Exhibit 99.2

FINAL TRANSCRIPT

Thomson StreetEvents

MMS - Q1 2010 MAXIMUS, Inc. Earnings Conference Call

Event Date/Time: Feb. 04. 2010 / 2:00PM GMT

C O R P O R A T E P A R T I C I P A N T S

Lisa Miles

MAXIMUS, Inc. - Vice President of Investor

Relations

David Walker

MAXIMUS, Inc. - CFO

Rich Montoni

MAXIMUS, Inc. - President, CEO

Bruce Caswell

MAXIMUS, Inc. - President and General Manager

of the Health Services Segment

C O N F E R E N C E C A L L P A R T I C I P A N T S

Lee Jagoda

CJS Securities - Director

George Price

Stifel Nicolaus - Principal

Brian Kinstlinger

Sidoti & Company - Equity Analyst

Richard Glass

Morgan Stanley - Analyst

P R E S E N T A T I O N

Operator

Please stand by for realtime transcript. The MAXIMUS, Inc. conference call will begin momentarily. +++ presentation Greetings and welcome to the MAXIMUS first quarter conference call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation.(Operator instructions). As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Ms. Lisa Miles, Vice President Investor Relations for MAXIMUS. Thank you, Ms. Miles, you may now begin.

Lisa Miles - MAXIMUS, Inc. - Vice President of Investor Relations

Good morning. Thank you for joining us today on today's conference call. I would like to point out that we have posted a presentation to our website under the investor relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Richard's prepared comments we will open the call up for Q&A. Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 out of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I will turn the call over to Dave.

David Walker - MAXIMUS, Inc. - CFO

Thank you, Lisa. Good morning, and thanks for joining us. This morning, MAXIMUS reported strong first quarter financial results driven by better than expected performance in the company's international employment services operations. In both Australia and the United Kingdom the sound performance was driven by strong revenue delivery, favorable case load mixes and volumes, as well as prudent resource management. I'll provide program-specific details during our segment discussion.

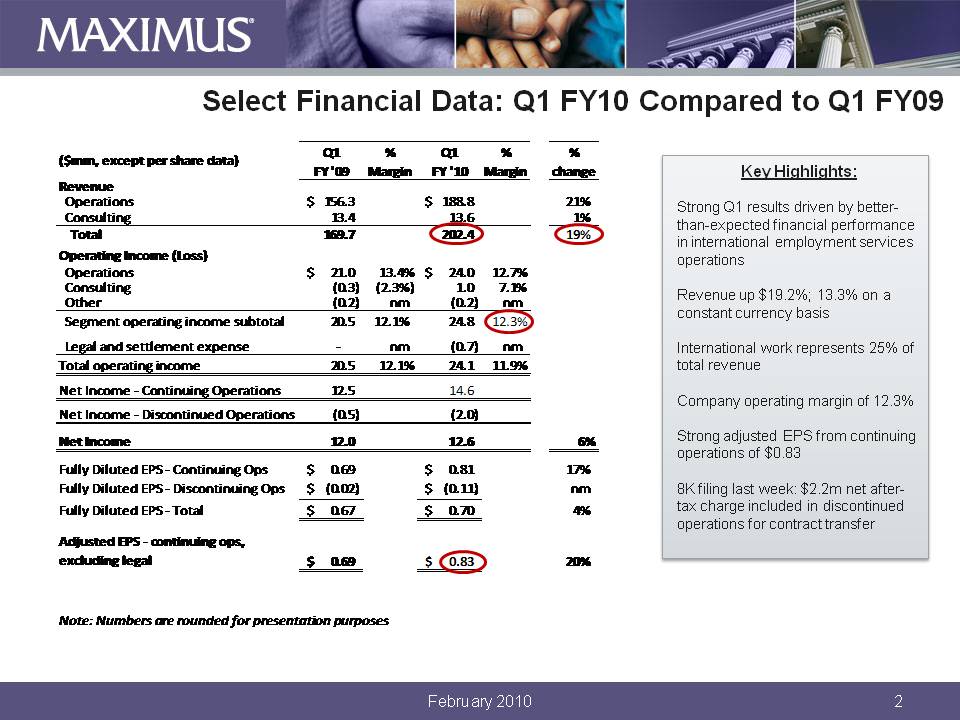

For the 2010 fiscal first quarter, revenue from continuing operations grew 19.2% to $202.4 million, compared to $169.7 million reported for the same period last year. On a constant currency basis, revenue grew 13.3% compared to last year, and nearly all growth was organic. International work accounted for 25% of total company revenue in the quarter. With exceptional top-line contributions from our international operations and solid contributions from our US operations, MAXIMUS delivered total company operating margin of 12.3% for the first fiscal quarter, which excludes legal. This translated into strong first quarter net income from continuing operations, which grew 17.5% to $14.6 million, compared to $12.5 million last year. Adjusted diluted earnings per share from continuing operations totaled $0.83 a share for the first quarter versus $0.69 reported for the same period last year.

As noted in our 8-K filing last week, we took another step towards the planned investment of the ERP division and mutually agreed to transfer a project back to a [transsent] client. As discussed in prior disclosures this contract had contributed to sizable losses over the last two years. As part of the agreement, we booked a net after-tax charge of $2.2 million, included in the results from discontinued operations. This had no impact on results or forward guidance from continuing operations. With the transfer of this contract, discontinued operations are expected to be mildly accretive in the future, as we continue to focus on the planned divestment of the remaining ERP division.

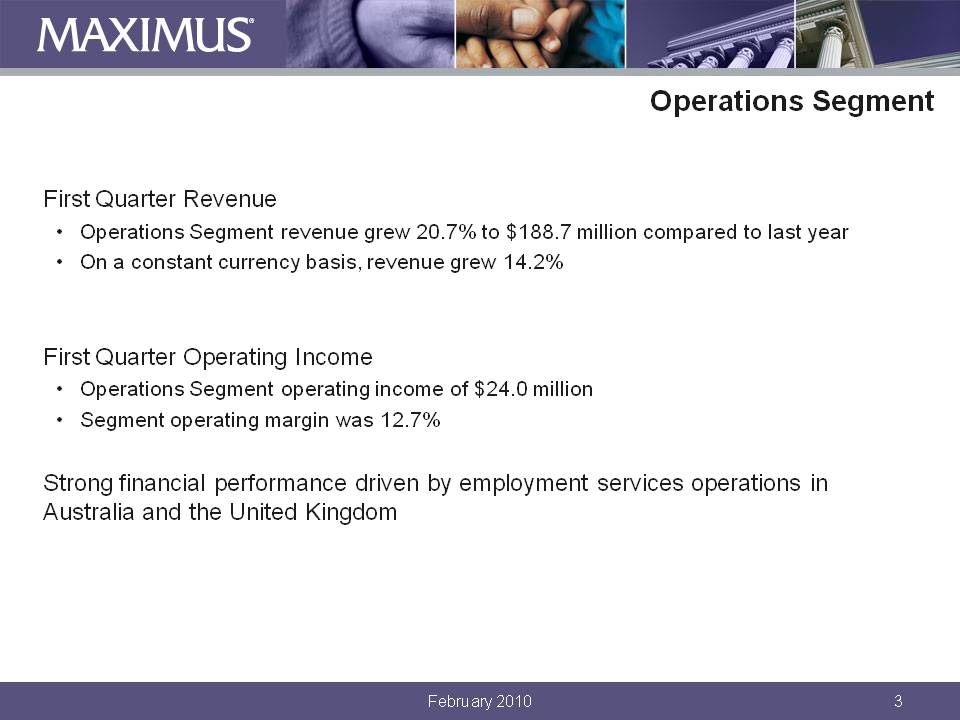

Let's turn our attention to financial results by segment starting with the operations segment. For the first quarter, revenue from operation segment grew 20.7% to $188.7 million, compared to the same period last year. On a constant currency basis, operation segment revenue grew 14.2%. Year-over-year revenue growth was driven principally by our international work. The domestic business met expectations and grew modestly compared to last year. Strong revenue delivery in Australia and the UK helped drive first quarter operating income for the operations segment to $24 million, or an operating margin of 12.7%.

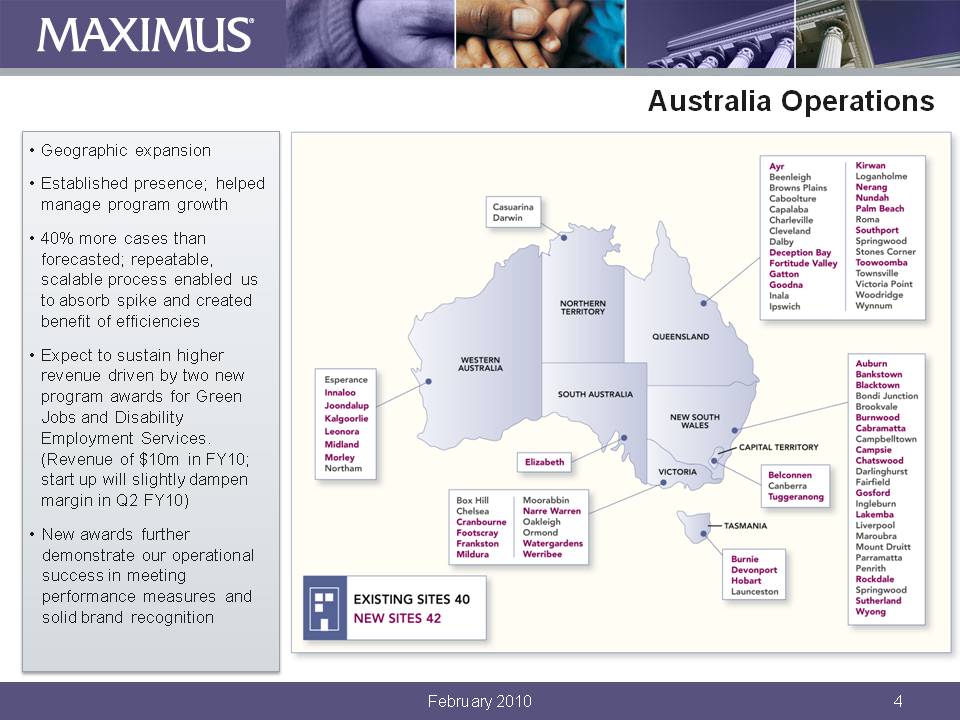

Let's turn our attention to the performance details in the Australian and the United Kingdom programs. Starting in Australia, where we benefited from a sizable geographic expansion on an existing program. Our well-established presence in Australia coupled with our proficiency in understanding the government's goals and objectives allowed the team to nicely manage the growth of this important program. In fact, during the quarter, case loads came on much stronger than initially expected, and we managed nearly 40% more cases than forecasted. Because our operations are built upon a repeatable and scalable process, we were able to absorb the spike in cases, which created an additional benefit of operational efficiencies. We do expect that the volumes will return to more normalized levels during the course of the year. However, we expect to sustain the higher revenue levels due to two new incremental programs that were recently awarded to MAXIMUS in Australia. The new work will begin contributing later in this fiscal year.

On a combined basis, the two new programs are expected to contribute just under $10 million in revenue in fiscal 2010. Startup will slightly dampen margin in the second quarter, but we do expect them to be break-even for the full year. The new work is right in our sweet spot. Under the first one, we are supporting employment initiatives that are tied to the government's green jobs program. The second piece of work is to provide disability employment services. This is similar to what we do here in the states for the Federal government's Ticket to Work program, where we help individuals with disabilities find meaningful employment to achieve self-sufficiency. Winning this new work further demonstrations our operational success, in meeting performance measures, and our ability to capitalize on our solid brand recognition in Australia. Frankly, the Australian team has done an exceptional job of growing the business base and managing in an effective and profitable manner.

Revenue in the UK came in as expected for the quarter. The costs were lower. The program was nearly break-even for the quarter, where we previously expected a loss. While the cases were slow to start,they have picked up to expected contractual levels within the last 30 to 45 days. So we still expect the program to achieve profitability in the second half of the year. With the benefit of a few months of operational trends under our belt in the UK, we still expect revenue in fiscal 2010 to total approximately $20 million, when the program is fully ramped in fiscal 2011, revenue is expected to be about $40 million a year, and nicely profitable.

Moving on to the consulting segment. Revenue for the first quarter totaled $13.6 million, which was comparable to the same period last year. For the first fiscal quarter, the consulting segment delivered operating income of $970,000, and margin improved to 7.1%. Performance in the quarter was improved as the team focused on the fundamentals such as labor utilization, and cost management. The segment also benefited from a better mix of work.

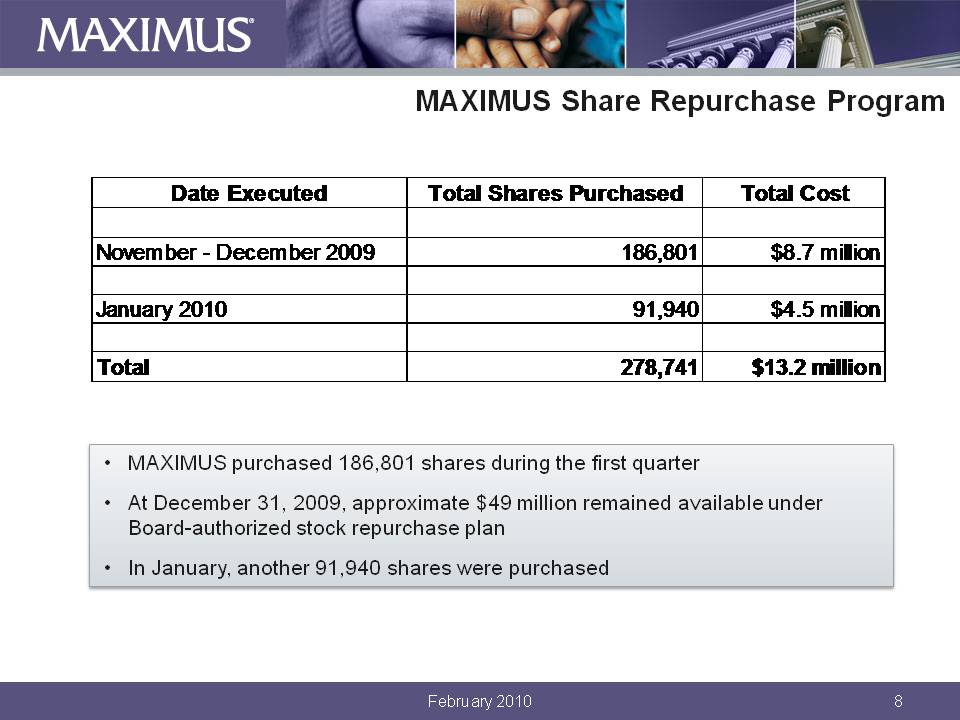

Moving on to balance sheet and cash flow items. At December 31st, 2009, MAXIMUS had healthy cash and cash equivalents of $126.9 million. Strong collections in the quarter improved DSOs to 64 days, and benefited from a large outstanding receivable that was collected in the quarter. MAXIMUS generated exceptionally strong levels of cash in the quarter, driven most notably by strong earnings, as well as advanced payments from our contracts in Australia and the United Kingdom. Cash provided from operating activities from continuing operations totaled $48.8 million in the first fiscal quarter with free cash flow from continuing operations of $42.2 million. The management team recognizes the importance of putting our cash to work, and we used cash in the quarter to resume our share repurchase program. During the quarter MAXIMUS bought back 186,801 shares for $8.7 million. Subsequent to quarter's end, we purchased an additional 91,940 shares for $4.5 million through the end of January.

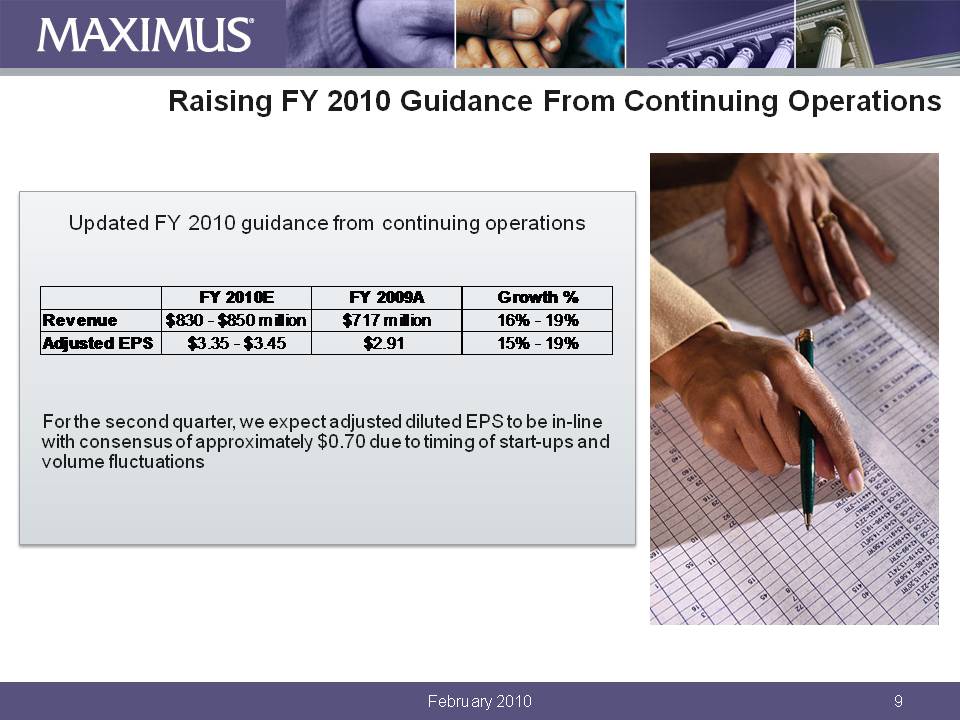

Moving on to guidance, as a result of our strong performance from our international employment services business, and the benefit of clear operational trends, we are raising our full-year estimates for continuing operations. Our new guidance also reflects favorable currency trends. We now expect revenue for fiscal 2010 to range between $830 million and $850 million. From a bottom-line perspective, we now expect fiscal 2010 adjusted diluted earnings per share from continuing operations to be in the range of $3.35, to $3.45. For the second quarter, we expect adjusted diluted EPS to be in line with consensus of approximately $0.70 per share due to the timing of startups and volume fluctuations. Thank you for your time this morning, and with that I'll turn the call over to Rich.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Thanks, David. Good morning, everyone. And thank you for joining us today. We are very pleased to report strong first quarter financial results, providing confirmation that our strategy is working as we aim to deliver long-term shareholder value. Our strategy encompasses operational focus, profitable growth, solid execution, client diversification, and geographic expansion. In recent years, we have focused our business on health and human services program administration and have divested non-core operations. This morning's results reflect the success we have had in deploying this strategy. We have pursued opportunities within our refined core business that offer more favorable terms and increased visibility through long-term recurring revenue. We have also sought to diversify our revenue and our client base to benefit from a broader range of opportunities, both domestically as well as abroad. Today international revenue represents 25% of our business mix. This compares to 15% this time last year. David thoroughly covered the performance by our international operations and our expectations for the full year, so I will focus my comments on a go-to-market strategy.

Our international market strategy is largely an extension of our domestic strategy. Fundamentally, we're helping foreign governments manage the delivery of their public health and human services programs. The demand is clearly there. Governments around the world are contending with remarkably similar social issues. These include increasing healthcare demands, long-term care issues with aging populations, job and employment services, and the rising number of cases with increased complexity.

Our international approach has been cautious and deliberate. We have focused primarily on stable countries with favorable labor laws and strong currencies. At the same time, as we continue to build our presence in these markets, we are actively managing the risk profile. This means we are applying the same stringent criteria we rely upon domestically when assessing new international opportunities of all sizes. As we have talked about on our previous calls, we have become more selective in our bidding strategies over the course of the last few years. We will pass on bids that do not meet our criteria of risk management, defined scope, and profitable growth. This emphasis on up-front diligence is shared throughout our entire organization, including our international markets.

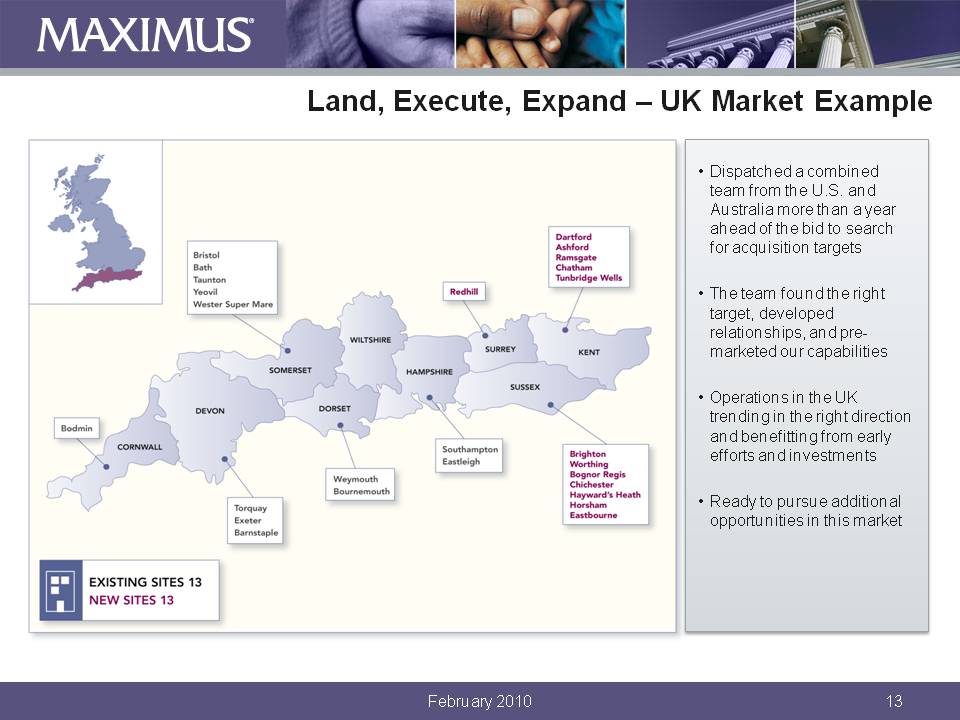

We're working smarter, more efficiently, and more effectively than ever before. The cornerstone of our international strategy is pretty simple, land, execute, and expand. Expand when we enter a market, gain a foothold and grow the business by filling a need with our core capabilities. We used this approach in Canada, Australia, and the United Kingdom. In all of these cases, we did small tuck-in acquisitions and grew the business with the benefit of a local team on the ground, as well as the experience and thought leadership from across the company. In fact, when we set our sights on getting in to the United Kingdom market, we dispatched a combined team from the United States and Australia to search for appropriate acquisition targets. We did this more than a year ahead of the potential bid opportunities. The team was immensely important in finding the right target, developing relationships, building momentum and premarketing our capabilities. As evidenced in our first quarter financial results, our operations in the United Kingdom are trending in the right direction, and benefiting from the efforts and investments we made early on.

Recently, our General Manager for human services, Akbar Piloti, and I returned from trips from the United Kingdom and Australia, where we visited several MAXIMUS locations, and had productive meetings with several government officials at various agencies. It is clear from those meetings that governments are trying to adopt new ways to deliver service more efficiently and effectively. We also spent time with our on-the-ground leadership teams, lead by Michael [Hobday], an Australian who has been running these operations for the past five years. Michael's team is built upon local managers who can navigate market-specific issues, while tapping into the resources of the entire MAXIMUS organization. Our ability to draw upon experience and knowledge across geographic markets allows us to readily deploy the same rigor and discipline in any location to ensure smooth startup and long-term success. We are pleased with the international market trends. We believe the United Kingdom market presents additional opportunities, and we remain cautiously optimistic that we are well positioned there.

As David noted, we have also received new incremental work in Australia for the green jobs and disability programs. This reaffirms our view that it is the right strategy at the right time. We are also actively marketing several new opportunities in Canada that are aligned with our core. Within our domestic markets, we continue to experience stable demand for our services. Thus far, new opportunities have offset any softness in the market. In fiscal 2009, we estimated that project reductions from state budget pressures only impacted about 1.5% of our total revenue base. This is offset by other opportunities, which resulted in overall growth.

We fully recognize that state governments will continue to wrestle with budgetary pressures. Yet, demand for our services has been resilient, and we expect this will continue. This is similar to our experiences in prior recessions. We believe this is the result of the critical nature of the services that we provide, and the fact that a large percentage of our work is Federally funded and Federally mandated. Our growth strategy of land, execute, and expand is evident in our domestic wins as we seek to enter new adjacent markets. We recently received notice of an award in a state where we already serve as the Medicaid enrollment broker to provide enrollment assistance for individuals with disabilities, seeking long-term care services. The operational services we provide are much the same, but we're serving a subset of the Medicaid population,those applying for Medicaid waiver programs. These programs provide a broad array of home and community-based services, to enable people with disabilities to remain in their communities as an alternative to institutionalization. This is an important first step into this new and exiting market in which states are adapting to new ways to deal with populations that need long-term care. We hope to pursue similar opportunities to help agencies improve the quality of care, while better managing the costs of providing services to a growing subset of the Medicaid population.

Longer term, we believe we will continue to benefit from trends that favor new service-delivery models that address the financial challenges that governments face, that help them meet their epigrammatic goals. Recent political developments related to healthcare reform do not alter our expectation that governments will require our services to meet ever-changing demographics, and increasing demands. We view this as a long-term process. From our perspective, it doesn't matter what form the legislation ultimately takes, whether it is sweeping legislation or smaller components designed to address the most pressing areas of reform, governments must still be able to respond in an efficient, and cost-effective manner. We think that healthcare reform will remain a focus of the current administration. As a leading provider in the administration of public health programs, we continue to work with agencies to devise strategies to meet this demand, no matter how the reform ultimately plays out. In the near term, the President's proposal to freeze the Federal budget will not have a material affect on MAXIMUS since most of his proposal does not affect entitlement programs. Additionally, our advisors tell us that the administration remains focused on programs that help low-income and middle class individuals. So we believe demand for our services will remain strong as it had in prior recessionary periods.

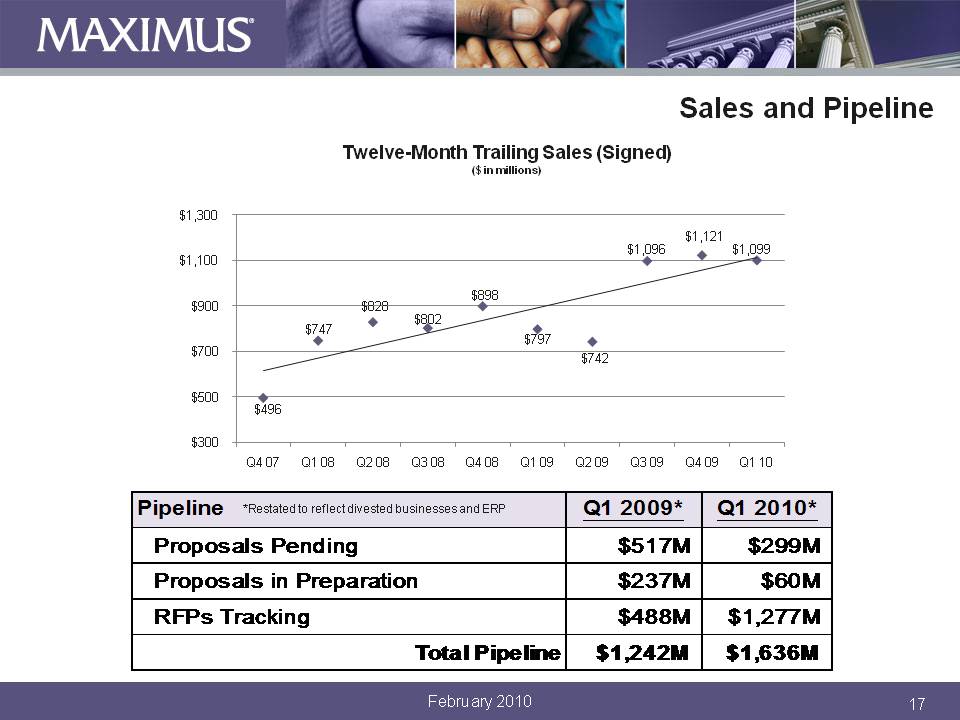

Let's turn now to our sales awards and pipeline numbers. Historical numbers are adjusted to exclude the ERP business. At January 29th, we had new signed awards of $182.8 million, and new contracts pending -- this includes awarded but unsigned -- new contracts pending of $346.8 million. Our total pipeline of new opportunities remains quite healthy at $1.6 billion, compared to the same period last year. This quarter, we are also introducing a new sales metric. We are now including a trailing 12-month sales chart in the accompanying presentation. This should provide you with added visibility, as well as clearer trend information on the company's quarterly sales. What is important about this metric is that it shows longer-term consistent trends in quarterly sales over the last two years. We'll continue to report this on an ongoing basis.

Moving on to liquidity. MAXIMUS continues to maintain healthy levels of cash. Our cash deployment strategy is focused on a mix of options, including investments in organic growth, tuck-in acquisitions, dividends, and share repurchases. During the quarter, we resumed our Board-authorized share-repurchase program. This is just one of the ways that MAXIMUS's Board and management team remain committed to delivering shareholder value. Our strong cash flows enable us to remain active with a stock repurchase program, while maintaining a strong balance sheet with no debt.

In summary, first quarter results reflect solid performance, driven most notably by stronger-than-expected contribution from our international operations. We also had consistent solid performance from our domestic business. All in all, we are pleased with our results, as we benefited from our strategy of operational focus, profitable growth, solid execution, client diversification, and geographic expansion. We remain focused on allocating our resources to maximize returns and drive targeted growth in all of our global markets. We are very enthusiastic, and look forward to helping our clients worldwide adopt new ways to deal with increasing demands, and meet the needs of their constituents. And with that, let's open it up for questions.

Q U E S T I O N S A N D A N S W E R S

Operator

Thank you. We will now be conducting a question-and-answer session.(Operator instructions) one moment please, while we poll for questions. Our first question comes from the line of Lee Jagoda with CJS Securities. Please proceed with your question. Your mike is now live.

Lee Jagoda - CJS Securities - Director

Good morning. Congratulations on a good quarter.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Thank you, Lee.

Lee Jagoda - CJS Securities - Director

Cash flow in the quarter was very strong. What are your expectations there for the balance of the year.

David Walker - MAXIMUS, Inc. - CFO

Hey, Lee, it is Dave Walker, how are you?

Lee Jagoda - CJS Securities - Director

Pretty good.

David Walker - MAXIMUS, Inc. - CFO

It was a very good quarter, cash flow-wise, and we will revise our forecast upward, so question expect cash flow from continuing ops -- operating activities to be in the $100 to $110 million range for the year. So free cash flow from continuing ops will be in the $80 to $90 million range.

Lee Jagoda - CJS Securities - Director

Great. Rich, can you speak about the other opportunities internationally and the prospects and your goals for that business over the next few years?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Lee, I'll talk about it from a summary level perspective. As a matter of policy, I won't get into individual bids. But I would say we continue to see strong demand, and I think in our call notes we mentioned Canada, we mentioned Australia, we mentioned the United Kingdom. Canada tends to be more health-services oriented. UK and Australia, for the moment, is more workforce services oriented. We're very pleased in Australia to have picked up those two new recent wins, and one of them was health related. In the UK, we expect -- we are currently experiencing extensions -- geographic expansions on the current program that we're involved with, and that country remains very active with new concepts and new ideas. Again, in the work force services area. In terms of where international is headed, where could it be, directionally, I would say this, we now -- 25% of our revenue is from international. I think we'll end this year -- we might very well end this year, our fourth quarter, we might have 30% of our revenues from international, about 30% of our pipeline is now international in nature, and -- and naturally a lot of this depends upon the relative growth domestically, but it wouldn't surprise me if we find that 50% of our business is from international a couple of years out.

Lee Jagoda - CJS Securities - Director

Just one more question and then I'll hop back in queue. If I adjust for the quarterly outperformance you appear to be raising guidance by an additional $0.15. Other than the two new programs you spoke about, what are the things making you increasingly confident for the balance of the year?

Rich Montoni - MAXIMUS, Inc. - President, CEO

David you want to try to field that?

David Walker - MAXIMUS, Inc. - CFO

Sure. I mean, there's really two factors, or two drivers. A little bit of currency. So our uplift for the full year will be about $0.06. About $0.02 of that was in this quarter. So that's the over delivery in the quarter. And the primary driver was just the Australia delivery. So now that we see the real case load -- and remember, when we had those contracts, they were new, particularly the UK. We now can see the real case load going in. So our estimates were based upon this data the governments gave us for bidding assumptions. We are now able to refine based on real data,and we can revise our earnings forecast accordingly.

Lee Jagoda - CJS Securities - Director

Great. Thank you very much.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Yep.

David Walker - MAXIMUS, Inc. - CFO

You bet, Lee.

Operator

Thank you. Our next question comes from the line of George Price with Stifel Nicolaus. Please proceed with your question. Your mike is now live.

George Price - Stifel Nicolaus - Principal

Great. Thanks very much. And congratulations, guys, on a superb quarter. Wanted to just -- if I could just follow up real quick on the cash flow question. Could you remind me about the large receivable in the quarter, you know, what that was magnitude? And sort of -- obviously a big step-up in the cash flow guidance. How much -- how should we think about that? I guess on a more, you know, sustainable basis, you know, in terms of the large receivable, and then you mentioned some prepayments -- contract pays in the UK and Australia.

David Walker - MAXIMUS, Inc. - CFO

Hey, George, Dave Walker, how are you.

George Price - Stifel Nicolaus - Principal

Dave, good morning.

David Walker - MAXIMUS, Inc. - CFO

Good morning. I would say first of all when you look at cash flow, the big driver is obviously going to be just net income. So that's the way to look at it. And then we look at the rest of and it is working capital. We did receive a lot in normal working capital flux in the first quarter, and the big receivable that you were talking about was just timing on one out of California for about $10 million. You know, so it was a little slower than normal, came in right after the quarter end, and took our DSOs back in line with what we expected, but the nature of the contracts in both Australia and the UK is you get a lot more cash upfront, and after all we do have to spend a lot of infrastructure and hiring and putting them in place, so that tends to push us more into the deferred revenue, which you saw a lot of already in the first quarter. So to generate a lot of cash networking capital change.

And as you look at the last half of the year, you'll see that -- you'll see the net income in the forecast. The non-cash items, amortization, depreciation, things like that, about the same as you are seeing today. And you'll see the working capital actually consumes some cash as we grow, that will balance out to the total. Does that help you?

George Price - Stifel Nicolaus - Principal

Yeah, it does. If I was thinking ahead into fiscal '11 -- and I realize you are not giving guidance -- but I guess the assumption is we should see -- I'm trying to just think about how much moderation in some of the working capital benefits in the first half of this year under a more -- I don't know if normalized is the right word, but that's sort of what I'm trying to get to.

Rich Montoni - MAXIMUS, Inc. - President, CEO

George, this is Rich. Of the revised forecasted increased cash flow from continuing operations of 100 to 110, I would put the lion's share of that, the majority of that largely in the recurring category. We do have some benefit in there that is working capital flux. I think the working capital flux is going to stay, but I don't think it's fair to year in and year out expect that you are going to get continued improvement in working capital flux. But I tell you the lion's share of that by far is attributable to operations, recurring operations.

George Price - Stifel Nicolaus - Principal

Okay. Fair enough, and anything that you foresee at this point in terms of variability in March either positive or negative for cash flow?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Not really for cash flow. I mean in -- from an earnings perspective -- you know, and I think earnings is always a driver, we would actually expect -- and we talked about that in our call notes -- revenue to be, you know, sequentially slightly improved from Q1 followed by step-level increase in Q3 and 4, so revenue does drive working capital, so it has an impact in terms of the DSO counts. And in terms of profitability, we'll actually tend to see a sequential dip in the lower end of 10 to 11%, you know, operating income in the second quarter, and then a rise back up to margins, so if you just model that piece and then tie the cash flow with normal working capital and that income, I think you'll get there.

George Price - Stifel Nicolaus - Principal

Great. Okay. Rich, how should we think about the risks and opportunities in the international operations, given the budget deficits around the world, you know, coming out of the downturn? I guess to one extent, you know, it's forcing them to take a hard look at trying to make their programs more efficient, but -- you know, maybe if you could just talk a little bit about that because there's certainly a lot of attention about deficit spending all over the world, and how that may -- you know, what opportunities and risks --

Rich Montoni - MAXIMUS, Inc. - President, CEO

Yeah, I think that is one of the pressure points that the governments are dealing with. But it's not in isolation, George. The governments also are very much focused on demography, on demographics, and all of these large countries have very similar issues as the US, in that it's an increasing population, it's an aging population, health care is costing more, so I think as a common theme, they are coming to the conclusion that the current models are just not sustainable, they are not sustainable, not only financially, but I think governments are very worried about their ability to deliver the service to this increasing population. I think they just don't feel they have the infrastructure to get the job done. So as a result we're seeing them focus on not only the medical infrastructure per se, the hospitals, the doctors, the compositions, the geographies, how they are laid out, but also the supporting infrastructure, and whether or not that is capable of getting the job done, and that is -- as a result, leading towards some very interesting white boarding in terms of the need to create some change. Again, these types of things are very much long-term in nature.

George Price - Stifel Nicolaus - Principal

All right. Let me throw in one more and then I will cycle back around.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Sure.

George Price - Stifel Nicolaus - Principal

Healthy Families in California, I just want to kind of get your views on the potential risks in that program. I realize California is very powerful Democratic legislature and constituency, and certainly the Federal elements of the program, you know, it did get hit, potentially last year, then they found the money. There were certainly, you know, continued budget pressures in California that at least seem to only kind of be getting worse as we move through the next fiscal year -- into the next fiscal year. Can you give us your thoughts around that program? And would you say that is kind of the biggest, quote unquote, risk point that you can see in the domestic business or might it be something else?

Rich Montoni - MAXIMUS, Inc. - President, CEO

I think it's a the one that gets the most attention. It certainly gets the spotlight. Certainly California gets the most attention from a state perspective, I think because of its size and I also think just because of its culture and diversity, and they really do try to provide a lot of benefits to their citizens, and they try to keep their taxes low. So whenever you try to spend more and tax less, that's always a challenge. So I really think California is almost on a perpetual track of having these types of deliberations. You know, we went through this last year when the leaders of the state had to deal with the tough budgetary situation. At one point they actually went forward, and with the California Healthy Families program, which is the CHIP program, for those of you who don't know -- they at one point in time had decided to move forward and basically stopped future enrollments. We felt that would impact us from an annualized revenue perspective adversely, $10 million, and at the end of the day, there's some nonprofits in the state that stepped up, and contributed a significant amount. The state also found some additional dollars, so at the end of the day, they manned to basically bring it back to where it was and they did not reduce coverage. George, I expect that they'll continue to go through that type of exercise, and the operations in all of our programs remain on track in California. We certainly understand the budgetary challenges. And again, I expect we will likely see actions similar to prior years where the state will consider cuts in this program. There will be special sessions where it will be on the table, but at the end of the day, if history is any precursor, I expect what will happen is that there will be extra effort put forth to find a path of resolve, to resolve these issues and at least maintain the current level of coverage, again, as they have done in prior periods.

George Price - Stifel Nicolaus - Principal

Great. I appreciate the time. Thanks very much.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Okay. Thanks.

Operator

Thank you.(Operator instructions). Our next question comes from the line of Brian Kinstlinger with Sidoti & Company. Please proceed with your question. Your mike is now live.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Hi, good morning. Thanks.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Good morning, Brian.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

I wanted to touch on the pipeline a little bit. The pending awards are high, and the bids and preparation are low, and I'm sure there's couple of different arguments of why one could assume it is budgetary pressure that are extending awards getting finalized and maybe even RFPs that you can prepare. So maybe just go through those metrics, is there anything we should be concerned about, is it just a little bit choppy right now?

Rich Montoni - MAXIMUS, Inc. - President, CEO

First off I think it's great to look at the elements of what is in the pipeline, and we do routinely see flux in those elements. I too, when I look at it, Brian, get concerned: is the pipeline trending in one direction or another? And my read of the situation is that the pipeline remains very robust. I think we do have a high amount in pending -- we have one large project that is in pending, simply because that particular state has a very long approval process. So we have no reason to believe that it's challenged or difficult, it just has a very long approval process, and the rest of it in terms of -- you talk about bids in prep. In that situation, it's just really a function of the cycle. We have been -- as a general rule, I will tell you we have been very, very busy with our bids, our folks who focus on that function have been very, very active. So my read is I'm fairly encouraged that the pipeline remains consistent to strong.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Great. And when I take a look at what GMS casting for Medicaid enrollments, I think it's 6% this year, and 8% next year. Can you give us a sense in the first quarter the size of your Medicaid enrollment business, and how much that is up year-over-year.

Rich Montoni - MAXIMUS, Inc. - President, CEO

I have Bruce Caswell here, and Bruce feel free to chime in -- in fact what is your response to that question?

Bruce Caswell - MAXIMUS, Inc. - President and General Manager of the Health Services Segment

I think we had a similar question during the last call , Rich, and I think it's fair to say we are seeing enrollment levels trend with the national growth in the Medicaid program, and the statistics related to that were that in -- this is citing data from the Kaiser Family Foundation -- in 2009, Medicaid grew by about 5.4% and they are expecting Medicaid to grow in 2010 by 6.6%. There is a similar study being released by Health Affairs which would put at that 5.6% for 2010. I would say that we are seeing trends in growth in the lower end of that range. Probably the 4 to 5% range.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

4 to 5% is the enrollments piece that's growing or is it the revenue component that's growing? That growth rate?

Bruce Caswell - MAXIMUS, Inc. - President and General Manager of the Health Services Segment

The enrollments are that component of growth rate.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

And then can you talk about this revenue -- is revenue growing in line with that, more than that, or less than that?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Brian, we don't report enrollment revenue per se, it's a little more complicated than that because of the hybrid models we have. But I think our recent experience domestically in these programs, and our expectation for next year, very much correlates with the increase in enrollments. You know, we're looking for the domestic piece to really grow in the mid-single-digit range, which correlates to the enrollments.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Great. One more question on enrollments, obviously we have seen issues in Pennsylvania and Florida in the past with their former vendors about conflict of interest. Have we -- has there been any other states that have had a similar issue that have come through in the quarter, where CMS has identified it is a problem?

Rich Montoni - MAXIMUS, Inc. - President, CEO

That tends to be really a case-specific situation, so I wouldn't classify it as a trend. We haven't seen any new opportunities pop up. We are pleased to have picked up the Pennsylvania opportunity, but, again, I think turnovers like that are very much isolated and case specific.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Okay. And looking at the actual quarter that we just had, how much incremental earnings came from the lower costs on the UK program?

David Walker - MAXIMUS, Inc. - CFO

I think the majority of it came from the overdelivery in Australia, less so in the UK.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

So the lower cost was not material to the upside of earnings?

Rich Montoni - MAXIMUS, Inc. - President, CEO

I think it was -- I think it was material, but I -- again, we don't break out the earnings per share by program. So I don't think it is appropriate to get in to that particular metric, but I would say the majority plus is related to the Australian piece, but I wouldn't put the UK overdelivery in the immaterial category.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

And Dave I think you made a comment, the operating income -- and maybe I misunderstood -- improved because of the UK and Australia higher profits -- higher volumes than expected, but I thought those were unprofitable? And they will be unprofitable in the second quarter? Were they actually profitable given some of the surprises in the first quarter or no?

David Walker - MAXIMUS, Inc. - CFO

Yeah, I -- the higher volume had the benefit of bringing what we would expect to be a loss in the UK to a number that was pretty close to break even. And Australia we expected to be profitable, but it was dampened. Okay? And then it was really very much Australia driven, and the volume we saw in Australia gave us some real good top line growth, but some real accretive bottom line, and the way to think about it is, if we have like a classroom orientation session where normally a site-specific location we have 15 people, it can handle twice as many without an increasing cost of scale. That's what happened. So we really did get a spike operationally in profitability, but you should expect that to go back down to a normal level. That was because it was a new program, so a lot of folks coming on. So we did get a bit of a benefit. Overall as we said on the call, Australia's revenue is going to stay about the same because new programs are coming in. And they have with them these sort of start-up costs that come with these programs, although we were able to leverage a lot of existing infrastructure. That's why we're guiding the Q2 margin to go back down -- even though the revenue will be slightly up. And then you'll see our operating income go back up to what is our normal range in Q3 and 4.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Great. Two more questions. Could you mention the startup cost related to the new two programs you signed in Australia in the second quarter? You said there are some start-up costs, I think.

Rich Montoni - MAXIMUS, Inc. - President, CEO

There is some. We didn't give the amount. It just has the effect of dampening margins. And we gave the operating income range in the lower end of the 10 to 11%.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Right. On a earnings per share basis is it diluting earnings by about 0.02 or $0.03, is that what it is?

David Walker - MAXIMUS, Inc. - CFO

Oh, I don't know, you can do the math. The revenue goes up slightly over the current quarter with an operating income in the low end of 10 to 11%.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Just hard to determine how much of that -- is that coupled with -- how much of that is from Australia? Right? There's a bunch of different factors? That's why I'm just figuring on that.

Rich Montoni - MAXIMUS, Inc. - President, CEO

I think it's pretty much Australian driven in the second quarter.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Okay.

David Walker - MAXIMUS, Inc. - CFO

And frankly case loads. We get some seasonality in our business. I mean even domestically we get spikes in activity when we have enrollment periods, so we get some quarters that go up, and some quarters that go down. So second quarter is going to soften for those activities, and we'll see a return in Q3 and Q4.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

And the last question I thought I understand you in discussion with the DSO after talking about California that your DSO where it is -- is that give or take the range you expect the year tend to? Was that accurate what I thought I understood?

David Walker - MAXIMUS, Inc. - CFO

We still expect our range for DSOs to be about the same.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

And could you just remind us what that range is?

David Walker - MAXIMUS, Inc. - CFO

65 to 80.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

65 to 80.

David Walker - MAXIMUS, Inc. - CFO

Yeah, it's a pretty broad range, but you get big receivables on some big programs that if they just miss by a day, it can spill over to the next month. They aren't a real collections issue. It's just timing.

Brian Kinstlinger - Sidoti & Company - Equity Analyst

Okay. Thank you very much.

David Walker - MAXIMUS, Inc. - CFO

You bet.

Operator

Thank you. Our next question comes from the line of Richard Glass with Morgan Stanley. Please proceed with your question. Your mike is now live.

Richard Glass - Morgan Stanley - Analyst

Wow. I didn't think I was going to make it. Anyway, great quarter, guys, real impressive performance. I had a couple of questions, though. One is this -- well, one is on RFP -- I'm sorry on rebids, and what the expectations are for kind of calendar 2010. And the second I'll give you at the same time is the new contracts penning that -- that amount of $347 million, how should we think about how that translates to the P&L?

Rich Montoni - MAXIMUS, Inc. - President, CEO

Good morning, Rich. This is Rich Montoni.

Richard Glass - Morgan Stanley - Analyst

Hi, Rich.

Rich Montoni - MAXIMUS, Inc. - President, CEO

And thank for the compliment. We're pleased with the quarter. In terms of re-bids, I really don't see fiscal '10 as being a huge rebid year. We talk about where we -- as we enter every fiscal year, we talk about what is up for re-bid. And as we came in to fiscal '10, we had -- I think we had in total 12 jobs up for re-bid, and at this particular point in time, we have lost a very small one, and we're successful on a meaningful one. The total contract value on the 12 re-bids was about $190 million. So it's really not a big year for re-bid activities. And thus far we're off to a good start.

Richard Glass - Morgan Stanley - Analyst

Sounds good.

Rich Montoni - MAXIMUS, Inc. - President, CEO

I didn't hear your second question. Could you repeat it, please.

Richard Glass - Morgan Stanley - Analyst

The second question is -- gets to the -- you know, the backlog figures you gave and all of that kind of stuff. And the year to date signed contract wins of $183 million is pretty easy to get at. But the new contracts pending in terms of awarded but unsigned, how should we think about how that translates to the P&L? You know, the time frame and -- you know --

Rich Montoni - MAXIMUS, Inc. - President, CEO

I think there's a -- what we do in the course of planning the year and providing guidance during the year, we do a waterfall analysis, and we take not only our existing signed work, but we also take that pipeline and probability affect it, and flow it in to our forecasted revenues, and our forecasted earnings, and we do that on a quarterly update basis. So management as a matter of routine will go through that exercise, and on a case-by-case basis, feather those opportunities into our forecasted revenues and earnings per share, which we just shared with you. And the answer, I think, is that we have done that.

Richard Glass - Morgan Stanley - Analyst

Okay. All right.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Okay.

Richard Glass - Morgan Stanley - Analyst

Keep it up guys. Thanks.

Rich Montoni - MAXIMUS, Inc. - President, CEO

All right. Thank you.

Operator

Thank you, our last and final follow-up question comes from the line of George Price with Stifel Nicolaus. Please proceed with your question. Your mike is now live.

Richard Glass - Morgan Stanley - Analyst

Hi, thanks very much for taking another question. I wanted to follow up on the mention of the market, the new business for enrollment assistance for people with disabilities seeking, you know, the long-term care services. Is that -- I guess, you know, can you give us a sense of the size of that market opportunity, Rich, relative to -- you know, maybe compare it to other segments of your business, so we can just get a sense, is there a lot of potential out there?

Rich Montoni - MAXIMUS, Inc. - President, CEO

I'm going to ask Bruce Caswell, who runs that business for it. To comment upon it. And Bruce, two things, one, I think just give folks a flavor for why this is an important consideration in governments managing the cost and quality of healthcare, because I really believe it is. I think it's going to be a cornerstone to our future success, if we peer going to have success in managing healthcare, and then what is our best look in terms of quantification of that market.

Bruce Caswell - MAXIMUS, Inc. - President and General Manager of the Health Services Segment

Sure, I would be happy to, Rich. As Rich mentioned, clearly, governments are taking every step that they can to help manage the cost of delivery of healthcare, especially in the long-term care area. And this program represents really an opportunity to bring some of the basic principals of case management and operational efficiency to an area that historically has not been necessarily managed in that way. And this program, specifically, helps states and in this instance a state we'll be serving, take a population has that has had to go through a paper intensive, waiver application process, and eligibility process, working with local service providers, and bring it in to a more centralized model and an efficient model that will help them receive services more timely and ultimately save the Medicaid program dollars. And importantly, it helps them, as Rich noted in his call notes, keep from having to go in to institutionalized long-term care services, and receive services in a home and community-care based environment. That was a theme was struck at the national level. And has a lot of support at the national level. And with an aging population, we see it as a market opportunity that will continue. It will likely continue in the near term under the waiver programs that currently exist, creating that administrative need. It is fair to say that all state Medicaid programs have individuals that are served in long-term care settings, and many states have existing populations that similarly work through these waiver processes. I would not quantify this of the order of magnitude of an enrollment broker business, however, it's a substantial opportunity are, and one that is perfectly adjacent to what we currently do, so enables us to leverage the business processes that we deploy in other areas of our business to serve this population.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Is that helpful, George?

George Price - Stifel Nicolaus - Principal

Yeah, it is. How many contracts for this service do you have right now, how much of your revenue does it represent?

Rich Montoni - MAXIMUS, Inc. - President, CEO

We have one contract. It's new. I think it's less than $10 million a year for sure. So obviously it's something we're anxious to grow.

George Price - Stifel Nicolaus - Principal

Okay. And are there any -- any potential conflicts of interest or anything like that --

Rich Montoni - MAXIMUS, Inc. - President, CEO

No.

George Price - Stifel Nicolaus - Principal

You know, where you have other -- for Medicaid enrollment or anything like that

Rich Montoni - MAXIMUS, Inc. - President, CEO

No, I don't think there's any conflict issues with this service.

Bruce Caswell - MAXIMUS, Inc. - President and General Manager of the Health Services Segment

If I might just add a brief note. What caused the state to look to an independent company like MAXIMUS to provide this service, was CMS brought to their attention the conflict -- this is several years ago -- of having the actual service providers doing the eligibility process, and that lead the state to look to contract it out to an independent entity, so we are obviously look to similar situations where that may exist and work in that direction.

George Price - Stifel Nicolaus - Principal

Gotcha. Thanks very much.

Rich Montoni - MAXIMUS, Inc. - President, CEO

Thank you, Greg.

Operator

Thank you. Ladies and gentlemen, this does conclude today's conference. You may disconnect your lines at this time and we do thank you for your participation. May you all have a wonderful day. Thank you.

D I S C L A I M E R

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2010, Thomson Reuters. All Rights Reserved.

1 David N. Walker Chief Financial Officer and Treasurer First Quarter - Fiscal Year 2010 February 4, 2010

2 Select Financial Data: Q1 FY10 Compared to Q1 FY09 February 2010 Key Highlights:Strong Q1 results driven by better-than-expected financial performance in international employment services operationsRevenue up $19.2%; 13.3% on a constant currency basisInternational work represents 25% of total revenueCompany operating margin of 12.3%Strong adjusted EPS from continuing operations of $0.838K filing last week: $2.2m net after-tax charge included in discontinued operations for contract transfer ($mm, except per share data) Q1 % Q1 % % FY '09 Margin FY '10 Margin change Revenue Operations $156.30 $188.80 21% Consulting 13.4 13.6 1% Total 169.7 202.4 19% Operating Income (Loss) Operations $21.00 13.40% $24.00 12.70% Consulting -0.3 -2.30% 1 7.10% Other -0.2 nm -0.2 nm Segment operating income subtotal 20.5 12.10% 24.8 12.30% Legal and settlement expense - nm -0.7 nm Total operating income 20.5 12.10% 24.1 11.90% Net Income - Continuing Operations 12.5 14.6 Net Income - Discontinued Operations -0.5 -2 Net Income 12 12.6 6% Fully Diluted EPS - Continuing Ops $0.69 $0.81 17% Fully Diluted EPS - Discontinuing Ops ($0.02) ($0.11) nm Fully Diluted EPS - Total $0.67 $0.70 4% Adjusted EPS - continuing ops, excluding legal $0.69 $0.83 20% Note: Numbers are rounded for presentation purposes

3 Operations Segment First Quarter RevenueOperations Segment revenue grew 20.7% to $188.7 million compared to last year On a constant currency basis, revenue grew 14.2%First Quarter Operating IncomeOperations Segment operating income of $24.0 millionSegment operating margin was 12.7%Strong financial performance driven by employment services operations in Australia and the United Kingdom February 2010

4 Australia Operations Geographic expansion Established presence; helped manage program growth 40% more cases than forecasted; repeatable, scalable process enabled us to absorb spike and created benefit of efficiencies Expect to sustain higher revenue driven by two new program awards for Green Jobs and Disability Employment Services. (Revenue of $10m in FY10; start up will slightly dampen margin in Q2 FY10) New awards further demonstrate our operational success in meeting performance measures and solid brand recognition February 2010

5 Performance on New UK Program Financial results better-than-expected New employment services program under the Government’s Flexible New Deal New program, difficult for client to predict caseload trends Initially program did not produce contracted level of caseloads (cases have since picked up) MAXIMUS was paid at the contracted level of cases and managed resources to the actual, lower caseload volume. This created a one-time benefit to the Company. Putting it all together Q1 FY10 revenue in the UK was as expected and costs were lower (driven by lower cases); program nearly breakeven in Q1 Expect revenue in FY10 of approximately $20 million (profitable in 2H FY10) and in FY11 expect revenue of approximately $40 million and nicely profitable

6 Consulting Segment First quarter revenue totaled $13.6 millionOperating income of $970,000Operating margin of 7.1%Performance improved as the team focused on fundamentalsLabor utilizationCost managementBetter mix of work February 2010

7 Balance Sheet & Cash Flow Healthy cash and cash equivalents totaling $126.9 million at December 31, 2009 Fourth quarter DSOs of 64 days Benefited from large outstanding receivable that was collected in the quarter Generated exceptionally strong levels of cash in the first quarter Strong earnings Advance payments from contracts in Australia and the United Kingdom Cash provided by operating activities from continuing operations totaled $48.8 million; free cash flow* from continuing operations of $42.2 million February 2010 *The Company defines free cash flow as cash provided by operating activities, less property, plant and equipment and capitalized software

8 MAXIMUS Share Repurchase Program Date Executed Total Shares Purchased Average Share Price Total Cost November - December 2009 186,801 $46.49 $8.7 million January 2010 91,940 $49.01 $4.5 million Total 278,741$47.75 $13.2 million MAXIMUS purchased 186,801 shares during the first quarter At December 31, 2009, approximate $49 million remained available under Board-authorized stock repurchase plan In January, another 91,940 shares were purchased February 2010

9 Raising FY 2010 Guidance From Continuing Operations FY 2010E FY 2009A Growth % Revenue $830 - $850 million $717 million 16% - 19% Adjusted EPS $3.35 - $3.45 $2.91 15% - 19% Updated FY 2010 guidance from continuing operations For the second quarter, we expect adjusted diluted EPS to be in-line with consensus of approximately $0.70 due to timing of start-ups and volume fluctuations February 2010

10 Richard A. Montoni President and Chief Executive Officer First Quarter - Fiscal Year 2010 February 4, 2010

11 Strong first quarter financial results are confirmation that our strategy is working as we aim to deliver long-term shareholder value. Operational Focus - Focused on health and human services program administration and divested non-core operations Profitable Growth and Solid Execution - Pursued new revenue streams within refined core business that offered more favorable terms and increased visibility through long-term recurring revenue Client Diversification and Geographic Expansion - Diversified our revenue and client base to benefit from a broader range of opportunities, both domestically and abroad A Commitment to Deliver Shareholder Value February 2010

12 International Market Strategy International revenue now represents 25% of our business mix International market strategy largely an extension of domestic strategy Helping foreign governments manage the delivery of public health and human services programs Governments around the world are contending with similar social issues: increasing healthcare needs, long-term care with aging populations, employment services, rising caseloads International go-to-market approach is deliberate and cautious Focused on stable countries, with favorable labor laws and currencies Actively managing the risk profile, applying the same stringent criteria we rely on domestically More selective in our bidding strategies, passing on bids that do not meet our criteria of risk management, defined scope, and profitable growth February 2010 The cornerstone of our international strategy is Land, Execute, and Expand. We enter a market, gain a foothold, and grow the business by filling a need with our core capabilities.

13 Land, Execute, Expand – UK Market Example Dispatched a combined team from the U.S. and Australia more than a year ahead of the bid to search for acquisition targets The team found the right target, developed relationships, and pre-marketed our capabilities Operations in the UK trending in the right direction and benefitting from early efforts and investments Ready to pursue additional opportunities in this market February 2010

14 International Operations Recently visited several MAXIMUS locations in the UK and AustraliaSeveral productive meetings with government officials in the agencies we serveGovernments trying to adopt new ways to deliver service more efficiently and effectivelySpent time with on-the-ground leadership teamsNative Australian Michael Hobday has led these operations for the past five yearsLocal management teams able to navigate market-specific issues, while tapping into the resources of the entire MAXIMUS organizationPursuing additional work and new opportunities internationallyReceived new incremental work in Australia for the Green Jobs and Disability programsActively marketing several new core opportunities in Australia, the UK, and Canada Our experience and knowledge across geographic markets allows us to deploy the same rigor and discipline in any location, ensuring a smooth start up and long-term success. February 2010

15 Domestic Operations Stable demand; opportunities offsetting any softness in the market In fiscal 2009, we estimated that project reductions from state budget pressures only impacted 1.5% of our total revenue base State governments likely to continue to wrestle with budgetary pressures but demand remains resilient because of the critical nature of our services and the fact that a large percentage is federally mandated Gaining traction in adjacent domestic markets Recently received notice of award to provide enrollment assistance for individuals with disabilities seeking long-term care services Award is in a state where we already serve as the Medicaid enrollment broker (land & expand) An important first step into a new and exciting market in which states are adapting to new ways to deal with populations that need long-term care We hope to pursue similar opportunities to help agencies improve quality care while better managing the cost of providing services to a growing subset of the Medicaid population February 2010

16 Domestic Legislative Trends Governments will continue to require our services to meet ever changing demographics and increasing demands Health care reform is a long-term process; whether sweeping legislation or smaller components, governments must still be able to respond in an efficient and cost-effective manner As a leading provider in the administration of public health programs, we are ready to meet this demand no matter how the reform ultimately plays out In the near term, the proposal to freeze the federal budget does not include entitlement programs and will not have a material impact on MAXIMUS Administration remains focused on programs that help low-income and middle class individuals Believe demand for our services remains strong February 2010 We expect to benefit from trends that favor new service delivery models that address financial challenges that governments face and help them meet programmatic goals.

17 February 2010 Sales and Pipeline *Restated to reflect divested businesses and ERP Pipeline Q1 2009* Q1 2010* Proposals Pending $517M $299M Proposals in Preparation $237M $60M RFPs Tracking $488M $1,277M Total Pipeline $1,242M $1,636M Twelve-Month Trailing Sales (Signed)($ in millions)

18 Continue to maintain healthy levels of cash Cash deployment strategy focused on a mix of options, including investments in organic growth, tuck-in acquisitions, and returning cash to shareholders Resumed our board-authorized share repurchase program; remain committed to realizing shareholder value Strong cash flows enables us to remain active with the stock repurchase program while maintaining a strong balance sheet with no debt Cash Position February 2010

19 Solid first quarter results driven by stronger-than-expected contribution from international operations and consistent solid performance in domestic business Benefiting from our strategy of operational focus, profitable growth, solid execution, client diversification, and geographic expansion Focused on allocating our resources to maximize returns and drive targeted growth in all of our global markets We look forward to helping clients worldwide adopt new ways to deal with increasing demands and meet the needs of their constituents Conclusion February 2010