MAXIMUS

11419 Sunset Hills Road

Reston VA 20190

July 29, 2010

United

States Securities and Exchange Commission

Division of

Corporate Finance — Mail Stop 3010

Washington

DC 20549

Dear

Ms. Monick,

In response

to a telephone call from Howard Efron, we have been asked to provide further

examples of analysts’ reports from fiscal year 2008, focusing on the unusual

and infrequent events which occurred in that year and the charge of $2.2

million disclosed and recorded in the first quarter of that year.

In addition,

we acknowledge that:

· The Company

is responsible for the adequacy and accuracy of the disclosure in the filing;

· Staff

comments or changes to disclosure in response to staff comments do not

foreclose the Securities and Exchange Commission from taking any action with

respect to the filing;

· The Company

may not assert staff comments as a defense in any proceeding initiated by the

Securities and Exchange Commission or any person under the federal securities

laws of the United States.

There were

no significant, unusual events during the first quarter of fiscal year 2008.

However,

during the quarter, the Company did record a pre-tax charge of $2.2 million

($1.3 million after tax) reflecting the correction of an understatement of

stock compensation expense in 2006 and 2007.

As previously noted in our letter of June 18, 2010, this item was

mentioned in our earnings call and was the subject of questions at the time.

Following

the call, reports were prepared by a number of analysts, including the following:

· CJS

Securities, whose report is included in Appendix 1. This report mentions the $2.2 million charge

on page 1, “normalizing” EPS for the effect of the charge. In addition, there is no evidence that CJS

Securities considered the charge so significant that it affected their

understanding of the Company’s results in any of the years between 2006 and

2008.

1

· Jefferies &

Co (Appendix 2). This report mentions

the charge on page 1 and summarizes it (along with a temporary increase in

tax rates) as “transitory”. The charge

is excluded in preparing a pro forma calculation of EPS.

· UBS and GARP

Research & Securities published reports, but did not mention the

charge. The GARP report is included at

Appendix 3.

The Company

recorded some legal expenses in the second and third quarter and a gain on sale

of a building in the third quarter.

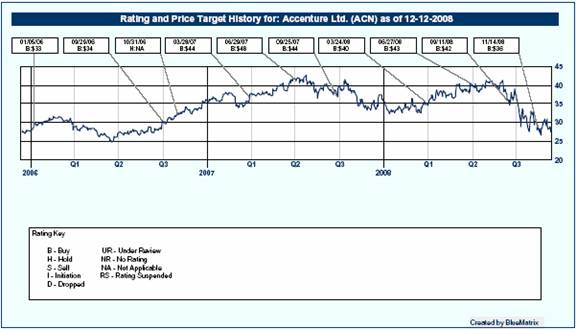

However, the most significant unusual events occurred in the fourth

quarter, where the Company recorded a $7.5 million pre-tax ($4.6 million

after-tax) goodwill impairment charge and a $37.5 million pre-tax ($23.2

million after-tax) legal and settlement charge related to the settlement with

Accenture over the Texas subcontract.

At the time

of the Company’s initial earnings call on November 13, 2008, the details

of the legal settlement were not known.

However, all analysts’ reports focused either on EBITDA (excluding the

impairment charge) or “pro forma” results with the impairment charge reversed

out. We believe this is significant

evidence that the analysts are focused on adjusted income. For example, in Appendix 4 we have included

the report of Stifel Nicolaus. We note

that:

· The report

acknowledges the goodwill impairment charge on page 2;

· The report

prepares an analysis of fourth quarter EBIT margin, which excludes goodwill

impairment and legal expenses.

Following

settlement of the Accenture matter, Stifel Nicolaus released a follow-up note

on December 15 ,2008, included as Appendix 5. This note focuses on the legal and settlement

charge, in itself a reflection of the nature of this charge to the analyst

community. As well as analyses similar

to those performed in the previous note, this report also includes a section called

“FY08 EPS Restated From Prior Periods” which mentions pro forma EPS of $0.71

for the quarter and $2.83 for the fiscal year.

These pro forma numbers are consistent with those used by the Company in

its press release of December 12, 2008 and include adjustments for legal

and settlement expense, goodwill impairment and the sale of the building.

It remains

our opinion that the error in stock compensation expense is immaterial to the

Company both in the aggregate and within each year affected. This is based upon the magnitude of the

adjustment, the nature of the charge and the comprehensive disclosure of the

correction by management in the Company’s Form 10-Q in the first quarter

of 2008. We feel that the review of the

analyst reports in 2008 confirms this view as:

· The focus of

the analysts appears to be on an earnings figure adjusted for unusual events,

such as the legal and settlement charge or the goodwill impairment. As a consequence, any adjustments must be

viewed in the context of a net income based upon a larger earnings figure than

that recorded under GAAP;

2

· Unlike the

goodwill impairment or legal and settlement expense, which are greater in scale

and significance to the Company, analysts did not place a significant amount of

interest in the stock-compensation correction, with some analysts omitting

mention of it entirely.

· We are not

aware of any shareholder viewing the correction of the error as a materially

misleading adjustment, notwithstanding the disclosure of the adjustment in the

financial statements, earnings call and certain of the analyst reports.

Please do

not hesitate to contact us if you need further information or clarification.

Sincerely

|

/s/ David

N. Walker

|

|

|

|

|

|

David N.

Walker

|

|

|

Chief Financial Officer

|

|

3

Appendix 1

CJS SECURITIES

50 MAIN ST

WHITE PLAINS

NY 10606

Telephone

(914)

287-7600

|

MAXIMUS

|

|

MARKET OUTPERFORM

|

|

FEBRUARY 7, 2008

|

|

(MMS-$39.91:NYSE)

|

|

|

|

P-TARGET:$49

|

COMPANY UPDATE

· GOOD START TO THE YEAR, EPS EX-CHARGE $0.07 BETTER THAN EXPECTED

· STRONG MARGINS IN OPERATIONS

SEG. MORE THAN OFFSET WEAK SYSTEMS

· ECONOMIC

DOWNTURN NOT EXPECTED TO IMPACT CO. AS EVIDENCED BY GROWING BACKLOG

· EPS GUIDANCE RAISED TO

ACCOUNT FOR BUYBACK ACCRETION

· RAISING FY09 ESTIMATES, REITERATE MKT. OUTPERFORM RATING

The core operations business

continues to drive solid results at MAXIMUS making up for poor results in its

systems segment. Overall top line sales of 202mm were 1mm shy of our model for

FQ1 08 but again can be attributed to the troubled systems unit which was over

2mm below our estimate. Operating

margins were 90bps better than expected as the operations unit delivered nearly

300bps higher profitability. Consulting was 80bps above our model and Systems

showed a loss of $3mm vs our just above break even expectation. The company has

struggled to turn this unit around as it appears software development costs

have been mounting and a couple of contracts may be operating at a loss. While

MMS tries to rework these contracts this segment remains a drag on earnings,

masking the strong performance of its core health and human services business

and it now appears that systems will not be profitable this year. Despite this

the other businesses are more than making up for this shortfall and we are

maintaining our prior estimates for the year.

Excluding a $2.2mm charge

for the forfeiture of options EPS would have been approximately $0.07 better

than our estimate. Cash flow from operations was strong at $20.8mm and FCF was

$16.7mm. The company has done an excellent

job focusing on reducing DSOs, which were 77 days in the quarter within the

targeted 75-85 day range. Guidance for FY08 CFFO remains at $50-60mm with FCF

expected to be $30-40mm. Overall guidance for sales remains unchanged at $850mm

to $880mm but EPS guidance is now higher at $2.60 to $2.85 (was $2.40 to $2.65

|

|

|

|

|

Financial

Metrics

|

|

GAAP

Earnings Per Share

|

|

|

Current Price

|

|

$35.82

|

|

Cash $(MM)

|

|

$62

|

|

FY (Sep)

|

|

2008e

|

|

was

|

|

2009e

|

|

was

|

|

|

52 Week Range

|

|

$26.65 - $48.33

|

|

Total Debt $(MM)

|

|

$0

|

|

Q1 Dec

|

|

$0.51 a

|

|

$0.50

|

|

|

|

|

|

|

Shares Out FD (MM)

|

|

19.0

|

|

Net Debt/Cap

|

|

0%

|

|

Q2 Mar

|

|

$0.62

|

|

|

|

|

|

|

|

|

Float (MM)

|

|

19

|

|

Return on Equity

|

|

-2%

|

|

Q3 Jun

|

|

$0.78

|

|

|

|

|

|

|

|

|

Average Daily Vol.

|

|

405 K

|

|

Est. 3-5 yr Rev growth

|

|

10-15%

|

|

Q4 Sep

|

|

$0.85

|

|

|

|

|

|

|

|

|

Market Cap ($MM)

|

|

$681

|

|

Est. 3-5 yr EPS growth

|

|

13-17%

|

|

Year

|

|

$2.75

|

|

|

|

$3.30

|

|

$3.15

|

|

|

Enterprise Value ($MM)

|

|

$618

|

|

Dividend Yield

|

|

1%

|

|

P/E

|

|

13.0X

|

|

|

|

10.9X

|

|

|

|

|

Mgmt/Director Ownership

|

|

1.6%

|

|

Book Value per Share

|

|

$18.49

|

|

EV/ EBITDA

|

|

27.7 X

|

|

|

|

5.5X

|

|

|

|

|

Charles Strauzer

|

cstrauzer@cjs-securities.com

|

|

PLEASE

REFER TO THE LAST PAGE OF THIS REPORT FOR IMPORTANT DISCLOSURES, ANALYST

CERTIFICATION AND PRICE CHART.

|

but excluded the buyback)

given the previously announced $150mm accelerated share repurchase and will

likely net more shares given the lower share price.

Backlog continues to grow

even though there are some investors who may have the perception that a tough

economic climate will impact MMS. The

total pipeline now stands at $1.5bln vs. 1.3bln in FY07. There are several

reasons we believe MMS can weather a challenging economic environment;

· 60% of its

business are BPO type services which are typically driven and funded by the

federal government,

· States tend to

outsource more in tougher budgetary environments to try and save money,

· Focus of

services on cost reductions and efficiencies, which is appealing to its

customer base during tougher times,

· Privatization

services typically are attractive during tighter fiscal cycles because MMS can

do the same job as government more efficiently and often with less expense.

· Lastly case

loads usually increase in more difficult times, as there are more people in

need of help increasing the need for the work performed by MMS.

We are maintaining our FY 08

estimates but raising our FY 09 EPS for continued progress in growing its core

operations margins. Our $49 valuation is based on 8X our FY08E EBITDA (below

takeout multiples and inline with comparable public company valuations). If MMS can rid themselves of unprofitable

businesses it would help further expand margins and could use cash proceeds

received to further enhance value. Accordingly, we reiterate our market

outperform rating.

MAXIMUS

Actual

vs. Estimates for Q1 12/07e (in MMs except EPS)

|

|

|

Year

Ago Actual

|

|

Current

Quarter Actual

|

|

Current

Q Estimate

|

|

Better/

|

|

|

|

|

Q1

12/06

|

|

%

Revs

|

|

Q1

12/07

|

|

%

Revs

|

|

Y/Y

|

|

Q1

12/07e

|

|

%

Revs

|

|

(Worse)

|

|

|

Segment

Revenues

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consulting

|

|

24.7

|

|

15.3

|

%

|

22.2

|

|

11.0

|

%

|

-10.1

|

%

|

22.2

|

|

10.9

|

%

|

-0.2

|

%

|

|

Systems

|

|

34.5

|

|

21.4

|

%

|

34.0

|

|

16.8

|

%

|

-1.6

|

%

|

36.3

|

|

17.8

|

%

|

-6.3

|

%

|

|

Operations

|

|

101.9

|

|

63.3

|

%

|

145.8

|

|

72.2

|

%

|

43.0

|

%

|

144.8

|

|

71.2

|

%

|

0.7

|

%

|

|

Total

Revenue

|

|

161.1

|

|

100.0

|

%

|

202.0

|

|

100.0

|

%

|

25.3

|

%

|

203.2

|

|

100.0

|

%

|

-0.6

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income

from Operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consulting

|

|

2.8

|

|

11.4

|

%

|

1.2

|

|

5.2

|

%

|

-59.1

|

%

|

1.0

|

|

4.4

|

%

|

16.8

|

%

|

|

Systems

|

|

(1.6

|

)

|

-4.6

|

%

|

(3.1

|

)

|

-9.2

|

%

|

96.7

|

%

|

0.6

|

|

1.5

|

%

|

-661.9

|

%

|

|

Operations

|

|

(16.0

|

)

|

-15.7

|

%

|

18.7

|

|

12.8

|

%

|

-216.8

|

%

|

12.8

|

|

8.9

|

%

|

46.0

|

%

|

|

Consolidating

Adjustments

|

|

0.5

|

|

|

|

(0.2

|

)

|

|

|

-151.0

|

%

|

0.5

|

|

|

|

-146.0

|

%

|

|

Total

Income from Operations

|

|

(14.4

|

)

|

-8.9

|

%

|

16.5

|

|

8.2

|

%

|

-214.9

|

%

|

14.9

|

|

7.3

|

%

|

11.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross

Profit

|

|

20.3

|

|

12.6

|

%

|

52.8

|

|

26.1

|

%

|

160.2

|

%

|

51.5

|

|

25.3

|

%

|

2.5

|

%

|

|

Selling,

General & Administrative

|

|

(34.7

|

)

|

-21.5

|

%

|

(36.3

|

)

|

-18.0

|

%

|

4.6

|

%

|

(36.6

|

)

|

-18.0

|

%

|

0.9

|

%

|

|

EBIT

|

|

(17.4

|

)

|

-10.8

|

%

|

16.5

|

|

8.2

|

%

|

NM

|

|

14.9

|

|

7.3

|

%

|

11.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

Income

|

|

1.6

|

|

1.0

|

%

|

1.5

|

|

0.7

|

%

|

-6.9

|

%

|

0.3

|

|

0.1

|

%

|

400.3

|

%

|

|

Pretax

Income

|

|

(15.8

|

)

|

-9.8

|

%

|

18.0

|

|

8.9

|

%

|

NM

|

|

15.2

|

|

7.5

|

%

|

18.7

|

%

|

|

Taxes

|

|

5.8

|

|

3.6

|

%

|

(7.4

|

)

|

-3.7

|

%

|

NM

|

|

(5.9

|

)

|

-2.9

|

%

|

-20.1

|

%

|

|

Tax Rate

|

|

36.9

|

%

|

NA

|

|

41.1

|

%

|

NA

|

|

4.2

|

%

|

39.0

|

%

|

NA

|

|

-2.1

|

%

|

|

Net

Income

|

|

$

|

(9.9

|

)

|

-6.2

|

%

|

$

|

10.6

|

|

5.3

|

%

|

NM

|

|

$

|

9.3

|

|

4.6

|

%

|

14.5

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EPS

(Fully Diluted)

|

|

$

|

(0.48

|

)

|

NA

|

|

$

|

0.51

|

|

NA

|

|

-205.9

|

%

|

$

|

0.50

|

|

NA

|

|

|

|

|

EPS

(Fully Diluted) Ex Items

|

|

|

|

|

|

$

|

0.57

|

|

|

|

|

|

$

|

0.50

|

|

|

|

|

|

|

Fully

Diluted Shares

|

|

21.6

|

|

NA

|

|

20.9

|

|

NA

|

|

-3.4

|

%

|

18.7

|

|

NA

|

|

-10.3

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

(10.9

|

)

|

-6.7

|

%

|

22.7

|

|

11.2

|

%

|

-308.5

|

%

|

21.5

|

|

10.6

|

%

|

5.5

|

%

|

|

Depreciation &

Amortization

|

|

5.1

|

|

3.1

|

%

|

5.1

|

|

2.5

|

%

|

0.0

|

%

|

5.5

|

|

2.7

|

%

|

8.8

|

%

|

Source: CJS Securities Estimates, Company Documents

MAXIMUS, Inc. (MMS)

Income

Statement

All

Figures $MM, except per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FY 2004a

|

|

FY 2005a

|

|

FY 2006e

|

|

Q1 12/06

|

|

Q2 3/07

|

|

Q3 6/07

|

|

Q4 9/07

|

|

FY 2007e

|

|

Q1 12/07

|

|

Q2 3/08e

|

|

Q3 6/08e

|

|

Q4 9/08e

|

|

FY 2008e

|

|

FY 2009e

|

|

|

Revenue

|

|

603.8

|

|

647.5

|

|

700.9

|

|

161.1

|

|

179.1

|

|

196.6

|

|

201.9

|

|

738.6

|

|

202.0

|

|

210.0

|

|

226.0

|

|

230.1

|

|

868.0

|

|

950.9

|

|

|

%

growth year-to-year

|

|

8.1

|

%

|

7.2

|

%

|

8.2

|

%

|

-1.0

|

%

|

-0.4

|

%

|

5.3

|

%

|

17.5

|

%

|

5.4

|

%

|

25.3

|

%

|

17.3

|

%

|

15.0

|

%

|

14.0

|

%

|

17.5

|

%

|

9.5

|

%

|

|

Cost of

Revenue

|

|

(427.7

|

)

|

(467.6

|

)

|

(547.4

|

)

|

(140.9

|

)

|

(136.2

|

)

|

(138.1

|

)

|

(146.4

|

)

|

(561.6

|

)

|

(149.2

|

)

|

(153.3

|

)

|

(160.8

|

)

|

(161.8

|

)

|

(625.1

|

)

|

(675.5

|

)

|

|

% of

Revenue

|

|

70.8

|

%

|

72.2

|

%

|

78.1

|

%

|

87.4

|

%

|

76.1

|

%

|

70.3

|

%

|

72.5

|

%

|

76.0

|

%

|

73.9

|

%

|

73.0

|

%

|

71.2

|

%

|

70.3

|

%

|

72.0

|

%

|

71.0

|

%

|

|

%

growth year-to-year

|

|

9.2

|

%

|

9.3

|

%

|

17.1

|

%

|

19.4

|

%

|

1.3

|

%

|

-13.0

|

%

|

7.5

|

%

|

2.6

|

%

|

5.9

|

%

|

12.6

|

%

|

16.4

|

%

|

10.6

|

%

|

11.3

|

%

|

8.0

|

%

|

|

Gross

Profit

|

|

176.0

|

|

180.0

|

|

136.3

|

|

20.3

|

|

42.9

|

|

58.4

|

|

55.5

|

|

177.1

|

|

52.8

|

|

56.7

|

|

65.2

|

|

68.3

|

|

242.9

|

|

275.4

|

|

|

Gross

Margin

|

|

29.2

|

%

|

27.8

|

%

|

19.5

|

%

|

12.6

|

%

|

23.9

|

%

|

29.7

|

%

|

27.5

|

%

|

24.0

|

%

|

26.1

|

%

|

27.0

|

%

|

28.8

|

%

|

29.7

|

%

|

28.0

|

%

|

29.0

|

%

|

|

%

growth year-to-year

|

|

7.0

|

%

|

2.2

|

%

|

-24.2

|

%

|

-54.7

|

%

|

-5.4

|

%

|

449.1

|

%

|

55.8

|

%

|

29.9

|

%

|

160.2

|

%

|

32.2

|

%

|

11.5

|

%

|

23.0

|

%

|

37.2

|

%

|

13.4

|

%

|

|

Selling,

General & Administrative

|

|

(113.0

|

)

|

(116.7

|

)

|

(129.7

|

)

|

(34.7

|

)

|

(34.5

|

)

|

(35.4

|

)

|

(31.1

|

)

|

(135.6

|

)

|

(36.3

|

)

|

(37.8

|

)

|

(40.7

|

)

|

(41.4

|

)

|

(156.1

|

)

|

(171.2

|

)

|

|

% of

Revenue

|

|

18.7

|

%

|

18.0

|

%

|

18.5

|

%

|

21.5

|

%

|

19.2

|

%

|

18.0

|

%

|

18.0

|

%

|

18.4

|

%

|

18.0

|

%

|

18.0

|

%

|

18.0

|

%

|

18.0

|

%

|

18.0

|

%

|

18.0

|

%

|

|

%

Growth Year-to-Year

|

|

5.2

|

%

|

3.3

|

%

|

11.1

|

%

|

9.8

|

%

|

11.5

|

%

|

9.5

|

%

|

-10.9

|

%

|

4.6

|

%

|

4.6

|

%

|

9.7

|

%

|

15.1

|

%

|

33.1

|

%

|

15.2

|

%

|

9.6

|

%

|

|

Write

off of deferred contract costs

|

|

|

|

|

|

(17.1

|

)

|

(28.0

|

)

|

(6.5

|

)

|

|

|

0.2

|

|

|

|

(2.2

|

)

|

|

|

|

|

|

|

|

|

|

|

|

Legal

Expense

|

|

0.0

|

|

(7.0

|

)

|

(9.4

|

)

|

(3.0

|

)

|

(6.1

|

)

|

(33.0

|

)

|

(2.5

|

)

|

(44.6

|

)

|

|

|

|

|

|

|

|

|

0.0

|

|

0.0

|

|

|

Operating

Profit

|

|

63.0

|

|

56.3

|

|

(2.8

|

)

|

(17.4

|

)

|

2.3

|

|

(9.9

|

)

|

21.8

|

|

(3.1

|

)

|

16.5

|

|

18.9

|

|

24.5

|

|

26.8

|

|

86.7

|

|

104.3

|

|

|

% of

Revenue

|

|

10.4

|

%

|

8.7

|

%

|

-0.4

|

%

|

-10.8

|

%

|

1.3

|

%

|

-5.1

|

%

|

10.8

|

%

|

-0.4

|

%

|

8.2

|

%

|

9.0

|

%

|

10.8

|

%

|

11.7

|

%

|

10.0

|

%

|

11.0

|

%

|

|

%

Growth Year-to-Year

|

|

10.5

|

%

|

-10.7

|

%

|

-105.0

|

%

|

-237.0

|

%

|

-83.1

|

%

|

-67.8

|

%

|

1281.0

|

%

|

11.0

|

%

|

-195.0

|

%

|

714.6

|

%

|

-346.6

|

%

|

22.8

|

%

|

-2865.9

|

%

|

20.2

|

%

|

|

Net

Interest Income & Other

|

|

1.0

|

|

3.3

|

|

6.9

|

|

1.6

|

|

1.6

|

|

0.9

|

|

2.1

|

|

6.3

|

|

1.5

|

|

0.4

|

|

0.3

|

|

0.3

|

|

2.5

|

|

1.8

|

|

|

Pretax

Income

|

|

64.1

|

|

59.6

|

|

4.0

|

|

(15.8

|

)

|

3.9

|

|

(9.0

|

)

|

24.0

|

|

3.1

|

|

18.0

|

|

19.3

|

|

24.8

|

|

27.1

|

|

89.2

|

|

106.1

|

|

|

% of

Revenue

|

|

10.6

|

%

|

9.2

|

%

|

0.6

|

%

|

-9.8

|

%

|

2.2

|

%

|

-4.6

|

%

|

11.9

|

%

|

0.4

|

%

|

8.9

|

%

|

9.2

|

%

|

11.0

|

%

|

11.8

|

%

|

10.3

|

%

|

11.2

|

%

|

|

%

Growth Year-to-Year

|

|

9.7

|

%

|

-7.0

|

%

|

-93.2

|

%

|

-207.1

|

%

|

-73.2

|

%

|

-68.4

|

%

|

633.9

|

%

|

-22.7

|

%

|

-214.3

|

%

|

390.4

|

%

|

-374.5

|

%

|

13.2

|

%

|

2761.2

|

%

|

18.9

|

%

|

|

Taxes

|

|

(25.3

|

)

|

(23.6

|

)

|

(1.6

|

)

|

5.8

|

|

(1.6

|

)

|

(5.4

|

)

|

(10.3

|

)

|

(11.4

|

)

|

(7.4

|

)

|

(7.6

|

)

|

(9.7

|

)

|

(10.6

|

)

|

(35.3

|

)

|

(41.4

|

)

|

|

Tax

Rate

|

|

39.5

|

%

|

39.5

|

%

|

39.0

|

%

|

36.9

|

%

|

40.0

|

%

|

-59.4

|

%

|

42.8

|

%

|

364.7

|

%

|

41.1

|

%

|

39.4

|

%

|

39.0

|

%

|

39.0

|

%

|

39.5

|

%

|

39.0

|

%

|

|

Net

Income

|

|

38.8

|

|

36.1

|

|

2.5

|

|

(9.9

|

)

|

2.4

|

|

(14.4

|

)

|

13.7

|

|

(8.3

|

)

|

10.6

|

|

11.7

|

|

15.1

|

|

16.6

|

|

54.0

|

|

64.7

|

|

|

% of

Revenue

|

|

6.4

|

%

|

5.6

|

%

|

0.4

|

%

|

-6.2

|

%

|

1.3

|

%

|

-7.3

|

%

|

6.8

|

%

|

-1.1

|

%

|

5.3

|

%

|

5.6

|

%

|

6.7

|

%

|

7.2

|

%

|

6.2

|

%

|

6.8

|

%

|

|

%

Growth Year-to-Year

|

|

9.7

|

%

|

-7.0

|

%

|

-93.2

|

%

|

-211.7

|

%

|

-73.4

|

%

|

-16.9

|

%

|

588.3

|

%

|

-435.6

|

%

|

-206.6

|

%

|

395.1

|

%

|

-205.1

|

%

|

20.7

|

%

|

-753.8

|

%

|

19.9

|

%

|

|

Net

Earnings per Share fd

|

|

$

|

1.76

|

|

$

|

1.67

|

|

$

|

0.11

|

|

$

|

(0.48

|

)

|

$

|

0.11

|

|

$

|

(0.65)

|

|

$

|

0.63

|

|

$

|

(0.38

|

)

|

$

|

0.51

|

|

$

|

0.62

|

|

$

|

0.78

|

|

$

|

0.85

|

|

$

|

2.75

|

|

$

|

3.30

|

|

|

%

Growth Year-to-Year

|

|

6.3

|

%

|

-5.4

|

%

|

-93.2

|

%

|

-218.1

|

%

|

-73.5

|

%

|

-18.8

|

%

|

589.3

|

%

|

-435.0

|

%

|

-205.9

|

%

|

472.6

|

%

|

-219.8

|

%

|

36.0

|

%

|

-827.7

|

%

|

20.1

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (Charges)/Income

|

|

0.0

|

|

(4.2

|

)

|

(23.8

|

)

|

(17.3

|

)

|

(7.6

|

)

|

(28.6

|

)

|

(1.2

|

)

|

(54.7

|

)

|

(1.3

|

)

|

0.0

|

|

0.0

|

|

0.0

|

|

(1.3

|

)

|

0.0

|

|

|

Pro-Forma Net Income(ex

one time items)

|

|

38.8

|

|

40.3

|

|

26.2

|

|

7.3

|

|

10.0

|

|

14.2

|

|

14.9

|

|

46.4

|

|

11.9

|

|

11.7

|

|

15.1

|

|

16.6

|

|

55.3

|

|

64.7

|

|

|

Pro-Forma

EPS (ex one time items)

|

|

$

|

1.76

|

|

$

|

1.86

|

|

$

|

1.20

|

|

$

|

0.34

|

|

$

|

0.45

|

|

$

|

0.65

|

|

$

|

0.68

|

|

$

|

2.12

|

|

$

|

0.57

|

|

$

|

0.62

|

|

$

|

0.78

|

|

$

|

0.85

|

|

$

|

2.82

|

|

$

|

3.30

|

|

|

%

Growth Year-to-Year

|

|

6.3

|

%

|

5.7

|

%

|

-35.4

|

%

|

-19.2

|

%

|

6.9

|

%

|

-1044.8

|

%

|

62.2

|

%

|

76.6

|

%

|

68.4

|

%

|

35.4

|

%

|

21.2

|

%

|

25.4

|

%

|

32.6

|

%

|

17.2

|

%

|

|

FAS 123R Options expense

pre-tax**

|

|

0.0

|

|

0.0

|

|

5.8

|

|

1.5

|

|

1.5

|

|

0.8

|

|

0.8

|

|

4.5

|

|

1.1

|

|

1.1

|

|

1.1

|

|

1.1

|

|

4.4

|

|

4.4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FD EPS

before options exp.

|

|

$

|

1.76

|

|

$

|

1.86

|

|

$

|

1.36

|

|

$

|

0.38

|

|

$

|

0.49

|

|

$

|

0.70

|

|

$

|

0.70

|

|

$

|

1.58

|

|

$

|

0.60

|

|

$

|

0.65

|

|

$

|

0.82

|

|

$

|

0.89

|

|

$

|

2.95

|

|

$

|

3.44

|

|

|

% Growth Year-to-Year

|

|

6.3

|

%

|

5.7

|

%

|

-26.7

|

%

|

-17.4

|

%

|

6.2

|

%

|

-2656.0

|

%

|

52.5

|

%

|

15.7

|

%

|

58.6

|

%

|

31.7

|

%

|

16.2

|

%

|

26.6

|

%

|

87.0

|

%

|

16.5

|

%

|

|

Weighted Avg. S/O

(mil)-fd

|

|

22.0

|

|

21.7

|

|

21.8

|

|

21.6

|

|

22.0

|

|

22.0

|

|

21.9

|

|

21.9

|

|

20.9

|

|

19.0

|

|

19.3

|

|

19.4

|

|

19.6

|

|

19.6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA

|

|

76.2

|

|

71.4

|

|

20.6

|

|

(10.9

|

)

|

8.7

|

|

29.3

|

|

30.7

|

|

22.3

|

|

22.7

|

|

25.5

|

|

31.1

|

|

33.4

|

|

112.7

|

|

128.7

|

|

|

% of

Revenue

|

|

12.6

|

%

|

11.0

|

%

|

2.9

|

%

|

-6.7

|

%

|

4.9

|

%

|

14.9

|

%

|

15.2

|

%

|

3.0

|

%

|

11.2

|

%

|

12.1

|

%

|

13.8

|

%

|

14.5

|

%

|

13.0

|

%

|

13.5

|

%

|

|

%

Growth Year-to-Year

|

|

11.6

|

%

|

-6.3

|

%

|

-71.1

|

%

|

-159.5

|

%

|

-54.8

|

%

|

-216.4

|

%

|

274.6

|

%

|

8.3

|

%

|

-308.5

|

%

|

191.7

|

%

|

6.1

|

%

|

9.0

|

%

|

404.6

|

%

|

14.2

|

%

|

|

Depreciation &

Amortization

|

|

13.2

|

|

15.1

|

|

17.6

|

|

5.1

|

|

5.0

|

|

5.4

|

|

5.5

|

|

21.0

|

|

5.1

|

|

5.5

|

|

5.5

|

|

5.5

|

|

21.6

|

|

20.0

|

|

|

% of

Revenue

|

|

2.2

|

%

|

2.3

|

%

|

2.5

|

%

|

3.1

|

%

|

2.8

|

%

|

2.8

|

%

|

2.7

|

%

|

2.8

|

%

|

2.5

|

%

|

2.6

|

%

|

2.4

|

%

|

2.4

|

%

|

2.5

|

%

|

2.1

|

%

|

|

%

Growth Year-to-Year

|

|

17.1

|

%

|

15.2

|

%

|

16.5

|

%

|

21.9

|

%

|

19.2

|

%

|

30.2

|

%

|

6.9

|

%

|

18.8

|

%

|

0.0

|

%

|

10.6

|

%

|

1.3

|

%

|

-0.3

|

%

|

2.8

|

%

|

-7.2

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Source: Company Reports and CJS Securities Estimates

Notes:

(1) Pro-forma

to include FAS 123 R option expense for years FY 05 and beyond

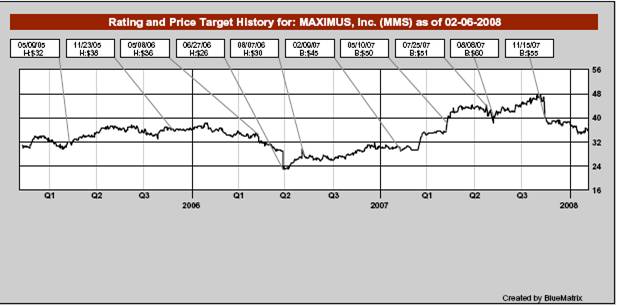

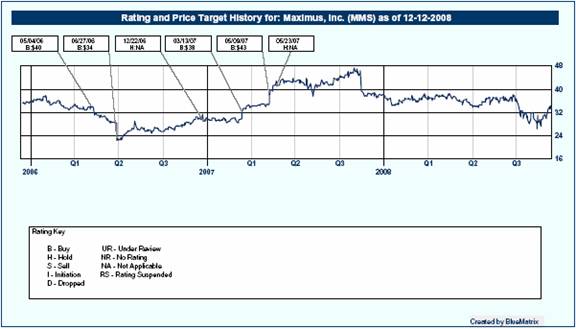

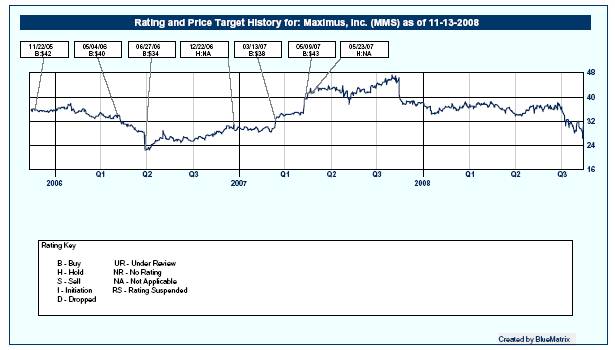

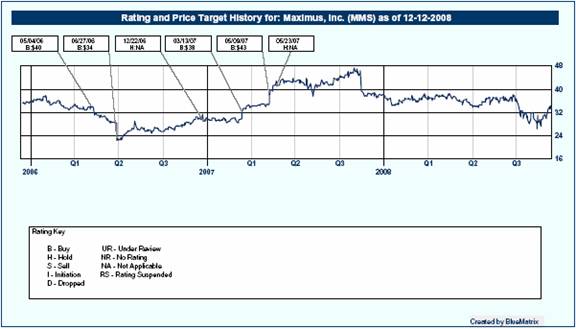

COMPANY

: MAXIMUS INC

CURRENCY

: USD

HISTORY

OF RECOMMENDATION AND PRICE TARGET CHANGES

|

DATE

|

|

CLOSING PRICE

|

|

RECOMMENDATION CHANGE

|

|

PRICE TARGET

|

|

16-Nov-2007

|

|

39.92

|

|

|

|

49.00

|

|

10-May-2007

|

|

39.93

|

|

|

|

46.00

|

|

12-Feb-2007

|

|

29.34

|

|

|

|

38.00

|

|

22-Dec-2006

|

|

29.77

|

|

|

|

31.00

|

|

07-Aug-2006

|

|

27.85

|

|

|

|

34.00

|

|

29-Jun-2006

|

|

23.79

|

|

|

|

30.00

|

|

29-Jun-2006

|

|

23.79

|

|

MARKET

OUTPERFORM

|

|

|

|

23-Nov-2005

|

|

37.00

|

|

|

|

44.00

|

|

19-Sep-2005

|

|

37.43

|

|

MARKET

PERFORM

|

|

|

|

01-Jul-2005

|

|

36.00

|

|

|

|

41.00

|

Source:

Firstcall & CJS Sec.

Charles Strauzer cstrauzer@cjs -securities.com

IMPORTANT

DISCLOSURES

Valuation Methodology: 8X

2008E EV/EBITDA

Investment Risks: TX

contract resolution and potential liability claims, State budget

cuts/reductions, management execution, competition, general macro economic

factors, timing of contracts, inability to reduce costs in underperforming

units, cost over-runs in fixed price contracts, penalties for non-performance,

acquisitions.

CJS Securities, Inc.

Equity Research rating system

Market

Outperform (MO): a stock that should perform at least 15%

better than the Russell 2000 index over the next 6-18 months Market Perform (MP): a stock that should

perform in line with or slightly better than the Russell 2000 index

Market

Under-Perform (MU): a stock expected to under-perform the Russell

2000 index

We will continue to have

some stocks on a Monitor List, where we are indicating to clients not to expect

a similar level of research coverage as companies on our active coverage list.

Hence, we do not have investment opinions, nor do we intend to publish

estimates, on Monitor list names.

As of 1/2/08, CJS Securities

provides active research on 66 companies, of which 42 (64%) are rated MO(buy)

and 24 (36%) are rated MP(hold) and 0 (0%) are rated MU(sell), we also have two

additional companies on our Monitor List (no rating, estimates or price

target).

The information and

statistics in this report have been obtained from sources we believe are

reliable but we do not warrant their accuracy or completeness. Prices and

opinions concerning the composition of market sectors included in this report

reflect the judgments as of this date and are subject to change without notice.

This material is for your information only and does not constitute an offer to

buy or sell, or the solicitation of any offer to buy or sell any securities.

CJS Securities Inc., its affiliates, directors, officers, stockholders,

employees (or members of their families), and accounts with respect to which

the forgoing have investment discretion, may have long or short positions in,

and may, as principal or agent, buy or sell the securities mentioned herein.

Occasionally, CJS Securities, Inc. may

receive sales credits or fees, directly or indirectly, when an individual

company under research coverage or a related peer company does an underwritten

offering. CJS intends to seek commission related non-investment banking services

over the next 3 months. Accordingly, the firm may have a conflict of interest

that could effect the objectivity of this report.

ANALYST

CERTIFICATION

The Research Analyst(s) who

prepared the document / email hereby certify that the views expressed in this

document / email

Appendix 2

Jefferies & Company, Inc.

February 7,

2008

Technology

IT Services

United

States of America

MAXIMUS

(NYSE: MMS)

Quarter

Offers Proof Point of Improved Health

Company

Update Estimate Change

|

Rating:

|

|

BUY

|

|

|

Price:

|

|

$35.82

|

|

|

Price

Target:

|

|

$55.00

|

|

|

Bloomberg:

|

|

NYSE:

MMS

|

|

Market Data

|

52-Week

Range:

|

|

$48.33-$26.65

|

|

|

Total

Entprs. Value (MM):

|

|

$689.9

|

|

|

Market

Cap. (MM):

|

|

$750.7

|

|

|

Insider

Ownership:

|

|

1.7

|

%

|

|

Institutional

Ownership:

|

|

97.0

|

%

|

|

Shares

Out. (MM):

|

|

20.9

|

|

|

Float

(MM):

|

|

18.2

|

|

|

Avg.

Daily Vol.:

|

|

190,017

|

|

Financial Summary

|

Book

Value (MM):

|

|

$

|

273.0

|

|

|

Book

Value/Share:

|

|

$

|

13.07

|

|

|

Net

Debt (MM):

|

|

$

|

(60.8

|

)

|

|

Net

Debt/Capital:

|

|

0.0

|

%

|

|

ROE:

|

|

15.3

|

%

|

|

3-5

Yr. Est. EPS Growth Rate:

|

|

15.0

|

%

|

|

ROIC:

|

|

16.5

|

%

|

|

Lg-Trm

Debt to Eqty:

|

|

0.0

|

%

|

ROE: Estimate for FYE 2008

ROIC: Estimate for FYE 2008

|

USD

|

|

2005A

|

|

2006A

|

|

2007A

|

|

2008E

|

|

|

Rev.

(MM)

|

|

—

|

|

700.9

|

|

738.6

|

|

877.7

|

|

|

Prev.

|

|

—

|

|

—

|

|

—

|

|

865.0

|

|

|

EV/Rev.

|

|

NM

|

|

1.0x

|

|

0.9x

|

|

0.8x

|

|

|

EPS

|

|

|

|

|

|

|

|

|

|

|

Cal.

|

|

1.66

|

|

(0.79

|

)

|

0.59

|

|

3.00

|

|

|

Prev. Cal.

|

|

—

|

|

—

|

|

—

|

|

2.88

|

|

|

Cal.

P/E

|

|

21.6x

|

|

NM

|

|

60.7x

|

|

11.9x

|

|

|

EPS Diluted

|

|

|

|

|

|

|

|

|

|

|

EPS

|

|

|

|

|

|

|

|

|

|

|

Dec

|

|

—

|

|

0.41

|

|

(0.48

|

)

|

—

|

|

|

Mar

|

|

—

|

|

0.41

|

|

0.11

|

|

—

|

|

|

Jun

|

|

—

|

|

(0.81

|

)

|

(0.65

|

)

|

—

|

|

|

Sep

|

|

—

|

|

0.09

|

|

0.63

|

|

—

|

|

|

FY Sep

|

|

—

|

|

0.11

|

|

(0.37

|

)

|

2.81

|

|

|

Prev. FY

|

|

—

|

|

—

|

|

(0.38

|

)

|

2.80

|

|

|

FY

P/E

|

|

NM

|

|

NM

|

|

NM

|

|

12.7x

|

|

|

GAAP EPS.

|

|

|

|

|

|

|

|

|

|

|

Consensus

|

|

—

|

|

0.11

|

|

(0.38

|

)

|

2.73

|

|

Investment

Summary

MMS should outperform the

market in C08 due to accelerating top-line growth to the upper teens, an

expanding operating margin likely in the double digits, and lowered operating risks

due to improved control systems. We remain bullish and highlight the healthy

quarter was actually even stronger than the results imply.

Event

Maximus reported revenue and

EPS of $202 million and $0.51. Revenue was ahead of consensus based on healthy growth

in the Operations segment. EPS met consensus expectations, though was

negatively impacted by a $2.2 million non-cash charge and temporarily higher

tax rate that veiled the upside in operating results.

Key Points

· Raising our

fiscal 2008 estimates to reflect new guidance. Our fiscal year 2008 revenue

and EPS estimates move to $877.7 million and $2.81 from $865 million and $2.80.

Management reiterated revenue guidance of $850–880 million, though made an

upward revision to EPS guidance to $2.60–2.85 from $2.35–2.65 to reflect

accretion from the accelerated share repurchase program. Supporting the

increased guidance is $324 million of new awards during the quarter,

representing a book-to-bill of 1.6x. New awards, including multi-hundred

million dollar contracts in California and Texas, and a healthy sales pipeline

lend confidence to our raise.

· Strong

quarter obscured by transitory events. Maximus reported a 25%

increase in revenue and the operating margin improved from negative 8.9% a

year-ago to 9.3%, after excluding a $2.2 million non-cash charge related to a

forfeiture calculation on previous years’ stock-based compensation. Results

were fueled by strong performance in the Operations segment (72% of revenue),

which grew its top-line by a normalized 24% and swung to a 13% operating margin

compared to a loss in the same quarter the previous year. The normalized growth

within Operations excludes a negative $15.7 million revenue impact from the

termination of the Ontario contract and reduction of the Texas contract last

year. Excluding this impact from overall

results reduces top line growth by about 10%. On the other hand, the company

reported a $2.2 million non-cash charge related to prior years’ stock-based

compensation and a more than 100 bp temporary increase in the tax rate from a

change in Canadian tax law. We note that the impact of these events combined to

impact EPS by approximately $0.07, exceeding our estimate by 8 cents.

Valuation/Risks

At 12x our raised C08 EPS

estimate, MMS is trading at nearly a 30% discount to its 10-year median forward

P/E of 18x. Key risks include the impact of discretionary spending cuts in a

softening economy and execution on improving the performance of the Systems

segment. Please refer to the attached DCF to understand the operating

assumptions supporting our $55 one-year price target.

Matthew G. McKay, CFA

(617) 342-7909, mmckay@Jefferies.com

|

Please see important

disclosure information on pages 7 - 9 of this report.

|

|

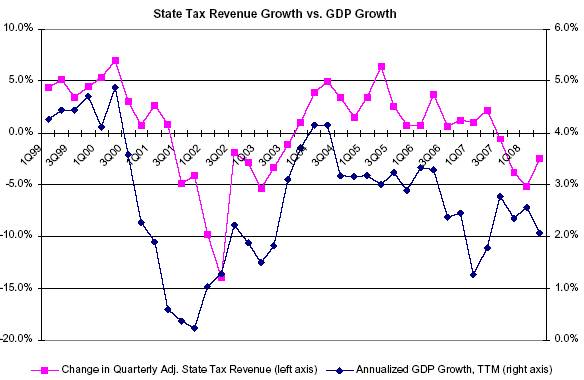

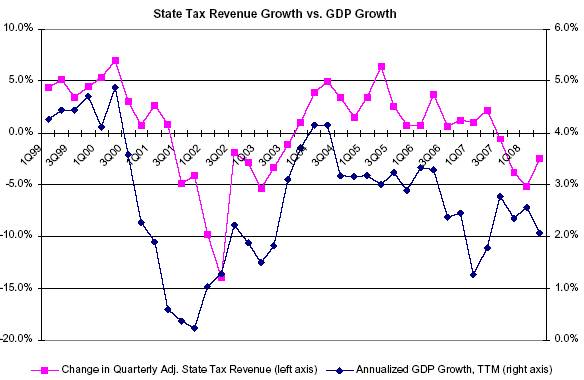

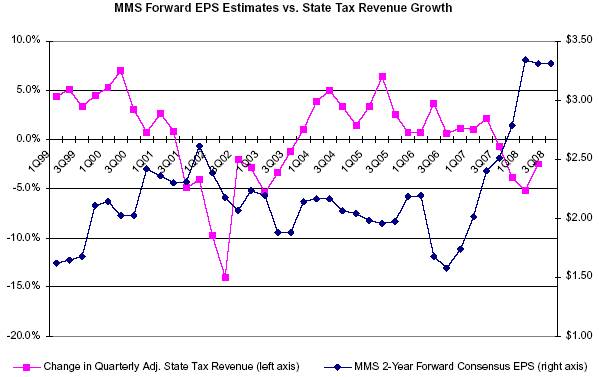

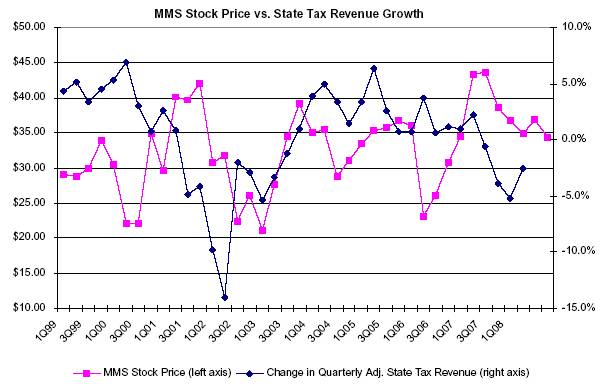

A softening economy will

potentially have a mixed impact on Maximus. Despite definitive undercurrents of

concern regarding a recession, the National Association of State Budget

Officers is still projecting fiscal year 2008 spending growth near 5% overall.

Furthermore, approximately 65–70% of the company’s revenue currently comes from

state run but federally mandated and largely federally funded programs that are

relatively insulated from changes in the level of tax receipts at the state

level. In past economic downturns, the company was more leveraged to the

economic cycle given that the Consulting and Systems segments represented 40%

of revenue, compared to approximately 28% today. The current mix is heavily

weighted to services outsourcing from the Operations segment and the nature of

the work being done on the Systems and Consulting side carries a stickier

revenue stream than before. That said, discretionary spending cuts at the state

level remain a risk, more so in fiscal 2009, though it likely does not have a

material impact on Maximus’ core book of business.

Maximus repurchased $150

million of stock during the quarter, retiring approximately 3.8 million shares

at a share price of $39.91. The company used UBS as its broker. While the

interests of confidentiality precluded full disclosure of details, management

was able to confirm that the bank is continuing to purchase shares and has not

completely covered its position to date. Contractual obligations call for UBS

to complete its transactions by August 15, 2008. Given an outlook for

improving stock performance in FY08, we are keeping a keen eye on the impact on

cash flow from UBS potentially having to purchase shares at a higher VWAP and

subsequently requiring Maximus to make a cash outlay for the difference. That

said, the stock has underperformed recently and therefore UBS may be able to

purchase shares below the initial price, resulting in excess cash with which

management can choose to repurchase additional shares. The share repurchase has

been accretive to EPS and has not been detrimental to Maximus’ ability to meet

future liquidity requirements and investment opportunities. Furthermore,

Maximus continues to be significantly cash generative and management has also

arranged a $50 million credit facility that carries the potential to increase

to $75 million.

Revenue for fiscal 1Q was

$202 million, a 25% increase y/y. Revenue growth was primarily driven by the

Operations segment, which increased 43% y/y. Operating income was $16.5

million, representing an 8.2% operating margin that met expectations. Operating

margins showed substantial improvement y/y though declined sequentially due to

some 4Q seasonality in the Operations segment, investments made in the

Consulting segment, and losses related to legacy contracts and product

build-outs in the Systems segment. Management still expects total company

operating margins of approximately 10% for the fiscal year. Net income for the

quarter was $10.6 million or $0.51 per diluted share. Backing out a temporary

increase in the overall tax rate and a $2.2 million non-cash charge related to

stock based compensation from previous years, we estimate that EPS could have

been $0.07 higher. Cash flow from operations for the quarter was $20.8 million,

with free cash flow of $16.7 million. Management expects full fiscal year cash

flow from operations of $50–60 million and free cash flow of $30–40 million.

Operations segment revenue

for the quarter increased 43% y/y to $145.8 million. The segment accounted for

72% of total company revenue for the quarter. Gross margin for the segment was

24.2% . Operating margin was 12.8%, compared to an operating loss during the

same quarter last year. The segment growth and improved profitability was

largely due to increased activity in health and workforce services and

execution of a project portfolio optimization. Management indicated that

operating margins for the segment should be sustainable in the 12% to 15% range

for the remainder of fiscal 2008.

Consulting segment revenue

for the quarter was $22.2 million or approximately 11% of total company

revenue. Gross margin for the segment was 38.3%. Operating margin was 5.2%, a

300 bp improvement y/y. The improved performance reflects the company’s

transition away from the contingent fee federal healthcare claim market and

entry into new markets. Performance was tempered somewhat by required

investments in state Medicaid fraud prevention services.

Systems segment revenue for

the quarter was $34 million or approximately 17% of total company revenue.

Gross margin for the segment was 26.3%. The segment reported an operating loss

of $3.1 million. Results were negatively impacted by losses related to legacy

project issues and losses related to the product build-out of some web-based

applications. Management indicated that the same optimization process

successfully used to turnaround performance in the Operations segment is now

being applied to the Systems segment. However, management also indicated that

it will likely be 9–12 months before the segment will turn profitable. During

that time period, management also intends to evaluate strategic alternatives

for the aspects of the segment that were the root of the underperformance.

2

Company

Description

MAXIMUS was incorporated in

1975, has been publicly traded since 1997, and is based in Reston, Virginia.

The company offers services primarily to state and local governments, as well as

the federal government. In fiscal 3Q04 management reorganized the company into

three business segments: health services, human services, and technical

services. The main drivers of the business are program management and

outsourcing of health and human services that are federally mandated and

funded. In addition, the company is positioned to take advantage of legislative

actions encouraging state and local spending on modernization of voting

technology, improving port security, and offering improved educational

services. MAXIMUS is a member of the Russell 2000 and S&P 600 SmallCap

index.

3

Maximus, Inc.

2006-2009E Profit and Loss Model

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in millions, except per share)

|

|

|

|

F2007A

|

|

|

|

F2008E

|

|

|

|

|

|

|

|

|

|

|

|

|

(FY End September)

|

|

F2006A

|

|

Q1A

|

|

Q2A

|

|

Q3A

|

|

Q4A

|

|

F2007A

|

|

Q1A

|

|

Q2E

|

|

Q3E

|

|

Q4E

|

|

F2008E

|

|

F2009E

|

|

C2006A

|

|

C2007A

|

|

C2008E

|

|

|

Income

Statement Data

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

700.9

|

|

161.1

|

|

179.1

|

|

196.6

|

|

201.9

|

|

738.6

|

|

202.0

|

|

208.6

|

|

231.0

|

|

236.2

|

|

877.7

|

|

991.8

|

|

699.3

|

|

779.5

|

|

904.0

|

|

|

Cost of revenue

|

|

547.5

|

|

140.9

|

|

136.2

|

|

138.1

|

|

146.4

|

|

561.6

|

|

149.2

|

|

154.8

|

|

167.4

|

|

171.5

|

|

642.9

|

|

722.8

|

|

570.4

|

|

569.9

|

|

658.0

|

|

|

Gross

Income

|

|

153.4

|

|

20.3

|

|

42.9

|

|

58.4

|

|

55.5

|

|

177.1

|

|

52.8

|

|

53.8

|

|

63.5

|

|

64.7

|

|

234.8

|

|

269.1

|

|

128.9

|

|

209.6

|

|

246.0

|

|

|

Selling,

general & administrative

|

|

129.7

|

|

34.7

|

|

34.5

|

|

35.4

|

|

31.1

|

|

135.6

|

|

34.1

|

|

35.5

|

|

37.0

|

|

37.8

|

|

144.3

|

|

169.6

|

|

132.8

|

|

135.0

|

|

153.1

|

|

|

Amortization of

intangibles

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

|

Other

|

|

26.5

|

|

3.0

|

|

6.1

|

|

33.0

|

|

2.5

|

|

44.6

|

|

2.2

|

|

0.0

|

|

0.0

|

|

0.0

|

|

2.2

|

|

0.0

|

|

29.0

|

|

43.8

|

|

0.0

|

|

|

Total operating expenses

|

|

703.7

|

|

178.5

|

|

176.8

|

|

206.5

|

|

180.0

|

|

741.8

|

|

185.4

|

|

190.3

|

|

204.4

|

|

209.3

|

|

789.4

|

|

892.3

|

|

732.2

|

|

748.7

|

|

811.1

|

|

|

Op Inc

- Exc Options & One-time

|

|

23.7

|

|

(14.4

|

)

|

8.4

|

|

23.1

|

|

24.4

|

|

41.5

|

|

18.7

|

|

18.4

|

|

26.6

|

|

26.9

|

|

90.6

|

|

99.5

|

|

(3.9

|

)

|

74.6

|

|

92.8

|

|

|

Interest income, net

|

|

6.9

|

|

0.5

|

|

1.6

|

|

1.1

|

|

2.6

|

|

5.8

|

|

1.5

|

|

0.4

|

|

0.5

|

|

0.5

|

|

2.9

|

|

2.5

|

|

5.3

|

|

6.8

|

|

1.9

|

|

|

Other, net

|

|

0.0

|

|

0.7

|

|

0.0

|

|

(0.2

|

)

|

0.0

|

|

0.5

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.7

|

|

(0.2

|

)

|

0.0

|

|

|

Pretax income -

Operating

|

|

30.5

|

|

(13.2

|

)

|

10.0

|

|

24.0

|

|

27.0

|

|

47.8

|

|

20.2

|

|

18.8

|

|

27.0

|

|

27.4

|

|

93.4

|

|

102.0

|

|

2.1

|

|

81.2

|

|

94.7

|

|

|

Taxes - Operating

|

|

11.9

|

|

(4.7

|

)

|

4.0

|

|

9.5

|

|

11.3

|

|

20.1

|

|

8.3

|

|

7.4

|

|

10.7

|

|

10.8

|

|

37.2

|

|

40.3

|

|

1.3

|

|

33.1

|

|

37.4

|

|

|

Cumulative effect

accounting change

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

0.0

|

|

|

N.I. - Exc. One-time,

Options & Div

|

|

18.6

|

|

(8.5

|

)

|

6.0

|

|

14.5

|

|

15.6

|

|

27.7

|

|

11.9

|

|

11.3

|

|

16.3

|

|

16.6

|

|

56.2

|

|

61.7

|

|

0.8

|

|

48.1

|

|

57.3

|

|

|

Diluted EPS - Operating

|

|

$

|

|

0.85

|

|

$

|

|

(0.39

|

)

|

$

|

|

0.27

|

|

$

|

|

0.65

|

|

$

|

|

0.69

|

|

$

|

|

1.26

|

|

$

|

|

0.57

|

|

$

|

|

0.60

|

|

$

|

|

0.86

|

|

$

|

|

0.87

|

|

$

|

|

2.88

|

|

$

|

|

3.20

|

|

$

|

|

0.03

|

|

$

|

|

2.19

|

|

$

|

|

3.00

|

|

|

Diluted

EPS - Reported

|

|

$

|

|

0.11

|

|

$

|

|

(0.48

|

)

|

$

|

|

0.11

|

|

$

|

|

(0.65

|

)

|

$

|

|

0.63

|

|

$

|

|

(0.37

|

)

|

$

|

|

0.51

|

|

$

|

|

0.60

|

|

$

|

|

0.86

|

|

$

|

|

0.87

|

|

$

|

|

2.81

|

|

$

|

|

3.20

|

|

$

|

|

(0.79

|

)

|

$

|

|

0.59

|

|

$

|

|

3.00

|

|

|

Diluted Shares

Outstanding

|

|

21.8

|

|

21.6

|

|

22.0

|

|

22.0

|

|

22.6

|

|

22.0

|

|

20.9

|

|

19.0

|

|

19.1

|

|

19.2

|

|

19.5

|

|

19.3

|

|

21.5

|

|

21.8

|

|

19.1

|

|

|

Growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

8.2

|

%

|

(1.0

|

)%

|

(0.4

|

)%

|

5.3

|

%

|

17.5

|

%

|

5.4

|

%

|

25.3

|

%

|

16.5

|

%

|

17.5

|

%

|

17.0

|

%

|

18.8

|

%

|

13.0

|

%

|

6.3

|

%

|

11.5

|

%

|

16.0

|

%

|

|

Operating income

|

|

(62.6

|

)%

|

N/A

|

|

(41.7

|

)%

|

N/A

|

|

3521.4

|

%

|

75.3

|

%

|

N/A

|

|

117.9

|

%

|

15.1

|

%