It will blend out for the year. So we will use that full-year rate every quarter and it is driven substantially by the UK. So, if you think about it, the tax rate in the UK, which was making -- in our slides, we show you making an EBIT of about $5 million at 27%, which is a lower benefit than the overall average in the US, right? And next year, you actually have a loss and the tax rate goes down to 26%. So, you actually get less tax benefit on the loss. So, year-over-year it has the effect of driving up the weighted average rate. Does that make sense?

James Kumpel - BB&T Capital Markets - Analyst

I think so.

David Walker - Maximus Inc - CFO

Okay.

James Kumpel - BB&T Capital Markets - Analyst

Can you give sort of a sense for what the incremental uptick was on interest and other income in the quarter? Is $1.1 million a good number to be using or is it closer to the kind of $500,000 to $900,000 that you had earlier in the year.

David Walker - Maximus Inc - CFO

Interest income? Just a minute.

James Kumpel - BB&T Capital Markets - Analyst

Interest and other income. Did you find some higher rate CDs we're just not aware of?

David Walker - Maximus Inc - CFO

Yes. Well, if you're talking sequentially, quarter-over-quarter or year-over-year?

James Kumpel - BB&T Capital Markets - Analyst

Well, sequentially it is up from like the $900,000 range, right?

David Walker - Maximus Inc - CFO

That's right. $961,000 to about $1.1 million, right. And that's largely coming from overseas. Last year was ranging more like a couple hundred thousand dollars. So.

James Kumpel - BB&T Capital Markets - Analyst

Okay. And then just a little bit more strategically. Rich, can you comment about what if any major rebid do you expect in 2012. Looks like you got the bulk of it taken care of this past year.

Rich Montoni - Maximus Inc - President, CEO

Yes, that's a great question. In terms of rebids -- first off, fiscal '11 was a great year. As you know, it was a big year for rebid and very fortunate, and maybe it is a sign of the times where clients instead of going to rebid are just extending contracts. I think in part some of our government clients are focused on other things, they are apprehensive to change vendors on the eve of healthcare reform and health insurance exchanges. And I think that makes an awful lot sense.

So, we were fortunate in fiscal '11 not only with the wins in terms of rebid percentage and options; but for example, the extension of California Healthy Families was a great thing, and we had some Texas work that was extended as well. So interesting as we go into fiscal '12, it shapes up to be a fairly light year. We have specifically -- when we add it up we have 14 contracts that are up for rebid in fiscal '12 and the total contract value of those 14 contracts is $414 million.

James Kumpel - BB&T Capital Markets - Analyst

Yes. On average over like a three to five year period?

Rich Montoni - Maximus Inc - President, CEO

Yes, they average three to five years, but interesting, we also run the math in terms of what does it means to fiscal '12 revenue and it is nominal. The total fiscal '12 revenue up for rebid is $42 million, of the 41 because the rebids happen throughout their year. And interestingly enough, already, we have won one of those for $8.2 million of the $414 million, and we've received extensions on 3 of them, Jim, for up to about $108 million. So at this point in time, of the 14 we have 10 left; we've won 4 effectively of the 14. We have 10 left for TCV of about $298 million and a fiscal '12 revenue of $17.4 million. So it's really shaping up to be a great situation from a rebid perspective.

James Kumpel - BB&T Capital Markets - Analyst

With regard to the UK, can you just clarify if in that $9.5 million expected drag in 2012, if that includes the benefit of that transition payment?

David Walker - Maximus Inc - CFO

I'm sorry the answer is yes. Yes it does.

James Kumpel - BB&T Capital Markets - Analyst

Okay. And then finally, again, Bruce, can you offer up some perspective about the state of mind of the bulk of the states with regard to exchanges? You are talking about delays and requests for information phases as opposed to RFPs, but is it just that they are burdened with so much stuff that they haven't gotten around to the meat of it? Or is it just that there is so much uncertainty in an election year that they are going to await the results of that and-or the Supreme Court decisions on health reform before they methodically move forward?

Bruce Caswell - Maximus Inc - President, Health Services

Jim, I think the first way to look at that is just the legislative status across the states, and we talked about this a little bit about this a little bit on the last call. And I'll give you kind of an updated snapshot. As of today, there are 31 states that have either signed legislation, have implemented a workaround, have a live bill that they are considering, or have a bill that is on hold in the legislature yet to be resolved. And so that leaves, including the District of Columbia, 20 states that -- where the legislation is either dead or they don't have a bill all.

And interestingly though, even in some of those 20 states, there are very significant planning and execution activities underway because they anticipate bringing the legislature back, either getting a bill through or working to administrative workarounds and executive orders. So that's kind of an objective view of it from a legislative perspective. I would actually say that having spent time, as Rich mentioned, over the last few days looking very closely at this with a number of current and prospective clients, states are not backing off of their activities at all. They see that they have a very heavy lift in front of them and they are eager to get a number of the major issues resolved from a regulatory perspective.

The federal government has just recently accepted the first set of comments on the regs that were published in July and then extended the comment period, which only means that the final rules won't come out as timely as originally anticipated and states are very hungry for those final rules as they relate to areas like the essential benefit package and so forth. So, I would actually say that states have turned -- those states that have the money from the federal grants and that have programs underway have now turned very much toward implementation activities and the work plan associated with that; and in many ways, they are -- if they are calling for any type of delay in implementation, it is because of the lack of available time to execute fairly complex procurements that need to occur to get this in place.

There's only 22 months between now and when these exchanges go live, and you could easily see 10 months consumed in conducting a procurement and another remaining 12 in implementing the solution. So that's the state of mind of the states. They are very, very pragmatic and practical and focused on what they need to do to get it implemented.

Our next question comes from the line of Constantine Davides from JMP Securities. Please proceed with your question.

Constantine Davides - JMP Securities - Analyst

One follow-up on the UK -- the transition or termination payment. David, is that going to be an item that is recognized in revenue or is it in adjustment to operating expense? Where is exactly is that going to hit?

David Walker - Maximus Inc - CFO

A little of both. A little of both. So a piece of it relates to past services so we're getting payment for what the revenue would have been had they just run out. So that notionally goes through revenue. And some of them, it is a reimbursement or paying us for costs that we would otherwise incur such as lease termination so to offset expenses that we'll have to pay. And there also is some subcontractor costs. So we end up with a piece of the revenue relates to the subcontractor, so we run it through the revenue and we push it through the cost.

Constantine Davides - JMP Securities - Analyst

And the $5 million delta between what you guided to at the analyst day on the UK and I think that $30 million you've laid out for us, does that contemplate the payment or is that just a function of the volumes coming in a little bit better?

David Walker - Maximus Inc - CFO

It contemplates the payment.

Constantine Davides - JMP Securities - Analyst

Okay. And then I guess just on that note, when you say volumes are coming a little bit strongly --

David Walker - Maximus Inc - CFO

It's both, Constantine. So the volumes as we are tracking are coming in a little higher, so we track volumes by job stream. We also track outcomes and it is early days on the outcomes; but in job placements, our models are working quite well, but our volumes are up a little bit from what we expected. So, internally, we've pushed up a little bit our numbers for that as well as this anticipated settlement.

Constantine Davides - JMP Securities - Analyst

Okay. And then last thing on the UK, just any sense for if they are going to start implementing the type of transparency blueprint that Australia has adopted? And I guess similarly, I'd appreciate your comments on how Canada is thinking about structuring that program, as well?

David Walker - Maximus Inc - CFO

Well, my understanding is they are certainly going through and keeping score unlike the Australians. They don't plan to make it a public scoring.

Rich Montoni - Maximus Inc - President, CEO

At this point in time, not that we know. I think they will give all of the providers a bit of a window to perform and what we've heard is 18 months from the beginning. So I think they will have a more formal look-see at performance and contemplate reallocations 18 months out and I think the start date officially was July 1st. So, but they are tracking score, we're aware of our scores, we're very pleased that were doing extremely well from a qualitative perspective and getting the job done. I think we are leader of the pack in that context.

So, it does set up an opportunity in the future. Realistically in terms of reallocation, it is more likely to be at that 18 month window, Constantine. As it relates to Canada, their formalities are not nearly as elaborated as the UK and certainly not as far advanced as Australia; but I just believe that in this performance-based environment, as governments are pressured to deliver outcomes that matter, these governments are very much focused on metrics.

And I would expect that we will see a leaning in Canada towards delivering the outcomes that matter, but they are not nearly as formalized or they have not articulated their plans at this point in time. So, we'll have to stay tuned and watch that one.

David Walker - Maximus Inc - CFO

At this point, it's more of a traditional fee-for-service in Canada. But we're going to -- I think you're going to see these trends to correlate outcomes to pay much more still worldwide as governments need to. So we are actually encouraged.

On the revenue too, and I will point this out and it's broader than the UK, currency has actually had a dampening effect the other way. So the UK as well as the Australian dollar and the Canadian currency, have all dropped in the last 90 days from about August to October timeframe, which we look at for forecasting. So it is pushing down what we otherwise would have been forecasting had we been looking at the end of the quarter by about $7 million of which the UK is about $1 million. So not to say currencies will stay there, that is just what we had at the time we did our forecast. If that helps.

Constantine Davides - JMP Securities - Analyst

Yes, that's helpful. Two questions on guidance and I'll let somebody else jump in. But first, does guidance factor in any repurchases beyond what you've disclosed in the month of October? And then also can you just give us a little bit more color on how to model the health and human services segments in terms of the topline for fiscal '12?

Rich Montoni - Maximus Inc - President, CEO

I'm going to ask Dave Walker to respond to the first, and I'll take the second part of your question.

David Walker - Maximus Inc - CFO

Yes, the only repurchases we normally forecast are just enough to keep restricted stock units from coming -- from being dilutive. So we keep it neutral.

Rich Montoni - Maximus Inc - President, CEO

Okay. On the second part of your question, which was for some added color as it relates to fiscal '12. There are several pieces that we need to put on -- I need to focus on here, Constantine. Let me first talk about revenue and in fiscal '12, we believe that revenue is going to be driven by our health services segment and the growth there is going to be attributable to new work in managed care expansion and that is in a number of programs as we've talked about in our call notes.

So, from a health services segment, we expect the revenue is going to be stronger in the first half of the year; and again, that's mostly -- that's driven mostly by a spike in the managed care expansion. And then on human services, when we look at the human services side for the full year, we expect that that segments revenue will be likely flat to somewhat up compared to fiscal '11. And factors you need to be aware of that would be behind that would be obviously the year-over-year decrease in revenue for the United Kingdom, we see positive growth pressures or opportunities in Canada as we talked about, I do think the US itself is going to be relatively soft. And we do expect that Australia will grow but not as fast as it has grown in the last couple of years, which has just been off the charts type growth.

I do also want to add on the human services side, it is important to note that the quarterly revenue is expected to take a sizable step down in the first half of the year, compared to our fourth quarter of 2011. We expect that run rate to decrease the first half of the year and that is mostly a result of the start up in the United Kingdom; and in the second half of the year, we expect that it is going to ramp back up. So, when you take all of this and put it together and start to form a consolidated view, we think that revenue is going to be fairly consistent quarter to quarter in fiscal '12. And, so those are my comments on the revenue side.

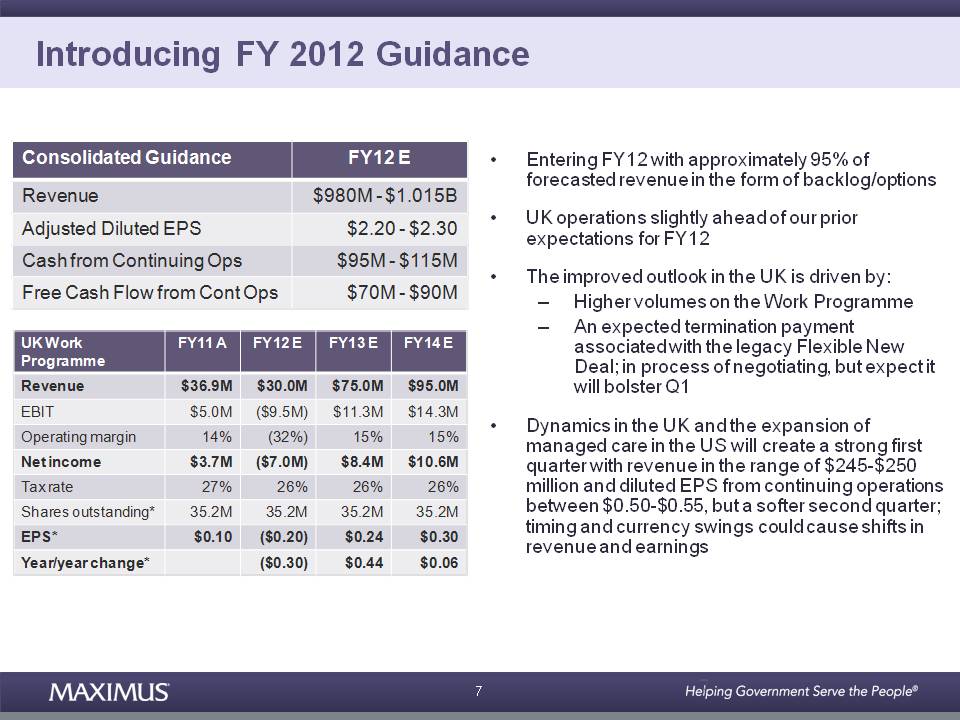

On the earnings side, and I know you're well aware of this, but you're very well aware that the bottom line earnings will be tempered in '12 by the UK startup. The startup losses in the UK are expected to be pretty much in line with what we shared with you before. We refined it, but $0.20 per diluted share in '12. As a reminder, it was $0.10 in earnings so we really have a $0.30 negative swing, '12 over '11. And on a normalized basis when we take a look at that, if the UK simply contributed the same earnings in '12 as it did in '11, then we would be looking at 13% earnings growth year-over-year based upon the midpoint of our guidance range today.

The last point I want to make, and this is important because we entered into the UK contract not because of the expected results in '11 or '12, but rather for the results in '13 and beyond. It really does set up a great opportunity in fiscal '13. The slingshot effect we expect is going to contribute $0.24 in '13. It creates a slingshot effect of about $0.44 per share, so it sets up a real great '13 and beyond. Constantine, does that help in terms of some views on the segment level? He may not be there.

Lisa Miles - Maximus Inc - IR

Operator, can we go to the next question please?

(Operator Instructions) Our next question comes from the line of Brian Kinstlinger from Sidoti & Company. Please proceed with your question.

Brian Kinstlinger - Sidoti & Company - Analyst

Thanks. Good morning, guys. The first question I had is related to the international slide you mentioned in your prepared remarks. You also talked about in the analyst day the welfare-to-work opportunities and named a couple of countries. So, I guess I'm wondering, with the austerity that's going on in Europe, when do you expect some of these opportunities would materialize is it 6, are we talking 12, maybe 18 months before we hear something; or are you in discussions would help?

Rich Montoni - Maximus Inc - President, CEO

I think it is a great question, Brian. I tend to not talk about specific countries because it is interesting as we go through this process, and look at different countries and opportunities, it's a bit of fits and starts. We will have an opportunity that we think has a lot of momentum to it and is moving post-haste and looks like it could either go to bid or close within a relatively short period of time; and given the size of these programs and the complexity and sometimes elongated procurement process and contracting process, as you well know they can take 12 months to 18 months to really go from concept to operation.

But we'll have some situations that will get accelerated. So, as we mentioned I think four countries on analyst day; and as we proceed and work with these and visit these countries and look at opportunities, the mix changes from month to month. So it's not helpful to handicap each country quarter to quarter, but I would say this. We have some where we are in active discussions. We have one opportunity in particular that if it works out, it could be operational in three months.

On the other hand, we have some countries that I really do think it's going to take 12 to 18 months before we really have significant revenue. So, for purposes of modeling today, we have not assumed any of these to be meaningful contributors to revenue in fiscal '12. It's not to say it won't happen, it could happen; but I really think that these are going to contribute more to fiscal '13 and beyond as opposed to '12.

David Walker - Maximus Inc - CFO

And I've might say, Brian, this is David Walker, a lot of these countries tend to do these in pilot programs. So they start out a little tepid and that's when we start to get more insight into what we're thinking and so the trick is to be there during the pilot phase, and to be in on the ground floor.

Brian Kinstlinger - Sidoti & Company - Analyst

If you want a pilot, would you announce that or no?

Rich Montoni - Maximus Inc - President, CEO

I think they would. The pilots themselves can be quite substantial.

Brian Kinstlinger - Sidoti & Company - Analyst

And are meaningful for future --

Rich Montoni - Maximus Inc - President, CEO

Exactly, and that's the point. Exactly right. If it were a de minimis pilot, we're more likely not to announce it but -- unless we felt it had strategic value. But we will be very communicative about these, more so when they start to break and become real awarded but unsigned or contracts.

Brian Kinstlinger - Sidoti & Company - Analyst

Great, and then a follow-up in Canada. We talked about your positioning, are you in discussions with other provinces? I mean you've won nearly a deal for most of your different businesses now in there, are you in active discussions with other provinces?

Rich Montoni - Maximus Inc - President, CEO

That business reports up to Bruce and he's here so let's have him comment on it.

Bruce Caswell - Maximus Inc - President, Health Services

Sure. We do see a great deal of opportunity across Canada, as Rich mentioned in his remarks, and we're optimistic that the continued work we do, particularly in the drug information system area has additional legs with other larger provinces going forward. We also think the fundamental premise of our BPO model and the coupling of the technology that DeltaWare provides with our BPO services can enable us to expand in other provinces. So we are marketing, as you would imagine into those other governments.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. And then you talked about managed care in several states, Texas being the largest, as benefiting you right now. Can you sort of talk about that shift specifically, collectively not just Texas? How much it is contributing to growth in revenues maybe in fiscal '12 versus fiscal '11?

Rich Montoni - Maximus Inc - President, CEO

Bruce?

Bruce Caswell - Maximus Inc - President, Health Services

Sure. We're seeing a blended growth rate of about 5% outside of the Texas contract. I'll say, our other contract base about 5% year-over-year contribution, and we expect that to continue. The states are clearly looking at that as a major lever to help control costs going forward. And really moving actively to bring populations as we've mentioned, ABD populations and other waiver populations into the program. So, that's a fairly meaningful and I think sustainable trend in the market.

Brian Kinstlinger - Sidoti & Company - Analyst

How does 5% split between managed care growth in shifting versus increases or enrollments of people that didn't have Medicaid originally?

Bruce Caswell - Maximus Inc - President, Health Services

Actually, I think Medicaid enrollments nationally are down year-over-year. So, this is more a reflection of the shift in delivery model.

Brian Kinstlinger - Sidoti & Company - Analyst

Yes. And then you mentioned the federal external review, the small contract you won there, is this the same client that is going to handle dispute resolutions for health exchanges or will that be run by the state level -- at the state level?

Bruce Caswell - Maximus Inc - President, Health Services

At present, I don't think that's been decided by the federal government. This contract would certainly present a viable platform for handling appeals for the exchanges and we would like to see it move in that direction. I think that the federal government, though, is in the planning stages and they've recently awarded a very small consulting contract to look at what that appeals process -- the form that process might take prior to then deciding which agency and at what level of government they will be handled.

Brian Kinstlinger - Sidoti & Company - Analyst

Two more questions. The first one is a competition question you got. If I look at the exchanges, that are -- that need to be operated, that you're hoping that opportunity comes to you, is the competition any different than what was in Medicaid enrollments, or for example, are there more participants that are looking to get into this market?

Rich Montoni - Maximus Inc - President, CEO

I think you have to break the market into two pieces. There's a systems integrator market to design and build any new systems that are necessary and then there is a business process outsourcing market, which as you know, the BPO's our primary interest. I don't see any significant new players in the BPO side of things. That tends to be one where you've had trusted providers who've been through lots of new federal programs and built out systems that are operating systems.

So come on the BPO side, I don't see any significant new entrants into the market. We also need to add the software vendors where we're seeing a lot of software solutions come to market and try to grab market share on the technology side of it in tandem with the system integrators. I think we do see the typical competitors on the systems integrator side, and I think we've got some others who are also stepping up in that context. So, I think that one's fairly competitive on the system integrator side, but you're going to have some very large firms that are well established with the states, with the federal government on the system integrator side.

Brian Kinstlinger - Sidoti & Company - Analyst

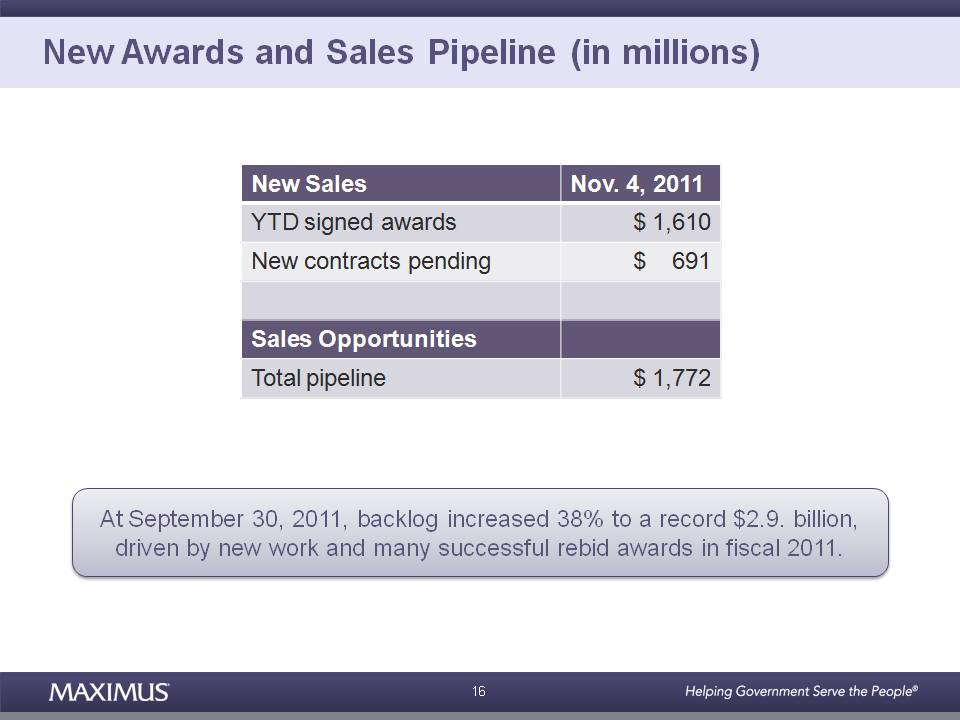

And then the last question I had. It's one of the first times I didn't see you break out the pipeline, can you just break it out in pending preparation and tracking?

Rich Montoni - Maximus Inc - President, CEO

Yes, we can do that. Lisa, do you have that data?

Lisa Miles - Maximus Inc - IR

It's in the press release, Brian,

Brian Kinstlinger - Sidoti & Company - Analyst

Oh. See that? I can get that then as long as it's in there. No worries.

Rich Montoni - Maximus Inc - President, CEO

Okay. It's in the press release. Any other questions, Brian?

Brian Kinstlinger - Sidoti & Company - Analyst

No, that's it. Thank you very much.

Lisa Miles - Maximus Inc - IR

Thanks Brian.

Our last question comes line of Brian Gesuale from Raymond James. Please proceed with your question.

Brian Gesuale - Raymond James & Associates - Analyst

Hey, guys. Wanted to see if we could dig into the pipeline a little bit more. Maybe look longer term and kind of gauge where the segment growth and geographic growth is going to come from; and if you could maybe just -- maybe give us some qualitative details on the pipeline by geography and then by segment, please?

Rich Montoni - Maximus Inc - President, CEO

I can give you some commentary on the pipeline. We don't -- we have not historically published pipeline by geography, by segment. So, we'll have to limit it to commentary for the moment, Brian.

But from a summary level perspective, we're seeing growth in the pipeline opportunities in both segments and in all geographies. I do sense -- I believe and I'm very pleased that we are identifying additional opportunities. So, I feel pretty comfortable that the opportunities are in front of us. I don't sense a dramatic shift from one segment to another segment, one geography to another geography.

I would give an edge to the international opportunities. Such that United Kingdom, Canada, probably from an international perspective would have greater proportionate opportunities. I 'd also say that on the US side of things, we're very pleased that we are experiencing growth and expect to have growth on -- in the health segment in fiscal '12 and that is driven as we've discussed by the shift to managed care.

But I also sense that there is pent up and I do think it will continue to be pent up demand in the US. There is a bit of an apprehension to go and build out new systems outside healthcare reform; and hence, I think we have some pent-up demand we are going to continue to experience. And I think the elections probably will keep that pent-up through fiscal '12, but thereafter I think we're going to see some pretty significant development to the US because of healthcare reform and also I think the election impact.

Brian Gesuale - Raymond James & Associates - Analyst

Okay. Great, that's helpful. And if I could just maybe ask a question on the UK for the seventh or eighth time, here? Can you just help me maybe with the quarterly progression of operating loss, and maybe I guess the starting point was with the termination payment, how close to breakeven does that get you to in Q1 and then maybe just what the progression might look like as we move through the year?

Rich Montoni - Maximus Inc - President, CEO

Dave Walker is beating in on his quarterly metrics that you asked about, so with one minute, I'll jump into it.

David Walker - Maximus Inc - CFO

I mean it doesn't, what it does is takes what would've been a bigger loss and makes it a smaller loss in Q1. And it returns back to a good sized loss in Q2. Where you get to breakeven by Q4. So without the settlement, you would've had a pretty progressive starting with a big loss all the way to breakeven by Q4. And what you really have is an offset to Q1 is the way to think about it, but it is still a loss. About half of it is in Q2.

Rich Montoni - Maximus Inc - President, CEO

Still a loss in Q1, a larger loss in Q2, and then at that point in Q2, that's the quarter in which we start to get some of these outcome payments, so the operating income starts to improve in Q2. So Q3 is improved over Q2 and then all along we've said we are looking to get damn close to breakeven in Q4; and that still remains our goal.

Brian Gesuale - Raymond James & Associates - Analyst

Okay, terrific. And then maybe just one final question for me is, can you give us the most recent news on what is happening in New York on the Medicaid side?

Rich Montoni - Maximus Inc - President, CEO

Sure. Bruce?

Bruce Caswell - Maximus Inc - President, Health Services

Sure. In New York, as you are aware, they continue to expand Medicaid and particularly managed care and they've expanded both the service areas. New York has always had a fairly high penetration rate of managed care but they've kind of continued that expansion into their remaining counties, as well as they've brought in populations that historically were exempted from managed care; and they've also shortened the number of effectively repeatable waivers that you could get to be exempt for managed care. So the overall effect is to increase obviously the number of clients that we are serving and serving through our enrollment broker contract.

Brian Gesuale - Raymond James & Associates - Analyst

Okay. Great. Thanks a lot, guys.

Rich Montoni - Maximus Inc - President, CEO

Thank you, Brian.

This concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

| |

|

DISCLAIMER

|

| |

|

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

|

| |

|

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies mayindicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

|

| |

|

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

|

| |

|

© 2011 Thomson Reuters. All Rights Reserved.

|

| |