MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 1

Operator: Greetings and welcome to the MAXIMUS Fiscal 2016 Third Quarter

Conference Call.

At this time, all participants are in a listen-only mode. A question-and-answer session

will follow the formal presentation. If anyone should require operator assistance during

the conference, please press star, zero on your telephone keypad. As a reminder, this

conference is being recorded.

I would now like to turn the conference over to your host, Lisa Miles, Senior Vice

President of Investor Relations. Thank you. You may begin.

Ms. Lisa Miles: Good morning and thank you for joining us. With me today is Rich

Montoni, CEO, Bruce Caswell, President, and Rick Nadeau, CFO.

I would like to remind everyone that a number of statements being made today will be

forward-looking in nature. Please remember that such statements are only predictions,

and actual events and results may differ materially as a result of risks we face including

those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the

summary of these risks in our most recent 10-K filed with the SEC. The company does

not assume any obligation to revise or update these forward-looking statements to

reflect subsequent events or circumstances.

Today's presentation may contain non-GAAP financial information. Management uses

this information in its internal analysis of results and believes this information may be

informative to investors in gauging the quality of our financial performance, identifying

trends in our results and providing meaningful period to period comparisons. For a

reconciliation of the non-GAAP measures presented in this document, please view the

company's most recent quarterly earnings press release.

And with that, I'll hand the call over to Rick.

Mr. Rick Nadeau: Thanks, Lisa.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 2

This morning, MAXIMUS reported financial results for the third quarter of fiscal year

2016. All things considered, MAXIMUS delivered a solid quarter of financial results led

by our Health Services Segment.

But, first, I want to review two unusual items that occurred in the third quarter. During

the third quarter, the company sold its K-12 education practice. This software oriented

non-core business was part of the Human Services Segment. As a result, MAXIMUS

recorded a pretax gain on the sale of $6.5 million, which after-tax computes to 6 cents

of diluted earnings per share.

On the expense side, we recorded legal expense of $2.1 million or 2 cents of legal cost

in the third quarter of fiscal year 2016 that related to a matter that occurred in fiscal year

2014.

In addition to the unusual items, the better than expected earnings delivery in the third

quarter was due to the timing of revenue and profit from the start-up of a large

expansion to an existing contract that was accelerated into the third quarter. We

previously expected the start-up revenue in the fourth quarter.

Now, I will cover the total company financial results. For the third quarter of fiscal year

2016, total company revenue grew 8 percent to $617.1 million compared to the same

period last year. This was comprised of organic revenue growth of 8 percent, which was

driven by the Health Services Segment, acquired revenue growth of 2 percent from the

Ascend and Assessments Australia acquisitions, and a 2 percent decline or $9.9 million

from the effects of foreign currency translation. On a constant currency basis, total

company revenue would have grown 10 percent.

Operating margin for the third quarter of fiscal year 2016 was 13.7 percent compared to

12.4 percent in the prior year. For the third quarter, net income attributable to MAXIMUS

was $52.2 million, and diluted earnings per share totaled 79 cents.

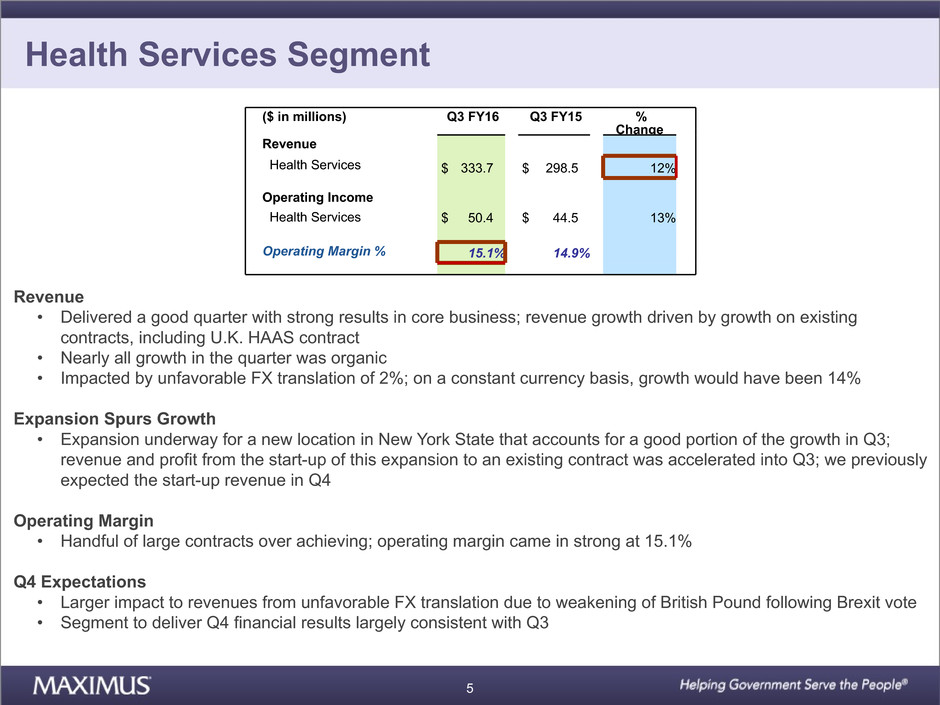

Let's turn our attention to Segment results starting with Health Services. Overall, the

Health Services Segment delivered a good quarter with strong results in our core

business. Segment revenue increased 12 percent over last year, driven by growth on

existing contracts including the U.K. HAAS contract. Nearly all growth in the quarter was

organic.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 3

Revenue in the quarter was also impacted by unfavorable foreign currency translation of

2 percent. On a constant currency basis, revenue growth for the Segment would have

been 14 percent.

As you may have already seen in the media, we also have an expansion underway for a

new location in New York State that accounts for a good portion of the growth in the

third quarter. The revenue and profit from the start-up of this expansion through an

existing contract was accelerated into the third quarter. We previously expected the

start-up revenue in the fourth quarter.

With a handful of large contracts overachieving, the operating margin for the Health

Services Segment came in strong at 15.1 percent and was relatively consistent with the

prior year.

Looking out to the fourth quarter, we currently expect a large impact to our revenues

from unfavorable currency translation due to the weakening of the British pound

following the Brexit vote. We expect the Segment to deliver fourth quarter financial

results that are largely consistent with the third quarter.

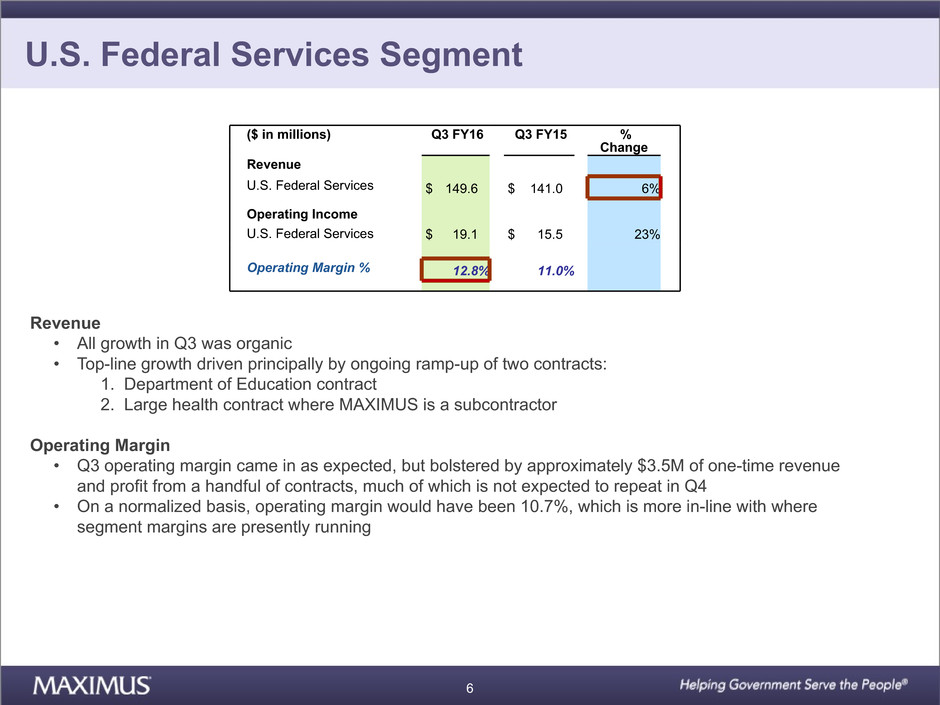

I will now speak to the U.S. Federal Services Segment. Revenue in the third quarter of

fiscal year 2016 increased 6 percent compared to the prior year, and all growth in the

quarter was organic. Top line growth was driven principally by the ongoing ramp of two

contracts, the Department of Education contract and a large health contract where

MAXIMUS is performing as a subcontractor.

The third quarter operating margin for the Federal Segment came in as expected and

was 12.8 percent. This was bolstered by approximately $3.5 million of one-time revenue

and profit from a handful of contracts, much of which is not expected to repeat in the

fourth quarter. On a normalized basis, operating margin would have been 10.7 percent,

which is more in line with where our Federal Segment margins are presently running.

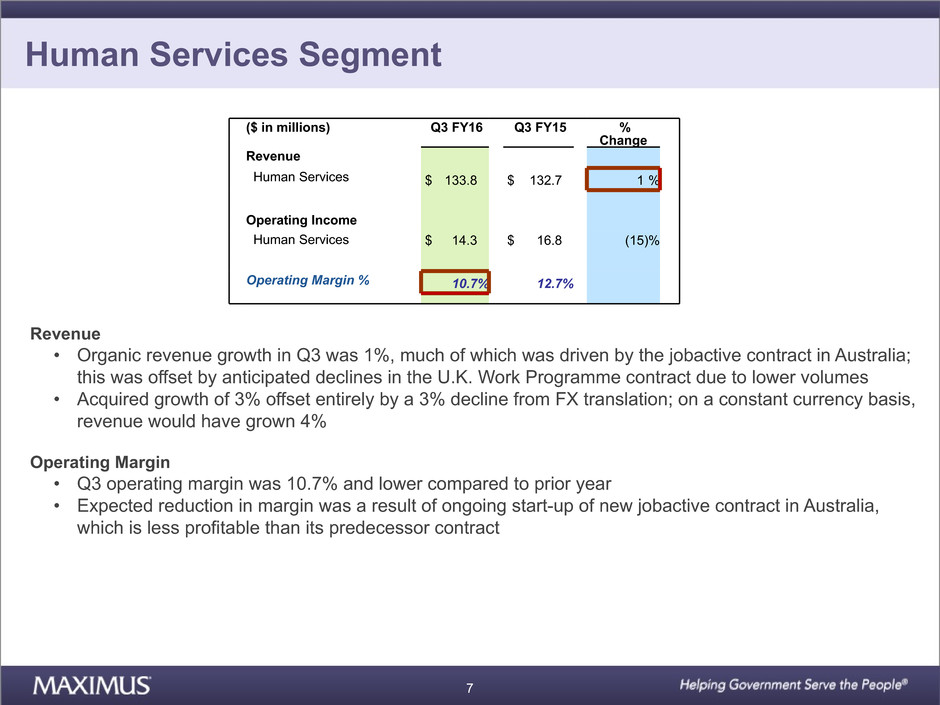

I'll wrap up our Segment discussions with the financial results for the Human Services

Segment. For the third quarter of fiscal 2016, revenue grew 1 percent compared to the

same period in the prior year. Organic revenue growth in the quarter was 1 percent,

much of which was driven by the jobactive contract in Australia. This organic growth

was offset by the anticipated decline in the U.K. work program contract due to lower

volumes.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 4

The Human Services Segment also had acquired growth of 3 percent, which was offset

entirely by a 3 percent decline from foreign currency translation. On a constant currency

basis, revenue would have grown 4 percent.

As expected. the Human Services Segment operating margin in the third quarter of

fiscal 2016 was 10.7 percent and lower compared to the prior year. The expected

reduction in margin was a result of the ongoing startup of the new obactive contract in

Australia, which is currently less profitable than its predecessor contract.

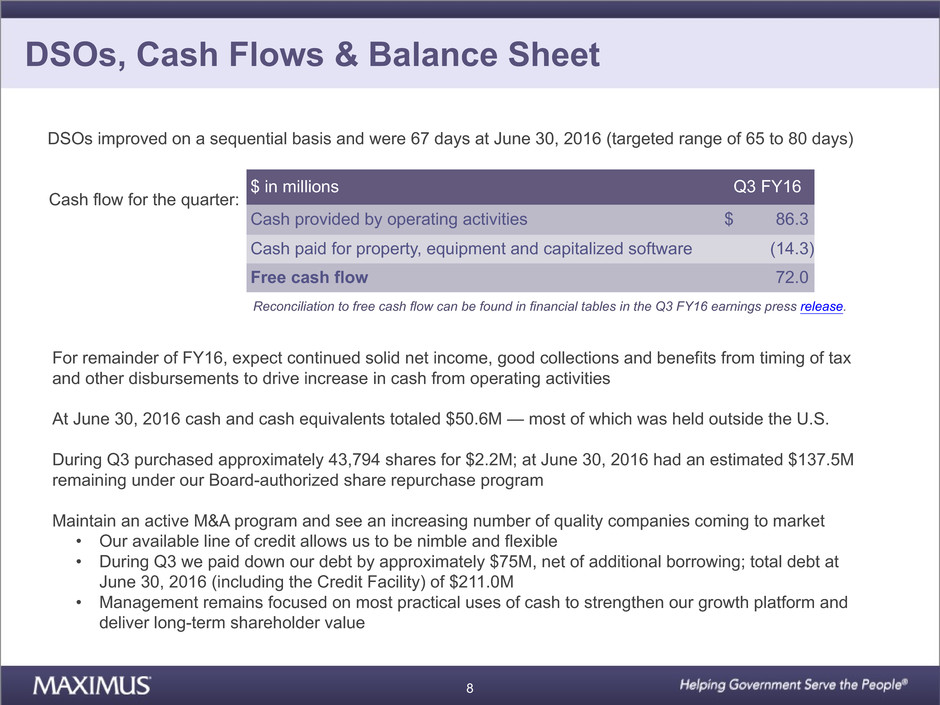

Let me move on to discuss cash flow and balance sheet items. As expected, days sales

outstanding improved on a sequential basis and were 67 days at June 30th. This

remains in line with our targeted range of 65 to 80 days.

For the third quarter of fiscal 2016, cash provided by operating activities totaled $86.3

million with free cash flow of $72.0 million. For the remainder of the year, we expect

continued solid net income, good collections and benefits from the timing of tax and

other disbursements to drive an increase in cash from operating activities.

At June 30th, we had cash and cash equivalents totaling $50.6 million with most of our

cash held outside of the United States. During the third quarter, we purchased 43,794

shares for $2.2 million. At June 30th, we had an estimated $137.5 million remaining

under our Board authorized share repurchase program.

In terms of capital deployment, we maintain an active M&A program, and we’ve seen

increasing number of quality companies coming to market. Our available line of credit

allows us to be nimble and flexible. During the quarter, we paid down our debt by

approximately $75 million net of additional borrowing.

Our total debt at June 30th, including the credit facility, was $211 million. Above all,

management remains focused on the most practical uses of cash in an effort to

strengthen our growth platform and deliver long-term shareholder value.

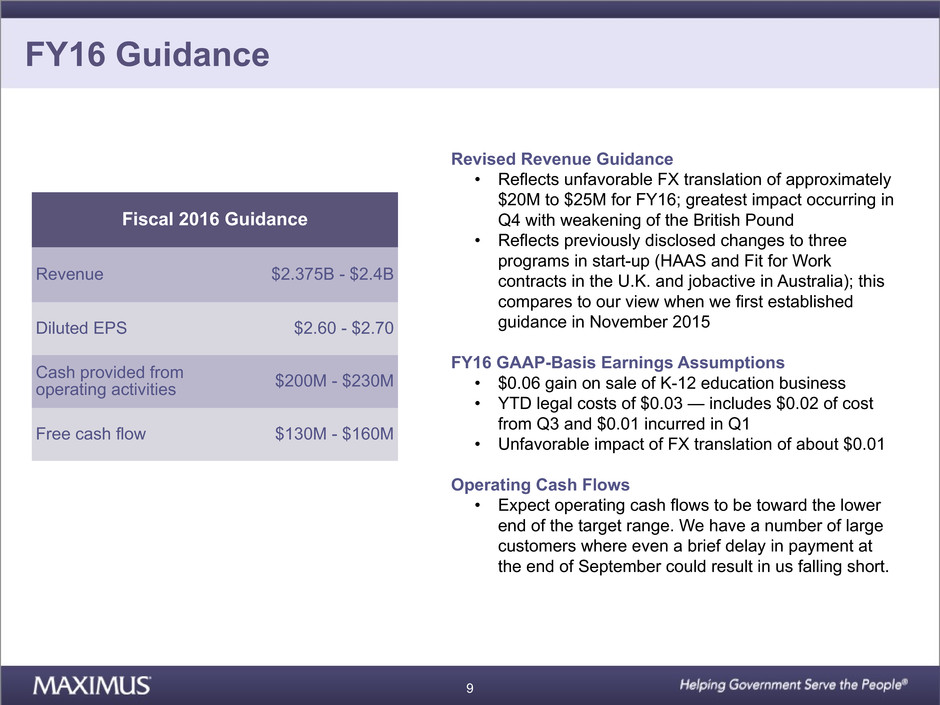

And lastly, guidance - as noted in this morning's press release, we are lowering our

revenue guidance and now expect revenue for the full year of fiscal 2016 to range

between $2.375 billion and $2.4 billion. This is due in large part to unfavorable foreign

currency translation of approximately 20 to $25 million for the full fiscal year with the

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 5

greatest impact occurring in the fourth quarter with the weakening of the British pound.

The revised revenue guidance also reflects the previously disclosed changes to three of

our programs in startup, which are the HAAS and Fit for Work contracts in the U.K. and

the jobactive contract in Australia. This compares to our view when we first established

guidance in November of 2015.

On the bottom line, MAXIMUS is tightening our earnings guidance for fiscal 2016 and

now expects GAAP basis diluted earnings per share to range between $2.60 and $2.70.

There are a couple of puts and takes in the earnings range, so let me recap. This range

includes the 6 cent gain on sale of our K-12 education business, year-to-date legal

costs of 3 cents. This includes the 2 cents of cost from this quarter and a penny that

was incurred in the first quarter. And we also expect diluted earnings per share to be

unfavorably impacted by foreign currency translation by about a penny for fiscal 2016.

For the full year of fiscal 2016, we continue to anticipate operating cash flows in the

range of 200 to $230 million but at the lower end of that range. However, even a brief

delay in payment from one of our large customers at the end of September could result

in us falling short of this target. We still anticipate free cash flow in the range of 130 to

$160 million for the full fiscal year.

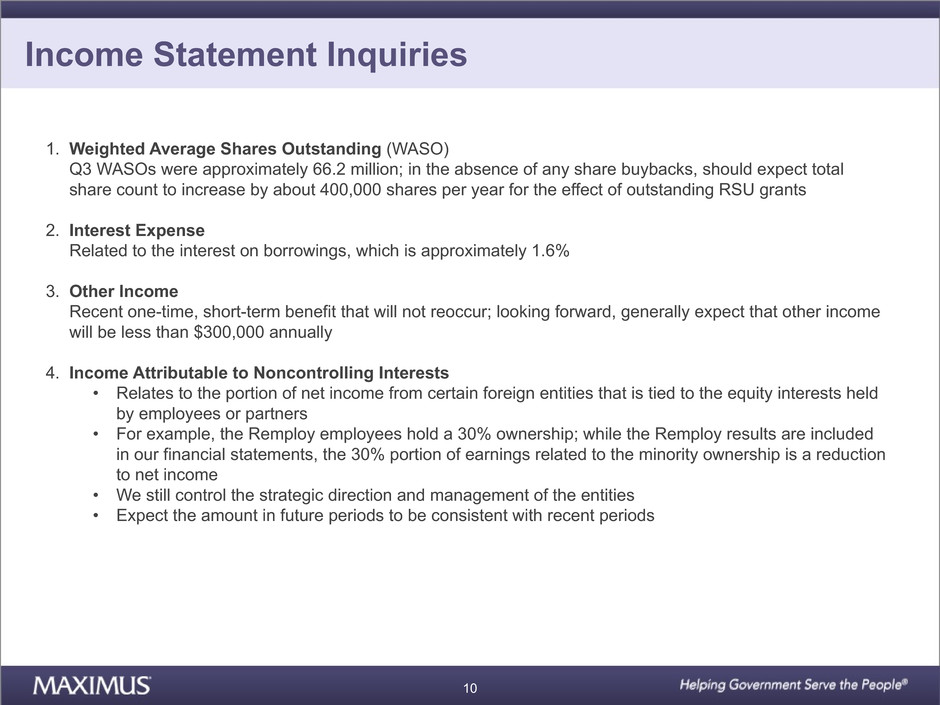

In addition, I'd like to provide some commentary on a few specific items from the income

statement that have generated some questions. The first is our expectations for

weighted average shares outstanding. For the third quarter, this was approximately 66.2

million shares. In the absence of any share buybacks, we should expect our total share

count to increase by approximately 400,000 shares per year for the effect of outstanding

restricted stock unit grants.

The second is the interest expense line. This is related to the interest on our

borrowings, which is approximately 1.6 percent.

The third is the other income line, which recently had a one-time short-term benefit that

will not recur. Looking forward, we generally expect that our other income will be less

than $300,000 annually.

A final item is the income attributable to non-controlling interests. This relates to the

portion of net income from certain foreign entities that is tied to the equity interest held

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 6

by employees or partners. A good example would be the Remploy employees who hold

a 30 percent ownership. While the Remploy results are included in our financial

statements, a 30 percent portion of earnings related to the minority ownership is a

reduction to net income. Nevertheless, we still control the strategic direction and

management of the entities. We expect the amount of income attributable to non-

controlling interest in future periods to be consistent with recent periods. We hope that

you find these additional details helpful.

Thanks for your continued interest, and now I will turn the call over to Rich.

Mr. Rich Montoni: Thank you, Rick, and good morning, everyone. As we move into the

home stretch of fiscal 2016, I will focus my comments today on two topics. The first is

new work where we are creating value for existing clients, and the second is industry

trends that complement our core capabilities and serve as markers for long-term growth

opportunities.

Let's start with a couple of key contract wins and expansions that have transpired since

the last quarter. In the category of good news, the centers for Medicare and Medicaid

services recently awarded MAXIMUS the Part A West Medicare Appeals Work. The $42

million contract covers a one year base and three one-year option periods.

MAXIMUS previously held this contract but lost it in the competitive bid in 2014, and our

contract ended in 2015. Winning back this work demonstrates the quality, efficiency and

value we bring to our government clients. As the Part A West Qualified Independent

Contractor, or what's referred to as QIC, MAXIMUS is responsible for all

reconsiderations of Part A related claims that originate in 24 western states and three

territories.

Recall that MAXIMUS has provided independent determinations for the Medicare

program for more than 25 years. With the addition of this latest contract, MAXIMUS now

holds four of the Medicare QIC contracts serving Part A East and West, Part C and Part

D.

Over the years, our work for Medicare program has served as a springboard for our

growing global appeals and assessments business. In the U.S., this includes eligibility

appeals for the federal marketplace, independent medical and billing reviews for

California's workers compensation program and appeals for state Medicaid programs.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 7

With our recent acquisition of Ascend, we have extended our assessment capabilities

into a new set of services. This includes preadmission screening and resident review

services known as PASRR. MAXIMUS now conducts Level 2 PASRR evaluations for

individuals with mental health conditions, developmental disabilities or other related

conditions.

The evaluations help ensure appropriate placements in a nursing facility or community

based setting. They also help ensure individuals receive the required services

regardless of placement. In June, MAXIMUS won a key rebid contract to provide

PASRR services for the state of Tennessee. This contract was the largest from the

acquired Ascend portfolio and runs for three years with a total contract value of $28

million. We also brought our assessment capabilities into states where we first

established a foothold as the Medicaid enrollment broker.

You may recall that MAXIMUS operates New York's conflict free assessment center.

The center helps the state to determine eligibility for adults who are seeking home and

community based long-term services and support as well as enrolment into a managed

long-term care plan.

Since we started this project, we have worked closely with our client to achieve the goal

of timely, professional and independent assessments conducted by skilled nurses in a

home based setting. As the needs of the state have increased, we have grown our

scope of work to include additional populations. And as populations continue to age and

their healthcare needs become more complicated, coupled with a growing complexity of

government programs, demand for our services increases. States are always looking for

ways to bend the Medicaid cost curve while also ensuring high quality services.

This is particularly true for certain high needs, high cost populations who may need to

be assessed in order to be placed in the appropriate setting, receive the correct level of

services or move from fee per service models into managed care. Like most markets,

such future opportunities will take time to fully materialize, but MAXIMUS is well

positioned to provide independent, conflict free assessment services and a cost

effective model for our clients.

As part of an expansion of our work in New York, MAXIMUS recently launched hiring

efforts for a new customer contact center Rochester. The expansion is tied to an

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 8

increased level of administrative and contact center services for several different health

programs that we support throughout the state. We are on the process of hiring

approximately 2,000 new staff positions. We expect it will take several months to

achieve full ramp.

MAXIMUS has a long history of operating both state and federal government programs

out of New York. Since 1998, MAXIMUS has provided administrative support services

for a variety of programs. These include Medicaid, CHIP, the Physician Profile Program

and the State’s Health Insurance Exchange. We also provide services for several other

state and federal health programs out of New York, including appeals and adjudication

services for Medicare. With an excellent talent pool, New York serves as an important

hub for many MAXIMUS operations, and we are pleased to be expanding our footprint.

Moving on to our U.K. operations, with a brief update on the Health Assessment

Advisory Services contract - we still expect the HAAS contract to be a mid single-digit

margin contributor for fiscal 2016. Today, I can report that the contract carried its weight

in the third quarter. We are pleased with the important improvements we’ve brought to

the customer experience. While our U.K. team continues to work diligently to meet our

targets, at the end of the day, it’s a tough contract and a high profile program who may

have additional progress to achieve.

Following the Brexit referendum, many wondered how the U.K.'s departure from the

European Union will impact MAXIMUS. From an operating perspective, this is a neutral

event because none of our existing contracts are tied to any European social funds. For

now, it’s steady as she goes for our current operations.

From a political perspective, the new Prime Minister has introduced a new ministerial

team at the Department for Work and Pensions. DWP is one of our largest clients, so as

the new team ramps up, we are working to inform them about the work we do and the

value we add to their programs.

From an economic perspective, it’s difficult for us to speculate on how Brexit will

ultimately impact the U.K. economy. As Rick mentioned, the effect of the Brexit vote and

value of the British pound is expected to impact our foreign currency translation in the

fourth quarter. In summary, the U.K. remains an important market for MAXIMUS. We

remain committed to supporting the government in achieving its goals.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 9

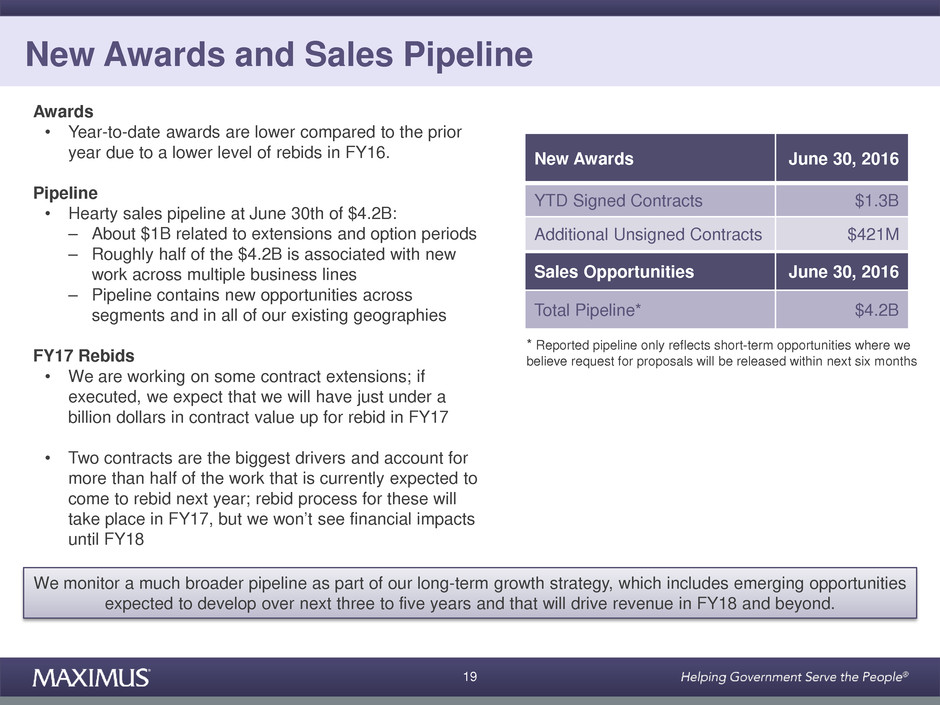

Moving on to our new awards in the pipeline, year-to-date signed contracts at June 30th

totaled $1.3 billion. We also had an additional $421 million in awarded unsigned

contracts. As expected, year-to-date awards are lower when compared to the prior year.

As a reminder, this is principally due to the lower level of rebids in fiscal 2016 compared

to 2015. In fact, the total contract value of rebids in fiscal 2015 was approximately $1

billion higher than in 2016.

Our sales pipeline at June 30th was hearty at $4.2 billion. Of the $4.2 billion,

approximately $1 billion is related to extensions and option periods. In addition, about

half of the $4.2 billion is associated with new work across multiple business lines. This

compares to a pipeline of $2.8 billion for the same period last year. On sequential basis,

the pipeline is up from $3.2 billion reported in the second quarter of fiscal 2016. The

pipeline contains new opportunities across Segments and in all of our existing

geographies.

Looking ahead to rebids in fiscal year 2017, we have some contract extensions that

we’re working on. If executed, we expect that we’ll just under $1 billion in contract value

up for rebid in fiscal 2017. There are two contracts that are the biggest drivers and

account for more than half of the work that is currently expected to come to rebid next

year. It’s important also to point out that the rebid process for these will take place in

fiscal 2017, but we won’t see the financial impacts from the new contracts until fiscal

2018. We will provide the details for fiscal 2017 rebids on our November call.

As a reminder, we monitor a much broader pipeline as part of our long-term growth

strategy. It includes emerging opportunities that we expect to develop over the next

three to five years and that will drive revenue in fiscal 2018 and beyond.

In closing, we remain keenly focused on helping our government clients run effective

and efficient programs. Our number one goal is high quality service delivery to ensure

the satisfaction of our clients.

As part of our quality and risk management strategy, MAXIMUS conducts an annual

client satisfaction survey. This allows our customers to rank us in areas such as

competency of our project staff, how accessible and responsive we are to our clients'

needs and our ability to provide value to public programs by delivering outcomes that

matter.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 10

This year’s survey results showed strong performance across the entire company with

an average score that's above our goal. In fact, more than 50 projects received a perfect

score. Congratulations to the team on another successful year as we remain a trusted

partner to governments around the world.

We are pleased with the results of this quarter and expected results for the remainder of

fiscal 2016. We believe the long-term growth drivers for future years remain in place

and are strong. Yet, as Rick noted, we have lots of irons in the fire, so it’s still too early

to speak to fiscal 2017. As is our standard practice, we will issue formal guidance on our

year end call in November.

And with that, let's open it up for questions. Operator?

Operator: Thank you. At this time, we will be conducting a question and answer

session. If you would like to ask a question, please press star, one on your telephone

keypad. A confirmation tone will indicate your line is in the question queue. We ask that

you limit your questions to one with one follow up so that others may have an

opportunity to ask questions. You may reenter the queue at any time by pressing star,

one. If you do need to remove your question from the queue, you may press star, two.

For participants using speaker equipment, it may be necessary to pick up your handset

before pressing the star keys.

Our first question is from Dave Styblo from Jefferies. Please go ahead.

Mr. Dave Styblo: Hi there, good morning.

Mr. Rich Montoni: Good morning, David. How are you?

Mr. Dave Styblo: Good, thanks. So, let’s start on the New York details that you guys

brought up to speed. So, part of--I guess in the third quarter here, you had some benefit

pull forward from the fourth quarter. Can you just help us understand a little bit about the

magnitude of that and if that’s sort of continues into the fourth quarter?

And then more broadly on New York, you've got a sizable hire of ramping up a couple of

thousand employees. That's pretty large on your relative base. So, is that just to support

New York or other--or is it for activities outside of this state? And can you just give us a

better sense of how much revenue that you see in the pipeline coming from this, is it in

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 11

the pipeline now or is this sort of expansion work that wouldn't necessarily flow through

the pipeline?

Mr. Rich Montoni: Okay, let's take the second half of that question first, and Bruce and I

will tag team it, but I think there's a couple of parts to it - how much of this work relates

to other states, and is this work that was in the pipeline, not in the pipeline. Bruce,

you're quarterbacking this with your team. How would you answer that question?

Mr. Bruce Caswell: Sure. Well, all of this work really relates to our work in New York

State. We've been working in New York since 1998, and we support multiple benefit

programs for the state across the board, Medicaid and CHIP and health insurance

exchange programs. So, it really is just a growth in our relationship with the state of

New York.

Mr. Rich Montoni: Okay. And I do think this went through the pipeline in a normal

course. So, it’s reflected in the pipeline, and when we look at pipeline dynamics, you

actually see this move through opportunities, tracking, etc., through the pipeline. Okay?

Rick Nadeau as it relates to the details on the quarter.

Mr. Rick Nadeau: Yeah, Dave, some of the over delivery that we had in this quarter

was related to the accelerated timing of the startup of the project that Bruce just talked

about, and really specifically the infrastructure built of that expansion project. We

actually got started earlier and captured the revenue earlier than we had initially

forecasted.

So, as you look forward I think you really ought to think about or I guess my suggestion

would be that you think about moving 3 cents from Q4 to Q3 from the fact that we did

capture that revenue earlier on that infrastructure build-out.

Mr. Rich Montoni: And the one last one I'd emphasize Dave is that it relates to multiple

projects in New York.

Mr. Dave Styblo: Okay. Can you guys sort of size the total revenue opportunity that is

gonna be sort of progressing across the state from this and the 2,000 lives that need to

support that? I mean, I think that’s like an 11 percent increase to your employee base,

so sounds like this is quite large.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 12

Mr. Rich Montoni: Yeah, we can't at this point in time, because of client restrictions on

disclosures, give you those details. But, I think you can use the number of employees,

which we estimate when this thing ramps up to be an additional 2,000 employees. So, I

think you can use that as a reasonable proxy for revenue implications.

Mr. Dave Styblo: Okay.

Mr. Rich Montoni: Okay?

Ms. Lisa Miles: Thanks, Dave. Next question please.

Operator: Our next question is from Richard Close from Canaccord Genuity.

Mr. Richard Close: Great. Thank you for taking the questions. With respect to the

HAAS contract and just going--digging in a little bit deeper, there I appreciate, you

know, you saying mid-single digit margin contributor for the entire fiscal '16. Maybe if

you could provide us a little bit more detail in terms of where you expect to be as you

exit fiscal '16 in terms of sort of a run rate margin there, first of all?

And then I guess a follow-up question on a different subject on the health assessments

and the Ascend acquisition - I was wondering if you could sort of give us a total

addressable market maybe for some of the services that Ascend is providing on

assessments?

Mr. Rich Montoni: Okay. Two questions - we’re going to ask Rick Nadeau to address

the HAAS question. In particular I think you're asking where do we think we will exit

fiscal '16 as it relates to an operating margin for the HAAS contract.

Mr. Rick Nadeau: Yeah, Richard, I look at it as--we look at FY '17. We believe this

program will during FY '17 come into our normal range of operating income. As we’ve

told everyone previously, that's in our 10 to 15 percent range. And we do believe that

that is where we will perform in FY '17 for HAAS.

Mr. Rich Montoni: Okay. On help assessments addressable market, my reaction to it--

and Bruce Caswell, feel free to chime in here. I don't have a specific number I’m gonna

share with you, Richard, but I do think this - I think the demand for conflict free

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 13

assessments and appeals is quite substantial. We’re actually pleasantly surprised and

pleased as it relates to how we're seeing those come at us in the marketplace.

We're seeing it directly through channels, but we’re also seeing it start to elevate and

become part of our normal service offerings, as well. I would tell you that I think the

market for appeals and assessments is hundreds of millions of dollars, but I'm going to

there and not provide more detail. Bruce Caswell?

Mr. Bruce Caswell: I would agree completely because there really are a number of

different assessments out there that we're now performing beyond just those that are

part of the Ascend portfolio. And Rich mentioned in his remarks that, past our

assessments, there are supports intensity scale assessments, there are assessments

that we perform separate from what we combine with Ascend in terms of capabilities

that relate to, as Rich said, conflict free assessments to help individuals qualify for long-

term services and supports and manage long-term care in a number of states.

So, looking at it at a high-level, there are 46 million seniors in America, and, you know,

most of them have covered obviously through Medicaid. Many of them--I read recently

at Keiser report that would suggest 50 percent of them need some form of long-term

services and supports, and it’s often an assessment that is done that's part of the

gateway to that process and access to those services. And that was emphasized a bit

as part of the Medicaid regs that came out about a quarter ago that we spoke to on the

last call.

So, I think Rich is correct in saying it's a robust and broad market for us.

Ms. Lisa Miles: Thanks, Richard. Next question please.

Operator: Our next question is from Charlie Strauzer from CJS Securities.

Mr. Charlie Strauzer: Hi, good morning. Just picking up on those previous questions, if

you look at, you know, the total pipeline overall, you had a pretty nice--it's a pretty nice

healthy amount of new work that you’re tracking there. And as it relates to Ascend, you

know, are you starting to see some of the fruits of their, you know, their contract, you

know, ability, I should say, in that pipeline?

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 14

Mr. Rich Montoni: In fact, we are. My thoughts on Ascend at this point in time include

the fact that I think it's a great complementary expansionary addition to what we do and

expansion of our core. I think the integration is going quite well. We’re really pleased

with the team that's joining us, the employees from Ascend. I think, most importantly--

and this acquisition was really about revenue synergies, not cost synergies.

I think the revenue synergies are starting to take hold. I think our team and their team--

teams are very much engaged in addressing the market. We're really pleased with that

this most--the largest contract of Ascend was up for rebid this past quarter, and the

teams did a great job to win that rebid. So, we're really pleased about that. So, it's a

factor, Charlie, in the growth in our pipeline. So, I think that's a hallmark of a good

acquisition. Bruce--?

Mr. Charlie Strauzer: --Great. Excellent.

Mr. Bruce Caswell: I agree completely, yes. We're seeing it now show up in the pipeline

in a very positive fashion.

Mr. Rich Montoni: Yeah.

Mr. Bruce Caswell: Absolutely.

Mr. Charlie Strauzer: Excellent. And then just my follow-up is just on the U.K. and the

new DWP team and the new government there. What do you--you know, Rich if you

could maybe expand a little bit more your thoughts on, you know, how they approach,

you know, privatization and the contracts like you're performing there?

Mr. Rich Montoni: Yeah, my view is I don't think there is much of a change as it relates

to that government's inclination to partner with firms like MAXIMUS. Every indication I

receive is that they fully appreciate the work we do, the partnership. You know, one

good thing about our hard work over the last several years in the U.K. is I really do think

that we have the on the ground teams that work very, very well in a positive fashion.

And every indication I have, Charlie, is that that continues today.

Mr. Charlie Strauzer: Great. Thank you.

Mr. Rich Montoni: Thank you.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 15

Ms. Lisa Miles: Thank you, Charlie. Next question please.

Operator: Our next question is from Shane Svenpladsen from Avondale Partners.

Mr. Shane Svenpladsen: Good morning. With respect to recent rebids and new

opportunities in your eligibility enrollment business, are there any notable changes in

bidding behavior in the part of your competitors that are worth calling out or any new

entrant into that space?

Mr. Rich Montoni: Changes in new entrants - in terms of changes, I would say no, I

don't notice any meaningful change in behavior. It is--it's a somewhat open market,

meaning that it’s not a duopoly or a monopoly. On the other hand there are meaningful

barriers to entry. Our customers do place a very significant weighting on any bidder's

past performance and ability to deliver quality service.

That being said, there are half a dozen of competitors. We do see some ebb-and-flow,

particularly at the smaller level or the lower level, but I wouldn't consider to be a sea

change of any sort.

You do have some larger competitors historically that have gone through some very

significant business combinations, and now we’re going through some business

disaggregation. So, we should all watch in terms of what's that mean in the

marketplace. I think there’s a little bit of to be determined, especially with those larger

players. That would be my commentary.

In terms of pricing behavior, it remains competitive, so we're always compelled to look

for new ways to deliver more efficient services. That's very, very important in this

industry.

Mr. Shane Svenpladsen: I appreciate that. And then just as a follow-up, how would you

characterize the near and medium-term procurement environment in each of the U.S.,

U.K. and Australia?

Mr. Rich Montoni: I would characterize the overall environment as it relates to

procurement as steady as she goes. Most of this work is in place and is--and rebids are

normally required. I think we're in an environment where there's a tendency of our

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 16

clientele to--certainly to exercise option periods. In fact, I think we're betting 100 this

year in terms of option periods. I think we betted 100 percent last year.

And on top of that, there is a tendency in the marketplace for clients to extend,

sometimes beyond option periods, to avoid what otherwise would be a costly rebid

situation. And I think that perhaps is even heightened, given the changes in the

leadership and elections that we have in hand.

So, if anything, I think the so what is gonna be that we’re gonna see more extensions

and option periods elected. And in addition, we do--and I think evidence of what we’re

seeing in our health business in the US. What's behind that what I think is very

respectable growth is additional work that we're doing for our clients. That's, I think, a

very significant long-term growth driver.

I'm pleased we are seeing it today, and I think we’ll continue to see it. As these

governments continue to ratchet down eligibility qualifications, there seems to be a

heightened interest in demand for the integrity of the program. So, we work very closely

with our clients to ensure that. And as we shared with you in my notes, we continue to

see increased focus on long-term support services, the elderly and the disabled. And

those are areas where we’re quite accomplished. Is that helpful Shane?

Mr. Shane Svenpladsen: Yes, thank you.

Mr. Rich Montoni: Sure.

Ms. Lisa Miles: Thanks for your questions, Shane. Next question please.

Operator: Our next question is from Brian Kinstlinger from Maxim Group.

Mr. Brian Kinstlinger: Great, thanks so much. Hi, guys. The first question I have was

just a numbers question. Can you quantify the rebids in fiscal '15 that you won versus

year-to-date in '16? I know you mentioned the difference is $1 billion, but maybe you

can give us some numbers?

Mr. Rich Montoni: Well, if Lisa can look it up quickly, we can give you some numbers,

but I'll give you some thoughts. When I think about rebid situations '15 versus '16, '15

was a very, very--or '16, rather, is a very, very lean year as it relates to rebid situations.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 17

And we've done very well from a win percentage whereas the prior year '15 seem to be

more normal with a much, much higher rebid, amount up for rebid. I think from a win

perspective in both situations, it seems as if we're running 90 percent plus in terms of

winning our rebid.

So, I think that's pretty reflective of industry-standard. As you know, our clients are not

inclined to change frequently. They tend to stick with the incumbent. We know there’s a

huge home-court advantage in this situation. And I think MAXIMUS enjoys that due to

our solid performance.

So, when I think about the situation year-over-year, last year was normal but much

heavier than '16, this year is a lighter year. And '17 we expect is gonna be more towards

normal. But, ultimately, '17 will depend upon extension and option activity between now

and November when we give you a final number.

Ms. Lisa Miles: And, Brian, relative to 2015, we had about $1.2 billion up for rebid last

year, and we closed out the year with winning all of that but $9 million.

Mr. Brian Kinstlinger: And this year, should I--to finish the first question, you had 200

million so far. Is that right then?

Ms. Lisa Miles: So, for the--for fiscal 2016--.

Mr. Rich Montoni: --170 million up for rebid--.

Ms. Lisa Miles: --170 million up for rebid.

Mr. Rich Montoni: And so far, we've won 115 of--and that represents four--six of the 10

contracts that were up this year. So, that leaves about 55 million remaining, and we

haven't lost anything thus far, Brian.

Mr. Brian Kinstlinger: Great. That helps explain the bookings, for sure. My second

question is, in the past, you’ve provided on some of these large contracts a boomerang

effect. I think you guys have patented that name. So, maybe if you look to fiscal '17, talk

about the boomerang effect for HAAS, maybe in terms of earnings-per-share if it's a--it

seems like a large range of 10 to 15 percent, but maybe you can help us understand

that?

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 18

Mr. Rich Montoni: I think we’re going to help your understanding, qualitatively. We're

not today going to get into boomerang effects because--and it's--you know, the reason

we don't want to get into fiscal '17 guidance even as it relates to certain data points, of

which HAAS is one data point, it's not fair to fiscal '17 unless we holistically talk about it.

But, HAAS is one data point as is Fit For Work another data point as is Australia. So, as

you know, we have a number of startups. You know, fiscal '16 has been a year of

extraordinary more than normal startups, and that does set the table for a boomerang

effect in fiscal '17. We’re going to have to take that holistically when we talk about fiscal

'17 guidance, Brian.

Mr. Brian Kinstlinger: Okay. Thank you.

Mr. Rich Montoni: Sure.

Ms. Lisa Miles: Thanks, Brian. Next question please.

Operator: Our next question comes from Allen Klee from Sidoti and Company.

Mr. Allen Klee: Yes, hi. Any update on the U.K. Fit for Work contract?

Mr. Rich Montoni: Yeah, we can give you a little bit of an update. Bruce, you want to--I

know you’ve been working with the team over there, as we all have been working with

the team. And before Bruce jumps into it, as you would expect, the changeover in the

leadership is probably the headline as it relates to all of our business over there, but

most notably, our intent to restructure the Fit for Work contract.

Mr. Bruce Caswell: Yeah, that’s really, Allen. The, you know, the fact is--and you can

certainly appreciate the Brexit vote really caused a lot of changes in the leadership at

the top level and into the department and the ministers and so forth that are responsible

for the various portfolios including the Fit for Work contract.

So, a bit of a pause, but now that things are settling in and we’re getting to know the

new ministers and leaders, we’re continuing to work actively with our client and really

considering all the available options for the Fit for Work program. So, not much more to

report at this point, but active discussions remain in progress with our new client.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 19

Mr. Allen Klee: Thank you.

Mr. Rich Montoni: Sure. You're welcome.

Ms. Lisa Miles: Next question please.

Operator: Our next question is from Stephen Lynch from Wells Fargo.

Mr. Stephen Lynch: Hey, thanks for taking the question. Just looking at the change in

revenue guidance at the mid-point, it’s coming down by 62.5 million. Can you help us

understand which contracts are driving the difference that is not accounted for in the 20

to 25 million that you talked about from Brexit currency headwinds?

Mr. Rich Montoni: Sure. Rick Nadeau.

Mr. Rick Nadeau: Yes, I think we did talk on the script about $22 million on the currency

related to Brexit. I think you also have a reduction in the expectations of the revenue

that we would be getting off of our start up contracts, and I think you ought to think of

that number probably around $50 million or so.

Mr. Stephen Lynch: Okay, thanks. And then I do also have a follow-up. I know we’re

not getting into preliminary fiscal ’17 guidance, but is there any way you could help us

understand the potential impact of currency headwinds from Brexit if the exchange rates

hold where they are right now, maybe how many percentage points of growth should we

be assuming that it will take away from the top line next year?

Mr. Rich Montoni: Yeah.

Mr. Rick Nadeau: Yes, it’s a great question, and, you know, we’ve done some

preliminary modeling, and we’ve looked at it as compared to the prior year. But, I do

think that you should think that we’ll be maybe a 1 percent down on the EPS as a result

of that, maybe 3 or 4 cents.

Ms. Lisa Miles: Thanks, Stephen. Next question please.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 20

Operator: Once again, if you'd like to ask a question, please press star, one on your

telephone keypad.

Our next question is from Frank Sparacino from First Analysis.

Mr. Frank Sparacino: Hi, guys, just one from me - going back to the pipeline in terms of

new opportunities, particularly on the federal side and maybe even Human Services,

are there any sort of new areas emerging, you know, maybe outside of the core work

that you're doing today that you would call out, you know, potentially exciting new

opportunities?

Mr. Rich Montoni: The answer is yes. I'm going to give you a little bit of a backstop

explanation here. And Bruce and his team have been working really hard to expand our

telescope as it relates to what we call tier three opportunities. And as you would expect

our business development folks in all of our Segments have been working really hard to

identify those opportunities and develop those opportunities.

And I think in federal, there are several areas that represent adjacencies for us. We

certainly would like to take our capability as it relates to citizen service centers and

deliver that to the amazing amount of such services that the U.S. federal government

procures. We’d certainly like to take our skill sets as it relates to Acentia and couple

those and embed them in our business process outsourcing services in the federal

government. And as you will recall from that pinwheel slide, there are a number of

agencies with whom we have historically not done business, and we did--it would take

some time to really penetrate those opportunities, but I think that the federal team has

done a very good job to do that.

On the Human Services side, I think there are growth opportunities as we move

forward. Most notably, we are aware of a lot of, I’ll call it, academic and high level

legislative discussions about how do we better engineer some of the large federal

programs that are out there relative to human services type entitlement programs

including the TANF program, etc.

So, it is possible that, over the next couple of years--and I don’t think it’s gonna happen

until this federal election is behind us, but it is possible that we see new legislation that

calls for a reengineering of those programs. And at the heart of the debate is, you know,

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 21

our welfare programs. Are we going to have a welfare program where it’s a guaranteed

check or is it gonna be a guaranteed job or something in between?

There are lots of discussions occurring, as they say, on the Hill at this point in time, at

the governor association levels. We’re well plugged into it. So, you know, that’s an area

where we may see additional growth opportunities down the road. Is that helpful, Frank?

Ms. Lisa Miles: Thanks, Frank. Next question.

Mr. Frank Sparacino: Yep, thank you.

Mr. Rich Montoni: Thank you.

Operator: Our next question is a follow-up from Richard Close of Canaccord Genuity.

Mr. Richard Close: Yes, thanks. Can you go over maybe into a little bit more detail the

two contracts that are coming up for bid next year? I think you said that’s more than

half of what's up for rebid. So, if you could just go into that in terms of maybe where they

are and maybe the length or your tenure with those contracts, historical tenure.

Mr. Rich Montoni: Yeah, Richard, unfortunately, we're gonna decline that opportunity

because what happens is--and principally for competitive reasons and the fact that, as I

said earlier, all of our contracts or many of our contracts that are scheduled for rebid,

there are discussions about perhaps extension of those contracts. So, that may change.

So, for competitive reasons, we won’t get into those details. By November, when we

announce fiscal '17, I think most of that dust will have settled, and we’ll give you details

at that point in time.

Mr. Richard Close: Okay. Can I try another one then?

Mr. Rich Montoni: Sure.

Mr. Richard Close: Okay. I believe you were in contention for a federal contract on the

census. If you can go into that, provide us some background in terms of that opportunity

and where it stands?

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 22

Mr. Rich Montoni: I'm glad to do that, and Bruce and I will talk about this, but, you

know, I’d give you some--the commentary on that would be that’s an example of an

agency with whom we have not worked in the past. Given our organic growth and

inorganic growth, we built qualifications to the point where we felt that we could submit a

very credible bid. And hats off to our team, which did submit a very credible bid. As you

may know, we were not successful in that bid, and we stand at this point in time--that

award is not been formalized. And, Bruce, your commentary would be?

Mr. Bruce Caswell: Yeah. And so, certainly, as you can appreciate since the award has

not been formalized, we can’t comment on any protest that’s in process. But, to give you

a little more color on the nature of the work and how it was reflected in our pipeline, at a

very high level, it was principally for an inbound and outbound centralized contact

center. And the real thrust of the census and the strategy of the census for 2020 is a

web first strategy. They want, you know, most respondents, if possible, to complete the

census through the web, but if necessary, to be able to call into the contact center and

handled where you’d have handling of general questions and, if necessary, assisting

those respondents in completing the census.

Interestingly, the enumerators, the folks in the field that actually would go door to door

and collect information would be kind of the last level of data collection as part of the

new census.

In terms of how we carry that in the pipeline, as you know and can appreciate, we carry

just the base contract value. And in this case, it was one year base with less than $50

million of revenue. The contract had a sizable ramp up so that year one was much

smaller than subsequent years. Does that help?

Mr. Richard Close: Yep, thank you.

Mr. Rich Nadeau: Yep.

Mr. Rich Montoni: You're welcome.

Ms. Lisa Miles: Thanks, Richard. Next question please, and I believe is our last

question.

MAXIMUS Fiscal 2016 Third Quarter Conference Call

August-04-2016

Page 23

Operator: Our last question is a follow-up from Shane Svenpladsen from Avondale

Partners.

Mr. Shane Svenpladsen: Just a quick housekeeping item - what was the annual

revenue contribution for the divested K-12 biz?

Mr. Rick Nadeau: Yes. Back in--it was running around $4 million of revenue on an

annual basis. Last year in FY ’15, it contributed a little bit less than one penny, and this

year, it was running pretty flat at about zero.

Mr. Shane Svenpladsen: Okay, thanks much.

Mr. Rick Nadeau: You're welcome.

Ms. Lisa Miles: Thanks, Shane.

And with that, I think that wraps our question-and-answer period for this earnings call.

Thank you very much for joining us, and have a good day.

Operator: Thank you. This does conclude today's conference. Thank you for your

participation. You may disconnect your lines at this time.

Fiscal 2016 Third Quarter Earnings

Richard J. Nadeau

Chief Financial Officer

August 4, 2016

Forward-looking Statements & Non-GAAP Information

These slides should be read in conjunction with the Company’s most recent quarterly earnings press

release, along with listening to or reading a transcript of the comments of Company management from the

Company’s most recent quarterly earnings conference call.

This document may contain non-GAAP financial information. Management uses this information in its

internal analysis of results and believes that this information may be informative to investors in gauging

the quality of our financial performance, identifying trends in our results, and providing meaningful period-

to-period comparisons. These measures should be used in conjunction with, rather than instead of, their

comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP

measures presented in this document, see the Company’s most recent quarterly earnings press release.

Throughout this presentation, numbers may not add due to rounding.

A number of statements being made today will be forward-looking in nature. Such statements are only

predictions and actual events or results may differ materially as a result of risks we face, including those

discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to

our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or

update these forward-looking statements to reflect subsequent events or circumstances.

2

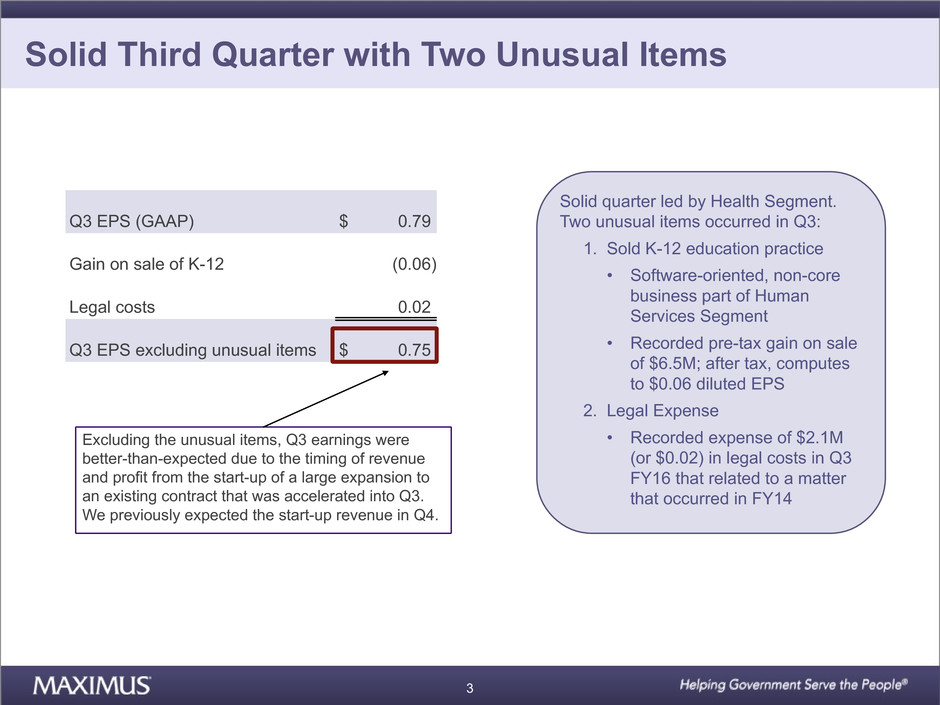

Solid Third Quarter with Two Unusual Items

Q3 EPS (GAAP) $ 0.79

Gain on sale of K-12 (0.06)

Legal costs 0.02

Q3 EPS excluding unusual items $ 0.75

Solid quarter led by Health Segment.

Two unusual items occurred in Q3:

1. Sold K-12 education practice

• Software-oriented, non-core

business part of Human

Services Segment

• Recorded pre-tax gain on sale

of $6.5M; after tax, computes

to $0.06 diluted EPS

2. Legal Expense

• Recorded expense of $2.1M

(or $0.02) in legal costs in Q3

FY16 that related to a matter

that occurred in FY14

Excluding the unusual items, Q3 earnings were

better-than-expected due to the timing of revenue

and profit from the start-up of a large expansion to

an existing contract that was accelerated into Q3.

We previously expected the start-up revenue in Q4.

3

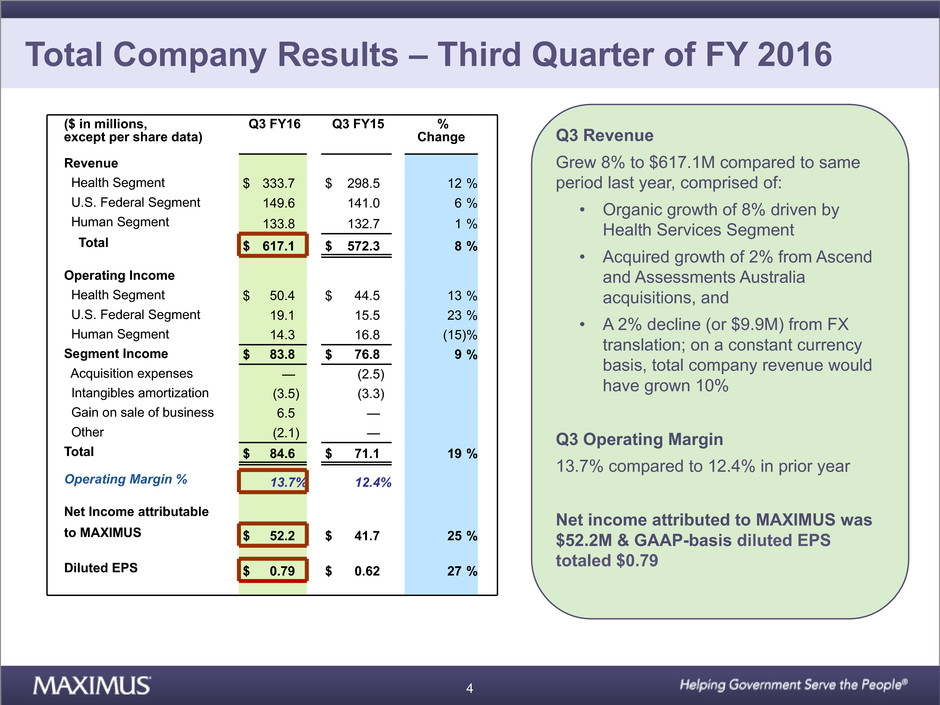

Q3 Revenue

Grew 8% to $617.1M compared to same

period last year, comprised of:

• Organic growth of 8% driven by

Health Services Segment

• Acquired growth of 2% from Ascend

and Assessments Australia

acquisitions, and

• A 2% decline (or $9.9M) from FX

translation; on a constant currency

basis, total company revenue would

have grown 10%

Q3 Operating Margin

13.7% compared to 12.4% in prior year

Net income attributed to MAXIMUS was

$52.2M & GAAP-basis diluted EPS

totaled $0.79

Total Company Results – Third Quarter of FY 2016

($ in millions,

except per share data)

Q3 FY16 Q3 FY15 %

Change

Revenue

Health Segment $ 333.7 $ 298.5 12 %

U.S. Federal Segment 149.6 141.0 6 %

Human Segment 133.8 132.7 1 %

Total $ 617.1 $ 572.3 8 %

Operating Income

Health Segment $ 50.4 $ 44.5 13 %

U.S. Federal Segment 19.1 15.5 23 %

Human Segment 14.3 16.8 (15)%

Segment Income $ 83.8 $ 76.8 9 %

Acquisition expenses — (2.5)

Intangibles amortization (3.5) (3.3)

Gain on sale of business 6.5 —

Other (2.1) —

Total $ 84.6 $ 71.1 19 %

Operating Margin % 13.7% 12.4%

Net Income attributable

to MAXIMUS $ 52.2 $ 41.7 25 %

Diluted EPS $ 0.79 $ 0.62 27 %

4

($ in millions) Q3 FY16 Q3 FY15 %

Change

Revenue

Health Services $ 333.7 $ 298.5 12%

Operating Income

Health Services $ 50.4 $ 44.5 13%

Operating Margin % 15.1% 14.9%

Revenue

• Delivered a good quarter with strong results in core business; revenue growth driven by growth on existing

contracts, including U.K. HAAS contract

• Nearly all growth in the quarter was organic

• Impacted by unfavorable FX translation of 2%; on a constant currency basis, growth would have been 14%

Expansion Spurs Growth

• Expansion underway for a new location in New York State that accounts for a good portion of the growth in Q3;

revenue and profit from the start-up of this expansion to an existing contract was accelerated into Q3; we previously

expected the start-up revenue in Q4

Operating Margin

• Handful of large contracts over achieving; operating margin came in strong at 15.1%

Q4 Expectations

• Larger impact to revenues from unfavorable FX translation due to weakening of British Pound following Brexit vote

• Segment to deliver Q4 financial results largely consistent with Q3

Health Services Segment

5

Revenue

• All growth in Q3 was organic

• Top-line growth driven principally by ongoing ramp-up of two contracts:

1. Department of Education contract

2. Large health contract where MAXIMUS is a subcontractor

Operating Margin

• Q3 operating margin came in as expected, but bolstered by approximately $3.5M of one-time revenue

and profit from a handful of contracts, much of which is not expected to repeat in Q4

• On a normalized basis, operating margin would have been 10.7%, which is more in-line with where

segment margins are presently running

U.S. Federal Services Segment

($ in millions) Q3 FY16 Q3 FY15 %

Change

Revenue

U.S. Federal Services $ 149.6 $ 141.0 6%

Operating Income

U.S. Federal Services $ 19.1 $ 15.5 23%

Operating Margin % 12.8% 11.0%

6

Revenue

• Organic revenue growth in Q3 was 1%, much of which was driven by the jobactive contract in Australia;

this was offset by anticipated declines in the U.K. Work Programme contract due to lower volumes

• Acquired growth of 3% offset entirely by a 3% decline from FX translation; on a constant currency basis,

revenue would have grown 4%

Operating Margin

• Q3 operating margin was 10.7% and lower compared to prior year

• Expected reduction in margin was a result of ongoing start-up of new jobactive contract in Australia,

which is less profitable than its predecessor contract

Human Services Segment

($ in millions) Q3 FY16 Q3 FY15 %

Change

Revenue

Human Services $ 133.8 $ 132.7 1 %

Operating Income

Human Services $ 14.3 $ 16.8 (15)%

Operating Margin % 10.7% 12.7%

7

DSOs improved on a sequential basis and were 67 days at June 30, 2016 (targeted range of 65 to 80 days)

Cash flow for the quarter:

For remainder of FY16, expect continued solid net income, good collections and benefits from timing of tax

and other disbursements to drive increase in cash from operating activities

At June 30, 2016 cash and cash equivalents totaled $50.6M — most of which was held outside the U.S.

During Q3 purchased approximately 43,794 shares for $2.2M; at June 30, 2016 had an estimated $137.5M

remaining under our Board-authorized share repurchase program

Maintain an active M&A program and see an increasing number of quality companies coming to market

• Our available line of credit allows us to be nimble and flexible

• During Q3 we paid down our debt by approximately $75M, net of additional borrowing; total debt at

June 30, 2016 (including the Credit Facility) of $211.0M

• Management remains focused on most practical uses of cash to strengthen our growth platform and

deliver long-term shareholder value

Reconciliation to free cash flow can be found in financial tables in the Q3 FY16 earnings press release.

$ in millions Q3 FY16

Cash provided by operating activities $ 86.3

Cash paid for property, equipment and capitalized software (14.3)

Free cash flow 72.0

DSOs, Cash Flows & Balance Sheet

8

FY16 Guidance

Fiscal 2016 Guidance

Revenue $2.375B - $2.4B

Diluted EPS $2.60 - $2.70

Cash provided from

operating activities $200M - $230M

Free cash flow $130M - $160M

Revised Revenue Guidance

• Reflects unfavorable FX translation of approximately

$20M to $25M for FY16; greatest impact occurring in

Q4 with weakening of the British Pound

• Reflects previously disclosed changes to three

programs in start-up (HAAS and Fit for Work

contracts in the U.K. and jobactive in Australia); this

compares to our view when we first established

guidance in November 2015

FY16 GAAP-Basis Earnings Assumptions

• $0.06 gain on sale of K-12 education business

• YTD legal costs of $0.03 — includes $0.02 of cost

from Q3 and $0.01 incurred in Q1

• Unfavorable impact of FX translation of about $0.01

Operating Cash Flows

• Expect operating cash flows to be toward the lower

end of the target range. We have a number of large

customers where even a brief delay in payment at

the end of September could result in us falling short.

9

Income Statement Inquiries

1. Weighted Average Shares Outstanding (WASO)

Q3 WASOs were approximately 66.2 million; in the absence of any share buybacks, should expect total

share count to increase by about 400,000 shares per year for the effect of outstanding RSU grants

2. Interest Expense

Related to the interest on borrowings, which is approximately 1.6%

3. Other Income

Recent one-time, short-term benefit that will not reoccur; looking forward, generally expect that other income

will be less than $300,000 annually

4. Income Attributable to Noncontrolling Interests

• Relates to the portion of net income from certain foreign entities that is tied to the equity interests held

by employees or partners

• For example, the Remploy employees hold a 30% ownership; while the Remploy results are included

in our financial statements, the 30% portion of earnings related to the minority ownership is a reduction

to net income

• We still control the strategic direction and management of the entities

• Expect the amount in future periods to be consistent with recent periods

10

11

Fiscal 2016 Third Quarter Earnings

Richard Montoni

Chief Executive Officer

August 4, 2016

12

Introduction

As we move into the home stretch of FY16,

our focus today is on two topics:

• New work where we are creating value

for existing clients

• Industry trends that complement our core

capabilities and serve as markers for

long-term growth opportunities

13

A couple of key contract wins and expansions that

have transpired since last quarter

Centers for Medicare & Medicaid Services recently awarded

MAXIMUS the Part A West Medicare Appeals work

• $42M contract (one-year base and three one-year options)

• MAXIMUS lost this contract in a competitive rebid in 2014

• Winning this back demonstrates the quality, efficiency and

value we bring to our government clients

• As Part A West Qualified Independent Contractor (QIC),

MAXIMUS is responsible for all reconsiderations of Part A-

related claims in 24 western states and 3 territories

• MAXIMUS has provided independent determinations for

Medicare for 25+ years

• With addition of this latest contract, MAXIMUS now holds

four of the Medicare QIC contracts, serving Part A East and

West, Part C and Part D

New Work – Part A West

14

U.S. Appeals & Assessments Business

Over the years, our work for Medicare program has served as a springboard

for our growing global Appeals and Assessments business.

U.S. work includes:

• Eligibility appeals for Federal Marketplace

• Independent medical and billing reviews for California’s

workers compensation program

• Appeals for state Medicaid programs

Ascend gave us a new set of assessment services, including

pre-admission screening and resident review (PASRR).

MAXIMUS now:

• Conducts Level II PASRRs for individuals with mental

health conditions, intellectual disabilities or other related

conditions

• Performs evaluations to help ensure appropriate

placements in nursing facilities or community-based

settings; also help ensure individuals receive the

required services

We won a key rebid contract to provide PASRR services for

the State of Tennessee; this contract was the largest from

the Ascend portfolio and runs for three years with a total

contract value of $28M

15

We also have brought our assessment capabilities into states where we first established a foothold as the

Medicaid enrollment broker.

MAXIMUS operates New York’s conflict-free assessment center, which helps the state determine eligibility for adults

who are seeking home and community-based long-term care services and support, as well as enrollment into a

managed long-term care plan.

• Worked closely with client to achieve the goal of timely, professional and independent assessments conducted

by skilled nurses in a home-based setting; as needs have increased, we have grown our scope of work to

include additional populations

• As populations continue to age and their health care needs become more complicated — coupled with growing

complexity of government programs — demand for our services is growing

• States are always looking for ways to bend Medicaid cost curve, while also ensuring high-quality services —

particularly for certain high-needs, high-cost populations who may need to be assessed in order to be placed in

appropriate setting, receive correct level of services, or move from fee-for-service models into managed care

Medicaid Foothold Led to Expansion into Assessments

Future opportunities will take time to fully materialize but MAXIMUS is well-positioned to provide

independent, conflict-free assessment services in a cost-effective model for our clients.

16

New Work – Rochester Expansion

MAXIMUS recently launched hiring efforts for a new

customer contact center in Rochester:

• Expansion is tied to an increased level of

administrative and contact center services for

several health programs that we support throughout

the state

• In process of hiring approximately 2,000 new staff

positions, but expect it will take several months to

achieve full ramp

MAXIMUS has a long history of operating both state and

federal government programs out of New York:

• Since 1998, MAXIMUS has provided administrative

support services for a variety of programs, including

Medicaid, CHIP, physician profile program and

state’s health insurance exchange.

• We also provide services for several other state and

federal health programs out of New York, including

appeals and adjudications services for Medicare.

• With an excellent talent pool, New York serves as an

important hub for many MAXIMUS operations and

we are pleased to be expanding our footprint.

17

• We still expect HAAS contract to be a mid-single-digit

margin contributor for FY16

• We are pleased with important improvements we

have brought to customer experience

• Working diligently to meet targets

• At the end of the day, it’s a tough contract and a high-

profile program — and we have additional progress to

achieve

U.K. Health Assessment Advisory Service Contract Update

18

Operational perspective

• Neutral: none of our existing contracts are tied to any

European Social Funds

• For now, “steady as she goes” for our current operations

Political perspective

• New Prime Minister introduced a new ministerial team at

the Department for Work and Pensions (DWP)

• As the new team ramps up, we are working to inform

them about the work we do and the value we add to their

programs

Economic perspective

• Effect of Brexit vote on value of the British Pound is

expected to impact our FX translation in Q4 of FY16

Impact of Brexit Referendum on MAXIMUS

U.K. remains an important market for MAXIMUS and we remain

committed to supporting the government in achieving its goals.

19

New Awards June 30, 2016

YTD Signed Contracts $1.3B

Additional Unsigned Contracts $421M

Sales Opportunities June 30, 2016

Total Pipeline* $4.2B

Awards

• Year-to-date awards are lower compared to the prior

year due to a lower level of rebids in FY16.

Pipeline

• Hearty sales pipeline at June 30th of $4.2B:

– About $1B related to extensions and option periods

– Roughly half of the $4.2B is associated with new

work across multiple business lines

– Pipeline contains new opportunities across

segments and in all of our existing geographies

FY17 Rebids

• We are working on some contract extensions; if

executed, we expect that we will have just under a

billion dollars in contract value up for rebid in FY17

• Two contracts are the biggest drivers and account for

more than half of the work that is currently expected to

come to rebid next year; rebid process for these will

take place in FY17, but we won’t see financial impacts

until FY18

* Reported pipeline only reflects short-term opportunities where we

believe request for proposals will be released within next six months

New Awards and Sales Pipeline

We monitor a much broader pipeline as part of our long-term growth strategy, which includes emerging opportunities

expected to develop over next three to five years and that will drive revenue in FY18 and beyond.

20

• Remain keenly focused on helping our government clients run

effective and efficient programs

• Number one goal is high-quality service delivery to ensure

satisfaction of our clients

• As part of our quality and risk management strategy, MAXIMUS

conducts an annual client satisfaction survey. Customers rank us

in areas:

– Competency of our project staff

– How accessible and responsive we are to our client’s needs

– Our ability to provide value to public programs by delivering

outcomes that matter

• This year’s survey results showed strong performance across the

entire company, with an average score that’s above our goal and

more than 50 projects with a perfect score

• Congratulations to the team on another successful year as we

remain a trusted partner to governments around the world

• Pleased with results in Q3 and expected results for remainder of

FY16; long-term growth drivers for future years remain in place

and are strong

• Lots of irons in the fire, so it is still too early to speak to FY17; will

issue formal guidance on our year-end call in November

Conclusion