David N. Walker Chief Financial Officer and Treasurer Second Quarter Fiscal Year 2009 May 7, 2009

Second Quarter Fiscal 2009 Financial Results Revenue of $184.2 million, up 1% on a constant currency basis compared to same period last year Net income from continuing operations of $11.4 million Q2 09 diluted EPS of $0.64 from continuing operations – Pro Forma diluted EPS of $0.66, which excludes legal and settlement expense – Residual costs with discontinued operations of $0.02 per share Operating margin of 10.2% Clean, solid quarter in line with expectations

Operations Segment Revenue increased 5.6% to $155.6 million – Q2 08 benefitted from $6.9 million in non-recurring revenue – and on a constant Normalized for this infrequent revenue, currency basis, revenue grew 5.6% Q2 operating income of $19.9 million with a 12.8% operating margin – Expected lower as a result of transition to a new contract and related upfront investments – Also impacted by less favorable currency exchange rates contracts often require Large Operations investments that can reduce current earnings as a result of start-up costs – Australia: Start-up investments and revenue lag from out-come based revenue – Expect combined start-up from new work and revenue lag in Australia to be per diluted share in second half of FY 09 approximately $0.20 – As a result, Operations margin expected to be at the lower end of the Company’s stated range of 10% to 15% for the second half of the year

Segment Consulting Revenue totaled $28.6 million in Q2 09 – Performance driven by revenue and profit from the NYC Department of Education project – Included approximately $4.8 million in non-recurring pass through revenue The segment improved approximately 1 0 sequentially by $1.0 million in operating income, but continues to underperform Focus on the fundamentals including labor utilization, winding down certain practice areas areas, improving an underperforming fixed price contract and cost management

Balance Sheet MAXIMUS maintains strong liquidity and flexibility in this demanding market In 09, generated cash from operating activities related to continuing operations of $40.0 million and free cash flow1 from continuing operations of $34.5 million – Included a $12.5 million insurance reimbursement received in February Cash at March 31, 2009 totaled $85.1 million and credit line of $24.6 million put MAXIMUS in a strong position in a difficult economic environment DSOs improved to 66 days During the quarter MAXIMUS repurchased 187,200 shares of stock for $6.8 million – At March 31, $53.4 million was available under the Board-authorized program Paid quarterly cash dividend of $0.12, a cash use of $2.1 million 1The Company defines free cash flow as cash from operations less purchased property and equipment and capitalized software costs

Guidance Updating fiscal 2009 guidance – Revenue to be in the range of $745 million to $755 million – Earnings per share in the range of $2.75 to $2.85 – Currently expect Q3 09 to be consistent with Q2 09, depending on the timing of start-up expenditures. Q4 09 is expected to be strong, driven by new work coming on stream and the annual seasonality from tax credit business – The bulk of the revision – approximately $0.20 per diluted share – is related to investments in work mostly from our expanded book of new work, business in Australia – Tempered outlook for Consulting May have additional investments tied to new work that will help fuel new growth in FY 10 and beyond but premature to predict potential start up for work that is not yet won Reiterating cash flow guidance to be in the range of $35 to $45 million with free cash flow of $15 to $25 million

Richard A. Montoni President and Chief Executive Officer Second Quarter Fiscal Year 2009

Second quarter results in line – Reflective of the repositioned Setting the Table for Meaningful Growth in 2010 and Beyond resilient nature of our business – Aside from start-up investments from new work and tempered outlook in consulting, progressing as expected Major rebid and expansion of the Jobs Services Australia Program– Three-year base contract valued at $266 million (USD) begins July 1, 2009 – Includes six additional option years, if exercised will take contract out to 2018 – New contract with double annual revenue run rate for all our Australian operations to an estimated $90 95 90-million (USD) – Net increase of 36 training and employment sites – MAXNetwork the #1 for-profit provider under the Star Ratings program (Australian government) – Longer term, Australian market could provide broader opportunities in other verticals, such as health Child support enforcement award for Shelby County, TN – Five-year contract valued at $49 million Largest child privatization – support contract in the US

CHIP legislation seeks to expand enrollment from 7 million to 11 million CHIP Reauthorization children over the next five years Could be a significant catalyst for growth in the long term As the leading provider of CHIP administration services, is best equipped to help states meet challenges from new legislation We expect funds to lag over next few quarters and the growth in this market to be beyond this fiscal year – States must complete legislation and allocate funds – Administrating agencies must negotiate or amend agreements with health plans – As a result, we expect this will likely pause any meaningful growth in CHIP enrollments in the near term.

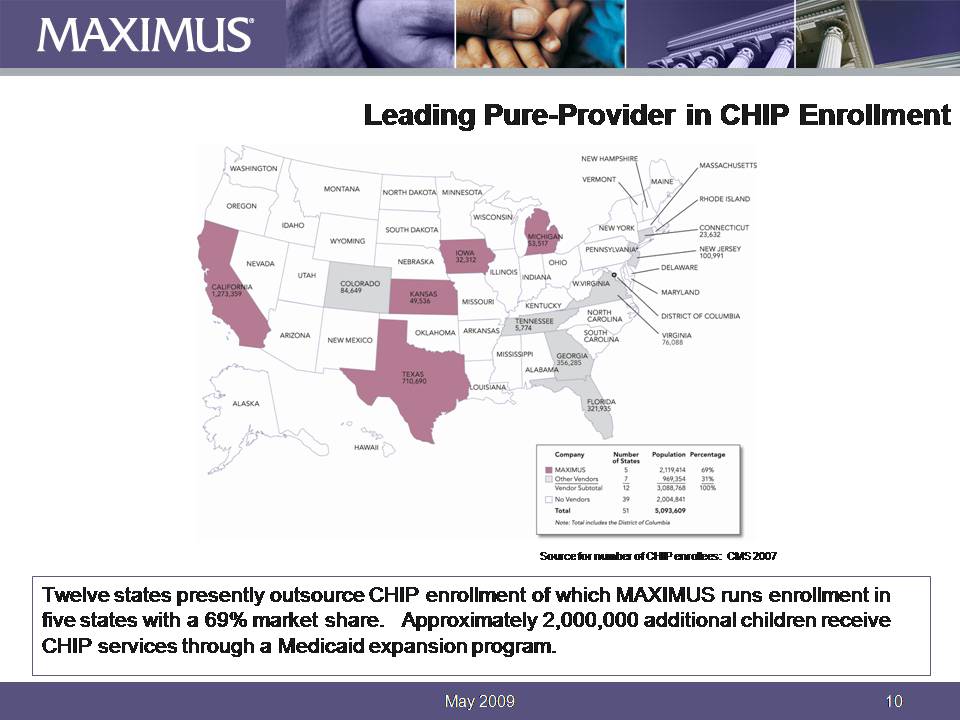

Leading Pure-Provider in CHIP Enrollment Twelve states presently outsource CHIP enrollment of which MAXIMUS runs enrollment in share 2,000,000 additional Source for number of CHIP enrollees: CMS 2007 five states with a 69% market share. Approximately 2,000,000 children receive CHIP services through a Medicaid expansion program.

FY Guidance and FY 2010 Top-2009 Line Commentary Fiscal 2009 earnings – Adjusted primarily to account for ramp-up investments in new work – Tempered outlook in Consulting but executing plan to improve portfolio, focus on fundamentals, manage costs and bring it to consistent profitability New start-up work investments are the precursor to meaningful growth in 2010 Directional insight into our top-line prospects for FY 2010 – Assumes our base business remains intact, based solely with work we’ve won thus far in 2009 – Top-line organic growth of approximately 7% – Does not factor in any potential additional new work we are currently pursuing Our business remains stable, with positive demand trends for the Operations Segment

Capitalizing on New Opportunities Closely monitoring Federal health care reform efforts – Administration has three main goals for reform: improve quality, contain costs and cover the uninsured MAXIMUS brings valuable experience to the table – Ability to contain administrative costs and increase access to cover uninsured and underinsured – MAXIMUS has demonstrated success achieving these goals at the state level – Longstanding positive relationship with Federal key decision makers 50 state outreach program to dissect CHIP and stimulus legislation and identify pressure points for key program administrators – Helping states currently not partnering with a managed services provider to implement broader measures to expand CHIP enrollment MAXIMUS remains the leading administration provider of CHIP administration, working with 5 of the 12 states that currently partner with managed service providers

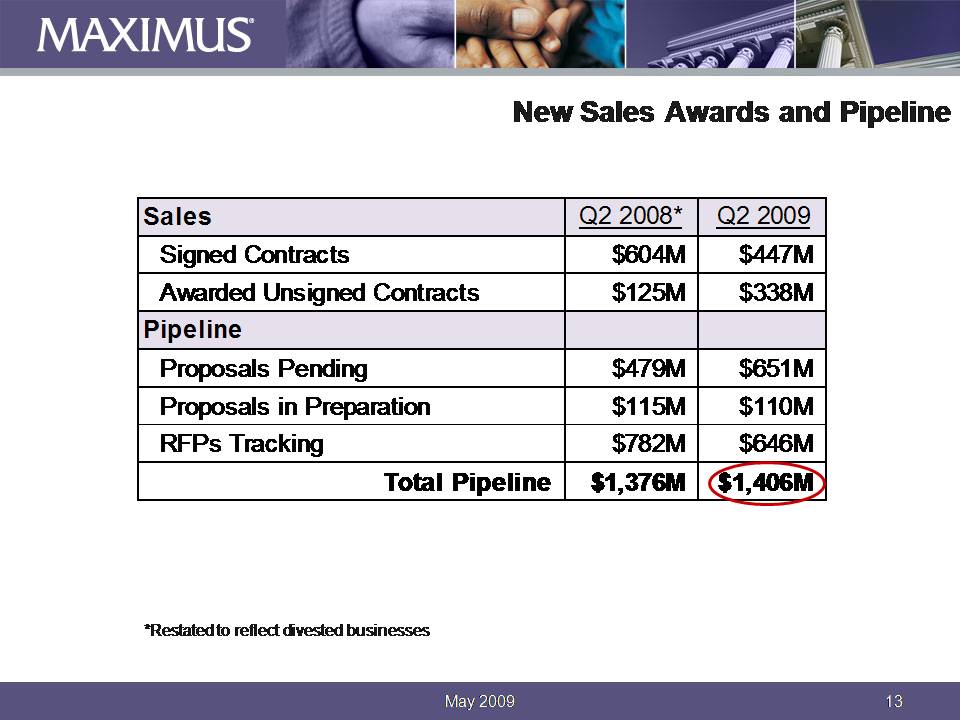

New Sales Awards and Pipeline S l Q2 2008* Sales Q2 2009 Signed Contracts $604M $447M Awarded Unsigned Contracts $125M $338M Pipeline Proposals Pending $479M $651M $115M $110M Proposals in Preparation RFPs Tracking $782M $646M Total Pipeline $1,376M $1,406M *Restated to reflect divested businesses

MAXIMUS maintains a healthy cash balance Conclusion We will invest in ramping up our new contracts in the coming quarters We are actively considering ways to deploy cash in a strategic fashion– Stock repurchase and dividend programs – Evaluation and pursuit of tuck-in acquisitions as appropriate We will use the remaining quarters in FY 09 to position the business for meaningful contribution in FY 10 and beyond We will capitalize on the many opportunities before us today and translate them into successes for MAXIMUS and value to our shareholders

FINAL TRANSCRIPT

MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Event Date/Time: May. 07. 2009 / 9:00AM ET

|

© 2009 Thomson Financial. Republished with permission. No part of this publication may be reproduced or transmitted in any form or by any means without the prior written consent of Thomson Financial.

|

|||

CORPORATE PARTICIPANTS

Lisa Miles

MAXIMUS - Vice President, Investor Relations

David Walker

MAXIMUS - CFO

Rich Montoni

MAXIMUS - CEO

CONFERENCE CALL PARTICIPANTS

Anurag Rana

KeyBanc Capital Markets - Analyst

Charlie Strauzer

CJS Securities - Analyst

Jason Kupferber

UBS - Analyst

George Price

Stifel Nicolaus - Analyst

Adam Peck

Hartford Funds - Analyst

PRESENTATION

Operator

Ladies and gentlemen, welcome to the MAXIMUS second quarter conference earnings call. (Operator Instructions) At this time I will turn the call over to Lisa Miles, Vice President of Investor Relations.

Lisa Miles - MAXIMUS - Vice President, Investor Relations

Good morning. Thank you for joining us today on today's conference call. I would like to point out that we have posted a presentation to our website under the Investor Relations page to assist you in following along with today's call.

With me is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared commentswe will open the call up for Q&A.

Before we begin, I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual results or events may differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

And with that, I will turn the call over to Dave.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

David Walker - MAXIMUS - CFO

Good morning and thanks for joining us. This morning, MAXIMUS reported revenue for the quarter totaling $184.2 million, up 1% on a constant currency basis compared to the same period last year. Second quarter net income from continuing operations totaled $11.4 million with diluted earnings per share of $0.64 that are in line with our expectations and slightly ahead of consensus estimates.

On a pro forma basis, diluted earnings per share from continuing operations were $0.66, which excludes legal and settlement expense. We also incurred $0.02 per share of residual costs associated with discontinued operations in the quarter. We achieved a total Company operating margin of 10.2% which is consistent with the stated goal of an operating margin at or above 10% over the long term. All in all, it was another clean, solid quarter that was in line with our expectation.

Let's turn our attention to segment level results. For our fiscal second quarter, the Operations Segment posted revenue of $155.6 million. In the second quarter of last year, the Segment arrived an unusual benefit of approximately $6.9 million related to hardware and software purchases on a large health managed services program. After normalizing for this infrequent revenue, the Operations Segment revenue grew 5.6% compared to the same quarter last year on a constant currency basis. The Operations Segment delivered operating income of $19.9 million and operating margin of 12.8%, well within our target margin for the Segment of 10% to 15%.

As a reminder, at the beginning of the second quarter we commenced a project we successfully rebid last year. We expected the margin to be lower as a result of the transition to this new contract and the associated investment in the technology refresh. Our Operations Segment has a business model which provides visibility into future periods. What we sell this year typically translates into revenue next year.

Rich will talk in greater detail about our new contract wins, the large award, such as the recently announced contract in Australia, will help fuel next year's growth. These large operations contracts often involve start-up costs that cannot always be capitalized and, therefore, reduce current earnings. In addition, certain contracts, such as the Australian contract, have outcome-based targets which results in a lag of revenue recognition. We expect the combined earnings impact of the revenue lag and the projected start-up expenses on current wins, not considered in our previous guidance, to be approximately $0.20 per diluted share for fiscal 2009. As a result of these investments associated with recent awards we now expect profit margins for the Operations Segment to be in the lower end of our target range of 10% to 15% for the second half of fiscal 2009.

These large contract wins also can use considerable amounts of working capital. For example, with the recent win this Australia, we anticipate capital expenditures in excess of $7 million associated with the net increase of 36 new operational sites. This will be discussed shortly in terms of guidance for the balance sheet and cash flow.

Moving on to the Consulting Segment. For the second quarter, Consulting Segment revenue totaled $28.6 million. Performance in the quarter was driven principally by the revenue contribution on the New York City Education Project, which included approximately $4.8 million in pass-through revenue in the quarter. While this Segment continues to under-perform from our expectations, the Segment showed sequential improvement of approximately $1 million in operating income. We continue to focus on fundamentals in the Consulting Segment, such as labor utilization, winding down certain practice areas, improving an under-performing legacy fixed-price contract, and cost management.

Moving on to balance sheet and cash flow items. MAXIMUS continues to maintain healthy liquidity levels and no outstanding debt. For the second quarter, MAXIMUS generated cash from operating activities related to continuing operations of $40 million and free cash flow from continuing operations of $34.5 million. Cash flow in the quarter included a $12.5 million insurance reimbursement we received in February related to a settlement from the prior fiscal year.

Excluding the settlement receipt, cash flow from operations was still exceedingly strong. We ended the second quarter with cash totaling $85.1 million at March 31, 2009. Our cash, coupled with the $24.6 million available under our line of credit, certainly puts us in a strong position in a difficult, economic environment. This is something that is increasingly important to our clients, who prefer a financially stable partner when outsourcing important programs.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

We have maintained a rigorous focus on cash and receivable management. As a result, DSOs continue to run at the favorable end of guidance. DSOs for the second quarter were 66 days. There will be fluctuations due to timing, so overall, we continue to expect that DSOs could range between 65 to 80 days.

Early in the second fiscal quarter, we repurchased 187,200 shares of MAXIMUS common stock for approximately $6.8 million. At March 31, 2009, MAXIMUS had $53.4 million available under its Board authorized repurchase program. During the quarter, we also paid a quarterly cash dividend of $0.12 per share, a cash use of $1.2 million.

Before I turn the call over to Rich, I will wrap up with some guidance. We are adjusting fiscal 2009 guidance and now expect revenue in the range of $745 million to $755 million and diluted earnings per share of $2.75 to $2.85. At this, we expect the third quarter to be largely consistent with the second quarter depending on the timing of start-up expenditures. The fiscal fourth quarter is expected to be strong as a result of the new work coming onstream and annual seasonality from our Tax Credit Business. As noted in my earlier comments, the bulk of the revision, or approximately $0.20 per diluted share, is related to investments in new work, mostly from our expanded book of business in Australia.

We have also slightly tempered our outlook for Consulting in this revised guidance. While we have seen sequential improvement in this Segment's performance, improvement has been more moderate than we previously anticipated.

And lastly, cash flow guidance. While some of our new contract wins require increased capital spending and use of working capital, our strong performance in the quarter allows us to maintain our full year cash flow guidance. Just to reiterate that, we continue to expect cash flow from continuing operations for the full year to be $35 million to $45 million with free cash flow from continuing operations of $15 million to $25 million.

Thank you for your time this morning. Now I will turn the call over to Rich.

Rich Montoni - MAXIMUS - CEO

Thank you, David. Good morning, everyone. Thank you for joining us today.

At the beginning of the fiscal year, we envisioned 2009 would be an improved year and one that sets the table for meaningful growth; meaningful growth in 2010 and beyond. And these are really shaping up as expected. Our second quarter results were in line with the expectations and reflective of the resilient nature of our repositioned business. We are pleased with our year-to-date results and principally - aside from start-up investments resulting from new work, one, and a modestly tempered outline in Consulting - we are progressing as expected.

The cornerstone of our enthusiasm for fiscal 2010 is today's announced win of a major rebid and expansion of the Job Services Australia Program. This win further demonstrates our market leading position in the administration of Health and Human Services programs.

I will share with you the highlights of the Australian win. And by the way, all the dollars I will mention will be in US dollars, although the contract itself is valued in Australian dollars. The contract is a three year based contract in Australia and it is valued at $266 million. The contract also allows for up to six additional option years and, if exercised, will take the contract out to 2018. The new contract will double our annual revenue run rate for all of our Australian operations to an estimated $90 million to $95 million. The new contract, through our MAXNetwork subsidiary, calls for a major ramp in our Training and Employment Services with a net increase of 36 sites across Australia. In line with the program's goals, we will broaden our focus to include longer term, more comprehensive skills training to increase the length of employment for the most disadvantaged clients.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

MAXIMUS has been the number one rated for-profit provider under the Australian government's Star Ratings Program. We are reaping the benefits of the exceptional performance of our MAXNetwork team.

This gain, in this important international market, stems from our concentrated focus on our core, our core Health and Human Services offerings and our emphasis on maintaining a number one or number two position in key markets. Our strategy is working. Longer term, we think the Australian market could provide broader opportunities in other core vertical markets such as Health.

In addition to Australia, we recently won a five year, $49 million Child Support Enforcement Award for Shelby County, Tennessee. This contract represents the largest child support privatization contract in the nation.

Our ability to continue to win contracts and expand our business is a reflection of our optimization efforts over the last three years as we become more effective in our core markets. Our demonstrated success further defines MAXIMUS as the leading pure-play provider in the government Health and Human Services market.

Let me review some the important events of the second quarter. We were pleased that both the CHIP reauthorization and stimulus bills were passed into law. The CHIP legislation seeks to expand the program from seven million children to 11 million children over the next five years. This could be a significant catalyst for future growth. As the leading provider of CHIP administration services, we are best equipped to help States meet the challenges of the new requirements.

As discussed on last quarter's call, we expect new spending from these bills to start to ramp up over the next few quarters. This is due to the multi-step process of completing legislation and allocating funds down to the States and applicable agencies. State administered programs such as CHIP may also require State legislative action to increase funding levels while administrating agencies must negotiate or amend agreement with health plans. This, in turn, will likely pause growth in CHIP enrollments in the near term and push out any meaningful growth from these bills beyond this fiscal year.

As David explained, our 2009 earnings forecast has been adjusted primarily to account for the start-up cost on new work. In addition, we have slightly tempered our outlook for Consulting. In Consulting, we are executing a plan to improve the Segment's overall portfolio and our main focus is on improving the fundamentals, managing costs, and bringing it to consistent profitability.While we have made progress here, we are focused on driving additional improvement.

But the largest driver behind modification to guidance is the new work start-up. This is a net positive, reflecting typical start-up costs, that are the precursor to meaningful growth. This meaningful growth we expect to start in the upcoming fourth quarter. In fiscal 2010, we expect a full year of benefit in growth, in revenue, and profit from this new work.

It is still early to introduce formal guidance for 2010 but we are comfortable enough with the contracts we have won thus far this year to provide some directional insight into our top-line prospects for the coming fiscal year. Assuming our base business remains intact, based solely on the new work we've won thus far this year, we have locked in expected top line organic growth of approximately 7%. This is based off the mid point of our 2009 revenue guidance. It is important to note that this projected growth does not factor in any additional growth from potential new work on the runway that we are currently pursuing, which, by the way, is quite robust.

All in all, we believe our business remains stable and we continue to see positive demand-trends in our Operations business. Our ability to navigate this challenging environment has been a direct result of our focus on core services for federally funded and federally mandated Health and Human Services work. We continue to win new work in these areas at both the State and Federal levels. However, it is critical, that we continue to take advantage of new work opportunities as they develop. We have several ongoing initiatives to monitor legislative action and capitalize on opportunities for our Consulting and Managed Services.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

On the Federal front, we continue to closely monitor President Obama's healthcare reform efforts. The Congressional Budget Office estimates a steady increase in healthcare spending, as a percentage of GDP, and it is likely that health reform will remain a legislative priority in the long run. The administration has three goals for health reform - improve quality, contain costs, and cover the uninsured. MAXIMUS brings valuable experience to the table, particularly with our ability to contain administrative costs and increase access to include coverage for the uninsured and the under-insured. We have demonstrated success in achieving these goals for our State clients in the administration of State, Medicaid and CHIP programs. We anticipate that House and Senate committees will introduce legislation in June and take action in early August. Right now, the likely vehicle to move this legislation is undefined, but as an independent provider, we are actively participating in health reform dialogue.

We believe our ongoing work in the Health and Human Services market has enabled us to build upon our long-standing, positive relationship with key decision makers, particularly those at the Centers for Medicare and Medicaid services, the Department of Defense TRICARE management activity and other Federal agencies. Our strong past performance as a key Federal contractor makes us confident about additional opportunities that will likely result from health reform.

At the State level, we are also aggressively working to raise awareness of our capabilities and experience to help position the Company with prospective new clients. We established a 50 State outreach program to help dissect CHIP and stimulus legislation and identify pressure points for program administrators and key decision makers. As part of this outreach effort, we are helping States currently not partnering with a Managed Services provider to implement broader measures to expand CHIP enrollment.

Today, MAXIMUS is the leading provider of CHIP administration working with five of the 12 States, including two of the largest, that currently partner with Managed Service Providers. We are exploring every opportunity to stay ahead of the curve and expand our leadership, both with existing and prospective customers.

Now, turning to our pipeline and rebid data. On May 4th, we had new signed awards of $447 million and new contracts pending, or awarded but unsigned, totaling $338 million. Our pipeline of new opportunities remains steady at $1.4 billion. This includes $651 million in proposals pending, $110 million in proposals-in-preparation, and $646 million in opportunities we are tracking and expect to come out in the next few months.

Finally, our cash position remains robust. In the coming quarters we will invest in ramping up our new contracts while maintaining a healthy cash balance. This, by the way, continues to serve as a competitive differentiator in our government markets. As we de-risk and focus the business, we are also mindful of ways to deploy cash in a strategic fashion to drive growth and strengthen our core competencies. Company Management and our Board of Directors regularly review opportunities to return capital to shareholders through our repurchase and dividend programs. We also continue to evaluate tuck-in acquisitions and will pursue these opportunities as appropriate.

In summary, as we look ahead, fiscal year 2009 will be a solid year and a time to position the business for meaningful future growth. Not only in fiscal year 2010, but in the years beyond. We will continue to optimize our business operations, provide our clients with high quality services, build relationships with key decision maker, and closely monitor legislative changes. We have many prospects before us today and I am optimistic about our capability to capitalize on these opportunities and translate them into successes for MAXIMUS and value to our shareholders.

With that, let's open it up for questions. Operator?

QUESTIONS AND ANSWERS

Operator

Thank you, ladies and gentlemen, at this time we will be conducting a question-and-answer session. (Operator Instructions)

Our first question today comes from Anurag Rana with KeyBanc Capital Markets. Please proceed with your questions.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Anurag Rana - KeyBanc Capital Markets - Analyst

Good morning, everyone. This is Adam in for Anurag. Couple of questions for your guys. When you refer to the new work you're pursuing, what areas in particular are you focusing on?

Rich Montoni - MAXIMUS - CEO

Good morning, Adam, this is Rich Montoni. We are really focused, across the board, in all of our business units, on new work. The items that come in mind, in terms of foremost, would certainly be in the Federal arena. Over the last couple of years we've experienced pretty meaningful growth in our Federal business. We think strategically it is a great match with the expertise we've built up over the years. We also think it plays handsomely into our capabilities in Dispute Resolution and the fact that we are an independent provider of Dispute Resolution Services, as well as Quality Oversight Services. So certainly in the Federal arena, we expect new work.

State and local, I think, we expect new work certainly in the Health and Human Services area. Some of this is resulting from the ongoing trend towards outsourcing by governments, and we can talk about what those drivers might be. But certainly, to quickly share with you some of the drivers behind it -- it's the retiring government workforce, it is the increasing complexity of the cases, the increasing number of the cases that I think really constitutes meaningful pressure points to increase demand in those service lines and then Consulting. And we expect to grow Consulting service capabilities when they best fit with our core capabilities. And that is really the can of Consulting space.

Anurag Rana - KeyBanc Capital Markets - Analyst

Great. Two more. Can you elaborate on your timing expectations for the State CHIP legislation and fund allocation?

Rich Montoni - MAXIMUS - CEO

I would be glad to talk about that. I have got to tell you, there is really no clear cut, quick answer. It really will depend upon, first and foremost, State by State -- the individual State situation, and how those State leaders decide to move forward with the opportunity presented to them by this new Federal legislation. And there is a continuum. Some States may choose not to modify their programs extensively. Others will choose to move forward.

I'd also say, keep in mind, I believe the intent of the new legislation, the CHIP legislation, it's really a five year program and the goal is to grow the coverage to children from 7 million to 11 million over five years. I think there's an earnest intent by the States to get there, but I don't think it's a three month or six month exercise. I think it is multi year.

Anurag Rana - KeyBanc Capital Markets - Analyst

Thanks, Rich. And lastly, to what extent have the additional Federal matching funds for Medicaid offset State's budget shortfalls to this point?

Rich Montoni - MAXIMUS - CEO

Well, that is really where you need to read tea leaves. It is tough to quantify and, from our perspective, impossible to quantify. So qualitatively, I would tell you, I think it's to a meaningful extent and I think it is very helpful. I think a lot of States did appreciate it and use it to help maintain the current level of service. So, I can just give it to you qualitatively, I think it is substantial.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Anurag Rana - KeyBanc Capital Markets - Analyst

Thanks very much, Rich.

Rich Montoni - MAXIMUS - CEO

You bet. Thank you.

Operator

Thank you. Our next question comes from the line of Charlie Strauzer with CJS Securities. Please proceed with your question.

Charlie Strauzer - CJS Securities - Analyst

Good morning.

Rich Montoni - MAXIMUS - CEO

Good morning, Charles, how are you?

Charlie Strauzer - CJS Securities - Analyst

Good, thanks. Couple of things. First of all, if you could expand a little bit on the guidance and how we should think about the Segments' margins for the next couple of quarters. Are you also implying with the tempering of Consulting that that could actually turn back into a loss on the operating margin-side? Just give us a little bit more help if you could.

Rich Montoni - MAXIMUS - CEO

I would be glad to do that. The key highlights as we move forward by quarter would be, generally, we expect the third quarter to be relatively consistent top line and bottom line with the second quarter. And the big driver there, obviously, is the incurrence of the start-up cost and, by the way, most of the start-up cost -- and by most I mean 90% plus -- relate to this Australian expansion. And as you are aware, the adjustment and the guidance is mostly related to the start-up cost. We expect that there will be a weighting of the start-up cost towards the third quarter. If I were to share with you percentages, I think it would be 70/30, 60/40 weighting as it relates to Q3, Q4. So we'll get a bit of uplift in the fourth quarter relative to that weighting.

And other things that will give you flux between Q3 and Q4. As you're well aware, we have that seasonality that comes into play with our Tax Credit Business in the fourth quarter, it is its most handsome quarter and we expect that to repeat. We also see improvement in Growth and Health operations in the fourth quarter. We also see the Child Support Business as improving in the fourth quarter versus relatively flat in the third quarter. And the big driver to that is the Shelby contract that we mentioned in my call notes. That should kick in operationally and contribute to revenue and profit in the fourth quarter, but not so much in the third quarter.

And lastly, on the Consulting side, we do expect Consulting should be pretty close to break even in Q3 and then profitable in Q4.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Charlie Strauzer - CJS Securities - Analyst

Ok. And then segueing into Australia to get a little bit more color there. When you look at the work you're doing now verses what you are going to be ramping to do, can you give us a little bit of flavor of what is different from what you had been doing in the past there? And with the size of the contract are you --? I know it is a little bit above the target type of sized contract that you had dialed the Company back towards. Are you comfortable with the size of the contract and the scope of it as well? Because, I think in the past, larger contracts, I think, you kind of shied away from before.

Rich Montoni - MAXIMUS - CEO

Great question. I have got some points that are very appropriate. First off, as you are aware, Risk Management has been -- it has really been the cornerstone to our strategy for the last three years. And we worked really hard to design, buildout -- not only our Risk Management strategy, but all the tools and protocols that really execute it and make it work in real life. It still is very much an important part of the strategy. And will continue to be an important part of the strategy.

This project in particular, I believe, should be most viewed as an expansion and it has been subject to our higher level protocols. We've put it through our Business Review Committee. We've addressed the risk of this project expansion head-on. And we feel very comfortable that MAXIMUS is very capable of handling this project expansion.

To really understand this situation and the risk profile you need to go back to 2002. We had purchased a small business in Australia. This was the seed, this was their main contract at the time, so MAXIMUS and its predecessor have been running the contract and participating in this contract before 2002, so well over a decade. The risk on this is really spread over many locations. It is really picking up new geography as opposed to inventing and designing and building new systems. We are simply expanding on what we do today.

Another important data point is, last year we received, under the old contract, additional work, 11 additional sites. And we successfully ramped up those sites last year and they went live on time, on budget, and were, as expected, profitable and remain profitable today.

The last important point here is, we just have a great Management team there. They have extensive government experience; a lot of them used to work with the government itself. They have a great relationship with this client. This client, itself, is a very sophisticated client. They know their business. They know their systems. And they're a very fair client.

When we put it all together, we think this is a great contract and we're very capable of executing on it. We see it as a low risk expansion from an operational perspective.

Charlie Strauzer - CJS Securities - Analyst

Excellent. That's a great clarification. And then, Rich, you've purchased a fair amount of shares over the years. Can you maybe just recap for us, if you have it, on the total number of shares you've purchased in the last two or three years, just to kind of highlight the use of your cash for shareholder value?

Rich Montoni - MAXIMUS - CEO

That's a great point. To take a step back, over the last two years, I believe, we've purchased 1.3 million shares.

Charlie Strauzer - CJS Securities - Analyst

Excellent, thank you very much.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Rich Montoni - MAXIMUS - CEO

Thank you, Charles.

Operator

Thank you. (Operator Instructions) Our next question comes from the line of Jason Kupferber from UBS. Please proceed with your question.

Jason Kupferber - UBS - Analyst

Thanks. I just wanted to follow up on the Australia contract. I might have missed this, but how much revenue is actually being deferred here?

Rich Montoni - MAXIMUS - CEO

Dave Walker?

David Walker - MAXIMUS - CFO

Yes. It is less that it is deferred than it is not matched with the cost. So, in this particular contract, we get these incentives or performance based payments and we've historically always had that, so it is the same structure, it is just double the size. And so you incur the cost to run them when people are employed for a certain period of time and they stay in the position. And we get incentive payments for retention and so it lags a little over a quarter. And we have had a very reliable revenue stream from it and we expect it to continue. It is just doubled in size and so the deferral relative to the cost of operations are off about a quarter and half.

Jason Kupferber - UBS - Analyst

Okay. So it sounds like there is nothing that unique about the financial structure of this rebid or expansion piece of work. I guess I am just trying to understand what surprised you guys here. You said, this is most the reason for the guide-down in EPS, is this contract specifically. If I heard you right? I am just trying to understand -- You weren't sure you were going to get the extension? What was the surprise here?

Rich Montoni - MAXIMUS - CEO

Well, it's a new contract rebid. When they award them you don't know what they are going to award. So they could award somewhere between zero sites or, and the other end of the continuum, is this additional amount of work. So, call it conservatism, but what we don't do in our guidance is factor new work into in it. We have basically assumed that we would basically win the same amount of work we are doing today, but we didn't factor in to our guidance that we would win a net new 36 sites. And it is really the cost of expanding those sites, that is the start-up cost. There are no start-up costs with the existing sites that we manage.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Jason Kupferber - UBS - Analyst

Right. Okay. Right. I noticed that the unbilled DSO it spiked a bit quarter over quarter. Is that related to Australia specifically or any other factors?

David Walker - MAXIMUS - CFO

No. Not at all. We started up the contract in New York. We had a big, large front loaded hardware/software pass through. The milestone should be reached to be able to bill that next quarter, but the reality is -- And the DSOs are very competitive, there. You just have one large revenue and an unbilled receivable on a fixed-price contract that hit this quarter.

Jason Kupferber - UBS - Analyst

Okay. Just one last question. Any update on the rebids down in Texas from a timeline perspective? I know the State has kind of pushed that out.

Rich Montoni - MAXIMUS - CEO

They have pushed it out. And the main contract that is involved here -- There was one small contract that they let to a small provider that was about $3 million a year, that happened in November. The main contract here, which is the main one that MAXIMUS is interested in, still remains not awarded. There is activity -- active sessions between the State -- in the State and their process to move forward to the decision. We are anxious to hear a definite decision, I'm going to say, over the next 30 days.

Jason Kupferber - UBS - Analyst

Okay. We'll stay tuned. Thanks.

Rich Montoni - MAXIMUS - CEO

Thank you.

Operator

Thank you. Our next question comes from the line of George Price with Stifel Nicolaus. Please proceed with your question.

George Price - Stifel Nicolaus - Analyst

Hi. First, just to -- Good morning, by the way, everyone.

Rich Montoni - MAXIMUS - CEO

Good morning, George.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

George Price - Stifel Nicolaus - Analyst

Just to clarify on Australia. How much of the $0.20 of new -- of ramp up impact from new work -- How much of that $0.20 is Australia and how much of it is other stuff?

Rich Montoni - MAXIMUS - CEO

More than 90% is Australia. We have one other job that is in a start-up phase, the Shelby situation that will incur some start-up costs in the period, but it is really not a material amount. It is all, virtually all, more than 90%, Australia.

David Walker - MAXIMUS - CFO

We routinely get these, with these large ops jobs, but it is pretty easy to bake inside of what it is. But when you get something as large as Australia that ramps up -- and while it is not operationally risky, and you've got the deferral stream, it is pretty noticeable and it is very tough to forecast when you don't know what volume or number of sites that you are going to get.

George Price - Stifel Nicolaus - Analyst

The reason we hadn't seen this earlier, is the base part of the contract that is ongoing is stuff that you have been doing for awhile?

David Walker - MAXIMUS - CFO

Forever.

George Price - Stifel Nicolaus - Analyst

I couldn't recall anything since BC that had a similar kind of impact. Maybe I'm not remembering.

Rich Montoni - MAXIMUS - CEO

No, we did have that BC contract that was started up, but that was a total new start contract.

George Price - Stifel Nicolaus - Analyst

And I guess, in terms of the timing of the ramp up of the contract revenue and beyond the start-up costs, any other timing to the full margin of the Australia contract?

David Walker - MAXIMUS - CFO

Well it is interesting. The contract has two payment streams. You get a basement. And then you get these revenue stream sets deferred, that's performance based. So you'll actually see the revenues spike up in Q4 on it, so the revenue will start to come on line pretty quickly. And when these bigger performance streams come in that relate to the cost that we incurred earlier, they'll be highly accretive. And so they will start to run in about the second quarter of 2010.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

George Price - Stifel Nicolaus - Analyst

And then margin characteristics? Is this -- are the margins on this one up to full run rate?

David Walker - MAXIMUS - CFO

Very comfortable expected margin. We think that the contract should operate well within the target range for this type of business.

George Price - Stifel Nicolaus - Analyst

Okay. Last thing, also to understand. It looks like $0.05 to $0.10 of the EPS lowering in the guidance is from Consulting, right? It is going down 25% to 30%. And you are citing 24%, the start-up costs. Is this just general fiscal pressures around Consulting and discretionary demand, or is it more performance related with the legacy stuff?

Rich Montoni - MAXIMUS - CEO

I think it's more the legacy stuff. We're working really hard to wrap those up. We believe we have our arms around it, it's just that executing the remedies takes a little bit of time. I do think that you've got -- I was not under the impression that the order of magnitude with Consulting was $0.10. I thought it was $0.00 to $0.05 depending upon the range verses $0.05 to $0.10, George. But it is moreso legacy wrap up. And I think that's good news because in that type of situation we don't expect it to be a recurring, quarter after quarter, type situation.

George Price - Stifel Nicolaus - Analyst

I just thought $315 million to $285 million, that's $0.30.

Rich Montoni - MAXIMUS - CEO

Oh, at the upper end of the range, yes.

George Price - Stifel Nicolaus - Analyst

Last thing. You talked about fiscal '10, throwing out growth. You throw out any kind of thoughts around profitability? I mean, do you think, I know you said at least 10%, do you think you guys could be at or north of a 11% on an operating margin basis?

Rich Montoni - MAXIMUS - CEO

I think -- First off, I'm just very, very pleased to have these wins in our pocket at this point in time, such that we have this minimum 7% top-line growth as we start to look at fiscal 2010. I would expect that it all of it should contribute within the range that we've targeted. As you know, we've historically said the Company should be 10% plus top-line, and 10% plus operating income percentage performer. I think with this development, it certainly puts us in a position where that's a very, very achievable metric. I don't quite want to go to the point to declare that victory at this point in time. It is just too early in the season to do that. But I think it gives us a really good position to at least start asking the question if something beyond that is achievable?

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

George Price - Stifel Nicolaus - Analyst

Alright. Fair enough. Thanks.

Rich Montoni - MAXIMUS - CEO

Thank you, George.

Operator

Thank you. Our next question comes from the line of [Adam Peck] with Hartford Funds. Please proceed with your question.

Adam Peck - Hartford Funds - Analyst

Good morning, thank you for taking the call. On to your 2010 guidance, you said that the base business would be intact. What would that assume for Consulting?

Rich Montoni - MAXIMUS - CEO

It assumes that Consulting will continue to perform pretty much at its constant level. I don't expect that it is going to be a big negative draw. I think that Consulting is positioned to do better in 2010 than it is expected to do in 2009 because we remedied a lot of situations, we discontinued the RevMax business, so it's gone, which is in Consulting. But again, we're not giving granular guidance for 2010, so that it's not appropriate to say that we're assuming inside -- that directional guidance that Consulting is going to improve dramatically or not.

Adam Peck - Hartford Funds - Analyst

Ok. Coming at the margins again for 2010. Given that the start-up costs will come in 2009, is it fair to assume that margins will be higher in 2010 overall than they are in 2009?

David Walker - MAXIMUS - CFO

All things held equal, that is true because we wouldn't repeat the start-up costs which are pretty substantial.

Adam Peck - Hartford Funds - Analyst

Ok. Great. Thanks.

Rich Montoni - MAXIMUS - CEO

But I want to come back to your question as it relates to Consulting. Again, we have a plan in place to deal with the Consulting and our plan anticipates that Consulting will not be as negative a contributor in future years as it is in 2009.

Adam Peck - Hartford Funds - Analyst

Okay. Thank you.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

Operator

Thank you. Our next question comes from Charles Strauzer with CJS Securities. Please proceed with your question.

Charlie Strauzer - CJS Securities - Analyst

Just a quick follow up, Rich, on guidance in Texas. Is there anything assumed in Texas for guidance yet?

Rich Montoni - MAXIMUS - CEO

We generally assume the current level of run rate in rebid situations and I believe that's what we are doing in Texas too as well, Charles.

Charlie Strauzer - CJS Securities - Analyst

Great. Thank you very much. We look forward to getting you on the road in a couple of weeks.

Rich Montoni - MAXIMUS - CEO

Same here. Thanks.

Operator

Thank you. Our next question comes from from the line of George Price with Stifel Nicolaus. Please proceed with your question.

George Price - Stifel Nicolaus - Analyst

Hi. Thanks. I wanted to follow up on one or two things. Mainly, first around stimulus. You talked about CHIP, but beyond just CHIP what are you seeing in terms of flow of funds related to the stimulus package?

Rich Montoni - MAXIMUS - CEO

Here is what we are seeing as it relates to stimulus. We're seeing a lot of activity, and by that I mean at the State level and the Federal level as well, a lot planning activity, a lot of organizational activity. Who has responsibility for what? How are we going to organize to deal with this? A lot of analysis, a lot of policy discussions in a preliminary policy setting. Ranging from some States, they're asking themselves, "To what extent, if any, do we want to avail ourselves of these bills?"

We see -- we've actually won several smaller jobs, George. And by smaller, I mean the $1 million plus or minus range, more consulting in nature, advisory in nature. And there is a lot of State clients that are focused on the CHIP expansion, as we've mentioned. As a company we've had a 50 State call program for both of these new pieces legislation. My take is that we were seeing meaningful interface at the Federal level as a couple of these agencies that we deal with are stepping up to take over their new responsibilities. In fact, we've got a couple of bids that are pending at this point in time. And we are optimistic about the awards in the short term.

As I said earlier, our sense is that a lot of this is perhaps going to be used against existing state deficits; tough to measure. So, when I sum it all up, as I've said before and I think we have said on prior calls, there may be some lift in fiscal '09 in terms of new revenue and opportunity for MAXIMUS, but I wouldn't put it in the category of material at this point in time. I expect most ofthe lift will come in fiscal 2010. And really, it is really too soon to quantify.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

George Price - Stifel Nicolaus - Analyst

Okay. Last question. Status, maybe, of the UK contract. I think there was a large opportunity in the UK that you've talked about before. And I am wondering if that is some of the potential investments to fuel growth in 2010 that you've indicated in the slides that there could be incremental impact to current guidance from something like that. I assume you are referring to start-up costs or transition costs of some sort?

Rich Montoni - MAXIMUS - CEO

Yes. From a modelling perspective, again, we approach it as we will not model in any impacts from pending new work, bids we have out there, until such time as we are awarded the work. And then we'll factor in the additional revenue and the cost ramifications and earnings ramifications.

So, at this point in time, we haven't factored in any new work for the pending bids that we have out there, one of which is this fairly sizeable opportunity in the UK. And again, there is a continuum we may not receive any of the award, or it may be a de minimus amount, or it could be quite substantial. And when we learn of that, that's when we adjust our model. We do expect that the UK will decide their course of action probably in the next 30 days.

George Price - Stifel Nicolaus - Analyst

Okay. But just to clarify, that is sort of what the language was alluding to or referring to, right?

Rich Montoni - MAXIMUS - CEO

I think that's exactly right. That if we've got additional awards and additional ramifications we'd change our model.

George Price - Stifel Nicolaus - Analyst

Thank you.

Operator

Thank you, ladies and gentlemen, this concludes today's presentation. (Operator Instructions) Thank you, ladies and gentlemen, for your participation. You may now disconnect.

FINAL TRANSCRIPT

May. 07. 2009 / 9:00AM, MMS - Q2 2009 MAXIMUS, Inc. Earnings Conference Call

DISCLAIMER

Thomson Financial reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes.

In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON FINANCIAL OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2009, Thomson Financial. All Rights Reserved.

© 2009 Thomson Financial. Republished with permission. No part of this

publication may be reproduced or transmitted in any form or by any means

without the prior written consent of Thomson Financial.

16