Fiscal 2018 Fourth Quarter & Year End Earnings Call Rick Nadeau Chief Financial Officer November 20, 2018

Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent earnings press release and annual report. Throughout this presentation, numbers may not add due to rounding. A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks the Company faces, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the information contained in our earnings release and our most recent Forms 10-Q and 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances, except as required by law. 2 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

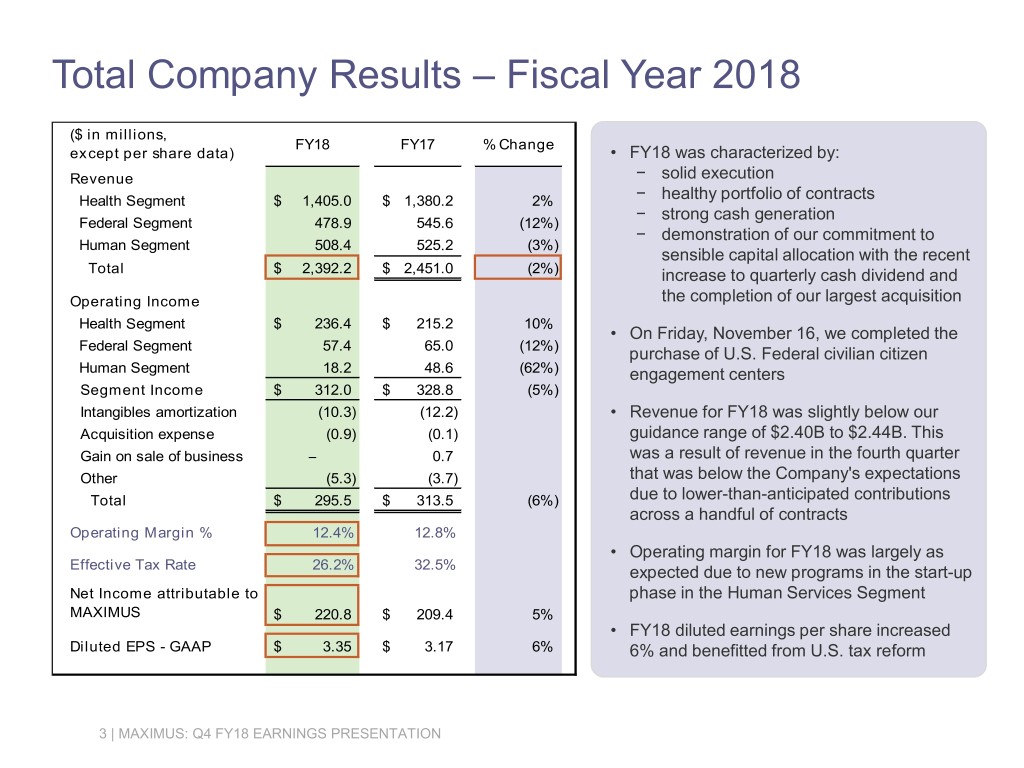

Total Company Results – Fiscal Year 2018 ($ in millions, FY18 FY17 % Change except per share data) • FY18 was characterized by: Revenue − solid execution Health Segment $ 1,405.0 $ 1,380.2 2% − healthy portfolio of contracts − strong cash generation Federal Segment 478.9 545.6 (12%) − demonstration of our commitment to Human Segment 508.4 525.2 (3%) sensible capital allocation with the recent Total $ 2,392.2 $ 2,451.0 (2%) increase to quarterly cash dividend and Operating Income the completion of our largest acquisition Health Segment $ 236.4 $ 215.2 10% • On Friday, November 16, we completed the Federal Segment 57.4 65.0 (12%) purchase of U.S. Federal civilian citizen Human Segment 18.2 48.6 (62%) engagement centers Segment Income $ 312.0 $ 328.8 (5%) Intangibles amortization (10.3) (12.2) • Revenue for FY18 was slightly below our Acquisition expense (0.9) (0.1) guidance range of $2.40B to $2.44B. This Gain on sale of business ̶ 0.7 was a result of revenue in the fourth quarter Other (5.3) (3.7) that was below the Company's expectations Total $ 295.5 $ 313.5 (6%) due to lower-than-anticipated contributions across a handful of contracts Operating Margin % 12.4% 12.8% • Operating margin for FY18 was largely as Effective Tax Rate 26.2% 32.5% expected due to new programs in the start-up Net Income attributable to phase in the Human Services Segment MAXIMUS $ 220.8 $ 209.4 5% • FY18 diluted earnings per share increased Diluted EPS - GAAP $ 3.35 $ 3.17 6% 6% and benefitted from U.S. tax reform 3 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

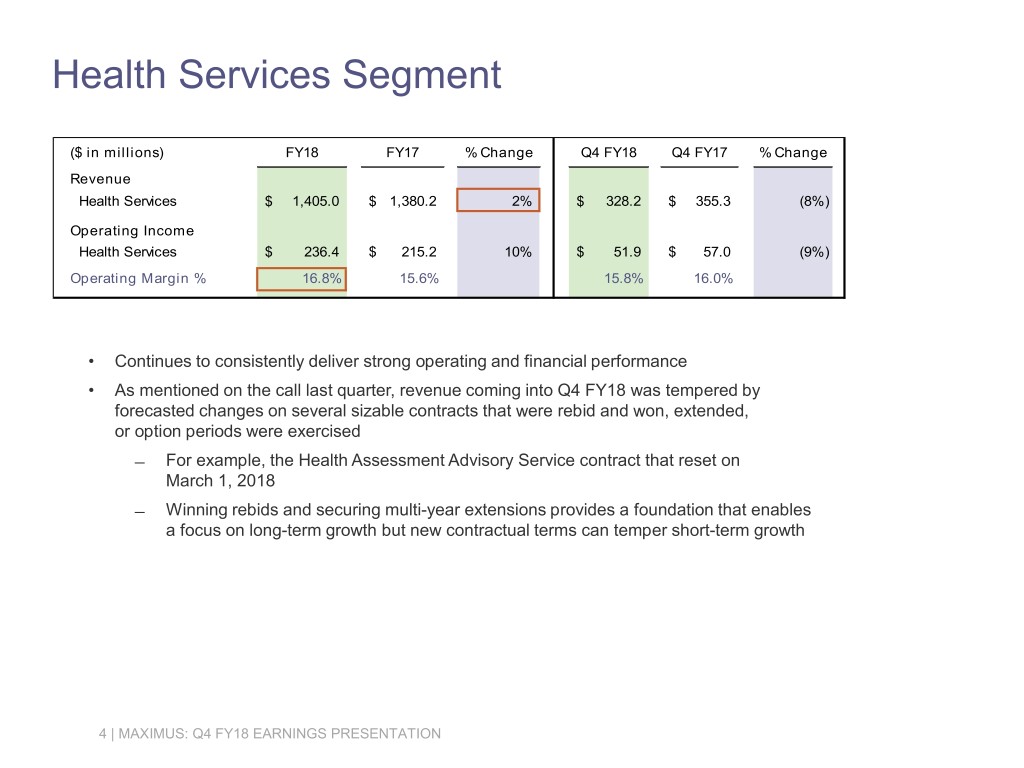

Health Services Segment ($ in millions) FY18 FY17 % Change Q4 FY18 Q4 FY17 % Change Revenue Health Services $ 1,405.0 $ 1,380.2 2% $ 328.2 $ 355.3 (8%) Operating Income Health Services $ 236.4 $ 215.2 10% $ 51.9 $ 57.0 (9%) Operating Margin % 16.8% 15.6% 15.8% 16.0% • Continues to consistently deliver strong operating and financial performance • As mentioned on the call last quarter, revenue coming into Q4 FY18 was tempered by forecasted changes on several sizable contracts that were rebid and won, extended, or option periods were exercised ̶ For example, the Health Assessment Advisory Service contract that reset on March 1, 2018 ̶ Winning rebids and securing multi-year extensions provides a foundation that enables a focus on long-term growth but new contractual terms can temper short-term growth 4 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

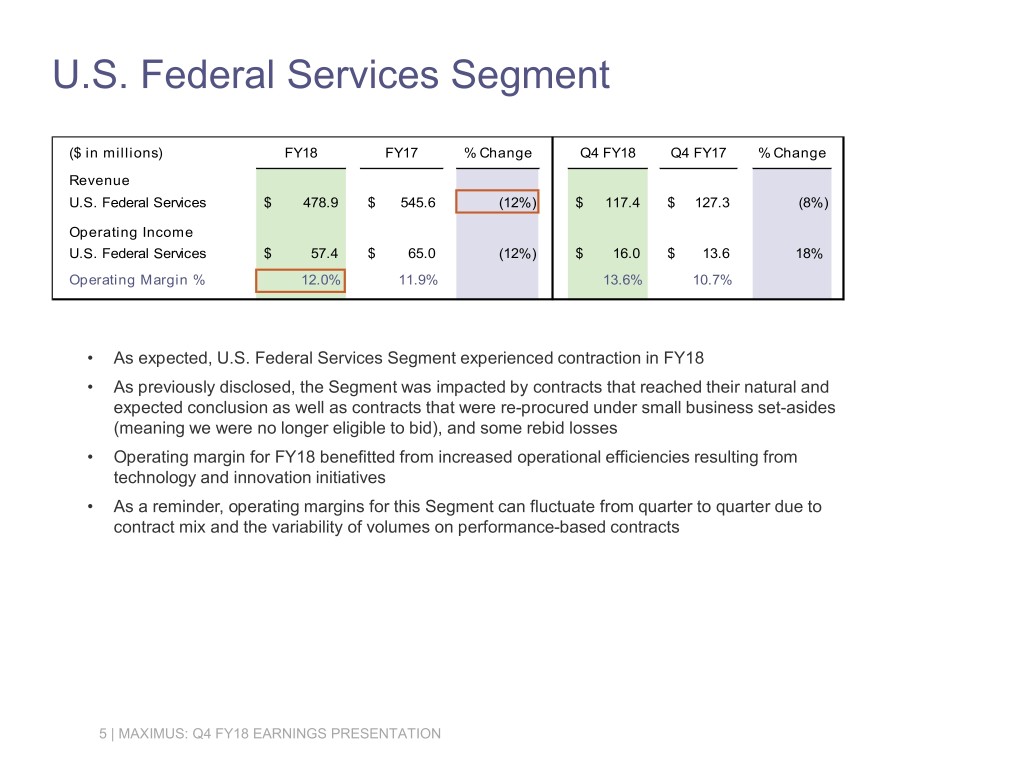

U.S. Federal Services Segment ($ in millions) FY18 FY17 % Change Q4 FY18 Q4 FY17 % Change Revenue U.S. Federal Services $ 478.9 $ 545.6 (12%) $ 117.4 $ 127.3 (8%) Operating Income U.S. Federal Services $ 57.4 $ 65.0 (12%) $ 16.0 $ 13.6 18% Operating Margin % 12.0% 11.9% 13.6% 10.7% • As expected, U.S. Federal Services Segment experienced contraction in FY18 • As previously disclosed, the Segment was impacted by contracts that reached their natural and expected conclusion as well as contracts that were re-procured under small business set-asides (meaning we were no longer eligible to bid), and some rebid losses • Operating margin for FY18 benefitted from increased operational efficiencies resulting from technology and innovation initiatives • As a reminder, operating margins for this Segment can fluctuate from quarter to quarter due to contract mix and the variability of volumes on performance-based contracts 5 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

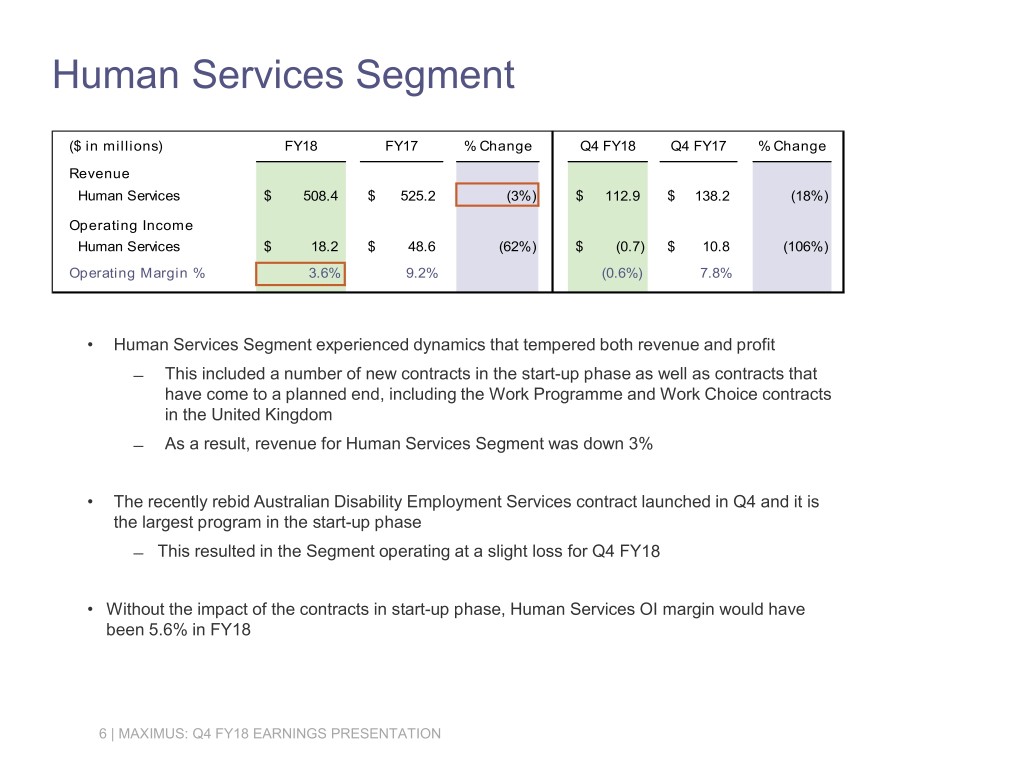

Human Services Segment ($ in millions) FY18 FY17 % Change Q4 FY18 Q4 FY17 % Change Revenue Human Services $ 508.4 $ 525.2 (3%) $ 112.9 $ 138.2 (18%) Operating Income Human Services $ 18.2 $ 48.6 (62%) $ (0.7) $ 10.8 (106%) Operating Margin % 3.6% 9.2% (0.6%) 7.8% • Human Services Segment experienced dynamics that tempered both revenue and profit ̶ This included a number of new contracts in the start-up phase as well as contracts that have come to a planned end, including the Work Programme and Work Choice contracts in the United Kingdom ̶ As a result, revenue for Human Services Segment was down 3% • The recently rebid Australian Disability Employment Services contract launched in Q4 and it is the largest program in the start-up phase ̶ This resulted in the Segment operating at a slight loss for Q4 FY18 • Without the impact of the contracts in start-up phase, Human Services OI margin would have been 5.6% in FY18 6 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

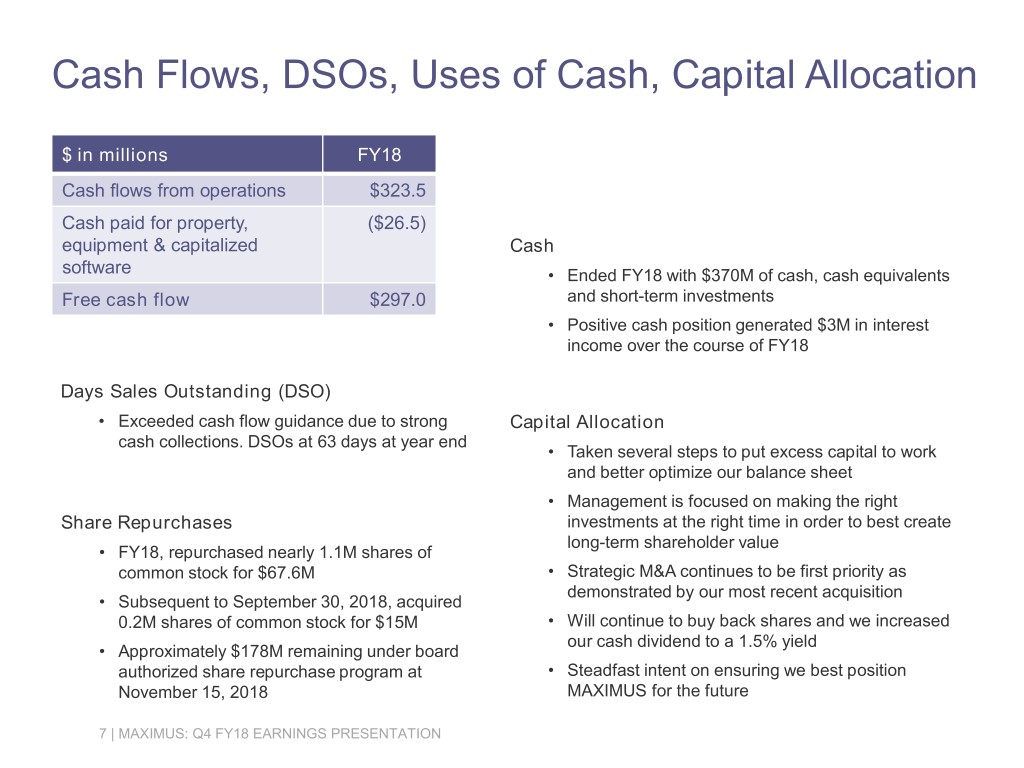

Cash Flows, DSOs, Uses of Cash, Capital Allocation $ in millions FY18 Cash flows from operations $323.5 Cash paid for property, ($26.5) equipment & capitalized Cash software • Ended FY18 with $370M of cash, cash equivalents Free cash flow $297.0 and short-term investments • Positive cash position generated $3M in interest income over the course of FY18 Days Sales Outstanding (DSO) • Exceeded cash flow guidance due to strong Capital Allocation cash collections. DSOs at 63 days at year end • Taken several steps to put excess capital to work and better optimize our balance sheet • Management is focused on making the right Share Repurchases investments at the right time in order to best create long-term shareholder value • FY18, repurchased nearly 1.1M shares of common stock for $67.6M • Strategic M&A continues to be first priority as demonstrated by our most recent acquisition • Subsequent to September 30, 2018, acquired 0.2M shares of common stock for $15M • Will continue to buy back shares and we increased our cash dividend to a 1.5% yield • Approximately $178M remaining under board authorized share repurchase program at • Steadfast intent on ensuring we best position November 15, 2018 MAXIMUS for the future 7 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

Acquisition of U.S. Federal Citizen Engagement Centers Acquisition provides MAXIMUS with a level of scale that makes us a more viable prime contractor to the U.S. Federal Government and reduces our need to partner with other companies to win business. This acquisition also enables us to become more competitive on procurements in the federal marketplace. Expected impacts to our financial statements resulting from the acquisition • Expect revenue for the remaining 10 ½ months of FY19 between $600M and $625M • The two largest acquired contracts are cost-plus ̶ Revenue and billings for cost-plus contracts include the allowable expenses, plus a fee ̶ These types of contracts carry a lower risk and operate at a lower operating margin – in the mid-single digits • While the profit earned on the acquired cost-plus contracts are mid-single digits, they will provide significant synergistic benefits to MAXIMUS and a lift in profitability in other segments. Two main drivers: 1. While total Company SG&A costs will increase in order to handle the additional volume of work, the acquired assets will significantly expand the business base used for the allocation of indirect costs. Simply put, adding this business into the total Company portfolio allows us to spread the corporate SG&A cost across a substantially larger base of revenue 2. The two largest contracts that we acquired are cost-plus contracts. Accordingly, MAXIMUS will be reimbursed for the portion of these corporate SG&A costs that are allowable under U.S. Federal procurement rules and our agreed upon allocation methodologies • Bottom line: The amount of indirect costs that MAXIMUS will recover under the new cost-plus contracts is greater than the overall increase in SG&A dollars to support the new assets, and while dilutive to the overall operating margin it provides an overall lift in operating income to the Company 8 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

Acquisition Impact on Fiscal Year 2019 Guidance • FY19 guidance, includes certain estimated expenses related to the acquisition: ̶ Interest expense on our borrowings and the reduction in interest income forfeited from the cash used for the acquisition ̶ One-time acquisition costs ̶ Amortization of intangibles; the appraisal is currently in process and expected to be completed in coming weeks. Amortization is a non-cash charge and EBITDA will increase more than operating income • Considering all elements of the transaction, we now expect the acquisition will contribute approximately $0.45 of diluted EPS in FY19 9 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

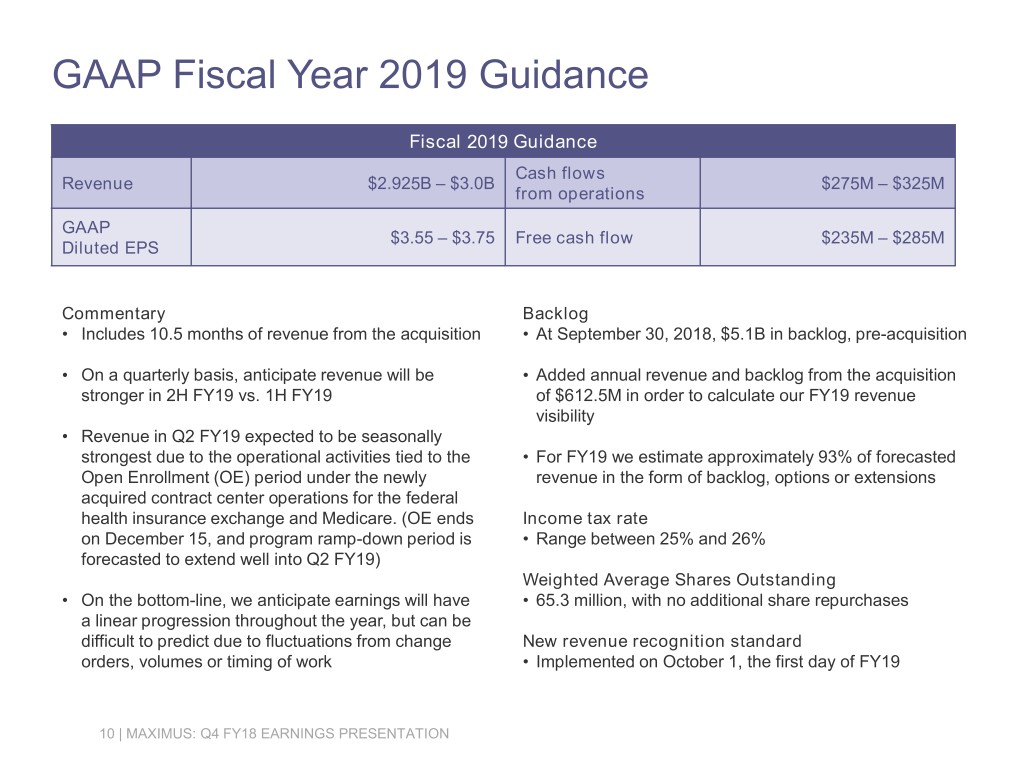

GAAP Fiscal Year 2019 Guidance Fiscal 2019 Guidance Cash flows Revenue $2.925B – $3.0B $275M – $325M from operations GAAP $3.55 – $3.75 Free cash flow $235M – $285M Diluted EPS Commentary Backlog • Includes 10.5 months of revenue from the acquisition • At September 30, 2018, $5.1B in backlog, pre-acquisition • On a quarterly basis, anticipate revenue will be • Added annual revenue and backlog from the acquisition stronger in 2H FY19 vs. 1H FY19 of $612.5M in order to calculate our FY19 revenue visibility • Revenue in Q2 FY19 expected to be seasonally strongest due to the operational activities tied to the • For FY19 we estimate approximately 93% of forecasted Open Enrollment (OE) period under the newly revenue in the form of backlog, options or extensions acquired contract center operations for the federal health insurance exchange and Medicare. (OE ends Income tax rate on December 15, and program ramp-down period is • Range between 25% and 26% forecasted to extend well into Q2 FY19) Weighted Average Shares Outstanding • On the bottom-line, we anticipate earnings will have • 65.3 million, with no additional share repurchases a linear progression throughout the year, but can be difficult to predict due to fluctuations from change New revenue recognition standard orders, volumes or timing of work • Implemented on October 1, the first day of FY19 10 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

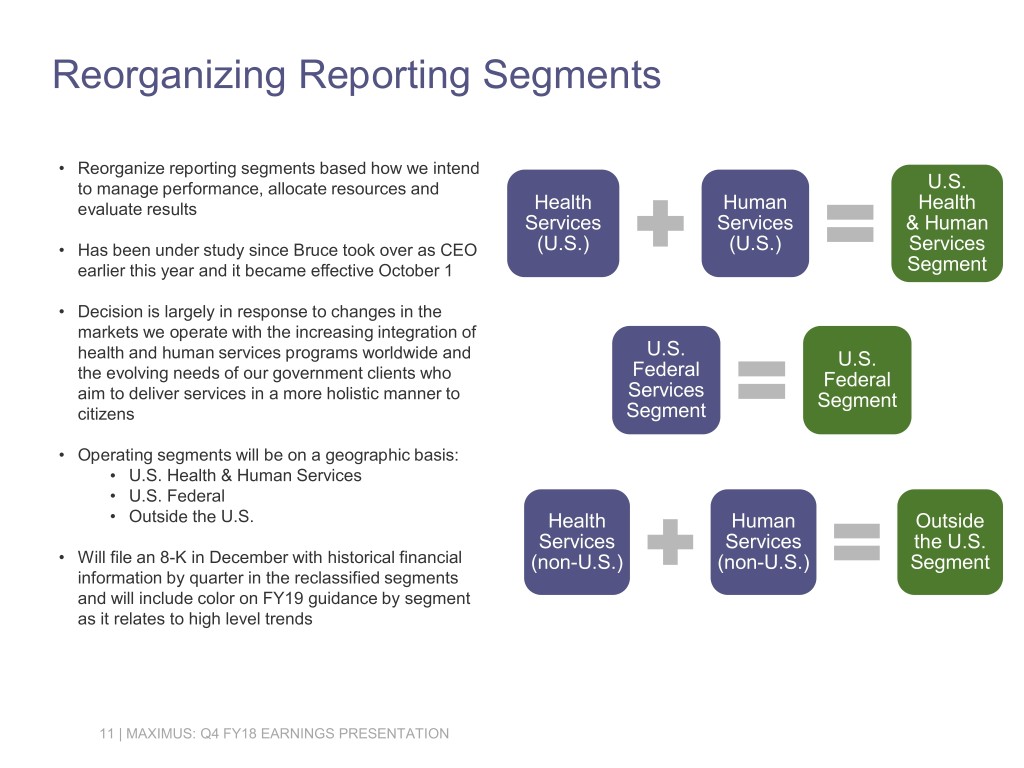

Reorganizing Reporting Segments • Reorganize reporting segments based how we intend to manage performance, allocate resources and U.S. evaluate results Health Human Health Services Services & Human • Has been under study since Bruce took over as CEO (U.S.) (U.S.) Services earlier this year and it became effective October 1 Segment • Decision is largely in response to changes in the markets we operate with the increasing integration of U.S. health and human services programs worldwide and U.S. Federal the evolving needs of our government clients who Federal Services aim to deliver services in a more holistic manner to Segment citizens Segment • Operating segments will be on a geographic basis: • U.S. Health & Human Services • U.S. Federal • Outside the U.S. Health Human Outside Services Services the U.S. • Will file an 8-K in December with historical financial (non-U.S.) (non-U.S.) Segment information by quarter in the reclassified segments and will include color on FY19 guidance by segment as it relates to high level trends 11 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

Fiscal 2018 Fourth Quarter & Year End Earnings Call Bruce Caswell President & Chief Executive Officer November 20, 2018

Positioning MAXIMUS for the Next Phase • Embarked upon a digital transformation, extended our reach into new markets and customer areas and are working to offer more clinically related services on a global scale • Today, I want to focus my comments on our recent M&A activities and the acquisition • We believe the federal market is a long-term growth area — one of the priority markets identified as part of our strategic market evaluation • MAXIMUS can play a more meaningful role in the U.S. Federal market. With the acquisition we have taken decisive action towards building scale, expanding our customer base & improving our competitive position • Makes the total Company more competitive in our markets • These assets: − Are a natural fit that align with our existing capabilities bringing together extensive experience and knowledge in managing large citizen-centric government programs − Cover some of the largest civilian citizen engagement centers in the federal government and across the nation 13 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

CMS Contact Center Operations (CCO) Contract • MAXIMUS has served as a subcontractor on this contract since 2014 • The programs that this contract supports, include the federal exchange under the Affordable Care Act and the primary support engagement center for Medicare — also known as 1-800-MEDICARE • Overall scope of the contract is focused on efficiently handling general inquiries for the federal exchange as well as general and claims-related Medicare inquires • As with most of the operations across the MAXIMUS portfolio, the contracts manage multiple communications channels from beneficiaries and consumers, their families and caregivers, and other individuals or entities that support the agency in these critical programs • We are in the middle of the 2019 open enrollment period for both the programs and we are running at peak operations • Consists of 11 customer engagement centers across the U.S. We provide 24 hour operations, seven days a week, 52 weeks a year. • Annually, we will handle for Medicare and the federal exchange: ̶ 40M+ phone calls ̶ 200,000 pieces of correspondence ̶ 250,000 web chats • This will now be the largest contract in the MAXIMUS portfolio 14 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

2020 Census Contract and Other Programs • Known as the Census Questionnaire Assistance 2020 — or CQA • Under the program, MAXIMUS will provide operations support and citizen engagement centers for the 2020 Decennial Census; contract runs through June 2021 • Contract is designed to provide questionnaire assistance for respondents about specific items on the 2020 census form • We will offer telephone assistance to citizens via multilingual customer contact centers. We are contractually required to operate in a minimum of 12 languages • Program will operate in three primary phases and we are currently entering phase two • Overall scope includes a significant ramp-up in equipment, facilities, technology integration, testing and staffing levels Other notable programs include: • CDC Info – for the Centers for Disease Control and Prevention • Consumer Resource Center Support Services for the Consumer Financial Protection Bureau • Annuitant Health Benefit Open Season Printing, Distribution and Processing Services for the Office of Personnel Management 15 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

Integration & Advancing Our Position in Federal Market • A number of key members of the management team have joined MAXIMUS. Focused on transitioning operations seamlessly, keeping an open dialogue with our clients, and ensuring that we maintain world-class service levels to citizens • This acquisition significantly enhances the Company’s size and position in the federal market, building on our solid foundation of program management and IT services • Enables greater economies of scale and brings enhanced technology and added operational capabilities that will benefit the entire MAXIMUS portfolio • More specifically, these assets help to further advance our digital strategy for federal civilian agencies by providing an integrated set of commercial products for call center operations, including call routing, managing scripts, call recording and overall management • This scalable platform is already FedRAMP certified ― an important qualification. It will accommodate evolving capabilities in machine learning and artificial intelligence that we are advancing • Ultimately, we believe this combination creates an unrivaled government partner of best-in-class, multichannel contact center support for complex citizen services 16 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

GSA Contract Vehicle Contact Center SIN • Named first awardee under the General Services Administration IT 70 Contact Center Solutions vehicle • This vehicle enables federal agencies to procure citizen engagement center technology and operational requirements with a diverse set of pre-vetted citizen engagement center solutions through a single contract • Contact Center SIN is focused on a wide range of technologies that support citizen engagement, including artificial intelligence, chat bots, robotic process automation and voice/speech recognition • We expect this vehicle will present opportunities to more broadly apply the work we’ve done for governments on driving digital modernization strategies • Contact Center SIN also aligns with the President’s Management Agenda, which calls for federal agencies to adopt customer service approaches that have been successful in the commercial sector • This is an area where MAXIMUS can maximize its core competencies of operationalizing complex policies, driving innovative business processes and supporting vulnerable populations as they engage with governments • Fundamentally, we are transforming the citizen journey 17 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

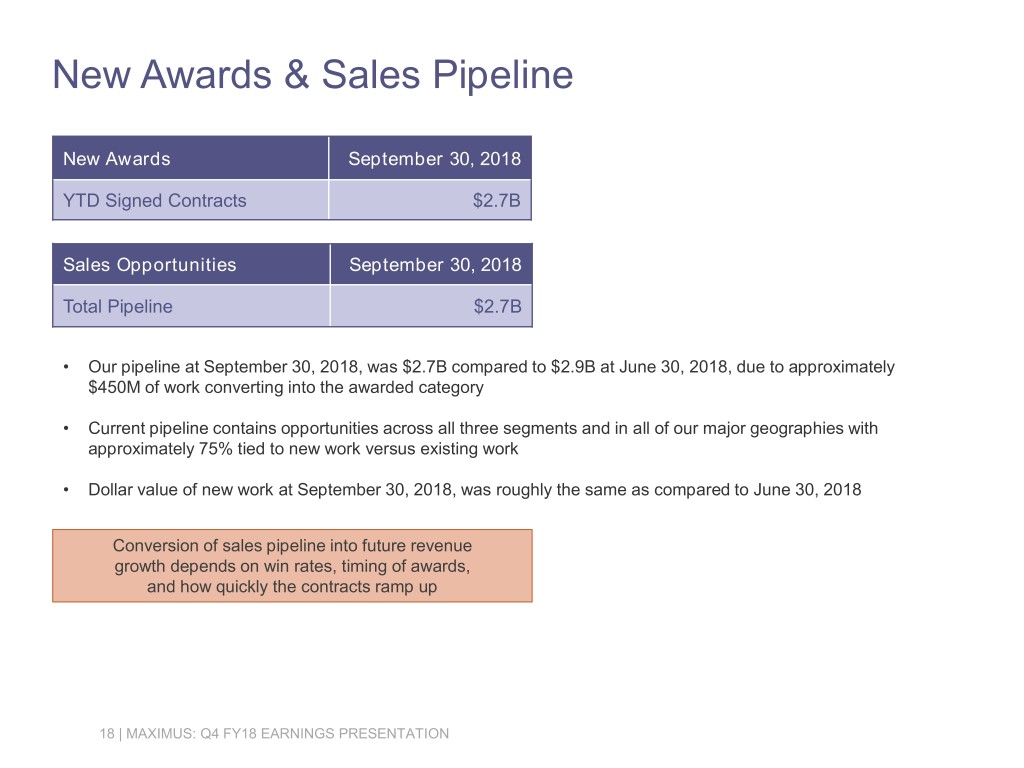

New Awards & Sales Pipeline New Awards September 30, 2018 YTD Signed Contracts $2.7B Sales Opportunities September 30, 2018 Total Pipeline $2.7B • Our pipeline at September 30, 2018, was $2.7B compared to $2.9B at June 30, 2018, due to approximately $450M of work converting into the awarded category • Current pipeline contains opportunities across all three segments and in all of our major geographies with approximately 75% tied to new work versus existing work • Dollar value of new work at September 30, 2018, was roughly the same as compared to June 30, 2018 Conversion of sales pipeline into future revenue growth depends on win rates, timing of awards, and how quickly the contracts ramp up 18 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

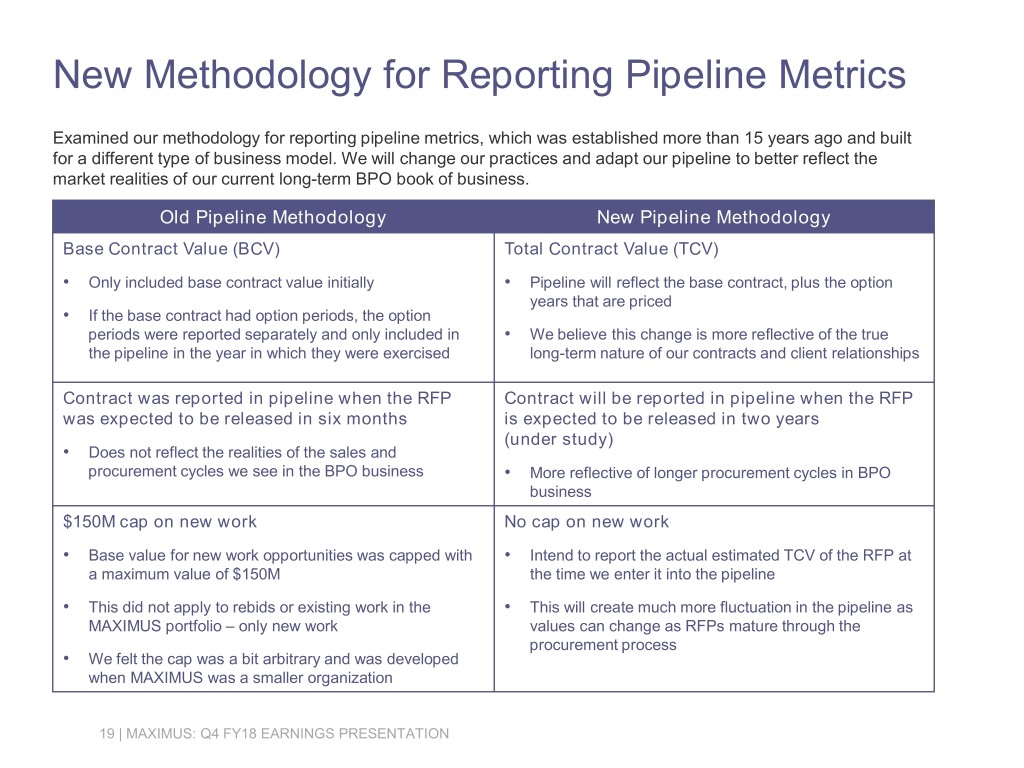

New Methodology for Reporting Pipeline Metrics Examined our methodology for reporting pipeline metrics, which was established more than 15 years ago and built for a different type of business model. We will change our practices and adapt our pipeline to better reflect the market realities of our current long-term BPO book of business. Old Pipeline Methodology New Pipeline Methodology Base Contract Value (BCV) Total Contract Value (TCV) • Only included base contract value initially • Pipeline will reflect the base contract, plus the option years that are priced • If the base contract had option periods, the option periods were reported separately and only included in • We believe this change is more reflective of the true the pipeline in the year in which they were exercised long-term nature of our contracts and client relationships Contract was reported in pipeline when the RFP Contract will be reported in pipeline when the RFP was expected to be released in six months is expected to be released in two years (under study) • Does not reflect the realities of the sales and procurement cycles we see in the BPO business • More reflective of longer procurement cycles in BPO business $150M cap on new work No cap on new work • Base value for new work opportunities was capped with • Intend to report the actual estimated TCV of the RFP at a maximum value of $150M the time we enter it into the pipeline • This did not apply to rebids or existing work in the • This will create much more fluctuation in the pipeline as MAXIMUS portfolio – only new work values can change as RFPs mature through the procurement process • We felt the cap was a bit arbitrary and was developed when MAXIMUS was a smaller organization 19 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION

Conclusion • While FY18 was characterized by solid execution, we fell a little short in achieving some of our revenue goals. Taken steps to aggressively address this head-on, including: − Assessing and prioritizing new and adjacent markets − Stepping-up our M&A activities − Bringing in new sales and capture leadership − Realigning our business segments beginning in FY19 to maximize our go-to-market strategy — all of which are designed to address this period of slower growth • Our vision is to be the premier provider of large-scale complex program management solutions, offering unparalleled support to citizens who access and utilize critical government programs • Demonstrated progress in executing our strategic initiatives, and committed to delivering solid operational and financial execution, and strong cash generation • We continue to see evidence that long-term macro trends remain in our favor and the core of the business is sound • Thank you to: • our customers for the trust they place in us each day • our employees across the globe for their continued service and commitment • our new citizen engagement center employees as they transition to MAXIMUS 20 | MAXIMUS: Q4 FY18 EARNINGS PRESENTATION