Exhibit 99.2

FINAL TRANSCRIPT

Thomson StreetEvents(SM)

MMS

- Q1 2009 MAXIMUS, Inc. Earnings Conference Call

Event

Date/Time: Feb. 05. 2009 / 9:00AM ET

C O R P O R A T E P A R T I C I P A N T S

Lisa

Miles

MAXIMUS, Inc. - VP of IR

David Walker

MAXIMUS,

Inc. - CFO

Rich Montoni

MAXIMUS, Inc. - CEO

Bruce

Caswell

MAXIMUS, Inc. - Pres of Health Services

C

O N F E R E N C E C A L L P A R T I C I P A N T S

Charlie

Strauzer

CJS Securities - Analyst

Adam

KeyBanc

- Analyst

Steve Fordham (ph)

UBS - Analyst

George

Price

Stifel Nicolaus - Analyst

Richard Glass

Morgan

Stanley - Analyst

P R E S E N T A T I O N

Operator

Ladies and gentlemen welcome to the MAXIMUS first quarter conference earnings call. (Operator Instructions) At this time I would like to turn the call over to Lisa Miles, Vice President of Investor Relations.

Lisa Miles - MAXIMUS, Inc. - VP of IR

Good morning. Thank you for joining us on the MAXIMUS first quarter earnings conference call. I'd like to point out that we've posted a presentation to our website under the Investor Relations page to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments we will open the call up for Q&A.

Before we begin I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as results of risks we face including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10K filed with the SEC. The does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

With that I'll turn the call over to Dave.

David Walker - MAXIMUS, Inc. - CFO

Thank you Lisa. Good morning and thanks for joining us.

This morning MAXIMUS reported EPS results that were in line with our expectations and slightly ahead of consensus estimates. For the first quarter, MAXIMUS reported diluted earnings per share of $0.67 compared to $0.51 reported for the same period last year.

Revenue for the period totaled $180.1 million. On a cost and currency basis, the top line grew 5% driven by the Operations Segment which grew 11% and offset attrition from the business. Compared to the same period last year net income grew 13% to $12 million and was driven by continued growth in the Operations Segment.

The current economic environment has bolstered the US dollar which reduces the relative earnings of our international businesses when translated into US dollars. As we discussed on our last earnings call, our ongoing share repurchase program helps to neutralize the impact of the strengthening dollar on our earnings. All in all, it was a clean solid quarter that was in line with our expectation.

Let's turn our attention to segment level results. The Operations Segment now comprises 87% of total Company revenue and provides long-term visibility and predictability with a steady stream of recurring revenue. First quarter revenue for the Operations Segment increased 6% to $156.3 million compared to first quarter 2008 and 11% on a constant currency basis. As a reminder all of our foreign operations are housed in the Operations Segment. As we've emphasized before, top-line growth from the Segment continues to be fueled by new and expanded work primarily in our health and federal business lines.

In the first quarter, growth in our domestic business helped balance the currency impacts from our international operations. For the Operations Segment, first quarter operating income grew 20% and totaled $21.3 million with margins coming in at expected levels of 13.7%.

In the second quarter we expect to experience a temporary dip in Segment operating income and margin with a return to higher margin levels in Q3. The dip in Q2 is principally related to project timing and refresh of a large contract, a project we successfully rebid last year. January 1 marks the start of this contract and the margin fluctuation is a result of the transition to the new contract and the associated investment in the technology refresh. The operation segment also experiences a seasonal uptick in the second half of the year most notably in our tax credit business. Despite the fluctuation in Q2 on a full year basis we continue to expect that the Operations Segment will still be able to deliver margins toward the higher end of our 10% to 15% range.

Moving on to the Consulting Segment, this segment represented 13% of total Company revenue, with revenue totaling $23.8 million for the first quarter of 2009. The Segment posted an operating loss in the quarter of $1.5 million. While this was sequential improvement over the fourth quarter of fiscal year '08, the loss in the quarter in principally due to a $2.5 million project charge due to cost growth on a legacy fixed-price ERP contract.

Beginning in the second quarter we do expect improvement in the Consulting Segment driven most notably from new work including a new contract award with the New York City Department of Education. We did have a delayed start on this project which shifted contribution to the right, but the project is expected to provide a meaningful revenue and profit stream that will extend well beyond fiscal 2009. We will begin working revenue on this new project in the second quarter and at that time, we also expect to record an additional $5 million in non-recurring passthrough revenue.

Let's turn our attention to total Company margins. For the first quarter, we achieved total Company operating margins of 11%. This was driven by the solid margin from our Operations Segment of 14% which was tempered by the loss in the Consulting Segment. While it's not unusual to see market fluctuations quarter to quarter, we still maintain that the Business can continue to run at or above a 10% operating margin over the long term.

Moving on to balance flow and cash items. In December, MAXIMUS paid approximately $40 million in cash to settle its outstanding arbitration. As part of the settlement, MAXIMUS will receive an insurance reimbursement of $13 million in the second quarter. For the first quarter, MAXIMUS used cash from operating activity related to continuing operations of $21.2 million. Normalizing continuing operations cash flow for the $40 million cash settlement paid in the quarter results in cash flow from Operations of $18.8 million and free cash flow from continuing operations of $14.7 million.

With a continued focus on receivables management, DSOs improved to 67 days in the first quarter. While there will be fluctuations due to timing, overall, we expect DSOs could range between 65 to 80 days. Management remains committed to its ongoing cash deployment strategies, including our share repurchase program and cash dividends.

During the first quarter, we repurchased 740,490 shares of MAXIMUS common stock for approximately $23.2 million. At December 31st, 2008, MAXIMUS had $59.5 million available under its Board authorized program. Also during the quarter, we declared an increase of our quarterly cash dividend from $0.10 to $0.12 per share beginning in February. We ended the first quarter with cash, totaling $61.5 million at December 31st, 2008. We also have available a line of credit of $24.6 million, providing the Company strong liquidity and flexibility in this demanding market.

Before I turn the call over to Rich, I'll wrap up with guidance. Based on what we see today, we remain on track to meet the expectations that we laid out at the onset of the fiscal year. While MAXIMUS is reasonably insulated given the current environment we have experienced some immaterial work delays due in part to the state's consternation in dealing with the current fiscal challenges.

This has resulted in some revenue getting pushed to the right. However, we believe these fiscal challenges could be offset by some modest benefits that the Obama initiatives could provide in the latter part of the fiscal year. At this time, the majority of the potential benefits from any new legislation will be longer term in nature and are not expected to have a material impact till fiscal year 2010 and beyond.

As a result we are maintaining our full year revenue guidance but expect it to be towards the lower end of the $750 million to $775 million range. We are also reiterating our earnings guidance of $3 to $3.15 per diluted share. We expect that second quarter earnings will be slightly down compared to our first quarter. We anticipate a return to earnings growth in both Segments in the second half of the year driven by new work and seasonality.

The larger element of improvement will be from seasonality in our tax credit business, a seasonal factor we have experienced annually in the past. We also maintain our cash flow guidance which we revised when we announced the arbitration settlement. Cash flow from continuing operations for the full year is expected to be $35 million to $45 million with free cash flow of $15 million to $25 million.

Thank you for your time this morning. Now I'll turn the call over to Rich.

Rich Montoni - MAXIMUS, Inc. - CEO

Good morning, everyone. I'm pleased to be here with you today to discuss our solid performance in the first quarter.

In summary, we delivered steady performance in the past quarter and we are ready to deal with the substantial opportunities ahead despite the economic challenges out there. Dave has already covered the quarter's financial results in detail, and I will focus my comments today on what is in stored for MAXIMUS going forward.

We are operating in a time of fast moving market dynamics that surely will impact our prospects and performance over the next several quarters and years. And I believe that impact will be very positive for MAXIMUS.

Our business today stands well positioned to benefit in the long run from greater demand for our services due to the economic slowdown and new legislation that calls for expansion of existing programs. This includes increased funding through the proposed $800 billion plus stimulus plan as well as increased SCHIP funding of $32.8 billion in new spending over the next 4.5 years. The anticipated American Recovery and Reinvestment Act and the reauthorization of SCHIP both encompass many of the benefit programs in which we operate, in fact, in offerings where MAXIMUS is the market leader.

The stimulus package is expected to deliver much needed relief to states. The Bipartisan National Governor's Association in a statement issued last week urged congress to pass the bill quickly. The National Governor's Association statement noted that with anticipated budget shortfalls governor's support several key elements of the bill critical to the states including increased federal support for Medicaid.

So it's clear that many states are anxiously awaiting the opportunity to put these federal dollars to work. As you know most states cannot operate at a deficit and the stimulus package would help states deal with the deficit challenges.

These legislative developments will play a significant role in shaping the marketplace for our services over the next several years. The social wins are clearly moving in the direction of increasing the number of people covered under government run benefit programs. In order for states to receive funds, the legislation must be passed in corresponding federal regulatory and state legislative processes must be completed. Once the legislation is passed, we expect that it will begin to benefit MAXIMUS perhaps somewhat in the tail end of fiscal 2009 but materially so in fiscal 2010 and beyond.

As with any government funding the expected leg of funds over the next few quarters simply reflects the process of completing legislation followed by the allocation of funds down to the states in the alliable agencies. In addition, as you may know, state administered programs such as SCHIP requires state legislative action to increase funding levels while administering agencies must negotiate for amend agreements with health plans. So in relation to our business and expected future benefit, it is important to remember that once legislation passes, the flow of funding is not immediate.

That said, there are several areas where the new legislation could translate into new long term opportunities for MAXIMUS most notably in health services where we will see a direct benefit from rising Medicaid and SCHIP enrollments in the states where we operate. According to the Georgetown University Health Policy Institute, the reauthorization bill increases funding by $32.8 billion taking it to about $69 billion over the next 4.5 years. The major goal of the increased spending is to allow states to expand eligibility to include families with incomes up to 300% of the federal poverty level. This is up from the current levels which vary state by state.

SCHIP reauthorization also calls for $100 million for increased outreach, including marketing, advertising, and translation services to spur enrollment of those eligible. The reauthorization also includes provisions for the removal of waiting periods for determining eligibility related to immigration. The goal and expectation of reauthorization is to grow enrollment from seven million kids to 11 million over the next five years as a result of these changes. We believe the reauthorization of SCHIP will result in a substantial increase in enrollments in the programs we currently operate over the longer term. We expect that this will likely translate into a meaningful growth in 2010 and beyond as the program expands over the next five years.

And, thanks to our hard work and continued technological improvements we are well positioned to meet future increasing demand. In the past two years we have realigned staff, disposed of underperforming or non-strategic assets, resolved legacy issues, increased efficiencies and fundamentally changed our approach to new business with an emphasis on profitable growth with clear scope in defined performance milestones.

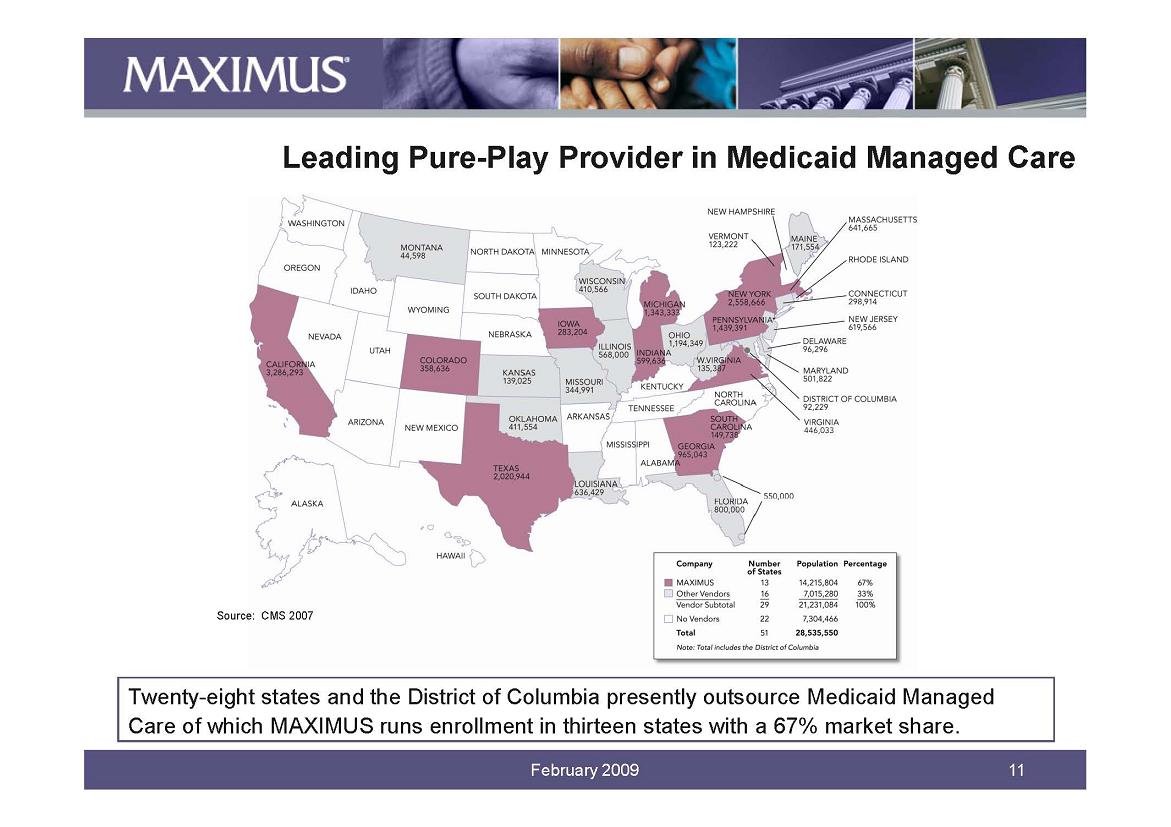

We have transformed the business to focus on our core Health and Human Services program administration capabilities. We believe this provides us with a competitive leg up as we are the leading pure plate provider for the administration of Medicaid and SCHIP enrollment and eligibility services. Today there are 28 states and the District of Columbia that presently outsource Medicaid managed care. MAXIMUS runs the Medicaid enrollment in 13 of those states and commands a 67% market share based on beneficiaries served. This includes the new award in Pennsylvania for the Medicaid Enrollment Assistance Program that we announced in this morning's press release. We are in the process of completing contract negotiations and hope to have a final signed contract in the coming weeks.

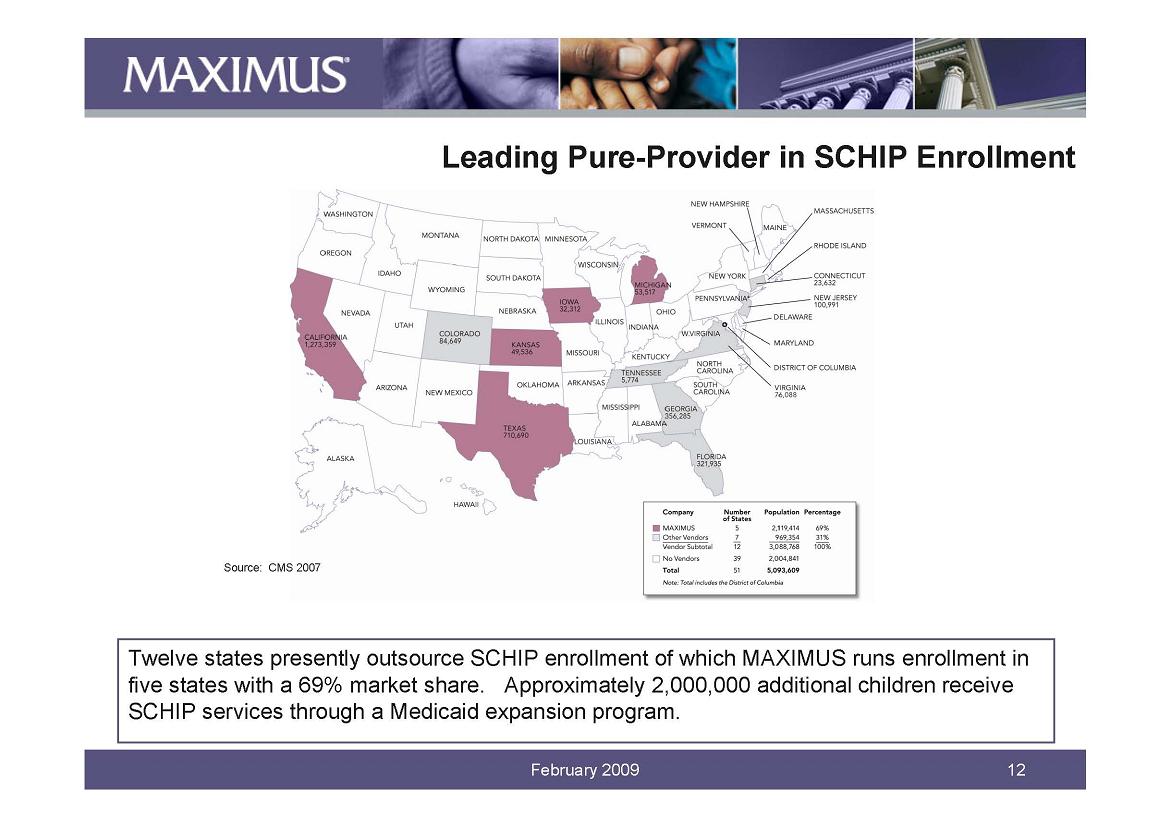

Across the national market there are 22 states that don't presently procure managed services and this represents approximately 7.3 million beneficiaries. In the area of SCHIP we are only 12 states presently outsourced, MAXIMUS serves five states with 69% of the market share-based on beneficiaries. 38 states plus the District of Columbia presently perform this function in-house.

Positioned as the market and thought leader in Medicaid and SCHIP managed services, we believe that the opportunity to further penetrate this market is well within our reach. While the movement towards a public private partnership can move slowly for those states that presently provide services in-house, the opportunity to grow this business has never been greater.

Today our clients are looking for us to help them handle a larger workload while reducing costs and increasing processing efficiencies. We are well equipped to do that and we are always willing to work with our clients to ensure long term positive outcomes and expand established relationships.

We spent a lot of time today talking about the prospects for our health and human services operations but I also wanted to comment on the recent performance of our Consulting Segment and how we view this business strategically. Performance in the Segment was soft in the quarter but we expect improvement going forward as a result of our focus to optimize the business and new contracts like our recently announced signing of a $55 million contract with the City of New York for a special education case management solution. New York City joins the Chicago Public School District as one of our marque clients in this promising area. These strategic wins and our successful execution on them help us establish a leading market position as we pursue new opportunities in this area.

We think it's important to point out that the proposed stimulus package includes an additional funding of approximately $27 billion in the area of special education services. Clients continue to look to us for consulting services that compliment our BPO offerings, especially in more difficulty times like we are experiencing where the emphasis is on how best to drive cost out. Those states that do not presently use managed services will look to the private sector for proven solutions to optimize their business models. As part of our effort to transition the business and improve its performance we will also continue to explore opportunities to reposition the portfolio and we'll take the necessary actions as we've done in other areas of our business to shape Consulting into a profitable compliment to our Operations Segment.

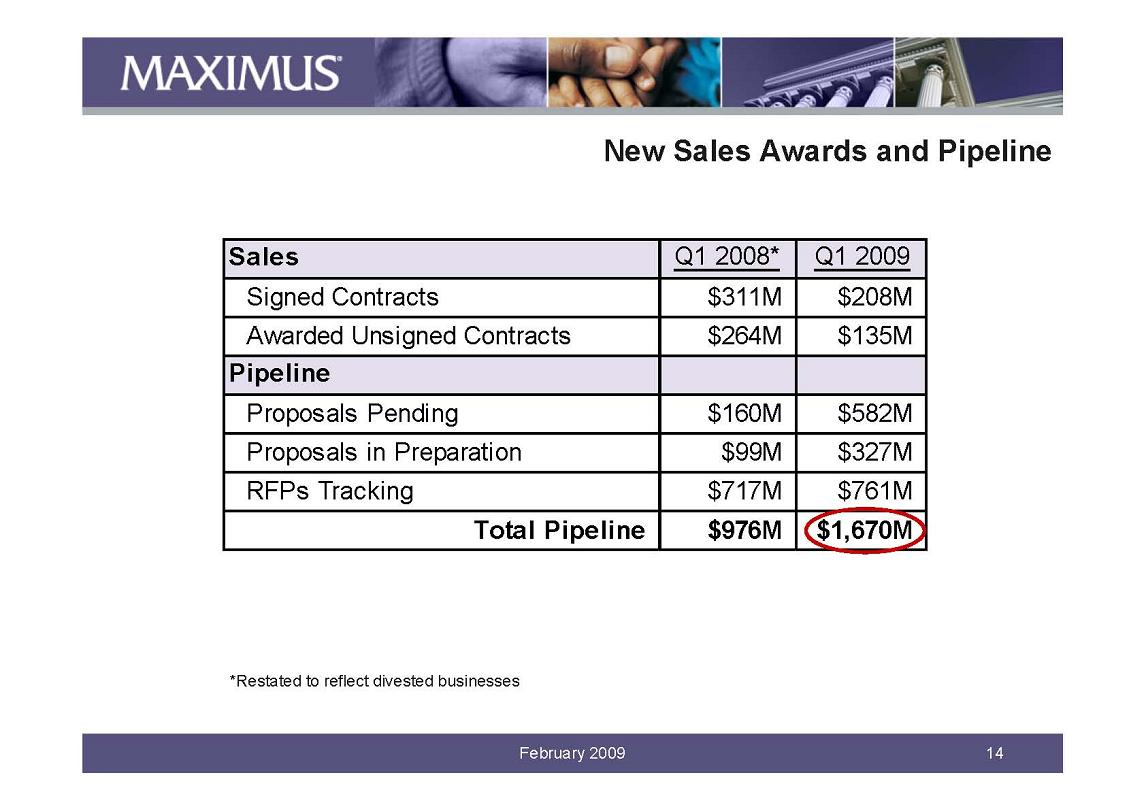

Now turning to our pipeline. At February 3, we had new signed contracts of $208 million and new contracts pending or awarded but unsigned totaling $135 million. At February 3, 2009 our pipeline of new opportunities remains robust and total $1.7 billion. The components include $582 million in proposals pending, $327 million in proposals and preparation, and lastly $761 million in opportunities we are tracking and expect to come out in the next six months.

And finally, we remain confident in our earnings outlook in our longer term prospects based on what we know today. We also have reiterated our revenue guidance for the full year towards the low end of our range and it now includes a modest potential benefit from the pending legislation which could offset approximately $10 million in revenue that has been delayed.

We also continue to maintain the healthy capital position that remains a competitive strength in this market as governments look to partner with well-capitalized companies. Our current cash position coupled with our available credit line provides us with a comfortable cushion should it be needed. In prior years the Company has faced short-term payment delays from state customers all of which were ultimately recovered. We believe our liquidity and capital positions are adequate to weather short-term payment delays. This also gives us a competitive advantage over some smaller private players who may not have sufficient financial resources to navigate a protracted financial downturn.

During the quarter, we removed our last major legacy overhang with the settlement of an outstanding arbitration matter with Accenture. After this payment, we closed the quarter with $61.5 million in cash at December 31. With a healthy cash position, no debt and expected full year positive cash flows, we are very comfortable with our financial position. That said, our priority remains delivering value to our shareholders and returning excess cash when possible.

To conclude, despite the fiscal challenges that states face, demand for social programs that we administer is increasing as the numbers of unemployed and uninsured grow. New federal legislation is expected to support these programs and in some instances like SCHIP, expand them to increase eligibility and participation over the next five years. And with well over 70% of our revenue coming from federally funded programs such as Medicaid and SCHIP, we believe we stand to benefit from this shift over the long term.

Our job is to work with our clients to provide high quality execution and maximize efficiencies to ensure a successful public private partnership. I believe we are up to the challenge, and look forward to leveraging our leading market share and capabilities as we pursue these substantial opportunities.

With that, let's open it up for questions. Operator?

Q U E S T I O N S A N D A N S W E R S

Operator

Thank you. (Operator Instructions) Our first question is coming from the line of Charlie Strauzer with CJS Securities. Please go ahead with your question, sir.

Charlie Strauzer - CJS Securities - Analyst

Hi, good morning.

Lisa Miles - MAXIMUS, Inc. - VP of IR

Good morning Charlie, how are you?

Charlie Strauzer - CJS Securities - Analyst

Good, thank you. A couple of quick questions to you Rich. When you look at the SCHIP reauthorization year and you talked about the jump in the eligibility to 300%, you look at California, what is the current eligibility cap there?

Rich Montoni - MAXIMUS, Inc. - CEO

Bruce Caswell is with us today. Bruce, why don't you see if you can dig that up?

Bruce Caswell - MAXIMUS, Inc. - Pres of Health Services

In California the current federal poverty level -- eligibility limit is 250%. So, that would be a 50% increase for them.

Charlie Strauzer - CJS Securities - Analyst

Got it, so that would potentially increase your enrollment work there. And remind us again with that kind of a contract, you are paid on volume of enrollees, is that correct?

Rich Montoni - MAXIMUS, Inc. - CEO

I think as a generality, the amount of work that we do is tied linearly to the number of enrollees and the exact pay point will vary from contract to contract but I think that contract is per member, per month. But that clearly is a reflection of the number of enrollees.

Charlie Strauzer - CJS Securities - Analyst

If you look at the overall revenue for MAXIMUS roughly what percentage is tied to or correlated to enrollment growth, one way or the other?

Rich Montoni - MAXIMUS, Inc. - CEO

I think the way I would look at that Charlie is to say what is our book of business as it relates to enrollment broker and what's our book of business as it relates to SCHIP. And order of magnitude I think our SCHIP revenue run rate is about $113 million a year and I think we are about a couple hundred million dollars a year in enrollment broker. Those are the two larger service finds that we have.

Charlie Strauzer - CJS Securities - Analyst

Excellent, fair enough. The New York City contract for special ed, how much of that is going to require new training and new expertise to bring on board in terms of new costs versus taking from your core competencies and being able to translate that into new opportunity?

Rich Montoni - MAXIMUS, Inc. - CEO

I think the majority is by far the latter component. This is not a custom build. This is implementing our existing TIENET software which has an installed base across the country. It's the same software that we've implemented in the Chicago public school systems and naturally we'll have to interface it with the systems of New York City and we'll have to train the users in New York City on how to use it. But should not be viewed as a custom build situation.

Charlie Strauzer - CJS Securities - Analyst

Got it. Lastly when you look at the award pipeline for proposals pending, et cetera, are there any potential contracts or [RPs] throughout that that are pending that you think could be delayed or at risk right now Rich when you look at that?

Rich Montoni - MAXIMUS, Inc. - CEO

Well, we have a number of rebids that are up in the normal course and we are not seeing any movement as it relates to those, that existing work that we do. We are quite busy from a new work perspective and there are some contracts that I think are being pushed a bit to the right as a result of that, but surprisingly so, less to the right than I would expect in this environment. Net net we still feel -- actually our proposal folks and new (inaudible) business development folks are very, very busy.

Charlie Strauzer - CJS Securities - Analyst

Excellent. Thank you very much.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks Charlie.

Operator

Our next question will be coming from Anurag Rana with KeyBanc. Go ahead with your question.

Adam - KeyBanc - Analyst

Good morning, everyone. This is Adam in for Anurag. A couple of questions for you. The first is related to the SCHIP reauthorization. Can you discuss some specific spending programs dedicated to increasing enrollment in the program that would pertain to MAXIMUS, for instance, the $100 million for outreach that you discussed earlier?

Rich Montoni - MAXIMUS, Inc. - CEO

Good morning Adam and welcome to the call. As it relates to the SCHIP spending, our view is that there are some specific provisions in the legislation in the most notably would be the $100 million as it relates to outreach and outreach is certainly one of our core competencies. We provide this in many of the programs that we administer.

So I think that is just increasing demand and on a case by case basis we'll expand that capacity. It might be as simple as adding new hires to the situation. I really do view the SCHIP situation as increasing case loads, increasing the number of participants and really just increasing the breadth and depth of our existing offering. So it's really puts us in a position where we don't have to re-invent or invent new services, new products but rather just expanding existing services and offerings generally.

Adam - KeyBanc - Analyst

Got it. A couple of other questions. One is, in terms of the Medicaid spending slowdown across states do you think this will impact enrollment or just benefits?

Rich Montoni - MAXIMUS, Inc. - CEO

This would be benefits.

Adam - KeyBanc - Analyst

So no impact on enrollment?

Rich Montoni - MAXIMUS, Inc. - CEO

I think it's unfair to say no impact on enrollment. It's such a broad universe out there that you'll get some changes in enrollment, but I think generally the lion's share really is in benefits and that is really the number one lever that states tend to pull when they need to manage the spend level is the benefits.

Adam - KeyBanc - Analyst

And lastly can you provide an update on universal healthcare programs in terms of any new programs that are underway or being discussed?

Rich Montoni - MAXIMUS, Inc. - CEO

I think that's a great question, and I do think that what we are looking at is really a mosaic of a system that includes many different parts. I think the general trend to cover more people is very much a value of the new administration. I think the SCHIP is the first step in that direction.

I think the macroeconomic situation plays into it because any universal health solution, and I still think it's going to be resolved on a state by state basis with the federal government as a back drop is going to be a mosaic of the players and how they participate -- the providers, the payors not only including government as a main payor, but also corporations and their participation as well as individuals and their sacrifice.

And I do think that as we move forward -- it is today an employer based model. I think all expect that we're going to preserve that employer based model and I think we're going to see incremental growth in terms of the public programs themselves.

Adam - KeyBanc - Analyst

Thanks very much.

Rich Montoni - MAXIMUS, Inc. - CEO

You are quite welcome.

Operator

(Operator Instructions) Our next question is coming from the line of Jason Kupferberg of UBS. Please go ahead with your question.

Steve Fordham - UBS - Analyst

Hey guys, this is actually Steve Fordham sitting in for Jason. What are some milestones that we can look for to see that MAXIMUS is actually benefiting from the SCHIP installation I guess in the future?

Rich Montoni - MAXIMUS, Inc. - CEO

I think that is a great question, Steve. First of, I keep a close eye on the pipeline statistics that we shared with you, and we just talked about pipeline statistics and the sales pipeline statistic and in particular $1.7 billion and I think we shared with you the components of that. The first -- the base layer of that which is the opportunities that we track currently at $761 million. As you would expect we are having active live discussions with our clients in terms of how do they deal with in some cases the mandatory provisions of this new legislation.

Those are the things that they have to do some of which have a short window and we are also talking to our clients realtime in terms of how do they take advantage of this new legislation and in the spirit of the new legislation to quickly inject these dollars into the economy.

So I expect what is going to happen is the details in those discussions will continue to increase over the next several months and I would expect that we'll start to see specific increases in our opportunities tracking, perhaps when we report in March and certainly in June, and then we would expect those would quickly move up the chain and result in new wins and new opportunities. And, also, I'd say in the margin, we may just see the increasing number of cases result in increasing revenue in our health Operations business.

Steve Fordham - UBS - Analyst

Great. And the other question was should we expect any more charges with the ERP contract in the Consulting Segment or can you guys get us more comfortable that there won't be (inaudible)?

Rich Montoni - MAXIMUS, Inc. - CEO

I think the answer is really somewhere in between. We are comfortable with the provision today. The provision in the last -- in this quarter quite frankly wasn't expected and resulted from an updated situation with a subcontractor who is not performing to our expectations. So we have to work that situation very very closely. We have tempered a little bit in our forecast and expectations, so we can absorb a reasonable amount but it's something that we are watching very very closely so I can't give you absolute assurance.

Steve Fordham - UBS - Analyst

Okay. That's it. Thanks.

Rich Montoni - MAXIMUS, Inc. - CEO

Thank you.

Operator

Our next question is coming from the line of George Price from Stifel Nicolaus.

George Price - Stifel Nicolaus - Analyst

Good morning guys. Nice job.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks, George.

George Price - Stifel Nicolaus - Analyst

A couple of things to follow up. The EPS down quarter-over-quarter this coming quarter, so that sounds primarily due to a ramp-up expenses with the new contract. Is there anything in terms of timing issues or other impacts or is that primarily attributable to ramp-up cost?

Rich Montoni - MAXIMUS, Inc. - CEO

That is the number one driver. We have lots of -- obviously lots of moving parts underneath it but that is the number one driver as it relates to the second quarter, George.

George Price - Stifel Nicolaus - Analyst

Okay. And what was the large rebid that started in January?

Rich Montoni - MAXIMUS, Inc. - CEO

That was our HCO contract.

George Price - Stifel Nicolaus - Analyst

Okay.

Rich Montoni - MAXIMUS, Inc. - CEO

California HCO contract. One other point as it relates to the seasonality of the business we intend to focus our thoughts as it relates to the full year. And we are still focused $3 to $3.15 for the full year.

And when we look at the first half of the year as compared to what we think is going to happen in the second half of the year, there is over a $0.40 improvement in the second half of the year as with you probably calculated George and the one thing that you need to keep in mind is the biggest driver to that -- and I think there three main drivers -- but the largest driver is the seasonality in our tax credit business. That's well over a third of it, and in years past on a recurrent basis the way that business is structured we don't have a pay point until our corporate clients get to take the tax credit on their corporate tax return when the corporate tax return is filed. And most corporations having a December 31 year end file their corporate taxes in the quarter ended June 30 or some will extend and file them in the quarter ended September 30.

So that business is very profitable in the June and September quarter, the second half of our year and it losses money in the first half of the year and the order of magnitude of the swing of that business alone accounts for more than one third of the seasonality or the first half verse second half comparison. The other two drivers -- the education services business is the second largest second half over first half, and that's really facilitated by the New York contract win that was signed such that it's a revenue producing and profit producing situation starting in

George Price - Stifel Nicolaus - Analyst

To New York?

Rich Montoni - MAXIMUS, Inc. - CEO

To New York. That really helps education services . And then we've continued to experience growth and new work -- steady growth in our health ops business. So when we ran out the new work we have, it shows improvement -- continued steady

improvement in the second half of the

George Price - Stifel Nicolaus - Analyst

Following up on that and which I appreciate that level of detail there. Just following up on that last point, so basically you are giving them some incentive in the early part of the year. You are starting to realize through implementation and efficiency and so forth, a profit -- things improve for you as you go through the second half of the year. Is that something that -- confirm that I understand that correctly -- and is that something that you are seeing given the environment, you are seeing a lot more in terms of when states come to you or cities come to you?

Rich Montoni - MAXIMUS, Inc. - CEO

Well, my thoughts are, I've got two data points. I'll share with you one.

A couple of years ago when we started down this path, we've got a great team and we've got a great starting point, but they've really been very productive and effective in building new business and that started a couple of years ago. So, even the wins last year start to cycle such that we have a full year in '09 and some of it in '08, it was a partial year. We've continued to have good wins in our health Operations business, even this year, most notably this Pennsylvania win -- the enrollment broker work there -- that is scheduled to start up April 1. So that launches and that is a nice year-over-year even second half over first half growth type situation.

So a lot of the selling a couple of years ago. We continue to see increasing demand.

The second thought is now what happens on top of this is the increase in case loads that result from these folks losing their jobs and having to seek Medicaid assistance. We'll keep our eye open it terms of what happens with this COBRA requirement and how that fits into our business, but I do think the storm clouds from the macro environment are actually increasing the amount of work that we have to do and that facilitates it as well.

George Price - Stifel Nicolaus - Analyst

Just to be clear, let me re-ask the question. Maybe I misunderstood. But are more of the new opportunities that are coming out that you are looking at -- is there any trend toward clients basically trying to pull benefits out of you up front beyond normal given their fiscal situation?

Rich Montoni - MAXIMUS, Inc. - CEO

I'm sorry. Basically the deal structure --

George Price - Stifel Nicolaus - Analyst

It sounds like that's what you are talking about with New York and correct me if I'm wrong, but I wanted to see if that is a trend given the environment.

Rich Montoni - MAXIMUS, Inc. - CEO

No. We are not seeing that trend. We don't have any such concession in New York. So it's a good question, and theoretically you might expect clients to pursue that type of situation but by and large I think the contracts are structured very much like they've been in the past without upfront concessions.

George Price - Stifel Nicolaus - Analyst

Last question. Any potential concerns about cash flow timing issues specifically with the couple of states that you do a lot of work for that are having more acute challenges like in California?

Rich Montoni - MAXIMUS, Inc. - CEO

Sure. As you are probably aware California is the one state that said they will have to defer payments otherwise due in February. We have -- and this is all on a state by state basis -- California is the one that we are aware of having stated this. We have some work in California that we know is not subject to this intention and we have some work that is.

At this point in time, we believe that we will have roughly $4 million otherwise due in February that California plans -- I'm sorry, $6 million -- otherwise due in February that California plans to delay 30 days. So if they stick to that plan, it shouldn't be an issue come March 31 but you also have to ask the question might they continue with that program or have to defer another 30 days.

Aside from California we have not heard any program like that from any other state, and I think at the end of the day, two points I would make. One is, we feel very comfortable that from a cash position, a financial position we can absorb this type of situation. But more importantly when we go back over prior recessions and prior years, we've had similar situations including with California. You may recall with California we even had the issue last June and in all these situations the states have managed to find the money and they've managed to pay their bills.

George Price - Stifel Nicolaus - Analyst

Sure. I appreciate it. Just from a modeling perspective what we might need to sort of have in the back of our heads. Thank you very much for the time.

Rich Montoni - MAXIMUS, Inc. - CEO

You bet, thanks George.

Operator

(Operator Instructions) Our next question is coming from the line of Richard Glass with Morgan Stanley. Please go ahead with your question.

Richard Glass - Morgan Stanley - Analyst

Nice quarter.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks Rich.

Richard Glass - Morgan Stanley - Analyst

Your core Operations business -- I guess everything's core now -- grew 11% in this environment. Sounds like a pretty good number. I was wonder if we can talk about the Consulting business here. If you -- how much drag is that or what is the overall drag on both the top line this year and on the operating income from that Segment once you layer in some of these start up and other things going on in New York?

And following on to that, what should the margin in this business -- meaning the Consulting specifically -- really get to? Because it sounds like 10% is a rather modest number for almost any consulting business out there, and considering you guys have let the -- or are trying to let -- the unprofitable business leave and are bringing on hopefully better business, why shouldn't that be a higher number as well?

Rich Montoni - MAXIMUS, Inc. - CEO

Rich, I think that is a great question and a couple data points for the folks out there who may not be as focused on the consulting piece at the moment but the Consulting business is a small part of our overall business, and we knew in plan that it would decrease in revenue size. One of the drivers behind that is we have proactively and for very strategic reasons chosen to exit the RevMax business which historically has been a very -- in years past it has been a profitable business but the competitive aspects plus the risk aspects of that business -- and most importantly our desire to align MAXIMUS hand and glove with the federal government as well as the state governments and not be opposed to them given all the opportunities we see has really led us down the path to eliminate that service business that RevMax business.

And where we see the first impact of that where effectively it is going to be closed this December 31. So that's been tempering the revenue, the top line perspective.

Our long-term aspirations for Consulting is that it works very closely with our Operations business to help drive operations excellence and make sure that we have strategic advantage in the outsourcing world focused on our core health and human services and it's the Consulting business that needs to do that. So we are transforming this Consulting business from -- what it had been with little I'll say connectivity to our outsourcing business -- to much connectivity.

So we've said in the past this Consulting business is going through a transition and we expect it to turn to start to be reflective this coming March 31. We are starting to see some pings of improvement in Consulting. This quarter most notably our education services business with this New York contract -- that was critical for it to turn the corner and achieve profitability. And also we have a business in Consulting which is considered to be one of the premier independent verification and validation functions for MMIS systems -- Medicaid Managed Information Systems -- across the United States which I think fits very well with our Medicaid business.

So we are in a period of flux here. When we get done with it I agree with you that a consulting business should be much more than a 10% contributor. Frankly I think it should be 15% plus and I could go the case that it should be a 20% plus business.

I will say at the end of the day the Consulting business is not so much about how big is it from a revenue perspective. It's more important that it really achieves its strategic mission to work with our Operations to further enhance our leadership position in the health and human services environment. Does that answer your question?

Richard Glass - Morgan Stanley - Analyst

Mostly but I'll follow up asking basically -- so given your expectations, your guidance for the year -- is that sort of a break-even business this year with it losing some money in the first half and then starting to make money in the second half?

David Walker - MAXIMUS, Inc. - CFO

Rich, Dave Walker, how are you? Here's directionally what I would say. When we talked about the New York contract moving a bit to the right, it wasn't that we had a lot of startup costs because I've heard some questions about that.

It just took us a long time to get the contract in place and it moved revenue in the year to the right relative to our total plan which gives us some challenges but it really didn't impact the quarter. The loss in this quarter was driven by the ERP job.

What we will see next quarter is the revenue will spike because there is a lot of front end passthrough sort of stuff on that education job. But then you'll see in Q3 and 4 with it returning back down to about the levels it is today.

That being said there's a lot of dynamics. So the education work is back filling a lot of other legacy work and other work that we are exiting. So we are exiting the RevMax business. There are other contracts that have been clear underperforms and we exited those this quarter.

So we continue to do the things that I think you should sensibly do in a consulting business which is make sure your labor utilization is up, drive out people that just frankly couldn't continue the way they were as we changed some of our product lines, et cetera. You are not going to see any dramatic shift in terms of the growth this year, and I think growing a consulting business in this economy can be demanding but you will see a focus on core profitable business that is complimentary to the operation business as we move toward it. So we will move to profitability this year.

Richard Glass - Morgan Stanley - Analyst

All right. Thanks guys.

Rich Montoni - MAXIMUS, Inc. - CEO

Thank you Rich.

Operator

Our final question is a follow-up from George Price from Stifel Nicolaus.

George Price - Stifel Nicolaus - Analyst

Thanks guys, I just wanted to follow up on a couple of things. In terms of SG&A, was it on a continuing ops basis was it down year-over-year, David?

David Walker - MAXIMUS, Inc. - CFO

I actually think it was pretty flat.

George Price - Stifel Nicolaus - Analyst

Okay.

David Walker - MAXIMUS, Inc. - CFO

It's a -- down a few points but I'd always say on SG&A, when it's good and bad, that we tend to take a lot of operators if you will -- cost of sales people away from contracts -- with a lot of proposal activity. So it can move that SG&A line around. So overall we do focus on operating continually -- we continue to do that.

Rich Montoni - MAXIMUS, Inc. - CEO

But as a percentage of revenue it was flat with the comparable quarter last year -- 15%?

George Price - Stifel Nicolaus - Analyst

Yes. Okay.

David Walker - MAXIMUS, Inc. - CFO

With that said do we manage SG&A very vigorously? You bet. Particularly in this environment.

George Price - Stifel Nicolaus - Analyst

What kind of work is getting delayed at this point? You mentioned about $10 million in revenue.

David Walker - MAXIMUS, Inc. - CFO

Well, the New York City thing we talked about moved to the right.

George Price - Stifel Nicolaus - Analyst

Right.

David Walker - MAXIMUS, Inc. - CFO

So we actually had hoped it would start earlier and like any large contract, it just takes a while to negotiate and work through it. No problem there. It just took time. That was the bulk of it.

George Price - Stifel Nicolaus - Analyst

I'm wondering from a trend perspective, I would imagine it would be the more incremental systems development kind of work.

Rich Montoni - MAXIMUS, Inc. - CEO

I think that is right. As a generality I think all of the capital spend items are under the microscope. I don't think it's fair to say that as a rule they are all being delayed. I think there are isolated situations.

So for example a new ERP system certainly is a discretionary spend item and it might get delayed or pushed to the right. Although I'll tell you I'm surprised at the number of requests for proposals that we continue to see and haven't been delayed.

David Walker - MAXIMUS, Inc. - CFO

Although, if you look at Consulting -- that net when I gave you the trends with Rich -- we talked about some revenue going down, some revenue going up, this education will drive it up, and some of the ERP will go down is what I would normally expect in this environment. So it will swing around, but the profitability profiles and the risk profiles are dramatically different between the two lines of work.

George Price - Stifel Nicolaus - Analyst

And last question. I just kind of wanted to get your views on the stimulus and the federal money. Clearly we have some expansion in SCHIP. But, how would you say we should think about what's happening in SCHIP -- what is coming out of the stimulus plan for Medicaid and TANF and stuff like that in terms of the timing of it and whether -- when it sort of moves or could move from stemming the bleeding if it were with what's happening in the state and local fiscal situation to being actually incremental if that makes sense?

Rich Montoni - MAXIMUS, Inc. - CEO

It makes a lot of sense and when you read the bill or variations on the bill and we are very very close to this legislation. We spent a lot of time to understand what is being proposed and how MAXIMUS is able to take what we think is going to be new law, new policy and translate that into action for our clients.

Some of the key themes that are inside of this legislation is -- For example one of the concepts is right up front of the bill is this concept of a quick start.

And they strongly encourage quick start programs whereby I believe 50% of the specified funds are spent in a very short period of time, and I think that's earmarked more so for infrastructure matters but a lot of what we see from a MAXIMUS opportunity is in the area of infrastructure.

While the bill is intended to provide benefits over several years, I think the hope of the leaders is that much of it will be spent very quickly. Our thoughts also are that from a state perspective they need some of these funds very quickly.

One of the detailed provisions that I think that is very important to our state clients is the increase in what's referred to as the FMAP percentage that will help the states go and plug basically their otherwise significant budgetary deficits. It won't eliminate all of the state budgetary deficits, but it's going to go a long way to help to manage those such that they can maintain the current coverage levels at the various states.

The one last thing I would share with you is that when we read this stimulus bill, there's three main areas where there is just a lot of anticipated spend. Certainly health is the number one area and we've worked really hard to draft that legislation, work on that legislation, stay close to that legislation, but we see that the health is evolving as we expected.

But what was a pleasant surprise actually is the amount that's pointed towards education. And, there's almost $40 billion in education dollars that are designated, and almost 30 of that we think falls within an area that we operate, and that's in particular the special needs area. So we are excited about some education opportunities there as well.

George Price - Stifel Nicolaus - Analyst

Okay. Last question if I could. In terms of the Consulting the legacy ERP contracts, can you just update where we are with those -- how many, when do they finish, that sort of thing -- just to round out the question that came before.

Rich Montoni - MAXIMUS, Inc. - CEO

I think that's fine and I think this is in line with what we shared with you in the past. We have four, we really have -- we have three large remaining ERP projects and we watch them very, very closely. The one that we've been dealing with and this is the second quarter where it's a been a -- we've taken a charge -- is limited to one particular project. And that's the one of the three that is legacy in nature that we think is the challenged project. Otherwise based on what we know today the others seem to be headed in the right direction and performing satisfactorily.

George Price - Stifel Nicolaus - Analyst

Great.

Rich Montoni - MAXIMUS, Inc. - CEO

The net take away is we've eliminated the number of projects dramatically from what they had been in prior years.

George Price - Stifel Nicolaus - Analyst

Great. Thanks very much.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks, George.

Operator

Ladies and gentlemen, this concludes today's presentation. A replay of this call will be available to you within two hours. You can access the replay by dialing 877-660-6853 or internationally 201-612-7415 enter account number 316 followed by the replay ID number 311570. Thank you for your participation. You may now disconnect.

D I S C L A I M E R

Thomson Financial reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes. In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON FINANCIAL OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

David N. Walker Chief Financial Officer and Treasurer First Quarter Fiscal Year 2009 February 5, 2009

First Quarter Fiscal 2009 Financial Results Q1 09 EPS of $0.67 Revenue of $180.1 million Top line grew 5% on a constant currency basis – Operations Segment revenue grew 11% on a constant currency basis Compared to same period last year, net income grew 13% to $12.0 million Current economic environment has bolstered the U.S. dollar Ongoing share repurchase program helps neutralize the impact of the strengthening dollar on MMS earnings Clean, solid quarter that was in line with expectations & consensus 2 February 2009

Operations Segment Operations Segment is now 87% of total Company revenue Revenue increased 6% to $156.3 million in Q1 compared to the same period last year and 11% on a constant currency basis Top-line growth fueled by Health and Federal business lines Growth in the domestic business helped balance the currency impacts from our international operations Q1 operating income grew 20% to $21.3 million with a 13.7% operating margin Expected dip in operating income and margin in Q2 Related to project timing, the refresh of a large project, and seasonality of our tax credit business Margin fluctuation due to the transition to a new contract and the associated investment in technology Will return to higher margin levels in Q3 FY 09 Operations margin still expected to trend at the higher end of the Company’s stated range of 10% to 15% driven by a seasonal uptick in the second half of the year, most notably in our tax credit business 3 February 2009

Consulting Segment Consulting represented 13% of total Company revenue Revenue totaled $23.8 million in Q1 09 The Segment had a first quarter loss of $1.5 million due to a $2.5 million project charge due to cost increase on a legacy fixed price contract Beginning in Q2, expect improvement driven from new work including the recently won New York City Department of Education project Delayed start shifted revenue to the right Project expected to provide meaningful revenue and profit that will extend well beyond FY 2009 Will begin booking revenue in the second quarter, at which time we expect to record an additional $5 million in non-recurring, pass-through revenue 4 February 2009

Total Company Margins Q1 09 operating margin of 11% Driven by solid margins in the Operations Segment of 14%, which was tempered by the loss in the Consulting Segment Expect fluctuations quarter to quarter but management still maintains that the business can continue to run at or above a 10% operating margin over the long term 5 February 2009

Balance Sheet In December, MAXIMUS paid approximately $40 million in cash to settle its outstanding arbitration As part of the settlement, MAXIMUS will receive an insurance reimbursement of $13.0 million in the second quarter In Q1 09, MAXIMUS used cash from operating activities related to continuing operations of $21.2 million Normalizing continuing operations cash flow for the $40 million settlement paid result in: Cash flow1 from operations of $18.8 million flow – Free cash flow from continuing operations of $14.7 million DSOs improved to 67 days During the quarter MAXIMUS repurchased 740,490 shares of stock for $23.2 million At December 31, $59.5 million was available under the Board-authorized program Cash at December 31, 2008 totaled $61.5 million and credit line of $24.6 million MAXIMUS maintains strong liquidity and flexibility in this demanding market 1The Company defines free cash flow as cash from operations less purchased property and equipment and capitalized software costs 6 February 2009

Guidance We remain on track to meet expectations MAXIMUS is reasonably insulated given the economic environment Experienced some work delays given states consternation in dealing with fiscal challenges Some revenue pushed to the right Anticipate that fiscal challenges may be offset by some modest benefits that the Obama initiatives could provide in the latter part of FY 09 Expect majority of potential benefits from any new legislation will be longer-term in nature and not expected to have a material impact until FY 2010 and beyond As a result, MAXIMUS is maintaining full year revenue guidance but towards the lower end of its $750 million to $775 million range Reiterating earnings guidance of $3.00 to $3.15 per diluted share Expect Q2 to be slightly down compared to Q1 and the latter half of FY 09 will show increases, with the largest driver being seasonality from our tax credit business Maintaining cash flow guidance with cash from continuing ops of $35 million to $45 million and free cash flow of $15 million to $25 million 7 February 2009

Richard A. Montoni President and Chief Executive Officer First Quarter Fiscal Year 2009 February 5, 2009

MAXIMUS delivered a solid quarter with steady performance and is prepared to handle the opportunities ahead We are well-positioned to benefit from greater demand for our services due to the economic slowdown and new legislation Both the American Recovery Act and the reauthorization of SCHIP encompass many of the benefit programs in which we operate Well-Positioned in Current Economic and Political Climate National Governors Association urged Congress to pass the Stimulus Package Once passed, the new legislation is expected to translate into new, long-term opportunities in the areas of health, workforce services, and education Benefits to MAXIMUS possible in the tail end of FY 09 but materially in FY 10 and beyond 9 February 2009

Legislation includes $32.8 billion in new spending over the next four and a half years Georgetown University Health Policy Institute expects total SCHIP spending of $69 billion Expands eligibility to include families with income up to 300% of the Federal Poverty Level Opportunities from SCHIP Reauthorization Anticipated enrollment will increase from 7 million to 11 million children over the next five years May result in substantial increase in enrollments in programs we currently operate 10 February 2009

Leading Pure-Play Provider in Medicaid Managed Care Twenty-eight states and the District of Columbia presently outsource Medicaid Managed Care of which MAXIMUS runs enrollment in thirteen states with a 67% market share. 11 February 2009 Source: CMS 2007

Leading Pure-Provider in SCHIP Enrollment Twelve states presently outsource SCHIP enrollment of which MAXIMUS runs enrollment in five states with a 69% market share. Approximately 2,000,000 additional children receive SCHIP services through a Medicaid expansion program. 12 February 2009 Source: CMS 2007

Poised to Meet Changing Demand Positioned as market & thought leader in Medicaid & SCHIP managed services Opportunity to further penetrate these markets has never been greater Well-equipped to assist clients in increasing caseloads and improving processing efficiencies to ensure long-term positive outcomes and expand established relationships Consulting Segment to benefit from New York City Dept of Education project Clients look to MAXIMUS for consulting services that complement our current BPO offerings Efforts underway to transition the Consulting business and improve its performance Exploring other opportunities to reposition the portfolio 13 February 2009

New Sales Awards and Pipeline Sales Q1 2008* Q1 2009 Signed Contracts $311M $208M Awarded Unsigned Contracts $264M $135M Pipeline Proposals Pending $160M $582M 14 Proposals Pending Proposals in Preparation $99M $327M RFPs Tracking $717M $761M Total Pipeline $976M $1,670M February 2009 *Restated to reflect divested businesses

MAXIMUS holds a competitive advantage with healthy cash position, available credit line, and no debt $61.5 million in cash at December 31, 2008 Increased quarterly cash dividend by $0.02 to $0.12 per share Healthy Capital Position Remain active under our Board-authorized share repurchase program We will capitalize on our financial position to provide high quality execution and maximize efficiencies to ensure a successful public/private partnership with our clients 15 February 2009