Exhibit 99.2

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

C O R P O R A T E P A R T I C I P A N T S

Lisa Miles

MAXIMUS - VP, IR

David Walker

MAXIMUS - CFO

Rich Montoni

MAXIMUS - Pres. CEO

Bruce Caswell

MAXIMUS - Director, Health Operations

C O N F E R E N C E C A L L P A R T I C I P A N T S

Torin Eastburn

CJS - Analysts

Steve Porter

UBS - Analyst

Brian Kinstlingler

Sidoti - Analyst

George Price

Stifel Nicolaus - Analyst

Greg McCaskel

Lloyd Abbot and Co - Analyst

P R E S E N T A T I O N

Operator

Greetings, and welcome to the MAXIMUS fourth quarter conference call. (Operator Instructions) It is now my pleasure to introduce your host Lisa Miles Vice President Investor Relations for MAXIMUS. Thank you., Ms. Miles, you may begin.

Lisa Miles - MAXIMUS - VP, IR

Good Morning. Thank you for joining us today on today's conference call. I would like to point out that we posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer and David Walker, Chief Financial Officer. Following Rich's prepared comments we will open the call up for q&a.

Before we begin, I'd like to remind everyone that a number of statements being made today would be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face including those discussed in exhibits 99.1 of our SEC filings. We encourage you to review the summary of these risks and our most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I'll turn the call over to Dave.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

David Walker - MAXIMUS - CFO

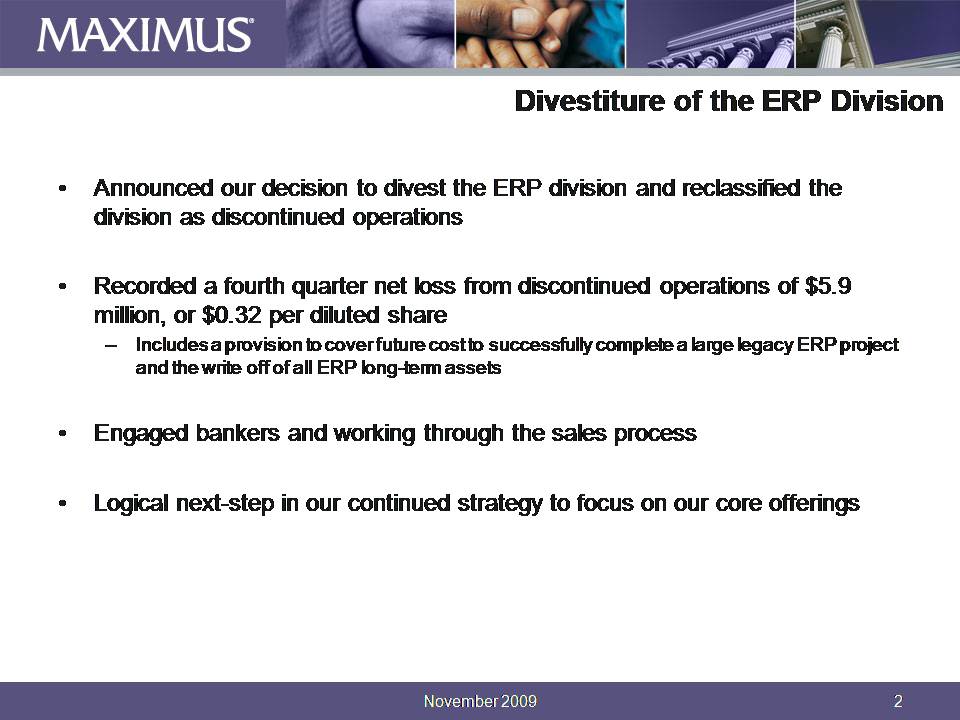

Thank you, Lisa. Good morning and thanks for joining us. In this morning's press release we announced our decision to divest the ERP division and we reclassified the division as discontinued operations. Concurrently we have filed an 8K reclassifying the last two years worth of financial results by quarter.

For the fourth quarter, we recorded a net loss from discontinued operations of $5.9 million or $0.32 per diluted share. This includes a provision to cover future cost, to successfully complete a large legacy ERP project and a write-off of all ERP long-term assets. Our decision to divest the ERP division is the logical next step in our continued strategy to focus on our core offerings that Rich will discuss later. We have engaged bankers and are working through the sales process. While we can't speculate on the length of time it might take to complete a transaction, we are encouraged by the interest we have seen thus far.

Let's turn our attention to results from continuing operations, which is where I will focus the remainder of my comments. Revenue from continuing operations grew 9.3% in the fourth quarter to $194 million and 3.4% for the full fiscal year to $717.3 million compared to the same periods last year. On a constant currency basis revenue grew 10.9% for the fourth quarter and 6.5% for the year compared to the same periods last year. Total company operating margins continued to trend as expected. For the fourth quarter MAXIMUS delivered a 12.3% operating margin and 11.9% for the full fiscal year.

As we discussed on previous earnings calls, margins in the second half of the year were tempered by startup investments on new contracts in the operations segment. Year-over-year margin expansion was driven by improvement in the consulting segment which was a positive contributor in fiscal 2009. Earnings per diluted share from continuing operations were $0.80 for the fourth quarter and $3.05 for the full fiscal year. Excluding severance and legal, adjusted earnings per share from continuing operations for the fourth quarter grew 11% to $0.81 and increased 8.2% to $2.91 for the full fiscal year compared to the same periods last year. As a reminder, under the accounting treatment for discontinued operations we reallocate the overhead from the discontinued business back into continuing operations. Our results and guidance include the absorption of these costs.

Moving on to segment results. With today's announced divestiture the operation segment now comprises 92% of total company revenue. Operations revenue for the fourth quarter grew 11.1% to $181.7 million and for the full year, grew 4.8% to $659.2 million compared to the same periods last year. Acquired growth accounted for approximately 1.3% in the operations segment for fiscal 2009. On a constant currency basis, operations revenue grew 12.8% in the fourth quarter and 8.2% for the full year. Top-line growth was fueled by our domestic help and federal operations as well as the expansion in our international workforce services operations.

In the fourth quarter operating income for the operations segment benefited from seasonality in our tax credit business which is offset by expected startup investments primarily related to new work in Australia. Nevertheless, the segment delivered strong income and margins for the fourth quarter with operating income of $24 million and a margin of 13.2%. For the full fiscal year the operations segment had operating income of $83.8 million with a margin of 12.7%. Even with the required investments for new work in the second half of fiscal 2009, the operation segment had a great year both operationally and financially. This momentum is expected to carry into fiscal 2010 driven principally by new international work but as we discussed last quarter, revenue in the UK will initially lag behind cost tempering margin somewhat in fiscal 2010.

As a result, we still expect that the project will lose money in the first half of the year. However, we now have an improved outlet for the full year and expect the project to be break-even as revenue ramps up. Moving on to the consulting segment which now represents 8%, of total company revenue, revenue in the fourth quarter totaled $12.3 million and a $58.1 million for the full year. Revenue declined year-over-year as the company exited its legacy healthcare claiming business. This was offset by revenue growth in the segment education business which was ramping up a large project for New York City in fiscal 2009. The segment was slightly profitable in the fourth quarter and for the full year recorded income of $2.7 million with an operating margin of 4.6%.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Moving on to balance sheet and cash flow items, we ended the fourth quarter with cash totaling $87.8 million at September 30. Fourth quarter DSO of 71 days are consistent with the third quarter and remain well within our targeted range of 65 to 80 days. DSOs were impacted by increased receivables on a large health services contract, the bulk of which was paid in October. As we discussed last quarter, we also have an outstanding receivable tied to milestone based dealing on a technology refresh which is expected to be paid in the second quarter.

Cash provided by operating activities from continuing operations totaled $34.2 million in fiscal 2009 with free cash flow from continuing operations of $7.6 million. The company defines free cash flow as cash provided from operating activities from continuing operations less property, equipment, and capitalized software. If we normalize cash flow for the Texas settlement net of recoveries, adjusted cash provided by operating activities from continuing operations was approximately $47 million. As you know, MAXIMUS successfully rebid its Australia business last year doubling our presence as well as our revenue. As a result of this growth, capital expenditures increased in the fourth quarter driven principally by required startup related to the acquisition of fixed assets necessary to outfit nearly 40 new locations. As a result, fourth quarter cash provided by operating activities from continuing operations totaled $8.4 million with negative free cash flow of $2.6 million.

Moving on to guidance. For fiscal 2010, we expect top-line growth of 10 to 13% with revenue ranging between $790 million to $810 million driven principally by new international work. From a bottom line perspective, we expect diluted earnings per share for fiscal 2010 to be in the range of $3.05 to $3.15. As I noted earlier, earnings per share is tempered by the revenue lag in the UK which on a normalized basis would be contributing an additional $0.10 per share in the year.

While we historically haven't provided detailed guidance on a quarterly basis, we believe it's important to provide some clear direction for Q1 because ratable revenue recognition in the UK will depress income in the first half of the year. It's also important to remind everyone that our fiscal fourth quarter is traditionally our strongest quarter due to the seasonality in certain business lines and as a result first quarter results are expected to be lower due to seasonal trends. As such, we expect diluted earnings per share of $0.62 to $0.67 for the first fiscal quarter of 2010. Now I'll turn the call over.

Rich Montoni - MAXIMUS - Pres. CEO

Good morning everyone. Thank you for joining us today. I'm very pleased with the results for our fiscal 2009 fourth quarter and full year as well as our outlook for fiscal 2010 that we introduced today. Our employees have made tremendous progress over the last three and a half years to optimize operations, drive efficiencies, increase earnings and drive shareholder value. Today's MAXIMUS is a much more streamlined profitable organization. One that is focused and positioned well for the future with reduced business risk and tremendous growth opportunities as both domestically and abroad.

First, let me touch upon our decision to divest the ERP division. This is just the next step in building a more reliable organization with a sharpened focus on the administration of Health and Human Services in related consulting offerings. As David discussed earlier, we booked a provision for discontinued operations in the fourth quarter related to a large legacy project. We believe this provision is adequate to cover all future cost through successful completion. We are actively marketing the property and have solid interest from key players in the market. We intend to use any proceeds from a sale to repurchase MAXIMUS shares in the open market.

Let's talk about outlook. Today we have an increased level of revenue visibility that is unparallel in the recent history of MAXIMUS. We anticipate 2010 top-line growth between 10% and 13% compared to last year. This excludes any growth that may result from acquisitions. An increase in component of our revenues in fiscal 2010 would be in the form of our growing international business as well as federal work. For fiscal 2010, approximately 93% of forecasted revenues are in the fold of backlog and option periods. So the go get for fiscal 2010 is really limited to approximately 7% of forecasted revenues.

We also reported record backlog of $1.8 billion. This sets the platform for accelerating future growth as new programs ramp-up in fiscal 2010 and become larger contributors in 2011. As David discussed, 2010 earnings are expected to grow between 5% and 8% with a range of $3.05 to $3.15 per diluted share. This guidance is tempered by the affect of the revenue lag in the United Kingdom. However on a normalized basis, the UK would be contributing an additional $0.10 per share to earnings. This equates to implied bottom line growth of 8 to 12%. This also provides a good start on growth in fiscal 2011 over fiscal 2010.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

We should note that while advancing healthcare reform legislation offers us potential, perhaps substantial future growth, we have not assumed any material work from this in fiscal 2010. Rather, we see this as a likely material growth driver in fiscal 2011 and beyond. We'll discuss this later in the call. And to wrap up our guidance I also want to address the state fiscal environment. During fiscal '09 most states experienced significant financial pressures. However, we estimate that only 1.5% of our total revenue base in fiscal 2009 was impacted by a project reductions related to state budgetary pressures. This is more than offset by increases in other projects and new work.

Based on our experience to date consistent demand at the state level and the inelastic nature of our services, we do not expect the material adverse impact related to state budgetary challenges in fiscal 2010. In fact, as it relates to new opportunities, we are seeing the opposite with an increasing trend toward more business process outsourcing. In today's environment, states are looking to control cost while managing an increasing number and increasing complexity of cases. These cases are stemming from greater reliance on government assistance in these trying times. As a result, states are looking to independent private providers who offer readiness, preparedness and flexibility in meeting these challenges. Our position as an industry leader that is independent, well capitalized and offering significant domain expertise enables us to distinguish ourselves in the marketplace as new opportunities emerge.

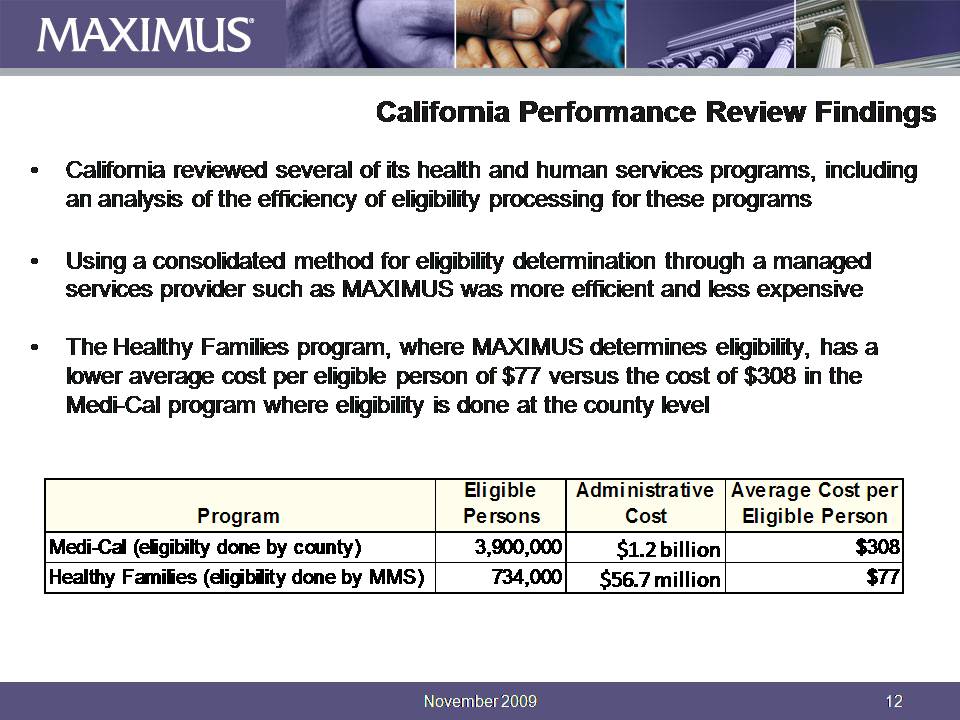

Many of these opportunities are a result of states advancing new ways to run these important programs as they seek to create efficiencies and administrating them. Let me give you an example. California completed a performance review of several of its Health and Human Services programs. This included an analysis of the efficiency, eligibility processes for these programs. The report concluded that using a consolidated method for eligibility determination through a managed service provider such as MAXIMUS was more efficient and less expensive. In fact, in the healthy families program where MAXIMUS determines eligible the average cost per eligible person is $77. This compares to $308 in the Medi-Cal program where eligibility is done at a county level.

The reports findings have recently been thrust to the front of the debate as to how California might find more creative and streamlined ways to utilize their finite resources for these important programs. Analysis like the performance review are driving decisions as government officials look to improve cost effectiveness and deliver their health human programs. In the case of California, MAXIMUS provides efficient services without compromising quality as evidenced by our performance in the state's CHIP program which boasts the lowest payment error rate in the nation of less than 1%. This compares to a national average of 11%.

Several states are also looking to streamline enrollment operations in the public health programs. We were recently notified of a new award on a multi-year Medicaid and CHIP contract for a large state as traditionally done much of this work in-house. The work includes the consolidation, simplification and centralization of enrollment services and provides beneficiaries with a single point of entry and targets those who are currently uninsured. We are in contract negotiations related to this practice. This is expected to launch in the second half of fiscal 2010 so we're unable to provide any details related to its value or specify the state at this time. However, this represents another strategic win for MAXIMUS as the nation's leading administrator and go-to provider for government health and human services programs.

Let's move on to legislative update. On the legislative front we continue to monitor the unfolding events in federal healthcare reform and the impacts on both our state and federal health operations. We see substantial synergies between opportunities from healthcare reform in our demonstrated capabilities in the areas including beneficiary outreach, education and enrollment. Both the House and Senate versions of healthcare reform include provisions to expand Medicaid eligibility. The House bill sets the Federal poverty level for Medicaid expansion at 150% and the two Senate bills vary between 133% and 150%. An eligibility increase to 133% of the federal poverty level, or FPL, translates to 10 million new Medicaid beneficiaries while an increase to 150% of the FPL translates to 15 million new beneficiaries for Medicaid programs across the nation.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

MAXIMUS currently serves approximately 70% of the Medicaid population residing in those states that presently out source their programs. We are well positioned to help government enroll these additional individuals and families into Medicaid. As I mentioned earlier, our cost to deliver these services and the level of quality we offer provides government with a competitive alternative to the traditional methods of providing services. Today, several legislative options remain on the table. We expect that actions necessary to merge, debate and reconcile the final Senate and House bill will take some time. We recognize it's often a slow moving process. However, we remain confident that we will play an important role as an independent provider in the resulting opportunities. We expect to see new work related to these initiatives beginning in 2011 and into fiscal 2012. On the international business, our solid brand recognition and ability to deliver in the United States has put MAXIMUS at the forefront of helping governments abroad who face the same social challenges including increasing case loads and case complexity in the area of health and workforce services. In Australia, the approximately 40 new operational centers are fully ramped and performing to expectation thus far with a positive contribution to income in the fourth quarter. In the United Kingdom we launched operations on October 5 and our ramp-up efforts are progressing as planned with all service locations open for business. These two new sizable wins represent extensions of our core competency in human services and we expect them to continue smoothly. We will continue to pursue additional opportunities in both of these markets as well as Canada where our British Columbia health enrollment operations recently achieved 48 straight months of meeting or exceeding all key performance requirements.

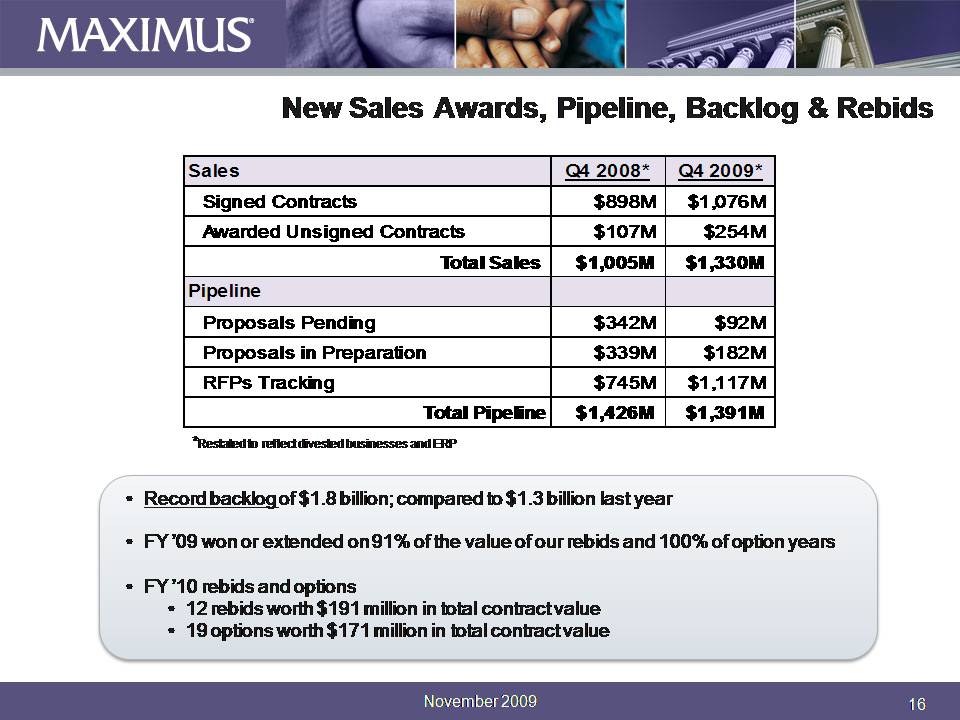

Let's turn now to our sales awards and pipeline numbers. And these are adjusted to exclude the ERP division. At September 30, 2009, we had new signed awards of $1.1 billion compared to $898 million last year. New contracts pending, this would include awarded but unsigned, total $254 million. At November 3, 2009, our total pipeline of new opportunities remain quite healthy at $1.4 billion consistent with the same period last year. Moving on to rebids and options. In fiscal 2009, we won or received extensions on 91% of the value of our rebids and 100% of option years for one or extended. In fiscal 2010, we have 12 rebids worth a total of $191 million, the largest relates to the Texas enrollment broker contract and 19 option near renewals valued at $170 million.

On our cash position, our strong balance sheet and lack of debt positions MAXIMUS as a reliable partner for our government clients. Our ongoing dividend program is one means for returning excess capital to our shareholders. We also continue to review opportunities for smaller tuck-in acquisitions that complement our health and human services business portfolio.

In closing, our results for fiscal 2009 indicate that we continue to provide our government clients with effective and efficient services. Although state and local budgets will likely remain under significant pressure in the next fiscal year and beyond, we believe the critical nature of the programs we administer will drive steady demand for our services. In addition, we believe these times are creating new opportunities as governments consider managed services in those areas historically managed internally. So we see fiscal 2010 as a year of meaningful growth as well as a platform for accelerating future growth both from existing program expansions and new contract awards. Especially as we emerge from the startup phases of new work. We look forward to continuing to support our government clients in the upcoming year and pursuing new growth opportunities. With that, let's open it up for questions. Operator?

Q U E S T I O N S A N D A N S W E R S

Operator

Thank you. (Operator Instructions) Our first question comes from Torin Eastburn of CJS Securities.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Torin Eastburn - CJS - Analysts

Good morning.

Rich Montoni - MAXIMUS - Pres. CEO

Good morning.

Torin Eastburn - CJS - Analysts

Could you provide an update on ACS and I guess where you stand with the Florida contract in particular?

Rich Montoni - MAXIMUS - Pres. CEO

I'd be glad to do that. The Florida contract went out for bid, and I think there were conflict of interest matters related to ACS that precipitated that and we submitted bids, we were not the successful awardee. In fact we were technically disqualified from that bid situation because of our technical situation in Florida, and frankly we think it's isolated but it's disappointing, it's unfortunate but unfortunately at this point in time it doesn't look like we'll be the successful bidder for that work.

Torin Eastburn - CJS - Analysts

Okay. Your ERP division, now that you've sold it, or you're in the process of selling it, how does that affect your view of profitability in the consulting segment going forward?

Rich Montoni - MAXIMUS - Pres. CEO

My view of profitability for consulting on a go-forward basis is that versus historical profitability I expect we are going to continue to see increasing operating margins versus historical. I do think for the next year it's going to operate at less than their optimal targeted percentage which we've historically held out to be in the 15% range. I think they are likely to operate next year in the 10%, slightly less than 10% operating margin range. I do think with the divestiture of ERP, it significantly helps the visibility, the predictability of that consulting segment.

David Walker - MAXIMUS - CFO

And I think it's important to point out that it was, in fact, profitable without ERP for the year '09 . We expect it to continue to be profitable and we laid a lot of groundwork in '09 and pushed off some thing that are driving consulting toward what we think is more core and will bolster the rest of the business. So we actually think net net there's going to be more synergies and we are very excited.

Torin Eastburn - CJS - Analysts

Okay. Last question. (inaudible) not backlogged What are they and what would take to earn them?

Rich Montoni - MAXIMUS - Pres. CEO

What we call the go-get. 93% of our revenue is in the form of backlog or option renewals which is historically the option renewals as like last year we had 100% success in that category. What we refer to as the go-get is in this particular category, 7%. That is the additional work and historically we've been able to fill that gap with new sales during the year, add ons, extensions. The nature of the consulting business is they tend to carry less back log than the managed services business. That's pretty comparable, in fact it is slightly better than the same metric a year ago. I think going into fiscal '09 we had 92% of our revenue in the form of backlog or options. This year 93%.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Torin Eastburn - CJS - Analysts

Okay. Thank you.

Rich Montoni - MAXIMUS - Pres. CEO

You bet.

Operator

Our next question comes from Steve Porter with UBS. Please proceed with your question.

Steve Porter - UBS - Analyst

Hi guys. Thanks for taking my question. I wonder if you have, what do you guys think would close the ERP transaction?

Rich Montoni - MAXIMUS - Pres. CEO

We are marketing that now, so as you are well aware, these processes can accelerate. They can slow down. I think that's going to be an event that's going to happen in the next three to six months would be my best estimate at this time.

Steve Porter - UBS - Analyst

And then I noticed, can you give us an update on the cash strategy? At quarter you had (inaudible) do you expect that to continue?

Rich Montoni - MAXIMUS - Pres. CEO

Well, we haven't purchased share in the most recent quarter and I think the prior couple of quarters, but that doesn't mean that we don't routinely consider it. The board routinely considers the cash position, and we would seriously consider share repurchases as we go forward. As I've said in my call notes, the proceeds of the sale of the ERP division we would intend to repurchase shares with that but again we do take a hard look at our share repurchase program on a quarterly basis.

Steve Porter - UBS - Analyst

Last quick question. Any guidance on operating cash flow or free cash flow?

Rich Montoni - MAXIMUS - Pres. CEO

Dave Walker would you field that one?

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

David Walker - MAXIMUS - CFO

Sure. Absolutely. The cash flow from operations from continuing ops should be in the range of $65 million to $75 million in fiscal year '10 with CapEx of about $20 million. So free cash flow $45 million to $55 million.

Steve Porter - UBS - Analyst

Thanks a lot.

David Walker - MAXIMUS - CFO

Sure.

Operator

Our next question comes from Brian Kinstlingler with Sidoti & Company. Please proceed with your question.

Brian Kinstlingler - Sidoti - Analyst

Great. Thank you. The first one is a follow up. You mentioned you would have margins maybe slightly below 10% in the consulting business. It looks like on the restated basis you are below 5%. That would assume a doubling of if you get to 10% or more of operating income. Is there more cost cutting that would drive that or is 10% even overstating it there?

David Walker - MAXIMUS - CFO

I'm showing margin in consulting at about 7%. I'm sorry. Of about 4.6%. That's what I have. And we've done a lot of cost cutting in fact during the year. So embedded in the number is a lot of activity and a lot of growth that we think to be again directionally in the positive way.

So there's two ways to do it head directionally in the positive way, so there are two ways to do it, head directionally and the stuff that's core we add more synergies and you tend to get better margin as well as managing the cost and the consulting business is as simple as making sure you manage your utilization, and I actually think they are doing a good job on that and we'll push it up a bit. With that said, we are still rebuilding.

Rich Montoni - MAXIMUS - Pres. CEO

I would say, Brian, this is Rich. I would say to add to David's comments, the expected year-over-year improvement would be benefiting from the actions that largely have been taken already. Management of that segment has done a good job to balance our cost, improve utilization.

So I don't anticipate there would be significant additional cost reductions, but rather just reaping the full year benefit of what actions have been taken thus far. And I would say the consulting business of late has had some very commendable successes in our IV and V work they recently closed on some opportunities. They've been working very hard on. Honestly the ERP business had a recent win that was very commendable so it positions that business favorably. And other aspects of our consulting business continue to win work. So there are very good performance and opportunities in the consulting world.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Brian Kinstlingler - Sidoti - Analyst

So outside of the second quarter, (inaudible) because of the past through related to New York, you expect that-- the other three quarters f that business will grow faster or slower than the rest of the business?

Rich Montoni - MAXIMUS - Pres. CEO

We are not looking, our focus with consulting is to better align consulting with what we do in health and human services. So it's getting to the point where it a relatively small piece of the business so I'm really not looking, challenging it to grow fast if you will but to better align with what we do and help our operations go to market particularly in some of these opportunities that are emerging in healthcare reform.

Brian Kinstlingler - Sidoti - Analyst

Okay. Turning to California I want to talk about two of the programs there. First of all, healthy families, the legislation that was passed and last quarter you had a lower guidance, a little bit on the top line related to that program. There was going to be a cap it seems like some of those children or most of them were safe from keeping under that program. How did that affect your guidance? Was that part of the raise on the top line? Give us a sense of that please.

Rich Montoni - MAXIMUS - Pres. CEO

In fact I think that is the case. As you know that particular program was one of the programs considered for reductions by California as they try to manage their budgetary situation. They had advanced a concept of some scope reduction and when we ran those numbers, we estimated it would reduce the amount of business on that program by roughly $12 million a year. We had talked about that and feathered that into our guidance and since that point in time, the state reversed its position and found funding to basically fill the gap and that obviously was -- that was helpful to us in the quarter.

Brian Kinstlingler - Sidoti - Analyst

Will you recoup that roughly $12 million you think a year that you thought you might lose for fiscal 2010 or is it slightly lower than that?

Rich Montoni - MAXIMUS - Pres. CEO

We have taken all of that new assumption, that new update and factored into our guidance.

Brian Kinstlingler - Sidoti - Analyst

Okay. And on the California Medi-Cal program which was refreshed maybe a year ago or so. I don't know the exact date, I guess I'm curious-- obviously when you do the refresh profitability on that contract pulls back substantially. Initially. how far are you from sort of normalized or mature margins on that contract?

Rich Montoni - MAXIMUS - Pres. CEO

Well, we are entering our second year. We did refresh it this year. And this is a contract that runs I believe for five years. And they tend to start to generate additional benefits, improve margins two, three years out into the situation. So we are not anticipating on that particular contract a steep ramp in terms of operating margins or Steady Eddie if you will, and again all of that has been factored into our 2010 guidance.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Brian Kinstlingler - Sidoti - Analyst

Okay. You had mentioned on the, I think it was the UK contract, you made comments about $0.10 of earnings is what-- , was that the fourth quarter or the year that will cost you that

Rich Montoni - MAXIMUS - Pres. CEO

That's in all of fiscal '10. As you know, in fiscal '10, particularly in the front end of fiscal '10, that's when that contract will be ramping up and for revenue recognition purposes there's a lag factor so we'll be having our cost incurred, expense on the front end and then the lag on the revenue. So as a result we've got depressed profitability on the front end and once we normalize that, once it's up and running, it should provide an additional $0.10 per year. So I view it as FY11 when the whole program should be normalized versus fiscal '10, fiscal '11 should be $0.10 better just because of that program.

Brian Kinstlingler - Sidoti - Analyst

To me that seems very low and the reason I say that is I thought it was more like $0.15 to $0.20 startup cost and so once you recoup that and the contract becomes $0.10 profitable, it more of a $0.20 to $0.25 swing. Explain where my logic is wrong please.

Rich Montoni - MAXIMUS - Pres. CEO

Sure. I think the startup is Australia related not UK.

Brian Kinstlingler - Sidoti - Analyst

But there's not a lot of cost,right now. There's not a lot of revenue with the cost associated right now with the UK. right?

David Walker - MAXIMUS - CFO

UK becomes operational October 5. So in fact most of the startup costs were incurred in this year, in the fourth quarter. We still have some CapEx spend to go, but that doesn't affect the P&L. So what you are really looking at in fiscal year 10 is that just deferred revenue recognition.

Brian Kinstlingler - Sidoti - Analyst

So in a sense it's not an unprofitable contract in fiscal 2010?

David Walker - MAXIMUS - CFO

It should be break-even for fiscal year 2010, but because revenue deferred relative to cost, it will have some losses in the first two quarters with that turning around and being profitable in the second half of the year to be break-even is the current expectation for the year. If you kept the revenue at the current run rate you would up lift the profit by that $0.10 a share going into 2011.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Brian Kinstlingler - Sidoti - Analyst

Okay. The new Medicaid contract you have other startup costs in there as well? Obviously there's only negotiations but you seem to have more startup costs than a couple of the other companies. I'm curious should we expect that you incorporated that into your guidance for 2010?

Rich Montoni - MAXIMUS - Pres. CEO

You should expect all of those factors are factored into the model.

Brian Kinstlingler - Sidoti - Analyst

Okay. And I guess I was curious and I'll get back into the queue after this question. If I look at the fourth quarter and even to fiscal 2010, how much cost associated with the discontinued operation is actually in the P&L right now outside of discontinued operations based on the accounting rules and would that come out? Will you be able to cut costs once the divestiture is completed? Does that make sense?

David Walker - MAXIMUS - CFO

I think your question, let me rephrase it to make sure I hit it. There's overhead that moves from discontinued up to continuing ops, you can allocate all that cost and that is about $3 million.

Brian Kinstlingler - Sidoti - Analyst

A quarter or a year?

David Walker - MAXIMUS - CFO

A year. And we are in fact going through it to make sure that between combinations of growing the business and taking what we think to be rational cost reductions we can balance that out but that is baked into our guidance.

Brian Kinstlingler - Sidoti - Analyst

Meaning you won't have all that $3 million in fiscal 2010?

Rich Montoni - MAXIMUS - Pres. CEO

I would think -- in the normal course we look at our course pool so it would be a matter of balancing growth, perhaps more reallocating resources. So I wouldn't look for a radical reduction but just more so continued focus on the cost pool and what makes sense.

Brian Kinstlingler - Sidoti - Analyst

Great. I have a couple more. I'll get back in the queue. Thank you.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Rich Montoni - MAXIMUS - Pres. CEO

Great.

Operator

Our next question comes from George Price with Stifel Nicolaus. Please proceed with your question.

George Price - Stifel Nicolaus - Analyst

Sure. Thank you. And commendations for the continued efforts in transforming the business Good morning, everyone.

Rich Montoni - MAXIMUS - Pres. CEO

Good morning, George. Thank you.

George Price - Stifel Nicolaus - Analyst

I wanted to start on the UK. not losing $0.05 to $0.10 in fiscal '10 now, break-even, what can you -- can you give more color maybe on the changes that are allowing the profitability improvement in fiscal '10? Are those changes appearing more in the back half are they sort of spread out through the year?

David Walker - MAXIMUS - CFO

Yes George when we gave guidance we had just been notified a preliminary award and we are spending a lot of time getting to know the contract better, planning better, getting a better estimate with our client of what the volumes we can recognize would be and we can size the staff accordingly. We have a much better bead.. As you would expect when we initially give you guidance, we try to be conservative and as we get closer to the situation we can refine it. It's just a more precise estimate of where we think we'll be.

George Price - Stifel Nicolaus - Analyst

Okay. Makes sense. So would that be generally sort of throughout the year, or does that have implications in how you would expect it to ramp through the year

Rich Montoni - MAXIMUS - Pres. CEO

In terms of the modeling , the way to work is the revenue -- because it is this ratable recognition phenomenon, the cost, while it will ramp-up a bit on a relatively steady state but the revenue will grow towards the back end of the year. So you'll actually have losses and we talked about $0.10 a share Those things will translate into losses on the first half of the year, and then the second half of the year will be profitable to get

George Price - Stifel Nicolaus - Analyst

So you have better revenue growth in the back half of the year?

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

David Walker - MAXIMUS - CFO

Yes.

George Price - Stifel Nicolaus - Analyst

What I guess, what are some of the key upcoming milestones that we should be trying to pay attention to or asking you about?

Rich Montoni - MAXIMUS - Pres. CEO

On the UK contract?

George Price - Stifel Nicolaus - Analyst

Yes, sir.

David Walker - MAXIMUS - CFO

You know, now that we are operational, what we watch is in fact the cases that come in and we look at placements, and based upon the placements we get payment based upon how long they stay in their jobs. So those are what we will generally look at as key operational metrics. The milestones you should look at is how we are doing relative to earnings. If we think there's a change in position during the year, we'll revise that view. At this point we feel pretty comfortable with it.

Rich Montoni - MAXIMUS - Pres. CEO

We are actually beyond the build stage of things. This is more on the ramp up stage. and Dave hit the nail on the head as it relates to the things to look at. When a project like this is ramping-- the first stage we are beyond which is basically going out and finding suitable space at acceptable terms and conditions hiring up a work force with necessary qualifications, training them, et cetera. That phase is behind us. So now we are into the ramp-up phase.

George Price - Stifel Nicolaus - Analyst

Okay. All right. Great. Fiscal '10 guidance, definitely a top-line growth obviously. You started out talking recent quarters about sort of at least 7% or around 7%. You had 2% add back from California healthy families funding. The incremental revenue growth beyond that I'm assuming is-- how much of that I guess is your new Medicaid win or new wins like that as opposed to not having what I would assume would have been a continued shrinking ERP business dragging at the top line?

Rich Montoni - MAXIMUS - Pres. CEO

The thing that I like about the accounting for discontinued OPs is you pull out the revenue and the cost in operating income from the ongoing operations. So this is apples-to-apples taking out the ERP. So ERP is no longer a factor and frankly prior to it we were looking for ERP to be-- because it had real spikes in the prior year, it was more maintain the status quo. It wasn't really a growth driver. I think year over year in terms of the revenue growth, clearly the drivers of those two big wins internationally, George, but in addition our domestic business most notably in our health operations has some new work and some growth and some existing programs. We are seeing growth in existing programs because of the increase number of cases on Medicaid programs in some of our states. So that's helping as well. So it's a collection of things as you would expect.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

George Price - Stifel Nicolaus - Analyst

Okay. Is the state that you are talking about the new Medicaid deal is that a state where there was potential conflict of interest issue?

Rich Montoni - MAXIMUS - Pres. CEO

No, there's no conflict of interest issue.

George Price - Stifel Nicolaus - Analyst

I'm talking about in terms of the incumbent.

Rich Montoni - MAXIMUS - Pres. CEO

No. no conflict of interest issue.

George Price - Stifel Nicolaus - Analyst

Even sort of adjusting for UK as you noted in the slide, there's, EPS is still growing a little bit slower than the top line. Is there anything else contributing here for that?

David Walker - MAXIMUS - CFO

I don't think so. I think it's principally the UK situation and its lower margin during the ramp-up phase. That is the major item and then I'm sure beyond that there's a number of different things that contribute to the performance of the portfolio as a whole. That's really the major item. I think once you adjust for, I would normalize that forecast for fiscal '10 for the $0.10 and once you do that you would be close to parity between top line and EPS.

George Price - Stifel Nicolaus - Analyst

Okay. For fiscal '10, since you did put at least me, pretty well within the range, David, is EBITDA, is that about a $100 million or so? Is that a pretty good guesstimate of what you see in fiscal '10 or am I low?

David Walker - MAXIMUS - CFO

I don't really have the DA broken out. I'd have to calculate it for you. I'll do that.

Rich Montoni - MAXIMUS - Pres. CEO

Why don't we come back to that one George. I was going to say 2009 you had $102 million in EBITDA but we'll come back to David's estimate for 2010. He's going to have to research that.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Lisa Miles - MAXIMUS - VP, IR

George one item on your question that relates to the new job, I do want to point out that there wasn't an incumbent for that. That is in fact a new out source job. So it continues along the line of trends that we are seeing as state seeks to find more ways to save money and create efficiencies. So this is a new out source program.

Rich Montoni - MAXIMUS - Pres. CEO

Don't let that go overlooked George. It's an important driver in our industry and we have said it's a big long term driver is the propensity of state to move towards procuring managed services because of the retiring of the work force and increasing complexities and challenges of these large, large programs. But in addition I think it's being fueled by and more attention is being paid to the cost of these programs. And I think you are going to see also as governments tend to factor in the-- what I call the true cost of government into these equations.

Historically they basically look at their internal cost to perform on a pay as you go basis, so they don't factor in future pension cost, retirement benefits of state workers. We are seeing more attention being paid to that, and that further tips the scale from the financial perspective in terms of utilizing a third party like MAXIMUS to do this work.

George Price - Stifel Nicolaus - Analyst

I think that's an important point. I apologize, I'm going to ask one more. Is there any way that you can give us a sense of breaking down the impact of the discontinued OPs on the P&L to give us a sense of what the overall business would have looked like had ERP not gone to discontinued OPs?

Rich Montoni - MAXIMUS - Pres. CEO

Yes. Let me take that question.

George Price - Stifel Nicolaus - Analyst

I'm trying to make sure on an apples-to-apples basis because we model it still including ERP.

Rich Montoni - MAXIMUS - Pres. CEO

Sure. And frankly it's a difficult one to answer because it's a hypothetical. It's in the category of woulda coulda. There are many components to the results for the quarter and year so I don't think it's practical to map it over with specificity. I will tell you, when we go through the factors, we end up, if we had maintained ERP in continuing operations, we would have been materially in line but probably at the lower end of the guidance but still materially in line with the guidance.

I'd also say that the key here again is we are pleased with the base OPs for the quarter and the year and most importantly we are really excited about the benefits in terms of moving ERP to discontinued OPs the benefits being increased focus and we have demonstrated the benefit of the increased focus and the expected increased predictability.

George Price - Stifel Nicolaus - Analyst

I appreciate that. Thanks very much for taking the time.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Lisa Miles - MAXIMUS - VP, IR

Thanks George.

Operator

(Operator Instructions) Our next question comes from [Gregory McCaskel. with Lloyd Abbot and Co.] Please proceed with your question.

Greg McCaskel - Lloyd Abbot and Co - Analyst

Yes. Thank you. Just with regard to the backlog with regard to the pipeline, that 1.4 pipeline, give me some color on that if you could.

Rich Montoni - MAXIMUS - Pres. CEO

Okay.

Lisa Miles - MAXIMUS - VP, IR

I guess in terms of the pipeline numbers, Greg, I'm assuming you are wondering where the sales opportunities lie.

Greg McCaskel - Lloyd Abbot and Co - Analyst

Yeah. For the 7% that we are looking for.

Lisa Miles - MAXIMUS - VP, IR

Okay. That's actually a bit different. So the backlog relates specifically to the work in which we fully expect to recognize revenue on moving forward. So it's been a signed award or it's been awarded and unsigned. Pipeline relates to pure sales opportunities that we are tracking and have not been notified on award so they are different. As it relates to the 7% go-get of our forecasted revenue currently in the form of backlog I will go ahead and let Rich talk more about that.

Rich Montoni - MAXIMUS - Pres. CEO

That would be fine. The 7% go-get really any business going into the beginning of the year would have an amount of revenue that it needs to generate, new sales that lead to revenue in a particular year. Our model is one where we are fortunate to have 93% of our forecasted revenue in the form of contracts or expected option renewals and our go-get is-- 7% is very low for an average company. The source of that go-get and filling that 7% which I imagine is your question, George?

George Price - Stifel Nicolaus - Analyst

Yes.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Rich Montoni - MAXIMUS - Pres. CEO

It's really the $1.4 billion backlog that we are tracking, our pipeline rather, our pipeline that we are tracking and we did give you some metrics in terms of the components. So the good news is that our pipeline remains quite hardy year over year. So I think that sets us up for a very achievable hurdle as it relates to the go-get.

Greg McCaskel - Lloyd Abbot and Co - Analyst

Okay. And then just with regard to the other questions regarding margin, et cetera, is there, you said that basically the startup costs a lot were done for the UK but is it fair to say that you are going to have startup costs that are in your guidance relative to Australia?

David Walker - MAXIMUS - CFO

No we incur, Australia is in fact already operational and we incurred them this year. That's a good question. In fact just as a followup some of the large CapEx spend you see this quarter is part of those startup costs. They don't fall to the bottom line but much of the capital spending this quarter was opening those offices in Australia. They are up, they are running, they are operational.

Greg McCaskel - Lloyd Abbot and Co - Analyst

So then the UK does have some startup costs in the first and second quarter.

David Walker - MAXIMUS - CFO

No, no. They don't have -- it's a good question. They had them this year.

Greg McCaskel - Lloyd Abbot and Co - Analyst

Both Australia and UK this year?

David Walker - MAXIMUS - CFO

That's correct. And there's a little bit of capital spending left to go in the UK. won't affect the bottom line but it affects cash flow.

Greg McCaskel - Lloyd Abbot and Co - Analyst

Okay.

David Walker - MAXIMUS - CFO

And that's in our guidance as well.

Rich Montoni - MAXIMUS - Pres. CEO

Does that help Greg?

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Greg McCaskel - Lloyd Abbot and Co - Analyst

Yes. Thank you.

David Walker - MAXIMUS - CFO

George, to follow up -- George, as a followup, this year the EBITDA is about $98 million, right, and then if you take out the legal charges from the operating income and we are looking at about $107 million in 2010.

Greg McCaskel - Lloyd Abbot and Co - Analyst

Okay.

Operator

Our next question, we have a followup question from George Price with Stifel Nicolaus. Please proceed with your question.

George Price - Stifel Nicolaus - Analyst

I guess you answered one of my follow ups.

David Walker - MAXIMUS - CFO

All right.

George Price - Stifel Nicolaus - Analyst

I guess looking at, looking from a margin perspective, full year margin perspective, if my model is close to right given where we, where I sit in guidance, so you are going to be relative flattish may be a hair up in terms of operating margin depending on where you come in on revenue, but I know consulting is fairly small now, but obviously I think the expectations are you should see material improvement in profitability. The profitability in operations, therefore, is going to I guess come down a little bit. Is that all just UK flow through or is there anything else in that? Is that the reasonable way to look at it?

David Walker - MAXIMUS - CFO

George, I'd say consulting while I think important isn't big enough to move the needle on the overall margin. And I think that the margin going down slightly in operations is in fact the result of these deferred revenue situations internationally which on a normalized basis if you look beyond 2010 would bolster it back up.

George Price - Stifel Nicolaus - Analyst

All right. Fair enough. One more question. In terms of thoughts on M&A, you mentioned M&A I guess both in terms of acquisitions that you guys would be interested in if you can be more specific about areas that you'd be particularly focused on, types of services, et cetera, and then to the extent that you can kind of comment on it, what you think about broader interest given some of the consolidation we have recently seen in the industry with Dell and with Xerox, what you think about interest in MAXIMUS?

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Rich Montoni - MAXIMUS - Pres. CEO

Dave Walker do you want to talk about M&A as it relates to MAXIMUS acquisition? Historically we have focused on what we call tuck-in acquisitions George and those would be acquisitions that are relatively small in size that fit well within our strategic direction which would be focus on health and human services. I do believe that acquiring companies that give us capabilities and sometimes that is in the category of process and sometimes it's in the category of knowledgeable folks and sometimes it's dedicated applications, ie, software, we would be interested in those types of opportunity and that's what we've been looking at.

Tuck-in acquisitions tied to our focus would be MAXIMUS' M&A strategy. As it related to the bigger picture and these business combinations that are happening out there, it's very interesting to observe that there's, the justification for the transactions are operational synergies in the marketplace or not convinced that they are really going to stick in the marketplace. We think we know our customer base fairly well, and have solutions that are I think quite responsive to what our customers are looking for.

That being said, we are always interested in expanding our capability internationally. I do believe that we have some great subject matter expertise. I do believe that the same social issues that we help government serve the people here in the United States exist around the world, and we have actually seen that with inbound inquiry interest. So something that provided an international footprint, and I do think that technology will continue to play an increasing role in dealing-- best providing these services. Strategically I would look to build that capability.

George Price - Stifel Nicolaus - Analyst

Okay.

Rich Montoni - MAXIMUS - Pres. CEO

In closing I would like to say we are quite comfortable with where we are and with our plan and the trend that we are on. So we are not compelled to do anything but you have to keep your eyes and ears open.

George Price - Stifel Nicolaus - Analyst

Okay. David, could I ask you a couple of quick ones on cash flow and then be done?

David Walker - MAXIMUS - CFO

Sure.

George Price - Stifel Nicolaus - Analyst

You mentioned increasing AR from large health services contract. Is that California?

David Walker - MAXIMUS - CFO

It is California.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

George Price - Stifel Nicolaus - Analyst

Okay. And that was paid in October?

David Walker - MAXIMUS - CFO

It was.

George Price - Stifel Nicolaus - Analyst

Okay. And are collections at this point --

David Walker - MAXIMUS - CFO

Normal. Back to normal. That's a good question. We saw a little bit of stutter step as the agencies were figuring out what they were doing, slowed it up a little bit and frankly a lot of it came in right after we closed the quarter. So timing is everything unfortunately.

George Price - Stifel Nicolaus - Analyst

Right. And then you mentioned a-- I sort of missed some of this, I apologize, but you mentioned a refresh that would impact cash flow by CapEx in fiscal 2010.

David Walker - MAXIMUS - CFO

The way that works is we had a contract that required delivery and after the delivery accepted it actually has a deferred payment term. So it's a valid bill. It just has to age a certain period of time. And so that's about two days of DSO, and that we feel comfortable we'll get paid in early Q2.

George Price - Stifel Nicolaus - Analyst

Okay. Great. Thank you.

David Walker - MAXIMUS - CFO

You bet.

Operator

We have a followup question as well as from Brian Kinstinger with Sidoti & Company.

Brian Kinstlingler - Sidoti - Analyst

Thanks. In times of unemployment we've always heard that Medicaid and CHIP volumes increase. I'm curious what kind of increase in volume you saw in fiscal 2009 versus fiscal 2008.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Rich Montoni - MAXIMUS - Pres. CEO

I'll ask [Bruce Caswell] who runs our health operations business to field that one, Brian.

Bruce Caswell - MAXIMUS - Director, Health Operations

Good morning, Brian. How are you?

Brian Kinstlingler - Sidoti - Analyst

How are you?

Bruce Caswell - MAXIMUS - Director, Health Operations

Fine. Thanks. Clearly it varies by state so it's fair to say that in some of the larger states that we serve the increase has been, I would have to say in the 3 to 5% range. I wouldn't say that we have seen anything in excess of the 5% number. The metric that I think you probably heard is that 1% increase in the unemployment rate ends up putting 1.1 million more people on Medicaid and CHIP nationally. So I think that our experience has been fairly consistent with that.

Brian Kinstlingler - Sidoti - Analyst

As part of the pipeline you guys mentioned you won the new contract, but that's not part of the pipeline, it's part of the backlog, and that more states are looking to out source and that's a big driver here. Can you talk about the number of states that are not currently outsourcing Medicaid or CHIP whether it's enrollment or adjudication services and whether, and how many you are bidding on those right now?

Rich Montoni - MAXIMUS - Pres. CEO

I'll comment on parts of that, Brian. First of all it's important to realize when those opportunities come at us it's very difficult to predict quarter to quarter. They tend to be isolated in nature and the gestation period is fairly significant. So I think we have additional interest from a couple of states at this point in time, not only in the health arena but in our child support and workforce services arena.

In terms of numbers, Bruce, the numbers I believe in terms of the state, you need to remember the bigger states already out source these functions so the remainder of the states as it relates to enrollment broker are the smaller states. I think the real opportunity is going to be expanding it into some of these poriferal areas and centralize services and component aspects but it's going to be isolated and very difficult to predict quarter to quarter.

Brian Kinstlingler - Sidoti - Analyst

Okay. On the interest income line, you have a lot of cash. Was there something else that cause expenses there? Rates are pretty poor but your income line was -- something had to happen there. Right?

Rich Montoni - MAXIMUS - Pres. CEO

We have someone taking a look at that.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Brian Kinstlingler - Sidoti - Analyst

In the meantime, the revenue on the Texas enrollment, that's up for renewal, how much was generated in fiscal 2009?

Lisa Miles - MAXIMUS - VP, IR

It was about roughly $35 million in revenue in '09.

Brian Kinstlingler - Sidoti - Analyst

And there wouldn't be a refresh piece if you are successful there, would there be?

Rich Montoni - MAXIMUS - Pres. CEO

We don't anticipate a significant refresh piece there.

Brian Kinstlingler - Sidoti - Analyst

The last question I have other than the interest income question is on the CapEx, how much in the fourth quarter and how much in fiscal 2010 relates to your two new international programs?

Rich Montoni - MAXIMUS - Pres. CEO

The CapEx in '09 how much related --

Brian Kinstlingler - Sidoti - Analyst

Fourth quarter and fiscal 2010 total is estimated and why isn't the fourth quarter related to the UK and Australia.

David Walker - MAXIMUS - CFO

In the fourth quarter there's about $7 million of CapEx related to Australia. And there's, I think it's in the category of about $600,000 in the UK, and we expect to have about another $1.5 million in CapEx in the UK in fiscal year '10.

Brian Kinstlingler - Sidoti - Analyst

Australia the $7 million was the fourth quarter, is that also in fiscal 2010 a significant number?

Lisa Miles - MAXIMUS - VP, IR

No.

Brian Kinstlingler - Sidoti - Analyst

CapEx is completed there.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

Lisa Miles - MAXIMUS - VP, IR

In Australia for the most part yes.

David Walker - MAXIMUS - CFO

Australia is complete, UK has about $1.5 million yet to go. There's ongoing CapEx spending in Canada because we are engaged in a transformation change project. That will continue into 2010.

Brian Kinstlingler - Sidoti - Analyst

Great. That's it.

David Walker - MAXIMUS - CFO

The answer is that what gets, it's interest and other. We have an ownership interest in a joint venture in Israel and it was very profitable and you have to eliminate that minority interest. So you have an adjustment that creates a neglect there.

Brian Kinstlingler - Sidoti - Analyst

That would remain negative for fiscal 2010?

David Walker - MAXIMUS - CFO

Kind of depends on how well Israel does. But we generally have enough interest to cover that elimination metric. Thank you.

Operator

There are no further questions in queue at this time. I would like --

Rich Montoni - MAXIMUS - Pres. CEO

Operator, I do have one other follow up comment and I would like to say that MAXIMUS is very pleased to announce that we have a new website that was launched yesterday and Lisa Miles quarterbacked that whole effort. Your welcome to go take a look at it. I think it's quite impressive but we just wanted to point that out to you so you have an opportunity to go check out that new website. Operator that completes our call. Thank you very much.

Operator

This concludes today's teleconference. You may disconnect your lines at this time. Thank you for your participation.

F I N A L T R A N S C R I P T

Nov. 12. 2009 / 2:00PM, MMS - Q4 2009 MAXIMUS, Inc. Earnings Conference Call

D I S C L A I M E R

Thomson Reuters reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes. In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON REUTERS OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2009, Thomson Reuters. All Rights Reserved.

David N. Walker Chief Financial Officer and Treasurer Fourth Quarter and Fiscal Year 2009

Q4 & Fiscal 2009 Financial Results – Continuing Operations Revenue growth of 9.3% in the fourth quarter to $194.0 million and 3.4% for FY 09 to $717.3 million compared to last year On a constant currency basis, revenue grew 10.9% in Q4 ‘09 and 6.5% for FY ‘09 compared to the same periods last year Operating margin of 12.3% for Q4 ‘09 and 11.9% for FY ‘09 Margins in the second half of the year were tempered by start-up investments on new contracts in the Operations Segment, principally in Australia, Shelby County & the UKYear-over-year margin expansion compared to last year was driven by improvement in the Consulting SegmentEPS were $0.80 for the fourth quarter and $3.05 for the full fiscal yearExcluding severance and legal, adjusted earnings per share from continuing operations for Q4 ‘09 grew 11.0% to $0.81 and increased 8.2% to $2.91 for FY ‘09, compared to last year 3 November 2009

Operations Segment Operations Segment revenue growth compared to the same periods last yearFourth quarter ‘09 revenue grew 11.1% to $181.7 million; 12.8% on a constant currency basis Fiscal 2009 revenue grew 4.8% to $659.2 million; 8.2% on a constant currency basisAcquired growth accounted for approximately 1.3% in the Operations Segment for FY 09 Top-line growth for the quarter and the year was fueled by our domestic Health and Federal operations and the expansion of International workforce services operations Strong income and margin for the fourth quarter with operating income of $24.0 million and a margin of 13.2% Q4 operating income benefitted from seasonality from the tax credit business which offset expected start-up investments primarily related to new work in Australia Operating income of $83.8 with a margin of 12.7% for the full fiscal year Revenue in the UK to initially lag behind cost, tempering margins in fiscal 2010 Improved FY 10 profitability outlook; still expected to lose money in the first half of fiscal 2010 but we now expect the project to be breakeven for the full fiscal year 4 November 2009

Consulting Segment Revenue for the fourth quarter of $12.3 million and $58.1 million for the full year Revenue declined year-over-year as the Company exited legacy health care claiming business at March 31st Offset by revenue growth in the Segment’s education business which was ramping up a large project for New York City Segment slightly profitable in the fourth quarterIncome of $2.7 million and an operating margin of 4.6% for the full year 5 November 2009

Balance Sheet Cash totaling $87.8 million at September 30 Fourth quarter DSOs of 71 days Consistent with the third quarter and well within our targeted range of 65 to 80 daysImpacted by increased receivables on a large health services contract, the bulk of which was paid in October An outstanding receivable tied to milestone based billing on a technology refresh, expected to be paid in the second quarterCash provided from continuing operations totaled $34.2 million in fiscal 2009 with free cash flow of $7.6 millionFourth quarter cash provided by operating activities from continuing operations totaled $8.4 million with negative free cash flow of $2.6 million. As a result of growth in Australia, capital expenditures increased in the fourth quarter Driven principally by required start-up related to the acquisition of fixed assets necessary to outfit nearly 40 new locations 6 November 2009

Guidance Fiscal 2010 guidance from continuing operations Top-line growth of 10% to 13% with a revenue range of $790 million to $810 million compared to revenue of $717.3 in FY ‘09Diluted earnings per share growth of 5% to 8% with EPS in the range of $3.05 to $3.15 compared to EPS from continuing operations in FY ‘09 Quarterly guidanceRatable revenue recognition in the UK to depress income in the first half of the year Fiscal fourth quarter traditionally our strongest quarter due to seasonality in certain business lines and as a result, first quarter results traditionally been lower due to seasonal trendsFor the first quarter of FY 2010, expected diluted EPS in the range of $0.62 to $0.67 7 November 2009

Richard A. Montoni President and Chief Executive Officer Fourth Quarter and Fiscal Year 2009 November 12, 2009

Our announcement to divest the ERP division is the next step in building a more reliable organization with a sharpened focus on the administration of health and human services and related consulting offerings Booked a provision in the fourth quarter on a large legacy ERP project to cover all future costs through successful completion and wrote off all long-term assets associated with ERP Actively marketing the property with solid interest from key players 9 ERP Divestiture Today’s MAXIMUS is a much more streamlined, profitable organization – one that’s positioned well for the future. November 2009

2010 Outlook Top-line growth in FY 10 between 10% to 13% with approximately 93% of forecasted revenues in the form of backlog and optionsRecord backlog of $1.8 million which sets the platform for accelerating future growth FY 2010 earnings guidance expected to grow between 5% to 8%, which is tempered by revenue lag in the UK On a normalized basis the UK would contribute an additional $0.10 per diluted share in FY 10Equates to an implied bottom-line growth of 8% to 12%Advancing Health Care Reform a likely growth driver in FY 2011 and beyondFY 10 guidance does not include any material work from thisBased on experience, demand and inelastic nature of services, do not expect a material impact from state budgets to impact 2010In FY 09, estimate only 1.5% of total revenue base was impacted by reductions 10 November 2009

Capitalizing on New Opportunities Increasing trend towards more business process outsourcingStates looking to control costs while managing an increase in the number and complexity of cases from greater reliance on government assistance Additional opportunities where states are advancing new ways to run public programs and seeking to create efficiencies in program administration Our position as an acknowledged industry leader that is independent, well capitalized, and offers significant domain expertise enables us to distinguish ourselves in the marketplace 11 November 2009

12 November 2009 California Performance Review Findings California reviewed several of its health and human services programs, including an analysis of the efficiency of eligibility processing for these programs Using a consolidated method for eligibility determination through a managed services provider such as MAXIMUS was more efficient and less expensive The Healthy Families program, where MAXIMUS determines eligibility, has a lower average cost per eligible person of $77 versus the cost of $308 in the Medi-Cal program where eligibility is done at the county level

New Awards & Strategic Wins Several states looking to streamline enrollment operations in their public health programs Recently notified of a new award on a multi-year Medicaid and CHIP contract for a large state that has traditionally done much of this work in-house Work includes the consolidation, simplification, and centralization of enrollment services, providing beneficiaries with a single point of entry and targeting those who are currently uninsured We are in contract negotiations related to this program, which is expected to launch in the second half of fiscal 2010 13 November 2009

Health Care Reform Substantial synergies between opportunities from health care reform and our demonstrated capabilitiesBoth the house and senate legislation include provisions to expand Medicaid eligibility An eligibility increase to 133% of the FPL represents 10 million new beneficiariesAn eligibility increase to 150% of the FPL represents 15 million new beneficiariesMAXIMUS currently serves approximately 70% of the Medicaid population residing in states that presently outsource their programs We are well positioned to help government enroll these additional beneficiaries and our cost to deliver these services and the level of quality we offer provides government with a competitive alternativeRemain confident that we will play an important role as an independent provider in the resulting opportunities Expect to see new work related to these initiatives to begin in the latter part of 2011 and into fiscal 2012 14 November 2009

International Business Helping governments abroad who face the same social challenges, including increasing caseloads and case complexity in the areas of health and workforce servicesIn Australia, approximately 40 new operational centers are fully ramped; program performing to expectations with a positive contribution in Q4 ‘09In the UK, launched operations on October 5th and ramp-up efforts are progressing as planned with all service locations open for businessContinue to pursue additional opportunities in both of these markets, as well as in Canada, where our British Columbia health enrollment operations recently achieved 48 straight months of meeting or exceeding all key performance requirements 15 November 2009

*Restated to reflect divested businesses and ERP 16 November 2009 New Sales Awards, Pipeline, Backlog & Rebids Record backlog of $1.8 billion; compared to $1.3 billion last yearFY ’09 won or extended on 91% of the value of our rebids and 100% of option years FY ’10 rebids and options12 rebids worth $191 million in total contract value19 options worth $171 million in total contract value

Reliable partner with strong balance sheet and no debtOngoing dividend program returns excess capital to our shareholdersContinue to review opportunities for smaller, tuck-in acquisitions that complement our health and human services business portfolio The critical nature of the programs we administer will continue to provide steady demand for our servicesFiscal 2010 as a year of meaningful growth, both from existing program expansions, as well as new contract awardsPlatform for accelerating growth in FY 2011 as we emerge from start-up phases 17 Conclusion November 2009