1 | Maximus: Q2 FY22 Earnings Presentation David Mutryn Chief Financial Officer Fiscal 2022 Second Quarter Earnings Call May 5, 2022

2 | Maximus: Q2 FY22 Earnings Presentation These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. In this presentation, we use terms such as “normalized organic growth.” We calculate this number by removing the effects of the U.S. Census contract, the estimated revenues from COVID-19 response work, the benefit from our acquisitions and the period-over-period currency effects from our revenue. We believe normalized organic growth allows our investors to understand the effect on our revenue and revenue growth of various key drivers whose effects will vary from year to year. It should be used to complement analysis of our revenue and revenue growth. Included in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: "anticipate," "intend," "plan," "goal," "seek," "opportunity," "could," "potential," "believe," "project," "estimate," "expect," "forecast," "strategy," "future," "likely," "may," "should," "will," and similar references to future periods. Forward-looking statements that are not historical facts, including statements about our confidence, strategies and initiatives and our expectations about revenues, results of operations, profitability, liquidity, market demand or the impact of the pandemic are forward-looking statements that involve risks and uncertainties such as those related to the impact of the pandemic and our recently-completed acquisitions. These risks could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. A summary of risk factors can be found in Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the year ended September 30, 2021, which was filed with the Securities and Exchange Commission (SEC) on November 18, 2021. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Throughout this presentation, numbers may not add due to rounding. Forward-looking Statements & Non-GAAP Information

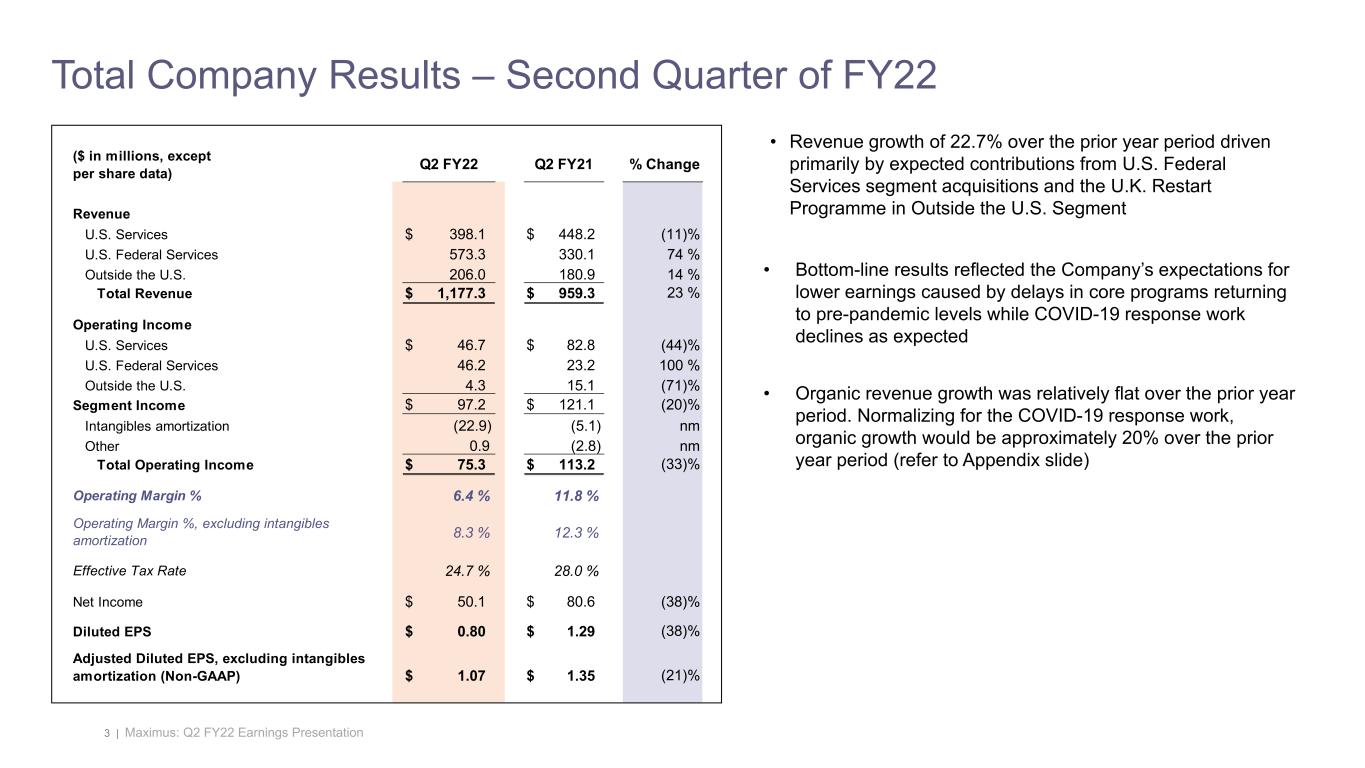

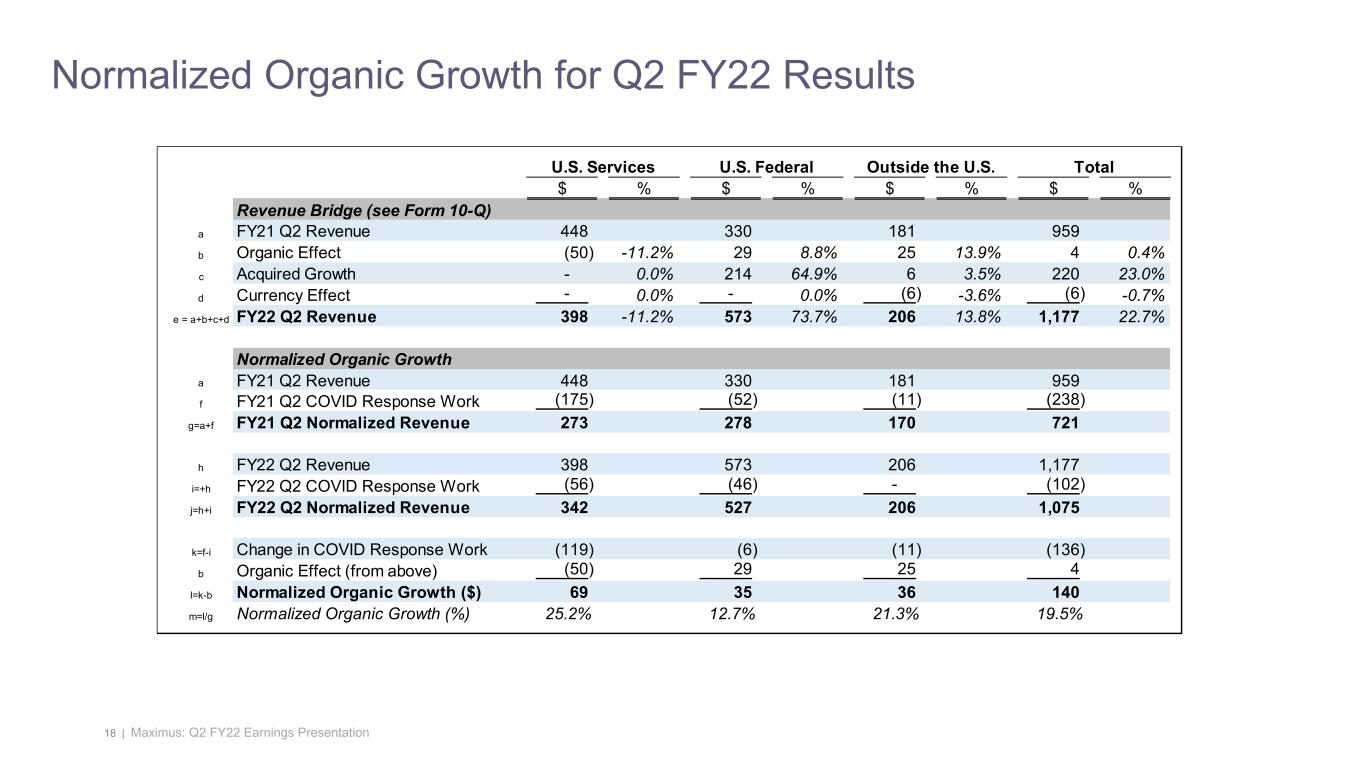

3 | Maximus: Q2 FY22 Earnings Presentation Total Company Results – Second Quarter of FY22 • Revenue growth of 22.7% over the prior year period driven primarily by expected contributions from U.S. Federal Services segment acquisitions and the U.K. Restart Programme in Outside the U.S. Segment • Bottom-line results reflected the Company’s expectations for lower earnings caused by delays in core programs returning to pre-pandemic levels while COVID-19 response work declines as expected • Organic revenue growth was relatively flat over the prior year period. Normalizing for the COVID-19 response work, organic growth would be approximately 20% over the prior year period (refer to Appendix slide) ($ in millions, except per share data) Q2 FY22 Q2 FY21 % Change Revenue U.S. Services $ 398.1 $ 448.2 (11)% U.S. Federal Services 573.3 330.1 74 % Outside the U.S. 206.0 180.9 14 % Total Revenue $ 1,177.3 $ 959.3 23 % Operating Income U.S. Services $ 46.7 $ 82.8 (44)% U.S. Federal Services 46.2 23.2 100 % Outside the U.S. 4.3 15.1 (71)% Segment Income $ 97.2 $ 121.1 (20)% Intangibles amortization (22.9) (5.1) nm Other 0.9 (2.8) nm Total Operating Income $ 75.3 $ 113.2 (33)% Operating Margin % 6.4 % 11.8 % Operating Margin %, excluding intangibles amortization 8.3 % 12.3 % Effective Tax Rate 24.7 % 28.0 % Net Income $ 50.1 $ 80.6 (38)% Diluted EPS $ 0.80 $ 1.29 (38)% Adjusted Diluted EPS, excluding intangibles amortization (Non-GAAP) $ 1.07 $ 1.35 (21)%

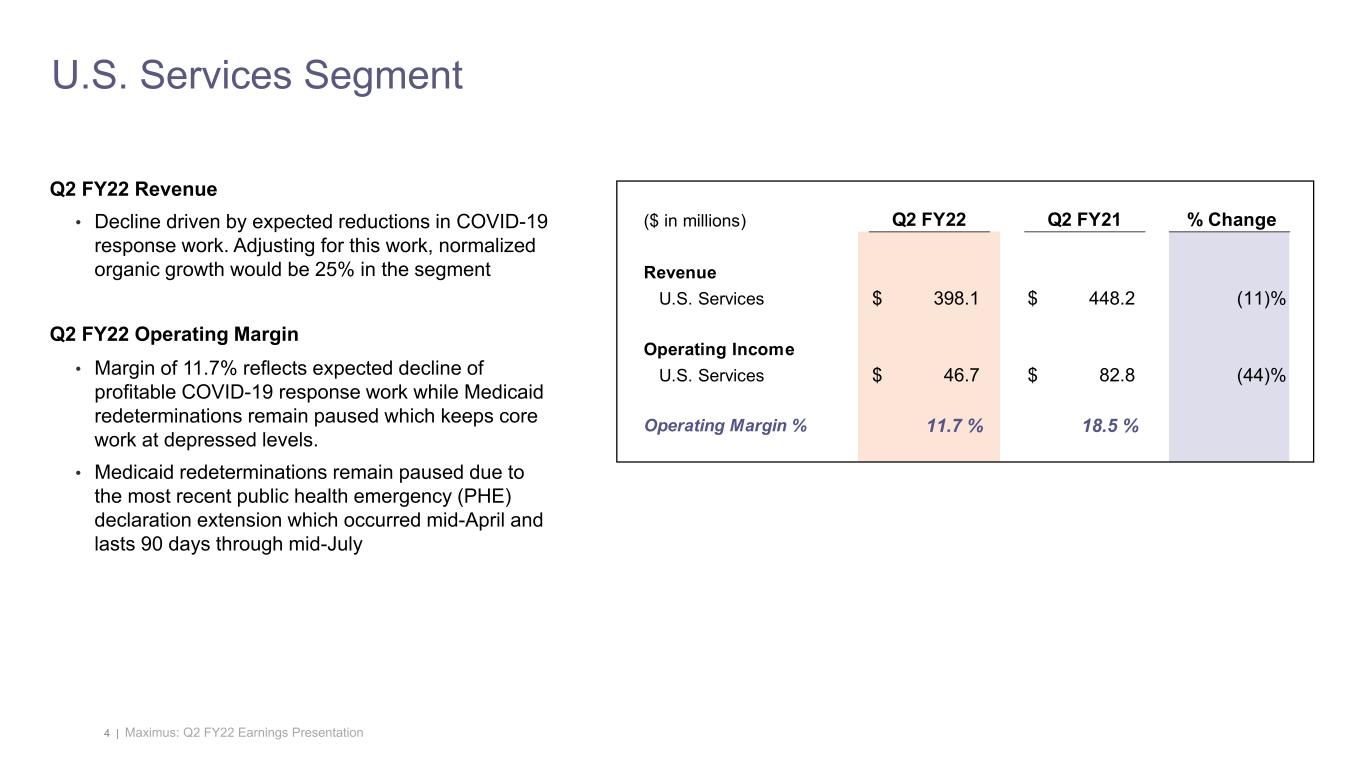

4 | Maximus: Q2 FY22 Earnings Presentation Q2 FY22 Revenue • Decline driven by expected reductions in COVID-19 response work. Adjusting for this work, normalized organic growth would be 25% in the segment Q2 FY22 Operating Margin • Margin of 11.7% reflects expected decline of profitable COVID-19 response work while Medicaid redeterminations remain paused which keeps core work at depressed levels. • Medicaid redeterminations remain paused due to the most recent public health emergency (PHE) declaration extension which occurred mid-April and lasts 90 days through mid-July U.S. Services Segment ($ in millions) Q2 FY22 Q2 FY21 % Change Revenue U.S. Services $ 398.1 $ 448.2 (11)% Operating Income U.S. Services $ 46.7 $ 82.8 (44)% Operating Margin % 11.7 % 18.5 %

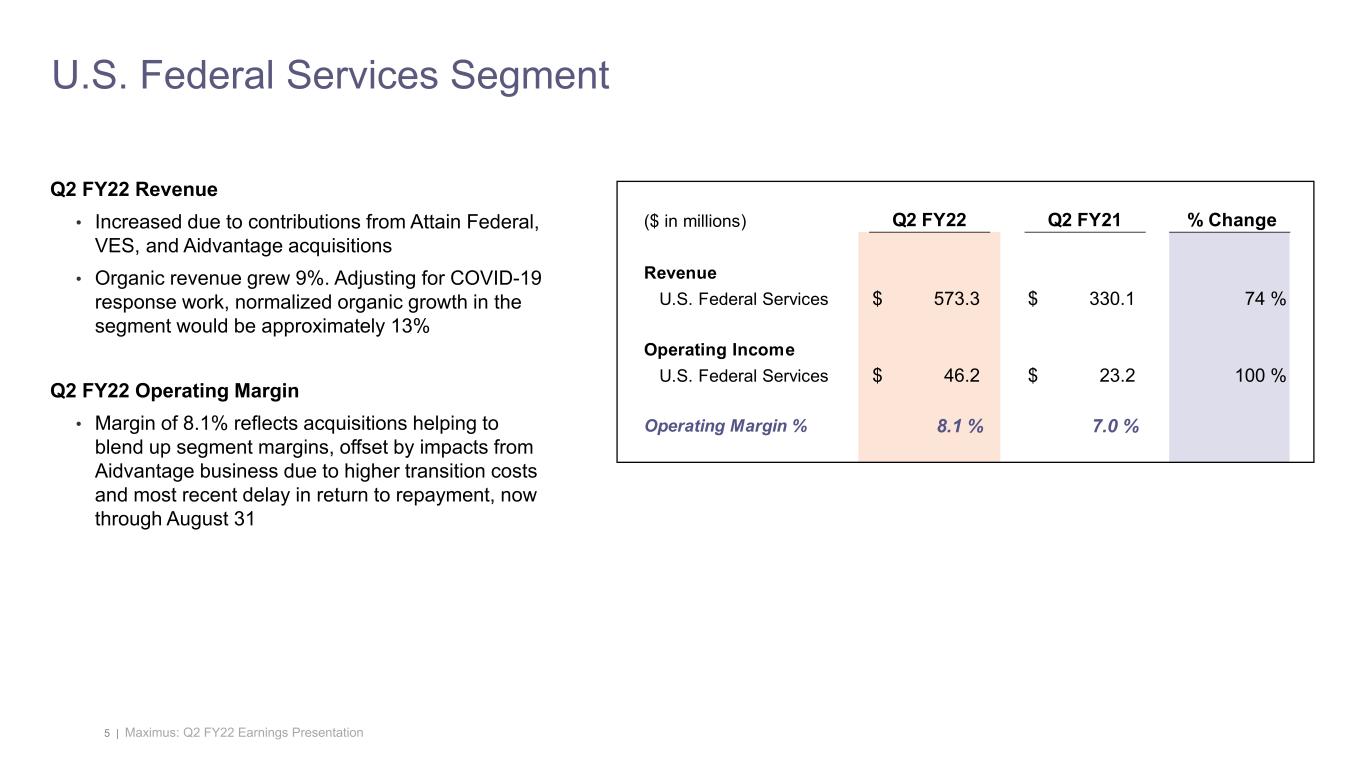

5 | Maximus: Q2 FY22 Earnings Presentation U.S. Federal Services Segment Q2 FY22 Revenue • Increased due to contributions from Attain Federal, VES, and Aidvantage acquisitions • Organic revenue grew 9%. Adjusting for COVID-19 response work, normalized organic growth in the segment would be approximately 13% Q2 FY22 Operating Margin • Margin of 8.1% reflects acquisitions helping to blend up segment margins, offset by impacts from Aidvantage business due to higher transition costs and most recent delay in return to repayment, now through August 31 ($ in millions) Q2 FY22 Q2 FY21 % Change Revenue U.S. Federal Services $ 573.3 $ 330.1 74 % Operating Income U.S. Federal Services $ 46.2 $ 23.2 100 % Operating Margin % 8.1 % 7.0 %

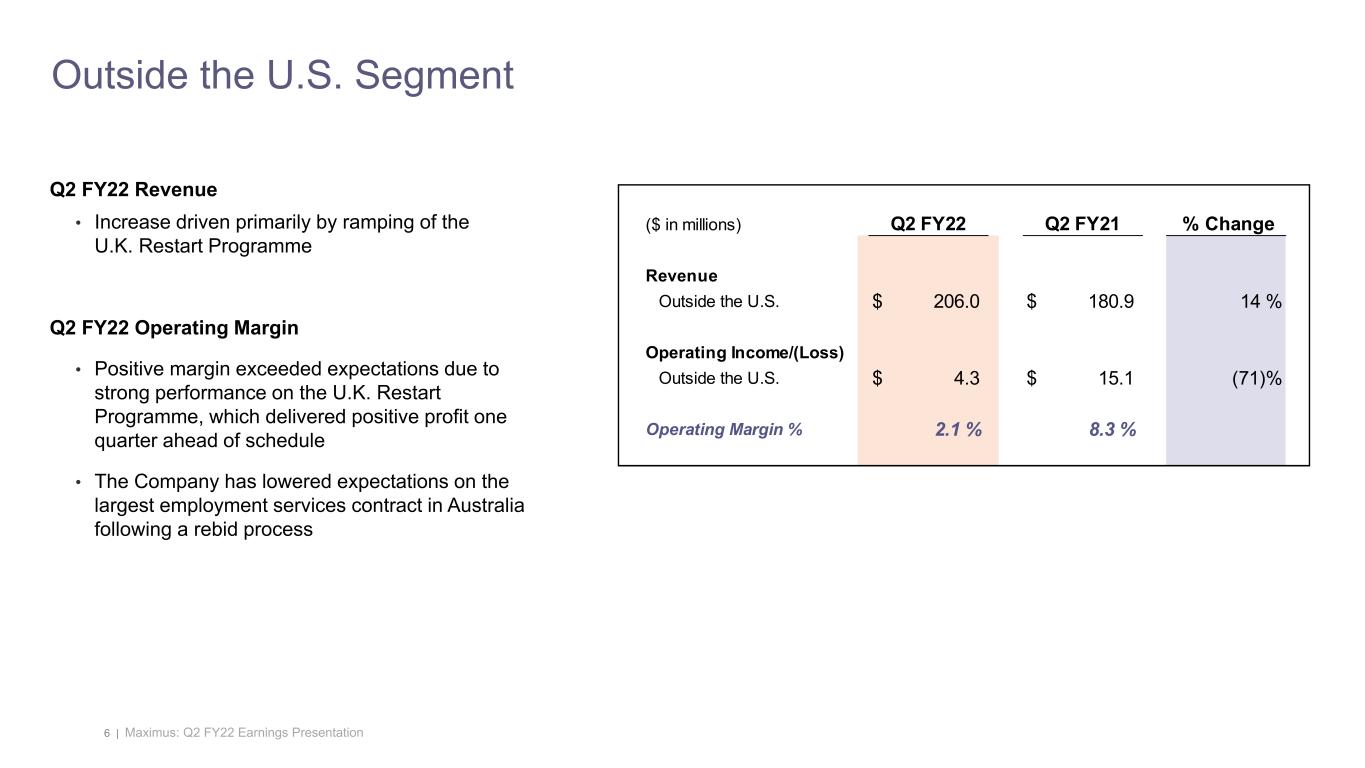

6 | Maximus: Q2 FY22 Earnings Presentation Outside the U.S. Segment Q2 FY22 Revenue • Increase driven primarily by ramping of the U.K. Restart Programme Q2 FY22 Operating Margin • Positive margin exceeded expectations due to strong performance on the U.K. Restart Programme, which delivered positive profit one quarter ahead of schedule • The Company has lowered expectations on the largest employment services contract in Australia following a rebid process ($ in millions) Q2 FY22 Q2 FY21 % Change Revenue Outside the U.S. $ 206.0 $ 180.9 14 % Operating Income/(Loss) Outside the U.S. $ 4.3 $ 15.1 (71)% Operating Margin % 2.1 % 8.3 %

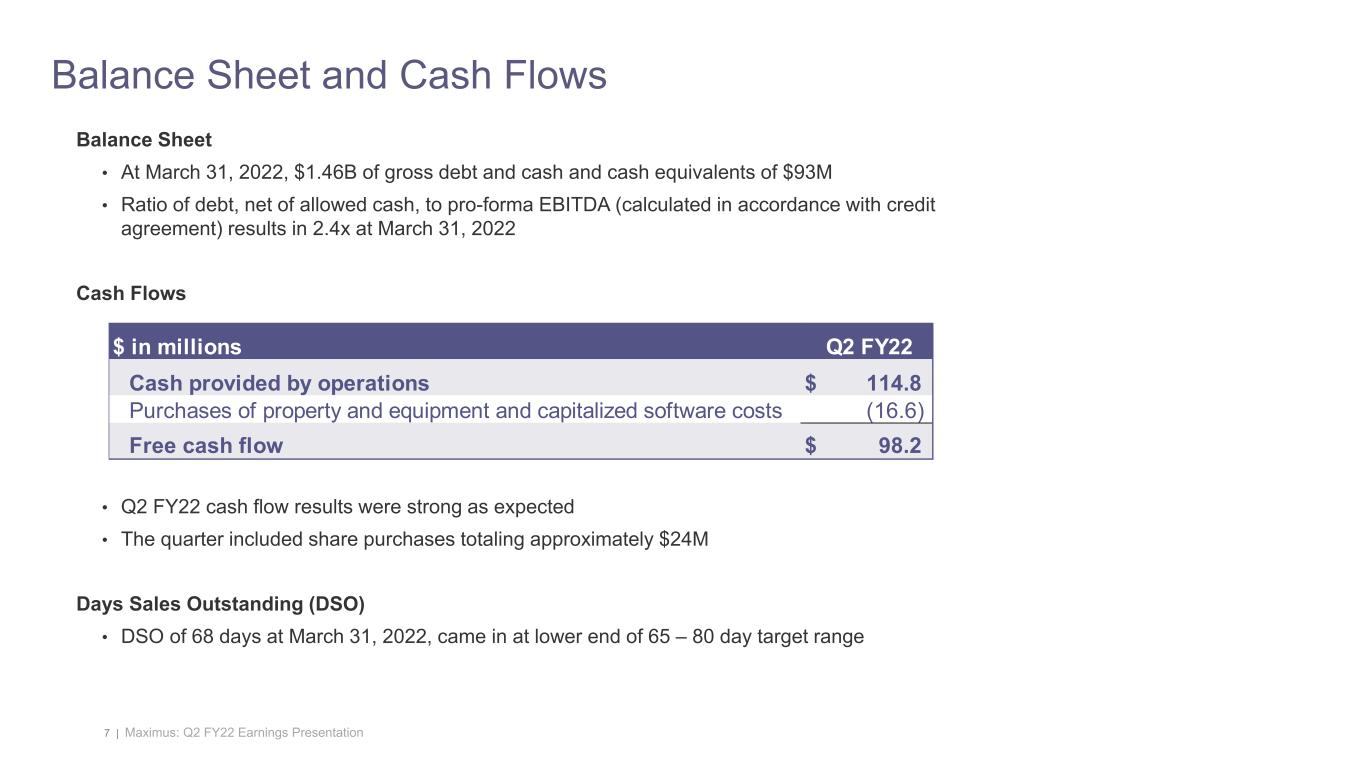

7 | Maximus: Q2 FY22 Earnings Presentation Balance Sheet • At March 31, 2022, $1.46B of gross debt and cash and cash equivalents of $93M • Ratio of debt, net of allowed cash, to pro-forma EBITDA (calculated in accordance with credit agreement) results in 2.4x at March 31, 2022 Cash Flows • Q2 FY22 cash flow results were strong as expected • The quarter included share purchases totaling approximately $24M Days Sales Outstanding (DSO) • DSO of 68 days at March 31, 2022, came in at lower end of 65 – 80 day target range Balance Sheet and Cash Flows $ in millions Q2 FY22 Cash provided by operations $ 114.8 Purchases of property and equipment and capitalized software costs (16.6) Free cash flow $ 98.2

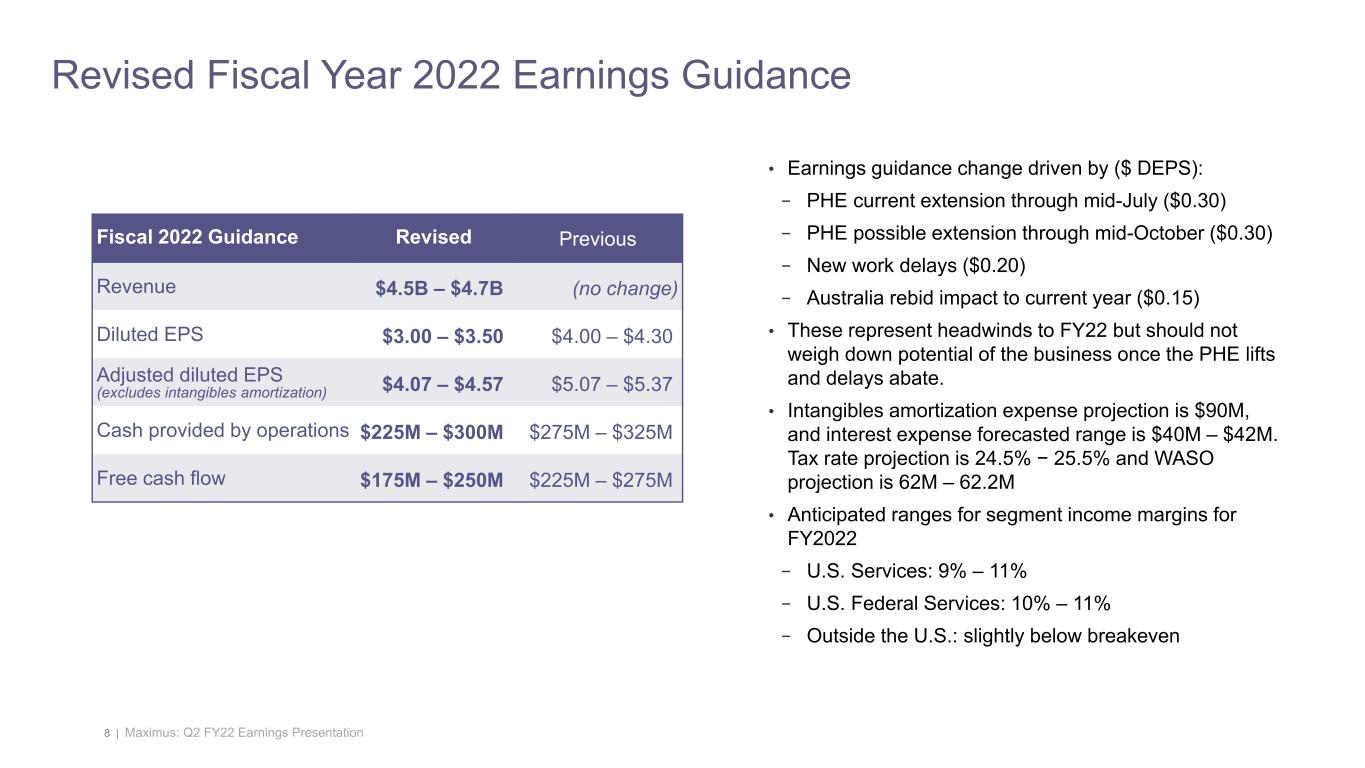

8 | Maximus: Q2 FY22 Earnings Presentation Revised Fiscal Year 2022 Earnings Guidance • Earnings guidance change driven by ($ DEPS): − PHE current extension through mid-July ($0.30) − PHE possible extension through mid-October ($0.30) − New work delays ($0.20) − Australia rebid impact to current year ($0.15) • These represent headwinds to FY22 but should not weigh down potential of the business once the PHE lifts and delays abate. • Intangibles amortization expense projection is $90M, and interest expense forecasted range is $40M – $42M. Tax rate projection is 24.5% − 25.5% and WASO projection is 62M – 62.2M • Anticipated ranges for segment income margins for FY2022 − U.S. Services: 9% – 11% − U.S. Federal Services: 10% – 11% − Outside the U.S.: slightly below breakeven Fiscal 2022 Guidance Revised Previous Revenue $4.5B – $4.7B (no change) Diluted EPS $3.00 – $3.50 $4.00 – $4.30 Adjusted diluted EPS (excludes intangibles amortization) $4.07 – $4.57 $5.07 – $5.37 Cash provided by operations $225M – $300M $275M – $325M Free cash flow $175M – $250M $225M – $275M

9 | Maximus: Q2 FY22 Earnings Presentation Bruce Caswell President & Chief Executive Officer Fiscal 2022 Second Quarter Earnings Call May 5, 2022

10 | Maximus: Q2 FY22 Earnings Presentation New Headquarters • Joining you from our new Headquarters in Tysons, Virginia • Reduced overall footprint in the Washington, D.C. area while growing the company • Modern and attractive space, combining visual appeal, wellness, comfort, technology, and a little fun • A differentiator in recruiting and retaining the best talent in the area

11 | Maximus: Q1 FY22 Earnings Presentation Revised Guidance • Revised earnings guidance reflects how portions of our business are, in the near term, tied to current political climate and, still to a degree, the ongoing uncertainty of the pandemic • PHE extended another 90 days, through July 15, impacting the volumes on many of our state contracts • Revised guidance considers both July 15 end date and possible further 90-day extension • Given lack of predictability, illustrates the potential impact of a further extension through end of FY22 Timing of the PHE Unwinding • While largely outside of our control, seeing certain signs supporting an unwinding and addressing critical concerns of states • CMS released additional, comprehensive guidance on March 3, providing important details on the process • On March 21, CMS announced execution of a task order for national outreach efforts related to unwinding • Certain states engaged Maximus to assist with certain allowed pre-unwinding activities, including communications to beneficiaries to encourage contact information updates • Significant national effort remains in front of us; it is a matter of timing Guidance and Public Health Emergency

12 | Maximus: Q1 FY22 Earnings Presentation • Anticipated caseload reductions to one of our employment services contracts in Australia due to further digitization through government-operated self-service • Disappointed with results which left Maximus with a disproportionately large reduction in volume in comparison to other providers • Noteworthy the degree to which the supplier base, including tenured and well-performing companies like ourselves, was turned over • Clear that past performance did not play as significant a role in the process as we would typically expect • As one of the largest market participants, this rebalancing affected us the most • Despite the outcome, we remain one of the few large-scale providers in terms of caseloads and will continue to serve to the highest standard • View events like this as short-term consequence of political environment in which we operate, distinct from the longer-term macro drivers that underpin the business Australia Caseload

13 | Maximus: Q2 FY22 Earnings Presentation Success in our Recent Acquisitions VES • Two awards at a combined TCV of $383M • Perform medical disability exams for District 6 & 7 • While both districts to be shared with other vendors, expect the net result to be an increase to our overall revenue run rate • Performance-based contracts with a 6-month base period and 6 subsequent 12-month option periods • Demonstrate successful execution of strategic M&A to grow clinical market share • Well-positioned to support the VA and address other Federal government assessment programs Attain Federal • Awarded Department of Defense (DOD) Joint Artificial Intelligence Center (JAIC) Data Readiness for Artificial Development (DRAID) services Basic Order Agreement • Provides an easily accessible path to innovate commercial capabilities, like ours, to prepare data for use in AI applications and identify new use cases across the DOD • Reflects our acquired capabilities and experience integrating technologies to support mission-driven customers • Demonstrates ability to co-create innovative solutions and deliver next-generation mission-centered technology solutions We are confident in our ability to win business, grow organically, create value through capital investments, and drive long-term shareholder value.

14 | Maximus: Q2 FY22 Earnings Presentation Enacting Upon our Strategy Digitally Enabled • New York State of Health mobile application improves customer experience • Nearly 200K downloads • More than 250K documents submitted • 4.6 stars on Apple app store • 4.7 stars on Google • Small digital transformation serves larger purpose of improving access and equity for Medicaid applicants • Long-term differentiator is our deep understanding of complex intersections of government policy and consumer needs, enabling us to transform how government and the public interact Business Process Solutions • Continue to enhance our delivery of business process solutions (BPS) • Expanding our footprint of core program services across new and existing markets Indiana • Executed a prime contract, subsequent to March 31, to provide eligibility operations support to Indiana Family and Social Services Administration • Four-year base period worth $425M, with option for two one-year renewals – expect revenue contribution in FY23 • Illustrates the durable strength of our brand • Excited to expand our services to Hoosiers U.K. Restart Programme • Strong performance, delivering positive profit one quarter ahead of schedule • Anticipate continued, strong performance for remainder of FY22, driving by a buoyant labor market in the U.K. We continue to position ourselves for the future as a leader in delivering outcomes-focused solutions through customer-preferred channels.

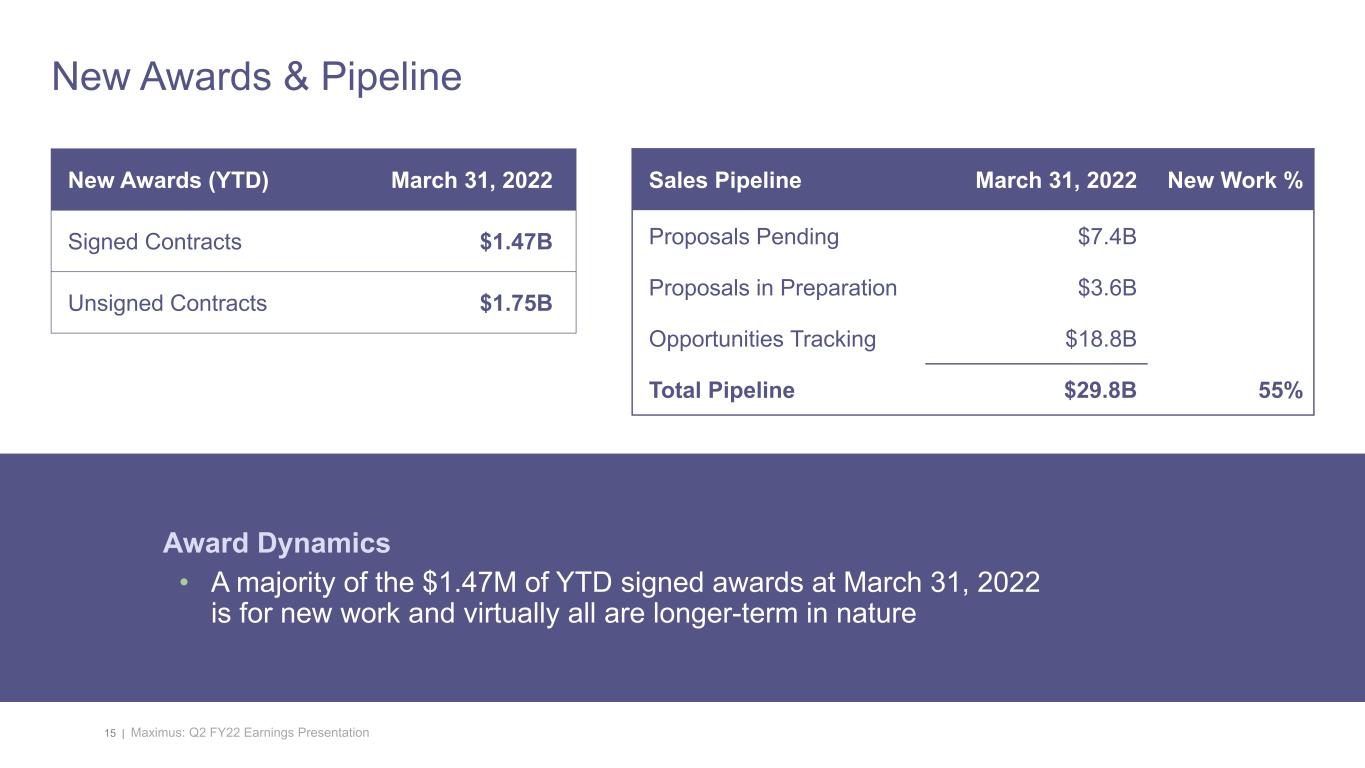

15 | Maximus: Q2 FY22 Earnings Presentation Sales Pipeline March 31, 2022 New Work % Proposals Pending $7.4B Proposals in Preparation $3.6B Opportunities Tracking $18.8B Total Pipeline $29.8B 55% New Awards (YTD) March 31, 2022 Signed Contracts $1.47B Unsigned Contracts $1.75B New Awards & Pipeline Award Dynamics • A majority of the $1.47M of YTD signed awards at March 31, 2022 is for new work and virtually all are longer-term in nature

16 | Maximus: Q2 FY22 Earnings Presentation • Exciting period of change for Maximus • New collaborative headquarters, cusp of rolling out a major brand refresh, forthcoming update on our 3 – 5 year strategy • Brand refresh reflects our expanding ability to harness the promise of technology and data to drive insights, making our services more customer-centric and impactful on our clients’ mission • Updated current year outlook largely driven by temporary headwinds expected to abate over the coming year • Continue to have strong, new work awards and confidence we are well-positioned for mid-single-digit organic growth and margin expansion going forward • Long-term macro drivers are well intact as well as our durable role as a preeminent partner to governments • Our growing capabilities, particularly in technologies that drive efficiency in operations and deliver modernized systems to our customers, create opportunity to build scale and expand our base • Join us for Investor Day on Tuesday, May 24 at 9:00 a.m. ET – Learn more and register: maximus.com/InvestorDay • Submit questions in advance for management’s consideration – Email IR@maximus.com Stay Tuned

17 | Maximus: Q2 FY22 Earnings Presentation Appendix

18 | Maximus: Q2 FY22 Earnings Presentation Normalized Organic Growth for Q2 FY22 Results $ % $ % $ % $ % Revenue Bridge (see Form 10-Q) a FY21 Q2 Revenue 448 330 181 959 b Organic Effect (50) -11.2% 29 8.8% 25 13.9% 4 0.4% c Acquired Growth - 0.0% 214 64.9% 6 3.5% 220 23.0% d Currency Effect - 0.0% - 0.0% (6) -3.6% (6) -0.7% e = a+b+c+d FY22 Q2 Revenue 398 -11.2% 573 73.7% 206 13.8% 1,177 22.7% Normalized Organic Growth a FY21 Q2 Revenue 448 330 181 959 f FY21 Q2 COVID Response Work (175) (52) (11) (238) g=a+f FY21 Q2 Normalized Revenue 273 278 170 721 h FY22 Q2 Revenue 398 573 206 1,177 i=+h FY22 Q2 COVID Response Work (56) (46) - (102) j=h+i FY22 Q2 Normalized Revenue 342 527 206 1,075 k=f-i Change in COVID Response Work (119) (6) (11) (136) b Organic Effect (from above) (50) 29 25 4 l=k-b Normalized Organic Growth ($) 69 35 36 140 m=l/g Normalized Organic Growth (%) 25.2% 12.7% 21.3% 19.5% U.S. Services U.S. Federal Outside the U.S. Total