Exhibit

99.2

MAXIMUS

QUARTERLY EARNINGS CALL David N. Walker Chief Financial Officer and Treasurer

1st Quarter Fiscal 2007 February 8, 2007

Confidential

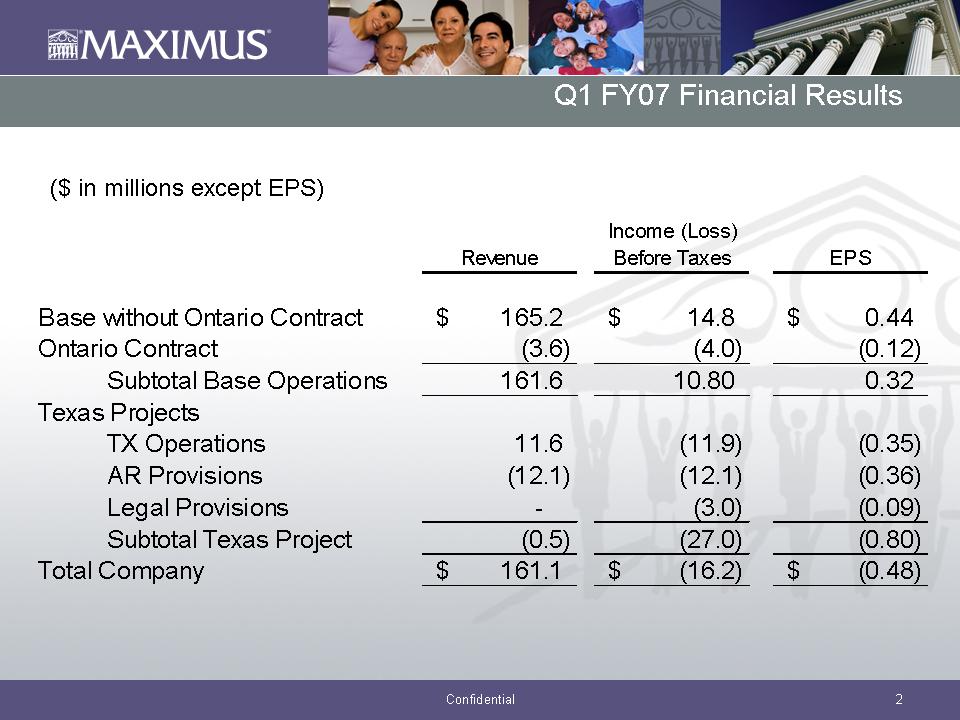

2 Q1 FY07 Financial Results ($ in millions except EPS) Income (Loss) Revenue

Before Taxes EPS Base without Ontario Contract 165.2 $ 14.8 $ 0.44 $ Ontario

Contract (3.6) (4.0) (0.12) Subtotal Base Operations 161.6 10.80 0.32 Texas

Projects TX Operations 11.6 (11.9) (0.35) AR Provisions (12.1) (12.1) (0.36)

Legal Provisions - (3.0) (0.09) Subtotal Texas Project (0.5) (27.0) (0.80)

Total

Company 161.1 $ (16.2) $ (0.48) $

Confidential

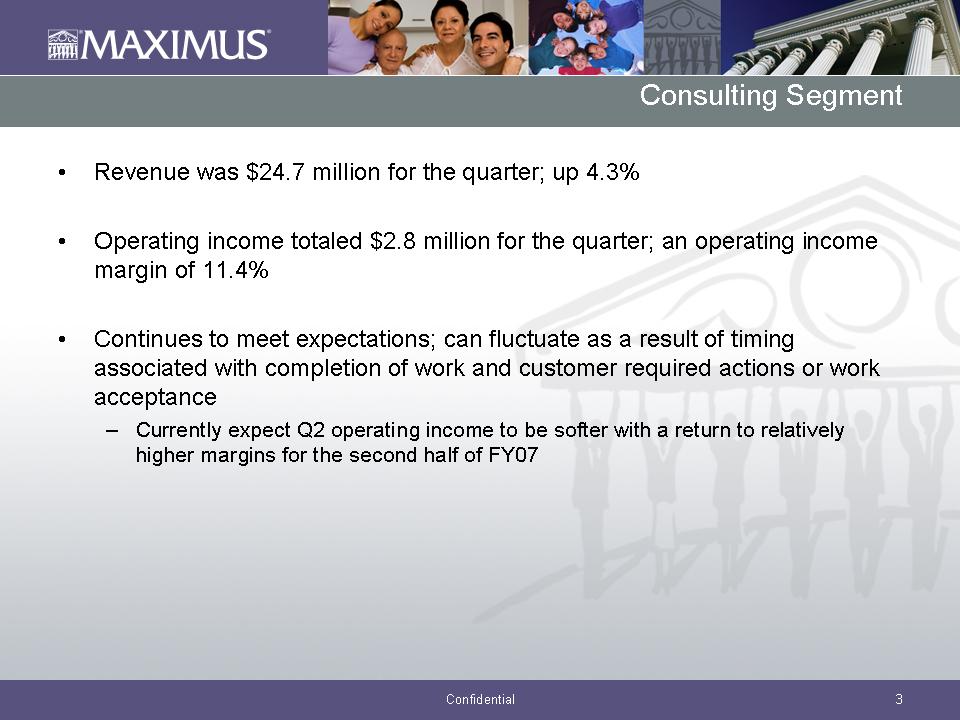

3 Consulting Segment • Revenue was $24.7 million for the quarter; up 4.3% •

Operating income totaled $2.8 million for the quarter; an operating income

margin of 11.4% • Continues to meet expectations; can fluctuate as a result of

timing associated with completion of work and customer required actions or

work

acceptance - Currently expect Q2 operating income to be softer with a return

to

relatively higher margins for the second half of FY07

Confidential

4 Systems Segment • Revenue in Q1 totaled $34.5 million; lower compared to Q1

FY06 • Operating loss in Q1 of $1.6 million; related to weakness in the

Educational Systems division • Large software licensing contracts take longer to

negotiate and implement and generally require license revenue to be recorded

ratably • 2007 will be a transition year for Systems

Confidential

5 Operations Segment • Revenue totaled $101.9 million for Q1 and was reduced by

$16.0 million as a result of the Texas and Ontario provisions • Lost $16.0

million in Q1 - $11.9 million pre-tax operating loss in Texas - $12.1 million

provision in Texas for outstanding receivables - $ 4.0 million loss provision

for the Ontario project • Normalized operating margin - Excluding Texas 7.7% -

Excluding Texas and Ontario 11.7%

Confidential

6 Other P&L Items • Expect total Company margins may return to more

normalized levels later FY07; depending on Texas outcome • SG&A as a

percentage of revenue was adversely impacted by the revenue reductions in

Q1 of

approx. $16.0 million - SG&A expense remained relatively flat sequentially

to the Q4 FY06 - The reductions in revenue have caused SG&A as a percentage

of revenue to increase • Other income was $0.5 million; result of currency

losses of approximately $0.7 million, offset by a comparable amount relative

to

the gain on the sale of the corrections business - closed Q1

Confidential

7 Balance Sheet and Cash Flow $166.9 $201.1 $184.5 $185.8 $170.8 Total AR

$39.9

$47.7 $45.3 $46.2 $47.2 Unbilled AR $126.9 $153.4 $139.2 $139.6 $123.6 Billed

AR

Q1 07 Q4 06 & FY 06 Q3 06 Q2 06 Q1 06 • Cash, cash equivalents, and

marketable securities of $163.8 million • Accounts receivable totaled $166.9

million - $2.2 million in long-term accounts receivables; classified within

other assets on the balance sheet • Solid headway made in unbilled receivables;

reflection of efforts to achieve better contract terms and complete older

fixed

price, milestone contracts • DSOs improved to 96 days driven by strong

collections and AR management

MAXIMUS

QUARTERLY EARNINGS CALL Richard A. Montoni President and Chief Executive

Officer

1st Quarter Fiscal 2007 February 8, 2007

Confidential

9 Operational Items on Texas Three Main Components to the Project: • Children’s

Health Insurance Program (CHIP) - Transitioned the majority of operations

to

Accenture - Remaining ramp down in the next few weeks • Medicaid Enrollment -

Assessing our role on this program on a go-forward basis • Integrated

Eligibility - Notified Accenture of intent to pursue termination of the

subcontract; If not cured by February 16, 2007 - Potentially begin the

transition of the integrated eligibility operations as early as

mid-February

Confidential

10 Operational Items on Texas • Texas losses of $27.0 million pre-tax ($24

million related to operating loss and AR provision, $3 million for legal

provision) • Expect Texas operating losses to trend down - Expect between $13 -

$18 million of pre-tax losses in 2Q - Full year pre-tax loss $45 - $55 million

range • Texas likely to become less of an operational issue and the large

recurring losses may move off the P&L in the next few months. -

Responsibility for the losses will be an element of the arbitration proceedings

- Texas should require less operational oversight and enable focus on

strengthening the remainder of base business

Confidential

11 Arbitration Process • Timeline of Arbitration Process with Accenture -

Arbitration panel is not finalized - Following finalization of the panel

-

expect a discovery phase which may take several months - Hearing would probably

occur sometime in 2008 • We remain confident in the merits of our case • Each

side claiming damages in excess of $100 million • Limit of liability on the

Texas subcontract $250 million

Confidential

12 • Provision for receivables for systems implementation project in Ontario -

Beyond our core Child Support operations; traditionally focus on the front

end

case management and call center operations - Client came by referral from

peer

customer - No longer performing work on the project and expect no further

operating losses - Continuing dialogue to finalize a resolution; could end

up in

litigation - The contract sets forth a limitation of liability; cap our exposure

at $4.3 million (USD) Ontario, Canada Project

Confidential

13 • Contracts were written years ago under different protocols, policies, and

procedures - Identify issues in existing projects as we finish work on them

-

Mitigate future risk in new projects • Issues typically arise in the project

life cycle in three main areas - Contract terms, project start up, and bidding

•

Important steps to root out problems before they surface - Contracts

Administration and Quality and Risk Management - Created centralized contract

management process Addressing Legacy Challenges

Confidential

14 Old Approach • Not subject to a formal internal contract review • Emphasis on

driving sales • Contract was signed with unclear back ended milestones • Not

enough clarity on what constituted completion • Resulted in cost overruns New

Approach • Formal internal review conducted • Elevated to senior executive bid

review committee (BRC) • Rigorous review processes ensures key criteria are met

and more favorable terms are negotiated • Achieved goal by negotiating with

clients up front to clearly define milestones, completion, and payment terms

New

Contract Approach Example

Confidential

15 QA organization conducts a number of key reviews for existing projects

•

Reviews include: - Independent Verification and Validation - IV&V reviews -

Full detailed field reviews - Self assessment reviews Quality & Risk

Management

Confidential

16 • Not a one quarter fix - Aggressive implementation oversight - Moving from

an entrepreneurial approach to one that is more disciplined and driven by

the

bottom line - Represents a cultural shift within our organization • Elements in

fixed priced contracts have been a recurring source of financial

underperformance - Need to shift away from fixed price conditions for certain

contract components • Data conversions • Systems interface • Report generation

Mitigate Levels of Future Risks

Confidential

17 • Earnings in the short term will come from optimizing the existing base

business - Long-term growth is contingent upon bringing in new, profitable

business - New sales awards and current pipeline reflect emphasis on “singles

and doubles” rather than home runs • Awarded a new Health enrollment broker job

- Should contribute $30 million over the 5-year term of the contract • Overall

year-to-date sales are down compared to FY06; jobs won thus far reflect smaller

projects in core competency and a more disciplined approach to new business

•

Long term growth is not tied to the performance of one large, complicated

project New Sales and Pipeline

Confidential

18 • Year-to-date signed contract wins - $80 million • New contracts pending -

$142 million • Overall pipeline - $1.3 billion - Sales opportunities across all

segments of the business • Pipeline is healthy with many opportunities; jobs up

to $50 million New Sales and Pipeline

Confidential

19 • Booked a gain on the sale of our corrections business • Exited the student

loan business • Possible there may be additional dispositions in 2007 • Continue

to review the business portfolio; no plans finalized

Dispositions

Confidential

20 • Estimate revenue for fiscal 2007 to be in the range of $710 - $730 million;

reflects the impact from the Texas project • Incur pre-tax losses on the Texas

project for fiscal 2007 of $45 - $55 million - Q2 Texas loss to range between

$13 - $18 million; abate substantially in 2nd half of FY07 • Base operations

will deliver a diluted EPS range between $2.00 - $2.10; includes $4.0 million

impact from the Ontario project in Q1 • Total Company diluted earnings per share

for FY 07 between $0.40 - $0.80 FY07 Guidance

Confidential

21 • Took necessary steps in the quarter to clean up legacy issues and position

MAXIMUS for long-term profitable growth • Failing a cure, transition IE

component of the Texas project starting as early as this month. The transition

of the CHIP program has largely been completed • More accountable structure for

size and caliber of company • New business we are winning provides for more

favorable terms and meets our more stringent review process • Disciplined steps

taken with fewer unknowns today than there were a year ago and more compelling,

sustainable opportunities for growth. Conclusion