Exhibit 99.3

Operator

Ladies and gentlemen, welcome to Maximus's third quarter earnings call. During the session, all lines will be muted until the question-and-answer portion of the call. (Operator Instructions).

I would like to turn the call over to Lisa Miles, Vice President of Investor Relations.

Lisa Miles - MAXIMUS, Inc. - VP - IR

Good morning and thank you for joining us on today's conference call. If you wish to follow along we've posted a presentation on our website under the Investor Relations page.

On the call today is Rich Montoni, Chief Executive Officer, and David Walker, Chief Financial Officer. Following our prepared comments we will open the call up for Q&A.

Before we begin I would like to remind everyone that a number of statements being made today will be forward-looking in nature. Please remember that such statements are only predictions and actual events or results may differ materially, as a result of risks we face including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC.

The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

With that, [all] over to Dave.

David Walker - MAXIMUS, Inc. - CFO

Thank you, Lisa. Good morning, and thanks for joining us.

Before we begin, a quick bit of housekeeping. Earlier this week, MAXIMUS filed an 8-K which reflected businesses sold in the third quarter. This document reclassifies revenue and costs associated with our divested businesses out of our continuing operations and financial statements we provided the last two years to provide good baseline financial information. We hope you found this information helpful.

So today I'll focus primarily on results from continuing operations.

Let's turn our attention to financial results. Total Company revenue for the third quarter was $206.3 million, a 9% increase compared to revenue of $189.7 million reported for the same period last year. All growth was organic and driven by new and expanding work in the operations segment.

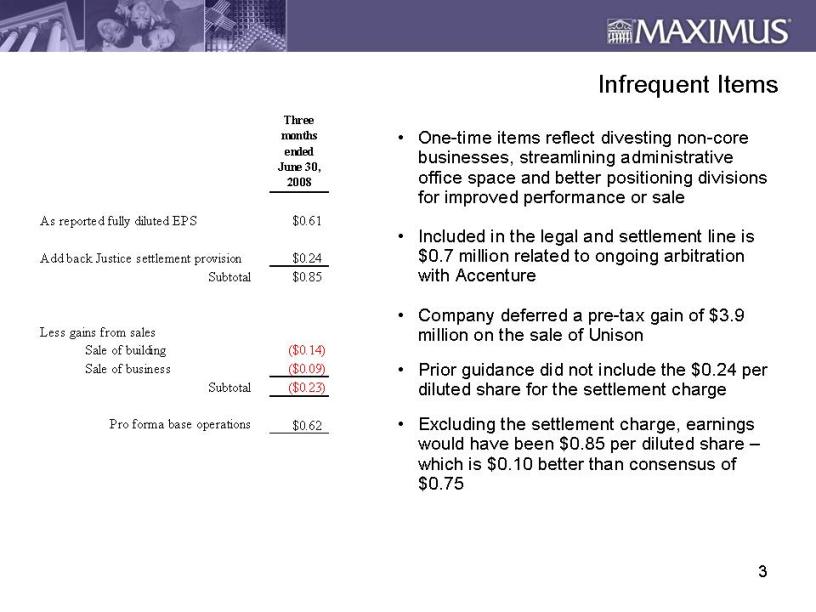

The Company reported net income of $11.4 million in the third quarter or earnings of $0.61 per diluted share. Our earnings were favorably impacted by a gain of $0.23 associated with the sale of two businesses and a property in McLean, Virginia. This unusual gain was offset by a charge for an anticipated settlement of $0.24.

Excluding these onetime items, pro forma earnings were $0.62 per diluted share. The onetime items relate to divesting noncore businesses, streamlining administrative office space, and better positioning divisions for improved performance for sale. These are clear steps taken towards becoming a focused Health and Human Services operations pure play.

The gains from the sale of the noncore businesses are included in the income from discontinued operations, net of taxes, of $1.6 million or $0.09 per diluted share. The gain largely relates to the sale of the Security Solutions division.

We also completed the sale of our Unison subsidiary for which the Company has deferred recognition of a pre-tax gain of $3.9 million. The Company also recognized a pre-tax gain of $3.9 million or $0.14 a diluted share related to the sale of an administrative office in McLean, Virginia, as we continue to take steps to streamline our operating costs.

The sum of these divestiture and property gains of $0.23 per share were offset by the Justice Settlement provision of $7 million pre-tax, included in the legal and settlement line of the financial along with $700,000 in anticipated legal charges related to the ongoing arbitration with Accenture.

Since our prior guidance did not include the $0.24 per diluted share for the settlement charge, it needs to be added back to earnings to be comparable to the consensus estimate of $0.75. Excluding the settlement charge, earnings would have been $0.85 per diluted share, which is $0.10 a share better than consensus, indicative of the continuing strong performance in our core Health and Human Services business.

Let's turn our attention to financial results by segment. Starting with the Operations segment, revenue for the Operations segment increased 13% to $157.9 million, compared to $140.3 million reported for the same period last year. Third quarter revenue growth was fueled by new and expanding work, most notably from our work for services and health operations.

As a reminder, on last quarter's call we discussed that our second quarter revenue was bolstered by infrequently occurring revenue of approximately $6.9 million, related to a large hardware and software purchase. Normalizing for this large purchase, revenue grew sequentially relative to the second fiscal quarter by 2.5%.

Moving onto segment margin, the Operations segment recorded third quarter operating income of $23.8 million, or an operating margin of 15%, compared to income of $24.6 million and operating margin of 18% for the same period last year, which included a onetime profit uplift of approximately $3.2 million related to accounts receivables collections which, were previously reserved on the Texas project.

Overall, the Company continues to enjoy a solid stream of predictable long-term recurring revenue from the Operations segment. As a result we still expect this segment to deliver operating margin in the 12% to 15% range for the full fiscal year. Both our growth and financial performance in Operations continues to confirm our strategy of focusing on our core Health and Human Services business offerings.

Let's turn our attention to the Consulting segment which had revenue of $19.7 million for the third quarter, compared to $19.2 million reported for the same period last year. Consulting segment operating income totaled approximately $0.5 million for the third quarter. Segment results for the period were in line with our expectations.

We continue to transition the segment away from the contingency-based RevMax work and make investments into new markets such as program integrity and Medicaid fraud waste and abuse. Rich will talk in greater detail about our longer-term plans for Consulting and its importance to the Operations business later in the call.

Moving onto the Systems segment, as expected, financial results continue to be mixed within the segment. Third quarter revenue for the segment totaled $28.7 million with a loss of approximately $5.6 million. Asset solutions and ERP divisions delivered results that were in line or better than our expectations. The financial performance by both assets and ERP offset some of the losses in Justice and Education.

The justice settlement this quarter results all remain in contractual requirements and our legacy environment. Justice has been working on product development requirements in both its legacy and next-generation web-based product. In anticipation of this settlement, we have been able to significantly reduce the overhead in this division and allow the team to provide its development focus on a single development environment.

In addition, we will eliminate a project that has been losing money and as part of the anticipated settlement we expect to receive an accretive maintenance revenue stream from this client. We believe this position positions us to drive more efficiency in the operation, hence improved financial performance of this business. This, in turn, better positions the division for additional investment or a potential sale.

As we discussed on our last earnings call, we remain committed to a parallel path for these underperforming systems businesses. As we streamline and optimize these businesses, we are also actively exploring alternatives for these operations.

Overall, both gross profit and SG&A as a percent of revenue have been running at consistent levels over the last several quarters. During the third quarter, total Company operating margin was affected by several non-recurring events, such as gains from the property sale and the divested businesses, as well as legal and settlement expense.

Normalized for all of these items, MAXIMUS achieved an 8.0% margin in the quarter. Excluding the losses in systems the margin would've been in excess of 11%.

Moving onto balance sheet and cash flow items, we ended the third quarter with cash totaling $77.9 million. As announced in this morning's press release, we've completed our accelerated share repurchase program and received a refund of cash in excess of that required to purchase the shares under the program of approximately $13.9 million.

With the completion of our ASR and the $13.9 million in cash from the true-up, the Board of Directors has adopted a resolution to increase funds available under our prior Board-authorized repurchase program. The Board has approved repurchases up to $75 million, expanding the program by approximately $30 million.

Total accounts receivable for the third quarter is $176.5 million. We also have an additional $1.7 million in long-term accounts receivable which are classified within other assets on the balance sheet. With our ongoing focus on AR and cash management, we ended the quarter with day sales outstanding totaling 79 days -- well within the level we normally anticipate of 75 to 85 days.

MAXIMUS generated cash from operations totaling $12.8 million. Free cash flow, which the Company defines as cash from operations, less property and equipment and capitalized software, was $6 million.

Thank you for your time this morning. And with that, I'll turn the call over to Rich.

Rich Montoni - MAXIMUS, Inc. - CEO

Thanks, David, and good morning, everyone. I appreciate that the reported results for the quarter are complex and there are a lot of moving pieces.

I also appreciate that recurring charges may be concerning. So I want to take the time this morning to help you understand what's behind the numbers. When you do look behind the numbers, you'll see how the quarter constitutes a positive step in our strategy to focus and solidify MAXIMUS as the leading pure play provider in government, health and human services.

When we complete this phase of concentrating our focus, and rest assured we will, Special Charges will not be a recurring theme and our business will be more focused, more predictable, well positioned to grow and more profitable.

This quarter's results have two key points. First, we are proceeding with our plan to refine our business focus on our core Health and Human Service offerings. Hence, our efforts to divest certain noncore businesses and exit a certain Justice contract. Second, our core Operations segment delivered another solid quarter. The ongoing success of our Operations segment reaffirms our strategy of optimizing our existing book of business while sensibly adding new revenue.

This segment is the engine to our future and it is delivering on all cylinders. Operations now constitutes 77% of our revenue and delivered an operating margin of approximately 15%. Understanding both of these points is critical to understanding the heart of our strategy.

Let's take a closer look at our progress to focus. With our actions over the last several quarters, we are clearly headed in the right direction. During the third quarter, we completed two noncore divestitures -- Unison and Security Solutions. These divestitures resulted in gains on sales, one of which was deferred.

In addition, we are actively moving along a parallel path of pursuing divestitures of other noncore operations, while working at the same time to improve performance through the elimination of recurring losses. Our efforts have been very consistent with our strategy of business optimization that's been successfully deployed within our Operations segment.

In the third quarter, we booked a $7 million provision in anticipation of settling and exiting a legacy Justice Solutions contract. This action serves a dual purpose. It better positions the business from proved performance, and it was a necessary step to remove a significant impediment to future investment or conveyance.

It's very important to point out that, while pursuing this strategy, we are very cognizant of the needs of our key customers and our employees. We've assured our key clients that their needs will continue to be at the forefront of our plans.

On a divestment front, we have bankers engaged and we are in an active dialogue with potential buyers for certain divisions within our Enterprise System segment. While we are very active in making solid progress, it is not appropriate to provide any details or assurances of the potential outcome of these efforts. Also, any future divestment could yield significant gains or losses, depending on business unit and timing.

Again it is important to see our divestment strategy in concert with initiatives to improve performance of our overall operations as we strive to become the leading Health and Human Services pure play in the government market.

On Operations, as David noted, Operations' 15% operating margin was at the high end of our long-term 10% to 15% range for the segment as we've benefited from seasonal tax credit work. Continued strength in the Operations segment reflects the addition of new profitable work, most notably in the areas of Health and [work for] services, both domestically and international; the transformation of the Texas project and additional profit expansion due to optimization initiatives.

Our optimization efforts over the last two years have focused on pursuing new business more selectively, including (inaudible); the improved use of technology such as our productization efforts, as we talked about last quarter; and other critical business process improvements, such as call centers, best practices that can be replicated from project to project.

On the top line, 2008 will represent a year of exceptional growth from our Operations segment. Our organic growth and ability to layer on new profitable work within the Operations segment reflects our industry-leading position in the market.

Additionally, our long-established brand and proven expertise provides clients with a demonstrated resource for some of their most important programs, many of which are federally funded and federally mandated. This leaves us well positioned to target and win opportunities in the Health and Human Services arena that we're tracking in our pipeline, which remains at record levels.

On our Consulting segment, in addition to profitably growing our core Health and Human Services business, we've furthered our efforts to improve performance in our Consulting segment. Within Consulting, we continue to transition away from our historical contingency-based RevMAX practice and, ultimately, to an orderly transition out of this business.

We've taken major strides towards realigning our core competencies with the key drivers we see for longer-term market demand. As we continue to de-emphasize our RevMAX programs we have focused our resources more in favor of program integrity-based initiatives including Medicaid fraud, waste and abuse, third party liability and payment error rate measurement or PERM.

These developing markets have a lot of promise. And we made several key investments in the future of this product line and longer-term growth prospects.

Let me give you an example. Our existing Fraud, Waste, and Abuse program with the state of New York has generated a lot of interest and positions us well for the next round of states coming out with RFPs or similar initiatives. While investments in new markets will dilute our margins and consulting in the short term, we remain optimistic about our overall direction.

The recent appointment of Deanne Wertin to lead our Consulting segment underscores our commitment to leveraging our Operations and Consulting together in the marketplace. Deanne has extensive consulting experience and comes out of our Health Operations practice where she previously managed a $125 million business and oversaw some of our most critical programs, including two major programs in California. We're very pleased to have Deanne in this key role.

Before we move on, I want to comment on the market environment. We all read the headlines of state and local leaders expressing concern over revenue shortfalls for upcoming budgets. Ultimately we are not completely immune to budgetary constraints and a difficult economic environment, and we've experienced some isolated instances on the fringe that are not material.

Quite frankly, we believe that we are better insulated today than in prior years. Today our mix of business is weighted much more towards the administration of federally mandated Health and Human Services programs.

In fiscal 2002 and 2003 the Operations business was just under 60% of total Company revenue. Today the segment is approaching 80% of our total book of business. We view this mixed shift as extremely positive and believe it further validates our narrow focus. But, overall, we remain cautiously optimistic on the market environment for our services.

Also with the presidential election looming in the fall, I would say that despite obvious distinctions between the parties, we consider this election a neutral factor for MAXIMUS. For example, Democrats tend to be more focused on spending domestically in creating programs which require our services, but are more in favor of a government run model. Republicans are generally more apt to reduce spending on social programs, but they are stronger proponents of outsourcing.

Both candidates are focused on health care and the long-term need to deliver more services. More value for dollar spent can only mean an increasing need for value-added Consulting and Administrative services.

Regardless of the outcome we are not anticipating a major impact on the demand for our services either way. And in the long run, we believe the long-term demand drivers will continue to strengthen.

On acquisitions, beyond the domestic landscape we will complement our organic growth initiatives with the right tuck-in acquisitions, particularly where we can add (inaudible) expertise and increase our geographic footprint.

On August 1st, we closed the acquisition of Westcountry Training and Consultancy Services Ltd, or WTCS, a UK employment and training company that specializes in helping people who are disadvantaged in the labor market to gain employment. WTCS operates within the welfare to work initiative. It has a regional focus in 15 locations throughout the southwest of England.

This acquisition provides MAXIMUS with a foothold into the United Kingdom employment and training marketplace, and creates a solid platform to compete for several key tenders being issued under the flexible New Deal program. This acquisition dovetails with our strong presence in the welfare to work market.

MAXIMUS is a leader in (inaudible) funded work for services programs here in United States. We've not only successfully built this practice into a profitable enterprise, but we are also the top-ranked for profit provider in the Australian workforce services marketplace as well.

The Company has also played a critical role in supporting Israel in the creation and development of a well-regarded workforce services program.

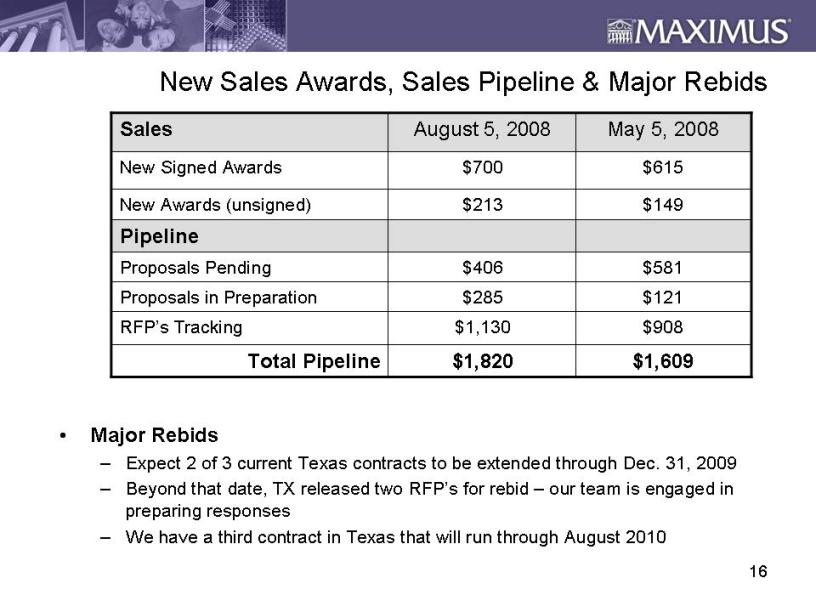

Switching gears, let's talk about our new sales awards and total Company sales pipeline. At August 5th, 2008, we had new signed awards totaling $700 million and another $213 million in contracts that had been awarded but not yet signed. Our sales pipeline is at a record level and at August 5th totaled $1.8 billion.

The increase compared to last quarter was driven by new opportunities across all segments. Some of these opportunities are in the early stages and, based upon historical procurement cycles, they're more likely to provide revenue in late 2009 and 2010. But this only reaffirms our longer-term vision of focusing our efforts in this market where demand continues to remain favorable.

Our pipeline also includes rebids, some of which are substantial. On that front, I'm very pleased to also report that we expect two of our current contracts in Texas will be extended until December 31st, 2009. For work beyond this state two of the RFPs were released and our team is engaged in preparing responses.

As a reminder, we have a third contract in Texas that will run through August of 2010.

Let's look at our capitalization. As Dave discussed, we completed our accelerated share repurchase program, re-activated our share buyback program and have increased the authorization to $75 million. In light of our strong cash flows and demonstrated success improving our operational performance, we are now in a position to resume our Board-authorized share repurchase program.

With our ASR buyback program and ongoing dividend, returning cash to shareholders and delivering long-term value are clearly important to us and our actions support this. At the same time, and in light of our consistent cash flow generation, we are comfortable with our working capital requirements and our ongoing strategy of cultivating our core operations through organic growth and tuck-in acquisitions.

Let me move on to guidance. As noted in this morning's press release we are modifying our revenue guidance to remove revenue for the now discontinued operations, which contributed revenue in fiscal '08 of approximately $13 million. As a result we now expect revenue in the range of $815 million to $830 million for fiscal 2008.

On EPS, principally as a result of the $0.24 provision for the anticipated Justice Division settlement, the Company now expects diluted earnings per share in the range of $2.30 to $2.35 for the full fiscal year. This guidance excludes any gains or losses from potential future divestiture or restructuring activities.

Before I open it up to Q&A, I just wanted to thank you for joining us on today's call and for your ongoing support. As I hope was clear, we are very pleased with the successes we have generated in our Operations segment and we continue to address remaining challenges head-on in other areas of our business, while exploring alternatives for noncore operations.

When we update you in November, we will share with you our detailed expectations for fiscal 2009. In short, despite a tougher economic environment, we are excited in our prospects and we will continue to emphasize sustainable profitable growth in the coming quarters. We see fiscal 2009 as being a much more focused platform with the expectation of delivering much improved financial results generated from our base operations.

This will principally come from strong performance resulting from our more narrow focus on our core Health and Human Services offerings.

And now let's open up the call to your questions.

QUESTION AND ANSWER

Operator

(Operator Instructions). Anurag Rana from KeyBanc Capital Markets.

Anurag Rana - KeyBanc Capital Markets - Analyst

Nice job on getting some of this issues in the Justice division's out. Now that you have some movement over there, what should we expect losses out of assistance for this year and more importantly how should we look at this division next year?

Rich Montoni - MAXIMUS, Inc. - CEO

We are pleased to be moving forward with this focusing program and as we look forward, a whole lot of it depends. I view most of the dynamics will occur in connection with divestiture of these businesses, and will be an important subset of any gain or loss on sale.

And I think as I talked about in my call notes that that will really depend upon which business is sold for what price and what timing. And we'll have to factor into that equation, obviously, the cost of the business that is on our books.

I view it less as an operating loss from the Enterprise divisions. I really like this Justice Solution provision. I view it as really positioning them -- better positioning them for sale.

Anurag Rana - KeyBanc Capital Markets - Analyst

And just on a macro environment, you did touch on it, but can you give a little more specific about how should we expect, I would say rewards coming into the fourth quarter and more so your visibility going into next year?

Rich Montoni - MAXIMUS, Inc. - CEO

The way we look at next year [in] FY '09. I'll talk a little bit about FY '09 and, again, we don't detail guidance until we finish our planning process which we are in the midst of doing now, and we print our final fiscal '08 results. So we will talk about that in November.

But nevertheless when we frame fiscal 2009, this is the way we think about it. First off, a lot of the efforts in 2008, it's not so much about the onetime gains and losses, but it's more about positioning 2009 and beyond. And as we enter 2009, our goal is to be completing our efforts to divest/remedy the noncore business particularly those that are generating losses. So that will provide us a purified, more focused base operations as the platform for fiscal '09.

Winning rebids will be very, very important in fiscal '09. We've got some big rebids coming up and we are in the process of preparing for those now. And I do think we will see organic growth opportunities, not only domestically but internationally.

And lastly I tell you I think '09 is going to be more about -- not so much topline growth issues. That is not our strategy. As you know the last couple of years we've focused -- it's not about making the sales and increasing revenues, it's about generating operating income. We will continue with that strategy.

So FY '09 is not going to be about topline. The key will be reducing the drain of the noncore businesses as quickly as possible; and we want to continue the stellar delivery of great results from our Operations segment. If we achieve those two goals alone, FY '09 should shape up to be a very pleasing year bottom line.

So I say stay tuned.

Operator

Charles Strauzer with CJS Securities.

Charles Strauzer - CJS Securities - Analyst

Quick question for you, probably for Rich. When you look at the consulting business and I appreciate there's been a lot of work and effort going into systems and getting that fixed and, hopefully, piece is sold.

But Consulting used to be a double-digit operating margin business. It hasn't been there for quite some time. In fact it hasn't even been in the high single digits for quite some time.

What gives you confidence that you can get it back to those levels? And, really, is that going to be kind of more the main focus in '09 once you are going to get systems behind you?

Rich Montoni - MAXIMUS, Inc. - CEO

I think that's an important thing in '09 that it is not the primary thing in '09. We believe it is important and opportunistic and creates value to our shareholders by having a consulting business.

That being said, the consulting business of the future is -- and needs to be -- much different than the consulting business we've had in the past. A lot of the profitability that was driven that was behind the profits of the Consulting segment in the past came from the RevMax claiming business.

And when you study that business of think you'll find that it is saturated. It's competitive and just the profit margins are not what they used to be years ago nor do we believe that they will return to those levels.

So we are exiting that product line and we are looking to new product lines where we think there is increasing demand. And as I mentioned earlier today those areas will include Fraud, Waste and Abuse, error rate work that we do and third party liability work. We think there's some pretty significant work in that area, Charles, and so we are gearing up to go in that direction.

The other thing I would say is in the course of operating these large programs for states and our Operations segment, we have tremendous subject matter expertise. We know what best practices are from state to state and when we talk to our customers they very much say they rely upon MAXIMUS to bring to them these best practices.

And really that is something that should be packaged in the form of Consulting Services. That is one of the directions we're headed.

Charles Strauzer - CJS Securities - Analyst

So basically [it's] shipping towards kind of some of these new opportunities. That's some of the areas that I think are -- have been viewed as higher margin by some of your competitors. Is that a corret assumption?

Rich Montoni - MAXIMUS, Inc. - CEO

That's correct.

Charles Strauzer - CJS Securities - Analyst

Great. Then if you could talk a little bit, too, about Q4 and the applied guidance that you've given out. If you can give us a little bit more granularity about what to expect by segment for both sales and margin.

Rich Montoni - MAXIMUS, Inc. - CEO

You know, let's -- Dave, do you want to comment on that just from a top level perspective? What do we see, and maybe just on a comparative basis?

David Walker - MAXIMUS, Inc. - CFO

We gave overall guidance on the top level for the year and so that's easy enough to back into. And generally speaking I think you'll see Operations -- heading where it is -- I think you'll see the losses reducing in systems in part because of the actions that we're taking. And it will shape up to those points together to get to where we've given you guidance.

Rich Montoni - MAXIMUS, Inc. - CEO

And I would say from an overall perspective, I would expect the trend that you've seen not only in this quarter, but in preceding quarters and that, thematically, is a solid performance from our Operations segment. That, again, I think will lead the parade and (multiple speakers).

David Walker - MAXIMUS, Inc. - CFO

In fact even once again you look at this quarter you just -- add the Justice settlement back of $0.24 to our reported EPS of $0.61 and that's the sheet that we had on our press release that gets you back to that $0.85. That is what you ought to be comparing to what was consensus was $0.75.

So we overdelivered due to that Health and Human Services-based business. And that just says the base business is really strong and is continuing to be.

Charles Strauzer - CJS Securities - Analyst

And David, is there something that would cause the margins to decline significantly in Q4 from Q3 in operations, correct?

David Walker - MAXIMUS, Inc. - CFO

No. In fact some of the tax credit businesses tell -- actually help us in the fourth quarter. We saw some of the benefit in the third. And we will see some of that in the fourth and then it will return back to lower levels when you get to the next year. So there is some seasonality in the tax crediting business.

Charles Strauzer - CJS Securities - Analyst

Got it. So then the (multiple speakers)

David Walker - MAXIMUS, Inc. - CFO

That's helpful in Q4.

Charles Strauzer - CJS Securities - Analyst

Right and then when we look at the topline by segment just maybe a little bit more direction there. Consulting was roughly $20 million I would assume something similar to that so it doesn't sound like there is going to be much growth there until you start to see some of these (inaudible) let out and (multiple speakers) --.

David Walker - MAXIMUS, Inc. - CFO

Yes. I would say Consulting is in investment mode for the future. We are doing a lot of work there but that is not translating into immediate topline.

But it is certainly pressuring the bottom line. And that is what you're seeing and Operations, it's pretty predictable trend rate, I think.

Charles Strauzer - CJS Securities - Analyst

One housekeeping question. The Unison deferral of the gain. When do you expect to realize that gain?

David Walker - MAXIMUS, Inc. - CFO

The way that worked is, there's a note which includes the interest of about 6.3 and so anytime you have a big note you wait until is much more reasonably assured. So it will be some time out in the future. Its a facts and circumstance situation.

Charles Strauzer - CJS Securities - Analyst

But not in Q4 correct?

Rich Montoni - MAXIMUS, Inc. - CEO

No. Probably at least a year.

Charles Strauzer - CJS Securities - Analyst

Thank you very much. We look forward to seeing you at the conference next week.

Operator

(Operator Instructions). George Price. Stifel Nicolaus.

George Price - Stifel Nicolaus - Analyst

Just wanted to follow up on a couple of things. First, in terms of demand can you just maybe give a little bit more granularity in terms of what, maybe what types of services you've seen, starting to be impacted on the fringe? Maybe what stage, what the timing of that was?

Rich Montoni - MAXIMUS, Inc. - CEO

Yes I would be glad to talk about that. First off, when I think about demand for what we do, the first cut at it that I find helpful is to address exactly what we do and what's the criticality of what we do to the customer. And the significance of it to the customer -- and I think when we talked about mix shift, this makes the point that in the Operations world, most of what we do is the administration of these large federally mandated programs. And it's the administration piece.

So I think when the states look at managing their budgets, it's more difficult actually the low hanging fruit for them is actually to go after reductions than the benefits spend per se. That is where most of the money is spent. So when they are looking to save hundreds of millions of dollars that's where they tend to focus their reductions.

And I think that has a pretty significant consequence to those folks who are providing benefits under these programs. We don't generally provide benefits under these programs. I think it is a different view the states take towards the administration. They have to continue the administration and in fact when they reduce on the administration beckon actually be significant increases in the form of fraud waste and abuse or folks not getting appropriate services. Hence, there can be real difficulties to the constituents.

So we are experiencing on the administrative side of things the states continue to require and engage us on the administrative spend side. We do have some programs where what (technical difficulty) and this is in that welfare to work arena that starts to get towards benefits spend providing services where we help people find jobs.

And then the last softening of the economy as well as this point in time that is where we've seen some reductions on the margin. We had a couple programs -- one I recall being in Southern California, where they reduced their spend 5% on the welfare to work type circumstances.

But it's really not a big book of our business so it really hasn't been material to us. Does that help?

George Price - Stifel Nicolaus - Analyst

Yes, that does help. And just if you could also -- I don't want to make too much of it, but the -- so the divested business is $13 million through divestiture in April in revenue, right? Is that right?

Rich Montoni - MAXIMUS, Inc. - CEO

That's correct.

Charles Strauzer - CJS Securities - Analyst

Okay. So that's roughly halfway through the year right? An extra month guidance is coming down $15 million to $20 million in revenue?

Rich Montoni - MAXIMUS, Inc. - CEO

I think that's right. So I think it annualizes to be pretty much the revised guidance just simply stripped out, but (inaudible) Discontinued Operations.

George Price - Stifel Nicolaus - Analyst

Is there anything else going on in there? I mean it can be off bu a minor amount, I'm just wondering if there's anything (multiple speakers) ?

Rich Montoni - MAXIMUS, Inc. - CEO

I think the only difference would be rounding. We just rounded the numbers given the level of precision that exists with it.

David Walker - MAXIMUS, Inc. - CFO

One quarter to go.

Rich Montoni - MAXIMUS, Inc. - CEO

And one quarter to go, but really the adjustment in the guidance is to bring down that topline for the stripped out reclassification of Discontinued Operations for the full year.

George Price - Stifel Nicolaus - Analyst

Okay and then last question is on the justice stuff. What is the -- I don't know if you can quantify a little bit some of the comments you've made before in terms of how much the maintenance revenue stream is that you anticipate on the other side of this project? And what the ongoing losses are going to be from the product development portion. As I understood it, you had losses from the project related stuff and the you are also making some investments in product development (inaudible) if you could just. I don't know if you can clarify that any further. Thank you.

Rich Montoni - MAXIMUS, Inc. - CEO

It's really not possible at this point in time and I do want to make it clear that we -- the provision in the quarter is a provision for anticipated settlement. We are well down the path of negotiations with the customer and have every reason to believe that we will sign a firm agreement and we also believe as part of that negotiation that we have ongoing work that we will do.

But when you add all that up its really not practical to forecast how much revenue that will be, what the profit will be so I think it's best just to hold that off as a contingent upside situation. And in terms of what the ongoing justice business will look like, we have not and will not get into the detailed metrics for each division, but we have shared that the two divisions -- Education and Justice -- in the past have generated and are expected to generate substantial losses that between the two of them for fiscal '08 pretax order of magnitude $30 million. And they are pretty much on track to do that.

We will get some -- we've taken some actions to reduce cost which should help us in that situation. And we do have some upside obviously with a new contract should we sign and move forward and realize the revenue and profit from that new contract. But I would hold that aside.

George Price Thank you very much for taking the time.

Operator

(Operator Instructions). Jason Kupferberg. UBS.

Jason Kupferberg - UBS - Analyst

I just had a question on California, specifically. Understand there's been some news about the budget impact there that's been going on for sometime and I believe there's still talk about the state -- your biggest customer. You made a reference to I think a welfare program in Southern California that maybe saw a little bit of cuts, but anything more broadly affecting you in California because of the budget situation there?

Rich Montoni - MAXIMUS, Inc. - CEO

No it really hasn't impacted us. I know it has impacted other providers. Again I think it's more on the folks who provide direct benefits and services. I think it's probably what's part of the equation is the fact that the [HCO] contract which is one of the contracts was just let this year and awarded this year.

So I think as a matter of protocol, once you go -- in the year you go to a competitor and then you award it, it's not appropriate really to turn around and try to reduce that. So we don't sense that there's any imminent likelihood of impact -- adverse impact in California in part or in total.

The other interesting observation is one of our other top five contracts is Texas. And Texas happens to be in a very unique situation given the price of oil and gas so I don't see any jeopardy for that state. The one last datapoint I will share with you, last night I was looking at our book we prepare for the call.

And we've had a couple of project international in scope that are actually becoming large projects for us. I was very pleased to see that. It diversifies our situation and these two locations don't have the fiscal stress that the states themselves do. So it further insulates the circumstance.

Jason Kupferberg - UBS - Analyst

Just a question on the EPS guidance that I understand the numbers here. The midpoint of the range is being cut by $0.30 and we know that $0.24 of that is because of the Justice contract. Correct?

Rich Montoni - MAXIMUS, Inc. - CEO

That's correct.

Jason Kupferberg - UBS - Analyst

So what's the other $0.06?

Rich Montoni - MAXIMUS, Inc. - CEO

I think it's just we are just ending up for the lower end of the range as we wrap up the year. There's really no one specific item.

Jason Kupferberg - UBS - Analyst

Okay. That's helpful. Just lastly on the Accenture arbitration, can we get any update there? I know there was about $700,000 of legal charges for that and you guys had talked about $0.07 or so total legal expected expenses for the second half of the year.

Is that still the right number and is that just Accenture? Is that other stuff, too, and where do we stand with the Accenture arbitration? Thanks.

Rich Montoni - MAXIMUS, Inc. - CEO

That is just in the Accenture arbitration and that was a provision for anticipated costs in the fourth quarter. I also say as it relates to the arbitration itself that proceeding is still an active proceeding. The parties are working to come up with a date certain or a timeframe certain. We don't have one at this point in time but I suspect that it's going to be sometime next spring when the arbitration will likely occur.

Jason Kupferberg - UBS - Analyst

Thanks.

Operator

Ladies and gentlemen, this concludes today's presentation. A replay of this call will be available to you within two hours. You can access the replay by dialing 1-877-660-6853 or internationally you may dial 1201-61 2-7415. Enter account number 316 followed by the conference number 292124. Thank you for your participation. You may now disconnect.

Slide: 1 David N. Walker Chief Financial Officer and Treasurer Third Quarter Fiscal 2008 August 7, 2008

Slide: 2 Title: Third Quarter Financial Results Body: Q3 revenue was $206.3 million – a 9% increase over same period last year All growth was organic - driven by new & expanding work in Operations segment Company reported net income of $11.4 million or $0.61 per diluted share Favorable impact of $0.23 with gains of sale of businesses & property Offset by $0.24 provision for anticipated settlement Pro forma earnings were $0.62 per diluted share

Slide: 3 Title: Infrequent Items Body: One-time items reflect divesting non-core businesses, streamlining administrative office space and better positioning divisions for improved performance or sale Included in the legal and settlement line is $0.7 million related to ongoing arbitration with Accenture Company deferred a pre-tax gain of $3.9 million on the sale of Unison Prior guidance did not include the $0.24 per diluted share for the settlement charge Excluding the settlement charge, earnings would have been $0.85 per diluted share – which is $0.10 better than consensus of $0.75

Slide: 4 Title: Operations Segment Body: Revenue increased 13% to $157.9 million compared to Q3 07 Growth fueled by new and expanding work – notably from Workforce Services and Health operations Normalized, Segment revenue grew sequentially relative to Q2 08 by 2.5% Reminder: 2Q 08 revenue was bolstered by infrequently occurring revenue of approximately $6.9 million related to a large hardware & software purchase Operating income totaled $23.8 million – an operating margin of 15% Company continues to enjoy solid stream of predictable, long-term recurring revenue from Operations Segment Segment is expected to deliver operating margin in the 12%-15% range for full fiscal year 2008

Slide: 5 Title: Consulting Segment Body: Consulting segment revenue for Q3 totaled $19.7 million Operating income for Consulting totaled approximately $0.5 million Segment results were in-line with expectations Continuing to transition this segment away from contingency-based RevMax work while making investments into new markets Program Integrity such as Medicaid Fraud, Waste & Abuse

Slide: 6 Title: Systems Segment Body: Third quarter revenue for segment totaled $28.7 million Loss of approximately $5.6 million reported for quarter Financial performance of both Asset Solutions and ERP offset some losses in Justice and Education Justice settlement in Q3: Resolves all remaining development in our legacy environment, which reduced overhead and focused the team on a single development environment Eliminates a project that has been losing money Positions segment to drive more efficiently in the operation – hence, improved financial performance Better positions the Division for additional investment or a potential sale Committed to a parallel path for underperforming businesses As we streamline and optimize these businesses, we are actively exploring all alternatives for these operations

Slide: 7 Title: Expenses & Margin Body: Gross profit and SG&A as a percent of revenue have been running at consistent levels over last several quarters During Q3 total Company operating margin was affected by several non-recurring events Gains from the McLean property sale Divested businesses Legal and settlement expenses Normalized for all of these items, MAXIMUS achieved an 8.9% margin in the quarter Excluding losses in Systems, margin would have been in excess of 11%

Slide: 8 Title: Balance Sheet and Cash Flow Items Body: Cash at June 30, 2008 totaled $77.9 million Received a refund of cash of approximately $13.9 million due to completion of ASR Board has approved repurchases up to $75 million, expanding program by approximately $30 million Total Current Accounts Receivable for Q3 was $176.5 million Additional $1.7 million in long-term accounts receivable classified with other assets on balance sheet DSO’s totaled 79 days Well within the level we normally anticipate of 75 to 85 days Cash from operations totaled $12.8 million Free cash flow (cash from operations less Property & Equipment and Capitalized Software) was $6.0 million

Slide: 9 Richard A. Montoni President and Chief Executive Officer Third Quarter Fiscal 2008 August 7, 2008

Slide: 10 Title: Refining Business to Focus on Core Health & Human Services Business Body: With concentrated focus, business will be: More focused, more predictable, well positioned to grow and more profitable Two Key Points Proceeding with our plan to refine our business focus on our core Health and Human Services offerings Ongoing effort to divest certain non-core businesses Operations Segment delivered another solid quarter Reaffirms our strategy of optimizing existing book of business while sensibly adding revenue Operations Segment now constitutes 77% of revenue and delivered margin of 15% These points are critical in understanding heart of our strategy

Slide: 11 Title: Divestitures Body: Two non-core divestures completed in Q3: Unison & Security Solutions Results were a gain in sales – one was deferred Divestitures of other non-core operations being actively pursued while working to improve performance through elimination of recurring losses Efforts are consistent with successful strategy of business optimization employed within Operations Segment Currently in active dialogue with potential buyers $7.0 million provision to settle and exit legacy Justice Solutions contract was booked Better positions the business for improved performance Was necessary step to remove significant impediment to future investment or conveyance Divestment strategy runs parallel with initiatives to improve performance of our overall operations

Slide: 12 Title: Operations Segment Body: Operating margin of 15% was at high end of range for segment Benefited from seasonal tax and credit work Continued strength reflects addition of new profitable work - Health & Workforce Services (both domestically and internationally) Transformation of the Texas project & additional profit expansion due to optimization initiatives Optimization efforts over last two years have focused on: Pursuing new business more selectively, including rebids Improved use of technology such as our productization efforts Critical business process improvements that can be replicated from project to project such as call center best practices 2008 was a year of exceptional growth Proven brand expertise in federally mandated & funded programs Well positioned to target and win new opportunities we’re tracking in our pipeline

Slide: 13 Title: Consulting Segment Body: Major strides in realigning core competencies with key drivers for longer-term market demand De-emphasizing Rev Max practice Focusing resources in favor of integrity-based initiatives Medicare Fraud, Waste & Abuse (FWA), Payment Error Rate Measurement (PERM) and Third Party Liability (TPL) MAXIMUS has made several key investments in the future of this product line and longer-term growth prospects Existing FWA program with New York positions us well for next round of states coming out with RFP’s Appointment of Deanne Wertin to lead Consulting Segment Underscores commitment to pair Operations and Consulting expertise in the market

Slide: 14 Title: Market Environment Body: Continued demand for services despite concerns of state and local leaders over expected revenue shortfalls for upcoming budgets Not immune to budgetary constraints, some immaterial isolated instances Better insulated today than in prior years Mix of business is weighted towards federally mandated Health & Human Services programs – we remain cautiously optimistic on market environment for our services 2002 & 2003 Operations was approximately 60% of business 2008 Operations is approaching 80% of total revenue Mix shift is extremely positive & further validates our narrowed focus Upcoming presidential election considered a neutral event Democrats more focused on spending domestically and creating programs which require our services –more in favor of government-run models Republicans more apt to reduce spending on social programs but are proponents of outsourcing

Slide: 15 Title: Acquisitions Body: Acquisitions abroad complement organic growth initiatives Adds domain expertise & increases geographic footprint Westcountry Training & Consultancy Services (WTCS) Completed August 1 Provides MAXIMUS a foothold into UK employment & training marketplace Operates within the Welfare-to-Work initiative with a regional focus in 15 locations throughout Southwest of England Creates solid platform to compete for several key tenders being issued under Flexible New Deal program Dovetails with our strong presence in Welfare-to-Work market MAXIMUS is leader in TANF-funded workforce services program in U.S. MMS is top-ranked for-profit provider in Australian workforce services market MAXIMUS played critical role in supporting Israel in creation & development of a well-regarded workforce services program

Slide: 16 Title: New Sales Awards, Sales Pipeline & Major Rebids Body: Major Rebids Expect 2 of 3 current Texas contracts to be extended through Dec. 31, 2009 Beyond that date, TX released two RFP’s for rebid – our team is engaged in preparing responses We have a third contract in Texas that will run through August 2010

Slide: 17 Title: Capitalization Body: Accelerated Share Repurchase Plan completed, settled in cash and received $13.9 million in July Reactivated share buyback program & increased authorization to $75 million Now ready to resume board authorized program in light of strong cash flows and demonstrated success in improving our operational performance Returning cash to shareholders & delivering long term value are important – evidenced by our actions We are comfortable with working capital requirements & ongoing strategy of cultivating core operations through organic growth and tuck in acquisitions

Slide: 18 Title: Guidance & EPS Body: Revenue Modifying revenue guidance to exclude revenue from the now-discontinued operations which contributed revenue in FY08 of approximately $13 million We now expect revenue in range of $815 million to $830 million for fiscal 2008 Diluted EPS As a result of the $0.24 provision for the Justice settlement, MAXIMUS now expects FY 08 diluted EPS guidance in the range of $2.30 to $2.35 This guidance excludes any gains or losses from potential future divestiture or restructuring activity FY 09 Will provide detailed guidance on November call FY 09 will be on a more focused platform with the expectation of delivering much improved financial results generated from base operations