1

Rick Nadeau

Chief Financial Officer

August 3, 2017

Helping Government Serve the People®

2

Forward-looking Statements & Non-GAAP Information

These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along

with listening to or reading a transcript of the comments of Company management from the Company’s most recent

quarterly earnings conference call.

This document may contain non-GAAP financial information. Management uses this information in its internal

analysis of results and believes that this information may be informative to investors in gauging the quality of our

financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons.

These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For

a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the

Company’s most recent quarterly earnings press release.

Throughout this presentation, numbers may not add due to rounding.

A number of statements being made today will be forward-looking in nature. Such statements are only predictions

and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC

filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed

with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements

to reflect subsequent events or circumstances.

3

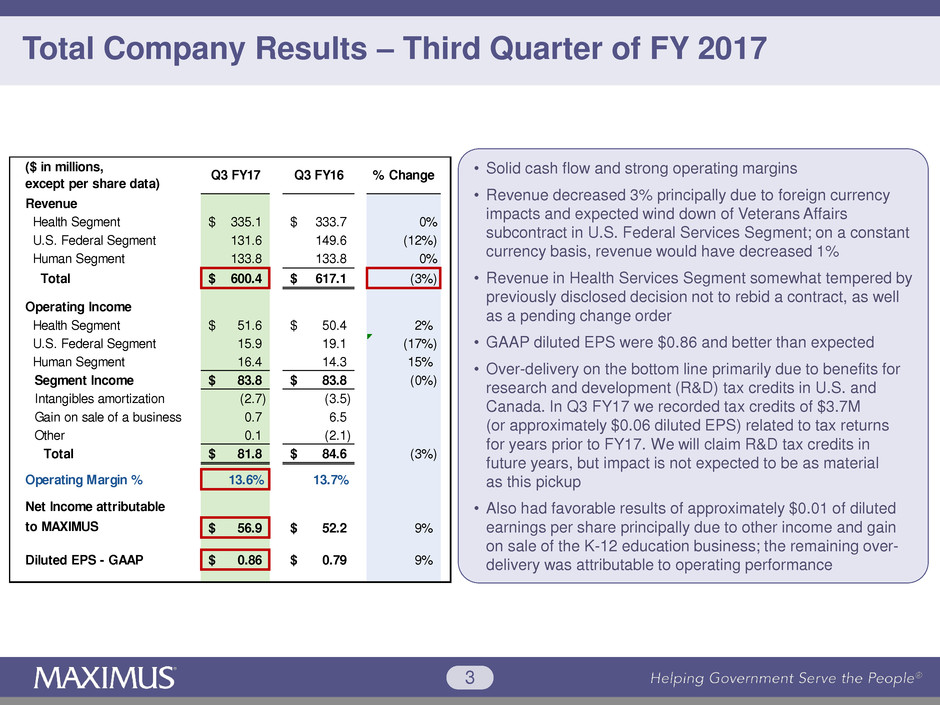

Total Company Results – Third Quarter of FY 2017

• Solid cash flow and strong operating margins

• Revenue decreased 3% principally due to foreign currency

impacts and expected wind down of Veterans Affairs

subcontract in U.S. Federal Services Segment; on a constant

currency basis, revenue would have decreased 1%

• Revenue in Health Services Segment somewhat tempered by

previously disclosed decision not to rebid a contract, as well

as a pending change order

• GAAP diluted EPS were $0.86 and better than expected

• Over-delivery on the bottom line primarily due to benefits for

research and development (R&D) tax credits in U.S. and

Canada. In Q3 FY17 we recorded tax credits of $3.7M

(or approximately $0.06 diluted EPS) related to tax returns

for years prior to FY17. We will claim R&D tax credits in

future years, but impact is not expected to be as material

as this pickup

• Also had favorable results of approximately $0.01 of diluted

earnings per share principally due to other income and gain

on sale of the K-12 education business; the remaining over-

delivery was attributable to operating performance

Revenue

Health Segment 335.1$ 333.7$ 0%

U.S. Federal Segment 131.6 149.6 (12%)

Human Segment 133.8 133.8 0%

Total 600.4$ 617.1$ (3%)

Operating Income

Health Segment 51.6$ 50.4$ 2%

U.S. Federal Segment 15.9 19.1 (17%)

Human Segment 16.4 14.3 15%

Segment Income 83.8$ 83.8$ (0%)

Intangibles amortization (2.7) (3.5)

Gain on sale of a business 0.7 6.5

Other 0.1 (2.1)

Total 81.8$ 84.6$ (3%)

Operating Margin % 13.6% 13.7%

Net Income attri utabl

to MAXIMUS 56.9$ 52.2$ 9%

Diluted EPS - GAAP 0.86$ 0.79$ 9%

($ in millions,

except per share data)

Q3 FY17 Q3 FY16 % Change

4

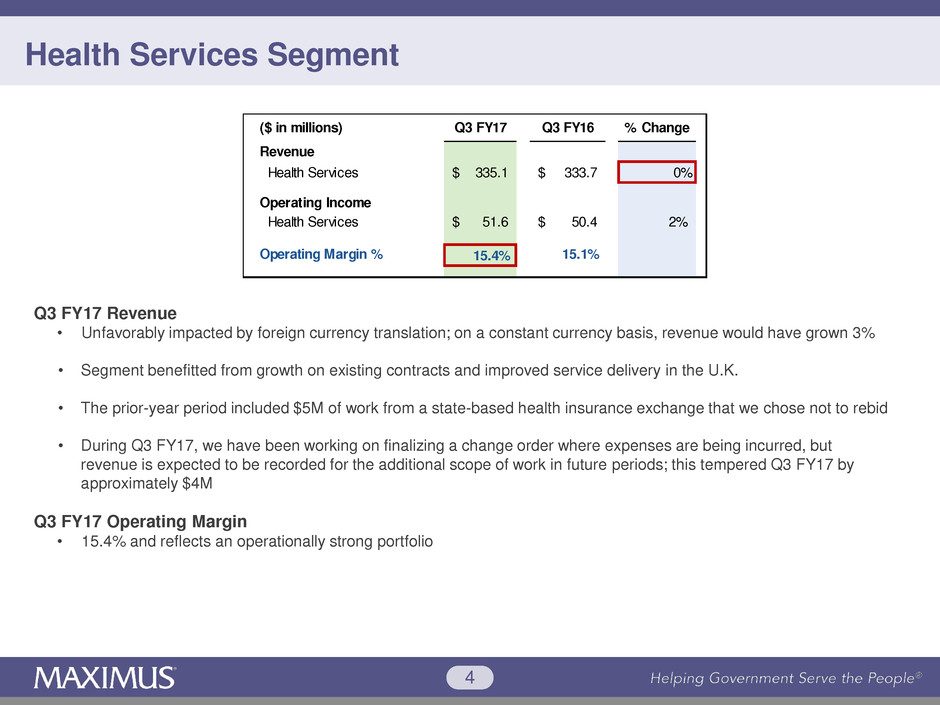

Health Services Segment

Q3 FY17 Revenue

• Unfavorably impacted by foreign currency translation; on a constant currency basis, revenue would have grown 3%

• Segment benefitted from growth on existing contracts and improved service delivery in the U.K.

• The prior-year period included $5M of work from a state-based health insurance exchange that we chose not to rebid

• During Q3 FY17, we have been working on finalizing a change order where expenses are being incurred, but

revenue is expected to be recorded for the additional scope of work in future periods; this tempered Q3 FY17 by

approximately $4M

Q3 FY17 Operating Margin

• 15.4% and reflects an operationally strong portfolio

Revenue

Health Services 335.1$ 333.7$ 0%

Operating Income

Health Services 51.6$ 50.4$ 2%

Operating Margin % 15.4% 15.1%

($ in millions) Q3 FY17 Q3 FY16 % Change

5

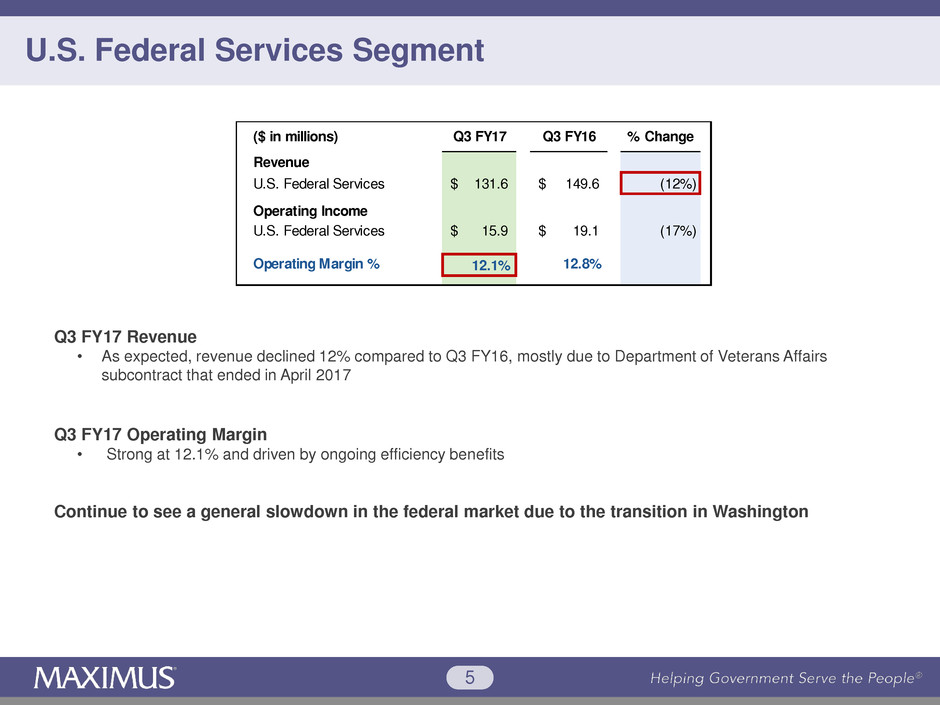

U.S. Federal Services Segment

Q3 FY17 Revenue

• As expected, revenue declined 12% compared to Q3 FY16, mostly due to Department of Veterans Affairs

subcontract that ended in April 2017

Q3 FY17 Operating Margin

• Strong at 12.1% and driven by ongoing efficiency benefits

Continue to see a general slowdown in the federal market due to the transition in Washington

Revenue

U.S. Federal Services 131.6$ 149.6$ (12%)

Operating Income

U.S. Federal Services 15.9$ 19.1$ (17%)

Operating Margin % 12.1% 12.8%

($ in millions) Q3 FY17 Q3 FY16 % Change

6

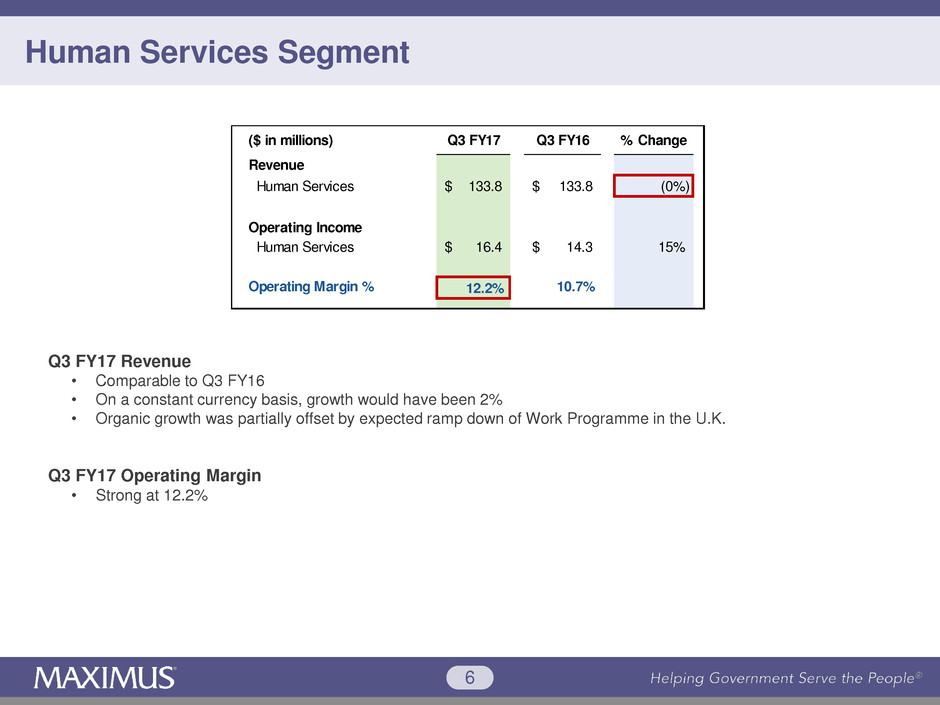

Human Services Segment

Q3 FY17 Revenue

• Comparable to Q3 FY16

• On a constant currency basis, growth would have been 2%

• Organic growth was partially offset by expected ramp down of Work Programme in the U.K.

Q3 FY17 Operating Margin

• Strong at 12.2%

Revenue

Human Services 133.8$ 133.8$ (0%)

Operating Income

Human Services 16.4$ 14.3$ 15%

Operating Margin % 12.2% 10.7%

($ in millions) Q3 FY17 Q3 FY16 % Change

7

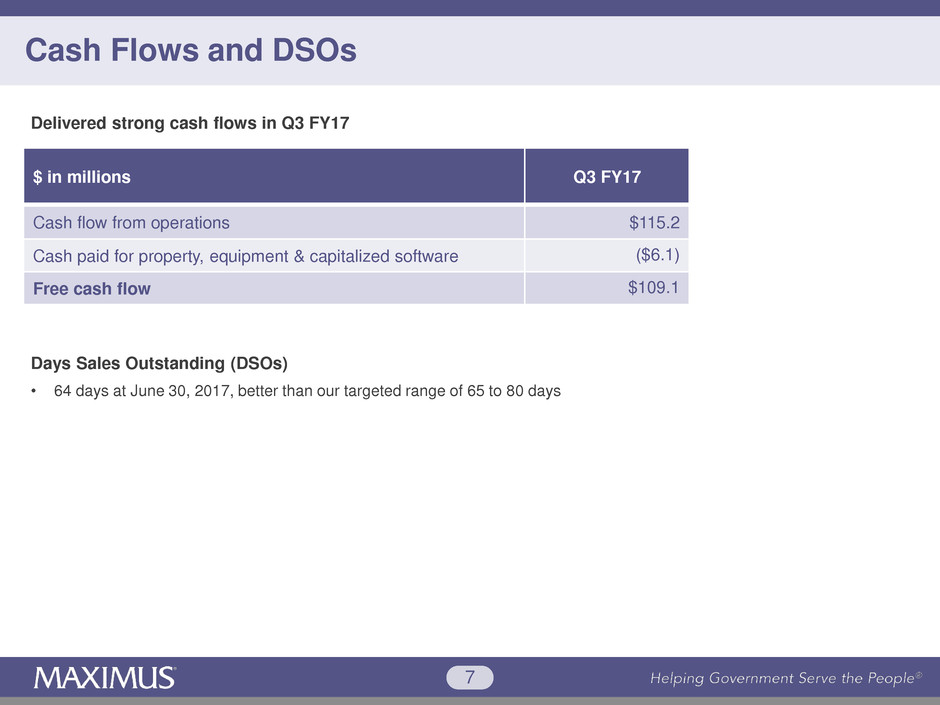

Cash Flows and DSOs

$ in millions Q3 FY17

Cash flow from operations $115.2

Cash paid for property, equipment & capitalized software ($6.1)

Free cash flow $109.1

Days Sales Outstanding (DSOs)

• 64 days at June 30, 2017, better than our targeted range of 65 to 80 days

Delivered strong cash flows in Q3 FY17

8

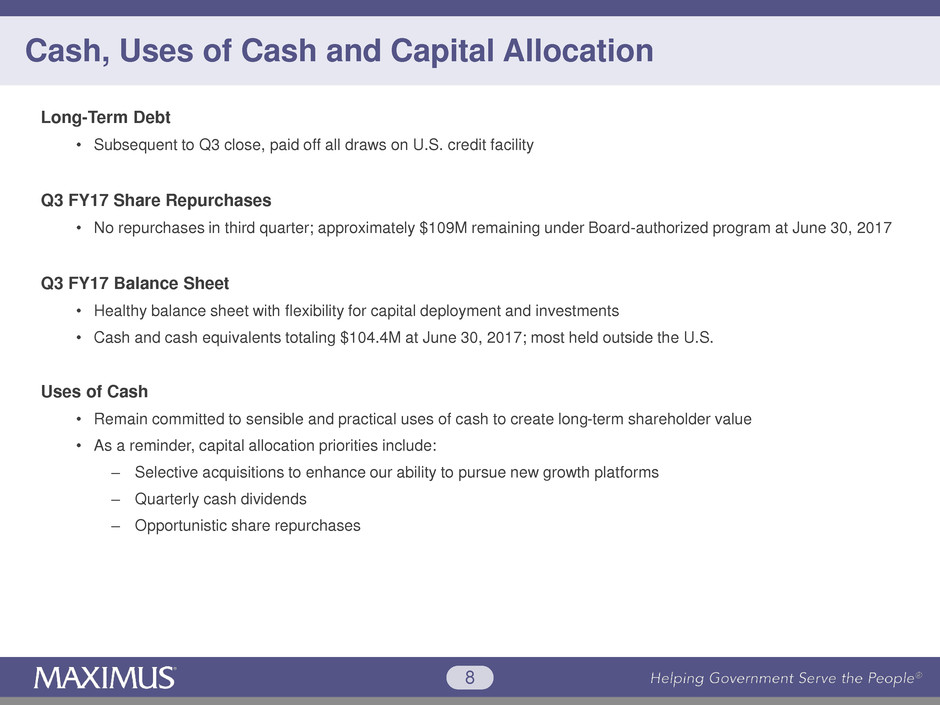

Cash, Uses of Cash and Capital Allocation

Long-Term Debt

• Subsequent to Q3 close, paid off all draws on U.S. credit facility

Q3 FY17 Share Repurchases

• No repurchases in third quarter; approximately $109M remaining under Board-authorized program at June 30, 2017

Q3 FY17 Balance Sheet

• Healthy balance sheet with flexibility for capital deployment and investments

• Cash and cash equivalents totaling $104.4M at June 30, 2017; most held outside the U.S.

Uses of Cash

• Remain committed to sensible and practical uses of cash to create long-term shareholder value

• As a reminder, capital allocation priorities include:

‒ Selective acquisitions to enhance our ability to pursue new growth platforms

‒ Quarterly cash dividends

‒ Opportunistic share repurchases

9

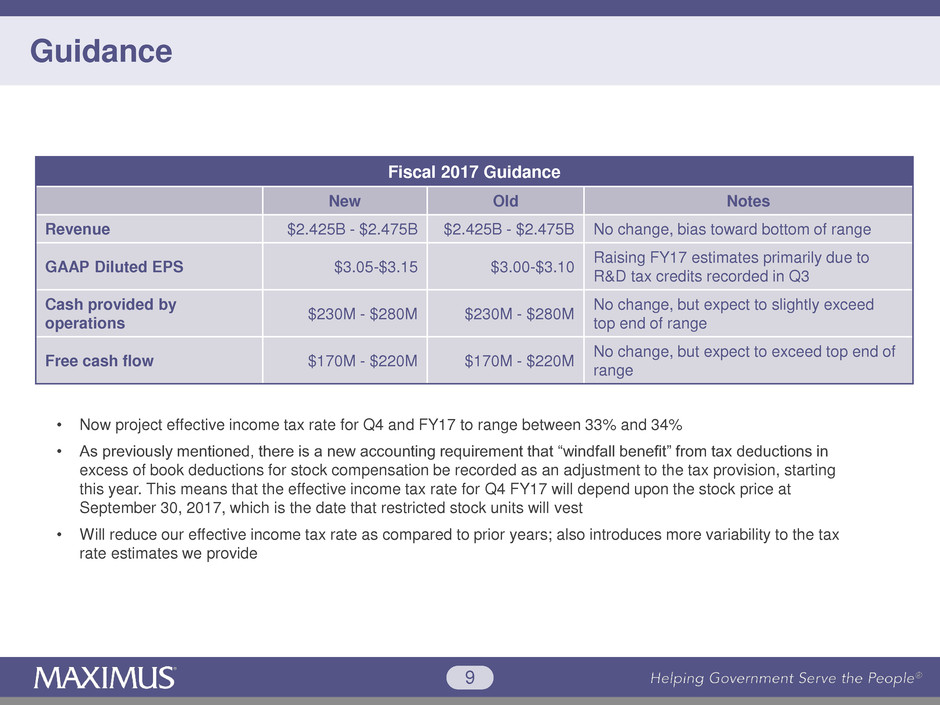

Guidance

Fiscal 2017 Guidance

New Old Notes

Revenue $2.425B - $2.475B $2.425B - $2.475B No change, bias toward bottom of range

GAAP Diluted EPS $3.05-$3.15 $3.00-$3.10

Raising FY17 estimates primarily due to

R&D tax credits recorded in Q3

Cash provided by

operations

$230M - $280M $230M - $280M

No change, but expect to slightly exceed

top end of range

Free cash flow $170M - $220M $170M - $220M

No change, but expect to exceed top end of

range

• Now project effective income tax rate for Q4 and FY17 to range between 33% and 34%

• As previously mentioned, there is a new accounting requirement that “windfall benefit” from tax deductions in

excess of book deductions for stock compensation be recorded as an adjustment to the tax provision, starting

this year. This means that the effective income tax rate for Q4 FY17 will depend upon the stock price at

September 30, 2017, which is the date that restricted stock units will vest

• Will reduce our effective income tax rate as compared to prior years; also introduces more variability to the tax

rate estimates we provide

10

Richard Montoni

Chief Executive Officer

August 3, 2017

Helping Government Serve the People®

11

Good Third Quarter & Remain on Pace for Solid FY17

• Good Q3 with healthy operating margins

and cash flows; remain on pace for a

solid FY17

• Core business remains strong and long-

term macro environment remains favorable

• Today, will address the most common

questions about short- and long-term

growth

12

Short-Term Growth

Our short-term view has not changed

• Still view pause in the industry as temporary, it is impractical

to speculate when we might see a break in the pause. In the

U.S., we are currently seeing:

smaller deal sizes reflecting budget uncertainty

increased delays and longer procurement cycles reflecting

policy uncertainty

less deal flow of opportunities overall

• Staffing shortfalls continue to hinder the decision-making

progress at both federal and state level

• Leads us to believe that single-digit, top-line growth is a more

realistic target in the short term, until new priorities, legislation

and programs have solidified

• MAXIMUS possesses a healthy and stable portfolio, which is

a good foundation to build upon

• Benefitting in the short-term from our stable portfolio and

actively planting seeds for long-term future growth; this

includes new growth opportunities that allow us to augment

and further leverage our core capabilities

13

Long-Term Growth

Management commitment to identify and invest in

long-term growth opportunities

• Over the next five years, the macro environment is

as favorable as it’s been in a long time

• Governments increasingly require solutions to

manage aging populations, individuals with more

complex health needs, and growing caseloads in a

cost-effective and efficient way

• We have ample longer-term opportunities as

governments around the world address these

macro trends

• As we look ahead to the next five years, we are

keenly focused on capitalizing on macro demand

trends and bringing us more in-line with our stated

10% long-term growth target

• While 10% growth is never assured, our three-

pronged approach gives us multiple paths:

1. Growing in our current core markets

2. Moving into the next set of adjacent markets

3. Incorporating new growth platforms

Three Pronged Approach to

Long-Term Growth

Moving into

adjacent

markets

Incorporating

new growth

platforms

Growing in

current core

markets

14

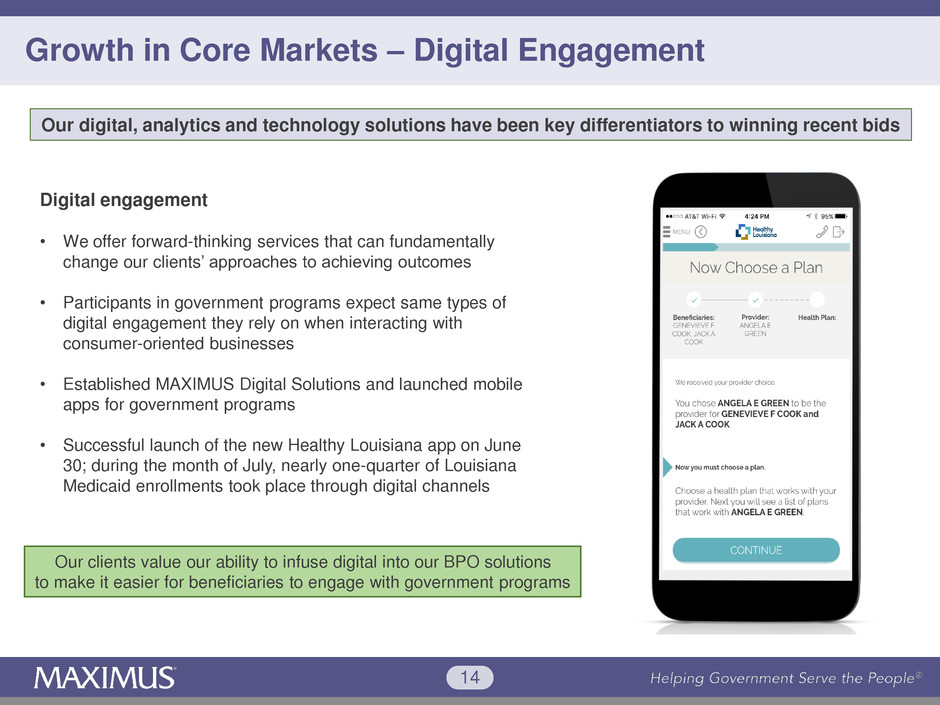

Growth in Core Markets – Digital Engagement

Our digital, analytics and technology solutions have been key differentiators to winning recent bids

Digital engagement

• We offer forward-thinking services that can fundamentally

change our clients’ approaches to achieving outcomes

• Participants in government programs expect same types of

digital engagement they rely on when interacting with

consumer-oriented businesses

• Established MAXIMUS Digital Solutions and launched mobile

apps for government programs

• Successful launch of the new Healthy Louisiana app on June

30; during the month of July, nearly one-quarter of Louisiana

Medicaid enrollments took place through digital channels

Our clients value our ability to infuse digital into our BPO solutions

to make it easier for beneficiaries to engage with government programs

15

Growth in Core Markets – Analytics & Technology

Innovation and technology enables us to operate more efficient and effective programs –

a key priority for clients at all levels of government

These differentiators will play an important role in helping us to continue to grow our core business

Analytics

• Increasing role in service delivery– from operations

optimization, staffing models and performance

management initiatives

• Performance analytics have improved our

operational processes both in the U.S. and abroad

• Clients appreciate how analytics provide improved

outcomes through greater insight into populations

served

Technology

• Allows us to drive efficiencies and improve quality

• By incorporating more process automation into our

solution sets, we lower overall program costs by

reducing number of required staff and reassigning

resources to more complex and high-value tasks

• Have successfully deployed automation to increase

efficiency and quality across a number of projects

16

Adjacent Markets – Long-Term Services & Supports

Emerging Long-Term Services and Supports Market

• Given demographic trend of aging populations with more complex health needs, we anticipate increasing

demand in the emerging Long-Term Services and Supports (LTSS) market

• Our LTSS work is in its infancy with roots tied to our commitment to independence and conflict-free services

• As the market further evolves, governments seek to protect the line between independent assessors,

determining what services are needed and the health care providers delivering care

• Built our conflict-free assessments business in NY off our existing Medicaid enrollment broker platform

− Assessments are for residents seeking home and community-based long-term care services, or have

requirements for intellectual and developmental disability services

− Shift in workforce composition (highly skilled nurses as evaluators and qualified assessors to

determine program eligibility for individuals with disabilities and/or chronic illnesses); contracts with

highly skilled workers serving populations with complex needs can lead to longer client relationships

• Since supplemented LTSS skill sets and experiences through Ascend acquisition

• LTSS portfolio recently grew with new assessment contracts helping state agencies determine the most

appropriate placement and health care needs for program beneficiaries

When management contemplates the next set of adjacencies, we consider our clients’

longer-term visions for reengineering their social programs and delivery mechanisms

17

Adjacent Markets – Geographic Expansion

Singapore Pilot Program

• Another successful path into adjacent markets;

plays a key role in our land and expand strategy

• Often begins with an acquisition or pilot program

where we deliver our core services to a new

population

• Small but strategic workforce services pilot

program in Singapore

• Providing professional career guidance to local

job seekers who are unemployed or seeking

career transitions

• While it’s early days, pilot program start-up went

smoothly; we are pleased to establish a small

foothold in the Asia market

18

New Growth Opportunities

• Entered the U.K. occupational health market through acquisition

• Gained a workforce that included health care professionals delivering health

and well-being services to a new set of public and private sector clients

• Provided the qualifications to win the Health Assessment Advisory Service,

which ultimately created significant tangible, long-term shareholder value

Management continues to identify and implement new growth opportunities, particularly those that support

governments’ ability to address changing demographics, evolving social policy and legislative reforms

• Continue to target new growth opportunities that will play a role for the next five years

• Recently acquired Revitalised, a provider of digital solutions to engage employees

and communities in the areas of health, fitness and well-being

• Revitalised helps to educate and motivate individuals to lead a balanced, healthy

lifestyle through the latest digital technology

• Flagship wellness platform used by clients in both the U.K public and private sector

• Enhances our health and well-being solutions and is a natural complement to our

core global health services

In summary, growing our core, entering into new adjacencies, and incorporating new growth platforms

are three ways MAXIMUS will continue to grow and deliver value for our clients and shareholders.

19

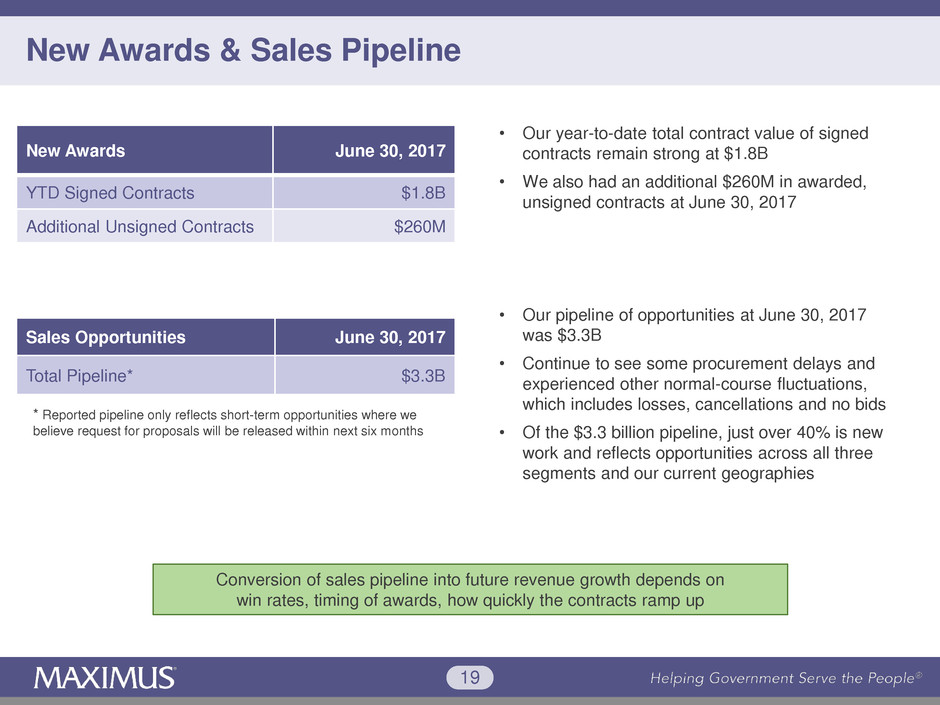

New Awards June 30, 2017

YTD Signed Contracts $1.8B

Additional Unsigned Contracts $260M

Sales Opportunities June 30, 2017

Total Pipeline* $3.3B

* Reported pipeline only reflects short-term opportunities where we

believe request for proposals will be released within next six months

New Awards & Sales Pipeline

• Our year-to-date total contract value of signed

contracts remain strong at $1.8B

• We also had an additional $260M in awarded,

unsigned contracts at June 30, 2017

• Our pipeline of opportunities at June 30, 2017

was $3.3B

• Continue to see some procurement delays and

experienced other normal-course fluctuations,

which includes losses, cancellations and no bids

• Of the $3.3 billion pipeline, just over 40% is new

work and reflects opportunities across all three

segments and our current geographies

Conversion of sales pipeline into future revenue growth depends on

win rates, timing of awards, how quickly the contracts ramp up

20

Conclusion

• Seizing the opportunity during this period of pause and

actively engaged in working all three primary avenues for

growth

• Yesterday’s adjacencies and new growth platforms are

today’s core business – our approach today is no

different than how management has successfully grown

the Company in the past

• Constantly looking for new opportunities as markets

evolve over time; maintain a significant amount of

flexibility as we pursue these opportunities, which include

new geographies, acquisitions or new service offerings

• Our ability to meet our long-term financial and operational

objectives will come from:

Well-timed investments in both organic and acquired

solutions that address macro demand trends

Disciplined delivery and management of these

solutions

Continued focus on achieving the outcomes that

matter most to our clients and the citizens we serve