1

Rick Nadeau

Chief Financial Officer

November 9, 2017

Helping Government Serve the People®

2

Forward-looking Statements & Non-GAAP Information

These slides should be read in conjunction with the Company’s most recent earnings press release, along with

listening to or reading a transcript of the comments of Company management from the Company’s most recent

quarterly earnings conference call.

This document may contain non-GAAP financial information. Management uses this information in its internal

analysis of results and believes that this information may be informative to investors in gauging the quality of our

financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons.

These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For

a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the

Company’s most recent earnings press release.

Throughout this presentation, numbers may not add due to rounding.

A number of statements being made today will be forward-looking in nature. Such statements are only predictions

and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC

filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed

with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements

to reflect subsequent events or circumstances.

3

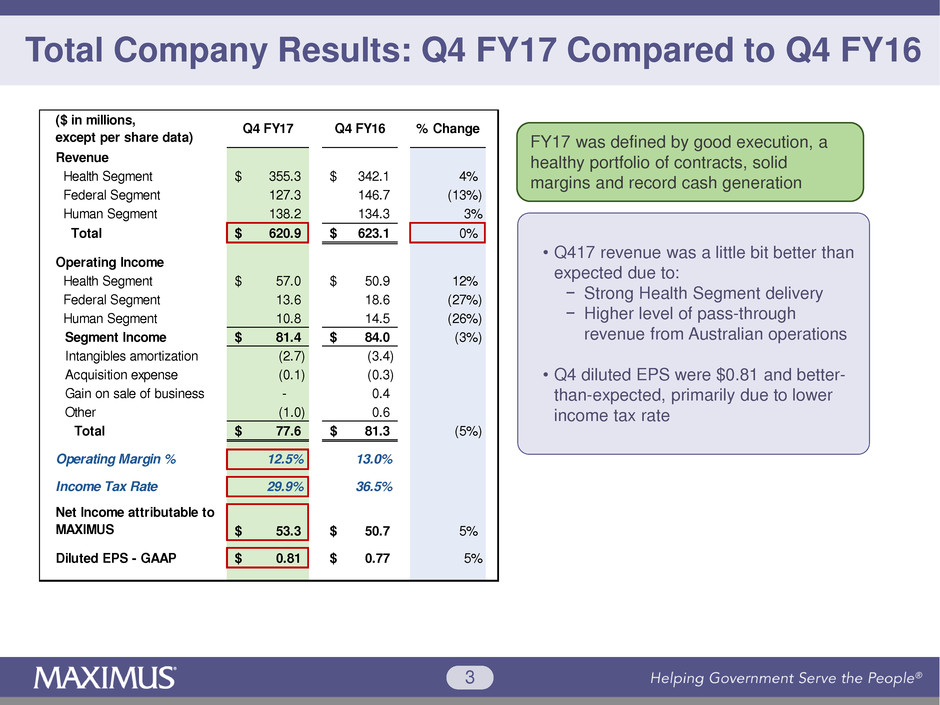

Total Company Results: Q4 FY17 Compared to Q4 FY16

• Q417 revenue was a little bit better than

expected due to:

− Strong Health Segment delivery

− Higher level of pass-through

revenue from Australian operations

• Q4 diluted EPS were $0.81 and better-

than-expected, primarily due to lower

income tax rate

FY17 was defined by good execution, a

healthy portfolio of contracts, solid

margins and record cash generation

Revenue

Health Segment 355.3$ 342.1$ 4%

Federal Segment 127.3 146.7 (13%)

Human Segment 138.2 134.3 3%

Total 620.9$ 623.1$ 0%

Operating Income

Health Segment 57.0$ 50.9$ 12%

Federal Segment 13.6 18.6 (27%)

Human Segment 10.8 14.5 (26%)

Segment Income 81.4$ 84.0$ (3%)

Intangibles amortization (2.7) (3.4)

Acquisition expense (0.1) (0.3)

Gain on sale of business - 0.4

Other (1.0) 0.6

Total 77.6$ 81.3$ (5%)

Operating Margin % 12.5% 13.0%

Income Tax Rate 29.9% 36.5%

Net Income attributable to

MAXIMUS 53.3$ 50.7$ 5%

Diluted EPS - GAAP 0.81$ 0.77$ 5%

($ in millions,

except per share data)

Q4 FY17 Q4 FY16 % Change

4

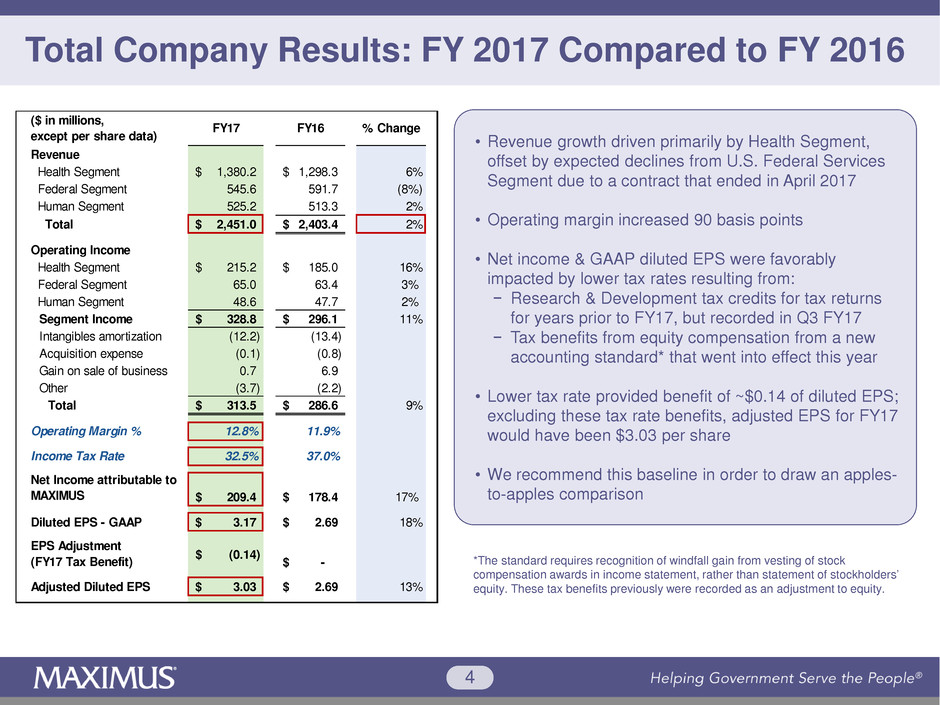

Total Company Results: FY 2017 Compared to FY 2016

• Revenue growth driven primarily by Health Segment,

offset by expected declines from U.S. Federal Services

Segment due to a contract that ended in April 2017

• Operating margin increased 90 basis points

• Net income & GAAP diluted EPS were favorably

impacted by lower tax rates resulting from:

− Research & Development tax credits for tax returns

for years prior to FY17, but recorded in Q3 FY17

− Tax benefits from equity compensation from a new

accounting standard* that went into effect this year

• Lower tax rate provided benefit of ~$0.14 of diluted EPS;

excluding these tax rate benefits, adjusted EPS for FY17

would have been $3.03 per share

• We recommend this baseline in order to draw an apples-

to-apples comparison

*The standard requires recognition of windfall gain from vesting of stock

compensation awards in income statement, rather than statement of stockholders’

equity. These tax benefits previously were recorded as an adjustment to equity.

Revenue

Health Segment 1,380.2$ 1,298.3$ 6%

Federal Segment 545.6 591.7 (8%)

Human Segment 525.2 513.3 2%

Total 2,451.0$ 2,403.4$ 2%

Operating Income

Health Segment 215.2$ 185.0$ 16%

Federal Segment 65.0 63.4 3%

Human Segment 48.6 47.7 2%

Segment Income 328.8$ 296.1$ 11%

Intangibles amortization (12.2) (13.4)

Acquisition expense (0.1) (0.8)

Gain on sale of business 0.7 6.9

Other (3.7) (2.2)

Total 313.5$ 286.6$ 9%

Operating Margin % 12.8% 11.9%

Income Tax Rate 32.5% 37.0%

Net Income attributable to

MAXIMUS 209.4$ 178.4$ 17%

Diluted EPS - GAAP 3.17$ 2.69$ 18%

EPS Adjustment

(FY17 Tax Benefit) (0.14)$ -$

Adjusted Diluted EPS 3.03$ 2.69$ 13%

($ in millions,

except per share data)

FY17 FY16 % Change

5

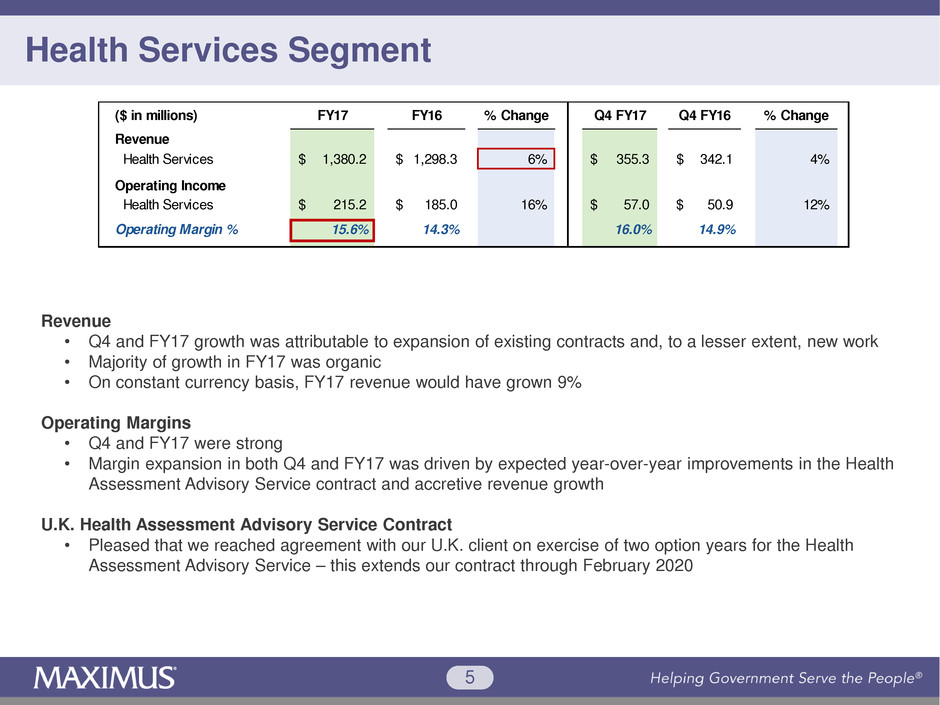

Health Services Segment

Revenue

• Q4 and FY17 growth was attributable to expansion of existing contracts and, to a lesser extent, new work

• Majority of growth in FY17 was organic

• On constant currency basis, FY17 revenue would have grown 9%

Operating Margins

• Q4 and FY17 were strong

• Margin expansion in both Q4 and FY17 was driven by expected year-over-year improvements in the Health

Assessment Advisory Service contract and accretive revenue growth

U.K. Health Assessment Advisory Service Contract

• Pleased that we reached agreement with our U.K. client on exercise of two option years for the Health

Assessment Advisory Service – this extends our contract through February 2020

Revenue

Health Services 1,380.2$ 1,298.3$ 6% 355.3$ 342.1$ 4%

Operating Income

Health Services 215.2$ 185.0$ 16% 57.0$ 50.9$ 12%

Operating Margin % 15.6% 14.3% 16.0% 14.9%

% Change($ in millions) Q4 FY17 Q4 FY16 % ChangeFY17 FY16

6

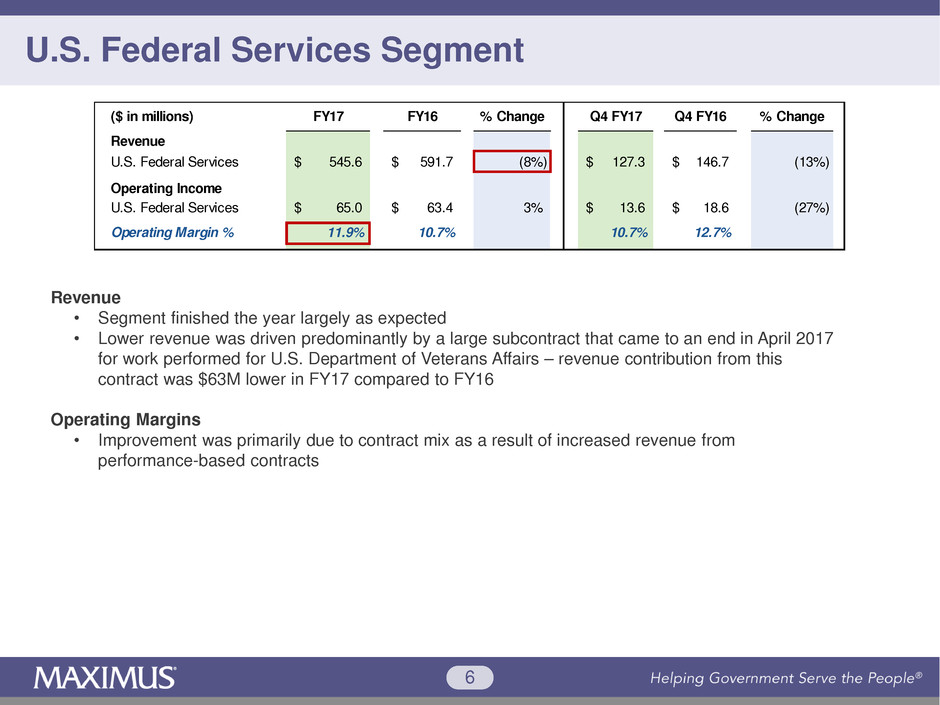

U.S. Federal Services Segment

Revenue

• Segment finished the year largely as expected

• Lower revenue was driven predominantly by a large subcontract that came to an end in April 2017

for work performed for U.S. Department of Veterans Affairs – revenue contribution from this

contract was $63M lower in FY17 compared to FY16

Operating Margins

• Improvement was primarily due to contract mix as a result of increased revenue from

performance-based contracts

Revenue

U.S. Federal Services 545.6$ 591.7$ (8%) 127.3$ 146.7$ (13%)

Operating Income

U.S. Federal Services 65.0$ 63.4$ 3% 13.6$ 18.6$ (27%)

Operating Margin % 11.9% 10.7% 10.7% 12.7%

($ in millions) Q4 FY17 Q4 FY16 % ChangeFY17 FY16 % Change

7

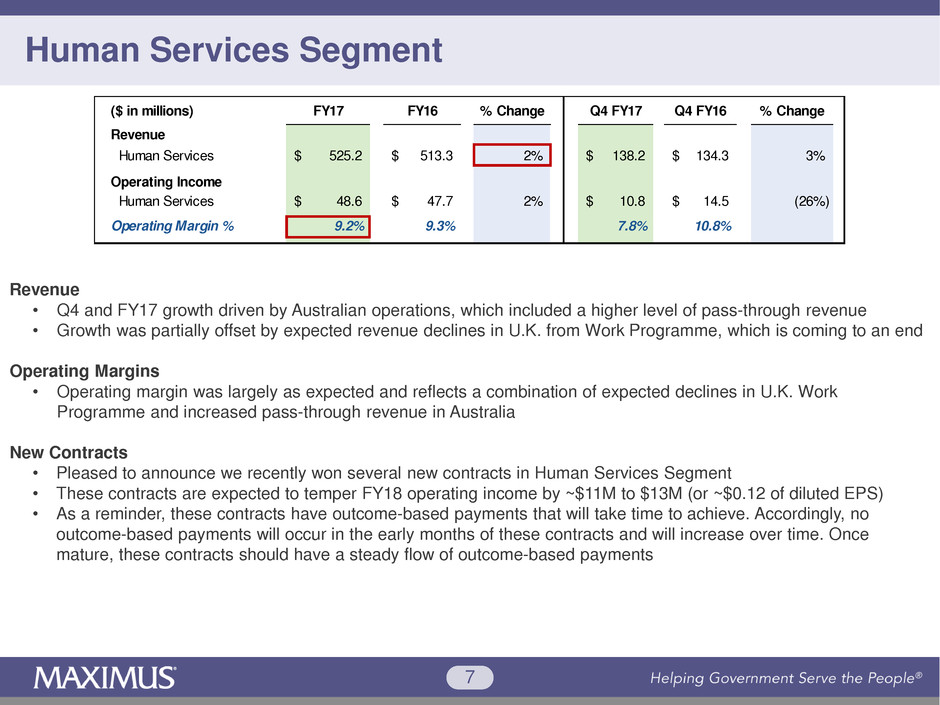

Human Services Segment

Revenue

• Q4 and FY17 growth driven by Australian operations, which included a higher level of pass-through revenue

• Growth was partially offset by expected revenue declines in U.K. from Work Programme, which is coming to an end

Operating Margins

• Operating margin was largely as expected and reflects a combination of expected declines in U.K. Work

Programme and increased pass-through revenue in Australia

New Contracts

• Pleased to announce we recently won several new contracts in Human Services Segment

• These contracts are expected to temper FY18 operating income by ~$11M to $13M (or ~$0.12 of diluted EPS)

• As a reminder, these contracts have outcome-based payments that will take time to achieve. Accordingly, no

outcome-based payments will occur in the early months of these contracts and will increase over time. Once

mature, these contracts should have a steady flow of outcome-based payments

Revenue

Human Services 525.2$ 513.3$ 2% 138.2$ 134.3$ 3%

Operating Income

Human Services 48.6$ 47.7$ 2% 10.8$ 14.5$ (26%)

Operating Margin % 9.2% 9.3% 7.8% 10.8%

% Change($ in millions) Q4 FY17 Q4 FY16 % ChangeFY17 FY16

8

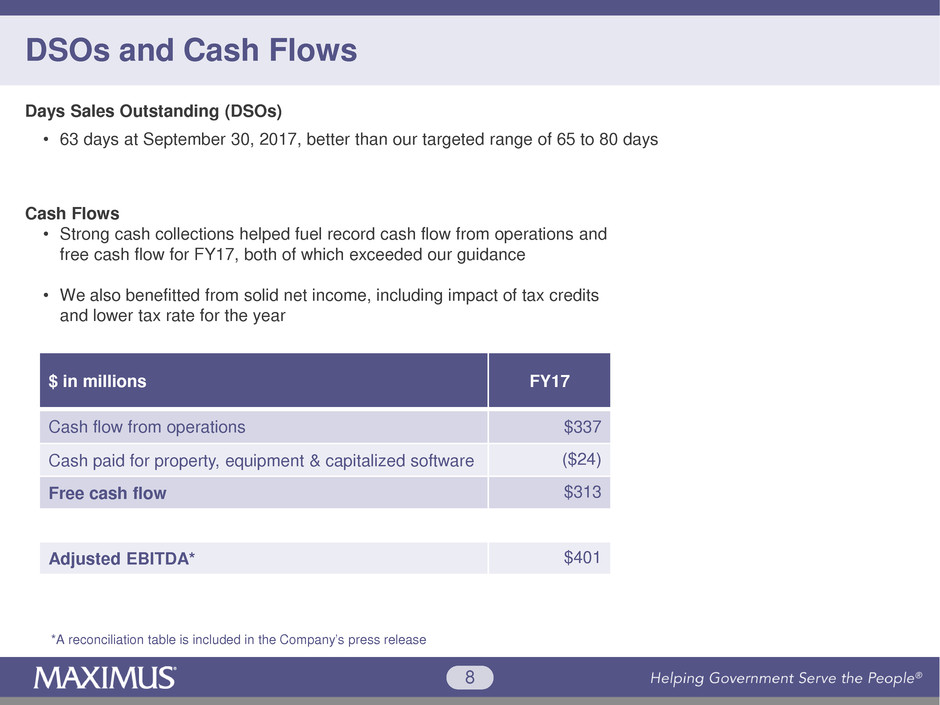

DSOs and Cash Flows

$ in millions FY17

Cash flow from operations $337

Cash paid for property, equipment & capitalized software ($24)

Free cash flow $313

Adjusted EBITDA* $401

Days Sales Outstanding (DSOs)

• 63 days at September 30, 2017, better than our targeted range of 65 to 80 days

Cash Flows

• Strong cash collections helped fuel record cash flow from operations and

free cash flow for FY17, both of which exceeded our guidance

• We also benefitted from solid net income, including impact of tax credits

and lower tax rate for the year

*A reconciliation table is included in the Company’s press release

9

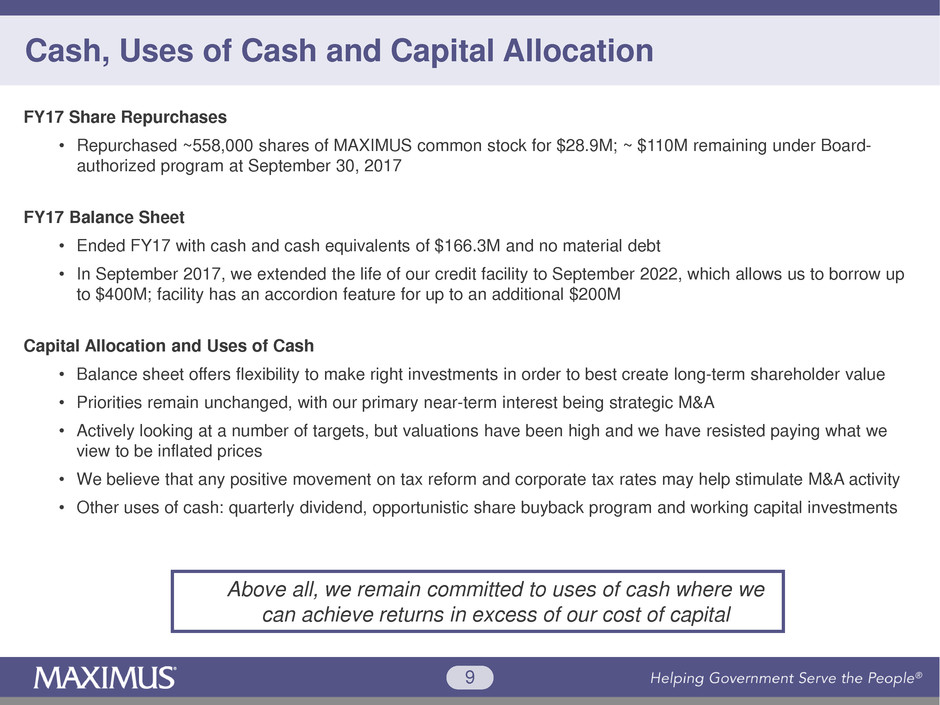

Cash, Uses of Cash and Capital Allocation

FY17 Share Repurchases

• Repurchased ~558,000 shares of MAXIMUS common stock for $28.9M; ~ $110M remaining under Board-

authorized program at September 30, 2017

FY17 Balance Sheet

• Ended FY17 with cash and cash equivalents of $166.3M and no material debt

• In September 2017, we extended the life of our credit facility to September 2022, which allows us to borrow up

to $400M; facility has an accordion feature for up to an additional $200M

Capital Allocation and Uses of Cash

• Balance sheet offers flexibility to make right investments in order to best create long-term shareholder value

• Priorities remain unchanged, with our primary near-term interest being strategic M&A

• Actively looking at a number of targets, but valuations have been high and we have resisted paying what we

view to be inflated prices

• We believe that any positive movement on tax reform and corporate tax rates may help stimulate M&A activity

• Other uses of cash: quarterly dividend, opportunistic share buyback program and working capital investments

Above all, we remain committed to uses of cash where we

can achieve returns in excess of our cost of capital

10

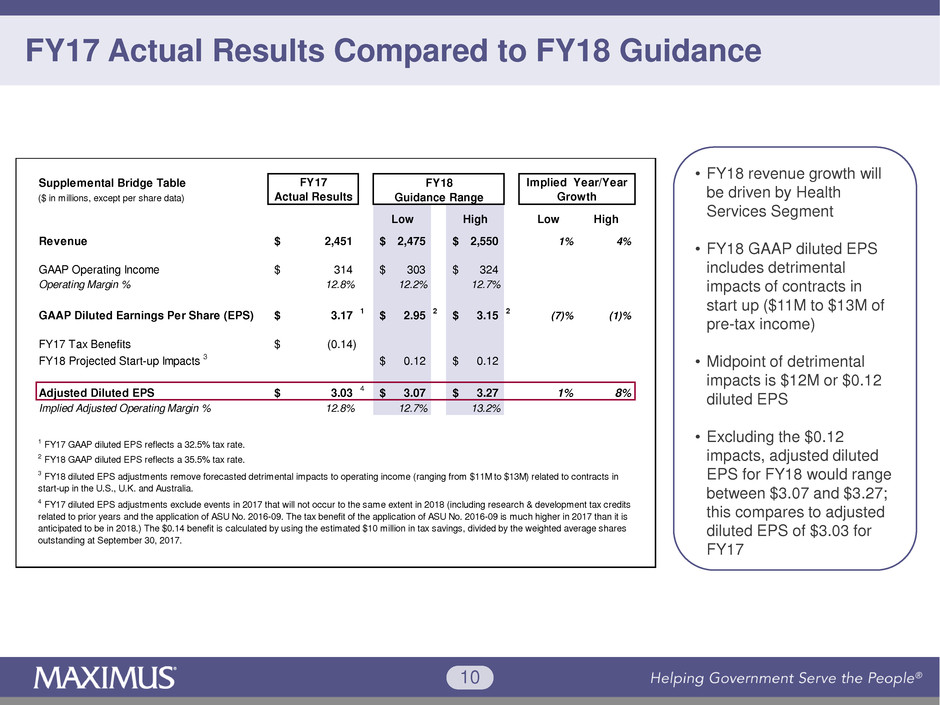

FY17 Actual Results Compared to FY18 Guidance

• FY18 revenue growth will

be driven by Health

Services Segment

• FY18 GAAP diluted EPS

includes detrimental

impacts of contracts in

start up ($11M to $13M of

pre-tax income)

• Midpoint of detrimental

impacts is $12M or $0.12

diluted EPS

• Excluding the $0.12

impacts, adjusted diluted

EPS for FY18 would range

between $3.07 and $3.27;

this compares to adjusted

diluted EPS of $3.03 for

FY17

Supplemental Bridge Table FY18

($ in millions, except per share data) Guidance Range

Revenue 2,451$ 2,475$ 2,550$ 1% 4%

GAAP Operating Income 314$ 303$ 324$

Operating Margin % 12.8% 12.2% 12.7%

GAAP Diluted Earnings Per Share (EPS) 3.17$ 1 2.95$ 2 3.15$ 2 (7)% (1)%

FY17 Tax Benefits (0.14)$

FY18 Projected Start-up Impacts 3 0.12$ 0.12$

Adjusted Diluted EPS 3.03$ 4 3.07$ 3.27$ 1% 8%

Implied Adjusted Operating Margin % 12.8% 12.7% 13.2%

1 FY17 GAAP diluted EPS reflects a 32.5% tax rate.

4 FY17 diluted EPS adjustments exclude events in 2017 that will not occur to the same extent in 2018 (including research & development tax credits

related to prior years and the application of ASU No. 2016-09. The tax benefit of the application of ASU No. 2016-09 is much higher in 2017 than it is

anticipated to be in 2018.) The $0.14 benefit is calculated by using the estimated $10 million in tax savings, divided by the weighted average shares

outstanding at September 30, 2017.

2 FY18 GAAP diluted EPS reflects a 35.5% tax rate.

3 FY18 diluted EPS adjustments remove forecasted detrimental impacts to operating income (ranging from $11M to $13M) related to contracts in

start-up in the U.S., U.K. and Australia.

FY17

Actual Results

Implied Year/Year

Growth

Low High Low High

11

Backlog, Quarterly Trends, Operating Margins

Backlog

• At September 30, 2017, we had $5.7B in backlog

• With a high level of visibility into our forecasted revenue for FY18, we estimate that ~94% of our forecasted FY18

revenue is already in the form of backlog, options or extensions (based on the mid-point FY18 revenue guidance)

Quarterly Financial Trends

• Anticipate revenue will be stronger in 1H FY18 vs, 2H FY18 driven by two items:

− First, temporary work in our U.S. Federal Services Segment, as a subcontractor to CSRA, in support of disaster

relief efforts. We have forecasted this short-term work based on facts and circumstances today, we may

experience fluctuations on this subcontract

−Second, a pending change order in the Health Segment (disclosed Q3 FY17) is now expected to be recognized

in Q1 FY18

• On the bottom line, expect Q1 FY18 will be lower than Q4 FY17 because we expect a more normalized tax rate

Operating Margins by Segment

• Health Services Segment: Full-year margins at or above mid-point of targeted range of 10% to 15%

• U.S. Federal Services Segment: Full-year margins towards the low to mid-point of targeted 10% to 15% range

• Human Services Segment: Full-year margins in the single digits (due to detrimental impacts from start-ups)

12

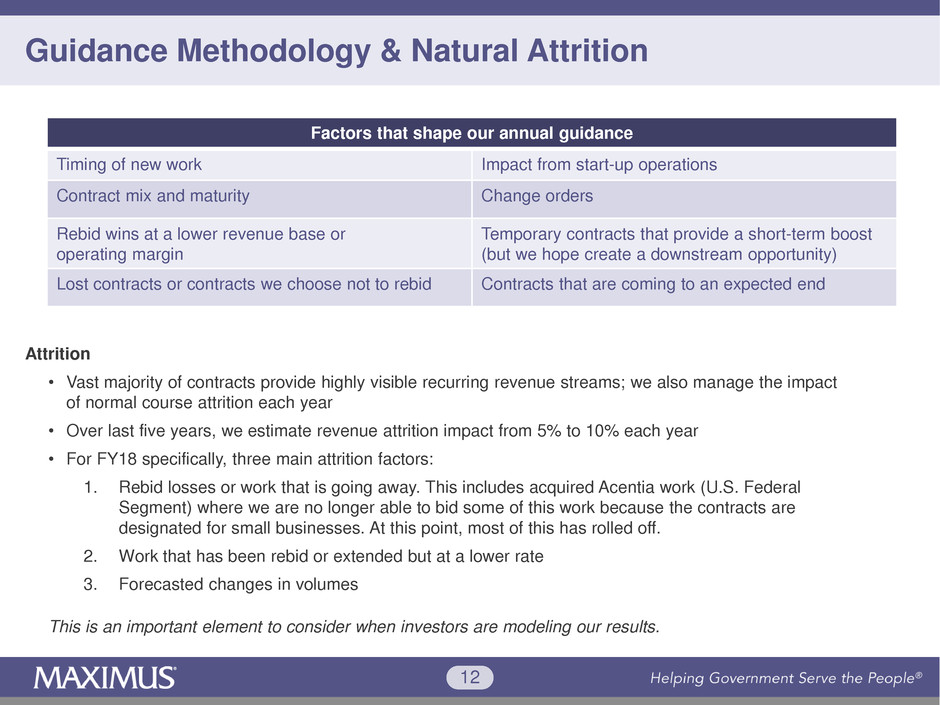

Guidance Methodology & Natural Attrition

Attrition

• Vast majority of contracts provide highly visible recurring revenue streams; we also manage the impact

of normal course attrition each year

• Over last five years, we estimate revenue attrition impact from 5% to 10% each year

• For FY18 specifically, three main attrition factors:

1. Rebid losses or work that is going away. This includes acquired Acentia work (U.S. Federal

Segment) where we are no longer able to bid some of this work because the contracts are

designated for small businesses. At this point, most of this has rolled off.

2. Work that has been rebid or extended but at a lower rate

3. Forecasted changes in volumes

This is an important element to consider when investors are modeling our results.

Factors that shape our annual guidance

Timing of new work Impact from start-up operations

Contract mix and maturity Change orders

Rebid wins at a lower revenue base or

operating margin

Temporary contracts that provide a short-term boost

(but we hope create a downstream opportunity)

Lost contracts or contracts we choose not to rebid Contracts that are coming to an expected end

13

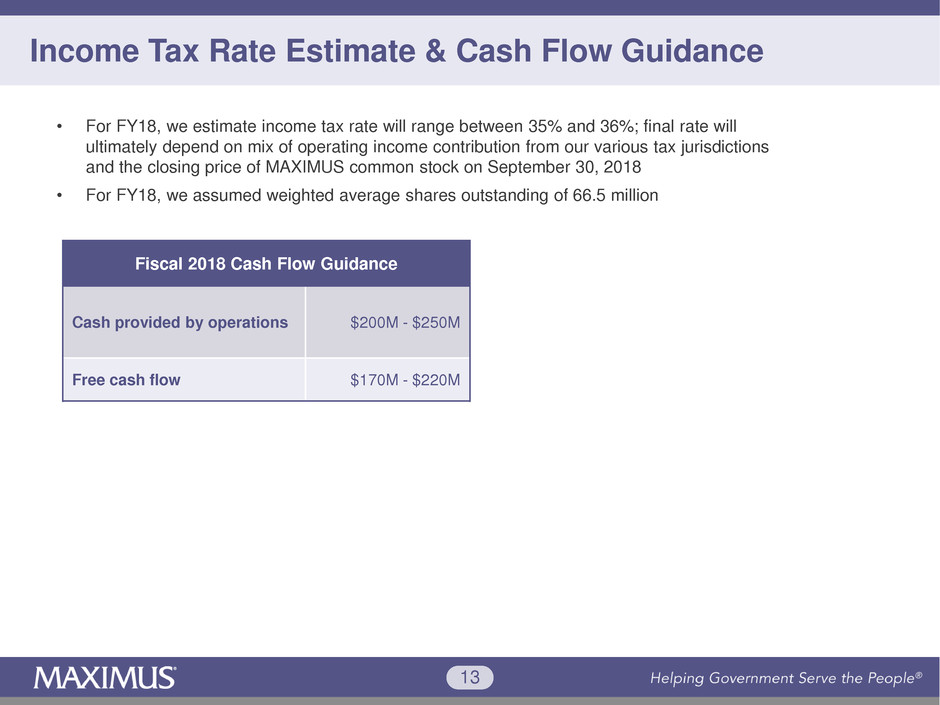

Income Tax Rate Estimate & Cash Flow Guidance

Fiscal 2018 Cash Flow Guidance

Cash provided by operations $200M - $250M

Free cash flow $170M - $220M

• For FY18, we estimate income tax rate will range between 35% and 36%; final rate will

ultimately depend on mix of operating income contribution from our various tax jurisdictions

and the closing price of MAXIMUS common stock on September 30, 2018

• For FY18, we assumed weighted average shares outstanding of 66.5 million

14

Richard Montoni

Chief Executive Officer

November 9, 2017

Helping Government Serve the People®

15

Finished FY17 on Firm Footing

• Finished 2017 on firm footing, with healthy

operating margins and record cash flow

• Today’s presentation will cover:

− ACA open enrollment period

− New work awards that provide paths to

long-term growth

− Successful rebids that help protect the base

16

Affordable Care Act (ACA) Update

• Open Enrollment began November 1st

• Early press coverage included initial reports from the

federal marketplace and several state-based exchanges

show more Americans signing up for coverage at a

higher rate than last year

• We are seeing similar early trends during the first few

days of open enrollment at our state-based exchange

contact centers, with slightly higher call volumes

compared to last year

• Hard to speculate why volumes are a little bit higher;

anecdotally, we have received incoming calls from

consumers who think they may be losing coverage as a

result of the legislative efforts to repeal and replace ACA

17

New LTSS and Workforce Contracts

Expanded Long-Term Services & Supports Business

• Won three new contracts for pre-admission screening

and resident review (PASRR) services

• Assessments help ensure appropriate placements in a

nursing facility or community-based setting and that

individuals receive required services, regardless of

placement

• Awaiting final execution of each contract and are

unable to share financial details

• These key wins enhance our position as a leading

provider of LTSS assessments

Actively planting seeds for long-term growth; for example, applying core competencies to new programs and clients

Launched Indiana Workforce Services Project

• Six-year, ~$50M statewide contract

• Case management, employment and retention

services to public program beneficiaries

• Indiana has a pending waiver to move its

voluntary Medicaid work requirement to one that

is mandatory for certain beneficiary populations

• New contract is not related to Medicaid work

requirements, but MAXIMUS now offers both

health and human services in a state that has

been at the forefront of work requirements

18

New Disability Employment Services Contracts

Work & Health Programme in Wales

• Seven-year, ~$45M USD contract expected to

launch in December 2017

• Employment support for unemployed individuals

and those with health conditions or disabilities

• More holistic approach to help individuals

overcome certain barriers to employment

• 75+ delivery locations, offering personalized and

integrated support to 16,000 job seekers

Congratulations to our business development and operations teams for these strategic additions.

These wins are good news, but some of the start-ups will temper FY18 earnings.

Fair Start Programme in Scotland

• Three, five-year contracts, with a combined annual run

rate of ~$6M USD

• Seeking to close employment gap between people

with disabilities and mainstream working population

• Creating support plans and equipping individuals with

the right skills to move into sustainable employment

• More than half of our staff in Scotland has a declared

disability or health condition, so we bring a unique

understanding to this socially important program

19

Protecting the Base – Key Rebids & Contract Extensions

• California

− 10-year renewal for Medicaid enrollment broker (EB); term started last month and runs through June 2027

− Annual revenue for FY18 is expected to range between $75M and $80M

− MAXIMUS has served as California’s enrollment broker since 1996, providing conflict-free choice counseling to

more than 12M participants each year

• Texas and Michigan

− Texas EB contract has been formally extended through August of 2018

− Michigan EB contract has been extended for five years

− We do not expect any material change to the annual run rate for either contract

• United Kingdom

− DWP exercised its option to extend our Health Assessment Advisory Service contract

− Extends our work through February 2020

− Delivered key service-level improvements and are proud of the significant progress made

New awards and rebids provide a nice addition to our healthy and stable portfolio and reflect governments’

confidence in our ability to operate efficient and effective programs that achieve intended outcomes.

These well-rooted contracts represent the stable base of our portfolio of contracts.

20

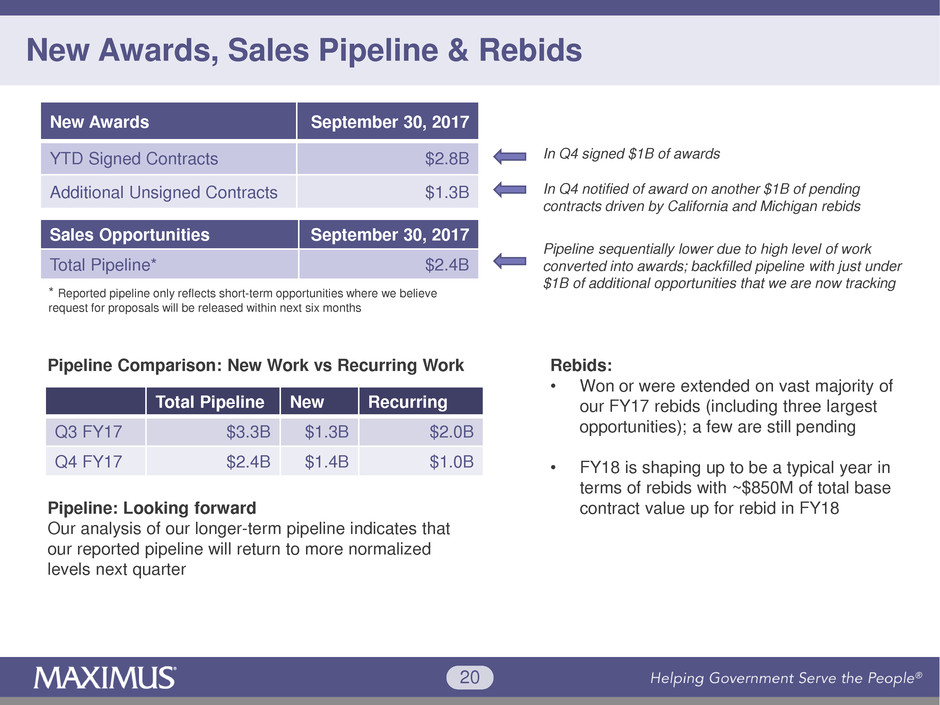

New Awards September 30, 2017

YTD Signed Contracts $2.8B

Additional Unsigned Contracts $1.3B

Sales Opportunities September 30, 2017

Total Pipeline* $2.4B

* Reported pipeline only reflects short-term opportunities where we believe

request for proposals will be released within next six months

New Awards, Sales Pipeline & Rebids

In Q4 signed $1B of awards

Pipeline Comparison: New Work vs Recurring Work

Pipeline: Looking forward

Our analysis of our longer-term pipeline indicates that

our reported pipeline will return to more normalized

levels next quarter

In Q4 notified of award on another $1B of pending

contracts driven by California and Michigan rebids

Pipeline sequentially lower due to high level of work

converted into awards; backfilled pipeline with just under

$1B of additional opportunities that we are now tracking

Rebids:

• Won or were extended on vast majority of

our FY17 rebids (including three largest

opportunities); a few are still pending

• FY18 is shaping up to be a typical year in

terms of rebids with ~$850M of total base

contract value up for rebid in FY18

Total Pipeline New Recurring

Q3 FY17 $3.3B $1.3B $2.0B

Q4 FY17 $2.4B $1.4B $1.0B

21

Conclusion

• Continue to feel lingering effects of industry pause

but taking advantage of the time to position

MAXIMUS for next wave of growth; have

experienced similar pauses in the past

• Ended the year on a positive note with key rebid

and new work wins; remain focused on encouraging

longer-term macro environment

• Believe governments will continue to seek solutions

to manage aging populations, individuals with more

complex health needs, and growing caseloads in a

more cost-effective and efficient way

Growing in current core markets

Moving into next set of adjacent markets

Incorporating new platforms

Three-pronged approach designed to

bring us more in-line with our long-term

growth targets:

Thank you to our 20,000+ employees around the world: their dedication to providing the highest

quality of services to our clients, as well as to the citizens served by the programs we operate, is very

much appreciated and key as we strive to deliver shareholder value.