1

Rick Nadeau

Chief Financial Officer

February 8, 2018

Helping Government Serve the People®

2

Forward-looking Statements & Non-GAAP Information

These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along

with listening to or reading a transcript of the comments of Company management from the Company’s most recent

quarterly earnings conference call.

This document may contain non-GAAP financial information. Management uses this information in its internal

analysis of results and believes that this information may be informative to investors in gauging the quality of our

financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons.

These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For

a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the

Company’s most recent quarterly earnings press release.

Throughout this presentation, numbers may not add due to rounding.

A number of statements being made today will be forward-looking in nature. Such statements are only predictions

and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC

filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed

with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements

to reflect subsequent events or circumstances.

3

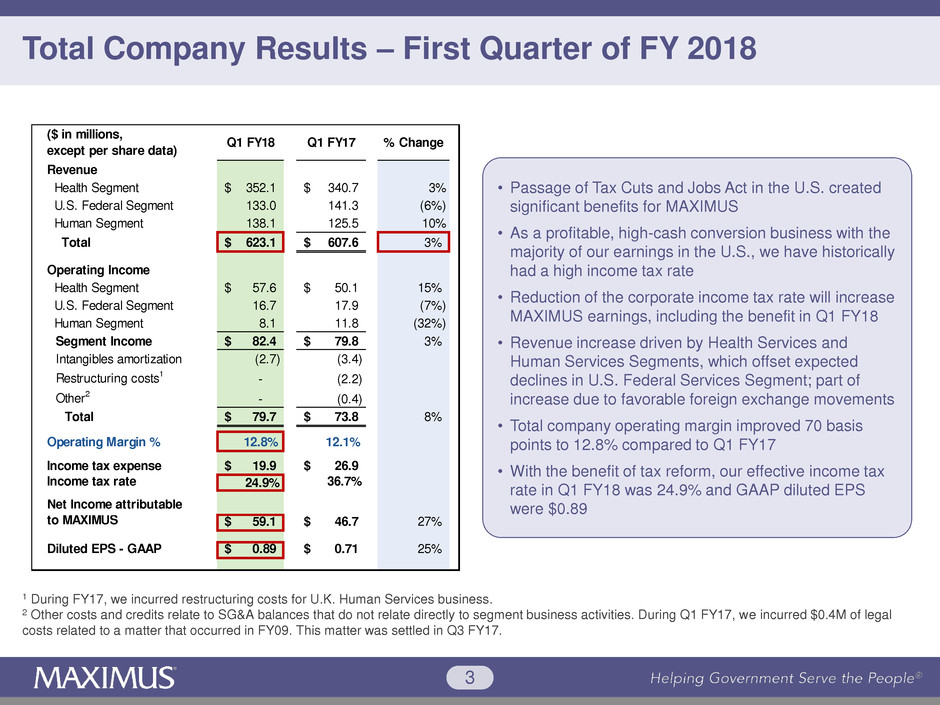

Total Company Results – First Quarter of FY 2018

• Passage of Tax Cuts and Jobs Act in the U.S. created

significant benefits for MAXIMUS

• As a profitable, high-cash conversion business with the

majority of our earnings in the U.S., we have historically

had a high income tax rate

• Reduction of the corporate income tax rate will increase

MAXIMUS earnings, including the benefit in Q1 FY18

• Revenue increase driven by Health Services and

Human Services Segments, which offset expected

declines in U.S. Federal Services Segment; part of

increase due to favorable foreign exchange movements

• Total company operating margin improved 70 basis

points to 12.8% compared to Q1 FY17

• With the benefit of tax reform, our effective income tax

rate in Q1 FY18 was 24.9% and GAAP diluted EPS

were $0.89

1 During FY17, we incurred restructuring costs for U.K. Human Services business.

2 Other costs and credits relate to SG&A balances that do not relate directly to segment business activities. During Q1 FY17, we incurred $0.4M of legal

costs related to a matter that occurred in FY09. This matter was settled in Q3 FY17.

Revenue

Health Segment 352.1$ 340.7$ 3%

U.S. Federal Segment 133.0 141.3 (6%)

Human Segment 138.1 125.5 10%

Total 623.1$ 607.6$ 3%

Operating Income

Health Segment 57.6$ 50.1$ 15%

U.S. Federal Segment 16.7 17.9 (7%)

Human Segment 8.1 11.8 (32%)

Segment Income 82.4$ 79.8$ 3%

Intangibles amortization (2.7) (3.4)

Restructuring costs1 - (2.2)

Other2 - (0.4)

Total 79.7$ 73.8$ 8%

Operating Margin % 12.8% 12.1%

Incom tax expense 19.9$ 26.9$

Income tax rate 24.9% 36.7%

Net Income attrib table

to MAXIMUS 59.1$ 46.7$ 27%

Diluted EPS - GAAP 0.89$ 0.71$ 25%

($ in millions,

except per share data)

Q1 FY18 Q1 FY17 % Change

4

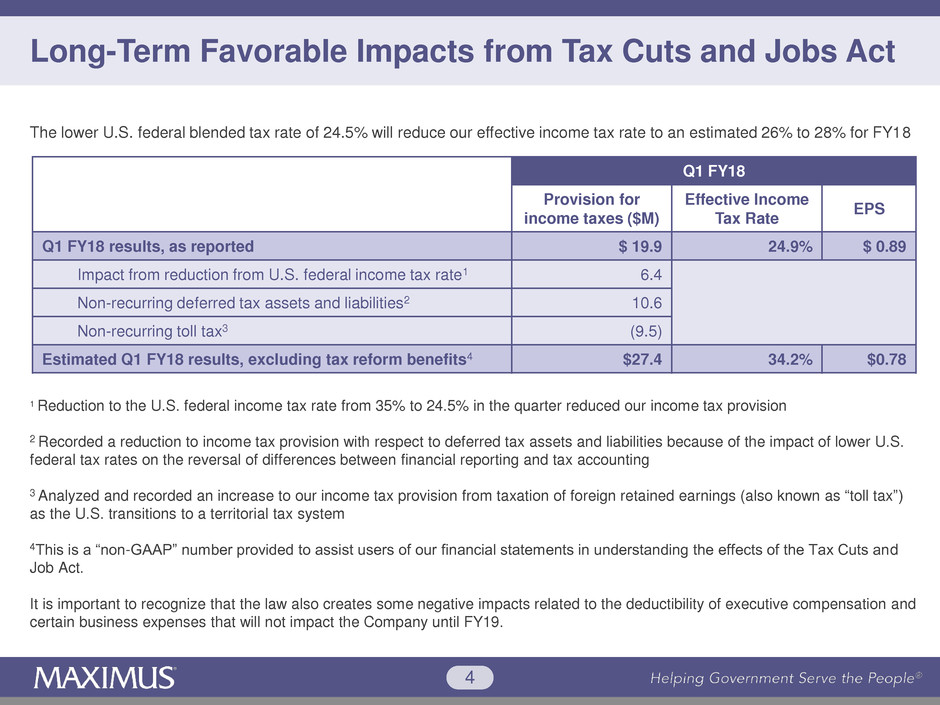

Long-Term Favorable Impacts from Tax Cuts and Jobs Act

Q1 FY18

Provision for

income taxes ($M)

Effective Income

Tax Rate

EPS

Q1 FY18 results, as reported $ 19.9 24.9% $ 0.89

Impact from reduction from U.S. federal income tax rate1 6.4

Non-recurring deferred tax assets and liabilities2 10.6

Non-recurring toll tax3 (9.5)

Estimated Q1 FY18 results, excluding tax reform benefits4 $27.4 34.2% $0.78

1 Reduction to the U.S. federal income tax rate from 35% to 24.5% in the quarter reduced our income tax provision

2 Recorded a reduction to income tax provision with respect to deferred tax assets and liabilities because of the impact of lower U.S.

federal tax rates on the reversal of differences between financial reporting and tax accounting

3 Analyzed and recorded an increase to our income tax provision from taxation of foreign retained earnings (also known as “toll tax”)

as the U.S. transitions to a territorial tax system

4This is a “non-GAAP” number provided to assist users of our financial statements in understanding the effects of the Tax Cuts and

Job Act.

It is important to recognize that the law also creates some negative impacts related to the deductibility of executive compensation and

certain business expenses that will not impact the Company until FY19.

The lower U.S. federal blended tax rate of 24.5% will reduce our effective income tax rate to an estimated 26% to 28% for FY18

5

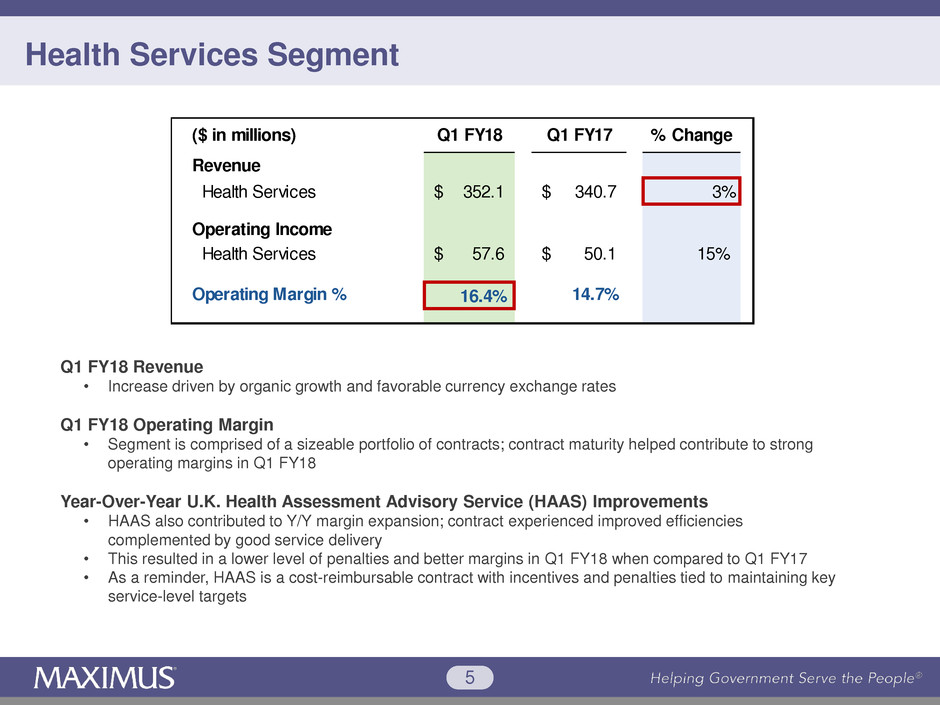

Health Services Segment

Q1 FY18 Revenue

• Increase driven by organic growth and favorable currency exchange rates

Q1 FY18 Operating Margin

• Segment is comprised of a sizeable portfolio of contracts; contract maturity helped contribute to strong

operating margins in Q1 FY18

Year-Over-Year U.K. Health Assessment Advisory Service (HAAS) Improvements

• HAAS also contributed to Y/Y margin expansion; contract experienced improved efficiencies

complemented by good service delivery

• This resulted in a lower level of penalties and better margins in Q1 FY18 when compared to Q1 FY17

• As a reminder, HAAS is a cost-reimbursable contract with incentives and penalties tied to maintaining key

service-level targets

Revenue

Health Services 352.1$ 340.7$ 3%

Operating Income

Health Services 57.6$ 50.1$ 15%

Operating Margin % 16.4% 14.7%

% Change($ in millions) Q1 FY18 Q1 FY17

6

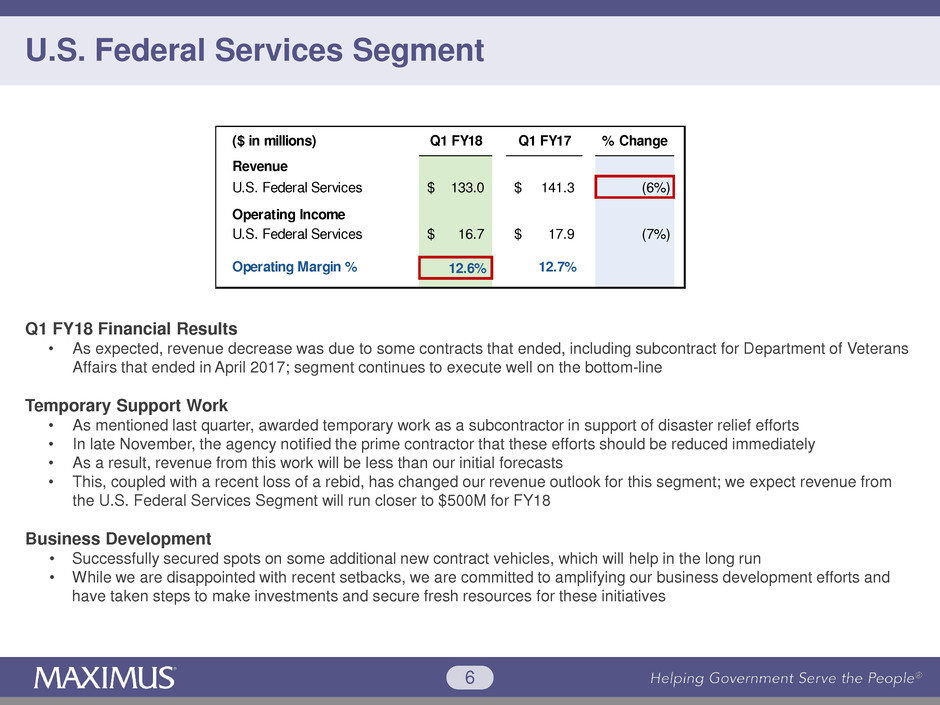

U.S. Federal Services Segment

Revenue

U.S. Federal Services 133.0$ 141.3$ (6%)

Operating Income

U.S. Federal Services 16.7$ 17.9$ (7%)

Operating Margin % 12.6% 12.7%

% Change($ in millions) Q1 FY18 Q1 FY17

Q1 FY18 Financial Results

• As expected, revenue decrease was due to some contracts that ended, including subcontract for Department of Veterans

Affairs that ended in April 2017; segment continues to execute well on the bottom-line

Temporary Support Work

• As mentioned last quarter, awarded temporary work as a subcontractor in support of disaster relief efforts

• In late November, the agency notified the prime contractor that these efforts should be reduced immediately

• As a result, revenue from this work will be less than our initial forecasts

• This, coupled with a recent loss of a rebid, has changed our revenue outlook for this segment; we expect revenue from

the U.S. Federal Services Segment will run closer to $500M for FY18

Business Development

• Successfully secured spots on some additional new contract vehicles, which will help in the long run

• While we are disappointed with recent setbacks, we are committed to amplifying our business development efforts and

have taken steps to make investments and secure fresh resources for these initiatives

7

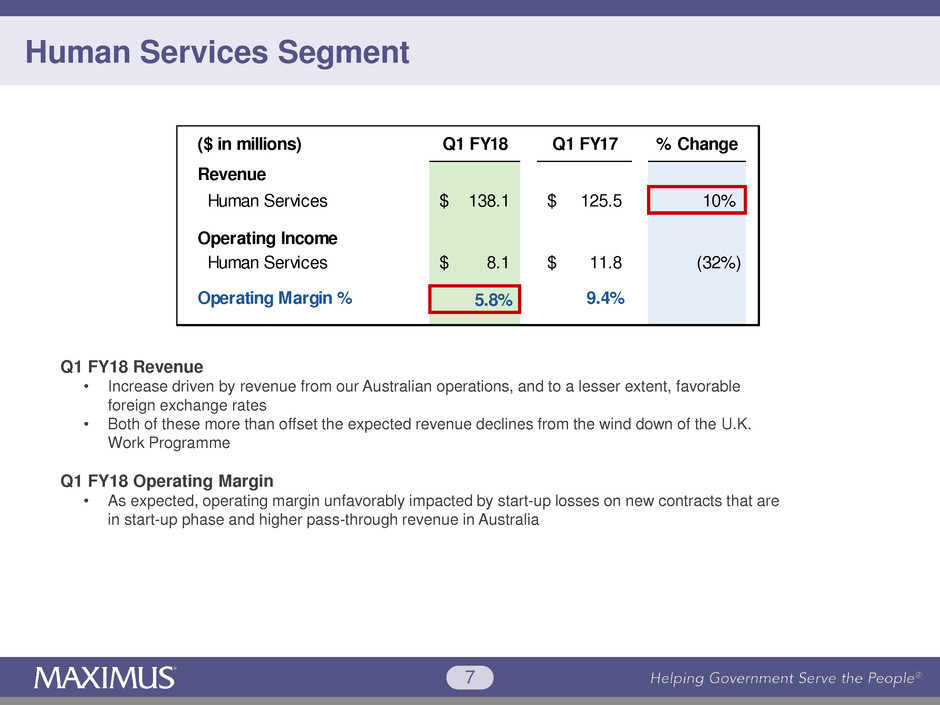

Human Services Segment

Revenue

Human Services 138.1$ 125.5$ 10%

Operating Income

Human Services 8.1$ 11.8$ (32%)

Operating Margin % 5.8% 9.4%

($ in millions) Q1 FY18 Q1 FY17 % Change

Q1 FY18 Revenue

• Increase driven by revenue from our Australian operations, and to a lesser extent, favorable

foreign exchange rates

• Both of these more than offset the expected revenue declines from the wind down of the U.K.

Work Programme

Q1 FY18 Operating Margin

• As expected, operating margin unfavorably impacted by start-up losses on new contracts that are

in start-up phase and higher pass-through revenue in Australia

8

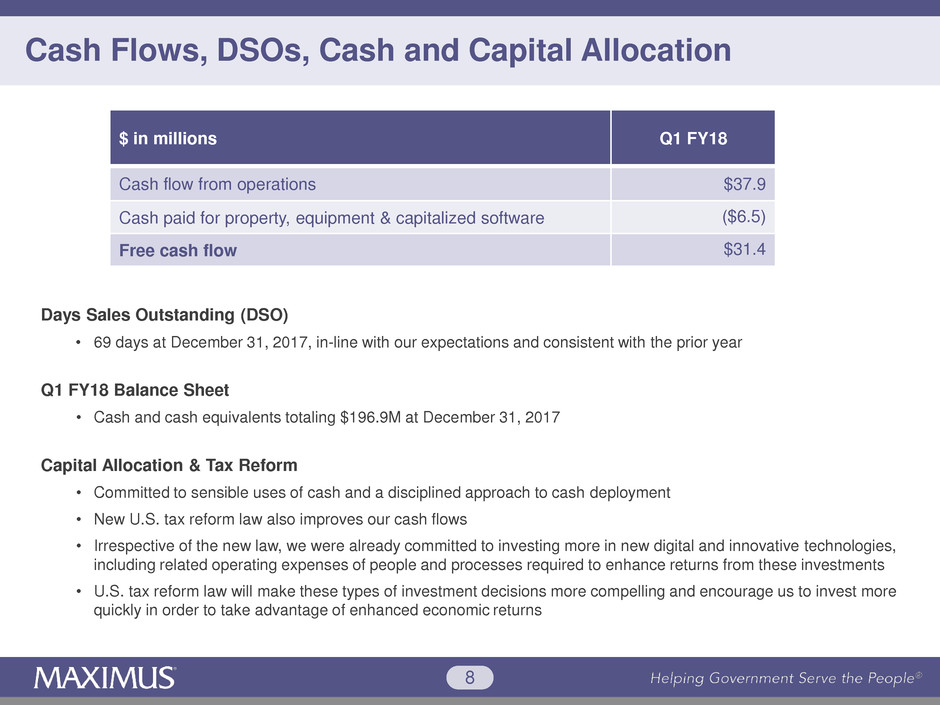

Cash Flows, DSOs, Cash and Capital Allocation

$ in millions Q1 FY18

Cash flow from operations $37.9

Cash paid for property, equipment & capitalized software ($6.5)

Free cash flow $31.4

Days Sales Outstanding (DSO)

• 69 days at December 31, 2017, in-line with our expectations and consistent with the prior year

Q1 FY18 Balance Sheet

• Cash and cash equivalents totaling $196.9M at December 31, 2017

Capital Allocation & Tax Reform

• Committed to sensible uses of cash and a disciplined approach to cash deployment

• New U.S. tax reform law also improves our cash flows

• Irrespective of the new law, we were already committed to investing more in new digital and innovative technologies,

including related operating expenses of people and processes required to enhance returns from these investments

• U.S. tax reform law will make these types of investment decisions more compelling and encourage us to invest more

quickly in order to take advantage of enhanced economic returns

9

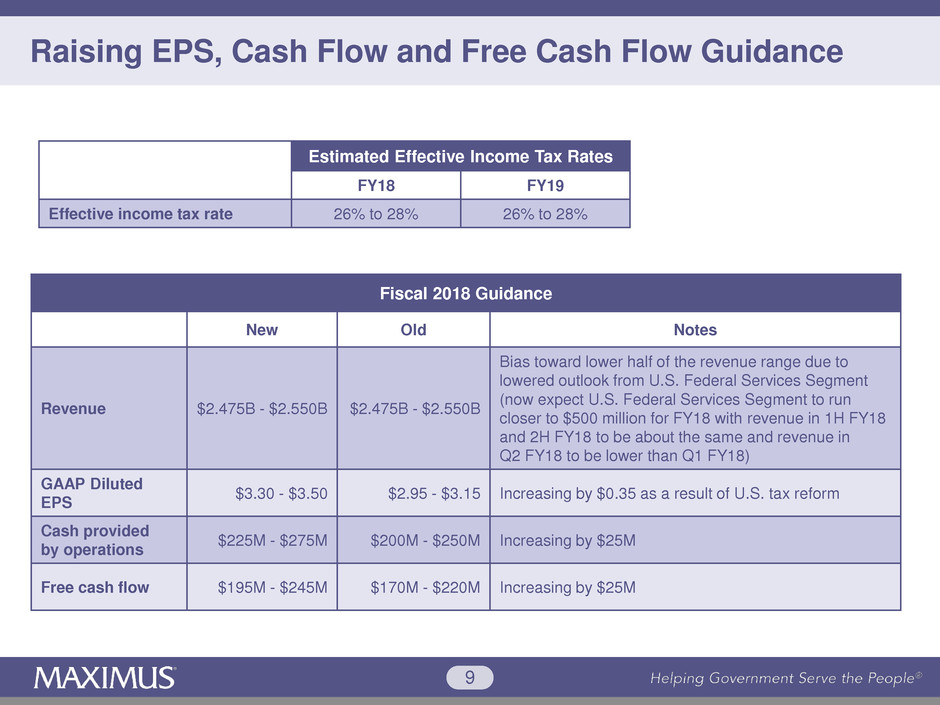

Raising EPS, Cash Flow and Free Cash Flow Guidance

Fiscal 2018 Guidance

New Old Notes

Revenue $2.475B - $2.550B $2.475B - $2.550B

Bias toward lower half of the revenue range due to

lowered outlook from U.S. Federal Services Segment

(now expect U.S. Federal Services Segment to run

closer to $500 million for FY18 with revenue in 1H FY18

and 2H FY18 to be about the same and revenue in

Q2 FY18 to be lower than Q1 FY18)

GAAP Diluted

EPS

$3.30 - $3.50 $2.95 - $3.15 Increasing by $0.35 as a result of U.S. tax reform

Cash provided

by operations

$225M - $275M $200M - $250M Increasing by $25M

Free cash flow $195M - $245M $170M - $220M Increasing by $25M

Estimated Effective Income Tax Rates

FY18 FY19

Effective income tax rate 26% to 28% 26% to 28%

10

Richard Montoni

Chief Executive Officer

Bruce Caswell

President

February 8, 2018

Helping Government Serve the People®

11

Chief Executive Officer Transition

• Bruce will succeed as CEO effective April 1, 2018

• Working together to ensure a smooth transition

• The time is right and Bruce is the right person to guide MAXIMUS in the future

• Key accomplishments during Rich’s tenure as CEO:

− helping governments implement major reform efforts

− expanding into new geographies

− divesting non-core businesses

− implementing the structures and processes to better manage enterprise risk

− incorporating acquired solutions and skills sets

• Rich’s vision helped transform MAXIMUS into a highly focused, preeminent

partner to governments around the globe

Bruce Caswell, President

& Incoming CEO

Richard Montoni, Outgoing

CEO & Newly Appointed

Special Advisor to the CEO

12

Transforming to Meet the Needs of Clients

1

2

Digital Transformation

Clinical Evolution

Operating in a changing and

competitive world

Clients expect continual

evolution and innovation

Constantly seeking ways to

create more efficiencies and

improve service delivery

MAXIMUS is already transforming to meet the demands of our clients

13

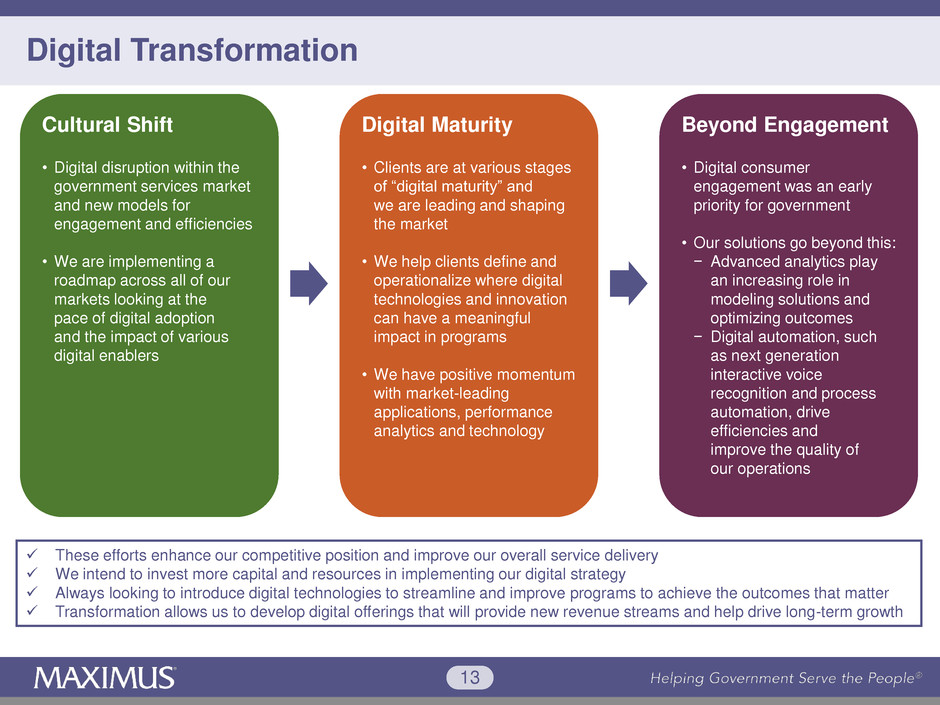

Digital Transformation

Cultural Shift

• Digital disruption within the

government services market

and new models for

engagement and efficiencies

• We are implementing a

roadmap across all of our

markets looking at the

pace of digital adoption

and the impact of various

digital enablers

Digital Maturity

• Clients are at various stages

of “digital maturity” and

we are leading and shaping

the market

• We help clients define and

operationalize where digital

technologies and innovation

can have a meaningful

impact in programs

• We have positive momentum

with market-leading

applications, performance

analytics and technology

Beyond Engagement

• Digital consumer

engagement was an early

priority for government

• Our solutions go beyond this:

− Advanced analytics play

an increasing role in

modeling solutions and

optimizing outcomes

− Digital automation, such

as next generation

interactive voice

recognition and process

automation, drive

efficiencies and

improve the quality of

our operations

These efforts enhance our competitive position and improve our overall service delivery

We intend to invest more capital and resources in implementing our digital strategy

Always looking to introduce digital technologies to streamline and improve programs to achieve the outcomes that matter

Transformation allows us to develop digital offerings that will provide new revenue streams and help drive long-term growth

14

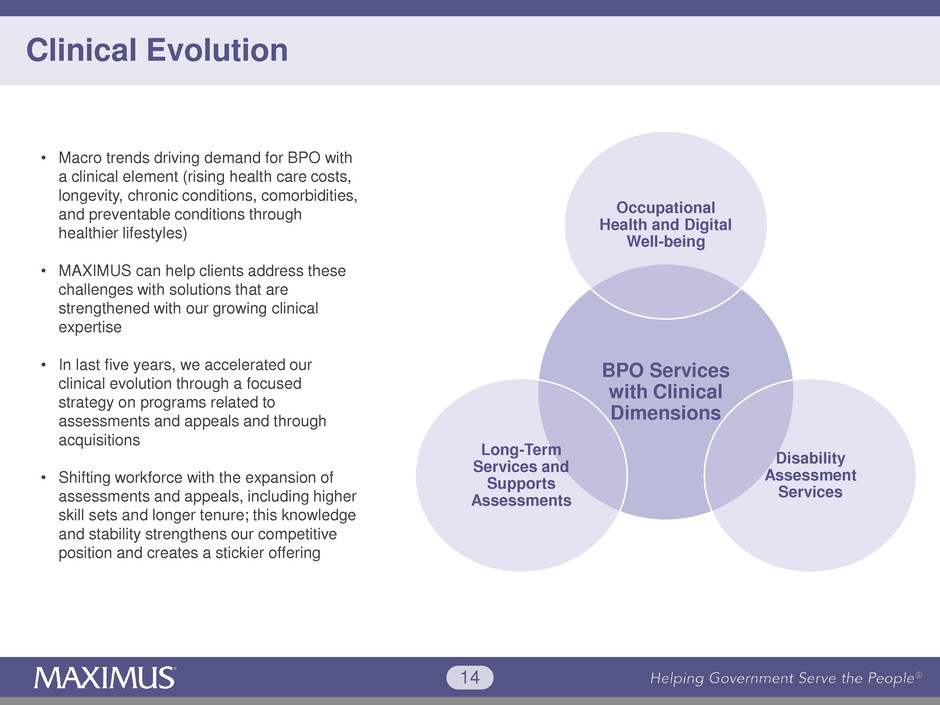

BPO Services

with Clinical

Dimensions

Occupational

Health and Digital

Well-being

Disability

Assessment

Services

Long-Term

Services and

Supports

Assessments

Clinical Evolution

• Macro trends driving demand for BPO with

a clinical element (rising health care costs,

longevity, chronic conditions, comorbidities,

and preventable conditions through

healthier lifestyles)

• MAXIMUS can help clients address these

challenges with solutions that are

strengthened with our growing clinical

expertise

• In last five years, we accelerated our

clinical evolution through a focused

strategy on programs related to

assessments and appeals and through

acquisitions

• Shifting workforce with the expansion of

assessments and appeals, including higher

skill sets and longer tenure; this knowledge

and stability strengthens our competitive

position and creates a stickier offering

15

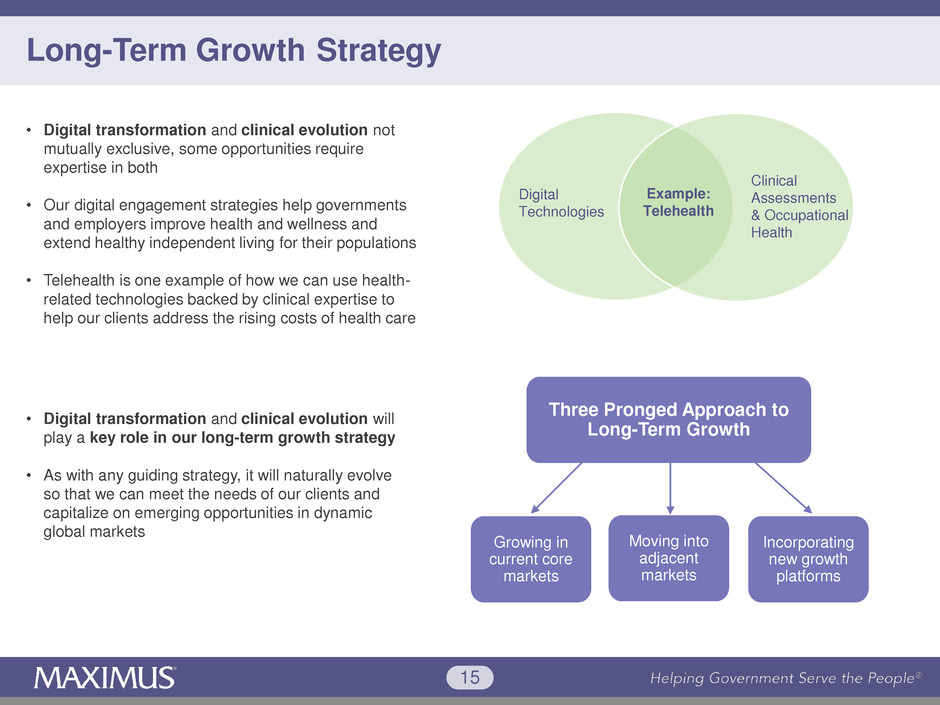

Long-Term Growth Strategy

Three Pronged Approach to

Long-Term Growth

Moving into

adjacent

markets

Incorporating

new growth

platforms

Growing in

current core

markets

• Digital transformation and clinical evolution not

mutually exclusive, some opportunities require

expertise in both

• Our digital engagement strategies help governments

and employers improve health and wellness and

extend healthy independent living for their populations

• Telehealth is one example of how we can use health-

related technologies backed by clinical expertise to

help our clients address the rising costs of health care

Digital

Technologies

Clinical

Assessments

& Occupational

Health

Example:

Telehealth

• Digital transformation and clinical evolution will

play a key role in our long-term growth strategy

• As with any guiding strategy, it will naturally evolve

so that we can meet the needs of our clients and

capitalize on emerging opportunities in dynamic

global markets

16

Affordable Care Act Operations Update

• Completed the most recent open

enrollment season under the Affordable

Care Act (ACA)

• Launched with a bit of a bang with higher

call volumes, likely due to consumer

confusion over the status of the program

• However, as open enrollment progressed,

it was business as usual

17

U.S. Federal Operations Update

• Gained credibility and respect as a trusted contractor, but recognize

that there is more work to be done

• Federal government procures a significant amount of work through

pre-competed contract vehicles (as opposed to full and open

competition); it is important to be on the right vehicles

• Recently secured positions on two new acquisition vehicles:

− GSA IT 70, the largest and most widely used vehicle

− Alliant/2, an important next-generation vehicle

• Given the challenges in a tough U.S. federal environment, including

the ongoing pause, making important changes as we position

MAXIMUS as a more meaningful player

• Recognize the need to amplify the segment’s sales and business

development efforts

• Dedicating additional resources to shape longer-term opportunities

driven by emerging customer priorities

• Firmly believe that there are significant opportunities to drive our core

capabilities into the federal market

18

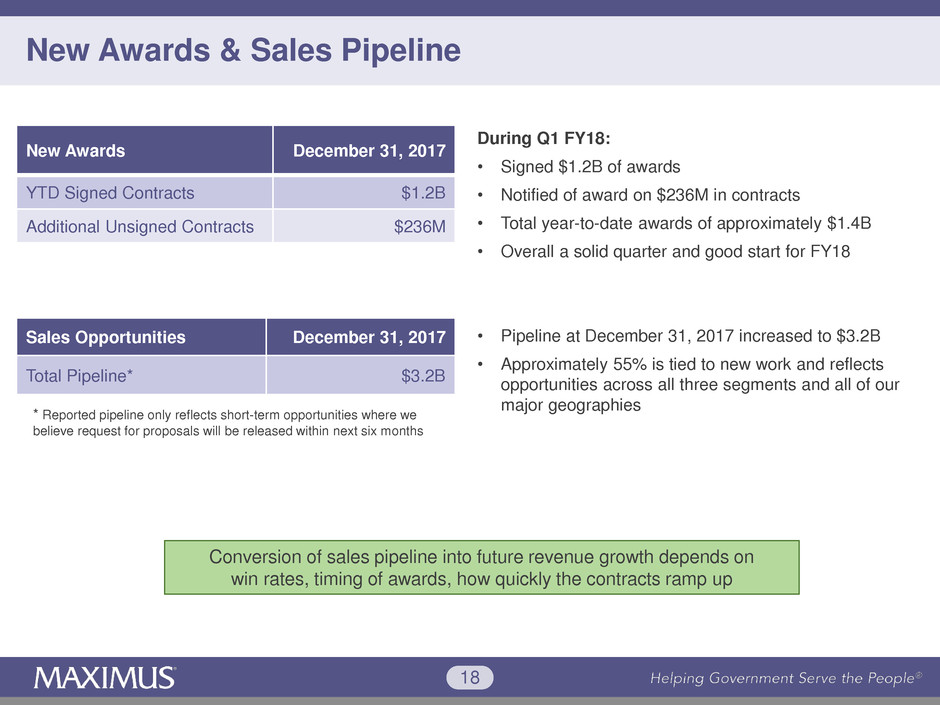

New Awards December 31, 2017

YTD Signed Contracts $1.2B

Additional Unsigned Contracts $236M

Sales Opportunities December 31, 2017

Total Pipeline* $3.2B

* Reported pipeline only reflects short-term opportunities where we

believe request for proposals will be released within next six months

New Awards & Sales Pipeline

During Q1 FY18:

• Signed $1.2B of awards

• Notified of award on $236M in contracts

• Total year-to-date awards of approximately $1.4B

• Overall a solid quarter and good start for FY18

• Pipeline at December 31, 2017 increased to $3.2B

• Approximately 55% is tied to new work and reflects

opportunities across all three segments and all of our

major geographies

Conversion of sales pipeline into future revenue growth depends on

win rates, timing of awards, how quickly the contracts ramp up

19

Conclusion

• Appreciation to the MAXIMUS

management team and our

employees

• Great pride at what we accomplished

together and it has been a pleasure to

work with such a talented group