Exhibit

99.2

FINAL

TRANSCRIPT

MMS

- Q1 2008 MAXIMUS, Inc. Earnings Conference Call

Event

Date/Time: Feb. 06. 2008 / 9:00AM ET

Feb.

06. 2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

CORPORATE

PARTICIPANTS

Lisa

Miles

MAXIMUS,

Inc. - VP IR

David

Walker

MAXIMUS,

Inc. - CFO

Rich

Montoni

MAXIMUS,

Inc. - CEO

CONFERENCE

CALL PARTICIPANTS

Anurag

Rana

Keybanc

Capital Markets - Analyst

Charles

Strauzer

CJS

Securities - Analyst

Matthew

McKay

Jefferies

& Company - Analyst

Jason

Kupferberg

UBS

- Analyst

Shlomo

Rosenbaum

Stifel

Nicolaus - Analyst

Richard

Glass

Morgan

Stanley - Analyst

PRESENTATION

Operator

Ladies

and gentlemen, welcome to MAXIMUS first quarter earnings conference call. During

this session, all lines will be muted until the question and answer portion

of

the call. (OPERATOR INSTRUCTIONS)

At

this time, I would like to turn the call over to Lisa Miles, Vice President

of

Investor Relations.

Lisa

Miles-

MAXIMUS, Inc. - VP IR

Good

morning. Thank you for joining us on today's conference call. If you wish to

follow along, we've posted a presentation on our web site under the investor

relations page. On the call today is Rich Montoni, Chief Executive Officer

and

David Walker, Chief Financial Officer. Following our prepared comments, we

will

open the call up for Q&A.

Before

we begin, I'd like to remind everyone that a number of statements being made

today will be forward-looking in nature. Please remember that such statements

are only predictions and actual events or results may differ materially as

a

result of risks we face, including those discussed in exhibit 99.1 of our SEC

filings. We encourage you to review the summary of these risks in our most

recent 10-K filed with the SEC. The Company does not assume any obligation

to

revise or update these forward-looking statements to reflect subsequent events

or circumstances.

And

with that, I'll turn the call over to Dave.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

David

Walker-

MAXIMUS, Inc. - CFO

Thank

you, Lisa. Good morning. This morning, we reported financial results which

were

in line with our prior guidance. Total company revenue for the first quarter

was

$202 million, a 25% increase over the first quarter of last year. Part of this

increase relates to a provision for receivables in the operation segment that

we

recorded last fiscal year that reduced revenue by approximately $15.7 million.

Excluding this adjustment in 2007, revenue growth was still quite strong at

12.5%. This year-over-year increase was driven by the operation segment where

we

had substantial new organic growth in nearly every division. The company

reported net income in the first quarter of $10.6 million or $0.51 per diluted

share.

Operating

margin was 8.2%, which was consistent with our expectations. Our total company

operating margin target is still 10%, but we anticipated some softness in the

early part of the year from project start-up as well as quarterly margin

fluctuations related to seasonality. We also closed credit facility with

SunTrust and secured an immediate $50 million bridged loan with a possible

syndication up to $75 million. We discussed our intention to seek such a loan

line on our last call and it ensures our capital structure remains flexible.

Given the current credit markets, we view this as a compliment to our business

model.

Let's

move into the results by business segment. Starting with the operation segment,

revenue for the operation segment increased 43% to $145.8 million compared

to

the same period last year. Our 2007 results included the $15.7 million revenue

impact from two legacy projects we previously discuss. Normalizing the prior

year revenue for these items, year-over-year growth for the ops segment was

exceptional at 24%. This revenue increase was driven by strong growth from

new

work in health, our Texas operations, as well as our domestic and international

workforce service operations. The operations segment recorded first quarter

operating income of $18.7 million or an operating margin of 13% compared to

a

loss of $16 million reported for the same period last year. This dramatic

operating income improvement highlights solid progress in optimizing our current

book of business, as well as strong margins on our new

work.

The

operating income is down sequentially from last quarter, which is in line with

our plans. The largest driver is seasonality related to our tax credit business,

in which revenue and associated operating income is back end loaded in the

fiscal year. Also contributing were planned start-up costs required for certain

new contracts in the first half of the year. Overall, we're very pleased with

both the growth and 13% operating margin delivered by the operation segment

for

the first quarter. The nature of these contracts provides strong visibility

into

revenue for the remainder of the year and a predictable recurring revenue stream

into the future. With this view in mind, we're hoping to sustain a margin in

the

range of 12 to 15% for the remainder of the year. This is well within our

historical target margin for this segment of 8 to

15%.

Consulting

segment revenue was $22.2 million for the first quarter with operating income

of

$1.2 million, which is a 5% operating margin. While operating margin was down,

compared to the first quarter of last year, on a sequential basis, operating

margin increased 300 basis points compared to the fourth quarter. The consulting

segment is performing as expected, as we transition away from the contingent

fee, federal healthcare claiming work, that was a predominant part of our

business four to six quarters ago. In addition, we continue to make investments

as we secure a stronger foothold in new markets. Particularly in program

integrity where we're assisting clients in combating Medicaid fraud waste and

abuse. As noted in our last call, these efforts will require investments which

will soften earnings for the consulting segment in the short term, but we do

expect operating margin to improve by the end of the

year.

Moving

on to systems. First quarter results from the systems segment were lower than

expected. Systems revenue in the first fiscal quarter totaled $34 million,

compared to $34.5 million reported for the same period last year. The segment

lost $3 million in the first quarter compared to a loss of $1.6 million reported

for the first quarter of last year. Quarterly results continue to be depressed

by ongoing investments for software development and our efforts to address

legacy issues. In light of the segment's results in the first quarter, we have

modified our full-year expectations for the segment. We now expect that the

systems segment will be in a loss position for the full fiscal year, although

we

are targeting improvement for the latter half of the year. Rich will talk more

about our efforts and commitment to improve performance in this

segment.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Moving

on to SG&A expense in the quarter. The current quarter SG&A as a percent

of revenue is 18%. A full basis point in the current quarter or $2.2 million

is

related to a correction of noncash stock-based compensation from previous years

related to the forfeiture calculation. Despite this charge, the SG&A as a

percentage of revenue is consistent with the full-year 2007 results. Overall,

MAXIMUS achieved an 8.2% operating margin which is consistent with our

expectations for the quarter. While the results for the system segment are

disappointing to us, we are encouraged by the overall positive results driven

by

the operation segment performance.

Moving

on to the balance sheet and cash flow items. This is an area where we are also

pleased. We ended the quarter with cash, totaling $62.3 million. As noted

earlier, we completed a $50 million credit facility, which can be syndicated

up

to $75 million. Should we need to use this facility in the future, it is

available for general corporate purposes, as well as for potential investments

and growth initiatives. In any case, the establishment of the facility adds

a

key element of stability to our solid capital position. Total accounts

receivable for the first quarter was $169 million. We also have an additional

$1.8 million in long-term accounts receivable, which are classified within

other

assets on the balance sheet.

We

managed a reduction in our receivables of $6.1 million in the quarter, reducing

DSOs to 77 days. This is somewhat better than expected since our first fiscal

quarter can be slower period for client payment simply due to the holidays.

While we were very pleased with the DSO balance for the quarter, we continue

to

expect DSOs to range between 75 to 85 days.

MAXIMUS

generated strong cash from operations totaling $20.8 million. Free cash flow,

which the Company defines as cash from operations, less property and equipment,

and capitalized software was $16.7 million. In light of continued strong cash

flow, we feel the full-year outlook will be a bit better than what we previously

guided to. So we're making a slight upward adjustment with expected full year

cash from operations likely in the range of 50 to $60 million. And free cash

flow ranging from 25 to $35 million.

Thank

you for your time this morning. With that, I'll turn the call over to

Rich.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Thanks,

David. Good morning, everyone. Our first quarter results tracked in line with

our expectations for the period. I'm very pleased with posting another solid

quarter of overall results driven by the operations segment. However, while

we

are well down the path of performance improvement, especially in the operations

segment, we still have work to do. Most notably, we are focused on improving

the

performance of our systems segment. This is very much a top

priority.

Let's

first talk about the significant progress that we've made in the last year

in

the operations segment, because frankly, it's important to understand how we're

pushing to fully replicate that success across the other parts of the business.

The strong financial results delivered by the operations segment reflect changes

in how we pursue new business, structure awards and service existing accounts.

We've also put significant resources into quality initiatives to better manage

the downside risk and push towards optimizing our portfolio. Operations segment

results over the last few quarters demonstrate the progress we've made in

improving and expanding profitability throughout the segment's project

portfolio. We are really starting to see where the rubber meets the road. Much

of the progress, which is most observable in our operations segment, stems

from

our head-on approach to legacy contracts thereby improving

performance.

Let

me give you some flavor for the type of significant achievements in our quality

and risk management programs that I'm talking about. You've heard us discuss

the

concept of high-profile projects or HPPs. A key tool we developed and deployed

as part of our business optimization program. A project is targeted and

designated as an HPP if it loses $25,000 or more in any quarter. Above and

beyond our focus on the Texas and Ontario projects, we have had a focus on

all

our HPP projects. Within operations, we've realized the most meaningful impact.

This focus has resulted in improved profitability in many contracts ,including

turning loss contracts into ones with a fair operating income for the risk

we

assume and the value we create.

Feb.

06. 2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Quantitatively,

we estimate this focus has improved annualized operating income for the

operations segment by approximately 8 to $10 million. And again, this excludes

impacts from the Texas project in the Ontario

situation.

I

think our emphasis on quality and risk management has played a predominant

role

in this improvement, particularly through our extensive project manager

training, started just one year ago. In this past year, we have trained over

400

employees through our mandatory project management program. This program focuses

on all areas of project management including cost control, change control,

and

contracting. Our project managers learn management discipline, better client

communications, handling of contract change control processes for out-of-scope

work and overall operating efficiencies. We also now require a mandatory

continuing education training in webinars, which take a scenario driven hands-on

approach.

And

lastly, all project managers now attend an annual three day conference with

an

emphasis on shared best practices. We have completed our planning for our 2008

Project Manager Training annual event which will occur this June. Given the

overall enthusiasm for this event, it is clear to me that our project managers

very much value and support this key initiative.

I

think the increased level of training and communication with our project

managers has paid off in other ways as well. In a recent internal project

self-assessment survey, our project managers felt much more confident in meeting

forecasted profit margins on their project with a 50% reduction in the number

of

those expressing concern. Significant improvements were also seen in risk

identification with a reduction in contracts not following a formal change

of

scope. Most importantly this has led to increasing client satisfaction as

evidenced by a recent client survey. The success we've had in generating

improved results through our quality and risk management initiatives is

certainly reason to be proud and it is most observable in our operations

segment. We are focused on replicating the success across the entirety of our

other segments.

One

point of note, while our progress is most observable in our operations segment

it is important to acknowledge that all of our segments have been part of this

ongoing optimization program, in within each we've had meaningful individual

successes. I think it's important to acknowledge those who have accomplished

these successes. That said, we've not yet achieved our overall performance

improvement goals in the systems segment. It will take longer in the system

segment, which continues to be impacted by software development costs and

pockets of softness related primarily to legacy

contracts.

But

within systems, we are actively working problem areas and are executing a plan

to resolve outstanding matters. While it may take a few quarters to realize

improvements in systems, we plan to finish the year with these businesses in

a

much improved condition. We are currently in the process of working a couple

of

key contracts within the system segment to better define terms whereby we agree

to a scope and a statement of work that clearly outlines steps to mutually

agreed upon completion. Currently, we are working to complete the buildout

of

software product enhancements, the cost of which is being

expensed.

Overall,

it's important to remember that as a company, we manage a large portfolio of

projects. While we have pushed through some major achievements through our

optimization program, it's the nature of the business that performance across

the entire project portfolio will be mixed and we don't manage our business

under the expectation that all projects will hit on all cylinders at all

times.

On

focus and divestitures, we're also maintaining an eye towards concentrating

our

focus on core markets to fuel growth. These are defined to be our traditional

BPO service offerings centered around our government health and human services

programs. As part of this effort to focus our resources, we have identified

two

noncore businesses that are viable candidates for divestiture in the near term.

For competitive reasons, and out of interest of maintaining employee focus,

we

cannot identify these opportunities at this time, however, these attractive

businesses that, despite today's market challenges, we believe will be of

interest to a variety of players. We will provide updates to this progress

as

appropriate.

Let's

switch gears and move on to current demand conditions and how that's shaping

future opportunities. In general, I think it's fair to say the economic mood

is

cautious with recessionary undercurrents. The state environment is largely

a

mixed bag of budget projections with some states forecasting shortages and

others still forecasting revenue growth. However, in the most recent data

released by National Association of State Budget Officers in mid-January, fiscal

2008 state expenditures are still expected to grow by just under 5%. While

there

are fiscal issues impacting local governments, mostly stemming from the impacts

on real estate taxes from the real estate market shakeout, we don't see this

as

a major factor to MAXIMUS.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

The

final macro factor of note is the political environment. It is most relevant

with the presidential campaign in full froth. It brings a recurring, often

daily, debate on those major social values, programs, and spending which are

at

the center of our business. This includes universal health, children's health

insurance, education, welfare, and jobs. As we've discussed in the past,

weakening in the economy tends to have a mixed impact on our business.

Historically, demand for our services has remained stable, particularly around

certain entitlement programs within our operations segment. However, in other

areas, [directionary] spend around the periphery can be impacted. The election

factor will likely temper any consideration to reduce spending, while

recessionary pressure may temper the will to increase

spending.

When

you look at our historical performance since the Company's formation in 1975,

our business has been quite resilient to recession and has not suffered a

decline in annual revenue since inception. This is due to the fact that

approximately 65% to 70% of our revenue comes from programs that are run at

the

state and local level but are federally mandated and largely federally funded.

Given that we are into our second fiscal quarter, I think it's a reasonable

expectation that a slowdown in state spending will not impact our fiscal 2008

results. Looking into fiscal 2009, we believe there will not be a material

impact on our core book of business, particularly in health and human

services.

Healthcare

reform remains a topic of interest and at the state level it is generally

embraced by both ends of the political spectrum. In fact, most states are

motivated to increase the availability of healthcare options to their

constituents. With 47 million people uninsured this population is at record

levels and continues to be a financial drag on state budgets. Massachusetts

and

Indiana have industry-leading programs in place. Wisconsin has just received

the

green light from the feds to move forward with their plan to increase

eligibility to capture those that earn up to 250% of the federal poverty level.

While these states are the first out of the gate, most others are in varying

stages of development, with some states having plans in front of the feds and

others working through final recommendations. We believe the healthcare reform

will continue to be a front burner topic over the next several years. States

view healthcare reform as a way to appropriately serve their populations more

cost effectively. As a result, we expect to see more states finalize their

funding plans, get buyout from the federal government and rollout their

programs.

It's

difficult to speculate what the size of the market could look like but it

certainly represents a compelling opportunity for us to provide a suite of

services in support of state initiatives like we already do in Massachusetts

and

Indiana. We also expect that these initiatives will likely be initially

approached as expansions to the state's existing Medicaid and s-chip

infrastructure. There is forward momentum in nearly every state to address

this

ongoing burden, but states must be able to create the economics in order for

healthcare reform to be financially viable for them.

Beyond

the domestic landscape, we continue to explore additional opportunities in

the

global market. Many foreign governments need to deal with the same social

challenges and are seeking to learn and avail themselves of best practices

and

providers like MAXIMUS. In recent years, we've been successful in exporting

our

workforce service offerings in markets including Israel and Australia. Building

on this international recognition, we are seeing to make inroads into new

markets, particularly in Europe and the UK where social and fiscal pressures

require new approaches to social programs. This increased interest is a function

of shifting demographics where aging populations are projected to overwhelm

the

social services infrastructure and government's ability to pay for these

programs under current models.

Let's

move on to our new sales awards. On January 29th, we had new sales awards

totaling $324 million, which includes the Texas project contract extensions

totaling approximately $225 million. In addition, we've been notified of award

on an additional $282 million, which includes the California healthcare option

rebid award. Total pipeline of sales opportunities remains robust at $1.5

billion, which reflects only those identified opportunities we believe will

be

coming out in the next six months. On the rebid front, we've received contract

extensions on two contracts totaling approximately $34 million. This leaves

us

with 11 outstanding rebids with an estimated value of about $245 million where

decisions are expected later in the year.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Moving

on to option year exercises. To date, out of the 27 options with a total value

of $223 million up for exercise this year, we've won 7 which carry a value

of

about $32 million. The 4 largest option exercises, totaling close to $170

million, are not expected to be exercised until the fourth

quarter.

Looking

at our capitalization. We recently closed a $50 million line of credit with

possible syndication up to 75 million, which provides for added financial

flexibility as we move forward. During the quarter, we bought back $150 million

of our own stock through an accelerated share repurchase program with UBS,

retiring approximately 3.8 million shares. In light of our strong cash flows,

we

will consider additional opportunities for generating immediate returns to

shareholders. MAXIMUS still has approximately $40 million available under its

previously authorized board repurchase program, additional options are available

to us, including the possibility of an increased dividend, and we will explore

them with our board in March, while being mindful of future liquidity

requirements and growth opportunities including

acquisitions.

On

guidance, as stated in this morning's release, we are reiterating our full-year

revenue guidance in the range of $850 million to $880 million. We also updated

our earnings guidance to include accretion from the accelerated share repurchase

program. We now expect diluted earnings per share for fiscal 2008 in the range

of $2.60 to $2.85.

And

now, let's open the call up for your questions.

Operator?

Lisa

Miles-

MAXIMUS, Inc. - VP IR

Jerry,

before we open the call up to questions, I just wanted to correct a misprint

in

the materials related to cash flow. We are actually maintaining our prior cash

flow guidance of of 50 to $60 million and free cash flow of 30 to $40 million.

With that, we can go ahead with Q & A. Thanks.

QUESTIONS

AND ANSWERS

Operator

Thank

you. (OPERATOR INSTRUCTIONS) One moment, please, while we poll for questions.

Thank you. Our first question comes from the line of Anurag Rana with Keybanc,

please, proceed with your question.

Anurag

Rana-

Keybanc Capital Markets - Analyst

Good

morning, everyone, I just wanted to get an idea about the [actuated] stock

repurchase plan, is that complete now, and are you free to initiate a buyback

plan?

Rich

Montoni-

MAXIMUS, Inc. - CEO

Anurag,

this is Rich Montoni, good morning. We're not in a position to disclose the

exact status of the buyback by UBS, that's really a UBS position. We are aware

that they continue to purchase shares. They have purchased shares. I don't

believe they've completed their buyback at this point in time, and we do know

that they're contractually committed to wrap up that full buyback by August

15th.

Anurag

Rana-

Keybanc Capital Markets - Analyst

Thank

you. And just looking at bookings. Bookings are very good. State and local

budgets have been the biggest concern over the last, I would say, few months,

have you seen any impact on your pipeline on sales opportunities in the past

month or so?

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Rich

Montoni-

MAXIMUS, Inc. - CEO

No.

We really have not seen any adverse impact on our pipeline in the last month

or

so. And I think that's largely reflective of our business model. As we've talked

in the past, some of these, there's a long lead time with these programs. But

most importantly, and I think I touched upon this in my call notes, the nature

of our services, even in softer times, our model is such that there's a high

degree of resilience. When we look at what has happened in the past, during

downturns, we've actually grown our revenues in every case, and frankly we

expect to do so as we move forward in the future. When we ask the question

why

is that? I think there's several factors that come into play, including the

fact

in our BPO services, which constitutes approximately 60% of our business, it

remains largely insulated from downturns principally because it's federally

funded and federally mandated.

Secondly,

what we do is really at the core to state functions. They really do have to

continue to provide these services. While customers do have less to spend as

their revenues are lower, customers being states, they tend to find ways where

they'll borrow funds, they'll tap into rainy day funds. And as I mentioned

in my

call notes, recent study indicates that historically they spend roughly 5 to

6%

more every year even in softer periods, and the current spend is anticipated,

as

I said in the call notes, to be slightly less than 5%. We tend to focus our

services on cost reductions and efficiencies, which is appealing to our customer

base during these times. Our privatization services actually become a bit more

attractive during these times because we offer, I think, high quality. We can

do

the same job as government and often times with less expense. The last point

I'd

make in terms of what we'd see is case loads actually sometimes increase in

more

difficult times, frankly because there's more folks out there that are suffering

and are in need of help and that actually increases the amount of work that

we

need to perform. Does that help?

Anurag

Rana-

Keybanc Capital Markets - Analyst

That's

a very good answer, Rich. Thank you. Just one more. Would it be possible for

to

you give us any idea about the number of high profile projects that you saw

last

year versus today? Thank you and that's it.

Rich

Montoni-

MAXIMUS, Inc. - CEO

That's

a fair question. We don't routinely disclose the number of high-profile

projects. And I've thought about it, by my preference is really just to focus

on

our financial performance as it relates to, as measured by generally accepted

accounting principles. I think at the end of the day, that's the key metric.

The

number of HPPs there's lots of reasons for them. Some are good HPPs, and some

are continuing. It's not so much the number, but really the impact on our

financial performance. So we're not going to routinely disclose the number

of

HPPs, but we'll focus on the operating results.

Anurag

Rana-

Keybanc Capital Markets - Analyst

Thank

you. Congratulations on a good quarter.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Thank

you very much.

Operator

Thank

you.

Our next question comes from Charles Strauzer with CJS Securities, please,

proceed with your question.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Charles

Strauzer-

CJS Securities - Analyst

Good

morning.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Good

morning, Charles.

Charles

Strauzer-

CJS Securities - Analyst

Just

a

quick type of housekeeping question, as we look at share count for the next

quarter and for the full year, also tax rate implications and D&A

assumptions if you could?

David

Walker-

MAXIMUS, Inc. - CFO

Yes.

It's

David Walker, how are you, Charles?

Charles

Strauzer-

CJS Securities - Analyst

Hi,

David.

David

Walker-

MAXIMUS, Inc. - CFO

On

a

weighted average basis, you would expect to see the share count go down because

the ASR took effect in the middle of this quarter, right?

Charles

Strauzer-

CJS Securities - Analyst

Right.

David

Walker-

MAXIMUS, Inc. - CFO

That's

what impacts shares. So, you would expect to see the share count go from the

current weighted average of about 20.6 to somewhere around 19 million, and

then

just climb up if there are any other outstanding shares from option exercises,

et cetera, right? So about 19.7 million weighted average for the year is what

we're currently thinking. In terms of the tax rate, the quarter actually had

a

higher tax rate than usual. There was a tax law change in Canada that required

a

true up in the current quarter, but for the next three quarters going forward,

you can assume a provision of about 39.5%.

Charles

Strauzer-

CJS Securities - Analyst

Okay.

And

D&A?

David

Walker-

MAXIMUS, Inc. - CFO

You

can

loot at our current spend in the quarter. And then we do have some

infrastructure we plan to build, so when you look at our free cash flow

guidance, I think we've baked in 20, 25 -- $20 million.

Feb.

06. 2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Charles

Strauzer-

CJS Securities - Analyst

Got

it.

We'll adjust accordingly there or look for it in the year.

David

Walker-

MAXIMUS, Inc. - CFO

Yes.

Charles

Strauzer-

CJS Securities - Analyst

And

then

the $2.2 million charge in the quarter, if you kind of use a 40% tax [rate],

that looks like a $0.06 hit in the quarter, is that about

right?

David

Walker-

MAXIMUS, Inc. - CFO

That's

about right. So if you back that out, you actually exceeded the number by a

fair

amount then? My only comment would be there are timing differences that occur

all the time between quarters and things like that. So I think the real good

news is we manage for those and accordingly.

Charles

Strauzer-

CJS Securities - Analyst

David,

what's a good number we should be using for kind of FAS expense for the full

year for the option expense number?

David

Walker-

MAXIMUS, Inc. - CFO

I

would

take our current numbers which you can see on the funds flow and I would

normalize it down for this adjustment.

Charles

Strauzer-

CJS Securities - Analyst

Great.

Thank you very much.

Operator

Thank

you.

Our next question comes from the line of Matthew McKay of Jefferies &

Company. Please proceed with your question. Matthew McKay with Jefferies &

Company, please proceed with your question.

Matthew

McKay-

Jefferies & Company - Analyst

Sorry

about that. Good morning, guys.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Good

morning, Matt.

Feb.

06. 2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Matthew

McKay-

Jefferies & Company - Analyst

Just

a

question on the business development side, given you're starting to talk about

expanding into Europe, maybe a little bit more internationally, but also,

probably the sales opportunity may be seeing a little bit more some

opportunities with some of the eligibility services in the U.S. Just love to

get

a little bit of color on hiring plans or investments on the business

development, maybe either by geography or with specific areas that you think

are

of more interest than others?

Rich

Montoni-

MAXIMUS, Inc. - CEO

That's

a

fine question. My thoughts are this, that first off, we do not plan to go out

and recruit an extensive amount of net add as it relates to business development

resources. We actually have, I think, a reasonable amount of resources ready

and

available. Our business model is that we tend to pull those -- that expertise

out of our existing capability and use that to develop new business. Two, a

lot

of these have long lead times, so we need to pulse pursuant to it. Particularly

the international opportunities. We don't want to get ahead of the opportunity.

Then, the other point is, we tend to really ramp up the project related

resources once we win the work. The real answer is we will add significant

new

project related resources once we have those specific new wins. Those generally,

particularly in large outsourcing programs, there's an average lead time of

probably one year.

Two,

on

the domestic front in particular, we have, and this is part of the story behind,

I think very positive sales pipeline statistics, we have well down the path

a

number of new opportunities, state-specific opportunities, in the enrollment

broker in the s-chip world, which I think is fair to say, represent outsourcing

of work that would have previously been done in-house by states. So that's

fairly well along, so I see that being less than a one-year lead time. Does

that

help?

Matthew

McKay-

Jefferies & Company - Analyst

Yes.

That

helps very much. Thank you. Just kind of one other question on the accelerated

share repurchase program, just the accounting of it, when we get to the end

of

it in August, if it turns out, just help me to think about, if it turns out

that

UBS is by any chance repurchase shares for less than the initial price that

you

started it at, or if it was greater at, just help me out thinking about the

potential cash implications of that?

David

Walker-

MAXIMUS, Inc. - CFO

Yes.

The

way the contract works is really takes the V whopper, basically the weighted

average of the price outstanding from the period of when they began and when

they ended. So, if the price is lower than the 3991 that we use for accounting

purposes on the day of the transaction, there's going to be some additional

cash

that's available to either, one, by additional shares or could be returned

to

MAXIMUS. Conversely, if the share price went up, we would either owe additional

shares to UBS or would have to pay them the difference. Okay? So there is a

trueing up at the end. And at the end, beyond that cash or share transaction,

whatever happens at the end, if we ended up buying more shares, if there were

cash available, for example, that would affect the weighted average from that

day forward. Does that help?

Matthew

McKay-

Jefferies & Company - Analyst

Very

much

so. Hopefully they [spend] quite agressive.

David

Walker-

MAXIMUS, Inc. - CFO

Thank

you.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Operator

Thank

you.

(OPERATOR INSTRUCTIONS) The next question comes from the line of Jason

Kupferberg with UBS. Please proceed with your question.

Jason

Kupferberg-

UBS - Analyst

Good

morning, guys.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Good

morning, Jason.

Jason

Kupferberg-

UBS - Analyst

Just

have

a question on the fiscal '08 outlook at the segment level, I believe last

quarter the expectation was 10% revenue growth in consulting and 10 to 15%

in

systems. Obviously both are starting a negative [territory] here in Q1, and

I

know you changed the outlook for operating profit in systems for the full year,

but can you comment on the revenue expectations for the full year for both

those

segments since they've changed?

Rich

Montoni-

MAXIMUS, Inc. - CEO

Yes.

Would

I tell that you from a macro perspective, we are not expecting meaningful

revenue growth or positive revenue growth somewhere between the two in

consulting and systems. Most of the growth we expect will occur in our

operations segment.

Jason

Kupferberg-

UBS - Analyst

Okay.

Just

to clarify then, neither of those segments you expect to grow or in aggregate

you don't expect them to grow?

Rich

Montoni-

MAXIMUS, Inc. - CEO

They'll

grow but at a lower rate.

Jason

Kupferberg-

UBS - Analyst

Okay.

The

systems loss for the full-year fiscal '08, do you expect it to be similar to

the

loss you incurred in fiscal '07, or a little more or a little less? And do

you

expect it to break even by then?

Rich

Montoni-

MAXIMUS, Inc. - CEO

I

actually

think, based upon Q1 results, that the results for our systems segment will

be

different than we previously forecasted, and I think we have been positive

before, we expect they're going to incur a loss for the year. I should probably

talk a little about why that is, what's behind that. The systems loss is a

result of losses in the education systems and justice systems division. So

education division and justice division are the two divisions driving this

adjustment in the overall systems segment. Otherwise, the system segment itself

in this quarter performed reasonably well and I expect the full FY '08 it will

perform reasonably well, and we have three other divisions inside that segment,

just so you understand it.

Feb.

06. 2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

If

it

would be helpful, I'll talk a little about what's going on in education systems

division and justice. So my comments from here on in will relate strictly to

these two divisions, not the entire system. So, relative to these two divisions,

first off, these two divisions last year lost $19 million pretax, but this

did

include approximately $6.5 million of amortization of Sun costs. Secondly,

for

FY '08, we modeled into our guidance, a similar annual loss of these two

divisions, with a higher loss rate in Q1, and this is due to some project

reserves and we expect some improvement, particularly project performance

related, towards the latter part of the year.

When

we

talk about the losses, within these two divisions, they stem from two

categories. One is losses related to certain legacy projects or less profit

on

those legacy projects, and cost of product buildout and enhancements. Both

of

these divisions have significant development stage initiatives. They're building

out and enhancing their web-based versions. Very, very important and very much

in demand in the marketplace. That's what the marketplace is looking for is

web-based capabilities, and hence both of these divisions are building out

their

web-based versions to replace their client server versions. We as a company

have

made significant investments in what we believe is world class technology in

these markets. We're the long term demand drivers, very, very strong. As a

management team, and I can assure you our board, we are very, very much focused

on these two divisions and focused on improving the performance of these two

divisions.

The

key

factors clearly are finishing the buildout and simply completing existing

contract obligations. So Jason, our plan is to finish this buildout and to

focus

on our contract commitments. Realistically, I think this is going to take 9

to

12 months before these two divisions achieve profitability. And I'll also tell

you that if other alternatives surface, such as a strategic partner willing

to

work with us and invest in this business with us, we'll naturally consider

it,

but we'll do such in a responsible manner, and we have to do such with top

regard for our customer base, our employees, and naturally what we believe

are

real growth prospects here. Again, in wrapping this up, it's key to keep in

mind

that these are assets that we think have significant value. When we think about

delivering shareholder value, we need to execute on our plan yet keep an open

view to other alternatives that are responsible that could enhance shareholder

value.

The

last

point I want to make here is that we are deploying the same concerted efforts

of

our quality and risk management process that work very well in our operations

segment. We're applying those same efforts and processes in this situation

and

we're adding more. The add include additional resources from our quality

oversight group. It includes added external contractual resources and an extra

focus on customer communication.

Jason

Kupferberg-

UBS - Analyst

That

color

is great, actually. Just one last one on Texas. Can you tell us what the

revenues and operating income from Texas were in the quarter? And any update

on

the Accenture arbitration?

Lisa

Miles-

MAXIMUS, Inc. - VP IR

Jason,

we're no longer providing the operating income on Texas, but we will be more

than happy to give you what the revenue was. Revenue from Texas in the first

quarter -

David

Walker-

MAXIMUS, Inc. - CFO

While

she's looking that up, Jason, I will say that, by and large the Texas project

is

performing well at expectation and pretty much where we expected it to be when

we talked about it earlier.

Lisa

Miles-

MAXIMUS, Inc. - VP IR

The

revenue is running as expected between 7 and $8 million, as we told you last

quarter.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Jason

Kupferberg-

UBS - Analyst

Any

update

on the arbitration? I think you had a hearing scheduled for April. Is that

still

the case?

Rich

Montoni-

MAXIMUS, Inc. - CEO

No.

On the

arbitration piece, frankly my focus is running the day-to-day operations. The

good news is that this is no longer an operational issue, it's really an

arbitration issue, as you know. We're going through the arbitration process.

It's been set in place, and at this point, we know that the arbitration had

been

scheduled for April. That has been delayed but at this point in time a new

date

has not been set. But my realistic expectation is that that arbitration process

will not be completed in this fiscal year '08. Okay.

Jason

Kupferberg-

UBS - Analyst

Thank

you,

guys.

Lisa

Miles-

MAXIMUS, Inc. - VP IR

Jason,

I'm

not sure you caught my last word. It was 7 to 8 million a month for

Texas.

Jason

Kupferberg-

UBS - Analyst

Yes.

Great. Thanks, Lisa.

Lisa

Miles-

MAXIMUS, Inc. - VP IR

Good.

Operator

Thank

you.

Our next question comes from the line of Shlomo Rosenbaum with Stifel Nicolaus.

Please proceed with the question.

Shlomo

Rosenbaum-

Stifel Nicolaus - Analyst

Thank

you

very much for taking my question. It was a very good quarter, guys. I want

to

commend you on that. I just want to step back and ask you a bigger picture

question. You talked about how the Company's performed since 1975, obviously,

you've only been public since the '90s. I've been covering the stock through

the

last downturn. During the last downturn, there were significant issues with

the

discretionary spending, the emerged with the state and local segments,

particularly in the consulting and the systems segment. Now, it was more like

40% of revenue, now it's in the lower 30s% of revenue. I just want to go --

get

your view on why things are different now and why the Company is positioned

better whether any issues with state budget deficits, this did impact the

Company at the end 2002, and the beginning of 2003 guidance ended up getting

lower, like, 25%. I want to see what's different now? What program -- is the

program mix different? If you could just go through that?

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Rich

Montoni-

MAXIMUS, Inc. - CEO

Shlomo,

this is Rich. I think that's a very good observation, and during the last

recession, we did experience reductions, state spending reductions in some

discretionary areas. You make a good point, and I think it's a very significant

factor, during that time frame, the consulting and systems business did

constitute roughly 40% of our business and that's decreased significantly.

I do

think the more resilient part of our business is in the outsourcing services

piece of our business. And as we've talked, that tends to be about a one-year

lead time. So, you may recall, and I think in the prior quarter, we talked

about

the percentage of our business that is already complete. Within that segment

it's largely complete. The pipeline is full as we enter our fiscal year. So

we

see little risk in that outsourcing part of the business. It's a bigger part

of

our business today. One footnote to that is, I do think in one particular

contract, in the prior recessionary period, we saw a reduction in state spend.

I

think they reduced their workforce services program spend by 10%. This is a

California county. Their view was why spend money when there's really no jobs

to

obtain out there.

So,

my

view is that the largest piece of our business is already complete, and on

a

consulting side of our business, we've been working really hard to reconfigure

that component of the business, and a lot of our consulting work, one, goes

to

save states money, help them get reimbursed, so I think that type of work is

very sticky. And I also think in our systems business, we're not forecasting

a

whole lot of increase in the systems component, and I do think that based upon

our analysis of their pipeline, even given the customer pressures that might

exist, it's very, very achievable. A lot more of our business in the systems

world, actually, is software maintenance than it had been in the past which

largely is recurring. So I do expect we may see some pressures on the margin.

I

don't think it's going to be substantial.

Shlomo

Rosenbaum-

Stifel Nicolaus - Analyst

If

I could

just speak in a little bit more, just on the cash flow, these are housekeeping,

deferred income taxes was a benefit this quarter, it's been a drag for most

of

the last two years. Is there any detail you can provide on

that?

David

Walker-

MAXIMUS, Inc. - CFO

Taxes

swing around from one quarter to the next, frankly, on the payment of bills.

And

sometimes the deferred's tied to the balance sheet.

Rich

Montoni-

MAXIMUS, Inc. - CEO

As

Dave

said, it's a function of cash payments when cash payments are

made.

Shlomo

Rosenbaum-

Stifel Nicolaus - Analyst

If

you

don't mind, I'll sneak in one more. Just the operations segment. Some of your

commentary about optimization of the Company's project portfolio, you discussed

some of the derisking that has gone on. Normally, we do see a fourth quarter

to

first quarter drop off in revenue. I was wondering is there some kind of

additional sales that you have worked on to sort of optimize that that made

the

revenue come out higher than expected there? Or was there any one-time revenue?

And just wanted to see why we didn't see a normal seasonal pattern

there?

David

Walker-

MAXIMUS, Inc. - CFO

Let

me get

to the data point that you're referring to. You're referring to operations

segment revenue.

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Shlomo

Rosenbaum-

Stifel Nicolaus - Analyst

Yes.

David

Walker-

MAXIMUS, Inc. - CFO

Which

we

reported 145.8 million for this recent Q1. Your question is why did that

increase over the 141 the Q4 sequentially?

Shlomo

Rosenbaum-

Stifel Nicolaus - Analyst

Yes.

And

if there was anything one time issue, or is there any change in the business

that has resulted in that going up sequentially as opposed to, normally you

see

a little bit of a decline there.

David

Walker-

MAXIMUS, Inc. - CFO

I

think

first off, there is an inherent seasonal part of our business that does normally

bring it down, but we've had a number of projects that we've added that are

in a

ramp up phase. So we're seeing that revenue come on stream, so any seasonality

that like naturally exists in the book of business, I think, is overcome by

the

ramp up in this new work that we have.

Shlomo

Rosenbaum-

Stifel Nicolaus - Analyst

Okay.

Thanks.

David

Walker-

MAXIMUS, Inc. - CFO

Yes.

Operator

Thank

you.

Our final question comes from the line of Richard Glass with Morgan Stanley.

Please proceed with your question.

Richard

Glass-

Morgan Stanley - Analyst

Hi,

guys.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Hey,

Rich.

Richard

Glass-

Morgan Stanley - Analyst

So,

if I

understand things correctly, just to clarify, on a normalized tax rate, you

would have beaten the number pretty handily, is that right?

Feb.

06.

2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Rich

Montoni-

MAXIMUS, Inc. - CEO

At

40%,

sure. It's a blip, and for the full year, it'll come around to that same

rate.

Richard

Glass-

Morgan Stanley - Analyst

No

one

would be, if it went the other way, no one would be making excuses for you

either, so I wouldn't exactly downplay that, because your performance is better

than it looks. It's a little discouraging though, with the operations segment

doing so well, to have the systems segment move to a larger loss. This is

something that it seems should be, shouldn't be lingering another year from

now.

Your stock would be selling at a significant premium to where it is, if not

for

the drags from two relatively small divisions within systems of education and

justice. And I don't know if bodies should be flying out the door or what should

be happening but that should be a smaller problem and not a larger problem.

That's not encouraging to see from our perspective. On another note, with an

actual question, why should the range of DSOs not have moved down at all? You

guys put up 77 with some of David, and other attention that that's gotten,

you

guys have moved it down now pretty nicely. Why are we still sticking with the

old 75 to 85 range of DSOs? Is there anything going on there that we should

know

about or should maybe that range move down and you guys should get a little

bit

agressive with your target?

David

Walker-

MAXIMUS, Inc. - CFO

That's

a

great question. Here's the reality of cash flow, and in our ops world we have

very, very large contracts. And a lot of the cash, it's driven by when the

bill

goes out, when the cash comes in, tends to come in near the end of the month

or

the end of the quarter. So it's actually sometimes a matter of days, if just

a

receivable gets slowed down by a state or whatever could really materially

swing

our DSOs one way or the other. So we've actually been very, very good at working

and partnering with the states to make sure that the payments come in well

and I

think pretty consistently. That's what it's showing. But, it's very difficult

to

manage a state bureaucracy sometimes. So it's quite possible to have a quarter

where it swings up. That's where we put that range, okay? I think it's fair

to

say that our cash flow guidance, we tend to conserve very conservatively on

the

DSOs. Okay.

Richard

Glass-

Morgan Stanley - Analyst

Okay.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Rich,

this

is Rich Montoni. I want to respond to your prior observation on the positive

performance being masked by the systems performance. We are -- point noted

and

we are very, very cognizant of that and we are very, very focused on it. As

I

said in my notes, and my commentary, we are bringing to bear everything we

can

to focus and improve on this situation. I say 9 to 12 months, if there's way

to

demonstrate improvement and achieve that beforehand, you can rest assured we

are

pursuing it.

Richard

Glass-

Morgan Stanley - Analyst

All

right

thank you. Best of luck.

Rich

Montoni-

MAXIMUS, Inc. - CEO

Thank

you.

Feb.

06. 2008/9:00AM, MMS-Q1 2008 MAXIMUS, Inc. Earnings Conference

Call

Operator

All

right,

thank you. Ladies and gentlemen this concludes today's presentation. A replay

of

this call will be available to you within two hours. You can access the replay

by dialing 877-660-6853. Or internationally, 201-612-7415. Enter account number

316 followed by the conference number 271353. Again that's account number 316

and the conference number 271353. Thank you for your participation. You may

now

disconnect.

D

I S C L A I M E R

Thomson

Financial reserves the right to make changes to documents, content, or other

information on this web site without obligation to notify any person of such

changes.

In

the conference calls upon which Event Transcripts are based, companies may

make

projections or other forward-looking statements regarding a variety of items.

Such forward-lookingstatements

are based upon current expectations and involve risks and uncertainties.

Actual

results may differ materially from those stated in any forward-looking statement

based on anumber

of important factors and risks, which are more specifically identified in

the

companies' most recent SEC filings. Although the companies may indicate and

believe that theassumptions

underlying the forward-looking statements are reasonable, any of the assumptions

could prove inaccurate or incorrect and, therefore, there can be no assurance

that theresults

contemplated in the forward-looking statements will be

realized.

THE

INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF

THE

APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO

PROVIDEAN

ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES

IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY

DOESTHOMSON

FINANCIAL OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT

OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED

ONTHIS

WEB SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE

COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC

FILINGSBEFORE

MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2008,

Thomson Financial. All Rights Reserved.

1

David N. Walker Chief Financial Officer and Treasurer First Quarter Fiscal

2008

February 6, 2008

2

First Quarter Results in Line with Expectations Q1 revenue was

$202.0m a 25% increase over the same quarter last

year Excluding a Q107 revenue adjustment related to

receivables, growth for 1Q08 was still strong at 12.5% - driven by Operations

Segment Net income for Q1 was $10.6m - or $0.51 per diluted

share Operating margin was 8.2% - consistent with

expectations Still expect total Company margin of approximately

10% for the year, but quarter was lower sequentially Secured a

$50m loan through SunTrust with possible syndication up to

$75m Ensures our capital structure remains

flexible

3

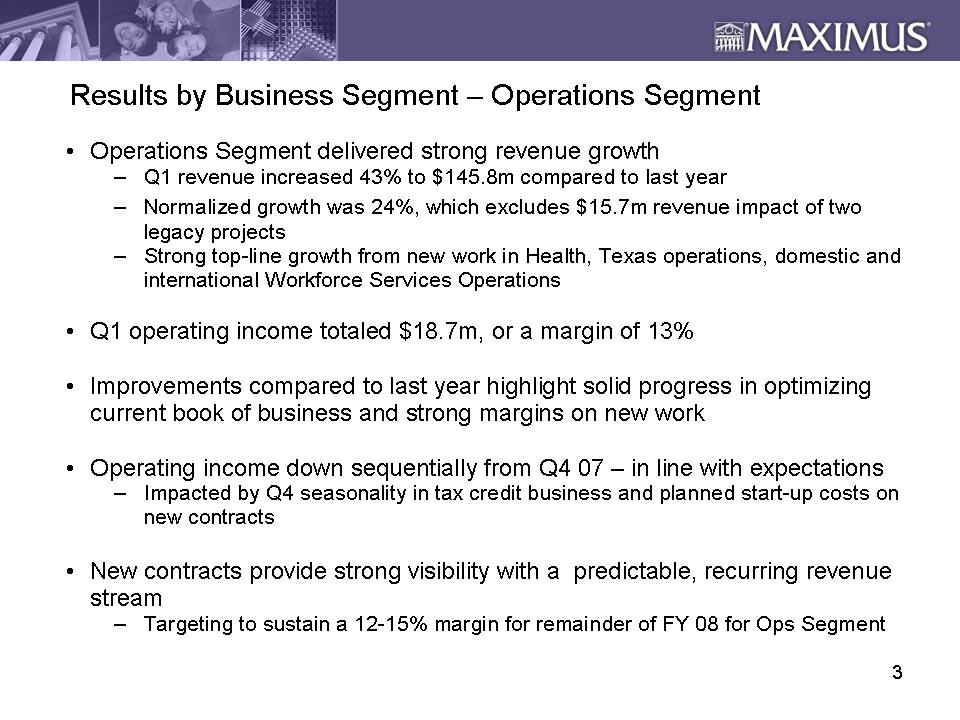

Results by Business Segment Operations

Segment Operations Segment delivered strong revenue

growth Q1 revenue increased 43% to $145.8m compared to last

year Normalized growth was 24%, which excludes $15.7m revenue

impact of two legacy projects Strong top-line growth from new

work in Health, Texas operations, domestic and international Workforce Services

Operations Q1 operating income totaled $18.7m, or a margin of

13% Improvements compared to last year highlight solid progress

in optimizing current book of business and strong margins on new

work Operating income down sequentially from Q4

07 in line with expectations Impacted by Q4

seasonality in tax credit business and planned start-up costs on new

contracts New contracts provide strong visibility with a

predictable, recurring revenue stream Targeting to sustain a

12-15% margin for remainder of FY 08 for Ops Segment

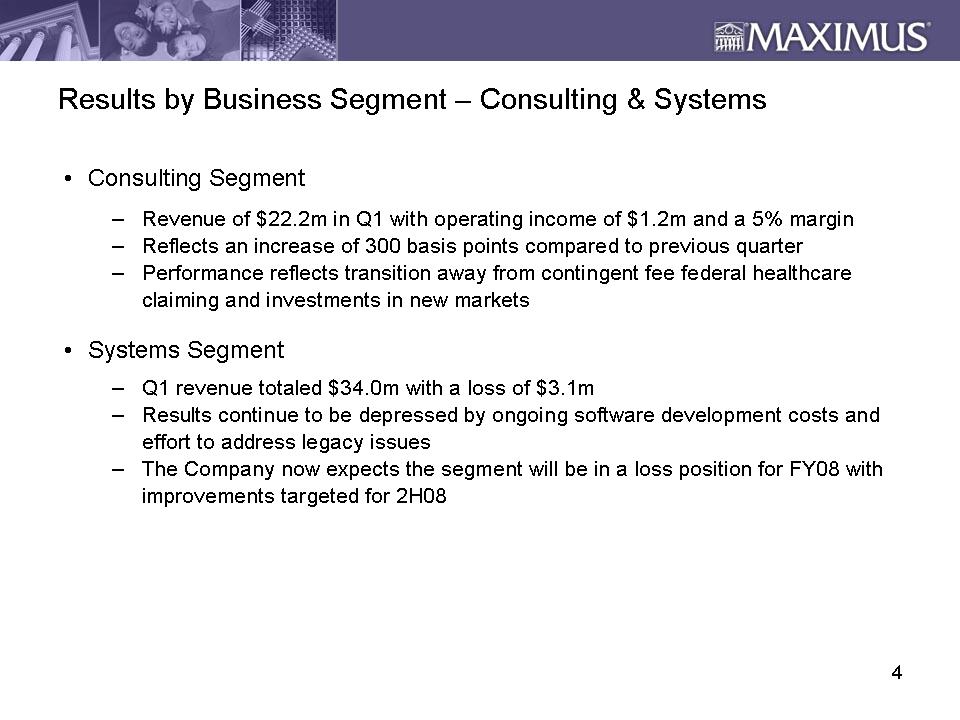

4

Results by Business Segment Consulting &

Systems Consulting Segment Revenue of $22.2m

in Q1 with operating income of $1.2m and a 5% margin Reflects

an increase of 300 basis points compared to previous

quarter Performance reflects transition away from contingent

fee federal healthcare claiming and investments in new

markets Systems Segment Q1 revenue totaled

$34.0m with a loss of $3.1m Results continue to be depressed by

ongoing software development costs and effort to address legacy

issues The Company now expects the segment will be in a loss

position for FY08 with improvements targeted for 2H08

5

Expense Items SG&A as a percent of revenue was 18% for

1Q08 The Company took a $2.2m non-cash charge related to

stock-based compensation from previous years as a result of the forfeiture

calculation Despite this charge SG&A as a percentage of

revenue is consistent with FY07 results MAXIMUS achieved an

8.2% operating margin consistent with our expectations for the

quarter

6

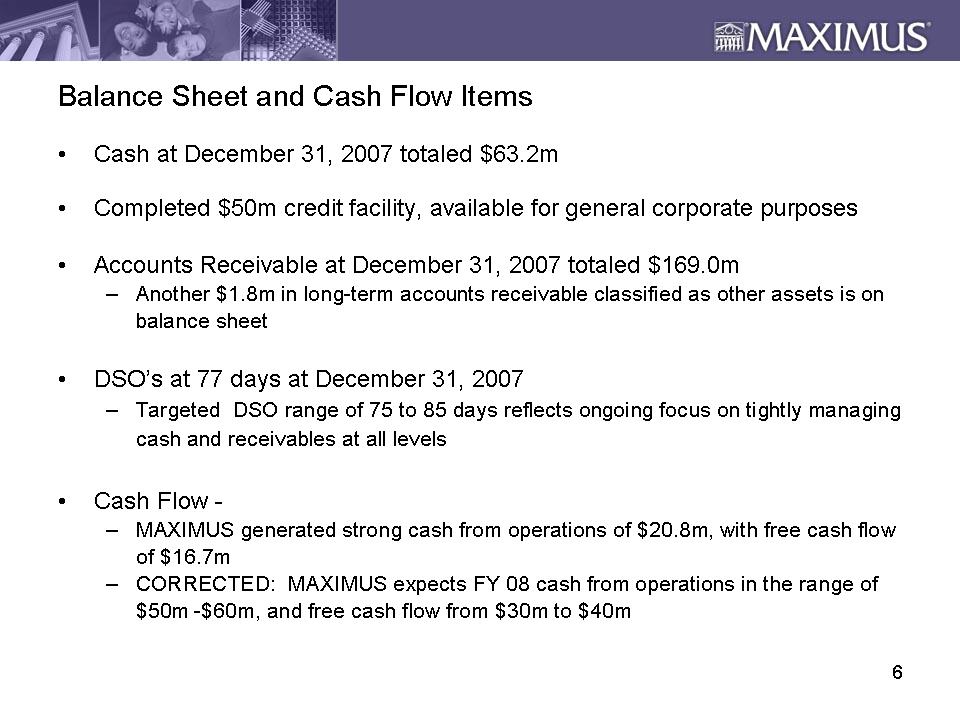

Balance Sheet and Cash Flow Items Cash at December 31, 2007

totaled $63.2m Completed $50m credit facility, available for

general corporate purposes Accounts Receivable at December 31,

2007 totaled $169.0m Another $1.8m in long-term accounts

receivable classified as other assets is on balance sheet DSO’s

at 77 days at December 31, 2007 Targeted DSO range of 75 to 85

days reflects ongoing focus on tightly managing cash and receivables at all

levels Cash Flow MAXIMUS generated strong cash

from operations of $20.8m, with free cash flow of

$16.7m CORRECTED: MAXIMUS expects FY 08 cash from operations in

the range of $50m -$60m, and free cash flow from $30m to $40m

7

Richard A. Montoni President and Chief Executive Officer First Quarter Fiscal

2008 February 6, 2008

8

First Quarter Results in Line with Expectations Financial

results driven by Operations Segment performance Reflects

changes in pursuing new business, structuring awards and servicing existing

accounts Demonstrates progress in improving and expanding

profitability by optimizing our current book of

business Achievements in Quality and Risk Management has played

a predominant role in improvements High profile projects

(HPP) key tool in our business optimization program Mandatory

project manager training Focused on replicating this success

across our Systems and Consulting segments

9

Top Priorities: Optimize and Focus on Core Business Optimize

Each segment has had meaningful successes, but we have not achieved performance

improvements goals in the Systems Segment Softness related to

legacy contracts where we are actively working to execute a plan to resolve

outstanding matters Working to complete software product

enhancements, the cost of which is being expensed We plan to

finish the year with this segment in a much improved

position Focus on core markets to fuel

growth Traditional BPO service offerings centered around our

government health and human services programs Identified two

non-core businesses for divestment

10

Economic and Industry Environment Economic mood is cautious but

the state environment remains mixed National Association of

State Budget Officers still projecting FY08 growth just under

5% Not a major factor to MAXIMUS During weak

economic times, demand for our services has remained stable particularly

in

Operations Discretionary spend could be

impacted Overall historical company performance resilient to

recession with no decline in annual revenue since

inception 65% 70% of our revenue comes from

state run, federally mandated and largely federally funded

programs Current 2009 outlook we believe there

will not be a material impact on our core book of business

11

Health Care Reform Topic of interest at the state level which

is embraced by both ends of the political spectrum States

seeking to increase availability of health care options to

constituents 47 million uninsured people continues to be a drag

on state budgets Massachusetts and Indiana already have

industry leading programs, Wisconsin moving forward with their initiative

and

most other states in various stages of program

development States view health care reform as a means to serve

their populations more cost effectively Represents a compelling

opportunity with forward momentum in nearly every state to address this ongoing

burden

12

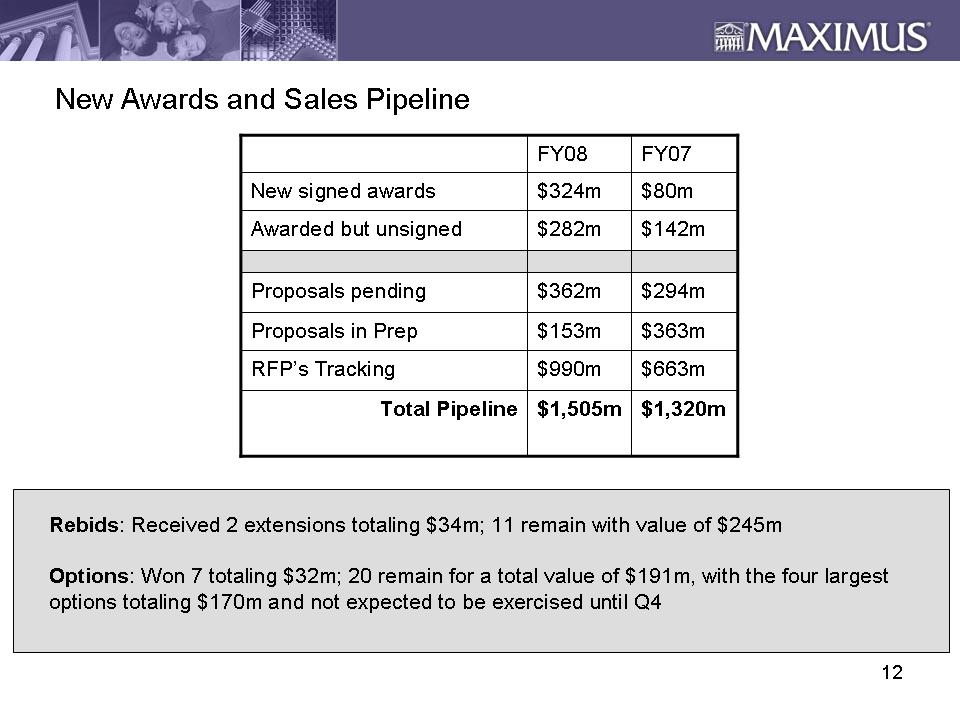

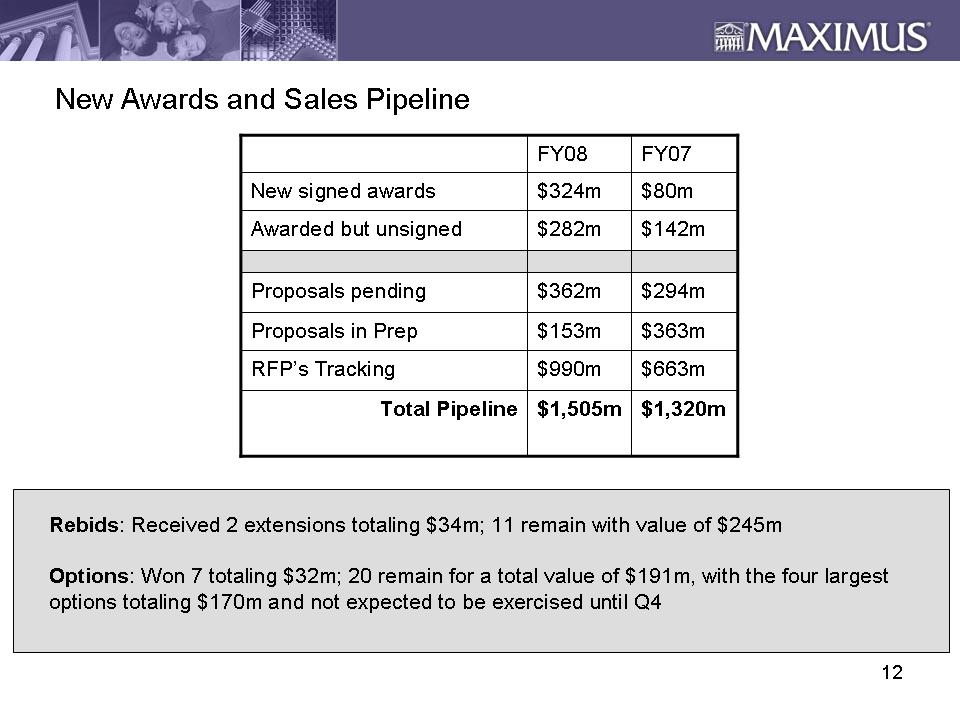

New Awards and Sales Pipeline $663m $990m RFP’s Tracking $1,320m $1,505m Total

Pipeline FY07 FY08 $80m $324m New signed awards $363m $153m Proposals in

Prep

$294m $362m Proposals pending $142m $282m Awarded but unsigned Rebids: Received

2 extensions totaling $34m; 11 remain with value of $245m Options: Won 7

totaling $32m; 20 remain for a total value of $191m, with the four largest

options totaling $170m and not expected to be exercised until

Q4

13

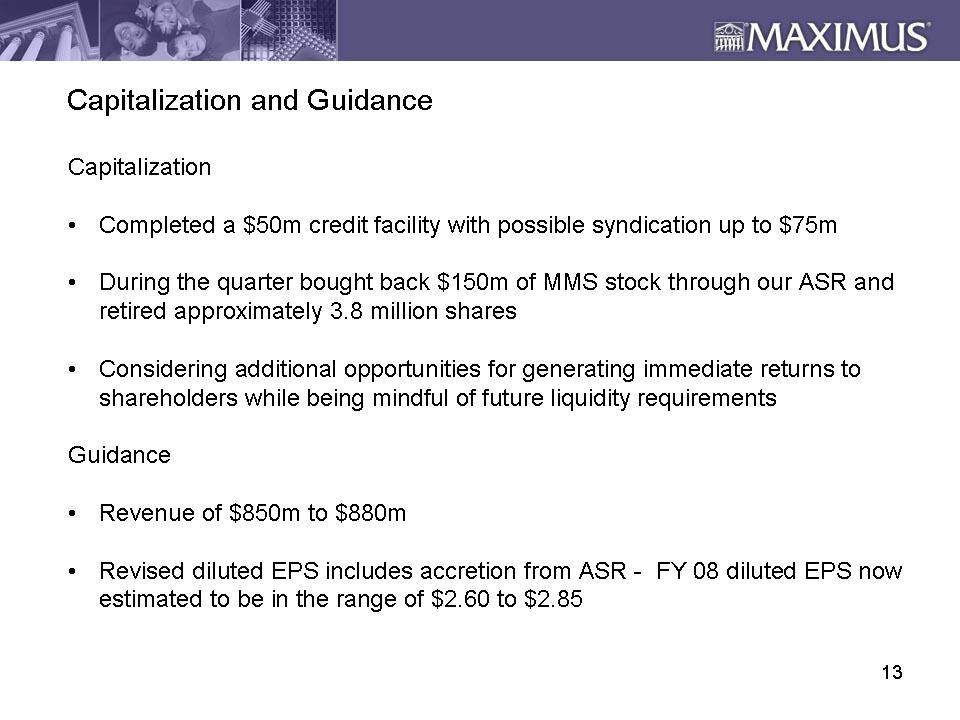

Capitalization and Guidance Capitalization Completed a $50m

credit facility with possible syndication up to $75m During the

quarter bought back $150m of MMS stock through our ASR and retired approximately

3.8 million shares Considering additional opportunities for

generating immediate returns to shareholders while being mindful of future

liquidity requirements Guidance Revenue of $850m to

$880m Revised diluted EPS includes accretion from ASR - FY 08

diluted EPS now estimated to be in the range of $2.60 to

$2.85