1 | Maximus: Q3 FY20 Earnings Presentation Rick Nadeau Chief Financial Officer Fiscal 2021 Second Quarter Earnings Call May 6, 2021

2 | Maximus: Q1 FY21 Earnings Presentation These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. Included in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “opportunity,” “could,” “potential,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements that are not historical facts, including statements about our confidence, strategies and initiatives and our expectations about revenues, results of operations, profitability, liquidity, market demand or the impact of the pandemic are forward-looking statements that involve risks and uncertainties such as those related to the impact of the pandemic and our recently-completed and announced acquisitions including but not limited to: • Completing the acquisition of VES Group, Inc. ("VES") within the timeframe anticipated or at all, difficulties in integrating VES and the Federal business of Attain, LLC (“Attain”) including realization of the expected benefits, and adverse effects on the business including the ability to meet obligations resulting from indebtedness required to complete the VES acquisition • The ultimate duration of the pandemic • The threat of further negative pandemic-related impacts These risks could cause the Company’s actual results to differ materially from those indicated by such forward-looking statements. A summary of risk factors can be found in Item 1A, "Risk Factors" in our Annual Report on Form 10-K for the year ended September 30, 2020, which was filed with the Securities and Exchange Commission (SEC) on November 19, 2020. A supplemental description of risk factors related to the Company's completed acquisition of the Federal business of Attain and proposed acquisition of VES are included in our Quarterly Report on Form 10-Q for the quarter ended March 31, 2021, to be filed shortly. The Company's SEC reports are accessible on maximus.com. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. Forward-looking Statements & Non-GAAP Information • Delays in our core programs returning to normal volumes and operations • The potential impacts resulting from budget challenges with our government clients • The possibility of delayed or missed payments by customers • The potential for further supply chain disruptions impacting IT or safety equipment • The impact of further legislation and government policies on the programs we operate

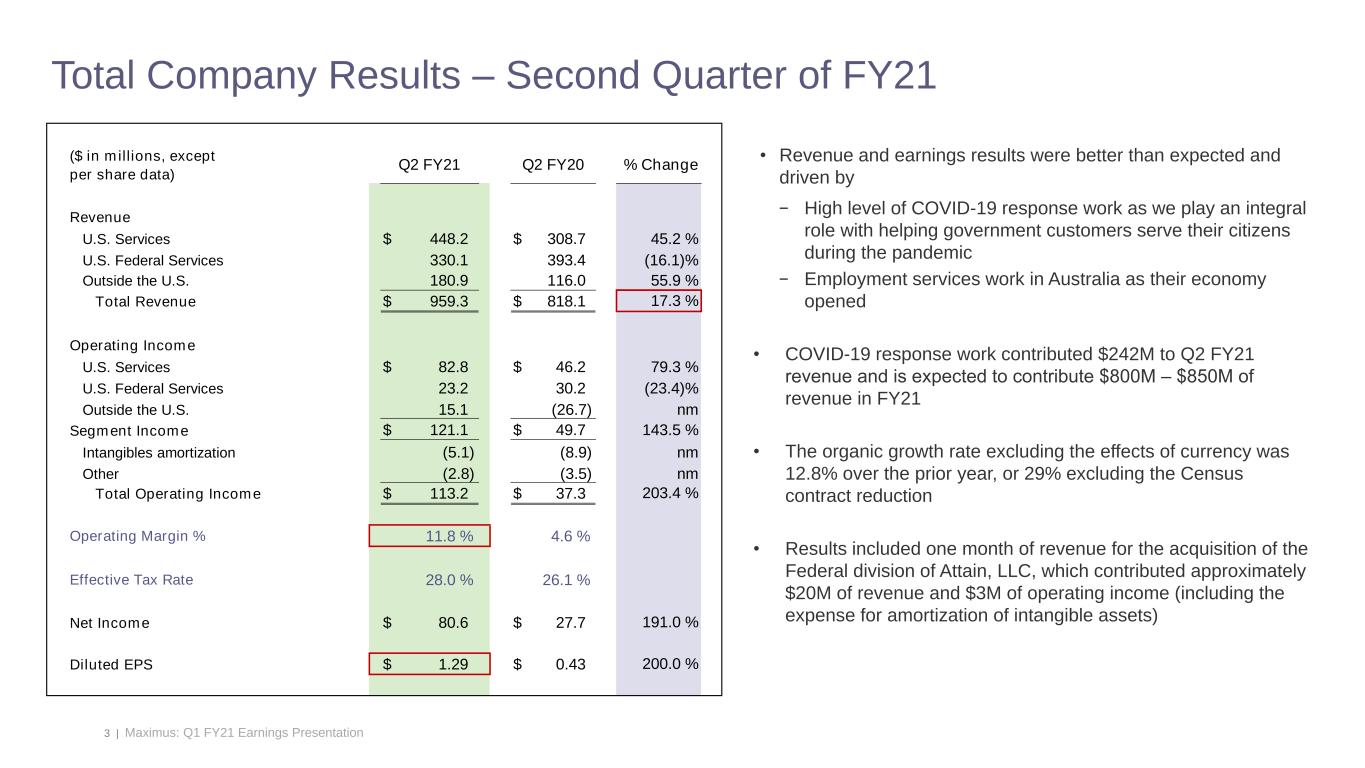

3 | Maximus: Q1 FY21 Earnings Presentation Total Company Results – Second Quarter of FY21 • Revenue and earnings results were better than expected and driven by − High level of COVID-19 response work as we play an integral role with helping government customers serve their citizens during the pandemic − Employment services work in Australia as their economy opened • COVID-19 response work contributed $242M to Q2 FY21 revenue and is expected to contribute $800M ‒ $850M of revenue in FY21 • The organic growth rate excluding the effects of currency was 12.8% over the prior year, or 29% excluding the Census contract reduction • Results included one month of revenue for the acquisition of the Federal division of Attain, LLC, which contributed approximately $20M of revenue and $3M of operating income (including the expense for amortization of intangible assets) ($ in millions, except per share data) Q2 FY21 Q2 FY20 % Change Revenue U.S. Services $ 448.2 $ 308.7 45.2 % U.S. Federal Services 330.1 393.4 (16.1)% Outside the U.S. 180.9 116.0 55.9 % Total Revenue $ 959.3 $ 818.1 17.3 % Operating Income U.S. Services $ 82.8 $ 46.2 79.3 % U.S. Federal Services 23.2 30.2 (23.4)% Outside the U.S. 15.1 (26.7) nm Segment Income $ 121.1 $ 49.7 143.5 % Intangibles amortization (5.1) (8.9) nm Other (2.8) (3.5) nm Total Operating Income $ 113.2 $ 37.3 203.4 % Operating Margin % 11.8 % 4.6 % Effective Tax Rate 28.0 % 26.1 % Net Income $ 80.6 $ 27.7 191.0 % Diluted EPS $ 1.29 $ 0.43 200.0 %

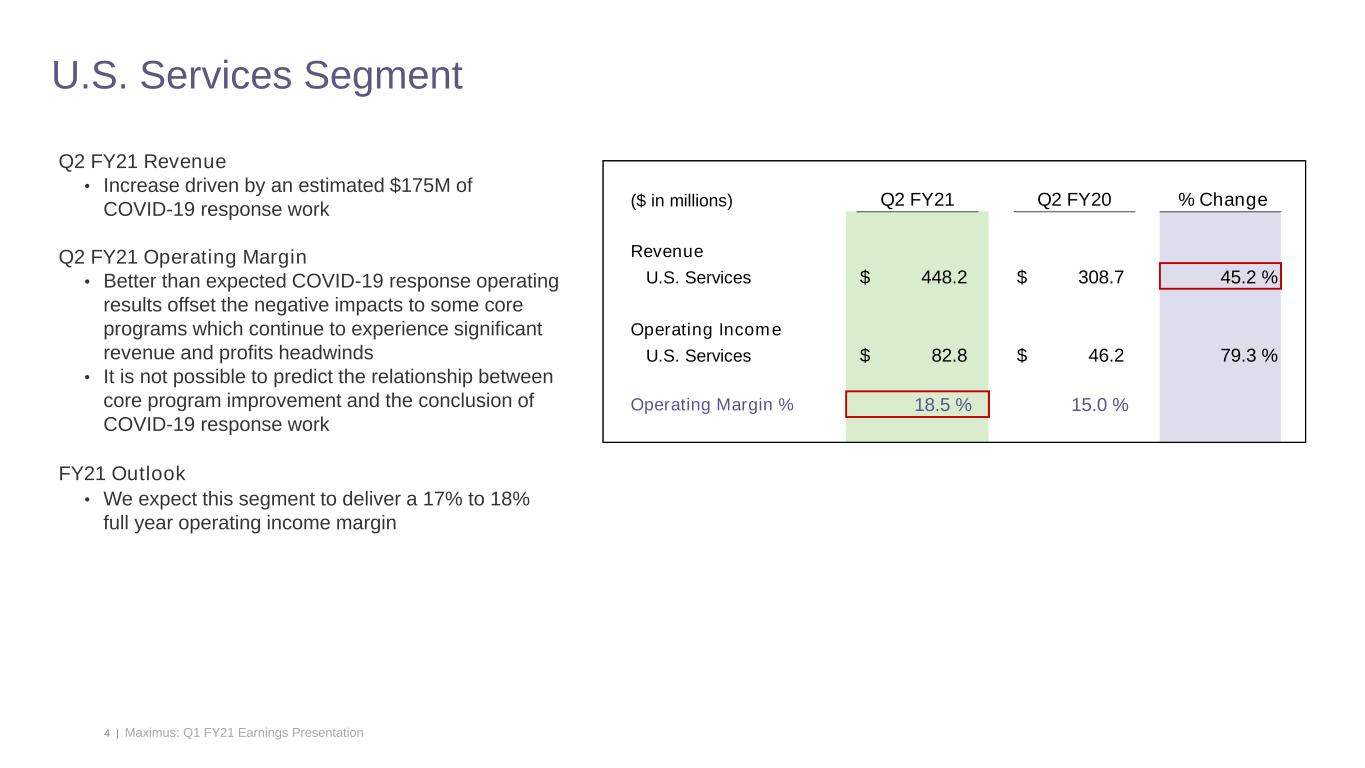

4 | Maximus: Q1 FY21 Earnings Presentation Q2 FY21 Revenue • Increase driven by an estimated $175M of COVID-19 response work Q2 FY21 Operating Margin • Better than expected COVID-19 response operating results offset the negative impacts to some core programs which continue to experience significant revenue and profits headwinds • It is not possible to predict the relationship between core program improvement and the conclusion of COVID-19 response work FY21 Outlook • We expect this segment to deliver a 17% to 18% full year operating income margin U.S. Services Segment ($ in millions) Q2 FY21 Q2 FY20 % Change Revenue U.S. Services $ 448.2 $ 308.7 45.2 % Operating Income U.S. Services $ 82.8 $ 46.2 79.3 % Operating Margin % 18.5 % 15.0 %

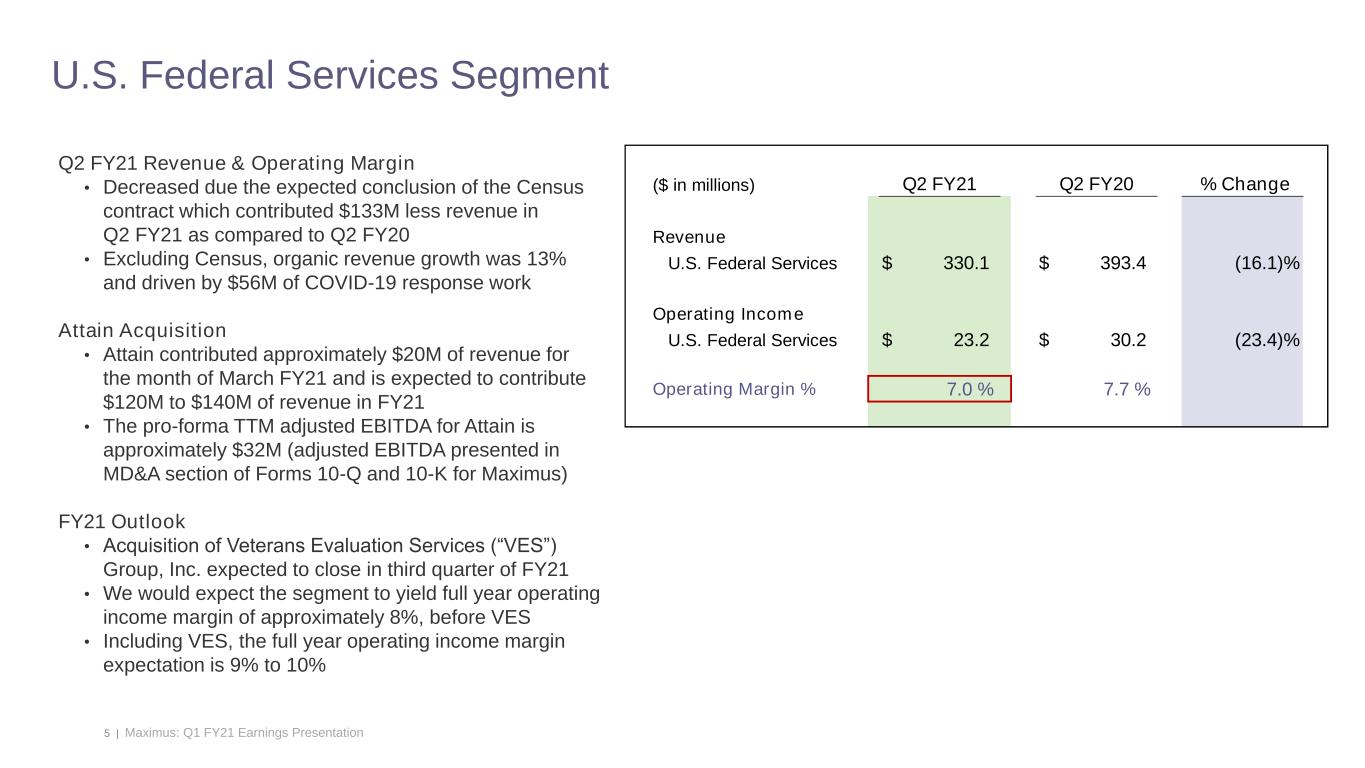

5 | Maximus: Q1 FY21 Earnings Presentation U.S. Federal Services Segment Q2 FY21 Revenue & Operating Margin • Decreased due the expected conclusion of the Census contract which contributed $133M less revenue in Q2 FY21 as compared to Q2 FY20 • Excluding Census, organic revenue growth was 13% and driven by $56M of COVID-19 response work Attain Acquisition • Attain contributed approximately $20M of revenue for the month of March FY21 and is expected to contribute $120M to $140M of revenue in FY21 • The pro-forma TTM adjusted EBITDA for Attain is approximately $32M (adjusted EBITDA presented in MD&A section of Forms 10-Q and 10-K for Maximus) FY21 Outlook • Acquisition of Veterans Evaluation Services (“VES”) Group, Inc. expected to close in third quarter of FY21 • We would expect the segment to yield full year operating income margin of approximately 8%, before VES • Including VES, the full year operating income margin expectation is 9% to 10% ($ in millions) Q2 FY21 Q2 FY20 % Change Revenue U.S. Federal Services $ 330.1 $ 393.4 (16.1)% Operating Income U.S. Federal Services $ 23.2 $ 30.2 (23.4)% Operating Margin % 7.0 % 7.7 %

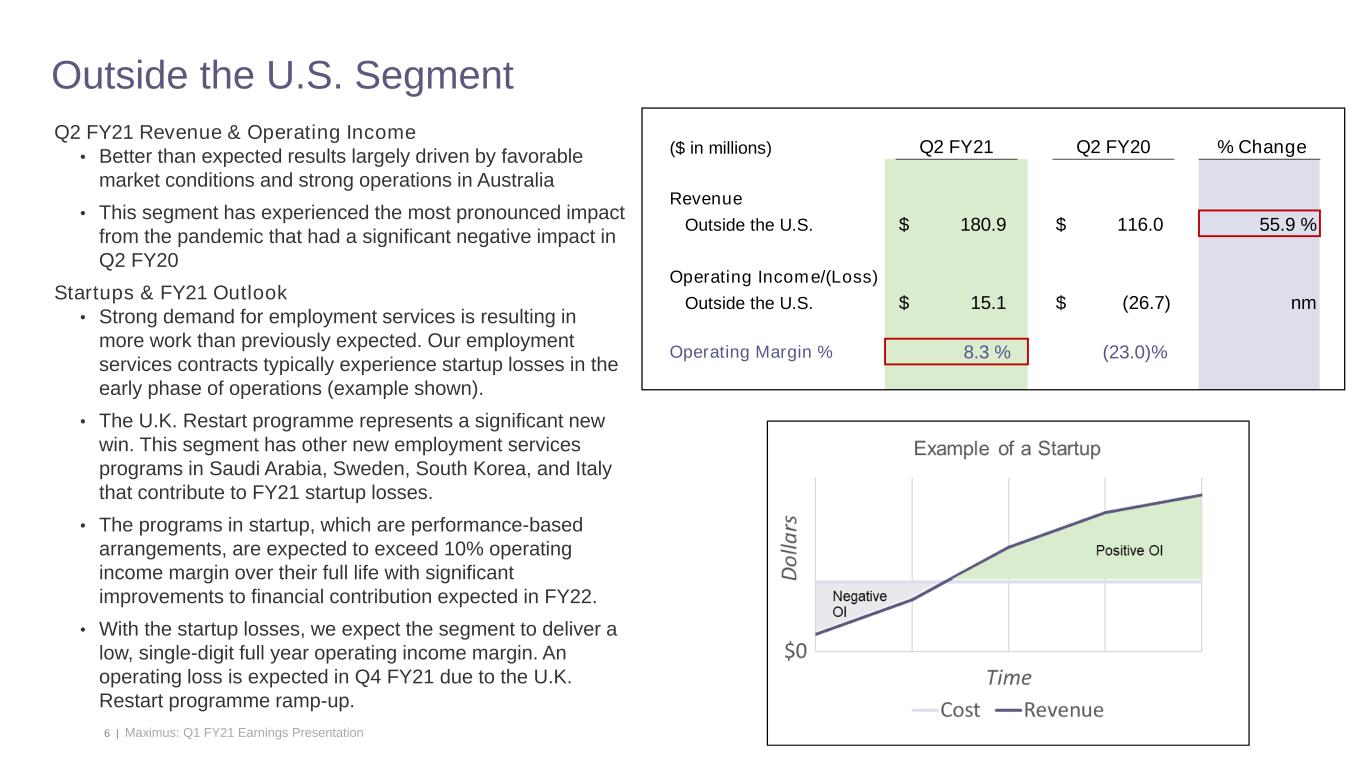

6 | Maximus: Q1 FY21 Earnings Presentation Outside the U.S. Segment Q2 FY21 Revenue & Operating Income • Better than expected results largely driven by favorable market conditions and strong operations in Australia • This segment has experienced the most pronounced impact from the pandemic that had a significant negative impact in Q2 FY20 Startups & FY21 Outlook • Strong demand for employment services is resulting in more work than previously expected. Our employment services contracts typically experience startup losses in the early phase of operations (example shown). • The U.K. Restart programme represents a significant new win. This segment has other new employment services programs in Saudi Arabia, Sweden, South Korea, and Italy that contribute to FY21 startup losses. • The programs in startup, which are performance-based arrangements, are expected to exceed 10% operating income margin over their full life with significant improvements to financial contribution expected in FY22. • With the startup losses, we expect the segment to deliver a low, single-digit full year operating income margin. An operating loss is expected in Q4 FY21 due to the U.K. Restart programme ramp-up. ($ in millions) Q2 FY21 Q2 FY20 % Change Revenue Outside the U.S. $ 180.9 $ 116.0 55.9 % Operating Income/(Loss) Outside the U.S. $ 15.1 $ (26.7) nm Operating Margin % 8.3 % (23.0)%

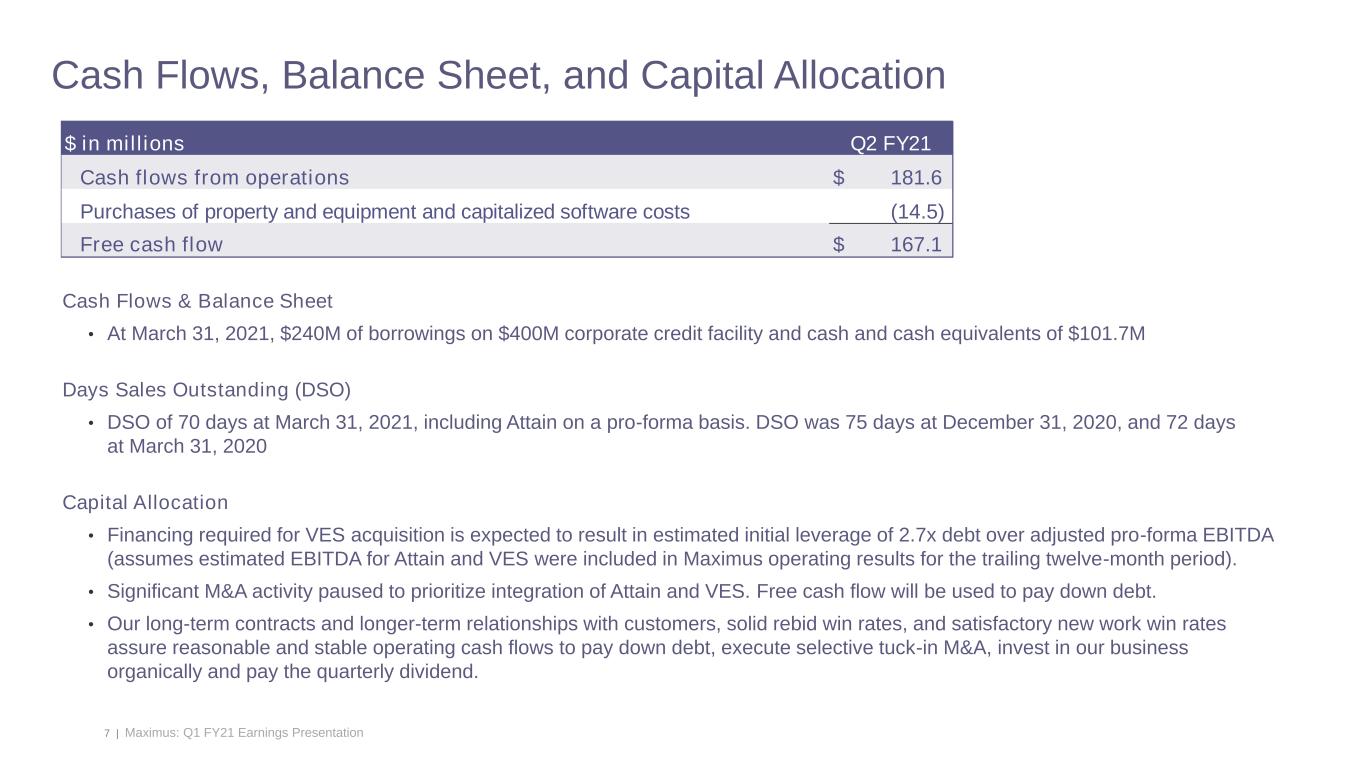

7 | Maximus: Q1 FY21 Earnings Presentation Cash Flows & Balance Sheet • At March 31, 2021, $240M of borrowings on $400M corporate credit facility and cash and cash equivalents of $101.7M Days Sales Outstanding (DSO) • DSO of 70 days at March 31, 2021, including Attain on a pro-forma basis. DSO was 75 days at December 31, 2020, and 72 days at March 31, 2020 Capital Allocation • Financing required for VES acquisition is expected to result in estimated initial leverage of 2.7x debt over adjusted pro-forma EBITDA (assumes estimated EBITDA for Attain and VES were included in Maximus operating results for the trailing twelve-month period). • Significant M&A activity paused to prioritize integration of Attain and VES. Free cash flow will be used to pay down debt. • Our long-term contracts and longer-term relationships with customers, solid rebid win rates, and satisfactory new work win rates assure reasonable and stable operating cash flows to pay down debt, execute selective tuck-in M&A, invest in our business organically and pay the quarterly dividend. Cash Flows, Balance Sheet, and Capital Allocation $ in millions Q2 FY21 Cash flows from operations $ 181.6 Purchases of property and equipment and capitalized software costs (14.5) Free cash flow $ 167.1

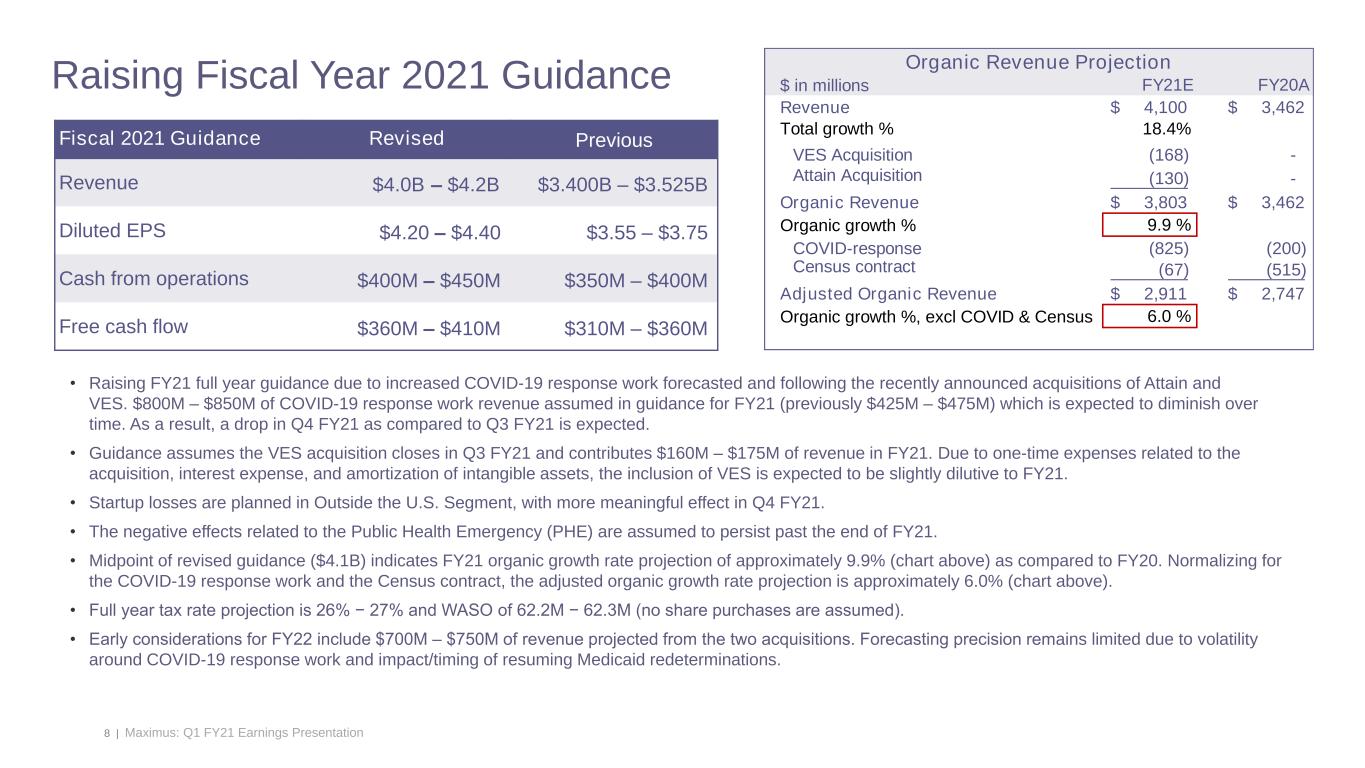

8 | Maximus: Q1 FY21 Earnings Presentation Raising Fiscal Year 2021 Guidance Fiscal 2021 Guidance Revised Previous Revenue $4.0B – $4.2B $3.400B – $3.525B Diluted EPS $4.20 – $4.40 $3.55 – $3.75 Cash from operations $400M – $450M $350M – $400M Free cash flow $360M – $410M $310M – $360M • Raising FY21 full year guidance due to increased COVID-19 response work forecasted and following the recently announced acquisitions of Attain and VES. $800M – $850M of COVID-19 response work revenue assumed in guidance for FY21 (previously $425M – $475M) which is expected to diminish over time. As a result, a drop in Q4 FY21 as compared to Q3 FY21 is expected. • Guidance assumes the VES acquisition closes in Q3 FY21 and contributes $160M – $175M of revenue in FY21. Due to one-time expenses related to the acquisition, interest expense, and amortization of intangible assets, the inclusion of VES is expected to be slightly dilutive to FY21. • Startup losses are planned in Outside the U.S. Segment, with more meaningful effect in Q4 FY21. • The negative effects related to the Public Health Emergency (PHE) are assumed to persist past the end of FY21. • Midpoint of revised guidance ($4.1B) indicates FY21 organic growth rate projection of approximately 9.9% (chart above) as compared to FY20. Normalizing for the COVID-19 response work and the Census contract, the adjusted organic growth rate projection is approximately 6.0% (chart above). • Full year tax rate projection is 26% − 27% and WASO of 62.2M − 62.3M (no share purchases are assumed). • Early considerations for FY22 include $700M ‒ $750M of revenue projected from the two acquisitions. Forecasting precision remains limited due to volatility around COVID-19 response work and impact/timing of resuming Medicaid redeterminations. $ in millions FY21E FY20A Revenue $ 4,100 $ 3,462 Total growth % 18.4% VES Acquisition (168) - Attain Acquisition (130) - Organic Revenue $ 3,803 $ 3,462 Organic growth % 9.9 % COVID-response (825) (200) Census contract (67) (515) Adjusted Organic Revenue $ 2,911 $ 2,747 Organic growth %, excl COVID & Census 6.0 % Organic Revenue Projection

9 | Maximus: Q1 FY21 Earnings Presentation Bruce Caswell President & Chief Executive Officer Fiscal 2021 Second Quarter Earnings Call May 6, 2021

10 | Maximus: Q1 FY21 Earnings Presentation Long-term Corporate Strategy Three-pronged strategy to accelerate progress and drive next phase of growth 1. Digital transformation within the government services market, enabling new solution offerings to address the mission requirements of our customers and improve overall service delivery across our operations 2. Clinical evolution to address long term macro- trends driving demand for independent and conflict free business process management (BPM) services with a more clinical dimension, while maintaining the foundational elements of our business 3. Market expansion as we evaluate adjacent and emerging markets, organically grow the portfolio, and acquire capabilities and contracts to establish a foothold in these markets

11 | Maximus: Q1 FY21 Earnings Presentation ▪ Furthers two primary strategic pillars: • Digital transformation – application development & modernization – enterprise business solutions – cybersecurity – data sciences (advanced analytics & machine learning) • Expanding U.S. federal market – Securities & Exchange Commission – Department of Homeland Security – Department of Health & Human Services ▪ Our teams are working together on pipeline opportunities with shared experience and skills for our federal customers ▪ Attain brings innovation and experience while Maximus offers scale and highly desirable contract vehicles ▪ Together, we can now address opportunities where neither company would have previously been competitive Attain Acquisition

12 | Maximus: Q3 FY20 Earnings Presentation • Premier provider of Medical Disability Examinations (MDE) to the U.S. Department of Veterans Affairs (VA) • Significantly advances our clinical evolution, while meaningfully expanding our presence in the VA • Clinical assessments business (state level growth through acquisition of Ascend [2016]) VES expertise creates opportunity federal level growth • Independent health and disability assessments and appeals will comprise a larger share of our overall portfolio and pipeline, federal and non-federal markets • An important time as the Veterans Benefits Administration (or VBA) has been focused on reducing the inventory of pandemic-related exams while preparing for the future needs of Veterans with qualifying conditions • The VBA recently launched a market assessment to better understand industry capacity and capabilities • Maximus and VES bring the credibility and quality of an established partner increasing capacity and improving technology to benefit Veterans and the VBA • Our goal: contribute to the timely reduction of pandemic-related inventory and be the partner of choice in MDE services • Adding Attain and VES, with Acentia [2015] and GDIT [citizen engagement center operations, 2018] helps us play a more meaningful role in the U.S. federal market, improving our competitive advantage Veterans Evaluation Services Acquisition* * expected to close in Q3 FY21

13 | Maximus: Q1 FY21 Earnings Presentation COVID-19 related new wins • Pandemic-related needs continue to evolve, resulting in new wins for related work at the state and federal level (CDC Vaccination Hotline award) • Expand into new areas of service with existing customers, and increase our impact on their behalf • Unemployment insurance has demonstrated the value of our model to long term relationships with state departments of labor • “modular” capabilities — makes this event- driven work a beneficial element of our business model • Digital transformation plus decades of experience equals real time support during pandemic Addressing the Pandemic-related Needs of our Customers United Kingdom • Two new prime contracts: Restart programme (through CAEHRS framework), provides tailored community-based support for people facing long-term unemployment • Startup costs are typical with significant new contracts so Q3 and then Q4 earnings may step down sequentially, with rebound estimates in FY22 • Total value: more than $960M (£690 million British Pounds Sterling) over base and option periods totaling 6 years; hiring more than 1,500 people • Core operations in the U.K. continue to face disruption from pandemic-related volume and revenue declines Australia • With decreased volume in some geographies, seeing strong volumes as economy re-opens • Demand is holding more than anticipated during the holiday season and serves as an example of anticipated volume return

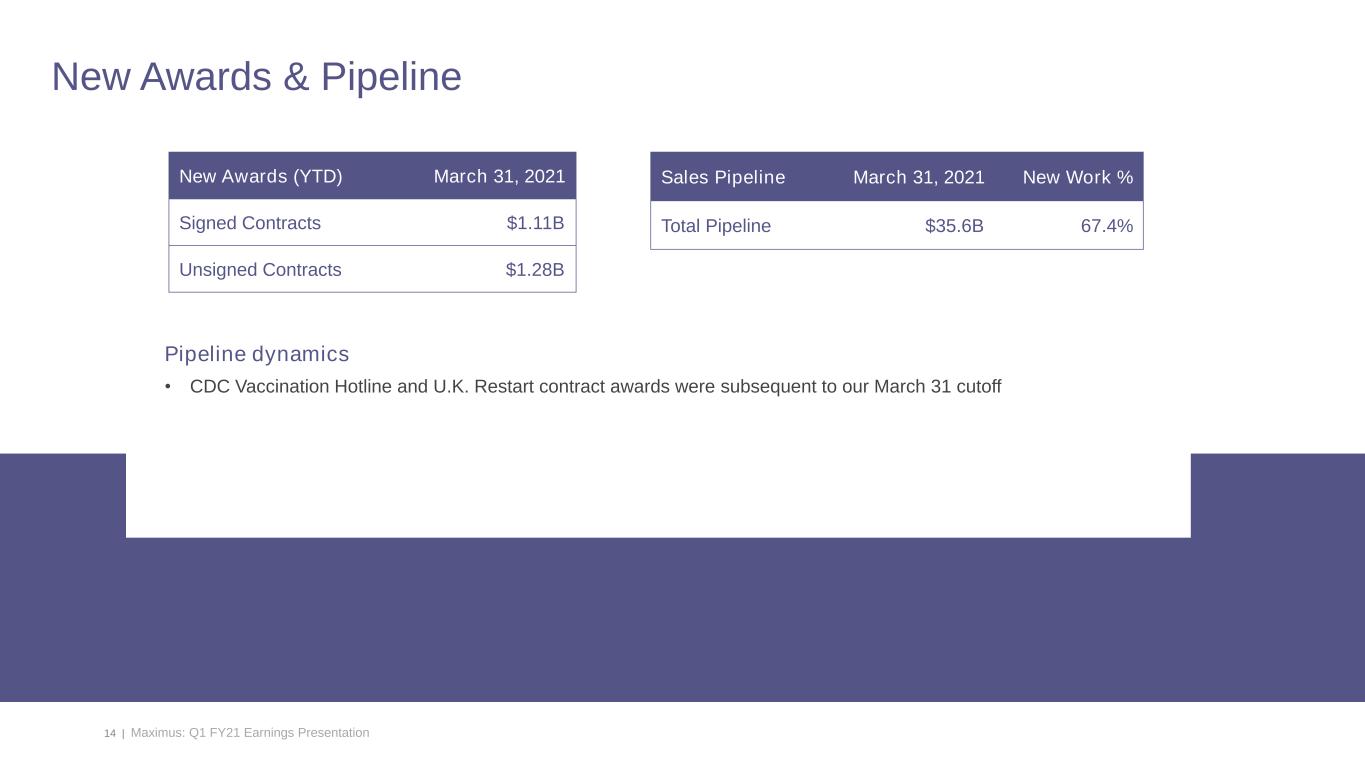

14 | Maximus: Q1 FY21 Earnings Presentation Sales Pipeline March 31, 2021 New Work % Total Pipeline $35.6B 67.4% New Awards (YTD) March 31, 2021 Signed Contracts $1.11B Unsigned Contracts $1.28B New Awards & Pipeline Pipeline dynamics • CDC Vaccination Hotline and U.K. Restart contract awards were subsequent to our March 31 cutoff

15 | Maximus: Q1 FY21 Earnings Presentation Welcome • Attain employees and prospective colleagues from VES • We are very focused on corporate culture as an integration leadership team • Our goal for Attain and VES is to have more opportunities, take on new challenges, advance your careers, and be rewarded for quality work Thank you • Congratulations and thanks to the global Maximus team for ongoing efforts during the pandemic for best-in-class service to the individuals and families we serve • We are well-positioned to respond to the needs of government at a very challenging time through the efforts of our colleagues and delivery-partner staff worldwide Conclusion