Exhibit 99.2

FINAL TRANSCRIPT

Thomson StreetEvents

MMS - Q4 2008 MAXIMUS, Inc. Earnings

Conference Call

Event

Date/Time: Nov. 13. 2008 / 8:30AM ET

C O R P O R A T E P A R T I C I P A N T S

Lisa Miles

MAXIMUS, Inc. - VP of IR

Dave Walker

MAXIMUS, Inc. - CFO

Rich Montoni

MAXIMUS, Inc. - CEO

C O N F E R E N C E C A L L P A R T I C I P A N T S

Anurag Rana

KeyBanc Capital - Analyst

Charles Strauzer

CJS Securities - Analyst

George Price

Stifel Nicolaus - Analyst

Jason Kupferberg

UBS - Analyst

Richard Glass

Morgan Stanley - Analyst

P R E S E N T A T I O N

Operator

Ladies and gentlemen, welcome to MAXIMUS year-end earnings call. During this session all lines will be muted until the question and answer portion of the call. (OPERATOR INSTRUCTIONS)

At this time, I would like to turn the call over to Lisa Miles, Vice President of Investor Relations. Thank you, Ms. MIles, you may begin.

Lisa Miles - MAXIMUS, Inc. - VP of IR

Good morning and thank you for joining us on today's conference call. I would like to point out that we have have posted a presentation to our website, under the Investor Relations page, to assist you in following along with today's call. With me today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following Rich's prepared comments, we'll open the call up for Q&A. Before we begin I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with to the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. And with that, I'll turn the call over to Dave.

Dave Walker - MAXIMUS, Inc. - CFO

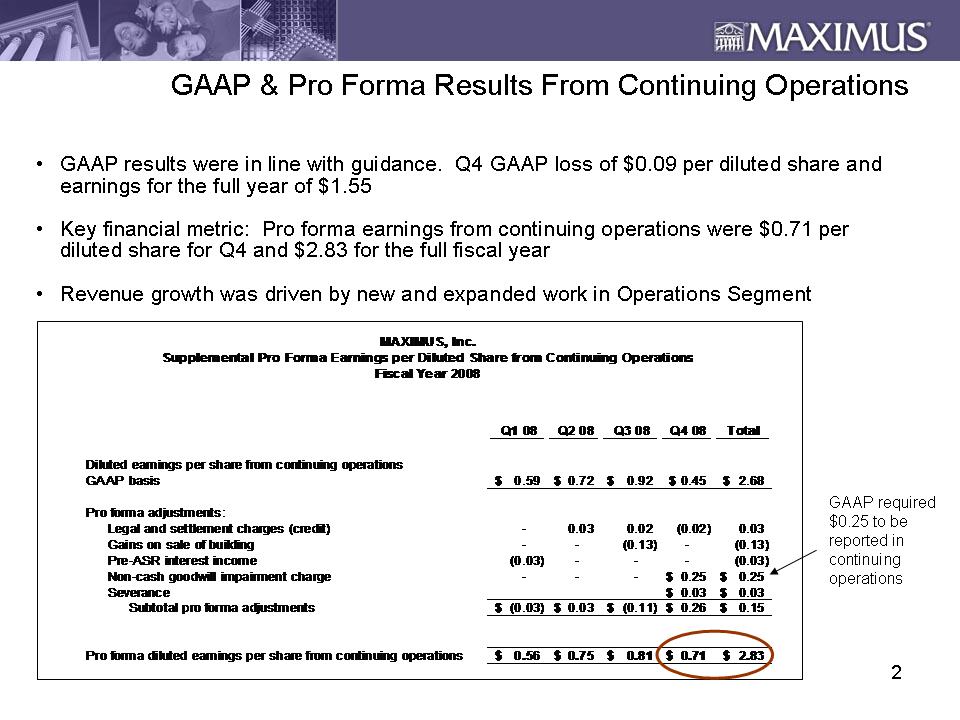

Thank you, Lisa. Good morning and thanks for joining us. This morning, MAXIMUS reported GAAP results that were in-line with our guidance in September, as well as consensus estimates. For the fourth quarter MAXIMUS reported a GAAP loss of $0.09 per share and for the full fiscal year, MAXIMUS reported GAAP earnings of $1.55 per diluted share. The results for the quarter are highlighted by the divestiture of our asset, justice and education Systems businesses.

This divestiture further solidifies our presence as the leading government health and human services pure play. You should direct your attention to the pro forma results from continuing operations. The key here is that pro forma diluted EPS from continuing operations were $0.71 for the fourth quarter and $2.83 for the full year. This is important as a benchmark going into fiscal 2009 and these results are well in-line with our prior expectations that we shared with you.

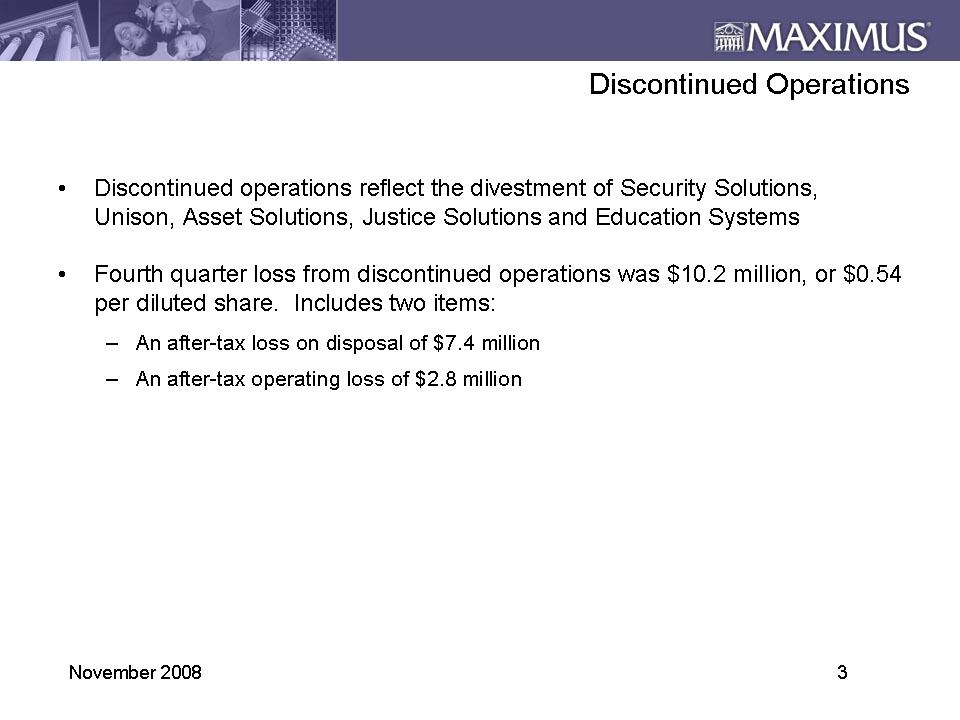

The most significant item is the noncash goodwill impairment charge to continuing operations of $7.6 million pretax, or $0.25 per share in the fourth quarter. This charge is the end result of disposing of the Systems segment. Accounting rules require a portion of the former Systems segment excess goodwill to be included as continuing operations. It is simply income statement geography of what we previously estimated our loss on the disposal would be, but GAAP requires it to be reported within continuing operations. For the fourth quarter, the loss from discontinued operations was $10.2 million, or $0.54 per diluted share. This includes an after-tax loss and disposal of $7.4 million and an after tax operating loss of $2.8 million. Let's turn our attention to top-line results from continuing operation and segment level data.

Revenue from continuing operations for the fourth quarter grew 9% to $189.1 million and for the full fiscal year grew 19% to $745.1 million compared to the same period a year ago. The growth was driven by new and expanding work in the operation segment. For the divestitures now completed, the operation segment comprises 84% of total Company revenue. This provides additional visibility and predictability into the overall business with Ops delivering a steady stream of long-term recurring revenue. The operations segment had a great year, both operationally and financially. Fourth quarter revenue for the operations segment increased 14% to $163.5 million. And for the full fiscal year, revenue increased 24% to $629.2 million. As we have emphasized throughout the year, top-line growth from the segment has been fueled by new and expanding work in our workforce services and health operations. This includes both domestic and international businesses.

For the operations segment, fourth quarter operating income totaled $22.2 million, with margins coming in at expected levels of 13.6%. During the fourth quarter, the operations segment was active with proposals, which amounted to higher bidding costs of approximately $1 million, or about $0.03 per share. For the full fiscal year, the operation segment margins were 13.6% and in-line with our overall expectations. Moving into fiscal 2009, we expect that operating margins will continue to trend in the higher end of our stated range of 10% to 15% for the operation segment. Moving on to the consulting segment. This segment represented 16% of total Company revenue. With the divestiture of the Systems business, we consolidated the ERP division into the consulting segment. The consulting segment had revenue of $25.5 million for the fourth quarter and $115.9 million for the full fiscal year.

The segment posted an operating loss in the quarter of $2.1 million. The largest contributor was a year-end adjustment in the quarter of approximately $2.7 million on a fixed price contract. We do expect softness in the consulting segment to continue into fiscal 2009, as we wind down nonperforming businesses and further streamline these operations. Now let's talk about cost management and margins. With the divestiture of the Systems business, we would expect that SG&A as a percent of revenue will likely trend in the 15% to 17% range. Generally, the timing of proposals will cause the SG&A percentage to vary on a quarter to quarter basis. Total Company operating margins were consistently above our 10% target margin for fiscal 2008. We are very pleased to meet the commitments we've made to our shareholders in better positioning the business and creating long-term shareholder value.

We continue to focus on proactively managing our risks during the contracting process to insure these results are sustainable. For the fourth quarter and full fiscal year 2008, we achieved operating margins of 10.5% and 11.6% respectively. We believe this validates our long-term strategy of focusing on our core health and human services business. We took decisive action during the quarter to realign and right-size our support staff after divesting our non-core business base. As previously discussed, our results included severance costs of approximately $1 million, or $0.03 per share, largely related to corporate staff reductions. Our cost structure is well-positioned heading into 2009. Going forward, cost management will continue to be an important tool and we must remain vigilant in insuring that our costs remained aligned with the business. We will continue to seek ways to reduce costs, drive operational improvements, and operate as effectively as possible.

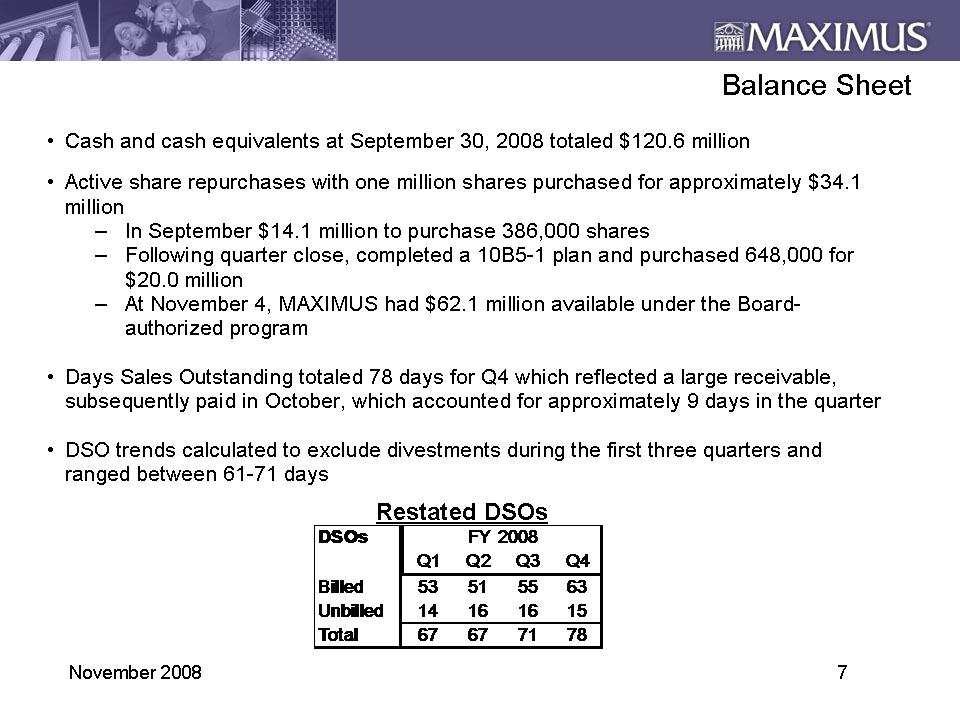

Moving onto balance sheet and cash flow items. We ended the fourth quarter with cash totaling $120.6 million at September 30th. MAXIMUS remains committed to an aggressive share repurchase program. Since our earnings call last quarter, we have repurchased approximately 1 million shares of MAXIMUS common stock for approximately $34.1 million. During the month of September, we used $14.1 million to purchase approximately 386,000 shares of MAXIMUS common stock under our board authorized program. Following the quarter close on September 30, we also completed a 10b5-1 buyback plan, which allowed us to purchase an additional 648,000 shares for $20 million. At November 4th, MAXIMUS still had approximately $62.1 million available under its board authorized program.

Fourth quarter DSOs of 78 days reflected a large receivable, which accounted for approximately 9 days, that was paid the first week in October. While there will be fluctuations due to timing, overall we expect DSOs on an ongoing basis to be in the range of 65 to 80 days. MAXIMUS generated cash from continuing operations totaling $9 million in the fourth quarter and $51.7 million for the full year. Free cash flow, which the Company defines as cash from continuing operations, less property and equipment and capital software, was $5.2 million for the fourth quarter and $36.3 million for fiscal year 2008. For fiscal 2009, MAXIMUS expects to generate cash from continuing operations in the range of $60 million to $70 million and free cash flow from continuing operations ranging between $40 million to $50 million. This calculation excludes approximately $11 million we expect to disburse in fiscal 2009 relative to discontinued operations.

As we noted in this morning's press release, we expect fiscal 2009 revenue will be impacted by the volatile currency exchange trends we're seeing as a result of the strengthening dollar. In both Australia and Canada, the translation gains have dropped precipitously compared to the averages in fiscal 2008. Compared to last year's translation rates, we've witnessed an average decline for the months of October and November of 24% in Australia and 10% in Canada. As many of you have probably seen with many other companies you follow, this is not an economic issue, it's purely isolated to the strengthening dollar and the translation rates. As a result, we've reset our guidance model to reflect more current translation rates and we're revising revenue guidance to a range of $750 million to $775 million for fiscal 2009. From a bottom-line perspective, we are reiterating our diluted earnings per share guidance of $3.00 to $3.15 per diluted share for the full fiscal year.

This guidance reflects the positive benefit from the approximately 1 million shares repurchased through November 3rd that offset the decreased earnings caused by foreign exchange rates. While we don't provide quarterly guidance, it's important to remind everyone that our fiscal fourth quarter is traditionally our strongest quarter due to seasonality in certain business lines. We do expect our fiscal first quarter to be sequentially lower due to seasonal trends. Thank you for your time this morning. Now I'll turn the call over to Rich.

Rich Montoni - MAXIMUS, Inc. - CEO

Good morning, everyone. We accomplished a great amount in fiscal 2008, that sets a strong foundation for an encouraging long-term future. I am very pleased with the progress we've made to position MAXIMUS as the leading pure play provider in the administration of government health and human services programs. With the divestiture of three of our systems businesses at the end of the fourth quarter, we enter fiscal 2009 as a leaner organization focused on our core Health and Human Services operations portfolio, complemented by our Consulting Services. Going forward, a critical go goal is delivering more predictable financial performance. With a narrowed focus on our operations, we hope to achieve more predictability and certainly more simplicity in our reported financial results. As David discussed, we have lowered our revenue guidance for fiscal 2009 to reflect current exchange rates as a result of the strengthening dollar.

As to our EPS guidance, the positive benefit of the share repurchase program has offset the currency declines. As a result, we are reiterating our bottom-line guidance of $3.00 to $3.15 per diluted share. We still anticipate total operating margin north of 10%, with operating margin for our operating segment in the 12% to 15% range. We will also continue with our aggressive share buyback program. Despite the turmoil in the general economy and beyond the news concerning projected state budget deficits, today we are comfortable reiterating our fiscal 2009 bottom-line guidance for the three main reasons as follows. First, over 87% of projected revenues for fiscal 2009 is in the form of backlog. This is a testament to our strong base of recurring revenue from our long-term contracts. Second, our backlog remains strong at $1.4 billion and our pipeline of new opportunities is at a record level totaling $1.8 billion, which bodes well for long-term demand.

Third, at this time, we're not seeing a substantial slowdown in current demand for our services. While customers at the state level are certainly experiencing fiscal challenges, we've seen only isolated procurement delays and we have not experienced any material impact on our business at this time. In fact, in some cases, the procurement delays have been a net positive for MAXIMUS, leading to extended contracts in additional option year periods. While we are not immune to market slow downs, our core services are less susceptible to wholesale reductions. This is because we provide administrative support to many federally mandated programs. Overall, demand for our services remains at a consistent level. We belive this trend will largely continue, even in a softening economy. So pulling it all together, we still see our outlook for 2009 as on target. We don't view the currency volatility as an operational issue.

Fundamentally speaking, our business is in good shape and the market demand for our services remains encouraging. We have more visibility and we have eliminated many overhangs, which had resulted from a prior emphasis on growth at the expense of profitability. At the onset of fiscal 2009, I spent time with our operational leadership outlining our objectives as a firm. Meeting our operational and financial objectives should pave the way for increasing and solidifying long-term shareholder value. We have undergone a cultural shift over the past two and a half years to where our formula for success is a combination of targeted growth, focused retention, and execution excellence. We are making infrastructure investments, such as the installation of a new ERP system, as we shift towards a more collaborative organization with integrated support functions dedicated to meet the needs of our operational teams.

We will continue our emphasis on quality and risk management. Our existing initiatives to improve execution include our focus on project management training, contracts and project management, and above all, client and scope management. We will continue to manage by the numbers, strengthen our forecasting tools, and hold our folks accountable. As David mentioned, we will remain diligent in reining in costs wherever possible. Following the divestitures we took decisive, fast, and substantive action to realign our corporate overhead with our revised scope of operations. As a result, we reduced our corporate staff by 15%. Fourth quarter severance expense of $1 million is expected to translate into cost savings of approximately $3.5 million on an annualized basis. We will continue to evaluate our business portfolio and we will not hesitate to exit underperforming businesses, as we are presently doing if our RevMax business.

Ultimately, our consulting business can provide critical services for core operations clients to improve program operations and overall program performance. We envision the consulting segment as creating and supporting a pipeline of relationships and opportunities for our core operations business. Our core health and human services operations business continues to deliver financial results that are in-line with our expectations and we believe the long-term growth drivers remain encouraging. I think it's also important to look at MAXIMUS in our core business within the context of the broader political landscape and the opportunities related to a new federal administration. As we noted in the past, Democrats tend to be strong supporters of the types of health and human services programs that we administer.

We expect that Obama's administration will follow in this tradition. With a tough fiscal environment, there may be increased demand for partners like MAXIMUS. We believe there are increasing opportunities with health and human services programs that not only address the pressing health needs of the low to moderate income population, but are also linked to Obama's other policy priorities in the areas of early childhood development and sustainable employment. I also think it's fair to say that we believe the landscape for SCHIP reauthorization in the spring of 2009 is vastly changed compared to last year. While the scope of SCHIP reauthorization is open at this point, we believe states could possibly seek to revive plans to expand programs that were shelved last year. It's also possible that healthcare reform or expansions of current health programs could move more quickly under a new administration.

Statistics from the Kaiser Family Health Foundation have shown that during the last economic downturn there were spikes in Medicaid caseloads. In fact, Medicaid enrollment increased nationally by 40% from 2000 to 2005, with an annual growth of nearly 10% in 2002. The administration may take steps to broaden the group of eligibles under Medicaid with the use of Medicaid waivers. Certainly the new administration has other viable options for dealing with the

increasing caseloads, including modifications to the federal medical assistance percentages. These are the percentages used to determine the level of federal matching funds for qualified state health expenditures. So, the federal government has the ability to increase the matching funds to cover programs designed to expand Medicaid coverage at the state level. Any anticipated expansion to these government run health programs or increases of federal matching funds needs to be tempered with fiscal realities.

Overall, we are cautiously optimistic given the importance the Obama campaign placed on healthcare. One thing is certain, and that is that we expect that states will increasingly turn to managed care as the means to control the delivery of healthcare costs. As you know, MAXIMUS leads the country in providing Medicaid managed care enrollment broker services to nearly two-thirds of the beneficiaries in states using contracted enrollment brokers. We also expect that there will be a push in the areas of Medicaid and other government run programs to reduce upfront administrative and enrollment cost by mainstreaming eligibility determination. MAXIMUS is also the leading provider in eligibility support services, which puts us in an excellent position to meet any increase in demand in this area as well. Let's turn our attention to our strong sales awards in fiscal 2008. All sales and pipeline information has been restated to exclude the divested divisions.

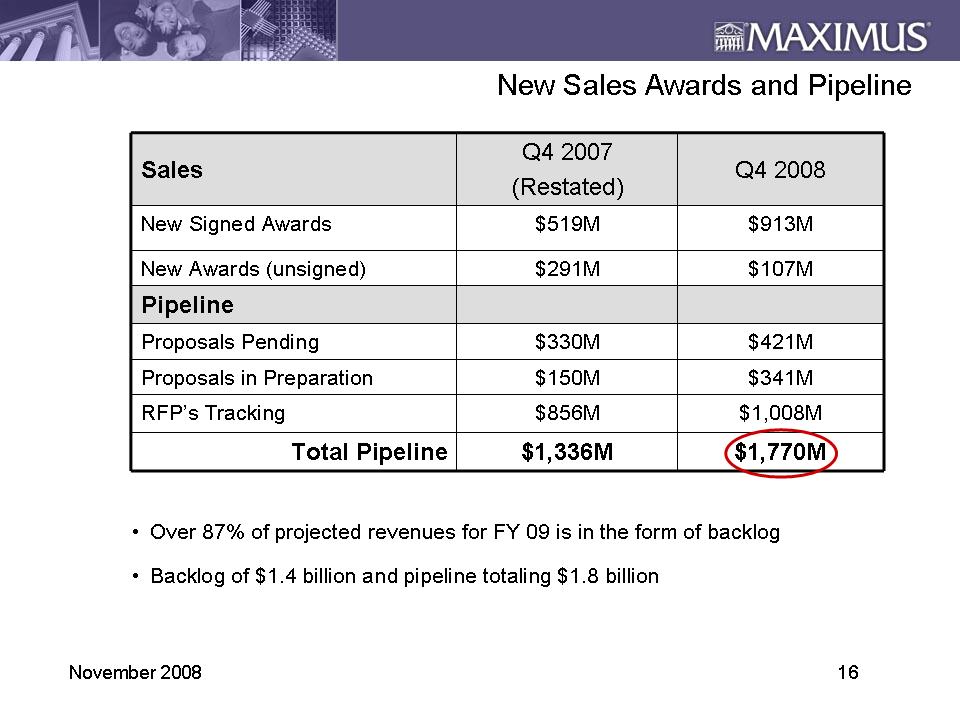

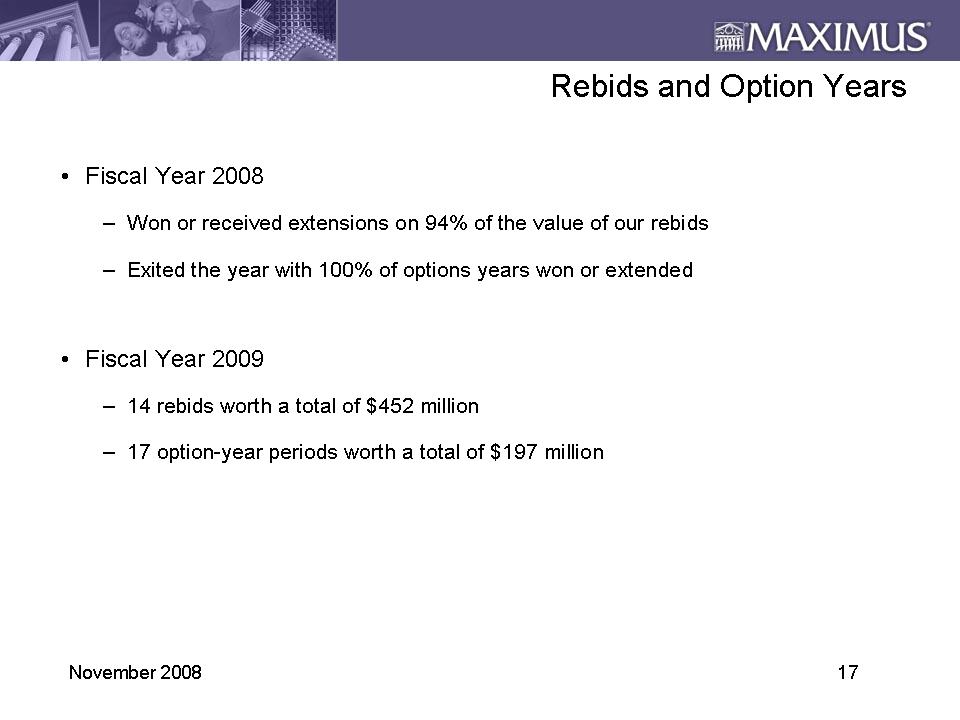

At September 30, we had new signed awards of $913 million, compared to $519 million reported last year. New contracts pending, or awarded but unsigned, totaled $107 million. At November 7, 2008, our total pipeline of opportunities was at record levels with a total pipeline of $1.8 billion, compared to $1.3 billion last year. Our pipeline consists of three categories, which include $421 million in proposals pending, $341 million in proposals and preparation, and $1 billion in opportunities we are tracking and expect to come out in the next six months. Moving on to rebids and options and wrapping up fiscal 2008. We won or received extensions on 94% of the value of our rebids. We also exited the year with 100% of option years won or extended. It's certainly been a very solid year for rebids and options. looking into fiscal 2009, we have 14 rebids worth $425 million. We have 17 option year periods with a total value of $197 million.

Our formula for success is focused on client retention and creating lasting, long-term client relationships. I also want to point out that we've maintained a strong capital position that, in this market, serves us well. Clients are seeking partners with strong balance sheets and financial wherewithal during this economic environment. MAXIMUS certainly meets these criteria with cash of $120.6 million at September 30th, and no debt. MAXIMUS continues to generate strong cash flows and we will continue to deploy capital to shareholders. We plan to continue to pay a quarterly cash dividend and we intend to remain active under our board authorized share repurchase program. And finally, it's important to remember that our government customers, whether federal, state, local, or international, are facing significant challenges in a very difficult economic environment.

At the same time, they have high aspirations to provide an even greater level of health and human services to an increasing number of beneficiaries. MAXIMUS is very well positioned to serve these emerging needs in these key areas. Our sole mission is helping government serve the people and we will be an important partner to our government clients, as they tackle the challenges within their critical health and human services programs. Today, the challenges clients face and the opportunities for MAXIMUS have never been greater. And MAXIMUS is well positioned and prepared for these opportunities. And with that, let's open it up for questions. Operator.

Q U E S T I O N S A N D A N S W E R S

Operator

(OPERATOR INSTRUCTIONS) Our first question is coming from Anurag Rana with KeyBanc Capital. Please state your question.

Anurag Rana - KeyBanc Capital - Analyst

Good morning, everyone. Rich, the contract signs were unusually strong this quarter. Is it just timings or should we read more into this? Also, does this mean that the first quarter could be lighter that what we have seen in the past?

Rich Montoni - MAXIMUS, Inc. - CEO

Anurag, I view the contract signing trends -- really I think the best view is to take an annualized basis. From quarter to quarter, it does fluctuate and you'll see larger contracts go from one category in the pipeline statistics to another, from quarter to quarter. So I tend to focus on the year-to-date trends. I think last year certainly was a very, very strong year. You may recall it included the rebid win for HCO. It included a number of extensions for Texas. It includes a rebid win for our New York -- it was an option year, as it relates to New York, but by and large, I think fiscal '08 was a very solid year for option and new sales activity. The other metric that's important is the trend in that overall pipeline statistic.

As we report, it is very strong at this date. I know on the surface that may seem contrary to what we sense in the macroeconomic backdrop, but we're experiencing continued strong interest in what we do. It provides efficiencies and I think governments are very, very concerned, rightfully so, about making sure they have the right effective efficient infrastructure in place, partner in place, to help them deal with what, very likely, could be increasing caseloads.

Anurag Rana - KeyBanc Capital - Analyst

Thanks. And also, the SG&A in terms of dollars for operations was a bit higher than what we were expecting. Is that due to higher bid activity or due to some severance costs?

Rich Montoni - MAXIMUS, Inc. - CEO

Dave Walker?

Dave Walker - MAXIMUS, Inc. - CFO

There's certainly some severance in there and there is a higher than normal B&P in there, so you get swings between categories at gross profit and SG&A.

Rich Montoni - MAXIMUS, Inc. - CEO

That's the reason we tend to focus on the net, the operating income percentage, because from quarter to quarter you will get the same individuals, in some situations, charging SG&A because of B&P activity and then in the next quarter back to a project and charging cost of sales. So we tend to focus on the net line operating income percentage.

Anurag Rana - KeyBanc Capital - Analyst

And is that because you're looking at -- you are seeing more opportunities out there or you're bidding on more contracts at this point?

Rich Montoni - MAXIMUS, Inc. - CEO

We have a lot of B&P activity that is going on.

Anurag Rana - KeyBanc Capital - Analyst

That's good.

Rich Montoni - MAXIMUS, Inc. - CEO

Yes, it is.

Anurag Rana - KeyBanc Capital - Analyst

And any thoughts -- I heard your comments about share buyback given the macroenvironment, but just what's the thought behind it, given not sure where the equity markets are going to be in the six, the next six to 12 months, but it seems you're still continuing with your buyback plan aggressively. Could you also give a little bit more information about the 10b5 plan that you talked about and is that still in place?

Rich Montoni - MAXIMUS, Inc. - CEO

Be glad to do. Our general thinking is that of the several alternatives available to us to repatriate earnings to our shareholders, we prefer the repurchase avenue. We try not to be traders. We think at this point in time the stock has good value. We know it's accretive to us at this value and that's really the cutoff for us. And hence given the fact that we do have excess cash, we anticipate continuing to generate cash from operations and free cash flow, we think it's important to our shareholders to repatriate cash to them and our preferred method is the repurchase of shares. As it relates to the 10b5 filing, we knew coming into this market that we would -- when we last talked in September, we enter a quiet period and we still wanted to continue our repurchase program. Because it's our year-end, it means we would have been blocked out of the market for quite a period of time, actually through today, so we chose to implement a 10b5-1 program. I'm pleased that we did. It expired a short time ago, a matter of days ago, and hence it's no longer active at this point in time, but, again, I think starting tomorrow a window is open.

Anurag Rana - KeyBanc Capital - Analyst

Thank you. And just one last thing on universal healthcare. Any thoughts how it can benefit you guys over the next several years, as we get more information of how if we see any plan on that regards and how that's going to play out for you guys? Thank you so much.

Rich Montoni - MAXIMUS, Inc. - CEO

Okay, Anurag, thank you. Boy, there's so many paths to answer your question as to how universal healthcare can be important to MAXIMUS. Step back and you may -- it's important to think that universal healthcare is not a new initiative. It goes back several, several years. We have been working very hard over the last several years to best position MAXIMUS as a key player in universal health. Our mantra, on an operating level, as we take policy and we translate it into action. And we've been working with several states as they develop their universal healthcare program and there are many states out there, including the larger states, that have prepared universal healthcare plans unique to those state. And with the new administration coming on-board, we expect that the dialogue is going to become very, very significant as it relates to universal healthcare and the starting point I expect will be with SCHIP. That's very, very important to Democrats and I think you are going to see a big push to advance the SCHIP programs and MAXIMUS is very much a key player in the SCHIP arena.

Operator

Our next question from Charles Strauzer with CJS Securities. Please state your question.

Charles Strauzer - CJS Securities - Analyst

Hi, good morning. My two questions are - the first question is related to the guidance and if you can give us a little bit better sense of kind of the dollar impact of the currency and also what depreciation and amortization number we should be using in '09. I know it's something kind of -- some what of a moving target after the divestiture.

Rich Montoni - MAXIMUS, Inc. - CEO

Dave Walker.

Dave Walker - MAXIMUS, Inc. - CFO

Hi, Charles. I'm going to starting with the currency. About 16% of our business is overseas and we talk about currency. We're not sending currency back and forth between countries. These businesses are accretive, there are very profitable, they generate their own cash flow. So all of it is just translation losses, SO. But again 16% of our revenue and profits are from overseas and the largest of those individual subsidiaries happens to be Australia, while we won't break out by country, it certainly was hit the hardest at about a 24% decline in revenue when we look at this last quarter compared to October and November, followed by Canada, where we saw a 10% decline. So that's the flavor of what's going on there. So there's no real change in economics, no real currency risk, it's just translation. So that's the currency and the impact on that. When I move on to depreciation and things of that ilk, maybe it would help you, we -- our EBITDA is about $100 million to about $105 million imbedded in that number. So you can kind of --

Rich Montoni - MAXIMUS, Inc. - CEO

Next year.

Dave Walker - MAXIMUS, Inc. - CFO

For next year.

Charles Strauzer - CJS Securities - Analyst

I got it. I can back out of it, that's fine. So basically, when you look at the currency, the differential between your kind of original guidance, X systems -- I'm sorry, the differential in currency we can extrapolate is basically the difference between the new guidance versus the old guidance is basically, roughly all translation?

Dave Walker - MAXIMUS, Inc. - CFO

Yes.

Charles Strauzer - CJS Securities - Analyst

Got it.

Dave Walker - MAXIMUS, Inc. - CFO

Well, largely offset by additional shares. So that's why the guidance is really a reiterating. So the currency was offset by the shares.

Charles Strauzer - CJS Securities - Analyst

Got it. Excellent. And just my second question is -- relates to the cash on the balance sheet and repurchase is obviously still the priority, which is excellent, but when you look at some of the valuations of your peers in the marketplace, both public and private companies, and I would imagine the valuations have come down materially, probably even more so than your own, are there opportunities, some things that you think may be of interest to you now that the prices have gotten to the point where transactions could be accretive to you?

Rich Montoni - MAXIMUS, Inc. - CEO

Charles, this is Rich. I would say from an M&A perspective -- first off, we feel very comfortable where we are today, so we're not compelled to go out and buy a Company. I also think that given all of the dynamics in the marketplace, it's a pretty tenuous environment out there. So getting a real fix on long-term value on these properties, and frankly, from a M&A perspective, we're seeing more properties available than in recent history. So there are lots of opportunities out there. Our approach will continue to be opportunistic for tuck-in type acquisitions. We don't have anything sizable in our strategic plan at this point in time. And, again, I think our policy is going to be more towards tuck-in type acquisitions and to maintain pretty solid financial positioning in these time.

Charles Strauzer - CJS Securities - Analyst

Excellent. Thank you very much. I'll get back in the queue.

Rich Montoni - MAXIMUS, Inc. - CEO

Thank you.

Operator

(OPERATOR INSTRUCTIONS) Our next question is coming from George Price with Stifel Nicolaus. Please state your question.

George Price - Stifel Nicolaus - Analyst

Hi. Thanks very much, good morning, everyone. A couple of things. First, just on consulting, I guess, another contract adjustment now there we've gotten rid of systems, but we have something going on in consulting. Can you give us a little color around what's going on with the contract that had the adjustment and I guess, stepping back you've done a good job de-risking the business, but obviously there's still a little exposure, a little more work to do. How, going forward, in this kind of budgetary environment do we get comfort around what's happening in consulting and particularly just performance and execution on some of these things? I mean, I imagine pricing pressure could be a factor, as this stuff is more exposed.

Rich Montoni - MAXIMUS, Inc. - CEO

George, this is Rich. My thinking is, I don't think it's so much pricing pressure as it is execution and I think you're right. We've done -- we've done a lot of work, as you know, to derisk the portfolio and I do think it's down to the point where it's normal risk for what we do. And as we all know, the nature of our business is you do have -- you do have projects that do get delayed, you do have project challenges that sometimes translate into additional costs. So on consulting's performance this quarter, the disappointing aspect came mostly from this one project. It's an ERP related project. This is a division that we transferred into consulting from what had been in our enterprise systems segment. This project does go back many years. It's a legacy project, but in the normal course we take a look, in connection with our year-end, we take a hard look at all of our projects, all of our material projects, and look at EACs.

This particular project, as we provided guidance earlier, we had concerns that there might be some slippage from a timeline perspective. I do want to emphasize that the project itself is delivering what it's supposed to be delivering. So it is not a deliverable type issue. It's just that there's delays in the project. The delays were longer than we had anticipated and hence the charge was larger than we anticipated. So it's normal course, larger than we had anticipated, so it's disappointing in that context, but it's an isolated instance and I think it's normal recurring business, if you will, and we're looking not to make sure -- we're looking to make sure that that project doesn't repeat with another sizable charge. We've taken all the management actions I think are necessary and sufficient to assure us of that, including some changes in management of that business unit.

George Price - Stifel Nicolaus - Analyst

What's the, I guess, the legacy exposure? You didn't get rid of all of systems. You got rid of most of it, right, and then the rest folded back in. This is one thing. How many of these legacy contracts, what's the lingering exposure, I guess

Rich Montoni - MAXIMUS, Inc. - CEO

It's less than the number of fingers on your right hand. Not an extensive amount. They're normal course. But more importantly, I put the portfolio in the normal course category. But for the additional surprise on this one, it would have been the normal thing that we deal with in forecasting our numbers and, as you know, when you close the books, you have some projects that over deliver, some that under deliver, and you look for a blended result that's within your bandwidth.

George Price - Stifel Nicolaus - Analyst

Right, got you. 16% of international revenue, David, I heard you are say that Canada is the bigger --

Dave Walker - MAXIMUS, Inc. - CFO

Actually, George, it's Australia.

George Price - Stifel Nicolaus - Analyst

Oh, so I'm worry. I'm sorry, if I mixed that up. Can you just -- of the 16% of revenue, can you give us a sense roughly of what the percentages are for each of those? I'm trying to get a sense of currency exposure as a percent of revenue for each of the currencies you're exposed to.

Dave Walker - MAXIMUS, Inc. - CFO

Australia is over half of it, followed largely by Canada. Very small amount in other countries at this point.

George Price - Stifel Nicolaus - Analyst

Okay. Which I guess would be Israel.

Dave Walker - MAXIMUS, Inc. - CFO

We have Israel, we have a UK subsidiary.

George Price - Stifel Nicolaus - Analyst

How big -- is the UK material?

Dave Walker - MAXIMUS, Inc. - CFO

Not at this point.

George Price - Stifel Nicolaus - Analyst

Okay. And then I guess last --

Dave Walker - MAXIMUS, Inc. - CFO

Although, George, there are many big tenders that we're looking at overseas. Not sure the world is looking at well thoughted work opportunities, as are we, so when we look out into the future, it can have a bigger effect, but these are great opportunities for us.

George Price - Stifel Nicolaus - Analyst

Okay.

Dave Walker - MAXIMUS, Inc. - CFO

They're in our sweet spot.

George Price - Stifel Nicolaus - Analyst

Okay. Last question, if I could, the, and I apologize if I missed this, the $11 million being disbursed in fiscal '09 related to the divestiture, what is that, exactly?

Dave Walker - MAXIMUS, Inc. - CFO

Sure. There were some things, for example last quarter we talked about the Houston settlement and so that cash payment, actually, went out subsequent to the fiscal year-end. That's a large portion of it and that was $5 million. And there's some other things. For example, certain employees weren't assumed group level staff, et cetera, and other technical employees by the Company that acquire these subsidiaries. So it's the severance, vacation payouts, other liabilities on that.

And there are some other reasonable reserves that happen in these sort of transactions.

George Price - Stifel Nicolaus - Analyst

Okay. I'll get back in the queue. Thank you very much.

Dave Walker - MAXIMUS, Inc. - CFO

Thanks.

Rich Montoni - MAXIMUS, Inc. - CEO

Thank you, George.

Operator

Our next question is coming from Jason Kupferberg with UBS. Please state your question.

Jason Kupferberg - UBS - Analyst

Thanks. Good morning, guys. How fast do you think the consulting business will grow in fiscal '09, or is it going to be another year of negative growth? I'm trying to triangulate the overall revenue guidance down to the segment level. I think the growth for fiscal '08 ended up coming in maybe flat to slightly down and sounds like there's still some moving pieces there. So are you guys budgeting for a down year in consulting? And also what should we expect from a margin perspective there?

Rich Montoni - MAXIMUS, Inc. - CEO

Jason, this is Rich. Our approach with consulting is to get in the shape and get in a composition where it's positioned to best complement us, our operations business on a go-forward basis and from a risk perspective. So the moving pieces in that regard are, as you know, exiting the RevMax business, so that revenue will go away. It's now in a downward trend and it was a little bit of a factor in this quarter. It will continue to be a factor into FY '09 as we complete the exiting of that business. And over all, I think that consulting will have a sequential year-over-year slight decline in revenue. I'm not looking for it to increase. I'm more interested in just getting it right, doing the right thing, but at a critical mass level.

And from a margin perspective, I expect that it's going to start out slow, somewhere near breakeven. And for the year, I expect it's going to get into, frankly, probably the mid-single digits. We do have one very significant contract that has been awarded to us. It's in the contract final negotiations stages. That's very much a swing factor, a very important factor to the consulting segment. I'm quite optimistic we're going to move forward with that, so that's good news. And it's good work we're very capable of performing and it's a nice contract. So that's how consulting is shaping up. The other thing you need to remember is we've changed out a lot of the management and consulting. Deanne Wertin has taken over that business. Look forward to working with her very, very closely. Those are the big drivers.

Jason Kupferberg - UBS - Analyst

The new contract that you just won in consulting is that an ERP contract?

Rich Montoni - MAXIMUS, Inc. - CEO

No.

Jason Kupferberg - UBS - Analyst

Okay. And as far as the buybacks go, it sounds like you're still being fairly aggressive here. Obviously there's a lot more sensitivity in the current environment around balance sheet liquidity, but do you guys envision exhausting the remainder of the current authorization this year and does the EPS guidance assume any more buybacks on top of what you have already executed fiscal year-to-date.

Rich Montoni - MAXIMUS, Inc. - CEO

First off, our guidance does not -- our guidance only assumes the beneficial impact of the share repurchases that we've completed to date, which is the 1 million shares we've talked about. It does not assume any benefit from future purchases. Two, we have $62 million remaining authorized. We intend to remain aggressive in the share buyback program and my board, as a matter of routine revisits our share buyback status essentially every board meeting, and I expect they will continue to do that.

Dave Walker - MAXIMUS, Inc. - CFO

Yes. And might just for the math, Jason, might be helpful, most of the shares that we bought back were subsequent to September. On a weighted average basis those that we acquired in Q4 really negligible. They won't even -- didn't even move EPS $0.005, so they were immaterial to '08's results, but much more so in '09. If that is helpful.

Jason Kupferberg - UBS - Analyst

Yes. And that math is helpful. And just last question, can you recap where we are on any outstanding remaining legal issues and have you planned for any legal expenses in the fiscal '09 guidance?

Rich Montoni - MAXIMUS, Inc. - CEO

I can do that. We've worked really hard this year to eliminate many overhangs, legal overhangs, project overhangs. At this point in time, we still have the Center arbitration, which is pending. So that remains open. We have the Connecticut situation, which remains open. We have provided for some reserve on that contract and we have not provided for any legal expense on a go-forward basis in our guidance for fiscal '09.

Jason Kupferberg - UBS - Analyst

Okay. Thanks, guys.

Rich Montoni - MAXIMUS, Inc. - CEO

I should also add, I think Dave Walker has accrued some dollars for legal expense at 930 that we think should be necessary to get us through these remaining issues.

Operator

Thank you. Our next question is coming from Richard Glass with Morgan Stanley. Please state your question.

Richard Glass - Morgan Stanley - Analyst

Hi, guys. Nice quarter. Can you help us or give us any sense of the Accenture timing or what's going on there, number one, and number two, can you give us a little more understanding of what you are pursuing in the international arena and what the potential there is, what the growth could be there, what the contract sizes are, things like that, what markets?

Rich Montoni - MAXIMUS, Inc. - CEO

Rich, I would be glad to do that, and thanks for the compliment on the quarter. On the Accenture arbitration situation, it remains in arbitration stage between us and Accenture. There's always alternatives, but at this point, technically, it's in arbitration stage, so I can't go into details on that. On the international side, there's a lot of opportunities out there. We started to talk about the international opportunities on the basis that what we do for governments here, the same social issues, we help governments deal with here, are experienced by countries around the world. We are seeing international interest, inbound international interest where we get calls, unsolicited calls, from countries to learn about what we do in the area of helping people find jobs and in the area of healthcare systems. They look for best practices.

And I think a lot of countries, when they fast forward their demographics, they realize that the existing programs, the existing infrastructure is not sufficient, won't get the job done, so they are looking to learn about and contract with world class partners and MAXIMUS routinely is identified as one of those partners. We see significant opportunities and have active dialogue from developing countries in Africa, South America, Europe, Canada. Several years ago we expanded our business into Canada and that has worked out quite well. And generally it is in the are of health and employment. One, just one data point, the United Kingdom is in the process of bidding and we are submitting bids to re-engineer their welfare to work program.

That's a national initiative. They call it the flexible new deal. We're very excited about that opportunity, but that's just one example, Rich, of the opportunities that are out there. I think this is a very, very long-term trend. We intend to pursue it seriously. We have got several key executives dedicated to it, but we're also going to do it in the appropriate fashion. Doing business internationally has different risk, different environment, different cultures, so you have got to go about it in the right fashion.

Richard Glass - Morgan Stanley - Analyst

All right. Thanks, guys.

Rich Montoni - MAXIMUS, Inc. - CEO

Thank you.

Operator

Our next question is from Charles Strauzer with CJS Securities. Please state your question.

Charles Strauzer - CJS Securities - Analyst

Rich, just a quick kind of bigger picture question for you. Obviously CMS puts out their budget for what they expect Medicaid expenditures to increase each year and I think they're taking about roughly 8% this upcoming year, but that's was obviously before things started falling off a cliff back in September, October. As unemployment creeps up and grows and ultimately the expenditures grow, do you see any -- do you have any kind of volume upticks in your contracts

that if you have growth in the number of enrollees, are there benefits to that in the contracts you have, is really what I'm trying to get at.

Rich Montoni - MAXIMUS, Inc. - CEO

That's a fair question. The number one driver to our revenues in the health related programs we do administration is the number of cases that we handle. And there will be variations on that theme. Sometimes it's the number of new cases coming into a program that we handle. Sometimes it's just maintaining cases in a program. Sometimes it's disenrolling folks in a program. But fundamentally, our revenue is a function of the number of cases that we handle. It correlates to our direct cost, including folks in a call center, et cetera. So historically, and I'm told that the number for FY '09 is 5.8% is CMS's expected increase spend. I would tell you that if they are able to stay within that, I'll be surprised. I would think that given the number of cases that one should expect -- I think what is going to happen here is you are going to see a lot more folks unemployed. I mean that's a given. We are seeing that trend and the debate is is the unemployment rate going to be 8% or 8.5%. Or some folks say 10%.

When that happens, several things occur in our business. One, we find that a lot of those folks then look to get enrolled. They go off their corporate health plans. They look to get enrolled in these public health plans, so that causes a spike in terms of the number of eligible individuals. Although -- and that also causes pressures on the state in terms of the more cases and the more they have to fund, so it remains to be seen. I think the relationship between the state and the new federal government, how they're going to pay for what I think is going to be increasing case loads and increasing cost. I would say on a daily basis stay tuned. I expect you will see our national leaders interface with the President-elect to come up with a solution to that. The second dynamic that it causes is that there's more unemployed people and they look for job opportunities. And that plays right into the sweet spot for our welfare to work programs and there will be equilibrium that needs to be achieved there. There will be more people looking for jobs and fewer jobs available. So their challenge is heightened, but their opportunity is heightened as well.

Charles Strauzer - CJS Securities - Analyst

Excellent. That's what I was getting at. Thank you very much.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks.

Operator

Our last question is a follow-up from George Price with Stifel Nicolaus. Please state your question.

George Price - Stifel Nicolaus - Analyst

Hi, thanks very much. A couple of things. On the rebids and the options, the 452, the 197, can you give us a sense of what the kind of the annualized revenue impact of those are and kind of where -- what -- how much could impact in fiscal '09. Are they concentrated in certain parts of the year or spread out, that sort of thing.

Rich Montoni - MAXIMUS, Inc. - CEO

Sure. We can do that. The data that I have on the rebids for '09, and that's about $425 million up in '09, the annualized revenue in FY '09, and some of this is partial year, is roughly $56 million, George.

George Price - Stifel Nicolaus - Analyst

Okay.

Rich Montoni - MAXIMUS, Inc. - CEO

Okay? And on the option years, I think we talked about $196 million, $197 million up for option in '09. The FY '09 revenue impact is approximately $28 million.

George Price - Stifel Nicolaus - Analyst

Okay. And how about timing of the rebids or when the options get decided. Is it early, late, spread out, any concentration?

Rich Montoni - MAXIMUS, Inc. - CEO

Yes. It's -- it's really spread across the board. We do have one that's scheduled fairly early on. The Texas rebids are now in process at this point in time, so I expect that that's going to be -- at least in the first half of the year that decision will be made and that's the largest one next year.

George Price - Stifel Nicolaus - Analyst

Okay. So Texas and -- will Texas get done -- probably not done by the end of the year, right, so probably what, second fiscal quarter?

Rich Montoni - MAXIMUS, Inc. - CEO

I think no later than the second fiscal quarter based on what we know today. Sometimes they get deferred.

George Price - Stifel Nicolaus - Analyst

Okay. And then CapEx, I guess, looking at about 2.6%, 2.7% of revenue, which seems in-line, actually below, historically, depending on the year, but looks to be up year-over-year, and that's -- you're business profile is a little bit different now, right, on a continuing operations or after the divestiture. I guess, is that reflective of investment in ERP? Is there -- are there anything else in there?

Dave Walker - MAXIMUS, Inc. - CFO

Well, there's investment in ERP, and every so many --

Rich Montoni - MAXIMUS, Inc. - CEO

The internally ERP.

Dave Walker - MAXIMUS, Inc. - CFO

Internally ERP.

Rich Montoni - MAXIMUS, Inc. - CEO

Not the ERP consulting.

George Price - Stifel Nicolaus - Analyst

Yes, I meant the internal -- right.

Dave Walker - MAXIMUS, Inc. - CFO

But there is also investment going on and you will see it on Cap software, so the financial's restated and you can see -- have more visibility in that, primarily in the health area. So while we are a provider of outsource services, we employ a great deal of technology to, in fact, provide those services on an efficient basis. And every few years we make investment in that technology to make sure that we stay competitive. So there's some of that going on.

George Price - Stifel Nicolaus - Analyst

Okay. Okay. Great. Appreciate it and just I guess one word of caution, careful on those large UK government programs, they can be tough. (laughter)

Rich Montoni - MAXIMUS, Inc. - CEO

All right, George, thank you very much.

Operator

Gentlemen, we have no further questions at this time. I would like to turn the floor back over to management for any closing comments.

Lisa Miles - MAXIMUS, Inc. - VP of IR

We would like to thank everyone for joining us on today's conference call and with that, our call is over.

Operator

Ladies and gentlemen, this concludes today's presentation. A replay of this call will be available to you within one hour. You can access the replay by dialing 1-877-660-6853, or internationally, 1-201-612-7415. Enter account number 316 followed by replay I.D. number 302929. Thank you for your participation. You may now disconnect.

D I S C L A I M E R

Thomson Financial reserves the right to make changes to documents, content, or other information on this web site without obligation to notify any person of such changes. In the conference calls upon which Event Transcripts are based, companies may make projections or other forward-looking statements regarding a variety of items. Such forward-looking statements are based upon current expectations and involve risks and uncertainties. Actual results may differ materially from those stated in any forward-looking statement based on a number of important factors and risks, which are more specifically identified in the companies' most recent SEC filings. Although the companies may indicate and believe that the assumptions underlying the forward-looking statements are reasonable, any of the assumptions could prove inaccurate or incorrect and, therefore, there can be no assurance that the results contemplated in the forward-looking statements will be realized.

THE INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES THOMSON FINANCIAL OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2008, Thomson Financial. All Rights Reserved.

1 David N. Walker Chief Financial Officer and Treasurer Fourth Quarter and Fiscal Year 2008 November 13, 2008

2 GAAP & Pro Forma Results From Continuing Operations GAAP results were in line with guidance. Q4 GAAP loss of $0.09 per diluted share and earnings for the full year of $1.55 Key financial metric: Pro forma earnings from continuing operations were $0.71 per diluted share for Q4 and $2.83 for the full fiscal year Revenue growth was driven by new and expanded work in Operations Segment GAAP required $0.25 to be reported in continuing operations

3 Discontinued Operations Discontinued operations reflect the divestment of Security Solutions, Unison, Asset Solutions, Justice Solutions and Education Systems Fourth quarter loss from discontinued operations was $10.2 million, or $0.54 per diluted share. Includes two items: An after-tax loss on disposal of $7.4 million An after-tax operating loss of $2.8 million November 2008

4 November 2008 Operations Segment Operations Segment is now 84% of total Company revenue Revenue increased 14% to $163.5 million in Q4 and increased 24% to $629.2 million for the full fiscal year compared to the same periods from last year Q4 Operating income totaled $22.2 million with an operating margin of 13.6% Growth was fueled by new and expanding work in health and workforce services projects, both domestically and abroad. Operations Segment had an increase in proposal activity of approximately $1 million, or $0.03 per diluted share Margin for the full fiscal year of 13.6% FY 09 expected margin for the Operations Segment will continue to trend at higher end of the Company’s stated range of 10% to 15%

5 November 2008 Consulting Segment Consulting represented 16% of total Company revenue Revenue totaled $25.5 million in Q4 and $115.9 million for the full fiscal year The Segment had a fourth quarter net loss of $2.1 million; the largest contributor to the loss was a $2.7 million year-end adjustment on a fixed price contract Expect softness in the Consulting Segment to continue into fiscal 2009 as we wind down non-performing businesses and further streamline these operations

6 November 2008 Expenses & Margin With the divestments in fiscal 2008, expect SG&A as a percent of revenue will trend in the 15%-17% range Total Company margins consistently above 10% management target Meeting commitments to shareholders which better positions the business for creating long-term shareholder value Fourth quarter and full fiscal year 2008 operating margins of 10.5% and 11.6%, respectively

7 November 2008 Balance Sheet Cash and cash equivalents at September 30, 2008 totaled $120.6 million Active share repurchases with one million shares purchased for approximately $34.1 million In September $14.1 million to purchase 386,000 shares Following quarter close, completed a 10B5-1 plan and purchased 648,000 for $20.0 million At November 4, MAXIMUS had $62.1 million available under the Board-authorized program Days Sales Outstanding totaled 78 days for Q4 which reflected a large receivable, subsequently paid in October, which accounted for approximately 9 days in the quarter DSO trends calculated to exclude divestments during the first three quarters and ranged between 61-71 days Restated DSOs

8 Net cash from continuing operations totaled $9.0 million for Q4 and $51.7 million for the full fiscal year Free cash flow from continuing operations (cash from operations less purchased property and equipment and capitalized software) was $5.2 million for Q4 and $36.3 million for the full fiscal year For fiscal 2009, MAXIMS expects to generate cash from continuing operations in the range of $60 million to $70 million and free cash flow from continuing operations in the range of $40 million to $50 million This excludes approximately $11 million we expect to disburse in fiscal 2009 relative to discontinued operations Cash Flow November 2008

9 Currency Fluctuations & Guidance FY 2009 revenue will be impacted by volatile currency exchange trends as a result of the strengthening dollar Average decline for October and November of 24% in Australia and 10% in Canada Not an economic issue, isolated to exchange rates Reset guidance model to reflect more current translation rates and we’re revising revenue guidance to a range of $750.0 million to $775.0 million Reiterating bottom-line guidance of $3.00 to $3.15 per diluted share. Guidance reflects the positive benefit from the one million shares repurchased that offset the decreased earnings caused by foreign exchange rates Fiscal fourth quarter is traditionally strongest due to seasonality and we expect fiscal first quarter will be sequentially lower due to seasonal trends November 2008

10 Richard A. Montoni President and Chief Executive Officer Fourth Quarter and Fiscal Year 2008 November 13, 2008

11 November 2008 Leading Health & Human Services Pure-Play Accomplishments in FY 08 set the foundation for FY 09 and beyond Entering fiscal 2009 repositioned to focus on core health and human services business Outlook for 2009 is on target 87% of projected revenue for FY 09 is in the form of backlog Backlog of $1.4 billion and pipeline totaling $1.8 billion Consistent demand for our services Not seeing a substantial slowdown in demand Market demand for our services remains encouraging Fundamentally, business is in good shape More visibility, less exposure to budgetary cutbacks

12 November 2008 A Formula for Success Cultural shift towards targeted growth, focused retention, and execution excellence Investments in infrastructure as we become a more collaborative organization Installation of a new ERP system Integrated support functions to meet operational teams’ needs Emphasis on quality and risk management Improve execution, project manager training, contracts, project management, and client and scope management Manage by the numbers Rein in costs wherever possible Realigned our corporate overhead with revised scope of operations, reducing staff by 15% Q4 severance expense of $1 million is expected to result in cost savings of approximately $3.5 million on an annual basis Continue to evaluate our portfolio and exit underperforming businesses

13 November 2008 Business Segments Consulting Focus on improving program operations and overall program performance Creates and supports a pipeline of relationships and opportunities for our core Operations businesses Operations Financial results are inline with our expectations Encouraging long-term growth drivers

14 November 2008 The New Political Landscape Obama administration likely to support the health and human services programs we administer Increasing opportunities in programs addressing the needs of the low to moderate income population: early childhood development, and sustainable employment SCHIP Reauthorization in 2009 Likely increase in Medicaid caseloads during economic downturns Possibility of broadening the eligibility group for Medicaid We are cautiously optimistic about any anticipated expansion to government health programs or increases in federal matching funds

15 November 2008 Opportunities for MAXIMUS States will increasingly turn to managed care as a means to control costs of healthcare delivery MAXIMUS leads the industry in providing Medicaid Managed Care enrollment broker services to nearly two-thirds of beneficiaries in states using contracted enrollment brokers A push to reduce up-front administrative and enrollment costs by mainstreaming eligibility determination MAXIMUS is the leading provider in eligibility support services and we are well positioned to meet any increase in demand in this area

16 November 2008 New Sales Awards and Pipeline Over 87% of projected revenues for FY 09 is in the form of backlog Backlog of $1.4 billion and pipeline totaling $1.8 billion

17 November 2008 Rebids and Option Years Fiscal Year 2008 Won or received extensions on 94% of the value of our rebids Exited the year with 100% of options years won or extended Fiscal Year 2009 14 rebids worth a total of $452 million 17 option-year periods worth a total of $197 million

18 November 2008 Strong Capital Position MAXIMUS maintains strong balance sheets and financial wherewithal during this economic environment $120.6 million in cash at September 30, 2008 No debt MAXIMUS continues to generate strong cash flows and deploy capital to shareholders Plan to continue to pay a quarterly cash dividend Remain active under our Board-authorized share repurchase program