’re reiterating guidance, and the good news about our business is it’s somewhat predictable. But, the reason it's somewhat predictable is, when we take a look at '14, 95 percent of that’s coming from backlog. So we’re pretty comfortable with the range.

That being said, there are transactional volumes that can cause some variability in the top-line, and I think we’ve demonstrated our ability to manage our cost structure to manage the bottom line around that variability. But there will always be a range driven by those things.

And I would say new business really is a big driver and something we’re very focused on, but it will drive more, fiscal '15.

11/15/13 - 9:00 a.m. ET - 27

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Mr. Rich Montoni: And, Dave, I would, add at this point, you know, while there are dynamics, the nature of our business, given there's such a long lead time, with new business development, it really is a sort of thing where, this year, we sell next year’s growth.

So, you’ll note that the pipeline remains very, very hardy. A good portion of that is new business. I look at that as really being the drivers to growth in '15 when we get--we may get some of those wins in '14 and get partial years, but the full year kicks in '15.

So, you know, I’m pleased to see that we’ve got growth aspirations that are solid for beyond '14. But, it also means it’s difficult to go and find real large contracts for '14, just given the nature of the business development cycle.

Mr. Dave Styblo: Thanks, guys.

Mr. Rich Montoni: Okay.

Ms. Lisa Miles: Next question please.

Operator: Our next question comes from the line Richard Close with Avondale Partners. Please proceed with your question.

Mr. Richard Close: Yes, thank you. Congratulations on a very solid, fiscal year.

Talking a little bit about the Health Services division, you talked about revenue, I think you mentioned level loaded through the year. Can you just walk us through, maybe the quarterly progression, sort of the puts and takes on, the revenue on a quarterly basis in Health?

Mr. David Walker: Sure, Richard.

11/15/13 - 9:00 a.m. ET - 28

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So, when we talk about revenue for Health, ACA, we think, that you'll see more of an initial surge in Q1, partially Q2. They have an open enrollment. So, notionally, when we looked at it, that’s what we think will happen, you know, very much tied to volumes.

And then on the back end of the year--you know, so you'd say well that have front ended you and then it would have trailed down a little bit, but on the back end of the year, we think we’ll see the eligibility appeals and Department of Ed contracts kicking in. So, that'll tend to have a leveling effect for the year.

Mr. Richard Close: So--and how do Medicare appeals factor into that? I know that was a big growth driver in the fourth quarter, of outperformance. How are you thinking about that business?

Mr. David Walker: Well, we think they will, level off. We had a lot of growth last year, in those appeals, but we think those will level off, and that’s what we--our outlook is.

Mr. Richard Close: And then just--.

Mr. David Walker: --Relatively flat.

Mr. Richard Close: Okay.

And just as a follow-up on this revenue, with respect to I guess add-on, services, that type of stuff that you’re being asked to do to fill the holes or voids, with some of the, initial ACA, stuff, whether it’s state or federal, can you quantify any type of, you know, maybe revenue, incremental revenue opportunity? And I assume that’s part of the front-end loaded, or the first and second quarter ACA, contribution.

Mr. David Walker: Well, I think the good news about our BPO business is it’s over the life cycle. So, there's constant evolution of these programs, policies, and I think that’s what we do very well, and that’s what we're known for. But remember, we have a lot of reimbursable contracts to the degree we provide that help that'll provide revenue - won’t necessary drive the bottom-line so much on a weighted average basis.

11/15/13 - 9:00 a.m. ET - 29

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

But in fact, in our forecast, we weighted in and factored, some opportunities of that nature within those existing contracts because we do anticipate, the clients have a lot of change to manage and, frankly, they're happy to have MAXIMUS on their team to do exactly that.

Mr. Richard Close: Okay.

Mr. Rich Montoni: And it's really the difference between, the midpoint of our forecast and the 95 percent of which is in the form of backlog. That will give you some consolidated perspective on--.

Mr. Richard Close: --Sure--.

Mr. Rich Montoni:--The quantification of it.

Mr. Richard Close: Okay.

And then, just a final question for me, and I appreciate the time - when we talk about pipeline and the strength of your pipeline, is there any way you could give us indication, at least directionally, or percentages, rough percentages in terms of how that breaks down, maybe international versus, Health and Human and sort of on a divisional basis? Or, do you not want to get into that type of granularity?

Mr. Rich Montoni: More the latter, Richard, although, we will say directionally it’s across the board. We do have, significant opportunities in both our domestic and international and, and Health.

11/15/13 - 9:00 a.m. ET - 30

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

And don’t forget Human Services - while its performance last year--this year versus last year, this quarter versus last quarter was more flattish, we still think there's long-term great opportunities for the Human Services segment, as well.

The other highlight is that we have noted that a substantial portion, which is a qualitative direction for you, of this year’s new wins happens to be in the new business category as does, and I think we used the term the majority of our sales pipeline, is new work.

Mr. Richard Close: Great, thank you. Congratulations again.

Mr. Rich Montoni: Thank you, Richard.

Ms. Lisa Miles: Next question please.

Operator: And our next question comes from the line of Frank Sparacino with First Analysis. Please proceed with your question.

Mr. Frank Sparacino: Hi, guys. Just, one question for me on the Human Services side - can you just talk, you know, a little bit longer term in terms of where you see new opportunities? But, also, I’m curious - you know, I think there was an expectation the Saudi contract would, come to fruition and be substantially larger than the pilot you're running. So maybe if you can talk about that in more detail, but also, you know, what the expectation is next year in the UK?

Mr. Rich Montoni: Glad to answer that I think three part question, Frank. First, I’ll tackle the Saudi situation.

As it relates to the Saudi contract here's where we are - we just signed an MOU, memorandum of understanding, that extends the work for another three years. I think that’s one year base and two option years - that’s three years in total. And, we do see some promising opportunities as we dialog with our client in terms of what their needs are and where they need assistance. So, we believe there is some real opportunity long-term.

11/15/13 - 9:00 a.m. ET - 31

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

But you need to keep in mind that, that market, takes time to move these things along, just as the nature of business, sometimes international and, in the case of the Kingdom of Saudi Arabia.

So, I see that one really as a fact that we are very focused on our existing markets, and we’re looking to expand those existing markets in our land and expand, mantra, which has worked very, very well in Canada, United Kingdom, Australia, and we hope like KSA.

And, I’d also add that, historically, our growth internationally has been mostly, in the area of Human Services, but our strategy is to advance our health new business development in those geographies where we have Human Services and, that customer has a need for what we do.

So, I would say, we are anxious to see some new opportunities there, which dovetails to, as you're well aware, we acquired a company HML in the United Kingdom in July, and that’s very--a very important part, building block of that strategy. Is that helpful?

Mr. Frank Sparacino: It is. Thank you. And then, just, UK?

Mr. Rich Montoni: Oh, in the UK situation, we’re still excited about growth in the UK, Health and Human Services. While we don’t see great opportunities to pick up new work within a region, when the government does move forward to reallocate work, between regions, we think we’re very well positioned. But, the big driver there is when and if the government will move forward. They do express their intent to do so.

11/15/13 - 9:00 a.m. ET - 32

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

So we’re anxious to see when that will happen, and I think we’re very well positioned for it. We have identified other opportunities in, the UK that are Human Services, significant opportunity, as well.

Mr. Frank Sparacino: Thank you, Rich.

Mr. Rich Montoni: Okay, Frank.

Ms. Lisa Miles: Thanks, Frank.

Next question please.

Operator: And our next question comes from the line of Brian Gesuale with Raymond James. Please proceed with your question.

Mr. Brian Gesuale: Hey. Good morning, guys. Nice job on the results here.

Really just, two quick ones - can you tell us where you put, the Department of Education contract in terms of the business development or pipeline metrics? And then, also, I don’t recall if the Texas, renewal was, part of bookings this quarter.

Mr. Rich Montoni: Good morning, Brian. Thank you very much.

The Department--if I understand your question, the Department of Education business--and that would be the BD results, that would be the, forecasted revenue and operating income--that work resides within our federal business in Health, which is part of our Health segment.

Ms. Lisa Miles: And I think, Brian, to further your question, because I think you’re getting to pipeline, that actually resided in the awarded signed numbers at 9/30.

11/15/13 - 9:00 a.m. ET - 33

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Mr. Brian Gesuale: Okay, perfect. That’s great. That’s very helpful. And then, Texas?

Mr. Rich Montoni: That’s what you spoke to was Texas.

Mr. David Walker: No, he's talking--.

Ms. Lisa Miles: --No, that was--.

Mr. David Walker: DOE.

Ms. Lisa Miles: DOE.

Mr. Rich Montoni: Oh, DOE.

Mr. David Walker: And the Texas--.

Mr. Rich Montoni: --Oh, the Texas renewal?

Ms. Lisa Miles: That sits in the awarded unsigned bucket at 9/30.

Mr. Brian Gesuale: Okay, great.

And then, maybe you could just comment a little bit on visibility into the guidance you guys have out there. I think you said 95 percent, is coming from, existing customers or options.

Mr. Rich Montoni: Backlog.

Mr. Brian Gesuale: Backlog.

Mr. Rich Montoni: Actually backlog, right, yeah.

Mr. Brian Gesuale: How does that compare to previous years? And then, I guess with your pipeline at record numbers, and also the mix of it being incremental with new business, in that pipeline, you know, how should we think about what visibility might look like versus, years in the past?

11/15/13 - 9:00 a.m. ET - 34

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Mr. David Walker: Well, last year was about 90 percent, okay? But, you know, I think generally that 90 to 95 percent is where it’s always been. So, I would say, we’re pretty consistent with I think the prior years and no surprise given the nature of the business.

Mr. Brian Gesuale: Great. Thanks a lot.

Mr. David Walker: Uh-huh.

Ms. Lisa Miles: Next question please.

Operator: Our next question comes from the line of Charlie Strauzer with CJS Securities. Please proceed with your question.

Mr. Charlie Strauzer: Hi, good morning.

Mr. Rich Montoni: Good morning, Charlie.

Mr. Charlie Strauzer: Two, short questions, if I could - the first is on the--when you look at the, the pipeline of kind of, you know, tracking, you know, proposals, you know, any sense of the timing of when some of those proposals will be coming out and, you know, what areas might those be, you know, kind of predominately focused on?

Mr. Rich Montoni: Our view on it is, and you need to appreciate the nature of government procurement--we say it’s glacial, which means it’s very big and very slow and also subject to, pushing to the right, more likely get pushed to the right than to the left, Charlie. So, you need to operate within that contact.

That being said, we have what I think is a prudent policy that we don’t count anything as, sales pipeline unless we have, an expectation the RFP is going to come out within six months. So, that kind of sets the pipeline as being something, where we should be proposing, a good portion of it within the next year. And that’s about as precise as we can get with that soft data.

11/15/13 - 9:00 a.m. ET - 35

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Mr. Charlie Strauzer: That’s fair.

And then, also, too, just in terms of, you know, what you think, in terms of the, maybe the opportunities that are in that--those tracking proposals - are they particularly larger ones, or is it more federally bases, is it more Human Services or Health Services based?

Mr. Rich Montoni: When we analyze that, and I think this is good news, it really is all over the map, from a segment perspective, from a geography perspective and, I would even say from a size perspective. We don’t want to become too dependent upon big wins to grow single, big wins to grow the company, singles and doubles are very, very good in our business.

Mr. Charlie Strauzer: Excellent.

And then, just lastly, on the CapEx side, in terms of, you know, implied guidance for next year, I see CapEx is coming down a fair amount next year, but still looks like it’s about $50 million, for the year. Can you talk a little bit more about what's, what's gonna be in that number there?

Mr. David Walker: Yeah, I think you got it exactly right. You know, so we’ve targeted about 50 million, and it is down from last year. But, that’s because we had so many new contracts launching, particularly at the beginning of this year with all the health insurance exchanges. So, that’s what it reflects.

Mr. Charlie Strauzer: Got it. Thank you very much.

Mr. David Walker: Yep.

11/15/13 - 9:00 a.m. ET - 36

MAXIMUS Q4 and FY13 Earnings Call

November 15, 2013

Ms. Lisa Miles: I actually only have one other thing to add as it relates to our Texas contract and the question, from pipeline - subsequent to quarter close, the Texas contract was signed.

Mr. Rich Montoni: Next question, please.

Operator: It seems we have no further questions at this time. So, ladies and gentlemen, this does conclude today’s teleconference. You may disconnect your lines at this time, and thank you for your participation.

11/15/13 - 9:00 a.m. ET - 37

Slide: 1 SubTitle: David N. WalkerChief Financial Officer and TreasurerNovember 15, 2013 Title:Fiscal 2013 Fourth Quarter & Full Year Earnings

Slide: 2 Title: Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from the Company’s most recent quarterly earnings conference call.This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release.A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

3 Total Company Financial Results • Q4 revenue increased 28%; Organic revenue growth of 23% − Revenue better-than-expected due to several change orders in Q4, that were expected to occur in FY14 • Q4 operating margin of 15%; GAAP income from continuing operations, net of taxes, totaled $35.6M ($0.51 per diluted share) • FY13 revenue increased 27% to $1.33B; organic growth of 19%; FY13 included $16M of non-recurring revenue from a terminated contract that we excluded from guidance • FY13 revenue growth was driven by new work, the expansion of existing contracts, and the PSI and Health Management acquisitions • FY13 GAAP income from continuing operations, net of taxes, totaled $117.1M ($1.68 per diluted share) and included ~$0.09 benefit due to the terminated contract and ~$0.01 of acquisition expense • Excluding the $0.08, FY13 adjusted diluted EPS from continuing operations increased 36% to $1.60 *Excluding terminated contract, legal, settlement and acquisition expense Note: numbers may not add due to rounding Q4 FY13 Q4 FY12 FY13 FY12 Actual Actual Actual Actual Total Company Revenue 384.3 $ 300.7 $ 28% 1,331.3 $ 1,050.1 $ 27% Revenue from Terminated Contract ‐ ‐ (16.0) ‐ Adjusted Total Company Revenue 384.3 $ 300.7 $ 28% 1,315.2 $ 1,050.1 $ 25% Total Company Operating Income 57.1 $ 40.0 $ 43% 186.2 $ 127.6 $ 46% Operating Income from Terminated Contract ‐ ‐ (10.9) ‐ Adjusted Total Company Operating Income 57.1 $ 40.0 $ 43% 175.3 $ 127.6 $ 37% Operating Margin %* 15.0% 13.9% 13.5% 12.4% Total Company Operating Income 57.1 $ 40.0 $ 43% 186.2 $ 127.6 $ 46% Interest and Other Income, net 0.4 1.1 nm 2.9 4.2 nm Income Before Taxes ‐ Continuing Ops 57.5 41.1 40% 189.1 131.8 43% Provision for Income Taxes 21.9 17.3 26% 71.9 55.7 29% Net Income ‐ Continuing Operations 35.6 $ 23.8 $ 50% 117.1 $ 76.1 $ 54% GAAP Earnings Per Share 0.51 $ 0.34 $ 50% 1.68 $ 1.09 $ 54% Legal, Settlement & Acquisition, net ‐ 0.01 0.01 0.03 Adjustment for Terminated Contract ‐ ‐ (0.09) ‐ Adjustment for Tax Accounts ‐ 0.02 ‐ 0.06 Adjusted EPS ‐ Continuing Ops* 0.51 $ 0.37 $ 38% 1.60 $ 1.18 $ 36% ($mm, except per share data) % Change % Change

4 The Health Segment had a Record Year of Profitable Growth Health Services Segment Fourth Quarter Results Compared to Last Year • Revenue increased 49% driven by new work, expansion on existing contracts, and the Health Management acquisition • Operating income increased 130% to $45.9M • Operating margin of 16.9%, benefitting from strong accretive, transactional-volume growth in our Medicare appeals business Fiscal Year 2013 Results Compared to Last Year • Revenue grew 29%, was largely organic and driven by new work and expansion on existing programs • Operating income increased 61% to $129.8M • Operating margin of 15.0% compared to 12.0% operating margin in the prior year − Margin expansion driven principally by the accretive nature of the higher volumes in our federal Medicare business Q4 FY13 Q4 FY12 % FY13 FY12 % Actual Actual Change Actual Actual Change Revenue Health Services 271.0 $ 181.6 $ 49% 862.9 $ 671.2 $ 29% Operating Income Health Services 45.9 $ 20.0 $ 130% 129.8 $ 80.6 $ 61% Operating Margin % 16.9% 11.0% 15.0% 12.0% ($ in millions)

5 Human Services Segment Fourth Quarter Results Compared to Last Year • Revenue decreased 5% to $113.3M • Operating income totaled $11.9M; operating margin of 10.5% • Both operating income and margin are lower compared to Q4 FY12 − Q4 of FY12 results included short-term work in U.S. operations that was highly accretive and drove up operating margins for that period Fiscal Year 2013 Results Compared to Last Year • Segment benefitted from a one-time, non-cash revenue and profit contribution related to a terminated contract ($16.0M in revenue and $10.9M in profit excluded from guidance and discussion of full year results) • Excluding terminated contract, revenue grew 19%, driven principally from the UK, Saudi Arabia and the PSI acquisition • Excluding terminated contract, operating income of $47.2M; operating margin of 10.4% Certain Infrequently Occurring Benefits in Fiscal 2012 and Fiscal 2013 • FY12 operating margin benefitted primarily from reductions in cost to complete a fixed-price contract that largely offset startup losses in the UK • FY13 expected margin improvement from the UK contract helped offset lowered margins in Australian operations related to permanent program changes, as well as lower margins in domestic Human Services business Q4 FY13 Q4 FY12 % FY13 FY12 % Actual Actual Change Actual Actual Change Revenue Human Services 113.3 $ 119.2 $ (5%) 468.4 $ 379.0 $ 24% Revenue from terminated contract - - (16.0) - Segment Revenue, (excluding terminated contract) 113.3 $ 119.2 $ (5%) 452.4 $ 379.0 $ 19% Operating Income Human Services 11.9 $ 21.8 $ (45%) 58.1 $ 49.9 $ 16% Operating Income from terminated contract - - (10.9) - $ Segment Operating Income, (excluding terminated contract) 11.9 $ 21.8 $ (45%) 47.2 $ 49.9 $ (5%) Operating Margin % (excluding terminated contract) 10.5% 18.3% 10.4% 13.2% ($ in millions)

6 Balance Sheet and Cash Flows Cash Flows & DSOs • Q4 DSOs of 69 days • Cash provided by operating activities for Q4 and FY 13 were impacted by timing of payments at year end − Large weighting of billable revenue occurred at the end of the quarter (change orders and timing on large transactions) − Receivables in the past year have landed more squarely in the guidance range of 65 to 80 days • Full year free cash flow slightly below expected range, due, in part, to required cap-ex for new contracts Cash Usage and Cash Balances • Cash and cash equivalents of $125.6M (60% held overseas) at September 30, 2013 • In Q4, used cash of $71.4M to complete the purchase of Health Management and ~$5.5M to purchase 145,600 shares of MMS stock under share repurchase program; For FY 13 we repurchased a total of 974,498 shares for $32.5M and at September 30, 2013, we had $97M available for future share repurchases • Ongoing cash deployment activities will include dividends, repurchases and strategic acquisitions • MMS can handily address our cash flow needs with the generation of free cash flow and available line of credit Reconciliation to Free Cash Flow Note: numbers may not add due to rounding

Slide: 7 Title: Total Company Guidance Confirming Fiscal 2014 Revenue and Earnings GuidanceRevenue range of $1.555B to $1.650B, driven principally by growth in the Health SegmentIn excess of 95% of our forecasted FY14 revenue in the form of backlog or contract optionsEntering fiscal 2014 with record backlog of $3.4B at September 30, 2013Adjusted diluted EPS of $1.75 to $1.85, implies total company margin (excluding legal) of 12% to 13%Assuming a tax rate of 37.8%, a change from August disclosure of a flat 37%Increase principally driven by geographic mix with strong growth from U.S. operations

Slide: 8 Title: Segment Guidance Other Placeholder: Health Services SegmentFY14 quarterly revenue expected to be more level-loaded throughout the year due to:An initial surge of work tied to the ACA launch and open enrollment in Q1 and partially in Q2; This revenue will be seasonally lower in 2H of FY 14 and will be backfilled by new work ramping up such as the Eligibility Appeals contractLower margins are expected in FY14 compared to FY13, with three primary drivers:Contract mix While new federal contracts may drive a lot of revenue, the largest contributors are cost-reimbursable. While they have low execution risk, they have a lower marginDepartment of Education contract expected to be in a nominal-to-moderate loss position in year one start-up phaseHighly accretive work going away in FY14Minnesota HIX contract is currently winding downSizeable reduction in revenue and profit from the California Healthy Families CHIP program that ended in FY13Acquired contract from PSILaunched October 1; will be dilutiveIdentified during due diligence as strategic, but loss-making contract; reflected in the acquisition purchase priceAcquisition of PSI has been accretive, including the anticipated results of this contractHuman Services SegmentFY14 revenue expected to be fairly flat on the top-line compared to FY13, and level-loaded across the quartersThis does assume that growth in international operations will be offset by a decline in the U.S. largely related to the successful completion of a large, multi-year fixed price contractUnusual benefits from a couple of contracts in FY12 and FY13 that will not repeat next yearFull-year operating margins expected to be towards the lower end of stated 10% to 15% range

Slide: 9 SubTitle: Richard A. MontoniPresident and Chief Executive Officer November 15, 2013 Title:Fiscal 2013 Fourth Quarter & Full Year Earnings

Slide: 10 Title: Progress on Long-Term Growth Objectives in FY13 Continued solid top- and bottom-line growthTremendous efforts in making FY13 successful from our 12,000 employeesOperational expansion and future growth trajectory are a direct result of employee contributions Significant progress was made in FY13 on long-term growth objectives and other areas to best maximize shareholder valueSecuring our fair share (and a little more) of work related to health care reform in the U.S.Growing our U.S. federal book of businessExpanding our international operations in both segments

Slide: 11 Title: Established Leader for HIX Customer Contact Centers Helped Minnesota build and launch exchangeSupported California with short-term work to help train customer service staffCemented position as the leading partner for providing high-quality customer service for the exchangesLaunched operations for six state-based and two federal customer contact centersContact centers ramped up as planned; answered consumer calls ahead of October 1 “go-live”When exchanges faced technology challenges, MAXIMUS took on additional tasks to help fill the gaps; continue to serve as a reliable partner for our clientsAssisting individuals, families, small business owners and employeesWorking with other stakeholders (Navigators, Assistors and Brokers) Initial calls from consumers focused on learning more about ACA; more recently, how it affects them personally (plan availability and cost, provider networks, eligibility for Medicaid and tax subsidies, and enrollment into a health plan)Serving as channels for consumers to complete applications over the phone and by Web-chatHIX operations also serve Americans by interacting with them “on their terms” as they apply for coverage over the phone, on paper, through the Web, or with the assistance of a Navigator or Broker

Slide: 12 Title: Eligibility Appeals Services for the Federal Exchange New contract to provide the overall management of the eligibility appeals process:Operate a resolution process for appealsReview appeal requests and supporting documentsCoordinate data collections with appellantsProvide general case managementHelping individuals who believe their eligibility determination was incorrect and are appealing the decision Scheduled to fully launch operations in early January

Slide: 13 Title: Health Care Reform - Looking Ahead Other Placeholder: Continue to view health insurance exchanges and other work related to the Affordable Care Act as a multi-year growth driverOver the next several years, expect some states will consider transitioning to state-based exchangesDemographic trends likely to push certain states to consider expansion of companion programs, such as Medicaid

Slide: 14 Title: Federal Operations Expansion Success in expanding the federal book of business in our traditional service lines supporting CMSOver the past two years, we have:Enhanced our current offeringsInvested heavily in business development and delivery resourcesIdentified opportunities to apply our core areas of expertise to new federal agenciesContract win announced last month for the U.S. Department of EducationAward has been protested to GAOAgency has 100 days to review protestStopped work while protest is under reviewWill not have a meaningful financial impact on FY14Pleased with the substantial progress that our federal team achieved in FY13 Focus on executing new winsOptimistic about other opportunities as they work to backfill their pipeline

Slide: 15 Importing core competencies into both existing and new markets, as well as increasing the scope of current operationsContinue to assess new geographies where governments seek assistance for important reform effortsPrimary efforts are focused on delivering new services into existing marketsTitle:Expanding Our International Operations

Slide: 16 Title: Update on United Kingdom Operations Health ManagementAcquisition provided strategic platform for introducing core health offerings in UKDelivery team well-positioned for future opportunities that may lead to proposal activity during FY14Growth plans upon reputation and demonstrated performance of UK welfare-to-work operationsWork ProgrammeDepartment for Work and Pensions issued quarterly report in September covering vendor performance through June 2013; MAXIMUS remains one of the highest performing providers MAXIMUS Thames Valley region ranked third across all regions MAXIMUS is tied for third out of the 18 providers for cumulative performance since beginning of the program

Slide: 17 Title: Other Areas of International Growth Formal memorandum of understanding with the Kingdom of Saudi Arabia that extends the pilot program for three years; expect signed contract by the end of this quarterInternational growth strategy continue to be based on our “land and expand” approach, driven by multiple factors:Review opportunities across both segments with governments implementing health and human services reform programsAdministrative and policy changes can accelerate or delay these reform initiativesInternational operations have the potential to be significant contributors to total company revenue over the long-term, as they have been in recent years

Slide: 18 Title: Rebids and Option Periods FY13 successful year for rebids & options14 contracts with a total contract value ~$475MSecured 95% of this total contract value through contract wins and extensionsWon 100% of our option periods by September 30 FY14 expected to be a light year for rebids & optionsContract rebids are cyclical; reported numbers sensitive to timing of procurement and awards15 contracts with a total value ~$225M 15 option periods with a total value of ~$135MFewer rebids up for bid could ultimately lower overall total awards in FY14FY15 anticipated to be a heavier rebid yearBased on what we know today, more than $1.0B of total contract value is up for rebid in FY15Governments may extend contracts, which is a trend we have seen

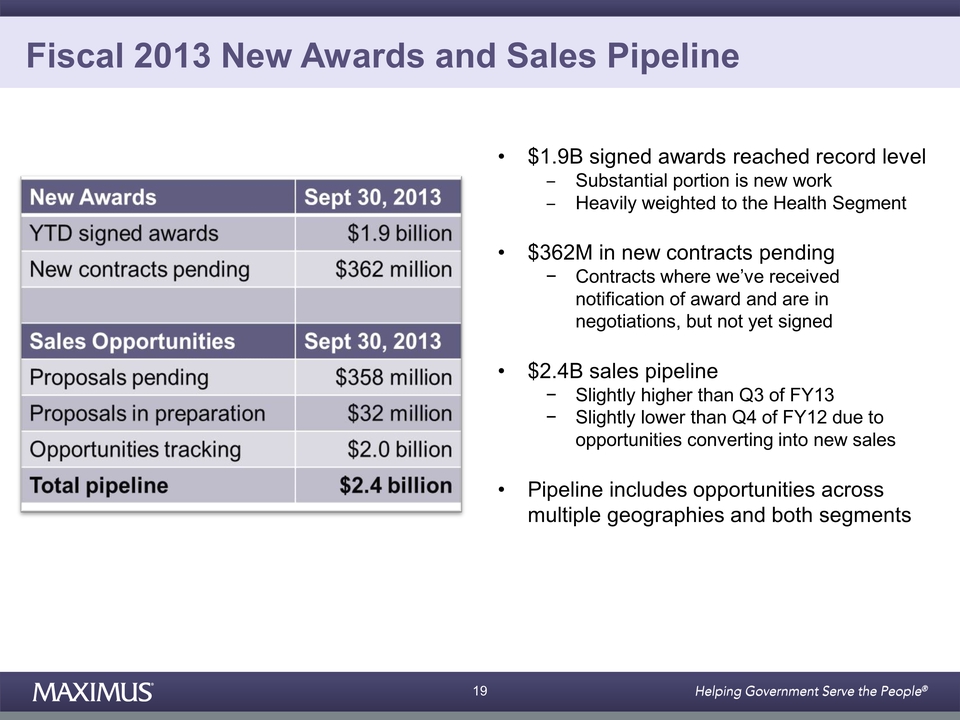

Slide: 19 Title: Fiscal 2013 New Awards and Sales Pipeline $1.9B signed awards reached record levelSubstantial portion is new workHeavily weighted to the Health Segment$362M in new contracts pendingContracts where we’ve received notification of award and are in negotiations, but not yet signed$2.4B sales pipelineSlightly higher than Q3 of FY13Slightly lower than Q4 of FY12 due to opportunities converting into new salesPipeline includes opportunities across multiple geographies and both segments