1891 Metro Center Drive

Reston, Virginia 20190

(703) 251-8500

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held March 16, 2016

The 2016 Annual Meeting of Shareholders (the “Annual Meeting”) of MAXIMUS, Inc. will be held at our corporate headquarters at 1891 Metro Center Drive in Reston, Virginia on March 16, 2016 at 11:00 a.m., Eastern Time, to consider and act upon the following matters:

| |

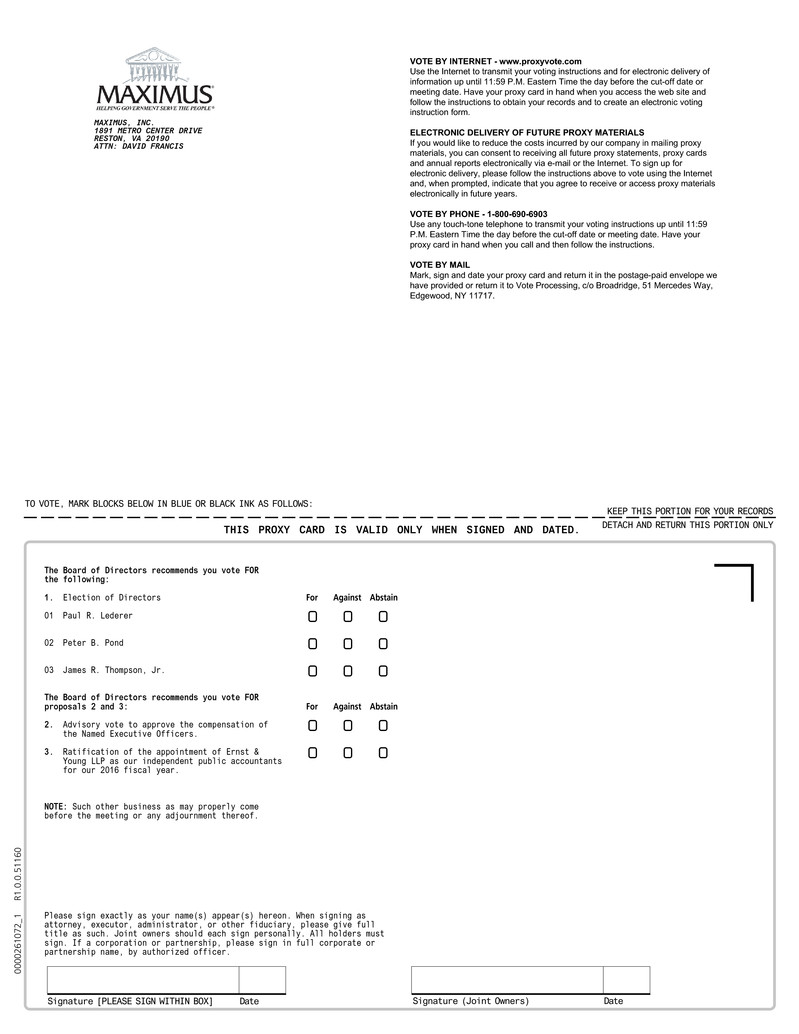

1. | The election of three Class I Directors to serve until the 2019 Annual Meeting of Shareholders. |

| |

2. | An advisory vote to approve the compensation of the Named Executive Officers. |

| |

3. | The ratification of the appointment of Ernst & Young LLP as our independent public accountants for our 2016 fiscal year. |

| |

4. | The transaction of any other business that may properly come before the meeting or any adjournment of the meeting. |

Shareholders of record at the close of business on January 15, 2016 will be entitled to vote at the Annual Meeting or at any adjournment of the Annual Meeting.

Under Securities and Exchange Commission rules, we have elected to deliver our proxy materials to shareholders over the Internet. That delivery process allows us to provide shareholders with the information they need while at the same time conserving natural resources and lowering the cost of printing and delivery. On or about January 29, 2016, we will mail to our shareholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our 2016 proxy statement and 2015 annual report. This notice also provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will attend the Annual Meeting. Whether or not you plan to attend, your vote is very important, and we encourage you to vote promptly. There are several ways that you can cast your ballot — by telephone, by Internet, by mail (if you request a paper copy) or in person at the Annual Meeting.

|

| | | | |

| | | By Order of the Board of Directors, | |

| | | | |

| | By: | /s/ David R. Francis | |

| | | David R. Francis | |

| | | General Counsel and Secretary | |

This proxy statement is dated January 29, 2016 and is first being distributed to shareholders on or about January 29, 2016.

MAXIMUS, INC.

TABLE OF CONTENTS

1891 Metro Center Drive

Reston, Virginia 20190

(703) 251-8500

PROXY STATEMENT

Our board of directors is making this proxy statement, our 2015 annual report on Form 10-K and a form of proxy available to you in connection with the solicitation of proxies by the board of directors for use at the 2016 Annual Meeting of Shareholders (the “Annual Meeting”) to be held at our corporate headquarters at 1891 Metro Center Drive in Reston, Virginia on March 16, 2016 and at any adjournments of the meeting.

Pursuant to Securities and Exchange Commission (“SEC”) rules, we have elected to provide our proxy materials to our shareholders primarily over the Internet rather than mailing paper copies of those materials to each shareholder. Accordingly, on or about January 29, 2016, we will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to shareholders to provide website and other information for the purpose of accessing our proxy materials. All shareholders will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy will be included in the Notice. In addition, shareholders may request proxy materials in printed form by mail on an ongoing basis. We encourage you to take advantage of the availability of the proxy materials on the Internet in order to help reduce the cost and environmental impact of the Annual Meeting.

GENERAL INFORMATION ABOUT VOTING

Who can vote. You will be entitled to vote your shares of MAXIMUS common stock at the Annual Meeting if you were a shareholder of record at the close of business on January 15, 2016. As of that date, 64,894,171 shares of common stock were outstanding and entitled to one vote each at the meeting. You are entitled to one vote on each item voted on at the meeting for each share of common stock that you held on January 15, 2016.

How to vote your shares. You may vote your shares either by attending the Annual Meeting and voting in person or by voting by proxy. If you choose to vote by proxy, you may vote your shares in any of the following ways:

| |

• | By Internet. You may vote online by accessing www.proxyvote.com and following the on-screen instructions. You will need the control number included on the Notice or on your proxy card, as applicable. You may vote online 24 hours a day. If you vote online, you do not need to return a proxy card. |

| |

• | By Telephone. You may vote by calling toll free 1-800-690-6903 and following the instructions. You will need the control number included on the Notice or on your proxy card, as applicable. You may vote by telephone 24 hours a day. If you vote by telephone, you do not need to return a proxy card. |

| |

• | By Mail. If you requested printed copies of the proxy materials, you will receive a proxy card, and you may vote by signing, dating and mailing the proxy card in the envelope provided. |

| |

• | In Person. If you are a shareholder of record, you may vote in person at the Annual Meeting. You will receive a ballot when you arrive. If you are a beneficial owner of shares held in street name, you must obtain a legal proxy from the broker, bank or other nominee that holds your shares in order to vote your shares in person at the Annual Meeting. Follow the instructions on the Notice to obtain the legal proxy. |

Online and telephone voting are available through 11:59 p.m. Eastern Time on March 15, 2016.

If you vote by proxy, the named proxies (Richard J. Nadeau, Dominic A. Corley and David R. Francis) will vote your shares as you have instructed. If you are a shareholder of record and you sign and return a proxy card without giving specific voting instructions, the proxies will vote your shares in favor of each of the proposals recommended by the board of directors contained in this proxy statement. If you are a beneficial owner of shares held in street name and do not provide the broker, bank or other nominee that holds your shares with specific voting instructions, it could result in a “broker non-vote.” For more information, see “Abstentions and broker non-votes” below.

Quorum. A quorum of shareholders is required in order to transact business at the Annual Meeting. A majority of the outstanding shares of common stock entitled to vote must be present at the meeting, either in person or by proxy, to constitute a quorum. Abstentions and broker non-votes are counted in determining whether a quorum is present at the meeting.

Number of votes required. The number of votes required to approve each of the proposals scheduled to be presented at the Annual Meeting is as follows:

|

| | |

Proposal | | Required Vote |

1. Election of directors | | For each nominee, a majority of the votes cast are “for” such nominee. |

2. Advisory vote to approve named executive officer compensation | | A majority of the votes cast are “for” the proposal. |

3. Ratification of the Audit Committee’s selection of independent public accountants | | A majority of the votes cast are “for” ratification. |

Shares Held Through a Bank, Broker or Other Nominee. If you hold your shares in street name through a bank, broker or other nominee, such bank, broker or nominee will vote those shares in accordance with your instructions. To instruct your bank, broker or nominee how to vote, you should follow the information provided to you by such entity. Without instructions from you, a bank, broker or nominee will be permitted to exercise its own voting discretion with respect to so-called “routine matters” but will not be permitted to exercise voting discretion with respect to non-routine matters, as described below. We urge you to provide your bank, broker or nominee with appropriate voting instructions so that all your shares may be voted at the meeting.

Abstentions and broker non-votes. A broker non-vote occurs when a broker cannot vote a customer’s shares registered in the broker’s name because the customer did not send the broker instructions on how to vote on the matter. If the broker does not have instructions and is barred by law or applicable rules from exercising its discretionary voting authority on a particular matter, then the shares will not be voted on the matter, resulting in a “broker non-vote.” A broker cannot vote on the election of directors or on matters relating to executive compensation without instructions; therefore, there may be broker non-votes on Proposals 1 and 2. A broker may vote on the ratification of the independent public accountants without instructions from you; therefore, no broker non-votes are expected in connection with Proposal 3. Abstentions and broker

non-votes will not count as votes cast with respect to the proposals listed above. Therefore, abstentions and broker non-votes will have no effect on the voting on these matters at the Annual Meeting.

Discretionary voting by proxies on other matters. Aside from the proposals listed above, we do not know of any other proposal that may be presented at the 2016 Annual Meeting of Shareholders. However, if another matter is properly presented at the meeting, the persons named as proxies (Richard J. Nadeau, Dominic A. Corley and David R. Francis) will exercise their discretion in voting on the matter.

How you may revoke your proxy. You may revoke your proxy card at any time before the named proxies exercise it at the meeting by substituting a subsequent vote using any of the methods described in “How to vote your shares” above or by timely delivering a written notice of revocation to our Corporate Secretary that is dated later than the date of your proxy.

Expenses of solicitation. We will bear all costs of soliciting proxies. We will request that brokers, custodians and fiduciaries forward proxy soliciting material to the beneficial owners of stock held in their names, for which we will reimburse their out-of-pocket expenses. In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone and/or personal interviews.

Shareholders sharing the same surname and address. In some cases, shareholders holding their shares in a brokerage or bank account who share the same surname and address and have not given contrary instructions are receiving only one copy of the Notice. This practice is designed to reduce duplicate mailings and save printing and postage costs as well as natural resources. If you would like to have additional copies of our annual report, proxy statement or Notice mailed to you, please call or write us at our corporate headquarters, 1891 Metro Center Drive, Reston, Virginia 20190, Attn: Vice President of Investor Relations, telephone: (800) 368-2152. If you want to receive separate copies of the proxy statement, annual report to shareholders or Notice in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker or other nominee record holder.

SECURITY OWNERSHIP

The following tables show the number of shares of our common stock beneficially owned as of January 15, 2016 (unless otherwise indicated), by (i) the only persons known by us to own more than five percent of our outstanding shares of common stock, (ii) our directors and director nominees, (iii) the executive officers named in the Summary Compensation Table contained under the heading “Executive Compensation” in this proxy statement and (iv) all of our current directors and executive officers as a group. Unless set forth in the tables below, the address of each beneficial owner is c/o MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190.

The number of shares beneficially owned by each holder is based upon the rules of the SEC. Under SEC rules, beneficial ownership includes any shares over which a person has sole or shared voting or investment power, as well as shares which the person has the right to acquire within 60 days by exercising any stock option or other right and shares of restricted stock that will vest with 60 days. Accordingly, this table includes shares that each person has the right to acquire on or before March 15, 2016. Unless otherwise indicated, to the best of our knowledge, each person has sole investment and voting power (or shares that power with his or her spouse) over the shares listed in the table. By including in the table shares that he or she might be deemed beneficially to own under SEC rules, a holder does not admit beneficial ownership of those shares for any other purpose.

To compute the percentage ownership of any shareholder or group of shareholders in the following tables, the total number of shares deemed outstanding consists of 64,894,171 shares that were outstanding on January 15, 2016 rather than the percentages set forth in the shareholders’ filings with the SEC.

Security Ownership of Certain Beneficial Owners

The following table shows the number of shares of our common stock beneficially owned by the only persons known by us to own more than five percent of our outstanding shares of common stock as of January 15, 2016 (unless otherwise indicated):

|

| | | | |

Name and Address of Beneficial Owner | | Amount and Nature of Beneficial Ownership | | Percent of Class |

BlackRock, Inc. 40 East 52nd Street

New York, New York 10022 | | 5,905,303(1)

| | 9.1%

|

FMR LLC 245 Summer Street Boston, Massachusetts 02210 | | 5,067,011(2)

| |

7.8% |

The Vanguard Group 100 Vanguard Boulevard

Malvern, Pennsylvania 19355 | |

4,931,344(3) | |

7.6% |

BAMCO, Inc. 767 Fifth Ave, 49th Floor

New York, New York 10153 | |

3,809,705(4) | |

5.9% |

________________ | | | | |

| |

(1) | According to Schedule 13G/A filed with the SEC on January 15, 2015, BlackRock, Inc. reported that through BlackRock Advisors (UK) Limited, BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Asset Management Ireland Limited, BlackRock Financial Management, Inc., BlackRock Fund Advisors, BlackRock Institutional Trust Company, N.A., BlackRock International Limited, BlackRock Investment Management (Australia) Limited, BlackRock Investment Management (UK) Ltd, BlackRock Investment Management LLC, BlackRock Japan Co. Ltd, and BlackRock Life Limited, it had sole dispositive power with respect to 5,905,303 shares of common stock and sole voting power with respect to 5,690,770 shares of common stock. |

| |

(2) | According to a Schedule 13G filed with the SEC on February 13, 2015, FMR LLC, Edward C. Johnson 3d and Abigail P. Johnson reported that they had sole dispositive power over 5,067,011 shares of common stock, and FMR LLC reported that it had sole voting power with respect to 1,057,447 shares of common stock. |

| |

(3) | According to a Schedule 13G/A filed with the SEC on February 11, 2015, The Vanguard Group reported that it had sole dispositive power over 4,846,878 shares of common stock, shared dispositive power over 84,466 shares of common stock, and sole voting power with respect to 90,866 shares of common stock. |

| |

(4) | According to a Schedule 13G/A filed with the SEC on February 17, 2015 (i) BAMCO, Inc. reported that it had shared dispositive power over 3,645,800 shares of common stock and shared voting power with respect to 3,245,800 shares of common stock, (ii) Baron Capital Group, Inc. and Ronald Baron reported that they had shared dispositive power over 3,809,705 shares of common stock and shared voting power with respect to 3,409,705 shares of common stock and (iii) Baron Capital Management, Inc. reported that it had shared dispositive power over 163,905 shares of common stock and shared voting power with respect to 163,905 shares of common stock. |

Security Ownership of Management

The following table shows the number of shares of our common stock beneficially owned by our directors and director nominees, the executive officers named in the Summary Compensation Table contained in this proxy statement and all of our current directors and executive officers as a group as of January 15, 2016 (unless otherwise indicated).

|

| | | | |

| | Amount and Nature of Beneficial Ownership (1) | | Percent of Class |

Directors and Director Nominees | | | | |

Russell A. Beliveau | | 126,564 | | * |

John J. Haley | | 125,927 | | * |

Paul R. Lederer | | 90,466 | | * |

Richard A. Montoni | | 653,282 | | 1.0% |

Peter B. Pond | | 250,488 | | * |

Raymond B. Ruddy | | 481,642 | | * |

Marilyn R. Seymann | | 94,641 | | * |

James R. Thompson, Jr. | | 133,986 | | * |

Wellington E. Webb | | 102,210 | | * |

Named Executive Officers (except Directors) | | | | |

Mark S. Andrekovich | | 31,482 | | * |

Bruce L. Caswell | | 189,386 | | * |

Richard J. Nadeau | | 6,889 | | * |

Akbar Piloti | | 10,860 | | * |

All directors and executive officers as a group | | 2,325,274 | | 3.6% |

________________ | | | | |

| |

* | Percentage is less than 1% of all outstanding shares of common stock. |

| |

(1) | Amounts include shares issuable under stock options exercisable within 60 days as follows: Caswell 160,000. The non-employee directors have elected to defer receipt of RSUs for tax purposes over periods varying from three years until termination of their board service. Therefore, the amounts also include the following deferred/unvested RSUs that could vest within 60 days in the event a non-employee director’s Board service terminated: Beliveau 81,085, Haley 125,927, Lederer 14,474, Pond 236,113, Ruddy 168,090, Seymann 10,258, Thompson 133,986, Webb 101,735, and all directors and executive officers as a group 871,668. |

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Our directors, our executive officers and anyone owning beneficially more than ten percent of our equity securities are required under Section 16(a) of the Securities Exchange Act of 1934, as amended, to file with the SEC reports of their ownership and changes of their ownership of our securities. They must also furnish copies of the reports to us. Based solely on our review of the reports furnished to us and any written representations that no other reports were required, we believe that during our 2015 fiscal year, our directors, executive officers and ten percent beneficial owners complied with all applicable Section 16(a) filing requirements.

PROPOSAL 1 – ELECTION OF DIRECTORS

General

The board of directors currently consists of nine directors. Under our articles of incorporation, the board is divided into three classes, with each class having as nearly equal a number of directors as possible. The term of one class expires, with their successors being subsequently elected to a three-year term, at each annual meeting of shareholders. At the Annual Meeting, three Class I Directors will be elected to hold office for a three-year term expiring at the 2019 Annual Meeting of Shareholders or until their successors are elected and qualified. The board has nominated Paul R. Lederer, Peter B. Pond and James R. Thompson, Jr. for election as Class I Directors. Mr. Lederer, Mr. Pond and Mr. Thompson presently serve as our Class I directors. If you sign and return your proxy card, the persons named in such proxy card will vote to elect these three nominees unless you mark your proxy card otherwise. You may not vote for a greater number of nominees than three. Each nominee has consented to being named in this proxy statement and to serve if elected. If for any reason a nominee should become unavailable for election prior to the Annual Meeting, the proxy holders may vote for the election of a substitute. We do not presently expect that any of the nominees will be unavailable.

Vote Required

The Company’s bylaws provide for majority voting in director elections. The board of directors also has adopted a Director Resignation Policy. Under that policy, each director nominee has submitted a written contingent resignation which will become effective only if (i) the director fails to receive the required number of votes for re-election as set forth in the Company’s bylaws and (ii) the board of directors accepts the resignation. The affirmative vote of a majority of the total number of votes cast for or against each of Mr. Lederer, Mr. Pond and Governor Thompson is required to re-elect each nominee to our board. Abstentions and broker non-votes will not be counted as votes cast and will have no effect on the voting of this matter.

Biographical Information of Directors and Nominees

The following presents biographical information about the nominees and current directors whose terms of office will continue after the 2016 Annual Meeting of Shareholders. As part of the information below, we have included a brief description of the experience, qualifications, attributes and skills that led to the conclusion that each director should serve on the board. Information about the number of shares of common stock beneficially owned by each nominee and director, directly or indirectly, as of January 15, 2016, appears above under “Security Ownership – Security Ownership of Management.”

Nominees for Class I Directors (for terms expiring in 2019)

Paul R. Lederer

Age 76

Paul R. Lederer has served as one of our directors since 2003. Mr. Lederer retired from Federal Mogul in 1998 as Executive Vice President, Worldwide Aftermarket, following its acquisition of Fel-Pro where he served as President and Chief Operating Officer from November 1994 to February 1998. Mr. Lederer brings more than 30 years of management experience and leadership in the commercial business sector to MAXIMUS. During his distinguished career, Mr. Lederer held various senior positions with Federal Mogul, Fel-Pro, Stant, Epicor Industries, and Parker Hannifin. Mr. Lederer holds a B.A. from the University of Illinois and received his J.D. from Northwestern University.

Mr. Lederer is a director of Dorman Products, Inc. and O’Reilly Automotive, Inc.

The board of directors believes that Mr. Lederer’s qualifications and skills include, among other things, his experience in various leadership and management positions of large, publicly-traded businesses and public company directorship experience together with his understanding of legal matters.

Peter B. Pond

Age 71

Peter B. Pond has served as one of our directors since 1997 and as Chairman of the Board since 2001. Mr. Pond is a founder of ALTA Equity Partners LLC, a venture capital firm, and has been a General Partner of that firm since June 2000. Prior to that, Mr. Pond was a Principal and Managing Director in the Investment Banking Department at Donaldson, Lufkin & Jenrette Securities Corporation in Chicago and was head of that company’s Midwest Investment Banking Group. Mr. Pond holds a B.S. in Economics from Williams College and an M.B.A. in Finance from the University of Chicago.

Mr. Pond served as a director of Navigant Consulting, Inc. from 1996 to 2014.

The board of directors believes that Mr. Pond’s qualifications and skills include, among other things, his experience in the investment and financial industry and as a public company director.

James R. Thompson, Jr.

Age 79

James R. Thompson, Jr. has served as one of our directors since 2001. Governor Thompson has served as Senior Chairman of the law firm of Winston & Strawn LLP since 2006. He will retire from the firm on January 31, 2016. He was Chairman of the firm from 1993 to 2006. He joined that firm in 1991 as Chairman of the Executive Committee after serving four terms as Governor of the State of Illinois from 1977 until 1991. Prior to his terms as Governor, he served as U.S. Attorney for the Northern District of Illinois from 1971 to 1975. Governor Thompson has served as the Chief of the Department of Law Enforcement and Public Protection in the Office of the Attorney General of Illinois, as an Associate Professor at Northwestern University School of Law, and as an Assistant State’s Attorney of Cook County. He is a former Chairman of the President’s Intelligence Oversight Board. Governor Thompson also served on the National Commission on Terrorist Attacks Upon the United States (9-11 Commission). Governor Thompson attended the University of Illinois and Washington University, and he received his J.D. from Northwestern University.

Governor Thompson is currently a member of the board of directors of Navigant Consulting, Inc. He previously served as a director of John Bean Technologies Corporation from 2008 to 2013.

The board of directors believes that Governor Thompson’s qualifications and skills include, among other things, his extensive experience in state government, leadership and management skills gained as Governor and chairman of a large law firm, public company directorship experience, as well as his legal background.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE FOR THE THREE NOMINEES SET FORTH ABOVE.

Class II Directors (terms expiring in 2017)

Russell A. Beliveau

Age 68

Russell A. Beliveau has served as a director since 1995. He served as our President of Investor Relations from 2000 until his retirement in 2002 and served as President of Business Development from 1998 until 2000. Prior to that, he served as President of the Government Operations Group from 1995 to 1998. Mr. Beliveau has worked in the health and human services industry since 1983. During that time, he held both government and private sector positions at the senior executive level. Mr. Beliveau’s past positions include

Vice President of Operations at Foundation Health Corporation of Sacramento, California from 1988 through 1994 and Deputy Associate Commissioner (Medicaid) for the Massachusetts Department of Public Welfare from 1983 until 1988. Mr. Beliveau received his Masters in Business Administration and Management Information Systems from Boston College and his B.A. in Psychology from Bridgewater State College.

The board of directors believes that Mr. Beliveau’s qualifications and skills include, among other things, his experience in state government and managing government health and human services programs and his prior service with the Company.

John J. Haley

Age 66

John J. Haley has served as one of our directors since 2002. Since January 2016, Mr. Haley has served as the Chief Executive Officer of Willis Towers Watson, an insurance broker and human resources and employee benefits consulting firm formed through the merger of Willis Group Holdings Public Limited Company and Towers Watson & Co. From 2010 until January 2016, Mr. Haley served as the Chief Executive Officer and Chairman of the Board of Towers Watson & Co. Previously he served as President and Chief Executive Officer of Watson Wyatt Worldwide, Inc. from 1999 until its merger with Towers Perrin, Forster & Crosby, Inc. in 2010. Mr. Haley joined Watson Wyatt in 1977. Mr. Haley is a Fellow of the Society of Actuaries and is a co-author of Fundamentals of Private Pensions (University of Pennsylvania Press). He has an A.B. in Mathematics from Rutgers College and studied under a Fellowship at the Graduate School of Mathematics at Yale University.

Mr. Haley is a director of Willis Towers Watson. He previously served as a director of Towers Watson & Co. from 2010 until its merger with Willis Group Holdings Public Limited Company in January 2016. He also served as a director of Watson Wyatt Worldwide, Inc. from 1992 until its merger with Towers Perrin, Forster & Crosby, Inc. in 2010 and as a director of Hudson Global, Inc. from 2003 to 2015.

The board of directors believes that Mr. Haley’s qualifications and skills include, among other things, his experience as the Chief Executive Officer and Chairman of a large, publicly-traded consulting firm together with his knowledge of finances, human resources and compensation matters, as well as his public company directorship experience.

Marilyn R. Seymann

Age 73

Marilyn R. Seymann has served as one of our directors since 2002. Since early 2013 Dr. Seymann has served as Chief Executive Officer of Caring Capital, LLC, which provides consulting services to organizations to create sustainable solutions to social problems. From 2009 to 2013 Dr. Seymann served as CEO of the Bruce T. Halle Family Foundation, a charitable foundation. From 1991 to 2009 Dr. Seymann served as President and Chief Executive Officer of M One, Inc., a corporate strategy and governance consulting firm for public and private companies. From 2007 to 2008 Dr. Seymann served as Chairman and Chief Executive Officer of the International Institute of the Americas, a college focused on adult education. Before that she was Associate Dean of the College of Law at Arizona State University from 2005 to 2007. Prior to forming M One, she held senior management positions with Chase Bank, Arthur Andersen, and was the Associate Dean of the College of Business at Arizona State University. Dr. Seymann holds a B.A. from Brandeis University, an M.A. from Columbia University, and a Ph.D. from California Western University. Among her other publications, Dr. Seymann is co-author of The Governance Game: What Every Board Member & Corporate Director Should Know About What Went Wrong in Corporate America & What New Responsibilities They Are Faced With.

The board of directors believes that Dr. Seymann’s qualifications and skills include, among other things, her previous government experience as well as her understanding of finances, the educational system and the

consulting industry and her recognized expertise in corporate governance gained through her experience in senior management and leadership positions at various companies and colleges.

Class III Directors (terms expiring in 2018)

Richard A. Montoni

Age 64

Richard A. Montoni has served as Chief Executive Officer and a director of MAXIMUS since 2006. He also served as President from 2006 through 2014. Previously, Mr. Montoni served as our Chief Financial Officer and Treasurer from 2002 to 2006. Mr. Montoni served as Chief Financial Officer for Towers Perrin, a global professional services firm, during April 2006 before rejoining MAXIMUS and his appointment as Chief Executive Officer and President. He also currently serves as the Vice Chairman of the Northern Virginia Technology Council, the membership and trade association for the technology community in Northern Virginia. Before his employment with MAXIMUS, Mr. Montoni served as Chief Financial Officer and Executive Vice President for Managed Storage International, Inc. in Broomfield, Colorado from 2000 to 2001. From 1996 to 2000, he was Chief Financial Officer and Executive Vice President for CIBER, Inc., a NYSE-listed company in Englewood, Colorado where he also served as a director until 2002. Before joining CIBER, he was an audit partner with KPMG, LLP, where he worked for nearly 20 years. Mr. Montoni holds a Masters Degree in Accounting from Northeastern University and a B.S. degree in Economics from Boston University.

The board of directors believes that Mr. Montoni should serve as a director based on his qualifications and skills which include, among other things, his audit and financial experience together with the detailed knowledge of the operations of the Company he possesses as the current Chief Executive Officer.

Raymond B. Ruddy

Age 72

Raymond B. Ruddy has served as one of our directors since 2004 and Vice Chairman of the Board of Directors since 2005. Mr. Ruddy retired from MAXIMUS in 2001. Before his retirement Mr. Ruddy served as the Chairman of the Board of Directors from 1985 to 2001 and President of our Consulting Group from 1989 to 2000. From 1969 until he joined us, Mr. Ruddy served in various capacities with Touche Ross & Co., including Associate National Director of Consulting from 1982 until 1984 and Director of Management Consulting (Boston, Massachusetts office) from 1978 until 1983. Mr. Ruddy received his M.B.A. from the Wharton School of Business of the University of Pennsylvania and his B.S. in Economics from Holy Cross College.

The board of directors believes that Mr. Ruddy should serve as a director based on his qualifications and skills which include, among other things, his consulting and financial experience as well as his knowledge of government programs and our business from his prior service with the Company.

Wellington E. Webb

Age 74

Wellington E. Webb has served as one of our directors since 2003. Since 2003, Mr. Webb has served as President of Webb Group International, an economic development and public relations consulting firm. Mr. Webb served three terms as Mayor of the City and County of Denver, Colorado from 1991 to 2003. Prior to first being elected as Mayor, he served at the state, local, and federal levels of government in several capacities including Denver City Auditor, Executive Director of the Colorado Department of Regulatory Agencies, and Regional Director of the U.S. Department of Health Education and Welfare. Mr. Webb’s distinguished public career began in 1972 when he was elected to the Colorado House of Representatives. In 2009, Mr. Webb was nominated by President Obama and approved by the Senate to be Alternate Representative of the United States of America to the Sixty-fourth Session of the General Assembly of the United Nations. In 2012, Mr. Webb was appointed to the board of directors of First Responder Network

Authority (FirstNet) an independent authority within the Department of Commerce’s National Telecommunications and Information Administration. Mr. Webb holds a B.A. in Sociology from the Colorado State College at Greeley and a M.A. in Sociology from the University of Northern Colorado. He also holds honorary Doctorates from the University of Colorado at Denver, Metropolitan State College of Denver, University of Northern Colorado, Greeley Colorado and The American Baptist Seminary, Berkeley California.

The board of directors believes that Mayor Webb should serve as a director based on his qualifications and skills which include, among other things, his extensive knowledge of and experience in state and local government and leadership skills gained during such service.

CORPORATE GOVERNANCE

AND THE BOARD OF DIRECTORS

Our business and affairs are managed under the direction of the board of directors in accordance with the Virginia Stock Corporation Act and our articles of incorporation and bylaws. Members of the board are kept informed of our business through discussions with the Chief Executive Officer and other officers, by reviewing materials provided to them and by participating in meetings of the board and its committees. Our corporate governance practices are summarized below.

Board Leadership

MAXIMUS has maintained separate Chief Executive Officer and Chairman of the Board positions since before the Company’s initial public offering in 1997. Richard A. Montoni currently serves as Chief Executive Officer, and Peter B. Pond currently serves as our non-executive Chairman of the Board. We believe that the separation of those roles is appropriate for us because it is a good corporate governance practice that promotes board and director independence from the management team.

Board’s Role in Risk Oversight

The board of directors as a whole oversees the risk management of the Company. The Senior Vice President of Quality and Risk Management regularly reports to the board on operational and financial risks relating to the Company’s projects. She also serves as our Compliance Officer and regularly reports to the board about compliance with the Company’s code of ethics and policies and procedures. The Audit Committee oversees management of market and operational risks that could have a financial impact, such as those relating to internal controls and liquidity. The Nominating and Governance Committee manages the risks associated with governance issues, such as the independence and performance of the board, and the Compensation Committee is responsible for managing the risks relating to the Company’s executive compensation and succession plans and policies.

Management regularly reports to the board or relevant committee on actions the Company is taking to manage the risks identified above. The board and management periodically review, evaluate and assess the risks relevant to the Company.

Corporate Governance Guidelines

The board of directors has adopted Guidelines for Corporate Governance that set forth the practices of the board with respect to the function of the board, management review and responsibility, board composition, selection of directors, operation of the board and meetings, committees of the board, director responsibilities and tenure and evaluation of the board and committees. The Guidelines are available on our Corporate Governance web page at http://investor.maximus.com/corporate-governance. A printed copy is available, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190.

Director Independence

From time to time, MAXIMUS and its subsidiaries may provide services to, and otherwise conduct business with, companies of which certain members of the board or members of their immediate families are or were directors or officers. To comply with the New York Stock Exchange (“NYSE”) listing standards, the Guidelines for Corporate Governance establish categorical standards under which the board views the following relationships as impairing a director’s independence:

| |

• | a director who is currently, or in the past three years has been, employed by the Company or by any subsidiary of the Company; |

| |

• | a director who has accepted, or has any family member who has accepted, payments from the Company or its affiliates in excess of $120,000 within the current fiscal year or any of the past three fiscal years (except for board services, retirement plan benefits, or non-discretionary compensation); |

| |

• | a director who has an immediate family member who is, or has been in the past three years, employed by the Company or any subsidiary of the Company as an executive officer; |

| |

• | a director who is a partner, controlling shareholder or an employee, or has an immediate family member who is an executive officer of any for-profit business to which the Company made, or from which it received, payments (other than those which arise solely from investments in the Company’s securities) in the current fiscal year or in any of the last three fiscal years that exceed 2% of consolidated gross revenue for the business, or the Company, for that year, or that exceed $1,000,000, whichever is greater; |

| |

• | a director who is employed, or has an immediate family member who is employed, as an executive officer of another company where any of the Company’s executive officers serves on that other company’s compensation committee, or such a relationship has existed within the past three years; and |

| |

• | a director who (a) has been a partner or employee of the Company’s internal or external auditor within the past three years, (b) has an immediate family member who is a current partner of such a firm, (c) has an immediate family member who is a current employee of such a firm and personally works on the Company's audit, or (d) had an immediate family member who was, within the last three years, a partner or employee of such a firm and personally worked on the Company's audit within that time. |

Apart from the categorical standards, the board of directors also assesses the materiality of a director’s relationship with us to ensure that there is no material relationship that would adversely affect the director’s independence.

The board of directors in its business judgment has determined that the following eight directors are independent as defined by NYSE listing standards: Russell A. Beliveau, John J. Haley, Paul R. Lederer, Peter B. Pond, Raymond B. Ruddy, Marilyn R. Seymann, James R. Thompson, Jr. and Wellington E. Webb. None of our independent directors, their immediate family members, or employers, is engaged in relationships with us that the categorical standards cover and, as a result, each independent director meets our categorical standards. In addition, none of the independent directors has any relationship with us that would adversely affect such director’s independence.

Code of Ethics

We have adopted a code of ethics that applies to all employees including our principal executive officer, principal financial officer and principal accounting officer or controller, or persons performing similar functions. That code, our Standards of Business Conduct and Ethics, can be found posted on our Corporate Governance web page at http://investor.maximus.com/corporate-governance. A printed copy is available, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190. The board regularly reviews our code of ethics, and any amendment or waiver of our code of ethics will be reflected on our website.

Board and Committee Meeting Attendance

Our board expects that its members will prepare for, attend and participate in all board and applicable committee meetings. Our board of directors held seven meetings during fiscal year 2015. During our 2015 fiscal year, all of our directors attended at least 75% of the aggregate board and applicable committee meetings.

Executive Sessions

Executive sessions where non-management directors meet on an informal basis are scheduled either at the beginning or at the end of each regularly scheduled board meeting. Peter B. Pond, the Chairman of the Board, serves as chairman for executive sessions.

Communications with Directors

Any director may be contacted by writing to him or her c/o MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190. Communications to the non-management directors as a group may be sent to the same address, c/o the Chairman of the Nominating and Governance Committee. We promptly forward such correspondence to the indicated directors.

Committees of the Board

The standing committees of the board of directors are the Audit Committee, the Nominating and Governance Committee and the Compensation Committee.

Audit Committee

The Audit Committee assists the board of directors in fulfilling its responsibility to oversee management’s conduct of our financial reporting processes and audits of our financial statements. The Audit Committee specifically reviews the financial reports and other financial information provided by the Company, our disclosure controls and procedures and internal accounting and financial controls, the internal audit function, the legal compliance and ethics programs, and the annual independent audit process. The Audit Committee operates under a written charter adopted by the board. The Audit Committee’s charter, as amended and currently in effect, is available on our Corporate Governance web page at http://investor.maximus.com/corporate-governance. A printed copy is available, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190. The information contained on our website is not a part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public filing made with the SEC.

The members of the Audit Committee are Peter B. Pond (Chair), Paul R. Lederer, Raymond B. Ruddy, Marilyn R. Seymann, and Wellington E. Webb, each of whom is independent as defined by applicable NYSE listing standards and SEC regulations governing the qualifications of audit committee members in effect on the date of this proxy statement. The board of directors has determined that all of the committee members are financially literate as defined by the NYSE listing standards and that Mr. Pond qualifies as an audit committee financial expert as defined by regulations of the SEC.

The Audit Committee held four meetings during fiscal year 2015. For additional information regarding the Audit Committee, see “Audit Information – Report of the Audit Committee” below.

Nominating and Governance Committee

The purpose of the Nominating and Governance Committee is to identify, evaluate and recommend candidates for membership on the board of directors, to establish and assure the effectiveness of the governance principles of the board and the Company and to establish the compensation of our directors. The Nominating and Governance Committee is responsible for assessing the appropriate mix of skills, qualifications and characteristics for the effective functioning of the board in light of the needs of the Company. The committee considers, at a minimum, the following qualifications in recommending to the board potential new directors, or the continued service of existing directors:

| |

• | personal characteristics, such as highest personal and professional ethics, integrity and values, an inquiring and independent mind, with a respect for the views of others, ability to work well with others and practical wisdom and mature judgment; |

| |

• | broad, policy-making level experience in business, government, academia or science to understand business problems and evaluate and formulate solutions; |

| |

• | experience and expertise that is useful to the Company and complementary to the background and experience of other directors; |

| |

• | willingness and ability to devote the time necessary to carry out duties and responsibilities of directors and to be an active, objective and constructive participant at meetings of the board and its committees; |

| |

• | commitment to serve on the board over a period of several years to develop knowledge about the Company’s principal operations; |

| |

• | willingness to represent the best interests of all shareholders and objectively evaluate management performance; and |

| |

• | diversity of background and experience. |

As described above, diversity is one of several factors that the committee considers in evaluating director nominees. The Nominating and Governance Committee defines ‘‘diversity’’ broadly to include diversity with respect to background, experience, viewpoints, skill, education, national origin, gender, race, age, culture and organizations with which the individual may be affiliated.

The Nominating and Governance Committee will consider shareholder recommendations for candidates to serve on the board of directors and would evaluate any such candidate in the same manner described above. Shareholders entitled to vote for the election of directors may submit candidates for consideration by the committee if it receives timely written notice, in proper form, for each such recommended director nominee. If the notice is not timely and in proper form, the nominee will not be considered by the committee. To be timely for the 2017 Annual Meeting of Shareholders, the notice must be received within the time frame set forth in “Shareholder Proposals for Our 2017 Annual Meeting of Shareholders” below. To be in proper form, the notice must include each nominee’s written consent to be named as a nominee and to serve, if elected, and information about the shareholder making the nomination and the person nominated for election. These requirements are more fully described in Article I, Section 6, of our bylaws, a copy of which will be provided, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190.

Under the process we use for selecting new board candidates, the Chief Executive Officer, the Nominating and Governance Committee or other board members identify the need to add a new board member with specific qualifications or to fill a vacancy on the board. The Chairman of the Nominating and Governance Committee will initiate a search, working with staff support and seeking input from board members and senior management, hiring a search firm, if necessary, and considering any candidates recommended by shareholders. An initial slate of candidates that will satisfy the criteria and otherwise qualify for membership on the board may be presented to the Nominating and Governance Committee. A determination is made as to whether Nominating and Governance Committee members or board members have relationships with preferred candidates and can initiate contacts. The Chief Executive Officer and at least one member of the Nominating and Governance Committee interview prospective candidates. The Nominating and Governance Committee meets to conduct further interviews of prospective candidates, if necessary or appropriate, and to consider and recommend final candidates for approval by the full board of directors.

The Nominating and Governance Committee is comprised of John J. Haley (Chair), Paul R. Lederer, Peter B. Pond, Marilyn R. Seymann, and Wellington E. Webb, each of whom is independent as defined by applicable NYSE listing standards governing the qualifications of nominating and governance committee members in effect on the date of this proxy statement. The Nominating and Governance Committee operates under a written charter adopted by the board in 2003. The Nominating and Governance Committee’s charter, as amended and currently in effect, is available on our Corporate Governance web page at http://investor.maximus.com/corporate-governance. A printed copy is available, without charge, to any shareholder

upon written request to the Secretary of the Company, whose address is MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190. The information contained on our website is not a part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public filing made with the SEC.

The Nominating and Governance Committee met three times during fiscal year 2015.

Compensation Committee

The Compensation Committee is responsible for reviewing, approving, and overseeing the administration of our compensation and benefit programs, evaluating their effectiveness in supporting our overall business objectives and ensuring an appropriate structure and process for management succession. Specifically, the committee is responsible for:

| |

• | evaluating the performance and setting the compensation of the Chief Executive Officer and other members of senior management, |

| |

• | reviewing the Company’s compensation policies and practices, |

| |

• | reviewing executive succession plans, and |

| |

• | reviewing our executive development programs, including the performance evaluation process and incentive compensation programs. |

The Chief Executive Officer provides the Compensation Committee with the financial and strategic performance accomplishments of the executive management team and recommends raises, bonuses and long-term equity awards for those executives (excluding himself). To assist in its efforts to meet the objectives outlined above, the Compensation Committee retained Pay Governance, LLC, an independent consulting firm, to advise it on a regular basis on executive compensation programs. Pay Governance provides information to the Compensation Committee so that it can determine whether the Company’s executive compensation programs are reasonable and consistent with competitive practices. The Compensation Committee has reviewed the independence of Pay Governance in light of SEC rules and has concluded that the consultant’s work for the Compensation Committee is independent and does not raise any conflict of interest.

The Compensation Committee operates under a written charter adopted by the board in 2003. The Compensation Committee’s charter, as amended and currently in effect, is available on our Corporate Governance web page at http://investor.maximus.com/corporate-governance. A printed copy is available, without charge, to any shareholder upon written request to the Secretary of the Company, whose address is MAXIMUS, Inc., 1891 Metro Center Drive, Reston, Virginia 20190. The information contained on our website is not a part of this proxy statement and is not deemed incorporated by reference into this proxy statement or any other public filing made with the SEC.

The members of the Compensation Committee are Marilyn R. Seymann (Chair), Russell A. Beliveau, John J. Haley, Paul R. Lederer, Peter B. Pond and Raymond B. Ruddy, each of whom is independent as defined by applicable NYSE listing standards governing the qualifications of compensation committee members in effect on the date of this proxy statement.

The Compensation Committee held four meetings during fiscal year 2015. For additional information regarding the committee, see “Compensation Committee Report” below.

Annual Meeting Attendance

We encourage members of the board of directors to attend the Annual Meeting. All of our directors attended the 2015 Annual Meeting of Shareholders.

EXECUTIVE OFFICERS

Our executive officers and their respective ages and positions are as follows:

|

| | | | |

Name | | Age | | Position |

Richard A. Montoni | | 64 | | Chief Executive Officer and Director |

Mark S. Andrekovich | | 54 | | Chief of Human Capital and President Tax and Employer Services |

Bruce L. Caswell | | 50 | | President |

David R. Francis | | 54 | | General Counsel and Secretary |

Richard J. Nadeau | | 61 | | Chief Financial Officer and Treasurer |

Akbar Piloti | | 58 | | General Manager, Global Group and Human Services Segment |

The following information sets forth biographical information for all executive officers for the past five years. Such information with respect to Richard A. Montoni, the Company’s Chief Executive Officer, is set forth above in the “Proposal 1 – Election of Directors” section.

Mark S. Andrekovich has served as our Chief of Human Capital since 2005. Since September 2008, he has also served as the President of our Tax and Employer Services Division. He has more than 25 years of comprehensive human resources experience with multi-national companies such as General Electric, Nordson Corporation and Cytec Industries.

Bruce L. Caswell was appointed President of MAXIMUS effective October 1, 2014. He previously served as the President of Health Services from 2007 through 2014. Before that he was President of Operations from 2005 to 2007 and President of our Human Services Group from 2004 to 2005. Previously, he worked at IBM Corporation for nine years, serving most recently as Vice President, State and Local Government & Education Industries for IBM Business Consulting Services.

David R. Francis has served as our General Counsel and Secretary since 1998. He has over 25 years of legal experience having previously served in both law firm and in-house attorney positions.

Richard J. Nadeau joined MAXIMUS in June 2014 as Chief Financial Officer and Treasurer. From 2009 to 2014 he served as Executive Vice President and Chief Financial Officer of SRA International, Inc. Previously he served as Chief Financial Officer for Sunrise Senior Living, Inc., The Mills Corporation and Colt Defense LLC. Before that Mr. Nadeau was a partner at KPMG LLP and at Arthur Andersen LLP.

Akbar M. Piloti has served as the General Manager, Global Group and Human Services Segment since 2015. From 2007 to 2015 he was President of the Human Services Segment. Mr. Piloti has been with MAXIMUS since 1989 and has held several senior leadership roles including President of the Workforce Services division from 2000 to 2006 and Chief Operating Officer of the Operations Segment from 2006 to 2007. Mr. Piloti has over 30 years of experience in human services delivery.

EXECUTIVE COMPENSATION

Compensation Committee Report

The Compensation Committee has reviewed the Compensation Discussion and Analysis included in this proxy statement and discussed it with the Company’s management. Based on this review and discussion, the Compensation Committee recommended that the Compensation Discussion and Analysis be included in the Company’s annual report on Form 10-K for the year ended September 30, 2015 and this proxy statement.

Compensation Committee

Marilyn R. Seymann, Chair

Russell A. Beliveau

John J. Haley

Paul R. Lederer

Peter B. Pond

Raymond B. Ruddy

Notwithstanding anything to the contrary set forth in any of the Company's filings under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act of 1934 (the "Exchange Act") that might incorporate future filings, including this proxy statement, in whole or in part, the Report of the Compensation Committee shall not be deemed to be "Soliciting Material," is not deemed "filed" with the SEC and shall not be incorporated by reference into any filings under the Securities Act or Exchange Act whether made before or after the date hereof and irrespective of any general incorporation language in such filing except to the extent that the Company specifically requests that the information be treated as soliciting material or specifically incorporates it by reference into a document filed under the Securities Act or the Exchange Act.

Compensation Committee Interlocks and Insider Participation

All members of the Compensation Committee are independent outside directors. There are no compensation committee interlocks with other entities with respect to any member of the Compensation Committee.

Compensation Discussion and Analysis

General

The Compensation Committee of our board of directors reviews and establishes the compensation of our executive officers, including the named executive officers, and provides oversight of our compensation programs. The Compensation Committee consists entirely of non-employee, independent members of our board of directors and operates under a written charter approved by the board of directors.

During 2015, the Compensation Committee engaged Pay Governance LLC (“Pay Governance”) to assist it in carrying out its responsibilities with respect to executive compensation. In connection with that engagement, the Compensation Committee evaluated the independence of Pay Governance and determined that Pay Governance was an independent advisor.

Pay Governance was asked to review market conditions and peer company practices and to evaluate the Company’s executive compensation programs against them. Pay Governance performed market analyses of peer group companies and the general market for executive talent, and advised the Compensation Committee as to peer company and best practices regarding incentive opportunities for executive compensation.

Information on the Compensation Committee’s processes and procedures for the consideration and determination of executive compensation is included under the caption “Corporate Governance and the Board of Directors – Committees of the Board – Compensation Committee.”

Objectives of Our Compensation Program

The primary objective of our executive compensation program is to attract and retain highly skilled and motivated executive officers who will manage the Company in a manner that promotes our growth and profitability and advances the interests of our shareholders. Additional objectives of our executive compensation program are to:

| |

• | align executive pay with shareholders’ interests; |

| |

• | recognize individual initiative and achievements; and |

| |

• | unite the executive management team under common objectives. |

Executive Compensation Principles

The Company’s primary focus is on longer-term earnings growth. Accordingly, we endeavor to align our compensation with building shareholder value and encouraging our executives to make sound long-term decisions. The Compensation Committee monitors the relationship of pay realized over the past three years relative to the Company's performance to ensure our program provides the desired alignment. To that end, the Compensation Committee annually reviews with the independent consultant, Pay Governance, the relationship of the realizable pay of the Chief Executive Officer to the total return to the Company’s shareholders.

Our executive compensation program consists of base salaries, performance-based cash incentive payments in the form of annual bonuses and long-term equity incentives. We believe that short-term annual cash incentive compensation should be tied directly to both corporate performance and individual performance for the fiscal year, including the achievement of identified goals as they pertain to the areas of our operations for which the executive officer is personally responsible and accountable and other strategic objectives that will grow long-term shareholder value. Under our program, performance above targeted standards results in increased total compensation, and performance below targeted standards results in decreased total compensation.

Our long-term equity incentives generally are awarded in the form of restricted stock units (“RSUs”). Before 2007 long-term equity incentives also included stock options. Although the Company has made some stock option awards since then, primarily in connection with executive hires or promotions, the Company presently intends to make future equity awards in the form of RSUs.

These components of executive compensation are used together to achieve an appropriate balance between cash and equity compensation and between short-term and long-term incentives. A significant portion of each executive officer’s total compensation is at risk, tied both to our annual and long-term performance as well as to the creation of shareholder value. In particular, 78% of the target compensation of the Chief Executive Officer and at least 63% of the target compensation of the other executive officers is variable, at-risk compensation.

How Executive Pay Levels are Determined

The Compensation Committee regularly reviews our executive compensation program and its elements. All decisions by the Compensation Committee relating to the compensation of our executive officers are reported to the full board of directors.

The Compensation Committee monitors the results of the annual advisory “say-on-pay” proposal and considers those results as one element in connection with the discharge of its responsibilities. A substantial

majority of our voting shareholders (nearly 94%) approved the compensation program described in our proxy statement for the 2015 Annual Meeting of Shareholders. Based on the demonstrated effectiveness and the significant shareholder support of our current compensation program, no changes to the overall structure of the program were made as a direct result of such shareholder vote. It is currently expected that we will hold annual say-on-pay votes until the next time the frequency of such votes is put before our shareholders.

The Company’s Chief Executive Officer, the General Counsel/Secretary, the Chief of Human Capital and a representative from Pay Governance regularly attend Compensation Committee meetings. They are primarily responsible for providing analysis and recommendations to the Compensation Committee, but they do not participate in Compensation Committee decisions regarding their own compensation. In addition, the Secretary is responsible for documenting the minutes of each meeting, and the Chief Executive Officer and the Chief of Human Capital oversee the implementation of the Compensation Committee resolutions.

In determining the compensation of our executive officers, the Compensation Committee evaluates total overall compensation, as well as the mix of salary, cash bonus incentives and equity incentives, using a number of factors including the following:

| |

• | our financial and operating performance, measured by attainment of specific objectives including earnings per share (“EPS”) results, revenue growth, new business awards, client satisfaction, stock price performance and a variety of other organizational financial and non-financial measures; |

| |

• | the duties, responsibilities and performance of each executive officer, including the achievement of identified goals for the year as they pertain to the areas of our operations for which the executive is personally responsible and accountable; |

| |

• | internal pay equity considerations; and |

| |

• | comparative industry market data to assess compensation competitiveness. |

With respect to comparative industry data, the Compensation Committee reviews executive compensation (including the mix of base salary, bonus and equity compensation elements) and evaluates compensation structures of comparable companies with assistance from its executive compensation consultant, Pay Governance. That group consists of public companies in the same or similar business lines as MAXIMUS as well as competitors for executive talent. For these purposes, the Compensation Committee reviewed compensation practices for several comparable companies including:

|

| | | |

| Booz Allen Holding Corp. | | ICF International |

| CACI International | | Leidos Holdings |

| DST Systems | | ManTech International |

| Gartner | | Science Applications International Corp. |

| Harris Corp. | | Unisys Corp. |

During 2015 the Compensation Committee evaluated the composition of the comparator group of companies described above and made certain changes. In addition to the comparability of service offerings, the Compensation Committee considered the market capitalization and annual revenues of the companies in the comparator group. Companies with market capitalizations less than 25% and annual revenues less than 50% of those of MAXIMUS were considered too small to be good comparators. The following companies were removed from that list for the reasons indicated:

|

| | | |

| Ciber | | market cap and revenues no longer comparable |

| Navigant | | market cap and revenues no longer comparable |

| Sapient | | no longer a public company |

| SRA International | | no longer a public company |

The Compensation Committee added the following companies to the comparator group based on an assessment of their business lines, market capitalizations and revenues:

|

| | | |

| Booz Allen Holding Corp. | | Gartner |

| DST Systems | | Harris Corp. |

The Compensation Committee periodically reviews a compensation analysis prepared by Pay Governance. The most recent study was conducted in August 2015. The study included the companies identified above and general industry survey data and considered our need to attract and retain a motivated team of skilled executives. In years that a full study is not conducted, the Compensation Committee considers the average market increase for executive talent as provided by the Compensation Committee’s consultant. The consultant also conducts an annual competitive compensation review of the Chief Executive Officer and the positions of the other named executive officers. The study reflects that our market for executive talent is broader than just the government business process outsourcing sector. As such, for 2015 we reviewed base pay, cash bonus, long-term equity and total compensation data from an industry survey, adjusted for revenue size, as a comparator group. The survey reflected a large cross section of over 1000 general industry companies and provided the Compensation Committee with a broad industry comparison. The identity of the specific companies comprising the survey is not disclosed to, or considered by, the Compensation Committee in its decision-making process.

In order to attract talent and offer market-competitive compensation, MAXIMUS has established the total target compensation levels for its executives taking into consideration peer company and general industry compensation data, including the level of compensation and the mix of base salary, bonus and long-term equity elements. In practice, total target compensation for the named executive officers at MAXIMUS approximates the 50th percentile of those comparator groups. However, MAXIMUS has not established formal benchmarking targets or objectives for total compensation or the individual elements thereof, and actual compensation may vary significantly from that of the comparator groups due to Company and individual performance.

Components of Executive Compensation

The elements of our compensation program in 2015 included base annual salary, short-term incentive compensation under our Management Bonus Plan (“MBP”), and long-term incentives through equity-based awards under our 2011 Equity Incentive Plan. We provide certain retirement benefits through our 401(k) savings plan. We also provide health and welfare benefits that include participation in our health, dental and vision plans and various insurance plans, including disability and life insurance.

Each of the three principal components of executive compensation is designed to reward performance and provide incentives to executive officers consistent with our overall objectives and principles of executive compensation. These components and the rationale and methodology for each are described below. Specific information on the amounts and types of compensation earned by the named executive officers during 2015 can be found in the Summary Compensation Table and other tables and narrative disclosures following this discussion.

Base Salary

Our base salary philosophy is to provide reasonable income to our named executive officers in amounts that will attract and retain individuals with a broad, proven track record of performance.

The Compensation Committee approves the salaries for the executive officers. In establishing the salaries, the Compensation Committee balances the need to offer competitive salaries that will limit turnover with the need to maintain careful control of salary and benefit expenses.

Individual salaries (except for the salary of the Chief Executive Officer) are recommended by the Chief Executive Officer to the Compensation Committee based on his subjective assessment in each case of the nature of the position, as well as the contribution, performance and experience of the executive officer.

In making salary determinations for 2015, the Compensation Committee evaluated the financial and strategic contributions of the executive officers based on overall Company financial performance, business unit financial performance, achievements in implementing our long-term strategy, and the recommendations of the Chief Executive Officer. As noted above, the Company has not established a formal benchmarking target versus peer companies when determining base salaries. The Compensation Committee gives meaningful weight to the recommendations of the Chief Executive Officer, but the final decisions regarding executive salaries are made by the Compensation Committee. The Chief Executive Officer does not make any recommendations to the Compensation Committee or its independent consultant regarding his own compensation. The Chief Executive Officer’s compensation is determined by the Compensation Committee with the assistance and advice of the outside consultant.

As Chief Executive Officer, Mr. Montoni is compensated pursuant to an employment agreement, which is described under “Supplemental Discussion of Compensation” below. He is eligible for base salary increases as the Compensation Committee may determine. In making this determination for 2015, the Compensation Committee evaluated Mr. Montoni’s performance based on our financial performance, achievements in implementing our long-term strategy, and the personal observations of the Chief Executive Officer’s performance by the members of the Board of Directors. As with the executive officers generally, the Compensation Committee also considered the survey data provided by Pay Governance. No particular weight was given to any particular aspect of the performance of the Chief Executive Officer. As described below, Mr. Caswell is also compensated pursuant to an employment agreement.

Changes to base salaries are typically effective as of January 1 of each year. Mr. Caswell’s base salary was increased in recognition of his expanded scope of responsibility since becoming the Company’s President on October 1, 2014. The salaries of the other named executive officers were unchanged. The annual base salaries for our named executive officers for 2015 and 2014 are below.

|

| | | | |

Name and Position | | 2015 Annual Salary | | 2014 Annual Salary |

Richard A. Montoni Chief Executive Officer | | $725,000 | | $725,000 |

Bruce L. Caswell President | | $500,000 | | $450,000 |

Richard J. Nadeau Chief Financial Officer | | $425,000 | | $425,000 |

Akbar Piloti General Manager, Global Group and

Human Services Segment | | $410,000 | | $410,000 |

Mark S. Andrekovich

Chief of Human Capital and

President Tax and Employer Services | | $395,000 | | $395,000 |

Annual Cash Incentives

Annual cash incentive awards, under the Company’s MBP, provide an opportunity for employees and executives to earn additional cash compensation for business and individual performance. In addition to the named executive officers, approximately 875 employees are participants in the MBP. The amount of each individual’s target MBP award has been set as a percentage of base pay. Actual awards may vary above or below the target based on achievement of Company, business unit and individual performance goals as well as the scope of the individual’s responsibility and the market for executives with similar skills

and background. The Compensation Committee established the percentages with consideration of survey information provided by Pay Governance, and they are intended to link a substantial portion of an executive’s compensation to the overall performance of the Company. The Company has not established a formal benchmarking target versus peer companies when setting MBP award targets.

The actual Company-wide bonus pool is determined by the Company achieving specific levels of “Distributable Income” performance at threshold, target and superior levels. For these purposes, Distributable Income is the net income of the Company before taxes adjusted to eliminate the effects of share repurchases, currency gains and losses, mergers and acquisitions, discontinued operations and legal settlements or recoveries. Distributable Income performance above the superior level results in additional bonus pool funding. The Distributable Income goals are set by the board of directors at the beginning of the fiscal year and are aligned with shareholder EPS expectations. At the end of the fiscal year, the Compensation Committee evaluates the Company’s Distributable Income and strategic performance and approves the final amount of the Company’s bonus pool.

Beginning in 2014, the Compensation Committee committed to an annual minimum funding of the overall Company bonus pool of $7.5 million. Any distributions from that pool to the named executive officers will be dependent on the Company’s achievement of the Section 162(m) goals (described below). The bonus pool is not funded beyond that minimum amount unless the Company achieves its threshold Distributable Income goal for the fiscal year. We believe this structure is effective in placing the overall goals of the Company ahead of the particular goals of any particular segment, functional area or executive officer. Therefore, the Company’s achievement of its Distributable Income goal is essentially a pre-condition and the primary driver for the funding of the bonus pool above the minimum amount. For MAXIMUS, this structure best aligns management incentives with shareholder interests.

If the Company achieves the threshold or greater level of Distributable Income, the Compensation Committee retains discretion to increase or decrease the bonus pool by the greater of $7.5 million or 25% of the earned bonus pool. If the threshold level is not met, the Compensation Committee funds a minimum bonus pool of $7.5 million to recognize individuals or groups of individuals who made exceptional contributions to the Company and to encourage retention of employees and executives. If the superior level of performance is exceeded, the bonus pool increases proportionately. In 2015, the Company exceeded the target performance level. Apart from record revenue and earnings, the Company successfully acquired and integrated Acentia and Remploy, won significant new business in Australia, continued the successful ramp-up of its business in the United States arising under the Affordable Care Act and positioned the Company for future international and domestic growth.

For fiscal year 2015, the Distributable Income goals were as follows:

|

| | |

Level | | FY15 Distributable Income |

Threshold | | $237,000,000 |

Target | | $258,000,000 |

Superior | | $283,000,000 |