|

Final Transcript

|

|

|

| |

| |

| |

|

Conference Call Transcript

|

| |

|

MMS - Q3 2011 Maximus Inc Earnings Conference Call

|

| |

|

Event Date/Time: Aug 04, 2011 / 01:00PM GMT

|

Final Transcript

|

Aug 04, 2011 / 01:00PM GMT, MMS - Q3 2011 Maximus Inc Earnings Conference Call

|

CORPORATE PARTICIPANTS

Lisa Miles

Maximus Inc - VP-IR

David Walker

Maximus Inc - CFO

Rich Montoni

Maximus Inc - President, CEO

Bruce Caswell

Maximus Inc - President and General Manager, Health Services

CONFERENCE CALL PARTICIPANTS

Torin Eastburn

CJS Securities - Analyst

Brian Kinstlinger

Sidoti & Company - Analyst

James Kumpel

BB&T Capital Markets - Analyst

PRESENTATION

Greetings and welcome to the Maximus fiscal 2011 third quarter conference call. Operator: At this time, all participants are in listen-only mode. A brief question-and-answer session will follow the formal presentation. (Operator Instructions). As a reminder, this conference is being recorded.

It is now my pleasure to introduce your host, Ms. Lisa Miles, Vice President of Investor Relations for Maximus. Thank you, Ms. Miles; you may begin.

Lisa Miles - Maximus Inc - VP-IR

Good morning. Thank you for joining us on today's conference call. I would like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filing. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I will turn the call over to Dave.

David Walker - Maximus Inc - CFO

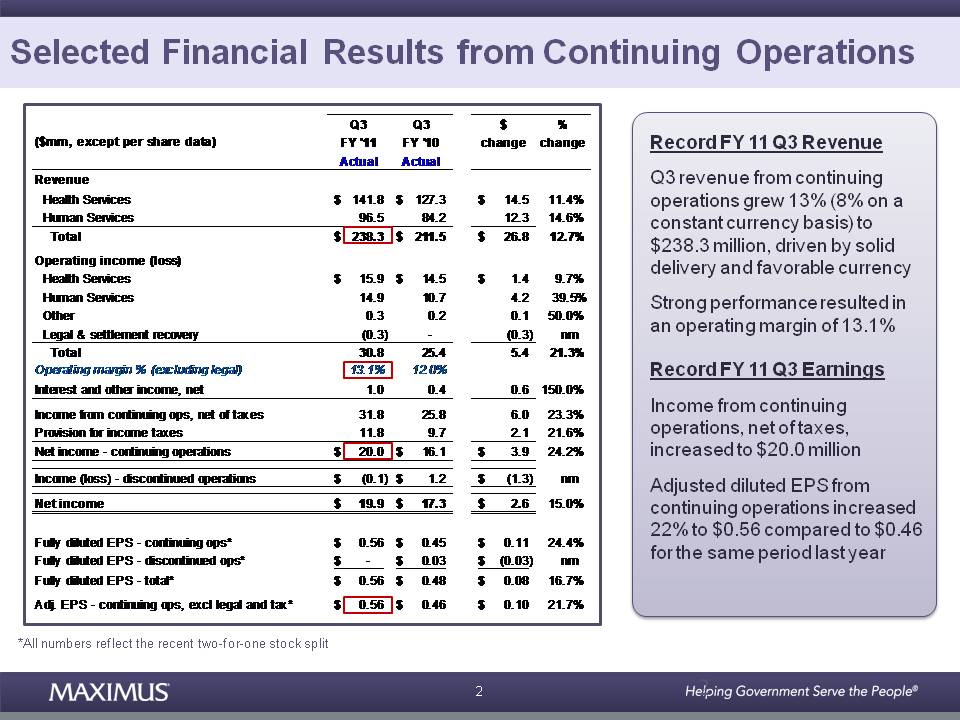

Thanks, Lisa. This morning, Maximus reported another quarter of record results from continuing operations. During the quarter, the Company completed a 2-for-1 stock split and all data reflect the split, which was effective at the close of trading on June 30th. Third quarter revenue from continuing operations increased 13% to $238.3 million or 8% on a constant currency basis compared to the same period last year. Revenue growth was driven by solid delivery in both segments, but also benefited from favorable currency rates.

Our strong performance in the third quarter resulted in a 23% increase in segment operating income, excluding legal and settlement expense, to $31.1 million compared to the same period last year, and we delivered a solid operating margin of 13.1%. For the third quarter of fiscal 2011, income from continuing operations net of taxes grew year-over-year to $20 million with adjusted diluted earnings per share increasing 24% to $0.56. Earnings in the quarter were ahead of expectations, mostly driven by strong performance in Australia, the timing of revenue and profit from the United Kingdom and favorable currency rates. So overall, we delivered a solid quarter with strong results and we are pleased with our year-to-date progress. Now, let's turn our attention to performance by business segment.

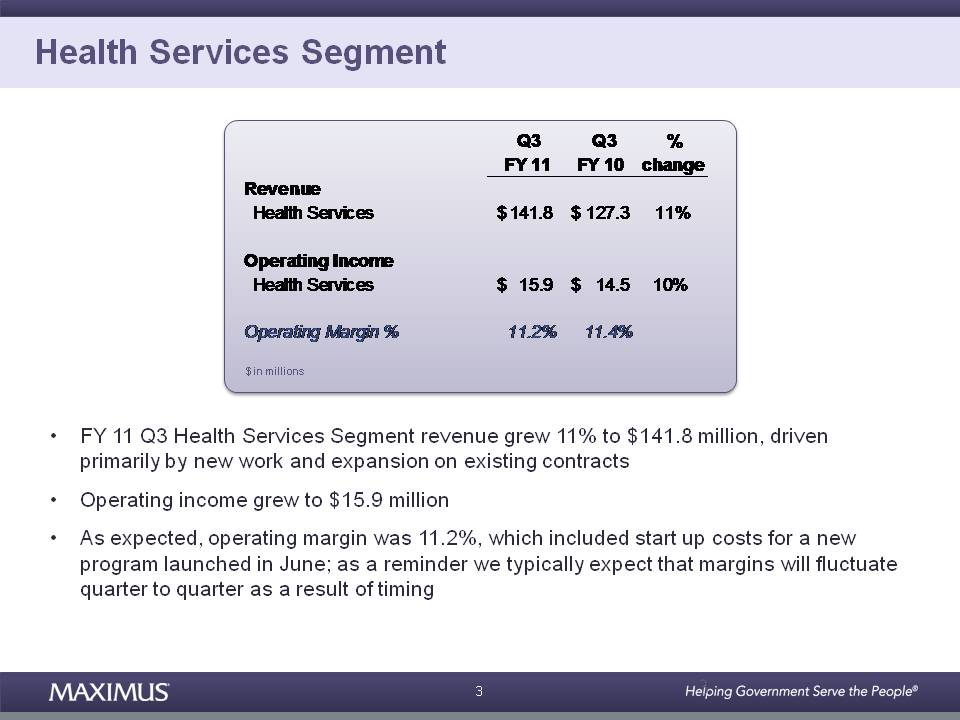

Revenue in the health segment grew 11% to $141.8 million in the third quarter compared to the same period last year, driven primarily by new work and expansion on existing contracts. Third quarter operating income for the Health Services segment grew to $15.9 million compared to $14.5 million in the third quarter of fiscal 2010. As expected, the segment delivered an operating margin of 11.2%, which included start-up costs on a new program that launched in June. As a reminder, we typically expect that margins in the health segment will fluctuate quarter-to-quarter as a result of timing.

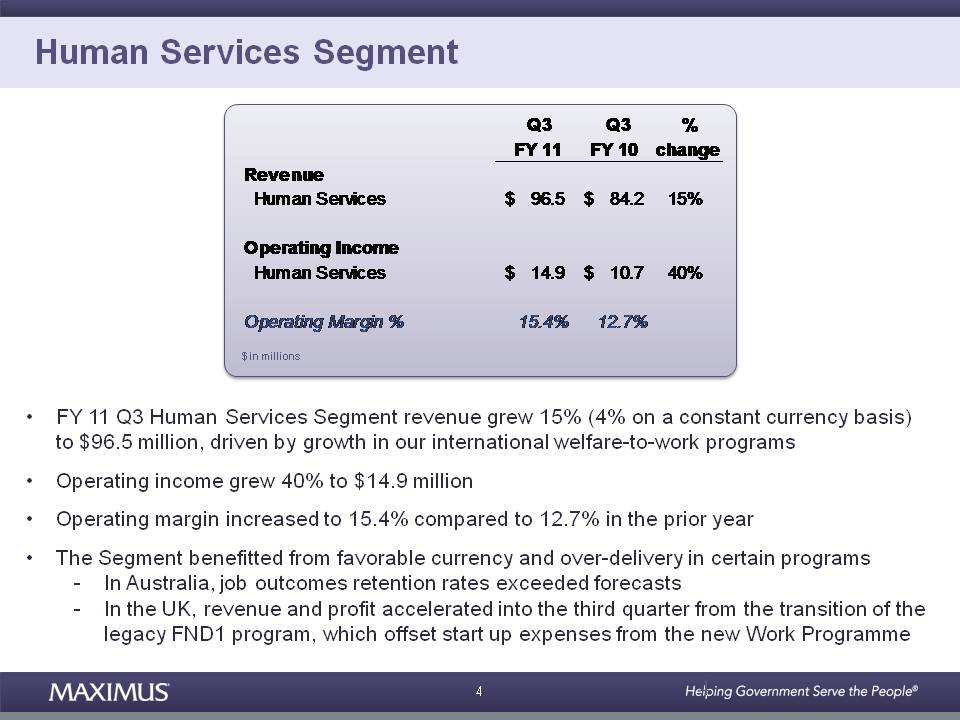

Turning to our human services segment, third quarter revenue grew 15% or 4% on a constant currency basis to $96.5 million compared to the same period last year. Segment operating income grew 40% to $14.9 million compared to the third quarter of last year, and operating margin increased to 15.4% compared to 12.7% in the prior year. The human services segment delivered exceptionally strong performance to the quarter and, as expected, growth was driven by our international welfare-to-work operations.

The segment benefited from favorable currency, as well as over-delivery in certain programs, most notably in Australia. Our job outcome retention rates exceeded forecasts, which bolstered both the top and bottom line for the segment. And in the United Kingdom, certain revenue and profit accelerated into the third quarter from the transition of the legacy FND project, which offset start-up expenses from the new UK Work Programme that successfully launched in June.

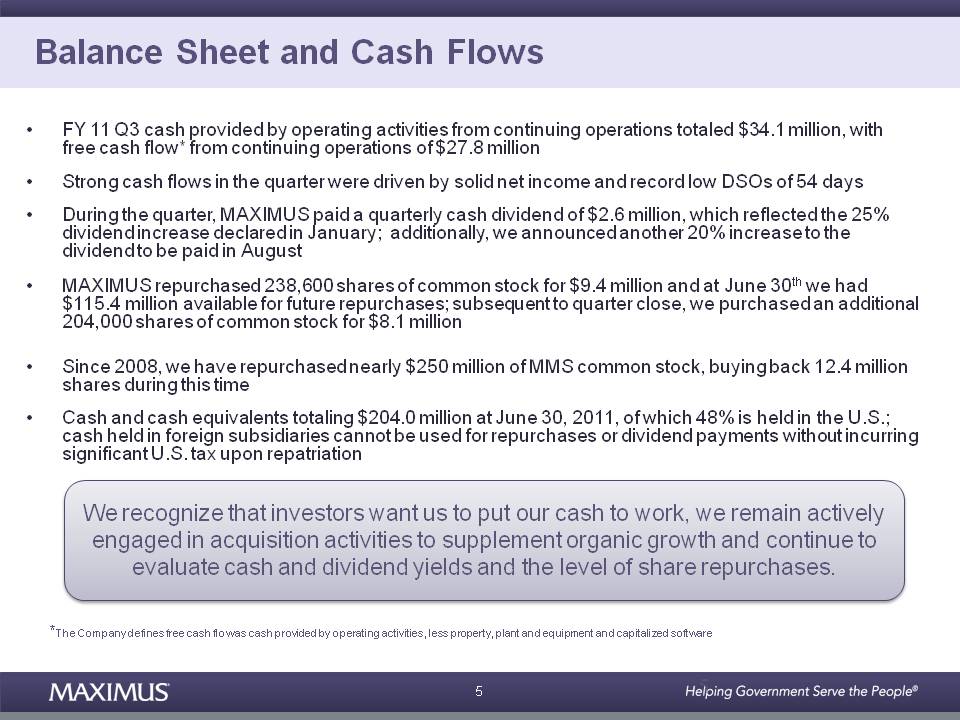

Moving on to cash flow and balance sheet items. Cash provided by operating activities from continuing operations for the three months ended June 30th was $34.1 million, with free cash flow from continuing operations of $27.8 million. Strong cash flows in the quarter were driven principally by solid net income and a record low DSO level of 54 days, which was the result of favorable timing of collections on certain receivables.

We remain committed to deploying capital to shareholders. During the third quarter, we paid a cash dividend of $2.6 million, which reflected the 25% dividend increase declared in January. Additionally in May, the Company announced another 20% increase to the quarterly cash dividend to be paid in August.

We also continue to deploy cash through our ongoing share repurchase program. In the third quarter, we repurchased 238,600 shares of Maximus common stock for $9.4 million and at June 30th, we had $115.4 million available for future repurchases under our board-authorized program. Subsequent to quarter close, we purchased an additional 204,000 shares for $8.1 million, which reflects purchases between July 1st and August 2nd under an active 10b5-1 plan.

It's important to recognize that over the last three years, we have deployed significant capital to shareholders through our active buy-back program. In fact, since 2008, we have repurchased nearly a quarter of a billion dollars worth of Maximus common stock, buying back 12.4 million shares during this time.

At June 30th, cash and cash equivalents totaled $204 million, of which 48% is held in the US. The remaining balance is held overseas for the funding of international expansion and acquisitions. As most of you know, our cash held in foreign subsidiaries cannot be used for our domestic share repurchase program or dividend payments without incurring additional US taxes.

As evidence this quarter, Maximus continues to generate strong levels of cash, and we recognize that investors want us to put that cash to work. To this end, we remain actively engaged in acquisition activities to supplement our organic growth. The management team, along with the Board, will continue to evaluate our cash and dividend yields on a quarterly basis, as well as the level of share repurchase activities under our ongoing buy-back program.

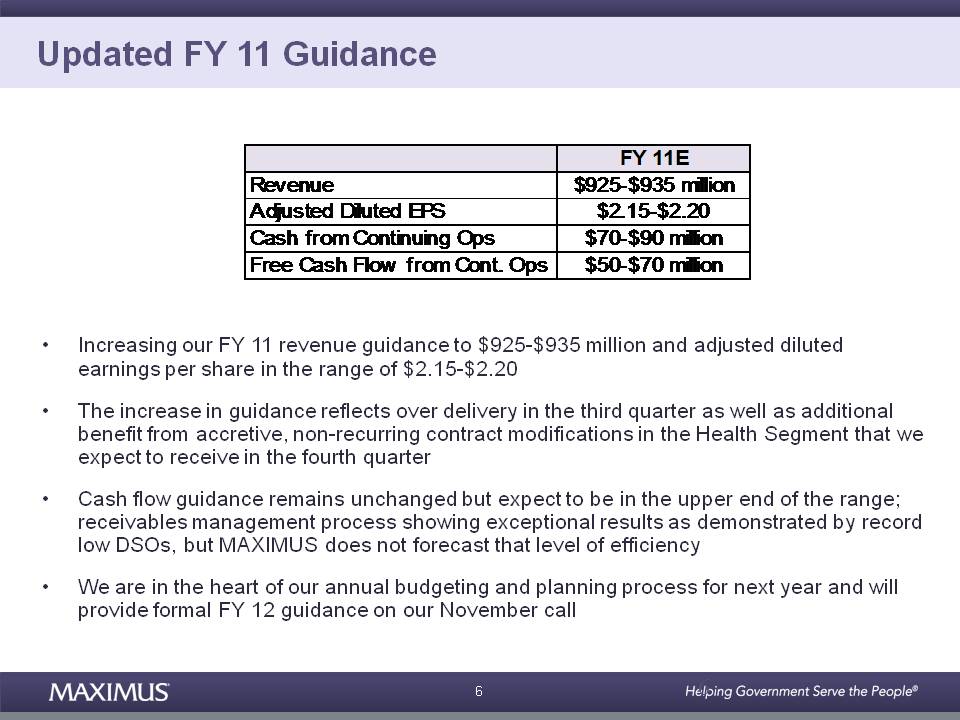

Moving on to guidance. As noted in this morning's press release, we are increasing our fiscal 2011 revenue and earnings guidance. We now expect revenue in the range of $925 million to $935 million and adjusted diluted EPS from continuing operations in the range of $2.15 to $2.20 for fiscal 2011. Our increase in guidance reflects our over-delivery in the third quarter, as well as additional benefit from accretive, non-recurring contract modifications in the health segment, which we currently expect to receive in the fourth quarter.

Our cash flow guidance remains unchanged but we expect to be in the upper end of the range. Our receivable management process is showing exceptional results, as demonstrated by our record low DSOs. But we normally do not forecast the level of efficiency that we achieved this quarter. As a result, we continue to expect cash provided by operating activities to rise from continuing operations to be in the range of $70 million to $90 million for fiscal 2011, with free cash flow from continuing operations in the range of $50 million to $70 million.

While it's too early to provide formal guidance for physical 2012, I can tell you that we are now in the heart of our budgeting and planning process for next year, but we recognize the importance of offering investors some visibility. So let me hand the call over to Rich for some color on how fiscal 2012 is shaping up.

Rich Montoni - Maximus Inc - President, CEO

Thank you, David, and good morning, everyone. Today, Maximus reported another quarter of record financial results which positions us well for next year. We continue to see growth in both segments and across all geographies and remain upbeat about the many opportunities ahead of us. As it is our traditional approach, we will provide formal 2012 guidance on our November call. However, I will touch upon some of the major themes we discussed on our last call and at Investor Day in June related to fiscal 2012.

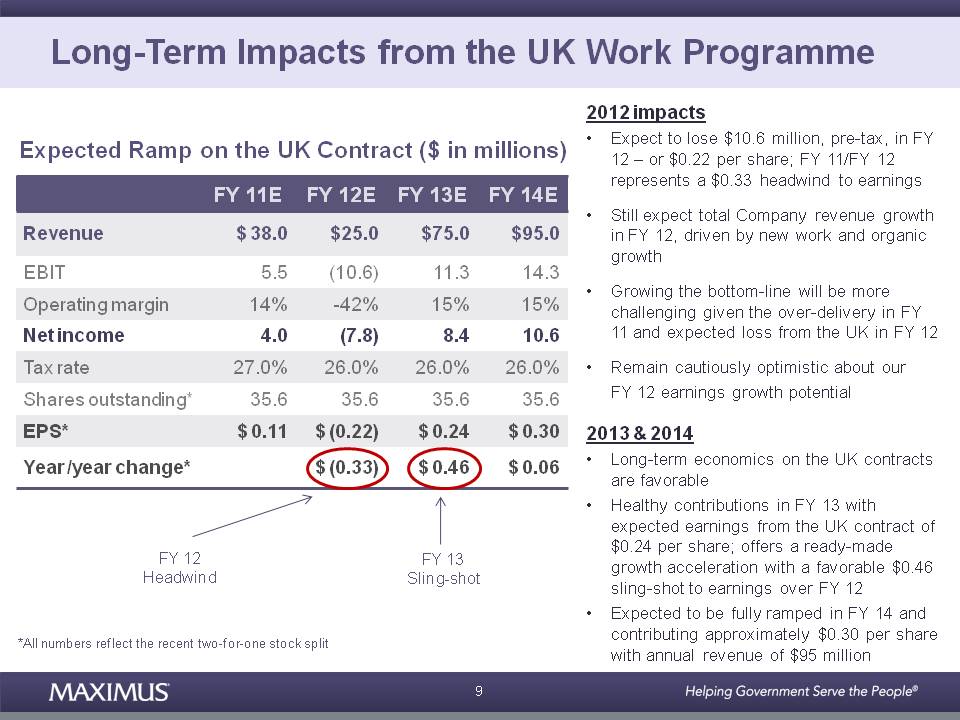

Let's start with the impact of the new UK contract in fiscal 2012 and beyond. The UK contract is expected to lose approximately $10.6 million pre-tax in fiscal 2012, or about $0.22 per share. But it's also important to remember that we are winding down an accretive stream of fully-ramped revenue from FND1. So when we compare fiscal 2012 to fiscal 2011, the UK contracts represent a total headwind to earnings of approximately $0.33 per share on a year-over-year basis.

Across the total Company, we still expect revenue growth for fiscal 2012 compared to fiscal 2011 driven by new work and organic growth. However, growing the bottom line will be more challenging given the over-delivery to earnings in fiscal 2011 and the expected loss from the ramp up in the UK next year. But we still remain cautiously optimistic about our earnings growth potential for fiscal 2012 and will provide you with an update on our next earnings call.

So what does this mean for Maximus beyond fiscal 2012? It's important to remember that the long-term economics over the life of the UK program are favorable, especially to vendors like Maximus who can deliver measurable outcomes. The benefits of the program and the associated revenue ramp are expected to start providing healthy contributions in fiscal 2013 when the program is expected to become profitable and generate earnings of approximately $0.24 per share.

This offers a ready-made growth acceleration in fiscal 2013 as the program is expected to slingshot by approximately $0.46 of earnings per share compared to fiscal 2012. The contract is expected to contribute even more earnings in fiscal 2014 when the program is fully ramped with a forecasted contribution of approximately $0.30 per share off a base of $95 million in annual revenue.

So let me update you on how operations are progressing in the UK under the new Work Programme. I recently returned from a visit and I'm pleased to report that our operations went live on time and we also received positive feedback from the client on the smooth implementation of our case management technology solution. The local management team has made significant strides in finalizing our facility requirements and bringing new employees on board.

Initial case referral volumes came in strong and largely as expected. The team is hard at work to achieve our placement targets as we deliver employment services throughout our regions, and I would like to commend the team on a job well done on the start-up phase and for their continued passion for helping job seekers prepare for and obtain sustainable employment. The team has certainly set the stage for a successful project over the long-term and is drawing on best practices gained as the top provider under the flexible new deal to deliver quality services under the new Work Programme contracts.

Moving on to Canada. Here we continue to see promising opportunities across both segments. The latest developments have been in the health segment as more provinces are looking for ways to provide secure electronic pharmacy and medication records to consumers through the implementation of new drug information systems, or DIS.

We were recently awarded a contract in Nova Scotia for the implementation of our Medigent product, which is one of the only three DIS products that conform to Canadian clinical drug messaging standards. Through these new standards, the province will seamlessly integrate our Medigent DIS with pharmacy point-of-service systems and physician electronic medical records. The implementation of the Medigent DIS represents a significant step towards the creation of individual electronic health records for the residents of Nova Scotia.

Canada remains a promising area of further expansion. Outside of Nova Scotia, we have several near-term opportunities in other provinces that we are actively pursuing and expect to have further clarity by the end of the calendar year. These opportunities align with our core health and human services offerings, including additional eHealth initiatives.

And finally, we have some very positive developments in Australia. The government has notified vendors of a potential three-year contract extension if vendors continue to achieve specific star-rating targets pending the government's next star-rating review in August. Based on our current star-rating achievements, we are tracking towards receiving a $450 million extension, which would take our current contract through June 30, 2015. Our continued success and solid ratings further demonstrate our commendable performance and solid execution in this key market.

Turning now to our US operations. In June, we successfully launched operations for the New York Enrollment Center contract. The Enrollment Center consolidates, standardizes, and simplifies the renewal process for the state's public health insurance programs. The work we do under this contract will help the state realize its three main goals, which include enrolling all New Yorkers eligible for public health insurance programs, reducing the number of individuals who lose coverage at renewal, and providing a more seamless eligibility experience to consumers.

As we mentioned in prior quarters, we continue to see states move Medicaid populations from fee-for-service to managed care. Texas is actively expanding their Medicaid managed care program across the state, enrolling approximately 980,000 additional individuals into managed care plans. Earlier this week, we launched a new customer contact center in Edinburgh, Texas, located in the Rio Grand Valley.

We are bringing on about 400 new staff to this new facility to help eligible Texans enroll in Medicaid, the Supplemental Nutrition Assistance Program, or food stamps, and Temporary Assistance for Needy Families. We continue to see new opportunities emerge in our core Medicaid and CHIP markets. In July, we received notification of a new contract award to provide enrollment broker services for Louisiana's Medicaid program.

The new win is very strategic and allows us to expand our presence into a new state. Maximus will be supporting the state's conversion to capitated manage care under the recently announced contracts with the managed care organizations. Pending the outcome of the bid protest, which is not uncommon in this market, we will provide eligible beneficiaries choice counseling, enrollment, disenrollment services for the state's Medicaid coordinated care network through a call center and a consumer website.

We also continue to see increased activity and forward progress on a healthcare reform front. Last month, the Department of Health and Human Services released proposed regulations on the implementation of health insurance exchanges, which the Congressional budget office estimates will serve 24 million individuals by 2019. The regulations offer different option for how states may structure and deploy their exchanges, including guidelines for implementation and basic operations of the exchange, as well as alignment of information systems.

These proposed regulations provide states with a more flexible implementation timeline with sliding deadline to set up their health insurance exchanges. We continue to closely monitor the progress of finalizing these initial regulations, as well as the release of subsequent rule-making related to eligibility, appeals, and quality standards.

In addition, a growing number of states are taking advantage of federal establishment grants, which are being made available each quarter to help them put the proper structures in place to operate exchanges. And we are seeing an increasing number of states issuing formal requests for information, as well as a small number of RFPs to procure exchange technology components. We are responding to these RFIs and RFPs and expect they will lead to procurements for technology and administrative services for the exchanges.

In the meantime, Maximus has been actively marketing the health insurance exchange solution developed through our strategic alliance with Connecture, a leader in web-based marketplaces and administration solutions for health insurance distribution. The Maximus Connecture alliance teams have been meeting with potential clients to demonstrate StateAdvantage, our ready to implement solution for the SHOP and Individual Exchanges.

Some of you on the call today had the opportunity to see a live demonstration of StateAdvantage at our Investor Day event. The response from potential state clients has been very positive, with specific feedback related to the ease of the seamless consumer experience. Maximus Center for Health Literacy has played an integral role in developing user-friendly content for consumers with varied levels literacy.

One state mentioned that StateAdvantage provides an easy to navigate online shopping experience that consumers have come to expect. States appreciate the more complicated eligibility scenarios since families may have members eligible for different health insurance programs at different times, and StateAdvantage greatly simplifies the beneficiary experience while benefiting from our experience of benefit program rules and business processes.

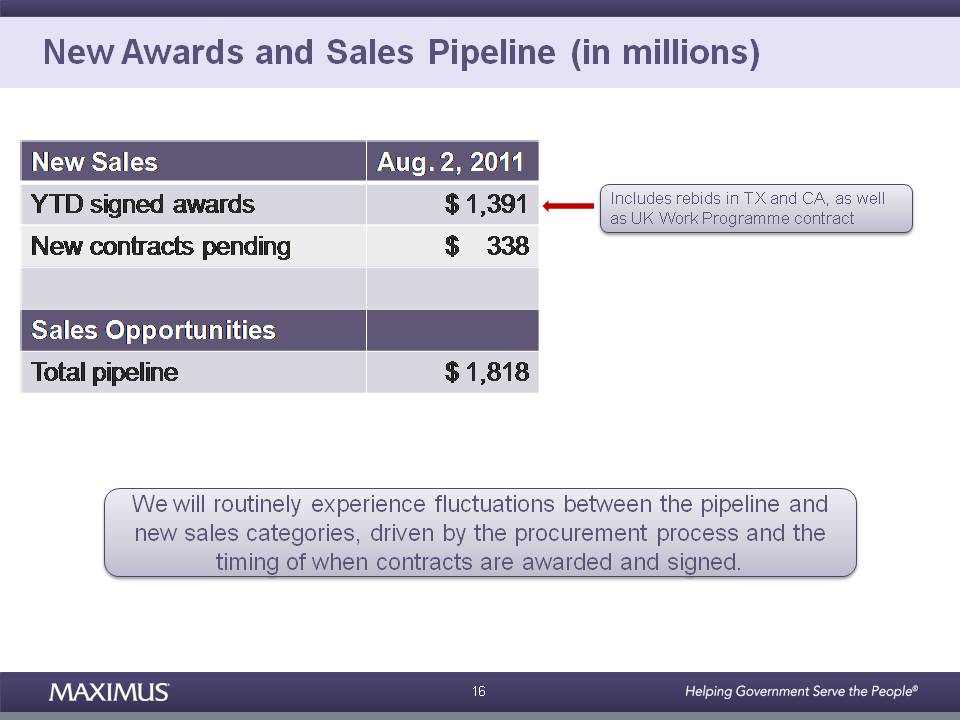

Moving on to new awards and sales pipeline. At August 2nd, our fiscal year-to-date signed contract wins total of $1.4 billion compared to $379 million reported last year. This large increase includes rebid awards in California and Texas, as well as the new UK Work Programme contract. New contracts pending, those contracts that are awarded but unsigned, total $338 million compared to $916 million last year.

Our pipeline of sales opportunities in August 2nd is a healthy $1.8 billion. And as a reminder, we will routinely experience fluctuations between the sales pipeline and new sales awards driven by procurement cycles and the timing of contract awards and signatures.

In closing, our record results in the quarter, combined with our recent stock split and dividend increase, demonstrate our continued success in driving profitable growth and delivering value to our shareholders over the long-term. While governments at all levels continue to experience financial pressure, and seek efficient solutions for public programs, Maximus remains well-positioned as a trusted partner that provides high quality administrative services.

With healthcare reform initiatives continuing to heat up and multiple domestic and global expansion initiatives before us, we see many opportunities across both segments. With our increased guidance for fiscal 2011, we look forward to delivering another great year and setting the growth platform for fiscal 2012 and beyond.

With that, let's open up the call to questions. Operator?

QUESTION AND ANSWER

Thank you, sir. Ladies and gentlemen, we will now be conducting a question-and-answer session. (Operator Instructions). Our first question today comes from the line of Torin Eastburn with CJS Securities. Please proceed with your question.

Torin Eastburn - CJS Securities - Analyst

My first question, quickly, on the Louisiana contract, can you give a value for that or at least a range?

Rich Montoni - Maximus Inc - President, CEO

Torin, good morning, this is Rich. We are not at liberty to disclose the amount of the contract at this point and time. You can appreciate we're in the process of finalizing the contract terms and other matters, so we can't give you an exact amount, but, you know, it's a meaningful amount. It's not what I would consider to be a mega-type contract. So I simply put it into the portfolio mix as opposed to being a total portfolio mover per se.

Torin Eastburn - CJS Securities - Analyst

Sure. Thank you. And you've mentioned expansion in developed Europe a number of times as part of your future plans. In your talks with people in the government and the administrators there, how are the events with the economies there affecting their plans for outsourcing some of their human services?

Rich Montoni - Maximus Inc - President, CEO

It's kind of interesting. I think that holds true not only on the international side of things but perhaps on the US side of things, as well, in that these difficult times for governments actually increase their propensity to consider outsourcing. It forces them to more seriously consider change, on the importance of change, and what we do and the efficiencies we offer is a benefit that they would like to take advantage of, so it tends to increase the attention.

On the international side, we continue to look at opportunities. We are actively marketing in some of these new markets. I will tell you that at this point, it's a bit premature to provide you specific country-by-country updates on the international side of things. We are actively looking for the right market conditions, and there are some that hold promise. But I would say that on the international side of things, I don't see that it's going to be a material driver to 2012. We may get some pilots in partial years and, certainly, it would gain more steam in 2013.

Torin Eastburn - CJS Securities - Analyst

Okay. And my last question. Can you provide any sort of quantification about how the shift to managed care is affecting your results and how you think it will in a year or two?

Rich Montoni - Maximus Inc - President, CEO

I am going to turn this over to Bruce Caswell, but I will tell you from a summary level, it is very, very meaningful even in 2011. You've got very significant populations that are in the process of being moved, getting partial year benefit in 2011, and we expect we're going to continue to see that into 2012. Bruce, any comment in terms of specifics?

Bruce Caswell - Maximus Inc - President and General Manager, Health Services

I think you are right, Rich. I think there are two dynamics in play here. The first is the existing and ongoing shift to move more populations into managed care, expanding service areas, and new populations as we've noted in prior calls in California with the SPD population, Texas, of course, with the growth into the Rio Grande Valley.

And in time, we will also, as we've noted at Investor Day and other occasions, see the ramp-up and readiness for the expansion of Medicaid in general to 138% of the federal poverty level. So I think we are seeing a precursor that puts us on a path to experience broader growth in the 2013 time period.

Torin Eastburn - CJS Securities - Analyst

All right. Thank you both.

Rich Montoni - Maximus Inc - President, CEO

You are welcome.

Thank you. Our next question comes from the line of Brian Kinstlinger with Sidoti & Company. Please proceed with your question.

Brian Kinstlinger - Sidoti & Company - Analyst

Hi, good morning, guys.

Rich Montoni - Maximus Inc - President, CEO

Hi, Brian.

Brian Kinstlinger - Sidoti & Company - Analyst

The first question I had, you mentioned Australia, the potential extension in August after review, and you mentioned a potential contract size. I'm curious if that is for the existing work you are already doing in the existing regions, or is there an opportunity at that point, as you've been gaining share over the last two to three years, is that a number that suggests also gaining share?

Rich Montoni - Maximus Inc - President, CEO

Good morning, Brian. Good question. The amount that we mentioned is essentially renewal of the current level of work that we are performing. That being said, there is the possibility for Maximus to pick up additional work above and beyond that. Whether that's going to happen and one's ability to predict that is a bit tough. Certainly, being a top performer positions Maximus for additional work, but it's difficult to forecast until such time as the government comes out with their decisions.

Brian Kinstlinger - Sidoti & Company - Analyst

But can I assume there will be some work for someone to take on because not everyone will meet, I would guess, that star rating? As a result, the number of people that are left over will be able to somehow bid for other work? Is that a way to think about it?

Rich Montoni - Maximus Inc - President, CEO

Yeah, I think that's the right way to think about it. It's a good handicapping that some of the top performing firms, including Maximus, will pick up additional work to take the next step in handicap, which firms and how much is the more difficult thing to do.

Brian Kinstlinger - Sidoti & Company - Analyst

Right. Right. Absolutely. Okay. Now, on the welfare-to-work at the Analyst Day, you documented or mentioned a number of countries. I think it was six that you were in various stages of discussions. I guess I am going to press you on it a little more. How is the progress of that and when might we hear any of, you know -- first of all, actually, is there any RFPs you've actually responded to? I'm just trying to get a sense of where you are in those negotiations and discussions.

Rich Montoni - Maximus Inc - President, CEO

It's a great question. We are all excited to advance what we sense is a very significant need in these various countries. We have had active, in-country initiatives, but what that really means is we send our executives in along with appropriate consultants to visit with key decision makers, leaders, managers of these programs, and politicians, and then look at the existing market, look for requests for proposals that are about to emerge.

And we're excited in several countries. We have specific identified opportunities that we're tracking, which is we want to get these things into our pipeline so it becomes part of our measurement. At this point and time, I think we have one RFP that we are actively contemplating responding to and we have had some partnering type discussions. So we've got all the activities that are good things to indicate we may have some real opportunity there ultimately, but I don't want to say that we have something that's imminent today.

David Walker - Maximus Inc - CFO

You know, I could probably characterize it as early days, Brian -- this is Dave Walker -- and I don't think they're going to move the needle in 2012, while they're exciting, their long time outlook.

Brian Kinstlinger - Sidoti & Company - Analyst

So is there anything other than that one RFP that's in the tracking bucket of RFPs that you're talking about?

Rich Montoni - Maximus Inc - President, CEO

Oh, we do. We have several opportunities that we're tracking, but the tracking is the step before an RFP.

Brian Kinstlinger - Sidoti & Company - Analyst

Right. Of course. Right. Okay. Now, you mentioned some start-up costs on the health side. I'm curious what that relates to. Is that in Texas, what you are talking about? And how much did it offset earnings in the quarter?

David Walker - Maximus Inc - CFO

We don't give specific numbers, but it was the New York Enrollment Center contract, Brian. So, as you know, we have a lot of contracts in a given time that is starting up; that was a good-sized one. So it had a dampering effect on the health margins this quarter. On the other hand is we gave you the guidance. Next quarter, we talked about a couple of contract mods, primarily in health that give us some non-recurring benefit next quarter. So health margins, as we talked about, can fluctuate from quarter-to-quarter. We try to give you some flavor on that.

Brian Kinstlinger - Sidoti & Company - Analyst

I guess I am just trying to understand when the start-up costs for that New York Enrollment contract end. Is this a one-quarter event, or will we see a couple more quarters?

David Walker - Maximus Inc - CFO

It went live very successful. It's ramp-up in that you have got to have the enrollees in and it's a transaction driven thing that takes time to build up, if you will, a backlog. So we will start to see the full benefit next year.

Brian Kinstlinger - Sidoti & Company - Analyst

Next year? Okay. Will there be start-up costs do you think on Louisiana?

Rich Montoni - Maximus Inc - President, CEO

I don't think the Louisiana contract's going to have material start-up costs. I don't think it's going to be material to the overall consolidated results.

David Walker - Maximus Inc - CFO

Brian, they all have some start-up costs. The contracts vary in terms of whether the client pays for them and the accounting treatment is usually the issue.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay. On the proposal side, I am curious. I know they fluctuate, but $39 million on proposals in preparation seems kind of low. Is that going to pick up significantly the next quarter that you're working on a lot? And then I guess I'm almost interested in Canada. You talked a lot about Canada. How big of the pipeline represents Canada right now?

Rich Montoni - Maximus Inc - President, CEO

A couple of things, Brian. One, the $39 million, you are right, in normal course trend in the analytics, that component of the pipeline is at belly, but, again, I'm very, very confident it's just fluctuations within the components of the pipeline. Overall, I am very happy with the quality and the nature of the pipeline, so it's strictly of timing.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay.

Rich Montoni - Maximus Inc - President, CEO

On the Canada situation, again, we don't slice and dice the pipeline by country, by line of business, but I will tell you from a qualitative perspective what we see in Canada is meaningful, it's very encouraging, and I am very, very pleased with our positioning, not only in British Columbia but in a potential in other countries. And I'm really pleased with the way that our initial investment in Canada has blossomed, as well as our -- the additional of Delta where it really seems like the partnership is starting to click.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Last question I have, kind of high level. We take a look at what's going on with Congress with the debt reduction, they've sort of got an agreement but we're still going to go through a lot and half of the cuts are going to come and have to get agreed upon over the next couple of months. I guess, A) I am interested how you think that's affecting the timing of awards and spending at all in the US. How it might affect Medicaid? We're really only hearing Medicare and Social Security, but maybe you could speak to what it means for Medicaid, and then finally, what it means for receivables over the next six months? Does it have any impact, do you think?

Rich Montoni - Maximus Inc - President, CEO

Let me take the first part of the question and ask Dave Walker to talk about receivables. But our overall thinking on this debt ceiling legislation, and it's clearly interfacing with what's going on in the macro economy or skittishness about the macro economy. First off on the legislation, clearly, it's important that the debt ceiling issue is resolved. Even if we view it as temporary, it's very important to get over that short-term hurdle.

Secondly, the cost reduction side of the legislation, it remains to be seen. Hence, the impacts are very difficult to specify. I agree with you, it seems like the intent is that Medicaid will remain untouched, although that's not a certainty, and then there is more focus, particularly in the default provision, on the defense side of things, and the payor side of things. In general, certainly, there are very, very major concerns about the economy and the market as a whole, and that's global.

So we need to be prepared for continued choppy waters, not unlike we've seen, you know, the last couple or few years. So to Maximus, I don't think this is going to diminish the return for more efficient administration services for these programs. In fact, I think these pressures increase the importance of changing old-world processes and, in fact, can foster additional opportunities for us.

Brian Kinstlinger - Sidoti & Company - Analyst

And on receivables, David, please?

David Walker - Maximus Inc - CFO

You know, short-term on that, obviously, there isn't any impact.

Brian Kinstlinger - Sidoti & Company - Analyst

Right.

David Walker - Maximus Inc - CFO

And in fact, if you look at the current quarter, for the first time in a long time as we approach the end of the fiscal, California's actually passed the budget. So where we have had some consternation for a month in prior years at the ends of our fiscal, we shouldn't see that this year. So I think in the short-term, the states are making some noise that they are just worried about the federals taking cut at their expense and pushing it onto them. But that aside, we don't know what's going to happen long-term yet. And given the direction of the cuts are primarily as the backstop, if you will, in defense or with the providers, I'm optimistic.

Brian Kinstlinger - Sidoti & Company - Analyst

Is that why your cash flow guidance is actually a range of free cash flow of minus-ten to plus-ten? I think if I did the numbers right, based on where you've been in the first three-quarters, there possibly could be some slow down? Or is there something else?

David Walker - Maximus Inc - CFO

No, I mean, really, just mechanically, right? We get a lot of revenue that shoots up in the fourth quarter. That consumes a work-in-process of receivables. So if you just take DSOs, and we are, while we are very happy with the record low DSOs at 54, a contract or two could swing that on me. Right? So I model at a more moderate rate, or if you will, slightly higher, and then if you just look at the revenue increase, which is a good thing, it consumes more receivables in the short run. That's all.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Thank you, guys.

Rich Montoni - Maximus Inc - President, CEO

You're welcome, Brian.

Thank you. Ladies and gentlemen, our next question comes from the line of James Kumpel with BB&T Capital Markets. Please proceed with your question.

James Kumpel - BB&T Capital Markets - Analyst

Good morning, guys.

Rich Montoni - Maximus Inc - President, CEO

Good morning, James.

James Kumpel - BB&T Capital Markets - Analyst

Hey, Rich, can you first comment a little bit about the environment where many states are engaged or basically using furloughs and reductions in state employees, and how that may affect your opportunities on enrollment outsourcing and services to the states?

Rich Montoni - Maximus Inc - President, CEO

The states, and I think it's a good thing that they have to balance their budget and I think we are now into several years where they're challenged to do so, and you study prior recessions, we've gone through much the same thing. So our experience has been that there's little to no impact on Maximus and what we do. And I personally believe it's the specific nature of the administrative services and the importance to get it right.

The programs that we run are very, very efficient and we negotiate those efficiencies with our clients and they know what sort of capabilities they need to get the job done. And by that, I mean applications coming in the door, timeliness of processing those applications, and responding to these citizens who are oftentimes going through life-changes that are very significant to them. So our clients tend not to want to lessen that capability. In fact, in difficult times, they want to make sure that these programs, the administrative aspects, run very, very well.

So our experience has been not to mirror the furloughs that states will often impose upon their employees. We will have conversations with them in terms of, you know, is there a desire to modify the program? And if necessary, we'll amend the contract accordingly. We have gone through a couple of those and all of that's reflected in our history. So I think there's going to be a continuation of the same thing. I think, again, the elasticity for demand of what we do, I think is very inelastic. I think it's important. I think our clients know that and I think we are very efficient at it. So I don't see a big risk to it, Jim.

James Kumpel - BB&T Capital Markets - Analyst

Would it be fair to say in most state that had basically done a number of enrollment processes and other administrative processes in-house may be more inefficiently that these furloughs might actually, or reductions in work forces might actually accelerate the inclination to move those services to a selling more efficient light like Maximus?

Rich Montoni - Maximus Inc - President, CEO

Well, think that's right. And again, that becomes a bit tricky in terms of how do the leaders of these governments transform from the old processes, the old models, to the new ones. We see some -- we see states take different approaches, but you are absolutely right, there is an inclination in these times to move towards the newer processes, the centralized processes, those that use technology to a much greater extent and to contract vehicles that are more based upon outcomes as opposed to activities. And that's very much what's happening as a big dynamic in the marketplace.

James Kumpel - BB&T Capital Markets - Analyst

And this regards health exchanges. Bruce, you've been doing an awful lot of work in outreach the states in the like. Can you offer up any sort of early observations as to, you know, collectively where the state's heads are at, what states seem to be taking the lead, and then if we engage in a little bit of navel gazing here, what sort of revenue model do you anticipate will become the norm for operating these changes?

Rich Montoni - Maximus Inc - President, CEO

Jim, I do think that there are states that are leaders and I am sure Bruce is willing to share a couple of names that he views as kind of the leaders of the pack. And I think there are some estimates about revenue modeling out there in terms of what the marketplace might be expecting. So, Bruce, what do you think about this?

Bruce Caswell - Maximus Inc - President and General Manager, Health Services

Well, Jim, I think one way to track kind of where the states, as you say, where their heads are is to look at the status of legislation by state. And at the most recent count as of yesterday afternoon, you could, I would say, comfortably put 25 states in the category of having made positive progress and that would be 12 states having signed legislation, seven with a live bill still under consideration, and six that have proceeded with the workaround. Now, that doesn't mean every live bill will need to enabling legislation in the state.

And this is not a perfect indicator of progress, as you know, because even states in which legislation itself is currently dead, a good example might be New York, are committed to moving forward. New York finds themselves in the early innovator category, as well, and has active procurements on the street and is likely to take up legislation again before the end of this summer session. But that's one way we kind of gauge the progress in the market. Another, as you are well aware, is those states that are making progress as early innovators and those that have applied for and received establishment grants.

So to be specific, some of the states making the greatest progress currently we would put in the categories of New York and Maryland, certainly some of the other early innovators like Wisconsin and Oregon. As then, as you are aware, and we commented on, there have been active RFIs from states including California, Indiana, Wisconsin, and some RFPs, as well. But Rich was right in saying that those RFPs are at this point limited to technology components and we won't see the broader services RFPs until later in the cycle.

James Kumpel - BB&T Capital Markets - Analyst

Do you see any sort of risk to these grants or other federally-subsidized projects associated with ObamaCare? There seems to have been, you know, not necessarily a cry, but an occasional argument by some politicians in Washington that either defunding or freezing the funding for some of these projects would be fiscally responsible. Could you give a comment about that?

Rich Montoni - Maximus Inc - President, CEO

Bruce, would you please respond to that?

Bruce Caswell - Maximus Inc - President and General Manager, Health Services

Sure. I would be happy to. I would just say, Jim, that we continue to read the papers every day as you do, and there's nothing at this point that we would characterize as moving the states off their current course. I think you are always going to have a lively debate as it relates to topics like this, particularly given the tight fiscal times that we've seen. But fundamentally, the money has been flowing to the establishment grantees.

I think as of current count that I have reviewed, about $35 million in establishment grant money has already flowed. And certainly the applications continue to come in. We are proceeding under current kind of course and speed on that.

James Kumpel - BB&T Capital Markets - Analyst

And just finally, with regard to the comment about acquisitions, again, could you just maybe touch on the types of skillsets or the type of capabilities that you're looking to maybe supplement your core capabilities?

Rich Montoni - Maximus Inc - President, CEO

Glad to do that. We do remain very, very active from an M&A perspective. I'd tell you that we see some real opportunities out there. I'd also say that in the past, our approach has really been to focus on tuck-ins, and while we're interested and we will take a look at tuck-ins that are a really good fit, our primary focus is on items that would be more meaningful to the Company.

We're certainly not going to bet the ranch, but we're going to look for things that do in fact move the needle, Jim. And just for risk management purposes, we're likely to stay within zero, one, or two adjacencies in terms of what we do. We just think if it's closer to our core and compliments our core, we are more likely to get cross synergies and we think the risk and integration risk will be lower.

James Kumpel - BB&T Capital Markets - Analyst

Great. Thank you very much.

Rich Montoni - Maximus Inc - President, CEO

You bet.

Thank you. Ladies and gentlemen, there are no further questions at this time. This concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

|

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies mayindicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

© 2011 Thomson Reuters. All Rights Reserved.

|