Fiscal 2020 Fourth Quarter & Year End Earnings Call Rick Nadeau Chief Financial Officer November 19, 2020 1 | Maximus: Q4 FY20 Earnings Presentation

Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our re sults, and providing meaningful period- to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. Included in this presentation are forward-looking statements within the meaning of the safe harbor provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “anticipate,” “intend,” “plan,” “goal,” “seek,” “opportunity,” “could,” “potential,” “believe,” “project,” “estimate,” “expect,” “strategy,” “future,” “likely,” “may,” “should,” “will” and similar references to future periods. Forward-looking statements that are not historical facts, including statements about our confidence, strategies and initiatives and our expectations about revenues, results of operations, profitability, liquidity, market demand or the impact of the COVID-19 pandemic are forward-looking statements that involve risks and uncertainties such as those related to impact of the COVID-19 pandemic including but not limited to: • The ultimate duration of the pandemic • The threat of further negative pandemic-related impacts • Delays in our core programs returning to normal volumes and operations • The potential impacts resulting from budget challenges with our government clients • The possibility of delayed or missed payments by customers • The potential for further supply chain disruptions impacting IT or safety equipment • The impact of further legislation and government policies on the programs we operate These risks could cause our actual results to differ materially from those indicated by such forward-looking statements. Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause our actual results and financial condition to differ materially from those indicated in the forward -looking statements include, among others, factors set forth in Item 1A of our Annual Report on Form 10-K, for the year ended September 30, 2020, to be filed shortly with the Securities and Exchange Commission and found on maximus.com. Any forward-looking statement made by us in this report is based only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise. 2 | Maximus: Q4 FY20 Earnings Presentation

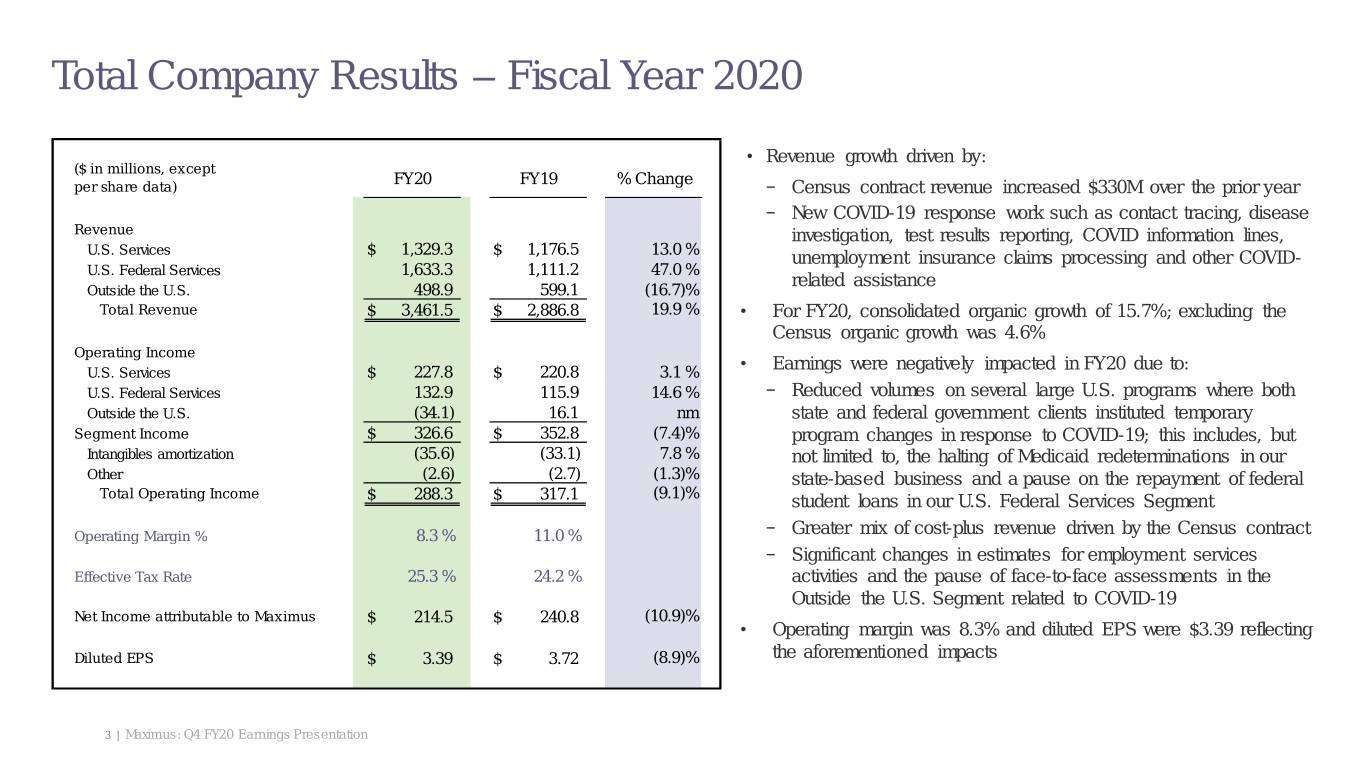

Total Company Results – Fiscal Year 2020 • Revenue growth driven by: ($ in millions, except FY20 FY19 % Change per share data) − Census contract revenue increased $330M over the prior year − New COVID-19 response work such as contact tracing, disease Revenue investigation, test results reporting, COVID information lines, U.S. Services $ 1,329.3 $ 1,176.5 13.0 % unemployment insurance claims processing and other COVID- U.S. Federal Services 1,633.3 1,111.2 47.0 % related assistance Outside the U.S. 498.9 599.1 (16.7)% Total Revenue $ 3,461.5 $ 2,886.8 19.9 % • For FY20, consolidated organic growth of 15.7%; excluding the Census organic growth was 4.6% Operating Income • Earnings were negatively impacted in FY20 due to: U.S. Services $ 227.8 $ 220.8 3.1 % U.S. Federal Services 132.9 115.9 14.6 % − Reduced volumes on several large U.S. programs where both Outside the U.S. (34.1) 16.1 nm state and federal government clients instituted temporary Segment Income $ 326.6 $ 352.8 (7.4)% program changes in response to COVID-19; this includes, but Intangibles amortization (35.6) (33.1) 7.8 % not limited to, the halting of Medicaid redeterminations in our Other (2.6) (2.7) (1.3)% state-based business and a pause on the repayment of federal Total Operating Income $ 288.3 $ 317.1 (9.1)% student loans in our U.S. Federal Services Segment Operating Margin % 8.3 % 11.0 % − Greater mix of cost-plus revenue driven by the Census contract − Significant changes in estimates for employment services Effective Tax Rate 25.3 % 24.2 % activities and the pause of face-to-face assessments in the Outside the U.S. Segment related to COVID-19 Net Income attributable to Maximus $ 214.5 $ 240.8 (10.9)% • Operating margin was 8.3% and diluted EPS were $3.39 reflecting Diluted EPS $ 3.39 $ 3.72 (8.9)% the aforementioned impacts 3 | Maximus: Q4 FY20 Earnings Presentation

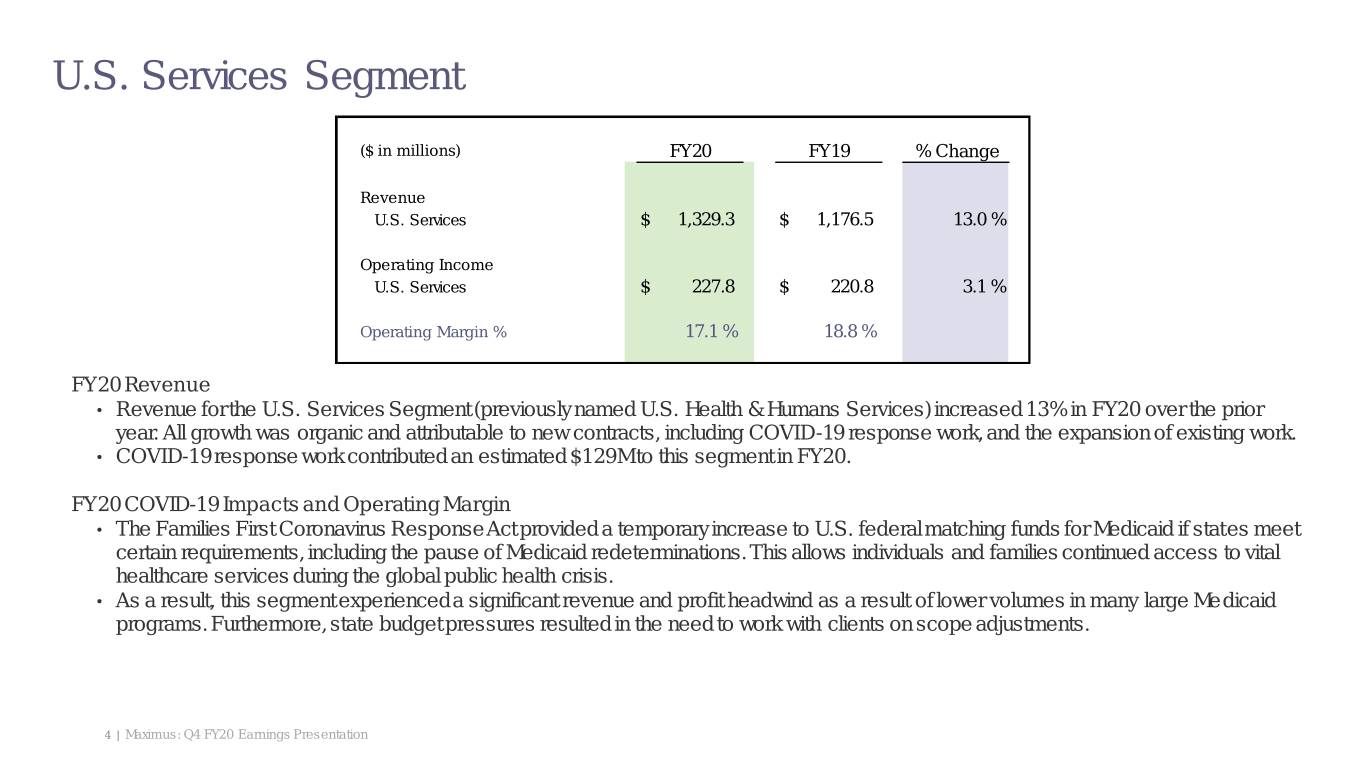

U.S. Services Segment ($ in millions) FY20 FY19 % Change Revenue U.S. Services $ 1,329.3 $ 1,176.5 13.0 % Operating Income U.S. Services $ 227.8 $ 220.8 3.1 % Operating Margin % 17.1 % 18.8 % FY20 Revenue • Revenue for the U.S. Services Segment (previously named U.S. Health & Humans Services) increased 13% in FY20 over the prior year. All growth was organic and attributable to new contracts, including COVID-19 response work, and the expansion of existing work. • COVID-19 response work contributed an estimated $129M to this segment in FY20. FY20 COVID-19 Impacts and Operating Margin • The Families First Coronavirus Response Act provided a temporary increase to U.S. federal matching funds for Medicaid if states meet certain requirements, including the pause of Medicaid redeterminations. This allows individuals and families continued access to vital healthcare services during the global public health crisis. • As a result, this segment experienced a significant revenue and profit headwind as a result of lower volumes in many large Medicaid programs. Furthermore, state budget pressures resulted in the need to work with clients on scope adjustments. 4 | Maximus: Q4 FY20 Earnings Presentation

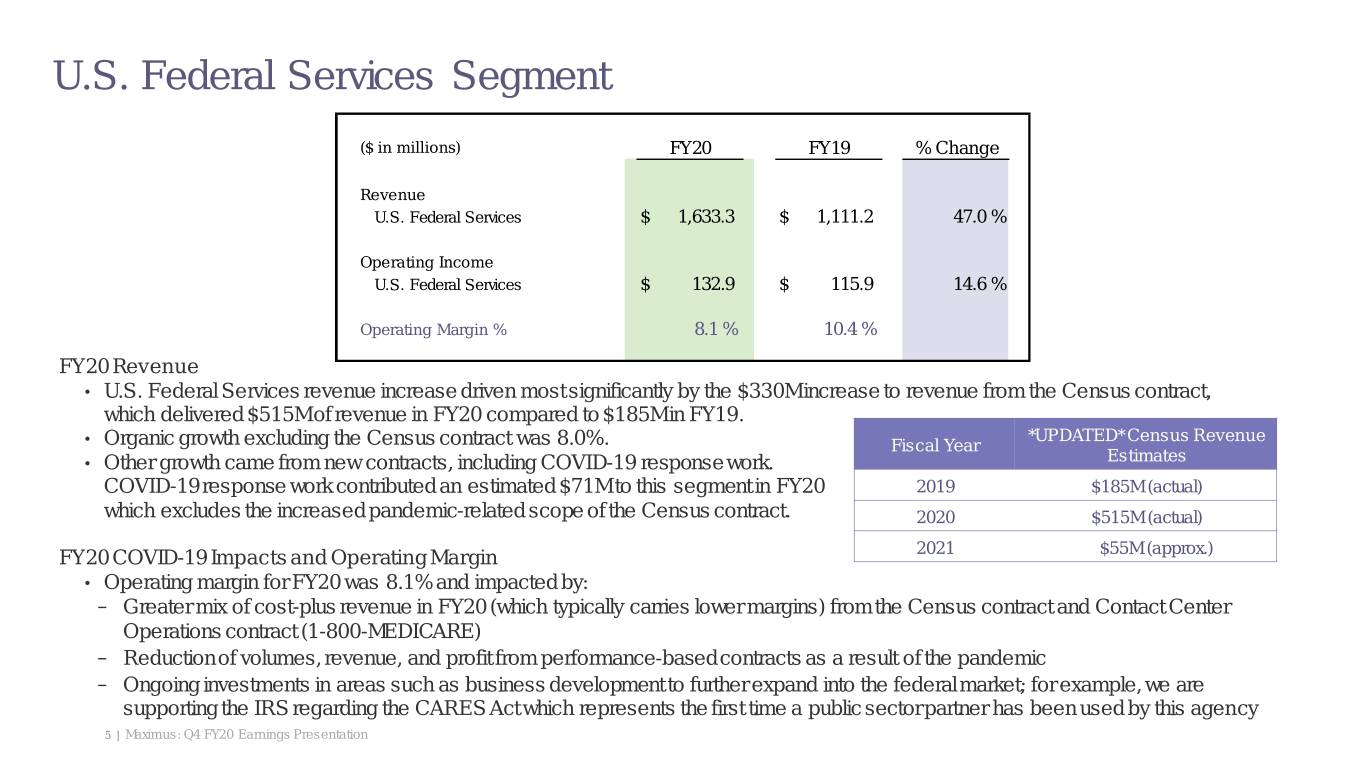

U.S. Federal Services Segment ($ in millions) FY20 FY19 % Change Revenue U.S. Federal Services $ 1,633.3 $ 1,111.2 47.0 % Operating Income U.S. Federal Services $ 132.9 $ 115.9 14.6 % Operating Margin % 8.1 % 10.4 % FY20 Revenue • U.S. Federal Services revenue increase driven most significantly by the $330M increase to revenue from the Census contract, which delivered $515M of revenue in FY20 compared to $185M in FY19. *UPDATED* Census Revenue • Organic growth excluding the Census contract was 8.0%. Fiscal Year • Other growth came from new contracts, including COVID-19 response work. Estimates COVID-19response work contributed an estimated $71M to this segment in FY20 2019 $185M (actual) which excludes the increased pandemic-related scope of the Census contract. 2020 $515M (actual) FY20 COVID-19 Impacts and Operating Margin 2021 $55M (approx.) • Operating margin for FY20 was 8.1% and impacted by: − Greater mix of cost-plus revenue in FY20 (which typically carries lower margins) from the Census contract and Contact Center Operations contract (1-800-MEDICARE) − Reduction of volumes, revenue, and profit from performance-based contracts as a result of the pandemic − Ongoing investments in areas such as business development to further expand into the federal market; for example, we are supporting the IRS regarding the CARES Act which represents the first time a public sector partner has been used by this agency 5 | Maximus: Q4 FY20 Earnings Presentation

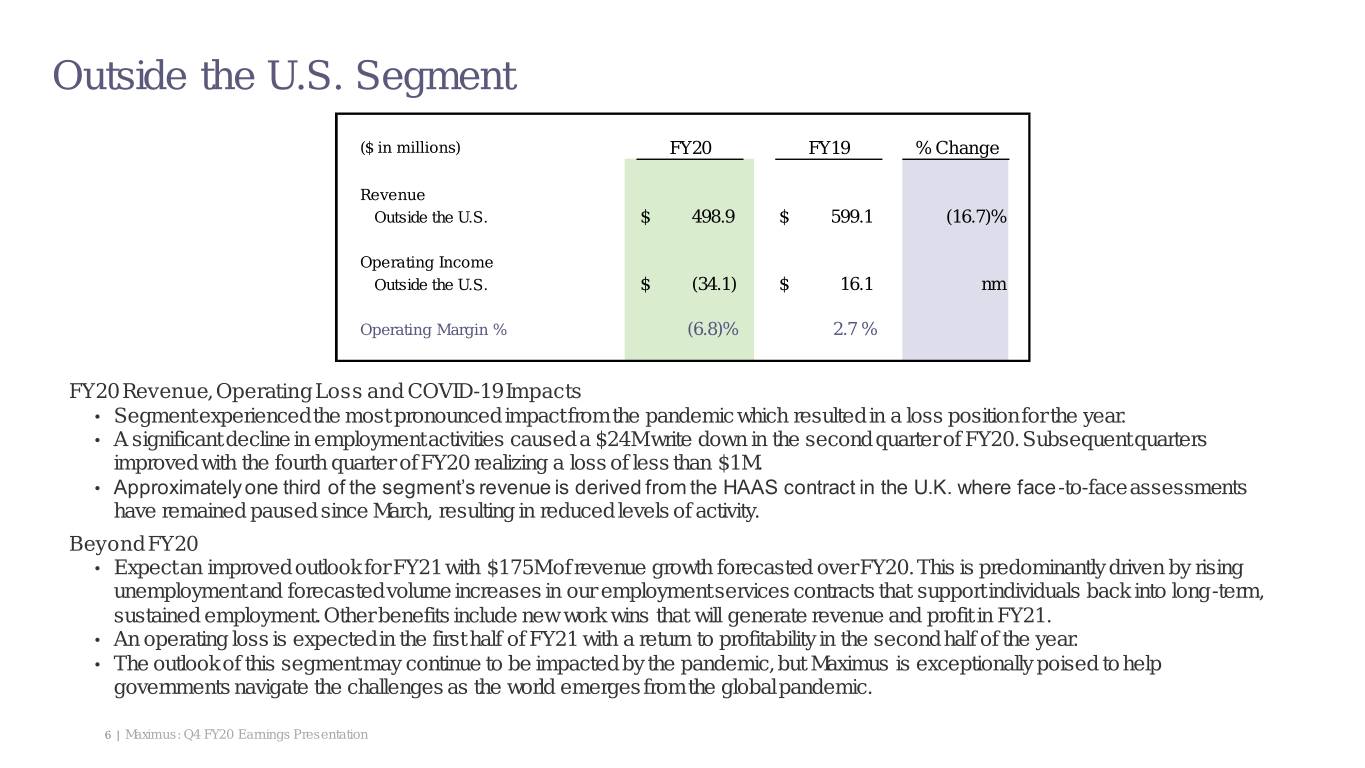

Outside the U.S. Segment ($ in millions) FY20 FY19 % Change Revenue Outside the U.S. $ 498.9 $ 599.1 (16.7)% Operating Income Outside the U.S. $ (34.1) $ 16.1 nm Operating Margin % (6.8)% 2.7 % FY20 Revenue, Operating Loss and COVID-19 Impacts • Segment experienced the most pronounced impact from the pandemic which resulted in a loss position for the year. • A significant decline in employment activities caused a $24M write down in the second quarter of FY20. Subsequent quarters improved with the fourth quarter of FY20 realizing a loss of less than $1M. • Approximately one third of the segment’s revenue is derived from the HAAS contract in the U.K. where face-to-face assessments have remained paused since March, resulting in reduced levels of activity. Beyond FY20 • Expect an improved outlook for FY21 with $175M of revenue growth forecasted over FY20. This is predominantly driven by rising unemployment and forecasted volume increases in our employment services contracts that support individuals back into long-term, sustained employment. Other benefits include new work wins that will generate revenue and profit in FY21. • An operating loss is expected in the first half of FY21 with a return to profitability in the second half of the year. • The outlook of this segment may continue to be impacted by the pandemic, but Maximus is exceptionally poised to help governments navigate the challenges as the world emerges from the global pandemic. 6 | Maximus: Q4 FY20 Earnings Presentation

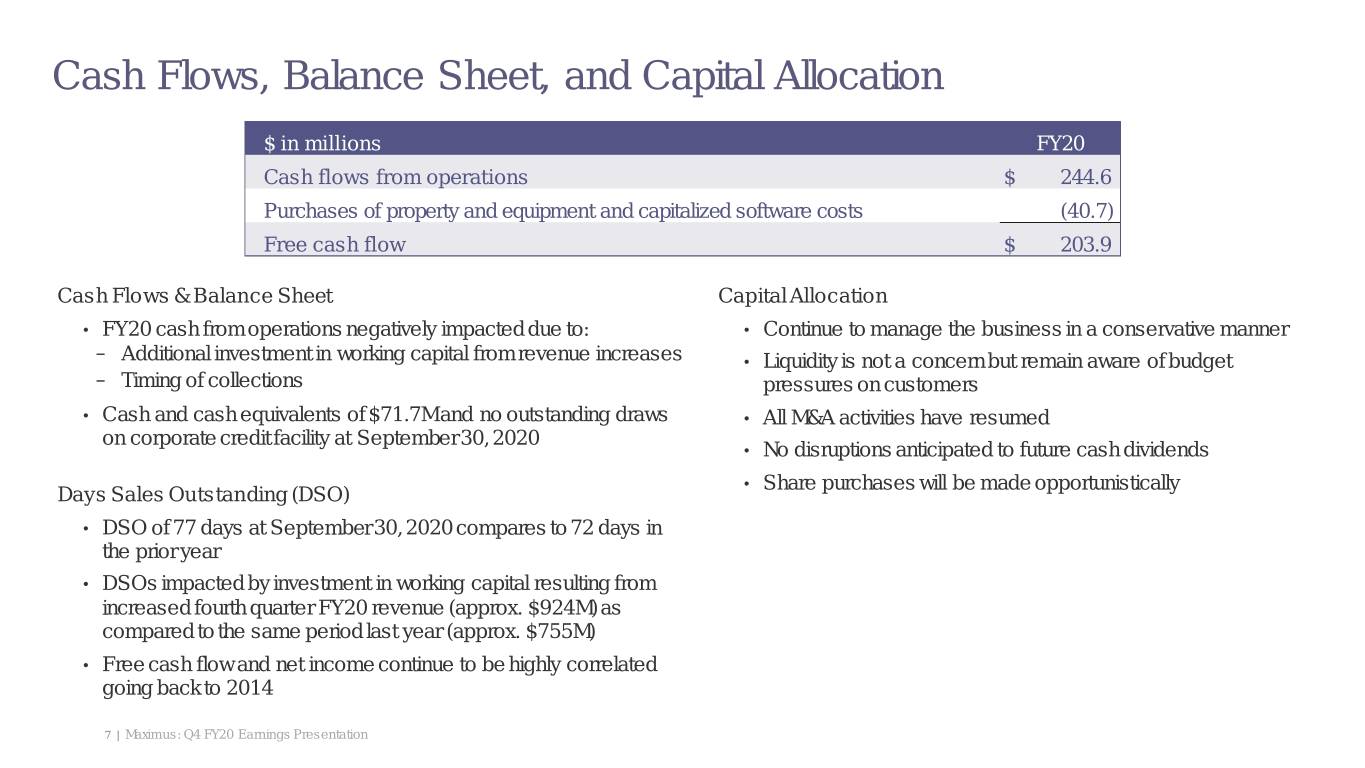

Cash Flows, Balance Sheet, and Capital Allocation $ in millions FY20 Cash flows from operations $ 244.6 Purchases of property and equipment and capitalized software costs (40.7) Free cash flow $ 203.9 Cash Flows & Balance Sheet Capital Allocation • FY20 cash from operations negatively impacted due to: • Continue to manage the business in a conservative manner − Additional investment in working capital from revenue increases • Liquidity is not a concern but remain aware of budget − Timing of collections pressures on customers • Cash and cash equivalents of $71.7M and no outstanding draws • All M&A activities have resumed on corporate credit facility at September 30, 2020 • No disruptions anticipated to future cash dividends • Share purchases will be made opportunistically Days Sales Outstanding (DSO) • DSO of 77 days at September 30, 2020 compares to 72 days in the prior year • DSOs impacted by investment in working capital resulting from increased fourth quarter FY20 revenue (approx. $924M) as compared to the same period last year (approx. $755M) • Free cash flow and net income continue to be highly correlated going back to 2014 7 | Maximus: Q4 FY20 Earnings Presentation

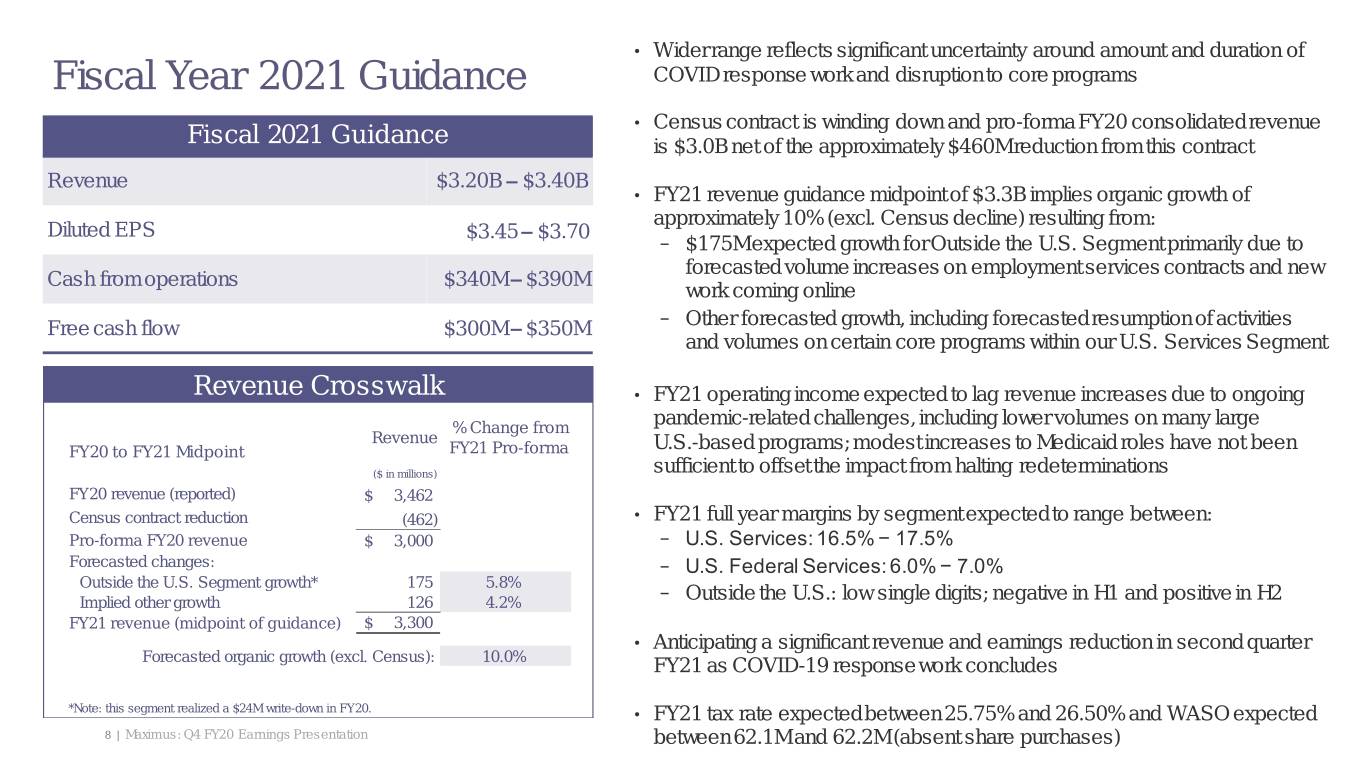

• Wider range reflects significant uncertainty around amount and duration of Fiscal Year 2021 Guidance COVID response work and disruption to core programs • Census contract is winding down and pro-forma FY20 consolidated revenue Fiscal 2021 Guidance is $3.0B net of the approximately $460M reduction from this contract Revenue $3.20B – $3.40B • FY21 revenue guidance midpoint of $3.3B implies organic growth of approximately 10% (excl. Census decline) resulting from: Diluted EPS $3.45 – $3.70 − $175M expected growth for Outside the U.S. Segment primarily due to forecasted volume increases on employment services contracts and new Cash from operations $340M – $390M work coming online Free cash flow $300M – $350M − Other forecasted growth, including forecasted resumption of activities and volumes on certain core programs within our U.S. Services Segment Revenue Crosswalk • FY21 operating income expected to lag revenue increases due to ongoing % Change from pandemic-related challenges, including lower volumes on many large Revenue FY20 to FY21 Midpoint FY21 Pro-forma U.S.-based programs; modest increases to Medicaid roles have not been ($ in millions) sufficient to offset the impact from halting redeterminations FY20 revenue (reported) $ 3,462 Census contract reduction (462) • FY21 full year margins by segment expected to range between: Pro-forma FY20 revenue $ 3,000 − U.S. Services: 16.5% − 17.5% Forecasted changes: − U.S. Federal Services: 6.0% − 7.0% Outside the U.S. Segment growth* 175 5.8% − Implied other growth 126 4.2% Outside the U.S.: low single digits; negative in H1 and positive in H2 FY21 revenue (midpoint of guidance) $ 3,300 • Anticipating a significant revenue and earnings reduction in second quarter Forecasted organic growth (excl. Census): 10.0% FY21 as COVID-19 response work concludes *Note: this segment realized a $24M write-down in FY20. • FY21 tax rate expected between 25.75% and 26.50% and WASO expected 8 | Maximus: Q4 FY20 Earnings Presentation between 62.1M and 62.2M (absent share purchases)

Fiscal 2020 Fourth Quarter & Year End Earnings Call Bruce Caswell President & Chief Executive Officer November 19, 2020 9 | Maximus: Q3 FY20 Earnings Presentation

U.S. 2020 Presidential and General Election Anticipated implications • Projected “blue wave” did not materialize, a likely indicator of a more moderate approach by Congress and the new Administration for at least the next two years • Headwinds and tailwinds as Democrats tend to design and promote more generous social programs while Republicans tend to focus on program integrity as it relates to access, coverage, and eligibility criteria • Both parties see value in public-private delivery models, often for different reasons • For decades, Maximus has partnered with government as it navigates the impacts of economic shocks and uncertainty that simultaneously drive greater reliance on program benefits while challenging budgets, notably at the state level • Near-term headwinds of lower volumes in some programs are far outweighed by the long-term tailwinds of being a decades-long partner to government, entrusted with the administration of critical social welfare programs in our nation • While some of our core programs may be a long way from resuming previous operational levels due to the sheer uncertainty of the times, we are managing our costs prudently, investing in new capabilities, and will be ready as a next equilibrium emerges 10 | Maximus: Q4 FY20 Earnings Presentation

Biden Administration Healthcare • Healthcare policy is a top priority for President-elect Biden who is expected to leverage ACA and address certain aspects through Executive Orders, agency orders, and potential Congressional action • Anticipate a focus by the new Administration on choice, reducing costs, and making the healthcare system easier to navigate • We understand the intersection between customers and public health insurance programs which uniquely position Maximus • Our demonstrated success in supporting state and federal exchange marketplaces under the ACA will enable us to assist the new administration in its core healthcare policy initiatives Transition • We do not expect the same level of slowdown in federal procurement as we saw with the 2016 transition In summary • Long-term demand for our services remains strong; governments turn to companies like Maximus to deliver outcomes that matter 11 | Maximus: Q4 FY20 Earnings Presentation

Operating in a Global Pandemic Ongoing safety response • Many of our operations were deemed “essential” by our government clients • Shifted as many employees to a work from home model as possible – Not all government programs allowed for this, particularly those with strict requirements related to the handling of PII • At peak, we successfully transitioned 63% of our U.S. workforce to work from home with 32% in an office setting and the remainder on leave • Outside of the U.S., 76% of our employees shifted to a work from home model at peak U.S. employee survey regarding COVID-19 measures • 80% of respondents believe we are protecting their health and safety • 80% also believe Maximus has taken necessary steps to provide appropriate income protections • Employee feedback continues to guide our COVID-19 action committee and ongoing strategy as we face rising levels of the pandemic again Ongoing management and execution of the business • While protecting our employees remains paramount, we aim to achieve our profitability objectives, generate strong cash flow, meet our contractual obligations, and continue to drive organic growth 12 | Maximus: Q4 FY20 Earnings Presentation

Growing Array of Clinical BPO Services Maximus Public Health (MPH) • In support of our growing clinical BPO services, we formed MPH to provide meaningful support to governments as they respond to COVID-19 and other public health threats • Team comprises public health clinicians, researchers, epidemiologists, biostatisticians, and geospatial analysts • Collaborates with academic partners and expanding partnerships with public health agencies, healthcare providers, data analytics platforms, and industry partners to serve as a resource to government in developing and executing their public health strategies • Focus on preparedness and effective response to public health crises • Initially supporting efforts to contain the spread of COVID-19 and toward the purchasing, distribution, and administration of vaccines U.S. Services • As we have grown, our array of services has become more robust • As a result, renamed our U.S. Health and Human Services Segment to the U.S. Services Segment to better represent the breadth of offerings provided by the Segment for our government clients 13 | Maximus: Q4 FY20 Earnings Presentation

Forward Momentum on Digital Transformation Earlier stages • Our digital transformation and early technology investments enabled us to successfully pivot and effectively serve those most reliant on the public programs we operate during the pandemic • Earlier in our digital transformation journey, we disrupted traditional models and developed the tools to meet citizens where they are, through mobile applications, robust portals, and omnichannel communications that seamlessly integrate chat and text messaging with conventional voice channels • Internally, applied robotic process automation or RPA at scale, furthering operational efficiencies Moving to the next stage • Continue maturing our digital delivery capabilities, and driving further automation into routine citizen transactions, while taking the next steps to build on the potential that our movement to the cloud has created in areas like natural language processing, AI, and cognitive computing • Our COVID-19 digital response is an early indicator of those efforts and I will share more as we continue along this trajectory 14 | Maximus: Q4 FY20 Earnings Presentation

Growing Core Operations to Address Changing Landscape FSA Next Gen • Successfully cemented our place on the U.S. Department of Education’s office of Federal Student Aid (FSA) Next Generation Pro cessing and Servicing Environment (Next Gen) contract vehicle • Maximus currently provides customer service to more than 7.5 million students as part of the Debt Management and Collections System (DMCS) project at FSA • Next Gen contract vehicle will allow us to bid on task orders that will ultimately provide resources to support all student i nteractions with FSA • This work is core to our offerings and illustrates our growth strategy to further expand in U.S. Federal Government agencies U.K. CAEHRS • Maximus secured an industry-leading position on the new U.K. Government Commercial Agreement for the Provision of Employment and Health Related Services (CAEHRS) framework, winning a place in all six areas in which we bid • Framework will be used for contracting national employment support programs and is expected to be the default vehicle for the Department for Work and Pensions, or DWP, national employment focused program contracts • Maximus already working with government commissioners in the U.K. to use our expertise to address labor market challenges caused by COVID-19 • For example, over recent months, Maximus has worked with DWP to expand our employment-focused programs, launching new initiatives in Wales and London – Believe our existing delivery, along with our record of performance and strong partnerships, puts us in a strong position for future contracts Rise in demand for employment support programs • Seeing a substantial rise in demand for employment support programs across all of our markets as governments struggle with rising unemployment • Trends point to a significant increase in revenue outside the U.S. where Maximus already has a large portfolio of employment services contracts • These programs will be essential as governments aim to get their economies back on track as we emerge from this global pandemic 15 | Maximus: Q4 FY20 Earnings Presentation

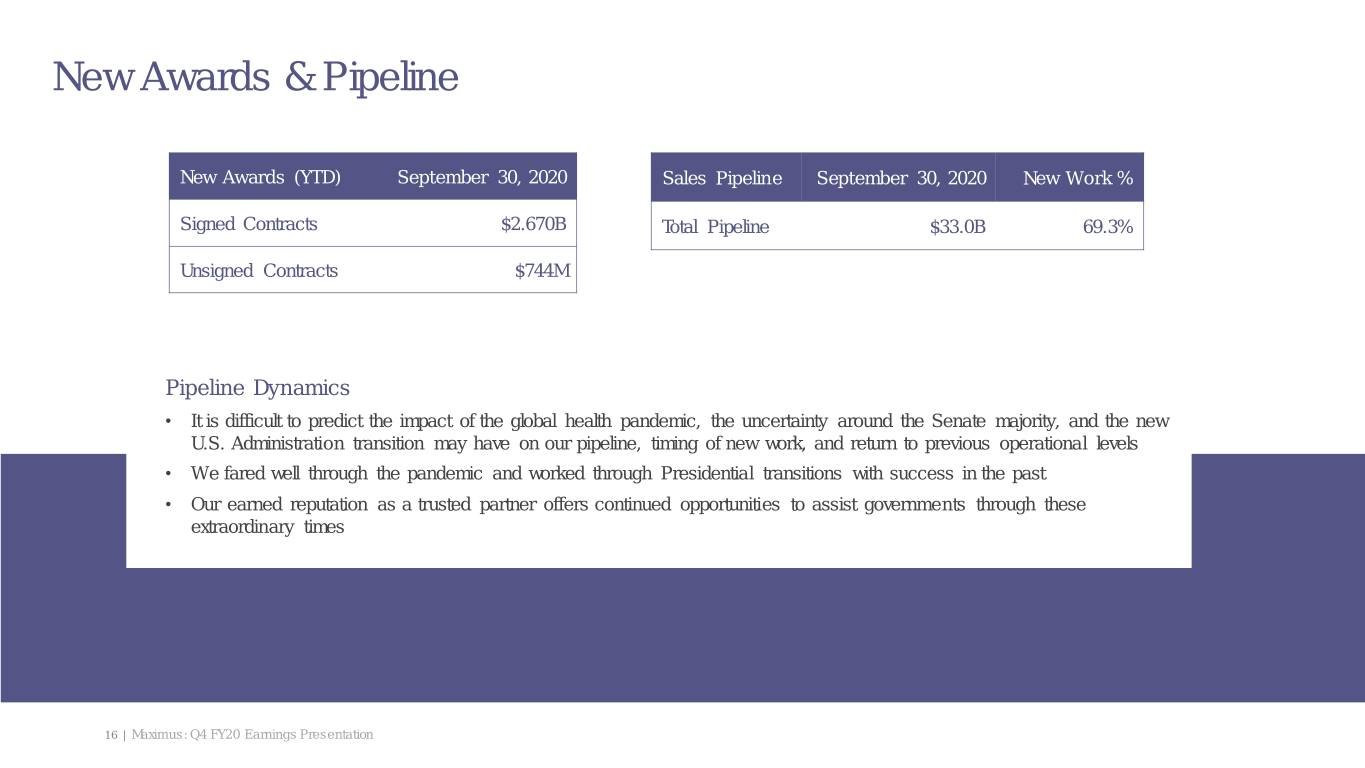

New Awards & Pipeline New Awards (YTD) September 30, 2020 Sales Pipeline September 30, 2020 New Work % Signed Contracts $2.670B Total Pipeline $33.0B 69.3% Unsigned Contracts $744M Pipeline Dynamics • It is difficult to predict the impact of the global health pandemic, the uncertainty around the Senate majority, and the new U.S. Administration transition may have on our pipeline, timing of new work, and return to previous operational levels • We fared well through the pandemic and worked through Presidential transitions with success in the past • Our earned reputation as a trusted partner offers continued opportunities to assist governments through these extraordinary times 16 | Maximus: Q4 FY20 Earnings Presentation

Conclusion • In fiscal 2020, we demonstrated our ability to respond to the changing needs of our clients by capitalizing on strategic and timely IT investments, using our digital capabilities, and leveraging our experienced teams to quickly ramp up a qualified workforce • We are cautiously optimistic that fiscal 2021 will be a year of progressive stability across the business, strong execution, and strong cash flow • While the global pandemic continues to impact many of our core programs, they will ultimately return to previous levels in the future; not a question of “if,” but rather a question of “when” • We remain committed to our diversity, equity, and inclusion strategy which includes extensive listening sessions with employees and engaging them in the process of defining future programs and initiatives – While I am pleased with the DE&I progress being made, I am reminded that there is more work ahead 17 | Maximus: Q4 FY20 Earnings Presentation