Exhibit

99.2

Conference

Call Transcript

MMS

- - Q2 2008 MAXIMUS, Inc. Earnings Conference Call

Event

Date/Time: May. 08. 2008 / 5:30AM PT

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

CORPORATE

PARTICIPANTS

Lisa

Miles

MAXIMUS,

Inc. - VP, IR

David

Walker

MAXIMUS,

Inc. - CFO

Rich

Montoni

MAXIMUS,

Inc. - CEO

CONFERENCE

CALL PARTICIPANTS

Charles

Strauzer

CJS

Securities - Analyst

Anurag

Rana

KeyBanc

Capital Markets - Analyst

Jason

Kupferberg

UBS

- - Analyst

Shlomo

Rosenbaum

Stifel

Nicolaus - Analyst

Steve

Balog

Cedar

Creek Management - Analyst

PRESENTATION

Operator

Ladies and

gentlemen, welcome to the MAXIMUS second quarter earnings call. During this

session all lines will be muted until the question-and-answer portion of the

call. (OPERATOR INSTRUCTIONS)

At this

time I would like to turn the call over to Lisa Miles, Vice President of

Investor Relations.

Lisa

Miles - MAXIMUS, Inc. - VP,

IR

Good

morning. Thank you for joining us on today's conference call. If you wish to

follow along, we've posted a presentation on our website under the investor

relations page. On the call today is Rich Montoni, Chief Executive Officer, and

David Walker, Chief Financial Officer. Following our prepared comments, we'll

open the call up for Q&A. Before we begin I'd like to remind everyone that a

number of statements being made today will be forward-looking in nature. Please

remember that such statements are only predictions and actual events or results

may differ materially as a result of risks we face including those discussed in

exhibit 99.1 of our SEC filings. We encourage you to review the summary of these

risks in our most recent 10K filed with the SEC. The company does not assume any

obligation to revise or update these forward-looking statements to reflect

subsequent events or circumstances. And with that, I'll turn the call over to

Dave.

David

Walker - MAXIMUS, Inc. -

CFO

Thank you,

Lisa. Good morning. This morning MAXIMUS reported financial results highlighted

by strong financial performance from the operation segment offset by softness in

the systems and consulting segments. As we continue to provide quality growth in

our core operations segment and divest noncore businesses, we are taking clear

steps towards becoming a focused health and human services operations pure play.

Let us turn our attention to financial results.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Total

company revenue for the second quarter was $210.6 million, an 18% increase

compared to revenue of $179.1 million reported for the same period last year.

All growth was organic and was driven by new and expanding work in the

operations segment. During the quarter the company incurred approximately $5.4

million of charges which include a $2.2 million charge related to a contract

modification that MAXIMUS initiated as part of a requirement to build software

functionality for a large education contract in the systems segment. The fixed

price portion of the contract price was reduced which creates an accounting

charge. But the $2.2 million value was moved to an incentive feature of the

contract which allows us to earn back this money, provided we meet a deliverable

schedule over the next 18 months. More importantly, we worked to modify the

contract to ensure there was clarity and a governance process related to the

software development requirements.

In the

consulting segment we also took a $2.3 million charge related to our share of a

client's reduced reimbursement on a legacy claiming project. This amount may be

recovered depending on the outcome of the client's appeal effort. And lastly,

the company also incurred approximately $.9 million of legal expenses

principally related to the ongoing arbitration with Accenture. Despite the $5.4

million of charges which is approximately $0.17 per share the company reported

net income in the second fiscal quarter of $9.6 million or $0.51 per diluted

share. We also announced in our press release this morning the successful

divestiture of two noncore divisions last week. First, within the system segment

we completed the sale of the security solutions divisions for cash proceeds of

$5 million. Second, we also completed the sale of the Unison division within the

consulting segment for proceeds of approximately $6.5 million. We have also

entered into a contract to sell an administrative office in [McClain], Virginia,

as we take steps to streamline our operating costs. The expected earnings per

share gained from the divestures and the building sale is expected to be

approximately in the range of $0.21 to $0.24 per share and will be recorded in

the third quarter.

Let us

move into the results by business segment. Starting with the operation segment.

Revenue for the operation segment increased 33% to $159.8 million compared to

$120.4 million reported for the same period last year. Second quarter revenue

growth was driven by new and expanding work, most notably from health

operations, the Texas project in both our domestic and international work force

services operations. Segment revenue also benefited from infrequently occurring

revenue of approximately $6.9 million related to a large hardware and software

purchase. The operations segment recorded second quarter operating income of

$23.6 million or an operating margin of 15%, compared to income of $7.1 million

and operating margin of 6% for the same period last year. Once again, the

sizable expansion in operating income reflects the optimization of the current

book of business, the transformation on the Texas project, as well as solid

margins on new work.

The

operations segment continues to benefit from a predictable stream of long-term

recurring revenue. Under the direction of exceptional segment and divisional

leadership, the segment continues to meet our operational and financial

expectations. As a result, we still expect the segment to deliver operating

margin in the 12% to 15% range for the full fiscal year. Both our growth and

financial performance and operations continues to confirm our strategy of

focusing on our core health and human services business offerings.

Let's turn

our attention to the consulting segment, which had revenue of $20.2 million for

the second quarter and a loss of approximately $800,000. The loss reflects a

$2.3 million charge related to the previously discussed legacy claiming project

which the client is appealing and may be recovered at some future date. For the

last nine months the company's been very clear about its expectations for the

consulting segment as we transition away from the claiming business. In parallel

with this transition we have already established a presence in new markets,

principally targeted in the areas of program integrity and fraud, waste and

abuse. We remain optimistic about these new markets and other plans which are

developing for this segment.

Moving on

to the system segment, financial results continue to be mixed within the

segment. System segment revenue totaled $30.5 million but lost approximately

$5.9 million. The asset solutions and ERP divisions continue to deliver strong

results, but this is offset by losses in both education and justice. We remain

unsatisfied with the continuing underperforming divisions within this segment.

These losses stem from software development commitments that ultimately will

position them well in the market. Rich will discuss our actions in more detail,

but steps we are taking include: managing scope of existing contracts very

judicially, and modifying contracts such as the education contract discussed

earlier, where contractual remedies are needed; tightly controlling new contract

terms that may contain software development requirements; changing and

supplementing the management team with individuals with proven track records and

prudent cost management. Segment results will continue to be soft as we drive

the necessary change.

Let's move

on to a discussion surrounding overall company margins. The majority of the

charges in the quarter impacted revenue and gross margins in the consulting and

systems segments. Overall, MAXIMUS achieved an 8% operating margin driven by the

strength in the operation segment which offset the charges in systems and

consulting. In the second quarter SG&A as a percent of revenue, 17.7%, which

was improved compared to the same period last year and was consistent with the

first quarter of fiscal 2008.

Moving on

to balance sheet and cash flow items. We ended the second quarter with cash

totaling $63.4 million. Total current accounts receivable for the second quarter

was $175 million. We also have an additional $1.7 million in long-term accounts

receivable which are classified within other assets on the balance sheet. We

continue to stay focused on cash management, and day sales outstanding continue

to trend favorably under 80 days with second quarter DSOs totaling 76 days. We

still anticipate DSOs to run between 75 to 85 days. MAXIMUS generated cash from

operations totaling $4.5 million. Free cash flow which the company defines as

cash from operations, as property and equipment and capitalized software, was

$1.5 million. For the full fiscal year we continue to expect cash from

operations totaling $50 million to $60 million and free cash flow ranging from

$30 million to $40 million. Thank you for your time this morning. And with that,

I'll turn the call over to Rich.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Rich

Montoni - MAXIMUS, Inc. -

CEO

Thanks,

David, and good morning, everyone. Our second quarter results were mixed. They

reflect our success to date in how we go to market and execute in our core

health and human services operations. We are well on our way to redefining our

company as the leading pure play in government, health and human services

program operations. This is what we define as our core market. And we believe

it's a strategy that will provide long-term sustained growth and increased

shareholder value.

Despite

our strong showing in operations which represented over 3/4 of the company's

revenue for the period, results for the second quarter were impacted as a result

of a one-off charge in consulting, ongoing legal expenses and costs related to

our continuing efforts to improve performance and address legacy contract issues

within our system segment. With our core operations business firing on all

cylinders, we remain focused on and are determined to achieve improvement in

underperforming areas of our business and to refine our focus to our core. And

we're doing just that. Just last week we closed a sale of two noncore divisions.

And within the system segment we are aggressively moving along parallel paths to

improve the underperforming divisions and to actively pursue all

alternatives.

Let's

first talk about the operations segment. Results from our operations segment for

the quarter reflects strong segment leadership and contractual discipline in how

we acquire and structure new awards. As part of this diligence we've declined

unacceptable rebid opportunities and renegotiated inequitable contracts. At the

same time, we focused on developing and pursuing new opportunities that

represent a source of new incremental revenue to ensure that we're putting our

operations business on a course for long-term success. Our emphasis on

sustainable recurring revenues and profitable growth resulted in top-line gains

of 33% compared to the same period last year and operating margins of 15%.

Historically, we've talked to an operating model for the operations segment with

margins in the range of 8% to 15%. However, in recent quarters we've weeded out

underperforming contracts and laid in more rewarding business. As a result, our

margins and operations have run closer to the top end of this

range.

We feel

confident in the strides we've made to strengthen the segment. As a result, we

are raising the lower end of our targeted operating margin range for this

segment and are now expecting its margin to consistently range between 10% and

15%. We're in a new chapter with our core operations and our refined margin

outlook for the business is the best validation for our success in getting the

segment on the right track for the long haul.

I should

also mention that we've been making strides with our productization effort

within the operations segment, another key element to streamlining our processes

and advancing our technology efforts. What I'm referring to here is our emphasis

on moving away from highly customized solutions to more of a component-based or

modular approach, where by we use plug-in play technology anchored in the

services-oriented architecture from program to program. Recently we completed

our enrollment broker platform which is already installed in Indiana and we're

also in the process of upgrading other existing clients to this technology. In

conjunction with this effort, we're also on a path to complete the

productization of other core components by the end of this fiscal year. We

believe our initiatives of coupling new technology with standardized business

processes will allow us to compete most cost effectively. This is just an

example of some of the operating enhancements we're working on and reflect the

benefits of focus.

Turning to

consulting, performance for the segment was in line with our expectations for

the period with the exception of the $2.3 million charge related to a legacy

claiming project the client is appealing. Let me give you some background on

this claim. Prior to taking on this job, we brought in specialized legal counsel

to review our claiming method. After review, counsel approved our method which

had been successfully utilized before. We do view this as a normal course

exercise and we feel reasonably confident that the client will prevail.

Regardless, as we've previously discussed, we're no longer providing federal

claiming on a contingency basis. Instead, our emphasis has been in other areas

which overlap more with our core program management offerings. This would be

like program integrity which includes combating Medicaid fraud, waste and

abuse.

Consulting

services are very important to our customer base, and they do dove-tail with our

core services. As such, we are pursuing more opportunities to pair our

consulting services with our health and human services portfolio. By aligning

consulting with our core competencies, our collaborative efforts will facilitate

better cross-selling while sharing best practices from state to

state.

As

announced today, we divested our Unison-MAXIMUS subsidiary to a division

management-led buyout. This subsidiary was part of the consulting segment and is

an airport, retail and financial consulting business. In this business, while

the profitable contributor was outside our core competency. We also announced

today the sale of our security solutions business to Cogent, which again, while

a stable contributor was not consistent with our refined business

focus.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

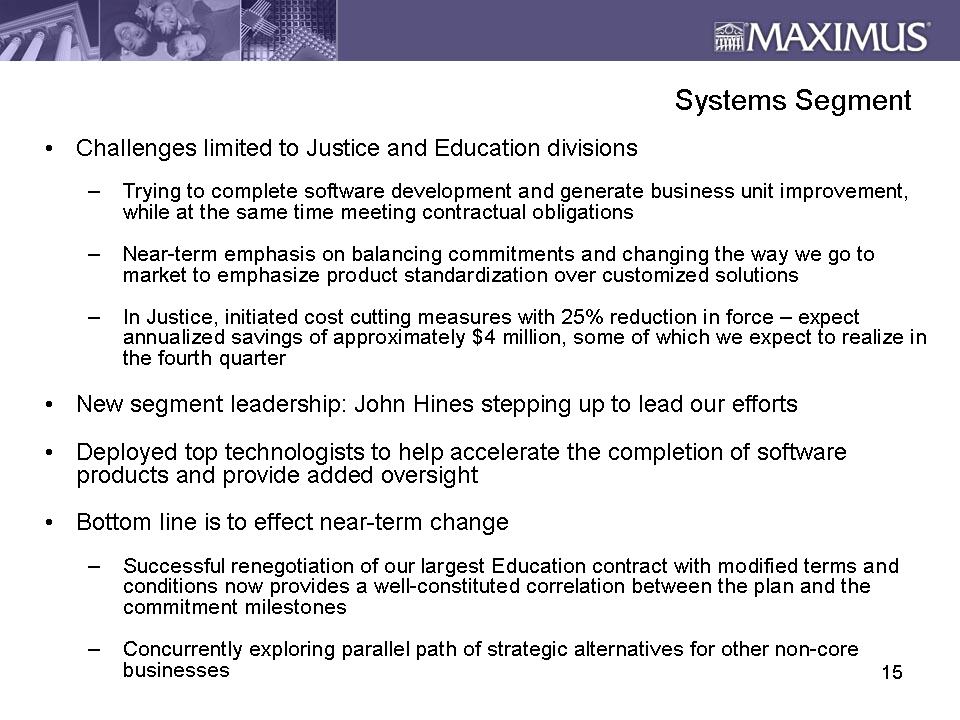

This

discussion represents a good opportunity to segway into a review of the systems

segment. As we've discussed in the past, the challenge in systems has been

limited to the justice and education divisions. These divisions are in the

process of completing the buildout of new software, enhanced our focus to

complete their development stage and generate business unit improvement while

meeting their contractual obligations and maintaining the integrity of the

MAXIMUS brand. As a result, our near-term emphasis has been balancing

commitments, completing the software development and changing the way we go to

market to emphasize product standardization over customized solutions. In the

area of justice, we have initiated cost-cutting measures to drive improvement

which should help lessen the losses for the remainder of the year.

The

justice division has been directed to focus principally on completing the

implementation commitments and service delivery with our current client base.

The division will also limit marketing of new contracts. This narrowed

concentration has allowed us to take appropriate initiatives including a

reduction in force. This week we eliminated approximately 25% of the justice

solutions work force and we believe this will deliver annualized savings of $4

million, some of which we expect to realize in the fourth quarter.

While this

is an important step in the right direction, we also want to announce we have

new segment leadership in place. John Hines, a very well-respected member of the

MAXIMUS management team is stepping up to lead our efforts. John brings over 30

years of commercial software development expertise to the table and he's been

with MAXIMUS for nearly a decade. His most recent role, John served as President

of our assets solutions division, which has been a long-standing profitable

contributor to MAXIMUS. In addition to John, we also have deployed two of our

top technologists to help accelerate the completion of our software products in

justice. These are some of the best and brightest project leaders who came out

of our top-performing divisions to serve on special assignment to help drive our

software development to completion and provide added oversight. The bottom line

is we are intent on affecting near-term change.

As noted

in this morning's press release, I think the successful renegotiation of our

largest educational contract demonstrates our commitment to improve and bring

resolution to the legacy situations. The modified terms and conditions of this

agreement outline milestones necessary to achieve completion. As a result,

there's now a well-constituted correlation between the plan and the commitment

milestones. As David noted earlier, the charge related to this modification is

not a permanent reduction, and we intend to earn the $2.2 million back as we

achieve implementation milestones over the next several quarters. In addition to

generating operational improvements within systems, wear also taking a parallel

path of exploring strategic alternatives for these businesses. As demonstrated

by the sale of Unison in our security solutions business, we've been proactive

in divesting noncore holdings. While we can offer no assurances on future

outcomes, we're actively pursuing a variety of options for additional noncore

assets and we'll update you as appropriate.

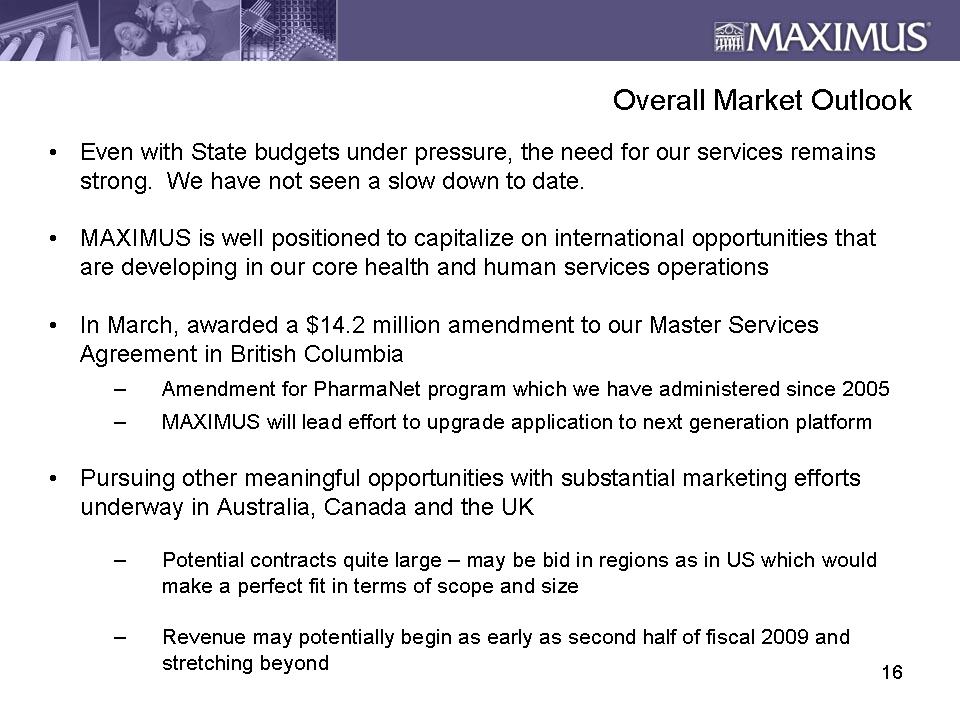

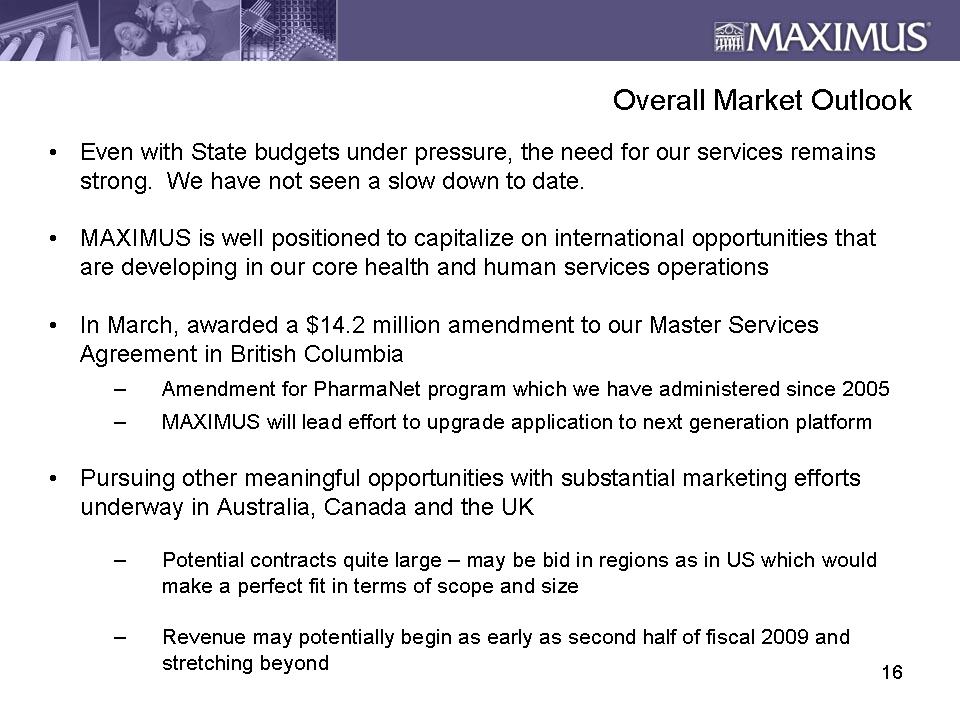

Let's turn

our attention to the overall market outlook. As we've said in recent quarters,

even while state fiscal budgets are under pressure, we see this as a time when

the need and value proposition of our core services remains strong. Generally

state cost-cutting actions have been aimed at the reduction of direct program

benefits where the significant savings lie, and not in program administration

because the need for administration remains. We've simply not seen a slowdown of

our work at this time. Beyond our work domestically, we're well-positioned to

capitalize on international opportunities that are developing in our core health

and human services operations, including expansion of current programs. For

example, in Israel where we run a major work force services program, we are

encouraged by the possible expansion opportunities we see on the

horizon.

Also,

during the quarter, we announced a $14.2 million amendment to our master

services agreement in British Columbia. This is related to the PharmaNet program

which we've administered since 2005. This important program links all pharmacies

in British Columbia to a central set of data systems and supports many

functions. Under the amendment, MAXIMUS will lead the effort to upgrade this

application to the next generation platform. We're very excited about our

expanding work in Canada and our ongoing efforts of excellence in operations

outsourcing. In addition we're pursuing other international opportunities with

substantial marketing efforts underway. We have staff on the ground in

Australia, Canada and the U.K. working these opportunities. While in aggregate

the potential contract values for these international opportunities could be

quite large, most indicators point to most of these programs as being good in

regions similar to approach we have here in the states.

We think

this approach provides mutual benefits to governments and to vendors. These

types of regional opportunities are expected to lie right within our sweet spot

in terms of scope and size. I expect them to be along the lines of singles and

doubles rather than a grand slam. I believe that many of these opportunities may

provide additional streams of revenue, potentially beginning as early as the

second half of fiscal 2009 and stretching beyond. Our extensive programmatic

expertise and demonstrated successes should provide us a competitive leg up as

we continue to strengthen our foothold in the international marketplace. We're

certainly excited about extending the breadth of our geographic footprint and

serving a broader market with core service offerings where MAXIMUS is the market

leader.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

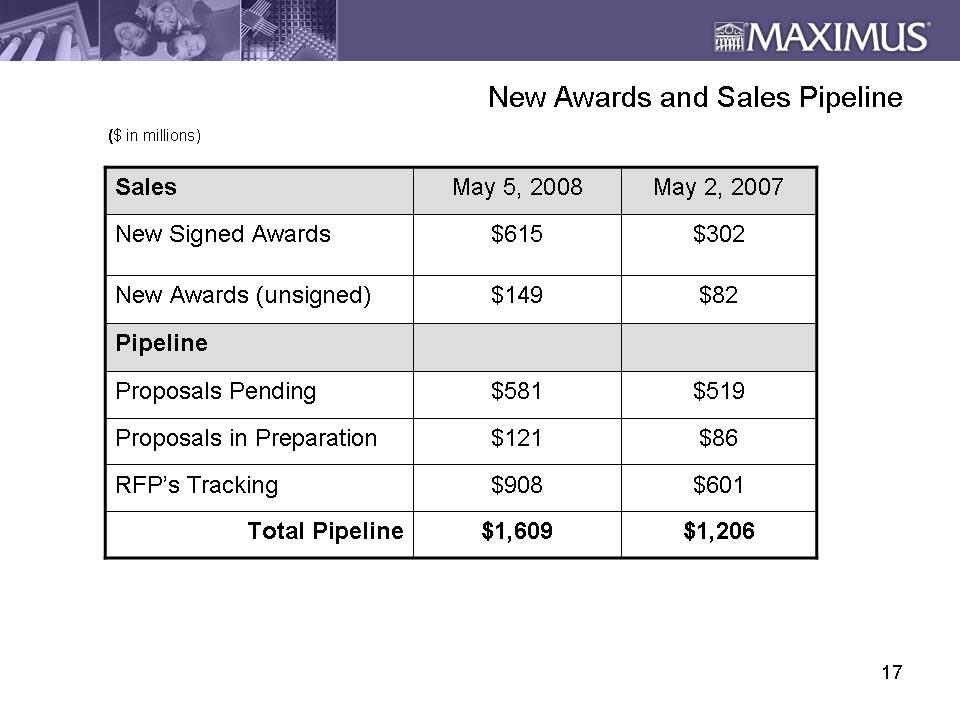

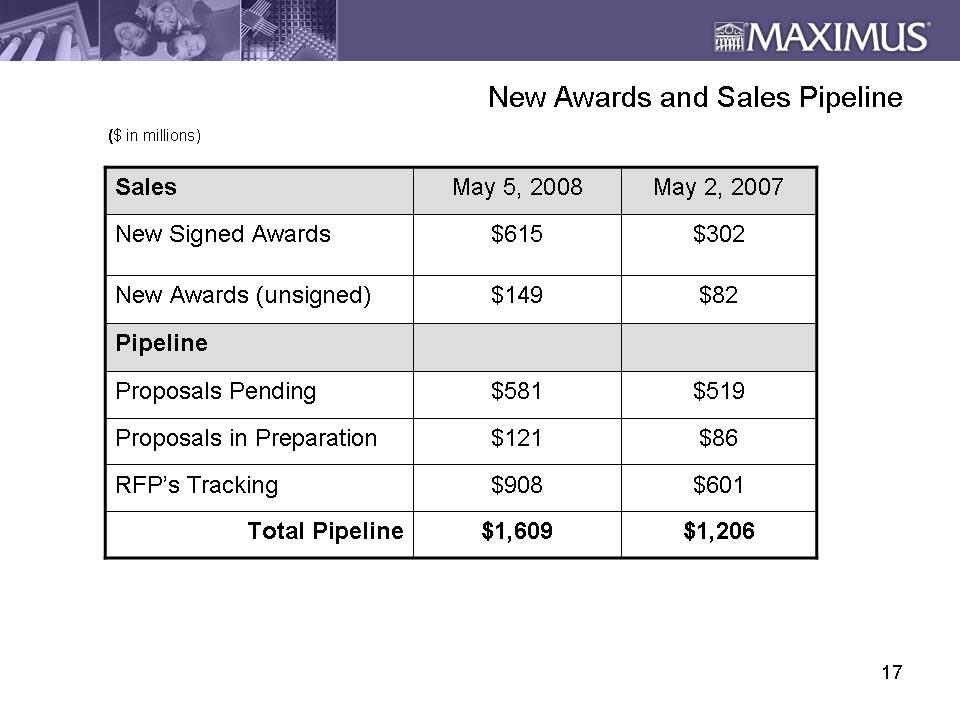

Let's turn

our attention to new awards in the sales pipeline. This data is very encouraging

and supports the position that we've not seen a slowdown at this time. Starting

with new signed awards, as of May 5th, 2008, MAXIMUS signed new awards totaling

$615 million, which includes approximately $200 million related to the signed

California health care options rebid. In addition, we've had another $149

million in awarded but unsigned contracts. Our sales pipeline continues to grow

and totaled $1.6 billion at May 5th, which is driven primarily by new

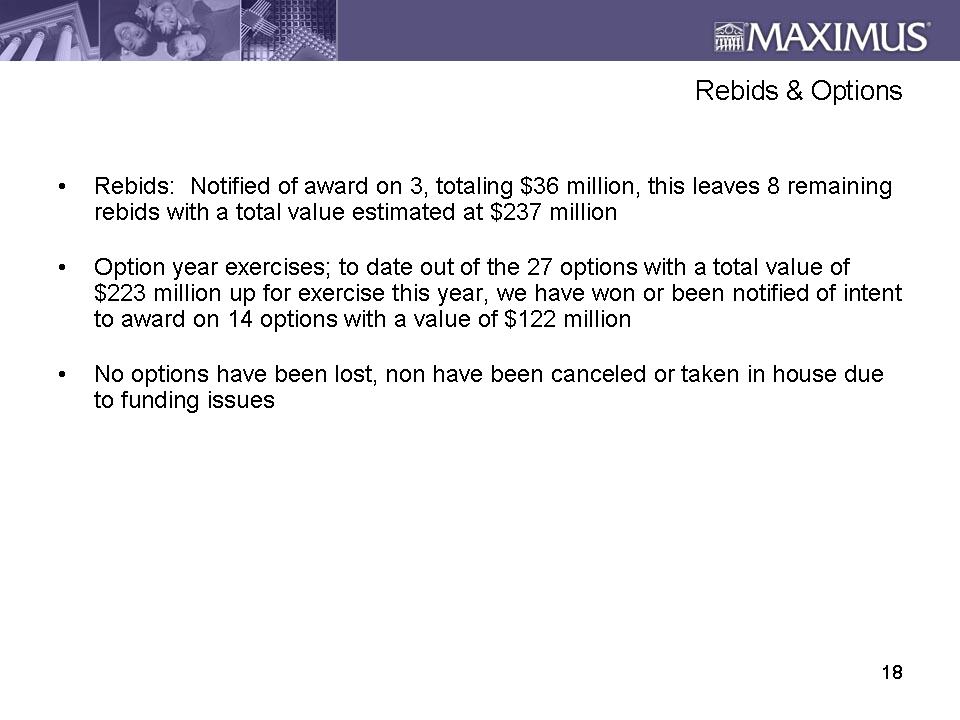

opportunities in the operations segment. On the rebid front we've been notified

of award or extension on three bids totaling approximately $36 million. That

leaves us with eight remaining rebids with a total contract value estimated at

$237 million, the largest of which are the three Texas contracts.

Moving to

option near exercises, to date out of the 27 options with a total value of $223

million up for exercise this year, we've won or been notified of intent to award

on 14 options which carry a value of about $122 million. This leaves us with 13

options with an estimated value of $101 million. So in summary, we've not lost

an option, and none have been cancelled or taken in-house due to funding

issues.

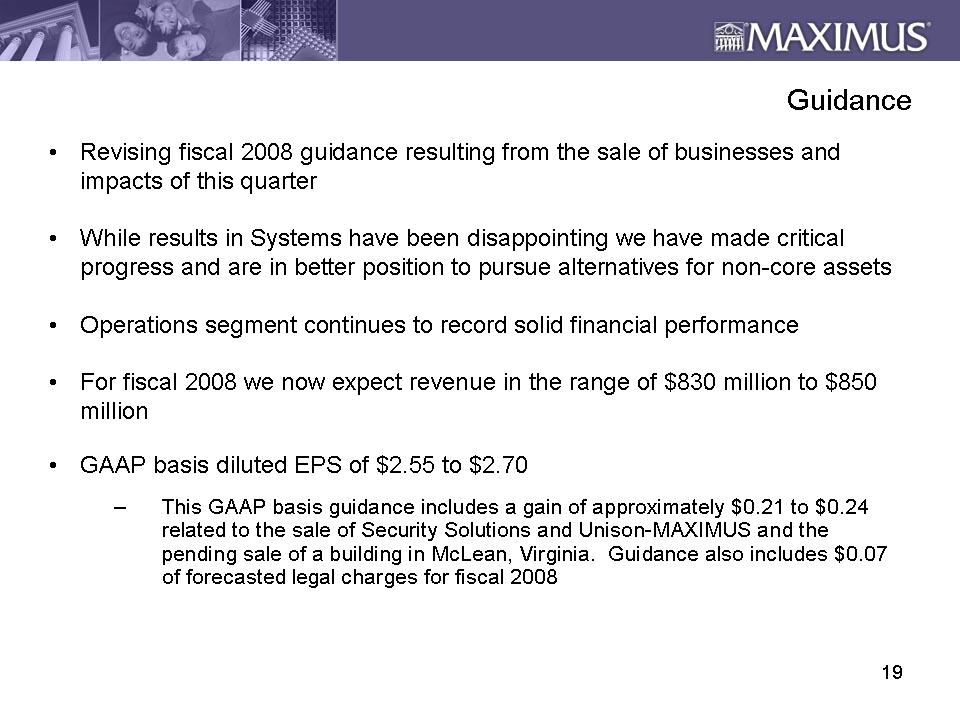

Moving on

to guidance. As noted in this morning's press release, we're revising our fiscal

2008 guidance principally as a result of the divestitures and performance from

the justice and education divisions inside the segment. For fiscal 2008 we now

expect revenue for fiscal 2008 in the range of $830 million to $850 million with

GAAP basis diluted EPS of $2.55 per share to $2.70 per share. This GAAP basis

guidance includes a gain of approximately $0.21 to $0.24 per share related to

the sale of the security solutions division, the sale of the Unison division

subsidiary and the pending sale of the property in McClain, Virginia. Guidance

also includes a $0.07 per share impact related to the forecasted legal charges

for fiscal 2008. Additionally, guidance does not include any gains or losses

from any potential future divestiture or restructuring activities.

Before we

open it up to Q&A, I just have a few closing comments. At the onset of the

year, we shared our views on the risk assessment for the year, and we felt the

risks were largely tied to the performance in the system segment. While

financial results in the systems have been disappointing, we've made critical,

needed progress, and we believe we are in a better position today to effectively

pursue alternatives for noncore assets. Despite the soft performance of the

system segment, the operations segment continues to deliver solid financial

results. This further confirms the advantages of our strategy to

focus.

As a

result, when we complete this transition phase in enterprise systems and

confident that our company will be solidified as the leader pure play provider

to government, health and human services, this will bring the significant added

benefits of focus to our clients, our employee, and to you, our shareholders. So

in closing, in addition to being determined to complete this transition phase,

we remain very enthusiastic about our future. And now let's open up the call to

your questions. Operator?

QUESTION AND

ANSWER

Operator

Thank you.

(OPERATOR INSTRUCTIONS) Thank you. Our first question is coming from Charlie

Strauzer of CJS Securities.

Charles

Strauzer - CJS Securities -

Analyst

Hi. Good

morning.

Rich

Montoni - MAXIMUS, Inc. -

CEO

Good

morning, Charlie, how are you?

Charles

Strauzer - CJS Securities -

Analyst

Good,

Rich. Thank you. Just a couple quick questions. The divested businesses in the

systems segment, beyond the gain that you're going to record in Q3, what is the

expected impact on that segment in terms of lost revenues and potential profits

from those businesses?

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

David

Walker - MAXIMUS, Inc. -

CFO

Hey,

Charlie, Dave Walker. Both of those businesses combined last year had revenue of

about $38 million and they made 4.3%, so they were profitable. And they were --

they had declined about 11% in the aggregate in '08.

Charles

Strauzer - CJS Securities -

Analyst

Got it. So

we'll adjust accordingly there. Rich or David, on the operating margin guidance

for the operations business of 10% to 15%, obviously you're doing very well

there, what are the factors that could cause the margins to kind of go towards

the lower end of that range over the year?

Rich

Montoni - MAXIMUS, Inc. -

CEO

Well, a

couple things. I think Dave Walker and his comments said for the full year we

expect that segment to deliver, I think Dave's comments was 12% to 15%. For year

in and year out we've reset our range to 10% to 15%. In terms of what are the

factors, there's many factors. The factors that come to mind that are most

significant would be the stage of new work that we take on. Generally on these,

while they're longer term contracts, we find front end we have investments.

Sometimes these expenditures need to be expensed as incurred pursuant to

generally acceptable accounting principals. Now you may find situations where

new work has negative margin or lower margin and as the contract matures and we

start driving efficiencies, we get greater margins towards the tail end of the

contract. So the nature and timing of the contracts would be a factor. I think

that's probably the largest factor.

David

Walker - MAXIMUS, Inc. -

CFO

Quarter

over quarter you get fluctuations due to timing of maybe the equivalent of open

enrollment. So we'll get big expenditures that may bear lower profit on

individual quarters.

Charles

Strauzer - CJS Securities -

Analyst

Got it.

Excellent. Okay. Thank you. And also then last thing, the Texas contracts is up

for rebid. What's the status of those RFPs, have they been submitted? Are they

in the review phase? Can you give us a sense of the time?

Rich

Montoni - MAXIMUS, Inc. -

CEO

That's in

a hold pattern at this point in time. The state has not moved forward with the

RFP process. We don't know when those RFPs will come out at this

point.

Charles

Strauzer - CJS Securities -

Analyst

Got it.

And then lastly, on the integrity, you mentioned there's a new area you're

focusing on some of the consulting businesses, that there's a number of kind of

the Medicare, Medicaid integrity contracts up for bid under the several task

orders. Are you bidding for any of those right now?

Rich

Montoni - MAXIMUS, Inc. -

CEO

I believe

we're very, very active in that space. We're very proud of our accomplishments

and we think we lead in many of those niches, if you will. We're excited about

the new opportunities that are coming in front of us. And te're very

active.

Charles

Strauzer - CJS Securities -

Analyst

Great.

Thank you very much.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Rich

Montoni - MAXIMUS, Inc. -

CEO

You bet.

Thanks, Charlie.

Operator

(OPERATOR

INSTRUCTIONS) Our next question is coming from Anurag Rana from

KeyBanc.

Anurag

Rana - KeyBanc Capital Markets

- - Analyst

Hi, good

morning, everyone. Rich, could you give us an idea out of the book you recorded

this -- so far, what percentage belongs to the operations segment versus the

other two segments?

Rich

Montoni - MAXIMUS, Inc. -

CEO

Generally

we don't share the detailed, the details behind the new contracts signed, etc.

But you can rest assured that the majority is in the operations segment. It

pretty much follows the proportion of revenues, and operations by far is the

leader.

Anurag

Rana - KeyBanc Capital Markets

- - Analyst

Yes. That

would make sense. And that brings me to my second question, then why even bother

in the consulting segment if you want operations to be your core area going

forward?

Rich

Montoni - MAXIMUS, Inc. -

CEO

I think

that's a great question. My view on consulting is this, I do think our clients

need consulting. And our approach to consulting as we go forward is to very much

marry our consulting expertise with our operations expertise. And in many

regards it's our consulting ability that leads and provides innovative view,

methodology, technology, which frankly that's the value add to our clients. They

look to us for that. So I think provided we operate consulting in that

complementary fashion, it adds value, gives us competitive advantage. And quite

frankly I think it can be a profitable business.

Anurag

Rana - KeyBanc Capital Markets

- - Analyst

Okay.

Thank you. The -- you just mentioned that the Texas contract is in a hold

process. So should we assume that if there is no RFP out you're going to still

continue doing work under the old order?

Rich

Montoni - MAXIMUS, Inc. -

CEO

I think

that's a fair assumption.

Anurag

Rana - KeyBanc Capital Markets

- - Analyst

Great. And

lastly, I know it's too early to talk about next year, but I've seen that your

bookings as far as the first half of this year is almost double what you -- or

actually more than double what you did last year so far. So, any kind of

indications as to what kind of organic growth rate should we expect on the base

off of the divestitures for next year?

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Rich

Montoni - MAXIMUS, Inc. -

CEO

It's

really too soon to tell. But I will tell you, just to give you some directional

sentiments in that context, we've always said we think our business model can

deliver 10% top line and 10% operating margin long-term. And I still think

that's a fair assessment. Naturally we do have economic, macro economic

situations we have to deal with in this environment. But I will tell you that

offsetting that and going in the opposite direction are some very significant

needs that our clients are facing where we provide what I think are effective,

unique solutions, and they seem to be very well-received at this time. Our

clients are dealing with some very significant challenges to comply with new

federal rules and regulations. And many of these programs in health and human

services, they're having to struggle with retiring work force, so they don't

have the focus to carry on the work in light of these additional requirements,

and that's, to a large extent, what's fueling our growth. Even when you strip

out the benefit of the Texas contract year-over-year, you'll find that the

organic growth for the company is north of 20%. So I'm not going to steer you to

expect that in FY '09. But it does give you an indicator that there's some

strong underpinnings in demand for what we're offering in a

marketplace.

Anurag

Rana - KeyBanc Capital Markets

- - Analyst

Okay.

Thank you.

Operator

Thank you.

Our next question is coming from Jason Kupferberg of UBS.

Jason

Kupferberg - UBS -

Analyst

Yes. Hi.

Good morning, guys.

Rich

Montoni - MAXIMUS, Inc. -

CEO

Hi,

Jason.

Jason

Kupferberg - UBS -

Analyst

I just

want to start with a question on the arbitration situation with Accenture. I

think this is the first quarter we've actually seen some legal costs associated

directly with those proceedings and there's a projection for $7 million, I

believe, over the course of the fiscal year. So can you give us an update on

what's incrementally changed to drive the need for those charges and where the

actual process stands in its chronology here?

Rich

Montoni - MAXIMUS, Inc. -

CEO

Okay. I'd

be glad to do that. Where the arbitration itself stands, Jason, is there is no

scheduled date for arbitration at this point in time. Originally when the

arbitration process was launched, I believe it was scheduled -- the arbitration

was scheduled to occur this spring. That's been postponed and no date has been

set at this point in time. So our counsel is involved in preliminary ongoing

analysis, preparation, making sure we remain ready for arbitration when the date

is set. The reason for the charge in this situation really relates to the

circumstance, the insurance situation. We have insurance on this matter. We had

been of the opinion that we had hit the deductible, if you will, and that the

insurance company should pick up and cover legal charges from that point

forward. That's a matter that's being "discussed between the parties." So until

such time as the insurance company agrees to pick up that legal bill, we felt it

best to record it and recover it when we come to terms with the insurance

company.

Jason

Kupferberg - UBS -

Analyst

So there's

a possibility that those charges then get reversed?

Rich

Montoni - MAXIMUS, Inc. -

CEO

There's a

possibility. But that remains to be seen.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Jason

Kupferberg - UBS -

Analyst

Okay.

Okay. And how should we think about for full year fiscal '08, what the growth in

margin expectations should be for the consulting and the systems segments? Maybe

you want to phrase that on more of a pro forma basis given the divestitures. So

we can get a sense as the business stands today, what kind of growth and

operating income might they be able to produce over the course of a

year.

Rich

Montoni - MAXIMUS, Inc. -

CEO

So just so

I understand your question, you're looking for some directional insights in

terms of margins for the full year by the segments?

Jason

Kupferberg - UBS -

Analyst

For

consulting and systems specifically as well as revenue growth

potential.

David

Walker - MAXIMUS, Inc. -

CFO

I would

say on the revenue side you shouldn't expect much growth. In systems what we're

doing is being very judicious about new work we take and make sure we don't

further add requirements to what is a development backlog. So I wouldn't expect

there in consulting we've got a lot of money going into investments in new

areas, which is why our operating income there is not as high as we'd normally

like in consulting. But again, I think those thing also pay off but not in

fiscal year '08.

Rich

Montoni - MAXIMUS, Inc. -

CEO

Said

another way, Jason, I would say from a top line perspective, I think all of our

revenue growth '08 over '07 will be driven by our operations

segment.

Jason

Kupferberg - UBS -

Analyst

Okay. That

makes sense. And if we look at the year to date award total, what would be the

mix of new versus renewed work in that year-to-date contract award

total?

Rich

Montoni - MAXIMUS, Inc. -

CEO

Well, we

don't have that metric. And historically we haven't published the metric. But I

will say that, we disclosed in the press release and had a separate press

release that the biggest award in that new contract signed of [518] -- I'm

sorry, of the [615], rather, the biggest award was that renewal offer the HCO

contract which is approximately $200 million.

Jason

Kupferberg - UBS -

Analyst

Yes.

Rich

Montoni - MAXIMUS, Inc. -

CEO

But we are

finding a significant portion of the new signed work is in fact new

work.

Jason

Kupferberg - UBS -

Analyst

Okay.

Okay. And just one last housekeeping item, how much potential proceeds might you

get from the sale of the headquarter building? Is that going to be a sale

lease-back situation or is that just excess real estate?

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

David

Walker - MAXIMUS, Inc. -

CFO

That's

just excess real estate. And the sales price is $6.1 million. There will be

taxes and a book value. So that it's not all gain. But that's the cash

proceeds.

Jason

Kupferberg - UBS -

Analyst

Okay.

Thank you.

Rich

Montoni - MAXIMUS, Inc. -

CEO

You're

welcome.

Operator

Thank you.

Our next question is coming from Shlomo Rosenbaum of Stifel

Nicolaus.

Shlomo

Rosenbaum - Stifel Nicolaus -

Analyst

Hi. Thank

you very much for taking my questions. I just want to focus a little bit on some

of the pain points? In justice and education. Just starting out with the

education contract, you said there was the largest contract. And I just want to

know, when was the contract signed exactly? And do you feel like after you sort

of worked through at least in that division, a lot of the headwinds you have on

the new development projects?

Rich

Montoni - MAXIMUS, Inc. -

CEO

On that

education contract it is a large contract. Was signed originally in 2003 and is

a long-term contract. And I think that this was a very significant and necessary

accomplishment for the division. The prior contract before the amendment did not

have sufficient clarity for us to effectively know what we needed to do and when

we would be complete with a contract. And I'm sure you can appreciate that's a

very important thing to drive these contracts to completion. So this amendment

gives us that benefit. And I'm of the opinion that the client and MAXIMUS

understand what the key milestones are as a result of this amendment. We've

agreed in terms of targeted deliverables and we're all working to accomplish

that.

Shlomo

Rosenbaum - Stifel Nicolaus -

Analyst

Okay.

Thanks. You've talked about, consulting really dove-tailing with a lot of the

work that you do in the operations segment. But if I'm reading you correctly, it

really sounds like pretty much the system segment is something that you guys

could see that on an ongoing basis would not be necessary. Am I reading it

correctly or are there some areas of systems that you still think would be

necessary in your end-state goal of an HSS pure play?

Rich

Montoni - MAXIMUS, Inc. -

CEO

I don't

think there's anything in our enterprise systems segment that is necessary -- or

closely correlated with our in-state goal as a health and human services pure

play. You may recall there were five divisions inside of that, the enterprise

systems segment. We just sold one of them, the securities solutions division.

That leaves us with four: asset solutions, ERP, justice and education divisions.

And each on those divisions, there's not much correlation, in fact, there's not

much correlation with our informations group.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Shlomo

Rosenbaum - Stifel Nicolaus -

Analyst

Okay.

Going on to the amendment in British Columbia contract, just to understand

you're going to be moving the platform to -- upgrading the platform. What do you

consider the risk profile of that amendment? Just is that something you guys

have done before? And can you talk about that a little bit more?

David

Walker - MAXIMUS, Inc. -

CFO

I actually

think the risk profile is very low. When we think about that and we don't have

time today to get into all of the detail points, we have a very effective

working relationship with the client. We have a very, very strong team from not

only an operational perspective but from a technical perspective that dedicated

on site in British Columbia. And this is simply -- I view this as simply an

add-on to our existing services. I think -- I'm very, very confident there's low

risk associated with this work.

Shlomo

Rosenbaum - Stifel Nicolaus -

Analyst

Okay. And

just a last question here on the operating margin on the operations segment, the

first half of the year the margins really come in very -- have been very good,

13% and then 15% for two quarters. Is there any reason to expect going that into

the second half of the year wouldn't be at the upper end or even above the upper

end of that range?

David

Walker - MAXIMUS, Inc. -

CFO

Let's take

a look here. Well, you get some mixed things that happen during the quarter. We

had some large things and good things that happened this quarter. At the tail

end of the year we tend to -- so while that was one time and should not benefit

us in the third and fourth quarter, on the other hand, our tax crediting

business that we've talked about in the past, tends to kick in strong on the

third and more particularly in the fourth quarter. So, they'll tend to net

themselves out. So it's just -- it's timing.

Rich

Montoni - MAXIMUS, Inc. -

CEO

To sum it

up, I think we see these tailwinds continuing through the rest of the

year.

Shlomo

Rosenbaum - Stifel Nicolaus -

Analyst

Okay.

Thanks a lot, guys.

Rich

Montoni - MAXIMUS, Inc. -

CEO

Thank

you.

Operator

Thank you.

Our last question is coming from Steve Balog of Cedar Creek

Management.

Steve

Balog - Cedar Creek Management

- - Analyst

Thanks.

The education contract, was the problem here centered in this one contract? And

Rich, were you involved in the renegotiation?

Rich

Montoni - MAXIMUS, Inc. -

CEO

Yes. The

challenges in the enterprise systems division were concentrated on this one

large contract which correlates, quite frankly, very closely to the development

build commitments of the division. So we have the benefit of having, I think, a

focused target, if you will, to complete the software development and will

concurrently complete our obligations to this, by far, our largest client of the

enterprise -- the education systems division. There were and are smaller

clients, and we have client commitments. But they are order of magnitude less

significant than this one large contract. And yes, I was involved at a minimum

on a weekly basis with the entire division and the contract itself as we moved

forward the negotiations and the amendment, the legal aspects of the

amendment.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Steve

Balog - Cedar Creek Management

- - Analyst

So it

looks like we take our lump here in education is reasonably on its feet. I'm

sensing other -- or understanding the justice division issue was a lot bigger

because you're bringing in some big guns to fix that. Is the software

development problem here, was this centered around one client, or was this a

system that you were productizing and it just got out of hand and we have a lot

of R&D against something with no expenses -- sorry, no revenue?

Rich

Montoni - MAXIMUS, Inc. -

CEO

A couple

of comments on this. First on education systems, I think we've positioned the

division to be successful, but they still need to execute. So that's not a

foregone conclusion. So we still have some significant management attention that

will be put to that and we're working real hard to make sure that that

happens.

On

justice, you're right, the justice situation is more complicated. There are more

clients involved. The they have a very significant installed base of an earlier

version of their software. And they launched a plan a couple of years ago to

build out a new web-based architecture which has a lot of appeal to it in the

marketplace. They've made some commitments to some very significant clients of

this company. We're focused on completing those commitments to those clients.

But by and large, the justice division simply didn't balance its commitments in

the marketplace with its capability to deliver those commitments on a timely

basis. So we're working hard to balance those commitments, fulfill the

commitments to those larger clients, and focus the company.

And I

think the right thing to do is focus on those commitments, complete the

commitments. In the meantime, let's not go out and sign up new big commitments

until we get the first part of the equation right. And then when we get that

software built out and it's demonstrated to the existing client base, then they

will open up the doors and look to market it further. But that's going to take a

little bit of time.

Steve

Balog - Cedar Creek Management

- - Analyst

Okay. Were

the divestitures dilutive or accretive or neutral?

Rich

Montoni - MAXIMUS, Inc. -

CEO

David?

David

Walker - MAXIMUS, Inc. -

CFO

They were

mildly dilutive. Currently they were making a 4% operating income. So

- --

Rich

Montoni - MAXIMUS, Inc. -

CEO

Let me

make one point on the divestitures. The divestitures were executed under the

element of our strategy which was to focus the company on its core. These were

not trouble business, they were not problematic businesses. In fact, they were

profitable businesses. And I view the time to divest those businesses is while

they're relatively healthy. They should thrive under their new ownership. I

think they have exciting opportunities with the focus that they're going to get

from their new owners. It's just that it wasn't our focal point. Inside our

company as a whole I'd like to emphasize that the two problem divisions we have

have been education justice challenged by software development commitments. And

they're very much development stage software build-out enterprises and we're

working to remedy those two. Aside from those two, I don't think we have any

problematic divisions inside the entire company. So we know where the challenges

are. We're focused on them and they're very, very limited.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

Steve

Balog - Cedar Creek Management

- - Analyst

Okay. And

lastly, a broader question. When you first took over and said, we're going to be

real, I guess, judicious in what new business we bring on, my first thought,

well, that's great, but the revenue slows down. That hasn't really happened. Can

you -- has that surprised you? Or could you talk to that -- I think it's kind of

surprising, we're being more judicious, but business is still

strong.

Rich

Montoni - MAXIMUS, Inc. -

CEO

I think

this, on the surface, I can appreciate your observation, and I think it's a fair

observation. But I think in business when you focus on your number one or two,

especially in our marketplace where we have a customer base that places an

inordinate amount of emphasis on the vendor's ability to deliver. They place a

tremendous value on your experience and look for confidence in your ability to

execute. And when that happens, you win more work than you otherwise would. And

your ability to execute because you focus on those areas increases

immensely.

So I think

there's -- I think it drives higher revenue growth than run of the mill

companies when you focus on your number one and two. I think it also drives

higher margins because you're better able to avoid marginal work. You're better

able to execute projects that you have. You discover your problems sooner and

you can remedy them in a more effective fashion. So in those areas where we

choose to focus, we have chosen to focus, we're seeing those benefits

today.

Steve

Balog - Cedar Creek Management

- - Analyst

That's it.

Thanks.

Rich

Montoni - MAXIMUS, Inc. -

CEO

You bet.

Thank you.

Lisa

Miles - MAXIMUS, Inc. - VP,

IR

Thank you

very much for joining our second quarter earnings call and that concludes our

call today.

Operator

Ladies and

gentlemen, this concludes today's presentation. A replay of this call will be

available to you within two hours. You can access the replay by dialing

(877)660-6853, or internationally (201)612-7415, enter account number 316,

followed by the conference number 271353. Again, enter account number 316,

followed by the conference number 271353. Thank you for your participation. You

may now disconnect.

Final

Transcript

|

May.

08. 2008 / 5:30AM PT, MMS - Q2 2008 MAXIMUS, Inc. Earnings Conference

Call

|

DISCLAIMER

Thomson

Financial reserves the right to make changes to documents, content, or other

information on this web site without obligation to notify any person of such

changes.

In the

conference calls upon which Event Transcripts are based, companies may make

projections or other forward-looking statements regarding a variety of items.

Such forward-looking statements are based upon current expectations and involve

risks and uncertainties. Actual results may differ materially from those stated

in any forward-looking statement based on a number of important factors and

risks, which are more specifically identified in the companies' most recent SEC

filings. Although the companies mayindicate and believe that the assumptions

underlying the forward-looking statements are reasonable, any of the assumptions

could prove inaccurate or incorrect and, therefore, there can be no assurance

that the results contemplated in the forward-looking statements will be

realized.

THE

INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE

APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE AN

ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES

IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES

THOMSON FINANCIAL OR THE APPLICABLE COMPANY OR THE APPLICABLE COMPANY ASSUME ANY

RESPONSIBILITY FOR ANY INVESTMENT OR OTHER DECISIONS MADE BASED UPON THE

INFORMATION PROVIDED ON THIS WEB SITE OR IN ANY EVENT TRANSCRIPT.

USERS ARE ADVISED TO REVIEW THE APPLICABLE COMPANY'S CONFERENCE CALL ITSELF AND

THE APPLICABLE COMPANY'S SEC FILINGS BEFORE MAKING ANY INVESTMENT OR OTHER

DECISIONS.

© 2005,

Thomson StreetEvents All Rights Reserved.

1

David N. Walker Chief Financial Officer and Treasurer Second Quarter Fiscal 2008

May 8, 2008

2

Second Quarter Financial Results Q2 revenue was $210.6

million an 18% increase over same period last

year All growth was organic driven by new or

expanding work in Operations segment MAXIMUS incurred charges

totaling $5.4 million (approximately $0.17 per share) to

include: A $2.2 million charge related to a contract

modification that MAXIMUS initiated as part of a requirement to build software

functionality for a large education contract in the Systems segment. The

modification allows us to earn back the $2.2 million provided we meet the

deliverable schedule over the next 18 months A $2.3 million

charge in Consulting segment related to our share of a client’s reduced

reimbursement on a legacy claiming project amount may be

recovered depending on client’s appeal effort Approximately

$0.9 million of legal expenses related to ongoing Accenture

issue Company reported net income of $9.6 million or $0.51 per

diluted share

3

Proceeds & Gains From Divested Businesses & Property

Sale Two non core divisions successfully divested in early

May Security Solutions from our Systems segment sold for cash

proceeds of $5 million Unison, a subsidiary from our Consulting

segment sold for approximately $6.5 million Entered into

contract to sell a building in McLean, Virginia in near

term EPS gain from divestitures and building sale expected to

be in range of $0.21 to $0.24 Gain to be recorded in third

quarter

4

Operations Segment Revenue increased 33% to $159.8 million

compared to the same period last year Growth driven by Health

Operations, the Texas project and domestic and international Workforce Services

operations Segment revenue benefited from hardware and software

purchases of approximately $6.9 million Operating income

totaled $23.6 million operating margin of

15% Expansion in income reflects optimization of current book

of business, transformation on Texas project and solid margins on new

work Segment is expected to deliver operating margin in 12 15%

range for full fiscal year 2008

5

Consulting Segment Consulting segment revenue for Q2 totaled

$20.2 million Loss of approximately $800,000 reported for the

quarter Loss reflects $2.3 million charge related to legacy

claiming project which the client is appealing and may be recovered at a future

date Transitioning away from legacy claiming

business Established presence in new markets targeting two

areas Program Integrity Fraud, Waste &

Abuse Optimistic about new markets and other plans which are

developing for this segment

6

Systems Segment Total revenue for Q2 totaled $30.5

million Loss of approximately $5.9 million reported for

quarter Asset Solutions and ERP divisions continue to deliver

strong results Losses in Education and Justice divisions stem

from software commitments that will ultimately position them well in the

market Steps being taken to improve underperforming

divisions Manage scope of existing contracts very judiciously

and modify contracts where necessary Tightly control new

contract terms that contain software requirements Change and

supplement the management teams with individuals who have proven track

records Prudent cost management

7

Expenses & Margin Majority of charges in quarter impacted

revenue and gross margins in Consulting and Systems segments An

8% operating margin was achieved in quarter driven by

Operations segment which offset charges in Systems and Consulting

segments SG&A as a percent of revenue was

17.7% An improvement over same period last

year Consistent with first quarter of fiscal 2008

8

Balance Sheet and Cash Flow Items Cash at March 31, 2008

totaled $63.4 million Total Current Accounts Receivable for Q2

was $175.0 million Additional $1.7 million in long term

accounts receivable classified within other assets on balance

sheet DSO’s totaled 76 days Anticipate DSO’s

to run between 75 to 85 days Continue to trend under 80

days Cash from operations totaled $4.5

million Free cash flow (cash from operations less Property

& Equipment and Capitalized Software) was $1.5 million Full

fiscal year cash from operations expected to total $50 to $60 million, with free

cash flow ranging from $30 to $40 million expected for full fiscal

2008

9

Richard A. Montoni President and Chief Executive Officer Second Quarter Fiscal

2008 May 8, 2008

10

Financial Results: Continuing Strength in Operations Offset Weakness in

Systems Redefining MAXIMUS as a leading pure play in government

Health and Human Services’ outsourcing Sharpened focus on core

business should provide long term sustained growth and increased shareholder

value Results for the second quarter were impacted by charges

in Consulting, Systems and legal expenses Management determined

to improve underperforming areas and actively pursuing all

alternatives Last week, MAXIMUS closed the sale of two non core

divisions

11

Operations Segment Operations Segment on Course for Long Term

Success Strong Segment leadership promotes focus and

diligence Contractual discipline in how we acquire and

structure new awards Declined unacceptable rebid

opportunities Renegotiated inequitable

contracts Developing and pursuing new opportunities that

represent sources of new incremental revenue Emphasis on

sustainable, recurring revenues and profitable growth Top line

gains of 33% compared to same period last year Operating margin

of 15% Confident in the strides we’ve made to strengthen the

segment and are now raising the lower end of target operating margin from 8 15%

range to 10 15% range Best validation of segment’s

success

12

Operations Segment Productization Efforts Productization is a

key element to advancing technology efforts Streamlining of

processes Moving away from highly customized solutions to more

component based/modular approach Utilize plug and play

technology anchored in Services Oriented Architecture

(SOA) Operating Enhancements Completed and

installed new enrollment broker platform in Indiana Currently

upgrading other existing clients to this new technology

platform On a path to complete productization of other core

components by the end of this fiscal year Coupling new

technology with standardized business processes will allow us to compete most

cost effectively

13

Consulting Segment Consulting segment incurred a $2.3 million

charge related to legacy claiming project Client is

appealing Prior to job start, brought in specialized counsel to

review and approve claiming methodology which had be utilized

before View this as a normal course

exercise We no longer provide federal claiming on contingency

basis Our emphasis has been on expanding into other areas which

overlap more with our core program management offerings like program

integrity fraud, waste, abuse Consulting

services very important to our customer base and dovetail with our core

services Pursuing opportunities to pair our consulting services

with our health and human services portfolio Collaborative

efforts will facilitate better cross selling while sharing best practices from

state to state

14

Significant Progress on Divestitures of Non Core

Assets Subsequent to quarter end, closed the sale of two

business UNISON MAXIMUS, which was part of the Consulting

segment, was divested through a division management led

buyout This is an airport, retail and financial consulting

business A profitable contributor but outside our core

business Security Solutions, which was part of the Systems

segment, was sold to Cogent While a stable contributor, was not

consistent with our refined business focus

15

Systems Segment Challenges limited to Justice and Education

divisions Trying to complete software development and generate

business unit improvement, while at the same time meeting contractual

obligations Near term emphasis on balancing commitments and

changing the way we go to market to emphasize product standardization over

customized solutions In Justice, initiated cost cutting

measures with 25% reduction in force expect annualized savings

of approximately $4 million, some of which we expect to realize in the fourth

quarter New segment leadership: John Hines stepping up to lead

our efforts Deployed top technologists to help accelerate the

completion of software products and provide added

oversight Bottom line is to effect near term

change Successful renegotiation of our largest Education

contract with modified terms and conditions now provides a well constituted

correlation between the plan and the commitment

milestones Concurrently exploring parallel path of strategic

alternatives for other non core businesses

16

Overall Market Outlook Even with State budgets under pressure,

the need for our services remains strong. We have not seen a slow down to

date. MAXIMUS is well positioned to capitalize on international

opportunities that are developing in our core health and human services

operations In March, awarded a $14.2 million amendment to our

Master Services Agreement in British Columbia Amendment for

PharmaNet program which we have administered since 2005 MAXIMUS

will lead effort to upgrade application to next generation

platform Pursuing other meaningful opportunities with

substantial marketing efforts underway in Australia, Canada and the

UK Potential contracts quite large may be bid

in regions as in US which would make a perfect fit in terms of scope and

size Revenue may potentially begin as early as second half of

fiscal 2009 and stretching beyond

17

New Awards and Sales Pipeline May 2, 2007 May 5, 2008 Sales $302 $615 New Signed

Awards $1,206 $1,609 Total Pipeline $601 $908 RFP’s Tracking $86 $121 Proposals

in Preparation $519 $581 Proposals Pending Pipeline $82 $149 New Awards

(unsigned) ($ in millions)

18

Rebids & Options Rebids: Notified of award on 3, totaling

$36 million, this leaves 8 remaining rebids with a total value estimated at $237

million Option year exercises; to date out of the 27 options

with a total value of $223 million up for exercise this year, we have won or

been notified of intent to award on 14 options with a value of $122

million No options have been lost, non have been canceled or

taken in house due to funding issues

19

Guidance Revising fiscal 2008 guidance resulting from the sale

of businesses and impacts of this quarter While results in

Systems have been disappointing we have made critical progress and are in better

position to pursue alternatives for non core assets Operations

segment continues to record solid financial performance For

fiscal 2008 we now expect revenue in the range of $830 million to $850

million GAAP basis diluted EPS of $2.55 to

$2.70 This GAAP basis guidance includes a gain of approximately

$0.21 to $0.24 related to the sale of Security Solutions and Unison MAXIMUS and

the pending sale of a building in McLean, Virginia. Guidance also includes $0.07

of forecasted legal charges for fiscal 2008