MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 1 Operator: Greetings and welcome to the MAXIMUS Fiscal 2016 First Quarter Conference Call. At this time, all participants are in a listen-only mode. A brief question-and-answer session will follow the formal presentation. If anyone should require operator assistance during the conference, please press star, zero on your telephone keypad. As a reminder, this conference is being recorded. It is now my pleasure to introduce your host, Ms. Lisa Miles, Senior Vice President of Investor Relations for MAXIMUS. Thank you, Ms. Miles, you may begin. Ms. Lisa Miles: Good morning and thank you for joining us. With me today is Rich Montoni, CEO, Bruce Caswell, President, and Rick Nadeau, CFO. I'd like to remind everyone that a number of statements being made today will be forward- looking in nature. Please remember that such statements are only predictions, and actual events and results may differ materially as a result of risks we face including those discussed in Exhibit 99.1 of our SEC filings. We encourage you to review the summary of these risks in our most recent 10-K filed with the SEC. The company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances. Today's presentation may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results and

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 2 providing meaningful period to period comparisons. For reconciliation of the non-GAAP measures presented in this document, please view the company's most recent quarterly earnings press release. And with that, I'll hand the call over to Rick. Mr. Rick Nadeau: Thanks, Lisa. This morning MAXIMUS reported financial results for the first quarter of fiscal year 2016. As noted in the press release, we had a pending change order at December 31, 2015 related to a state health contract, where we’re already performing the additional scope of work. Accordingly, the costs were incurred and recorded in our first quarter, and the revenue will be recorded once change order is signed. As a result, approximately $8.6 million of revenue and 8 cents of earnings per share shifted out of the first quarter. We presently expect the pending change order will be signed in the second quarter at which time we will record the revenue and related earnings. The delay in signing the pending change order is due to the states required process, which provides up to 90 days of review by the Comptroller's Office. The pending change order is presently awaiting this final approval.

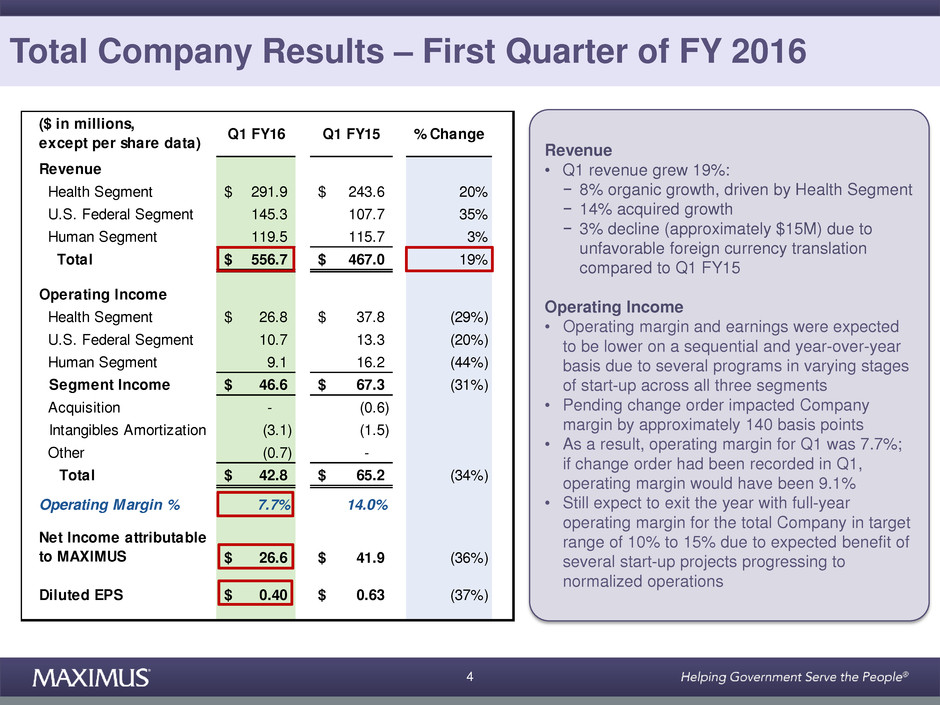

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 3 As you may already know, this is very common in government contracting. I want to reassure investors that this is just a shift of revenue and earnings from one quarter to the next. Our full year results and therefore our guidance are not impacted. For the first quarter of fiscal year 2016, the company's revenue grew 19 percent to $556.7 million as compared to the same period last year. Of this growth, organic revenue growth was 8 percent and was driven by the health segment. Acquired revenue growth totaled 14 percent, and total company revenue was unfavorably impacted by approximately $15 million or 3 percent due to the effects of foreign currency translation as compared to the first quarter of fiscal year 2015. As we mentioned on our last call, both operating margin and earnings were expected to be lower on both a sequential basis and year-over-year basis due to several programs in varying stages of startup across all three segments. In addition, the pending change order also impacted the company’s margin by approximately 140 basis points. As a result, operating margin for fiscal Q1 was 7.7 percent. If the change order had been recorded in the first quarter, total company operating margin would have been 9.1 percent. At this point in time, we still believe that we will exit the year with a full year operating margin for the total company in our targeted range of 10 to 15 percent, as we see the expected benefit of the several startup projects progressing to normalized operations.

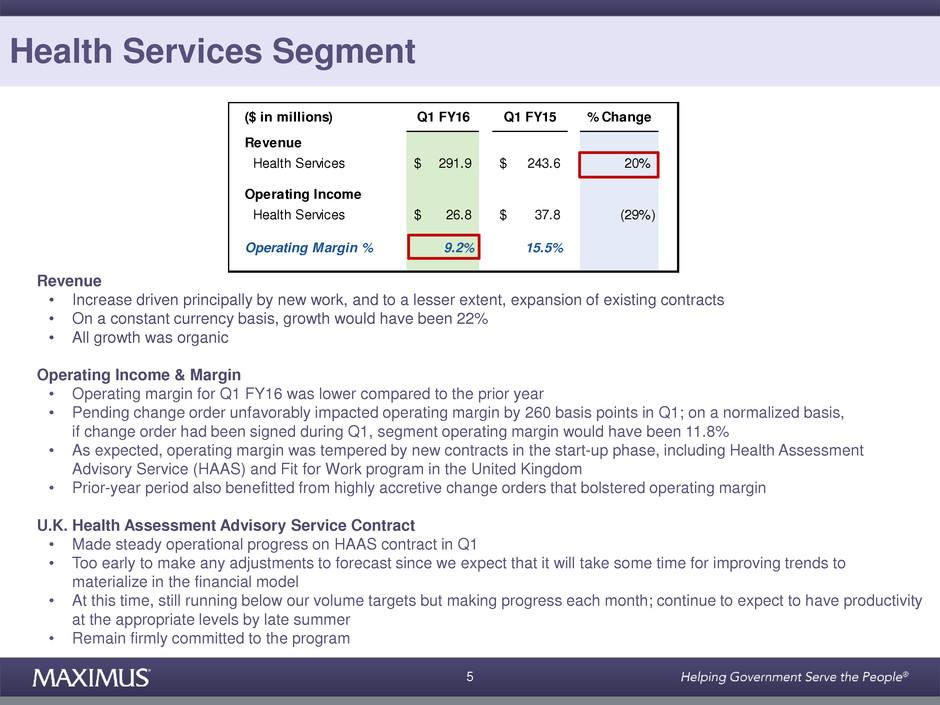

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 4 For the first quarter of fiscal year 2016, net income attributable to MAXIMUS was $26.6 million, and diluted earnings per share totaled 40 cents. Now I will speak to segment results, starting with Health Services. The Health Services segment revenue increased 20 percent, driven principally by new work, and to a lesser extent, the expansion of existing contracts. On a constant currency basis, growth would have been 22 percent. All growth in the Health Services Segment was organic. Operating margin for the first quarter was 9.2 percent and lower compared to the prior year. The aforementioned pending change order unfavorably impacted Health Segment operating margin by 260 basis points in the first quarter. On a normalized basis, if the change order had been signed during the first quarter, operating margin would have been 11.8 percent for the Health Services Segment. As expected, operating margin was also tempered by new contracts in the startup phase, including the Health Assessment Advisory Service and the Fit for Work program in the United Kingdom. As a reminder, the prior year period also benefited from highly accretive change orders that bolstered operating margin. During the quarter, we made steady operational progress on the Health Assessment Advisory Service contract. It is still too early to make any adjustments to our forecast since we expect that it will take some time for improving trends to materialize in the financial model.

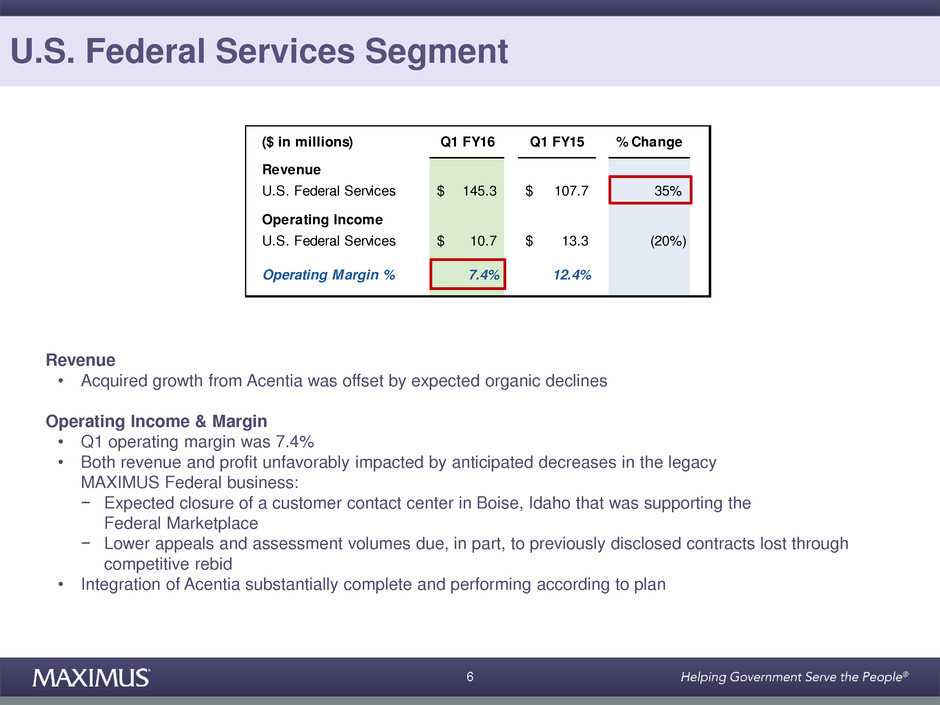

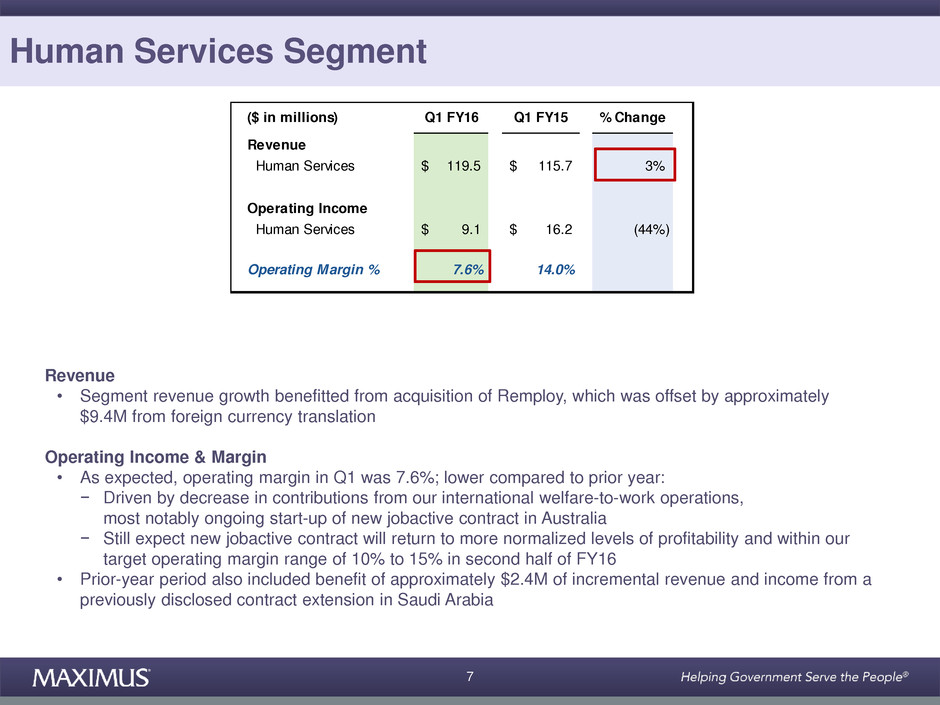

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 5 At this time, we are still running below our volume targets but making progress each month. We continue to expect to have our productivity at the appropriate levels by late summer. We remain firmly committed to the program, and Rich will provide additional details regarding our progress in his prepared remarks. Moving on the U.S. Federal Services Segment, first quarter revenue for the Federal Segment increased 35 percent as compared to the prior year. Acquired revenue growth from Acentia was offset by expected organic declines. First quarter operating margin for the Federal Segment was 7.4 percent. Both revenue and profit were unfavorably impacted by anticipated decreases in the Legacy MAXIMUS Federal business. This includes the expected closure of a customer contact center in Boise, Idaho, where we provided support to the federal marketplace. In addition, we also experienced lower appeals and assessment volumes due in part to previously disclosed contracts that were lost through competitive rebid. The integration of Acentia is substantially complete and performing according to plan. Let me turn to financial results for the Human Services Segment. For the first quarter, revenue increased 3 percent compared to last year. Segment revenue growth benefited from the acquisition of Remploy, which was offset by approximately $9.4 million from foreign currency translation.

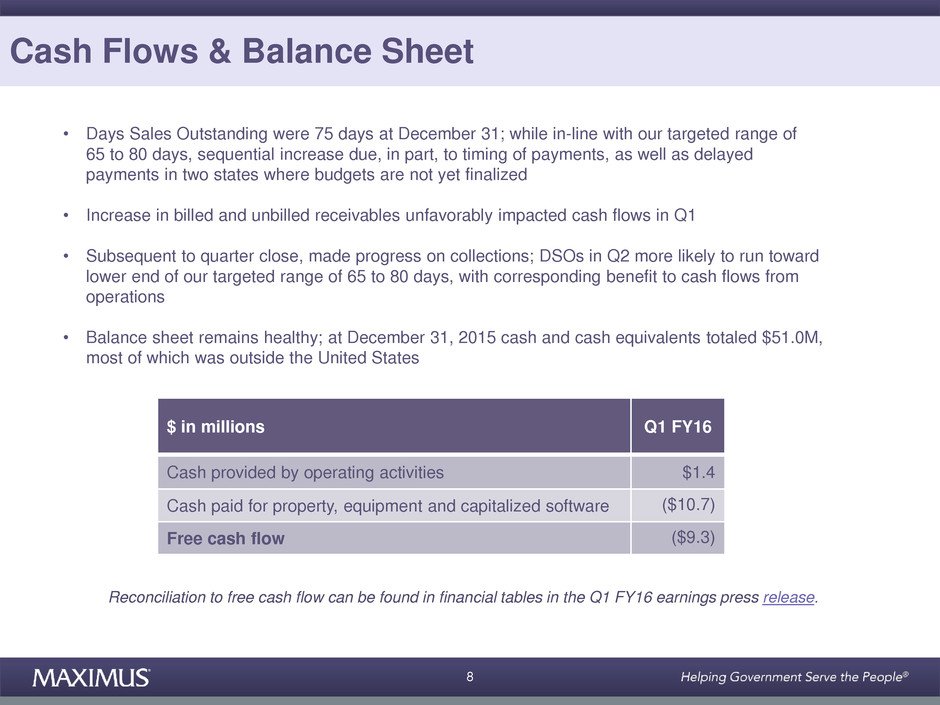

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 6 As expected, operating margin in the first quarter was 7.6 percent and lower as compared to the prior year. This was driven by the decrease in contributions from our international welfare-to- work operations, most notably the ongoing start-up of the new Jobactive contract in Australia. We still expect that the new contract will return to more normalized levels of profitability and within our target operating margin range of 10 to 15 percent in the second half of fiscal year 2016. The prior period also included the benefit of approximately $2.4 million of incremental revenue and income from a contract extension in Saudi Arabia, as previously disclosed. Let me move on to discuss cash flow and balance sheet items. Days sales outstanding were 75 days at December 31. While this is in line with our targeted range of 65 to 80 days, the sequential increase in DSOs was due in part to the timing of payments as well as delays in two states that are experiencing budgetary challenges. The increase in billed and unbilled receivables unfavorably impacted cash flows in the quarter. As a result, for the first quarter, cash provided by operating activities totaled $1.4 million with negative free cash flow of $9.3. Subsequent to quarter close, we have made progress on collections. We believe that DSOs in the second quarter are more likely to run towards the lower end of our targeted range of 65 to 80 days with a corresponding benefit to cash flows from operations.

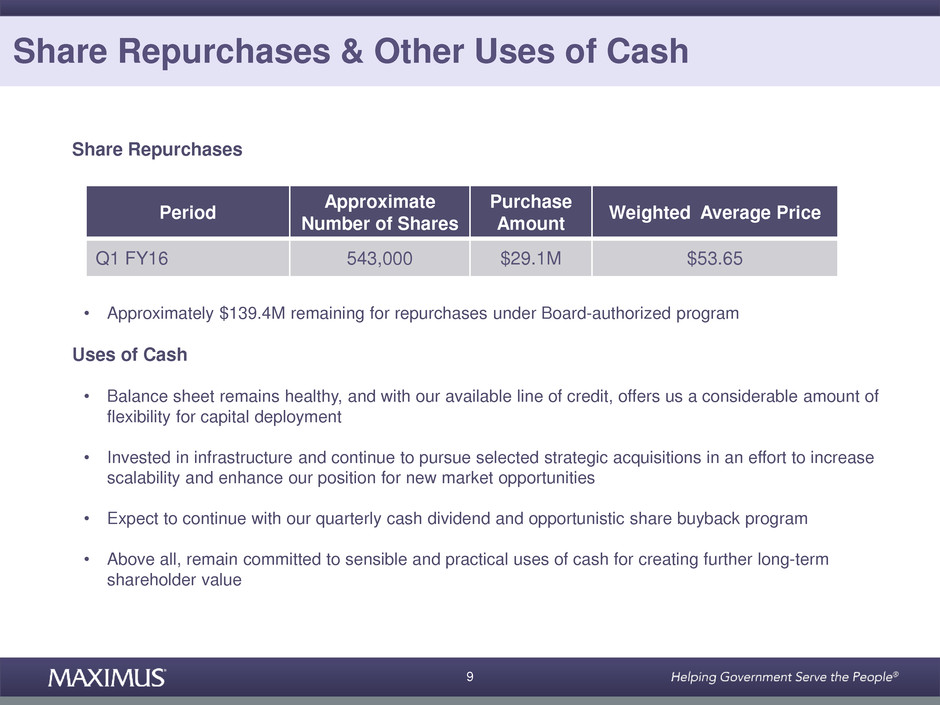

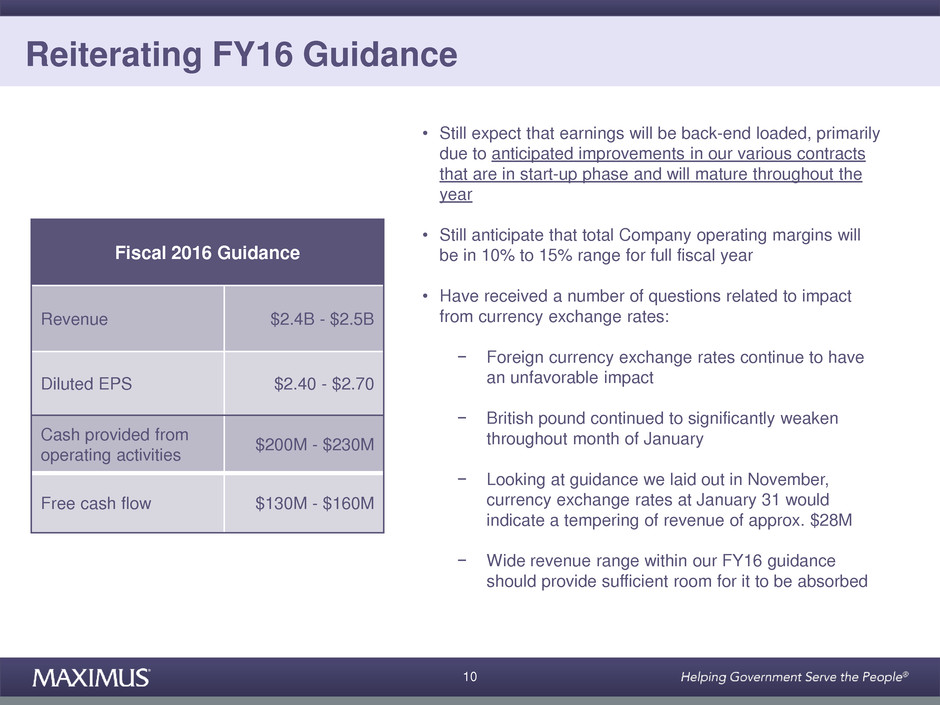

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 7 Our balance sheet remains healthy, and at December 31, we had cash and cash equivalents totaling $51 million, most of which was outside the United States. During the first quarter, we repurchased approximately 543,000 shares of MAXIMUS common stock for $29.1 million. The weighted average price was $53.65 per share. We presently have an estimated $139.4 million remaining under the board authorized program. Our balance sheet remains healthy, and with our available line of credit, offers us a considerable amount of flexibility for capital deployment. We have invested in our infrastructure and continue to pursue selective strategic acquisitions in an effort to increase our scalability and enhance our position for new market opportunities. We expect to continue with our quarterly cash dividend and opportunistic share buyback program. Above all, we remain committed to sensible and practical uses of cash for creating further long term shareholder value. And lastly, we are reiterating our fiscal year 2016 guidance. As a reminder, we are guiding to revenue in the range of $2.4 to $2.5 billion and diluted earnings per share to range between $2.40 and $2.70. We still expect cash provided by operating activities to be in the range of $200 to $230 million for fiscal 2016, and we expect free cash flow to range between $130 and $160 million.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 8 We still expect that earnings will be backend loaded, primarily due to anticipated improvements in our various contracts that are in the startup phase and will mature throughout the year. We still expect that total company operating margins will be in the lower end of the 10 to 15 percent range for the full fiscal year. We’ve received a number of questions related to the impact from currency exchange rates and how that might affect our guidance. Foreign currency exchange rates continue to have an unfavorable impact. The British pound continued to significantly weaken throughout the month of January. So, looking at the guidance we laid out in our November call, the currency exchange rates at January 31 would indicate a tempering of revenue of approximately $28 million. However, the wide range within our fiscal 2016 guidance should provide sufficient room for it to be absorbed. Thank you for your continued interest, and now I will turn the call over to Rich. Mr. Rich Montoni: Thank you, Rick, and good morning, everyone. As Rick mentioned, we have a pending change order that we now expect to be recognized in the second quarter. If the change order had been finalized in the first quarter, we would have been in line with our expectations for Q1. As expected, several large startups are also tempering earnings at this time.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 9 As they mature, we fully anticipate that they will be meaningful contributors to our continued growth and profitability in fiscal year 2016 and beyond. We believe it’s appropriate to focus on our full year guidance range because these types of quarterly fluctuations are common in our industry, and we remain on track to achieve our estimates for fiscal 2016. I’ll start my comments this morning with an update on the U.K. Assessment contract. Getting the contract in the right path to success remains a top priority for the management team, and we’ve made meaningful progress. I first want to acknowledge a report issued last month from the U.K. National Audit Office as well as the Public Accounts Committee meeting yesterday that discussed this report. The NAO published findings from an August 2015 audit of all the assessment contracts across the country. This included our U.K. Assessment contract. The audit only covered effectively five months of our operations. As a reminder, when we took over this contract, we acknowledged that it would take 12 to 18 months before we could improve any aspects of the operations. The NAO report echoed what we said in our November call as it relates to certain performance metrics, including volumes and quality. Let me bring you up to speed on our progress since the NAO audit and our last quarter’s call. Recall that the U.K. Assessment contract is predominantly cost reimbursable with significant performance incentives. The largest is tied to volumes, so I’ll share an update on our progress in this area.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 10 As a reminder, our ability to hit the volume targets is tied directly to three areas - one, the number of health care professionals that we recruit, two, the number that complete training and graduate, and three, the productivity of these new recruits. As I mentioned last quarter, we launched several initiatives to help drive our recruitment numbers, which have brought in a solid stream of well qualified candidates. During the autumn timeframe, we were hiring approximately 100 new health care professionals each month. We currently have the required staff in the pipeline to meet our production requirements, and we are now turning our attention to simply managing attrition and filling in the gaps in key locations. So, real progress here in our recruitment efforts are at the appropriate run rates. In the area of training and graduation rates, it’s fair to ask why is it so difficult for a new health care professional to complete the training. Performing functional assessments is a new skill for many health care professionals, especially if they were previously working in a clinical setting or providing direct patient care. The training program is rigorous, and the competency tests are challenging. We amended certain aspects of our training to help increase success. Our smaller training classes are giving new recruits more access to experienced staff. This individualized support has yielded solid improvements in retention rates. These changes have made a marked difference, and our most recent monthly data shows that graduation rates are north of 80 percent - so meaningful improvement in this area, as well.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 11 From a productivity perspective, it does take time for new health care professionals to be working at full capacity. Once they begin performing assessments, the learning curve to full productivity can take between six and eight months. Our new recruits are becoming more experienced and are reaching increased levels of productivity. And as they ramp up, the seasoned health care professionals who were previously serving as mentors will return to fully productive status. All of this has helped to increase our overall productivity, which has allowed us to make additional progress towards our volume targets. In fact, we delivered the highest number of assessments to date in January. In addition, we’ve also made significant headway on the more than half a million cases of backlog that we inherited at the time of contract takeover. To date, we’ve cut that figure down to 110,000 cases. Recall, at the time of our last call, we’d been through about a third of the backlog, so I'm very pleased with this ongoing steady progress, both with the new incoming assessments and the cases in backlog. We believe that the trends are indicative of the ongoing steady progress we’re making to increase our capacity and boost the number of assessments we complete. We remain cautiously confident that we will have all the pieces in place to get our productivity where it needs to be by the end of summer 2016.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 12 The NAO audit report also touched upon the areas of quality and cost. Delivering quality assessment reports is essential. The client uses our reports to make a determination about benefit levels, and we recognize the importance of delivering high quality reports. The report indicated that we were not achieving one of the quality metrics at the time of the audit in August. To put this in context, we are meeting or exceeding 10 out of 11 service level metrics for quality. We’ve implemented several measures that continue to strengthen the quality of our assessment reports. The NAO report also compared the cost for assessment under MAXIMUS versus the previous provider. This comparison is misleading as the two contracts are fundamentally different. Our contract requires a much greater proportion of face-to-face assessments, which simply cost more to perform. And while we've made meaningful progress on all fronts, we still have a ways to go. Therefore, we believe it’s premature to make any modifications to our estimates for this fiscal year. Nevertheless, we're on track to meet our volume targets that underpin our fiscal 2016 guidance. Turning now to our health operations in support of the Affordable Care Act in the U.S., we closed out the third open enrollment period, or what we refer to as OE3, on January 31st. Unlike the previous two open enrollment periods, OE3 did not include a special enrollment extension and therefore had a shorter duration than the prior periods. Despite this compressed timeframe,

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 13 call volumes across our contact centers were consistent with our expectations. This confirms our view that our ACA related revenue has largely stabilized into a relatively steady state. MAXIMUS continued to support our health insurance exchange clients with the ACA related activities. This includes completing redeterminations, answering tax related questions and managing certain aspects of consumer engagement through new digital offerings that assess Medicaid eligible consumers with eligibility and enrollment. Additionally, we have solid market activity in adjacent markets. This includes supporting state Medicaid programs with the enrollment and credentialing of providers. Looking ahead, we continue to expect normal course fluctuations year in and year out as states prioritize the wide-ranging set of initiatives for their public health insurance programs. In other health related good news, we signed the eligibility support services renewal contract with a Texas Health and Human Services Commission on December 18. The five year based contract is valued at $522 million. This is two years longer than our previous contract. The contract also has two additional option years. Under the contract, MAXIMUS will continue to provide support services for many of the state’s programs including Medicaid, the Children’s Health Insurance Program, the Supplemental Nutrition Assistance Program, Temporary Assistance for Needy Families and others.

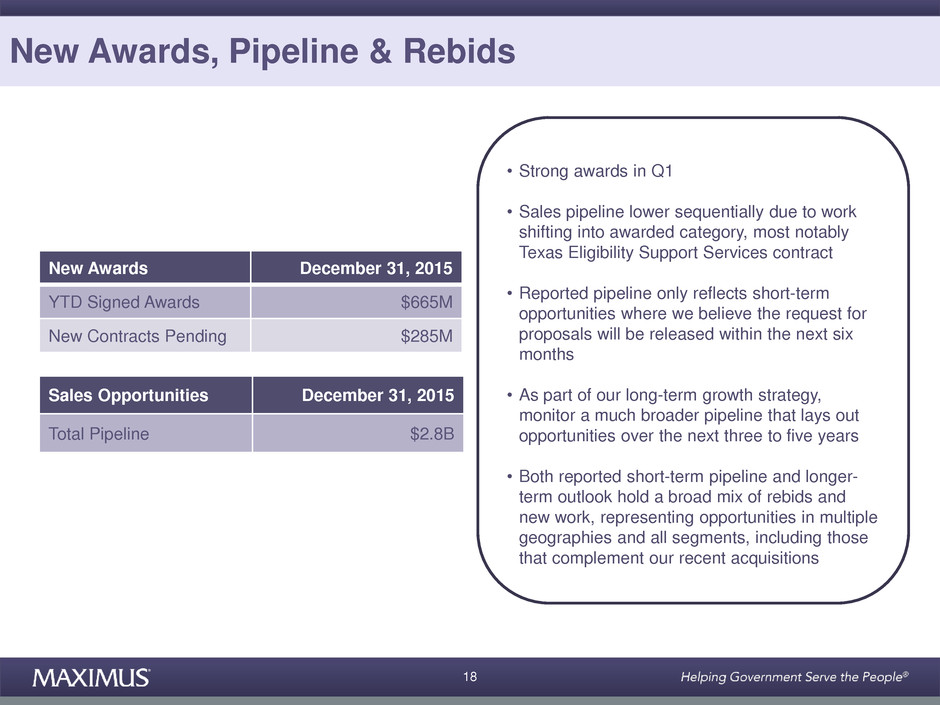

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 14 The increased contract length is conformation of our continued performance, and we are pleased to close on our fiscal 2015 rebids with this key win. As a reminder, fiscal 2016 will be a much lighter rebid year. We have ten contracts with a combined total contract value of approximately $170 million up for rebid in fiscal 2016. Moving on to new awards in the pipeline, we had strong awards in the first quarter with year-to- date signed contracts at December 31st of $665 million. We also had an additional $285 million in new awarded unsigned contracts. Our sales pipeline was $2.8 billion at December 31st and lowered sequentially due to work shifting into the awarded category, most notably the Texas Eligibility Support Services contract. As a reminder, our reported pipeline only reflects short term opportunities where we believe the request for proposals will be released within the next six months. As part of our long term growth strategy, we monitor a much broader pipeline that lays out opportunities over the next three to five years. Both on reported short term pipeline and our longer term outlook for the broad mix of rebids and new work, they represent opportunities in multiple geographies and all segments and include those that complement our recent acquisitions. In summary, we are making continual steady progress with the U.K. Assessment contract, we have a very positive working relationship with our client, and we remain confident that we will

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 15 have the right pieces in place to achieve our end of summer goals to meet our volume targets that underpin our fiscal 2016 guidance. Once fully ramped, the assessment contract, along with our other major startups, will deliver solid, long term shareholder value. In addition, the trends we experienced during the third open enrollment period of the Affordable Care Act in the U.S. confirms that this business has largely stabilized. We continue to be focused on progressing the several startups we have in progress to advance them to a normalized level and to contribute to our expected growth in the rest of our fiscal 2016 and beyond. As you know, an important component of our long term growth strategy is to look for opportunities where governments are transforming program. Oftentimes, these types of contracts have front end losses. But over time, they mature into programs that deliver recurring revenue streams, offer solid earnings contributions and create long term shareholder value. All in all, we remain on track to achieve our guidance for the full fiscal year. And with that, let’s open it up for questions. Operator? Operator: Thank you. We will now be conducting a question-and-answer session. Please limit yourself to one question and one follow-up question. If you’d like to ask additional questions, you may reenter the queue. If you'd like to ask a question, please press star, one on your

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 16 telephone keypad. A confirmation tone will indicate that your line is in the question queue. You may press star, two if you'd like to remove your question from the queue. For participants using speaker equipment, it may be necessary to pick up your handset before pressing the star keys. One moment please while we poll for questions. Our first question comes from the line of Dave Styblo with Jefferies. Please proceed with your question. Mr. Dave Styblo: Thanks for the questions. First one would just be on the HAAS contract. Kind of coming back to, the improvements that you made there, it sounds like January was your best month to date. Can you kind of give us an idea of how those numbers have trended in the last few months? And I think at the public hearing, you had mentioned it was at 75,000 was the volume in that month. I'm curious, again if there's any sort of maybe seasonality in that or anything unusual, but just the track record there and reconciling that to perhaps what is a--what is a year two, goal that the government has set forth from you? I think originally it was 1.2 million assessments, but curious if that part had changed at all? Mr. Rich Montoni: Good morning, Dave. This is Rich Montoni. Thanks for the question. I would parse it into three pieces - help us understand the 75,000 per month and how's it fit with the run rate, two, is there is any seasonality, and three, some views on year two. Bruce Caswell, our President, is with us today, and Bruce has been spending an awful lot of time, as you might imagine on this HAAS contract. I'm going to ask Bruce to feel that question.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 17 Mr. Bruce Caswell: Sure. Good morning, Dave. So, on the first question, the 75,000 was, yes, our largest, volume production, that we’ve achieved. And there is a bit of seasonality in that in that December was a lighter month, as you could expect, because there's more holidays during that period. So December, was lower than the preceding months. November, you see a little bit of that dynamic. But, generally speaking, it’s been a gradual march, you know uphill with volumes, and we’ve, hit a new plateau in the new, uh--actually a new, peak that we are continuing to grow from with January. So--and the dynamics, as we’ve explained, are, really driven by the, health care professionals now that we’ve had in training that are, exiting training at a very solid rate. We mentioned that our graduation rate is now, about 82 percent for staff, through the first three months whereas, when we inherited the contract, it was at about 30 percent, so it’s a dramatic difference. And as those staff come online, they become productive, and spend more time in the business, they become productive. And the staff, the very experienced staff that were training them have the ability to go back to their productive work, as well. So, we fully anticipate seeing, our productive capacity continue to grow from that January number. You had asked a little bit about contract year two. As you mentioned, and is also mentioned in the NAO report, the volume target for contract year two is 1.2 million assessments. We are still in the process of ramping up our staff. We feel like we have adequate capacity from our recruiting channels to achieve those, contract year two targets. And as I mentioned, that is really a function of, the staff that we have in training moving into productive, use and also the seasoned health care professionals that have been supporting them moving back into full

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 18 productivity. So, we feel like we are very much on a trajectory to hit the contract year two targets. Mr. Rich Montoni: next question please. Mr. Dave Styblo: Okay. Mr. Rich Montoni: Oh. Dave, you got a follow-up? Mr. Dave Styblo: I did. Actually, just on the federal business and the Human Service margins, I know they're a little bit lower because of the some of the startups and the factors you had called out there, around 7.5 percent. Can you give us a little bit better sense of maybe what the normalized margin over the long term would be in Federal Services? I suspect it might ramp up closer to 10 percent, but what would get you there? And same thing in Human Services - I guess it’s mostly the Australia overhang. How, how do we think about what that profit is in the first quarter versus getting to the 10 to 15 percent margin you called out for the second half? Mr. Rich Montoni: Okay, Dave. I’m going to have, Rick Nadeau, our Chief Financial Officer, respond to that question. Mr. Rick Nadeau: All right, Dave, on a historical basis, operating margins in our Federal segment back in the fiscal years ‘13 and ‘14 were abnormally high due to the increased, Medicare appeals volumes, which were really highly accretive. And we also experienced the

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 19 lower appeals and assessments volumes, in part due to some Medicare appeals contracts that we lost and filled that back in with more normalized margin type of work, and I think that you know that we had one contact center that we closed down Boise in Federal, and that’s a little bit why it’s been down. The operating margin for the U.S. Federal business should normalize around 10 percent. You know, as a reminder, if you've got cost plus contracts, and we do, yields tend to see lower margins while performance based or transaction based contracts will tend to operate in the target range. We do also, in the Federal group have one of our startup contracts, which is tempering that margin. And, yes, you're right - in the Human Services, the thing that’s tempering that margin is, is this Australia startup. Ms. Lisa Miles: Thanks, Dave. Next question please. Operator: Our next question comes from the line of Charlie Strauzer with CJS Securities. Please proceed with your question. Mr. Charlie Strauzer: Hi, good morning. Mr. Rich Montoni: Good morning, Charlie.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 20 Mr. Charlie Strauzer: Hi, Rich. just picking up on Dave’s second question a little bit further there, if you kind of take a look at the core business excluding the startups and the change order, you know, what did the core business kind of look like from a growth perspective? Mr. Rich Montoni: Good question. I’m going to have Rick Nadeau address that one. And, Rick, maybe just address it from, this most reported quarter of Q1. Mr. Rick Nadeau: Yeah. Charlie, if you exclude all of the startups and the pending change order that we talked about, the rest of the business is running in the middle of the, targeted operating margin range that we talk about, our targeted range of 10 to 15 percent, which does indicate that the base business is performing as we expected. You know, as a reminder, you know, as these startups mature, we do expect them to become meaningful contributors to our long term shareholder values. But, in the early parts of the contracts, they do depress the margins, as you know. Mr. Charlie Strauzer: Great. And then if you look at the guidance range, I know you--it’s still too early to raise the lower end of that guidance range, but, you know, as the year progresses, you know, what would kind of have to happen from year-over-year to kind of, you know, cause a raise in the lower end of that guidance? Thanks. Mr. Rich Montoni: Yeah, Charlie, I think that, similar to the answer I just gave you, I think we’re going to have to see the startup, contracts continue to mature. And as you know, HAAS is a big chunk of that, the biggest of the startups. So, as we continue to see progress toward that,

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 21 um--you know, we have made meaningful progress, but, you know, we still have a ways to go. As we see continued progress, then we would be thinking that we would be going toward the upper end of the range. But, it’s too early at this point. Ms. Lisa Miles: Thank you, Charlie. Next question please. Operator: Our next question comes from the line of Tom Carroll with Stifel. Please proceed with your question. Mr. Tom Carroll: Hey, guys, good morning. It's actually just a quick follow-up on the U.K. HAAS contract again. Your slide five in your presentation, trying to think between the lines there a bit more in the comments and the bullets that you made about, you know, still running below volume targets but making progress each month, and we’ve seen that in the data, is there some probability that you can claw back any of what you have given up this year, related to this contract, or is that completely just not a possibility at this point in time? Mr. Rich Montoni: Fair question, Tom. I’m going to have Rick Nadeau address that one. Mr. Rick Nadeau: Okay. Contract year one ends on February 29th. You can claw back within a year, within a contract year, but, once we get to February 29th, we start the clock over again. So, we do get in our assessed volume penalties on a month to month basis, but the ultimate target is for the whole year, and we could make up shortfalls that we had, for example, in March or April later in that year.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 22 Mr. Tom Carroll: But, if you haven’t shown improvement by Feb 29, you lose it in the contract year. So, is that--am I thinking of that right? Mr. Rick Nadeau: Yes, we couldn’t claw back anything after February 29th in that first contract year. Mr. Tom Carroll: Okay. Mr. Rick Nadeau: As a reminder--so we get 7/12s of a contract year in one fiscal year and 5/12s in the next. So, you know, it’s--we straddle years, unfortunately, against our fiscal year. Mr. Tom Carroll: Yeah. And then, secondly, just quickly, you said Acentia is essentially fully integrated. I guess what are the best practices, opportunities within that organization that perhaps will better support legacy federal business at MAXIMUS, perhaps improving margins? I guess that’s the crux of the question. Mr. Rich Montoni: Tom, good question I think. So, I think, when we say Acentia is, essentially fully integrated, I think the one area that, uh--and this is normal course with an integration--is really what I would call revenue synergy. So, what can we do, to more forward and drive the revenue synergies, that we felt were on the table with Acentia? The other aspects, which range from blocking and tackling, backroom functions I think are essentially complete.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 23 I think we've made good progress. I think we’ve got a unified business development team. We’ve integrated all of that with our, legacy federal business. we are advancing customer calls and, sharing with the business development aspects, customer relationships, customer needs, compelling customer, drivers and assessing what we think is out there in short term and longer term for new business development and advancing, solutions to differentiate the new MAXIMUS federal. And it just take some time to drive what we think will be the ultimate price here, and that’s BPO opportunities within contract vehicles that came along with Acentia. Ms. Lisa Miles: Thanks, Tom. Next question please. Operator: Our next question comes from the line of Stephen Lynch with Wells Fargo. Please proceed with your question. Mr. Stephen Lynch: Hey, guys. Thanks for taking the questions. My first one is related to your comments about the U.K. Health Assessment contracts running below volume target still. Can you just talk about maybe where those volume targets are in relation to the range that's built into guidance? Is that internal target, is it equivalent to the top end of guidance, the 15 percent operating margin, or is it closer to breakeven for that contract at the midpoint? Mr. Rick Nadeau: Yeah, I believe our guidance was pretty wide with respect to HAAS. And, I think it was $7 million of operating income on the low end, and it was about $20 million of operating income on the upper end.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 24 Mr. Rich Montoni: It is loss on the low end. Mr. Rick Nadeau: Yeah, I said--okay, I meant loss. If I said income, I misspoke - $7 million OI loss on the low end and 20 million on the upper end. Yes, as you get throughout that wide range, volumes are--this contract is very sensitive to volume. So, as you creep toward the upper end of that guidance, yes, you're implying that you're hitting your volume targets. Mr. Stephen Lynch: Okay, gotcha. follow-up question - you mentioned the exchange rate trends since November, represent an incremental headwind of somewhere in the neighborhood of $28 million for revenue. Is there any sense you can give us for what the EPS impact would be, if there's any? Mr. Rich Montoni: That would be much less, and since--it would be not material on the earnings per share number, and that’s because you have a mix of, contracts in there, some in the startup area, and they're having losses to them. So, the currency doesn’t hurt you there. Mr. Rick Nadeau: And you also need to take into account that you have a meaningfully different, tax rate that tends to, buffer the EPS impact with the negative FX effects on the revenue side. So, I agree with Rich in terms of it's not material from an EPS perspective. Ms. Lisa Miles: Thank you, Stephen. Next question please.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 25 Operator: Our next question comes from the line of Brian Kinstlinger with Maxim Group. Please proceed with your question. Mr. Brian Kinstlinger: Great, thanks. I wanted to follow-up with that volume question as it relates to guidance. You had mentioned yesterday that you expected about 900,000 cases could be achieved for the fiscal year. I'm curious if that volume is the midpoint or low point or high point of the wide range that you are predicting, for your guidance in operating income? Mr. Rich Montoni: As you look toward the upper end of that guidance range, you're--you would be seeing us hit the second year volumes toward that 1.2 million range. So--. Mr. Brian Kinstlinger: --Okay--. Mr. Rich Montoni: --Remember that the fiscal year ‘16 has seven months of contract year two in it. And so, I think the--we know--as of this point, we have three out of five of the months, in fiscal ‘16, we know what they are. I think your question is better answered by, as you get closer to the 1.2 million volume target for year, contract year two, you will see us go toward the upper end of that guidance range. Did that answer your question? Mr. Brian Kinstlinger: Got it. Yes, it does, much better. Thank you. Mr. Rich Montoni: Okay.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 26 Mr. Brian Kinstlinger: And then, I guess I'm curious from a high level, what’s different about your Federal Services segment versus your public federal IT peers? Their operating margins are well below 10 percent. They look more like yours. And then I guess, as it relates to the DOE contract in there, is that fully ramped, or is that still, well below earnings contribution potential? Mr. Rich Montoni: I’ll answer those two in reverse. on the debt management contract, yes, we're in full revenue service, but we're still in the uptick on the, on the P&L. So, we are continuing with the startup losses, and that should turn profitable during fiscal year ‘16 and then continue to ramp toward a more normal profit margin. Having come from a federal IT business, yes, our margins are better than the typical federal IT margin. And I think it’s the fact that, they have a lot of competition in their business, and, and they have a lot of cost plus. Although we have cost plus, you're, you know, you're going to see a cost plus margin down around 7 percent on a--you know, generally speaking. And so, the more cost plus the federal IT contractor has in their mix, the lower you're going to see their margins. The fact that we do a lot of performance based contracting tends to give us better margins. Ms. Lisa Miles: Next question please. Mr. Rich Montoni: That was his question. Operator: Our next question comes from the line of Richard Close with Canaccord Genuity. Please proceed with your question.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 27 Mr. Richard Close: Great. first question is, as it relates to the U.K. contract, can you talk about when you're able--assuming you're hitting the volume levels, for year two, when you're able to recognize the performance, incentives, is that come over the course of year two or at the end of the year, just a little bit of clarity there? Mr. Rick Nadeau: Yeah. The, um--this is Rick. When the--we actually get assessed any penalties or any awards or any incentives on a month to month basis, but there are true ups. So, we do recognize it over time, if that’s your question, on the revenue recognition. It’s not--it does not tend to be back loaded. If we did have, something like that, we would smooth it in, but that’s not the way the contract works. You see it over time. Mr. Richard Close: Okay. And my second question, maybe more for Bruce - there was an interesting article on Medicaid, in the Wall Street Journal a couple of days ago, talked about, you know, potential, incentives to get the states that have not expanded. Can you talk a little bit about, what you're seeing, on the Medicaid side, what you're, expecting, any changes over the course of the coming year? Mr. Bruce Caswell: Sure, I’d be happy to, Richard. So, I think you're referring to basically the administration’s plan to try to, get a minor change in legislation that would allow for three years of complete funding for Medicaid expansion regardless of when the state actually begins that expansion endeavor so that states wouldn’t be locked into the decline from 100 percent funding down to 90 and so forth that ties to the current, the current Affordable Care Act.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 28 So, yeah, I won’t comment or speculate on, you know, the likelihood of getting that through the legislative process or the regulatory process, but certainly, Medicaid expansion itself remains a very dynamic environment, with, you know, a large number of states still contemplating it, some due to changes in administration--for example, in Louisiana where Governor Jindal termed out and we have a new Governor moving ahead with expansion. So, we’ve said many times that it’s the kind of thing that will--I think we--we think we'll see gradual adoption over time as more states see the business case to it, and the benefit from an economic development perspective in their, in their health care industry. So we’ll continue to watch it, and I guess you could say that if, a change in regulation that provides that guaranteed three year funding, is made possible, that could create an added incentive for states to, to take that on. We also have spoken previously about how, in, 2017 there are some, new tools available to the states through the Section 1332 Waivers that give them the ability, to make some fairly substantial changes to their programs, that could incorporate a Medicaid expansion component as well as kind of re-crafting the exchanges, on a state based level - so, more to come there. I think those become options to them if this other option does not, so we’ll continue to watch it. Ms. Lisa Miles: Next question please.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 29 Operator: Once again, if you would like to ask a question, please press star, one on your telephone keypad. A confirmation tone will indicate that your line is in the question queue. And please limit yourself to one question and one follow up question. Our next question comes from the line Frank Sparacino with First Analysis. Please proceed with your question. Mr. Frank Sparacino: Hi, guys. On the U.K., with recruiting and training seemingly in order now, you know, what’s the greatest risk going forward with the contract? Mr. Rich Montoni: Good question, Frank. And I do think that, in comparison to prior periods, it’s very important to recognize that we’ve tackled and I think improved meaningfully, two out of three tougher aspects here. I would answer the question by saying now we focus, and shine the light on productivity and quality and getting those two aspects where we would like them to be. And I think in the call notes, we’ve talked extensively about the initiatives that we have place--in place to continue to improve. We've had meaningful improvement, here to date on the productivity side. We still think there's improvements that we can make, and we have initiatives in place to achieve productivity improvements as well as quality improvements. Those would be the areas where we now focus our attention. Bruce, anything to add on that one?

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 30 Mr. Bruce Caswell: I think, you're absolutely right, Rich. And we, I think noted that it does take up to six to eight months for the newly graduated staff to really become fully productive, and so now that we're seeing more and more of those staff come through graduation at a higher rate, we’ll continue to track toward those higher levels of productivity. And as we said, that’s consistent with our view that, by, the end of the summer, we’ll be able to completely erase the backlog. We, did mention yesterday that the backlog is now down to 110,000 cases from, a backlog of 550,000 that we inherited at the time of the contract, so we're very pleased with that progress, as well. Mr. Frank Sparacino: Great, thank you, guys. Mr. Rich Montoni: You’re welcome. Ms. Lisa Miles: Next question please. Operator: Our next question comes from the line of Peter Heckmann with Avondale Partners. Please proceed with your question. Mr. Shane Svenpladsen: Good morning. This is Shane Svenpladsen in for Pete. Regarding the U.K. work program, a recent government spending review suggested this program could be combined with the work choice program when the work program is retendered this year. Does

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 31 that still appear to be the case, and would you expect any material changes to those contracts if they were to be combined? Mr. Rich Montoni: Okay. Shane, we're going to ask Bruce Caswell to answer that question. Mr. Bruce Caswell: Hi, good morning, Shane. It’s a good question. And as you’ve noted, there has been some new guidance, as a result of the spending review in the United Kingdom. You know, let me just, begin by setting a bit of a backdrop. The U.K. is experiencing really historically low unemployment rates and high employment rates as a consequence. So, the government is shifting its focus to reducing the employment gap largely for individuals with disabilities. It’s interesting to note that when the work program was initially implemented, its focus was at the time on the long term unemployed, and that group has decreased by about 75 percent since, 2011. So, the government is now creating this smaller, more focused program on individuals with disabilities called the work and health program, and it is expected to absorb the work program and the work choice program, and be, focused on individuals with those specific health condition, and disabilities. So, first of all, clearly, helping individuals with disabilities into employment is a very much a core competency of our, Remploy, subsidiary in the United Kingdom, and we're very well positioned to, accommodate and take advantage of that change in government focus and approach.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 32 The new tender is not out yet, so we really don’t have a full sense, and--of the size of the contract. There are early indications, as you’ve noted, that the contract, should be expected to be smaller, and we’ll expect to have a clearer view in terms of the timing and the size of that opportunity, probably in the spring time. So, I’d probably just summarize by saying, when we look at the work that we perform, with both MAXIMUS, and Remploy in the work program and work choice, it’s also important to note that our profitability expectations for the combined programs in fiscal ‘16 are pretty low, so any proposed reduction that could happen as a result of that combination under a new contract, would be more of a top line, movement for us and relatively immaterial to the bottom line. Does that help? Mr. Shane Svenpladsen: Yeah, thanks. I'll get back in the queue. Mr. Bruce Caswell: All right. Good. Ms. Lisa Miles: Thanks, Shane. Next question please. Operator: Our next question comes from the line of Allen Klee with Sidoti. Please proceed with your question. Mr. Allen Klee: Yes, hi. If we look at three of the startup contracts, Australian jobactive, U.S. DOE and U.K. Fit for Work, is there a way we can quantify how that can move in terms of incremental EPS for, ‘16 and ‘17?

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 33 Mr. Rick Nadeau: I think that what you--this is Rick. I think what you will see--and I guess I look at the startups in the totality--is I think all of them are maturing phases, and I think that you will see us with our operating income margin climb steadily toward the middle of that 10 to 15 percent target range that we have. And I think all four of the startups will be contributing to that, and all four of them will be improving toward that goal. Does that answer your question? Mr. Allen Klee: Okay, thank you. And then, with Medicare appeals volumes, has been, lower, is there any sense of, if that’s going to continue to trend even lower or stabilize? Mr. Rich Montoni: Bruce? Mr. Bruce Caswell: Yeah, I think that, as we noted, the volumes have come down as we lost a couple of contracts, that--and we're seeing obviously the reflection of that. But, I think we, would say at this point we’ve reached a long term steady state, in terms of the volumes for the Medicare appeals program. Ms. Lisa Miles: Thanks, Allen. Next question please. Operator, next question please. Mr. Rich Montoni: Okay, why don't you--? Operator: --I'm sorry. If you'd like to ask a question, please press star, one on your telephone keypad.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 34 Our next question comes from the line of Charlie Strauzer with CJS Securities. Please proceed with your question. Mr. Charlie Strauzer: Hey, just a quick follow-up - if you look at the significant sales opportunity pipeline at like 2.8 billion versus the very light year of rebids coming up, it seems like there's a, you know, fair amount of new opportunities there. If you could help kind of give a little more, you know, granularity or color into the pipeline as to, you know, international versus domestic, and then maybe a sense of, you know, which kind of--you know, which are the three segments they kind of fall into, you know, maybe kind of give a percentage or, you know, a rough sense of that. Thanks. Mr. Rich Montoni: Okay, Charlie. Well, when I take a look at the pipeline, first off, I’d say, relative new work versus rebid, it’s a mix of both, as you would expect. And, the important aspect is that a good portion, roughly half of the sales pipeline relates to new work. In addition, from a domestic versus international, it’s really across all of our segments and international as well as domestic - I’d say well balanced. There's no disproportionate amount of opportunities in any segment or domestic versus international. Ms. Lisa Miles: Do you have a follow-up question? Mr. Charles Strauzer: No, that’s good for me. Thank you. Ms. Lisa Miles: Thanks, Charlie.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 35 Mr. Rich Montoni: Thank you, Charlie. Ms. Lisa Miles: Next question please. Operator: Our final question comes from the line of Richard Close with Canaccord Genuity. Please proceed with your question. Mr. Richard Close: Okay, thanks for slipping me in here. Two questions, one with respect to the higher salaries that you mentioned, in yesterday’s meeting - can you talk a little bit how, how you get, you know, compensated? Does that negatively impact you, or just with the dynamics on having to pay higher salaries in the U.K. on that contract? And then my second question would be, on the quarterly progression of earnings, you obviously have the 8 cents that is moving from first to second quarter. I think the current consensus for earnings, out there for second quarter is 56 cents. So, if you could talk to us about--talk about the progression as we go throughout the remainder of this year? Mr. Rich Montoni: Good. Let’s do this. I'm going to--the second question, we'll keep second and we’ll ask Rick to talk about quarterly progression and earnings and, Rick, if you want, you can talk about revenue, as well. Mr. Rick Nadeau: Sure.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 36 Mr. Rich Montoni: But, before we jump into that, let me take a high level stab at the first question, which I understand, in the HAAS contract, I believe it has been disclosed and was discussed yesterday, in, the government’s proceedings that, we are paying, higher salaries to the workforce that we inherited when we took the contract over on March 1st, 2015, as well as to those individuals, that we hired, since we took over the program. In the process of bidding this work and, negotiating this work, we felt it was necessary to pay higher salaries to be competitive and to be able to attract and retain the workforce. So, we very much negotiated that ability in the contract. The nature of this contract is to a lot of extent cost plus, so that was factored into the cost equation. And provided we don’t exceed the cap, Richard, it’s simply a cost reimbursable item, and I believe that’s factored into our forecast. Mr. Rick Nadeau: And I’ll handle the second question. You're correct - when we do look at the consensus estimates by quarter, Q2 is 56 cents. If you add the 8 cents, it is 64, as you noted. From there, we look at the remainder of the year, and we think your consensus numbers are reasonable. Now, when we look at the consensus estimates for Q2 revenue, we see it at around 594 million. I think this is a little light even after adding the 8.6 million of pending change. Remember, it’s not just 8.6 million of operating income. It'd be 8.6 million of revenue you would add to that. But, I still think that’s a little light. However, I do think Q4 consensus estimate of 644 might be a little bit heavy.

MAXIMUS Fiscal 2016 First Quarter Conference Call February 4, 2016 Confirmation #13629051 Page 37 Ms. Lisa Miles: I hope that answers your question on the progression through the year. And, I think that finishes the call today, and we don’t have any additional questions in the queue, so I’ll hand it back to the operator. Operator: Thank you. This does conclude today’s teleconference. You may disconnect your lines at this time and thank you for your participation.

1 Fiscal 2016 First Quarter Earnings Richard J. Nadeau Chief Financial Officer February 4, 2016

2 Forward-looking Statements & Non-GAAP Information These slides should be read in conjunction with the Company’s most recent quarterly earnings press release, along with listening to or reading a transcript of the comments of Company management from the Company’s most recent quarterly earnings conference call. This document may contain non-GAAP financial information. Management uses this information in its internal analysis of results and believes that this information may be informative to investors in gauging the quality of our financial performance, identifying trends in our results, and providing meaningful period-to-period comparisons. These measures should be used in conjunction with, rather than instead of, their comparable GAAP measures. For a reconciliation of non-GAAP measures to the comparable GAAP measures presented in this document, see the Company’s most recent quarterly earnings press release. Throughout this presentation, numbers may not add due to rounding. A number of statements being made today will be forward-looking in nature. Such statements are only predictions and actual events or results may differ materially as a result of risks we face, including those discussed in our SEC filings. We encourage you to review the summary of these risks in Exhibit 99.1 to our most recent Form 10-K filed with the SEC. The Company does not assume any obligation to revise or update these forward-looking statements to reflect subsequent events or circumstances.

3 Pending Change Order at December 31, 2015 • MAXIMUS had a pending change order at December 31, 2015 related to a state health contract where we were already performing the additional scope of work • Costs were incurred and recorded in Q1; revenue will be recorded once the change order is signed • As a result, approximately $8.6M of revenue and $0.08 of earnings per share shifted out of Q1; expect it will be signed in Q2, at which time we will record the revenue and related earnings • The delay in signing the pending change order is due to state’s required process, which provides up to 90 days of review by comptroller’s office − Amendment is presently awaiting this final approval − Very common in government contracting • This is just a shift of revenue and earnings from one quarter to the next; does not impact our full-year results and guidance

4 Revenue Health Segment 291.9$ 243.6$ 20% U.S. Federal Segment 145.3 107.7 35% Human Segment 119.5 115.7 3% Total 556.7$ 467.0$ 19% Operating Income Health Segment 26.8$ 37.8$ (29%) U.S. Federal Segment 10.7 13.3 (20%) Human Segment 9.1 16.2 (44%) Segment Income 46.6$ 67.3$ (31%) Acquisition - (0.6) Intangibles Amortization (3.1) (1.5) Other (0.7) - Total 42.8$ 65.2$ (34%) Operating Margin % 7.7% 14.0% Net Income attributable to MAXIMUS 26.6$ 41.9$ (36%) Diluted EPS 0.40$ 0.63$ (37%) ($ in millions, except per share data) Q1 FY16 Q1 FY15 % Change Total Company Results – First Quarter of FY 2016 Revenue • Q1 revenue grew 19%: − 8% organic growth, driven by Health Segment − 14% acquired growth − 3% decline (approximately $15M) due to unfavorable foreign currency translation compared to Q1 FY15 Operating Income • Operating margin and earnings were expected to be lower on a sequential and year-over-year basis due to several programs in varying stages of start-up across all three segments • Pending change order impacted Company margin by approximately 140 basis points • As a result, operating margin for Q1 was 7.7%; if change order had been recorded in Q1, operating margin would have been 9.1% • Still expect to exit the year with full-year operating margin for the total Company in target range of 10% to 15% due to expected benefit of several start-up projects progressing to normalized operations

5 Revenue Health Services 291.9$ 243.6$ 20% Operating Income Health Services 26.8$ 37.8$ (29%) Operating Margin % 9.2% 15.5% ($ in millions) Q1 FY16 Q1 FY15 % Change Health Services Segment Revenue • Increase driven principally by new work, and to a lesser extent, expansion of existing contracts • On a constant currency basis, growth would have been 22% • All growth was organic Operating Income & Margin • Operating margin for Q1 FY16 was lower compared to the prior year • Pending change order unfavorably impacted operating margin by 260 basis points in Q1; on a normalized basis, if change order had been signed during Q1, segment operating margin would have been 11.8% • As expected, operating margin was tempered by new contracts in the start-up phase, including Health Assessment Advisory Service (HAAS) and Fit for Work program in the United Kingdom • Prior-year period also benefitted from highly accretive change orders that bolstered operating margin U.K. Health Assessment Advisory Service Contract • Made steady operational progress on HAAS contract in Q1 • Too early to make any adjustments to forecast since we expect that it will take some time for improving trends to materialize in the financial model • At this time, still running below our volume targets but making progress each month; continue to expect to have productivity at the appropriate levels by late summer • Remain firmly committed to the program

6 Revenue U.S. Federal Services 145.3$ 107.7$ 35% Operating Income U.S. Federal Services 10.7$ 13.3$ (20%) Operating Margin % 7.4% 12.4% ($ in millions) Q1 FY16 Q1 FY15 % Change U.S. Federal Services Segment Revenue • Acquired growth from Acentia was offset by expected organic declines Operating Income & Margin • Q1 operating margin was 7.4% • Both revenue and profit unfavorably impacted by anticipated decreases in the legacy MAXIMUS Federal business: − Expected closure of a customer contact center in Boise, Idaho that was supporting the Federal Marketplace − Lower appeals and assessment volumes due, in part, to previously disclosed contracts lost through competitive rebid • Integration of Acentia substantially complete and performing according to plan

7 Revenue Human Services 119.5$ 115.7$ 3% Operating Income Human Services 9.1$ 16.2$ (44%) Operating Margin % 7.6% 14.0% ($ in millions) Q1 FY16 Q1 FY15 % Change Human Services Segment Revenue • Segment revenue growth benefitted from acquisition of Remploy, which was offset by approximately $9.4M from foreign currency translation Operating Income & Margin • As expected, operating margin in Q1 was 7.6%; lower compared to prior year: − Driven by decrease in contributions from our international welfare-to-work operations, most notably ongoing start-up of new jobactive contract in Australia − Still expect new jobactive contract will return to more normalized levels of profitability and within our target operating margin range of 10% to 15% in second half of FY16 • Prior-year period also included benefit of approximately $2.4M of incremental revenue and income from a previously disclosed contract extension in Saudi Arabia

8 Cash Flows & Balance Sheet Reconciliation to free cash flow can be found in financial tables in the Q1 FY16 earnings press release. $ in millions Q1 FY16 Cash provided by operating activities $1.4 Cash paid for property, equipment and capitalized software ($10.7) Free cash flow ($9.3) • Days Sales Outstanding were 75 days at December 31; while in-line with our targeted range of 65 to 80 days, sequential increase due, in part, to timing of payments, as well as delayed payments in two states where budgets are not yet finalized • Increase in billed and unbilled receivables unfavorably impacted cash flows in Q1 • Subsequent to quarter close, made progress on collections; DSOs in Q2 more likely to run toward lower end of our targeted range of 65 to 80 days, with corresponding benefit to cash flows from operations • Balance sheet remains healthy; at December 31, 2015 cash and cash equivalents totaled $51.0M, most of which was outside the United States

9 Share Repurchases & Other Uses of Cash • Approximately $139.4M remaining for repurchases under Board-authorized program Uses of Cash • Balance sheet remains healthy, and with our available line of credit, offers us a considerable amount of flexibility for capital deployment • Invested in infrastructure and continue to pursue selected strategic acquisitions in an effort to increase scalability and enhance our position for new market opportunities • Expect to continue with our quarterly cash dividend and opportunistic share buyback program • Above all, remain committed to sensible and practical uses of cash for creating further long-term shareholder value Period Approximate Number of Shares Purchase Amount Weighted Average Price Q1 FY16 543,000 $29.1M $53.65 Share Repurchases

10 Reiterating FY16 Guidance Fiscal 2016 Guidance Revenue $2.4B - $2.5B Diluted EPS $2.40 - $2.70 • Still expect that earnings will be back-end loaded, primarily due to anticipated improvements in our various contracts that are in start-up phase and will mature throughout the year • Still anticipate that total Company operating margins will be in 10% to 15% range for full fiscal year • Have received a number of questions related to impact from currency exchange rates: − Foreign currency exchange rates continue to have an unfavorable impact − British pound continued to significantly weaken throughout month of January − Looking at guidance we laid out in November, currency exchange rates at January 31 would indicate a tempering of revenue of approx. $28M − Wide revenue range within our FY16 guidance should provide sufficient room for it to be absorbed Cash provided from operating activities $200M - $230M Free cash flow $130M - $160M

11 Fiscal 2016 First Quarter Earnings Richard Montoni Chief Executive Officer February 4, 2016

12 Introduction • Pending change order that we now expect to be recognized in Q2 • If change order had been finalized in Q1, would have been in-line with our expectations • As expected, several large start-ups are also tempering earnings at this time – as they mature, fully anticipate that they will be meaningful contributors to our continued growth and profitability in FY16 and beyond • It’s appropriate to focus on our full-year guidance range because these types of quarterly fluctuations are common in our industry and we remain on track to achieve our estimates for FY16

13 U.K. Assessment Contract (HAAS) Project Update • Getting contract on right path to success remains a top priority for management team and we have made meaningful progress • U.K. National Audit Office (NAO) report and Public Accounts Committee meeting − On January 8, NAO published findings from an August 2015 audit of all assessment contracts across the country, including our U.K. assessment contract − Audit only covered effectively five months of operations − When we took over contract, we acknowledged that it would take 12 to 18 months before we could improve many aspects of operations − NAO report echoed what we said on our November call as it relates to certain performance metrics, including volumes and quality • HAAS Contract Background on Performance Metrics − U.K. assessment contract is predominantly cost-reimbursable with significant performance incentives, the largest tied to volumes − Our ability to hit volume targets is tied directly to: 1. Number of health care professionals (HCPs) we recruit 2. Number that complete training and graduate 3. Productivity of these new recruits

14 3. Productivity • Learning curve for HCPs – may take 6-8 months to achieve full productivity • As new HCPs ramp, seasoned HCPs previously serving as mentors will return to fully productive status • Delivered highest number of assessments to-date in January • Also made further headway on more than 550,000 cases of backlog • Have now reduced backlog to 110,000 cases Ongoing steady progress with new incoming assessments and backlog 2. Training & Graduation Rates • Performing functional assessments is a new skill for many HCPs – especially if they were previously working in a clinical setting or providing direct patient care • Rigorous training and competency tests are challenging • Amended aspects of our training to increase success • Smaller training classes give new recruits more access to experienced staff – yielded solid improvements in retention rates Recent monthly data shows that graduation rates are north of 80% 1. Recruitment • Launched initiatives to drive recruitment numbers • In Autumn, hired approximately 100 new HCPs each month • Currently have the required staff in pipeline to meet production requirements • Now focused on simply managing attrition and filling in the skill gaps in key locations Recruitment efforts are at appropriate run rates Meaningful Progress Since NAO Report & November Call The trends are indicative of the ongoing, steady progress to increase capacity and boost the number of completed assessments. We remain cautiously confident that we will have the pieces in place to get productivity where it needs to be by the end of summer 2016.

15 NAO Report Findings On Quality & Cost Quality • Delivering high quality assessment reports is essential; DWP uses them to determine benefit levels • NAO report indicated that we were not achieving one of the quality metrics at time of audit in August 2015 • Were meeting or exceeding 10 out of 11 service level metrics for quality in the month of December • Implemented several measures to continue to strengthen the quality of our assessment reports Cost • NAO report also compared cost per assessment under MAXIMUS versus previous provider • Comparison is misleading; contracts are fundamentally different • Our contract requires a much greater proportion of face-to-face assessments, which cost more to perform • Made meaningful progress on all fronts, but it is premature to make any modifications to our estimates for this fiscal year Remain on track to meet our volume targets that underpin our FY16 guidance

16 Affordable Care Act (ACA) & Open Enrollment Period • Closed out third Open Enrollment period (OE3) on January 31 • OE3 did not include a special enrollment extension and therefore had a shorter duration than prior periods • Despite compressed timeframe, call volumes across our contact centers were consistent with our expectations; confirms our view that ACA-related revenue has largely stabilized into a relatively steady-state • Continued to support clients with other ACA-related activities: − Completing redeterminations − Answering tax-related questions − Managing certain aspects of consumer engagement through new digital offerings that assist Medicaid-eligible consumers with eligibility and enrollment • Solid market activity in adjacent markets including supporting Medicaid programs with enrollment and credentialing of providers • Looking ahead, continue to expect normal course fluctuations year-in and year-out as states prioritize the wide-ranging set of initiatives for their public health insurance programs

17 Successful Texas Contract Renewal • Signed Eligibility Support Services renewal contract with Texas Health and Human Services Commission on December 18, 2015 • Five-year base contract valued at $522M – Two years longer than our previous contract – Also has two additional option years • Will continue to provide support services for many of the state’s programs, including: − Medicaid − Children’s Health Insurance Program − Supplemental Nutrition Assistance Program − Temporary Assistance for Needy Families • Increased contract length is confirmation of our continued strong performance; pleased to close out our FY15 rebids with this key win • FY16 will be a much lighter rebid year: 10 contracts with a combined total contract value of approximately $170M up for rebid

18 New Awards, Pipeline & Rebids New Awards December 31, 2015 YTD Signed Awards $665M New Contracts Pending $285M Sales Opportunities December 31, 2015 Total Pipeline $2.8B • Strong awards in Q1 • Sales pipeline lower sequentially due to work shifting into awarded category, most notably Texas Eligibility Support Services contract • Reported pipeline only reflects short-term opportunities where we believe the request for proposals will be released within the next six months • As part of our long-term growth strategy, monitor a much broader pipeline that lays out opportunities over the next three to five years • Both reported short-term pipeline and longer- term outlook hold a broad mix of rebids and new work, representing opportunities in multiple geographies and all segments, including those that complement our recent acquisitions

19 Conclusion • Making continual, steady progress with the U.K. assessment contract • Very positive working relationship with our client (DWP); remain confident that we will have the right pieces in place to achieve end-of-summer goals to meet our volume targets that underpin our FY16 guidance • Once fully ramped, the assessment contract and other major start-ups will deliver solid, long-term shareholder value • In addition, the trends we experienced during OE3 of ACA in the U.S. confirms that this business has largely stabilized • Continue to be focused on progressing the several start-ups we have in progress to advance them to a normalized level and contribute to our expected growth in the rest of FY16 and beyond • An important component of our long-term growth strategy is to look for opportunities where governments are transforming programs • Oftentimes, these types of contracts have front-end losses; over time they mature into programs that deliver recurring revenue streams, offer solid earnings contributions and create long-term shareholder value • All-in-all, we remain on track to achieve our guidance for the full fiscal year