MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 1

Operator: Greetings and welcome to the MAXIMUS Fiscal 2017 First Quarter Conference Call.

At this time, all participants are in a listen-only mode. A brief question-and-answer session will

follow the formal presentation. If anyone should require Operator assistance during the

conference, please press star, zero on your telephone keypad. As a reminder, this conference is

being recorded.

It is now my pleasure to introduce your host, Lisa Miles, Senior Vice President of Investor

Relations for MAXIMUS. Thank you. Ms. Miles, you may begin.

Lisa Miles: Good morning, and thanks for joining us. With me today is Rich Montoni, Chief

Executive Officer, Bruce Caswell, President, and Rick Nadeau, Chief Financial Officer.

I'd like to remind everyone that a number of statements being made today will be forward-

looking in nature. Please remember that such statements are only predictions and actual events

and results may differ materially as a result of the risks we face, including those discussed in

Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our

most recent 10-K filed with the SEC. The Company does not assume any obligation to revise or

update these forward-looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this

information in its internal analysis of results and believes this information may be informative to

investors in gauging the quality of our financial performance, identifying trends in our results,

and providing meaningful period-to-period comparisons. For a reconciliation of the non-GAAP

measures presented in these documents, please see the Company's most recent quarterly

earnings press release.

With that, I'll hand the call over to Rick.

Rick Nadeau: Thanks Lisa. This morning MAXIMUS reported financial results for the first

quarter of fiscal year 2017. As noted in the press release, results for the quarter were solid, and

with some areas delivering better than expected performance.

For the first quarter of fiscal year 2017, total Company revenue grew 9% to $607.6 million

compared to the same period last year. Most of the growth in the quarter was organic. This was

offset by unfavorable effects of foreign currency translation. On a constant currency basis, total

Company revenue would have grown 12% compared to the same period last year.

Total Company operating margin for the first quarter of fiscal year 2017 was solid at 12.1%. For

the first quarter of fiscal year 2017, net income attributable to MAXIMUS was $46.7 million, and

GAAP diluted earnings per share totaled $0.71. GAAP EPS was better than expected. Much of

the over delivery was tied to solid performance across the portfolio. Most notably, the US federal

services segment was better by approximately $0.04 per share. In addition, restructuring costs

in the UK were less than previously forecasted, and as a result, we picked up an additional

$0.02 per share.

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 2

When comparing to the prior year period, it is important to remember that results in the health

segment were negatively impacted by the timing of a change order that was pushed into the

second quarter of last year. As a reminder, we recognized the costs in the first quarter, but did

not record the associated revenue of approximately $8.6 million and earnings of approximately

$0.08 per share until the change order was signed in the second quarter of fiscal year 2016.

As mentioned in this morning’s press release, we reaffirmed our EPS guidance for fiscal year

2017 of $2.90 to $3.10. We reaffirmed our cash flow guidance, and we updated our fiscal year

2017 revenue guidance to range between $2.425 billion and $2.475 billion. The main driver to

our lower revenue outlook is a recently cancelled contract in the US federal services segment

where we are a sub-contractor. I will provide additional guidance details later in my remarks.

Now, I will speak to segment results starting with health services. First quarter revenue for the

health services segment increased 17% compared to the same period last year. Most of the

growth in the health services segment was organic. This was primarily due to the expansion on

existing contracts, including our increased scope-of-work in New York State. The decrease in

the value of the British pound tempered top line growth. On a constant-currency basis, growth

would have been 21%.

As expected, the health services segment operating margin for the first quarter of fiscal year

2017 increased to 14.7% compared to 9.2% reported for the same period last year. The margin

expansion is attributable to two main factors. First, margins were tempered in the same period

last year due to the aforementioned delayed contract amendment. Second, we realized

forecasted improvements from programs that were ramping up in the last fiscal year, including

the UK Health Assessment Advisory Service contract. We are pleased that the HAAS contract

continues to make solid progress and is still on track to deliver operating margins in our targeted

range. We have made significant process improvements, improved stakeholder relations, and

are pleased that our customer satisfaction now stands at 93%.

I will now address the US federal services segment. First quarter revenue for the federal

segment decreased 3% compared to the prior year. As we discussed last quarter, the lower

revenue was largely driven by significantly lower volumes on a large healthcare contract. This

work is for the Department of Veterans Affairs and MAXIMUS is a sub-contractor on that

contract. As noted in this morning’s press release, we were recently notified that the contract is

being cancelled due to insufficient volumes and it will now end in April, 2017. As I said, this is

the main driver to our revised revenue guidance for fiscal year 2017.

On the bottom line, US federal services segment was better than expected in the first quarter by

approximately $0.04 of diluted earnings per share. This was due to better than projected

volumes on a couple of transaction-based contracts, and to a lesser extent, we also realized

some savings that were tied to automation initiatives. As a result, operating margin for the first

quarter of fiscal year 2017 was 12.7% compared to 7.4% reported for the same period last year.

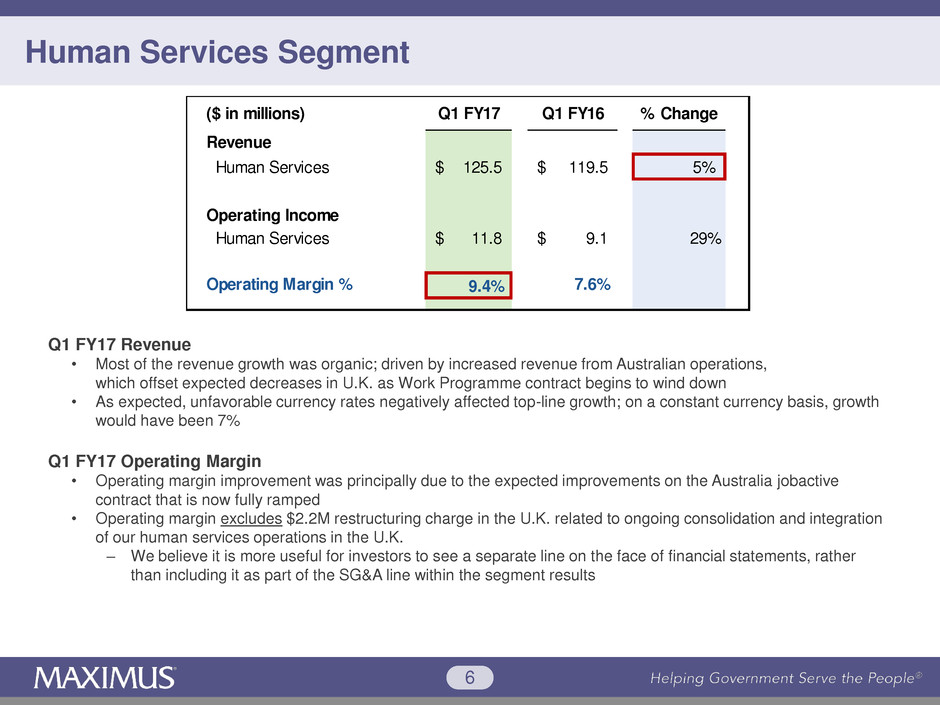

I will now turn to financial results for the human services segment. For the first quarter, revenue

increased 5% compared to last year. Most of the growth in the quarter was organic. This was

driven by increased revenue from our Australian operations, which offset expected decreases in

the United Kingdom, as the work program contract begins to wind down. As expected,

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 3

unfavorable currency rates negatively affected top line growth. On a constant currency basis,

growth would have been 7%.

Human services segment operating margin in the first quarter of fiscal year 2017 was 9.4%

compared to 7.6% reported for the same period last year. The operating margin improvement

was principally due to the expected improvement in the Australia job active contract that is now

fully ramped. It is important to note that segment operating margin excludes the $2.2 million

restructuring charge in the UK. As a reminder, the restructuring is related to the ongoing

consolidation and integration of our human services operations in the United Kingdom. We

believe it is more useful for investors to see a separate line on the face of the financial

statements, rather than including it as a part of the SG&A line within the segment results.

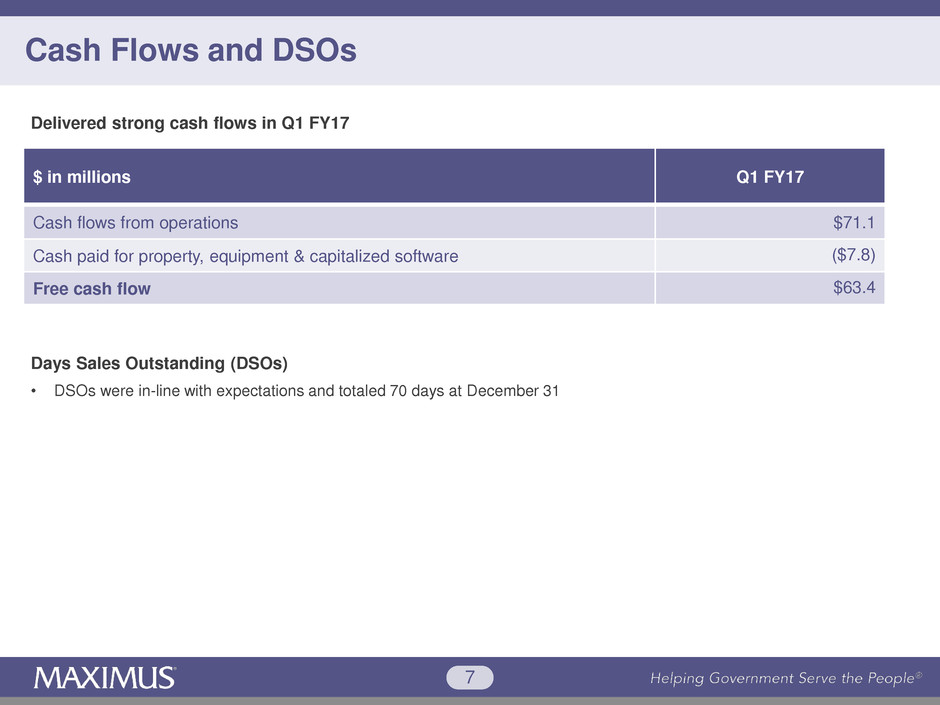

I will now briefly discuss cash flow and balance sheet items. In the first quarter, MAXIMUS

delivered strong cash flows, with cash flow from operations of $71.1 million, and free cash flow

of $63.4 million. Days sales outstanding were in line with our expectations and totaled 70 days

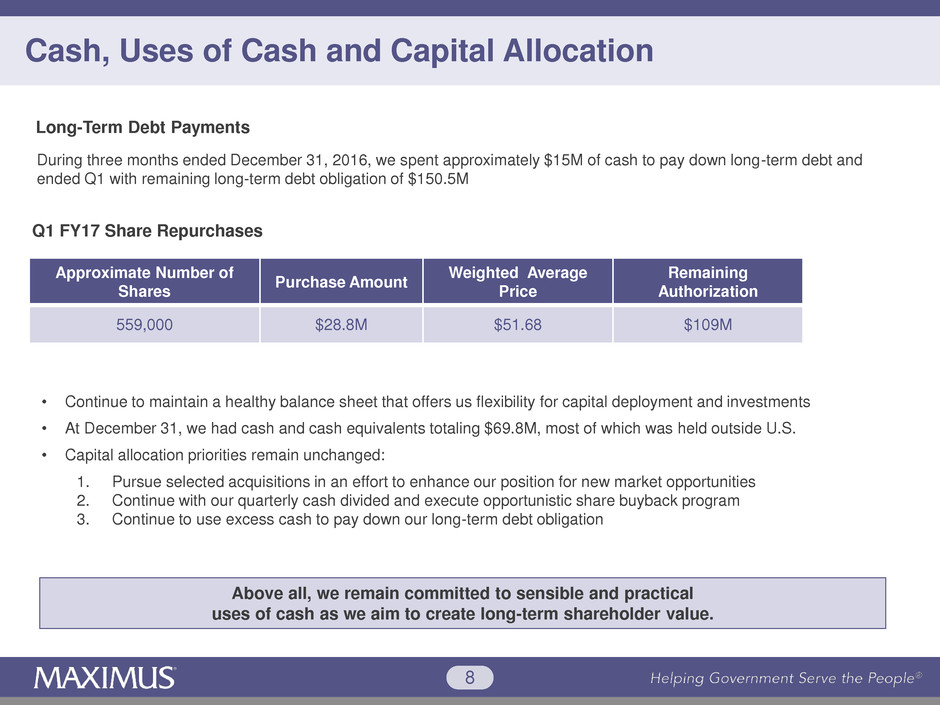

at December 31. During the three months ended December 31, we used cash of approximately

$15 million to pay down our long-term debt, and ended the quarter with a remaining long-term

debt obligation of $150.5 million. We also repurchased approximately 559,000 shares of

MAXIMUS common stock for $28.8 million. The weighted average price was $51.68 per share.

We presently have an estimated $109 million remaining under the Board authorized program.

We continue to maintain a healthy balance sheet that offers us flexibility for capital deployment

and investments. At December 31, we had cash and cash equivalents totaling $69.8 million,

most of which was held outside the United States. Our capital allocation priorities remain

unchanged. First, we will pursue selected acquisitions in an effort to enhance our position for

new market opportunities. Second, we will continue with our quarterly cash dividend and will

execute our opportunistic share buyback program, and lastly, we will continue to use excess

cash to pay down the debt. Above all, we remain committed to sensible and practical uses of

cash as we aim to create long-term shareholder value.

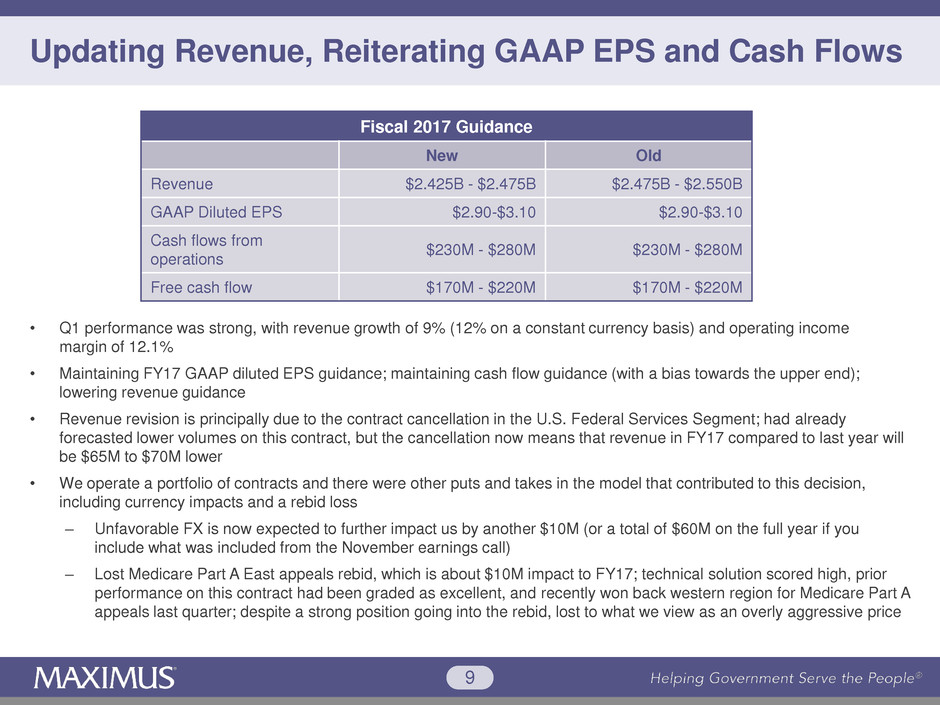

Lastly, I will close my prepared remarks with guidance. We note that our first quarter

performance was strong, with constant currency revenue growth of 12% and an operating

income margin of 12.1%. While we are maintaining our full-year earnings guidance and still

expect GAAP diluted earnings per share to range between $2.90 and $3.10, we are lowering

our revenue range. The revised range of $2.425 billion to $2.475 billion is principally due to the

aforementioned contract cancellation in the US federal services segment. While we already

forecasted lower volumes on this contract, the cancellation now means that revenue in fiscal

2017 compared to last year will be $65 million to $70 million lower, however, it is important to

note that we operate a portfolio of contracts, and there were other puts and takes in the model

that contributed to this decision, including currency impacts and a rebid loss.

Unfavorable foreign currency is now expected to further impact us another $10 million, or $20

million on the full year if you include what we said on our last call. We were recently notified that

we lost our Medicare Part A east appeals work, which will also impact the revenue for the year

by $10 million. Our technical solutions scored high, our prior performance on this contract had

been graded as excellent, and we recently won back the western region for Medicare Part A

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 4

appeals last quarter. Accordingly, we felt we had a very strong position going into the Part A

east rebid, but we lost to what we view as an overly aggressive price.

We are also maintaining our cash flow guidance, but with a bias towards the top end of the

range. We still expect cash flow from operations to be in the range of $230 million to $280

million and free cash flow to range between $170 million and $220 million for the fiscal year

2017. You may recall that the Company is adopting a new accounting standard for stock

compensation in fiscal year 2017. The standard requires companies to record the income tax

benefit or expense as a reduction to the income tax provision as a result of the exercising of

stock options, or vesting of restricted stock units. With the retirement of two of our Directors

effective January 1, 2017, we will recognize a benefit tied to the new accounting standard in the

second quarter of fiscal year 2017. As a result, we are estimating that our effective income tax

rate in the second quarter of fiscal year 2017 will be approximately 34%. For the full year, our

tax rate estimate is unchanged and we still expect it to range between 36% and 37%, with a

bias towards 36%.

Thanks for your continued interest, and now I will turn the call over to Rich.

Richard Montoni: Thank you Rick, and good morning everyone. Overall, we are pleased with

the solid results in the quarter and our full-year outlook for earnings per share, this despite

certain setbacks that led us to trim our revenue outlook for the remainder of the year. With $4

billion of opportunities in our reported pipeline, we see continuing demand for our services and

are keenly focused on capturing new organic growth while protecting our base business. Most

importantly, the long-term macro-economic drivers of rising caseloads and increasing demand

for effective government programs remain unchanged. Common themes have emerged across

all of our markets, as governments tackle changing demographics, decentralization initiatives,

and the need to get value for government spend.

First, as demographics shift, the fundamental need for a wide range of government program

administration, including critical citizen services, has not changed. People are living longer and

have more complex healthcare needs. Many face financial hardships and other barriers that

require a combination of social safety net programs and support into work. At the same time, we

are seeing in some markets an increased focus on citizen responsibility and engagement as a

condition of receiving benefits. Government programs that focus on measurable outcomes can

cost effectively address this need.

Second, we are seeing a shift towards a decentralization of some public programs. We see this

in the US with a proposal of blocked grant funding for Medicaid, and the potential removal of

certain federal mandates. We also see it in the United Kingdom with the devolution of

procurement program management to local authorities. This potential change to funding in

governance mechanics enhances the overall flexibility that state and local authorities can use to

shape their benefit programs.

Third, outsourcing and public/private partnerships continue to serve as a vehicle for cost-

effective solutions. Governments must ensure programs that address societal needs are a good

use of taxpayer dollars and achieve their intended outcomes. By laying out the performance

expectations, rewarding the partners who deliver, governments and citizens benefit from this

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 5

increased accountability. We believe this environment particularly favors companies like

MAXIMUS, who can deliver highly complex government programs in a transparent and

independent fashion.

Moving on to our US operations, we are just starting to see how these macro drivers intersect

with the priorities of the new Presidential administration, demographics in the US, and increased

demand for public benefit programs. Governments at all levels are looking for solutions across a

range of social programs; Medicaid, Medicare, long-term care programs, social security, welfare

to work, nutrition assistance programs and more. Transition periods are often the right time to

propose new ideas that can help governments at all levels achieve their goals.

In many of the President’s proposed directions, we are seeing common areas where MAXIMUS

provides value, such as creating efficiencies to manage the cost of government services;

increasing accountability to demonstrate that programs are achieving their desired outcomes;

promoting individual responsibility, such as co-pays and work requirements with beneficiaries of

health and human services programs; and ensuring the integrity of public programs by better

addressing fraud, waste, and abuse.

While it is still very early in the transition, we anticipate that some of these priorities will become

legislation and regulations, and will then be translated into actions at the program level. Front

and center is the Affordable Care Act, where the discussion has moved from repeal, to repeal

and repair. Congressional leadership have said they are committed to not pull the rug out from

citizens who are being covered by the ACA today, but they have not yet come to consensus on

a tactical plan.

For Medicaid, flexibility appears to be the common denominator. The new administration

reiterated its support for block grants in January, and state leaders are calling for things such as

reciprocity on waivers where states can leverage the pre-approved waiver of another state, less

prescriptive regulations so states can better shape their own programs based on their

demographics and values, and an adequate level of federal funding to achieve their desired

outcomes. It is important to note that these will take time, particularly if legislative changes are

required, or there are changes to funding mechanisms. Depending on the pace of change, this

may impact our growth over the short term, but this doesn’t change the long-term underpinnings

of the macro-demand trends that remain favorable.

Turning now to our operations outside the US where we have seen some movement in the

disability services market, as governments seek to improve ways for engaging and serving

these populations, we recently launched a handful of small, but strategic, employment program

contracts in the United Kingdom where we will be serving people with disabilities and the long-

term unemployed. On the health side of our UK business, we recently won a contract to deliver

mental health and well-being support to the Ministry of Defence Joint Forces Command. While

the contract is small, it does expand our presence into a new department.

Under the three-year contract, our health management subsidiary will deliver an online-based

solution, providing a variety of services to Joint Forces Command personnel. These services

include well-being advice and guidance, clinically validated mental health support, and

interactive tools that enable employees to monitor their own health and well-being. We also

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 6

continue to pursue the available opportunities for the new UK work and health program. We are

working hard on our pursuit for new work in Whales, London, and Manchester.

Moving on to new awards, pipeline, and rebids, our assigned contracts for the first quarter of

fiscal 2017 totaled $462 million. We also had an additional $150 million in awarded, unsigned

contracts at December 31, 2016. Our pipeline of opportunities at December 31, 2016 was $4

billion, sequentially down from the $4.3 billion last quarter. This decline is due, in part, to

contracts converting to new awards, and, as happens in a normal course, a handful of losses.

We’ve also experienced some procurement delays. During the quarter, we had several

opportunities delayed that, in aggregate totaled approximately $250 million. This means that the

$250 million has fallen out of our reported pipeline numbers because they no longer meet the

six-month parameter of our reported pipeline, however we expect that most of these

opportunities will come back into our pipeline over the next 12 months. Delays are quite normal

during any transition. Of the $4 billion pipeline, just under 60% is new work and reflects

opportunities across all three segments and our current geographies. Bear in mind that the

conversion of sales pipeline into future revenue growth will ultimately depend upon win rates,

the timing of awards, how they ramp up, and the rate of recurring revenue.

In summary, we are in a very dynamic environment with emerging political and economic

changes. We firmly believe that the challenges that arise during periods of change often mean

future opportunities for MAXIMUS. The macro trends for our business remain favorable, and we

remain positive about our long-term outlook. We believe MAXIMUS will continue to play a key

role in helping governments around the world address changing demographics and rising

caseloads with more effective and efficient programs that make best use of taxpayer spend, and

with that, we’ll now move on to Q&A. Operator?

Operator: Before we begin the Q&A session, I’ve been informed by Management that they

have a clarification.

Rick Nadeau: We have an incorrect number in our materials. In today’s presentation and in my

prepared remarks, we said that the foreign currency was an incremental $10 million unfavorable

impact. While the incremental impact of $10 million is correct, the number of $20 million for the

full year is not correct. For the full year, the unfavorable foreign currency impact is expected to

be $60 million, not $20 million. We will update the materials when we file our materials in the 8-

K with the Securities and Exchange Commission next week.

We will now begin the Q&A session. Operator?

Operator: Thank you. We will now be conducting the question-and-answer session. Please limit

your one question and one follow-up. If you wish to ask additional questions, you may re-enter

the queue.

If you would like to ask a question, please press star, one on your telephone keypad. A

confirmation tone will indicate your line is in the question queue. You may press star, two if you

would like to remove your question from the queue. For participants using speaker equipment, it

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 7

may be necessary to pick up your handset before pressing the star keys. One moment please,

while we poll for questions.

Our first question comes from Tom Carroll of Stifel. Please proceed with your question.

Thomas A. Carroll: Good morning everybody. Yes, so I just have a point of clarification and

another—a question on seasonality. First, the tax item that you called out in today’s release, I’m

pretty sure that was already captured in your guidance, but I think we had modeled it for fourth

quarter. I guess could you confirm this, especially in light of guidance that didn’t change or go

up commensurate with the tax benefit?

Richard Montoni: We will do that, Tom, and good morning to you. This is Rich. I’m going to ask

Rick Nadeau to field that one.

Rick Nadeau: Hello Tom. Yes, what the—we were referring to is we had two Directors that

retired, and in the second quarter of fiscal year 2017, the quarter that began January 1, 2017,

their restricted stock units that they had deferred became vested, so we did pick up

approximately $0.03 that will be recorded in the second quarter. So, if you use an effective rate

of 34% for the second quarter, I think that will give you what you want that period. We are

indicating that we think the effective tax rate—income tax rate for the full year will still be

between 36% and 37%. It’ll be closer to 36%. That’s why I said with a bias toward the lower

end, so that $0.03 was really incremental.

Thomas A. Carroll: Okay, and this was captured in the initial guidance that you provided to us?

Rick Nadeau: Not the guidance from last quarter, but it is in the guidance today.

Thomas A. Carroll: Okay, and then I have a question on seasonality. Your first quarter

margins, I think, are seasonally the lowest, and they expand sequentially through the year after

that. Has anything changed with that this year? Your margins are pretty strong this quarter, so

would you expect them to grow from here into the subsequent quarters?

Rick Nadeau: Yes, Tom, I think if you look at the history, we do have that—the margins do tend

to get a little better as we go through our fiscal year, so I wouldn’t think that that’s going to be

overly dramatic, but yes, that has been the general pattern that we have seen over the years.

Lisa Miles: Thanks Tom. Next question please.

Operator: Our next question comes from Richard Close of Canaccord Genuity. Please proceed

with your question.

Richard Close: Yes. I just want to hit on the current environment. Rich, you talk about seeing

increase, I guess, in personal responsibility for benefits, I think co-payments around there, and

shift towards decentralized programs. You also made a comment in terms of the pace of change

may impact growth over the short term, and really just trying to flush that out here for the

domestic market, whether you think you’re going to see more opportunities over the course of

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 8

the next one or two years, or is that more offset in terms of program changes that may

negatively impact your business?

Richard Montoni: Richard, I think those are great questions, and I think, in all fairness to the

situation, not just MAXIMUS, but I think almost every company that’s doing business here in the

US recognizes that with the new administration and their sense of urgency and initiatives,

there’s—there remains a number of questions and things to be determined. That being said,

what we are seeing and what we are pulsing is we’re hearing a lot of common themes or

common areas where we believe MAXIMUS provides some pretty significant value. You

touched upon a few of them. In my mind, we’re hearing things such as we need to move forward

and create efficiencies to better manage the cost of government services. We need to increase

accountability to demonstrate that programs are achieving their desired outcomes, and you

know for years we’ve encouraged governments to go towards outcomes-based relationships.

We’re also hearing, and you mentioned these, promotion of individual responsibility, such as co-

pays and work requirements for the beneficiaries of health and human services programs, and

lastly I’d mention there’s serious discussion about the integrity of public programs by better

addressing fraud, waste, and abuse. So, while it’s very early in the transition, we do in fact

anticipate that some of these priorities will become legislation and regulation, and that

eventually they will be translated into program-level actions and requirements, and I think

MAXIMUS is very, very well positioned in that context. So, I think it means that, while the new

administration is finding their way and moving forward there’ll be a short-term pause, but I would

expect that very soon in the short term we will start to see these things translate into

opportunities.

Richard Close: Okay. As a follow-up on that, with respect to the pipeline, have you seen any

new services in terms of maybe new agencies that you potentially contract—any type of new

initiatives that maybe were not there a year ago that offer up an opportunity?

Richard Montoni: I don’t think new agencies—I’m not aware of new agencies per se that we

would pursue. It’s the typical agencies with whom we operate in, we relate, so I expect that it’ll

be the same agencies, however I think the way it will play out is we’re starting to hear specific

initiatives as they move forward, and they’re not solidified yet, but I go back to my original

answer where we expect that those ideas will translate into action and program requirements.

Bruce, would you—Bruce Caswell’s here and Bruce also operates in this space.

Bruce Caswell: I would absolutely agree. I think we’re—for competitive reasons I don’t—we

shouldn’t name specific opportunities in specific agencies, but we are starting to see interest

expressed by those agencies for information from the vendor community to support plans and

programs that were part of the general policies articulated by the administration as they were on

the campaign trail, and now as they’ve entered office, so we’re starting to see those interests

begin to be expressed in the form of procurement activity.

Lisa Miles: Richard, thanks for your question. Next question please.

Operator: Our next question comes from Brian Kinstlinger of Maxim Group. Please proceed

with your question.

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 9

Brian Kinstlinger: Great, thank you. In terms of federal, maybe Rich, can you talk about the

pipeline and growth opportunity outside, and then outside of the contract cancellation, maybe

how you see the progress versus where you thought you would be in your positioning pipeline

and growth after acquiring Acentia. I know it was going to be a long-term game, not a short-term

game.

Richard Montoni: I’d be glad to do that Brian. Good question. It’s been about, I think, two years

since we acquired Acentia, and when we acquired Acentia, we knew that it would take time to

gain traction with new opportunities resulting from that acquisition, and at this point in time, I

would say it may take a little bit—it may take more time than we originally expected, particularly

given the impacts of the new administration, however we do have our business teams fully

integrated. They’re actively pursuing many new opportunities, so I would classify that as we’ve

really got good traction where we need it.

Our federal pipeline is, in fact, strong. We have new BPO business opportunities where we can

leverage the MAXIMUS core capabilities with the Acentia delivered strategic IT services

opportunities, and most importantly, we’re using Acentia contract vehicles to strengthen our

bids. We are finding that technology continues to play a very important role in our solutions, and

Acentia’s strong suit is technology, so I find it very comforting when we go to market with a BPO

bid, that we’ve got a strong element of IT capability that’s brought to the table by Acentia. So, I

think we’re still on target. It may take a little more time, Brian.

Brian Kinstlinger: Great, and then a follow-up I have and then I’ll get back in the queue,

related—can you talk about the profitability of that VA contract? I may have missed it if you did

say that, and is that loss the offsetting factor of your tax benefit?

Richard Montoni: Glad to answer that and Rick Nadeau’s anxious to do that.

Rick Nadeau: Yes. Hi Brian. Yes, that contract was in the normal range that we have of 10% to

15%. It started a little slower in the first year and it was—but it was in that normal 10% to 15%

range.

Lisa Miles: Next question please.

Rick Nadeau: I think, Brian, you had a second part of that question. I’m not sure I followed it.

Could you ask me that again? He’s gone? Okay. Sorry.

Lisa Miles: Next question please.

Operator: Our next question comes from Charlie Strauzer of CJS Securities. Please proceed

with your question.

Charles S. Strauzer: Hi. Good morning. Just picking up on Richard and Brian’s discussion with

you about the pipeline, and given the—how President Trump has basically been acting with

swift urgency in terms of putting out new mandates, have you seen—I know you’ve said there’s

some delays in the pipeline for about $250 million, but have you seen a pickup in pace in terms

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 10

of the urgency from some of the agencies you’re talking to, and have you had conversations

with the administration as well in terms of potential opportunities down the road?

Richard Montoni: Well, there’s two answers. You’ve got two questions in there, Charlie. Have

we seen any specific actions by these agencies, and then two, what are we pulsing out there

with the agencies with whom we deal, and I would say as it relates to the first part of your

question, no, we really haven’t seen any specific impact or action at the program level for the

programs that we operate, so nothing to the extent of the Executive Order, any immediate

impact it had as it relates to the seven countries where there’s immigration action. We haven’t

seen anything such as that.

As you would expect, we have a very active program to interface with the new administration, all

the way up to the Secretary level, and we’re very engaged. I think we’ve got a very good pulse

in terms of what’s being discussed and where we’re headed. I’m going to ask Bruce to chime in

here and share with you a little bit more color in terms of what we see happening in that space.

Bruce?

Bruce Caswell: I think that’s right. I think we’re finding, obviously, that a number of the Cabinet

Secretaries still need to be confirmed and go through that process. In fact with Tom Price next

up at HHS, there’s been some speculation that we’ll get a bit more clarity on the Trump

administration’s plans for ACA repeal/replace once Secretary Price is in place. So, I think part of

it is just gaited by getting those Executives in place and their Deputy Secretaries and the

Cabinet Secretaries in the programmatic staff before we’ll start to get a bit more clarity.

I think it was Tennessee Senator Bob Corker said just in the last couple of days, as it relates to

the Affordable Care Act, “There’s really no consensus from my vantage point. There is not a

consolidation around a particular thought yet,” so there’s a lot yet to be determined and we’re

monitoring it closely and staying engaged, and on occasion we may see things that are in early

stages like a request for information to industry, but nothing, as I said previously, in the form of

formal procurements that reflect the implementation of the policy at this point.

Charles S. Strauzer: Thank you very much.

Bruce Caswell: You bet.

Lisa Miles: Thanks Charlie. Next question please.

Operator: Our next question comes from Frank Sparacino of the First Analysis. Please proceed

with your question.

Frank Sparacino: Hi guys. I know we kind of talked around this, but I just want to go back to

the pipeline, and I guess more on, sort of, visibility, given the transition that’s going on, and how

do you get confidence in your ability this year to convert some of these contracts?

Richard Montoni: Frank, this is Rich. I think that’s a great question, and when we think about

growth and we think about the pipeline, it’s related, but the pipeline discussion is shorter term in

nature, and I’m going to talk about the longer-term thought process we have as it relates to

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 11

growth, and I think this is most apropos for MAXIMUS’ model, and when we think about long-

term growth, we’ve always said that there will be years where we have super growth and we’ll

have years where there’s less than average growth. In recent years, as you know, we’ve had

very, very favorable legislation, reform efforts, new programs in the US and other countries,

which in the long term, it’s really—those are short-term variables that tend to fluctuate year-to-

year, and I think that’s sort of where we are, and I’m going to come back to that as it relates to

pipeline, but when we consider long-term growth, we go back to the long-term growth drivers,

and you know them well. It’s the demographics in the intersection with government fiscal

situations. We think those are inevitable, irreplaceable drivers. They’re going to be here for a

very, very long time.

How it plays out in the pipeline, which is a shorter-term look at things, when we look at the pipe,

we look at the aggregate amount of the pipe, and $4.3 billion going to $4 billion sequentially,

while it’s down, we do have some wins that naturally that’s a good reason why pipeline goes

down. We did have some losses, and losses occur in the normal course, and I do think we had

roughly $250 million of impacts where things went out of the pipeline, moved to the right. I

expect that they will come back. So, I think the pipeline is steady state for the most part.

Naturally Management will continue to refresh the pipeline with best efforts.

I think ultimately how much of that translates into revenue depends upon four things. It depends

upon our win rate. It depends upon the timing of awards, and naturally how they ramp, and in

addition, the rate of recurring revenue. If we’ve got some revenue that’s not recurring, such as

this VA contract, it has a bit of an impact into how much of the pipeline translates into organic

growth. So, when I think about it, I think the pipeline’s at a good level. I think it positions us to do

well as we move forward. It’s not a foregone conclusion because we do have to focus on

winning our fair share and then ramping those projects up. I hope you find that helpful Frank.

Lisa Miles: Thanks Frank. Next question.

Frank Sparacino: Yes. Thanks.

Richard Montoni: You bet.

Operator: Our next question comes from Shane Svenpladsen of Avondale Partners. Please

proceed with your question.

Shane Svenpladsen: Good morning. It looks like there’ve been a handful of pre-admission

screening and resident review bids out lately. I’m just curious as to how your Ascend business is

doing there; any updates on new wins since acquiring that business?

Richard Montoni: Well, I’m going to ask Bruce to answer that in a minute, but I would say that

the dynamics we see in that space I see as a subset of appeals on assessments, and we’ve

been, I think, a major player for, oh, close to a decade in that space. I think our independence is

insurmountable and is very, very formidable, and I think the assessments space is very exciting

in general in terms of short-term dynamics. Bruce, anything you’d like to add on that?

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 12

Bruce Caswell: Sure. Shane, good morning. Thanks for the question. I would say, first of all,

we agree with you. Yes, there’s been a number of good paths or opportunities out in the market

and we were very pleased that the Ascend business won their single largest customer, the

Tennessee customer, won that rebid, and in winning that rebid, expanded the types of reviews

they’re doing from level one to also include level two. So, what we’re pleased to see is there’s

also, as these bids come out, additional assessment programs being added to make these

contracts much more comprehensive, and that plays to an organization like MAXIMUS, with

Ascend as our partner, that can handle larger, more complicated, multi-program assessments.

So, we’re really pleased with the performance to date and we’re very pleased with what we’re

seeing in the pipeline.

Shane Svenpladsen: That’s good to hear, and then just as a follow-up, with respect to the

Umbrella Agreement under which the Work and Health program is being bid, it appeared that

both MAXIMUS and the Remploy subsidiary put in bids in each of the six regions, but

MAXIMUS didn’t win any and Remploy only won one. Is there anything that’s changed there in

terms of either what the government is looking for or competitive bidding behaviors on parts of

your competitors? Have they explained that?

Richard Montoni: I think that’s a great question, Shane. We’re going to ask Bruce to field that

one.

Bruce Caswell: Sure Shane. Well, as it relates to the Work and Health program, you’re correct.

An interesting point that came out, I think it was in an article written by The Guardian, was that

the past performance component, as it weighed into the evaluation, was only 4.8%, so that

really opened up the market for vendors that had not been previously performing, or maybe not

performing at a high level on the Work program, or the Work Choice program, to become

entrants in the market.

As we indicated, on that specific program we were disappointed, clearly, with the outcome, and

felt that our bid fell short of our expectations in that area, but at the same time, when you look at

the total expected spend, and don’t forget, this is a framework off of which there’ll be call-off

opportunities in the future, the £69 million in contract value compares to what historically

through the Work Choice and the Work program, at its peak was about £500 million. So, we’ve

said for some time that the program will be shrinking and we factored that into our guidance and

so forth, and also, quite importantly, outside of this program, the two largest areas, London and

Manchester, will be procured separately by those local authorities, and when you look at that

£69 million total value, those being the large areas—largest areas, you could imagine the

largest component annual contract values will be for those areas. That’ll be a separate

competition, and as Rich mentioned in his remarks, we’re very focused, not just on London and

Manchester, but on the Whales opportunity that we have in front of us off of the framework.

Hope that provides some context.

Lisa Miles: Thanks Shane. Next question please.

Operator: Your next question comes from Allen Klee of Sidoti. Please proceed with your

question.

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 13

Allen Klee: Yes, hello. For your US federal segment, you commented that your operating

margins were mostly benefited from some transaction-based contracts. I’m just wondering if you

can give us a sense of the duration of those contracts, or do we think of this as kind of a longer-

term recurring type of thing, and then second, for your Affordable Care business, could you just

give us a sense of how it’s trended toward—in the quarter? Thank you.

Richard Montoni: We’re glad to do that. I think Rick Nadeau can answer both of those. To be

clear, your first question is a little more color on the margin for our federal business in the

quarter and the sustainability, the root cause of it, and then what we’re seeing from the

Affordable Care Act type business.

Rick Nadeau: Yes, you’re right. We did receive a benefit from a couple of volume-based

contracts in our federal segment, and we had in that particular case very good volume. As we’ve

tried to explain in the past, volumes do matter significantly to some contracts, and sometimes

it’s positive to a specific contract and sometimes negative. In this particular case, those are two

contracts that we have within the federal government—US federal government segment and we

had good volumes on it. Those are long-term contracts, but the volumes do not necessarily—

the volumes will fluctuate somewhat from quarter-to-quarter. So, we just happen to have very

good volumes on both of those contracts this quarter, but I think the margin this quarter is a little

higher than what you’ll see on a going-forward basis.

With respect to the second part of your question, we do not see a substantial change in the

revenue that we tag as being attributable to the Affordable Care Act this quarter.

Lisa Miles: Thanks Allen. Next question please.

Operator: Our next question is a follow-up from Brian Kinstlinger of Maxim Group. Please

proceed with your question.

Brian Kinstlinger: Great, thanks. If you look at the bookings trends on a trailing 12 months

basis, or on a quarterly basis, it’s down 30%, and that’s been going on for a few quarters, but

what I want to do, if we could, is maybe exclude the re-competes in there and maybe talk about

what the trend looks like year-over-year if we did adjust for that.

Richard Montoni: Okay. Well, Brian, I think as you know, we don’t disclose the two separately,

but I would say as it relates to rebids and—rebids in particular, we—actually there wasn’t much

up for rebid in this particular quarter. I think we had one situation up for rebid, and we’ve

mentioned that we were not successful in that particular situation. It was a cost—it was a

situation where, frankly, we had someone who bid what we think was a very, very low price. I

think it’s an isolated situation, but in general I think we’re in a good situation in that what we do

look at and what we do disclose is how much of that pipeline is new work versus recurring work,

and I believe at this point in time we’re—over 50% of the pipeline represents new work from a

total contract value perspective. That’s historically what we’ve disclosed, Brian, and I think it

puts us in a good position in terms of delivering some organic growth as we move forward.

Brian Kinstlinger: I guess just as a follow-up, if I looked at the trailing 12 months versus the

previous 12 months, since the awards are down so much, was that previous 12 months a

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 14

significant rebid year, for example, looking at fiscal ’15, which would be the majority of that

trailing 12 months? Was that a very large year in terms of re-competes, when you did $3.4

million in billing and bookings?

Richard Montoni: Yes, I think ’15 was a very significant year in terms of rebids. Sixteen, I think,

was a relatively light year. In fact, ’15, I believe, had Texas in there, which as you know, is a

very large contract.

Brian Kinstlinger: Right.

Richard Montoni: Fifteen is relatively light, and certainly, year-to-date ’17 is very, very light.

Overall I think ‘17’s going to be a light year for rebid work as well.

Brian Kinstlinger: Great, thanks Rich.

Lisa Miles: Thanks Brian.

Richard Montoni: You bet.

Lisa Miles: Next question please.

Operator: Before we move to the next question, I would like to remind all participants that if

they would like to ask a question, please press star, one on your telephone keypad.

Our next question is a follow-up from Tom Carroll of Stifel. Please proceed with your question.

Thomas A. Carroll: Hey there. Yes, thanks for the follow-up. I wanted to—high-level question,

if we think back to the healthcare reform debate before the Affordable Care Act that basically led

to increased contract opportunity for MAXIMUS, if we apply that timeline to today, when would

you expect to start seeing increased RFP activity that you guys are alluding to?

Richard Montoni: Well, yes, Bruce and I will tag team on this one. It’s a very interesting high-

level question. To recap the question, you’re curious to know if we map over before the

Affordable Care Act, what sort of discussions, activities, and there certainly was. It’s an

important thing to remember that there was a lot of discussion about healthcare reform before

the Affordable Care Act came into being. Bruce, what are your—what’s your recollection in

terms of timing on that?

Bruce Caswell: Well, I mean I think it was probably from when the legislation passed to when

we really started seeing RFP activities, about a year, maybe between 12 and 18 months,

because, of course, we had to get into the regulatory stage and get regulations established, and

then a lot of protocols established to the states in terms of how they would interact with the

federal government, and don’t forget, the first set of opportunities there, the first real RFPs were

related much more toward planning and the planning grants and so forth that the states got, so

it’s not a perfect analog to where we find ourselves right now, because obviously with any

activities around repairing, and then potentially replacing elements of the Affordable Care Act,

things could move on different timelines.

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 15

A case in point would be—and there was—actually there have been a number of fascinating

articles out there. I’m sure you’ve read some about what can be accomplished with 51 votes

versus what would take 60 or more votes, and there is some thinking that elements of the repair

could be accomplished as part of a reconciliation process requiring only 51 votes, and if it’s

possible to move in an expeditious fashion forward with some of the revisions to Medicaid, and

there’s been a lot of talk about block grants and Rich has mentioned that, our view and our

perspective would be that that would devolve authority to the states and give states the ability to

function in a way where they’re not then dependant on a protracted waiver process, so you

could see state-level RFP activity on a faster timeframe than you would have under the

Affordable Care Act, just given that we’re really modifying something that’s already in place.

When we’ve talked to our clients, our clients have said the thing about block granting, though, is

that nobody can really agree on how to establish the baseline, and whether it’s done on just a

snapshot of prior spend or whether it really becomes a per capita model, and the per capita

model sets more of a ceiling than a block grant, so I think as our clients handicap it, they will be

inclined to move forward with waivers and seek broader waiver authority, knowing that block

granting could be, kind of, the second phase of that. So, I guess my overall view would be

there’s some likelihood that we would see RFP activity sooner than we did under the Affordable

Care Act, because, quite frankly, we’re modifying existing structures and existing programs

rather than having to go through a formal design/development process as we did under ACA.

Does that help?

Thomas A. Carroll: Yes, very helpful. That’s a very good response. Thank you.

Lisa Miles: Any other questions Tom?

Thomas A. Carroll: No, that’s it.

Lisa Miles: Okay, great. Next question please.

Operator: Our next question is a follow up from Richard Close of Canaccord Genuity. Please

proceed with your question.

Richard Close: Yes. I’d like to jump off on that last discussion, Bruce, in talking about state-

level Medicaid. Obviously you guys benefited from Medicaid expansion in certain states.

Obviously did not necessarily benefit in certain states where you had contracts in terms of—that

decided not to expand. In talking—obviously those states are at a disadvantage. What are your

thoughts in terms of how they get made whole, maybe, on Medicaid as opposed to states that

did expand, and thoughts on that, whether that could be an opportunity, sort of a back-door

expansion in states like Georgia or Texas, Florida, Tennessee even?

Bruce Caswell: It’s a great question. Thanks Richard, so some thoughts on that. Number one, I

think that you’re seeing there are certain Republican governors out there that have gone

through expansion that are advocating pretty strongly that expansion be sustained in whatever

form the repair or replacement legislation takes. Most recently, as an interesting data point,

Governor Kasich in Ohio has included Medicaid expansion, the ongoing sustainment of it, in his

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 16

2017/2018 budget. So, for those states that have it, that—I think their view would be, if we’re

going to ultimately move to block grants, that’s a good thing, and there’s a debate raging right

now as to whether, for example, the baseline would include the expansion population or not, so

if you did it, you’re probably in a better position to argue for a higher funding level in your block

grant than if you didn’t.

Then comes the question about states that haven’t done it, and how would they go about

addressing it? I guess our view would be, while expansion itself is not—has not been,

obviously, wildly popular among the Republican party and the Republican governors, there’s a

point on Page 3 of the Paul Ryan summary plan that kind of speaks to this, about bringing

Medicaid into the 21st Century, and it says, “Instead of shackling states with more mandates,

our plan empowers states to design Medicaid programs that best meet their needs,” and so I

think that’s another way of saying block granting and devolving authority to states and giving

them the ability to design Medicaid programs that meet the unique demographic requirements

and market requirements of their populations is kind of what we would see on the horizon. In

that context, I think it’s kind of expansion by another name.

If you’re giving governors—it begins with the funding, but then if you’re giving the governors

broad authority to design how those programs will function and incorporate components like the

personal responsibility elements, maybe some of the health savings account like things that

we’ve seen in Indiana and Michigan, where parenthetically MAXIMUS has a great deal of

experience operating those programs for those governors, then I think you could see a broad

array of population, above the standard 100% of the federal poverty level being served. It’ll

come down to what the governors then try to put into the programs. Like, for example, I think it’s

the Helping Indiana Plan 2.0 anticipates a $20 payment for any individual in the expansion

population, so that would be up to 138% of the federal poverty level.

That itself is anticipated to generate $200 million in savings for the states. So, as the governors

are thinking about all this they’re trying to balance the pot of money they’ll get, the fact that it’s

going to be kind of capped from a federal perspective, and then if a gap opens up between their

needs, how do they kind of close the financial impact of that gap, and they’ll have to balance

that with those types of requirements. So, I think the answer to the back-door expansion which

you mentioned is probably block granting.

Richard Close: Just sort of follow-up to that, can you remind us how many states that you guys

are helping with Medicaid in some fashion, and how many of those expanded or did not

expand?

Bruce Caswell: Well, the answer to your first question is, we serve as the Medicaid managed

care enrollment broker in 22 states, so that’s kind of the broad array where we help enroll

individuals into managed care plans, and that has grown, as you are well aware, into

incorporate other individuals, developmentally disabled population, intellectually disabled

population, age/blind disabled populations, and so forth. In a subset of those states, we also

provide eligibility support services to the Medicaid programs, and I will have to get back to you

with the exact number of expansion states, but the largest ones, from a volume perspective, that

have expanded would be New York and California; and then certainly Michigan, as we’ve

MAXIMUS First Quarter Fiscal Year 2017 Earnings Call

February 9, 2017

Page 17

supported their program; and Pennsylvania, probably the top four, although, of course we

support Vermont and other states like that, smaller ones.

Of the states—you probably would ask the, kind of, other side of the coin question, which is

where do you operate Medicaid programs that haven’t expanded that could present upside, and

that would include places like Texas and Illinois.

Lisa Miles: Thanks Richard.

Operator: This concludes the question-and-answer portion of today’s call. You may disconnect

your lines at this time and we thank you for your participation.

1

Rick Nadeau

Chief Financial Officer

February 9, 2017

Helping Government Serve the People®

2

Forward-looking Statements & Non-GAAP Information

These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along

with listening to or reading a transcript of the comments of Company management from the Company’s most recent

quarterly earnings conference call.

This document may contain non-GAAP financial information. Management uses this information in its internal

analysis of results and believes that this information may be informative to investors in gauging the quality of our

financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons.

These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For

a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the

Company’s most recent quarterly earnings press release.

Throughout this presentation, numbers may not add due to rounding.

A number of statements being made today will be forward-looking in nature. Such statements are only predictions

and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC

filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed

with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements

to reflect subsequent events or circumstances.

3

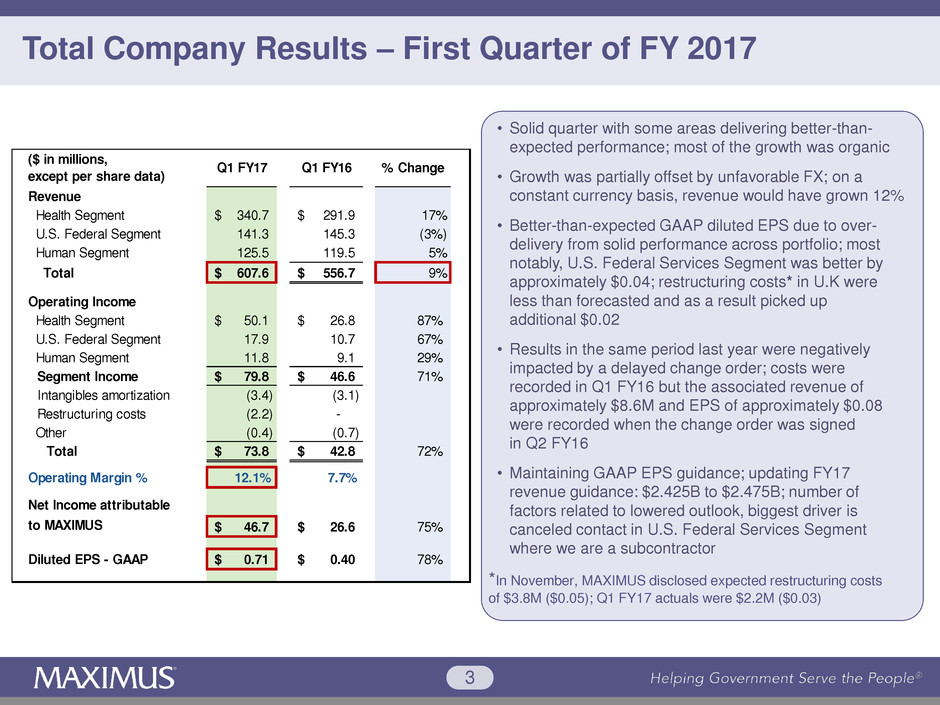

Total Company Results – First Quarter of FY 2017

• Solid quarter with some areas delivering better-than-

expected performance; most of the growth was organic

• Growth was partially offset by unfavorable FX; on a

constant currency basis, revenue would have grown 12%

• Better-than-expected GAAP diluted EPS due to over-

delivery from solid performance across portfolio; most

notably, U.S. Federal Services Segment was better by

approximately $0.04; restructuring costs* in U.K were

less than forecasted and as a result picked up

additional $0.02

• Results in the same period last year were negatively

impacted by a delayed change order; costs were

recorded in Q1 FY16 but the associated revenue of

approximately $8.6M and EPS of approximately $0.08

were recorded when the change order was signed

in Q2 FY16

• Maintaining GAAP EPS guidance; updating FY17

revenue guidance: $2.425B to $2.475B; number of

factors related to lowered outlook, biggest driver is

canceled contact in U.S. Federal Services Segment

where we are a subcontractor

*In November, MAXIMUS disclosed expected restructuring costs

of $3.8M ($0.05); Q1 FY17 actuals were $2.2M ($0.03)

Revenue

Health Segment 340.7$ 291.9$ 17%

U.S. Federal Segment 141.3 145.3 (3%)

Human Segment 125.5 119.5 5%

Total 607.6$ 556.7$ 9%

Operating Income

Health Segment 50.1$ 26.8$ 87%

U.S. Federal Segment 17.9 10.7 67%

Human Segment 11.8 9.1 29%

Segment Income 79.8$ 46.6$ 71%

Intangibles amortization (3.4) (3.1)

Restructuring costs (2.2) -

Other (0.4) (0.7)

Total 73.8$ 42.8$ 72%

Operating Margin % 12.1% 7.7%

Net Income attributable

to MAXIMUS 46.7$ 26.6$ 75%

Diluted EPS - GAAP 0.71$ 0.40$ 78%

($ in millions,

except per share data)

Q1 FY17 Q1 FY16 % Change

4

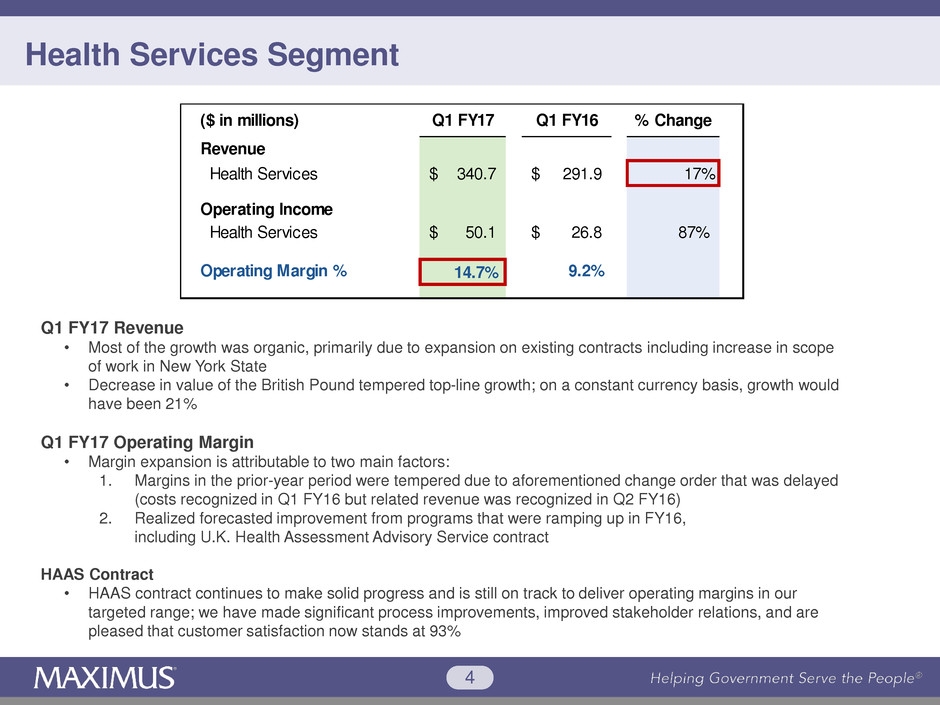

Health Services Segment

Q1 FY17 Revenue

• Most of the growth was organic, primarily due to expansion on existing contracts including increase in scope

of work in New York State

• Decrease in value of the British Pound tempered top-line growth; on a constant currency basis, growth would

have been 21%

Q1 FY17 Operating Margin

• Margin expansion is attributable to two main factors:

1. Margins in the prior-year period were tempered due to aforementioned change order that was delayed

(costs recognized in Q1 FY16 but related revenue was recognized in Q2 FY16)

2. Realized forecasted improvement from programs that were ramping up in FY16,

including U.K. Health Assessment Advisory Service contract

HAAS Contract

• HAAS contract continues to make solid progress and is still on track to deliver operating margins in our

targeted range; we have made significant process improvements, improved stakeholder relations, and are

pleased that customer satisfaction now stands at 93%

Revenue

Health Services 340.7$ 291.9$ 17%

Operating Income

Health Services 50.1$ 26.8$ 87%

Operating Margin % 14.7% 9.2%

($ in millions) Q1 FY17 Q1 FY16 % Change

5

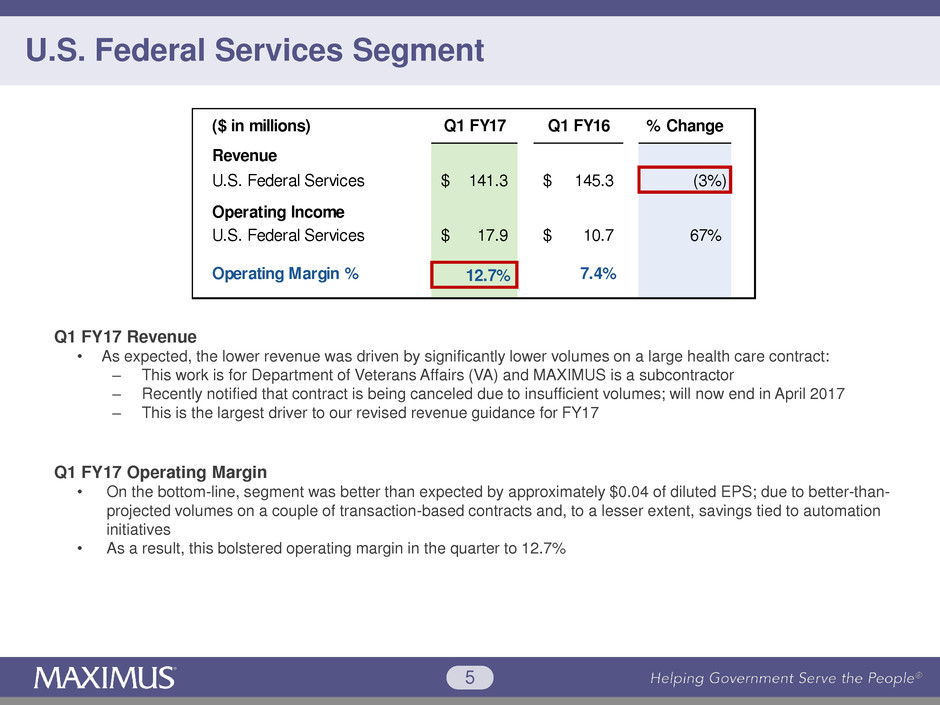

U.S. Federal Services Segment

Q1 FY17 Revenue

• As expected, the lower revenue was driven by significantly lower volumes on a large health care contract:

‒ This work is for Department of Veterans Affairs (VA) and MAXIMUS is a subcontractor

‒ Recently notified that contract is being canceled due to insufficient volumes; will now end in April 2017

‒ This is the largest driver to our revised revenue guidance for FY17

Q1 FY17 Operating Margin

• On the bottom-line, segment was better than expected by approximately $0.04 of diluted EPS; due to better-than-

projected volumes on a couple of transaction-based contracts and, to a lesser extent, savings tied to automation

initiatives

• As a result, this bolstered operating margin in the quarter to 12.7%

Revenue

U.S. Federal Services 141.3$ 145.3$ (3%)

Operating Income

U.S. Federal Services 17.9$ 10.7$ 67%

Operating Margin % 12.7% 7.4%

($ in millions) Q1 FY17 Q1 FY16 % Change

6

Human Services Segment

Q1 FY17 Revenue

• Most of the revenue growth was organic; driven by increased revenue from Australian operations,

which offset expected decreases in U.K. as Work Programme contract begins to wind down

• As expected, unfavorable currency rates negatively affected top-line growth; on a constant currency basis, growth

would have been 7%

Q1 FY17 Operating Margin

• Operating margin improvement was principally due to the expected improvements on the Australia jobactive

contract that is now fully ramped

• Operating margin excludes $2.2M restructuring charge in the U.K. related to ongoing consolidation and integration

of our human services operations in the U.K.

‒ We believe it is more useful for investors to see a separate line on the face of financial statements, rather

than including it as part of the SG&A line within the segment results

Revenue

Human Services 125.5$ 119.5$ 5%

Operating Income

Human Services 11.8$ 9.1$ 29%

Operating Margin % 9.4% 7.6%

($ in millions) Q1 FY17 Q1 FY16 % Change

7

Cash Flows and DSOs

$ in millions Q1 FY17

Cash flows from operations $71.1

Cash paid for property, equipment & capitalized software ($7.8)

Free cash flow $63.4

Days Sales Outstanding (DSOs)

• DSOs were in-line with expectations and totaled 70 days at December 31

Delivered strong cash flows in Q1 FY17

8

Cash, Uses of Cash and Capital Allocation

Q1 FY17 Share Repurchases

Approximate Number of

Shares

Purchase Amount

Weighted Average

Price

Remaining

Authorization

559,000 $28.8M $51.68 $109M

• Continue to maintain a healthy balance sheet that offers us flexibility for capital deployment and investments

• At December 31, we had cash and cash equivalents totaling $69.8M, most of which was held outside U.S.

• Capital allocation priorities remain unchanged:

1. Pursue selected acquisitions in an effort to enhance our position for new market opportunities

2. Continue with our quarterly cash divided and execute opportunistic share buyback program

3. Continue to use excess cash to pay down our long-term debt obligation

Above all, we remain committed to sensible and practical

uses of cash as we aim to create long-term shareholder value.

During three months ended December 31, 2016, we spent approximately $15M of cash to pay down long-term debt and

ended Q1 with remaining long-term debt obligation of $150.5M

Long-Term Debt Payments

9

Updating Revenue, Reiterating GAAP EPS and Cash Flows

Fiscal 2017 Guidance

New Old

Revenue $2.425B - $2.475B $2.475B - $2.550B

GAAP Diluted EPS $2.90-$3.10 $2.90-$3.10

Cash flows from

operations

$230M - $280M $230M - $280M

Free cash flow $170M - $220M $170M - $220M

• Q1 performance was strong, with revenue growth of 9% (12% on a constant currency basis) and operating income

margin of 12.1%

• Maintaining FY17 GAAP diluted EPS guidance; maintaining cash flow guidance (with a bias towards the upper end);

lowering revenue guidance

• Revenue revision is principally due to the contract cancellation in the U.S. Federal Services Segment; had already

forecasted lower volumes on this contract, but the cancellation now means that revenue in FY17 compared to last year will

be $65M to $70M lower

• We operate a portfolio of contracts and there were other puts and takes in the model that contributed to this decision,

including currency impacts and a rebid loss

‒ Unfavorable FX is now expected to further impact us by another $10M (or a total of $60M on the full year if you

include what was included from the November earnings call)

‒ Lost Medicare Part A East appeals rebid, which is about $10M impact to FY17; technical solution scored high, prior

performance on this contract had been graded as excellent, and recently won back western region for Medicare Part A

appeals last quarter; despite a strong position going into the rebid, lost to what we view as an overly aggressive price

10

New Accounting Standard

• As previously disclosed, MAXIMUS adopted a new, required accounting standard for stock compensation in FY17:

‒ New standard requires companies to record income tax benefit or expense as a reduction to income tax provision

as a result of exercising stock options or vesting Restricted Stock Units

‒ With retirement of two of our directors effective January 1, 2017, we will recognize a benefit in Q2 FY17

‒ As a result, we are estimating that our effective tax rate in Q2 FY17 will be approximately 34%

‒ For FY17, our tax rate estimate is unchanged at 36% to 37% (with a bias toward 36%)

11

Richard Montoni

Chief Executive Officer

February 9, 2017

Helping Government Serve the People®

12

Solid Results & Opportunities

• Solid results in Q1 and our full year

earnings outlook, despite certain setbacks

that led us to trim our revenue outlook for

the remainder of FY17

• With $4.0B of opportunities in our reported

pipeline, we see continuing demand for

our services and are keenly focused on

capturing new organic growth while

protecting our base business

13

Macro Drivers & Common Themes Drive Demand

• Long-term, macro-economic drivers of rising caseloads

and increasing demand for effective government

programs remain unchanged

• Three common themes have emerged across all of our

markets as governments tackle changing demographics,

decentralization initiatives, and the need to get value for

government spend

1. Demographics: Fundamental need for government

program administration, including critical citizen

services, has not changed:

‒ People are living longer and have more complex

health care needs

‒ Many face financial hardships and other barriers

that require a combination of social safety net

programs and support into work

‒ In some markets seeing an increased focus on

citizen responsibility and engagement as a

condition of receiving benefits

‒ Government programs that focus on measurable

outcomes can cost-effectively address this need

14

Macro Drivers & Common Themes (continued)

2. Decentralization: Shift toward decentralization of some

public programs:

‒ Block grant funding for Medicaid and potential removal of

certain federal mandates in the U.S.

‒ Devolution of programs to local authorities in the U.K.

‒ Potential change to funding and governance mechanics

enhances overall flexibility that state and local authorities

can use to shape their benefit programs

3. Value for Spend: Outsourcing and public-private

partnerships serve as a vehicle for cost-effective solutions:

‒ Governments must ensure programs that address societal

needs are a good use of taxpayer dollars and achieve their

intended outcomes

‒ By laying out performance expectations, rewarding partners

who deliver, and penalizing those who do not, governments

and citizens benefit from this increased accountability

‒ We believe this environment favors companies like

MAXIMUS who can deliver highly complex government

programs in a transparent and independent fashion

15

U.S. Operations: New Presidential Administration Priorities

• We are just starting to see how these macro drivers intersect with priorities of new presidential administration

• Demographics in the U.S. have increased demand for public benefit programs

• Governments at all levels are looking for solutions across social programs: Medicaid, Medicare, long-term

care programs, Social Security, welfare-to-work, nutrition assistance programs and more

• Transition periods are the right time to propose new ideas that can help governments achieve their goals

• Many of the president’s proposed directions, common areas where MAXIMUS provides value, such as:

‒ Creating efficiencies to manage the cost of government services

‒ Increasing accountability to demonstrate that programs are achieving their desired outcomes

‒ Promoting individual responsibility (such as co-pays and work requirements for beneficiaries of health

and human services programs)

‒ Ensuring integrity of public programs by better addressing fraud, waste and abuse

• Early in the transition and some of these priorities will become legislation and regulations, and will then be

translated into actions at program level

16

Affordable Care Act and Medicaid

• Affordable Care Act (ACA) discussion has moved from “repeal” to “repeal and repair”

• Congressional leadership are committed to “not pull the rug out” from citizens who are covered by the ACA

today, but they have not yet come to consensus on a plan

• For Medicaid, flexibility appears to be common denominator; new administration reiterated its support for block

grants in January and state leaders are calling for:

‒ Reciprocity on waivers where states can leverage the pre-approved waiver of another state

‒ Less prescriptive regulations so states can shape programs based on their demographics and values

‒ Adequate level of federal funding to achieve their desired outcomes

• Changes will take time, particularly if legislative changes are required or changes to funding mechanisms;

depending on the pace of change, this may impact our growth over the short-term; but this does not change

long-term underpinnings of macro demand trends that remain favorable

17

International Operations: New Contracts & Opportunities

• Seen some movement in disability services market as

governments seek improved ways for engaging and

serving these populations

‒ Recently launched a handful of small, but strategic,

employment program contracts in the U.K. for people

with disabilities and the long-term unemployed

• Health Management recently won a small, three-year

contract to deliver online mental health and well-being

support to the Ministry of Defense Joint Forces Command:

‒ Well-being advice and guidance

‒ Clinically validated mental health support

‒ Interactive tools that enable employees to monitor their

own health and well-being

• Contract expands our presence into a new department

• We also continue to pursue the available opportunities for

the new U.K. Work & Health Programme, including new

work in Wales, London and Manchester

18

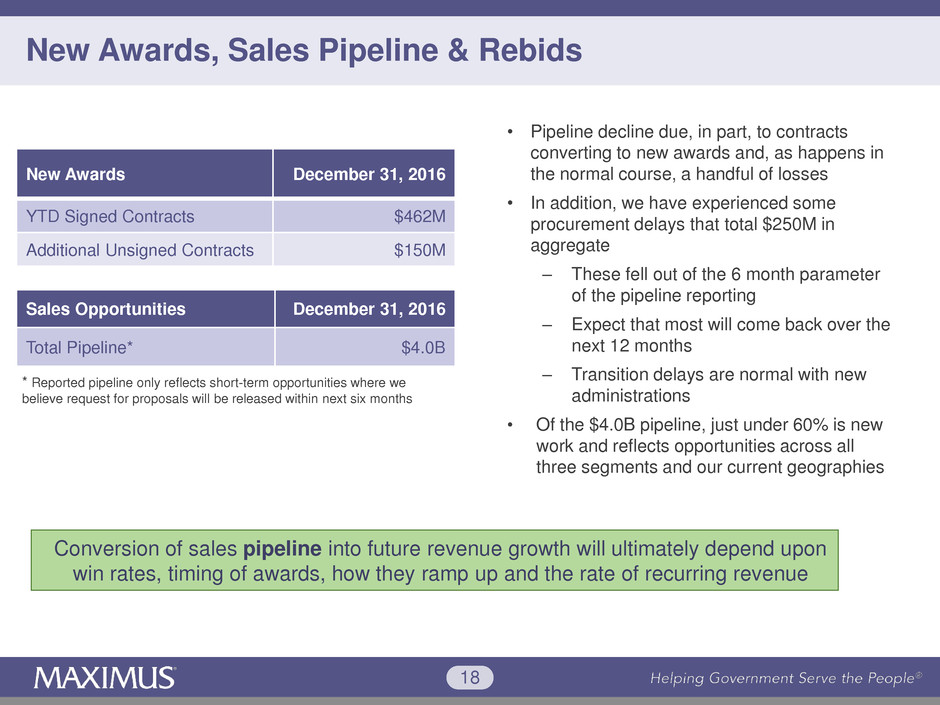

New Awards December 31, 2016

YTD Signed Contracts $462M

Additional Unsigned Contracts $150M

Sales Opportunities December 31, 2016

Total Pipeline* $4.0B

* Reported pipeline only reflects short-term opportunities where we

believe request for proposals will be released within next six months

New Awards, Sales Pipeline & Rebids

• Pipeline decline due, in part, to contracts

converting to new awards and, as happens in

the normal course, a handful of losses

• In addition, we have experienced some

procurement delays that total $250M in

aggregate

‒ These fell out of the 6 month parameter

of the pipeline reporting

‒ Expect that most will come back over the

next 12 months

‒ Transition delays are normal with new

administrations

• Of the $4.0B pipeline, just under 60% is new

work and reflects opportunities across all

three segments and our current geographies

Conversion of sales pipeline into future revenue growth will ultimately depend upon

win rates, timing of awards, how they ramp up and the rate of recurring revenue

19

Conclusion

• A very dynamic environment with emerging political

and economic changes

• Challenges that arise during periods of change often

mean future opportunities for MAXIMUS

• Macro-trends for our business remain favorable and

we remain positive about our long-term outlook

• MAXIMUS will continue to play a key role in helping

governments address changing demographics and

rising caseloads with more effective and efficient

programs that make best use of taxpayer spend