MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 1

Operator: Good morning, ladies and gentlemen, and thank you for standing by. Welcome to the

MAXIMUS Fiscal 2016 Fourth Quarter Conference Call.

At this time, all participants are in a listen-only mode. A question and answer session will follow

the formal presentation. Should you require operator assistance during the conference, please

press star, zero to signal an operator. Please note, this conference is being recorded.

I will now turn the conference over to your host, Lisa Miles, Senior Vice President, Investor

Relations for MAXIMUS. Thank you. You may begin.

Ms. Lisa Miles: Good morning, and thanks for joining us. With me today is Rich Montoni, CEO;

Bruce Caswell, President; and Rick Nadeau, CFO. I'd like to remind everyone that a number of

statements being made today will be forward-looking in nature.

Please remember that such statements are only predictions and actual events and results may

differ materially as a result of risks we face, including those discussed in Exhibit 99.1 of our SEC

filings. We encourage you to review the summary of these risks in our most recent 10-K filed

with the SEC. The company does not assume any obligation to revise or update these forward-

looking statements to reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses this

information in its internal analysis of results and believes this information may be informative to

investors in gauging the quality of our financial performance, identifying trends in our results,

and providing meaningful period-to-period comparisons. For a reconciliation of the non-GAAP

measures presented in this document, please view the company's most recent quarterly

earnings press release.

And with that, I'll hand the call over to Rich.

Mr. Rich Montoni: Thanks, Lisa, and good morning, everyone. With the U.S. presidential

election still fresh in everyone's mind, I will start by addressing our perspective on the elections

and the implications for MAXIMUS.

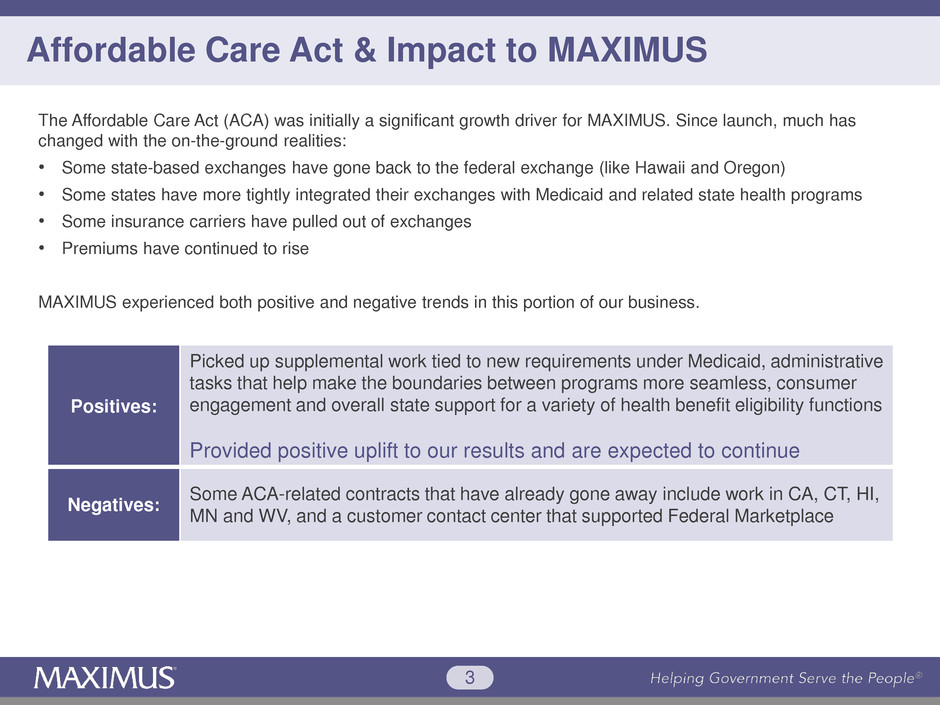

The Affordable Care Act was initially a significant growth driver for MAXIMUS. But, since its

launch, much has changed with the on-the-ground realities. Some states that initially launched

their own state-based exchanges have gone back to the federal exchange. Others have worked

to more tightly integrate their exchange with Medicaid and the related state health programs.

And some insurance carriers have pulled out of the exchanges and premiums have continued to

rise.

As a result of all these dynamics, we have experienced both positive and negative trends in this

portion of our business. In many cases, we picked up supplemental work tied to new

requirements under Medicaid, administrative tasks that help make the boundaries between

programs more seamless, consumer engagement, and overall state support for a variety of

health benefits eligibility functions, all of which provided positive uplift to our results, and are

expected to continue.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 2

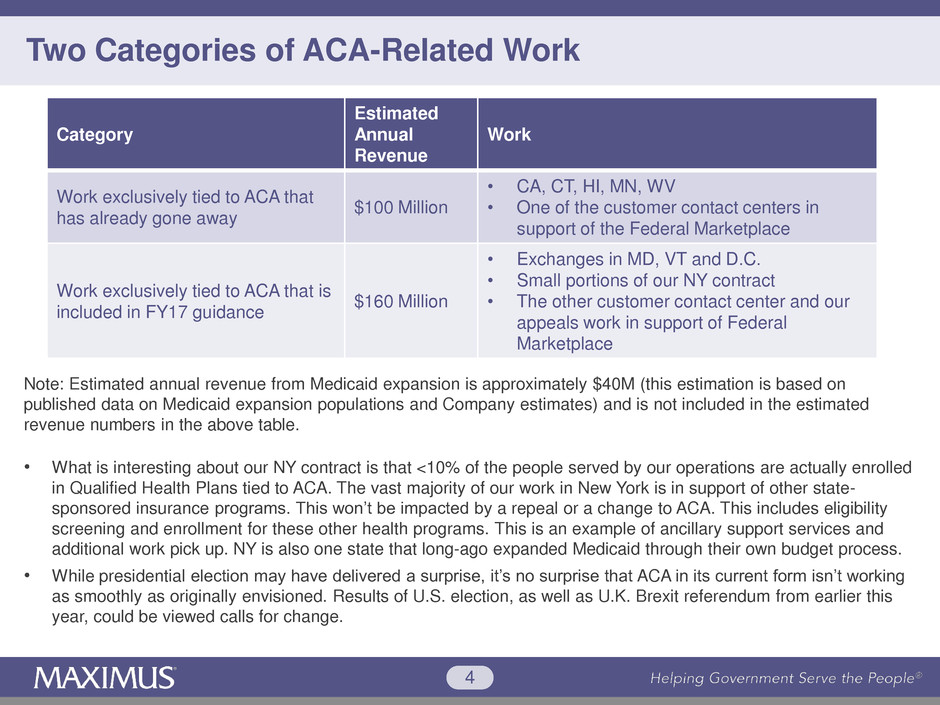

Offsetting these uplifts were ACA related contracts that have already gone away, including work

in California, Connecticut, Hawaii, Minnesota and West Virginia, as well as the closing of a large

customer contact center supported the federal marketplace. Consequently, the book of business

that was tied exclusively to ACA is actually lower now by roughly $100 million than when the

exchanges first launched.

In fact, we presently estimate that our remaining contracts directly tied to ACA will contribute

approximately $160 million of revenue in fiscal 2017. This is baked into our 2017 guidance that

we issued this morning. These contracts include the exchanges in Maryland, Vermont and

Washington D.C., small portions of our New York health contract, as well as our contact center

and appeals work in support of the federal marketplace.

What's most interesting about New York is that less than 10 percent of the people served by our

operations are actually enrolled in qualified health plans tied to ACA. The vast majority of our

work in New York is in support of the other state-sponsored insurance programs, which won’t be

impacted by a repeal or a change to ACA. This includes eligibility screening and enrollment for

those other health programs. This is an example of the ancillary support services and additional

work pick up that I referred to earlier.

Further, New York is also one of the states that long ago expanded Medicaid through their own

budget process. So, while the presidential election may have delivered a surprise, it’s no

surprise that ACA, in its current form, isn’t working as smoothly as originally envisioned. The

results of the U.S. election, as well as the U.K. Brexit referendum from earlier this year, could be

viewed as calls for change.

While some people are interested in the disruption of the status quo, it's important to remember

that the fundamental need for a wide range of citizen services has not changed. There are three

key aspects to how MAXIMUS brings value to government programs, and they continue to

remain relevant.

The first piece of the equation are the macro drivers that simply aren’t going away. Populations

around the world are living longer, have more complicated health care needs, and have a need

for social safety net programs. As a result, rising caseloads and increasing demands for

government services are challenges that government must continue to address.

The second piece of the equation is the tendency for republicans at all levels of government to

favor outsourcing and public-private partnerships as a vehicle for cost-effective solutions.

Governments must ensure programs that address societal needs are a good use of taxpayer

dollars and achieve their intended outcomes. And in many instances, governments will continue

to rely on trusted partners, like MAXIMUS, with established programs and a track record of

reliable delivery.

And the third piece of the equation is the shift to more state-based management of public

programs. President-elect Trump has articulated a plan to create public policy that will broaden

health care access, make health care more affordable, and improve the quality of the care

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 3

available to all Americans. He has also emphasized his support for block grant funding for

states to use for programs like Medicaid and the potential removal of certain federal mandates.

This potential change to funding and governance mechanics enhances the overall flexibility that

states can bring to bear in shaping certain benefit programs. As a result of these drivers, macro

population trends, republicans’ higher propensity towards public-private partnerships, and an

emphasis on increased state control of programs, we believe the table is being set for

MAXIMUS to step-up and provide additional support to our government clients.

MAXIMUS offers years of experience in supporting states to customize their federally funded

health and human services programs. We effectively translate legislative and regulatory change

into operational models that achieve the intended outcomes for the diverse groups of citizens

we serve. We can easily support states’ efforts as a result of any shifts in federal funding

mechanisms, which may include block grants. In light of this sea change, we believe that we will

likely experience a pause from major U.S. federal government programs as the new

administration enacts its agenda.

Nevertheless, the global macro trends that drive demand for our services continue to be the

underpinnings of our three long-term growth strategies. As a reminder, these include, first,

continuing to broaden our presence in the U.S. health services market. This includes the new

Medicaid regulations that have already created further opportunities to expand our services

beyond enrollment to include areas such as beneficiary services, provider services,

assessments and long-term services, and support.

Second, continuing to expand our U.S. federal book of business. This includes leveraging new

contract vehicles from the Acentia acquisition to import our core solutions into new programs

and agencies.

And third, continuing to grow our international operations. Our ongoing work in cultivating new

opportunities and raising our profile in all three areas will best position MAXIMUS for success in

these strategic growth markets.

The United States is not the only government that is seeking solutions to social challenges. As

some of you may have seen, just last week the U.K. government issued a document titled Work,

Health and Disability Green Paper. This paper is not intended to propose policies or legislation;

rather, the purpose is to solicit input from stakeholders on a variety of new initiatives to provide

people with more personalized support to get back into work.

The U.K. is taking a more holistic approach to examine how the ability of people to participate in

the workforce is influenced by their health, economic status, education level or housing

situation. Comments on the Green Paper are due back in mid-February. Since the purpose of

the paper is to generate feedback and ideas from the public, it's neutral to MAXIMUS and there

is no immediate impact to our U.K. offerings, including the U.K. HAAS contract.

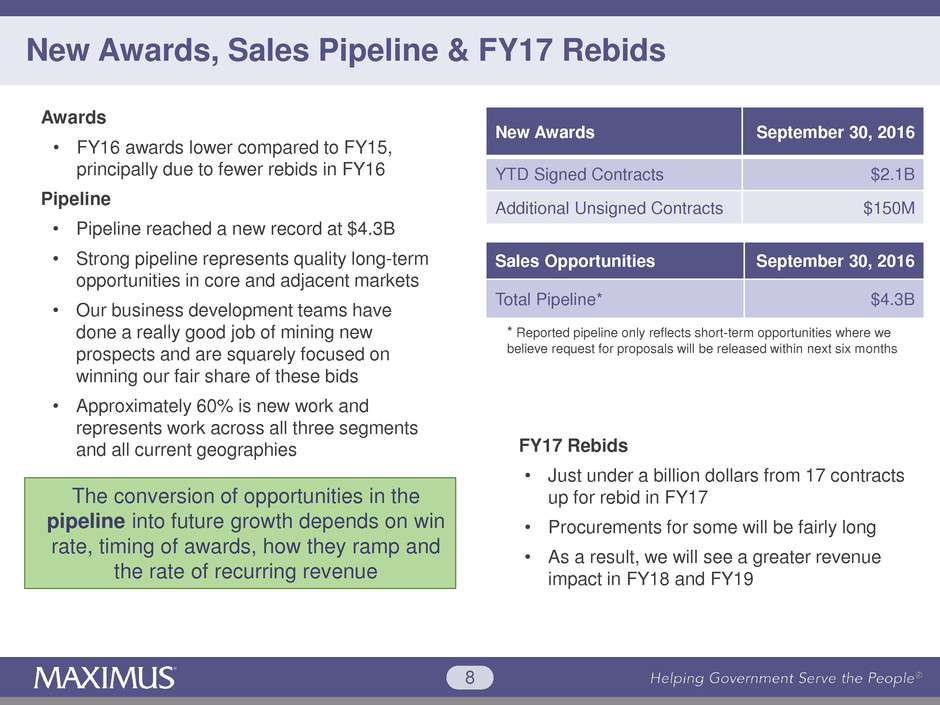

Moving on to new awards, pipeline, and rebids. Our signed contracts for fiscal 2016 totaled $2.1

billion. We also had an additional $150 million in awarded unsigned contracts at September 30,

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 4

2016. As expected, fiscal 2016 awards came in lower compared to fiscal 2015, principally due to

low level of rebids in fiscal 2016.

Our pipeline of opportunities at September 30th remains robust. In fact, we reached a new

record at $4.3 billion. We are pleased with the strength of our pipeline and it represents quality

long-term opportunities in core and adjacent markets. Our business development teams are

aggressively mining new prospects and they are squarely focused on winning our fair share of

these bids.

Of the 4.3 billion pipeline, approximately 60 percent is new work and reflects opportunities

across all three segments and our current geographies. The record pipeline, including the new

opportunities therein, lay the ground work for future awards. The conversion of sales pipeline in

the future revenue growth will ultimately depend upon win rates, the timing of awards, how they

ramp up, and the rate of recurring revenue.

As we previously disclosed, we have just under $1 billion from 17 contracts that are up for rebid

in fiscal 2017. It's interesting to note that the procurements for some of these contracts will be

fairly long. As a result, we will see a greater revenue impact in fiscal 2018 and fiscal 2019. I'll

now turn the call over to Rick to discuss the financial results.

Mr. Rick Nadeau: Thanks, Rich. Overall, we are pleased to meet our objectives, and deliver a

record year of solid double-digit growth for both revenue and earnings. As most of you know, we

started fiscal year 2016 with some challenges on one of our largest contracts. At that time, the

management team said we would tackle these issues head-on. During the year, we took the

necessary steps to get the program on track, which allowed U.S. to deliver full-year earnings

towards the top-end of that range.

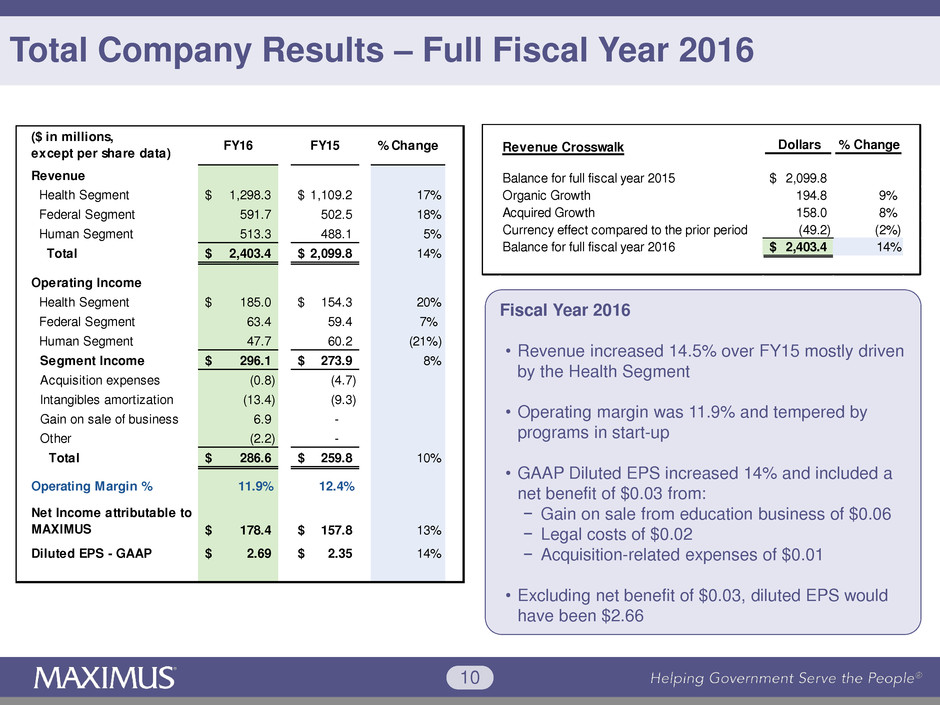

Revenue for fiscal year 2016 increased 14.5 percent over last year. Of this growth, 9 percent

was organic, driven by the health services segment, and 8 percent was acquired. All of this

growth was partially offset by a 2 percent decline tied to currency effects. On a constant-

currency basis, revenue would have increased 17 percent year-over-year. Total Company

operating margin for fiscal year 2016 was 11.9 percent, which, as expected, was tempered by

new programs and start-up.

For fiscal year 2016, net income attributable to MAXIMUS increased 13 percent. And GAAP

diluted earnings per share increased 14 percent to $2.69 compared to fiscal year 2015. This

included a net benefit of 3 cents from a gain of 6 cents from the sale of our education business,

legal costs of 2 cents related to a matter that occurred in 2014, and acquisition related expenses

of 1 cent. Excluding these items, diluted earnings per share for fiscal year 2016 would have

been $2.66.

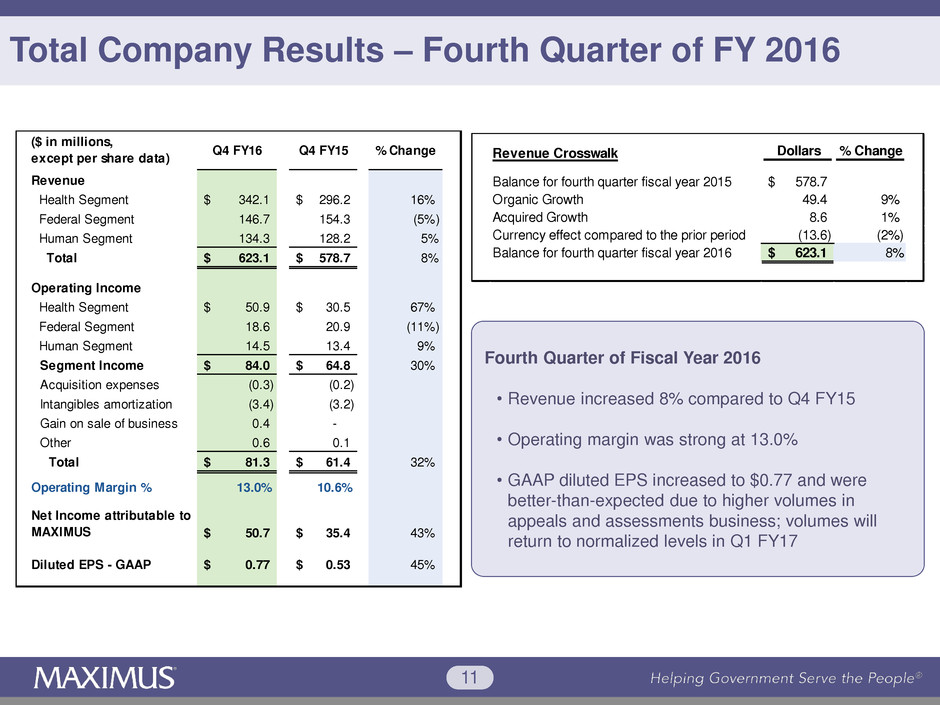

Let me discuss results for the fourth quarter. Revenue grew 8 percent compared to last year. Of

this, approximately 9 percent was attributable to organic growth and 1 percent was acquired.

This growth was partially offset by a 2 percent decline, or approximately $13.6 million, related to

foreign currency exchange rates. On a constant-currency basis, total revenue would have grown

10 percent for the quarter. Fourth quarter operating margin was strong at 13 percent.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 5

For the fourth quarter of fiscal year 2016, net income attributable to MAXIMUS totaled $50.7

million. And the company delivered diluted earnings per share of 77 cents for the fourth quarter.

Fourth quarter earnings were a little bit better than expected. This was due, in large part, to

higher than normal volumes from our appeals and assessments business, which are expected

to return to more normalized levels in the first quarter.

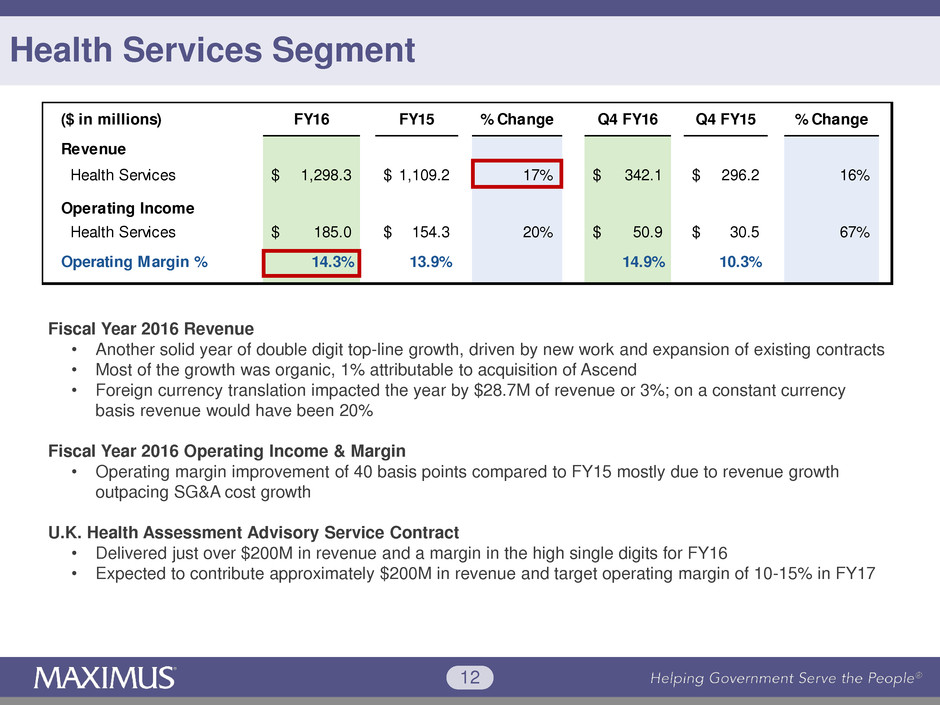

I will focus the remainder of my commentary, predominantly, on full-year results, starting with

the health services segment. The health services segment delivered a record year of solid

double-digit top-line growth, driven principally by new work and the expansion of existing

contracts. Fiscal year 2016 revenue grew 17 percent to approximately $1.3 billion compared to

the prior year.

The majority of growth in the quarter was organic and 1 percent was attributable to the

acquisition of Acentia. The segment was impacted by foreign currency translation, which

reduced full-year revenue by $28.7 million, or approximately 3 percent.

On a constant currency basis, revenue growth for fiscal year 2016 would have been 20 percent.

Segment operating margin for fiscal year 2016 was 14.3 percent. This represents an

improvement of 40 basis points relative to last year, mostly due to our revenue growth outpacing

SG&A growth. For fiscal year 2016, the U.K. HAAS contract delivered revenue totaling just over

$200 million, and operating margin in the high single-digits.

For fiscal year 2017, we continue to expect that this contract will contribute approximately $200

million in revenue, and that it will move into our targeted operating margin range of 10 percent to

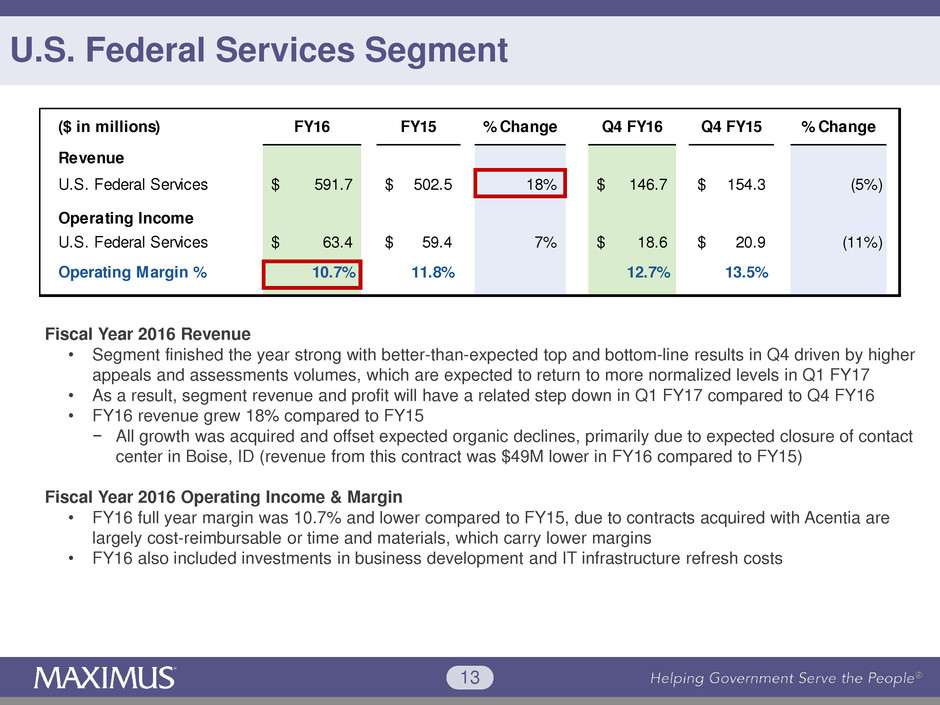

15 percent. The U.S. Federal Services segment finished the year strong with better than

expected top and bottom line results in the fourth quarter, driven principally by higher volumes in

our appeals and assessments business line.

We expect volumes to return to more normalized levels in the first quarter of 2017 and, as a

result, segment revenue and profit will have a related step-down in Q1 of 2017 compared to Q4

of 2016. For fiscal year 2016, revenue for the U.S. federal segment totaled $591.7 million and

grew 18 percent compared to the prior year. All growth in the year was acquired, offsetting

expected organic revenue declines, primarily due to the expected closure of a customer contact

center in Boise, Idaho, where we provided support for the federal marketplace under the

Affordable Care Act.

Revenue from this contract was $49 million lower in fiscal year 2016 compared to fiscal year

2015. Segment operating margin for fiscal year 2016 was 10.7 percent. This was lower than the

11.8 percent recorded for the prior year due impart to contracts acquired with Acentia that are

largely cost reimbursable or time and materials, which carry lower margins. As part of the

segment's long-term growth initiatives, we've made further investments in business

development, as well as incurred additional operating expenses in support of our IT

infrastructure refresh.

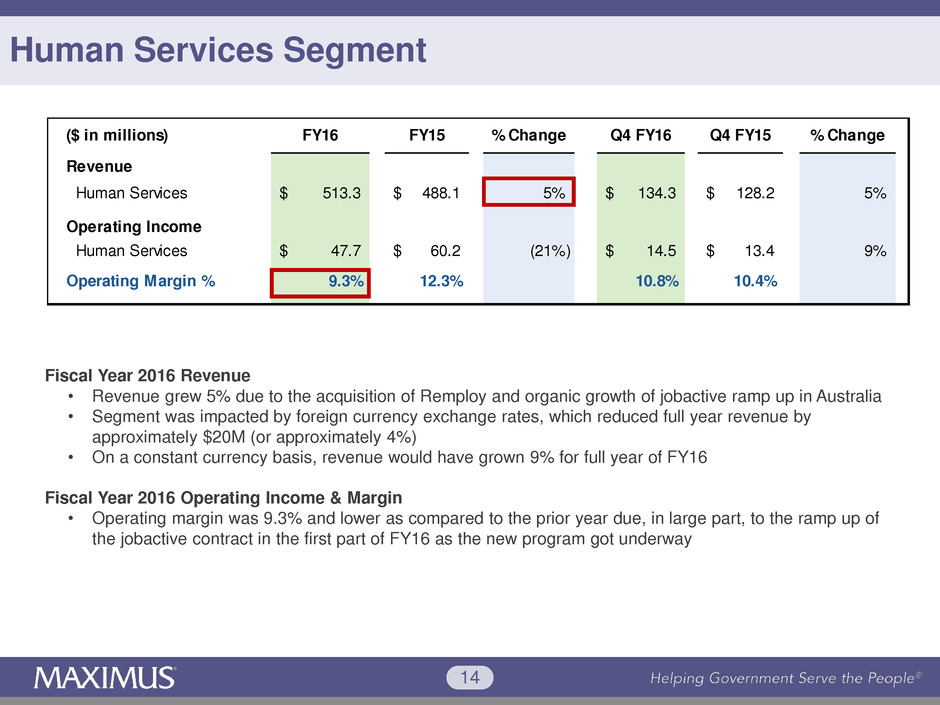

Let me turn to financial results for the human services segment. For fiscal year 2016, revenue

grew 5 percent to $513.3 million compared to fiscal year 2015. Top line increases were driven

by the acquisition of Remploy, and organic growth from the ramp-up of the jobactive contract in

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 6

Australia. The segment was impacted by foreign currency exchange rates, which reduced full

year revenue by $20 million, or approximately 4 percent. On a constant currency basis, revenue

would have grown 9 percent for the full year of fiscal 2016.

Operating margin for fiscal year 2016 was 9.3 percent, which was lower compared to the prior

year. This was due in part to the ramp up of jobactive in the first-half of fiscal year 2016 as the

new program got underway.

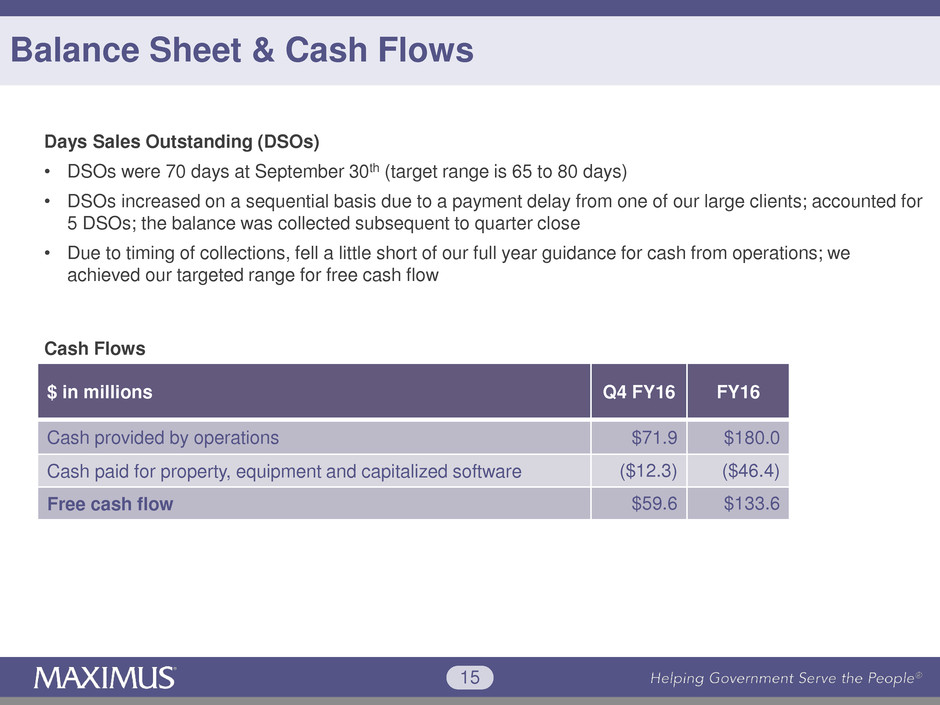

Let me move on to discuss cash flow and balance sheet items. Day sales outstanding were 70

days at September 30, which is in line with our targeted range of 65 to 80 days. DSOs

increased on a sequential basis due to a payment delay from one of our large clients. This

accounted for five DSOs. After the quarter closed, we collected the outstanding receivables. As

a result of the timing of collections, we fell a little short of our full year guidance for cash from

operations, but achieved our targeted range for free cash flow.

For the full fiscal year, cash provided by operations totaled $180.0 million with free cash flow of

$133.6 million. For the fourth quarter of fiscal year 2016, cash provided by operations totaled

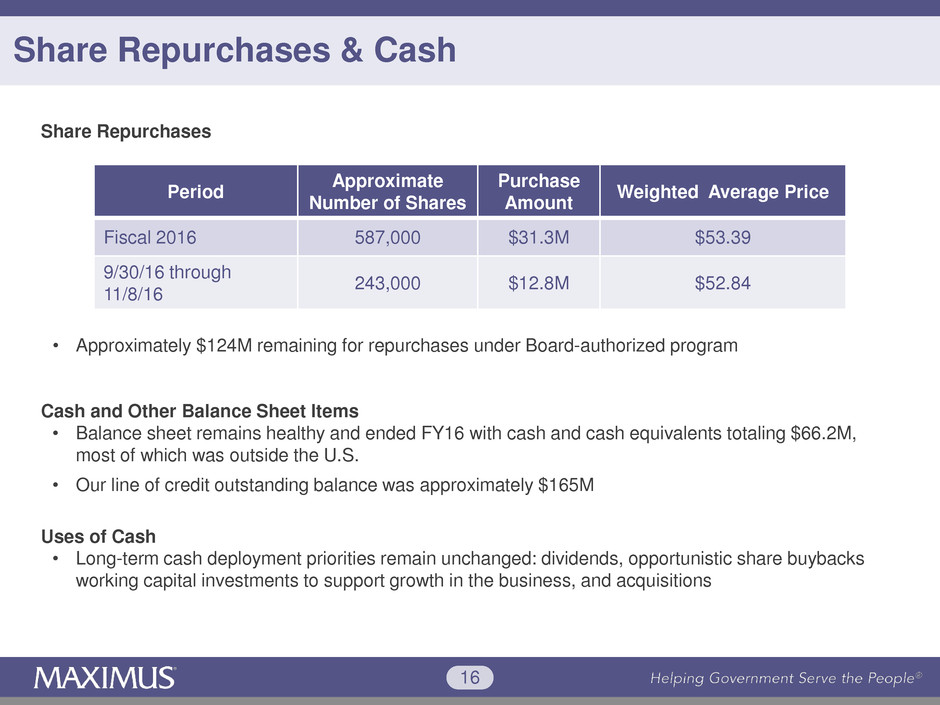

$71.9 million with free cash flow of $59.6 million. During fiscal year 2016, we repurchased

approximately 587,000 shares of MAXIMUS common stock for $31.3 million. We ended the

fiscal year with cash and cash equivalents of $66.2 million, most of which was outside of the

US. And the balance outstanding on our line of credit was approximately $165 million.

Our balance sheet gives U.S. flexibility to grow and invest in our business in order to best create

long-term shareholder value. Our cash deployment priorities remain unchanged and include

dividends, opportunistic share buybacks, working capital investments to support growth in the

business, and acquisitions. Overall, we remain committed to sensible and practical uses of

cash.

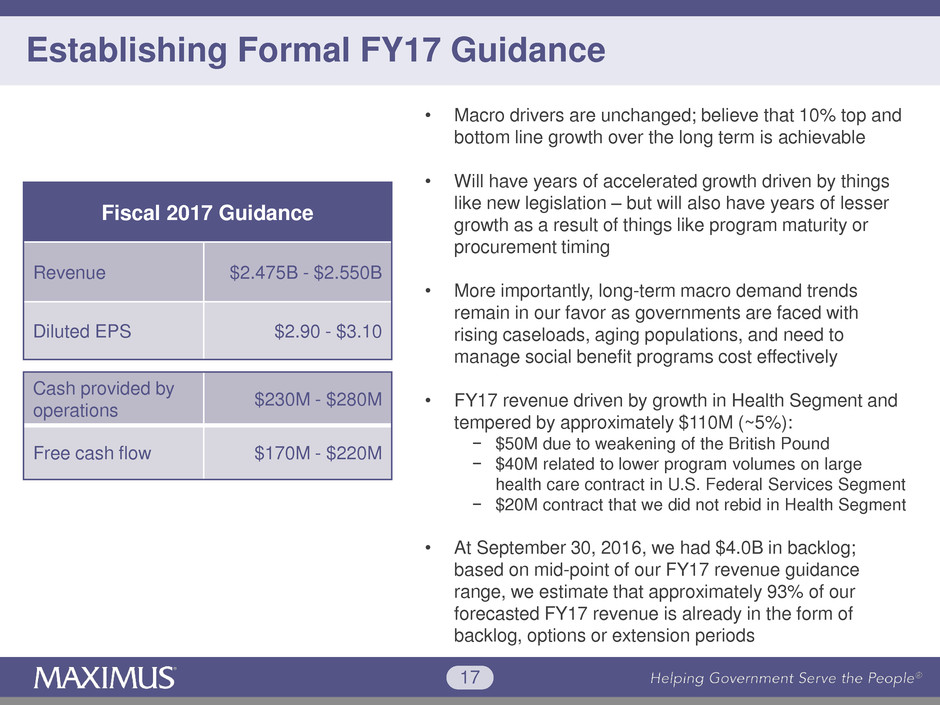

Before I wrap up with our 2017 guidance, we believe the macro drivers are unchanged. And I

want to reiterate that 10 percent top and bottom line growth over the long-term is achievable. As

we have consistently said, we will have years of accelerated growth, driven by things like new

legislation. But, we will also have years of lesser growth, as a result of things like program

maturity or procurement timing. More importantly, the long-term macro demand trends remain in

our favor as governments are faced with rising caseloads, aging populations, and the need to

manage social benefit programs cost effectively.

As indicated in this morning's press release, we are establishing revenue guidance for fiscal

year 2017 that will range between $2.475 billion and $2.55 billion, driven by growth in the health

segment.

We expect that revenue growth for fiscal year 2017 will be tempered by approximately $110

million, or roughly 5 percent, due to three factors. They are, first, we estimate that the

weakening of the British pound is roughly $50 million unfavorable to revenue. Second, in our

U.S. Federal Services segment, we expect that revenue will be $40 million lower for a large

healthcare contract. Program volumes are expected to be lower as the agency contemplates the

future strategic direction of the program. And third, and to a lesser extent, we have

approximately $20 million of heath segment revenue that is not recurring.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 7

In this instance, a contract was brought to rebid early because the client wanted to modify the

terms and conditions tied to specific performance metrics. We opted to no bid the new contract

because we felt the new terms would make it too difficult to be successful, both operationally

and financially.

We have a high level of visibility into our forecasted revenue for fiscal year 2017. At September

30, 2016, we had $4.0 billion in backlog. As a reminder, each year we adjust the backlog to

account for changes in performance based contracts. The $4.0 billion backlog reflects expected

reductions from three larger performance based contracts, including the U.K. HAAS contract.

Based on the mid-point of our fiscal year 2017 revenue guidance, we estimate that

approximately 93 percent of our forecasted fiscal year 2017 revenue is already in the form of

backlog, options, or extension periods.

As expected, the bottom line is growing faster in fiscal year 2017, and reflects start-up contracts

that are becoming more mature and achieving higher margins in fiscal year 2017. As a result,

we expect diluted earnings per share for fiscal year 2017 to range between $2.90 and $3.10.

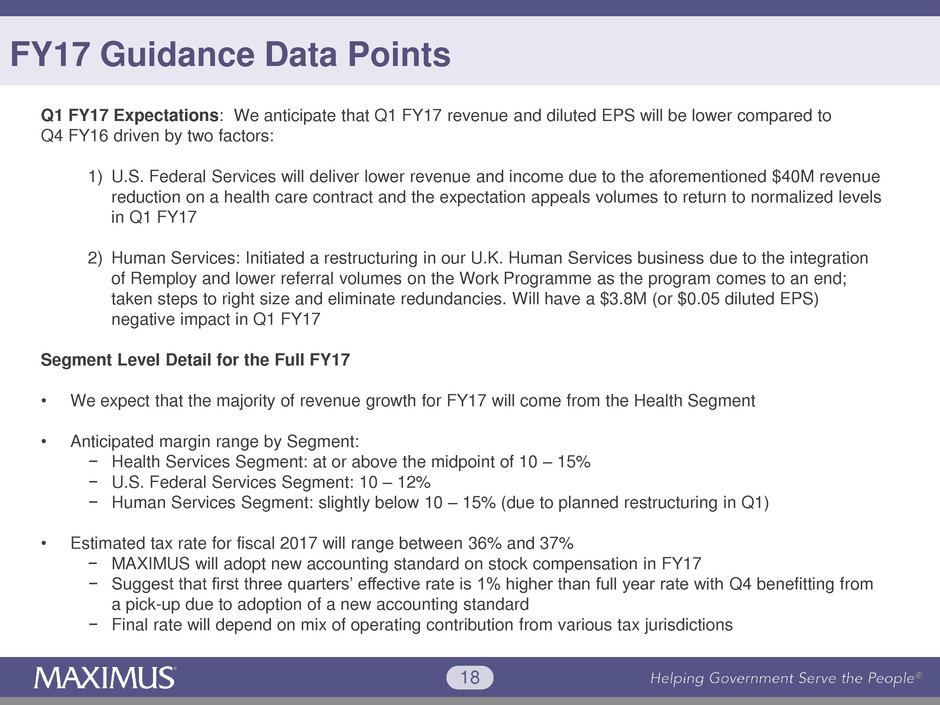

On a quarterly basis, we anticipate that both revenue and diluted earnings per share for the first

quarter of fiscal year 2017 will be lower compared to the fourth quarter of fiscal year 2016,

driven by two factors. First, the federal segment in expected to deliver lower revenue and

operating income in the first quarter. This is due to the aforementioned $40 million revenue

reduction on a health care contract. And because we expect the volumes in our appeals and

assessments business will return to more normalized levels in the first quarter.

Second, we initiated a restructuring in our U.K. human services business. With the integration of

Remploy and the lower referral volumes on the work program, we have taken steps to right size

the business and eliminate redundancies.

The restructuring is expected to have a positive impact to the full year. But, these adjustments

will have a negative impact in the first quarter of roughly of $3.8 million, or approximately 5

cents per diluted share. On a segment level basis, we expect that the majority of revenue

growth for fiscal year 2017 will come from the health segment.

In terms of operating margins, by segment. For the full year, we expect that the health services

segment will continue to achieve margins at or above the mid-point of our targeted range of 10

percent to 15 percent. For the federal segment, we still expect margins in the 10 percent to 12

percent range for the year. And in human services, we expect this segment will likely deliver full-

year operating margins that are slightly below our 10 percent to 15 percent range, principally

due to the planned restructuring costs in the first quarter.

For the full year of fiscal 2017, we are estimating that the income tax rate will range between 36

percent and 37 percent. As noted in this morning's press release, MAXIMUS will adopt a new

accounting standard on stock compensation in fiscal 2017. As a result, I suggest that for the first

three quarters of fiscal year 2017 you model the effective income tax rate as being 1 percent

higher than the rate you project for the full-year, with the pick-up in the fourth quarter. The final

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 8

tax rate will also ultimately depend on the mix of operating income contribution from our various

tax jurisdictions.

And finally, cash flow guidance. We expect cash provided by operations to be in the range of

230 to $280 million for fiscal year 2017, and we expect free cash flow to range between 170 and

$220 million.

And I'll hand it back to Rich for some closing comments.

Mr. Rich Montoni: Thank you, Rick. Now, more than ever, bringing together the understanding

of how costs, quality, and access to services intersect could not be more important. MAXIMUS

is really well positioned to address these challenges, and be a change agent. We offer scalable,

cost-effective, and operationally efficient services for a wide range of government programs.

We look forward for fiscal 2017 to be another year of growth, top and bottom line. Most

importantly, our longer term success in growing our business is dependent on our ability to

identify and win new work, and to deliver on our contractual obligations. Our robust pipeline

represents the core engine of this future growth.

Over the next three to five years, the macro trends for our business remain unchanged and

solid. And governments around the world need to find more ways to run their program more

effectively and efficiently, while at the same time, dealing with rising caseloads, shifting

demographics, and unsustainable program costs. We recognize that operating a business is a

balance of risk and reward.

We continue to believe our portfolio mix of core business, near adjacencies, and new growth

platforms will allow U.S. to achieve a healthy growth trajectory for years to come.

And in closing, I thank our more than 18,000 employees around the world for their dedication to

providing high quality services to our government clients and the citizens they serve.

Operator?

Operator: Thank you. At this time, we will be conducting a question and answer session. If you

would like to ask a question, please star, one on your telephone keypad. A confirmation tone will

indicate your line is in the question queue. If at any time you wish to remove your question from

the queue, please press star, two.

We ask that you limit your questions to one with one follow up so others may have an

opportunity to ask questions. You may re-enter the queue at any time by pressing star, one. For

participants using speaker equipment, it may be necessary to pick up your handset before

pressing the star key. One moment, please, while we poll for questions.

Our first question is from Brian Kinstlinger with Maxim Group. Please proceed with your

question.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 9

Mr. Brian Kinstlinger: Hi. Good morning, guys.

Mr. Rich Montoni: Good morning, Brian.

Mr. Brian Kinstlinger: I want to start with the obvious first question. I'm curious your view, Rich,

on the risk that all your ACA business, the $160 million goes away. And then if you could also

quantify for investors kind of a rough number of an EPS contribution this year for net revenue.

Mr. Rich Montoni: All right. Brian, I think you've asked a two part question, and I'm going to

hand this over to our Chief Financial Officer Rick Nadeau in a minute. But the two parts are,

one, what's the risk--our assessment of the risk that the $160 million, which is kind of our current

run-rate and what we’ve assumed in our fiscal '17 estimates relative directly related to the

Affordable Care Act. And then secondly, what would be the ballpark EPS contribution from that

book of business. Rick, thoughts?

Mr. Rick Nadeau: Yes. I think you've got to remember that inside that Affordable Care Act,

revenue was about $90 million of cost plus revenue. So, that's going to be lower margin. And

so, I look at it from an operating income standpoint. I think when you look at our normal range of

10 to 15 percent, you're going to be on the lower end of that 10 to 15 percent, because 90

million of it is lower than 10 percent, because it is cost plus type of revenue. Bruce?

Mr. Rich Montoni: Bruce Caswell actually has some thoughts he’d like to add to that, Brian.

Mr. Bruce Caswell: Yeah, Brian. I thought it’d be helpful just kind of frame the overall

discussion around repeal and replace the Affordable Care Act. So, I'll take a couple of minutes

to do that.

It's impossible really to speculate at this point about the specific details of how the efforts to

repeal and replace will proceed. But, Rich mentioned, and it's important to come back to, that

there are some underlying perspectives in terms of president-elect Trump’s position on health

care that are important. One is to broaden health care access; the second is to make it more

affordable; and the third is to improve quality.

So, we think it's--while there is certainly likelihood, right, that repeal will proceed, it'll be coupled

with a replacement. Putting it in context, the repeal would take a congressionally grant benefit

away from 20 million people. And with about 28.9 million Americans still uninsured, you could

see up to 50 million folks without insurance.

We think that the fundaments of a program that might replace the Affordable Care Act are still

obviously yet to be bolted down, but some of the options that are on the table have been

advanced by house republicans in the overtime. Those could include changing or ending the

individual or employer mandate, enacting insurance reforms to address things like the minimum

essential benefits. Restructuring premiums, you probably read a bit about, what might happen

with subsidies, and then individuals could receive a tax credit they could use to purchase

insurance so that low income populations have more access. And this could be done in

combinations possibly with heath savings accounts.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 10

So, there are lot of moving pieces here. And certainly, you know, a day or so into the new

administration, if you will, we’re really looking to fill-in a lot of those plans as are others.

We think the revenue overall, therefore, from our Affordable Care Act contracts is likely to be

shifted into the replacement model. And we feel we’re well positioned to provide administrative

services from eligibility support, enrollment and appeals in that environment because those--

fundamentally those needs just don’t go away. In fact, we’ve done some thinking about this and

we think that in certain models the demand could increase for our services as we’ve seen

historically in other programs because change fundamentally is the way that governments

continue to evolve and improve these programs.

And if we look back at United Kingdom’s experience, when they changed governments and they

replaced the flexible new deal program with the work program, there is an entire effort of

transition. I guess the analogy here for the Affordable Care Act will be disenrollment and then

re-enrollment of individuals that industry needs to support government with.

And that may be a final point. The Trump administration has made it very clear that they're

going to be very business oriented and they view the importance of public-private partnerships

and cooperating and working in conjunction with the private sector is key to implementing their

policy agenda. So, I hope that provides some additional context.

Mr. Brian Kinstlinger: It’s a lot of context. Thank you. A lot of good detail for us.

My follow-up is on the work program you had mentioned, which is coming to an end and had

some points at the end. I'm curious what the revenue contribution is for the year, when you

assume it's going to end so we don't have a situation where we’re guessing like Affordable Care

Act. And then is that 3.8 billion a one-time restructuring charge? Thanks.

Mr. Rich Montoni: Rick Nadeau is going to field that for us, Brian.

Mr. Rick Nadeau: It's actually three questions, I think. Let me try to make sure I get them all for

you, Brian.

I think first off for fiscal year '17, I think you should think about $65 million or so of revenue we

have in fiscal year '17 from the program. The program is scheduled in right toward the end of

fiscal year '17. So, really, this is a fiscal '18 type of event for you to think about.

And the last question on the restructuring charges. Yes, that is a one-time item. When we

acquired Remploy in April of 2015, we wound up with a back office along with that. So, then we

wound up and had two back offices for human services in the United Kingdom. And so, what

we're really doing is putting it together, so that we can rationalize the cost. And so, it'll be

severance and lease termination costs, those types of things.

Ms. Lisa Miles: Thanks, Brian. Next question, please.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 11

Operator: Our next question is from Richard Close with Canaccord Genuity.

Mr. Richard Close: Great. Thank you. With respect to the pipeline, Rich, can you talk a little bit

in terms of, is there anything significant from a size perspective in the pipeline? And then also

as you think about the new administration coming on, is there anything in the pipeline that could

possibly, you know, potentially go away with the new administration?

Mr. Rich Montoni: Let me answer the second question first. I don't think so. I think we've tried

to give you a reasonable understanding of what we think might be at risk relative to a new

administration when we talk about the direct Affordable Care Act work we do, order magnitude

of $160 million, Richard. So, I think that covers all of it.

As it relates to the composition of the pipeline, and I think we've disclosed that in fiscal '17 we'll

be looking at about $1 billion in rebids. I don't think there's any one item that's so large that it's

disproportionate. I think it's a good mix. So, I think it's — I think that's actually healthy and that

we've got a little concentration in the pipeline situation in fiscal '17.

Mr. Richard Close: So--and my follow-up question would be more longer term in nature. As

you think about the new administration, where do you think there will be opportunity for you? In

the past, you've talked about integration. Is there anything in what candidate Trump has talked

about that you think, you know, really is in the sweet spot for MAXIMUS?

Mr. Rich Montoni: It's a great question. Bruce Caswell, I know, has some thoughts he’d like to

share with you on that.

Mr. Bruce Caswell: A few thoughts, yes. I mean, first is, Rich mentioned that one of the

fundamentals here is that republicans tend to outsource more. And in the Trump administration,

we expect, is going to continue to be a strong proponent of state's rights and the concept of kind

of devolving authority and pushing program administration down to the states. And there's a

very healthy debate going on right now in policy circles about what that might mean for the

Medicaid program and for block granting. And nothing is assured.

You know, prior studies that looked at block granting Medicaid suggested, while it could reduce

federal expenditures by about $913 billion over 10 years, obviously, the costs have to be picked

up somewhere, and there are number of governors that don’t necessarily want to pick that up.

They see it as an unfunded mandate. So, there's a tension, but I think there is an overall

proclivity towards states rights and pushing program administration down, which I think plays

very much to our strengths.

Otherwise, it's very early days in terms of trying to speculate what other program areas within

human services, or within our federal businesses and so forth, might become a focal point. We

don’t have the answer page obviously for issues like immigration. But, there are welfare reform

efforts out there with TANF reauthorization, there are efforts to address employment challenges

on an ongoing basis. So, there could be new initiatives that do result from the transition of the

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 12

administration. But, we typically wouldn’t get into a lot of those details for competitive reasons,

at this point.

Mr. Rich Montoni: But, I think it's fair to say that, you know, this could very well be a breath of

fresh air to take a hard look at some of the macro processes here. And I do think welfare and

employment areas is one that will be right for that opportunity. So, we’re anxious to see how that

develops, Richard.

Ms. Lisa Miles: Thanks, Richard. Next question, please.

Operator: Our next question is from Charlie Strauzer with CJS Securities.

Mr. Charlie Strauzer: Hi. Good morning.

Mr. Rich Montoni: Good morning, Charlie.

Mr. Charlie Strauzer: If you could touch based a little bit more--I know that you touched little bit

on jobactive in Australia, but may be give U.S. a little better update there as to how the ramp is

going. And also what are your expectations for the year. Thanks.

Mr. Rich Montoni: So, we will do that, and Bruce will handle that one.

Mr. Bruce Caswell: Sure. Thanks very much, Charlie. So, with regard to jobactive, it's

important to note that most, if not all, of the vendors, and I think we’ve may be talked about this

before on the jobactive program, are experiencing volume related challenges. And it's not

unusual to see fluctuations in a new program like that from the estimates that were provided to

the vendors as part of the tender.

We've mentioned before that the Australian unemployment rate is fairly low. It's about 5.7

percent. And that's the lowest it's been since 2013. And that simply is lower than the rates that

were assumed in the tender.

However, we've also noted that the program is profitable, and we feel like it's done a nice job of

continuing to improve on the back half of FY '16, as the contract continues to mature and we

continue to execute strategies to make sure we manage our cost effectively, and really create

very much a performance management environment within the contract. So, you know,

jobactive has been more a story about the margins not being as robust as we may have initially

expected. But, we feel like the contract is on a solid footing.

Mr. Charlie Strauzer: Great. And just a follow-up, just on the U.K., the Fit for Work contract

there, any update there? Is that related to the $20 million of a contract that you’re not going to

revisit. Is that the contract that you're referring to? Or is it something else?

Mr. Bruce Caswell: No, that was not the contract that we were referring to in terms of the rebid.

But, I can provide a little bit of an update on Fit for Work itself. So, we have been working

closely with our clients in the United Kingdom. And we’re wrapping up a small pilot project in

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 13

partnership with the DWP that's looking to determine the impacts of certain marketing efforts in

a certain region of the country to a certain set of employers to see how that will affect uptake

within the program.

In addition, Rich spoke about the Green Paper that was recently published, and there are a

number of references to Fit for Work within the Green Paper that speak to new opportunities to

increase awareness of the program. So, we’re going to continue to work with the client and try

to find a balanced approach to meet their program objectives as they evolve overtime and fit

within the construct of their vision for a more holistic approach to employment and health in the

United Kingdom. And those dialogue will just continue over the next several months.

And I just--to answer the obvious follow-on question, which is what was the contract spend that

was the $20 million that we chose not to rebid. And that was the health insurance exchange

contract with the State of Connecticut.

Ms. Lisa Miles: Thanks, Charlie. Next question, please.

Operator: Our next question is from Allen Klee with Sidoti.

Mr. Allen Klee: Yes. Hi. Can you provide any comment on the two larger contracts that are up

for rebid this year? How--timing on them and just any color of your thoughts on it.

Ms. Lisa Miles: One second, Allen.

Mr. Rich Montoni: Okay. Allen, if I understand your question, it's the timing of the contracts that

are up for rebid. The timing of the contracts are really skewed to the tail-end of the year so that

for all practical purposes, the results of those rebids become a fiscal year '18 revenue topic, not

a fiscal year '17. So, it's skewed towards the end of the year.

Mr. Allen Klee: Okay. And could you give U.S. some color on the appeals business doing well

this quarter, although it's not supposed to continue? What do you think was behind that?

Mr. Rich Montoni: Glad to do that. Rick Nadeau's anxious to answer that question.

Mr. Rick Nadeau: It wasn't anything overly significant other than just a build-up in the backlog

of work that they worked to--they worked steadily during the fourth quarter, worked it down.

Greater volumes create an improvement in our revenue. But, also a pretty good lift in the

profitability inside the rates that you get or, you know, recovery of fixed and variable cost of

volumes. You know, when volumes are high, they're more accretive.

We worked that backlog down to more normal levels. So, what we're really just trying to say is

that it'll be a more normalized level in fiscal year '17 as we worked off that backlog that has built

up.

Ms. Lisa Miles: Allen, thank you for your question. Next question, please.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 14

Operator: Our next question is from Mark Kelly with Stifel.

Mr. Mark Kelly: Hey, guys. Thanks. I was just curious, you’ve mentioned block grants a couple

of times. Can you talk a little bit more specifically about what that could mean for MAXIMUS?

Thanks.

Mr. Rich Montoni: We will do that. Bruce is anxious to talk about that.

Mr. Bruce Caswell: Sure. Anything related to policy. Thanks, Mark.

Mr. Mark Kelly: Sure thing.

Mr. Bruce Caswell: So, you know, it's still early days, obviously, in terms of the thinking there.

But, I think president-elect Trump has mentioned as part of his overall approach to policy that he

supports the block granting in Medicaid. I think, couple of things. I mean, there is that tension

that I mentioned earlier about how--what kind of funding obligation that would create at the state

level, and whether the federal funding would be sufficient in that environment. And we're--we

can't comment necessarily on how that would be resolved.

But, presuming that it moves down, it opens up an interesting conversation because Medicaid

then becomes more akin to CHIP in terms of the, you know, overall responsibility and authority

given to the states to further put their stamp on the program, and kind of make it their own. And

it does raise the question then about whether there are opportunities to look at a broader role for

MAXIMUS in areas like eligibility determination.

You may recall that, historically, for programs like Medicaid and TANF, and the SNAP program,

or food SNAP program, historically, a merit-based employee has had to have to--has had to

make those final eligibility determinations. Whereas in CHIP, where it was more function, more

like a block grant, that's not been the case.

So, we're optimistic that we can enter into some dialogue with our clients about how that would

function for them. And I think that we’re extremely well positioned, given the existing state

infrastructure we have to support that, should it occur.

Mr. Mark Kelly: Great. Thanks so much.

Mr. Bruce Caswell: Yep.

Ms. Lisa Miles: Thanks, Mark. Next question, please.

Operator: Our next question is from Frank Sparacino from First Analysis.

Mr. Frank Sparacino: Hi, guys. Just one question on the federal services side of things. If we

were to adjust out the call center in Boise, I'm trying to figure out if that segment grew at all in

'16. And I guess longer term, you know, what is the expectation? You know, is that an area of

growth? You know, what--what’s on the horizon? What gets you excited about that segment?

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 15

Mr. Rich Montoni: I am going to ask Rick Nadeau in a minute to talk about that, Frank. But, I

think the dynamics inside of our federal segments are very, very interesting. When I think about

that topically, I do think about the size of the federal government, I think about our current

breadth and depth, and I do think about the Acentia acquisition and how our plan to take

advantage of the synergies is in place and is yet to be realized. But, rest assured, we do have

actions and plans in place to drive U.S. to that goal. Rick?

Mr. Rick Nadeau: Yes. You know, we had acquired growth in the federal sector that was from

the acquisition of Acentia. And then as you referred to, we had the Boise contact center and we

said that was about $49 million. I think if you take those two pieces out, you had about $35

million of organic growth. But, obviously the 49 is bigger than the 35.

Mr. Rich Montoni: That helpful Frank?

Mr. Frank Sparacino: Yes, thank you.

Mr. Rick Nadeau: Sure.

Ms. Lisa Miles: Frank, do you have a second question? If not, next question please, operator.

Operator: Once again, if you'd like to ask a question, please press star, one on your telephone

keypad.

Our next question is from Shane Svenpladsen from Avondale Partners.

Mr. Shane Svenpladsen: Good morning. Acknowledging--.

Mr. Rich Montoni: --Good morning, Shane.

Mr. Shane Svenpladsen: Acknowledging the new administration may take a more aggressive

stance in terms of outsourcing. Have you seen anything more recently in terms of changes on

the parts of governments being amenable to outsourcing certain means tested programs?

Mr. Rich Montoni: Well, I--and Bruce, I'm going to ask you to chime in here. But, I think we've

seen a decade’s worth of that in terms of governments moving towards partnering with firms.

Clearly, there's a trend towards working with fewer larger providers rather than historically

governments may have sprinkled a lot of contracts to smaller suppliers, and in some cases

hundreds and hundreds suppliers. So, the trend to consolidate that supplier base, I actually

think that that's being driven by the fact that there is a significant cost to manage all of the

suppliers.

So, we've experienced that here in the U.S. and most notably in Australia and the United

Kingdom and I think the amount of work that we’re doing when many of our clients seems to be

on the margin add-ons in terms of the work that we’re doing. Bruce, is that your view?

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 16

Mr. Bruce Caswell: Absolutely my view. I think that, you know, really, Shane, when we look at

the model, if you're in the right place and you're able to have the dialogue with the client about

the problems they're facing at the moment, and thirdly you've got the infrastructure and ability to

deliver, you can really grow nicely off of existing contracts. And we’ve actually even kind of

modified our business delivery model to accommodate that through the use of greater shared

services centers where we can dynamically allocate, you know, demand to meet search

requirements for our clients. And there are several examples out there where I think we've seen

a propensity to outsource when clients have kind of an immediate need.

So, for example, one that was in the press where--is where we're helping the state of Arkansas

address a backlog in Medicaid renewal determinations of over 100,000 cases. And we were

able to rapidly respond to that, stand-up capability and help them through that issue.

So, I will say, I've been pleased with how the value proposition and the ability to provide that

kind of support, which itself can lead to longer term relationships, has been a bit on the uptick in

the marketplace.

Mr. Shane Svenpladsen: Appreciate that color. And then just quickly, if you could provide an

update on Acentia and kind of your progress in creating, you know, BPO opportunities within

those contract vehicles.

Mr. Bruce Caswell: I'll go ahead and take that, Shane. So, as you know, when we combined

with Acentia, we were able to add to our portfolio, if you will, about 12 new contract vehicles that

cover largely civilian and federal agencies in terms of our ability to then market to those

agencies and create new opportunities. So, we've always maintained that it would take some

time to gain traction in new opportunities resulting from that acquisition. And I will say that I've

been pleased with some of the initial pings that we've seen in terms of contract vehicles where

we've had bids that have expanded as a consequence of a larger capability that we can bring to

the table.

We've--you know, we--Rich mentioned in his prepared remarks that our business development

teams are fully integrated now, really pushing and pursuing new opportunities. Federal pipeline

itself remains quite strong. It does include new BBO business where we can leverage our core

capabilities, but go-to-market through those contract vehicles that I mentioned.

And also, if you recall, the federal government contracting space is one where there are larger

government-wide acquisition contracts that companies have to qualify for to then subsequently

receive task order opportunities.

And I will say, without, you know, disclosing the names of the vehicles themselves, we are, as a

consequence of the Acentia combination, in a position now to qualify for much larger

government-wide acquisition contracts that overtime will then deliver a lot of revenue through

task order. So, we expect to see--you know, it's worth mentioning as the new administration

comes on board and they put their appointees in place, and really begin to enact their agenda,

there may be a bit of a slowdown on the federal side.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 17

But, many of the programs that we look at are tied to long-term transformational projects in key

government agencies. And generally those transformation programs that can be, you know,

decade in length don't change dramatically as administrations change.

Ms. Lisa Miles: Thank you for your questions, Shane. Next question, please.

Operator: Yes. As a reminder, if you'd like to ask a question, please press star, one. And our

next question is from Richard Close from Canaccord Genuity.

Mr. Richard Close: Thanks. With respect to HAAS, I guess 200 million this year, 200 million

expected next year, I think that's a little bit below the 225 that you guys have previously

adjusted to. Can you just go over that?

Mr. Rick Nadeau: Yeah, Richard, this is Rick. That would be currency. Following Brexit, the

currency exchange rate went from 1.42 or whatever --it went down below 1.20, but it's now at

about 1.25. So, that's really accounting for the reduction. It's all the difference between the U.K.

and the U.S. currency.

Mr. Richard Close: Okay. And another follow-up would be, the $40 million federal contract that

you talked about that's negatively--or included in your initial '17 guidance, just to be clear, that is

not ACA related; correct?

Mr. Rick Nadeau: That is correct. That is not an ACA contract.

Mr. Richard Close: Great.

Ms. Lisa Miles: Next question please.

Operator: Our next question is a follow-up from Brian Kinstlinger.

Mr. Brian Kinstlinger: Great. Thanks. In a similar discussion on the DoE contract, I'm not sure

if we discussed that today, I may have missed it. I'm curious if for the full-year of fiscal '17, it's

assume to be at mature margins. If not, when might it hit mature margins in your opinion?

Thanks.

Mr. Rick Nadeau: Yeah, it's Rick. It's crossed over and should be profitable. It will continue to

improve overtime. But, I think we're getting to the point where we’re getting a lot of closer to

mature margins.

Mr. Rich Montoni: And in fact I would--Brian, I would give our team a call-out for the way that

they've handled that transaction. There's been a lot of moving pieces and I think they've done a

very good job. And I agree with Rick that in our category, it's crossed over to--I'll put it out of

start-up. But as is always the case, large contracts have challenges.

MAXIMUS Fourth Quarter 2016 Earnings Call

November 10, 2016

Page 18

Mr. Brian Kinstlinger: So, just to be clear, in fiscal '18, there'll be a small slingshot effective in

the first half of the year it's not fully mature whereas it might be in the first half of fiscal '18. Is

that the way we should think about it?

Mr. Rick Nadeau: I would think that--the way I would put it is that all contracts that we have of

size, we should be improving the profitability of them overtime. But yes, we're still improving the

margin on that contract. But, I would be thinking smaller rather than bigger.

Mr. Rich Montoni: Yes, small slingshot, Brian.

Ms. Lisa Miles: Thanks, Brian. Next question, please.

Operator: Ladies and gentlemen, we have reached the end of the question and answer session

and are out of time for today’s call. MAXIMUS thanks you for your time and participation. You

may disconnect your lines at this time.