Shares held through a bank, broker or other nominee. If you hold your shares in “street name” through a bank, broker or other nominee, such bank, broker or nominee will vote those shares in accordance with your instructions. To instruct your bank, broker or nominee how to vote, you should follow the information provided to you by such entity. Without instructions from you, a bank, broker or nominee will be permitted to exercise its own voting discretion with respect to so-called “routine matters” but will not be permitted to exercise voting discretion with respect to non-routine matters, as described below. We urge you to provide your bank, broker or nominee with appropriate voting instructions so that all your shares may be voted at the meeting.

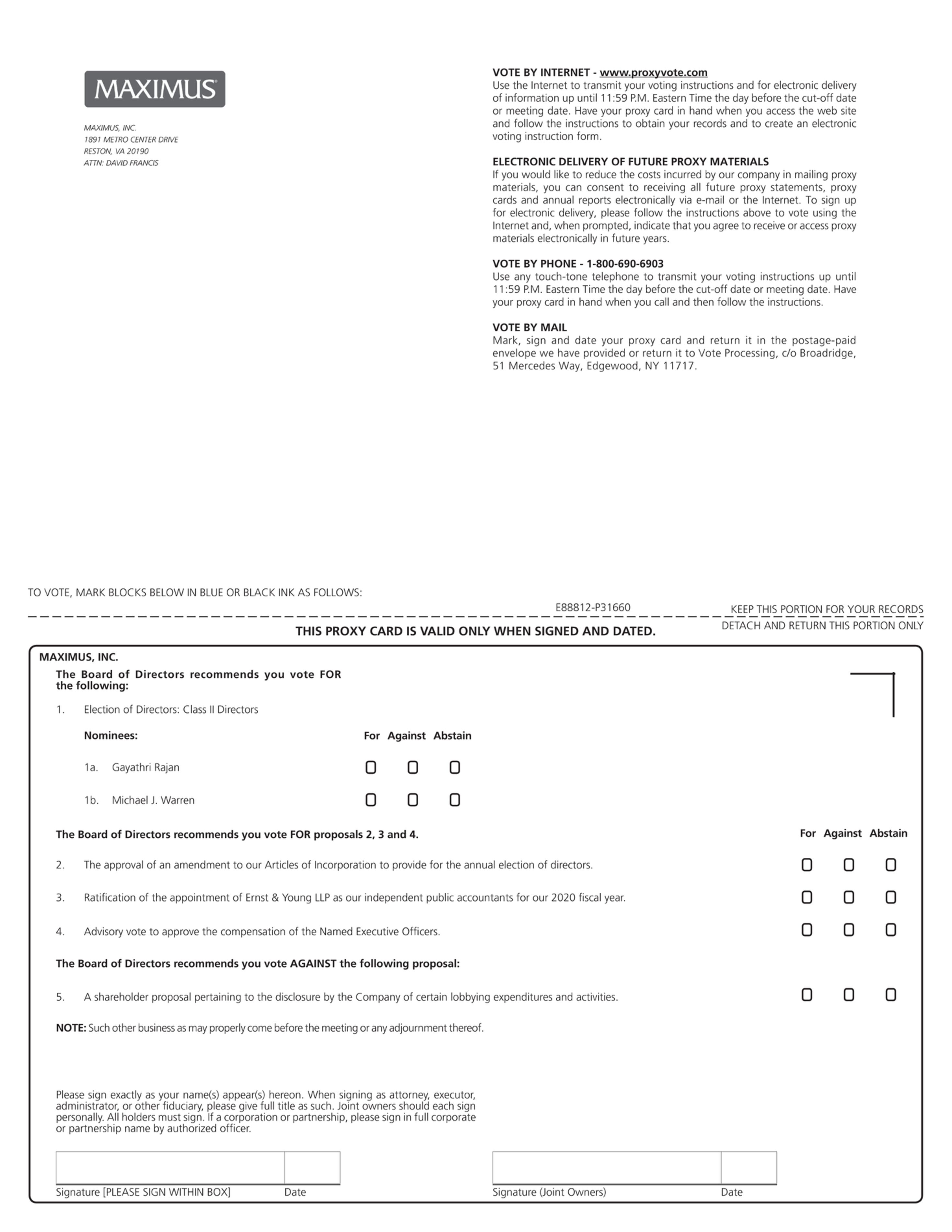

Abstentions and broker non-votes. A broker non-vote occurs when a broker cannot vote a customer’s shares registered in the broker’s name because the customer did not send the broker instructions on how to vote on the matter. If the broker does not have instructions and is barred by law or applicable rules from exercising its discretionary voting authority on a particular matter, then the shares will not be voted on the matter, resulting in a “broker non-vote.” A broker cannot vote on the election of directors, the amendment to our Articles of Incorporation to provide for the annual election of directors, on matters relating to executive compensation or on the shareholder proposal without instructions from you; therefore, there may be broker non-votes on Proposals 1, 2, 4 and 5. A broker may vote on the ratification of the independent registered accounting firm without instructions from you; therefore, no broker non-votes are expected in connection with Proposal 3. Abstentions and broker non-votes will not count as votes cast with respect to the proposals listed above. Therefore, abstentions and broker non-votes, if any, will have no effect on the voting on Proposals 1, 3, 4 and 5. Abstentions and broker non-votes will have the same effect as votes against Proposal 2.

Discretionary voting by proxies on other matters. Aside from the proposals listed above, we do not know of any other proposal that may be presented at the 2019 Annual Meeting of Shareholders. However, if another matter is properly presented at the meeting, the persons named as proxies (Richard J. Nadeau, Dominic A. Corley and David R. Francis) will exercise their discretion in voting on the matter.

How you may revoke your proxy. You may revoke your proxy at any time before the named proxies exercise it at the Annual Meeting by substituting a subsequent vote using any of the methods described in “How to vote your shares” above or by timely delivering a written notice of revocation to our Corporate Secretary that is dated later than the date of your proxy.

Attending the Annual Meeting. In order to attend the Annual Meeting in person, you must provide a current, government-issued photo identification (such as a driver’s license or passport). If you hold your shares through a broker, bank, or other nominee, you will also need to bring proof of beneficial ownership as of the record date, January 17, 2020, such as your most recent account statement, a copy of the voting instruction form provided by your broker, bank, or other nominee, or similar evidence of ownership.

Expenses of solicitation. We will bear all costs of soliciting proxies. We will request that brokers, custodians and fiduciaries forward proxy soliciting material to the beneficial owners of stock held in their names, for which we will reimburse their out-of-pocket expenses. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone and/or personal interviews.

Shareholders sharing the same surname and address. In some cases, shareholders holding their shares in a brokerage or bank account who share the same surname and address and have not given contrary instructions are receiving only one copy of the Notice. This practice is designed to reduce duplicate mailings and save printing and postage costs as well as natural resources. If you would like to have additional copies of our annual report, proxy statement or Notice mailed to you, please call or write us at our corporate headquarters, 1891 Metro Center Drive, Reston, Virginia 20190, Attn: Vice President of Investor Relations, telephone: (800) 368-2152. If you want to receive separate copies of the proxy statement, annual report to shareholders or Notice in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee record holder.