Exhibit

99.2

Lisa

Miles:

Good

morning and thank you for joining us for our first quarter earnings conference

call. If you wish to follow along, we’ve posted a presentation on our website,

under the Investor Relations page. On the call today is Rich Montoni, Chief

Executive Officer and David Walker, Chief Financial Officer. Following our

prepared comments, we will open the call up for Q&A.

Forward

Looking Statement:

Before

we

begin, I’d like to remind everybody that a number of statements being made today

will be forward-looking in nature. Please remember that such statements are

only

predictions, and actual events or results may differ materially as a result

of

risks we face, including those discussed in exhibit 99.1 of our SEC filings.

We

encourage you to review the summary of these risks in our most recent 10K,

filed

with the SEC on February 8th. The Company does not assume any obligation to

revise or update these forward-looking statements to reflect subsequent events

or circumstances.

And

with

that, I’ll turn the call over to Dave.

David

Walker

Draft

CFO comments Q2 2007

Thanks

Lisa. Good morning.

This

morning the Company reported second quarter revenue totaling $179.1 million

and

net income of $2.4 million or $0.11 per diluted share.

As

outlined in our press release, financial results are comprised of three

components:

| § |

Losses

on the Texas contract;

|

For

the

second quarter, revenue from the Texas project was $11.2 million and generated

a

pre-tax loss of $6.5 million or $0.18 per diluted share. You may recall that

we

had estimated that the second quarter pre-tax loss on the Texas project was

expected to be in the range of $13 million to $18 million.

Results

from Texas were better than expected due to the recognition of deferred revenue

and collection of previously reserved receivables. This was somewhat offset

by

costs incurred for work performed under the new contracts where we were unable

to recognize the revenue in the second quarter. This will provide a benefit

in

the third quarter as we expect results from the Texas project will be slightly

more accretive in the quarter.

The

Company is now operating under new contracts being performed directly for the

Texas Health and Human Services Commission. Beginning in the third quarter,

we

no longer plan to separately disclose the results of the Texas program. Looking

forward, we expect the Texas project will go from a loss position to become

a

positive contributor to earnings.

Rich

will

talk more about the new Texas contracts later in the call. (pause)

Legal

Costs, the second component of our financial results, had a pre-tax expense

in

the quarter of $6.1 million or $0.16 per diluted share. These legal costs

primarily relate to estimated future legal expenses for our ongoing arbitration

with Accenture and a final settlement for a previously disclosed legal matter

related to a contract in Ontario.

Base

Operations - which excludes results from the Texas project and legal expenses

--

delivered $0.45 per diluted share in the second quarter.

Let’s

move

into the results by business segment starting with Consulting.

| o |

Consulting

Segment revenue was $23.2 million for the second quarter, and operating

income totaled $1.0 million- or an operating margin of 4.4%.

|

| o |

The

Consulting Segment performed as expected during the quarter. If you

recall, I explained during our last quarterly call that we expected

the

results to be softer in Q2 as a result of timing associated with

completion of work and customer required actions or work acceptance.

On a

year-to-date basis the operating income margin was

8.0%.

|

Moving

into the Systems Segment - As expected, the Systems Segment showed improvement

over last quarter.

| · |

Systems

revenue in the second fiscal quarter totaled $35.4 million compared

to

$32.2 million reported for the same period last year and $34.5 million

reported last quarter. This revenue growth is primarily from new

contracts

in the ERP division.

|

| · |

The

Segment returned to profitability in the second quarter with operating

income of $93,000. During the quarter, the new work in the ERP division

drove the improved results. Over the last several months we’ve

successfully managed the ERP division to a solid rebound with a refreshed

backlog of profitable contracts. At the same time, we’re winding down a

couple of legacy contracts which created cost overruns in Fiscal

2006.

|

| · |

The

improvements in ERP helped offset weakness in the Educational Systems

division. Education launched an enterprise version of its Schoolmax

student information system at the end of last fiscal year and will

continue to deploy both technical and sales resources, which will

continue

to impact profitability for the remainder of the year.

|

| · |

As

we discussed on our last quarterly call, we see many large software

licensing opportunities in the market. These contracts have longer

procurement and installation cycles and generally require license

revenue

to be recorded ratably. While this intellectual property has tremendous

potential to provide long-term value for our shareholders, 2007 remains

a

transition year for the System segment.

|

Turning

to

the Operations Segment:

| · |

Revenue

for the Operations Segment totaled $120.4 million for the second

quarter,

compared to revenue of $121.2 million for the same period last year.

Revenue for the second quarter of 2006 was higher relative to 2007

by $6.9

million from a large voting hardware sale and the Corrections business

which has since been divested.

|

| · |

In

the current quarter, the Operations Segment posted operating income

of

$7.1 million. For the first time since the second quarter of last

year,

the Operations Segment has returned to profitability. This is principally

driven by the curtailment of the Texas losses. Excluding the Texas

loss

the operating income for the segment was $13.6 million or an operating

margin of 12.4%, which compares favorably to $12.8 million in the

same

quarter of the prior year, similarly adjusted for Texas. The normalized

12.4% operating margin is a solid indicator that the underlying Operations

business remains healthy.

|

| · |

Sequentially,

the Operations Segment revenue grew $18.5 million and operating income

grew and $23.1 million, over the first fiscal quarter of 2007. This

growth

largely reflects contract charges recorded during the first quarter

on the

Texas and Ontario projects of approximately $16.0 million. Reductions

in

the Texas operating loss of $5.5 million and expansion of other margins

also contributed to the operating income improvement.

|

Moving

onto balance sheet and cash flow items.

We

ended

the second fiscal quarter with cash, cash equivalents, and marketable securities

of $177.3 million.

Our

accounts receivable for the quarter totaled $165.8 million. We also have $2.1

million in long-term accounts receivables which are classified within other

assets on the balance sheet. DSOs improved in the quarter to 85 days, a

reduction of 11 days over last quarter. About 5 days of this improvement is

a

temporary benefit associated with recognition of deferred revenue on the

completed Texas contract and collection of previously reserved receivables.

But

approximately 6 days of the DSO improvement demonstrates that we are making

solid headway in our efforts to achieve better contract terms and complete

older

fixed price, milestone contracts.

Cash

flow

in the quarter was very strong. Cash provided from operating activities totaling

$17.5 million in the quarter with free cash flow of $14.0 million. Approximately

$10 million of this cash flow was derived from large subcontractors and vendors

as well as tax refunds received in the quarter.

Other

uses

of cash include $2.2 million used to pay a quarterly cash dividend of $0.10

per

share in February.

In

summary, we see continued improvements in our balance sheet. We are actively

focusing on optimizing contract management and performance. As we wind down

the

old Texas contract we should expect to see margins return to more normalized

levels over the coming quarters. Excluding the impact of the Texas project

during the quarter, operating margin for the consolidated company would have

been 8.9% and as I noted earlier, the Operations Segment would have delivered

a

normalized 12.4% operating margin.

We

believe

a 10% operating margin is a reasonable objective for the total Company and

we

continue to take the necessary steps to meet this objective in the

short-term.

And

with

that, I’ll turn the call over to Rich.

Q2

FY 07 Earnings Call Draft CEO Comments

Rich

Montoni

Thanks

David and Good morning, everyone.

I

believe

the quarter’s results reflect solid progress with several important developments

at MAXIMUS, and give us a positive outlook that the clouds are lifting and

there

are clearer skies ahead. The results evidence the progress we have made with

our

strategy to optimize our current business and remedy legacy project and overhang

matters. Inherent in this has been the implementation of management controls

designed to improve the risk profile and profitability of new work we sign-up.

Let’s look at the components of the $0.11 of GAAP EPS, as outlined in this

morning’s press release.

| · |

During

the quarter, we had a provision for legal expense of $6.1 million

pre-tax

or $0.16 per share,

|

| · |

A

pre-tax operating loss on the Texas project of $6.5 million or $0.18

per

share,

|

| · |

and

base operations delivered pre-tax income of $16.5 million or $0.45

per

share.

|

The

legal

provision in the quarter relates principally to two matters; a legal settlement

in Ontario, Canada and is for future estimated legal expenses related to the

ongoing Accenture arbitration.

We

decided

to settle the Ontario matter to avoid the cost, risk and distraction of

litigation. The provision for additional future arbitration costs is based

on

recent run rates, which have been higher than originally estimated, and should

be sufficient to cover costs at least through 9/30/07. Naturally, should the

matter be settled before then, these costs would not be incurred.

The

Ontario settlement is consistent with our previously stated strategy of managing

legacy issues aggressively and clearing out the remaining significant matters

that still exist today. We continue working to resolve both the DC matter and

the outstanding arbitration in Texas.

As

with

any outstanding legal matter, we are limited in our disclosures and cannot

provide any additional details at this time related to potential outcomes.

But

the

bottom line is that we are working to resolve these overhang matters timely,

get

them behind us, and move forward with growing our business over the long-term.

Let’s

turn

our attention to the positive new developments in Texas as outlined in this

morning’s press release. We are very pleased that we have turned a large

operating loss into what we expect to be a collection of profitable contracts

in

the second half of the year. We have signed four new interim contracts directly

with the Texas Health and Human Services Commission.

We

believe

that these new agreements with the Health and Human Services Commission are

reflective of our commitment to the State throughout this process. Despite

the

challenges of our previous role as subcontractor, we remained committed to

the

State. Our customer loyalty helped maintain the integrity of our brand in the

marketplace. We also believe that the new agreements reflect the professionalism

of our employees throughout the history of the integrated eligibility project

in

Texas.

We

expect

these contracts may evolve as the Commission seeks to transition services and

come to a decision on how these programs will operate over the longer term.

Today, we’re in the first phase with interim agreements that run for 60 days on

each of the four programs. Following that, it’s likely that the commission may

consider extended, but still short-term agreements as they work through

transition plans and ultimately recompetes.

Let

me

summarize the four agreements:

| · |

First,

on the enrollment broker contract, a service which we’ve actually been

managing for the State of Texas since 1997, we signed a 60-day agreement

effective March 15th. It is our expectation that we will reach

a long-term agreement for the enrollment broker work that will likely

carry us through June 2010.

|

| · |

The

Second agreement became effective March 15th, spans 60-days and covers

Eligibility Services.

|

| · |

The

third agreement covers systems work under the CHIP program and became

effective April 1st.

This also runs for 60 days.

|

| · |

And

lastly, we signed a 60-day agreement effective May 1st

on

the CHIP Operations program where MAXIMUS is responsible for the

enrollment of children whose families have too much income to qualify

for

Medicaid but can’t afford private insurance.

|

It

is our

expectation that these contracts in aggregate will initially produce revenues

on

a monthly basis of approximately $10 million

With

these

contracts now contributing to profitability and no longer representing a loss,

on a go-forward basis we will no longer report Texas separately. Results from

these operations will be included as part of results for our total

operations.

We

are

very pleased to have reached direct contractual agreements with the TX Health

and Human Services Commission which brings much of this chapter to resolution.

As

to

future operations of the new Texas contracts, those in place are interim

agreements and will expire from May 15th

to June

30th.

We

expect these may be renewed or extended, again in the short term, until

longer-term contracts can be put into place. As mentioned before, we expect

that

over the longer term the Enrollment Broker work will remain substantially the

same and a long-term contract will run through June 2010. The contracts

underlying the remaining work will depend upon the direction the State plans

to

take - so we’ll have to wait and see. But for practical purposes, much of the

work will need to be done at least for the foreseeable future.

Since

I

assumed the role of CEO one year ago, we implemented improved processes,

strengthened personnel and have moved decisively to address legacy issues.

In

the second quarter, we started to realize some of the benefits of this

direction. As we have discussed in prior calls, with new specific management

controls now in place, we have been much more disciplined in the upfront process

in terms of bidding, pricing, and project scope.

As

a

result, the work we are bidding on and winning is of higher quality with more

favorable terms. Of course, we continue to work through cleaning up some of

our

legacy contracts and overhangs, but at the same time we’ve been refreshing the

backlog with quality work. I’m very pleased with the progress we’ve made. We’re

clearly getting traction and making headway, which is reflective in our new

awards signed as of May 2nd,

which

topped out just over $300 million. More than half of our new awards are coming

from contracts sized between $3 and $30 million which also reflects our move

towards more profitable, less volume driven business.

We’ve

also

secured another $82 million of awarded but unsigned contracts. As outlined

in

the press release, the overall sales pipeline remains very healthy with

potential opportunities in excess of $1.2 billion.

We

see

several opportunities throughout all segments of the business with the overall

macro environment driving strong demand, particularly in areas such as Health

and Human Services.

The

Deficit Reduction Act has clearly influenced demand in areas such as Workforce

Services where states are now required to have a 50% work participation rate

and

the definition of work activities has changed. As a result we’ve seen increased

activity in this area with more jurisdictions moving towards an outsourcing

model. We recently expanded a current project with new work that was previously

performed in house. The work expansion nearly triples the size of that project

alone.

We’ve

also

witnessed some jurisdictions designing procurements for larger organizations

and

shying away from community based organizations. Along these lines, we just

secured a new, 5-year, $44 million workforce services job in Tennessee. This

work was previously performed by a network of small community based

organizations.

Switching

gears to the Health business, on our last conference call I told you that we

were notified of award on a new enrollment broker job. During the quarter,

we

started work on this new EB project for the State of South Carolina. This work

was previously performed in-house and was won through a competitive bid.

On

April

1st

we

started the implementation phase with an expected go-live date of August

1st.

Under

this new state-wide initiative, we are launching a regional rollout with all

operations across the state expected to be up and running by February 1, 2008.

The project is set to run through March 2010 but there are also two one year

options available.

In

the

Consulting Segment we’ve been advancing ways to expand into broader areas.

During the quarter, the Segment won a new project to provide program management,

change management and business process re-engineering to the Department of

Conservation in a large Western State. This is a great example of the Company’s

cross-collaboration and cross-selling efforts. The effort will largely focus

on

integrating the Oracle business suite into their business processes. We’re

excited about this single-agency project that has very well-defined scope.

As

Dave

touched upon in his comments, I’m also pleased with the improvements we’ve made

in certain areas of the Systems Segment, most notably in our ERP division.

The

division came off a particularly challenging year in fiscal 2006, in part,

due

to some of the contractual terms that we agreed to when we signed on to these

projects years ago. As FY 06 came to a close, the division was able to navigate

these legacy projects to completion while at the same time, they secured new

work and refreshed their backlog as they moved into FY 07. We’re seeing

improvement in the overall Systems segment but the results remain mixed with

solid performance from the Asset Services and ERP Division, offsetting softness

in Educational Systems Division.

Conclusion

So

in

conclusion, where do we go from here? We’ve talked this morning about how we are

gaining traction in some of our businesses and how we are addressing legacy

issues and implementing both changes in processes and personnel. While we have

had to contend with some high-profile challenges, I am proud of what our team

has accomplished in recent quarters.

Of

course,

there’s still more to do. We will continue our detailed initiatives including

our Business Review Committee, our Quality and Risk Management, and our ongoing

training with focus on project execution.

In

addition to clearing up the remaining legacy issues, our Board of Directors

continues to re-evaluate the Company’s capitalization. Our cash and marketable

securities remain substantial, at $177.3 million and with our positive quarterly

cash flow capability; we recognize that this may not be the most efficient

use

of our cash in the long term. Presently, there is no specific intent to effect

a

cash distribution, such as a resuming our Share Repurchase Program. However,

as

soon as we resolve the arbitration and the DC matter, you can expect that we

will address the excess capitalization.

For

now,

our focus is on returning the business as a whole to an operating margin of

10%,

which, we believe, is attainable. I know that’s a number that’s been floated

around before, but with the Texas operating losses substantially behind us,

we

are intent on returning to this level of operating profitability built on

quality, not volume. In order to reach the 10% threshold, we will need all

three

of our segments to contribute.

In

Consulting, our target operating margin for the segment is 15% plus. We think

this segment should be able to contributed 15% but realize that it can fluctuate

as a result of timing work.

Similarly

in Systems, we do see some margin fluctuation but our overall target is really

returning this segment to a 10% margin contributor. It has not performed there

over the last several quarters and we don’t expect it to be there in FY 07. But

as we look beyond this year, we expect that our Systems business will achieve

that 10% target. Even greater in the long-term.

In

Operations, our target operating margin for the segment is typically in the

range of 8-12%. The wide range results from the differences in margin

contributions across some of these divisions and the overall mix. We typically

see the Health business perform at the higher end of the range, certainly when

we have mature programs in place. But on the other side, the Child Support

and

Federal businesses typically run in the high single digits.

But

pushing this entire Segment towards the higher end of that range is a

longer-term goal. As disclosed in this morning’s press release, the Company now

expects total revenue in the range of $740 million to $770 million and GAAP

diluted earnings per share of $0.85 to $0.95, which includes the Texas project

results and legal expenses through the second quarter of fiscal 2007. Our

revised full year guidance does not include any costs associated with legal

settlements that may occur in the back half of fiscal 2007.

In

addition, we also established preliminary fiscal 2008 guidance. Our continued

efforts to improve the base business along with strong demand in the state

and

local markets are largely the basis for this early outlook. As a result, we

preliminarily expect revenue growth of roughly 10% in fiscal 2008 with diluted

earnings per share for fiscal 2008 in the range of $2.30 to $2.60.

And

with

that, let’s open it up for questions.

David

N. Walker Chief Financial Officer and Treasurer 2nd Quarter Fiscal 2007 May

9,

2007

2 Second Quarter FY2007 Results ? Revenue totaling $179.1 million and net income of $2.4 million, EPS of $0.11 ? Financial results are comprised of three components ? Losses on the Texas contract ? Legal provisions ? Base operations ? Texas: revenue of $11.2 million, pre-tax loss of $6.5 million, EPS of $0.18 ? Previous guidance expected the loss to be in the range of $13 - $18 million ? Better than expected results due to recognition of deferred revenue and collection of reserved receivables ? Legal Costs: $6.1 million pre-tax or EPS of $0.16 ? Estimated future legal expenses for ongoing arbitration with Accenture ? Final settlement related to a contract in Ontario, Canada ? Base Operations: delivered EPS of $0.45, or operating margin of 8.9% (excludes Texas and legal)

3 Results by Business Segment ? Consulting Segment revenue was $23.2 million, operating income totaled $1.0 million with an operating margin of 4.4% ? Year-to-date operating income margin of 8.0% ? Systems Segment revenue was $35.4 million compared to $32.2 million for FY06 Q2; FY07 Q1 was $34.5 million ? Return to profitability driven from new work in ERP Division with operating income of $93,000 ? Operations Segment revenue totaled $120.4 million, compared to revenue of $121.2 million for FY06 Q2 ? Returned to profitability with operating income of $7.1 million ? Excluding the Texas loss, the segment had operating income of $13.6 million or an operating margin of 12.4%

4 Balance Sheet and Cash Flow Items ? Cash, Cash equivalents, and marketable securities of $177.3 million ? Accounts Receivables totaled $165.8 million; $2.1 million in long-term accounts receivables ? DSOs improved to 85 days; reduction of 11 days over FY07 Q1 ? Improved 5 days from temporary benefit of deferred revenue recognition and the collect of previously reserved receivables ? Balance of Improvement demonstrates efforts to achieve better contract terms and complete older fixed price, milestone contracts ? Cash provided from operating activities totaling $17.5 million, free cash flow of $14.0 million ? $2.2 million used to pay a quarterly cash dividend of $0.10 per share in February

5 In Summary ? Continued improvements in balance sheet ? Actively focusing on optimizing contract management and performance ? Expect to see margins return to more normalized levels over the coming quarters ? Excluding the impact from TX, operating margin for the consolidated Company would have been 8.9%. Operations Segment delivered a normalized 12.4% operating margin ? Taking the necessary steps to achieve a 10% operating margin objective in the short-term

Richard A. Montoni President and Chief Executive Officer 2nd Quarter Fiscal 2007 May 9, 2007

7 Second Quarter Results - $0.11 GAAP EPS ? Provision for legal expense of $6.1 million pre-tax or EPS of $0.16 ? Pre-tax operating loss on the Texas project of $6.5 million or EPS of $0.18 ? Base operations delivered pre-tax income of $16.5 million or EPS of $0.45 ? Legal settlement in Ontario Canada ? Settled to avoid cost, risk, and distraction of litigation ? Consistent with strategy of legacy issues ? Ongoing Accenture arbitration ? Based on recent run rates

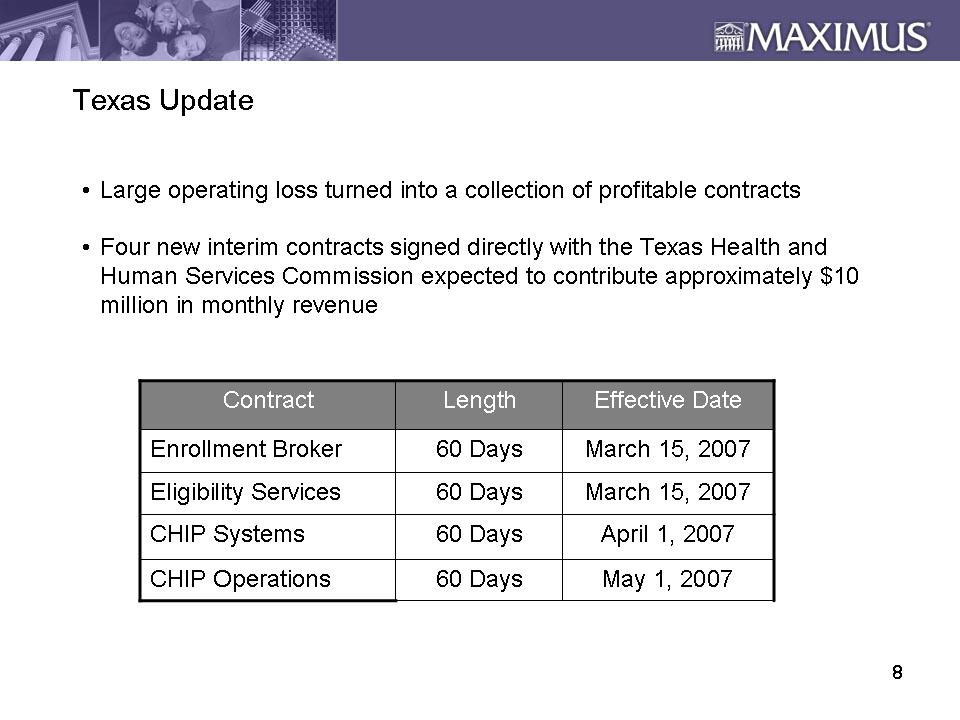

8 Texas Update ? Large operating loss turned into a collection of profitable contracts ? Four new interim contracts signed directly with the Texas Health and Human Services Commission expected to contribute approximately $10 million in monthly revenue March 15, 2007 60 Days Enrollment Broker May 1, 2007 60 Days CHIP Operations April 1, 2007 60 Days CHIP Systems March 15, 2007 60 Days Eligibility Services

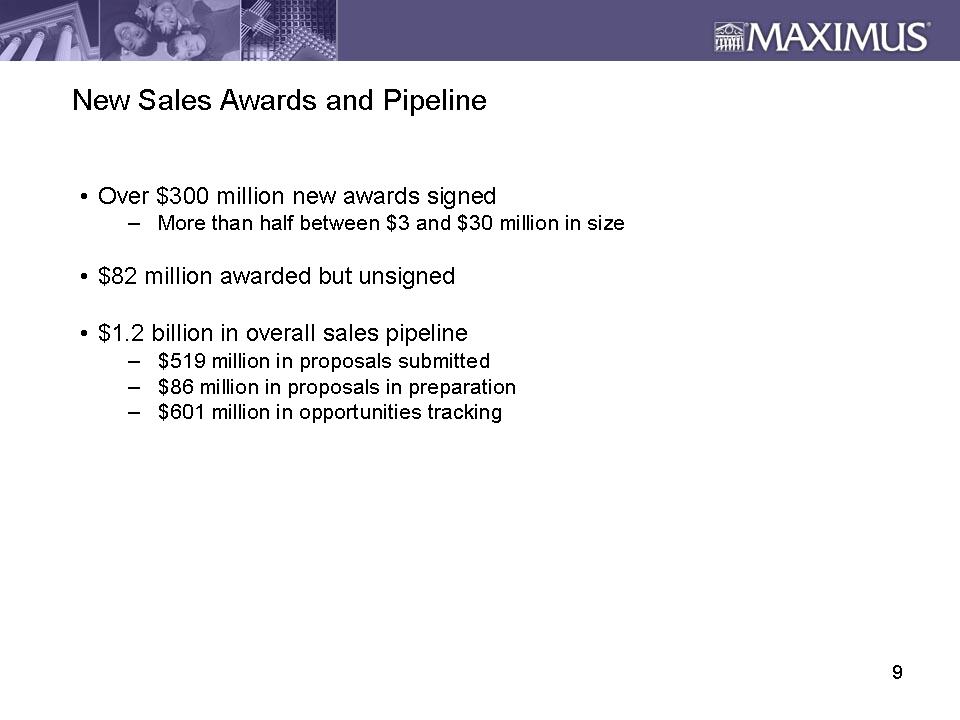

9 New Sales Awards and Pipeline ? Over $300 million new awards signed ? More than half between $3 and $30 million in size ? $82 million awarded but unsigned ? $1.2 billion in overall sales pipeline ? $519 million in proposals submitted ? $86 million in proposals in preparation

10 New Work Across all Segments ? Deficit Reduction Act influenced demand in Workforce services ? Expanded current project in Arizona tripling the size ? Secured 5-year $44 million workforce services job in Tennessee ? Health business awarded new $30 million 5-year Enrollment Broker job for the State of South Carolina ? Consulting won a new project with the Department of Conservation ? Exemplifies Company's cross-collaboration and cross-selling efforts ? New work in Enterprise Systems ? Secured several new projects in ERP and refreshed backlog

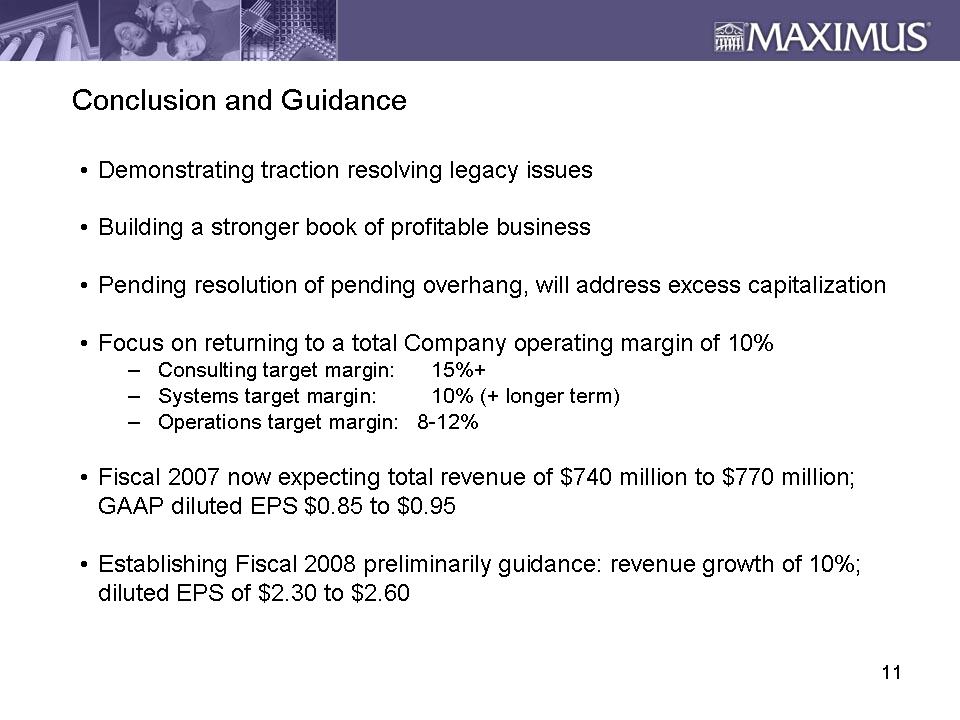

11 Conclusion and Guidance ? Demonstrating traction resolving legacy issues ? Building a stronger book of profitable business ? Pending resolution of pending overhang, will address excess capitalization ? Focus on returning to a total Company operating margin of 10% ? Consulting target margin: 15%+ ? Systems target margin: 10% (+ longer term) ? Operations target margin: 8-12% ? Fiscal 2007 now expecting total revenue of $740 million to $770 million; GAAP diluted EPS $0.85 to $0.95 ? Establishing Fiscal 2008 preliminarily guidance: revenue growth of 10%; diluted EPS of $2.30 to $2.60