Exhibit 99.2

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

1

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles MAXIMUS Inc - IR

David Walker MAXIMUS Inc - CFO

Rich Montoni MAXIMUS Inc - President, CEO

Bruce Caswell MAXIMUS Inc - President, Health Services

CONFERENCE CALL PARTICIPANTS

Charlie Strauzer CJS Securities - Analyst

Brian Kinstlinger Sidoti & Company - Analyst

Brian Gesuale Raymond James - Analyst

James Kumpel BB&T Capital Markets - Analyst

Constantine Davides JMP Securities - Analyst

Frank Sparacino First Analysis - Analyst

PRESENTATION

Operator

Greetings and welcome to the MAXIMUS fiscal 2012 first quarter conference call. At this time all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation.

(Operator Instructions)

As reminder, this conference is being recorded. It is now my pleasure to introduce your host, Lisa Miles, Vice President of Investor Relations for MAXIMUS. Thank you. Ms. Miles, you may begin.

Lisa Miles - MAXIMUS Inc - IR

Good morning. Thank you for joining us on today's conference call. I would like to point out that we have posted a presentation to our website under the investor relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments we will open the call up for Q&A.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events and results may differ materially as a result of risks we face including those discussed in exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. With that, I will turn the call over to Dave.

David Walker - MAXIMUS Inc - CFO

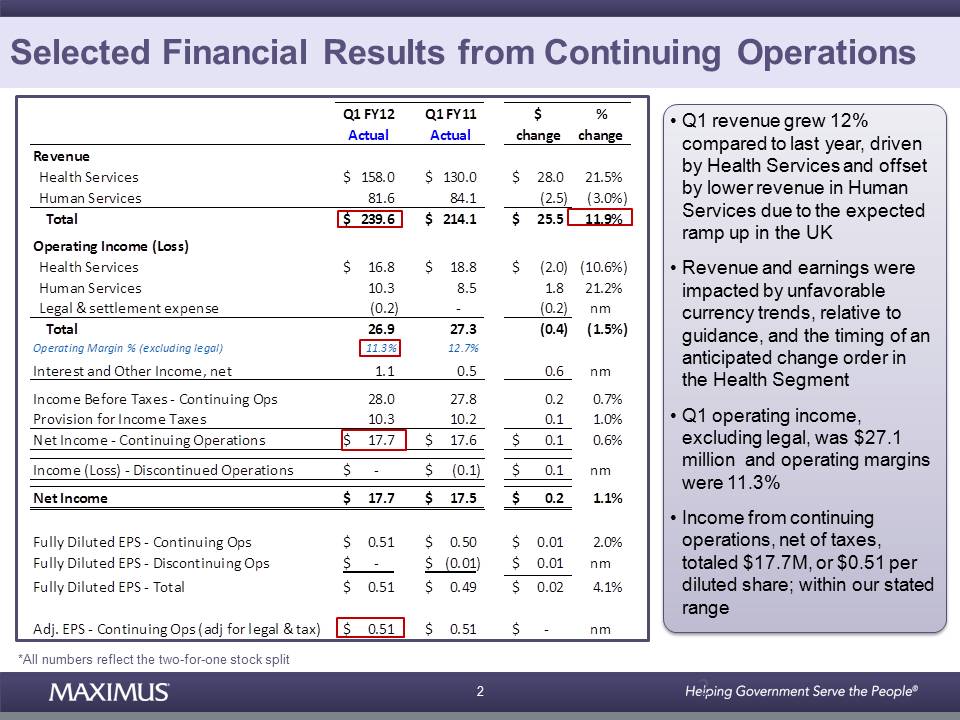

Thanks, Lisa. This morning MAXIMUS reported financial results for the first quarter of fiscal 2012. Revenue in the quarter grew 12% to $239.6 million compared to the same period last year. Fiscal first quarter revenue and earnings were impacted by unfavorable currency trends and the timing associated with an anticipated contract change order for a project in the Health Services Segment. We currently expect to recognize revenue from this change order in the back half of the year. Although first quarter revenue came in slightly below our stated guidance, our full-year outlook remains unchanged and we reiterate our annual revenue guidance of $980 million to $1.015 billion.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

2

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

As expected, top line growth is driven by the Health Services Segment which benefited most notably from the expansion of Medicaid managed care in Texas. This growth was offset by lower revenue in the Human Services Segment as a result of the planned revenue ramp-up on the Work Programme in the UK. As a result, operating income excluding legal and settlement expense totaled $27.1 million in the first quarter and operating margins were 11.3%. Income from continuing operations, net of taxes totaled $17.7 million or $0.51 per diluted share which is in line with the range we provided for the quarter.

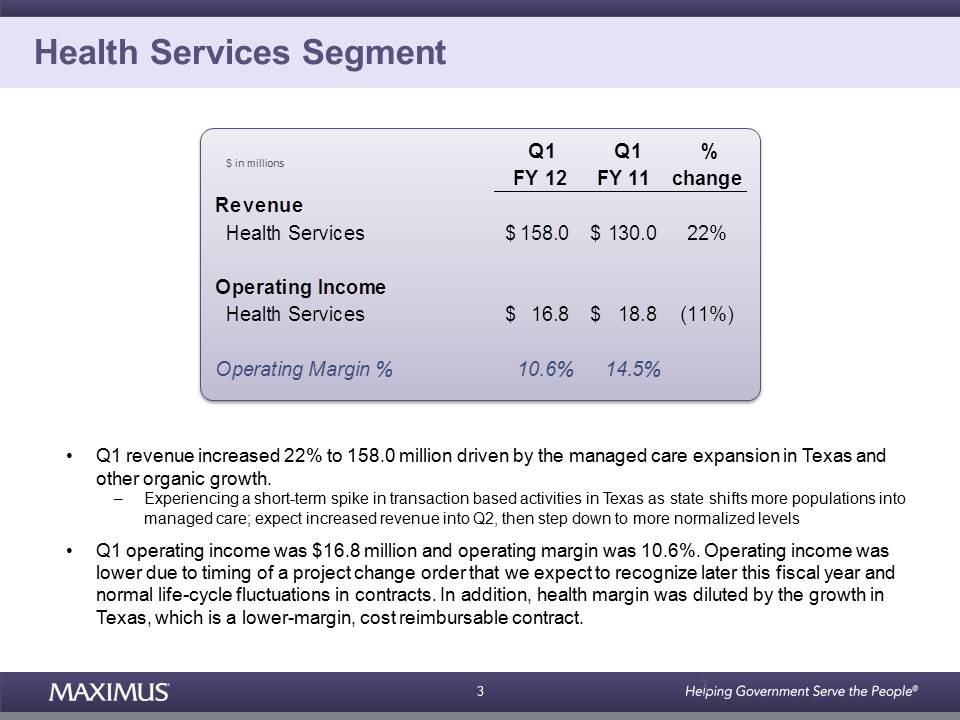

Let's jump into results by segment starting with Health Services. The Health Services Segment delivered a good quarter driven by the expansion in Texas and other organic growth. As a result fiscal first quarter revenue increased 22% to $158 million compared to the same period last year. As we discussed last quarter, we are experiencing a short-term spike in transaction based activities in Texas as the state shifts more populations into managed care plans. This short-term increase in work relates to outreach activities and call-center volumes as we help beneficiaries through this transition to managed care. We anticipate that this increased revenue will continue into the second quarter and then step down to a more normalized level in the second half of the year when the transition to managed care is largely complete.

For the first quarter of fiscal 2012 operating income for the Health Services Segment was $16.8 million and operating margin was 10.6%. Operating income was lower compared to the same period last year due to the timing of a project change order that we currently expect to occur later in the year. As well as normal life cycle fluctuations in contracts. In addition the health margin was diluted by the growth in Texas which is a lower margin cost reimbursable contract.

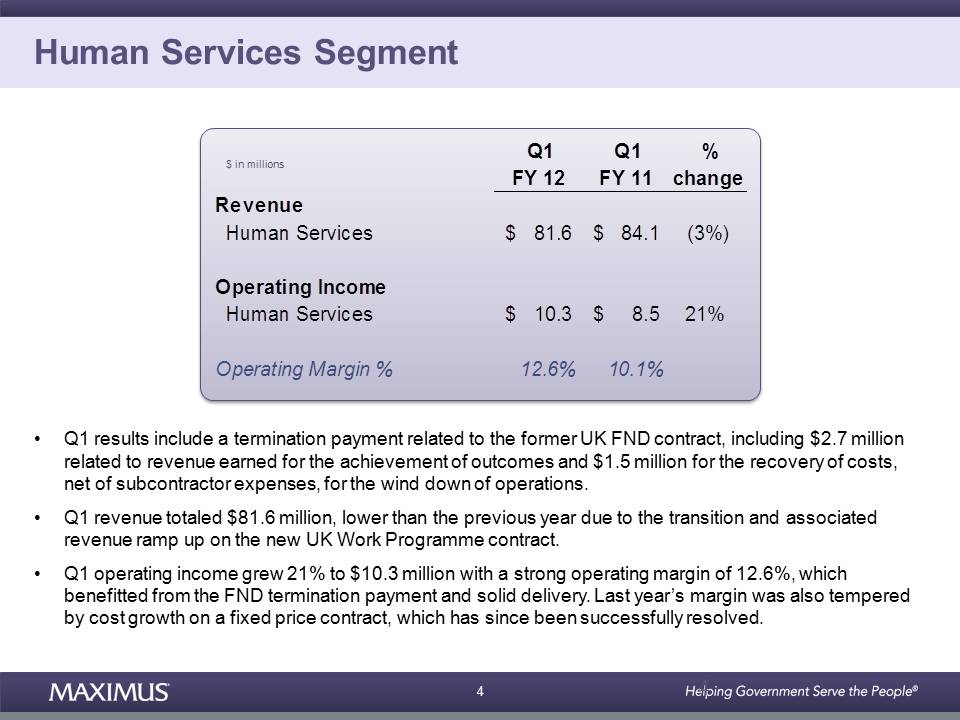

Let's now turn our attention to financial results for Human Services. As noted in this morning's press release, quarterly results for the Human Services segment include a termination payment related to the former Flexible New Deal or FND program in the United Kingdom. Under the terms of the FND contract, vendors were entitled to financial recoveries as a consequence of the government's decision to terminate the program early. There are two elements to the termination payment. The first, is $2.7 million related to revenue earned for the achievement of employment based outcomes. The second is $1.5 million for the recovery of costs net of subcontractor expenses for the wind down of program operations. As expected, these recoveries offset a portion of the losses from the ramp-up of the Work Programme which replaced the FND contract.

First quarter revenue for the Human Services Segment totaled $81.6 million which was 3% lower compared to last year principally due to the transition to the new UK contract. First quarter operating income for the Human Services Segment totaled $10.3 million delivering a strong operating margin of 12.6% and benefiting from the FND termination payment and solid delivery. The operating margin was higher than the same period last year since last year's results were impacted by a cost growth on a fixed price contract that has since been successfully resolved.

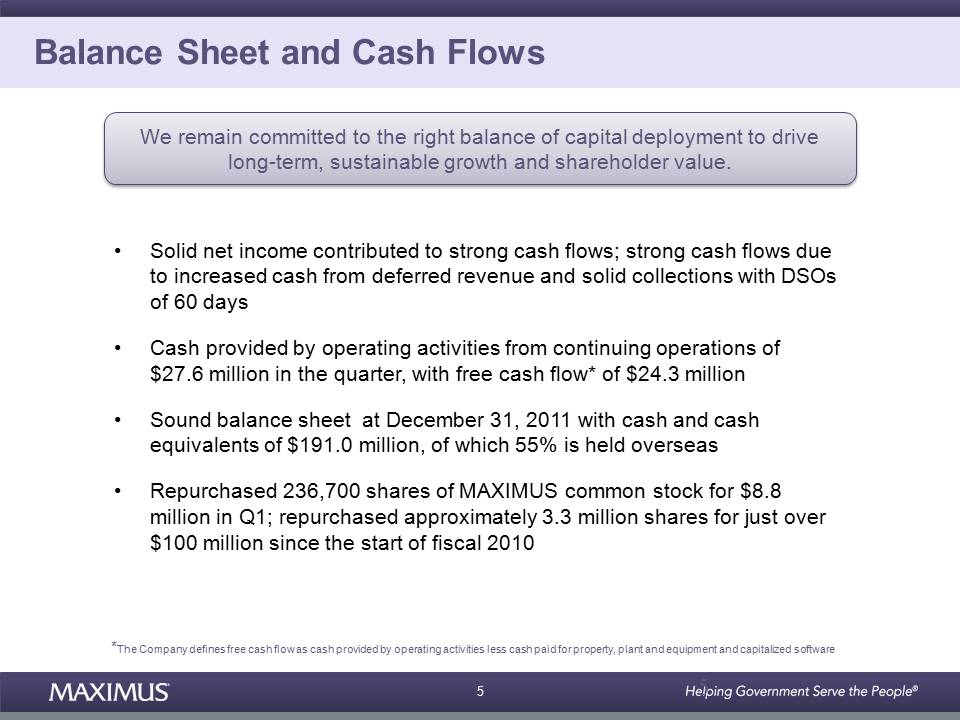

Moving on to cash flow and balance sheet items, we achieved another quarter of solid net income which contributed to strong cash flows keeping us on track for achieving our full-year cash flow guidance. Cash flow in the fiscal first quarter was strong. With increased cash from deferred revenue and continued strong receivable collections with day sales outstanding of 60 days. Cash provided by operating activities from continuing operations totaled $27.6 million for the first quarter with free cash flow of $24.3 million. Our balance sheet remains sound and at December 31, we had $191 million in cash and cash equivalents, of which 55% is held overseas.

During the quarter, we purchased 236,700 shares for $8.8 million. Over the last several years, we have taken an opportunistic approach to share repurchases. Since the beginning of fiscal 2010, we've purchased approximately 3.3 million shares for just under $100 million. Management remains committed to prudent and strategic cash deployment strategies to drive long-term shareholder value. The cornerstone of our activities will continue to include dividends and share repurchases with cash available domestically. At the same time we will continue to invest in business development and growth prospects across all our markets. This includes organic growth opportunities as well as expansion through acquisitions.

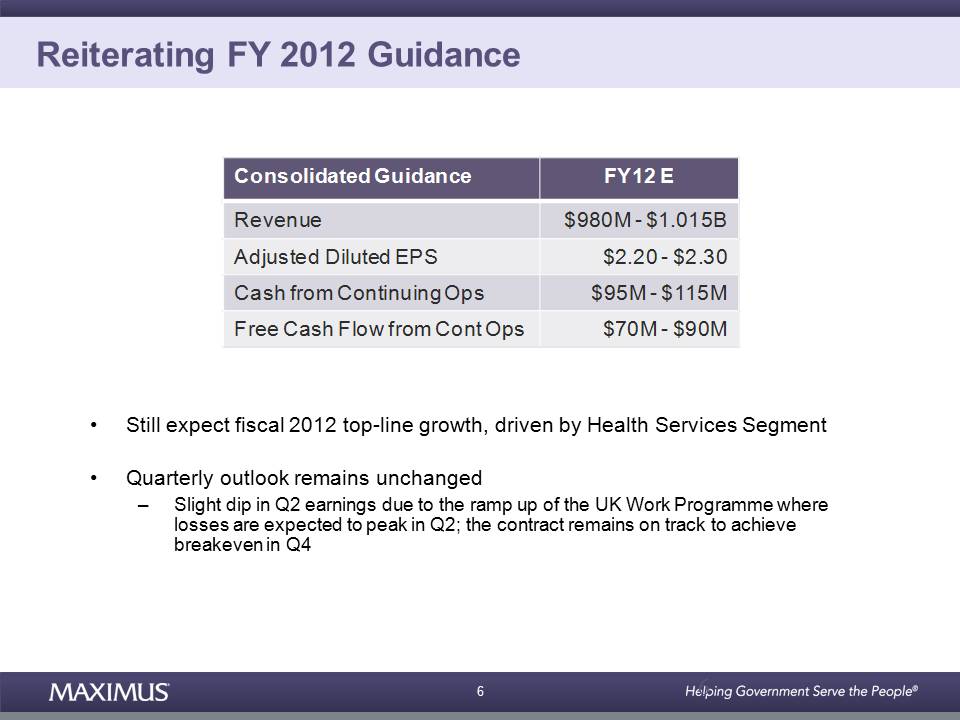

Lastly, we are reiterating our fiscal 2012 guidance. We still expect revenue to range from $980 million to $1.015 billion driven mostly by growth in the Health Segment. On the bottom line we still expect adjusted diluted EPS from continuing operations to range between $2.20 and $2.30 for fiscal 2012. In addition, our quarterly outlook remains unchanged. While the timing of transaction based revenue can fluctuate from quarter to quarter, we currently anticipate a slight dip in earnings in the second quarter compared to Q1. The second quarter will be impacted from the expected ramp up and resulting losses in the UK which are expected to peak in Q2. The UK contract remains on track to achieve breakeven status in our fiscal fourth quarter. We are also maintaining our cash flow guidance. We expect cash provided by operating activities derived from continuing operations to be in the range of $95 million to $115 million and we expect free cash flow from continuing operations to be in the range of $70 million to $90 million. Thanks for joining us this morning and now I will turn the call over to Rich.

Rich Montoni - MAXIMUS Inc - President, CEO

Thanks, David. Good morning everyone. This morning MAXIMUS reported first quarter year-over-year revenue growth of 12% and we remain on track to achieve our full-year guidance. As many as you know the Management team has spent a lot of time on the road over the last couple months. It's been a great opportunity for me personally to spend time with our investors and to introduce our story to many new faces. We have received very insightful feedback and value your input. I want to take a moment to thank you for your ongoing support.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

3

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

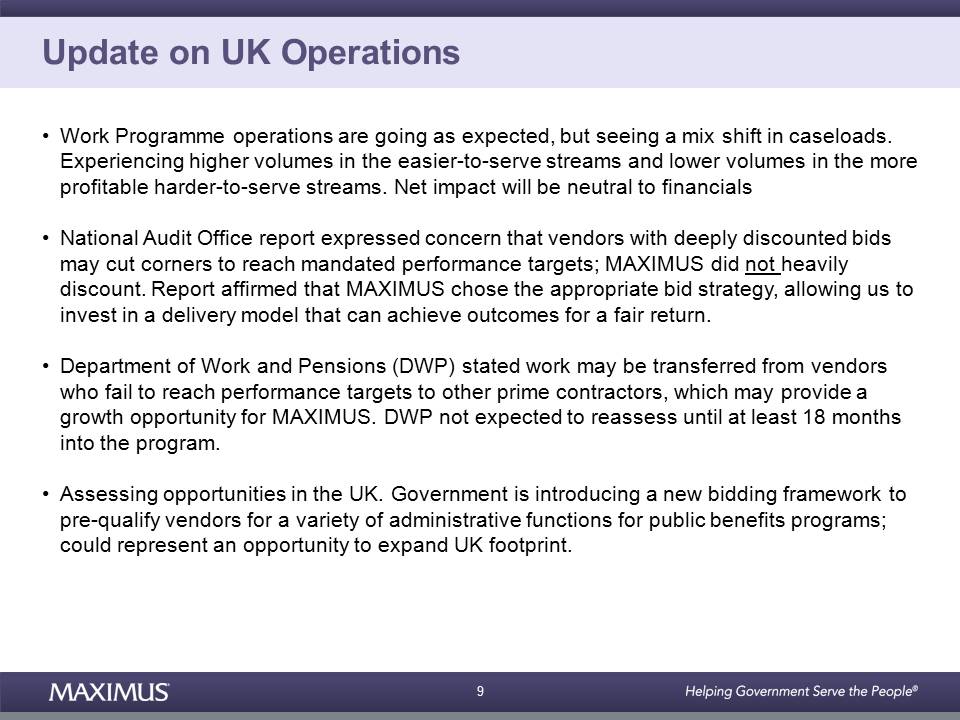

Our progress in the United Kingdom has been a common topic in our meetings. Since that is at the top of everyone's mind, let's start there. While the Work Programme is still in its early days, our operations are going largely as expected. We continue to see higher case volumes coming through the program. The Department of Work and Pensions anticipates this trend will continue for the near term as the UK economic outlook has weakened since the program commenced. In response to the increased volumes, our team is focused on balancing resources to service the case load. While we are seeing an increase in overall volumes, the case mix is different than initially contemplated. At this point we are seeing an increase in customer volumes for the easier to serve streams but lower volumes in the more profitable difficult to play streams. While we are working an increased case load, we currently expect the net impact will be neutral to our financial results and we still remain on track to achieve breakeven in the fourth quarter of fiscal 2012.

Over the last several weeks, the UK press has widely covered several news stories related to the Work Programme and all eyes continue to be focused on this ambitious reform effort. Last week, the National Audit Office, the entity responsible for auditing the work of UK Government agencies, issued a report that offered early feedback on the Work Programme. The NAO expressed concern that vendors who offered steep price discounts may be challenged by the mandated performance standards and cut corners in an effort to reach performance targets. MAXIMUS did not heavily discount prices because we recognize that the contract contained rigorous performance requirements. While the providers who discounted heavily received more work, we believe that we received the right allotment of regions at a fair price. The report affirmed for me that we chose the appropriate bid strategy by striking the right balance of risk and reward. Our approach for prudent, balanced and profitable growth has allowed us to make the necessary investments in a delivery model that we believe can achieve the desired outcomes for our client and yield a fair return.

In addition, the Department of Work and Pensions stated that one of the options for addressing those vendors who struggled to meet the performance targets is to transfer work to other prime contractors. This scenario may provide an opportunity for MAXIMUS to grow a footprint down the road. But as we have talked about previously, we don't believe the Department will reassess vendor performance until at least 18 months into the program when vendors can see clear performance trends related to sustained employment. All in all, we are confident that MAXIMUS will be at the forefront of performance under the Work Programme as demonstrated by our unparalleled results under the predecessor FND contract and our rich experience in service delivery in the United States and in Australia. We believe our operations will serve as an example of best practices and value for this important initiative for decades to come. In the meantime, we are actively assessing new opportunities within the UK as we look to bring our full capabilities to market. The government is in the process of introducing a new bidding framework to pre-qualify a list of potential vendors for a variety of administrative functions for public benefit programs. If we are successful in securing a spot in the framework, this could represent an expansion of our presence in the UK and open the door to many new and exciting opportunities.

Let's now turn our attention to Canada where we continue to make steady progress in growing our footprint in this key market. Last quarter we talked about several new wins and today we have more good news to share. The Ministry of Health and Long-Term Care in Ontario recently awarded us a contract to administer the province's Drug Benefit Program. The 3-year base contract includes several options periods that brings the total potential value to CAD43 million, and that is Canadian, CAD43 million over 10 years. Under the contract we will bring a blend of people, process and technology to meet the most populous province in Canada. There we will support nearly 3 million citizens who have drug benefit coverage under the senior co-payment and Trillium Drug Programs.

Our new customer contact operations center in Toronto will offer full document and case management to our service delivery model that's streamlined by business process management strategies. Starting in April, we will process applications, renewals, change notifications and receipts under strict information privacy and security standards. In fact, our experience in meeting these types of rigorous standards in our other Canadian operations made us well equipped for this new contract.

As David mentioned last quarter we've also been working with the province of British Columbia to help modernize its PharmaNet system. Upgrades to the system went live last week adding electronic prescribing and medication management capabilities. Now the province can begin onboarding physicians so they can create electronic prescriptions and receive real-time drug utilization reviews and potential adverse drug interactions. These functional benefits are similar to those provided by the Medegen drug information system that we are now implementing in Nova Scotia and proposing to other provinces. Across the globe, the underlying drivers for our services are substantial. Many countries are facing fiscal challenges coupled with more complex and rising case loads as well as the overarching need to reform welfare and health systems. We see some specific near-term opportunities that are right in our sweet spot and that we expect to ramp up over the next couple of years. We are actively engaged in pursuing initiatives where we can provide value through our core service offerings.

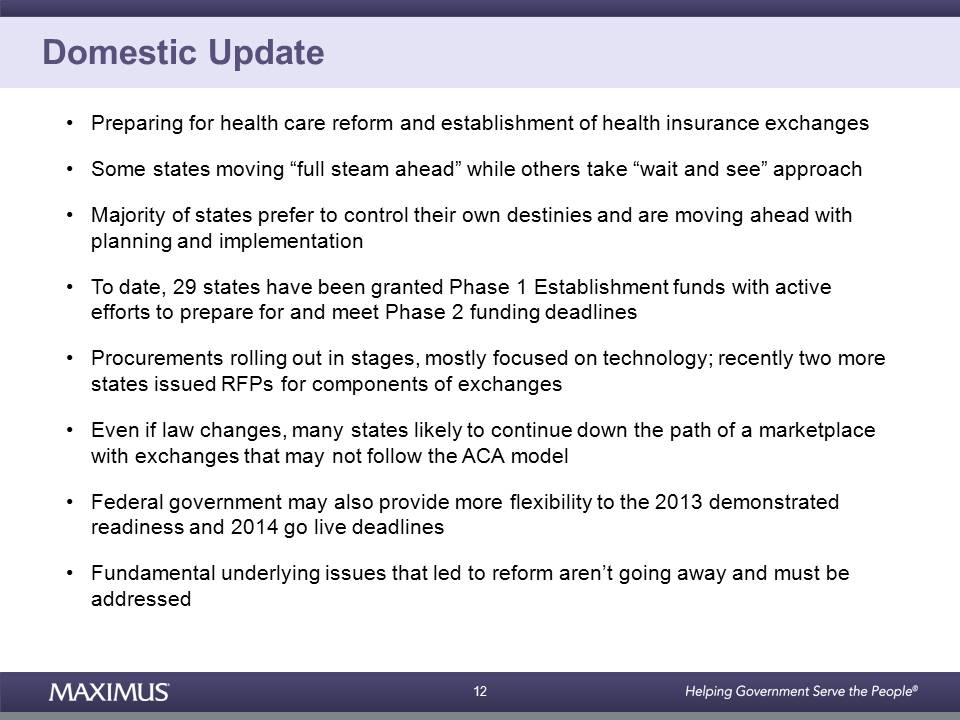

Turning now to our domestic operations where we continue to prepare for healthcare reform and the establishment of health insurance exchanges. While some states are moving full steam ahead with their procurements, others are taking a more wait and see approach. A small number of states have decided to participate in the federal exchange, are considering a hybrid federal state exchange, or are waiting for a legal decision on the law. However, the majority of states prefer to control their own destinies and are currently at various points in the planning and implementation process for a state-based exchange. To date, 29 states have been granted phase I establishment funds for their exchanges and we now see active efforts by states to prepare for and meet the phase II funding deadline.

As expected, the procurements are rolling out in stages. In recent weeks, two states issued RFPs for components of their health benefit exchanges. While many of the early our RFPs have been focused on the technology, as we expected, we are now starting to see RFPs that include business process services. We recognize that there is still much to be resolved as it relates to the law, but ultimately we firmly believe that many states will likely continue down the path of a health insurance marketplace even if their exchanges don't fit the ACA model. It's likely the federal government will give states more flexibility around the 2013 readiness deadline and the 2014 go-live date. This could create a gradual ramp for the establishment of exchanges but doesn't impact the overall demand for our services. At the end of the day, the fundamental underlying issues that led to reform are not going away and must be addressed.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

4

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

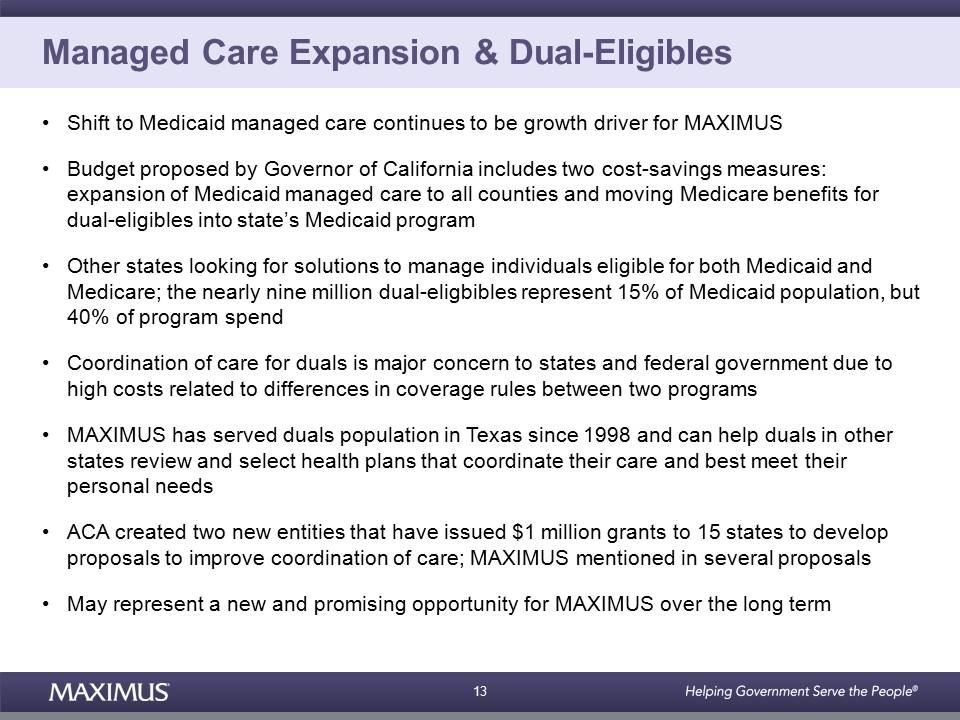

The shift to Medicaid managed care continues to be a growth driver for MAXIMUS and we continue to see states move in this direction. The governor of California recently issued his proposed budget which included a significant expansion of Medicaid managed care into all counties. In addition the budget also proposes moving Medicaid beneficiaries with dual eligibles into the state's Medicaid program, all this in an effort to improve coordination of care. Under these two initiatives, the state estimates that they could save approximately $1.7 billion by the end of 2014.

California is not the only state looking for solutions to manage beneficiaries who are eligible for both Medicaid and Medicare. According to the Kaiser Family Foundation, the nearly 9 million dual eligibles represent 15% of the Medicaid population, but account for nearly 40% of the program spend. Although this ratio varies from state to state, it is a major concern to governors and their agency directors because of the significant costs associated with serving this population. These high costs are attributed to a number of factors, but are primarily due to the difference in coverage rules between the two programs which leads to a lack of coordinated care for the beneficiaries. Improved coordinated care between Medicare and Medicaid will lower costs and improve quality, a shared goal for both the states and federal government. We believe we can help states better manage administrative services associated with the duals. For example, MAXIMUS has offered many of our core services to the duals population in Texas and we have done this since 1998. This includes education about managed care options, choice counseling, planned selection assistance, as well as application processing and enrollment.

As more Medicaid eligible baby boomers age into Medicare, they will seek support from an independent organization like MAXIMUS to help them select plans that coordinate their care and best meet their personal needs. ACA created two entities to help coordinate the care of dual eligibles. The Federal Coordinated Healthcare Office and the Center for Medicare and Medicaid Innovation. These two entities issued $1 million grants to 15 states to develop proposals for new approaches to better coordinate care for duals. Several of these states mentioned MAXIMUS and our delivery model in their proposals. We are pleased to see early reform activities at the state and federal level to address the care coordination and budgetary challenges associated with serving the growing duals population. While this may represent a new and promising opportunity for MAXIMUS in the long term, this market is still in the development stage and we look forward to future initiatives that strengthen both the Medicaid and Medicare programs.

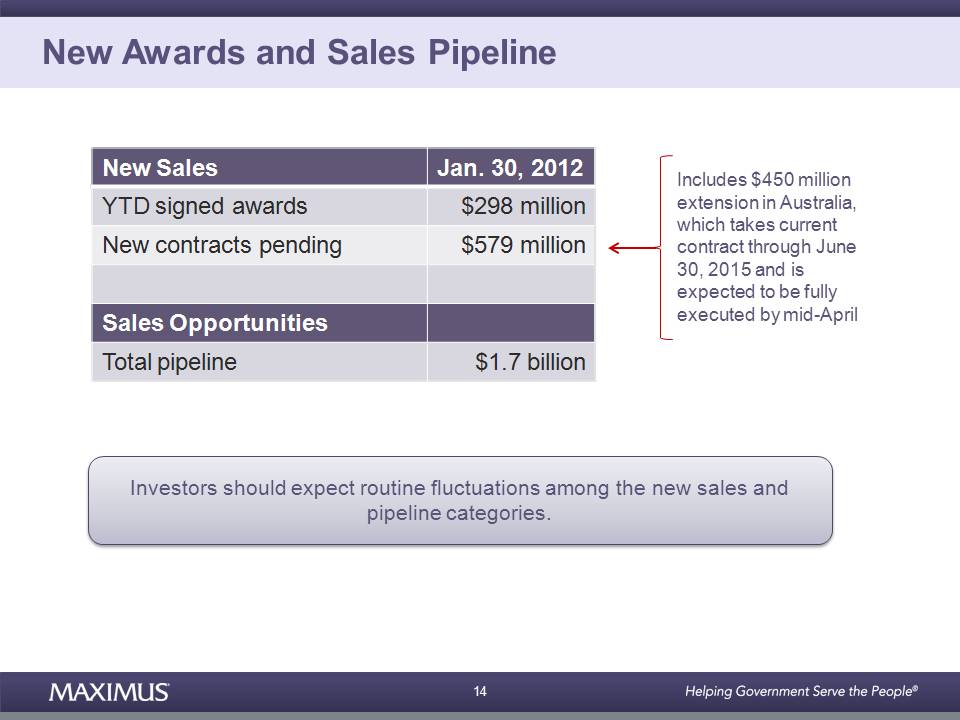

Moving onto new awards in sales pipeline. As a reminder, fiscal 2011 was an extremely active and successful year for re-bids which bolstered our contract awards last year. Fiscal '12 is fairly light for re-bids which is great news. So, when you review the fiscal '12 awards for comparison to the prior year, you should expect lower year-over-year awards. At January 30, our fiscal year-to-date signed contract wins totaled $298 million and new contracts pending, those that are awarded but unsigned totaled $579 million. The new contracts pending portion of the pipeline contained the full $150 million extension in Australia. We remain on track for the extension which will take our current contract through June 30, 2015. We expect to have this contract extension completed by mid April.

Our pipeline of sales opportunities at June 30 remained strong at $1.7 billion and is consistent with last year. As a reminder, investors should expect routine fluctuations among the pipeline and new sales categories. These shifts are driven by the stages of the procurement process as well as the timing of when contracts are awarded and ultimately signed. In summary, we are very well-positioned to achieve our objectives in fiscal 2012, the Management team is keenly focused on our near-term goals that include successfully ramping up our operations in the United Kingdom and achieving breakeven in the fourth quarter. Winning our fair share of healthcare reform in the United States and searching for qualified acquisitions. We continue to look for growth platforms that fit well within and complement our current business portfolio in an effort to drive long-term growth and deliver shareholder value. With that, let's open it up for questions. Operator?

QUESTION AND ANSWER

Operator

Thank you, we will now be conducting a question-and-answer session. In order to allow for as many questions as possible, we ask that you ask one question and please rejoin the queue for follow-up questions.

(Operator Instructions)

One moment while we poll questions. Charlie Strauzer, CJS Securities.

Charlie Strauzer - CJS Securities - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

5

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

Good morning. A quick question on the impact if you could, maybe quantify it a little bit for us of the currency and the shifting of the change order and maybe help us quantify the impact in the quarter.

Rich Montoni - MAXIMUS Inc - President, CEO

On the impacts of currency and change order on the quarter, I'm going to ask Dave Walker to respond.

David Walker - MAXIMUS Inc - CFO

Hey Charlie, the currency impact relative to our forecast, so it was the forecasted currency rate, not the year-over-year because currency is always relative to something.

Charlie Strauzer - CJS Securities - Analyst

Sure.

David Walker - MAXIMUS Inc - CFO

And most of the volatility came from Australia. At the time we gave guidance in early November, the 30 day running average for the Australian currency was about $1.03 and we came in about 1.01 on a weighted average for the quarter. So it's really that simple. They have been very volatile. For example, the 30 day average in Australia during that timeframe ranged from $0.97 up to $1.07. It's a difficult thing to peg but we hope it settles down. The Canadian dollar and Australian dollars kind of move sympathetically to the US dollars. So similar trends. All right? But to the top line, it is about $2 million as a result of currency. When you take all these rates, it is about $2 million of which Australia made up the lions share about 60%.

When you look at the change order, a little bit of background on change orders, this is an existing contract so it is a mod to an existing contract and these modifications typically occur just to better align the statement of work to what is actually going on. This is normal course activity that we engage in and both parties are negotiating in good faith. While estimating the amount for something being negotiated it is very judgmental. We estimate it could be as much as $4 million in the quarter and $7 million in the year. EPS impact on it would be between $0.04 in the quarter and about $0.07 in the year. In our mind the change order is a matter of timing. I think an important point to point out is with or without this change order, it is within the range of our guidance for the year so our guidance would remain unchanged. There are many dynamics that go into a range and this is just one. There is lots of things that we have to manage and there's many things that we can in fact manage.

Rich Montoni - MAXIMUS Inc - President, CEO

I reiterate that David, and to highlight your response to Charlie's question, the impact of currency in the quarter, top line was about $2 million, impact of the change order slippage was about $4 million. From an earnings perspective, the currency impact interestingly enough really wasn't that material. The EPS impact of the change order slippage about $0.04. Does that help?

Operator

Brian Kinstlinger, Sidoti & Company.

Brian Kinstlinger - Sidoti & Company - Analyst

Great thanks. Good morning guys. The first question I have is on the pipeline, the $1.7 billion you talk about, how much of that is new business or expansion of work?

Rich Montoni - MAXIMUS Inc - President, CEO

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

6

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

The $1.7 billion, we don't split it out and provide specific data on the mix but that being said, the pipeline, and I think it's still very robust, the majority of the opportunities that we are tracking relate to new work and it's new work in both segments and interestingly enough, new work in all geography. So, I think from a call out perspective, Brian, I am very encouraged as it relates to that pipeline number. As you know, we typically track re-bids and we have done it again this year. You know how it shapes up this year, that this is not a very big re-bid year. I think it's very important that we are seeing a lot of new work pulling through and coming into that pipeline.

Operator

Brian Gesuale, Raymond James.

Brian Gesuale - Raymond James - Analyst

Good morning. Thank you for the color on the UK work with FND, I'm wondering if you could quantify how the Work Programme came in with both costs and any revenues associated with it. And along those lines with the mix shift changing to easier populations, does that change the timing of the margin profile there as you're able to place people quicker at lower dollar rates or how should we think about all those moving parts?

Rich Montoni - MAXIMUS Inc - President, CEO

I think that's a great question. We have not either guided or provided actual results by quarter for the UK program. We have given folks some information as it relates to what we think will happen in the UK program for the year. The good news is that program is tracking pretty much where we expected it to be and where we shared with our external shareholders from a top line and bottom line perspective. It is on track. We also shared with you the impacts of the settlement in the UK in the first quarter and that's important to be aware of because, obviously we won't have a settlement benefit in Q2 so that's an important dynamic when you start to study expectations for Q2. As it relates to the mix shift, and it's different than what we originally contemplated. As we said I think in the notes or the call notes, we are seeing higher volumes in the easier to serve populations but lower volumes in the more profitable harder to serve streams. And when we run that through our existing model, we end up basically net-net where we expected to be, so we'd reiterate our guidance for the year and the timing of that, most notably we expect the project to turn -- improve over the year, improvement quarter-to-quarter and then to really turn and breakeven approximately in the fourth quarter of fiscal '12.

David Walker - MAXIMUS Inc - CFO

Brian, this is Dave Walker, just as a reminder, in Q1 our results were bolstered by the FND, the old contract termination payment so that provided us an uplift actually in our margins of about $4.2 million. We would expect actually things, the earnings to go slightly lower in the second quarter as a result of not having that benefit from the termination that we saw in the first quarter. While the UK will perform better year-over-year, you have to isolate out that one-time payment that we received in Q1 if that helps.

Operator

James Kumpel, BB&T Capital Markets.

James Kumpel - BB&T Capital Markets - Analyst

Good morning. Can you talk a little bit on the pipeline again? Would you characterize -- would you be able to characterize for us some of the mix between domestic opportunities versus international opportunities in that pipeline?

Rich Montoni - MAXIMUS Inc - President, CEO

Again, we don't share specific metrics, Jim, but I would say this, that I think both sides and all geographies are very, very robust. I don't think it's -- my view is it's not as if we have one leading the other. They are very robust on both sides of the ocean. I think it's reflective of what we said for quite some time that all these governments are quite compelled to reconsider their programs and I think there is a tendency towards working with the MAXIMUS for business process services. I would say that much of it is new scope, it is what I would consider to be an increase in the addressable market as opposed to some of it is increased revenue and increased earnings from increasing case loads on existing contracts, but the majority of the new work that we are looking at really falls in new scope, new programs, new governments, and new geographies. In both our Health and Human Services and both our domestic and international operations.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

7

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

Operator

(Operator Instructions)

Constantine Davides, JMP.

Constantine Davides - JMP Securities - Analyst

Maybe just a couple here. One follow-up on the last point, Rich. I'm somewhat surprised you're not seeing a little bit more emphasis on welfare-to-work abroad -- I'm sorry, here domestically just given what you are seeing overseas and given the fiscal budget crisis in many states. Can you talk a little bit about that dynamic a bit and when we might expect to see a little bit more of an inflection in the domestic Human Services business? And then just on the UK another follow-up, what is the mix between the two population pools just on a percentage basis and how does that differ than when the contract was awarded in terms of your expectations? Thanks.

Rich Montoni - MAXIMUS Inc - President, CEO

Thank you Constantine. Let me take the first one here in terms of welfare-to-work domestic. I think that's a very good observation, I think it's fair to ask the question. We do see a lot of press and political pressure as it relates to the unemployment rate and a lot of politicians have made it their number one priority to focus on improving that unemployment rate. I think where we stand today is we have a situation where for all practical purposes in terms of, at the program level, really all eyes are on the results of ACA, health insurance exchanges, and the departments seem to be focused on the health program in the United States.

There is early on discussions among the policymakers and the political world about the welfare-to-work program. I think the are a number of folks who believe rightfully so that our existing welfare-to-work programs are not optimal in terms of efficiency and there is a growing chatter out there in terms of should we take a look at our welfare programs, our job programs and re-engineer them. Those folks speculate that that is likely to be something that if it gains traction from a political and a lawmaking perspective, it is likely to occur after the presidential election. It looks like it would shape up to be a fiscal 2013 meaningful business development event for MAXIMUS, and as you would expect we are trying to stay very, very close to those initiatives and those folks that are involved and hopefully that is going to turn around and be a real big opportunity domestically in fiscal 2013 and beyond. In terms of the mix populations, at this point in time we're going to have to defer providing the details. One, they are not handy in this room, and two, we have not provided mix information on the program so we will give some thought to whether or not we can publicly disclose all those details but we don't have it available for public consumption today.

David Walker - MAXIMUS Inc - CFO

Just for clarification, it's really seven different streams, it's not like binary one or two. So it's more like a portfolio. It's a matter of degree and we are seeing short-term trending in the easier to place folks, but the rewards tend to be more back ended. Although early reads, and again, it's early days, so it's too early, our indications are the other streams are just slow out of the gate but they are coming. At this point I think it's too early to draw any conclusion about what the long-term mix will be on this program.

Operator

Frank Sparacino, First Analysis.

Frank Sparacino - First Analysis - Analyst

I just like to clarify on the Human Services side, if you took out the Work Programme and you looked at the margins profitability of that business it would seem to be lower than it was a year ago and I'm wondering if that's fair. And secondly, what would be driving that?

Rich Montoni - MAXIMUS Inc - President, CEO

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

8

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

On the Human Services business, (multiple speakers) --

David Walker - MAXIMUS Inc - CFO

Well, let's just take a look at --

Rich Montoni - MAXIMUS Inc - President, CEO

You have got the UK so last year you had FND running full bore and this year you're going through the restart ramp-up. As we have kind of laid out, we expected the margins to be lower although in the back end of the year the margins will rise rather nicely.

David Walker - MAXIMUS Inc - CFO

Frank, just to make sure were talking about the same data point here, are you talking about the margin for the segment Q1 '12 over Q1 '11 which would be 12.6%. I think we're talking about 12.6% compared to 10.1% last year. One of the big drivers this year versus last year where we see net improvement to 12.6% was the fact in the prior quarter we had a nonperforming contract which had some cost overruns that did not occur this year. As you analyze and reconcile those two data points, that becomes an important element. Thank you.

Operator

(Operator Instructions)

Brian Kinstlinger, Sidoti and Company.

Brian Kinstlinger - Sidoti & Company - Analyst

Good morning again. I guess I'm interested in how you are accounting in your guidance for the shift in managed care. For example, are there specific areas that you expect to occur similar to the Texas situation that is in there already, is it just sort of a high-level, you expect it to happen so it's kind of in your growth rate? Similar to Texas, does that flow through your backlog, it's already an existing contract, the volume, do we just not see that flow-through backlog in bookings or do you actually see some kind of numbers related to that?

Rich Montoni - MAXIMUS Inc - President, CEO

Oh I see, as it relates to how we account for the shift in managed care, how we, well we account for it as it occurs in the quarter it occurs so the actual increase in the work that we do is accounted for in that particular quarter as revenue and related costs associated with the project. In terms of how we forecast and model, we do it on a program by program basis. We don't just take a national percentage increase in populations, it is done on a program by program, contract by contract basis. I think that answers the first question that you had, Brian. The second one, does the flow-through new contracts, generally no. Generally it is an extension of our existing contract. It really comes to us as additional volumes, additional of cases or whatever the pay point would be with an existing contract. In most cases we would not record it as a new contract award. There may be some situations but I think they are more isolated where we get a new contract award specifically for that additional work, in which case it would be recorded as a booking and that may be the case as we talked in the call a little bit about duals, that might end up in many cases being separate contracts, add on contracts in which case it would flow through bookings.

David Walker - MAXIMUS Inc - CFO

Thank you.

Operator

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

9

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

James Kumpel, BB&T Capital Markets.

James Kumpel - BB&T Capital Markets - Analyst

This is part two. On the workforce contract that you have in British Columbia, can you give us sort of the sense of the size of the contract, when it would be expected to add positively to your numbers? Because you also mentioned it too about the change in case mix in the UK, are you seeing anything similar in Australia and are there any dynamics we should keep in mind should the global economy pick up more than currently expected?

Rich Montoni - MAXIMUS Inc - President, CEO

Okay, I think you have a four part question here, Jim, so I'm trying to get all the pieces. Call back if you don't. As it relates to the new opportunities, the British Columbia situation, that contract which is known to us as Colona Workforce Services contract is a $63 million contract, it's a seven-year duration. As you know and folks on the call may know, we will be delivering a wide range of employment services for the city of Colona. Very pleased to have the opportunity and very pleased to be working with some of the great existing providers in that area as part of our team. Point two, I think you were asking the dynamics in the United Kingdom, are we seeing similar dynamics in Australia, and I think that flowed into your final point or question which was, what happens if economies move one way or another as it relates to our jobs program. I think the dynamics in Australia as quite different than the dynamics in the United Kingdom. In fact I think they are perhaps going in the opposite direction.

We talk about a supply curve and a demand curve in our jobs business, effectively where you've got jobs looking for people and people looking for jobs and as an economy goes from a recessionary situation to a robust situation you will see shifts in those supply curves and demand curves and a new equilibrium is driven as we manage the programs. In the UK I think the general trend has been a softening of the economy since the Work Programme, and as a result the pressure points are finding jobs for individuals and our operators of the program are very, very good and they will reallocate resources to spend more time to work with the employers. I am pleased to see the UK government actually stepped up and I believe it's getting to be a month plus they decided to dedicate GBP1 billion toward the most challenging situation, is the very high unemployment rate with younger folks so they decided to dedicate GBP1 billion as an available credit to employers who employed youth, and they intend to use the GBP1 billion to subsidize 50% of the minimum wage. That helps programs like this, it helps employers, and motivate employers to create opportunities. In Australia, I actually think it's going the other way where the economy has fairly, has improved so as you would expect, we move to the situation where we have to rebalance and refocus our situation in that regard. I look at them as totally different. As we study these, I don't think it's appropriate to come up with just a global response. You really have to look at them country by country. Hopefully that helps.

Operator

Constantine Davides, JMP.

Constantine Davides - JMP Securities - Analyst

Rich or Dave, I don't know if I missed this but I think last quarter you talked about having 10 contracts left to renew worth about $300 million, did you give an update on that?

Rich Montoni - MAXIMUS Inc - President, CEO

I think we did not, and I do think we have some data available here on the re-bid situation. Let me share that with you. Here is where we stand. First off to set the table, and this is a very, very important point for folks to remember that this is a relatively light year for re-bids in the sense that fiscal '11, our prior fiscal year, was very, very heavy on re-bids and we were also very fortunate to have some extensions that would otherwise in the normal course have been perhaps re-bids this year. With that as a backdrop, we started the year with 14 re-bids with a total contract value of $415 million and thus far we have won or secured extensions on 8 of those 14. That means we have six re-bids left in the remainder of fiscal '13 as we judge the situation today. Of the $415 million that was on the table the beginning of the year, we have, the eight represents $212 million that we have secured or extended so that leaves six re-bids with a total value of $213 million remainder of year.

Operator

Brian Kinstlinger, Sidoti.

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

10

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

Brian Kinstlinger - Sidoti & Company - Analyst

Great, just to finish my thought too, I'm curious, are there any particular areas similar to Texas, are there any other states, you talked about California or others, that you see this already happening or is a trend, we think it's going to happen, we don't know specifically where it's going to happen yet?

Rich Montoni - MAXIMUS Inc - President, CEO

Brian, is this in the area of managed care shifting populations.

Brian Kinstlinger - Sidoti & Company - Analyst

Yes. Of course, thank you. Sorry.

Rich Montoni - MAXIMUS Inc - President, CEO

Bruce Caswell is here and he is feeling disappointed we haven't given him an opportunity respond.

Brian Kinstlinger - Sidoti & Company - Analyst

I'm happy to talk to Bruce.

Rich Montoni - MAXIMUS Inc - President, CEO

We're going to give him an opportunity to respond to that one. What are you seeing in the marketplace, Bruce?

Bruce Caswell - MAXIMUS Inc - President, Health Services

I think, Rich, what we are seeing, and Brian, is a trend nationally. There was a Kaiser report that came out that we've shared as part of our briefings at investor meetings and so forth that shows the map of the United States with managed care expansions, not just driven in terms of new populations, but for example, taking historical populations that were in waivers and taking them off those waivers, putting them into managed care. So that would be like non-dual ADD populations, and so forth. So it's really more of a national trend. There's a nice fitting if you will, between the current 14 states that MAXIMUS serves and the majority of states that are experiencing some growth in one way or another in their managed care population. We've also seen new states come on as clients, as they've shifted from a primary care case management model such as the case in Louisiana, to a full capitated risk based managed care model which creates net new opportunities as well. So it's not just expansion in the current base, but also new opportunities.

Brian Kinstlinger - Sidoti & Company - Analyst

Can ask one more question?

Rich Montoni - MAXIMUS Inc - President, CEO

Sure.

Brian Kinstlinger - Sidoti & Company - Analyst

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

11

|

FEBRUARY 02, 2012 / 02:00PM GMT, MMS - Q1 2012 MAXIMUS, Inc. Earnings Conference Call

|

You mentioned the press on the low cost providers on the UK welfare-to-work program. Is there actually a list of underperformers or disappointments? Because you said you were obviously not one of the low cost providers which I think we knew, or is it just a call out of the low cost providers aren't doing as well as others, so I'm curious about that.

Rich Montoni - MAXIMUS Inc - President, CEO

Brian, I think the basis for that data in the call out was this NAO report which I believe is publicly available, but I believe the Department has not, and the report does not identify specific providers. And as a general rule, I think the Department of Works and Pensions which is the relevant department there, they tend to hold this data fairly close to their vest, I think in part because they really want to help each provider be successful and do the best they can. They will periodically disclose vendor specific performance metrics but there is usually a fairly significant lag between that and the period under report. So, to answer your question in short, I'm not aware of any vendor specific data at this time.

Brian Kinstlinger - Sidoti & Company - Analyst

Thanks.

Rich Montoni - MAXIMUS Inc - President, CEO

We would love to get it. Next question please.

Operator

Thank you. We've come to the end of our questions. This concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

|

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2012 Thomson Reuters. All Rights Reserved.

|

|

THOMSON REUTERS STREETEVENTS | www.streetevents.com | Contact Us

|

|

|

© 2012 Thomson Reuters. All rights reserved. Republication or redistribution of Thomson Reuters content, including by framing or similar means, is prohibited without the prior written consent of Thomson Reuters. 'Thomson Reuters' and the Thomson Reuters logo are registered trademarks of Thomson Reuters and its affiliated companies.

|

|

12

David N. Walker Chief Financial Officer and Treasurer February 2, 2012 Fiscal 2012 First Quarter Earnings A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

Selected Financial Results from Continuing Operations 2 *All numbers reflect the two-for-one stock split Q1 revenue grew 12% compared to last year, driven by Health Services and offset by lower revenue in Human Services due to the expected ramp up in the UK Revenue and earnings were impacted by unfavorable currency trends, relative to guidance, and the timing of an anticipated change order in the Health Segment Q1 operating income, excluding legal, was $27.1 million and operating margins were 11.3% Income from continuing operations, net of taxes, totaled $17.7M, or $0.51 per diluted share; within our stated range

Health Services Segment 3 Q1 revenue increased 22% to 158.0 million driven by the managed care expansion in Texas and other organic growth. – Experiencing a short-term spike in transaction based activities in Texas as state shifts more populations into managed care; expect increased revenue into Q2, then step down to more normalized levels Q1 operating income was $16.8 million and operating margin was 10.6%. Operating income was lower due to timing of a project change order that we expect to recognize later this fiscal year and normal life-cycle fluctuations in contracts. In addition, health margin was diluted by the growth in Texas, which is a lower-margin, cost reimbursable contract. $ in millions

Human Services Segment 4 Q1 results include a termination payment related to the former UK FND contract, including $2.7 million related to revenue earned for the achievement of outcomes and $1.5 million for the recovery of costs, net of subcontractor expenses, for the wind down of operations. Q1 revenue totaled $81.6 million, lower than the previous year due to the transition and associated revenue ramp up on the new UK Work Programme contract. Q1 operating income grew 21% to $10.3 million with a strong operating margin of 12.6%, which benefitted from the FND termination payment and solid delivery. Last year’s margin was also tempered by cost growth on a fixed price contract, which has since been successfully resolved. $ in millions

Balance Sheet and Cash Flows 5 Solid net income contributed to strong cash flows; strong cash flows due to increased cash from deferred revenue and solid collections with DSOs of 60 days Cash provided by operating activities from continuing operations of $27.6 million in the quarter, with free cash flow* of $24.3 million Sound balance sheet at December 31, 2011 with cash and cash equivalents of $191.0 million, of which 55% is held overseas Repurchased 236,700 shares of MAXIMUS common stock for $8.8 million in Q1; repurchased approximately 3.3 million shares for just over $100 million since the start of fiscal 2010 *The Company defines free cash flow as cash provided by operating activities less cash paid for property, plant and equipment and capitalized software We remain committed to the right balance of capital deployment to drive long-term, sustainable growth and shareholder value.

Reiterating FY 2012 Guidance Still expect fiscal 2012 top-line growth, driven by Health Services Segment Quarterly outlook remains unchanged – Slight dip in Q2 earnings due to the ramp up of the UK Work Programme where losses are expected to peak in Q2; the contract remains on track to achieve breakeven in Q4 6

Richard A. Montoni President and Chief Executive Officer February 2, 2012 Fiscal 2012 First Quarter Earnings

First quarter year/year revenue growth of 12% Remain confident that we’re still on track to achieve full year guidance for fiscal 2012 Recent investor meetings have provided insightful feedback and progress in the UK has been a common topic Recap of Q1 of FY 12