Use these links to rapidly review the document

TABLE OF CONTENTS

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material Pursuant to §240.14a-12 |

|

MAXIMUS, Inc. |

||||

(Name of Registrant as Specified In Its Charter) |

||||

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

| Payment of Filing Fee (Check the appropriate box): | ||||

ý |

No fee required |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

![]()

11419 Sunset Hills Road

Reston, Virginia 20190

(703) 251-8500

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held March 18, 2004

The 2004 Annual Meeting of Shareholders of MAXIMUS, Inc. will be held at our corporate headquarters at 11419 Sunset Hills Road in Reston, Virginia on Thursday, March 18, 2004 at 11:00 a.m., Eastern Standard Time, to consider and act upon the following matters:

1. The election of three Class I Directors to serve until the 2007 Annual Meeting of Shareholders.

2. The amendment of our 1997 Employee Stock Purchase Plan to increase the number of shares of our common stock available for purchase under that plan.

3. The transaction of any other business that may properly come before the meeting or any adjournment of the meeting.

Shareholders of record at the close of business on Friday, January 9, 2004 will be entitled to vote at the annual meeting or at any adjournment of the annual meeting.

Our board of directors hopes that you will attend the meeting. Whether or not you plan to attend, please complete, date, sign and return the enclosed proxy card in the accompanying envelope. Your prompt response will greatly facilitate arrangements for the meeting, and your cooperation will be appreciated.

| By Order of the Board of Directors, | ||

David R. Francis, Secretary |

||

January 26, 2004 |

i

![]()

11419 Sunset Hills Road

Reston, Virginia 20190

(703) 251-8500

Our board of directors is soliciting your proxy with the enclosed proxy card for use at the 2004 Annual Meeting of Shareholders to be held on Thursday, March 18, 2004 and at any adjournments of the meeting. This proxy statement and accompanying proxy are first being sent or given to shareholders on or about January 26, 2004.

General Information About Voting

Who can vote. You will be entitled to vote your shares of MAXIMUS common stock at the annual meeting if you were a shareholder of record at the close of business on January 9, 2004. As of that date, 21,781,664 shares of common stock (which number does not include shares held by us as treasury shares) were outstanding and entitled to one vote each at the meeting. You are entitled to one vote on each item voted on at the meeting for each share of common stock that you held on January 9, 2004.

How to vote your shares. You can vote your shares either by attending the annual meeting and voting in person or by voting by proxy. If you choose to vote by proxy, please complete, date, sign and return the enclosed proxy card. The proxies named in the enclosed proxy card (David V. Mastran, Richard A. Montoni and David R. Francis) will vote your shares as you have instructed. You may authorize the proxies to vote your shares in favor of each of the proposals contained in this proxy statement by simply signing and returning the enclosed proxy card without indicating how your votes should be cast.

Even if you expect to attend the meeting, please complete and mail your proxy card in any case in order to assure representation of your shares. If you attend the meeting, you can always revoke your proxy by voting in person. No postage is necessary if the proxy card is mailed in the United States.

Quorum. A quorum of shareholders is required in order to transact business at the annual meeting. A majority of the outstanding shares of common stock entitled to vote must be present at the meeting, either in person or by proxy, to constitute a quorum.

Number of votes required. The number of votes required to approve each of the proposals that are scheduled to be presented at the meeting is as follows:

| |

Proposal |

Required Vote |

||

|---|---|---|---|---|

| 1. | Election of three Class I Directors | For each nominee, a plurality of the votes cast for or against such nominee. | ||

2. |

Amendment of 1997 Employee Stock Purchase Plan |

A majority of the votes cast for the amendment, provided that the total number of votes cast on the proposal is greater than 50% of the total number of shares entitled to vote on the proposal. |

Abstentions and broker non-votes. A broker non-vote occurs when a broker cannot vote a customer's shares registered in the broker's name because the customer did not send the broker instructions on how to vote on the matter. If the broker does not have instructions and is barred by law or applicable rules from exercising its discretionary voting authority in the particular matter, then the shares will not be voted on the matter, resulting in a "broker non-vote." Abstentions and broker non-votes will not count as votes cast in the election of directors or in the vote on amending the 1997 Employee Stock Purchase Plan. Therefore, abstentions and broker non-votes will have no effect on the voting on these matters at the meeting.

Discretionary voting by proxies on other matters. Aside from the election of directors and the amendment to the 1997 Employee Stock Purchase Plan, we do not know of any other proposal that may be presented at the 2004 Annual Meeting. However, if another matter is properly presented at the meeting, the persons named in the accompanying proxy card will exercise their discretion in voting on the matter.

How you may revoke your proxy. You may revoke the authority granted by your executed proxy card at any time before we exercise it by notifying our Corporate Secretary in writing, by executing a new proxy card bearing a later date and delivering the new executed proxy card to our Corporate Secretary, or by voting in person at the annual meeting.

Expenses of solicitation. We will bear all costs of soliciting proxies. We will request that brokers, custodians and fiduciaries forward proxy soliciting material to the beneficial owners of stock held in their names, for which we will reimburse their out-of-pocket expenses. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, telegraph and/or personal interviews.

Stockholders Sharing the Same Surname and Address. In some cases, stockholders holding their shares in a brokerage or bank account who share the same surname and address and have not given contrary instructions are receiving only one copy of our annual report and proxy statement. This practice is designed to reduce duplicate mailings and save significant printing and postage costs as well as natural resources. If you would like to have additional copies of our annual report and/or proxy statement mailed to you, please call or write us at our principal executive offices, 11419 Sunset Hills Road, Reston, Virginia 20190, Attn: Director of Investor Relations, telephone: (800) 368-2152. If you want to receive separate copies of the proxy statement or annual report to stockholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee record holder.

Security Ownership of Management and Five Percent Owners

The following table shows the number of shares of our common stock beneficially owned as of December 1, 2003 (unless otherwise indicated), by (i) the only persons known by us to own more than five percent of our outstanding shares of common stock, (ii) our directors and the nominees for director, (iii) the executive officers named in the Summary Compensation Table contained in this proxy statement and (iv) all of our directors and executive officers as a group.

The number of shares beneficially owned by each holder is based upon the rules of the Securities and Exchange Commission ("SEC"). Under SEC rules, beneficial ownership includes any shares over which a person has sole or shared voting or investment power as well as shares which the person has the right to acquire within 60 days by exercising any stock option or other right. Accordingly, this table includes shares that each person has the right to acquire on or before January 29, 2004. Unless otherwise indicated, to the best of our knowledge, each person has sole investment and voting power (or shares that power with his or her spouse) over the shares in the table. By including in the table shares that he or she might be deemed beneficially to own under SEC rules, a holder does not admit beneficial ownership of those shares for any other purpose.

To compute the percentage ownership of any shareholder or group of shareholders in the following table, the total number of shares deemed outstanding includes 21,394,585 shares that were outstanding on December 1, 2003 (which number does not include shares held by us as treasury shares), plus any shares that holder or group of holders could acquire upon exercising any options held by that holder or group of holders that are exercisable on or before January 29, 2004.

2

| |

Shares of Common Stock Beneficially Owned |

||||

|---|---|---|---|---|---|

| Beneficial Owner |

|||||

| Shares |

Percent |

||||

| Waddell & Reed Financial, Inc. 6300 Lamar Avenue Shawnee Mission, Kansas 66201 |

2,437,659 | (1) | 11.4 | % | |

| T. Rowe Price Associates, Inc. 100 East Pratt Street Baltimore, Maryland 21202 |

2,307,100 | (2) | 10.8 | % | |

| Wellington Management Company, LLP 75 State Street Boston, Massachusetts 02109 |

1,791,227 | (3) | 8.4 | % | |

| Royce & Associates, LLC 1414 Avenue of the Americas New York, New York 10019 |

1,754,300 | (4) | 8.2 | % | |

| David V. Mastran | 2,638,165 | (5) | 12.3 | % | |

| Russell A. Beliveau | 75,023 | (6) | * | ||

| Lynn P. Davenport | 68,731 | (7) | * | ||

| Thomas A. Grissen | 118,272 | (8) | * | ||

| John J. Haley | 16,034 | (9) | * | ||

| Peter B. Pond | 60,865 | (9) | * | ||

| Marilyn R. Seymann | 13,535 | (9) | * | ||

| James R. Thompson, Jr. | 24,249 | (9) | * | ||

| Paul R. Lederer | 6,361 | (9) | * | ||

| Wellington E. Webb | 5,597 | (9) | * | ||

| Richard A. Montoni | 15,000 | (9) | * | ||

| David R. Francis | 12,217 | (10) | * | ||

| David M. Johnson | — | * | |||

| All directors and executive officers as a group (13 persons) | 3,054,049 | (11) | 14.0 | % | |

footnotes continued on following page

3

Section 16(a) Beneficial Ownership Reporting Compliance

Our directors, our executive officers and anyone owning beneficially more than ten percent of our equity securities are required under Section 16(a) of the Securities Exchange Act of 1934 to file with the SEC reports of their ownership and changes of their ownership of our securities. They must also furnish copies of the reports to us. During some or all of our 2003 fiscal year, Dr. Mastran, Dr. Seymann, Messrs. Beliveau, Davenport, Grissen, Haley, Lederer, Pond, Thompson, Webb, Montoni, Johnson and Francis were our directors and/or executive officers. During some or all of our 2003 fiscal year, T. Rowe Price and Waddell & Reed Financial, Inc. and their respective affiliates as indicated in footnotes 1 and 2 above were ten percent beneficial owners of us. Based solely on our review of the reports furnished to us and any written representations that no other reports were required, we believe that during our 2003 fiscal year, our directors, executive officers and ten percent beneficial owners complied with all applicable Section 16(a) filing requirements, except that on December 12, 2002 Mr. Davenport filed a Form 4 reporting an exercise of 10,000 options that was due on December 10, 2002 and Mr. Webb filed a Form 3 on October 15, 2003 that was due on October 3, 2003.

4

PROPOSAL 1: Election of Directors

The board of directors currently consists of nine directors. Under our charter, the board is divided into three classes, with each class having as nearly equal a number of directors as possible. The term of one class expires, with their successors being subsequently elected to a three-year term, at each annual meeting of shareholders. At the 2004 Annual Meeting, three Class I Directors will be elected to hold office for three years and until their successors are elected and qualified. The board has nominated Paul R. Lederer, Peter B. Pond, and James R. Thompson, Jr. for election as Class I Directors at the upcoming annual meeting. Mr. Lederer, Mr. Pond and Mr. Thompson presently serve as our directors. If you return your proxy card in the enclosed envelope, the persons named in the enclosed proxy card will vote to elect these three nominees unless you mark your proxy card otherwise. The proxy may not be voted for a greater number of nominees than three. Each nominee has consented to being named in this proxy statement and to serve if elected. If for any reason a nominee should become unavailable for election prior to the annual meeting, the proxy may vote for the election of a substitute. We do not presently expect that any of the nominees will be unavailable.

The affirmative vote of a plurality of the total number of votes cast for or withheld from each of Messrs. Lederer, Pond and Thompson is required to re-elect each nominee to our board. Abstentions and broker non-votes will be considered as present for quorum purposes, but will not be counted as votes cast. Accordingly, abstentions and broker non-votes will have no effect on the voting of this matter.

The following table contains biographical information about the nominees for Class I Directors and current directors whose terms of office will continue after the 2004 Annual Meeting. Information about the number of shares of common stock beneficially owned by each nominee and director, directly or indirectly, as of December 1, 2003, appears above under "Security Ownership of Management and Five Percent Owners."

| |

Nominees for Class I Directors (present term expires in 2004) |

|

||

|---|---|---|---|---|

| Name and Age |

Director Since |

|||

| Business Experience and Other Directorships |

||||

| Paul R. Lederer Age: 64 |

Paul R. Lederer has served as one of our directors since his election to the board in April 2003. Mr. Lederer retired from Federal Mogul in 1998 as Executive Vice President, Worldwide Aftermarket, following its acquisition of Fel-Pro where he served as President and Chief Operating Officer from November 1994 to February 1998. Mr. Lederer holds a B.A. in Political Science from the University of Illinois and received his J.D. from Northwestern University. He is also a director of Trans Pro Corporation, I. Carz, R&B, Inc., O'Reilly Automotive, Inc. and Vita Foods, Inc. | 2003 |

5

Peter B. Pond Age: 59 |

Peter B. Pond has served as one of our directors since his election to the board in December 1997 and as Chairman of the Board since September 2001. Mr. Pond is a founder of ALTA Equity Partners LLC, a venture capital firm, and has been a General Partner of that firm since June 2000. Prior to that, Mr. Pond was a Principal and Managing Director in the Investment Banking Department at Donaldson, Lufkin & Jenrette Securities Corporation in Chicago and was head of that company's Midwest Investment Banking Group. Mr. Pond holds a B.S. in Economics from Williams College and an M.B.A. in Finance from the University of Chicago. He is also a director of Navigant Consulting, Inc. |

1997 |

||

James R. Thompson, Jr. Age: 67 |

James R. Thompson, Jr. has served as one of our directors since his election in March 2001. Governor Thompson currently serves as Chairman of the Chicago office of the law firm of Winston & Strawn, a position he has held since January 1993. He joined that firm in January 1991 as Chairman of the Executive Committee after serving four terms as Governor of the State of Illinois from 1977 until January 1991. Prior to his terms as Governor, he served as U.S. Attorney for the Northern District of Illinois from 1971 to 1975. Governor Thompson served as the Chief of the Department of Law Enforcement and Public Protection in the Office of the Attorney General of Illinois, as an Associate Professor at Northwestern University School of Law and as an Assistant State's Attorney of Cook County. He is a former Chairman of the President's Intelligence Oversight Board and presently serves as a member of the National Commission on Terrorist Attacks Upon the United States. Governor Thompson is currently a member of the boards of directors of Navigant Consulting, Inc., Prime Retail, Inc., FMC Corporation, FMC Technologies, Inc. and Hollinger International Inc., and he is a trustee of the Prime Group Realty Trust. Governor Thompson also serves on the boards of directors of the Board of Trade of the City of Chicago, Inc., the Japan Society (New York), the Museum of Contemporary Art and the Lyric Opera, and he is a member of the Abraham Lincoln Bicentennial Commission. Governor Thompson attended the University of Illinois and Washington University, and he received his J.D. from Northwestern University in 1959. |

2001 |

6

| |

Class II Directors (present term expires in 2005) |

|

||

|---|---|---|---|---|

| Name and Age |

Director Since |

|||

| Business Experience and Other Directorships |

||||

| Russell A. Beliveau Age: 56 |

Russell A. Beliveau has served as one of our directors since his election in 1995. Mr. Beliveau is currently semi-retired and also works as a self-employed business consultant. Mr. Beliveau served as President of Investor Relations at MAXIMUS from October 2000 until his retirement in September 2002 and as President of Business Development from September 1998 until October 2000. Prior to that, he served as the President of our Government Operations Group from 1995 to 1998. Mr. Beliveau has more than twenty-eight years of experience in the health and human services industry during which he has worked in both government and private sector positions at the senior executive level. Mr. Beliveau's past positions include Vice President of Operations at Foundation Health Corporation of Sacramento, California from 1988 through 1994 and Deputy Associate Commissioner (Medicaid) for the Massachusetts Department of Public Welfare from 1983 until 1988. Mr. Beliveau received his Masters in Business Administration and Management Information Systems from Boston College in 1980 and his B.A. in Psychology from Bridgewater State College in 1974. | 1995 | ||

John J. Haley Age: 54 |

John J. Haley has served as one of our directors since his election in June 2002. Mr. Haley is currently President and Chief Executive Officer of Watson Wyatt & Company Holdings, a human resources and employee benefits consulting firm. Mr. Haley joined Watson Wyatt in 1977. Mr. Haley is also a director of Watson Wyatt & Company Holdings and serves on the Watson Wyatt LLP Partnership Board. He is also a director of Hudson Highland Group, Inc. Mr. Haley is a Fellow of the Society of Actuaries and is a co-author of Fundamentals of Private Pensions (University of Pennsylvania Press). He has an A.B. in Mathematics from Rutgers College and studied under a Fellowship at the Graduate School of Mathematics at Yale University. |

2002 |

||

Marilyn R. Seymann Age: 61 |

Marilyn R. Seymann has served as one of our directors since her election in April 2002. Dr. Seymann is currently President and Chief Executive Officer of M One, Inc., a management risk and information systems and governance consulting firm specializing in the financial services industry. She has been with M One since 1991. Dr. Seymann holds a B.A. from Brandeis University, an M.A. from Columbia University, and a Ph.D. from California Western University. She is a director of EOS International, Beverly Enterprises, Inc., Community First Bankshares, Inc. and NorthWestern Corporation. |

2002 |

7

| |

Class III Directors (present term expires in 2006) |

|

||

|---|---|---|---|---|

| Name and Age |

Director Since |

|||

| Business Experience and Other Directorships |

||||

| Lynn P. Davenport Age: 56 |

Lynn P. Davenport has served as our President and Chief Operating Officer since October 2003. Previously, he served as the General Manager of our Health and Consulting Services Strategic Business Unit since October 2001. Before that he was President of our Consulting Group from October 2000 to September 2001. Previously he had been President of the Human Services Division since he joined us in 1991. Mr. Davenport has served as one of our directors since 1994. He has over 25 years of health and human services experience in the areas of administration, productivity improvement, management consulting, revenue maximization and management information systems. Prior to joining us, Mr. Davenport was employed by Deloitte & Touche, and its predecessor, Touche Ross & Co., in Boston, Massachusetts, where he became a partner in 1987. Mr. Davenport received his M.P.A. in Public Administration from New York University in 1971 and his B.A. in Political Science and Economics from Hartwick College in 1969. | 1994 | ||

David V. Mastran Age: 61 |

David V. Mastran has served as our Chief Executive Officer since he founded MAXIMUS in 1975 and as President until September 2003. Dr. Mastran received his Sc.D. in Operations Research from George Washington University in 1973, his M.S. in Industrial Engineering from Stanford University in 1966 and his B.S. from the United States Military Academy at West Point in 1965. |

1975 |

||

Wellington E. Webb Age: 62 |

Wellington E. Webb has served as one of our directors since his election to the board in September 2003. Mr. Webb completed his third, four-year term as Mayor of the City and County of Denver, Colorado in 2003. Since that time he has founded Webb Group International L.L.C., a business and government consulting business. Prior to first being elected as Mayor in 1991, he served at the state, local and federal levels in several capacities including Denver City Auditor, Executive Director of the Colorado Department of Regulatory Agencies and Regional Director of the U.S. Department of Health Education and Welfare. Mr. Webb's distinguished public career began in 1972 when he was elected to the Colorado House of Representatives. Mr. Webb holds a B.A. in Sociology from the Colorado State College at Greeley and a M.A. in Sociology from the University of Northern Colorado. He also holds honorary Doctorates from the University of Colorado at Denver and from the Metropolitan State College. |

2003 |

8

Our board expects that its members will prepare for, attend and participate in all board and applicable committee meetings and each annual meeting of shareholders. Our board of directors held seven meetings during fiscal 2003. During our 2003 fiscal year, each of our directors attended all of the meetings of our board of directors and all of the meetings of the committees of the board upon which each served, except that David V. Mastran and James R. Thompson, Jr. did not attend two meetings of the board, and Governor Thompson (who was a member of the Audit Committee until June 4, 2003) did not attend two Audit Committee meetings. All of our directors attended our 2003 annual meeting of shareholders.

Audit Committee

Our board has a standing Audit Committee that evaluates our independent accountants, reviews our audited financial statements, accounting processes and reporting systems and discusses the adequacy of our internal financial controls with our management and our independent accountants. The Audit Committee is directly responsible for the appointment, compensation and oversight of our independent accountants (including resolution of disagreements between our management and our independent accountants regarding financial reporting). The members of the Audit Committee are Peter B. Pond (Chair), Paul R. Lederer, and Marilyn R. Seymann, each of whom is independent as defined by applicable New York Stock Exchange listing standards governing the qualifications of audit committee members in effect on the date of this proxy statement. The Audit Committee held seven meetings during fiscal 2003. The Audit Committee operates under a written charter originally adopted by the board on May 16, 2000, as subsequently amended. The Audit Committee's charter, as amended and currently in effect, is available on our website at www.maximus.com. The Audit Committee's report appears in this proxy statement under the heading "Report of the Audit Committee."

Compensation Committee

Our board also has a standing Compensation Committee that is responsible for establishing cash compensation policies with respect to our executive officers, employees, directors and consultants. The members of the Compensation Committee are Marilyn R. Seymann (Chair), John J. Haley, Paul R. Lederer, Peter B. Pond, and James R. Thompson, Jr. The Compensation Committee's report appears in this proxy statement under the heading "Report of the Board of Directors and Compensation Committee." The Committee acts under a written charter, which is available on our website at www.maximus.com. During our 2003 fiscal year, the Compensation Committee did not meet separately from the full board.

Nominating and Governance Committee

Our board also has a standing Nominating and Governance Committee comprised of James R. Thompson, Jr. (Chair), John J. Haley, Paul R. Lederer, Peter B. Pond and Marilyn R. Seymann, each of whom is independent as defined by applicable New York Stock Exchange listing standards governing the qualifications of nominating and corporate governance committee members in effect on the date of this proxy statement. The Committee acts under a written charter, which is available on our website at www.maximus.com. During our 2003 fiscal year, the Nominating and Governance Committee did not meet separately from the full board.

The purpose of the Nominating and Governance Committee is to identify, evaluate and recommend candidates for membership on the board of directors, to ensure an appropriate structure and process for management succession and to establish and assure the effectiveness of the governance principles of the board and the company. The Committee does not employ a fixed set of qualifications for director nominees, however, minimum qualifications for nominees include the ability to dedicate the time and resources sufficient for the diligent performance of the duties required of a member of our board, not holding positions that conflict with their responsibilities to the company and compliance with any other

9

minimum qualifications for either individual directors or the board as a whole mandated by applicable laws or regulations. The Committee will consider shareholder recommendations for candidates to serve on the board of directors. The name of any recommended candidate for director, together with pertinent biographical information, a document indicating the candidate's willingness to serve if elected, and evidence of the nominating shareholder's ownership of our stock should be sent to the attention of our Secretary at the address below.

Stockholders may send communications to the board of directors to the attention of our Secretary at 11419 Sunset Hills Road, Reston, Virginia 20190.

Directors who are also MAXIMUS employees do not receive additional compensation for their services as directors. Outside directors are paid a $45,000 annual retainer (at least $25,000 of which must be received in stock options), a fee of $2,500 for each board meeting and a fee of $1,500 for each committee meeting in which they participate. Mr. Pond receives an additional $80,000 retainer for his services as Chairman of the Board and an additional $10,000 retainer for his services as Chairman of the Audit Committee. Dr. Seymann receives an additional $5,000 retainer for her services as Chair of the Compensation Committee. Directors who are entitled to directors' fees may elect to receive all or a portion of their cash fees in stock options granted under our 1997 Equity Incentive Plan, valued using the Black-Scholes option pricing method. For fiscal 2003, Mr. Haley, Mr. Pond and Governor Thompson elected to receive their annual retainers in the form of stock options, and Mr. Beliveau, Mr. Lederer and Dr. Seymann elected to receive their annual retainer in the form of cash. Mr. Webb elected to receive his annual retainer partially in stock options and partially in cash. Pursuant to their elections, Pond received options to purchase 7,015 shares of our common stock at $21.39 per share and Mr. Haley and Governor Thompson each received options to purchase 2,338 shares of our common stock at an exercise price of $21.39 per share. For fiscal 2003, Mr. Haley, Mr. Lederer, Mr. Pond, Dr. Seymann, and Governor Thompson also elected to receive all of their meeting attendance fees in the form of stock options. Mr. Beliveau elected to receive his meeting attendance fees in cash. Pursuant to these elections, Mr. Haley received options to purchase 1,351 shares of our common stock at exercise prices ranging from $19.88 to $37.35 per share, Mr. Lederer received options to purchase 656 shares of our common stock at exercise prices ranging from $21.40 to $37.35 per share, Mr. Pond received options to purchase 2,068 shares of our common stock at exercise prices ranging from $19.88 to $37.35 per share, Dr. Seymann received options to purchase 2,068 shares of our common stock at exercise prices ranging from $19.88 to $37.35 per share and Governor Thompson received options to purchase 997 shares of our common stock at exercise prices ranging from $19.88 to $37.35 per share. Mr. Webb was not elected to the board until September 23, 2003 and did not attend any meetings during fiscal year 2003.

Any director who is not a MAXIMUS employee is eligible to participate in our 1997 Director Stock Option Plan. Options under the Director Stock Option Plan are automatically granted to an eligible director upon the election or re-election of the director. Under the plan, each option consists of 5,000 shares of common stock for each year of the term of office to which the director is elected or re-elected, with any period of term of office less than a year deemed a full year. The option becomes exercisable for 5,000 shares immediately upon grant and, if the grant is for more than 5,000 shares, then it also becomes exercisable for an additional 5,000 shares at each subsequent annual shareholders meeting during which the optionee is an eligible director and shares remain unexercisable under the option. Options granted under the Director Stock Option Plan have a ten-year term. The exercise price for each option is equal to our common stock's last sale price on the trading day immediately preceding the date of grant, as reported on the New York Stock Exchange. During fiscal year 2003, the eligible directors were Mr. Beliveau, Mr. Haley, Mr. Lederer, Mr. Pond, Dr. Seymann, Governor Thompson and Mr. Webb.

10

Certain Relationships and Related Transactions

Governor Thompson, who has served as one of our directors since his election in March 2001, is Chairman of the law firm of Winston & Strawn in Chicago. Winston & Strawn has provided certain specialized legal services to MAXIMUS from May 2000 to the present.

John Haley, who has served as one of our directors since his election in June 2002, is President and Chief Executive Officer of Watson Wyatt & Company Holdings. Watson Wyatt has provided certain compensation consulting services to MAXIMUS from February 2002 to the present.

Russell Beliveau served as our President of Investor Relations until his retirement in September 2002. He currently has a consulting agreement with us to provide investor relations services on an as-needed basis. During fiscal 2003, Mr. Beliveau was paid $21,612 under that agreement.

Donna Muldoon Mastran was employed by us as an Executive Vice President until her retirement in April 2003. She is currently under contract as a consultant to the company. She is married to Dr. Mastran, our CEO and one of our directors. Mrs. Mastran earned $38,030 in salary from us during our 2003 fiscal year.

Keven L. Kvasnicka is employed by us as a Manager in our Office of Information Systems. Mr. Kvasnicka is married to Dr. Mastran's daughter. Mr. Kvasnicka earned $112,247 in salary and $5,000 in bonus from us during our 2003 fiscal year. As of the date of this proxy statement, Mr. Kvasnicka remains employed by us on similar terms.

Joseph L. Mastran, Dr. Mastran's brother, is employed by us as a Corporate Real Estate Specialist. Joseph Mastran earned $79,195 in salary and $2,900 in bonus from us during our 2003 fiscal year. As of the date of this proxy statement, Joseph Mastran remains employed by us on similar terms.

11

The table below provides earned compensation information for our CEO and our five most highly compensated other employees who served as our executive officers during some or all of our 2003 fiscal year whose salary and bonus from MAXIMUS earned for fiscal year 2003 exceeded $100,000.

| |

|

Annual Compensation |

Long-Term Compensation Awards |

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($)(1) |

Other Annual Compensation ($)(2) |

Restricted Stock Units ($)(3) |

Securities Underlying Options (#) |

All Other Compensation ($)(4) |

|||||||

| David V. Mastran Chief Executive Officer |

2003 2002 2001 |

395,155 375,000 350,000 |

— — — |

— — — |

— — — |

— — — |

— — — |

|||||||

Lynn P. Davenport President and Chief Operating Officer |

2003 2002 2001 |

385,000 360,000 340,000 |

35,000 20,000 — |

— — — |

— 256,190 — |

5,000 — — |

6,000 8,000 6,800 |

|||||||

Thomas A. Grissen General Manager, Technical Services SBU |

2003 2002 2001 |

385,000 360,000 340,000 |

25,000 20,000 30,100 |

— — — |

— 226,050 — |

5,000 — — |

4,500 6,500 6,800 |

|||||||

Richard A. Montoni* Chief Financial Officer |

2003 2002 2001 |

340,000 176,042 — |

25,500 54,166 — |

— 69,886(5) — |

— 105,490 — |

15,000 60,000 — |

8,833 3,250 — |

|||||||

David R. Francis General Counsel |

2003 2002 2001 |

228,462 218,077 215,384 |

17,500 15,000 18,060 |

— — — |

— 60,280 — |

— — — |

6,783 6,767 8,000 |

|||||||

David M. Johnson** former Chief Operating Officer |

2003 2002 2001 |

411,523 — — |

100,000 — — |

— — — |

— — — |

100,000 — — |

— — — |

|||||||

12

The following table provides information for options granted during our 2003 fiscal year to our CEO and our five most highly compensated other employees who served as our executive officers during some or all of our 2003 fiscal year.

Option Grants in Last Fiscal Year

| |

|

|

|

|

Potential Realizable Value at Assumed Annual Rates of Stock Price Appreciation for Option Term (1) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Individual Grants |

|||||||||||

| |

Number of Securities Underlying Options Granted (#) |

|

|

|

||||||||

| Name |

Percent of Total Options Granted to Employees in Fiscal Year (%) |

Exercise or Base Price ($/share) |

Expiration Date |

|||||||||

| 5% ($) |

10% ($) |

|||||||||||

| David V. Mastran | — | — | — | — | — | — | ||||||

| Lynn P. Davenport | 5,000 | 2.12 | 22.17 | 10/1/2012 | 69,700 | 176,650 | ||||||

| Thomas A. Grissen (2) | 5,000 | 2.12 | 22.17 | 10/1/2012 | 69,700 | 176,650 | ||||||

| Richard A. Montoni | 15,000 | 6.35 | 19.88 | 3/18/2013 | 187,500 | 475,200 | ||||||

| David M. Johnson (3) | — | — | — | — | — | — | ||||||

| David R. Francis | — | — | — | — | — | — | ||||||

13

Aggregate Option Exercises and Fiscal Year-End Option Values

The following table provides information regarding stock options exercised during our 2003 fiscal year by our CEO and our five most highly compensated other employees who served as our executive officers during some or all of our 2003 fiscal year and the value of unexercised stock options held on September 30, 2003 by our CEO and our five most highly compensated other employees who served as our executive officers during some or all of our 2003 fiscal year.

Aggregated Option Exercises In Last Fiscal Year and Fiscal Year-End Option Values

| |

Options Exercised During Fiscal Year 2003 |

Number of Securities Underlying Unexercised Options at Fiscal Year-End (#) |

Value of Unexercised In-the-Money Options at Fiscal Year-End ($)(2) |

|||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name |

Shares Acquired on Exercise (#) |

Value Realized ($) (1) |

Exercisable |

Unexercisable |

Exercisable |

Unexercisable |

||||||

| David V. Mastran | — | — | — | — | — | — | ||||||

| Lynn P. Davenport | 32,000 | 953,455 | 65,217 | 10,496 | 1,149,170 | 137,160 | ||||||

| Thomas A. Grissen | 95,900 | 547,291 | 111,007 | 14,236 | 662,595 | 188,398 | ||||||

| Richard A. Montoni | — | — | 15,000 | 60,000 | 26,700 | 298,650 | ||||||

| David M. Johnson | — | — | — | — | — | — | ||||||

| David R. Francis | — | — | 10,111 | 3,182 | 128,595 | 44,058 | ||||||

Executive Employment Agreements

Compensation. Dr. Mastran and Mr. Davenport formerly served as officers of MAXIMUS under executive employment agreements which expired in September 2001. Accordingly, these officers serve as employees-at-will. Mr. Grissen formerly served as an officer of MAXIMUS under an executive employment agreement that expired in March 2003. Mr. Grissen resigned from the company in December 2003. Mr. Montoni and Mr. Johnson served as officers of MAXIMUS during fiscal year 2003 under executive employment agreements which provide for minimum base salaries, subject to annual review for adjustment. Mr. Montoni's executive employment agreement set his initial base salary at $27,083 per month, and Mr. Johnson's executive employment agreement set his initial base salary at $35,417 per month. In addition, both of those officers were entitled to receive a year-end bonus consistent with our past practices under their employment agreements. Mr. Johnson left the company before he became eligible for a bonus.

Term and termination. Dr. Mastran's and Mr. Davenport's employment agreements expired on September 30, 2001, Mr. Grissen's employment agreement expired on March 1, 2003, and Mr. Johnson's agreement terminated effective September 15, 2003. Mr. Montoni's employment term began March 18, 2002 and continues through March 18, 2006. The employment of each of these officers is subject to our right to terminate the officer's employment if the officer breaches any material duty or obligation to us or engages in other proscribed conduct.

Other terms. Mr. Montoni's employment agreement provides that he will not compete with us and will maintain our trade secrets in strict confidence. Although now expired or terminated, our employment agreements with Dr. Mastran, Mr. Davenport, Mr. Grissen and Mr. Johnson contain provisions which survive the expiration of the agreements which similarly limit these officers from engaging in certain competitive activities and require these officers to maintain the confidentiality of our proprietary information.

14

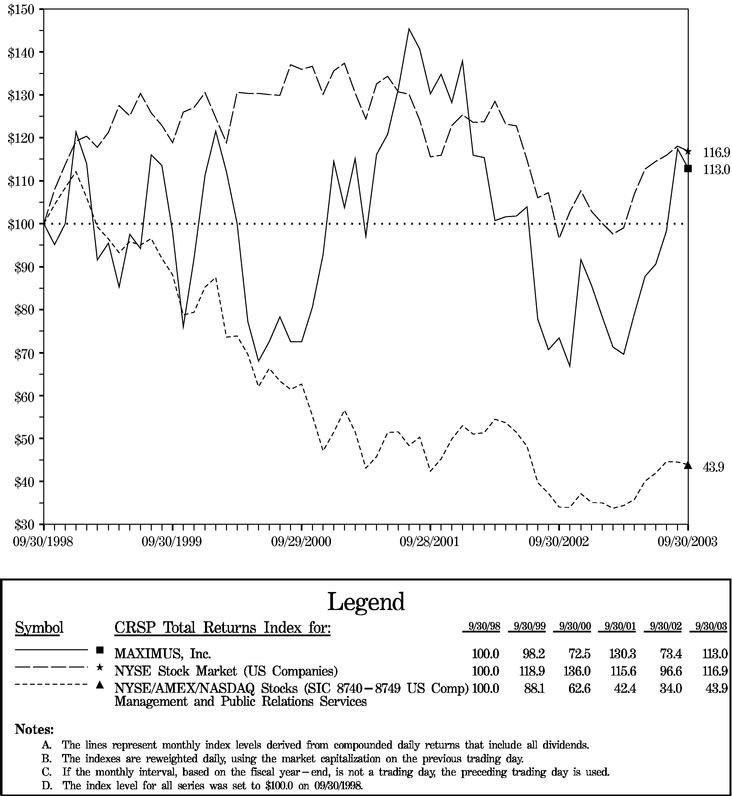

The following graph compares cumulative total shareholder return on our common stock for the five-year period from September 30, 1998 to September 30, 2003, with the cumulative total return for the NYSE Stock Market (U.S. Companies) Index and the NYSE/AMEX/NASDAQ Stocks (SIC 8740-8749 U.S. Companies) Management and Public Relations Services Index. This graph assumes the investment of $100 on September 30, 1998 in our common stock, the NYSE Stock Market (U.S. Companies) Index and the NYSE/AMEX/NASDAQ Stocks (SIC 8740-8749 U.S. Companies) Management and Public Relations Services Index and assumes dividends are reinvested.

15

Report of the Board of Directors and Compensation Committee

The Compensation Committee of our board of directors establishes the cash compensation policies for the company's executive officers. At the beginning of our 2003 fiscal year, the Compensation Committee consisted of Mr. Pond and Governor Thompson. On June 4, 2003, Mr. Haley, Mr. Lederer, and Dr. Seymann were also appointed to the Compensation Committee. Dr. Seymann presently serves as Chair of the Committee. The Compensation Committee is responsible for approving the equity compensation of executive officers under the MAXIMUS 1997 Equity Incentive Plan. The Compensation Committee submits this report on compensation policies and actions during fiscal year 2003 with respect to our executive officers, including Dr. Mastran in his capacity as our Chief Executive Officer and our five most highly compensated other employees who served as our executive officers during some or all of our 2003 fiscal year.

Compensation philosophy

MAXIMUS bases its executive compensation philosophy on the belief that competitive compensation is essential to attract, motivate, retain and reward highly-qualified and industrious executives who contribute to the company's long-term success. Through its compensation policy, MAXIMUS strives to provide total compensation that is competitive with other companies in comparable lines of business. The compensation program includes both motivational and retention-related compensation components. Effective individual performance that meets and exceeds MAXIMUS' current plans and objectives is encouraged through bonus awards and stock option and restricted stock unit ("RSU") grants. Stock options and RSUs are granted in order to link a meaningful portion of the compensation of MAXIMUS' executives with the performance of MAXIMUS' common stock.

MAXIMUS endeavors to reward each executive's achievement of designated targets that relate to MAXIMUS' annual and long-term performance, customer satisfaction and individual fulfillment of responsibilities. While compensation survey data are useful guides for comparative purposes, we believe that an effective compensation program also requires the application of judgment and subjective determinations of individual performance. Therefore, the Compensation Committee and MAXIMUS' board of directors apply their judgment to reconcile the program's objectives with the realities of retaining valued employees.

Compliance with Internal Revenue Code section 162(m)

Section 162(m) of the Internal Revenue Code, enacted in 1993, generally disallows a tax deduction to a public company for compensation over $1 million paid to its chief executive officer and its four other most highly compensated executive officers. However, if certain performance-based requirements are met, qualifying compensation will not be subject to this deduction limit. MAXIMUS currently intends to structure its stock options grants to executive officers in a manner that meets these performance-based requirements.

Executive compensation program

Compensation for MAXIMUS' executives consists of three principal elements: annual base salary, annual cash bonus and long term equity incentives.

Base salary. Mr. Grissen, Mr. Montoni, and Mr. Johnson received an initial monthly base salary under the terms of their employment agreements, subject to annual review for adjustment. Mr. Grissen's employment agreement was approved by MAXIMUS in 1999, and Mr. Montoni's and Mr. Johnson's agreements were approved by MAXIMUS in 2002. Messrs. Davenport and Francis do not have employment agreements, and their base salaries were adjusted after their annual reviews. MAXIMUS sets the salaries or minimum salaries of its executive officers by referring to the relevant executive's salary history and by considering internal and external factors, and MAXIMUS may adjust base salaries for

16

future periods based upon individual performance, experience and the salaries paid to individuals in comparable positions with other companies.

Cash bonus. Messrs. Davenport, Grissen, Montoni and Francis also may receive an annual cash bonus as significant part of their annual compensation. In fiscal 2003, their cash bonuses represented the following percentages of the indicated officer's total fiscal 2003 earned cash compensation: Mr. Davenport, 8.3%, Mr. Grissen, 6.1%, Mr. Montoni, 7.0% and Mr. Francis, 7.1%. A target cash bonus is established for Mr. Montoni by the terms of his employment agreement. We determine the amount of the cash bonuses awarded to our other executive officers based upon our financial performance and each officer's contribution to this performance. We review and evaluate the performance of the executive's division or activity, the impact on us of that division or activity and the skills and experience required for the job in assessing each executive's contribution to our success. We also compare these factors with similar factors applied to other executives, both inside and outside of MAXIMUS.

Equity ownership. MAXIMUS also provides long-term incentive compensation to its executives in the form of options to purchase common stock and RSUs. The MAXIMUS equity ownership program is designed to (i) highlight and reinforce the mutual long-term interests between employees and the shareholders and (ii) attract and retain important key executives, managers and individual contributors. The retention of key executives is essential to our growth and development.

Generally, the stock options and RSUs that MAXIMUS grants have relatively long vesting periods and, in the case of stock options, exercise prices equal to the fair market value per share of common stock on the date of the grant. The retention value of these options and RSUs is maximized, and our executive officers are provided with an incentive for longer-term success, through long vesting periods. Many of our stock options vest in equal annual installments over four years beginning on the first anniversary of the date of the option grant. If employees leave MAXIMUS before their options are exercisable, the unexercisable portions are forfeited. While MAXIMUS believes that these longer vesting periods are in the shareholders' best interest, the vesting periods may result in an increased number of outstanding options compared to companies with shorter vesting schedules. The RSUs typically vest in equal installments over six years beginning on the first anniversary of the RSU grant, subject to acceleration in the event the company achieves certain performance targets.

In general, the number of RSUs and shares of common stock underlying the stock options granted to each executive officer reflects the significance of that executive officer's current and anticipated contributions to MAXIMUS and the equity compensation policies of competitors and other privately-held and publicly-traded companies with similar capitalizations. MAXIMUS expects to continue to apply this philosophy to future grants of its stock options and RSUs. The value that may be realized upon exercise of options depends upon the price of our common stock at the time of exercise and the exercise price of the option. Each individual option-holder, and not the board, makes the decision as to whether to exercise options that are exercisable at any particular time.

Dr. Mastran's Compensation

Dr. Mastran's minimum base annual salary for fiscal 2003 was fixed at $430,000 by the Compensation Committee, representing a $55,000 increase from Dr. Mastran's base salary during fiscal 2002. Of the $430,000 salary approved for fiscal 2003, $395,155 was paid to Mr. Mastran due to certain uncompensated leave time taken by Dr. Mastran. The Committee set Dr. Mastran's base salary at a level it believed was consistent with Dr. Mastran's salary history at MAXIMUS. The Compensation Committee is responsible for determining Dr. Mastran's annual bonus after the end of the fiscal year by evaluating MAXIMUS' overall financial performance and Dr. Mastran's contribution to MAXIMUS' performance. Despite Dr. Mastran's substantial contributions to MAXIMUS' performance in fiscal 2003, Dr. Mastran received no bonus, stock awards or option grants in light of his existing significant equity ownership in MAXIMUS.

17

On October 13, 2003, the Compensation Committee approved an increase in Dr. Mastran's base salary for our 2004 fiscal year to $550,000.

| Compensation Committee | ||

| Marilyn R. Seymann John J. Haley Paul R. Lederer Peter B. Pond James R. Thompson, Jr. |

Compensation Committee Interlocks and Insider Participation

At the beginning of fiscal year 2003, the MAXIMUS Compensation Committee consisted of Mr. Pond and Governor Thompson. Mr. Haley, Mr. Lederer, and Dr. Seymann were added to the Committee on June 4, 2003. As disclosed under the caption "Certain Relationships and Related Transactions" above, Governor Thompson is Chairman of the law firm of Winston & Strawn, which firm has provided certain specialized legal services to MAXIMUS from May 2000 to the present, and Mr. Haley is the President and Chief Executive Officer of Watson Wyatt & Company Holdings, which firm has provided compensation consulting services to MAXIMUS from February 2002 to the present.

In addition, Dr. Mastran and Messrs. Beliveau, Davenport and Grissen, in their respective capacities as members of our board of directors, participated in our board's deliberations during our 2003 fiscal year concerning executive officer compensation. During our 2003 fiscal year, Dr. Mastran, Mr. Davenport and Mr. Grissen also served as officers and employees of MAXIMUS.

The Audit Committee of the board of directors' primary function is to assist the board in fulfilling its oversight responsibilities for financial reporting compliance by reviewing the audited financial statements, the systems of internal controls which management and the board of directors have established and the overall audit process. In the course of its oversight, the Audit Committee of the board has (i) reviewed and discussed with management the MAXIMUS audited financial statements for the fiscal year ended September 30, 2003, (ii) discussed with Ernst & Young LLP, MAXIMUS' independent accountants, the matters required to be discussed by Statement on Accounting Standards No. 61, Communication with Audit Committees, and (iii) received the written disclosures and the letter from the auditors required by Independence Standards Board Standard No. 1, Independence Discussions with Audit Committees. In addition, the Audit Committee discussed with the independent accountants the auditors' independence and considered whether the provision by Ernst & Young LLP of the non-audit services described in the section of this proxy statement captioned "Independent Public Accountants" below is compatible with maintaining the auditors' independence.

Based on this review and discussion, the Audit Committee recommended to the board of directors that the audited financial statements be included in the MAXIMUS Annual Report on Form 10-K for the year ended September 30, 2003 for filing with the Securities and Exchange Commission.

| Audit Committee | ||

| Peter B. Pond Paul R. Lederer Marilyn R. Seymann |

18

Independent Public Accountants

We expect to select the firm of Ernst & Young LLP as our independent public accountants for fiscal year 2004. Representatives of Ernst & Young are expected to attend the annual meeting to respond to questions and will have the opportunity to make a statement if they desire.

Fees Paid to Principal Accountants

During our 2003 and 2002 fiscal years, we retained Ernst & Young to provide services in the following categories and amounts (certain amounts for 2002 have been reclassified to conform to the 2003 presentation):

Audit Fees. The aggregate of fees billed to us by Ernst & Young for professional services rendered for the audit of our annual financial statements for our 2003 fiscal year and for reviewing our financial statements included in our Quarterly Reports on Form 10-Q filed with the SEC for our 2003 fiscal year was $417,000 and for our 2002 fiscal year was $347,000.

Audit-Related Fees. The aggregate of fees billed to us by Ernst & Young for professional services rendered for accounting consultations during our 2003 fiscal year and for all other audit-related services provided to us by Ernst & Young during our 2003 fiscal year was $30,000 and during our 2002 fiscal year was $162,000.

Tax Fees. The aggregate of fees billed to us by Ernst & Young for professional services rendered for tax compliance, tax advice and tax planning during our 2003 fiscal year was $247,000 and during our 2002 fiscal year was $161,000.

All Other Fees. There were no fees billed to us by Ernst & Young for services rendered to us by Ernst & Young for our 2003 and 2002 fiscal years, other than the fees disclosed in the preceding three paragraphs of this proxy statement.

All of the above services provided by Ernst & Young were approved by the Audit Committee.

19

PROPOSAL 2: Amendment of Employee Stock Purchase Plan

General

Our board of directors adopted the 1997 Employee Stock Purchase Plan (the "Plan") in January 1997, and our shareholders approved the Plan in February 1997. The Plan offers our employees the opportunity to purchase shares of our common stock at periodic intervals on tax-advantaged terms. The Plan may be amended by the board subject to such stockholder approval as is necessary or advisable.

As originally adopted, the Plan provided for up to 500,000 shares of our common stock to be issued. As of December 1, 2003, a total of 356,386 shares have been issued under the Plan and 143,614 remain available for issuance. Based on the current rate of employee participation, we believe the Plan may exhaust the available shares by the end of calendar year 2004. On December 10, 2003, the board of directors voted, subject to shareholder approval, to increase the number of shares of common stock available for issuance under the Plan to 1,000,000 shares. Accordingly, the proposal to increase the number of shares available under the Plan to 1,000,000 shares will be voted on at our 2004 Annual Meeting.

We believe that continuing to provide the benefits available under an employee stock purchase plan to our employees will help us attract and retain top quality personnel, motivate them to acquire an equity stake in MAXIMUS and provide an incentive for them to achieve long-range performance goals to the extent they retain the shares purchased under the Plan. Our board of directors strongly believes that continuing to offer a program in which our employees can purchase shares of our common stock is an important component of our compensation program. The Plan is intended to qualify as an "employee stock purchase plan" under Section 423 of the Internal Revenue Code.

Administration and Eligibility

The board is authorized to implement the Plan by establishing from time to time a date or series of dates during which rights to purchase shares of our common stock will be offered ("Offerings"). The rights granted pursuant to such Offerings will be exercisable periodically on specified dates as determined by the board (each an "Exercise Date"). The board is also authorized to administer, interpret and apply all provisions of the Plan as it deems necessary. The board may delegate all or part of its authority to administer the Plan to a committee of the board or to one or more individuals designated by the board (the "Administrator").

Any employee of the company or of any subsidiary designated by our board of directors as a participating subsidiary who (1) has completed at least six months of employment with the company or any of its subsidiaries, and (2) is a full-time employee is eligible to participate in the Plan. For this purpose, a "full-time employee" means an employee who customarily works or worked 20 hours or more per week and more than five months in the calendar year of a particular Offering under the Plan or the prior calendar year. While actual participation levels vary, there are currently approximately 4,354 employees eligible to participate in the Plan.

If the recommended amendment is adopted, a maximum of one million (1,000,000) of our authorized but unissued or reacquired shares of common stock will be available for issuance under the Plan, subject to appropriate adjustment in the event of any stock dividend, stock split, merger, consolidation, reorganization, recapitalization or similar change in our capital structure. If any purchase right expires or terminates, the shares subject to the unexercised portion of such purchase right will again be available for issuance under the Plan.

Each Offering may be up to twenty-seven (27) months in duration (each, an "Offering Period"). Currently, Offering Periods are set at three months. At present, there is one Exercise Date per Offering Period which occurs at the end of each Offering Period.

20

The purchase price per share for each grant of rights under the Plan is the lesser of (a) eighty-five percent (85%) of the fair market value of a share on the Offering Date, or (b) eighty-five percent (85%) of the fair market value of a share on the Exercise Date. At its discretion, the board of directors may determine a higher price for a grant of rights. The purchase price is paid through regular payroll deductions from a participant's basic or regular compensation.

Participation in the Plan is voluntary. A participant may withdraw from an Offering in whole, but not in part, by signing and delivering to the company a notice of withdrawal. Such withdrawal may be elected at any time during an Offering Period. In such event, the net balance in the participant's account for the Offering (payroll deductions less amounts used to purchase stock through the most recent Exercise Date) will be returned, without interest, to such participant and such participant will no longer be entitled to purchase any shares during that Offering. A participant's withdrawal from an Offering does not have any effect upon the participant's eligibility to participate in subsequent Offerings.

No employee will be granted a right to purchase shares under the Plan if, immediately after having subscribed, the employee would own 5% or more of the total combined voting power or value of all classes of stock of the company (including stock which may be purchased through subscriptions under the Plan or any other options). In addition, no employee will be granted a right to purchase shares under the Plan that would permit his right to purchase shares under all employee stock purchase plans of the company or any subsidiary corporation to accrue at a rate which exceeds $15,000 of fair market value of such stock (determined at the beginning of the Offering Period) for each calendar year during which such right is outstanding. The aggregate exercise price of all shares that can be subscribed for at any point in all Offerings in which an employee is then participating cannot exceed 15% of an employee's annual rate of compensation (or such lesser percentage as may be determined by the board).

The board can at any time amend or terminate the Plan, except that no such amendment or termination may adversely affect the existing rights of participants and certain amendments that require approval by our shareholders. No rights may be granted under the Plan after January 31, 2007.

Federal Income Tax Consequences

The Plan is intended to qualify as an employee stock purchase plan under Code Section 423. No taxable income will be realized by a participant either at the time participation begins (the first day of the Offering Period) or at the time shares are purchased under the Plan (the Exercise Dates). The federal income tax treatment upon disposition of shares purchased under the Plan depends on when such disposition occurs, as described below:

Dispositions both Two Years after Offering Period and One year after Exercise Date. If a participant disposes of the shares both two years after the first day of the Offering Period and one year after the Exercise Date or if the participant dies while owning the shares, the participant will recognize as ordinary income an amount equal to the lesser of (i) 15% of the fair market value of the shares on the first day of the Offering Period, or (ii) the excess of the fair market value of the shares on the date of such disposition or death over the exercise price. The difference between the disposition price and the participant's basis in the shares (i.e., the purchase price plus the amount, if any, taxed as ordinary income) will be treated as a long-term capital gain or loss. No deduction will be allowed to us for federal income tax purposes.

Dispositions before either Two Years after First Day of Offering Period or One Year after Exercise Date. If a participant disposes of the shares before either two years after the first day of the Offering Period or one year after the Exercise Date (a "Disqualifying Disposition"), the participant will recognize as ordinary income for the year of disposition an amount equal to the fair market value of the shares on the Exercise Date minus the exercise price for the shares. In addition, the participant will recognize capital gain or loss in an amount equal to the difference between the amount realized upon the disposition of the shares and the participant's basis in the shares (i.e., the purchase price plus the amount taxed as ordinary income). We

21

will be entitled to a deduction in an amount equal to the amount recognized by the participant as ordinary income upon such a Disqualifying Disposition.

The affirmative vote by the holders of a majority of the shares present, or represented by proxy, and entitled to vote at the meeting is required to approve this proposed amendment to the Equity Incentive Plan. Abstentions will be considered as present for quorum purposes, but will not be counted as votes cast. Accordingly, abstentions will have no effect on the voting of this matter. Under New York Stock Exchange rules, broker non-votes by New York Stock Exchange member brokers with respect to this amendment are prohibited.

The Board of Directors recommends a vote FOR this Proposal.

The following table provides information as of September 30, 2003 with respect to shares of our common stock that may be issued under our existing equity compensation plans:

| |

Number of securities to be issued upon exercise of outstanding options, warrants and rights |

Weighted-average exercise price of outstanding options, warrants and rights |

Number of securities remaining available for future issuance under equity compensation plans (1) |

|||

|---|---|---|---|---|---|---|

| Equity compensation plans/arrangements approved by the stockholders (2) | 2,819,679 | $25.18 | 1,803,187 | |||

| Equity compensation plans/arrangements not approved by the stockholders | 8,933(3) | $12.31 | — | |||

| Total | 2,828,612 | $25.14 | 1,803,187 |

22

Shareholder Proposals for Our 2005 Annual Meeting of Shareholders

Generally, our bylaws require a shareholder who wishes to bring business before or propose director nominations at an annual meeting to give written notice to our Corporate Secretary at least 45 days before the meeting. However, if we have given less than 60 days notice or public disclosure of the meeting, then we must receive a shareholder's notice within 15 days after our notice or disclosure was given. A shareholder notice must describe the proposed business or nominee and identify the shareholder making the proposal or nomination.

Any proposal you intend to present at the 2005 Annual Meeting of Shareholders must be received by MAXIMUS at our principal office at 11419 Sunset Hills Road, Reston, Virginia 20190, Attention: Corporate Secretary, not later than September 29, 2004 if you wish to have it included in the proxy statement and form of proxy for that meeting.

In addition, if we do not receive your proposal for presentation at the 2005 Annual Meeting by December 12, 2004, then our management proxies will be permitted to use their discretionary voting authority when the proposal is raised at the annual meeting, without having advised shareholders of the proposal in the proxy statement for the 2005 Annual Meeting.

Our summary annual report for fiscal year 2003 and our Annual Report on Form 10-K for our 2003 fiscal year as filed with the SEC on December 19, 2003 are being mailed to shareholders along with this notice and proxy statement on or about January 26, 2004. Upon written request, we will provide any recipient of this proxy statement, free of charge, one copy of our complete Annual Report on Form 10-K for our 2003 fiscal year. Requests should be directed to the Director of Investor Relations, MAXIMUS, Inc., 11419 Sunset Hills Road, Reston, Virginia 20190.

| By Order of the Board of Directors, | ||

David R. Francis, Secretary |

||

January 26, 2004 |

23

Appendix

MAXIMUS, INC.

1997 Employee Stock Purchase Plan

Adopted by the Board of Directors on January 31, 1997

Approved by the Shareholders on February 3, 1997

Amended by the Board of Directors on

June 23, 1998, December 14, 1998, March 4, 2002 and December 10, 2003

(subject to approval by the shareholders at the 2004 annual meeting)

1. Purpose.

The purpose of this 1997 Employee Stock Purchase Plan (the "Plan") is to provide employees of MAXIMUS, Inc. (the "Company"), and its subsidiaries, who wish to become shareholders of the Company an opportunity to purchase Common Stock of the Company (the "Shares"). The Plan is intended to qualify as an "employee stock purchase plan" within the meaning of Section 423 of the Internal Revenue Code of 1986, as amended (the "Code").

2. Eligible Employees.

Subject to the provisions of Sections 7, 8 and 9 below, any individual who is an eligible employee (as defined below) of the Company, or any of its subsidiaries (as defined in Section 424(f) of the Code), the employees of which are designated by the Board of Directors as eligible to participate in the Plan, is eligible to participate in any Offering of Shares (as defined in Section 3 below), made by the Company hereunder. Eligible employees shall include each employee of the Company or participating subsidiary who:

For purposes of this Plan, a "full-time employee" is any employee whose customary employment is 20 hours or more per week and five months per year in the calendar year during which said Offering Date (as defined in Section 3) occurs or in the calendar year immediately preceding such year.

3. Offering Dates.

From time to time, the Company, by action of the Board of Directors, will grant rights to purchase Shares to employees eligible to participate in the Plan pursuant to one or more offerings (each of which is an "Offering") on a date or series of dates (each of which is an "Offering Date") designated for this purpose by the Board of Directors.

4. Prices.

The price per share for each grant of rights hereunder shall be the lesser of:

(a) eighty-five percent (85%) of the fair market value of a Share on the Offering Date on which such right was granted; or

(b) eighty-five percent (85%) of the fair market value of a Share on the date such right is exercised.

At its discretion, the Board of Directors may determine a higher price for a grant of rights.

1

5. Exercise of Rights and Method of Payment.

(a) Rights granted under the Plan will be exercisable periodically on specified dates as determined by the Board of Directors.

(b) The method of payment for Shares purchased upon exercise of rights granted hereunder shall be through regular payroll deductions, as determined by the Board of Directors. All payments for Shares purchased upon exercise of rights hereunder shall be from an eligible employee's basic or regular compensation, and shall not be permitted from lump sum payments, bonuses, overtime, vacation payouts, severance pay. No interest shall be paid upon payroll deductions unless specifically provided for by the Board of Directors.

(c) Any payments received by the Company from a participating employee and not utilized for the purchase of Shares upon exercise of a right granted hereunder shall be promptly returned to such employee by the Company after termination of the right to which the payment relates or, if the participating employee, elects to participate in the next Offering of Shares, applied toward the purchase of shares in the next Offering.

6. Term of Rights.

The total period from an Offering Date to the last date on which rights granted on that Offering Date are exercisable (the "Offering Period") shall in no event be longer than twenty-seven (27) months. The Board of Directors when it authorizes an Offering may designate one or more exercise periods during the Offering Period. Rights granted on an Offering Date shall be exercisable in full on the Offering Date or in such proportion on the last day of each exercise period as the Board of Directors determines.

7. Shares Subject to the Plan.

No more than 1,000,000 Shares may be sold pursuant to rights granted under the Plan. Appropriate adjustments in the above figure, in the number of Shares covered by outstanding rights granted hereunder, in the exercise price of the rights and in the maximum number of Shares which an employee may purchase (pursuant to Section 9 below) shall be made to give effect to any mergers, consolidations, reorganizations, recapitalizations, stock splits, stock dividends or other relevant changes in the capitalization of the Company occurring after the effective date of the Plan, provided that no fractional Shares shall be subject to a right and each right shall be adjusted downward to the nearest full Share. Any agreement of merger or consolidation will include provisions for protection of the then existing rights of participating employees under the Plan. Either authorized and unissued Shares or issued Shares heretofore or hereafter reacquired by the Company may be made subject to rights under the Plan. If for any reason any right under the Plan terminates in whole or in part, Shares subject to such terminated right may again be subjected to a right under the Plan.

8. Limitations on Grants.

(a) No employee shall be granted a right hereunder if such employee, immediately after the right is granted, would own stock or rights to purchase stock possessing five percent (5%) or more of the total combined voting power or value of all classes of stock of the Company, or of any subsidiary, computed in accordance with Section 423(b)(3) of the Code.

(b) No employee shall be granted a right which permits his right to purchase shares under all employee stock purchase plans of the Company and its subsidiaries to accrue at a rate which exceeds fifteen thousand dollars ($15,000) for each calendar year (or six hundred twenty-five ($625) per bimonthly pay period) in which such right is outstanding, and in no event shall such right exceed the maximum amount prescribed from time to time by the Code.

2

(c) No right granted to any participating employee under an Offering, when aggregated with rights granted under any other Offering still exercisable by the participating employee, shall cover more shares than may be purchased at an exercise price equal to fifteen percent (15%) of the employee's annual rate of compensation on the date the employee elects to participate in the Offering or such lesser percentage as the Board of Directors may determine.

9. Limit on Participation.

Participation in an Offering shall be limited to eligible employees who elect to participate in such Offering in the manner, and within the time limitations, established by the Board of Directors when it authorizes the Offering.

10. Cancellation of Election to Participate.

An employee who has elected to participate in an Offering may cancel such election as to all (but not part) of the unexercised rights granted under such Offering by giving written notice of such cancellation to the Company before the expiration of any exercise period. Any amounts paid by the employee for the Shares or withheld for the purchase of Shares from the employee's compensation through payroll deductions shall be paid to the employee, without interest, unless otherwise determined by the Board of Directors, upon such cancellation.

11. Termination of Employment.

Upon the termination of employment for any reason, including the death of the employee, before the date on which any rights granted under the Plan are exercisable, all such rights shall immediately terminate and amounts paid by the employee for the Shares or withheld for the purchase of Shares from the employee's compensation through payroll deductions shall be paid to the employee or to the employee's estate, without interest unless otherwise determined by the Board of Directors.

12. Employees' Rights as Shareholders.

No participating employee shall have any rights as a shareholder in the Shares covered by a right granted hereunder until such right has been exercised, full payment has been made for the corresponding Shares and the Share certificate is actually issued.

13. Rights Not Transferable.

Rights under the Plan are not assignable or transferable by a participating employee and are exercisable only by the employee.

14. Amendments to or Discontinuation of the Plan.

The Board of Directors of the Company shall have the right to amend, modify or terminate the Plan at any time without notice; provided, however, that the then existing rights of all participating employees shall not be adversely affected thereby, and provided further that, subject to the provisions of Section 7 above, no such amendment to the Plan shall, without the approval of the shareholders of the Company, increase the total number of Shares which may be offered under the Plan.

15. Effective Date and Approvals.

This Plan became effective on January 31, 1997, the date it was adopted by the Board of Directors and approved by the shareholders of the Company.

The Company's obligation to offer, sell and deliver its Shares under the Plan is subject to (i) the approval of any governmental authority required in connection with the authorized issuance or sale of such Shares, (ii) satisfaction of the listing requirements of any national securities exchange on which the Shares are then listed and (iii) compliance, in the opinion of the Company's counsel, with all applicable federal and state securities and other laws.

3

16. Term of Plan.

No rights shall be granted under the Plan after January 31, 2007.

17. Administration of the Plan.

The Board of Directors or any committee or person(s) to whom it delegates its authority (the "Administrator") shall administer, interpret and apply all provisions of the Plan as it deems necessary to meet special circumstances not anticipated or covered expressly by the Plan. Nothing contained in this Section shall be deemed to authorize the Administrator to alter or administer the provisions of the Plan in a manner inconsistent with the provisions of Section 423 of the Code.

4

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS OF

MAXIMUS, INC.

PROXY FOR THE ANNUAL MEETING OF SHAREHOLDERS MARCH 18, 2004