Exhibit

99.2

FINAL

TRANSCRIPT

MMS

- Q4

2007 MAXIMUS, Inc. Earnings Conference Call

Event

Date/Time: Nov. 15. 2007 / 8:30AM ET

©

2007

Thomson Financial. Republished with permission. No part of this publication

may

be reproduced or transmitted in any form or by any means without the

prior

written consent of Thomson Financial.

C

O R P O

R A T E P A R T I C I P A N T S

Lisa

Miles

MAXIMUS,

Inc. - Director - Investor Relations

David

Walker

MAXIMUS,

Inc. - CFO

Rich

Montoni

MAXIMUS,

Inc. - President & CEO

Jerry

Weintraub

Weintraub

Capital - Analyst

C

O N F E

R E N C E C A L L P A R T I C I P A N T S

Anurag

Rana

KeyBanc

Capital Markets - Analyst

Matthew

McKay

Jefferies

& Company - Analyst

Charles

Strauzer

CJS

Securities - Analyst

Jason

Kupferberg

UBS

-

Analyst

Shlomo

Rosenbaum

Stifel

Nicolaus - Analyst

Rich

Glass

Morgan

Stanley - Analyst

Steve

Balog

Cedar

Creek Management - Analyst

P

R E S E

N T A T I O N

Operator

Ladies

and

gentlemen, welcome to MAXIMUS fourth quarter earnings call. During this session,

all lines will be muted until the question-and-answer

portion of the call. (OPERATOR INSTRUCTIONS) At this time I would like to turn

the call over to Lisa Miles, Director

of Investor Relations.

Lisa

Miles

- MAXIMUS, Inc. - Director - Investor

Relations

Good

morning, and thank you for joining us on today's conference call. If you wish

to

follow along we've posted a presentation on

our

website under the investor relations page. On the call today is Rich Montoni,

Chief Executive Officer; and David Walker, Chief

Financial Officer. Following our prepared comments, we will open the call up

for

Q&A. Before I begin I'd like to remind everyone

that a number of statements being made today will be forward-looking in nature.

Please remember that such statements are

only

predictions and actual events or results may differ materially as a result

of

risks we face including those discussed in exhibit

99.1 of our SEC filings. We encourage you to review the summary of these risks

in our most recent 10-Q filed with the SEC.

The

Company does not assume any obligation to revise or update these forward-looking

statements to reflect subsequent events

or

circumstances.

And

with

that I'll turn the call over to David.

David

Walker - MAXIMUS, Inc. - CFO

Thank

you,

Lisa. Good morning. Today we're reporting fourth quarter record revenue and

earnings per share. In addition we have

concluded the strategic review process and are launching a $150 million

accelerated share repurchase program, which is immediately

accretive and demonstrates our confidence in the future success of the Company.

Rich will talk about this in greater detail

later in the call. Let's jump right in to the details of the financial results

for the fourth quarter. Today, MAXIMUS reported fourth

quarter revenue totaling $201.9 million, a 17.5% increase over the same period

last year. The Company reported net income

in

the fourth quarter of $14.2 million, or $0.63 per diluted share. This includes

a

$2.5 million legal expense primarily related

to

the Accenture arbitration or $0.06 per diluted share. Excluding the legal charge

earnings per share was $0.69 per share.

Fourth

quarter operating margin was solid at 10.8%. This is consistent with the

double-digit operating margin delivered last quarter,

excluding the unusual legal and settlement cost. Earlier in the year, we talked

about the achievability of a 10% margin. The

management team remains committed to continuing this strong financial delivery.

We will see quarterly fluctuations related to

timing

or seasonality, but this target remains achievable. Other highlights in the

quarter include, cash and marketable securities

of $196.7 million at September 30, 2007. And as expected, DSOs were slightly

higher than last quarter but remained respectable

at 80 days.

Moving

to

results for the full fiscal year. For the full year, fiscal 2007 revenue

increased 5.4% to $738.6 million compared to $700.9

million last year. Excluding revenue from the divested businesses for fiscal

2006, year-over-year organic growth was 6.8%.

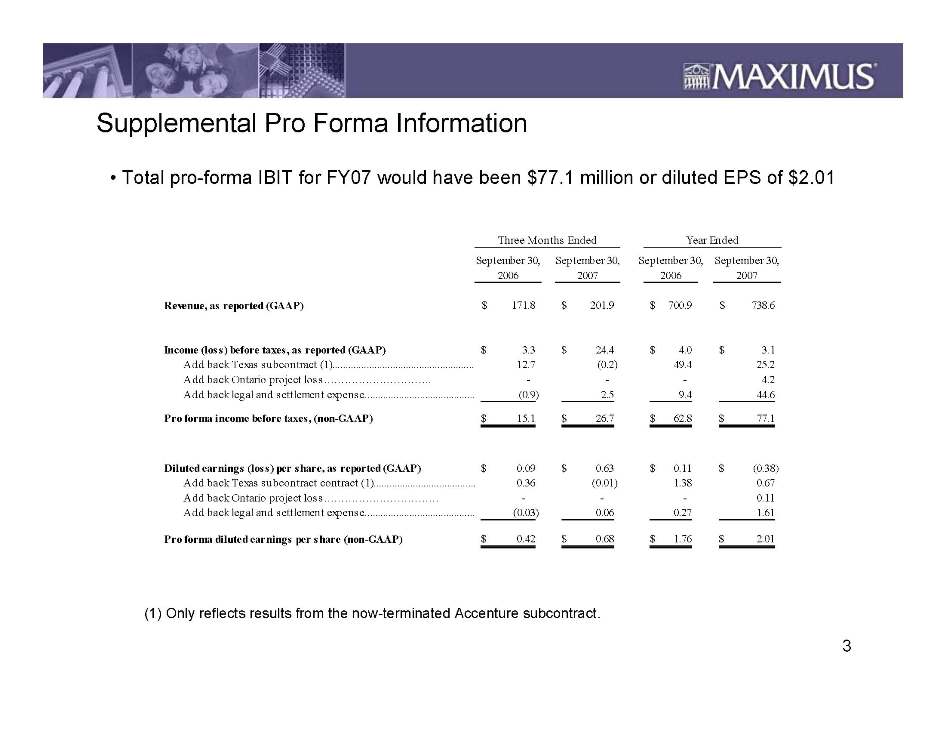

For

fiscal 2007, MAXIMUS reported a GAAP loss of $8.3 million or $0.38 per share.

This compares to fiscal 2006 net income of

$2.5

million and diluted EPS of $0.11 per share. In order to set the platform for

next year, let me walk you through results normalized

for certain items. On a full-year GAAP basis income before taxes was $3.1

million. As a result of large amount included in

legal

and settlement expense that is not tax deductible, we reported an after-tax

loss

of $0.38 per share.

This

after-tax loss was driven by three main items including: Losses on the

terminated Texas subcontract totaling $25.2 million or

$0.67 a

share; a $4.2 million loss or $0.11 a share related to the Ontario project;

and

legal and settlement expenses of $44.6 million

or

$1.61 a share. Excluding these items, total Company income before tax for the

full fiscal year would have been $77.1 million

for a pro forma diluted earnings per share of $2.01. Overall, financial results

for the quarter and the year were consistent with

the

expectations we outlined in our call in August. The fourth quarter is

traditionally our strongest quarter, due to seasonality in

certain

business lines and benefits derived in the quarter from the timing of indirect

expenditures. While our fourth quarter results

were strong, we expect our first quarter to be sequentially lower due to

seasonal trends and several large projects in operations

and consulting, which required planned start-up costs in the first half of

the

year.

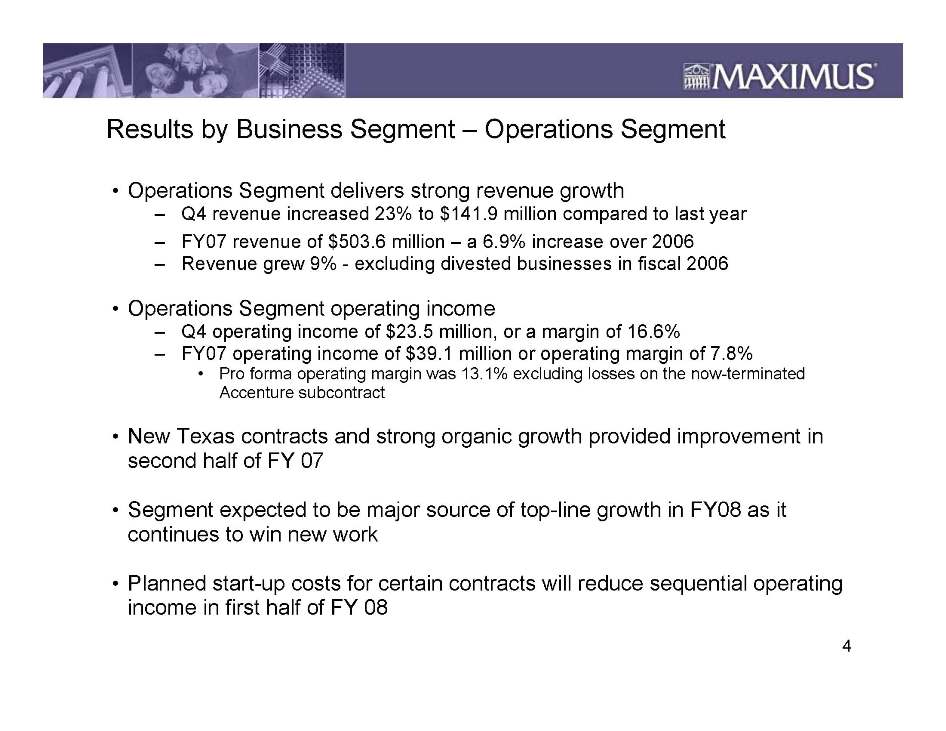

Let's

jump

into the details by segment, starting with the Operations segment, which posted

another solid quarter. Revenue for the

Operations segment increased 23%, to $141.9 million compared to the same period

last year. For the full fiscal year, the Operations

segment delivered revenue totaling $503.6 million, a 6.9% increase compared

to

the same period last year. Excluding revenue

from divested businesses in fiscal 2006, Operations segment revenue grew 9%.

The

Operations segment recorded fourth

quarter operating income of $23.5 million or an operating margin of 16.6%

compared to a loss of $2.9 million reported in

the

same period last year.

For

the

full fiscal year, the segment had operating income of $39.1 million or an

operating margin of 7.8%. Excluding the losses related

to

the now terminated Texas subcontract, the segment's pro forma operating margin

was approximately 13.1%. The new

contracts in Texas provided significant improvement in the second half of fiscal

2007. The segment also benefited from strong

organic growth. The segment continues to win new work, which will be a major

source of top-line growth in fiscal year '08.

As

previously discussed planned start-up costs required for certain new contracts

will reduce sequential operating income in

the

first half of fiscal 2008.

Consulting

segment revenue was $22.5 million for the fourth quarter with operating income

of $554,000 and a 2.5% margin. Full-year

revenue for the segment totaled $93.7 million with an operating income of $6.4

million and a margin of 6.9%. This compares

to last year's revenue of $102.8 million and an operating margin of 14.1%.

The

reductions in revenue and margin compared

to last year are primarily related to a couple of projects that were substantial

contributors in fiscal 2006. Also hindering revenue

growth and margin expansion is the transition away from contingency terms for

our federal healthcare practices. As we

make

this shift we're refreshing the backlog with new work in Medicaid program

integrity, such as our statewide fraud, waste

and

abuse program in New York, and our payment error rate measurement, or PERM,

contracts in Colorado, North Dakota and

Florida. Some of these new growth areas require up-front cost and will soften

earnings in the first half of the year.

Moving

on

to the Systems segment. Systems revenue in the fourth fiscal quarter grew to

$37.4 million, compared to $30 million reported

for the same period last year. For the full year, revenue increased 11% to

$141.3 million compared to fiscal 2006. Year-over-year

revenue growth was driven primarily by new contracts in the ERP division,

including state-wide implementations in

Tennessee and Delaware. The segment was slightly profitable in the fourth

quarter, earning $466,000. For the full year the segment

lost $4.7 million. Much of the full-year loss resulted from ongoing software

investments, as well as charges taken during the

year

related to efforts to resolve legacy contracts.

Moving

to

corporate expense items and corresponding profit margins. MAXIMUS achieved

a

solid 10.8% operating margin in the

fourth

quarter. SG&A was favorably impacted by timing of indirect cost, largely

between the third and fourth quarter, as well

as

cost-management actions. As I stated earlier, Q1 is traditionally our softest

quarter. The SG&A benefit recognized this quarter,

coupled with seasonality and planned start-up expenditures related to New York

[firm] operations, will result in a lower sequential

operating margin in the first quarter of 2008.

Moving

on

to balance sheet and cash flow items, our accounts receivable for the quarter

totaled $175.2 million. In addition, we also

have

$1.9 million in long-term accounts receivable, which are classified within

other

assets on the balance sheet, which brings

me

to DSOs. Over the last 18 months, Rich and I have talked a lot about management

actions such as requiring more stringent

business terms, enhancing our contracts and compliance team, and increasing

program training. The results are clearly showing

in

our DSOs, with fourth quarter levels at 80 days. As I stated last quarter,

we've

laid out a more aggressive DSO range of

75 to

85 days, which reflects our ongoing focus on tightly managing cash and

receivables throughout all levels of the organization.

As

expected, cash flow was negative in the quarter, principally resulting from

a

cash outlay of $30.5 million related to the previously-disclosed

settlement in the District of Columbia. Excluding the D.C. payment, cash from

operations in the fourth quarter

was $22.3 million, with free cash flow of $14.9 million. For fiscal 2007, cash

from operations totaled $51.2 million with free

cash

flow of $33.4 million. Adjusting for the D.C. settlement, cash flow from

operations was $81.7 million and free cash flow would

have

been $63.9 million. Our efforts to focus on balance sheet optimization as well

as our accelerated share repurchase program

demonstrate our commitment to managing working capital and enhancing shareholder

value.

And

with

that, I'll turn the call over to Rich.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Thanks,

David, and good morning, everyone. I want to kick off this morning with some

late, great breaking news. Last night MAXIMUS

received notification from the California Department of Healthcare Services

of

their intent to award the California health

and

care -- healthcare options rebid to MAXIMUS. This is truly fantastic news and

I'm very proud of our team's collective effort

to

solidify this win. Thanks. We're very pleased to continue our partnership with

the state in support of their efforts surrounding

this critical program. The base contract is expected to run for a 57-month

base

with additional options for three years

beyond that. We hope to finalize the contract in the next couple of weeks,

but

we're not at liberty to provide specific contract

details at that time.

Okay,

let's jump into our other announcements from yesterday. As noted in the press

release we recently concluded our strategic review

process in conjunction with UBS, our financial advisor. This is a thorough,

extensive process, and we considered all options.

Dynamics in the capital markets weighed in the process, and while we received

much interest from outside parties on a

variety

of fronts, we are not immune to those broader market conditions. There's been

substantial tightening of availability of

capital, which impacted the ability of buyers to strike acceptable terms and

conditions. As a result, we have concluded that continuing

as an independent public company, coupled with meaningful capitalization

efficiency, is the best option and in the best

interests of our shareholders. We're not going to talk specifically to how

the

process unfolded, but I would remind you that the

board

initiated this process, and I can assure you that the scope and the intensity

of

the process was very significant. MAXIMUS

has a great portfolio of assets and people and I am excited and dedicated to

leading the Company forward.

As

part of

our strategy we have three key initiatives underway. First, we're addressing

our

capitalization head on. We've launched an

accelerated share repurchase program, which will commence at the end -- at

the

end of business today. This is additive to our

current board authorization program. At September 30th, we had approximately

$40

million remaining under that program, and

in

addition we're seeking to secure a $50 million to $75 million line of credit

in

the coming weeks. Second, we're narrowing and

concentrating our focus on core markets to fuel growth. This includes potential

investments, partnerships, and tuck-in acquisitions.

Third, we may pursue selected divestitures of businesses that may not fit within

our primary markets but could be very

attractive to those more focused in those markets.

Our

program calls for the accelerated repurchase of shares in the amount of $150

million. We will purchase these shares effective today

from

UBS, which will then borrow the shares. Over the next nine months UBS will

purchase an equivalent number of shares

in

the open market to cover the shares it borrowed. At the end of that period,

MAXIMUS's initial purchase price will be adjusted

up or down based upon the volume-weighted average price of the stock, or what's

referred to as the VWAP, during this

period. The price adjustment may be settled in cash or shares of stock, and

we

expect this program will be accretive by approximately

$0.15 to $0.20 per diluted share in fiscal 2008, and it provides the Company

with the flexibility necessary to continue

to invest and grow the business.

This

is

the first window of opportunity we have had in at least the last 12 months

to

pursue a meaningful share repurchase. Clearly

the outstanding arbitration and the ensuing strategic review process factored

in

to the timing of share repurchases. To refresh

your memory on the Texas timeline, we had entered in to arbitration in December

of 2006, terminated our subcontract agreement

in February of 2007, and then entered in to contracts directly with the state

at

the end of March. Shortly thereafter we

began

laying the ground work for the strategic review process, which was announced

in

July. This ASR program will improve the

efficiency of our capital structure, lower the cost of capital, increase

earnings per share, and better position MAXIMUS for the

future.

In

addition to the ASR, MAXIMUS still has approximately $40 million available

under

its previous board-authorized repurchase program.

This additional authorization remains available us to for share repurchases

upon

the completion of the ASR program. After

the

$150 million use of cash for the ASR program, cash at September 30th on a pro

forma basis would have been approximately

$47 million. I also note that while we may have quarterly fluctuations, our

business has and is expected to generate

substantial cash from operations. However, we also intend and our moving to

put

in place an additional $50 million to

$75

million line of credit to be available for future business needs.

In

addition to our capitalization program announced today, we're taking positive

steps forward as we better define our longer-term vision

for

growth. We have a clear understanding of what businesses provide us with --

what

businesses provide us with the most

value

and best fit with our strategic growth objectives. The review process

facilitated a rigorous assessment of our individual businesses

and confirmed our view that a refined focus is the most appropriate path as

an

independent company. We've concluded

that returns are highest when a business such as ours focused on its core

competencies and this we define to be: Holding

a

number one or number two position in a market; having the ability to meet

clients' needs in cost-effective and efficient solutions;

significant growth potential in those markets, then, a business can drive think

highest returns to its shareholders. And

for us

that lands us squarely within our traditional BPO service offerings and

certainly in government health and human services

programs.

As

we look

at the overall portfolio we see businesses laid out across three major

categories: One, those business lines that are clearly

core to achieving our longer-term objectives; two, those businesses on the

periphery of these areas that, for example, may

share

common customer bases. These still make sense to have in the mix. This are

typically practice areas that remain accretive

and offer synergies; and three, certain business lines that may not be a clear

fit in our organization. Now in support of

this

effort to focus on our operations, we are actively working on alternatives

for

certain assets. We successfully benefited from

the

divestiture of two businesses in the beginning of fiscal 2007 which were not

consistent with our longer-term objectives and

we're

prepared to take additional action in this area.

With

a

wrap-up of fiscal 2007 and the completion of the strategic review process,

we

are entering fiscal 2008 with a much-improved business.

We've spent the last 18 months placing more emphasis on quality and risk

management, which has resulted in the elimination

of several legacy issues, more favorable contract terms on new awards, solid

cash flow, lower DSOs, improving operating

margins, and accelerating top-line growth. We successfully turned the Texas

projects into profitable contributors, which

speaks volumes about the Company's solid brand reputation, and perhaps more

importantly, our extensive experience in

providing cost-effective and efficient business process outsourcing in complex

government-funded programs, such as Medicaid

and SCHIP.

In

fiscal

2007 we resolved the majority of the legal overhangs, including matters such

as

Ontario, the District of Columbia Department

of Justice settlement, and we restructured our business relationships with

Emergis, which turned this into a partnership.

In the coming year we will build on the progress made in fiscal 2007 to further

optimize operations and fuel growth as

we

emphasize those businesses which offer us more predictable recurring streams

of

revenue and sustainable levels of income.

We

are investing in the necessary -- we are investing the necessary dollars to

succeed in these core areas where we see potential.

For example, we are investing in a productization effort around both our

enrollment broker and eligibility work, primarily

for our Medicaid, enrollment broker, and SCHIP operations. This is where a

plug-and-play technical solution is needed in

support

of our BPO services. Productization is key to maintaining a competitive leg

up

as we seek to serve a wide range of states.

Now

we're

launching this new technology platform in Indiana where we just signed a new

two-year $15 million base contract to

provide

enrollment broker services for several state Medicaid programs. The project

provides for the option to extend operations

for an additional two years, which would bring the total award to $26 million

over four years. This is an extremely strategic

award for MAXIMUS, with universal healthcare being a key component of the

overall program. In addition to serving as

enrollment broker for the state's primary Medicaid program, MAXIMUS will also

provide services for the state's new Healthy Indiana

Program, or what is referred to as HIP. The state-sponsored HIP program is

the

principal platform for providing affordable health

insurance for uninsured, low-income adults. This win further solidifies our

position as the nation's leading provider of Medicaid

enrollment broker service. More importantly it demonstrates our leadership

and

vision in assisting states with the rollout

of

universal healthcare. MAXIMUS remains at the forefront of the opportunities

surrounding universal healthcare initiatives. At

this

juncture we believe most state initiatives will continue to be complementary

to

their current SCHIP and Medicaid programs.

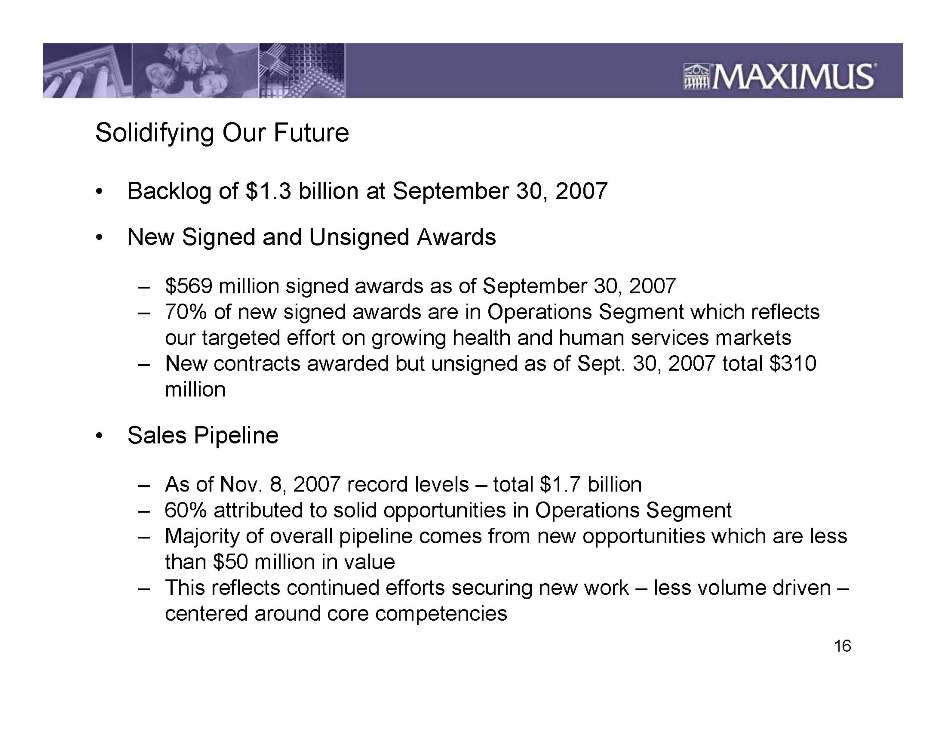

Let's

move

on to backlog, new awards, and total sales pipeline, all of which I believe

confirm and support our forecasted revenue growth

for

fiscal '08. At September 30, 2007, backlog totaled $1.3 billion, compared to

1.5

billion reported last year. This reflects certain

larger jobs moving into rebid or option phases. You may recall option-year

revenue is added to backlog when the option is

formally awarded by the client. In fiscal 2008 we have a few large programs

where the current base contract will run out in fiscal

'08

and is then followed by an exercisable option period. Signed awards at September

30, 2007 totaled $569 million, which compares

to $717 million reported same period last year. This is offset by an increase

in

awarded and unsigned at September 30,

2007

to $310 million from $103 million at September 30, 2006. For fiscal 2007

approximately 70% of new signed awards are in

the

Operations segment, which reflects a targeted effort on the growing health

and

human services markets.

Now

let's

take a moment to focus on the sales pipeline. As of November 8, 2007, our

overall sales pipeline is at record levels and total

$1.7

billion. This compares to $1.1 billion at September 30, 2006. As a reminder,

the

Company reported pipeline -- it only includes

those opportunities where an RFP is expected to be released in the next six

month, so the opportunity has to be on the

horizon for it to be included. Of the $1.7 billion pipeline, approximately

60%

is attributable to opportunities in the Operations segment.

In addition the majority of the overall pipeline is coming from new

opportunities that are less than $50 million in value.

This reflects our continued efforts of securing new work that is less volume

driven and centered around our core competencies

in the area of operation management and BPO outsourcing.

Moving

on

to rebids, as I noted earlier, late last night we received a notice of intent

to

award the California health and care options

contract to MAXIMUS, which was our final rebid in -- which was our final rebid

in 2007. We'll be working to finalize that award

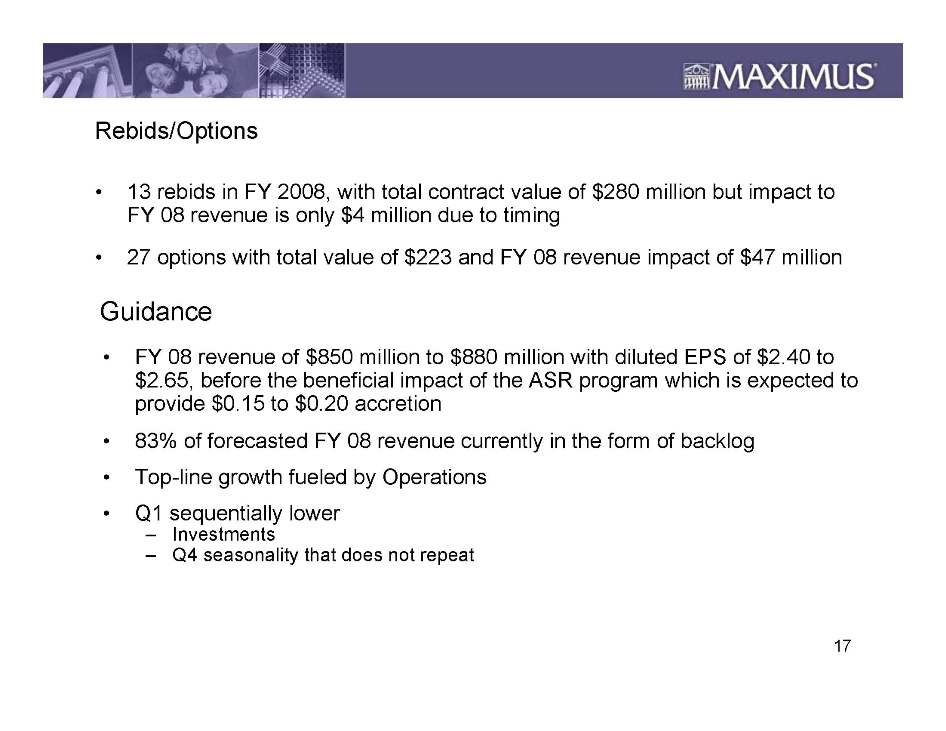

in

the coming weeks. As we look out to fiscal 2008, we have 13 rebids. These are

13

rebids expected during the year for a

total

contract value of approximately $280 million. Since most of this year's rebids

are in the second half of the year, the impact to

revenue

for fiscal 2008 is approximately only $4 million. Shifting over to option-year

exercises, we have 27 expected options in

fiscal

'08. These have a collective value of $223 million -- total contract value,

of

which we expect revenue of approximately $47

million in fiscal 2008.

Moving

on

to guidance, we expect revenue for fiscal 2008 to be in the range of $850

million to $880 million with a diluted EPS of

$2.40

to $2.65. Now this EPS range -- this is before the expected accretion of $0.15

to $0.20 per diluted share from the $150 million

ASR program, so that's -- you should note that that's before the accretion.

The

Company estimates that approximately 83%

of

forecasted fiscal 2008 revenue is presently in the form of backlog. This metric

is a very strong indicator in support of our forecasted

revenue for fiscal 2008. As we've talked about the last few quarters, fiscal

2008 top-line growth is expected to be fueled

by

new work in the Operations segment. We expect that Consulting will return to

more normalized financial performance in

fiscal

'08 with expected 10% growth. On the Systems side we're looking for revenue

growth in the range of 10% to 15% with a

much-improved operating income compared to fiscal 2007. As David talked about

earlier, the first quarter is expected to be sequentially

lower as a result of the planned investments related to new work and seasonality

in the fourth quarter that was not

repeat

in Q1.

And

now

before I open it up to Q&A I want to reinforce commitment of this management

team and the board of directors to creating

and delivering long-term shareholder value. We undertook this strategic review

process to assess MAXIMUS's future in

different scenarios, and we emerged with a focused strategy and clear sense

of

next steps. The repurchase plan provided us a

more

efficient capital structure and it is meant to send a message to our

shareholders that we are intent on delivering value, in

this

case immediately. I believe these actions underscore our confidence and our

prospects an independent Company, and our

outlook and current pipeline of new opportunities for the current year speaks

to

the anticipated growth in our operations as

we shed

legacy issues and focus our business on profitable work within our more-narrowly

defined scope of operations. I'll look

forward to updating you throughout the year on our progress. We also will be

reaching out to the investment community throughout

the year to broaden our audience and raise awareness and understanding of the

growth opportunities within MAXIMUS.

I

thank

you for your interest this morning, and now let's open the all up to

questions.

Q

U E S T

I O N S A N D A N S W E R S

Operator

[OPERATOR

INSTRUCTIONS) Our first question is from the line of Anurag Rana. Please go

ahead.

Anurag

Rana - KeyBanc Capital Markets - Analyst

Hi,

good

morning, everyone. Could you please give us some information on the offers

that

you received on the sale of the Company

and whether they were above the current stock price, and if the board was not

interested in the price that was offered?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Anurag,

this is Rich. Good morning. I'm not going to get into extensive details about

the buyers' specific offers, but I would say this

--

just let me talk about the process and give you a little bit of color. It is

clear that when we started this process in June, the capital

markets were totally different. I would say who would have guessed that both

the

equity and the debt markets would have

experienced the dynamics that they've gone through since that point in time.

And

we all know there's been an incredible drop

in

the volume of M&A activity in the marketplace and I dare say that not a day

has passed where a transaction has not been

tabled. We did receive very strong indications at first; nearly 70 indications

of interest. We did receive written and verbal offers,

but these started to dissipate as the market dissipated, just as you've seen

with other transactions. So those who had strong

initial interest did not advance to the finish line in this

process.

When

I

think about the situation, again, these folks were very, very mindful of the

premium that perhaps they sensed was factored

into price, and again, these are determinations to be made by buyers, not by

us.

But I do think, as you have, that some folks

were

mindful of what they sensed was a premium factored into the price of the stock.

I'd also add some folks were interested in

parts

but not all of the business, and some were preoccupied with other deals, quite

frankly, that they had in the hopper. And

lastly, I'd say that some were simply not financially or otherwise in a position

to pull it off, perhaps tied up with their own LBO

issues. As I wrap it up, I get back to the one predominant issue that was clear

in this situation was the overall condition and deterioration

of the capital markets. That helpful?

Anurag

Rana - KeyBanc Capital Markets - Analyst

That's

really helpful, thank you. Also your guidance for next year suggests the margins

around 10%. Now after your internal review

and

revised focus what do you think long-term margins for MAXIMUS could be in a

few

years?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

I

don't

think -- I don't want to go there at this point in time. I think what we need

to

do is -- is move forward and look at those business

units that require some action to get us the focus, and one of the bi-products

certainly will be margin. Certainly we'd like

to

take actions that improve and not deteriorate margin, but that's one element

of

the equation. So when those margin improves

happen and to what extent I think is really a question to be asked on future

calls but a very good one.

Anurag

Rana - KeyBanc Capital Markets - Analyst

Thank

you.

Operator

Our

next

question comes is from the line of Matthew McKay with Jefferies & Company.

Please go ahead.

Matthew

McKay - Jefferies & Company - Analyst

Good

morning, guys.

David

Walker - MAXIMUS, Inc. - CFO

Hi,

Matt.

Matthew

McKay - Jefferies & Company - Analyst

Fist

question just to you, Rich, is just what your plans are. If you plan to --

now

that there's a no-sale here, are you going to stay with

the

Company or just a little insight in to what your thinking is?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Matt,

no

question, I'm going to stay with the Company. I won't get into details about

why

I like the Company, what I like about the

Company, why I enjoy working here, that's a longer conversation, but the short

of it is I'm very committed to the Company, very

pleased to be here, and very pleased with this path and opportunity to take

it

to the next chapter.

Matthew

McKay - Jefferies & Company - Analyst

Okay,

good. And then just on the winning California, congratulations. If I

--

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Thank

you

very much.

Matthew

McKay - Jefferies & Company - Analyst

Yes.

If I

understand how that's going to work, I think the existing contract runs through

the end of this fiscal year for you guys. With

the

new contract, is it going to run in parallel through this fiscal year, so would

it actually be accretive to your guidance?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

No,

I

think the way that this will work, I think actually the new contract is

effective in January of '09, so this new contract -- I'm sorry

--

David

Walker - MAXIMUS, Inc. - CFO

Of

'08.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

So

for

purpo -- this is win that really is for purposes of revenue in Operations an

'09

issue, not an '08 issue.

Matthew

McKay - Jefferies & Company - Analyst

Okay,

so

you're not going to get any revenue from this starting January

2008?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

There's

a

transition period so we're not going to get additional or double up on

revenue.

Matthew

McKay - Jefferies & Company - Analyst

Okay.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

We've

already factors full operations of this project into our '08

forecast.

Matthew

McKay - Jefferies & Company - Analyst

Okay.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

So

really

what this does is solidify revenue beyond fiscal '08 -- '09 and even beyond

fiscal '09.

Matthew

McKay - Jefferies & Company - Analyst

Okay.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Okay?

Matthew

McKay - Jefferies & Company - Analyst

That

is

helpful. And just one last question, just I'm curious, as you went through

this

strategic alternative thought process and obviously

came with the accelerated stock repurchase, I just -- was there a good reason

why you didn't think about maybe doing

a

more aggressive acquisition strategy?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Yes,

I

think there is a good reason why, and there's several factors that went in

to

this, and we really did explore all alternatives. We

really

do think focus is important. Quite frankly, we think-- when we look at our

stock

price, and we look at the potential of our

operations -- and certainly you're well aware of what we've managed to do in

improving that in fiscal '07, and I think we've got

some

pretty good headway as we go in to fiscal '08 -- we think the price of the

stock

is ripe for purposes of repurchases. We think

it's

substantially accretive, and frankly, our shareholders -- and we've had

discussions with our shareholders -- they're very receptive

to some form of repatriation. I don't think we're excessively capitalized --

excessively under-capitalized with this ASR program.

I

think it leaves us with good capitalizations to consider alternatives as we

move

forward but we didn't want to rush into

an

acquisition-type situation. It was not the right path for us at this

time.

Matthew

McKay - Jefferies & Company - Analyst

Okay.

Great. Thanks a lot, guys.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

You

bet.

Operator

Our

next

question comes is from the line of Charles Strauzer with CJS Securities, Please

go ahead.

Charles

Strauzer - CJS Securities - Analyst

Good

morning, Rich.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Good

morning, Charles how are you?

Charles

Strauzer - CJS Securities - Analyst

Good,

thank you. Just a question just to clarify on the guidance, if I could. Last

quarter you gave initial '08 guidance of revenue greater

than 10%, and now you're implying mid to high teens top-line growth which is

very robust but you're sticking to the 10%

margin

goal and only raising the bottom end of your original EPS guidance. Are there

some facts in there other than the Medicaid

(inaudible) up-front costs? [Fact is that the EPS of this is] because the cash

interest income is going away? Is it higher tax

rates?

What are the factors that are going into that?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

I'm

going

to ask Dave Walker to respond to that.

David

Walker - MAXIMUS, Inc. - CFO

We

normalized revenue -- I guess the way I think of it, we normalized for you

at

$2,01, We're showing you our revenue increases, and

a lot

of reasons for that, a lot of new wins this year on the fourth quarter. Texas

for a full-year run rate under the new contract it

certainly drives up the top line, but that's why we've got the guidance of

the

$850 million, $880 million. If you take the 111 to

141,

which is the increment of revenue over this year and you put a 10% operating

margin, [add as tax affected], you're talking 30

--

$0.29 to $0.37 a share. And so -- of course, like all things, Rich and I take

on

additional challenges, so there's about a $0.10 to

$0.27

challenge to, in fact continue, to improve the operating income, so that's

the

basis of it. It's the $2.01 plus the $0.29 to $0.37

a

share that's implied in the revenue growth and it's $0.10 to $0.27 a share

just

really from continuing to drive up margins. And

certainly when we look at some of our segments we 'd like to see

improvement.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

And

I

would add, Charles, that this is before the ASR program, so --

David

Walker - MAXIMUS, Inc. - CFO

Yes.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

--

as you

move forward with your new models you'll have to factor in all of the impacts

of

the ASR, and that would include, as you

referred to, there'd be less other income, interest income, so that would have

to be adjusted, but also the big impact, obviously,

would be in the denominator of the EPS calculation, so you'd have to do that

on

top of $2.40 to $2.65. We felt very comfortable

in moving up the lower end of the range from what had been $2.35. Keep in mind

that $2.35 to -- that earlier range was

very,

very early in the year. It was before we went through our planning process.

We

felt comfortable moving up the lower end

of the

range, but I'd emphasis it is, by definition, the lower end of the

range.

Charles

Strauzer - CJS Securities - Analyst

Got

it. I

just was trying to get at, when you look at the various segments and you gave

up

some pretty good guidance for growth rates

for

the top line, but are you implying that certain segments will have less

profitability year-over-year; i.e., the Systems and Consulting

segments?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

We're

not

looking for any of our segments to have less profitability year over

year.

Charles

Strauzer - CJS Securities - Analyst

On

a

margin basis?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

On

a

margin basis.

Charles

Strauzer - CJS Securities - Analyst

Got

it,

great. Thank you very much. Is there any cap on the VWAP adjustments, Rich,

on

the ASR?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

I

can't

get into the details on that one. We'd have -- we're going through the legal

processes of filing that document and what should

be

public and what shouldn't be public is something the lawyers are deal with

right

now, Charles.

Lisa

Miles

- MAXIMUS, Inc. - Director - Investor

Relations

Charlie,

we will be filing that as an 8-K probably early next week, so you'll be able

to

take a look at it.

Charles

Strauzer - CJS Securities - Analyst

Well,

thank you very much.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

You

bet,

thank you.

Operator

(OPERATOR

INSTRUCTIONS) Our next question is from the line of Jason Kupferberg with UBS.

Please go ahead.

Jason

Kupferberg -

UBS -

Analyst

Thank

you,

and good morning. Just a question on -- Rich, as you said pretty much all

alternatives were considered here. I was curious

specifically with regard to the potential for a dutch tender, and why that

might

have been ultimately decided against in

favor

of the ASR, what the pros and cons specifically as it relates to that potential

option?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Yes,

I

think -- boy, it quickly gets very -- almost nearly judgment Jason, in terms

of

what form -- what vehicle do you select to effectuate

the return to your shareholders, and we went through that whole litany of

alternatives, including dutch tender, increasing

an ordinary dividend, large dividend, and we ended up on the ASR because there's

certain aspects to the ASR that we

liked.

We liked the certainty. We liked the immediate aspects of it. We liked the

immediate accretion. We felt that since we're not

necessarily stock pickers, it also provided us a vehicle to get the stock at

what we think is fair prices. The dutch tender had some

appeal, but also had some negatives it to as well. They're not always

successful. They're certainly not as -- as fast as an ASR,

so we

decided to go with the ASR for that -- those reasons.

Jason

Kupferberg -

UBS -

Analyst

Okay.

That's helpful. And on the Accenture arbitration, any updates there? And I

know

you had $0.06 of legal charges in Q4 for that,

what

are you looking for going forward? Are there going to be continuing ongoing

legal expenses there and are any of those

baked in to the EPS guidance?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Here's

where we are with the arbitration with Accenture. It's basically law firm to

law

firm and representing each side as they move

forward to a currently scheduled arbitration in the middle of April, I believe,

so that's really the process. There has not been

settlement discussions or negotiations at this time. We did accrue an additional

amount in this fourth quarter, and it depends

how things work out, but we believe that the accrual is necessary and sufficient

to get us through the beginning of next

year,

and we're also exploring the viability of some insurance coverage as it relates

to legal cost beyond that point in time.

Jason

Kupferberg -

UBS -

Analyst

Okay.

And

just --

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

The

last

element of your question, we have not baked into our '08 guidance any additional

legal costs for that matter.

Jason

Kupferberg -

UBS -

Analyst

Okay,

and

just a broad macro question. Obviously a lot of questions around the state

and

local budgets now with some of the slowdown

in the macro economy and property taxes being down and I think there was some

article about California specifically yesterday

facing some unexpected deficits. How are you guys looking at that? I'm sure

you

watch it closely and arguably your businesses,

different to some extent now than during the last time that the states faced

a

real fiscal crunch, but to what extent have

you

tried to factor some of that into your outlook as well, some of the stuff that

might be beyond your control?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Well,

I

think of it this way and I do think there are some macro issues -- state and

local issues that are circling, and certainly the general

state of the economy does have -- somewhat delayed, but does have impacts on

state and local budgets. The other factors

that one might mention is what 's going on from a political perspective with

SCHIP authorization, et cetera, so we watch that

very

closely. It's interesting with our business model -- and we've learned this

in

prior periods and you go back to the beginning

of 2000 when states had similar issues -- is most of our product line and

service offerings are tied to federally-mandated programs,

so the programs must continue. Our experience is that the states generally

continue with their current level of spending,

so we find during steep recessionary times some risk of marginal cut back on

some programs but the more hardy programs

those that are federally mandated, tend to continue at the same level of spend.

So I think that's one good thing about our

business model. States do have some discretionary spend areas, but we tend

not

to concentrate on those discretionary spend

areas.

Jason

Kupferberg -

UBS -

Analyst

Okay.

And

just a last question for David if I can. Operating and free cash flow

expectations for fiscal '08?

David

Walker - MAXIMUS, Inc. - CFO

Sure.

Your

cash flow from operations will range somewhere from $50 million to $60 million

-- and I'll provide a little flavor for that

--

and your free cash flow excluding the repurchase will be somewhere in the $30

million to $40 million range. And one of the

things

I'll say, if you look year over year, we did a great job in '07 of driving

down

DSOs, so receivables on a cash-flow perspective

actually was a net contributor. But as we grow -- when we look in to '08 --

the

receivables -- and we're using 80 days in

our

modeling -- we'll consume working capital, so growth has a tendency to do

that.

On

our

CapEx, we averaged about 1.8% of our revenue last year in CapEx spending --

capital assets, but we will need some additional

infrastructure, financial systems, et cetera, so we baked that additional

spending in. And then we spent cap software about

$1.5

million a quarter in '07, and I would expect something to continue in that

range. Last year we generated a lot of cash from

taxes, and we fortunately we'll be in a tax paying position. It's a high-class

problem and we like that, so that'll change the dynamics

a

little bit. So hopefully that helps.

Jason

Kupferberg -

UBS -

Analyst

It

does.

Thanks, guys.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Yes.

Operator

Our

next

question is from the line of Shlomo Rosenbaum with Stifel Nicolaus. Please

go

ahead.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Hi,

thank

you for taking my question. I wanted to delve in a little bit to business units.

The margins were very high in Operations segment

for the second quarter in a row. We historically have thought about that segment

being maybe 8% to 12% margins and

now

we're seeing like 17.6%, 16.6%. Could you talk specifically about what happened

in the last couple of quarters and has the

bar

been raised?

David

Walker - MAXIMUS, Inc. - CFO

There's

certain aspects of the Operations business is somewhat seasonal so you have

to

be careful for that. For example, we have

a tax

crediting business in there that tends to come on really strong in Q4, so that

certainly plays a factor. And some of our

growth

in Operations will be lower risk work, but lower margin work, so that on

weighted average will blend it down next year.

But

there's no doubt about it, the team's done a great job in '07, I think, of

optimizing return to shareholders and striking the

right

balance.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

And

I'd

only add to that in Q3 we did see a nonrecurring uptick as it relates to some

nonrecurring. in essence. recoveries on the Texas

project --

David

Walker - MAXIMUS, Inc. - CFO

Yes.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

--

so that

helped the margin quite a bit. And as Dave says, in Q3 and Q4 we do get a

respectable amount of seasonal profit from our

tax

business which dissipates in Q1 and Q2, so you should expect to see some flux

because of those dynamics.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Okay,

and

then on the consulting business you talked a little bit about some work that.

I

guess. was federal -- some healthcare work.

Is

that [RevMAX] work that you're not pursuing over there? Is that some of the

reasons -- some of the work that you're getting

out of?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Well,

we're pursuing RevMAX, we're just no longer pursuing RevMAX on a contingent

basis when we're chasing after federal dollars.

We don't think that's in our best interest. So we're still doing that on a

fixed-fee for basis -- on basis. But with that said, some

customers won't mind that model as attractive, even though we think it provides

a high-value proposition. So with that said,

I

think we're transitioning into some other work area and we've been pretty

successful; some wins in fraud, waste and abuse

and

the PERM work that we talked about. And the nature to sum that for the fraud,

waste and abuse, it's similar to RevMAX in

that we

have to incur some costs and build some models and do some things before we

start getting transactional revenue from

that.

So we're going to be spending some money towards that, which will ultimately

be

accretive in the year -- in the early parts

of

the year, and we should see the benefit on the back end.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

What

about

some of the timing and billing of work issues and consulting fees, just give

a

little bit more detail on what that was?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Well,

there's always seasonality inside of consulting, so when we have these

contingent work things, it could swing on an individual

contract by several million dollars from one quarter up or one quarter down,

so

it can be volatile quarter over quarter. And

frankly, as we get away from the RevMAX fee for service it should have the

effect of at least that portion of the work smoothing

it overall. But overall, we look to have an operating income margin there in

excess of 10%. It's a consulting business should

be

much better than that.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Okay.

Do

you have a percentage of your work that's federally funded, just of your overall

business?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

We

have

looked at that and we believe approximately 70% of our business is federally

funded. Now it may -- it may ultimately go

through

the states and the states would be the direct payor to us, but it's federal

funds that pay the states and then pay us, so

our

estimate is about 70% of our revenues.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Okay,

great, and I'm going to sneak in one last one.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Sure.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Are

there

any -- you talked about some of your contracts that are being rebid and then

some of the options. It seems like the rebids

are

not going to have a big impact this year, but are there any fairly large

dollar-sized contracts that we should be keeping our

eyes

on for either the rebid or the options?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Yes,

I

think '08 shapes up to have some significant rebid/option periods. Up until

last

night, I was thinking that HCO would be the

most

significant rebid event in '08, but as it works out, we're great to have that

in

the win column. It's a great way to start out

fiscal

'08 to put that one in the win column. As we go into '08, the significant

engagements that we're focused on would be winning

the long-term Texas contracts, because we have some work in Texas that will

run

through December of '08 and then will

be up

for rebid. We have some other work that runs through June of 2010, which

contracts we're in the process of finalizing.

So

some of

that work will be up for rebid in fiscal '08, so that will be important. And

I

think we also have large -- we have some work

that

we do for the federal government, CMS in particular, quality assurance work

in

our federal division within our Operations segment,

that's up for rebid. And then I think we have a New York contract where we've

got some option extensions that we need

to

achieve.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Okay.

But

your biggest two or three, are these the biggest two or three, basically? You're

looking at the Texas, the one with CMS,

and

then the New York contract?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

That's

correct.

Lisa

Miles

- MAXIMUS, Inc. - Director - Investor

Relations

I

just

wanted to clarify, Shlomo, on the rebids, Texas and the CMS work are the bulk

of

the rebids. New York Medicaid Choice, that

actually is an option year that will be decided in fiscal 2008 but it's not

a

revenue impact until fiscal 2009.

Shlomo

Rosenbaum - Stifel Nicolaus - Analyst

Okay.

I'll

let somebody else ask and I'll get back in line.

Lisa

Miles

- MAXIMUS, Inc. - Director - Investor

Relations

Okay,

thanks.

Operator

Our

next

question is from the line of Roger Chuchen with Morgan Stanley. Please go

ahead.

Rich

Glass

- Morgan Stanley - Analyst

Hi,

guys,

it's Rich Glass, actually. So much for that one-question rule, huh? Can I ask

you to give us a little more insight into the --

part of

your release where you talked about refining the focus on core health and human

services operations and seeking possible

alternatives for certain non-core assets and basically what we're talking about

there potentially?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

I'd

be

glad to do that, Rich. What we are doing, what we have done and will continue

to

do -- I don't think you just do this once and

go

back -- we're going through all of our business offerings and assessing them

vis-a-vis the criteria that I talked about in the

call.

And to recap that, we have some that fit squarely in what we consider to be

our

real growth areas. We have some that --

and

it's a bit of a circle in an oval peg, but still they're profitable, they're

accretive, there's no compelling reason to exit that line

of

business. And then we have some that, quite frankly, we don't have the time

to

best manage those businesses. We don't see

them

as synergistic with our other businesses, and we think in the hands of others,

they could do much better, the employees would

have

more growth opportunities, their shareholders would see greater

returns.

One

experience I've had over the last 18 months -- and this is a reconfirmation

that

I get on quarterly basis, it's a very pleasant confirmation

-- and that is we do extremely well in our model when we are number one or

number two. We just -- one of our key

differentiators in the market is our subject matter expertise and I think that's

another way to say we really know this space better

than other people. And when that happens our customers come to us. They have

a

strong preference to renew with us. They're

willing -- they're very willing to have more more fair negotiations about price

and terms, which translates into our margins.

They really have a bias for MAXIMUS serving them. And I think that's all good,

and I think that all translates from a shareholders

perspective into greater returns and better margins.

So

we're

going to focus the Company in that direction as opposed to being a quite

diversified Company. I really want to move the

Company to be focused on those growth areas, and we're mapping that over to

what

we think our macro growth area is. It's

very,

very clear in our society and our governments that they continue to have big

issues as it relates to health, government management

of health, fraud waste and abuse, even in all of those areas where we see

management of employment in these various

governments and we're seeing some strong indications of what we do in the work

force area as coming back, particularly with

DRA.

So there's a lot of things where we see strong growth and what we want to do

is

make that our bulls eye, be number one

or two

in the marketplace, and I think that's going to translate into better financial

performance. So with that as a backdrop, we

are

going through and looking at those business units that we think we should

consider -- for which we should consider alternatives.

I'm not going about it as a fire sale. I want to be reasonable about it and

I'll

be reasonable to the employees, but we

are

definitely marching down the path and looking for selective divisions for other

alternatives.

Rich

Glass

- Morgan Stanley - Analyst

Okay,

so

we are really focusing on maybe Operations here, considering on what you're

talking about in terms of focus --

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Yes,

our

model I think works best when we have long-term outsourcing contracts, contracts

that run two, three, four, five years. And

quite

frankly plan A is we're going to be doing this work for these governments for

not this contract, but our model works very

well

and the industry, I think, is very much driven toward renewing the contracts.

Plan A is that you do those contracts for 20

years,

not --

Rich

Glass

- Morgan Stanley - Analyst

If

I'm

hearing it right, your Systems and Consulting you don't have to own, maybe

they're worth more to somebody else, maybe they're

a

better fit. And you put in a buyback today of $150 million, and then $40 million

beyond that, and then you might have proceeds

from any other sales above and beyond that as well, which you could use for

other corporate purposes. Is that fair?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

That

is

very, very fair.

Rich

Glass

- Morgan Stanley - Analyst

Okay.

Sounds good. Thanks.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Good.

Thank you very much, Rich.

Operator

Our

next

question is from the line of Jerry Weintraub with Weintraub Capital. Please

go

ahead. Jerry, your line is open.

Jerry

Weintraub - Weintraub Capital - Analyst

I

have no

questions.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Okay.

Operator

Our

last

question is from the line of Steve Balog with Cedar Creek Management. Please

go

ahead.

Steve

Balog - Cedar Creek Management - Analyst

Thanks.

The original stated reason for selling the Company was there was some thought

we

should be part of a much larger company,

if I recall something with systems expertise, so that was not a financial buyer.

I would have thought that a -- that a larger

company like that, the equity markets -- excuse me, the debt markets and getting

financing wouldn't be an issue for the IBMs,

EVs,

Accentures of the world, companies of that class that wouldn't matter. That's

question one, where does that work? Are

we now

at a disadvantage because we're not part of larger company with the system's

expertise? And maybe the whole explanation

of this is -- not to put words in your mouth, but it were the strategics the

ones that only wanted part of the company, like

the

Operations part, but they didn't want the rest? Could you help me sort through

all that?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Actually

-- and again, I'm not going to get into individual buyer situations, but it's

a

not fair to map it over and say just the strategics

just wanted parts. That's not a general rule that's fair to the situation.

We

did receive substantial interest across the board,

and

as it relates to your question on the systems piece, you're right. One of the

reasons for considering a combination with

a

strategic, and perhaps the most compelling one, is to further improve the

Company's sure IT capabilities. That being said, we

have

not rested on our laurels and as we talked about in our call, we've made some

pretty significant investments in some proprietary

technology that gives us a competitive advantage as we offer our BPO solution

in

the marketplace, and I specifically mentioned

the productization efforts we've made in EB as well as SCHIP.

That's

not

the type of technology solution we were looking for from a complementary

partner. It would be more -- just think about

classic ITO. And I still think that that is a factor. I still think that that

remains how we couple with those types of providers, because

we

don't envision ourselves as being an ITO -- pure ITO outsourcing firm. As in

the

past we've partnered with them, we'll

sub

them in and we'll continue to do that. So we don't lose any -- I don't think

we'll lose any momentum, but I still think that's

a

potential synergy that's out there.

Steve

Balog - Cedar Creek Management - Analyst

Okay.

Back

to the other question I had, though, is those kinds of companies that I would

have thought would be interested are not

--

don't -- can find the financing no problem, this is a smallish acquisition

for

them. So I guess the highest interest -- or they didn't

want to pay this kind -- those types of buyers didn't want to pay the price

we

needed?

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

I

think

that's right. I think that's a fair conclusion, and it's very difficult. There's

no generalty in terms of why a strategic took a position.

As I said earlier, there's some factors out there that I think certain ones

may

have considered in the process, again, sensing

--

many were mindful of a premium being factored into the price. As I said, some

are interested in parts, but not all of the

business, and I do think that some were preoccupied. You've seen some

announcements lately that are pretty sizeable for some

of

those folks that you otherwise would think would have an interest.

Steve

Balog - Cedar Creek Management - Analyst

Great.

Thank you.

Rich

Montoni - MAXIMUS, Inc. - President &

CEO

Okay.

Okay. I have one last clarifying point in response to my discussion in response

to Rich Glass's situation about Consulting and

Systems. I want to emphasize that these are certain divisions inside these

segments, not persuasiveness as it relates to all of

Consulting or all of Systems. In fact I do think there's a very good fit for

some of our Consulting work that's complementary to

our

service offerings and product offerings in health and human services. It's

one

of the ways we distinguish ourselves as subject-matter

experts, okay?

Lisa

Miles

- MAXIMUS, Inc. - Director - Investor

Relations

Operator,

that ends our call today.

Operator

Ladies

and

gentlemen, a replay of this call will be available to you. Your replay

information can be found on the press release. The

direct

link is

reg.linkconferencecall.com/digitalplayback/digitalplaybackregistration.aspx?recie=5826.

Ladies and gentlemen, this

concludes today's presentation. Thank you for your participation. You may now

disconnect.

D

I S C L

A I M E R

Thomson

Financial reserves the right to make changes to documents, content, or other

information on this web site without obligation to notify any person of such

changes.

In

the

conference calls upon which Event Transcripts are based, companies may make

projections or other forward-looking statements regarding a variety of items.

Such forward-looking statements

are based upon current expectations and involve risks and uncertainties. Actual

results may differ materially from those stated in any forward-looking statement

based on a number

of

important factors and risks, which are more specifically identified in the

companies' most recent SEC filings. Although the companies may indicate and

believe that the assumptions

underlying the forward-looking statements are reasonable, any of the assumptions

could prove inaccurate or incorrect and, therefore, there can be no assurance

that the results

contemplated in the forward-looking statements will be realized.

THE

INFORMATION CONTAINED IN EVENT TRANSCRIPTS IS A TEXTUAL REPRESENTATION OF THE

APPLICABLE COMPANY'S CONFERENCE CALL AND WHILE EFFORTS ARE MADE TO PROVIDE

AN

ACCURATE TRANSCRIPTION, THERE MAY BE MATERIAL ERRORS, OMISSIONS, OR INACCURACIES

IN THE REPORTING OF THE SUBSTANCE OF THE CONFERENCE CALLS. IN NO WAY DOES

THOMSON

FINANCIAL OR THE APPLICABLE COMPANY ASSUME ANY RESPONSIBILITY FOR ANY INVESTMENT

OR OTHER DECISIONS MADE BASED UPON THE INFORMATION PROVIDED ON THIS

WEB

SITE OR IN ANY EVENT TRANSCRIPT. USERS ARE ADVISED TO REVIEW THE APPLICABLE

COMPANY'S CONFERENCE CALL ITSELF AND THE APPLICABLE COMPANY'S SEC FILINGS

BEFORE

MAKING ANY INVESTMENT OR OTHER DECISIONS.

©2007,

Thomson Financial. All Rights

Reserved.

David

N. Walker Chief Financial Officer and Treasurer 4th Quarter Fiscal

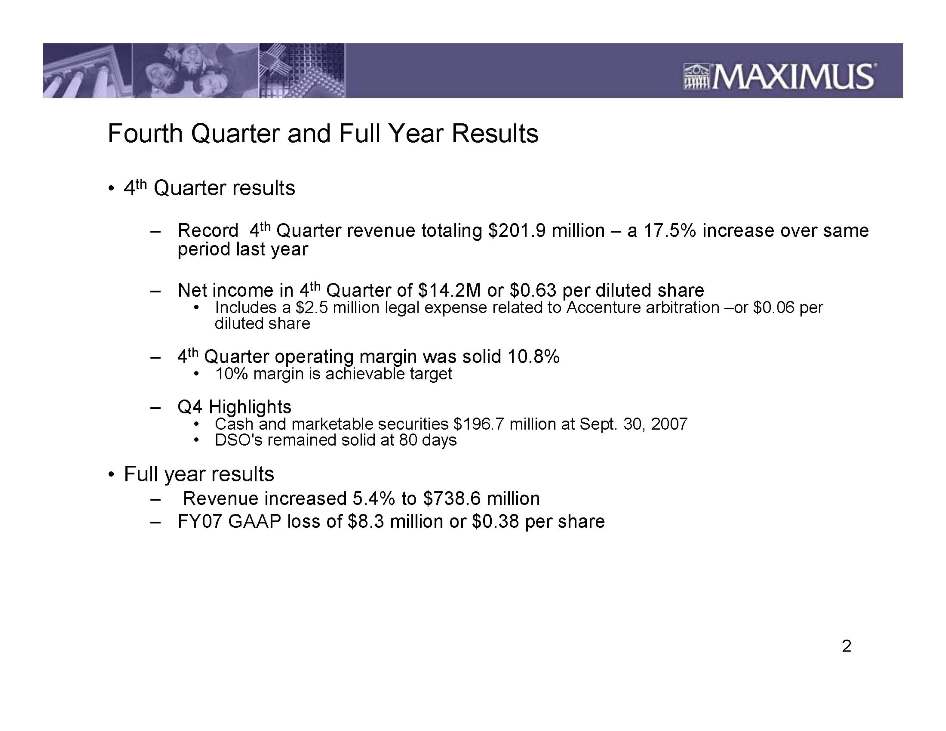

2007 November 15, 2007 Fourth Quarter and Full Year Results 4th

Quarter results

Fourth

Quarter and Full Year Results 4th Quarter results Record

4th Quarter revenue totaling $201.9 million a 17.5% increase

over same period last year Net income in 4th Quarter of $14.2M or

$0.63 per diluted share Includes a $2.5 million legal expense related to

Accenture arbitration or $0.06 per diluted share 4th

Quarter operating margin was solid 10.8% 10% margin is achievable

target Q4 Highlights Cash and marketable securities $196.7

million at Sept. 30, 2007 DSO's remained solid at 80 days Full year

results Revenue increased 5.4% to $738.6 million FY07 GAAP loss

of $8.3 million or $0.38 per share

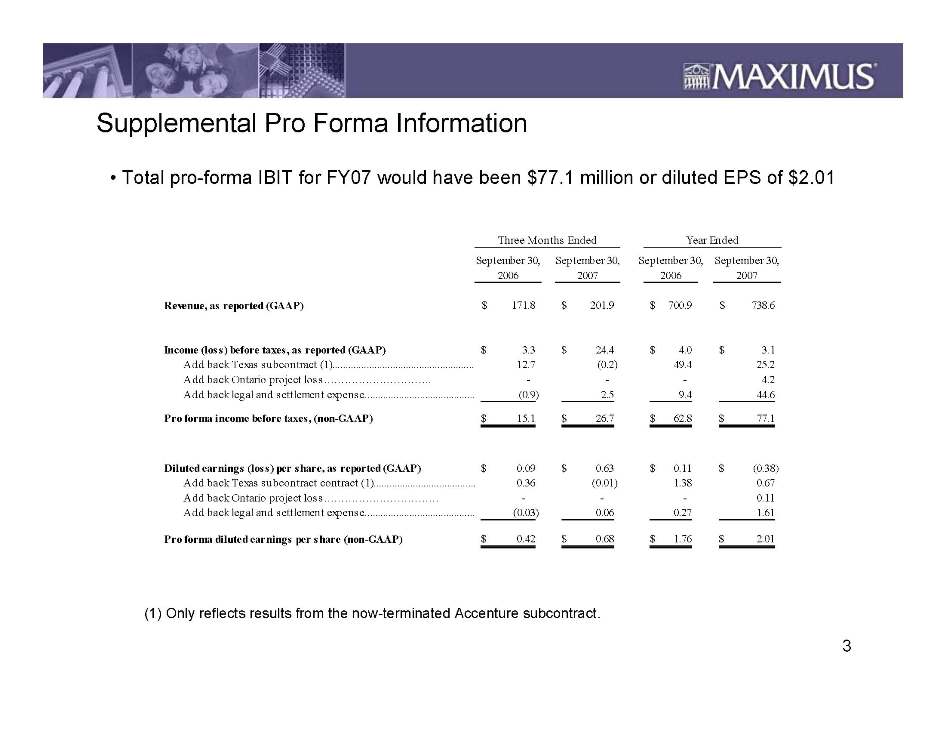

Supplemental

Pro Forma Information Total pro-forma IBIT for FY07 would have been $77.1

million or diluted EPS of $2.01 Three Months Ended Year Ended September 30,

September 30, September 30, September 30, 2006 2007 2006 2007 Revenue, as

reported (GAAP) $ 171.8 $ 201.9 $ 700.9 $ 738.6 Income (loss) before taxes

, as

reported(GAAP) $ Add back Texas subcontract (1) Add back Ontario project

loss

Add back legal and settlement expense 3.3 $ 24.4 $4.0 $ 3.1 12.7 (0.2) 49.4

25.2

---4.2 (0.9) 2.5 9.4 44.6 Pro forma income before taxes, (non-GAAP) $15.1

$ 26.7

$ 62.8 $ 77.1 Diluted earnings (loss)per share, as reported (GAAP) $ Add

back

Texas subcontract contract (1) Add back Ontario project loss Add back legal

and

settlement expense. 0.09 $ 0.63 $ 0.11 $ (0.38) 0.36 (0.01) 1.38 0.67 ---0.11

(0.03) 0.06 0.27 1.61 Pro forma diluted earnings per share (non-GAAP) $0.42

$

0.68 $ 1.76 $ 2.01 (1) Only reflects results from the now-terminated Accenture

subcontract.

Results

by Business Segment Operations Segment Operations Segment delivers strong

revenue growth Q4 revenue increased 23% to $141.9 million compared to last

year

FY07 revenue of $503.6 million a 6.9% increase over 2006 Revenue grew 9%

-excluding divested businesses in fiscal 2006 Operations Segment operating

income Q4 operating income of $23.5 million, or a margin of 16.6% FY07 operating

income of $39.1 million or operating margin of 7.8% Pro forma operating margin

was 13.1% excluding losses on the now-terminated Accenture subcontract New

Texas

contracts and strong organic growth provided improvement in second half of

FY 07

Segment expected to be major source of top-line growth in FY08 as it continues

to win new work Planned start-up costs for certain contracts will reduce

sequential operating income in first half of FY 08

Results

by Business Segment Consulting & Systems Consulting Segment Revenue $22.5

million in 4th quarter with operating income of $554,000 and a 2.5% margin

Full

year revenue totaled $93.7 million with operating income of $6.4 million

and a

margin of 6.9% Systems Segment Q4 Revenue grew to $37.4 million earned $466,000

Full year revenue increased 11% to $141.3 million compared to fiscal 2006

driven

by new contracts in ERP division with statewide implementations in TN and

DE The

Segment lost $4.7 million in fiscal 2007 resulting from ongoing software

investments and effort to resolve legacy contracts

Balance

Sheet and Cash Flow Items Accounts Receivable at September 30, 2007 totaled

$175.2 million Another $1.9 million in long-term accounts receivable classified

as other assets is on balance sheet DSO’s at 80 days at September 30, 2007

Targeted DSO range of 75 to 85 days reflects ongoing focus on tightly managing

cash and receivables at all levels Cash Flow Negative cash flow in the fourth

quarter resulting from outlay of $30.5 million in previously disclosed District

of Columbia settlement Excluding D.C. payment, cash from operations in 4th

quarter was $22.3 million with free cash flow of $14.9 million Fiscal 2007

cash

from operations totaled $51.2 million with free cash flow of $33.4 million

(Adjusting for D.C. settlement cash flow from operations was $81.7 million

and

free cash flow would have been $63.9 million)

Richard

A. Montoni President and Chief Executive Officer 4th Quarter Fiscal

2007 November 15, 2007

Breaking

News: CA HCO Rebid -Notice of Intent To Award NOTICE OF INTENT TO

AWARD CALIFORNIA DEPARTMENT OF HEALTH CARE SERVICES 1501 Capitol Ave,

Guard Station Sacramento, CA 95814 November 14, 2007 IN CONSIDERATION

OF THE RESPONSE TO THE CALIFORNIA DEPARTMENT OF HEALTH CARE SERVICES’ HEALTH

CARE OPTIONS PROGRAM REQUEST FOR PROPOSAL (RFP) 06-55000 THE DEPARTMENT HEREBY

ANNOUNCES ITS INTENT TO AWARD A CONTRACT TO: MAXIMUS, Inc. 11419

Sunset Hills Road Reston, VA 20190 THE ABOVE-NAMED PARTY WILL

PARTICIPATE WITH THE CALIFORNIA DEPARTMENT OF HEALTH CARE SERVICES IN THE

EXECUTION OF THE FINAL TERMS AND CONDITIONS OF THE CONTRACT FOR

AWARD.

Concluded

Strategic Review Process Thorough and extensive review process Much interest

shown from outside parties on variety of fronts Market dynamics impacted

process Not immune to broader market conditions Substantial increase

in cost of capital Remain an independent public, company, coupled with

meaningful capitalization efficiency

Three

Key Initiatives 1. Capitalization $150 million Accelerated Share Repurchase

(ASR) Plan to commence end of business today $40.0 million remains available

under board authorized share repurchase program at September 30, 2007 Plan

to

secure an additional $50 to $75 million line of credit to provideadditional

financial flexibility 2. Concentrate focus on core markets to fuel growth

Potential investments, partnerships and tuck-in acquisitions 3. Consider

pursuit

of selected divestitures Businesses which may not fit within our primary

markets

Could be attractive to a player more focused on that market

space

Accelerated

Share Repurchase program Program calls for accelerated repurchase of shares

up

to $150 million UBS to purchase equivalent number of shares in open market

over

next nine months MAXIMUS’ initial price to be adjusted up or down based on the

volume-weighted average price (VWAP) during this period Price adjustment

may be

settled in cash or shares of stock Program expected to be accretive by approx.

$0.15 to $0.20 per share in fiscal 2008 This is the first available opportunity

to pursue a meaningful repurchase program In addition to ASR, $40.0 million

remains available under the current board authorized share repurchase program

to

resume at the end of the ASR ASR program better positions MAXIMUS for the

future

Provides MAXIMUS financial flexibility necessary to continue to invest and

grow

business Improves efficiency of capital structure, lowers cost of capital,

and

is immediately accretive

Longer-Term

Growth Vision Refine focus on Core Competencies Holding #1 or #2 position

in its

markets The ability to meet clients’ needs with cost-effective and efficient

solutions Significant growth potential in expanding markets Best way to drive