Exhibit 99.2

FINAL TRANSCRIPT

MMS- Q4 2010 MAXIMUS, Inc. Earnings Conference Call

Event Date/Time: Nov. 11. 2010 / 2:00PM GMT

CORPORATE PARTICIPANTS

Lisa Miles

MAXIMUS,

Inc. - VP of IR

David Walker

MAXIMUS,

Inc. - CFO

Rich Montoni

MAXIMUS,

Inc. - CEO

CONFERENCE CALL PARTICIPANTS

Operator

James Kumpel

Madison

Williams - Analyst

Brian Kinstlinger

Sidoti

& Company - Analyst

Torin Eastburn

CJS

Securities - Analyst

PRESENTATION

Operator

Greetings and welcome to the MAXIMUS fourth quarter and year-end conference call.

(Operator Instructions)

As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Lisa Miles, Vice President of Investor Relations for MAXIMUS. Thank you. Ms. Miles, you may begin.

Lisa Miles - MAXIMUS, Inc. - VP of IR

Good morning. Thank you for joining us today on today's conference call. I would like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A. Before we begin, I'd like to remind everyone that a number of statements being made today will be forward-looking in nature.

Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks and our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I'll turn the call over to Dave.

David Walker - MAXIMUS, Inc. - CFO

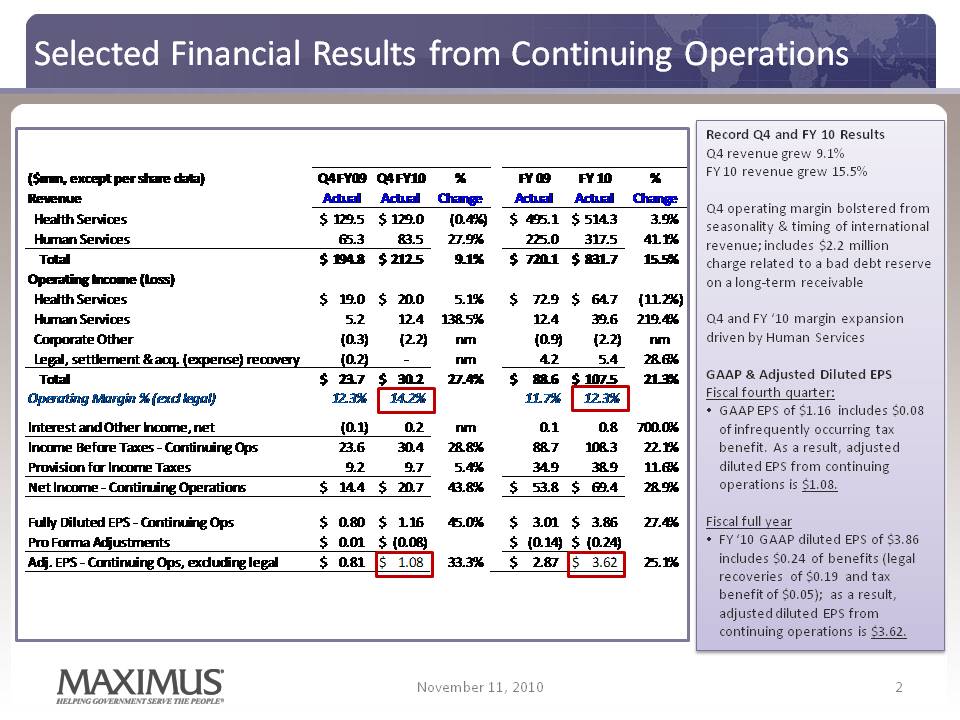

Thanks, Lisa. This morning MAXIMUS reported record revenue and record earnings for the fourth quarter and fiscal 2010. We had an exceptional year with full-year top line and bottom line growth outpacing our stated 10% growth targets. These results further demonstrate our commitment to grow the base business by bringing in new profitable work as we continue to deliver long-term shareholder value.

For the fourth quarter, total Company revenue from continuing operations grew 9.1% to $212.5 million and on a constant currency basis grew 7.4%. For fiscal year 2010, MAXIMUS revenue grew 15.5% or 11.2% on a constant currency basis to $831.7 million compared to last year. This growth was driven principally by expansion in our international employment services operations. Total Company operating margins were bolstered in the fourth quarter by expected seasonality and timing of revenue recognition primarily on international Human Services contracts. This benefit was partially offset by cost growth on a fixed-price education contract in Human Services.

Margin was also impacted by corporate, general and administrative expenses which contained a charge of $2.2 million principally related to a bad debt reserve on a long-term receivable. For the fourth quarter, MAXIMUS delivered a strong operating margin of 14.2% and 12.3% for the full fiscal year. The margin expansion in the quarter and the year were driven by strong top and bottom line growth in Human Services. During the quarter, the Company recorded a year-end tax adjustment which reduced the tax rate in the quarter to 31.9%. As a result, GAAP net income from continuing operations totaled $20.7 million for the fourth quarter or $1.16 per diluted share. This tax adjustment in the fourth quarter contains approximately $0.08 of benefit from infrequently occurring tax items as well as a year-to-date tax rate true-up related to the prior quarters. Normalized to remove these tax benefits, adjusted EPS from continuing operations in the quarter is $1.08 per diluted share.

GAAP net income from continuing operations for fiscal 2010 totaled $69.4 million or $3.86 per diluted share. This includes approximately $0.24 of infrequently occurring benefits related to legal recoveries and certain income tax adjustments. Normalized to remove these benefits, adjusted EPS from continuing operations grew 26% to $3.62 compared to adjusted EPS of $2.87 for fiscal 2009. A normalization table is presented in the supplemental table in the financial statements of the press release.

As disclosed in our 8K filing on October 29, we integrated our consulting practices into the rest of the business, eliminating the consulting segment. We will now report financial results under two segments, the Health Services and Human Services segments. We've reclassified historical segment results to reflect this realignment in our 8K. We believe this provides investors with added transparency into our financial results and better visibility into the most important drivers behind future growth.

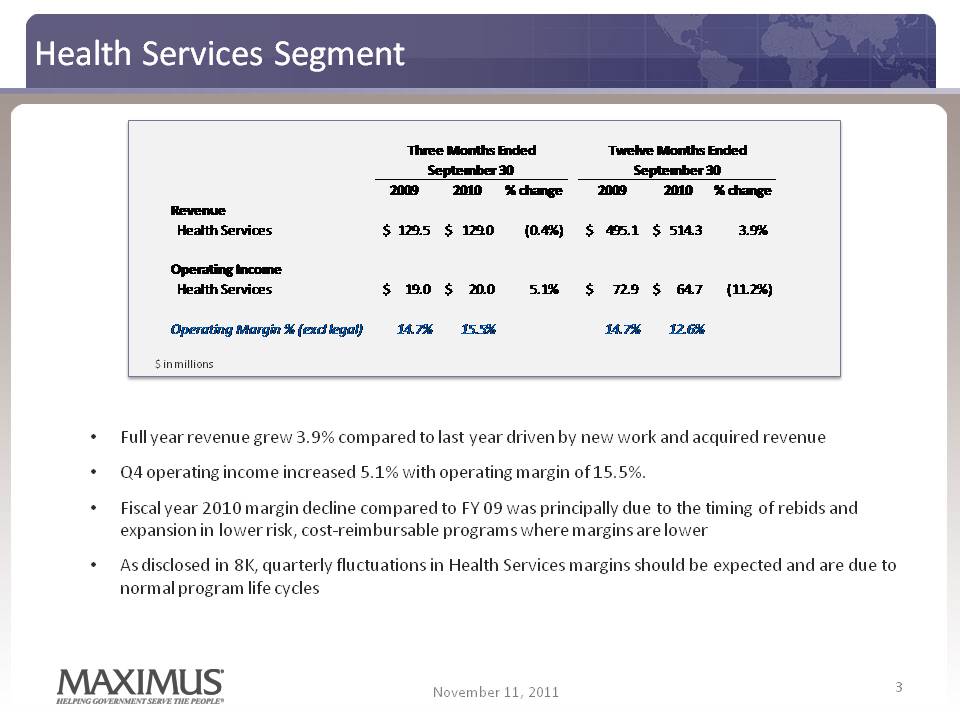

Let's jump into results by segment starting with Health Services. The Health Services segment delivered revenue for the fourth quarter of $129 million, which is comparable with the same period last year. For the full fiscal year, revenue grew 3.9% to $514.3 million driven by new work and acquired revenue. For the fiscal fourth quarter operating income for the Health Services segment grew 5.1% to $20 million with an operating margin of 15.5%, which has improved over the same quarter last year. For the full fiscal year, segment operating income totaled $64.7 million with an operating margin of 12.6%.

Margin decline over last year was principally due to the timing of rebids as well as expansion in lower risks cost reimbursable programs where margins are lower. As we discussed in our 8K filing, quarterly fluctuations in operating margin in the Health Services segment should be expected and are due to normal program life cycles. These events include competitive contract rebids, which typically reset margin as well as seasonality related to health insurance program open enrollment periods, which may provide an accretive benefit in certain quarters.

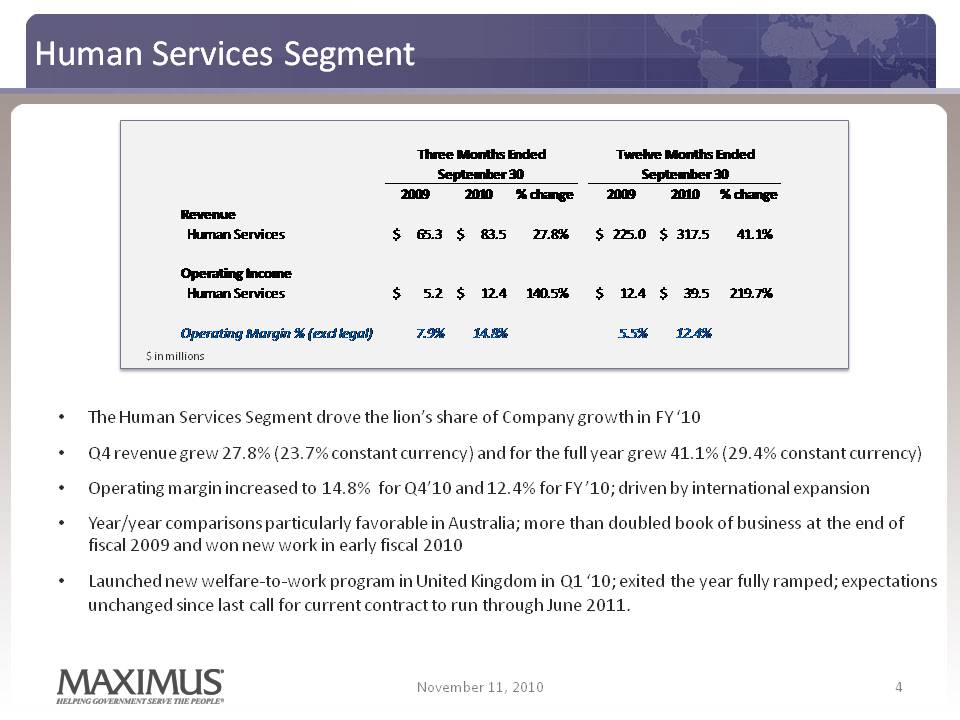

Let's turn our attention to financial results for the Human Services segment which drove the lion's share of the Company's growth in fiscal 2010. For the fourth quarter, revenue for the Human Services segment grew 27.8% to $83.5 million, or 23.7% on a constant currency basis compared to last year. For the full fiscal year, revenue grew 41.1%, or 29.4% on a constant currency basis, to $317.5 million compared to fiscal 2009. This revenue growth was primarily driven by international expansion of our welfare-to-work business.

Operating income for the Human Services segment grew 140.5% to $12.4 million in the fourth quarter, which equates to operating margin of 14.8%. The segment margin expansion was derived from economies of scale from our tremendous international growth and seasonality in the fourth quarter from the Tax Credit business. This benefit was partially offset by cost growth on a fixed-price education contract. For the full fiscal year, operating income for the segment increased 219.7% to $39.5 million, and operating margin expanded to 12.4% compared to 5.5% for fiscal 2009.

Growth in revenue and income for both the quarter and the year were driven by the international employment services operations in Australia and the UK. Year-over-year comparisons were particularly favorable from our Australian operations. We more than doubled our Australian book of business at the end of fiscal 2009 and won additional new work in the beginning of fiscal 2010. As a reminder, we also launched a new welfare-to-work program in the United Kingdom at the beginning of the fiscal year, which has shown sequential revenue and margin growth during the year. We exited the fiscal year with the program fully ramped.

As you know, this contract is being rebid as part of the welfare reform initiatives under the UK Government's austerity program. Rich will provide an update on the UK rebid later in the call but things are largely unchanged since our last earnings call. So for now, it's business as usual in the UK as we continue work under our current contract which runs through June 30, 2011. The Human services segment had a great year, and the management team continues to manage cost effectively, especially in our international programs that are volume sensitive.

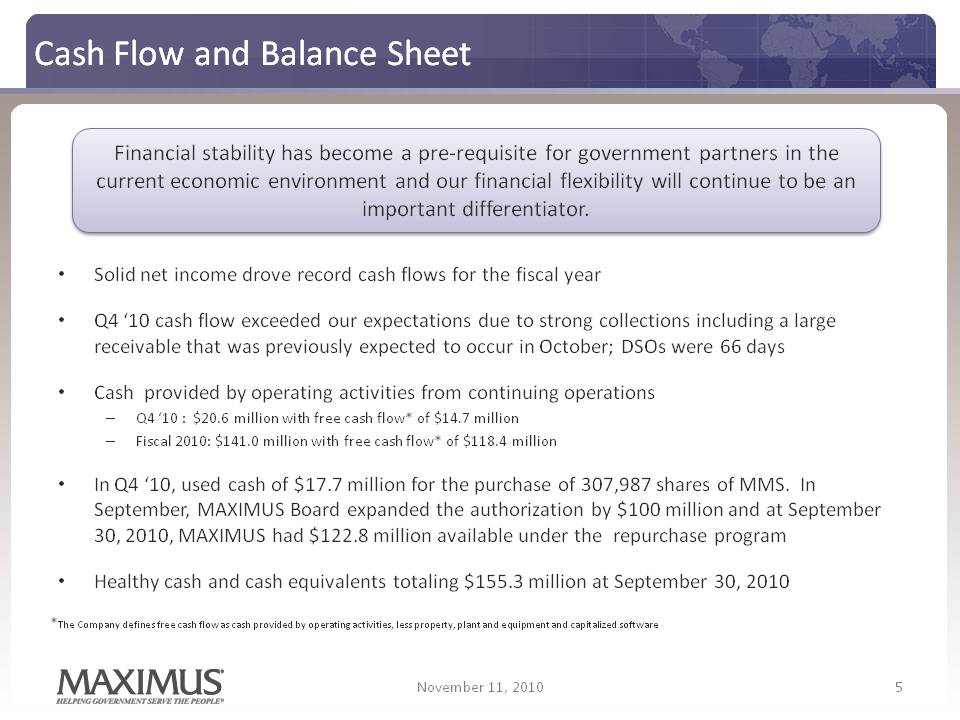

Moving onto cash flow and balance sheet items. Solid net income contributed to record cash flows for the fiscal year. Cash flow in Q4 exceeded our prior expectations largely due to strong collections including a large receivable that was previously expected to occur in October. Days sales outstanding was 66 days in the quarter and remained in our stated range of 65 to 80 days. For the three months ended September 30, cash provided by operating activities from continuing operations totaled $20.6 million and for the full fiscal year, totaled a record of $141 million. Free cash flow from continuing operations was $14.7 million for the fourth quarter and $118.4 million for the full fiscal year.

We remain committed to our cash deployment strategy, which includes quarterly cash dividends, opportunistic share repurchases, and selective acquisitions. During the quarter, the Company purchased 307,987 shares of MAXIMUS common stock for $17.7 million. In September, the Board of Directors authorized an additional $100 million to our ongoing repurchase program and at September 30, MAXIMUS had $122.8 million remaining under the repurchase program.

Our balance sheet remains healthy, and we exited the fiscal year with cash and cash equivalents totaling $155.3 million. Strong financial condition of the Company has been a competitive advantage in the market as financial stability has become almost a prerequisite for government partners in the current economic environment. We believe our financial flexibility will continue to be an important differentiator as government seeks to partner with reliable and financially solid firms.

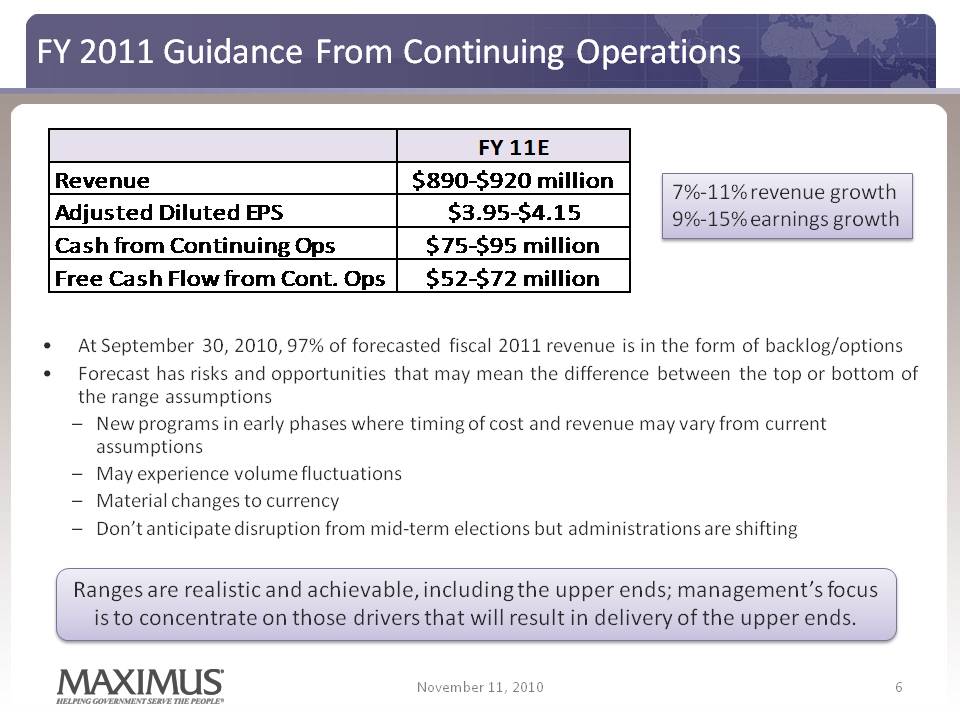

Moving onto guidance. For fiscal 2011, we expect revenue to grow between 7% and 11% with an expected range of $890 million to $920 million driven by new work in both segments. We enter fiscal 2011 with approximately 97% of this forecasted revenue in the form of backlog or option periods. On the bottom line, we expect adjusted diluted EPS from continuing operations to grow between 9% and 15% to a range of $3.95 to $4.15 for fiscal 2011. As with any forecast, we have risks and opportunities which might mean the difference between delivering EPS at either end of our stated range. So let me provide you with some details.

First, we have several new large programs in the early phases where the timing of cost and revenue may vary from our current assumptions. In addition, we may experience volume fluctuations in both domestic and international programs. And with a larger percentage of international business, we may be impacted by any material currency changes. Lastly, while we don't presently anticipate any disruptions as a result of the mid-term elections, we will see a shift in government administrations. So to sum it up, all of these factors may drive us towards either end of our guidance range. Nevertheless, we have put forward ranges that we believe are realistic and achievable.

Management's focus is to concentrate on those drivers that would result in the delivery of financial results towards the upper end of our stated range. For modeling purposes, our normalized tax rate going forward is expected to be 36.7%, which is substantially lower than in prior years. Not only is the international expansion diversifying our client base and increasing margins striving real economic benefit by reducing our tax rate and further delivering long-term shareholder value.

Moving onto cash flows guidance. We expect cash provided by operating activities derived from continuing operations to be in the range of $75 million to $95 million for fiscal 2011. We expect free cash flow from continuing operations of $52 million to $72 million. Thanks for joining us this morning, and now I'll turn the call over to Rich.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks, David. And good morning, everyone. We are very pleased to deliver a record year for fiscal 2010, which positions us for solid growth in fiscal 2011. This morning I'd like to share more information about the exciting opportunities we see in the upcoming year and beyond. First, let's talk about Health Care reform. The new segment structure that David mentioned helps us to focus our resources better, emphasize teamwork, increase predictability, and achieve operating synergies throughout the organization.

In our domestic Health Care business, this collaboration gives us a more comprehensive go-to-market strategy to help our clients address increasing demand for services. By blending our consulting thought leadership with our BPO services expertise, we've strengthened our competitive position and are already realizing benefits from this enhanced cross collaboration. As states begin to develop legislation and program implementation plans, we continue to engage both existing and potential clients nationwide both at the federal and state levels.

We are actively participating on conference panels, webinars, and industry and government workgroups to demonstrate how our services can help achieve the new requirements, including Medicaid expansion, health insurance exchanges, and long-term care programs. At the same time, we are pushing new innovations for enhancing our business process modeling and monitoring tools that further improve overall operational efficiency. These tools help us drive continuous process improvements so that our clients can further optimize their business operations and more effectively manage cost in the era of continued budget pressures.

Our business development efforts thus far have paid off. Over the past several months, we've generated traction in further establishing our presence in the health market. We've secured key contracts that represent the blueprint of Health Care reform as states prepare to legislate and implement the various requirements. In this morning's press release, we announced the signing of a new five-year award for Eligibility and Enrollment Monetization in New York for MAXIMUS' standardizing and simplifying the enrollment and renewal processes for the State's public health insurance programs. And within the past month, we've successfully launched operations for the Eligibility and Enrollment Monetization contract in Colorado.

These programs are similar to the future model for health insurance exchanges. Both are designed to share easy to understand information about health benefit availability, so that consumers can make informed choices while also providing a more seamless eligibility experience for consumers to move in and out of various public programs. The ultimate goal is to provide consumers with multiple ways to enroll efficiently into the right program or health plan.

During the quarter, we also secured a work related to the establishment of high-risk pools, part of the first wave of requirements enacted under Health Care reform. These strategic contracts support the pre-existing condition insurance plans in California and New York. They represent great examples of how states are successfully doing more with less. As an established vendor in both states, we are providing services to a new population of beneficiaries who are now eligible for insurance coverage. Under these contracts, we are able to help both states leverage their current IT and operations infrastructure and proven business processes to achieve the early requirements of the Affordable Care Act.

Our activities extend beyond our state clients. As eHealth initiatives come together, the federal government is seeking to further safeguard consumers' protected health information in areas that weren't contemplated under HIPAA such as websites, web portals and social media sites. MAXIMUS won a small, but strategic contract with the Office of the National Coordinator, or what's referred to as ONC, to help assess privacy and security practices of entities that are not covered by HIPAA. Under the HITECH Act, ONC must prepare or report to Congress regarding personal health records and develop recommendations on the appropriate privacy and security requirements for the vendors who handle these records.

Our Federal Services division has also increased its appeals book of business. With the addition of three more contracts, MAXIMUS now provides independent medical reviews to 37 states, making us the largest independent review organization in the country. These contracts are all very exciting for MAXIMUS and further validate our standing as a leader within the health market.

Let's talk about the domestic environment. Last week we saw a shift in power in the House during the recent mid-term elections. While we are hearing much discussion surrounding Health Care reform, any legislative attempts to reverse the law will be met with great resistance from the Democratic-controlled Senate and the President. There has been talk of minor technical fixes to the law, but any major changes will require a significant amount of negotiation from both political parties. We continue to respond to the needs of our state and federal clients who are still under obligation to meet the deadlines of the Affordable Care Act. But our go-to-market strategy aligns with the overarching need for governments to cost-effectively manage rising caseloads and increased demand.

It is also important to point out that the current law contains many components that appear to be supported by both parties as well as health care consumers. Components that address pre-existing conditions within the high-risk pools, extending appeals rights to health care consumers, and other initiatives that provide improved efficiencies and control costs within the current public insurance programs, they appear to be desirable by many stakeholders.

One of the ways states are addressing costs is to move subsidized health care populations away fee-for-service models and into managed care. For example, Texas is already moving more of its Medicaid beneficiaries into managed care in an effort to control costs. We are seeing the shift across the nation as traditional fee-for-service states are taking a hard look at the benefits, including cost savings, under Medicaid managed care.

In addition to our domestic efforts, we're also aggressively pursuing international opportunities. In the UK, the new coalition government is implementing austerity measures to reduce the country's debt. One of the key features of these measures is major reform of the welfare system. This includes a consolidation of several existing welfare work programs into a single 'back-to-work' program called The Work program. As we discussed last quarter, most current welfare-to-work contracts will end on June 30, 2011, and will be rebid under the new work program.

The Department of Work and Pensions is already well down the path for vendor procurements under The Work program and a two-step bid process is progressing as planned. We recently submitted our bid for spot on the Buying Framework. This is the first phase of the procurement process. We expect to hear the results by the end of November. The Buying Framework was established to narrow the field of qualified vendors who will be eligible to bid in Phase 2 for specific contracts within the 11 regional lots set up by the Department of Work and Pensions. We are actively preparing for the release of Phase 2 and we expect this will kick-off in December.

Now, due to size and significance, this procurement has attracted much attention. That said, we remain confident that MAXIMUS is a strong contender, largely in part because our performance to date has been very strong. We continue to surpass key performance requirements on the program with a job placement outcome rate at 13 weeks that is nearly double the UK national average. We believe this should and will go a long way in contending for an ongoing role. Outside of the UK, the evolution of social welfare programs in many European countries is well underway.

These countries are interested in our demonstrated ability to run model programs in a cost effective manner and to achieve key performance outcomes. With 27% of our revenues in the fourth quarter coming from international programs, we have demonstrated our ability to establish and scale programs while mitigating risk and maximizing opportunities. Whether it's markets where we have an established presence like Australia, Canada, or the UK, or emerging opportunities in markets in continental Europe, we will rigorously evaluate each opportunity.

Turning now to backlog, new awards, sales pipeline, and rebids. At September 30, 2010, backlog increased 17% to a record $2.1 billion compared to $1.8 billion in the prior year. As David noted, with 97% of forecasted revenue in the form of backlog or option periods, we are optimistic with our fiscal 2010 financial targets. At September 30, we had $685 million of new signed awards which includes the new enrollment center contract in New York. This contract was signed in September. Certainly, a great way to wrap up fiscal 2010. At September 30, we had $709 million in awarded but unsigned contracts. And, subsequent to quarter close, we signed a large portion including a five-year extension of our current contract for the California Healthy Families Program.

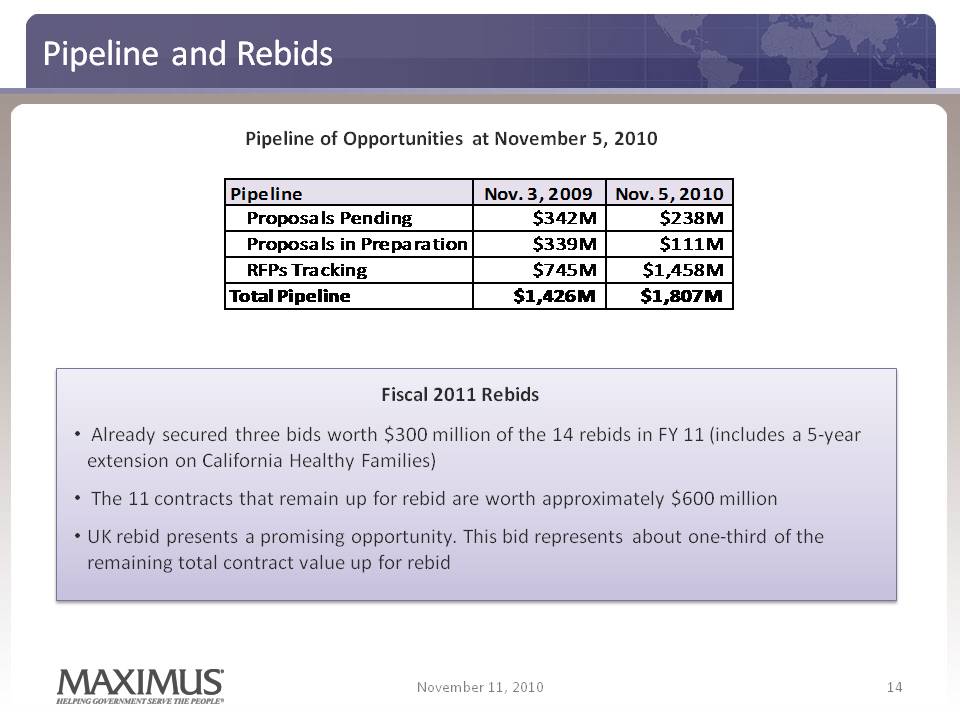

Moving onto our sales pipeline. At November 5, our total pipeline remained robust at $1.8 billion and consistent with the last quarter. With our ongoing development of opportunities domestically and abroad, we are confident about our future growth prospects. Looking forward to rebids. I am pleased that we're out of the gates strong with early wins. While fiscal 2011 was shaping up to be a big rebid year, we've already been successful in securing three of the contracts. These three contracts carry a total value of just over $300 million, which includes the California Healthy Families extension. A good solid start to fiscal 2011. As a result, we have 11 contracts that remain up for rebid, which have a total contract value of approximately $600 million. And, as I mentioned earlier, we believe the UK rebid present us with a promising opportunity. That rebid represents about one-third of the remaining total contract value up for rebid.

To conclude, we're excited for the coming year and beyond. Our guidance for 2011 reflects the success we've had in building a robust pipeline and converting identified opportunities into wins. We're particularly excited about the new contracts we have won that illustrates the traction we are building with government partnerships as they continue to prepare for health care reform. We're also excited about our prospects in the international markets, including the UK where we are looking to build upon our success in the welfare-to-work arena.

I'd like to extend a thank you to the entire MAXIMUS team for their efforts over the past year. We are ready to help our clients meet the challenges of increased demand, new regulations, and evolving markets. We look forward to getting the job done for our clients and our constituents, as well as for our shareholders. And, with that, let's open it up for questions. Operator?

QUESTIONS AND ANSWERS

Operator

Thank you. (Operator Instructions) Our first question is coming from the line of James Kumpel with Madison Williams. Please state your question.

James Kumpel - Madison Williams - Analyst

Hi. Good morning. Can you talk a little bit about what factors you're accounting for between the low end and the high end of your revenue guidance for fiscal 2011? What would have to happen for you to be at the high end of the range?

Rich Montoni - MAXIMUS, Inc. - CEO

Good morning, Jim. How are you? This is Rich.

James Kumpel - Madison Williams - Analyst

Thank you.

Rich Montoni - MAXIMUS, Inc. - CEO

Dave, why don't you talk about this in terms of low end versus high end?

David Walker - MAXIMUS, Inc. - CFO

Sure, glad to. Look, there are several contracts that we've kicked off. In the past, some of the start-up phase contracts we've actually done better than our estimate, but they create uncertainties, so that's part of the range in terms of the profitability. Sometimes when they get out of the block, we can pull more revenue through faster sometimes, and it's possible with the change of administration that some could move it to the right while they scratch their head and think about direction. So, we thought about all those things. Some things, just transactions on our welfare-to-work business, can be very difficult to predict. It's not as easy as the health business. They can move up or down.

What we've demonstrated time and time again is we have managed our cost structure, so we've kept it as variable as possible. So we were able -- we are generally able to adjust pretty well our cost structure and deliver the EPS we are after despite revenue fluctuations. So those are the things that we think about, and we actually, we certainly, look at the backlog. We certainly look at the pipeline and consider all that stuff. Okay?

James Kumpel - Madison Williams - Analyst

What was the magnitude of the charge to revenues on that education contract?

Rich Montoni - MAXIMUS, Inc. - CEO

Yes, it was actually in our guidance. Obviously, we fell right smack dab in the middle of our guidance range. It dampened revenue a little bit, but it was not -- about $4 million, $3 million to $4 million.

James Kumpel - Madison Williams - Analyst

Okay. And then also, could you talk a little bit about some of the factors that were unique to 2010 that helped free cash flow and maybe what some of those factors that won't be there in 2011 that demonstrates why there is that trajectory?

David Walker - MAXIMUS, Inc. - CFO

Yes, you bet. And really, you're spot on. The fiscal year cash flow was incredible relative to earnings. There were a couple of things. There actually was a receivable that we didn't collect at the end of fiscal year '09 of about $10 million. So those DSOs were high as it flipped into fiscal year '10, and our DSOs ended up pretty well at 66 days at the end of the year. In fact, a similar situation. We were able to pull through a receivable in fiscal year 2010 that when we forecast we don't necessarily think it will repeat itself in the next year. Some large receivables can break to the quarter end by just a few days one way or the other. They tend to be tough to predict. That's $20 million on the front end of the year and the back end of the year.

The deferred revenue and there's advance payments, we generated substantial cash flow advantages on some of these international contracts. We generated about $30 million worth of deferred revenue there this year. We picked up about $3 million in taxes. So when we go to next year, that's about $53 million is what that tallies, so if you normalize the free cash flow this year down, it will be pretty much in line with where we are next year. In fact, the deferred revenue will turn around next year. So, actually, our cash flow forecast for next year is pretty aggressive. It is on the doable side.

James Kumpel - Madison Williams - Analyst

This is going to be the last one. I appreciate all of your answers. Rich, you talked about how you're proud of the success in the UK, and then you talk about how you got double the UK outcome average at 13 weeks in job placement. Does that really translate into half the time to get people placed versus the national average?

Rich Montoni - MAXIMUS, Inc. - CEO

I don't know if it translates into half the time. It's really an outcome -- it's the most important outcome metrics as you can imagine. The customers -- this is a good trend that we see in the industry, and I believe it is the real driver why governments are looking to moving towards outsourcing with firms like MAXIMUS. They are very much focused on outcomes. Meaning, we exceed the national average by 2 X. It means that our outcome metrics is 2 X. It doesn't mean we do it twice as fast or for half the cost. In fact, we may make additional investments. I think it is more investments in the right area. It gets into things in terms of how you manage, how you flow those outcomes and targets down to your individuals, how you manage your workforce, what incentives you have, et cetera. I don't think it correlates strictly to a cost metric, Jim.

James Kumpel - Madison Williams - Analyst

Okay. Thank you very much.

Operator

Our next question is coming from the line of Brian Kinstlinger with Sidoti & Company. Please state your question.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Thanks. Good morning. The first question I had, for Dave or Rich I guess, the expectation for the growth rates of Health versus Human Services in fiscal 2011 based on your guidance. Is it similar -- the growth is similarly going to be coming from the Human Services as opposed to the Health Services this year?

Rich Montoni - MAXIMUS, Inc. - CEO

That's a great question, Brian. Good morning to you. Let me talk a little bit about where we see the growth coming from in fiscal '11. And, as we said, we expect the growth in fiscal '11 to be in the range of 7% to 11%. By segment, when we start to look at the segments, we expect both the segments will grow, but interestingly enough, we actually think it is going to be the Health Services segment that will grow faster than the Human Services segment. The reason for that is that Health Services has been very fortunate to sign up some new work, most of which we've talked about, including New York, Colorado, and the high-risk pools, et cetera. So, we've factored that into the growth for that segment.

Similarly, on the Human Services side, we are not counting on a growth rate as significant as the Human Services segment delivered in fiscal '10. The reason for that is Australia. That really has settled in. They basically doubled their business, their run rate, in fiscal '10. It is not reasonable to think they are going to continue at that clip.

Furthermore, the UK now is fully ramped, so when you add all of that in plus one-third factor in Human Services, most of the consulting work that we consolidated into our new lines of Health and Human Services segments, most of that went into the Human Services piece. In the consulting segment, that revenue by and large has been on a decreasing mode, so that's going to temper the Human Services growth rate. When you add it all up, we think the faster segment is going to be Health versus Human Services.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay. And the 97% visibility number, is that the low end of the revenue guidance? And then, how do you guys factor the awarded but unsigned contracts into guidance? I guess most of them have been awarded though.

Rich Montoni - MAXIMUS, Inc. - CEO

The 97% is really at the middle of the range. And then how we factor the pipeline, is that your question into the guidance?

Brian Kinstlinger - Sidoti & Company - Analyst

The ones that have actually been awarded but unsigned even still today because I know you signed some of them. How do you factor those?

David Walker - MAXIMUS, Inc. - CFO

We factor those, once it gets to the point that it's awarded and unsigned, by and large, it's 100% assured. It's not a probability game. We factor them in at 100%.

Brian Kinstlinger - Sidoti & Company - Analyst

And then when we look at the Health Services business, first of all, are there any refresh costs at all in California? And then you talked about the moving the cost reimbursements, some of your contracts? Do we expect to see margin pressure in that industry? In that segment, sorry.

Rich Montoni - MAXIMUS, Inc. - CEO

As it relates to refresh, it's very typical that we will have some refresh costs. I don't believe we have major material refresh costs in the rebids we've signed up thus far. But there'll be some, but it's not material. The second part of your question, could you repeat it for me, Brian?

Brian Kinstlinger - Sidoti & Company - Analyst

The reimbursable.

David Walker - MAXIMUS, Inc. - CFO

There -- we've actually been fortunate to get some growth through existing clients that happen to be reimbursable. They are lower margin. So that is just the nature of the risk. So we like that work. Going forward, we don't see that, that would be the bulk of the growth.

Brian Kinstlinger - Sidoti & Company - Analyst

So I guess the main question was, should margins be flat, up, or slightly down in that Health segment based on -

Rich Montoni - MAXIMUS, Inc. - CEO

Relatively consistent, Brian. We are looking for relatively consistent margins year-over-year.

Brian Kinstlinger - Sidoti & Company - Analyst

And then, I'm curious if you can go over the volumes, whether they're increasing or decreasing? You may have mentioned this in both the UK and Australia in terms of the number of cases and number of placements versus, say, six months ago.

David Walker - MAXIMUS, Inc. - CFO

Australia has been soft as we have been looking into the latter part of the quarter and we look at the beginning of this year but relatively flat, not distressingly soft.

Rich Montoni - MAXIMUS, Inc. - CEO

And that's pretty much in line within the nature of the business. As you may know, Australia's unemployment rate has been decreasing, so the number of cases that we handle to assist and helping them find opportunities would decrease naturally as well.

David Walker - MAXIMUS, Inc. - CFO

Yes, and Australia -- and the UK has been pretty flat. I mean, they're scratching their heads as they're working through. Everyone is focused on the new austerity program, so that's not a surprise to us at all. So it's pretty much status quo.

Brian Kinstlinger - Sidoti & Company - Analyst

Okay. And then finally on the buybacks, do you factor that at all in your guidance? Maybe what are your plans over the course of the year? Is it similar to the last year or two which have been $30 million to $40 million? Or are you getting a little bit more aggressive do you think this year?

Rich Montoni - MAXIMUS, Inc. - CEO

First off, no, we do not factor buybacks nor do we factor M&A into our forecasted results. That, obviously, is a variable that would come into play as we take those actions. And I would tell you that I think we will continue to remain opportunistic. We still think it's very creative to repurchase our shares and we'll balance, obviously, the use of our cash for share repurchases with other competing needs. We do like the dividend, and, obviously, we continue to consider merger and acquisition opportunities.

Brian Kinstlinger - Sidoti & Company - Analyst

Great. Thank you.

Rich Montoni - MAXIMUS, Inc. - CEO

You bet.

Operator

(Operator Instructions) Our next question is coming from Torin Eastburn with CJS Securities.

Torin Eastburn - CJS Securities - Analyst

Good morning, Rich and Dave. Good morning, Torin. How are you?

David Walker - MAXIMUS, Inc. - CFO

Good morning.

Torin Eastburn - CJS Securities - Analyst

Good. My first question is about the guidance and particularly what it contemplates with respect to the UK and how the various possible scenarios that can play out there would affect your guidance for 2011?

Rich Montoni - MAXIMUS, Inc. - CEO

Our assumptions in our guidance as it relates to the UK is that the programs will continue, for the most part, through the entire fiscal year as is level load. It can play out, I will say, less favorable if we were not to win the current level run rate of work, which I think is in the vicinity of $40 million a year. So if we were not successful in our rebid efforts to win at least that much work, that would be, obviously, a downward adjustment to our guidance, our assumptions in our guidance,

On the other hand, if we win additional work above and beyond that run rate, that would be -- I actually think that is more likely to be a fiscal '12 revenue event because most of that work would -- is anticipated to start July 1. It would have to ramp up. You would also need to keep in mind, depending upon terms and conditions, there could be start-up costs. There could be revenue recognition issues such that there may be a ramp period we'd have to deal with.

Torin Eastburn - CJS Securities - Analyst

Okay. And my other question. What can you tell us about the size or the timing of the new contract you've won in New York?

Lisa Miles - MAXIMUS, Inc. - VP of IR

Torin, it's Lisa. We have not disclosed the size of the contract at this time. When we announce a formal press release, we would hope to do that, given client approval.

Rich Montoni - MAXIMUS, Inc. - CEO

And, again, the key is just sensitivity to client disclosures. We've very sensitive to that. So we're anxious to disclose it, but we will have to be a bit patient.

Torin Eastburn - CJS Securities - Analyst

Okay. Thank you.

Operator

Your next question is a follow-up from James Kumpel with Madison Williams. Please state your question.

James Kumpel - Madison Williams - Analyst

Hi, guys again. Can you talk a little bit about the CHIP upselling or cross-selling to existing Medicaid enrollment clients? Is that at all factored into your guidance? Do you see some opportunities there in fiscal 2011?

Rich Montoni - MAXIMUS, Inc. - CEO

Yes. I think to just capsulize your question, cross-selling CHIP is an area that folks have talked about. We get into also the same area -- is your question in the area of due eligibles as well?

James Kumpel - Madison Williams - Analyst

That would be part of it. I guess the newly addressable populations that are not being accounted for at least currently.

Rich Montoni - MAXIMUS, Inc. - CEO

I would tell you this without getting into -- really, it becomes a bit speculative state-by-state. I do think there is a lot of focus in the populations and the programs. Are they best fit? Are individuals best fit into a Medicare program, a Medicaid program, a CHIP program? So there's a lot of focus state-by-state as it relates to which program makes the most sense, so we are seeing a lot of activity in that regard. We're counseling with our clients in terms of what they plan to do. At the moment, the most significant one, frankly, is this initiative to move folks from fee-for-service to managed care.

You may have read about Texas and their intent to move a very significant number of their beneficiaries from fee-for-service to managed care, and we're are fortunate to run that program. That will mean additional volume to us. I would not be surprised if we see that to continue to gain traction, Jim.

James Kumpel - Madison Williams - Analyst

Obviously, the more managed care representation there is, the better it is for you, because that's your bread and butter.

Rich Montoni - MAXIMUS, Inc. - CEO

That's exactly right. That's exactly right. As you recall also that this new assignment and project we have in Colorado, that's a CHIP program.

James Kumpel - Madison Williams - Analyst

Got it. Okay. The second thing I think I wanted to go into is internationally, can you talk about the efforts you've embarked on to maybe establish a foothold on the continent? I know you've got the UK, but in terms of continental Europe, are you in any sort of -- can you give us any a sense here in the third inning, [speck inning], first inning of pitching for more business?

Rich Montoni - MAXIMUS, Inc. - CEO

I'd be glad to do that. I am also going to be cautious, for obvious competitive reasons not to get into too much detail country by country, but we have spent a lot of time and we have dedicated resources advancing our study of what opportunities exist country by country.

We have made cuts in terms of those attributes that are important to our business of those countries into which we would have an interest. We've identified those countries. We have engaged advisors to help us understand the lay of the land, what type of work is made available by those governments, what's the propensity of those governments to utilize firms like MAXIMUS? And we're -- early stages of actually building, I would tell you the metric that we disclose to you folks once the quarter is, what do we see in terms of opportunities tracking?

I think the next step is to see some of those things bubble up. That would be the precursor to either a small investment in a country or just bidding on an opportunity in that country.

James Kumpel - Madison Williams - Analyst

Okay, on the business development front, can you also just give us a sense on the health exchange front? Obviously, Colorado is an early adopter, but are there other states that are similarly moving forward towards that end? Or because of the 37 elections for governors and the political turnover, has it been more of a wait and see?

Rich Montoni - MAXIMUS, Inc. - CEO

Boy, it's a very complicated answer. There are a lot of moving parts, as you can appreciate. All of the things that you've mentioned and more come into play. We also need to remember that not only is Colorado an early adopter in this context, but so is New York. I'd actually tell you that I think while a lot of what New York and Colorado are doing plays extremely well into health care reform, much of it also plays well into the fact that they are just reengineering how they do eligibility determination. To centralize some of these functions and bring new technology to bear just makes so much sense for them, whether it's under -- to get a better position to comply with the new federal legislation, the new federal law, or just to move forward with their existing programs, it makes an awful lot of sense.

In terms of the overall environment, I would best describe it as lots of dynamics, at the federal level and at the state level, as it relates to health exchanges. You have lots of folks at the table by industry, by group. It would be the insurance companies, it would be the insurance agents, it would be the providers of health care, it would be firms like MAXIMUS. Of course, all the federal agencies that are in charge of this. Generally, the states are at a point where they're trying -- they're focused primarily on governance. How do they want to structure? Do they want to have a separate quasi-governmental body to handle this similar to Massachusetts Connector? Or is this something that they simply put underneath the responsibility of either the insurance commissioner or the health commissioner, or both?

I think that is the topic du jour with most of the states, some of it's advanced further. Most of the states, I'd say, are at that point. The mid-term elections do put a put a pause in to the whole equation. And I do think we are going to see a couple of years where there will be challenges to health care reform, but it does feel like the exchanges will move forward in some form or fashion. The industry has not quite decided, Jim, in terms of what they will look like. My guess is that they will take different shapes and it will vary state-by-state. That very much plays into what we are doing, what we are focused on, on a national level. Again, both at the state level and the federal level.

James Kumpel - Madison Williams - Analyst

And my final follow-up is, if you guys are essentially assuming similar margins in 2011 to 2010 and you are not assuming buybacks of any particular magnitude in 2011. What's the cause of the operating leverage that we are seeing in terms of faster earnings growth versus the top line?

Rich Montoni - MAXIMUS, Inc. - CEO

I think you've got several -- there's a lot of things that factor into that. Such things as, we took a charge in this quarter relative to a cost overrun for a large project. Our plan is we're not going to have such items. I think we'll get some efficiencies as well.

David Walker - MAXIMUS, Inc. - CFO

Share repurchase is in this quarter that will spill over next year.

Rich Montoni - MAXIMUS, Inc. - CEO

You get some full-year benefits for share repurchases next year.

David Walker - MAXIMUS, Inc. - CFO

UK was ramping the last year so you'll get a full year of the benefit with a revenue recognition. So those all things spill into it.

James Kumpel - Madison Williams - Analyst

And presumably with health services being a higher margin, business growing faster? Is that part of it too?

Rich Montoni - MAXIMUS, Inc. - CEO

I don't know if I'd go to -- certainly, we have growth aspirations for Health Services. Again, the margin mix will depend upon the nature of the work as we move forward. If we have expansion in those states that are principally lower margin fixed fee, which I do think we'll have some in Texas, that won't provide additional margin, but it certainly will provide top line growth. So we'll have to see on that one.

James Kumpel - Madison Williams - Analyst

Okay. Thank you very much.

Rich Montoni - MAXIMUS, Inc. - CEO

You bet.

Operator

There are no further questions at this time. This will conclude today's teleconference. You may disconnect your lines, and we thank you for your participation.

DISCLAIMER

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

David N. Walker Chief Financial Officer and Treasurer Fourth Quarter – Fiscal Year 2010 November 1, 2010 1

Continuing Operations Record Q4 and FY 10 Results Q4 revenue grew 9.1% FY 10 revenue grew 15.5% Q4 operating margin bolstered from ($mm, except per share data) Q4 FY09 Q4 FY10 % FY 09 FY 10 % Revenue Actual Change seasonality & timing of international revenue; includes $2.2 million charge related to a bad debt reserve on a long‐term receivable Health Services 129.5 $ 129.0 $ (0.4%) 495.1 $ 514.3 $ 3.9% Human Services 65.3 83.5 27.9% 225.0 317.5 41.1% Total 194.8 $ 212.5 $ 9.1% 720.1 $ 831.7 $ 15.5% Operating Income (Loss) Health Services 19.0 $ 20.0 $ 5.1% 72.9 $ 64.7 $ (11.2%) Q4 and FY ‘10 margin expansion driven by Human Services GAAP & Adjusted Diluted EPS Fiscal fourth quarter: • GAAP EPS 1 16 0 08 Human Services 5.2 12.4 138.5% 12.4 39.6 219.4% Corporate Other (0.3) (2.2) nm (0.9) (2.2) nm Legal, settlement & acq. (expense) recovery (0.2) ‐ nm 4.2 5.4 28.6% Total 23.7 $ 30.2 $ 27.4% 88.6 $ 107.5 $ 21.3% Operating Margin % (excl legal) 12.3% 14.2% 11.7% 12.3% of $1.16 includes $0.08 of infrequently occurring tax benefit. As a result, adjusted diluted EPS from continuing operations is $1.08. Interest and Other Income, net (0.1) 0.2 nm 0.1 0.8 700.0% Income Before Taxes ‐ Continuing Ops 23.6 30.4 28.8% 88.7 108.3 22.1% Provision for Income Taxes 9.2 9.7 5.4% 34.9 38.9 11.6% Net Income ‐ Continuing Operations 14.4 $ 20.7 $ 43.8% 53.8 $ 69.4 $ 28.9% Fiscal full year • FY ‘10 GAAP diluted EPS of $3.86 includes $0.24 of benefits (legal recoveries of $0.19 and tax benefit of $0.05); as a result, adjusted diluted EPS from Fully Diluted EPS ‐ Continuing Ops 0.80 $ 1.16 $ 45.0% 3.01 $ 3.86 $ 27.4% Pro Forma Adjustments 0.01 $ (0.08) $ (0.14) $ (0.24) $ Adj. EPS ‐ Continuing Ops, excluding legal 0.81 $ 1.08 $ 33.3% 2.87 $ 3.62 $ 25.1% 2 continuing operations is $3.62.

2009 2010 % change 2009 2010 % change Twelve Months Ended September 30 Three Months Ended September 30 Revenue Health Services 129.5 $ 129.0 $ (0.4%) 495.1 $ 514.3 $ 3.9% Operating Income Health Services 19.0 $ 20.0 $ 5.1% 72.9 $ 64.7 $ (11.2%) Operating Margin % (excl legal) 14.7% 15.5% 14.7% 12.6% $ in millions • Full year revenue grew 3.9% compared to last year driven by new work and acquired revenue • Q4 operating income increased 5.1% with operating margin of 15.5%. • Fiscal year 2010 margin decline compared to FY 09 was principally due to the timing of rebids and y g p p p y g expansion in lower risk, cost‐reimbursable programs where margins are lower • As disclosed in 8K, quarterly fluctuations in Health Services margins should be expected and are due to normal program life cycles

2009 2010 % change 2009 2010 % change Three Months Ended September 30 Twelve Months Ended September 30 Revenue Human Services 65.3 $ 83.5 $ 27.8% 225.0 $ 317.5 $ 41.1% Operating Income Human Services 5.2 $ 12.4 $ 140.5% 12.4 $ 39.5 $ 219.7% Operating Margin % (excl legal) 7.9% 14.8% 5.5% 12.4% $ in millions h d h l ’ h f h ‘ The Human Services Segment drove the lion’s share of Company growth in FY 10 • Q4 revenue grew 27.8% (23.7% constant currency) and for the full year grew 41.1% (29.4% constant currency) • Operating margin increased to 14.8% for Q4’10 and 12.4% for FY ’10; driven by international expansion • • Year/year comparisons particularly favorable in Australia; more than doubled book of business at the end of fiscal 2009 and won new work in early fiscal 2010 • Launched new welfare‐to‐work program in United Kingdom in Q1 ‘10; exited the year fully ramped; expectations unchanged since last call for current contract to run through June 2011.

Financial stability has become a pre‐requisite for government partners in the current economic environment and our financial flexibility will continue to be an important differentiator • Solid net income drove record cash flows for the fiscal year differentiator. • Q4 ‘10 cash flow exceeded our expectations due to strong collections including a large receivable that was previously expected to occur in October; DSOs were 66 days • Cash provided by operating activities from continuing operations $ $ – Q4 ‘10 : 20.6 million with free cash flow* of 14.7 million – Fiscal 2010: $141.0 million with free cash flow* of $118.4 million • In Q4 ‘10, used cash of $17.7 million for the purchase of 307,987 shares of MMS. In September, MAXIMUS Board expanded September the authorization by $100 million and at 30, 2010, MAXIMUS had $122.8 million available under the repurchase program • Healthy cash and cash equivalents totaling $155.3 million at September 30, 2010 * 5 The Company defines free cash flow as cash provided by operating activities, less property, plant and equipment and capitalized software

7%‐11% revenue growth FY 11E Revenue $890‐$920 million Adj d Dil d $3 95 $4 15 9%‐15% earnings growth Adjusted Diluted EPS 3.95‐$4.15 Cash from Continuing Ops $75‐$95 million Free Cash Flow from Cont. Ops $52‐$72 million • At September 30, 2010, 97% of forecasted fiscal 2011 revenue is in the form of backlog/options • Forecast has risks and opportunities that may mean the difference between the top or bottom of the range assumptions – New programs in early phases where timing of cost and revenue may vary from current assumptions – May experience volume fluctuations – Material changes to currency – Don’t anticipate disruption from mid‐term elections but administrations are shifting Ranges are realistic and achievable, including the upper ends; management’s focus is on drivers will result delivery ends to concentrate those that in of the upper ends.

Fourth Quarter – Fiscal Year 2010 November 11, 2010 7 richard a montoni president and chief executive officer

Our Health Services and Human Services realignment has resulted in an enhanced cross‐collaboration and comprehensive go‐to‐market strategy. • Engaging both existing and potential clients at the state and federal levels. Active on conference panels, W bi di d t d t k Webinars and industry and government workgroups • Demonstrating how our services help clients meet increased demand for services and achieve requirements such as expansion health Medicaid expansion, insurance exchanges and long‐term care programs • Pushing new innovations for enhancing BPO modeling and monitoring tools These tools clients optimize tools. help their operations and more effectively manage costs in an era of continued budget pressures

Over the past several months, we’ve further established our presence as a market leader by securing key contracts that represent the blueprint of health care reform. • Signed new 5‐year Eligibility and Enrollment Modernization (EEM) contracts in New York and launched Colorado EEM. These represent the future model for health insurance exchanges • Offer seamless eligibility and are consumer friendly • Awarded new work for high risk pools in California and New York. States doin ith less le era in c rrent infrastr ct re doing more with less; leveraging current IT and BPO infrastructure • New work to assess personal health record for entities not covered by HIPAA for the Office of the National Coordinator (ONC) • Added new three state contracts to provide independent, evidencebased health appeals. With 37 states, MAXIMUS is now the largest Independent Medical Review Organization in the country

Election results and shift in power in House may lead to minor technical fixes to ACA, but major changes less likely • The current law contains many provisions that appear to have bi‐partisan and stakeholder support: • Addressing pre‐existing conditions within high risk pools • Extending health appeals rights to consumers Improving efficiencies and controlling costs of current public insurance programs • States already actively addressing increased costs • Transition traditional fee for service into away from fee‐for‐Medicaid managed care. Efforts are underway in Texas to move more beneficiaries into managed care as a way to control costs

We remain confident that MAXIMUS is a strong contender in the UK’s Work Programme due to our strong performance to date. • UK coalition government implementing austerity measures; key feature is a major welfare reform. Consolidating many welfare‐towork programs into the single ‘back‐to‐work’ Work Programme • Two‐step rebid process progressing as planned; recently submitted bid for a spot on the Buying Framework and expect results for phase one by the end of this month • Buying Framework was established to narrow the field of qualified vendors who will be eligible to bid on Phase two. • Actively preparing for the release of phase two for two, specific contracts within the 11 regional lots set up by the Dept of Work & Pensions • Strong performance to date with a job placement outcome rate at 13 weeks that’s nearly double the national average that s UK

The evolution of social welfare programs in many European countries is well underway. • In Q4 FY 10, 27% of revenue was from international programs Other countries interested in our demonstrated ability to run model programs in a cost‐effective way while meeting key performance outcomes • We are rigorously evaluating each opportunity abroad

At September 30th, backlog increased 17% to a record $2.1 billion. • With 97% of forecasted revenue in the form of backlog, we are optimistic with our FY 11 financial targets • At September 30th, signed contract wins totaled $685 million – Includes new enrollment center contract in New York • At September 30th, new contracts pending (awarded but unsigned) totaled $709 million – Subsequent to quarter close, we signed several contracts, including a five‐year extension for the California Healthy Families program

Pipeline of Opportunities at November 5, 2010 Pipeline Nov. 3, 2009 Nov. 5, 2010 Proposals Pending $342M $238M Proposals in Preparation $339M $111M RFPs Tracking $745M $1,458M Total Pipeline $1,426M $1,807M Fiscal 2011 Rebids • Already secured three bids worth $300 million of the 14 rebids in FY 11 (includes a 5‐year extension on California Healthy Families) • The 11 contracts that remain up for rebid are worth approximately $600 million UK rebid presents a promising opportunity. This bid represents about one‐third of the remaining total contract value up for rebid

Our guidance for fiscal 2011 reflects our success in building a robust pipeline and converting indentified opportunities into wins. • New contracts illustrate the traction we are building with our government partners as they prepare for health care reform • Excited about our prospects in international markets, including the UK • Ready to help our clients meet the challenges of increased demand, new regulations and evolving markets