1 | Maximus: Q3 FY20 Earnings Presentation Rick Nadeau Chief Financial Officer David Mutryn Senior VP of Finance Fiscal 2021 Third Quarter Earnings Call August 5, 2021

2 | Maximus: Q3 FY21 Earnings Presentation These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. Included in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “opportunity,” “could,” “potential,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements that are not historical facts, including statements about our confidence, strategies and initiatives and our expectations about revenues, results of operations, profitability, liquidity, market demand or the impact of the pandemic are forward-looking statements that involve risks and uncertainties such as those related to the impact of the pandemic and our recently-completed acquisitions are summarized in our 10-Q. These risks could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. A summary of risk factors can be found in Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the year ended September 30, 2020, which was filed with the Securities and Exchange Commission (SEC) on November 19, 2020. A supplemental description of risk factors related to the Company's completed acquisition of the Federal business of Attain and proposed acquisition of VES are included in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2021, to be filed shortly. The Company's SEC reports are accessible on maximus.com. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Forward-looking Statements & Non-GAAP Information

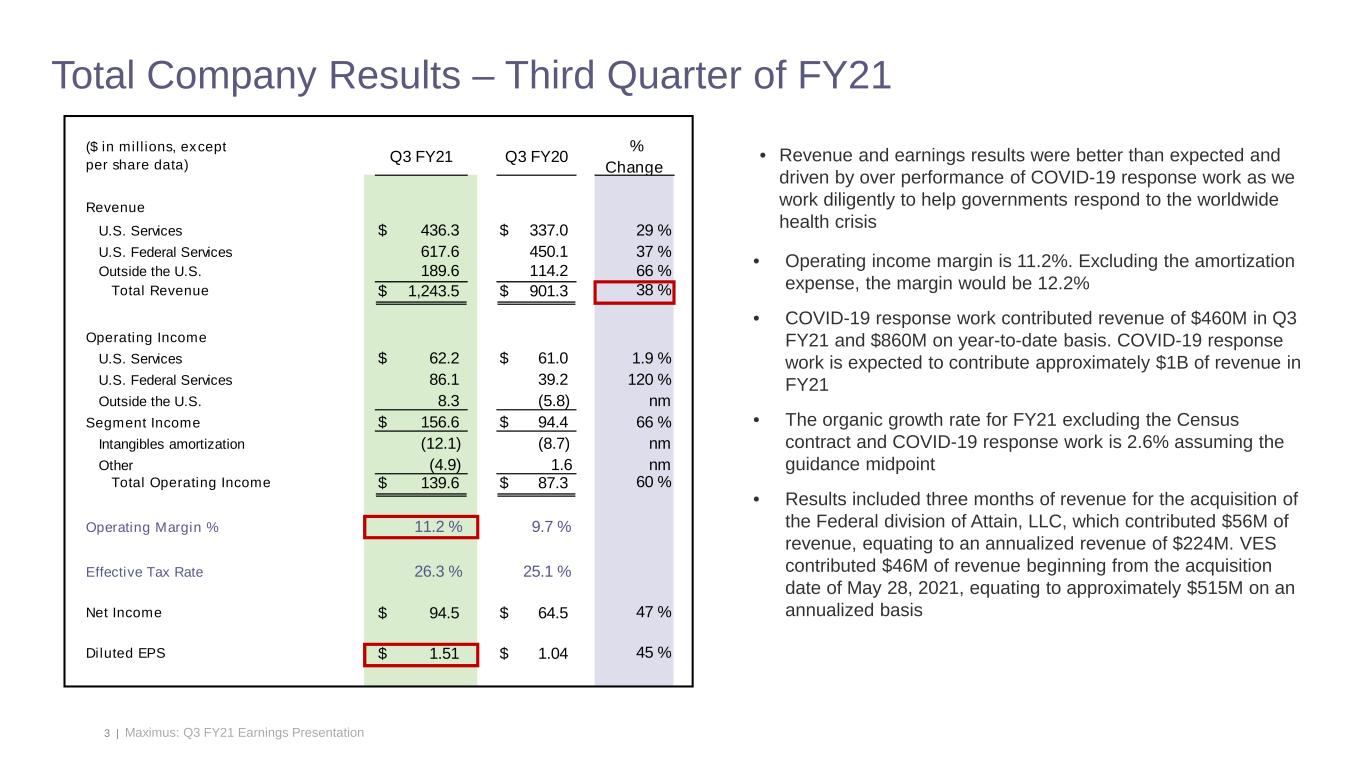

3 | Maximus: Q3 FY21 Earnings Presentation Total Company Results – Third Quarter of FY21 • Revenue and earnings results were better than expected and driven by over performance of COVID-19 response work as we work diligently to help governments respond to the worldwide health crisis • Operating income margin is 11.2%. Excluding the amortization expense, the margin would be 12.2% • COVID-19 response work contributed revenue of $460M in Q3 FY21 and $860M on year-to-date basis. COVID-19 response work is expected to contribute approximately $1B of revenue in FY21 • The organic growth rate for FY21 excluding the Census contract and COVID-19 response work is 2.6% assuming the guidance midpoint • Results included three months of revenue for the acquisition of the Federal division of Attain, LLC, which contributed $56M of revenue, equating to an annualized revenue of $224M. VES contributed $46M of revenue beginning from the acquisition date of May 28, 2021, equating to approximately $515M on an annualized basis ($ in millions, except per share data) Q3 FY21 Q3 FY20 % Change Revenue U.S. Services $ 436.3 $ 337.0 29 % U.S. Federal Services 617.6 450.1 37 % Outside the U.S. 189.6 114.2 66 % Total Revenue $ 1,243.5 $ 901.3 38 % Operating Income U.S. Services $ 62.2 $ 61.0 1.9 % U.S. Federal Services 86.1 39.2 120 % Outside the U.S. 8.3 (5.8) nm Segment Income $ 156.6 $ 94.4 66 % Intangibles amortization (12.1) (8.7) nm Other (4.9) 1.6 nm Total Operating Income $ 139.6 $ 87.3 60 % Operating Margin % 11.2 % 9.7 % Effective Tax Rate 26.3 % 25.1 % Net Income $ 94.5 $ 64.5 47 % Diluted EPS $ 1.51 $ 1.04 45 %

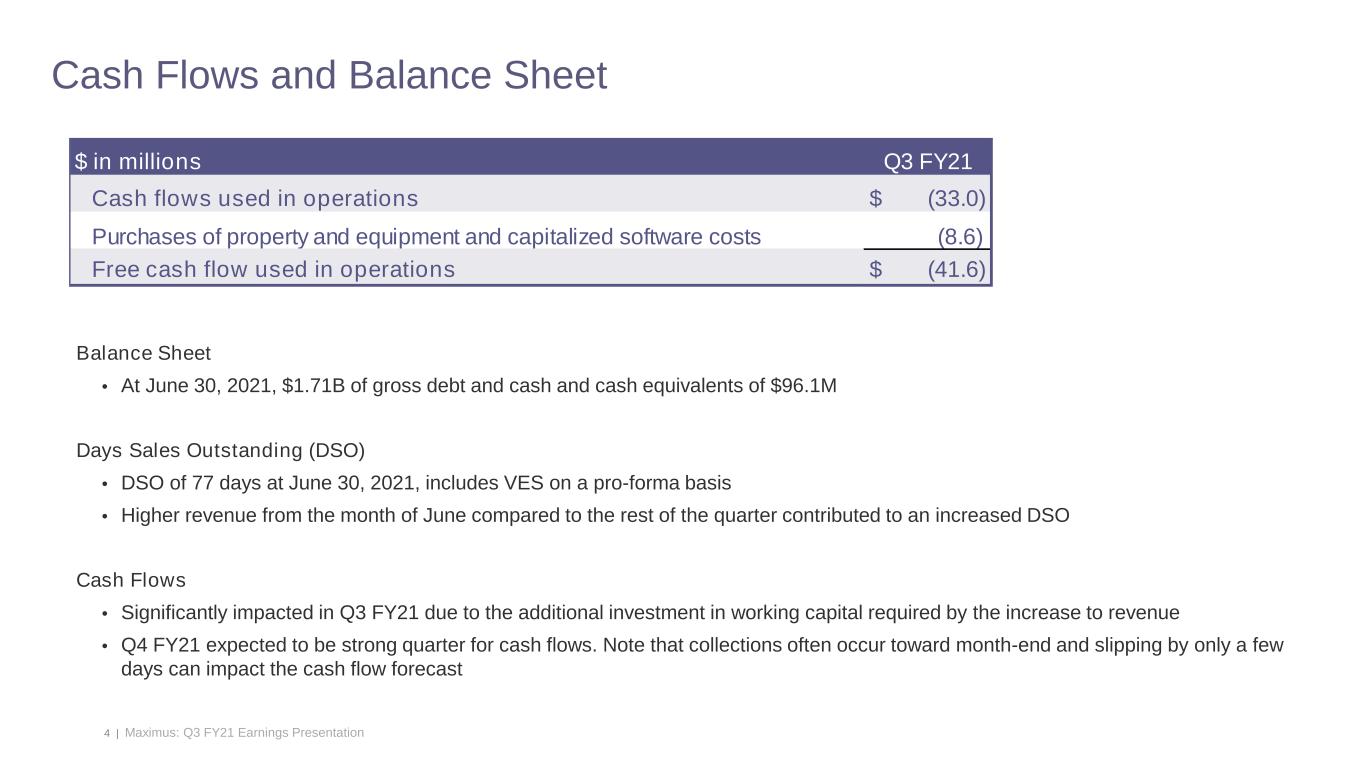

4 | Maximus: Q3 FY21 Earnings Presentation Balance Sheet • At June 30, 2021, $1.71B of gross debt and cash and cash equivalents of $96.1M Days Sales Outstanding (DSO) • DSO of 77 days at June 30, 2021, includes VES on a pro-forma basis • Higher revenue from the month of June compared to the rest of the quarter contributed to an increased DSO Cash Flows • Significantly impacted in Q3 FY21 due to the additional investment in working capital required by the increase to revenue • Q4 FY21 expected to be strong quarter for cash flows. Note that collections often occur toward month-end and slipping by only a few days can impact the cash flow forecast Cash Flows and Balance Sheet $ in millions Q3 FY21 Cash flows used in operations $ (33.0) Purchases of property and equipment and capitalized software costs (8.6) Free cash flow used in operations $ (41.6)

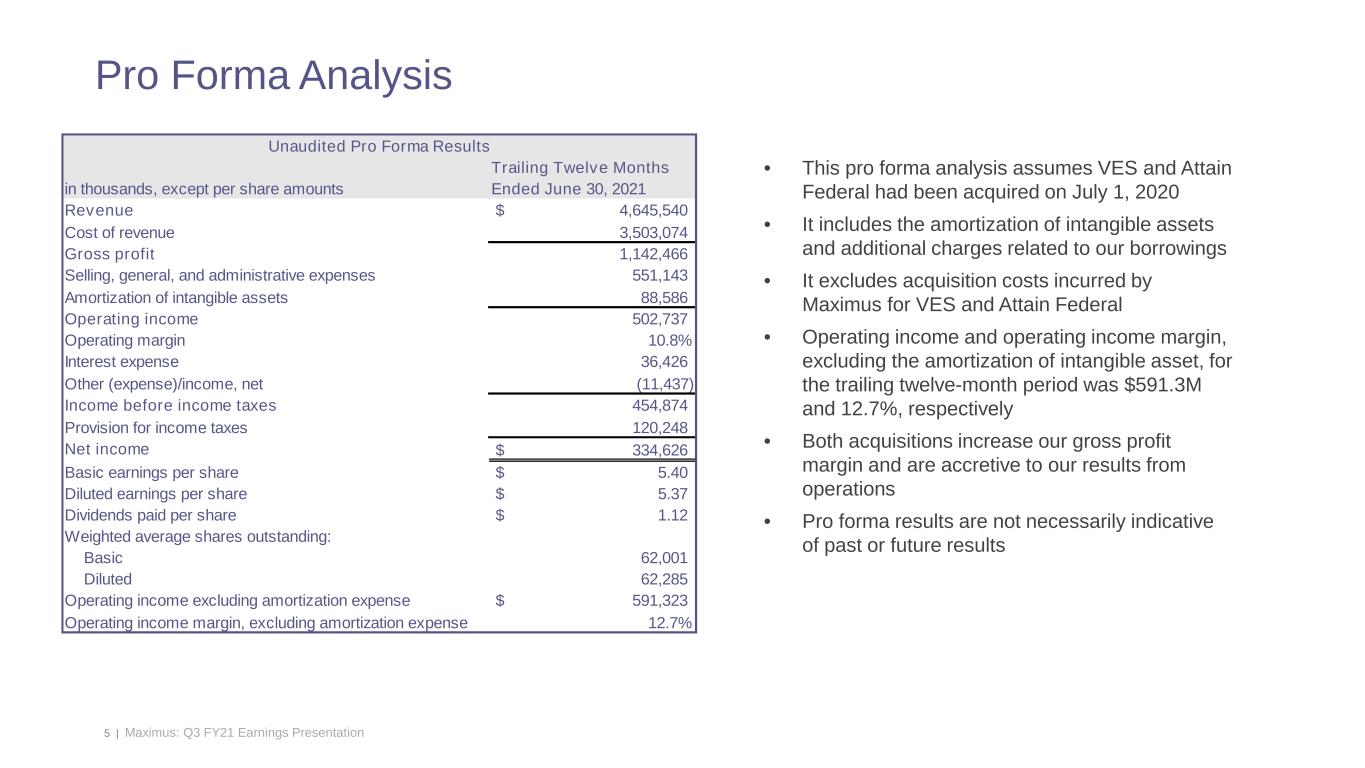

5 | Maximus: Q3 FY21 Earnings Presentation • This pro forma analysis assumes VES and Attain Federal had been acquired on July 1, 2020 • It includes the amortization of intangible assets and additional charges related to our borrowings • It excludes acquisition costs incurred by Maximus for VES and Attain Federal • Operating income and operating income margin, excluding the amortization of intangible asset, for the trailing twelve-month period was $591.3M and 12.7%, respectively • Both acquisitions increase our gross profit margin and are accretive to our results from operations • Pro forma results are not necessarily indicative of past or future results Pro Forma Analysis in thousands, except per share amounts Trailing Twelve Months Ended June 30, 2021 Revenue $ 4,645,540 Cost of revenue 3,503,074 Gross profit 1,142,466 Selling, general, and administrative expenses 551,143 Amortization of intangible assets 88,586 Operating income 502,737 Operating margin 10.8% Interest expense 36,426 Other (expense)/income, net (11,437) Income before income taxes 454,874 Provision for income taxes 120,248 Net income $ 334,626 Basic earnings per share $ 5.40 Diluted earnings per share $ 5.37 Dividends paid per share $ 1.12 Weighted average shares outstanding: Basic 62,001 Diluted 62,285 Operating income excluding amortization expense $ 591,323 Operating income margin, excluding amortization expense 12.7% Unaudited Pro Forma Results

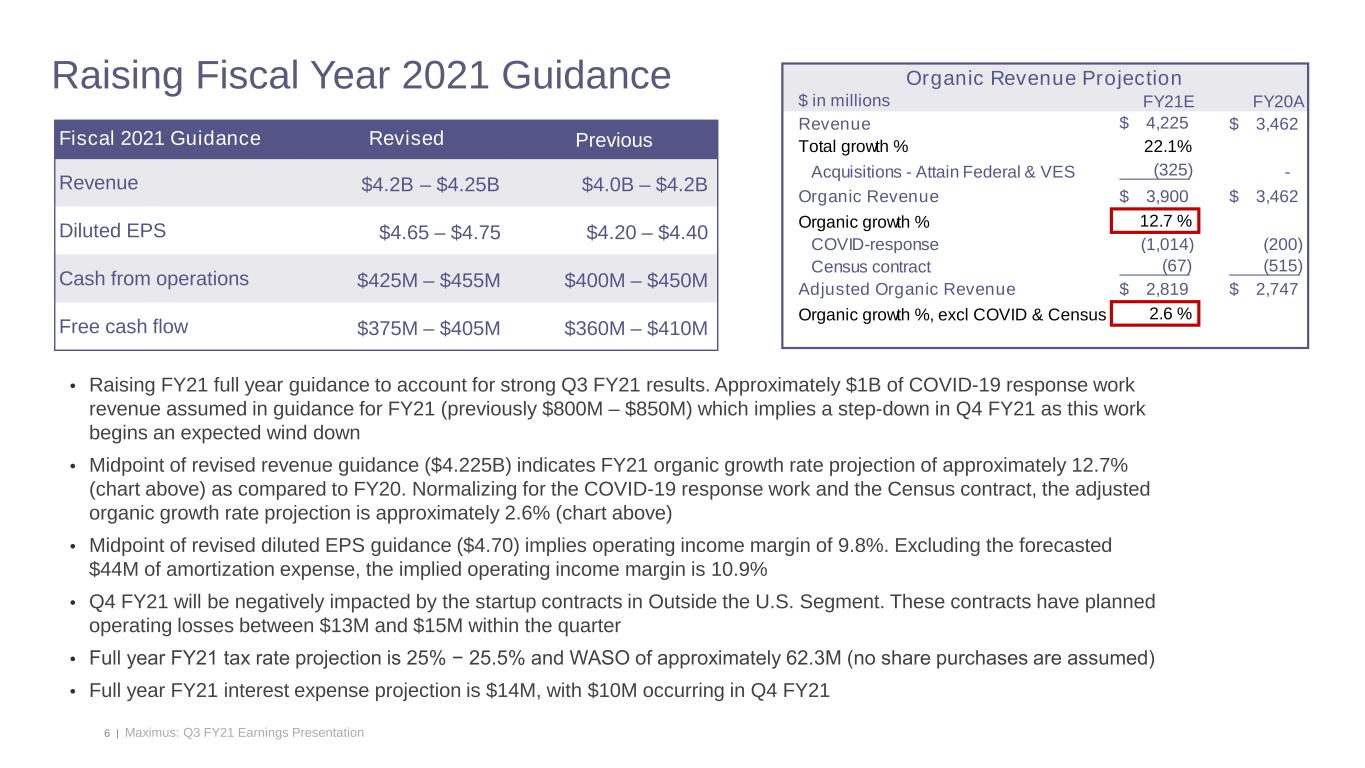

6 | Maximus: Q3 FY21 Earnings Presentation Raising Fiscal Year 2021 Guidance Fiscal 2021 Guidance Revised Previous Revenue $4.2B – $4.25B $4.0B – $4.2B Diluted EPS $4.65 – $4.75 $4.20 – $4.40 Cash from operations $425M – $455M $400M – $450M Free cash flow $375M – $405M $360M – $410M • Raising FY21 full year guidance to account for strong Q3 FY21 results. Approximately $1B of COVID-19 response work revenue assumed in guidance for FY21 (previously $800M – $850M) which implies a step-down in Q4 FY21 as this work begins an expected wind down • Midpoint of revised revenue guidance ($4.225B) indicates FY21 organic growth rate projection of approximately 12.7% (chart above) as compared to FY20. Normalizing for the COVID-19 response work and the Census contract, the adjusted organic growth rate projection is approximately 2.6% (chart above) • Midpoint of revised diluted EPS guidance ($4.70) implies operating income margin of 9.8%. Excluding the forecasted $44M of amortization expense, the implied operating income margin is 10.9% • Q4 FY21 will be negatively impacted by the startup contracts in Outside the U.S. Segment. These contracts have planned operating losses between $13M and $15M within the quarter • Full year FY21 tax rate projection is 25% − 25.5% and WASO of approximately 62.3M (no share purchases are assumed) • Full year FY21 interest expense projection is $14M, with $10M occurring in Q4 FY21 $ in millions FY21E FY20A Revenue $ 4,225 $ 3,462 Total growth % 22.1% Acquisitions - Attain Federal & VES (325) - Organic Revenue $ 3,900 $ 3,462 Organic growth % 12.7 % COVID-response (1,014) (200) Census contract (67) (515) Adjusted Organic Revenue $ 2,819 $ 2,747 Organic growth %, excl COVID & Census 2.6 % Organic Revenue Projection

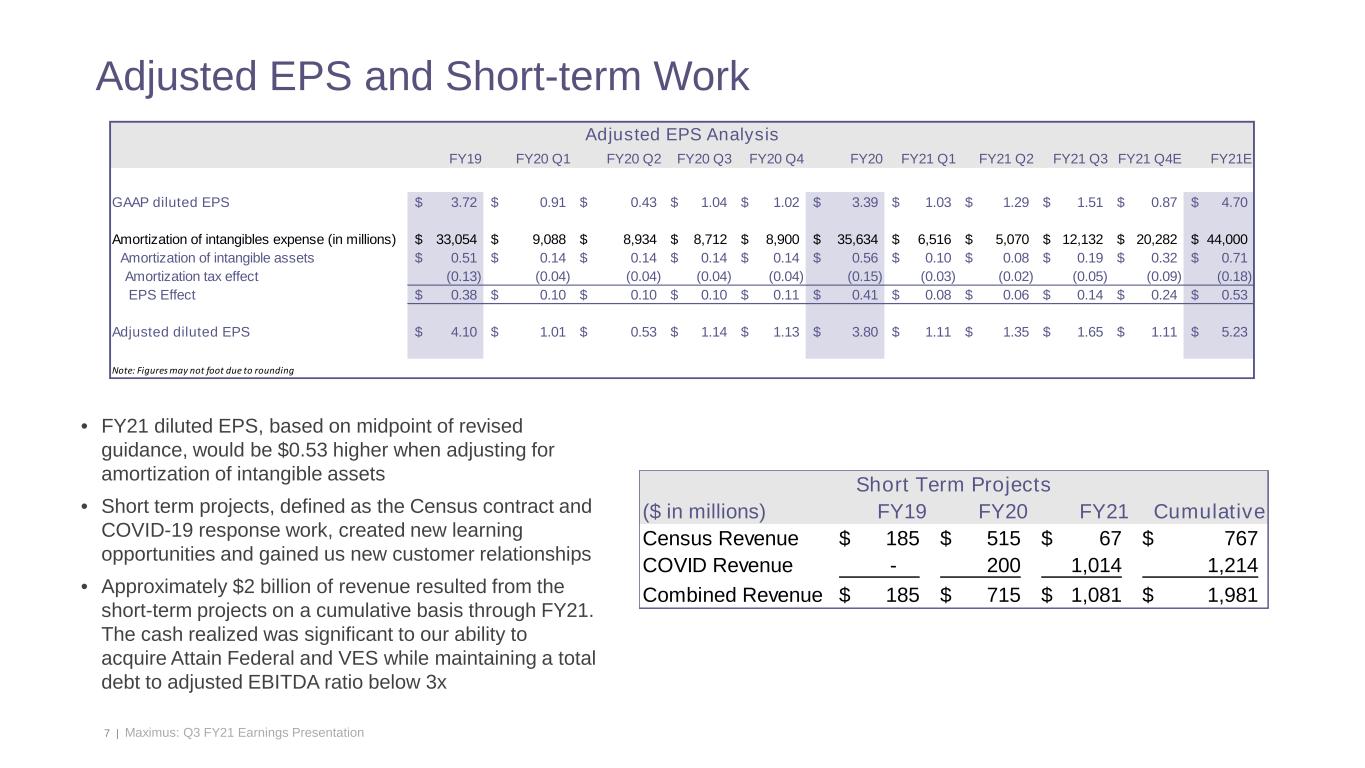

7 | Maximus: Q3 FY21 Earnings Presentation Adjusted EPS and Short-term Work • FY21 diluted EPS, based on midpoint of revised guidance, would be $0.53 higher when adjusting for amortization of intangible assets • Short term projects, defined as the Census contract and COVID-19 response work, created new learning opportunities and gained us new customer relationships • Approximately $2 billion of revenue resulted from the short-term projects on a cumulative basis through FY21. The cash realized was significant to our ability to acquire Attain Federal and VES while maintaining a total debt to adjusted EBITDA ratio below 3x ($ in millions) FY19 FY20 FY21 Cumulative Census Revenue 185$ 515$ 67$ 767$ COVID Revenue - 200 1,014 1,214 Combined Revenue 185$ 715$ 1,081$ 1,981$ Short Term Projects FY19 FY20 Q1 FY20 Q2 FY20 Q3 FY20 Q4 FY20 FY21 Q1 FY21 Q2 FY21 Q3 FY21 Q4E FY21E GAAP diluted EPS 3.72$ 0.91$ 0.43$ 1.04$ 1.02$ 3.39$ 1.03$ 1.29$ 1.51$ 0.87$ 4.70$ Amortization of intangibles expense (in millions) 33,054$ 9,088$ 8,934$ 8,712$ 8,900$ 35,634$ 6,516$ 5,070$ 12,132$ 20,282$ 44,000$ Amortization of intangible assets 0.51$ 0.14$ 0.14$ 0.14$ 0.14$ 0.56$ 0.10$ 0.08$ 0.19$ 0.32$ 0.71$ Amortization tax effect (0.13) (0.04) (0.04) (0.04) (0.04) (0.15) (0.03) (0.02) (0.05) (0.09) (0.18) EPS Effect 0.38$ 0.10$ 0.10$ 0.10$ 0.11$ 0.41$ 0.08$ 0.06$ 0.14$ 0.24$ 0.53$ Adjusted diluted EPS 4.10$ 1.01$ 0.53$ 1.14$ 1.13$ 3.80$ 1.11$ 1.35$ 1.65$ 1.11$ 5.23$ Note: Figures may not foot due to rounding Adjusted EPS Analysis

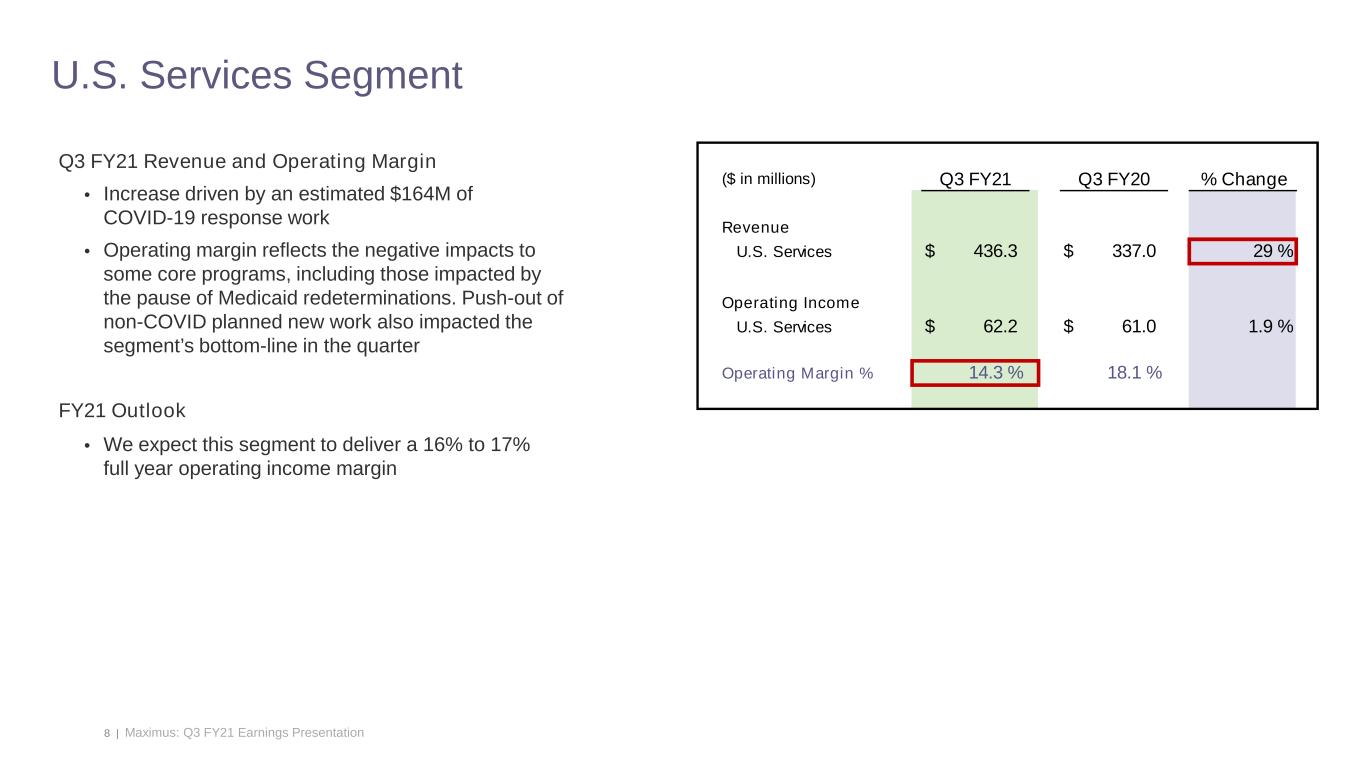

8 | Maximus: Q3 FY21 Earnings Presentation Q3 FY21 Revenue and Operating Margin • Increase driven by an estimated $164M of COVID-19 response work • Operating margin reflects the negative impacts to some core programs, including those impacted by the pause of Medicaid redeterminations. Push-out of non-COVID planned new work also impacted the segment’s bottom-line in the quarter FY21 Outlook • We expect this segment to deliver a 16% to 17% full year operating income margin U.S. Services Segment ($ in millions) Q3 FY21 Q3 FY20 % Change Revenue U.S. Services $ 436.3 $ 337.0 29 % Operating Income U.S. Services $ 62.2 $ 61.0 1.9 % Operating Margin % 14.3 % 18.1 %

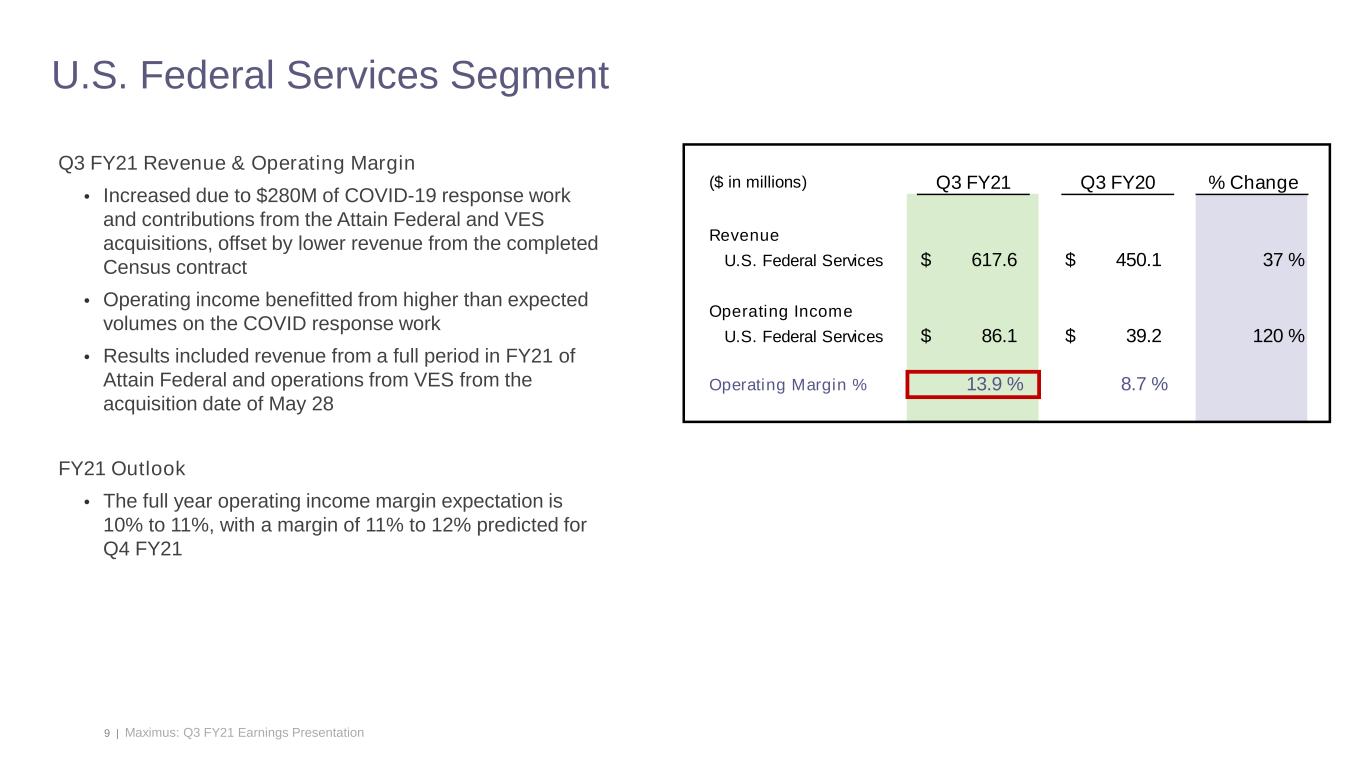

9 | Maximus: Q3 FY21 Earnings Presentation U.S. Federal Services Segment Q3 FY21 Revenue & Operating Margin • Increased due to $280M of COVID-19 response work and contributions from the Attain Federal and VES acquisitions, offset by lower revenue from the completed Census contract • Operating income benefitted from higher than expected volumes on the COVID response work • Results included revenue from a full period in FY21 of Attain Federal and operations from VES from the acquisition date of May 28 FY21 Outlook • The full year operating income margin expectation is 10% to 11%, with a margin of 11% to 12% predicted for Q4 FY21 ($ in millions) Q3 FY21 Q3 FY20 % Change Revenue U.S. Federal Services $ 617.6 $ 450.1 37 % Operating Income U.S. Federal Services $ 86.1 $ 39.2 120 % Operating Margin % 13.9 % 8.7 %

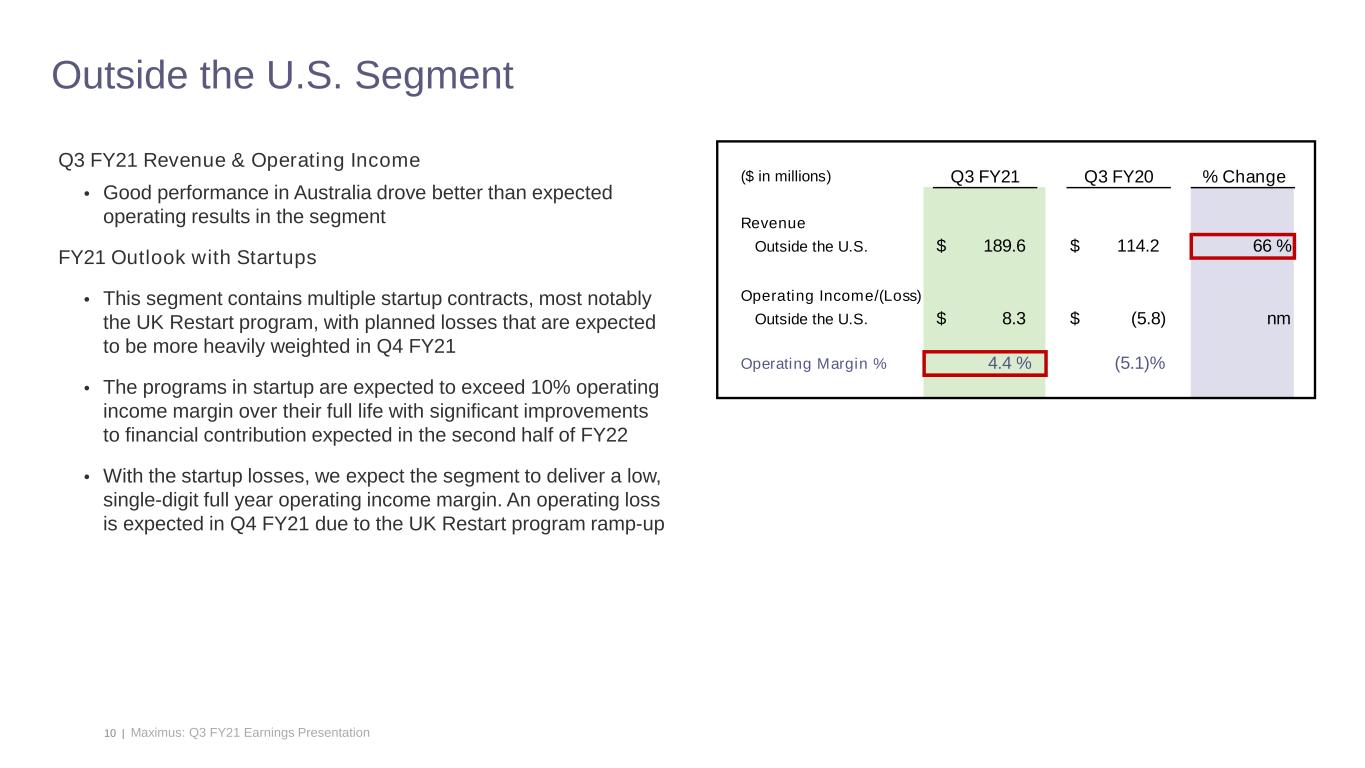

10 | Maximus: Q3 FY21 Earnings Presentation Outside the U.S. Segment Q3 FY21 Revenue & Operating Income • Good performance in Australia drove better than expected operating results in the segment FY21 Outlook with Startups • This segment contains multiple startup contracts, most notably the UK Restart program, with planned losses that are expected to be more heavily weighted in Q4 FY21 • The programs in startup are expected to exceed 10% operating income margin over their full life with significant improvements to financial contribution expected in the second half of FY22 • With the startup losses, we expect the segment to deliver a low, single-digit full year operating income margin. An operating loss is expected in Q4 FY21 due to the UK Restart program ramp-up ($ in millions) Q3 FY21 Q3 FY20 % Change Revenue Outside the U.S. $ 189.6 $ 114.2 66 % Operating Income/(Loss) Outside the U.S. $ 8.3 $ (5.8) nm Operating Margin % 4.4 % (5.1)%

11 | Maximus: Q3 FY21 Earnings Presentation Capital Allocation Capital Allocation • For the twelve months ended June 30, 2021, the ratio of debt (net of allowed cash) to pro forma EBITDA, calculated in accordance with our credit agreement, is 2.4 to 1 • Free cash flow will be used to pay down debt and we expect to push this ratio closer to 2 to 1 over the next few quarters • We will continue to search for and execute tuck-in transactions that are accretive, deliver good value and have a strong potential to drive future organic growth. Longer term, we will continue to prioritize strategic acquisitions as our preferred use of capital • We expect to continue paying a regular quarterly dividend that is fixed regardless of short-term earnings fluctuations and increases over time with earnings increases. We target a dividend yield between 1% and 2% of our stock price. The current annual dividend of $1.12 has ranged between a 1.2% and 1.4% yield based on our stock price over the last several months

12 | Maximus: Q3 FY21 Earnings Presentation Fiscal Year 2022 FY22 Early Thoughts • Acquisitions of Attain Federal and VES expected to contribute $750M of revenue, as compared to $320M - $330M forecasted in FY21 • COVID-19 response work expected to contribute revenue of $150M - $200M, as compared to approximately $1B in FY21. COVID-19 response work is now earning above our corporate average operating income margin • Start-up contracts outside of the U.S. are expected to contribute $150M higher revenues, as compared to FY21 • We expect amortization expense to be between $80M and $85M and interest expense to be between $30M and $33M, with an effective tax rate between 25% to 26% (assuming no change in U.S. Federal tax rates) • Earnings expected to be back-loaded in FY22. Q1 FY22 expected to be the low point followed by sequential improvement. This is due to: • Seeing signs that some core programs, which have been negatively impacted by the pandemic, should see performance improvements between Q1 and Q2 FY22. The associated costs are currently expected to be ramping up in Q1 FY22 • Negative impact to Q1 FY22 resulting from startup contracts in Outside the U.S. segment. These startup contracts are expected to achieve breakeven halfway through FY22, and make strong contributions in the back half of the year

13 | Maximus: Q3 FY21 Earnings Presentation Bruce Caswell President & Chief Executive Officer Fiscal 2021 Third Quarter Earnings Call August 5, 2021

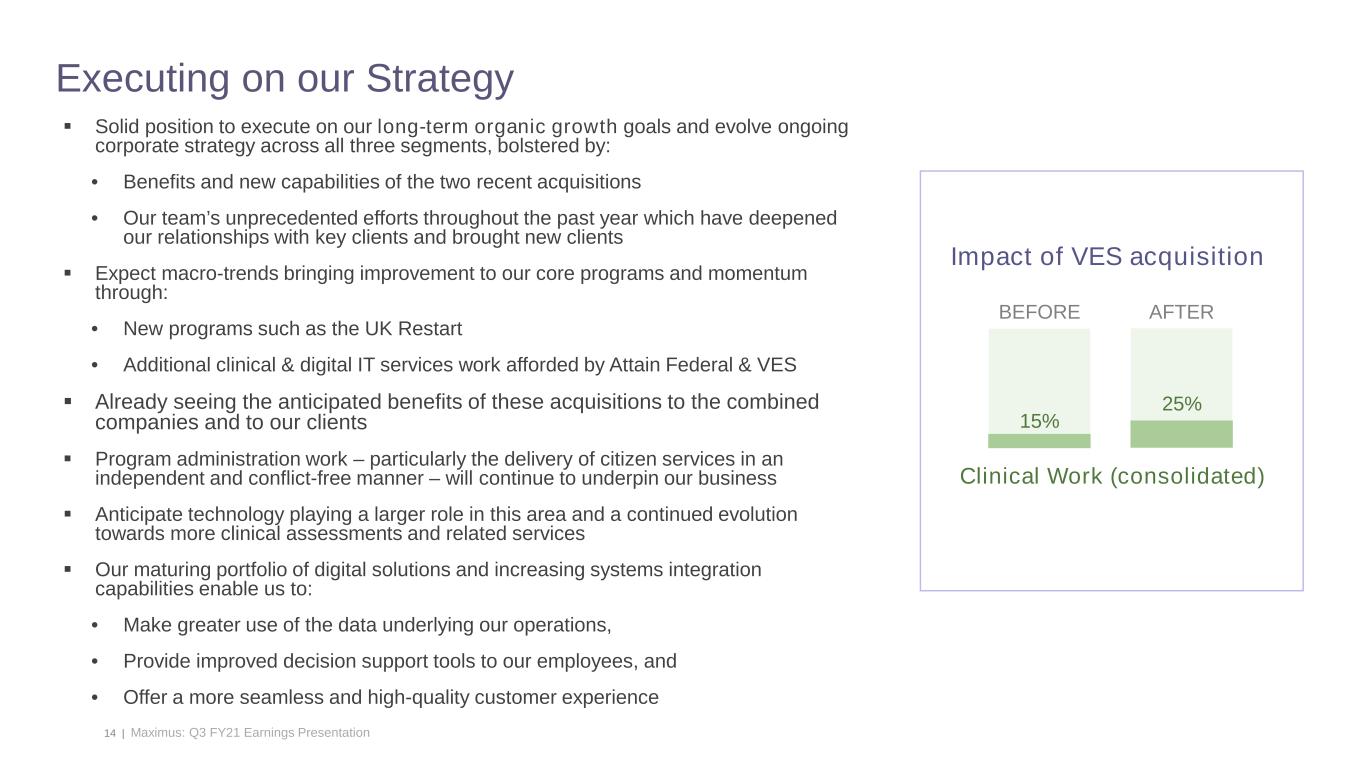

14 | Maximus: Q3 FY21 Earnings Presentation Executing on our Strategy Solid position to execute on our long-term organic growth goals and evolve ongoing corporate strategy across all three segments, bolstered by: • Benefits and new capabilities of the two recent acquisitions • Our team’s unprecedented efforts throughout the past year which have deepened our relationships with key clients and brought new clients Expect macro-trends bringing improvement to our core programs and momentum through: • New programs such as the UK Restart • Additional clinical & digital IT services work afforded by Attain Federal & VES Already seeing the anticipated benefits of these acquisitions to the combined companies and to our clients Program administration work – particularly the delivery of citizen services in an independent and conflict-free manner – will continue to underpin our business Anticipate technology playing a larger role in this area and a continued evolution towards more clinical assessments and related services Our maturing portfolio of digital solutions and increasing systems integration capabilities enable us to: • Make greater use of the data underlying our operations, • Provide improved decision support tools to our employees, and • Offer a more seamless and high-quality customer experience Impact of VES acquisition BEFORE AFTER Clinical Work (consolidated) 15% 25%

15 | Maximus: Q3 FY21 Earnings Presentation • • • • • • • Digital Services Position

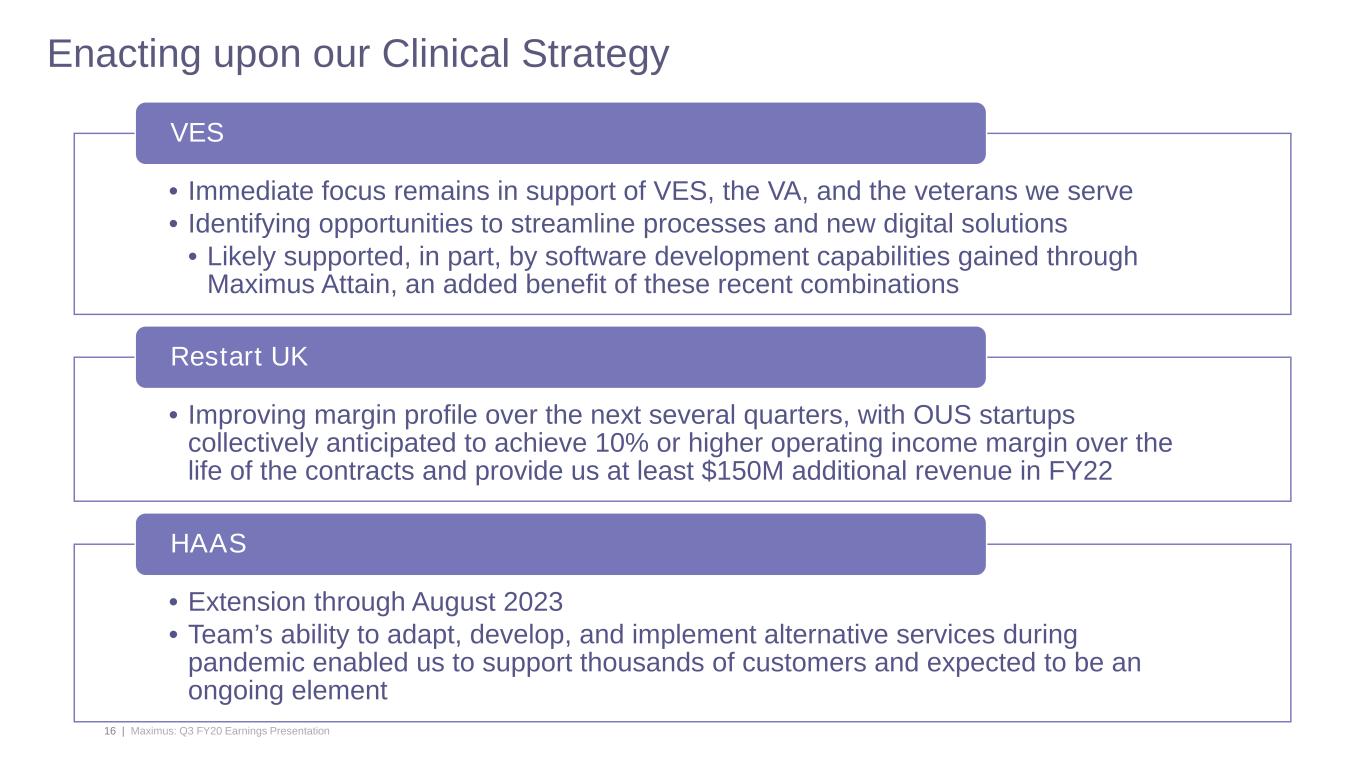

16 | Maximus: Q3 FY20 Earnings Presentation Enacting upon our Clinical Strategy • Immediate focus remains in support of VES, the VA, and the veterans we serve • Identifying opportunities to streamline processes and new digital solutions • Likely supported, in part, by software development capabilities gained through Maximus Attain, an added benefit of these recent combinations VES • Improving margin profile over the next several quarters, with OUS startups collectively anticipated to achieve 10% or higher operating income margin over the life of the contracts and provide us at least $150M additional revenue in FY22 Restart UK • Extension through August 2023 • Team’s ability to adapt, develop, and implement alternative services during pandemic enabled us to support thousands of customers and expected to be an ongoing element HAAS

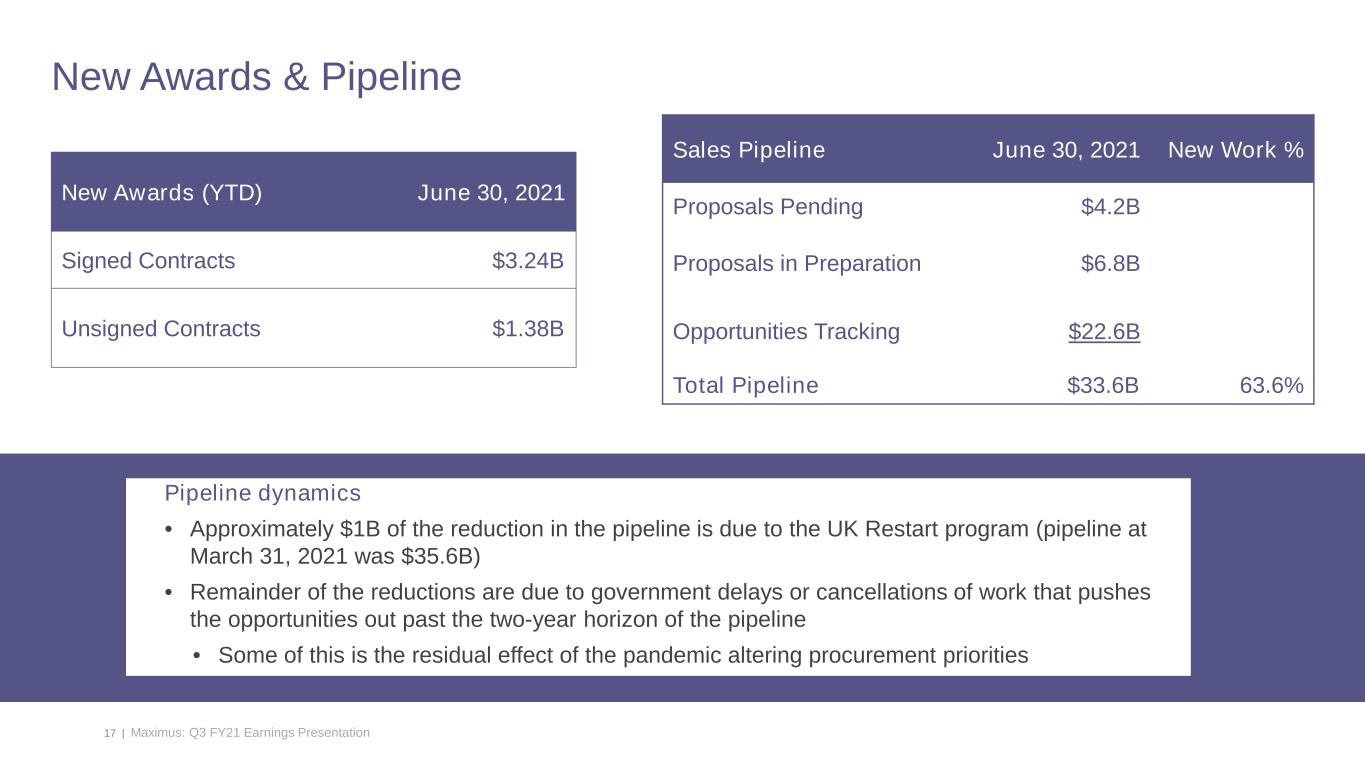

17 | Maximus: Q3 FY21 Earnings Presentation Sales Pipeline June 30, 2021 New Work % Proposals Pending $4.2B Proposals in Preparation $6.8B Opportunities Tracking $22.6B Total Pipeline $33.6B 63.6% New Awards (YTD) June 30, 2021 Signed Contracts $3.24B Unsigned Contracts $1.38B New Awards & Pipeline Pipeline dynamics • Approximately $1B of the reduction in the pipeline is due to the UK Restart program (pipeline at March 31, 2021 was $35.6B) • Remainder of the reductions are due to government delays or cancellations of work that pushes the opportunities out past the two-year horizon of the pipeline • Some of this is the residual effect of the pandemic altering procurement priorities

18 | Maximus: Q3 FY21 Earnings Presentation Responding to Changing Client Needs • Primarily beat our revenue expectations as a result of higher than anticipated volumes on COVID-19 response work in the U.S. Federal Segment • Ramped up approximately 13,000 agents on one contract alone, which required initially hiring nearly 20,000 prospective staff, with our largest starting class on one day of more than 12,500 remote agents • Built and stress-tested largest cloud-based telephony infrastructure for government, capable of handling up to a half-million calls per hour or 160 calls per second • Equally able to rapidly scale down the operations as directed by the client • Ability to capitalize on sizable opportunities of a shorter-term nature without stranding capital assets when the programs wind-down • Underscores our value to governments in times of need and provides returns that can be invested towards longer-term growth objectives

19 | Maximus: Q3 FY21 Earnings Presentation • Strategy execution is maturing as Attain Federal and VES become more fully integrated, and we leverage the platforms and capabilities they bring – Complements foundation we built across clinical services & digital technologies and our existing organic efforts • COVID-19 work is tapering off quickly while, with some exceptions like Australia, core programs have not yet returned to their pre-pandemic activity levels – Believe it is a matter of timing, not a shift in long-term market characteristics • Better positioned than ever to respond to macro-trends and meet needs of our government clients, as supported by: – Combination with recent acquisitions – Agility we demonstrated during COVID-19 – Desirable financial attributes of our business model Thank you • We thank the tens of thousands of Maximus employees and contracted staff worldwide who have risen to remarkable challenges during this period Conclusion