Fiscal 2018 Third Quarter Earnings Call Rick Nadeau Chief Financial Officer August 9, 2018

Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from our most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks the Company faces, including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the information contained in our earnings release and our most recent Forms 10-Q and 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances, except as required by law. 2 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

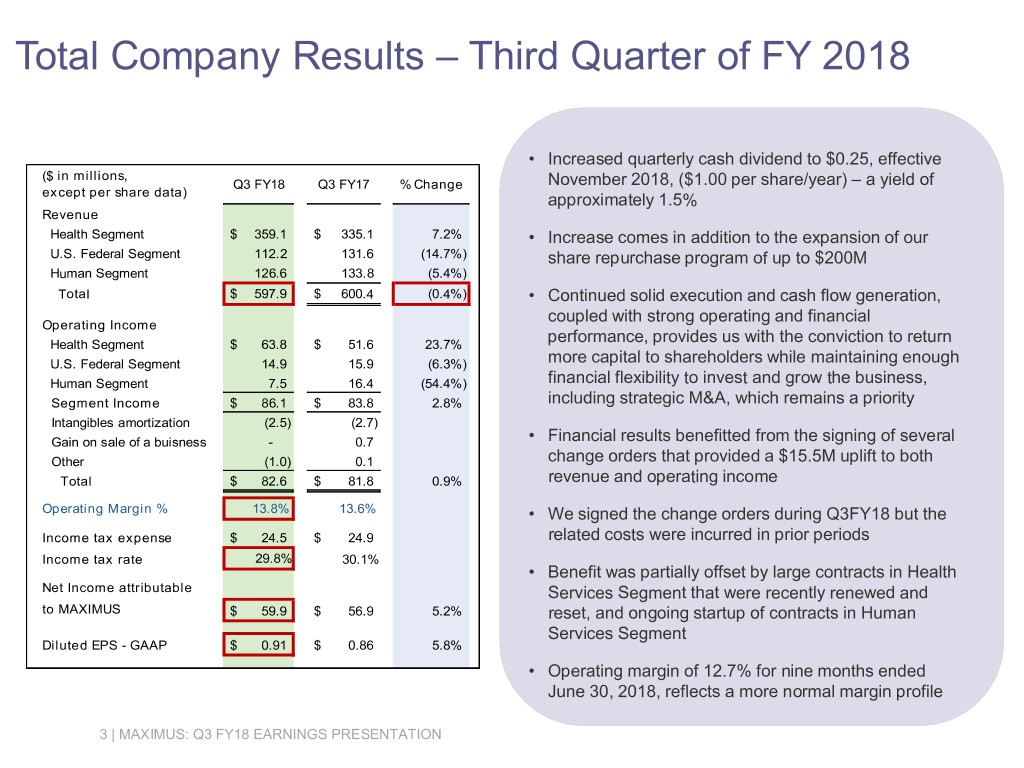

Total Company Results – Third Quarter of FY 2018 • Increased quarterly cash dividend to $0.25, effective ($ in millions, Q3 FY18 Q3 FY17 % Change November 2018, ($1.00 per share/year) – a yield of except per share data) approximately 1.5% Revenue Health Segment $ 359.1 $ 335.1 7.2% • Increase comes in addition to the expansion of our U.S. Federal Segment 112.2 131.6 (14.7%) share repurchase program of up to $200M Human Segment 126.6 133.8 (5.4%) Total $ 597.9 $ 600.4 (0.4%) • Continued solid execution and cash flow generation, coupled with strong operating and financial Operating Income Health Segment $ 63.8 $ 51.6 23.7% performance, provides us with the conviction to return U.S. Federal Segment 14.9 15.9 (6.3%) more capital to shareholders while maintaining enough Human Segment 7.5 16.4 (54.4%) financial flexibility to invest and grow the business, Segment Income $ 86.1 $ 83.8 2.8% including strategic M&A, which remains a priority Intangibles amortization (2.5) (2.7) Gain on sale of a buisness - 0.7 • Financial results benefitted from the signing of several Other (1.0) 0.1 change orders that provided a $15.5M uplift to both Total $ 82.6 $ 81.8 0.9% revenue and operating income Operating Margin % 13.8% 13.6% • We signed the change orders during Q3FY18 but the Income tax expense $ 24.5 $ 24.9 related costs were incurred in prior periods Income tax rate 29.8% 30.1% • Benefit was partially offset by large contracts in Health Net Income attributable Services Segment that were recently renewed and to MAXIMUS $ 59.9 $ 56.9 5.2% reset, and ongoing startup of contracts in Human Services Segment Diluted EPS - GAAP $ 0.91 $ 0.86 5.8% • Operating margin of 12.7% for nine months ended June 30, 2018, reflects a more normal margin profile 3 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

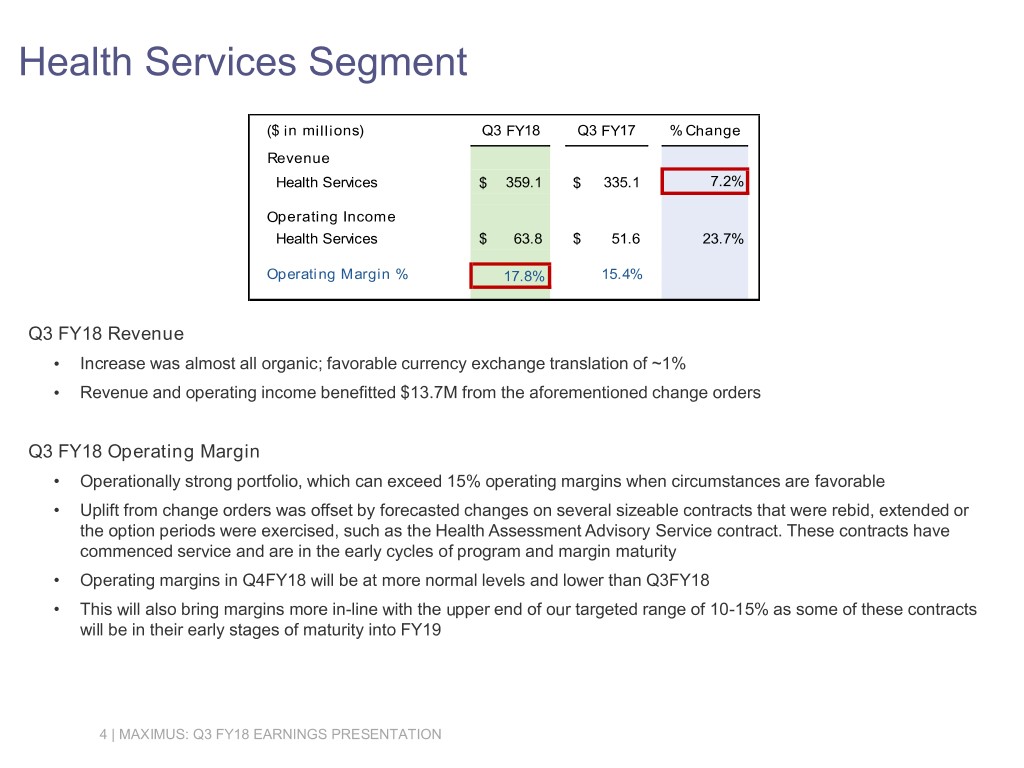

Health Services Segment ($ in millions) Q3 FY18 Q3 FY17 % Change Revenue Health Services $ 359.1 $ 335.1 7.2% Operating Income Health Services $ 63.8 $ 51.6 23.7% Operating Margin % 17.8% 15.4% Q3 FY18 Revenue • Increase was almost all organic; favorable currency exchange translation of ~1% • Revenue and operating income benefitted $13.7M from the aforementioned change orders Q3 FY18 Operating Margin • Operationally strong portfolio, which can exceed 15% operating margins when circumstances are favorable • Uplift from change orders was offset by forecasted changes on several sizeable contracts that were rebid, extended or the option periods were exercised, such as the Health Assessment Advisory Service contract. These contracts have commenced service and are in the early cycles of program and margin maturity • Operating margins in Q4FY18 will be at more normal levels and lower than Q3FY18 • This will also bring margins more in-line with the upper end of our targeted range of 10-15% as some of these contracts will be in their early stages of maturity into FY19 4 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

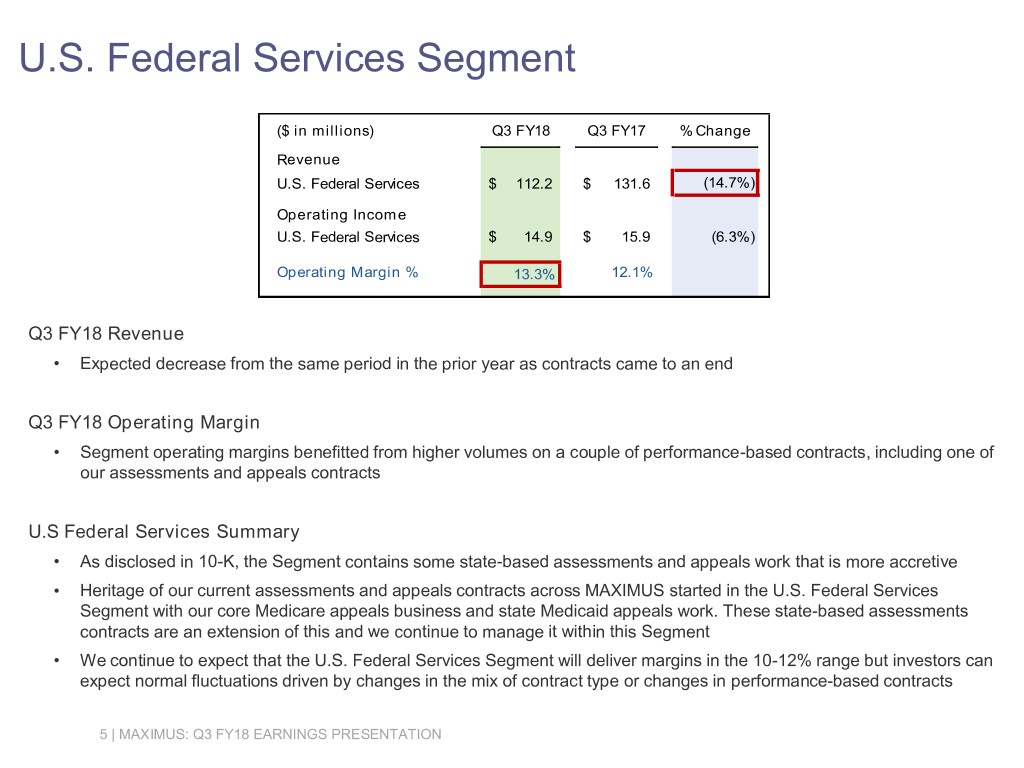

U.S. Federal Services Segment ($ in millions) Q3 FY18 Q3 FY17 % Change Revenue U.S. Federal Services $ 112.2 $ 131.6 (14.7%) Operating Income U.S. Federal Services $ 14.9 $ 15.9 (6.3%) Operating Margin % 13.3% 12.1% Q3 FY18 Revenue • Expected decrease from the same period in the prior year as contracts came to an end Q3 FY18 Operating Margin • Segment operating margins benefitted from higher volumes on a couple of performance-based contracts, including one of our assessments and appeals contracts U.S Federal Services Summary • As disclosed in 10-K, the Segment contains some state-based assessments and appeals work that is more accretive • Heritage of our current assessments and appeals contracts across MAXIMUS started in the U.S. Federal Services Segment with our core Medicare appeals business and state Medicaid appeals work. These state-based assessments contracts are an extension of this and we continue to manage it within this Segment • We continue to expect that the U.S. Federal Services Segment will deliver margins in the 10-12% range but investors can expect normal fluctuations driven by changes in the mix of contract type or changes in performance-based contracts 5 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

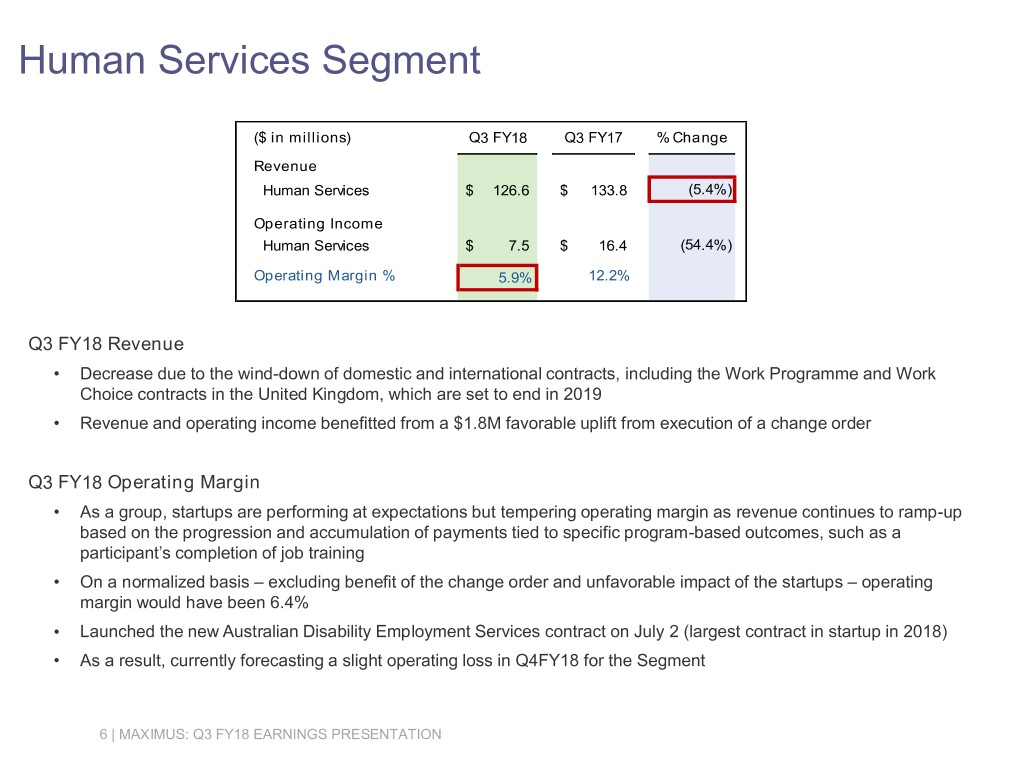

Human Services Segment ($ in millions) Q3 FY18 Q3 FY17 % Change Revenue Human Services $ 126.6 $ 133.8 (5.4%) Operating Income Human Services $ 7.5 $ 16.4 (54.4%) Operating Margin % 5.9% 12.2% Q3 FY18 Revenue • Decrease due to the wind-down of domestic and international contracts, including the Work Programme and Work Choice contracts in the United Kingdom, which are set to end in 2019 • Revenue and operating income benefitted from a $1.8M favorable uplift from execution of a change order Q3 FY18 Operating Margin • As a group, startups are performing at expectations but tempering operating margin as revenue continues to ramp-up based on the progression and accumulation of payments tied to specific program-based outcomes, such as a participant’s completion of job training • On a normalized basis – excluding benefit of the change order and unfavorable impact of the startups – operating margin would have been 6.4% • Launched the new Australian Disability Employment Services contract on July 2 (largest contract in startup in 2018) • As a result, currently forecasting a slight operating loss in Q4FY18 for the Segment 6 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

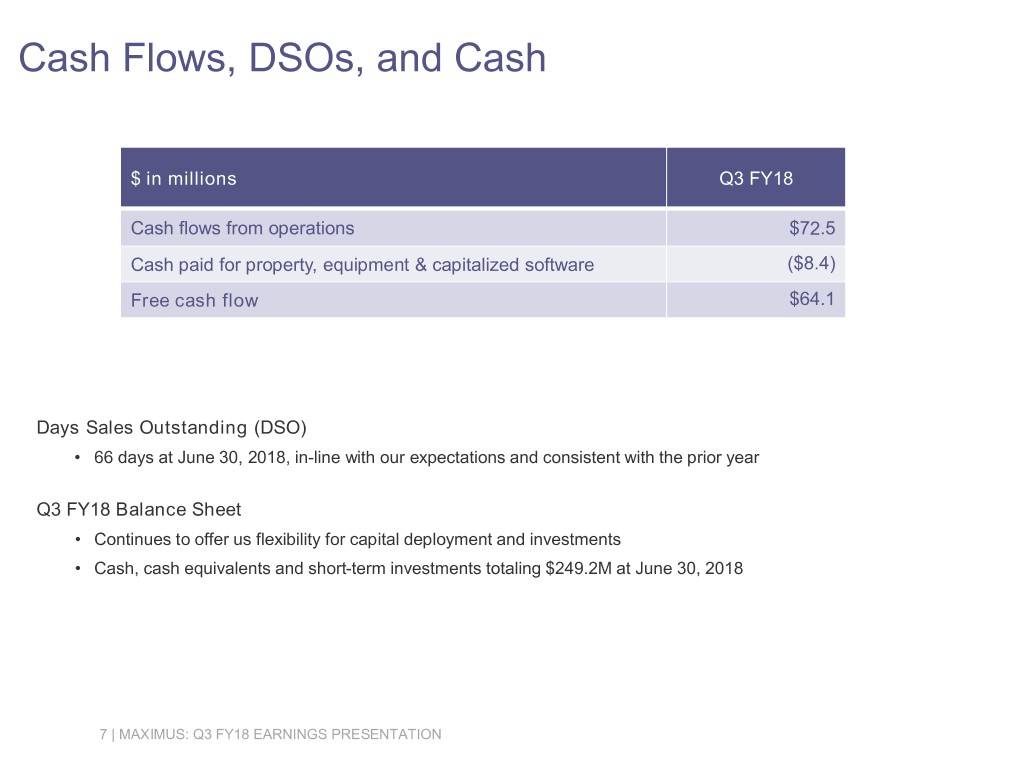

Cash Flows, DSOs, and Cash $ in millions Q3 FY18 Cash flows from operations $72.5 Cash paid for property, equipment & capitalized software ($8.4) Free cash flow $64.1 Days Sales Outstanding (DSO) • 66 days at June 30, 2018, in-line with our expectations and consistent with the prior year Q3 FY18 Balance Sheet • Continues to offer us flexibility for capital deployment and investments • Cash, cash equivalents and short-term investments totaling $249.2M at June 30, 2018 7 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

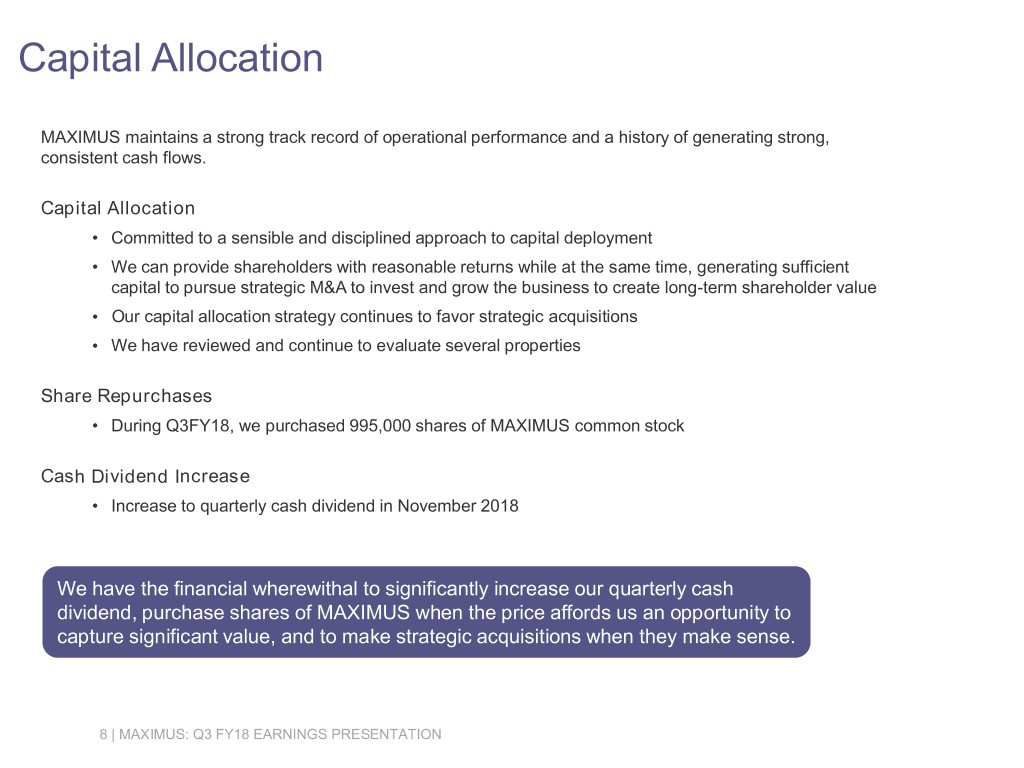

Capital Allocation MAXIMUS maintains a strong track record of operational performance and a history of generating strong, consistent cash flows. Capital Allocation • Committed to a sensible and disciplined approach to capital deployment • We can provide shareholders with reasonable returns while at the same time, generating sufficient capital to pursue strategic M&A to invest and grow the business to create long-term shareholder value • Our capital allocation strategy continues to favor strategic acquisitions • We have reviewed and continue to evaluate several properties Share Repurchases • During Q3FY18, we purchased 995,000 shares of MAXIMUS common stock Cash Dividend Increase • Increase to quarterly cash dividend in November 2018 We have the financial wherewithal to significantly increase our quarterly cash dividend, purchase shares of MAXIMUS when the price affords us an opportunity to capture significant value, and to make strategic acquisitions when they make sense. 8 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

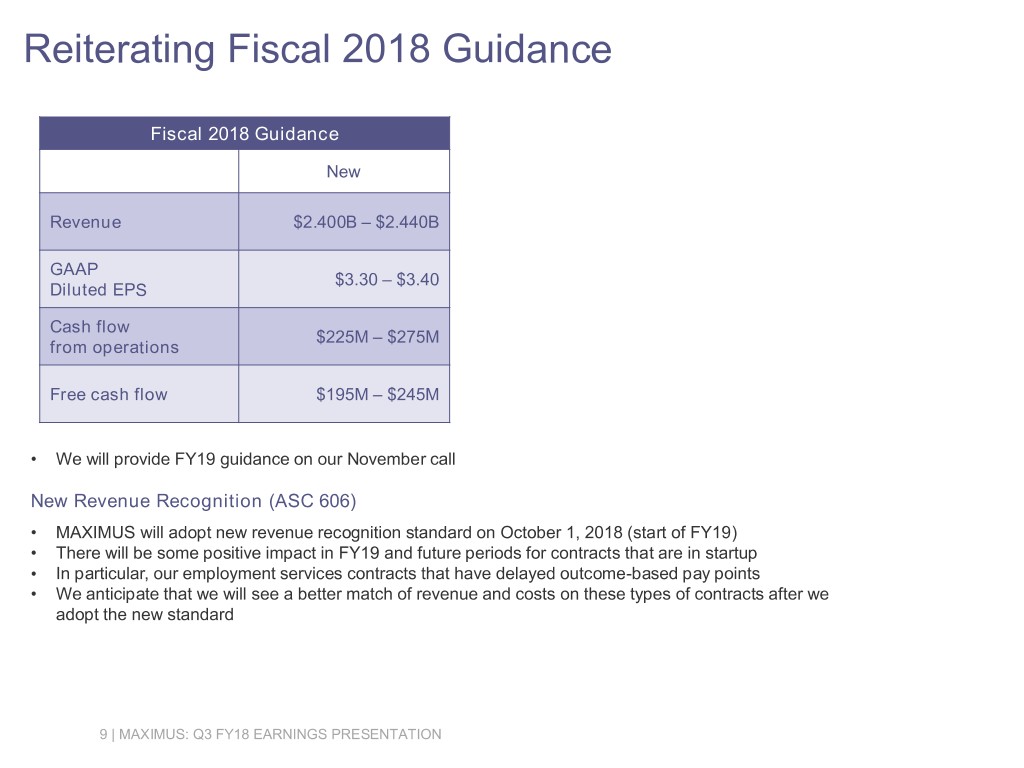

Reiterating Fiscal 2018 Guidance Fiscal 2018 Guidance New Revenue $2.400B – $2.440B GAAP $3.30 – $3.40 Diluted EPS Cash flow $225M – $275M from operations Free cash flow $195M – $245M • We will provide FY19 guidance on our November call New Revenue Recognition (ASC 606) • MAXIMUS will adopt new revenue recognition standard on October 1, 2018 (start of FY19) • There will be some positive impact in FY19 and future periods for contracts that are in startup • In particular, our employment services contracts that have delayed outcome-based pay points • We anticipate that we will see a better match of revenue and costs on these types of contracts after we adopt the new standard 9 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

Fiscal 2018 Third Quarter Earnings Call Bruce Caswell President & Chief Executive Officer August 9, 2018

Introduction • This quarter, MAXIMUS delivered solid financial results • With several recent new wins, we are focused on excellent execution and strong cash generation, driving innovation through digital solutions to simplify citizen engagement with critical programs, and effectively balancing resources in geographies where full employment has reduced referral volumes in certain programs we operate • Making meaningful progress on our strategic market evaluation and are turning now to execution, including alignment with our M&A priorities • As with any guiding strategy, our execution against this plan will continue to evolve – being focused and yet flexible – so we can meet the needs of our clients and capitalize on emerging opportunities • We established two new executive-level positions as we expand our clinical capabilities and push a broader digital agenda 11 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

Welcoming Our New CMO and CDO Dr. Michael Weiner, Chief Medical Officer Will help our GMs drive the overall strategic direction, growth and oversight of our global clinical health services. He has extensive government experience having worked with the Department of Defense for much of his career. In addition to being a board-certified physician, Dr. Weiner also holds a master’s degree in information systems technology and is one of only a handful of physicians ever to be certified as a Chief Information Officer by the United States General Services Administration. Dr. Weiner’s experience includes digital automation and innovation in the area of electronic health records, including the creation of a unified interagency electronic health record for more than 125,000 providers and 18 million beneficiaries worldwide for the Veterans Affairs interagency program office. David Cowles, Chief Digital Officer Will assume ownership of our core digital programs and delivery teams that we’ve tasked with building new capabilities that align with the strategic needs of the organization and our government clients. With nearly 30 years of operations management experience and a strong background in health care, David has a proven track record of driving innovation in data analytics, automation and digital transformation. David comes to MAXIMUS after spending much of his career in a variety of leadership roles at technology and consulting firms. 12 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

Digital Update Increasing digital footprint as we drive innovation by: Piloting new mobile solutions to improve workflow and reduce paper, Using virtual agents to streamline the online user experience and, Increasing the use of robotic process automation to manage certain business processes with greater efficiency Healthy Louisiana Medicaid Program and Digital Wins • As part of our core Medicaid offering, we provide a variety of digital support channels • Designed and implemented the state’s mobile app to help streamline, simplify and improve the customer enrollment journey • For the 2018 open enrollment period, digital enrollment volume – including both web and mobile – doubled over last year • Greatest year-over-year increase occurred using the Healthy Louisiana mobile app where Medicaid enrollment volume tripled over last year • Healthy Louisiana app has a 4.6 rating in both the App and Google Play stores • Ratings speak to three themes: the convenience, simplicity and speed by which a During the first week of open beneficiary can complete their Medicaid enrollment enrollment, the Healthy Louisiana Mobile App was the #2 trending • Demonstrates how we can help states improve the accessibility and usability of Medical App in Google Play and programs by having a keen understanding of the complex needs and circumstances during the first month of open enrollment, it consistently rated as a of the populations we serve top 100 Medical App in Google Play 13 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

Australian DES Contract Launch MAXIMUS remains one of the largest employment services providers, delivering DES across 197 sites to approximately 20,000 customers with disabilities • A significant shift in the Australian disability sector with the government’s introduction of a consumer choice model. In response, we introduced an innovative delivery model with a greater digital platform as part of our solution. This includes: ̶ New digital engagement for attracting and onboarding new customers ̶ Regular digital interaction throughout customer journey towards employment – including celebrating success and providing incentives ̶ Ability to provide regular feedback on the services they receive • Ultimately, data insights we gain from our end-users’ digital activity deepens our understanding of their needs and gives us the ability to further improve our business processes Disability Confident Achievements • First provider of jobactive and DES to achieve nationally recognized Disability Confident Recruiter status by the Australian Network on Disability • Represents competence in attracting, recruiting and employing individuals with disabilities • The Australian team joins our colleagues in the U.K. in achieving recognition for their work in serving individuals with disabilities • Remploy and Centre for Health & Disability Assessments among the first businesses to be awarded Disability Confident Leader status by U.K. Govt. • These are a testament to the commitment MAXIMUS has in supporting individuals with disabilities throughout our global business 14 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

United Kingdom New Business Updates Health Management recently awarded its first ever spot on a Framework to deliver services for NHS England in the area of Patient Empowerment • We are prequalified to bid on future RFPs in an area focused on support services for self-care programs • Our offerings under this umbrella Framework encompass a mix of clinical and digital interventions that combine our Revitalised digital wellbeing platform with our traditional occupational health services Recently secured our first ever BPO customer contact center contract with the Department for Education, extending our reach into a new agency • Under the Student Bursary Support Services contract, we will administer student applications for financial support and payments to eligible students • Combines our core BPO services with a digital platform to process nearly 30,000 applications and 40,000 expected inquiries annually • This three-year contract is valued at just under $9M 15 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

U.S. Contract Wins – California Lifeline & NC Medicaid New contract to administer the California Lifeline Program – natural extension of our core eligibility-related suite of services • California Lifeline is a state-run program that provides discounted home phone and cell phone services to eligible, low-income households • As the Lifeline Administrator, scope of work includes eligibility determination, call center services, web-based enrollments, document intake, processing and outbound mailhouse operations • $36M contract is projected to run 30 months and we expect to launch program operations in September Last week we signed a new contract with the North Carolina Department of Health and Human Services to provide our core Medicaid Managed Care Enrollment Broker services • $17M base (August 1, 2018 - December 31, 2020); plus three additional one-year option periods This win comes on the heels of the Wisconsin Medicaid Enrollment Broker contract that we announced last month Both of these contracts will support the states’ efforts in helping beneficiaries enroll into managed care plans 16 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

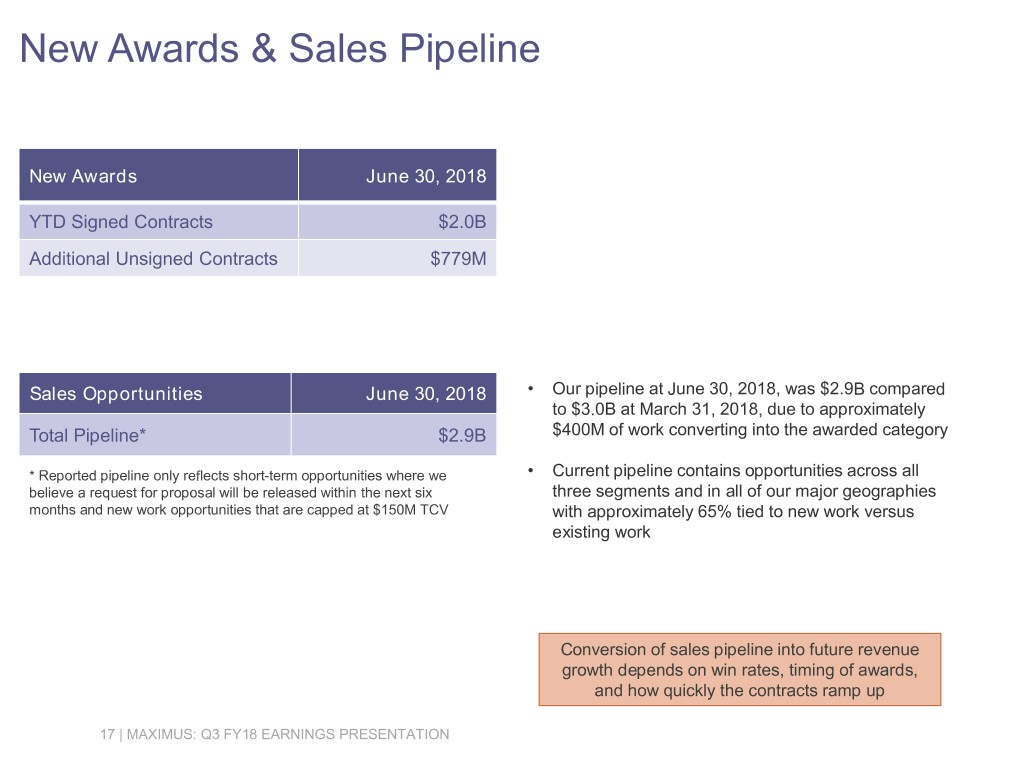

New Awards & Sales Pipeline New Awards June 30, 2018 YTD Signed Contracts $2.0B Additional Unsigned Contracts $779M Sales Opportunities June 30, 2018 • Our pipeline at June 30, 2018, was $2.9B compared to $3.0B at March 31, 2018, due to approximately Total Pipeline* $2.9B $400M of work converting into the awarded category * Reported pipeline only reflects short-term opportunities where we • Current pipeline contains opportunities across all believe a request for proposal will be released within the next six three segments and in all of our major geographies months and new work opportunities that are capped at $150M TCV with approximately 65% tied to new work versus existing work Conversion of sales pipeline into future revenue growth depends on win rates, timing of awards, and how quickly the contracts ramp up 17 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION

Conclusion • In summary, making steady progress with immediate focus on completing our market evaluation. This includes: ̶ Analyzing current markets where we can play a more meaningful role – such as providing more clinical solutions at scale and increasing the digital capabilities we provide our government clients ̶ Taking a fresh look at adjacent and new markets – entry to which can be enabled by strategic M&A • Acquisitions will play an important role in providing new capabilities, deepening our qualifications, and opening new markets – most importantly, they are fundamental to driving longer-term organic growth • While pleased with the progress we are making in executing our strategic initiatives, we want to reiterate our commitment to delivering solid operational and financial execution, and strong cash generation • We continue to believe that the long-term macro trends remain in our favor and the core of the business is sound 18 | MAXIMUS: Q3 FY18 EARNINGS PRESENTATION