Exhibit 99.1

Richard Montoni,President &

Chief Executive Officer Bruce Caswell,Health Services Segment President

& General Manager MAXIMUS Investor Presentation A number of statements

being made today will be forward-looking in nature. Such statements are

only predictions and actual events or results may differ materially as a

result of risks we face, including those discussed in our SEC filings.

We encourage you to review the summary of these risks in Exhibit 99.1 to

our most recent Form 10-K filed with the SEC. The Company does not

assume any obligation to revise or update these

forward-looking statements to reflect subsequent events or

circumstances. Barclays Global Healthcare Conference March 12, 2013

Miami 1

2• Economic and demographic

factors driving social reforms• Superior positioning for health care &

welfare reform• Healthy balance sheet:• $167.1 million in cash at

12/31/2012• Quarterly cash dividend• Opportunistic share buyback

program• No long-term debt• Strong Fiscal 2013 forecasted growth:•

Revenue growth of 19-24%• EPS growth of 27-33% Established Partner for

Government Social Programs Leading Operator of Government Health and

Human Services Programs Worldwide Five year, $265M contract extension

for Health Insurance British Columbia; runs through March 31, 2020

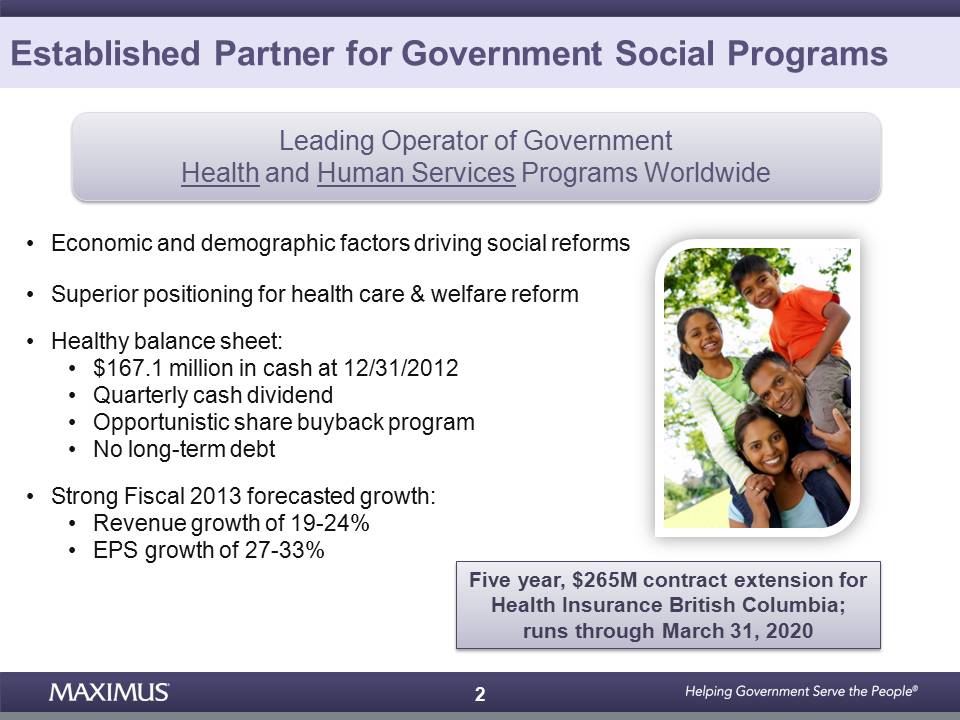

3 $697.9 719.8 831.7 929.6

1,050.0 FY 08 FY 09 FY 10 FY 11 FY 12 FY 13E $ in Millions $1.31 1.44

1.81 2.25 2.36 FY 08 FY 09 FY 10 FY 11 FY 12 FY 13E $ in EPS Annual

Revenue Adjusted Diluted EPS from Continuing Operations * FY 12 EPS

tempered by start up of Work Programme contract in the UK. 5-year CAGR:

11.7% 5-year CAGR: 12.8% 5-year CAGR: 11.7% 5-year CAGR: 18.8%

$3.00-3.15E Growth, Consistency & Predictability in Earnings

$1,250-1,300E *

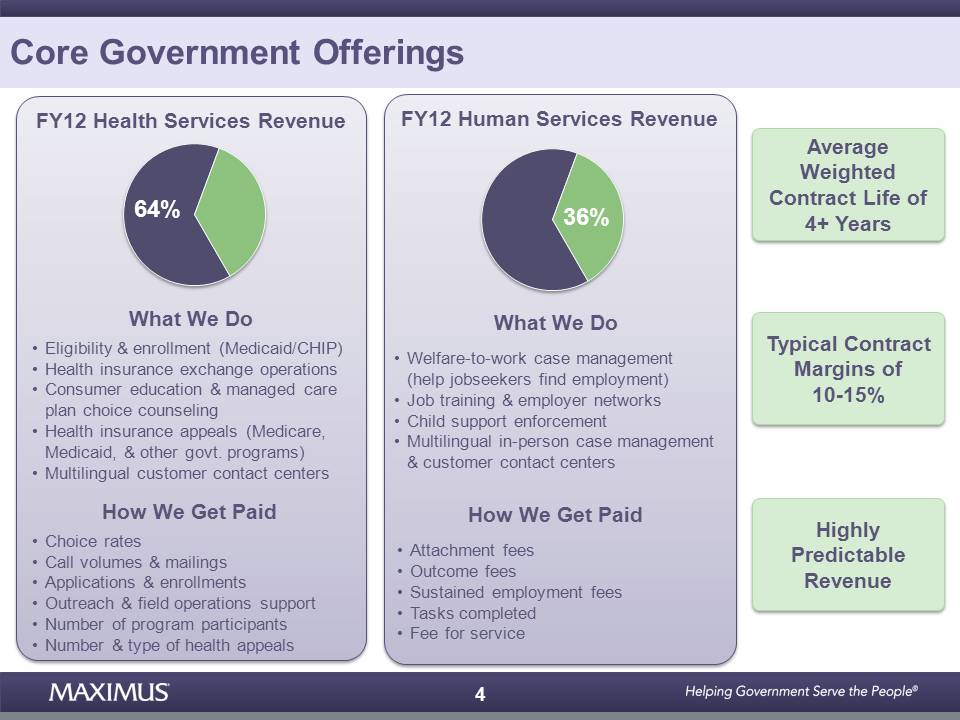

4 Highly Predictable

Revenue FY12 Health Services Revenue What We Do• Eligibility &

enrollment (Medicaid/CHIP)• Health insurance exchange operations•

Consumer education & managed careplan choice counseling• Health

insurance appeals (Medicare, Medicaid, & other govt. programs)•

Multilingual customer contact centersHow We Get Paid• Choice rates• Call

volumes & mailings• Applications & enrollments• Outreach & field

operations support• Number of program participants• Number & type of

health appeals 64% FY12 Human Services Revenue What We Do•

Welfare-to-work case management (help jobseekers find employment)• Job

training & employer networks • Child support enforcement• Multilingual

in-person case management & customer contact centers How We Get Paid•

Attachment fees• Outcome fees• Sustained employment fees• Tasks

completed• Fee for service 36% Core Government Offerings Typical

Contract Margins of 10-15% Average Weighted Contract Life of 4+ Years

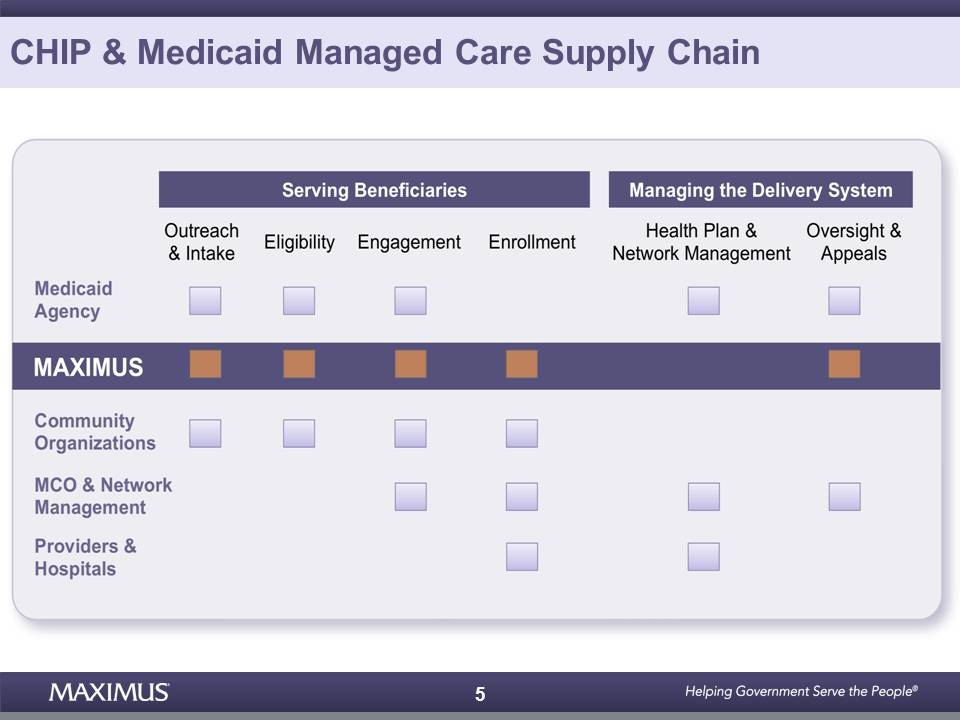

5 CHIP & Medicaid Managed

Care Supply Chain

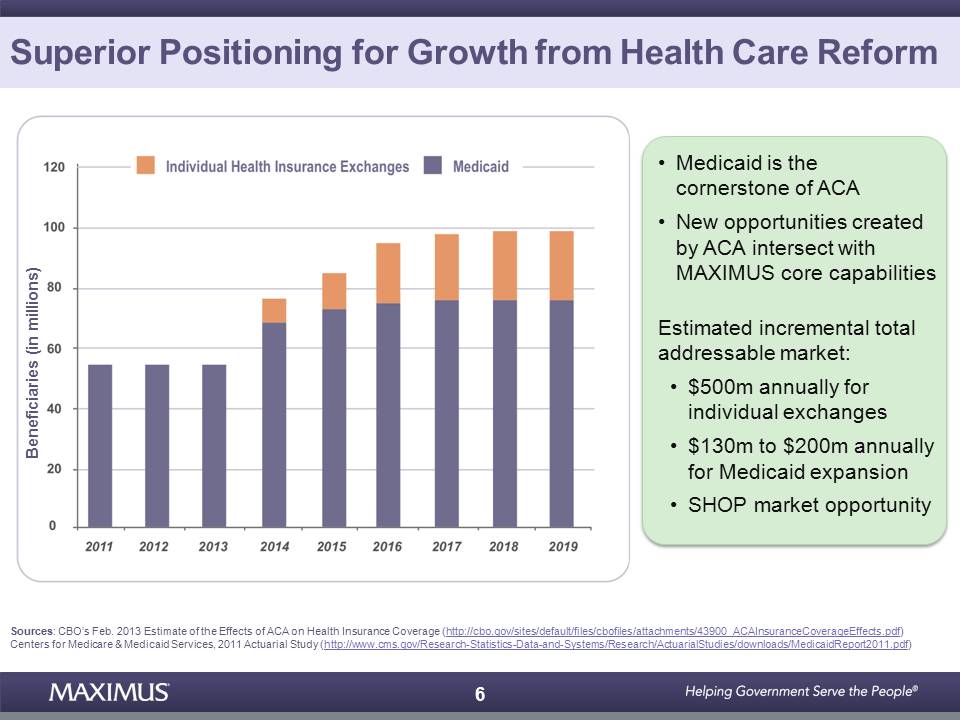

6 Sources: CBO’s Feb. 2013

Estimate of the Effects of ACA on Health Insurance Coverage

(http://cbo.gov/sites/default/files/cbofiles/attachments/43900_ACAInsuranceCoverageEffects.pdf)Centers

for Medicare & Medicaid Services, 2011 Actuarial Study

(http://www.cms.gov/Research-Statistics-Data-and-Systems/Research/ActuarialStudies/downloads/MedicaidReport2011.pdf)•

Medicaid is thecornerstone of ACA• New opportunities created by ACA

intersect with MAXIMUS core capabilities Estimated incremental total

addressable market: • $500m annually for individual exchanges • $130m to

$200m annually for Medicaid expansion • SHOP market opportunity

Beneficiaries (in millions) Superior Positioning for Growth from Health

Care Reform

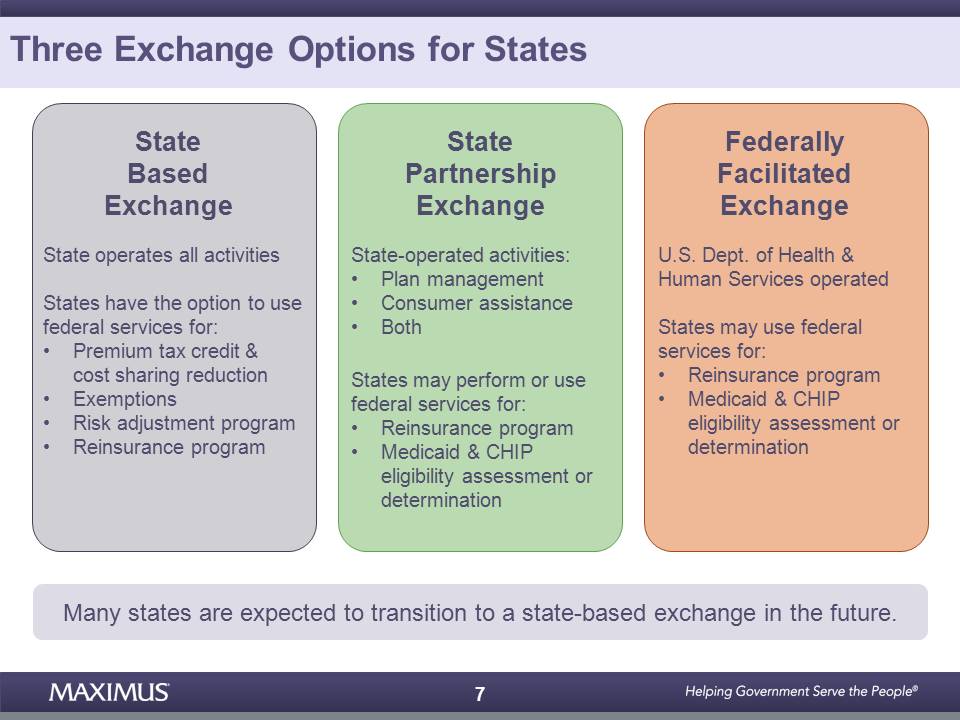

7Three Exchange Options for

States State operates all activities States have the option to use

federal services for:• Premium tax credit & cost sharing reduction•

Exemptions• Risk adjustment program• Reinsurance program State Based

Exchange State Partnership Exchange State-operated activities:• Plan

management• Consumer assistanc • Both States may perform or use federal

services for:• Reinsurance program• Medicaid & CHIP eligibility

assessment or determination U.S. Dept. of Health & Human Services

operated States may use federal services for:• Reinsurance program•

Medicaid & CHIP eligibility assessment or determination Federally

Facilitated Exchange Many states are expected to transition to a

state-based exchange in the future.

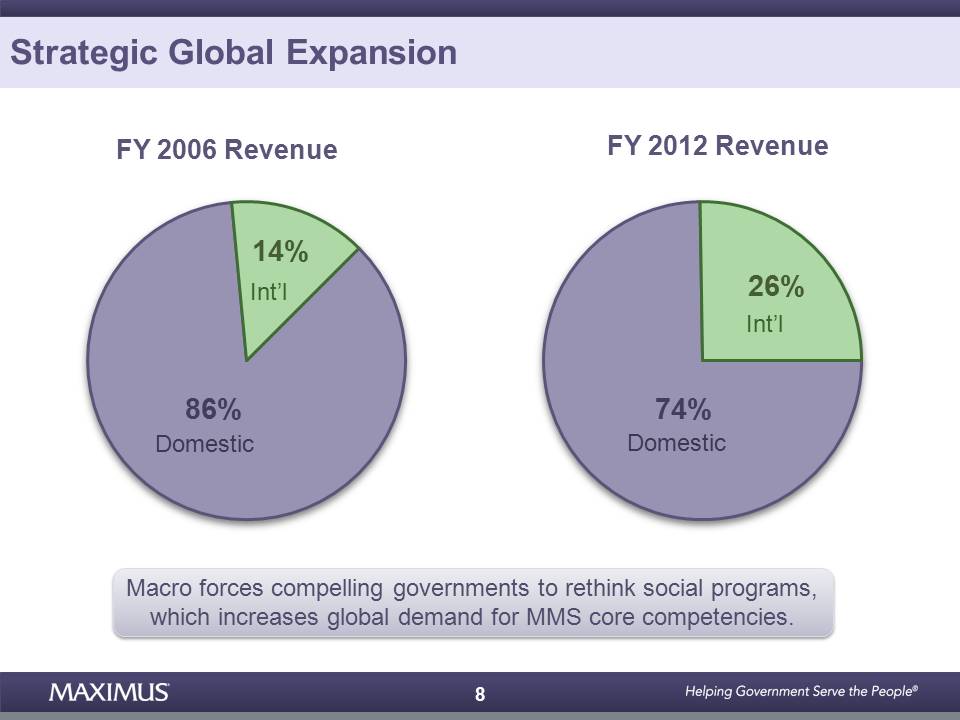

8 FY 2012 Revenue FY 2006

Revenue Macro forces compelling governments to rethink social programs,

which increases global demand for MMS core competencies. Strategic

Global Expansion 86% 14% 74% 26% Int’l Domestic Int’l Domestic

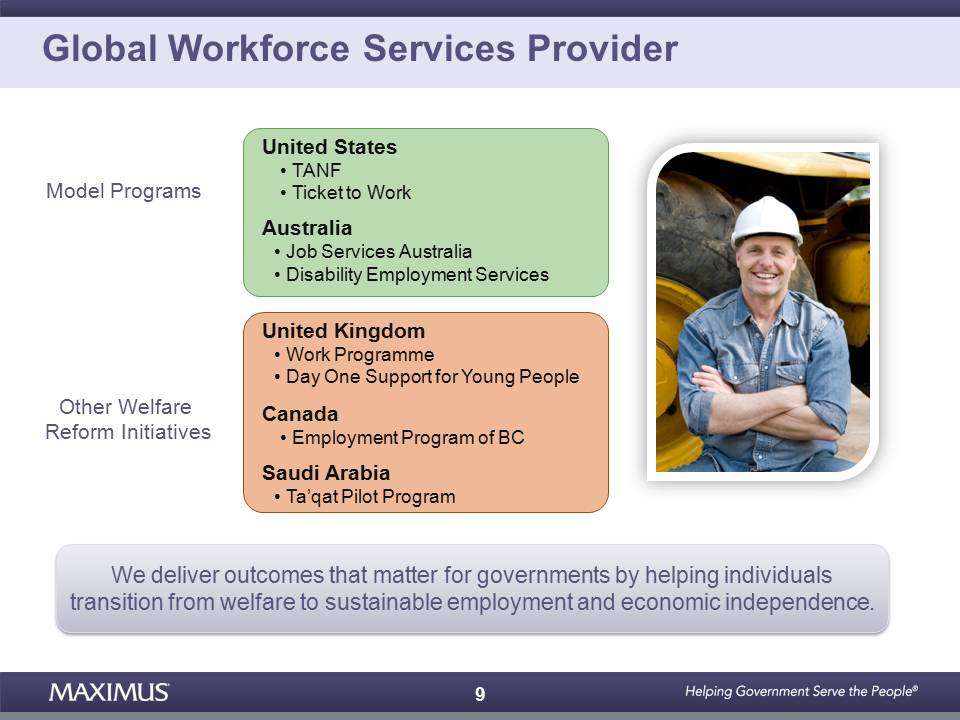

9Global Workforce Services

Provider United States• TANF• Ticket to Work Australia• Job Services

Australia• Disability Employment Services United Kingdom• Work

Programme• Day One Support for Young People Canada• Employment Program

of BC Saudi Arabia• Ta’qat Pilot Program Model Programs We deliver

outcomes that matter for governments by helping individuals transition

from welfare to sustainable employment and economic independence. Other

Welfare Reform Initiatives

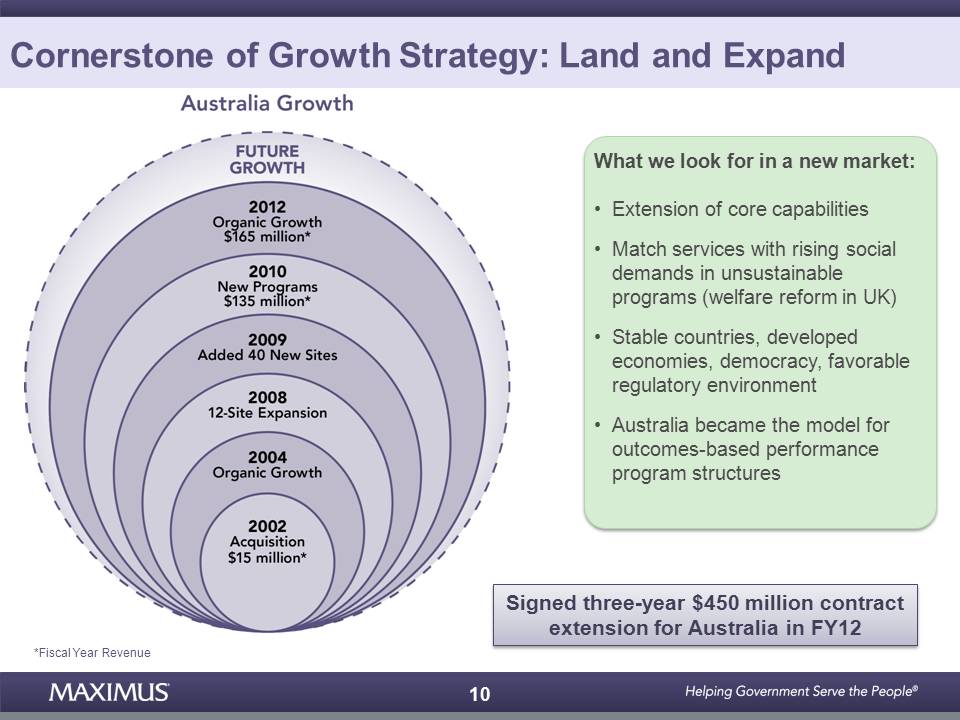

10 What we look for in a

new market:• Extension of core capabilities• Match services with rising

social demands in unsustainable programs (welfare reform in UK) • Stable

countries, developed economies, democracy, favorable regulatory

environment • Australia became the model for outcomes-based performance

program structures Cornerstone of Growth Strategy: Land and Expand

*Fiscal Year Revenue Australia Example Signed three-year $450 million

contract extension for Australia in FY12

11 MMS Value Add: Proven

Partner for Government Proven track record operating social programs

Deliver outcomes that matter to governments Cost effective Experience

working with diverse populations Independent with no conflict of

interest Innovative, scalable and flexible Successful operation of

performance-driven programs- Local hiring & workforce development-

Implementation of government policies- Rapid deployment of operations-

Achievement of critical program outcomes Governments value the level of

expertise, proven delivery, and brand recognition that MAXIMUS brings to

critical safety net programs.

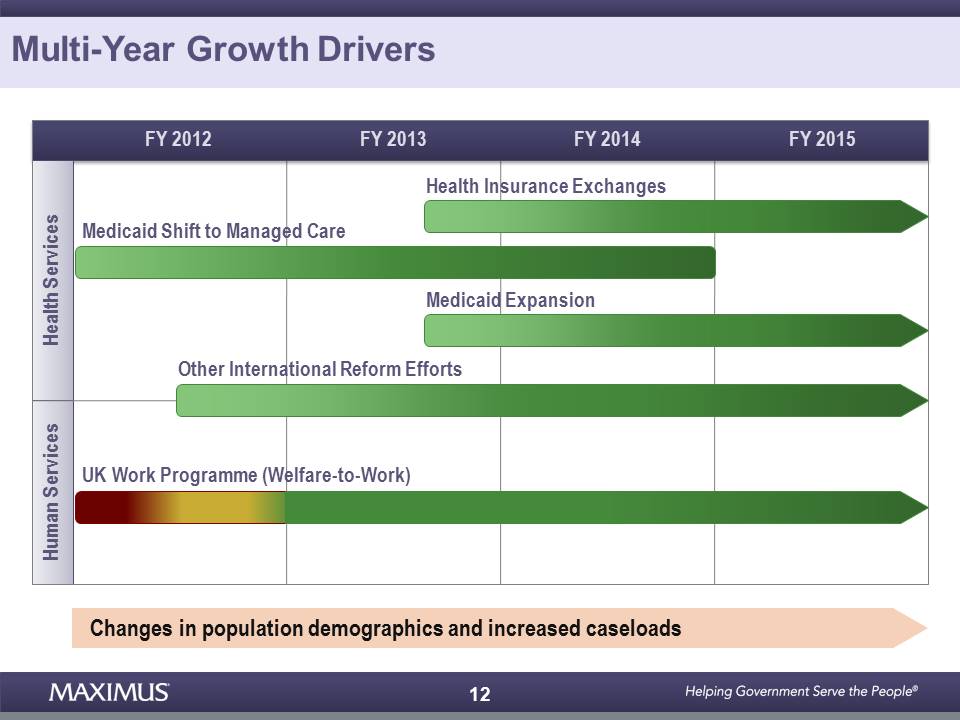

12 Changes in population

demographics and increased caseloads Medicaid Shift to Managed Care

Health Insurance Exchanges Medicaid Expansion Other International Reform

Efforts UK Work Programme (Welfare-to-Work) Health Services Human

Services FY 2012 FY 2013 FY 2014 FY 2015 Multi-Year Growth Drivers

13 Capitalizing On Growing

Demand Established global leader Positioned for significant growthacross

both Segments Strong financial position Experienced management team

Poised to Capitalize on Growth Opportunities

14 MAXIMUS Investor

Presentation MAXIMUS, Inc. (NYSE: MMS) Barclays Global Healthcare

Conference March 12, 2013 For more information, visit www.maximus.com or

contact Lisa Miles, Senior VP Investor Relations lisamiles@maximus.com

703.251.8637