FINAL TRANSCRIPT

Thomson StreetEvents SM

MMS - Q2 2010 MAXIMUS, Inc. Earnings Conference Call

Event Date/Time: May. 06. 2010 / 1:00PM GMT

C O R P O R A T E P A R T I C I P A N T S

Lisa Miles

MAXIMUS,

Inc. - VP - IR

David Walker

MAXIMUS,

Inc. - CFO

Richard Montoni

MAXIMUS,

Inc. - President, CEO

C O N F E R E N C E C A L L P A R T I

C I P A N T S

Brian Kinstlinger

Sidoti

& Co. - Analyst

Charles Strauzer

CJS

Securities - Analyst

P R E S E N T A T I O N

Operator

Ladies and gentlemen, greetings and welcome to the MAXIMUS Second Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation.

(Operator Instructions)

As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Miss Lisa Miles, Vice President - Investor Relations for MAXIMUS. Thank you, Miss Miles. You may begin.

Lisa Miles - MAXIMUS, Inc. - VP - IR

Good morning. Thank you, for joining us today on today's conference call. I would like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call.

With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments, we will open the call up for Q&A.

Before we begin, I'd like to remind everyone that a number of statements today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 out of our SEC filings.

We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

With that, I'll turn the call over to Dave.

David Walker - MAXIMUS, Inc. - CFO

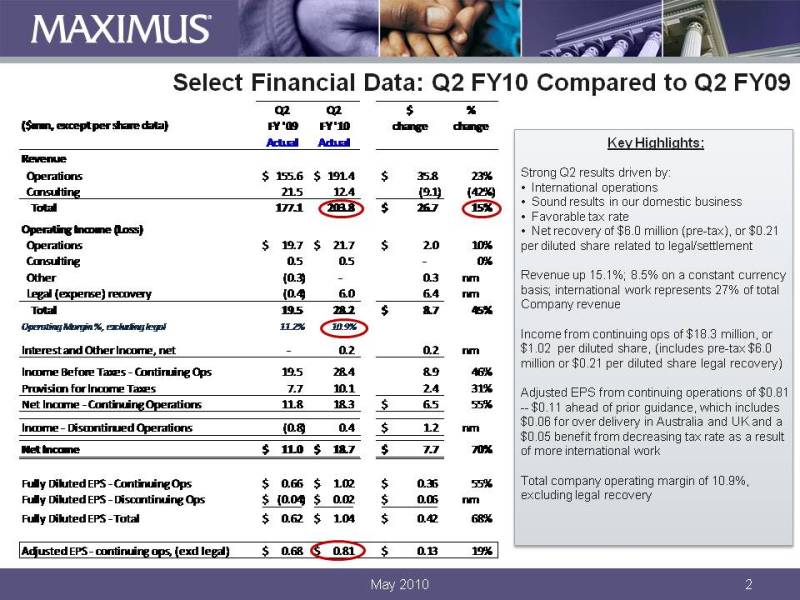

Thank you, Lisa. Good morning, and thanks for joining us. This morning, MAXIMUS reported strong second quarter financial results. These strong results were driven by better than expected bottom line performance in our international employment services operations, sound results in our domestic business and a favorable tax rate. Results also included a net $6 million pretax legal recovery.

For the 2010 second quarter, revenue from continuing operations increased 15% to $203.8 million compared to the same period last year. On a constant currency basis, revenue grew 8.5%. As expected, international revenue continues to grow and in the second quarter accounted for 27% of total company revenue.

Second quarter net income from continuing operations totaled $18.3 million, or $1.02 per diluted share. This included a pretax benefit of $6 million, or $0.21 per share, reported on the legal line of the financial statement, driven primarily by an insurance recovery, which was collected in the quarter.

Excluding the $0.21 legal recovery, adjusted diluted earnings per share from continuing operations were $0.81, which is 40.11 ahead of our prior guidance. Approximately $0.06 is related to over-delivery in our business operations, most notably in Australia and the United Kingdom. The remaining $0.5 reflects the benefit from a decreasing tax rate as our international work becomes a larger part of the overall business mix.

As noted in our press release we've modestly increased our guidance, largely to reflect the favorable results in the quarter as well as the lower tax rate for the remainder of fiscal 2010.

With continued strong top line and bottom line results, we continue to hit our objective of 10-percent-plus total company operating margin. For the second fiscal quarter, MAXIMUS delivered a total company operating margin of 10.9%, which excludes income reported on the legal line.

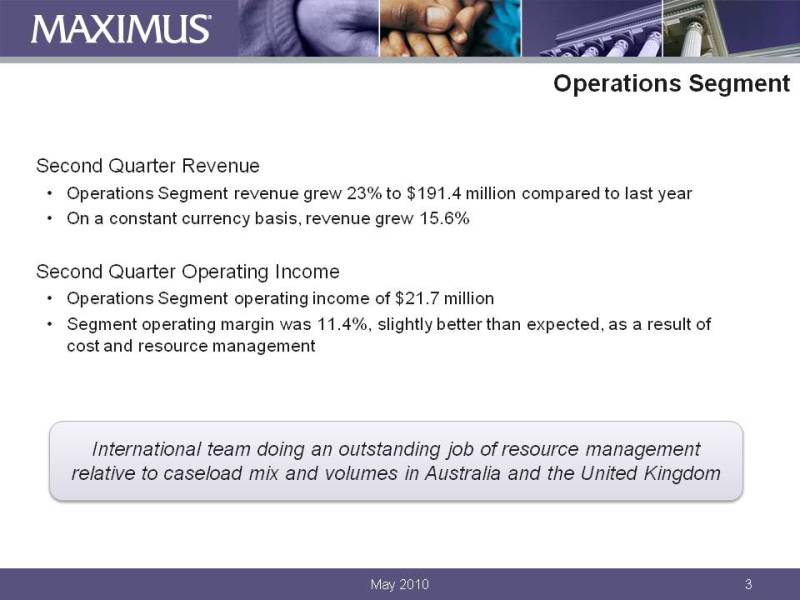

Let's turn our attention to the financial results by segment, starting with the operations segment. For the second quarter, revenue from the operations segment grew 23% to $191.4 million compared to the same period last year, driven by growth in our international employment services operations. On a constant currency basis, operations segment revenue grew 15.6%.

Despite the current state fiscal environment, the domestic BPO business continues to perform well and meet expectations, growing modestly compared to last year. Strong operational delivery in the second fiscal quarter bolstered the segment's operating income by 10.6% to $21.7 million compared to the same period last year.

For the 2010 second quarter, segment operating margin was 11.4%. This margin was better than expected as a result of tight cost management and resource management in our Australia and UK operations. Our ability to manage resources relative to caseload mix and volume is an important component delivering exceptional operational and financial performance.

The team continues to do an outstanding job in managing our international growth. Rich will talk more about the positive operational trends in Australia and the UK, but both programs remain on track with our financial expectations for the remainder of fiscal 2010.

Moving on to the consulting segment, as expected consulting revenue for the second quarter totaled $12.5 million, which decreased compared to the same period in fiscal 2009. The revenue was unusually high in the prior fiscal quarter from delivery of a large passthrough item related to a large education contract.

Also, we exited the RevMax business after the second quarter of last year. Consulting currently constitutes 6% of total company revenue. For the 2010 fiscal second quarter, the consulting segment remained profitable with operating income of $460,000 and margin of 3.7%.

Moving on to the balance sheet and cash flow items, at March 31st, MAXIMUS continued to enjoy healthy cash levels with cash and cash equivalents totalling $121.4 million. During the quarter, day sales outstanding were 68 and in line with our expectations.

With a sharper focus on health and human services business process outsourcing MAXIMUS continues to generate consistently strong levels of cash from a recurring stream of predictable and profitable operations. During the quarter, cash provided by operating activities from continuing operations totaled $21.4 million with free cash flow from continuing operations totaling $17.6 million.

During the quarter, there were both sources and uses of cash, so I'll summarize the major drivers. We received net cash of $6 million, primarily from a legal recovery related to the Accenture settlement.

We used cash of $10.7 million for the acquisition of Canadian-based DeltaWare and other earn-out payments on previous acquisitions. The DeltaWare acquisition is expected to be neutral to earnings in fiscal 2010, and Rich will talk more about how the acquisition will complement our core business offerings.

Relative to our share repurchase program we used cash of $5.9 million for the purchase of approximately 120,000 shares of MAXIMUS common stock during the second quarter. In March 31, $45 million remains available for future stock repurchases under the current authorization.

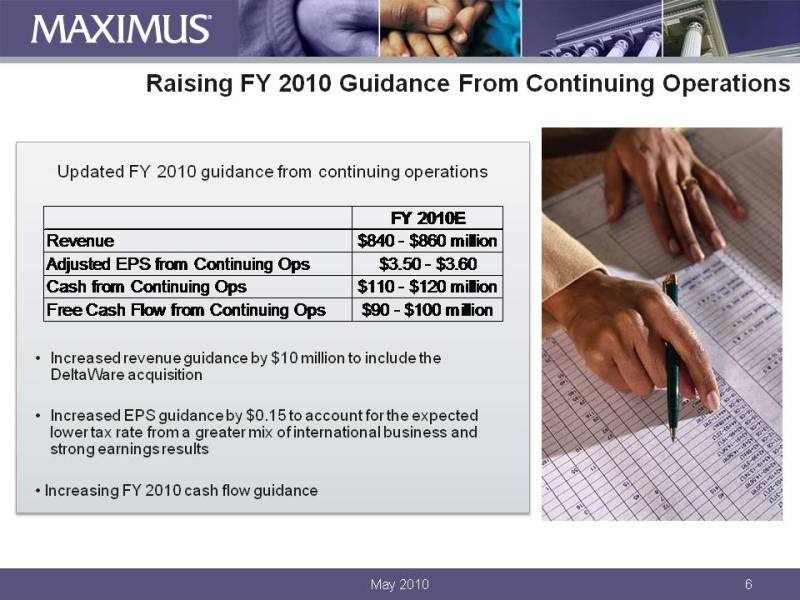

Moving on to guidance, we are increasing our fiscal 2010 revenue guidance by $10 million to include the DeltaWare acquisition. We now expect revenue for fiscal 2010 to range between $840 million and $860 million.

While we expect DeltaWare to be neutral to earnings, we are making an upward revision to our earnings per share guidance to account for the expected lower tax rate resulting from a greater mix of international business and better than expected results in the second quarter. On the bottom line, we now expected 2010 diluted earnings per share from continuing operations to be in the range of $3.50 to $3.60 per share.

Similarly, we are increasing our fiscal 2010 cash flow guidance. We now expect cash provided by operating activities derived from continuing operations to be in the range of $110 million to $120 million and free cash flow from continuing operation of $90 million to $100 million.

Thank you, for your continued support. With that, I'll turn the all over to Rich.

Richard Montoni - MAXIMUS, Inc. - President, CEO

Thanks, David. Good morning, everyone, and thank you for joining us today. Once again, I am pleased to be reporting on our progress on the heels of another strong quarterly performance.

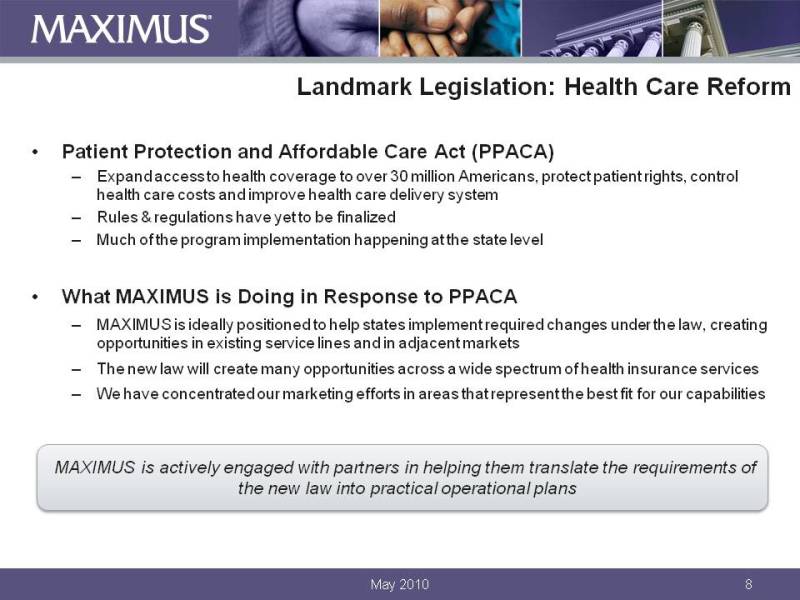

Since our last call, President Obama signed comprehensive healthcare reform legislation into law. This landmark legislation entitled the Patient Protection and Affordable Care Act is set to expand access to healthcare coverage to over 30 million Americans, protect patient rights, control healthcare cost and improve the healthcare delivery system.

Now, while the associated rules and regulations have yet to be finalized and much of the details of administering the expansion of health insurance have yet to be determined, we are pleased that the bulk of the program implementation is happening at the state level. Naturally, we also see opportunities at the federal level.

As the leading pure-play provider in the administration of government, health and human services programs, MAXIMUS is ideally positioned to help states implement the many programmatic changes required under the new law. MAXIMUS brings thought leadership and demonstrated operational success to help stated navigate these transformative times.

We believe that many provisions within healthcare reform create opportunities for organic growth in our existing lines of service as well as new adjacent markets that build upon our core competencies.

While the new law is expected to create many opportunities across a wide spectrum of health insurance services, we're concentrating our marketing efforts in those key areas that represent the best fit for our core capabilities.

Across these priority areas we have assigned leaders and added marketing resources. We are actively engaged with our partners at the state and federal level and are working with various associations to help translate the requirements of the new law into practical operational plans.

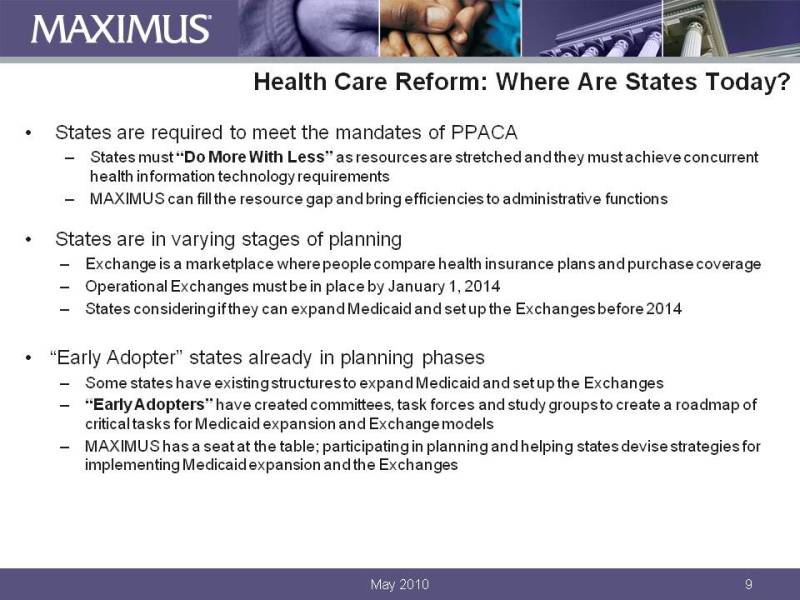

It's important to understand where states are today in their healthcare reform planning processes.

First, states are required, and in some regards they are stretched to address the mandates of the new law while achieving concurrent health information technology requirements. MAXIMUS is ready to help mitigate the resources gap, to help our clients plan, and implement in this environment of doing more with less. We bring efficiencies to administrative functions, which can relieve some of the fiscal pressure faced by states.

Second, although all states are considering whether they can expand Medicaid and set up the health insurance exchanges before the 2014 deadline, they are approaching the planning and design phase with a varying individual pace.

For those of you who are not familiar with the concept of health insurance exchanges, exchange is simply a marketplace where people can compare health insurance plans and purchase coverage in an efficient and consumer friendly way.

Some states are taking a more cautious approach to the design phase while others have existing structures and funding to expand Medicaid early and set up the exchanges. These early adopter states are already creating committees, task forces, and study groups to prepare a road map of critical task, the expansion and exchange models.

We are participating in these planning discussions and helping states devise their strategies for dealing with the legislative program expansions and creation of additional programs including those under the new exchanges.

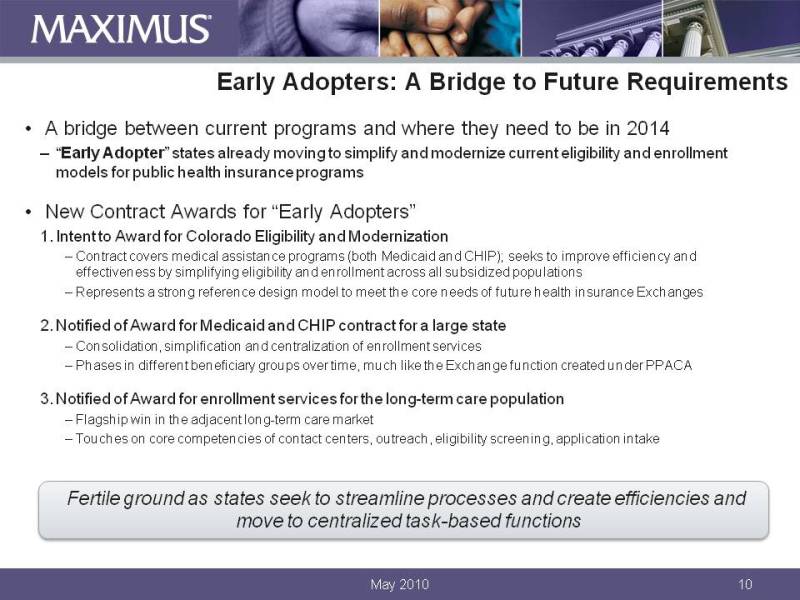

Many of the Early Adopter states have already moved to simplify and modernize their current eligibility enrollment models for public health insurance programs, like Medicaid and CHIP. We believe these new models will serve as a bridge, between where states are today in their eligibility enrollment systems and processes and where they need to be by 2014.

In fact, MAXIMUS is in the trenches already helping some states outline implementation road maps to meet the new requirements. We recently received notification of intent to award for the eligibility and modernization of Colorado's medical assistance programs. This includes CHIP and Medicaid.

The state is seeking to approve the overall efficiency and effectiveness of these programs by the modernization and simplification of eligibility enrollment services across all subsidized populations.

The new Colorado project represents an important win for two reasons. First, it further expands our market share and gives us good qualifications as other states look to modernize their programs.

Secondly, new eligibility enrollment platforms of this type, they represent a strong reference design model to meet many core needs of the future states health insurance exchanges. At the same time, the Colorado project represents our second state contract win related to modernization and simplification of eligibility and enrollment services.

We've previously announced the award of a multi-year Medicaid and CHIP contract that includes the consolidation, simplification and centralization of enrollment services for a large state. That same contract also includes work to provide beneficiaries with a single point of entry and to target those who are currently uninsured, phasing in different beneficiary groups over time, much like the exchange function created under the new law.

This is fertile ground as governments must seek new ways to streamline processes and create programs that are more efficient. In the current political and economic climate, many governments are moving away from a localized approach to centralized functions.

Under the new health care reform law, states must create efficiencies in how they determine and process eligibility for programs like Medicaid and CHIP, moving away from a case worker approach, which is high touch but inefficient. Moving towards a centralized task based function.

Another important provision within the law lays the groundwork for overhauling the long-term care system to promote greater usage of home and community based services. Consumers and advocacy groups want to move away from the most costly institutional services for seniors and individuals with disabilities.

Helping states implement changes in long term care service delivery, touches on many of our core competencies, including contact centre operations, outreach, materials development, eligibility screening, application intake and processing, choice counseling, selection of providers, quality assurance and oversight, financial transaction processing and core course development.

We see a similar Early Adopter situation in the long term care market. In many states, agencies use a case-worker approach to help people apply for long-term care programs, however, we are starting to see states implement centralized and streamline administrative models.

As I mentioned last quarter, a large state selected MAXIMUS to provide enrollment assistance for individuals with disabilities seeking long term care services. This is a new flagship program for MAXIMUS. This provides us with a strategic win in an adjacent market where we see significant opportunities unfolding over the next several years.

As states are adapting to new ways to meet the needs of aging and disabled populations that require long term care, these contracts will likely be used as platforms for the long term care components of the health care reform law.

Overall, states are at varying points of readiness along the planning continuum for health care reform. This works to our advantage as we can best balance resources to meet a steady stream of demand. At this point, we are quite pleased to be partnering with the Early Adopter states.

Our extensive experience in Medicaid and CHIP, working in partnership with these states will help us gain additional insights and continue to develop best practices that we can later leverage as we work with states that will need assistance.

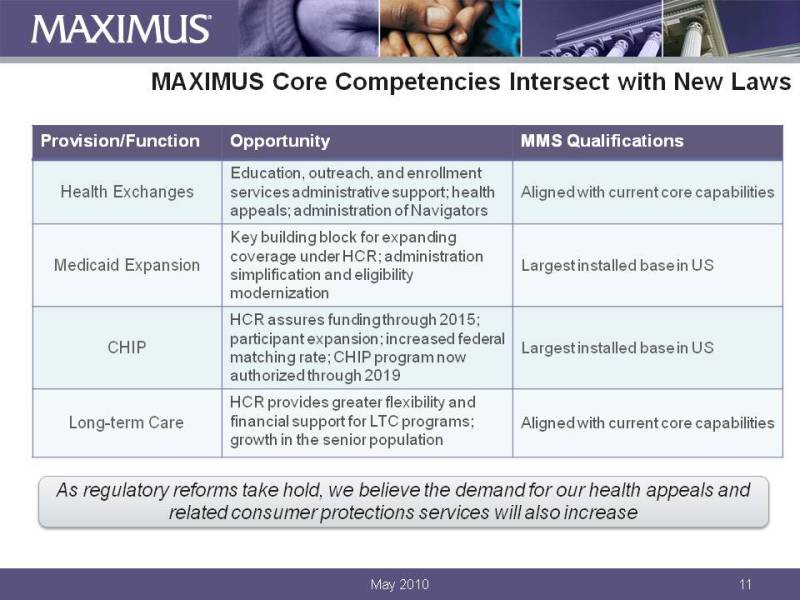

Ultimately, however, all states will need to have a Medicaid expansion model and state health insurance exchange in place by 2014. Under the health insurance exchanges provision of the law states must create one or more exchanges to expand access to health insurance options for individuals and for small businesses.

The goal of the exchange is to provide a seamless experience for beneficiaries who traverse the program boundaries between public health insurance programs like Medicaid, and the subsidized and unsubsidized coverage offered through the exchange. Our experience, serving a large portion of our nation's low and moderate income populations leaves us well equipped to ensure a positive consumer experience and maximize beneficiary choice on behalf of our state clients.

As most of you know, the new law uses Medicaid expansion as a key building block for expanding coverage, we think to about 16 million individuals. And expansion of this magnitude may serve as a tipping point, where states may need to turn to a partner to fill resource gaps.

MAXIMUS has the largest installed base in the nation, with the necessary infrastructure, people and resources in place to help states deal with expansion in an efficient and effective way. In addition to Medicaid, the Children's Health Insurance Program, or CHIP, remains a core stone of health care reform and the new law sustains program funding for CHIP through 2015. This is two years beyond the most recent CHIP Re-authorization Act of 2009.

After 2015, other improvements will be enacted including participant expansion, and increased federal matching rates. MAXIMUS can help states achieve their goals for expansion and maximization of the benefits of the new CHIP options for their low to moderate-income families.

Further, as millions of Americans gain insurance coverage for the first time and regulatory reforms take hold, we believe that the demand for our capabilities in the areas of health appeals and related consumer protection services are also likely to increase. While these represent just a few solutions in our portfolio, we believe they will resonate with governments as they seek to meet programmatic goals under health care reform.

Turning now to our growing international markets, we are on track for our international revenue to reach approximately 30% of our total business mix by fiscal year end. We see increased demand internationally as governments contend with social issues related to increasing health care demands, aging populations, job and employment services and a rising number of cases with increased complexity.

We are excited with our progress on our new projects in Australia and the United Kingdom. We are meeting the key performance requirements for both contracts. Consistent with our strategy of land, execute and expand. We are actively pursuing new opportunities in both of these markets.

In the UK, we expect to hear a decision on Phase 2 of the Flexible New Deal, which would represent a geographic expansion of the work we're already doing.

We are also seeking to expand our presence where we completed an acquisition in the [Corps]. DeltaWare and MAXIMUS have long been partners in British Colombia. We've enjoyed a rewarding relationship and the acquisition is a natural fit that complements our core offerings. DeltaWare brings new capabilities to MAXIMUS and broadens our portfolio in the adjacent e-health, medical claims and drug information systems markets.

We are well positioned in our international markets and believe there are many opportunities to further penetrate and gain market share within our current markets.

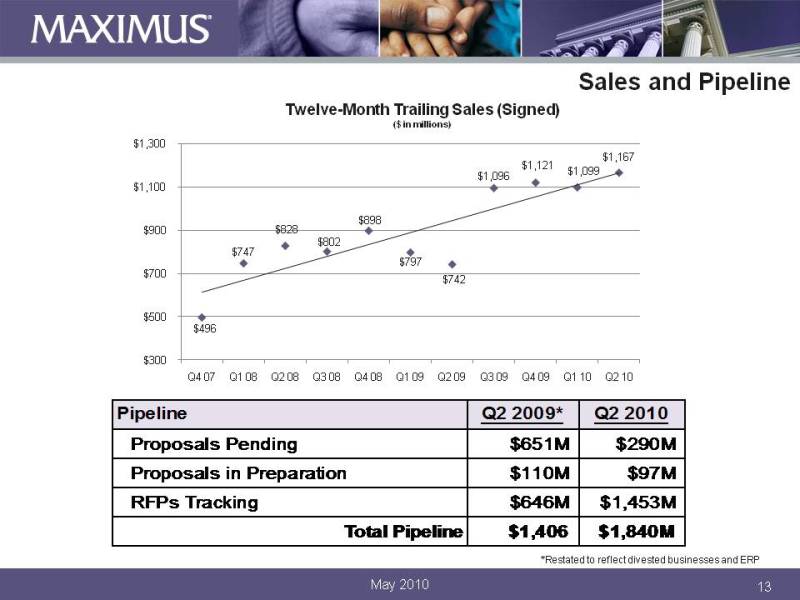

Turning now to Sales and pipeline. At May 4, we had new signed awards at $303.7 million and new contracts pending of $470.4 million. The increase in the awarded unsigned category, this quarter, is really just due to timing of final contract negotiations and signature. We have a number of contract set to be signed in the coming weeks, so we expect to have the bulk of them signed by the time we report third quarter earnings.

Our total pipeline of new opportunities remains quite healthy at $1.8 billion. We continue to see a good stream of domestic and international opportunities and we remain optimistic with the current level of RFP and bidding activity.

In closing, we're very pleased with another strong quarter, highlighted by our solid operational and financial delivery in our international markets, where we continue to see significant opportunities for our core offerings.

We are also excited about the many long-term opportunities we see as healthcare reform unfolds over the next several years. Yes, we've already gained early traction with bridge programs that are laying the groundwork and helping states devise their road map to achieve the fundamental requirements under the new law. But as important, we see healthcare reform as a decades' long growth driver.

With our proven capabilities and experience, MAXIMUS combines thought leadership and proven strategies to help our state and federal clients. We are excited to build upon our leadership position and long-standing client relationships to meet the challenges and opportunities in this fast evolving global health and human services market.

With that, let's open it up for questions. Operator?

Q U E S T I O N S A N D A N S W E R S

Operator

Thank you. Ladies and gentlemen, at this time, we will be conducting a question and answer session. (Operator Instructions). Our first question today comes from the line of Brian Kinstlinger with Sidoti and Company. Please proceed with your question.

Brian Kinstlinger - Sidoti & Co. - Analyst

Great. Thanks. Good morning. The -- when I look at the international business, where you're saying the margins are better than you would have expected, is that being driven more by more cases or more placements? Then as a result of this higher margin, are your margins approaching the average for the company or will that still happen a year or two out?

David Walker - MAXIMUS, Inc. - CFO

Hey, Brian. It's Dave Walker. How are you this morning.

Brian Kinstlinger - Sidoti & Co. - Analyst

Great. Thanks.

David Walker - MAXIMUS, Inc. - CFO

Good. Good. Hey, really the benefit and the trick to managing that business is managing the mix of cases. They aren't all created equal in terms of what we could pay per case. So it's a matter of math, balancing the mix with the staff required to do it. They actually -- Barry did a very skillful job of doing that. So it's really in the costs more than it is the cases.

So the cases are coming in as expected, but we were able to mix and blend the staff levels to achieve the objectives. So it's cost management.

Brian Kinstlinger - Sidoti & Co. - Analyst

But revenue is being driven by cases right now and not placements so much?

David Walker - MAXIMUS, Inc. - CFO

That's right.

Brian Kinstlinger - Sidoti & Co. - Analyst

Okay. Then my second question is, though, Rich, you mentioned timing was the key issue awarded, but on the signed contracts keep growing. I think it is the second straight all-time high you've had. So I'm wondering if there's any more behind timing, such as budgets?

Then, when I look at this -- the second quarter bookings, based on where you're awarded, but unsigned contracts for last quarter, I would have expected them to be higher. So maybe talk about those, please?

Richard Montoni - MAXIMUS, Inc. - President, CEO

I'd be glad to talk about them, Brian. As it relates to the amount that we have in the unsigned category, there's really -- it's really pretty simple. There's three large contracts that we've been awarded. I talk about them -- I believe I talk about two of them in the call notes. I view it as really normal core is just the complicity of getting something through government approval.

Three of them, which are actively in the process of being finalized, constitutes 90% of that balance in the unsigned category. Our expectation is that we're going to have those buttoned up by the time we talk next quarter.

Brian Kinstlinger - Sidoti & Co. - Analyst

So I'm going to squeeze one more in, because normally maybe the Medicaid and CHIP contracts, it sounded like you mentioned one of those and enrollment contracts have some start-up costs or they have at points in time. Will these have start-up costs?

Richard Montoni - MAXIMUS, Inc. - President, CEO

No, I don't think we've got significant start-up costs associated with these. Any such start-up costs are factored into our expectations at this point, in signing those contracts.

David Walker - MAXIMUS, Inc. - CFO

Yes, (inaudible).

Richard Montoni - MAXIMUS, Inc. - President, CEO

The other point you had raised, I wanted to answer the second half of your question as it relates to the signed awards year-to-date, which I think are relatively comparable to the first quarter. I think it's -- there's no big, large, particular award. I think it's normal course and, again, if you look at it quarter-to-quarter, we do see lumpiness in those statistics. But overall, we're very pleased with the level of new business we have in front of us year-to-date and I'd say short term as well as long term.

Brian Kinstlinger - Sidoti & Co. - Analyst

Great. I'll get back in the queue. Thanks.

Richard Montoni - MAXIMUS, Inc. - President, CEO

Thank you.

Operator

Thank you. (Operator Instructions). Our next question comes from the line of Charles Strauzer with CJS Securities. Please proceed with your question.

Charles Strauzer - CJS Securities - Analyst

Hi. Good morning.

Richard Montoni - MAXIMUS, Inc. - President, CEO

Good morning, Charles. How are you?

Charles Strauzer - CJS Securities - Analyst

Good, Rich. Thanks for taking my questions. Just a quick thing, if you look at the pipeline, it looks very strong. Especially when I look at the RFPs tracking up year-over-year, and one that double. You talk about some of the areas that you're most excited about there and also particularly are you seeing any push-back from the states in terms of the budget and the problems they're having in terms of maybe the lengthening of the sales cycle there?

Richard Montoni - MAXIMUS, Inc. - President, CEO

I'd be glad to talk about that. We are excited about where the pipeline stands and there is a significant increase in the RFP tracking. I think a lot of it, we're getting traction on the international side. We've got some exciting opportunities, not only in the United Kingdom, but in Canada and even in the United States, we have some very significant opportunities.

We talked about the -- those early adopters who are kind of out front and taking a look at their systems and improving their systems, really getting ready for healthcare reform requirements.

So I think that's what's driving the excitement and the improvement, the continued improvement, in that pipeline number. I think that's a couple of years now running where we're seeing sort of continuous improvement and that RFP tracking number.

As it relates to the states, that an interesting topic for discussion. It's been a worry point for everybody as we've gone through a pretty serious recession. There's been a lot of focus on the Californias of the world and other states.

I don't think it's fair to say that all states are up from underneath it. I think they're going to continue to struggle and watch their spend, not only in the rest -- I think the rest of fiscal '10, it's pretty much in hand. But fiscal '11 will have continued challenges.

We may see reductions on the margin. But there's -- as we've experienced in prior sessions, those reductions on the margin have not been material. I think in the prior year, we added it up and it was about 1.5% of our revenues. So it was immaterial and we managed to not only recover that, but still add significant growth on top of it.

So I look for much the same. The one ray of light is that we're starting to see some breaking in the clouds, if you will, with discussions that the recession may be over. We're seeing corporations report increased earnings and hence that does mean increased tax revenues to the states. So that could be helpful from that perspective.

So I think it's -- that one is in the category of perhaps in the direction of good news. So we'll continue to monitor it.

Charles Strauzer - CJS Securities - Analyst

Excellent. Just for a quick follow-up, when you look at your margins of roughly 11% in the quarter and kind of rapidly approaching the low-teens as the year progresses, if our numbers are correct, it seems that you're kind of your goal -- on track to kind of hit your long-term objectives of more of a kind of mid-teens operating margin, even maybe next year. Is there anything that could get in the way of you getting there?

Richard Montoni - MAXIMUS, Inc. - President, CEO

Boy, longer term, and we've always -- and years back, we started -- we said we'd be at 10% plus operating margin, 10% top-line grower. We've delivered handily over the 10% and it seems to -- the flux seems to be, right now, the big drivers and flux seems to be seasonality. So as you know, we do have a tax credit business that loses money in Q1 and Q2, makes money in Q3 and Q4. Believe it or not, while it's not a very big business, the margin flux is significant enough to move the needle in terms of operating income percentage. So that's always a factor year-to-year.

Then we'll see flux in the margin as it relates to new work that we take on or if that we've got large projects that are towards the tail-end of their maturity, where they may be more profitable, that will move the margin year-to-year.

I think it's premature to say we've got a beat on mid-teens in terms of operating margin percentage. I think we're sticking to our current mantra as it relates to where we think our margins could be.

Charles Strauzer - CJS Securities - Analyst

Excellent. Rich, congratulations again, to you and the team on doing an excellent job.

Richard Montoni - MAXIMUS, Inc. - President, CEO

Well, thanks, Charles. I appreciate that very much.

Charles Strauzer - CJS Securities - Analyst

You got it.

Operator

Thank you, ladies and gentlemen. (Operator Instructions). Thank you, ladies and gentlemen, but we have no further questions at this time. I'd like to turn the call back to management.

Lisa Miles - MAXIMUS, Inc. - VP - IR

We just want to thank everyone very much for joining us today and if you have any additional questions, please feel to -- feel free to give us a call and follow-up. Have a great day.

Richard Montoni - MAXIMUS, Inc. - President, CEO

Thank you.

Operator

Ladies and gentlemen, this concludes today's teleconference and you may disconnect your lines at this time. Thank you for your participation.

D I S C L A I M E R

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2010, Thomson Reuters. All Rights Reserved.

David N. Walker Chief Financial Officer and Treasurer Second Quarter - Fiscal Year 2010

Select Financial Data: Q2 FY10 Compared to Q2 FY09 May 2010 Key Highlights:Strong Q2 results driven by:International operationsSound results in our domestic businessFavorable tax rate Net recovery of $6.0 million (pre-tax), or $0.21 per diluted share related to legal/settlementRevenue up 15.1%; 8.5% on a constant currency basis; international work represents 27% of total Company revenueIncome from continuing ops of $18.3 million, or $1.02 per diluted share, (includes pre-tax $6.0 million or $0.21 per diluted share legal recovery)Adjusted EPS from continuing operations of $0.81 -- $0.11 ahead of prior guidance, which includes $0.06 for over delivery in Australia and UK and a $0.05 benefit from decreasing tax rate as a result of more international workTotal company operating margin of 10.9%, excluding legal recovery

Operations Segment Second Quarter RevenueOperations Segment revenue grew 23% to $191.4 million compared to last year On a constant currency basis, revenue grew 15.6%Second Quarter Operating IncomeOperations Segment operating income of $21.7 millionSegment operating margin was 11.4%, slightly better than expected, as a result of cost and resource management May 2010 International team doing an outstanding job of resource management relative to caseload mix and volumes in Australia and the United Kingdom

Consulting Segment Second quarter revenue totaled $12.5 millionDecreased compared to Q2 09 which was unusually high from delivery of a large pass-through item related to an education contract; we also exited the RevMax business after Q2 09 Operating income of $460,000Operating margin of 3.7%Consulting revenue currently constitutes 6% of total Company revenue

Balance Sheet & Cash Flow Healthy cash and cash equivalents totaling $121.4 million at March 31, 2010 Fourth quarter DSOs of 68 days, well within our expectations of 65-80 days Cash provided by operating activities from continuing operations totaled $21.4 million; free cash flow* from continuing operations of $17.6 millionUse of cash in the quarter:Received net cash of $6.0 million primarily from a legal recovery related to the Accenture settlementUsed cash of $10.7 million for the acquisition of DeltaWare and other earn-out payments on previous acquisitions Used cash of $5.9 million for the purchase of 120,040 shares of MAXIMUS common stock. At March 31, 2010, $45 million remains available under the Board-authorized program The Company defines free cash flow as cash provided by operating activities, less property, plant and equipment and capitalized software With a sharper focus on health and human services BPO, MAXIMUS continues to generate consistently strong levels of cash from a recurring stream of predictable and profitable operations

Raising FY 2010 Guidance From Continuing Operations Updated FY 2010 guidance from continuing operations Increased revenue guidance by $10 million to include the DeltaWare acquisitionIncreased EPS guidance by $0.15 to account for the expected lower tax rate from a greater mix of international business and strong earnings results Increasing FY 2010 cash flow guidance

Richard A. Montoni President and Chief Executive Officer Second Quarter - Fiscal Year 2010

MAXIMUS is actively engaged with partners in helping them translate the requirements of the new law into practical operational plans Body: Patient Protection and Affordable Care Act (PPACA)Expand access to health coverage to over 30 million Americans, protect patient rights, control health care costs and improve health care delivery systemRules & regulations have yet to be finalizedMuch of the program implementation happening at the state levelWhat MAXIMUS is Doing in Response to PPACAMAXIMUS is ideally positioned to help states implement required changes under the law, creating opportunities in existing service lines and in adjacent marketsThe new law will create many opportunities across a wide spectrum of health insurance servicesWe have concentrated our marketing efforts in areas that represent the best fit for our capabilities Landmark Legislation: Health Care Reform

Health Care Reform: Where Are States Today? Body: States are required to meet the mandates of PPACAStates must “Do More With Less” as resources are stretched and they must achieve concurrent health information technology requirementsMAXIMUS can fill the resource gap and bring efficiencies to administrative functionsStates are in varying stages of planningExchange is a marketplace where people compare health insurance plans and purchase coverageOperational Exchanges must be in place by January 1, 2014 States considering if they can expand Medicaid and set up the Exchanges before 2014“Early Adopter” states already in planning phasesSome states have existing structures to expand Medicaid and set up the Exchanges“Early Adopters” have created committees, task forces and study groups to create a roadmap of critical tasks for Medicaid expansion and Exchange modelsMAXIMUS has a seat at the table; participating in planning and helping states devise strategies for implementing Medicaid expansion and the Exchanges

Early Adopters: A Bridge to Future Requirements Body: A bridge between current programs and where they need to be in 2014“Early Adopter” states already moving to simplify and modernize current eligibility and enrollment models for public health insurance programsNew Contract Awards for “Early Adopters”Intent to Award for Colorado Eligibility and Modernization Contract covers medical assistance programs (both Medicaid and CHIP); seeks to improve efficiency and effectiveness by simplifying eligibility and enrollment across all subsidized populationsRepresents a strong reference design model to meet the core needs of future health insurance ExchangesNotified of Award for Medicaid and CHIP contract for a large stateConsolidation, simplification and centralization of enrollment servicesPhases in different beneficiary groups over time, much like the Exchange function created under PPACANotified of Award for enrollment services for the long-term care populationFlagship win in the adjacent long-term care marketTouches on core competencies of contact centers, outreach, eligibility screening, application intake Fertile ground as states seek to streamline processes and create efficiencies and move to centralized task-based functions

MAXIMUS Core Competencies Intersect with New Laws As regulatory reforms take hold, we believe the demand for our health appeals and related consumer protections services will also increase

Remain on track for international revenue to reach approximately 30% of total mix of business by fiscal year end Meeting all the key performance requirements in both Australia and the U.K. Actively pursuing new opportunities in international markets, including the U.K. where we are awaiting a decision on Phase 2 of the Flexible New Deal which represents a geographic expansion of the work we’re already doingExpanding presence in Canada; Acquired DeltaWareComplements core offeringsBrings new capabilities to MAXIMUS and broadens portfolio in the adjacent e-health, medical claims and drug information systems markets International Business Update

Sales and Pipeline Restated to reflect divested businesses and ERP Twelve-Month Trailing Sales (Signed)($ in millions)

Solid second quarter results highlighted by our solid operational and financial delivery in our international marketsExcited about the many long-term opportunities as Health Care Reform unfoldsGained early traction with ‘bridge’ programs that are laying the groundwork in helping states devise a roadmap to achieve the fundamental requirements under the new Health Care Reform laws Health Care Reform will be a decades-long growth driver MAXIMUS combines thought leadership and proven strategies to meet the challenges and opportunities in the global health and human services market